Lithuania has successfully exited the covid-19-crisis, but is now weathering the impact of Russia’s invasion of Ukraine. Growth is slowing and inflation has risen to one of the highest in the Euro area, fuelled by soaring energy and food prices. Fiscal policy is tightening amid a revised budget to help households and firms weather the energy crisis and support Ukrainian refugees. Ageing costs are rising. Accelerating reform of public firms and upgrading the education system will boost productivity and employment. Reducing poverty and regional disparities, improving institutional quality, and curbing carbon emissions will help make the Lithuanian economy more inclusive and sustainable.

OECD Economic Surveys: Lithuania 2022

1. Key Policy Insights

Abstract

Introduction

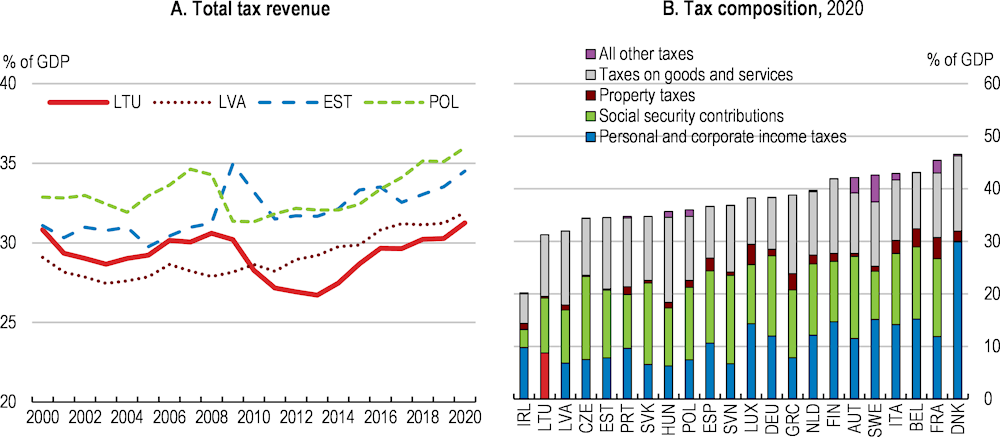

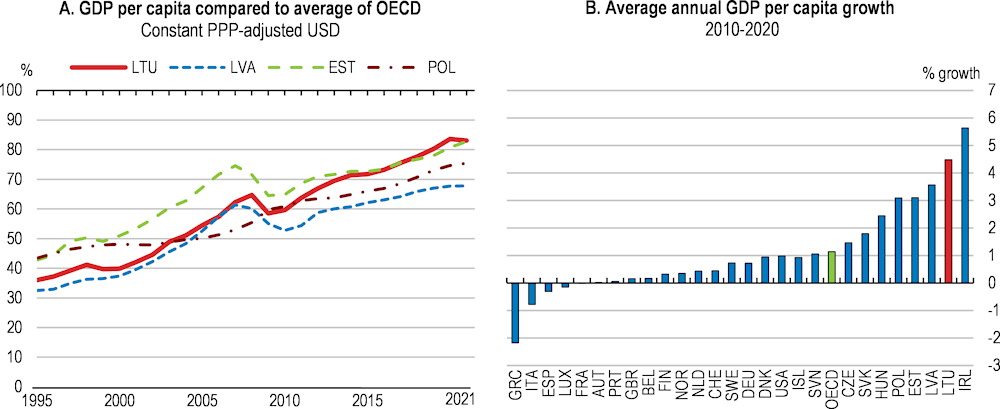

The Lithuanian economy has successfully exited the covid-19-crisis, but is now weathering the impact of Russia’s invasion of Ukraine. Lithuania was one of the fastest growing OECD economies of the past decade in per capita terms, buoyed by rising exports and integration into global value chains (Figure 1.1). Bold and effective policy helped households and firms through the pandemic, contributing to the mildest pandemic-induced recession of all European countries. A high vaccination rate helps protect the population against a new covid-19 wave. The government has embarked on an ambitious programme to boost investment in infrastructure, innovation, education, digitalisation and climate action, supported by the European resilience and recovery funds. A sound macroeconomic and financial framework and a friendly business climate enhance policy effectiveness. After a long period of net emigration, the migration balance turned positive in 2018.

Russia’s aggression against Ukraine will considerably affect the Lithuanian economy (Box 1.1). Lithuania has one of the highest inflation rates in the euro area, fuelled by soaring energy, food and housing prices. Russia is one of Lithuania’s largest trading partners, making the economy vulnerable to the impact of the war, even though much of the trade with Russia consists of transit trade. In Spring, Lithuania stopped importing oil, gas and electricity from Russia. A wave of refugees from Ukraine and Belarus could strain Lithuania’s absorption capacity and require considerable humanitarian aid. Given the nature of the shock, policy responses need to be carefully weighed. In view of these developments, Lithuania updated the budget in April to spend more on short-term support for households and firms as well as on investment in energy security.

Figure 1.1. Baltic tiger rising

Note: In Panel B, growth rates are based on real GDP per capita.

Source: OECD Economic Outlook No. 111 database (updated).

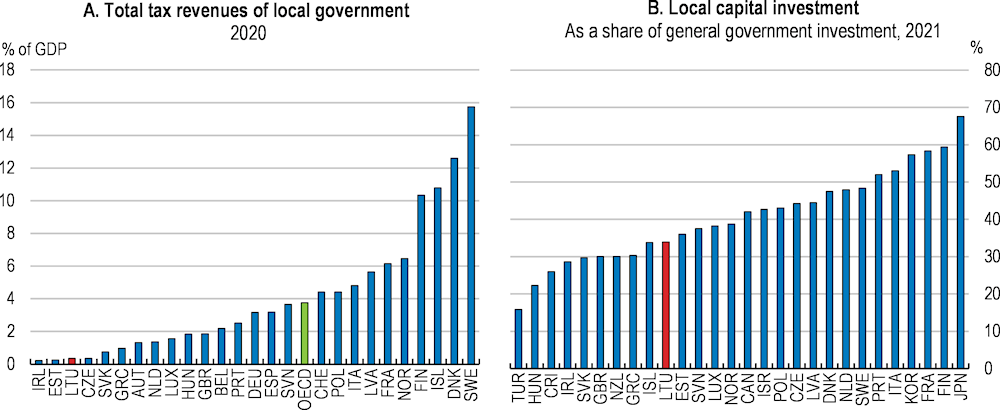

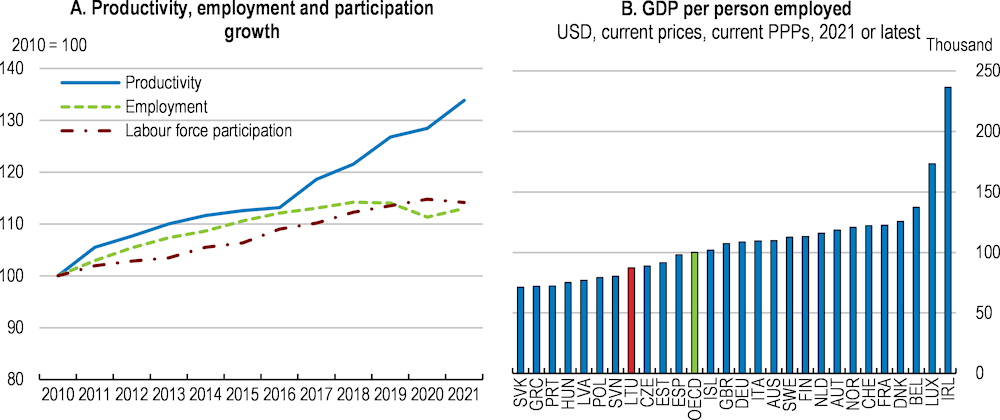

Besides the war-related crisis, Lithuania faces several challenges, mostly pertaining to productivity and employment (Figure 1.2). Productivity has accelerated over the past few years, but its level remains below the OECD average. Participation is well above the OECD average, limiting further contributions to GDP. Unemployment remains high despite strong growth, pointing at labour market imbalances, in particular considerable skills and job mismatch. Investment, both public and private, remains stubbornly low. The broad reach of state-owned enterprises and inadequate regulation in transport, Lithuania’s largest service export sector, could also hold back productivity growth. Trust in government and quality of institutions is below the OECD average. The pandemic cut men’s life expectancy, already among the lowest in the OECD, by 1.7 years (women 1.3 years) in 2020, the sharpest reduction in OECD Europe (OECD, 2018[1]).

Box 1.1. The impact on Lithuania of the war in Ukraine

Russia’s aggression against Ukraine is first a human tragedy, but it has also consequences for the Lithuanian economy. By late August, more than 60 000 Ukrainian refugees – equivalent to 2% of the Lithuanian population – had reached Lithuanian soil, with arrivals having gradually declined to less than a hundred per day. Ukrainians already make up the largest group of non-EU foreigners living in Lithuania. Starting in March Ukrainian refugees were able to obtain refugee status with a simplified procedure, granting them full access to health and social services and the labour market. Refugees also help alleviate labour shortages. Ukrainian teachers are allowed to teach in the Ukrainian language. Procedures to hand out work permits for workers from Russia and Belarus have also been streamlined, with the stated objective of relocating skilled workers and firms from these countries to Lithuania.

Trade with Russia, Belarus and Ukraine is collapsing. In early April, Lithuania stopped importing gas from Russia, drawing instead on the LNG terminal in Klaipeda, becoming the first EU country to cut ties with Russian gas deliveries. In May, it stopped all other energy imports from Russia. Rail transport is expected to almost halve from its 2021 level. Traffic between Russia and its Kaliningrad enclave, which passes through Lithuania, has shrunk to a fraction of its normal level, affected by ever tighter EU sanctions. Growth of service exports – mostly transport – is expected to drop from around 14% in 2021 to 4% in 2022. Oil prices have nearly doubled since December 2021, and headline inflation exceeded 22% in September. Lithuania is an agricultural exporter, so rising food prices hurt households but benefit exporters. End-March the central bank published some scenarios, with the most optimistic one projecting GDP growth at 2.7% in 2022, whereas the “severe shock” scenario projected a 1.2% contraction, assuming that all exports to Russia, Belarus and Ukraine stop entirely and imports from these countries are curtailed by one-fifth. In the best-case scenario inflation was projected at 10.5% in 2022, as against 11.5% in the severe shock scenario.

In early April the government presented a revised draft budget under the heading “Mitigating the effects of inflation and strengthening energy independence”, allocating around 1.4% of GDP in 2022 to help households and firms absorb energy price shocks and increase energy efficiency, as well as to diversify energy supply. Electricity and natural gas prices are capped at 140% of pre-war levels until end 2022 for households, with energy providers being compensated for revenue losses. To help households further, pensions have been increased; income taxes for low-income earners reduced; and means-tested benefits – increased already in December 2021 - were expanded further. A notable part of investment to increase energy independence goes into renovation and rehabilitation of multi-apartment buildings and the support of public and private solar and wind energy production and electricity storage. Some of this spending was contained in earlier budgets, and around half is covered by EU funds. Another 0.6% of GDP are budgeted to support Ukrainian refugees.

Source: Various government agencies and central bank of Lithuania.

Stepping up progress with digitalisation will be a key means to boost productivity economy-wide. While the country has advanced in this area, there is scope to further increase investment in innovation and remove barriers to the adoption of advanced technologies by firms, especially smaller ones, including by addressing regional disparities in digital infrastructure and improving access to finance. Digital skills need to strengthen to ensure a solid transition towards the digital economy and a fair distribution of the digitalisation dividend. The government is developing a digitalisation strategy to reap the benefits of new digital technologies and to boost innovation and productivity.

Figure 1.2. Productivity has started to accelerate but remains below the OECD average

Note: Panel A, productivity is defined as GDP per person employed. Panel B, OECD refers to simple average of its member countries.

Source: OECD, Productivity database; OECD, Labour Force Statistics database; and OECD, National Accounts database.

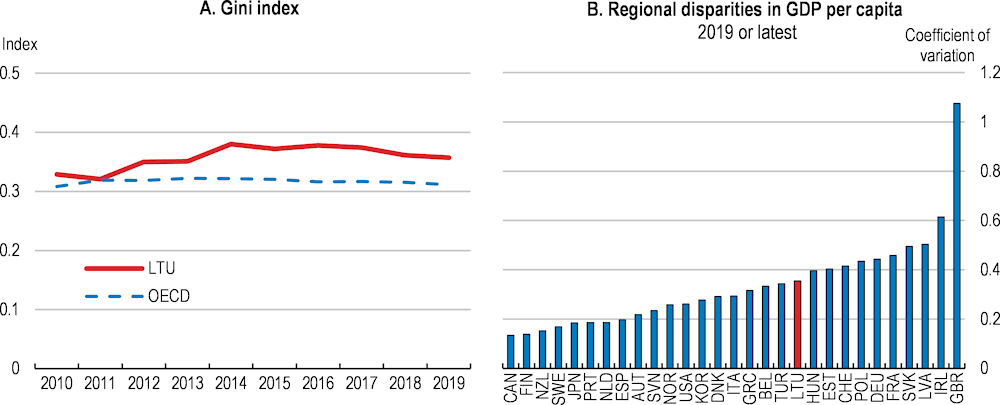

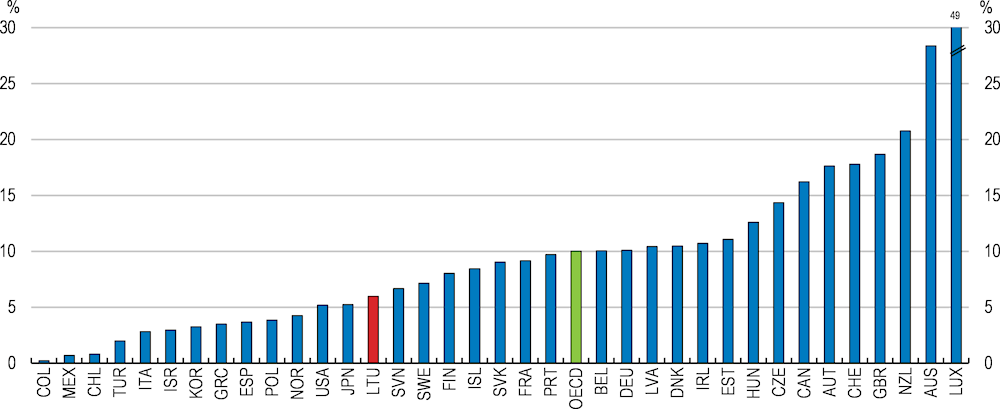

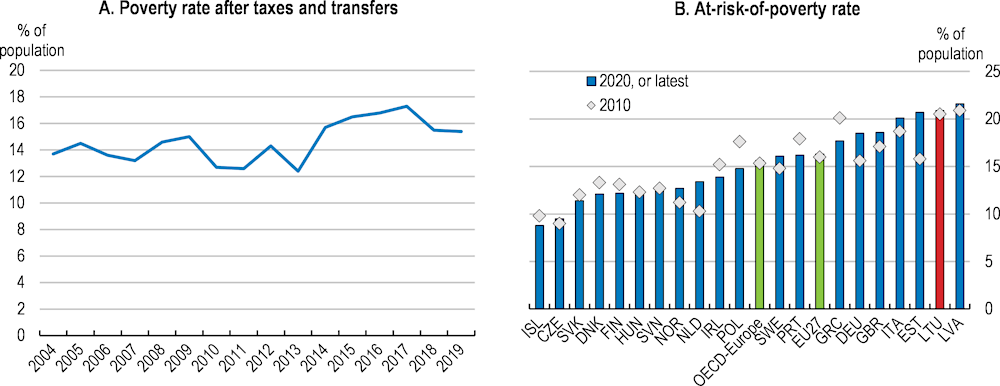

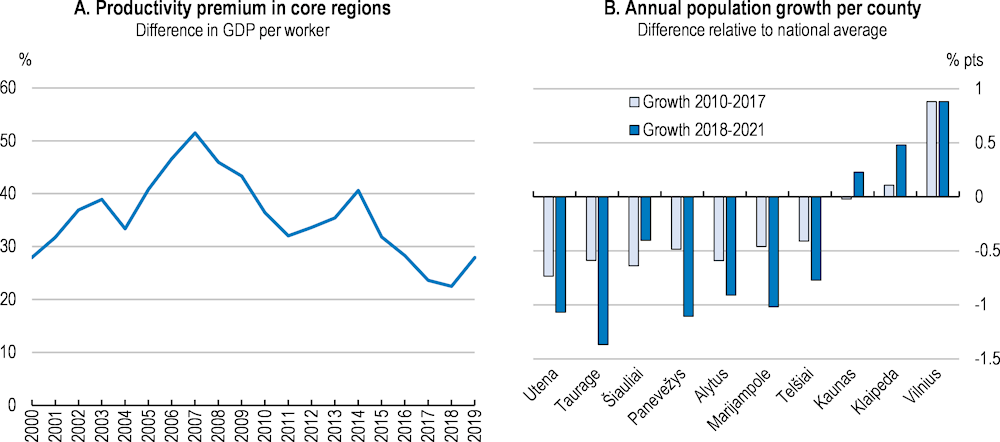

Lithuania still suffers from considerable social and regional imbalances. Income inequality remains high, as often seen in rapidly growing economies (Figure 1.3). Poverty has increased until a few years ago, although it recently started to decline. Old-age poverty is of particular concern. With the population ageing rapidly, the government will have to find ways to increase pension system adequacy while maintaining its sustainability. Differences in productivity and employment across regions are large despite the small size of the country. The government is reacting with resolve to social and regional disparities, though. The level and effectiveness of social spending are rising, and reforms of the institutional framework are underway, providing local governments with more power and resources to develop their own investment and growth policies.

Figure 1.3. Income inequality and regional disparities are relatively high

Note: In panel B, the coefficient of variation illustrates the relative dispersion of GDP per capita USD PPP at the lower regional level (TL3).

Source: OECD, Income Distribution database; and OECD, Regional Economy database.

Against this background, the Survey’s key messages are for Lithuania to:

Taking into account the impact of Russia’s aggression against Ukraine, strengthen energy independence; provide targeted support to vulnerable households and firms to help them cope with higher energy prices; and tighten fiscal policy at an appropriate pace to help adress inflationary pressures.

Continue structural reforms to raise productivity and employment, especially in the area of education and skills; address the fiscal costs of ageing; and reduce social and regional disparities further.

Foster digitalisation through more effective R&D support for businesses and by reducing barriers to technology adoption, especially among smaller firms, including through addressing regional gaps in digital infrastructure and improving access to finance, while accelerating progress towards digital government and strengthening digital skills.

The economy was booming until recently

The war in Ukraine exposes Lithuania’s vulnerability

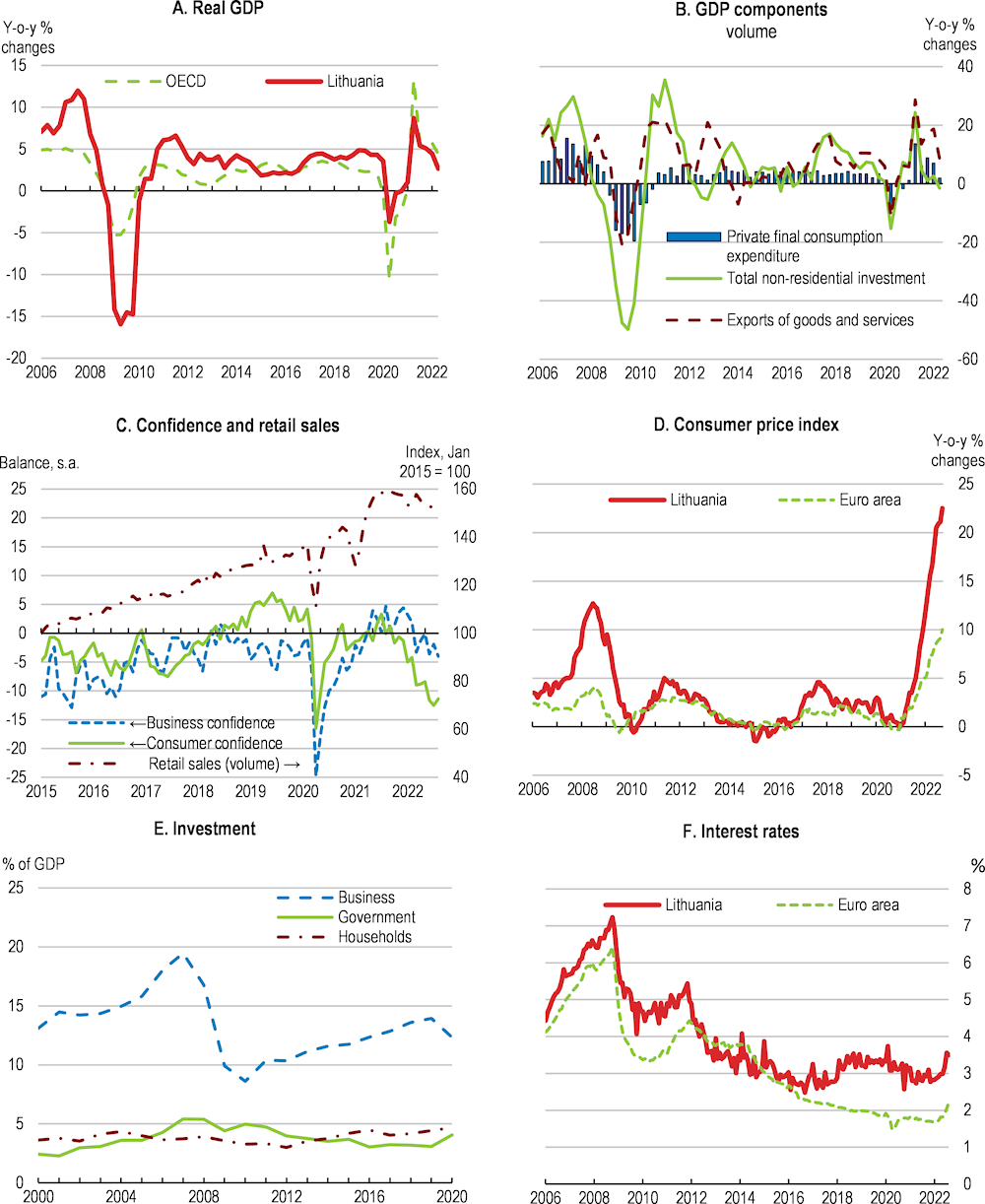

Lithuania’s economy has been one of the least affected by the covid-19 pandemic thanks to effective containment measures, a well-functioning health system and high vaccination rates. It was again growing fast until before Russia’s aggression in Ukraine (Figure 1.4). Output reached the pre-pandemic level already in early 2021 (Table 1.1). Economic activity remained solid in the first quarter of 2022, led by exports and housing investment and despite waning confidence and the outbreak of the war in Ukraine. Real GDP weakened however in the second quarter, contracting by 0.5% compared to previous quarter. Consumer confidence tumbled with the resurgence of COVID-19 cases in early 2022 and surging energy prices, but fast wage growth and some unwinding of savings prevented a larger contraction of private consumption. The unemployment rate had been gradually declining from a peak of around 9% in mid-2020 to 5.3 % in the second quarter of 2022, below its pre-crisis level. Fiscal policy has become expansionary, following a revised draft budget presented in April (see fiscal section).

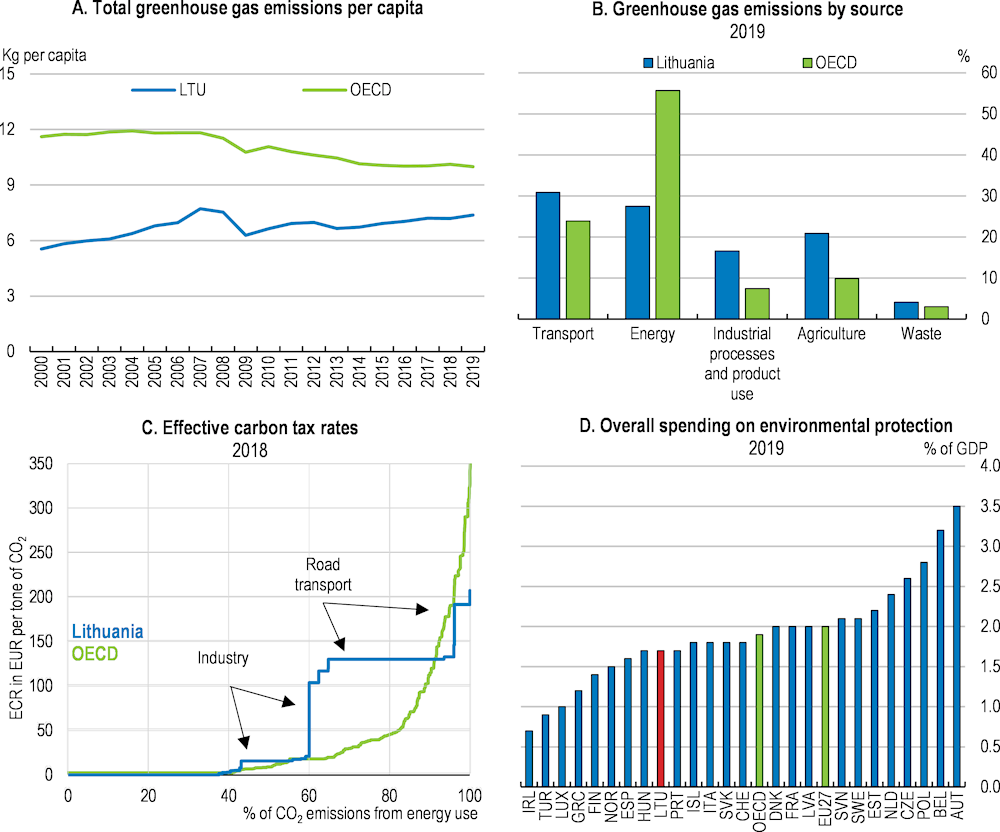

Consumer price inflation exceeded 22% in September 2022, the second-highest in the euro area, amidst soaring energy and food prices and, to a lesser extent, housing prices. Inflation would have been even higher if the government had not put a ceiling on energy price hikes. Relatively high energy intensity of the economy, energy inefficiency particularly in the housing sector (heating costs) and an excessive reliance on oil and gas – accounting for almost 80% of total energy production – account for the outsized impact of the energy price surge on headline inflation (Blöchliger and Strumskyte, 2020[2]). The comparatively large share of food purchases in the Lithuanian consumption basket works in the same direction. Strong domestic demand has facilitated the pass-through of cost increases to the prices of consumer goods and services, pointing at intensifying underlying price pressures. Export prices are rising more slowly than those of domestic inputs, suggesting that profit margins of export-oriented firms are being squeezed. Despite strong nominal wage growth, real wages started to decline from end 2021, keeping the risk of a wage/price spiral at bay so far. Even so, the high inflation rates point to the need for fiscal measures to mitigate the effect on domestic inflation of the European monetary policy stance calibrated for the euro area as a whole.

The economy is projected to slow to 1.6% in 2022 and 1.3% in 2023, affected by declining trade and increased uncertainty as the war in Ukraine, to which Lithuania is more exposed than most other OECD countries, takes its toll (Table 1.1). Investment, however, will gather pace during the projection period, supported by an inflow of EU funds and the government’s multi-year investment programme in several key areas. Lithuania will receive about 4.5% of 2020 GDP from the EU Recovery and Resilience Facility, around a third of which are expected to be spent by 2023. Headline inflation will decline but remain high due the EU embargo on Russian oil to take effect in 2023. Real wages will continue falling, albeit at a slower pace. The unemployment rate will rise because of the slowdown, although large skills shortages will keep labour market conditions tight.

Figure 1.4. The war in Ukraine has undermined an otherwise strong recovery

Note: Panel D, inflation data for September are provisional. Panel F, annualised rate on loans of less than, or equal to, 1 million euros to non-financial corporations (excluding revolving loans and overdrafts, convenience and extended credit card debt).

Source: OECD, National Accounts database; OECD, Main Economic Indicators database; OECD, Consumer Price Indices database; and ECB, MIR – MFI Interest Rate Statistics.

Table 1.1. Macroeconomic indicators and projections

|

|

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|---|

|

|

Current prices (EUR billion) |

Percentage changes, volume (2015 prices) |

||||

|

GDP at market prices |

45.5 |

4.6 |

0.0 |

6.0 |

1.6 |

1.3 |

|

Private consumption |

28.0 |

2.7 |

- 2.4 |

8.0 |

2.1 |

2.1 |

|

Government consumption |

7.5 |

- 0.3 |

- 1.4 |

0.9 |

0.7 |

0.3 |

|

Gross fixed capital formation |

9.5 |

6.6 |

- 0.2 |

7.8 |

2.7 |

3.8 |

|

Final domestic demand |

45.0 |

3.0 |

- 1.8 |

6.6 |

2.0 |

2.1 |

|

Stockbuilding1 |

- 0.3 |

- 1.6 |

- 1.8 |

- 0.3 |

- 0.2 |

0.0 |

|

Total domestic demand |

44.7 |

1.5 |

- 3.8 |

7.3 |

2.0 |

2.0 |

|

Exports of goods and services |

34.2 |

10.1 |

0.4 |

17.0 |

4.5 |

3.3 |

|

Imports of goods and services |

33.4 |

6.0 |

- 4.5 |

19.9 |

5.0 |

4.0 |

|

Net exports1 |

0.8 |

3.2 |

3.5 |

- 0.3 |

- 0.2 |

- 0.6 |

|

Memorandum items |

|

|

|

|

|

|

|

GDP deflator |

_ |

2.7 |

1.8 |

6.5 |

15.1 |

7.6 |

|

Harmonised index of consumer prices |

_ |

2.2 |

1.1 |

4.6 |

17.6 |

10.4 |

|

Harmonised index of core inflation2 |

_ |

2.3 |

2.6 |

3.4 |

9.8 |

7.8 |

|

Unemployment rate (% of labour force) |

_ |

6.3 |

8.5 |

7.1 |

5.8 |

6.5 |

|

Output gap (in % of potential GDP) |

_ |

2.1 |

- 1.4 |

0.8 |

- 0.5 |

- 1.7 |

|

Household saving ratio, net (% of disposable income) |

_ |

- 0.2 |

9.0 |

3.9 |

1.6 |

3.4 |

|

General government financial balance (% of GDP) |

_ |

0.5 |

- 7.3 |

- 1.0 |

- 4.2 |

- 3.6 |

|

Underlying primary fiscal balance (% of potential GDP) |

_ |

0.6 |

- 5.9 |

- 0.8 |

- 3.9 |

- 3.1 |

|

General government gross debt (% of GDP) |

_ |

44.5 |

55.5 |

51.4 |

52.8 |

55.1 |

|

General government debt, Maastricht definition3 (% of GDP) |

_ |

35.8 |

46.6 |

44.3 |

45.8 |

48.1 |

|

Current account balance (% of GDP) |

_ |

3.4 |

7.6 |

1.2 |

-4.5 |

-4.7 |

1. Contributions to changes in real GDP, actual amount in the first column.

2. Harmonised index of consumer prices excluding food, energy, alcohol and tobacco.

3. The Maastricht definition of general government debt includes only loans, debt securities, and currency and deposits, with debt at face value rather than market value.

Source: OECD Economic Outlook No. 111 database (updated).

The projections are subject to substantial uncertainty against the backdrop of the war in Ukraine and the sanctions on Russia (Table 1.2). Despite gradual decoupling over the past decade, Russia remains one of Lithuania’s most important trading partners, with Russia accounting for 11% of total goods exports and 12% of total imports in 2021 although re-exports make up a large part of that trade. Before Lithuania stopped importing all types of energy from Russia in spring 2022, its dependence on Russian energy was considerable, with 42% of natural gas and 73% of crude oil coming from Russia in 2020. Liquefied gas imported through the liquefied natural gas (LNG) terminal in Klaipeda is expected to bridge gas shortages until the end of the year. More severe sanctions on Russia and supply disruptions could dent growth further. Against this background, it is important to remain vigilant with respect to energy security and diversification.

Table 1.2. Events that could entail major changes to the outlook

|

Shock |

Potential economic impact |

|---|---|

|

Global energy supply disruptions |

Disruptions in global energy markets could lead to energy prices rising further, declining real household income and disruptions in energy-intensive sectors. |

|

New pandemic wave |

A new Covid-19 variant could affect the health status of the population – even if vaccinated - and hurt the economy. |

|

Financial market turbulence |

An increase in non-performing loans and a sharp correction in housing markets could cause financial duress. |

The labour market is recovering, but structural unemployment remains an issue

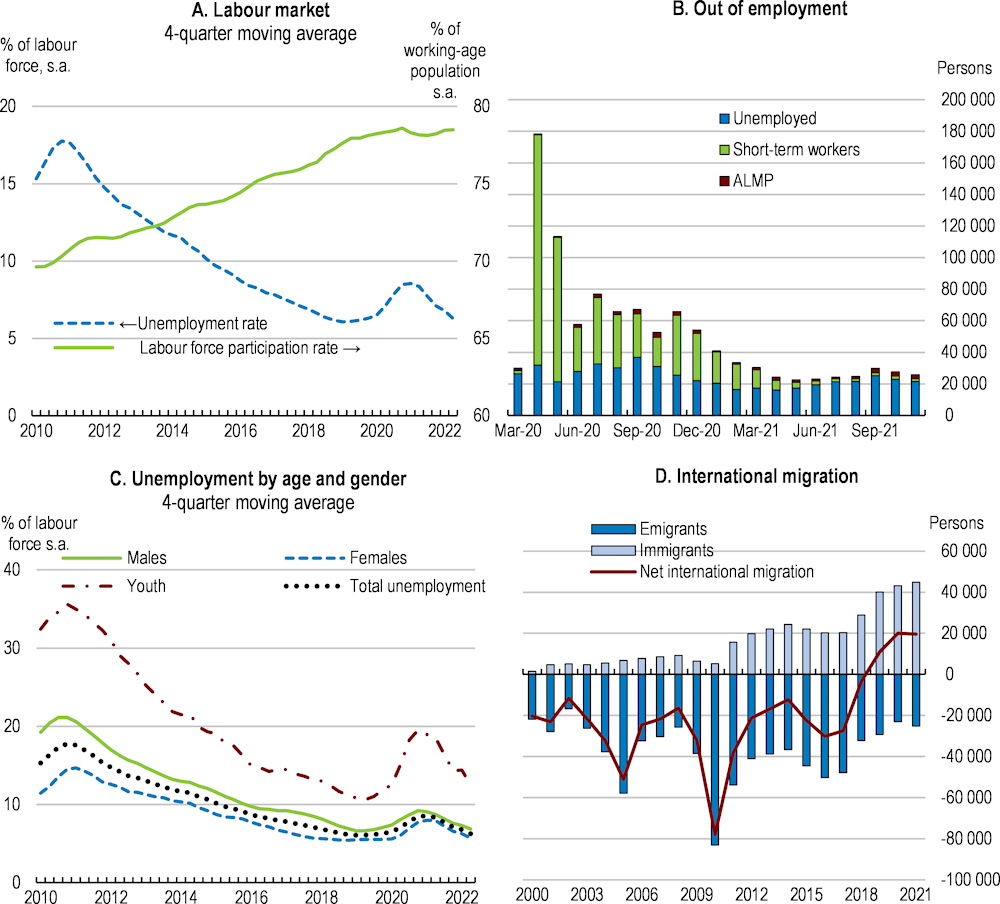

The labour market withstood the pandemic well, partly thanks to well-targeted government support (Figure 1.5). Unemployment stood below 7% in early 2022. The unemployment gap between men and women – unemployment has been traditionally higher for men – narrowed further during the pandemic and has virtually disappeared. The young, often working in contact-intensive service sectors, were disproportionally affected by pandemic-induced unemployment, and even though the gap is declining, youth unemployment remains above average. The short-term work scheme helped sustain most firms and jobs during shutdowns and other pandemic-related measures. When it was discontinued in 2021, unemployment hardly changed, pointing to an appropriate balance between the unemployment scheme protecting people and the short-term work-scheme protecting jobs (Giupponi, Landais and Lapeyre, 2021[3]).

Figure 1.5. The labour market is recovering

Note: Panel B, ALMP stands for active labour market policy.

Source: Eurostat, Labour Force Statistics; Statistics Lithuania; and Ministry of Social Security and Labour.

Lithuania’s labour market is flexible, adapting to evolving challenges, as documented in the 2018 OECD Economic Survey (OECD, 2018[1]). Workers are transiting from old to new jobs more rapidly than in most other OECD countries, contributing to the productivity and efficiency of Lithuanian firms and to cost competitiveness (Causa, Luu and Abendschein, 2021[4]). Labour market flexibility helps workers, especially young people entering the labour market, seizing better job opportunities and reducing wage inequalities, which might prove useful during the pandemic-induced structural shifts in the economy. Labour market participation continued to expand even during the pandemic, driven by a rising retirement age and rising immigration of skilled workers, both foreigners and returning Lithuanians. The spectacular turn in net migration over the past few years has likely been driven by rapidly rising living standards in Lithuania; a more welcoming immigration policy especially for high-skilled workers; an improving social climate; and the impact of Brexit, with many emigrants returning to their home country (Figure 1.5, Panel D).

Persistently high structural unemployment remains a salient feature of Lithuania’s labour market, though. Structural unemployment is estimated at around 6.5%, higher than in the surrounding countries and barely declining. According to the central bank, the relationship between vacancies and unemployment (“Beveridge curve”) has worsened during the pandemic, suggesting that the mismatch between available jobs and jobseekers has become even more acute. Labour market mismatch is largely driven by high skills mismatch - with many workers either under- or overqualified - and skills shortages, with high-skilled job offers often remaining unoccupied while low-qualified workers have difficulties in finding jobs. Against this background, Lithuania’s structural unemployment issues should be addressed by a framework that attracts, develops, upgrades and retains skills and brings them closer to labour market needs.

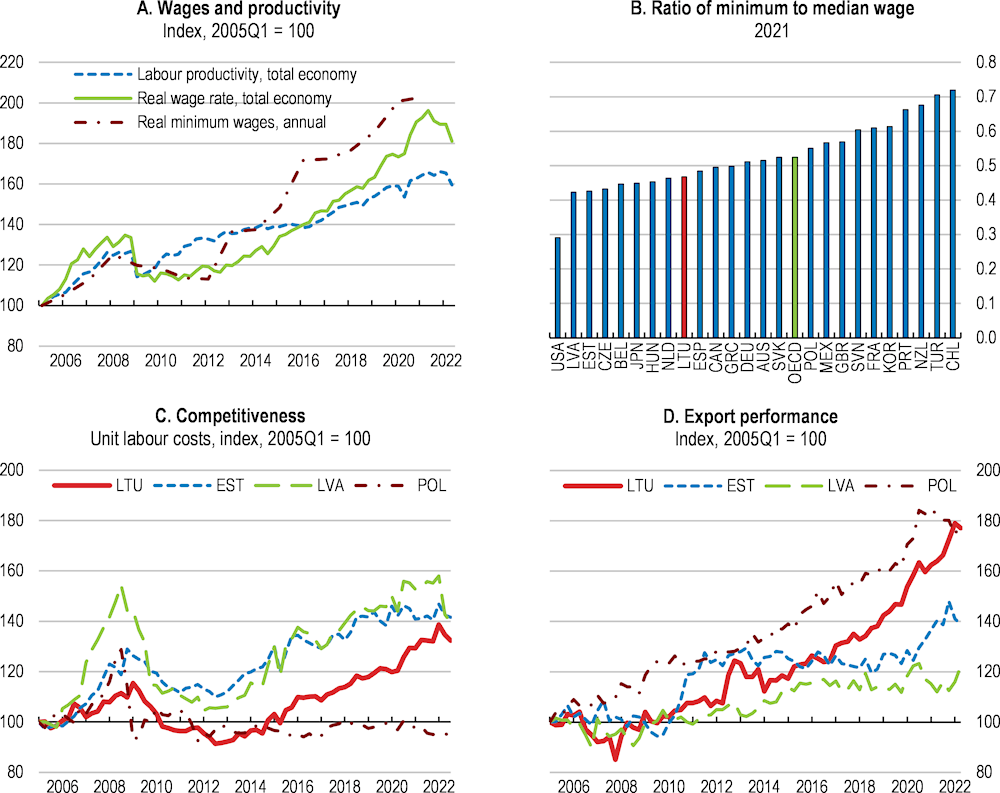

Competitiveness is declining

Lithuania’s competitiveness has declined vis-à-vis the OECD average, as measured by unit labour costs, although export performance – a measure for price and quality competitiveness - has improved (Figure 1.6). Lithuania’s labour productivity growth has accelerated to above the EU28 average but remains below leading European Union members or Central and Eastern European countries (National Productivity Board, 2020[5]). Aggregate real wages have consistently outpaced productivity since 2010, and the competitiveness gains achieved after the 2009 crisis are exhausted by now. Minimum wages accelerated even more, especially in the first half of the decade, with a potentially uneven impact on high- and low productivity regions in Lithuania, as shown in the 2020 OECD Economic Survey (OECD, 2020). Rising minimum wages likely helped reduce wage inequality and poverty, though. Moreover, the share of labour compensation in the total economy remains below that of the other Baltic countries.

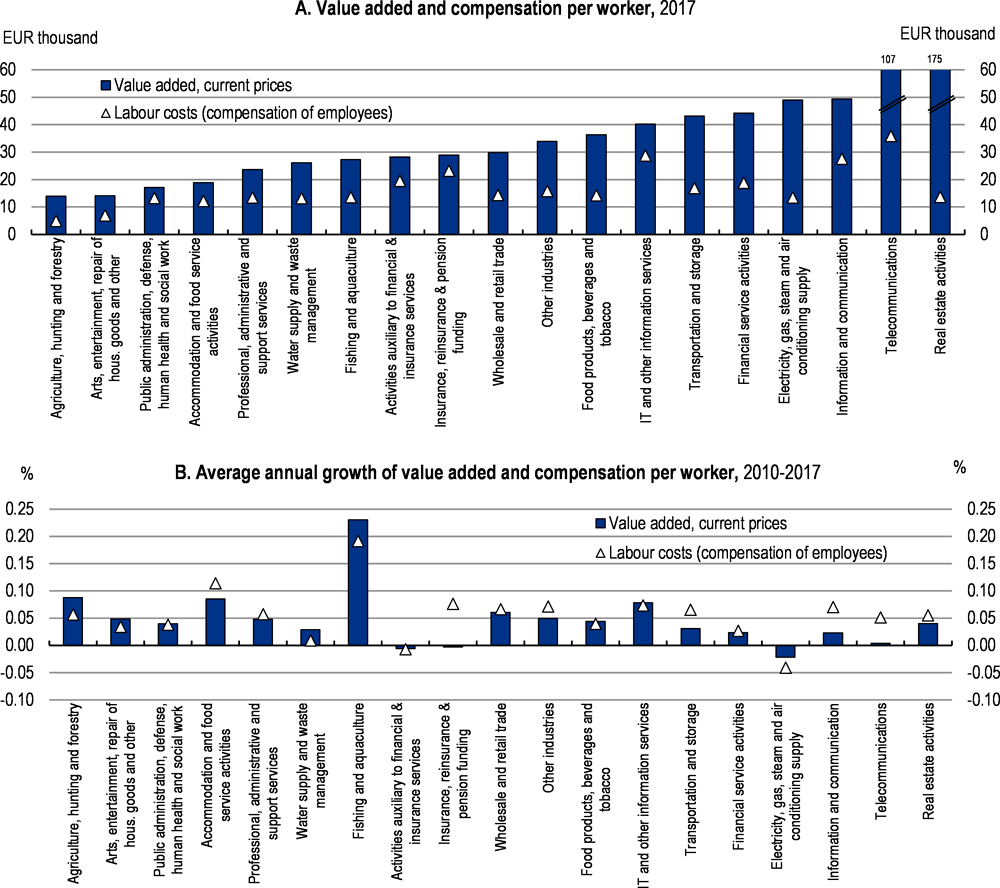

Growing wage pressure in the wake of rising inflation could dent competitiveness further. Productivity differences across sectors are large, and wage growth has exceeded productivity growth in most sectors over the past decade (Figure 1.7). Differences are particularly marked between the tradeable and the domestic sector, albeit with exceptions. The wide differences in productivity contrast with the narrower differences in wages. This pattern is typical for a small open and converging economy where wages are largely determined by the export sector, spilling over to the domestic sector where they are absorbed by either lower profit margins or higher prices. Imbalances would emerge if wage growth started to exceed productivity in the tradeable sector. Against this background, the way forward to avoid imbalances and further losses of competitiveness is to support productivity growth in both the tradeable and non-tradeable sectors through higher public and private investment, digitalisation, and reforms in the public sector, especially in education to better match skills to labour market needs.

Figure 1.6. Competitiveness is declining

Note: Panel A, wage growth is adjusted for income tax reform in 2019. Panel C, rising unit labour cost means declining competitiveness. Panel D, export performance reflects the growth of a country’s export markets compared to that of all other countries.

Source: OECD, Labour Force Statistics; OECD Economic Outlook No. 111 database (updated); and OECD, National Accounts database.

Figure 1.7. Productivity differs widely across sectors, but wages less so

External positions are sound

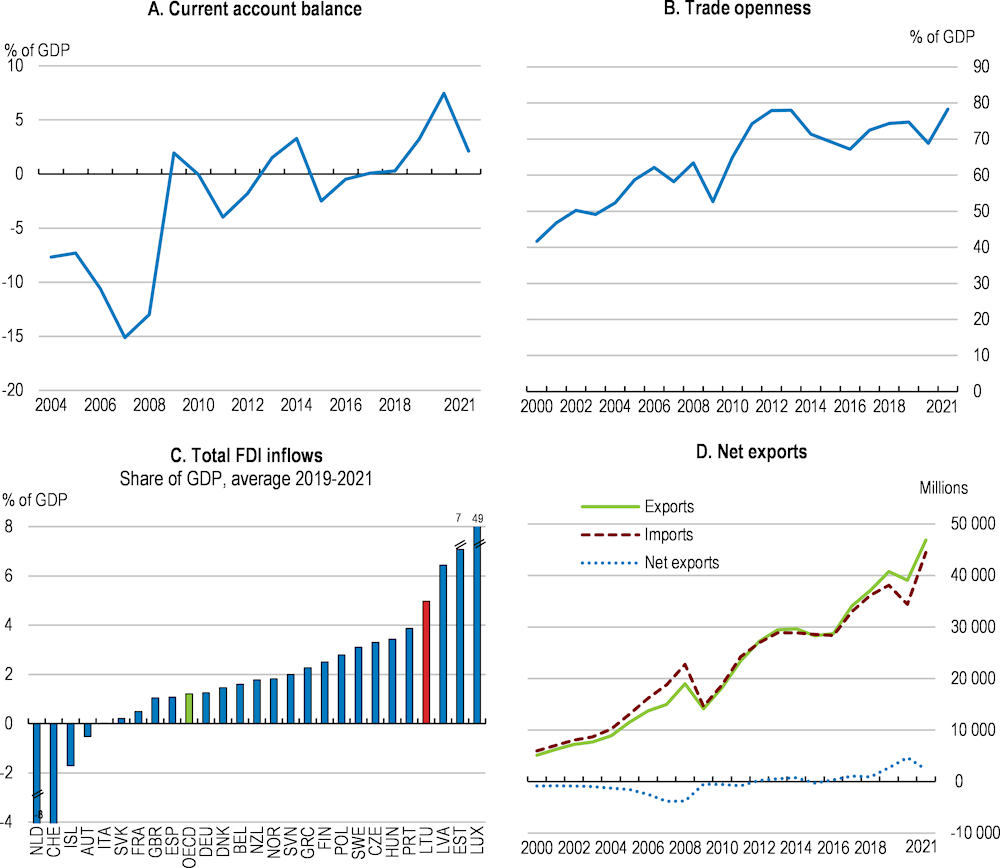

The current account surplus and net exports increased in 2020 as demand for Lithuanian goods and services withstood the pandemic-related restrictions (Figure 1.8, Panel A). The only export sector that suffered severely was international tourism – although it makes up a small a part of GDP - and transport services following disruptions in trade between Eastern and Western Europe. Foreign direct investment (FDI) has been expanding rapidly over the past few years, although the FDI stock remains low compared to other Eastern European OECD countries since an important activity of international firms in the past – setting up service centers - required little capital spending (OECD, 2018[1]). While trade openness declined a bit during the pandemic, Lithuania remains highly open to the world (Panel B). The war in Ukraine will impact both exports and imports, including international transport services, thereby reducing openness.

Figure 1.8. External positions are sound

Source: OECD, Balance of Payments statistics; OECD, National Accounts database; OECD, FDI Statistics; and OECD, Main Economic Indicators database.

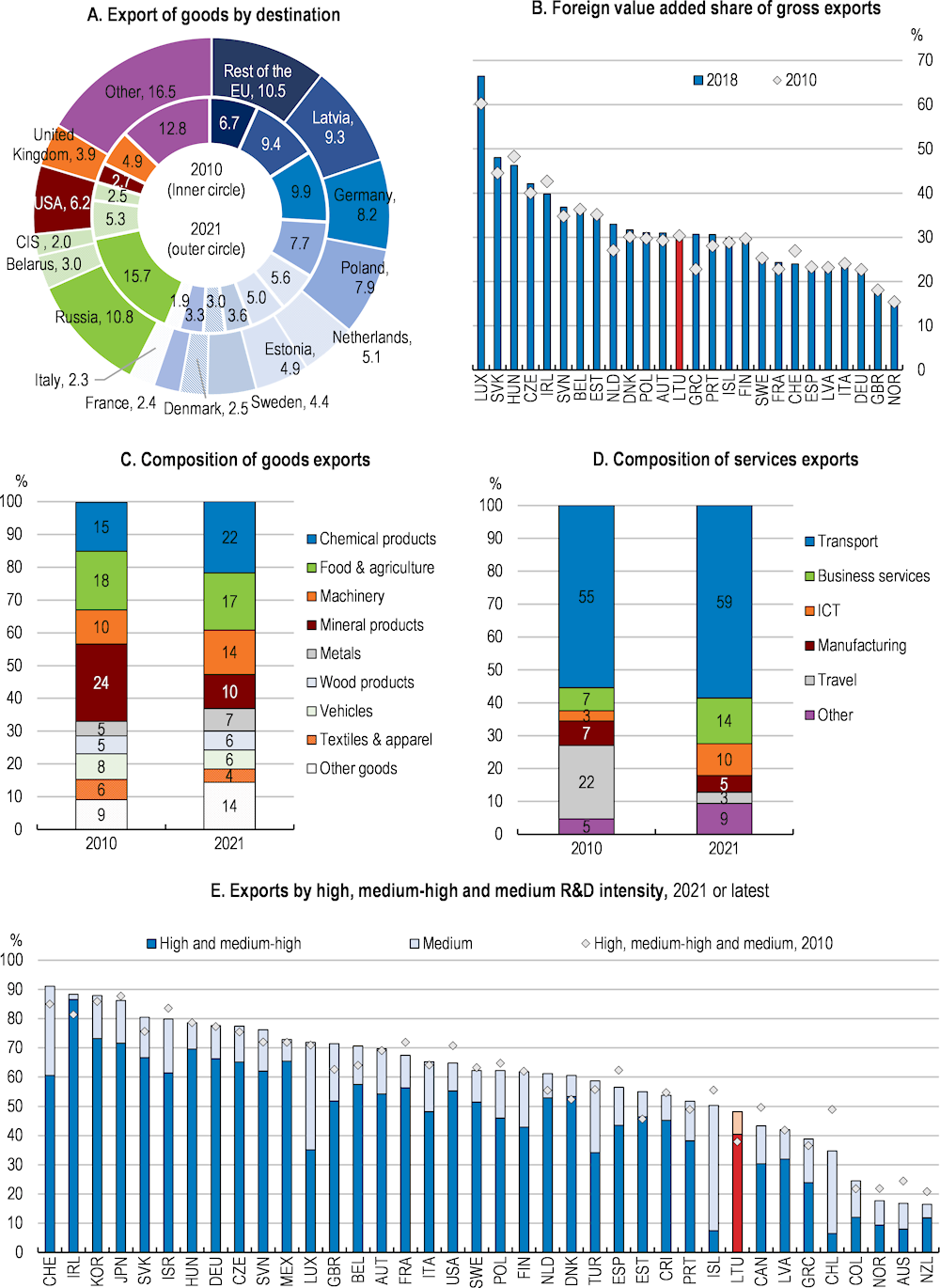

The destination of exports has changed considerably over the past decade or so, and Lithuania’s integration into global value chains has deepened (Figure 1.9). While Russia and other Commonwealth of Independent States countries made up more than 27% of goods exports in 2010 (and almost 100% in 1991), their share has declined to less than 23% by 2020. At the same time, exports to the United States rose from 2.7% to 4.4%. Asia also has become more important, with mainland China’s share growing from 0.7% in 2010 to 1.2% in 2020 and Chinese Taipei’s from 0.1% to 0.2%. An officially undeclared embargo of China on trade with Lithuania over a name dispute involving Chinese Taipei seems to have had little impact except for switching trade flows towards alternative markets, particularly South-East Asia and the United States. Lithuania increased the share of medium- and high-technology exports by more than any other OECD country, albeit from a relatively low baseline. While the country has become a cutting-edge exporter in life science, laser technology and some ICT sectors, the large share of transport services and agricultural products still weighs on domestic value-added. Since a higher export share and integration in global value chains is associated with firms becoming more resilient and productive (see thematic chapter), policies should help improve competitiveness of all sectors including transport and agriculture.

Figure 1.9. The composition of exports and their destination are evolving

Source: Statistics Lithuania; WTO, International Trade Statistics; and OECD Structural Analysis (STAN) database.

The large transport sector has economic and environmental implications. While transport is by far Lithuania’s single most important service export, its technology content and value-added is relatively low. Moreover, the European Union’s mobility package, putting limits on free carriage, risks affecting Lithuania’s transport companies which operate mainly across Europe, rarely touching Lithuanian soil. In addition, the east-west goods corridor could be subject to severe disruptions following the war in Ukraine and the sanctions on Russia. Finally, transport is the main driver of Lithuania’s high carbon emissions and air pollution. Against this background, Lithuania should strive for a rapid completion of the Rail Baltica project which will improve productivity of the transport sector, strengthen Lithuania’s international transport hub position between Western and Northern Europe and help reduce carbon emissions.

The financial system looks sound

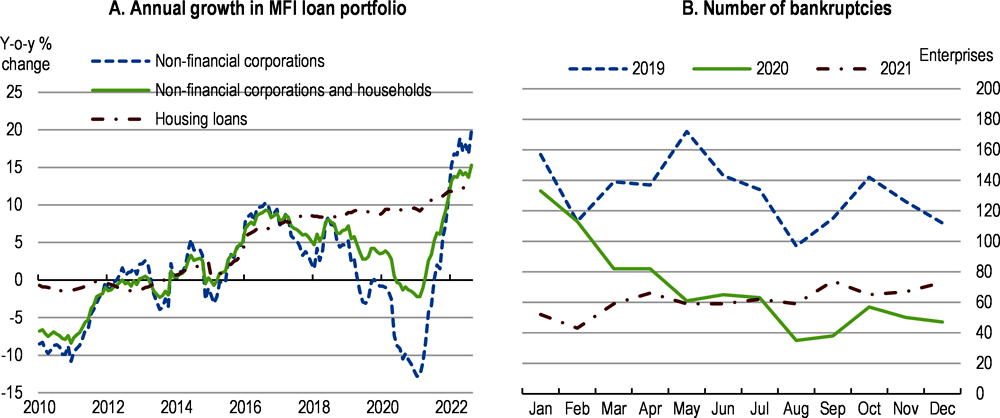

The financial system seems profitable, well capitalized and liquid. It has remained remarkably stable during the pandemic, with no apparent signs of imbalances. A robust and timely policy response helped provide liquidity to households and firms throughout the pandemic (OECD, 2020[6]). Household credit continued to grow almost unabated, while corporate credit took a hit and started to recover in the second half of 2021 only (Figure 1.10). As firms have deleveraged for years, corporate balance sheets look healthy, and insolvencies actually declined during the pandemic. Direct exposure to Russia is very small. The central bank tightened financial policies somewhat in early 2022 as the situation was normalising and some signs pointed at the housing market starting to overheat. In the absence of further pandemic-related restrictions to economic activity and given the potential emergence of financial imbalances, policies should help preserve the long-term resilience and stability of the financial system.

Figure 1.10. Credit growth has largely returned to trend and bankruptcies have been low

Banks seem well funded, but market concentration remains an issue

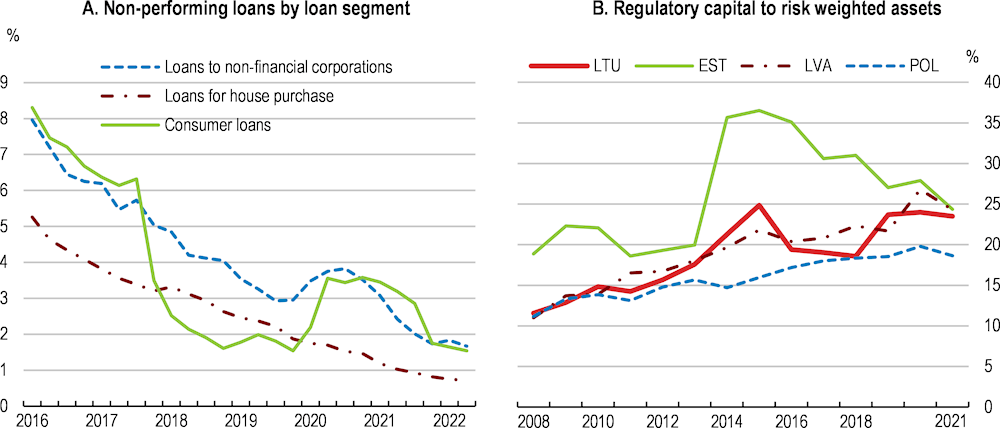

The banking sector looks financially sound. Capital adequacy ratios are well above the required minimum. The share of non-performing loans continued to decline during the pandemic despite a small surge of non-performing corporate and consumer loans. In April 2020, the central bank reduced the counter-cyclical capital buffer from 1% to 0%, where it has remained since, but introduced a sectoral systemic risk buffer of 2% for domestic mortgage loans in early 2022. Buffers should continue to be rebuilt through targeted macro-prudential tools or a rise in the counter-cyclical capital buffer if signs of persistent imbalances in particular sectors start to emerge, or macroeconomic risks materialize. The effectiveness of such levers could be limited, however, as liquidity and capital levels are well above current requirements (International Money Fund, 2021[7]) and a large share of housing purchases is financed through savings. In addition, macro-prudential tools could have an asymmetric impact across income groups and regions within Lithuania.

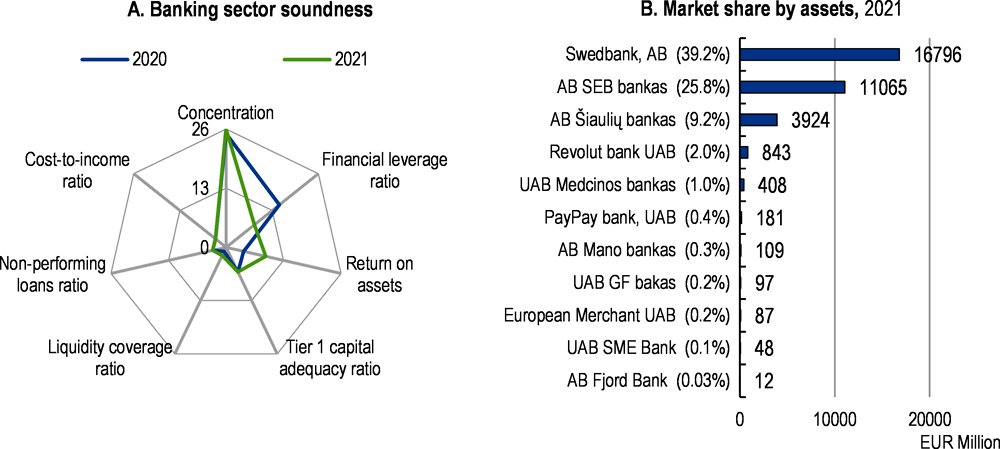

Figure 1.11. Banks are well capitalised

Lithuania’s banking sector remains highly concentrated and foreign-owned, with the three largest banks accounting for around 75% of overall assets (Figure 1.12). However, new financial institutions have sprung up since 2018, currently making up around 4% of assets and strengthening competition especially in payments and the consumer credit segment (Bank of Lithuania, 2021[8]). Lending to SMEs has recovered and the number of rejected loan demands has declined. Moreover, the share of SME lending from the non-banking sector, including crowdfunding, is increasing, suggesting that the credit market is gradually becoming more competitive and diverse.

A national investment fund (NPI) was legislated in 2019 and is currently being set up. Its purpose is to finance sustainable investment - in both the public and private sector - thought to be strategically important for the Lithuanian economy. The NPI is to consolidate four existing public investment funds and help harmonise investment strategies, financing models and risk management, thereby increasing leverage considerably. The NPI is expected to become operational by 2023. As recommended in the previous OECD Economic Survey, a rigorous governance framework is essential to avoid risky loans and the crowding-out of private finance (OECD, 2020[6]).

The authorities continue to step up anti-money laundering and counter-terrorist financing (AML/CTF) efforts and have substantially increased resources devoted to this end. As a result, the MONEYVAL expert group has rated Lithuania “largely compliant”, up from “partially compliant” (Moneyval, 2021[9]). Over the past two years, the central bank has been requiring more frequent and detailed AML/CTF data reporting and has increased the number of inspections. In May 2021, the Centre of Excellence in Anti-Money Laundering - a public-private partnership involving several government agencies, the central bank and commercial banks - started its activities. The centre acts as a platform for information exchange, research to improve the AML/CT framework and assistance to private sector entities in conducting internal risk assessments.

Figure 1.12. The banking sector is highly concentrated

Note: In Panel A, indicators reflect the ranking position in the European Union, with lower score indicating comparatively better performance, and higher score indicating comparatively worse performance.

Source: Bank of Lithuania.

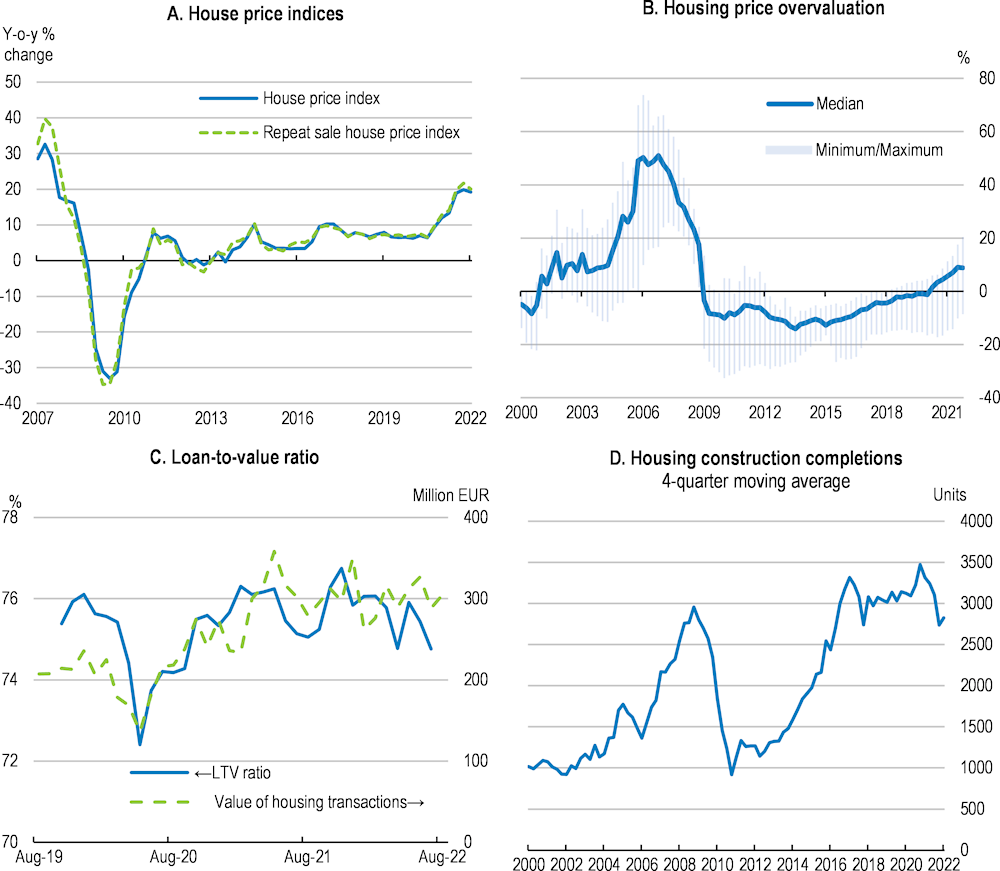

The housing market has been booming before the war

The housing market has continued to boom during the pandemic, and house prices have been rising fast before the war in Ukraine (Figure 1.13). Rapidly rising household income and credit, growing immigration including Ukrainian refugees and changing preferences for housing outside urban centres are among the reasons for high and rising housing demand. Surveys suggest that teleworking is set to endure, contributing to higher housing demand. Expectations of further house price hikes also seem to play a role. The phenomenon is broad-based, with prices rising in almost all parts of the country and for all types of housing. Construction remains strong, reflecting a relatively flexible housing market, although it recently declined in the capital area. Despite their upward trend, house prices seem to remain largely in line with fundamentals.

Against this backdrop, the central bank has taken several macro-prudential measures. The central bank has recently reduced the loan-to-value ratio for second loans from “less than 85%” to 70% and has introduced a systemic risk buffer of 2% for domestic mortgage loans. In the future, the central bank plans to address risks, if needed, with additional tools depending on the nature of developments on the housing market. Further tightening the macroprudential stance may be warranted should housing market developments start posing a risk to the financial system. To support the central bank in this area, the government could broaden the immovable property tax base, since a higher share of property tax in GDP is associated with less house price volatility (Blöchliger et al., 2015[10]).

Figure 1.13. The housing market has been booming

Note. In panel B, house price overvaluation is the median of six sub-indicators that assess sustainability of house prices: house price-to-income ratio; house price-to-rent ratio; HP-filtered nominal and real house price index; an indicator based on a disequilibrium model capturing the imbalance between fundamental and observed house prices; and a panel model estimating house prices and evaluating their deviation from market equilibrium prices. Vertical bars reflect the dispersion between minimum and maximum values of the six sub-indicators.

Source: Statistics Lithuania; and Bank of Lithuania.

The Fintech sector is expanding fast

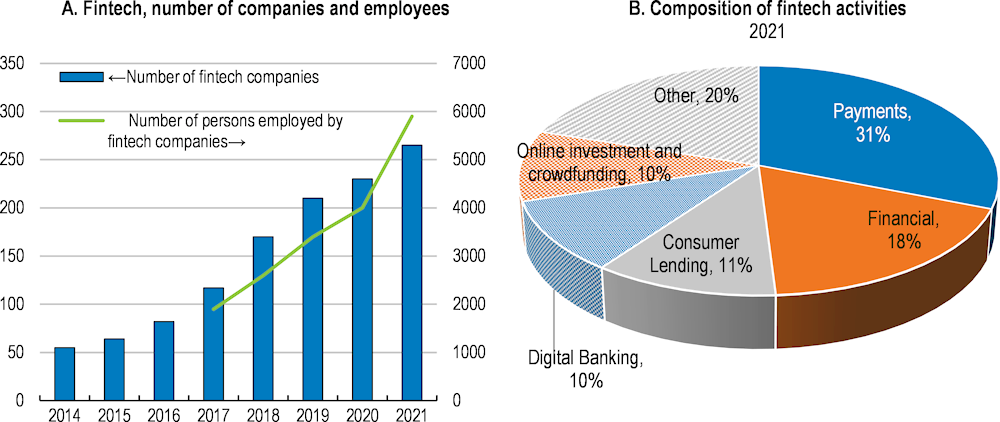

Lithuania’s financial technology sector (fintech) has become one of the largest in the European Union, having grown by 20% annually since 2016. By the end of 2021, it counted around 265 firms – both domestic and foreign - and 5 900 employees or around 0.4% of the labour force (Figure 1.14). Fintech started to take off in 2016 when several government institutions, including the central bank and the Ministry of Finance, implemented a coordinated strategy with a view to address excessive concentration and lack of competition in banking. A supportive regulatory framework with a transparent and well-communicated toolkit – including a regulatory sandbox, a blockchain sandbox and an enabling regulatory and licencing regime – helped the sector grow beyond traditional banking, now covering digital payment systems, crowdfunding and investment platforms, peer-to-peer lending platform operators, digital currencies and fast data analysis.

Figure 1.14. The fintech sector is rising fast

The authorities are well aware of the need for rigorous fintech supervision, including the AML/CFT framework and the promotion of cybersecurity and cyber-insurance. They have defined fintech guidelines covering four areas: ensuring fintech sector growth and maturity; promoting the use of digital financial services; promoting and using technological innovations; and strengthening risk management. The authorities seem to be well prepared for further fintech expansion. They remain aware of reputational risks and take a rigorous supervisory and enforcement approach to maintain financial stability. A potential registration of online banks with a non-resident business model will create new supervisory challenges, while the issuance of a digital collector coin will help gain experience with new fintech technologies.

To maintain fintech’s edge, the sector requires adequate regulation fostering competition and access to finance. While fintech innovations such as digital platforms tend to increase productivity, their beneficial effect for the economy depends on a functioning competition framework (Costa et al., 2021[11]). Fintech has been a boon to competition so far in Lithuania, yet the inherent characteristics of the sector can also make it prone to anti-competitive behaviour. Against this background, fintech should be more closely watched from the standpoint of access and barriers to entry. The financial market development center, established in the central bank in early 2022, is dedicated to attracting new financial services in Lithuania and strengthening competition in the banking sector.

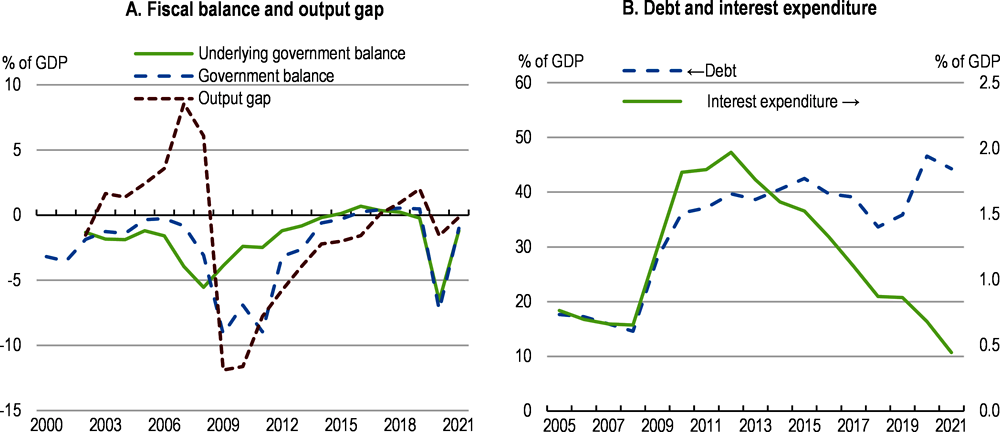

Fiscal policy: prospects for consolidation

After reaching a small surplus in 2019, the balance fell sharply to -7.4% of GDP in 2020 before recovering in 2021 (Figure 1.15). Public debt rose from around 36% of GDP in 2019 to around 46% in 2021, still lower than in most OECD and EU countries. Pandemic-related support, in particular the comprehensive and well-funded short-term work scheme, has been driving fiscal positions: netting out all discretionary covid-19 measures, the structural balance would have settled at around -1% of GDP in both 2020 and 2021, suggesting a timely and appropriate deployment and withdrawal of support measures (Ministry of Finance, 2022[12]). As such, the fiscal stance was highly expansionary in 2020 and became contractionary in 2021.

Figure 1.15. The fiscal position improved until the end of 2021

Note: Panel A, underlying government balance in percent of potential GDP.

Source: OECD Economic Outlook No. 111 database (updated).

The fiscal stance is becoming expansionary again in 2022. In early April the government presented a revised draft budget, allocating around 1.4% of GDP to help households and firms absorb energy price shocks, to increase energy efficiency and to diversify energy supply. A further 0.6% of GDP is dedicated to help Ukrainian refugees. To help households, pensions will be increased; the threshold for when the income tax kicks in will be lifted; and the means-tested heating compensation - increased already in December 2021 - will be expanded further to around 15-20 euro per month. Energy providers receive a compensation for lost revenue following capped energy prices for households. The programme is welcome, although it would be better to unwind energy price caps - as they tend to be costly and inefficient in the face of a supply shock - and increase targeted support to vulnerable households instead.

Before the war in Ukraine, the government had planned to return to the medium-term objective (structural deficit of minus 1% of GDP) rule by 2024, implying an improvement of the primary structural balance of around 1% per year. The stability programme 2022 published in May still echoes those targets. Various EU contributions planned to climb to around 3% of GDP annually will underpin public investment. Public debt was projected to remain at around 45% in 2024. Against the background of rising inflation and a still very expansionary euro area monetary policy stance, the government should tighten fiscal policy as originally planned to reduce demand, subject to additional support to vulnerable households and firms affected by the war and high energy prices.

Reforming the fiscal framework could strengthen sustainability

The fiscal framework has proved flexible during the covid-19 crisis, yet some institutional reforms could underpin the return to normal. The government is carrying out technical work to assess the possibility to introduce a debt target, which is welcome. Simplifying the budget balance rule – without amending its stringency - could also help make budgeting more predictable, as recommended in the previous OECD Economic Survey (OECD, 2020[6]). Finally, medium-term budget plans cover three years only, which is at the lower end of what is common in the European Union, and they should be extended to four or even five years to allow for better forward-looking fiscal policy. The government believes that amendments to the European Union’s fiscal framework will affect the national rules and wants to align national reforms with supra-national changes.

Spending reviews can help improve the efficiency and impact of public spending and keep expenditure under control. Following a budget reform adopted in 2021, the government has established the framework for spending reviews, including the methodology and the unit carrying out the reviews, and plans to carry out comprehensive spending review soon. Spending reviews should become a routine part of the budget process, especially in areas like education or health care where they could considerably help improve spending effectiveness. Spending reviews are now commonly used in OECD countries as part of performance budgeting, and the government should take inspiration from best practice, e.g. in the Nordic countries, the Netherlands or the United Kingdom (OECD, 2019[13]).

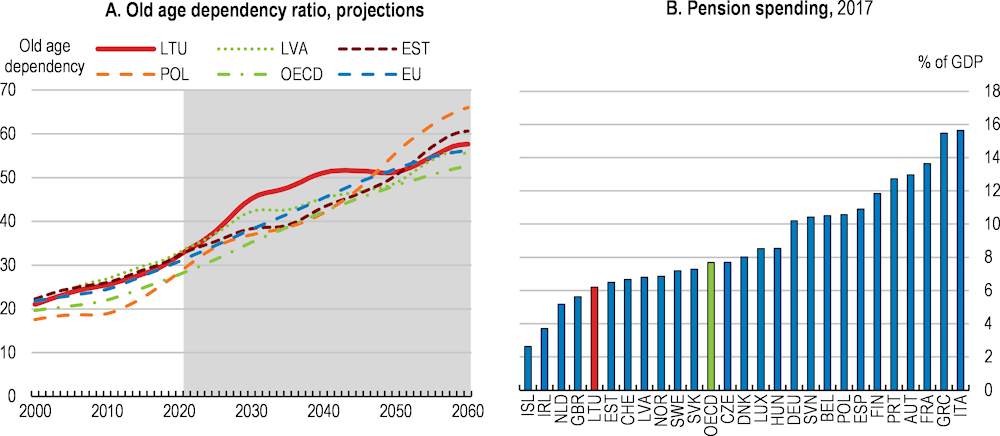

The fiscal costs of an ageing population will rise

Lithuania’s population is set to age rapidly (Figure 1.16). The old-age dependency ratio – the share of the population 65 years and older – is projected to almost double between 2020 and 2060. Past emigration of the young, as well as low immigration, contribute to ageing pressures, although the outlook has brightened recently with a spectacular turn in net migration. The old-age gender gap is one of the largest across the OECD: while women’s life expectancy is around average, men’s is among the lowest albeit rising rapidly. Older workers are well integrated into the labour market, but their incomes tend to be low and contributions to the pension system modest. The share of pension spending is one of the lowest in the OECD. The retirement age is currently rising by two months per year for men and four months for women until it will have reached 65 years for both sexes by 2026, maintaining pension sustainability so far.

Figure 1.16. Lithuania is ageing rapidly, putting pressure on pension spending

Note: The old age dependency ratio is the number of individuals aged 65 and more to the population aged between 15 and 64.

Source: United Nations, Department of Economic and Social Affairs, Population Division (2019). World Population Prospects 2019, Online Edition. Rev. 1; and OECD, Social Expenditure - Aggregated data.

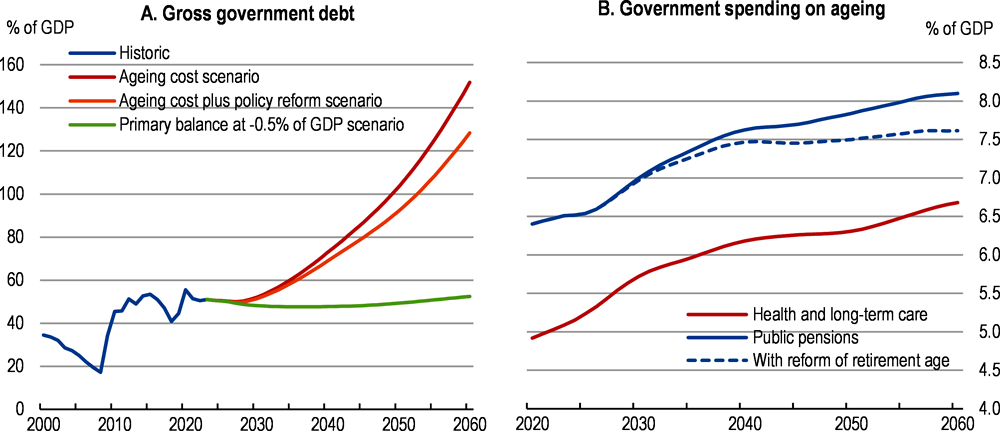

The government projects ageing-related fiscal costs, including for pensions, health and long-term care, to rise from 15.3% in 2019 to 17.6% of GDP in 2060 ( (Ministry of Finance, 2021[14])). Spending on health and long-term care is expected to contribute around 1.3 percentage points of that increase, and pension spending another percentage point. The relatively modest rise of projected pension spending can be attributed to a commendable “sustainability indicator” – like a balanced budget rule – that limits expansion of pension benefits to the growth of the economy-wide wage bill. To maintain sustainability, especially in the wake of several measures weakening the sustainability indicator, the government should consider establishing an automatic link between the retirement age and life expectancy beyond the year 2026, as recommended in the previous OECD Economic Survey ( (OECD, 2020[6])) and as practiced in several other countries (Box 1.2). Longer -run developments in health and long-term care should also be assessed. Recently the government mandated the OECD to develop a framework to improve the sustainability and adequacy of the long-term care system.

Box 1.2. Linking the retirement age to life expectancy: country experiences

Automatically adjusting the statutory retirement age to life expectancy is arguably the most effective means to maintain both sustainability and adequacy of a pension system. An automatic - or parametric - rule tends to adjust the retirement age in a less erratic, more transparent and more equitable way across generations than discretionary or ad-hoc changes. Moreover, introducing automatic adjustment might come at lower political cost than discretionary pension reform. Since an automatic adjustment to life expectancy needs a broad political consensus to remain viable after a change in government, its implications must be carefully assessed and debated. Public support for an automatic rule may increase if voters perceive it to be fair.

Altogether seven OECD countries (Denmark, Estonia, Finland, Greece, Italy, Netherlands and Portugal) link the statutory retirement age to life expectancy, with somewhat different parameters. The link is fully automatic in those seven countries except in Denmark, where parliamentary approval is required to activate the adjustment. Denmark, Estonia, Greece and Italy link their statutory retirement age one‑to‑one to life expectancy, meaning that a one‑year increase in life expectancy translates into a one‑year increase in the statutory retirement age. This parameter is two-thirds in the other countries, which keeps the share of adult life that people can expect to spend in retirement roughly constant and might hence have a broader appeal. In the Netherlands 2019 Pension Agreement, social partners and the government agreed to apply a two‑thirds automatic adjustment. Sweden is in the process of legislating an automatic two‑thirds link.

Source: (OECD, 2021[15]).

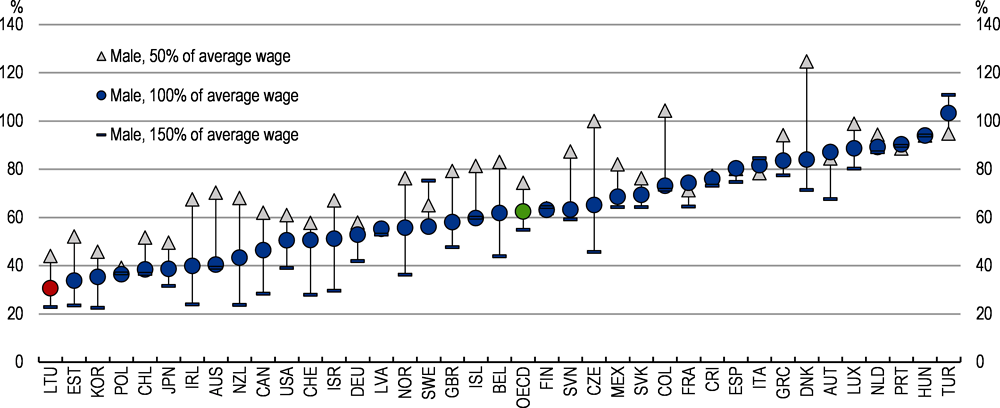

Although the pension system is quite redistributive – as replacement rates differ considerably between high- and low-income earners – it leaves many old people behind (Figure 1.17). Old-age poverty has increased over the past few years, often due to incomplete or informal work careers when Lithuania transited to a market economy, resulting in low pensions (the 2018 OECD Economic Survey provides an overview of the pension system). The government has reacted resolutely to the poverty challenge over the past two years, largely in line with the previous OECD Economic Survey recommendations (OECD, 2020[6]). First, the government raised benefits for pensioners with incomplete work careers; second, it increased social assistance pensions for those with low pensions; and third it will increase benefits for all if old-age poverty exceeds 25% and/or the current net replacement rate falls below 50%. However, options for early retirement were also extended, which weigh on the sustainability of the pension system, reduce work incentives and do little to reduce poverty. The measures, implemented from 2022, are expected to reduce the old-age poverty rate by around 2 percentage points overall.

Overall, Lithuania’s long-term debt scenarios depend on the implementation of structural reform, including an automatic link between retirement age and life expectancy (Figure 1.18). In a baseline scenario with the primary balance kept at -0.5% of GDP, debt will remain roughly constant at around 50% of GDP. Ageing costs, however, will make debt unsustainable, with age-related spending rising by 3.5% points until 2060 (from 11.3% to 14.8% of GDP), against the 2.3%-point increase projected by the government. Implementing the structural reforms described in Box 1.3 would improve debt sustainability but still fail to stabilise debt in the long term. The fiscal recommendations would improve the budget balance. Reform progress in the financial and fiscal domain is shown in Table 1.3.

Figure 1.17. Very low pension replacement rates could undermine inclusiveness

Replacement ratios for different wage levels, males, 2020

Note: The net replacement rate is the individual expected net pension entitlement divided by expected net pre-retirement earnings for a person having entered the labour market in 2020, taking into account personal income taxes and social security contributions paid by workers and pensioners.

Source: OECD, Pensions at a Glance 2021.

Figure 1.18. Ageing cost could make debt unsustainable

Note: Debt projections until 2026 follow the fiscal plan as published in October 2021. The baseline scenario assumes a primary balance of minus 0.5% of GDP and the age structure of the population remaining the same. The “ageing cost scenario” adds public health, long-term care and pension spending obligations on top of the baseline scenario. The “ageing cost plus policy reform scenario” reflects the positive growth effects of reforms shown in Box 1.5, subtracted from the ageing cost scenario. Based on Guillemette et al. (2017).

Source: OECD Economic Outlook No. 111 database; and OECD calculations.

Box 1.3. Quantifying fiscal policy recommendations

The following estimates roughly quantify the fiscal impact of selected recommendations within a 5-10 year horizon, using simple and illustrative policy changes. The reported effects do not include behavioural responses and growth effects.

Table 1.3. Illustrative fiscal impact of recommended reforms

|

Policy measure |

Impact on the fiscal balance, % of GDP |

|

|---|---|---|

|

Deficit-increasing measures |

||

|

Innovation |

Increase direct financial support from 0.025% to 0.1% of GDP (OECD average) |

-0.1 |

|

Deficit-reducing measures |

||

|

Retirement age |

Establish an automatic link between the retirement age and life expectancy beyond 2026 |

0.5 |

|

Value-added tax rates |

Raise the VAT rate for accommodation and restaurants from 9% to the standard rate of 21% |

0.3 |

|

Total fiscal impact |

0.7 |

|

Table 1.4. Past recommendations and actions taken in financial and fiscal policies

|

Recommendations |

Action taken |

|---|---|

|

Simplify the fiscal framework and establish a long-term debt target. |

Preliminary work to potentially establish a debt target is underway. |

|

Increase public investment against rigorous cost-benefit analysis. |

Public investment is increasing, and all national development programmes are subject to cost-benefit analysis. |

|

Ensure appropriate design for the planned public national development institution. |

A single national development institution is to be set up by 2023, by consolidating four existing sectoral development agencies. |

|

Increase local own-source revenues, in particular property taxes and development fees. |

The government plans to assign immovable property tax revenues fully to the municipalities. |

|

Introduce a carbon tax in sectors not covered by the European emission trading system, and reimburse at least partially the proceeds to households and firms. |

Legislation to include a CO2 component in excise duties on energy products is before Parliament. |

|

Remove environmentally damaging fuel subsidies. |

Legislation to reduce or abandon damaging subsidies is before Parliament. |

Spending quality has room to improve

Government spending accounts for around 43% of GDP, below the OECD average (Table 1.5). Spending increased considerably in recent years, not least because of pandemic-related support programmes, but also because of rising social benefits and public wage hikes in education and health. The Fiscal Council estimates that since 2015 public spending growth consistently exceeded growth of potential GDP, most often by a factor of two, and predicts spending obligations to continue to rise above GDP growth (Lithuanian National Audit Office, 2021[16]). Spending quality – i.e. the composition of spending across policy areas – is geared to foster more inclusive growth, with the share of spending on education slightly above the OECD average, spending on pensions and subsidies below, and social spending raising rapidly, especially on child and family benefits (OECD, 2020[6]).

Table 1.5. Composition of government spending and revenue, 2010 and 2020

|

General government expenditure (% of GDP) |

2010 |

2020 |

General government revenue (% of GDP) |

2010 |

2020 |

|---|---|---|---|---|---|

|

Total |

42.4 |

42.9 |

Total |

28.3 |

31.3 |

|

General public services |

5.1 |

3.5 |

Income taxes |

4.6 |

8.8 |

|

Of which: Interest payments |

1.8 |

0.4 |

Social security contributions |

11.6 |

10.4 |

|

Public order and safety |

1.8 |

1.5 |

Consumption taxes |

11.7 |

11.7 |

|

Economic affairs |

4.6 |

5.6 |

Property taxes |

0.4 |

0.3 |

|

Health |

5.4 |

5.9 |

|||

|

Education |

5.9 |

5.2 |

|||

|

Social protection |

15.9 |

16.3 |

|||

|

Others |

3.7 |

4.8 |

Source: Eurostat, Government Expenditure by Function dataset, and OECD, Global Revenue Statistics database.

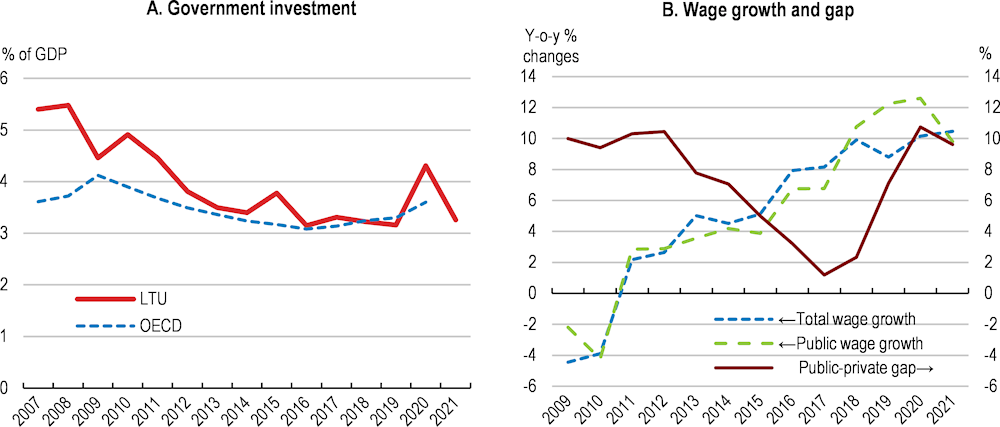

Public investment has been stepped up after years of neglect, as recommended in the previous OECD Economic Survey (OECD, 2020[6]). The government is increasing investment in digital and green infrastructure, health, social affairs, research and innovation, education, and public governance by around 1% points of GDP between 2021 and 2026, helped by the European Union’s “Next Generation” programme funds which cover around 80% of spending. These funds provide an opportunity to muster support around politically challenging structural reform, especially in education and health care where in the past rapidly rising public wages met with shy reform efforts (Figure 1.19). To improve productivity and the quality of the public finances in these sectors, the government should link investment to productivity-enhancing reforms such as the consolidation of the extensive school and hospital networks.

Figure 1.19. Public investment is rising, while public wage growth has stabilised

Note: In panel A. the wage growth is adjusted for tax reform in 2019.

Source: Statistics Lithuania; and OECD, Government at a Glance yearly database.

The tax base should be broadened

After several significant reforms to make taxation more efficient and equitable, the overall tax burden as well as progressivity of the tax system remain below the OECD average (Figure 1.20). Social security contributions remain high, discouraging work and encouraging informality, while income and property are taxed rather lightly. Consumption taxes are comparatively high. The VAT gap, i.e. the gap between actual and theoretical/maximum VAT collection, is declining but remains above the OECD average, reflecting both reduced VAT rates and informality.

Figure 1.20. Taxation is low and geared towards labour

The government’s plans to broaden the tax base go in the right direction. The government wants to reduce informality further by implementing 37 measures, especially digitalising the tax administration further, which is welcome. In addition, the government should again subject restaurants and accommodation to the standard VAT rate, which had been reduced during the pandemic to support this sector, as it has recovered. The government also has recently developed plans to broaden the base of the immovable property tax, currently considered a “luxury tax” yielding little revenue. To reduce the tax burden of low-income property owners, the government might consider introducing some progressivity into the system, either by introducing a progressive scale or by setting a property value threshold from which the tax kicks in. Finally, reducing social security contributions further and raising personal income taxes commensurately would help reduce the burden on labour and broaden the tax base.

Lithuania’s statutory business tax rate is 15%, below the OECD average of around 23%. Various tax incentives to foster investment and innovation reduce effective tax rates, although take-up is low (see thematic chapter). More generally, while tax incentives tend to have a positive effect on innovation, they likely favour incumbent firms at the expense of small innovative, credit-constrained start-ups (Box 1.4). Also, Lithuania’s policy mix is skewed: while tax incentives are generous, direct government support for innovation is tiny, with recent OECD research suggesting that a balanced policy of tax and direct support is more effective than reliance on tax incentives alone (Appelt et al., 2020[17]). Against this background, the government should thoroughly assess the effectiveness of tax incentives and consider increasing direct support for innovation, e.g. through grants or stronger collaboration with universities and schools, as in Germany, Switzerland or the Nordic countries.

Box 1.4. Tax incentives in Lithuania’s corporate tax system

Lithuania’s business (corporate income) tax framework provides several tax incentives to promote investment, research and development, and innovation. Incentives include enhanced deduction of R&D expenses; accelerated tax depreciation for R&D investment; a “patent box” regime; allowances for investment in “technological improvement”; free economic zones (“green channel”) where companies benefit from business tax relief for 10 years; and business tax holidays for up to 20 years for companies involved in large-scale investment projects. Small businesses are also supported through various business and personal income tax incentives encouraging entrepreneurship, such as reduced business tax rates or additional tax credits.

However, the take-up rate of the various R&D tax incentives is low. As a result, Lithuania actually spends only around 0.025% of GDP on R&D tax incentives, against more than 0.1% across the OECD. The various incentives seem to miss the trigger points of Lithuania’s catching-up economy involving many small, innovative start-ups. Credit-constrained innovative firms need funds as early as possible, but benefit from tax incentives only once intellectual property (IP)-related revenues materialise. Moreover, the patent box supports IP activities only if they lead to patents and copyrighted software, discouraging other forms of IP creation. Finally and unlike direct financial support, tax incentives do not address the key problem for innovative but risk-averse entrepreneurs, namely potential failure.

Source: Ministry of Finance.

Fostering decentralisation and local investment

Lithuania is one of the fiscally most centralised OECD countries, with local governments enjoying little tax and spending autonomy (Figure 1.21). The recurrent taxes on land and buildings are the only autonomous local taxes, yielding little revenue, although some limited autonomy is granted on the personal income tax. Municipalities rely on a fragmented system of intergovernmental grants that are conditional on narrowly defined investment purposes, thereby lowering spending effectiveness. Administrative capacity is considered weak. Coordination of investment projects between municipalities is poor, preventing economies of scale and scope. Stringent local fiscal rules limit municipalities’ capacity to borrow for investment purposes (OECD, 2020[18]). As a result, local investment largely relies on central government and EU funding, despite local budgets being in surplus in recent years.

The government has started to reform the intergovernmental fiscal framework. Reforms include the full assignment of the property tax to the municipalities, and a change in budgeting allowing municipalities to keep savings on transfers rather than having to return them to the central government. Moreover, the government plans a constitutional change allowing local governments more flexibility to borrow for implementing EU-co-funded projects. These reforms are welcome, but they could go further. For instance, providing some autonomy over income taxes; or overhauling the system of intergovernmental transfers could help municipalities to implement comprehensive and efficient investment projects (Box 1.5). More tax autonomy might have to be accompanied by effective equalisation as economic fortunes across local governments vary. The recently established regional development councils could play a larger role in governing supra-local investment projects.

Figure 1.21. Limited funding possibilities could explain low local public investment

Box 1.5. Encouraging local public investment: the cases of Ireland and Finland

Ireland and Finland provide some insights from opposite institutional angles - one centralised, the other decentralised - on how to promote local investment.

Ireland is even more centralised than Lithuania, yet has a strong tradition of integrated local investment funding. Comprehensive multi-annual planning and strong enforcement of policy priorities is one of the cornerstones of the Irish public investment-financing framework. In 2018, Ireland established a Rural and an Urban Regeneration and Development Fund, inspired by the EU structural funds’ competitive bidding process and matching requirements. Irish local governments are required to co-finance at least 25% of an investment project. Importantly, the funds are not bound by thematic or sectoral conditionality and hence allow for targeted and tailor-made local investment.

Finland is highly decentralised, with local government tax autonomy well above the OECD average. Finland’s municipalities also enjoy large discretion to borrow and spend, within a set of tightly enforced national fiscal rules. Incentives for productive local investment are high since returns accrue to the municipality in the form of higher personal or corporate income tax revenues. Cooperation between municipalities is extensive since joint projects offer mutual gains in the form of scale and scope economies. Borrowing costs are low as municipalities have strong incentives to remain solvent. Two municipally-owned financing and guarantee funds provide additional oversight on the sustainability of municipal finances.

Both Ireland’s integrated funding model and Finland’s high tax autonomy model may provide inspiration for Lithuania on its way towards a more effective intergovernmental fiscal framework.

Source: (OECD, 2020[18]).

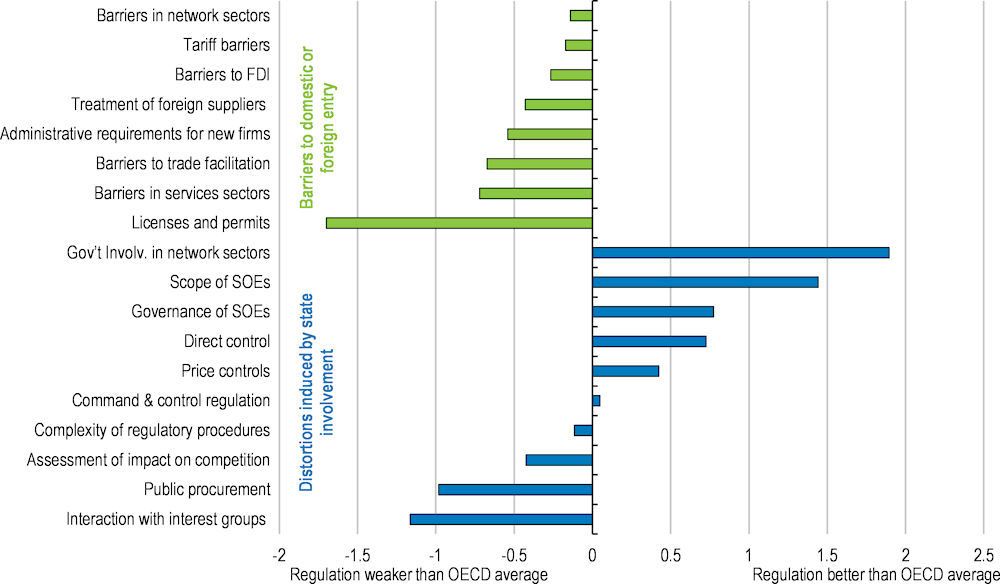

Reforms to improve the business climate

The business climate is friendly, with regulation stringency mostly below the OECD average, supporting domestic business and helping to attract foreign firms (Figure 1.22). In particular, market entry is highly facilitated, and the regulatory and administrative environment for small and innovative start-ups is favourable. Recent reforms, including a change to the Constitution, also eased restrictions to non-residents in areas such as legal services and land acquisition, although some barriers in these areas remain. Based on a “one-in, one-out” regulation principle, the government continues to aim at reducing compliance cost, facilitating the licencing procedure for businesses in sectors such as health care and reducing the number of areas where licencing is required at all. The only area with a less-than-average quality regulatory environment is that of state-owned enterprises. Reforms could help raise GDP per capita by up to 5% (Box 1.6). Reform progress is shown in Table 1.7.

Figure 1.22. The business climate is friendly, yet the state is active in many sectors

Product market regulation, gap vis-à-vis the OECD average

Note: Negative values reflect less stringent and positive values more stringent regulation. Green bars belong to the high-level indicator “Barriers to domestic and foreign entry”, while blue bars belong to the high-level indicator “Distortions induced by state involvement”.

Source: OECD, Product Market Regulation database.

Box 1.6. Quantification of structural reform

Selected reforms proposed in the Survey are quantified in the table below, using simple and illustrative policy changes and based on cross-country regression analysis. Other reforms, including in the areas of education or environmental policy, are not quantifiable under available information or given the complexity of the policy design. Most estimates rely on empirical relationships between past structural reforms and productivity, employment and investment, assuming swift and full implementation, and they do not reflect particular institutional settings in Lithuania. Hence, the estimates are merely illustrative, and results should be taken with caution.

Table 1.6. Potential impact of structural reforms on per capita income

|

Policy |

Measure |

10 year effect on GDP per capita, % |

Long-run effect on productivity, % |

|---|---|---|---|

|

State ownership |

Reduce public ownership and improve SOE governance to reach OECD average |

1.2 |

|

|

Regulation |

Fully separate companies owning the railway infrastructure from those operating trains |

0 to 0.6 |

|

|

Education and skills |

Improve PISA outcomes to reach the OECD average (500) |

3%-7% |

|

|

Retirement age |

Link retirement age one-to-one to life expectancy |

1.6 |

|

|

Innovation |

Increase support for business innovation from 0.025% to 0.1% of GDP |

0.2 |

|

|

Public integrity |

Improve control of corruption by 0.2 indicator points to reach the EU average |

0 to 1.5 |

Note: The following recommendations are included in the fiscal quantification, but their impact on GDP cannot be quantified: lower social security contributions against higher income taxes; increasing the VAT rate on accommodation and restaurants to reach the standard rate. Consolidating the school network will help rise PISA scores, in turn helping to raise long-term productivity.

Source: OECD calculations based on (Égert and Gal, 2017[19]) and (Egert, de la Maisonneuve and Turner, 2022[20]).

Table 1.7. Past OECD recommendations on structural policies

|

Recommendations |

Action taken |

|---|---|

|

Strengthen the governance of state-owned enterprises further. Sell to private investors if no compelling reasons for public ownership exist. |

Several SOEs have been transformed into limited stock companies. |

|

Facilitate access of private providers to the rail network. |

Rules governing access to the rail network have been amended. One private good and passenger company is now operating. |

|

Improve the governance of the innovation system by strengthening coordination and by consolidating agencies. |

Consolidation of innovation agencies is underway. |

Making public enterprises more productive

Public, or state-owned enterprises (SOE) are active in many areas, and the quality of their governance needs to improve further (Figure 1.22). Lithuanian SOEs are concentrated in the network industries such as energy and transport but are also active in agriculture, forestry and financial services. Around half of SOEs only (18 out of 33) reach the financial targets set by the supervising authorities, similar to earlier years, although the pandemic might be partly responsible for weaker results (Governance coordination centre, 2021[21]). Municipal SOEs in particular lack a transparent regulatory and governance framework, potentially distorting competition with private providers and exerting a burden on local economies (Lithuanian National Audit Office, 2021[22]). OECD-wide, the strength of SOE governance is positively associated with corporate efficiency (Égert and Wanner, 2016[23]).

Over the past few years, the government has substantially strengthened the public ownership strategy, reformed the SOE governance framework, and reduced the number of SOEs by two-thirds, which is welcome. At the end of 2021, it specified plans to convert all SOEs, including Vilnius airport, inland waterways and Klaipeda port into (state-owned) limited or public companies, thereby abandoning special legislation for these entities by 2024. The number of SOEs is planned to be reduced further, either by privatisation or mergers. The government should also turn its attention to the municipal sector, particularly in view of the planned strengthening of municipal fiscal capacity (see above). All public undertakings should be bound by the same legal, financial and regulatory framework as private firms.

Transport regulation should improve further

The regulation of transport – by far Lithuania’s largest service export - has improved, partly by addressing long-standing issues of a blatantly anti-competitive stance in the railway sector. The government has eased access for private operators on the rail network over the past two years, especially by reforming the “priority rule” which had unduly favoured the incumbent public railway company. Following the infrastructure management reform, one private company started to offer both freight and passenger transport services besides the state-owned operator. Even so, in May 2022 the competition authority raised concerns about the working of the new priority rules and urged the Ministry of Transport to grant more equal access to the rail infrastructure. The competition authority also found that the concession rules for bus companies providing regular passenger services restrict competition and impede the entry of new market participants. Given the inherent risk of anti-competitive behaviour in the network industries, the government should continue to reduce barriers to entry in the transport sector to raise productivity.

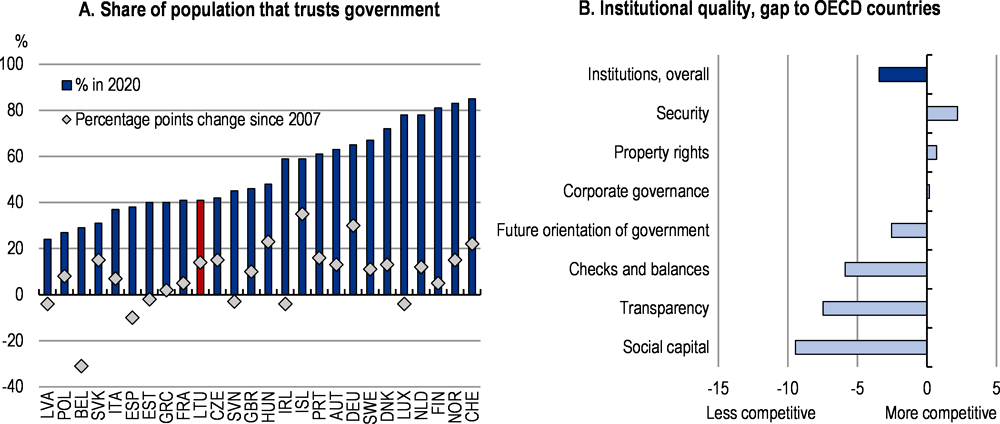

Trust, corruption and quality of institutions

Surveys and polls suggest that the share of Lithuanian citizens trusting their government is below the OECD average (Figure 1.23, Panel A). In the same vein, both the responsiveness of political institutions to citizens’ demands and satisfaction with the political process is considered poor, although they remain above the Central and Eastern European average (OECD, 2021[24]). Institutional quality is below the OECD average, especially with respect to political organisation, transparency and social capital (Panel B). Lower institutional quality is associated with less trust (Prats and Meunier, 2021[25]). Low trust may reduce the effectiveness of economic policy making when success of policy reform depends on citizens’ compliance, buy-in and participation. Improving communication with citizens, curbing rampant legal inflation, improving the design of laws and regulations, and fostering an evidence-based decision-making culture across government agencies could help improve institutional quality and citizens’ trust in government (OECD, 2021[26]). The government has made a better policy-making process one of its priorities.

Figure 1.23. Trust in government and institutional quality are low

Source: OECD, Government at a Glance - 2021; and World Economic Forum, Government Competitiveness Index 4.0.

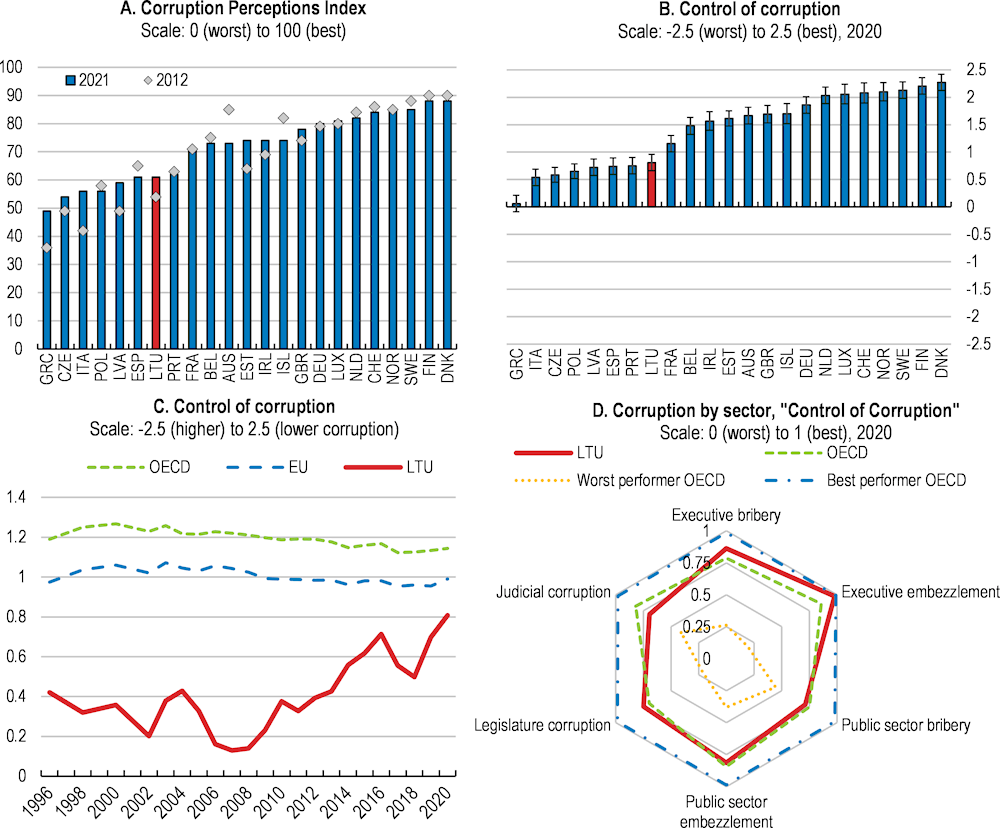

Lower trust and institutional quality tend to be associated with higher levels of corruption. Indicators of control and perceived risks of corruption suggest that Lithuania performs below the OECD average, although the gap has ostensibly been narrowing over the past 15 years (Figure 1.24). According to the authorities, personal experiences of corrupt practices – such as bribes in the health care sector or in public procurement – have become rarer, and no case of foreign bribery has been recorded since 2020. The government continues to implement measures to improve integrity. Since January 2022 amended legislation is promoting an anti-corruption environment; embracing measures to prevent corruption; raising anti-corruption awareness; and ensuring the reliability of staff. Moreover, in February 2022, an updated version of the whistle-blower protection law entered into force, establishing higher standards of protection in both the public and private sectors.

Figure 1.24. Corruption seems on a downward trend

Note: Panel B shows the point estimate and the margin of error. Panel D shows sector-based subcomponents of the “Control of Corruption” indicator by the Varieties of Democracy Project.

Source: Panel A: Transparency International; Panels B & C: World Bank, Worldwide Governance Indicators; Panel D: Varieties of Democracy

Institute; University of Gothenburg; and University of Notre Dame.

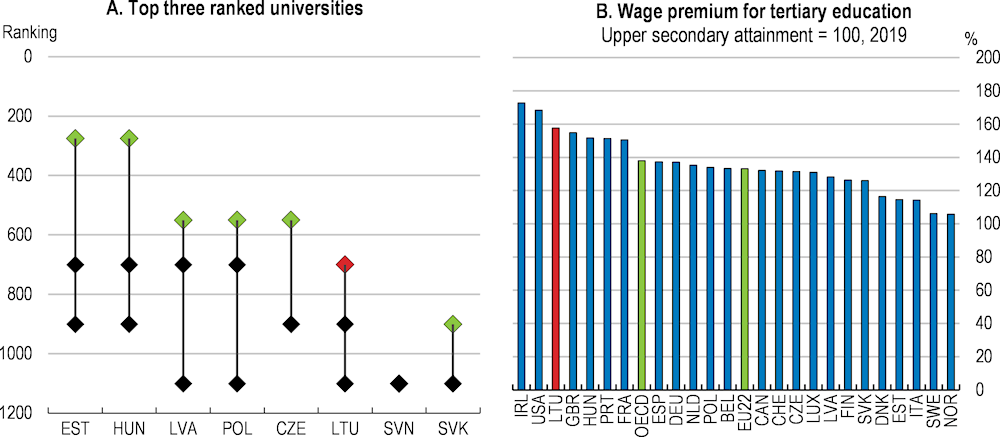

Improving education to raise skills and productivity

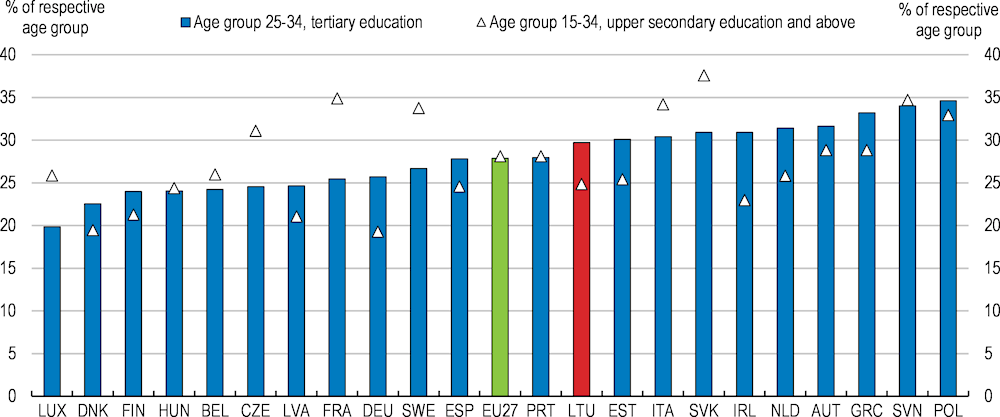

High-quality education can help raise human capital and productivity in the long term (Egert, de la Maisonneuve and Turner, 2022[20]). In Lithuania, education outcomes and skills are comparatively poor, and skills mismatch is considerable, although it declined over the past few years (Figure 1.25. Government spending on education is below the OECD average and skewed towards maintaining an extensive infrastructure that often fails to reach critical mass. Education is focused on the general rather than the vocational track, resulting in labour market imbalances as many graduates are not well matched to their jobs (OECD, 2021[27]).

Figure 1.25. Skills mismatch is considerable

Horizontal skills mismatch, 2020

Note: Horizontal skills mismatch is calculated as the sum of under- and overqualification of those in a job, having successfully completed the highest level of education within the past 15 years.

Source: Eurostat, Experimental Statistics database.

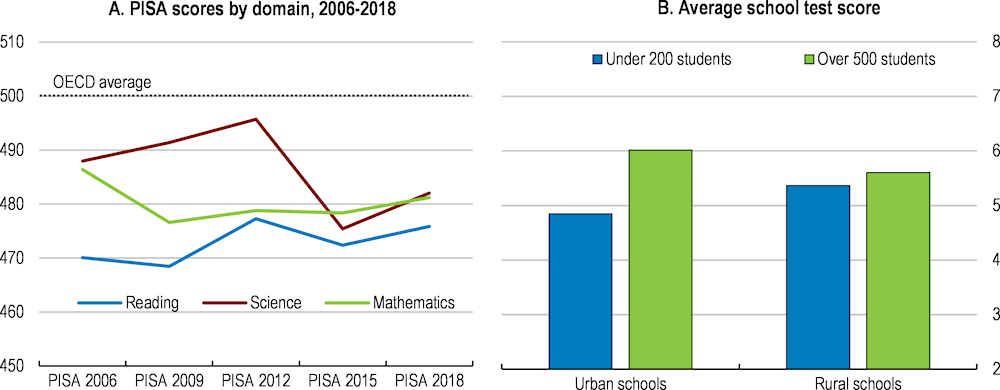

PISA outcomes are improving but remain below the OECD average

The quality of compulsory education as measured by PISA hovers below OECD averages and varies a lot across regions and schools (Figure 1.24). Reasons for weak performance include an excessive network of too many small schools; low teacher competencies with almost no remuneration for experience and excellence; and an inadequate curriculum (OECD, 2021A, 2021B). Recent OECD research suggests that PISA results are strongly associated with adult skills and productivity: persistently higher PISA scores close to the OECD average would be associated with a 3% to 7% increase in the level of multi-factor productivity, although this would take many years to materialise (Egert, de la Maisonneuve and Turner, 2022[20]).

The government has started a primary and lower secondary education reform in 2021, by developing a new teacher competency framework with better career opportunities, increasing wages for head teachers, adapting the curriculum towards more clearly defined basic skills and increasing minimum school and class size. These reforms are welcome and in line with recommendations in earlier OECD Economic Surveys. The government should continue reforming the school network as school size is an important factor determining the quality of education and interaction of children with peers (see also thematic chapter).

Figure 1.26. Compulsory education is improving but outcomes depend on school size

Note: Panel B: test scores are taken from standardised exams circulated to Grade 10 students and are scaled from one to 10.

Source: OECD, PISA 2018 database; Ministry of Education, Science and Innovation; OECD Economic Survey of Lithuania, 2020.

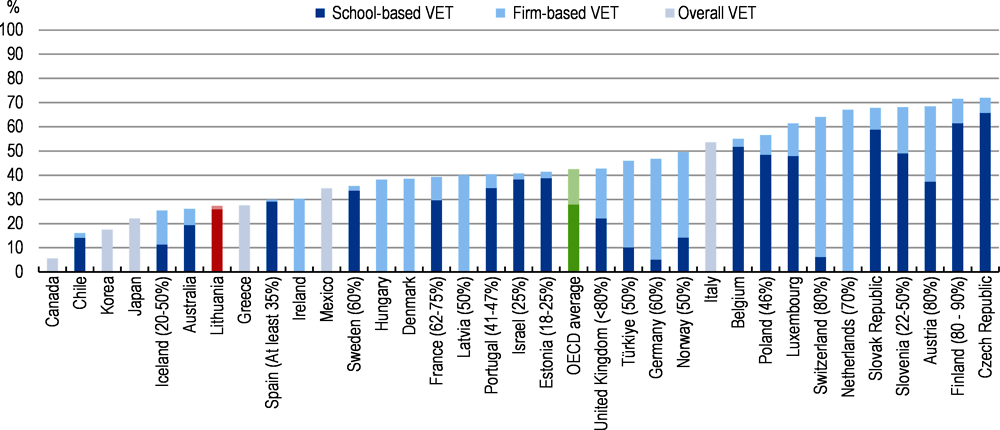

Bringing vocational education and training closer to the labour market

The significance of vocational education and training (VET) is among the lowest in the OECD (Figure 1.27). The reputation of VET is poor, even though many students go back to vocational training after graduating in the general track. The low VET share could be one responsible for the lack of trained professionals in certain areas and relatively high skills mismatch. The government has started to make the vocational path more attractive, however. Study programmes have been decentralised to the school boards composed mainly of businesses, and re-engineered to become more modular and reactive to labour market needs. Student career guidance after compulsory education has been strengthened. These initiatives are welcome. The government should continue to strengthen VET to develop, attract and retain skills, reduce youth unemployment and increase productivity, in particular by broadening pathways towards tertiary education, as is done in France, Germany and Switzerland.

Work-based learning – apprenticeships or “dual system” – is almost non-existent in Lithuania. The number of apprenticeships is only a few hundred overall and has even declined since 2017 when they became formalised in the labour code. Employers resist the dual system because they prefer students who graduated from the (cost-free) VET schools, and because they fear that trained talents would leave after completing work-based education. Collaboration between schools and employers is weak (OECD, 2021[27]) To increase employer interest in apprenticeships, the government has recently stepped-up financial support for firms that hire apprentices, by offering 70% instead of 40% of an apprentice’s wage in selected cases. Firm-based professionals’ (or master’s) teaching costs are also partly taken over. Given the importance of work-based learning for skills and employment, the government could do more to increase labour market relevance of firm-based learning, by making the apprenticeship system more beneficial to both employers and prospective apprentices (Box 1.7).

Figure 1.27. VET has little significance, and work-based VET even less so

Students in work- and school-based learning, share in upper-secondary education, 2018