The twin transitions – green and digital – have created new challenges and opportunities for Germany’s highly innovative business sector. Germany has a range of innovative competencies in many technology areas necessary for success in the transitional context, but future global leadership requires sustained investments. This section begins by benchmarking the capacities and performance of the German business sector for innovation in the context of the sustainability transition. It examines the automotive sector as an example of the challenges and opportunities involved in industrial innovation and transformation to this aim. It then introduces some key policy programmes that support innovative capacities in key enabling technologies. It concludes with a brief discussion on the role of public procurement as a demand-side instrument to spur innovation in key technologies and their diffusion to achieve the twin transitions.

OECD Reviews of Innovation Policy: Germany 2022

11. German business sector innovation for the green transition: Performance, challenges and opportunities

Abstract

Introduction

The twin digital and green transitions pose significant challenges to Germany’s historically innovative business sector. In line with the Paris Agreement on climate, which commits governments to limiting global warming to 1.5 degrees Celsius above pre-industrial levels, the Federal Government of Germany has essentially committed to reaching carbon neutrality (“net zero”) – i.e. balancing emissions of carbon dioxide (CO2) with its removal, often through carbon offsetting or eliminating emissions from society – by 2045 (BReg, 2021[1]). Following the 2021 elections, the new government reaffirmed Germany’s commitment to the Paris Agreement (SPD, Bündnis 90/Die Grünen und FDP, 2021[2]). This objective will require a substantial transformation of industry and transport, two of Germany’s biggest sectoral contributors to climate change. As noted by the International Energy Agency (IEA) in its 2020 Energy Policy Review of Germany, achieving the Federal Government’s decarbonisation goal of reaching carbon neutrality by 2050 exceeds the capacities of mature technologies, necessitating accelerated technology development and innovation (IEA, 2020[3]). Achieving the necessary reductions requires all firms, including the small and medium-sized enterprises (SMEs) that comprise 99% of the private sector, to transform their business processes.

Substantive change will also have come to industries and markets, and consumer preferences, by 2045. If in the past, the value of a German-produced car lay in the high-quality engineering of its engine, this may no longer be the case in the future, when the strength of electric cars’ battery, the autonomous driving offer, or the onboard services provided to passengers become essential. For many of Germany’s most innovative industries and firms, the green transition is a paradigm shift. The challenge for policy makers and the private sector is to ensure that the undeniable strengths of the German business sector, and the science, technology and innovation (STI) system more broadly, harness the opportunities inherent to this shift, rather than face the obsolescence of their accumulated knowledge and competencies.

Ensuring that the business sector – particularly the Mittelstand, given its importance to the German economy – can make a success out of the sustainability transformation is paramount. The challenge for the German business sector is twofold. First, can it innovate and adapt to new consumer and regulatory demands, drastically reducing emissions and contributing to a more resilient and sustainable economy? Second, can it do more than adapt, perhaps even lead in the technologies that will underpin the greener and more sustainable economies of the future and contribute to key objectives, including attaining energy security and resilience to crises?

This chapter begins with a recommendation on the use of public procurement as a demand-side tool to support the diffusion and commercialisation of the technologies necessary to success in the context of the sustainable and digital transitions. Section 1 proceeds with a benchmarking of Germany’s success in a range of technology areas for the green transition. Section 2 looks at the industrial transformation of the German automotive sector. Section 3 discusses the technological readiness of key technologies to achieve carbon neutrality. Section 4 introduces policy programmes and the corresponding technology areas necessary to the sustainable transition. By way of conclusion, Section 5 reviews current efforts in Germany to use public procurement as a tool to support the diffusion of technologies for the sustainable transition.

Recommendation 7: Strengthen the use of public procurement as a driver of innovation

Overview and detailed recommendations

use to better support the climate and digital transitions. The market-creating aspect of public procurement can also accelerate the transition of an idea to market by shortening the time required for commercialisation. Start-ups and Mittelstand firms in particular will be more inclined to engage in innovation efforts, as the government represents a reliable and high-profile client. A number of barriers, ranging from the low attractiveness of careers in public procurement to its fragmented and un-coordinated approach, currently prevent Germany from fulfilling the potential of public procurement as an instrument of innovative change. As discussed at Recommendation 10, using public procurement as a driver of innovation may require engagement with EU state-aid rules.

R7.1 Commit to innovation procurement by taking legislative action and creating co-ordinated innovation procurement programmes within public agencies at the federal, state, community and city levels. One line of action would be to require public agencies to allocate a dedicated amount or percentage to procurement of pre-competitive innovative research. Co-ordinating the different levels of public procurement (federal, state and municipal) will mitigate any potential fragmentation arising from this targeting. These efforts can support the overall “Germany 2030 and 2050” vision if it is linked to strategic projects emphasising innovation procurement, such as in sustainability, health and digitalisation.

R7.2. Invest in building capacity and incentives for implementing innovative public procurement. Acting on this commitment would entail a programme focusing on (i) the formulation of innovation agendas (roadmaps/challenges), as well as preparatory tasks for the definition and launch of innovation procurement programmes; (ii) capacity-building and training of staff in charge of public procurement; and (iii) offering incentives for public agencies in charge of procurement to reward innovative procurement (including through prizes). This would benefit from the support of the proposed laboratory on experimentation (see R2 in Chapter 15).

R7.3 Direct some of the public seed funds for technology commercialisation programmes to pre-commercial procurement programmes. This can take the form of staged-funding programmes, in the spirit of pre-commercial procurement programmes. The purpose of this approach is to add conditionality or challenges to publicly backed seed funds.

R7.4 Create incentives for SMEs and start-ups to engage in innovative procurement. This involves raising awareness of procurement opportunities and rationalising administrative barriers to the participation of SMEs and start-ups, such as clauses requiring past financial statements which start-ups cannot provide. Smaller and younger firms may currently be excluded from procurement tenders, limiting the ability of high-potential firms to scale and commercialise innovative solutions. The government could also create a platform that allows public authorities to issue challenge-oriented procurement tenders, which would draw smaller, high-potential firms. Such a platform would promote stronger innovative business creation through public procurement.

Relevant global experience

As in many areas examined in this review, the policies that can advance German innovation are themselves experimental and at the frontier of knowledge. This is also true of the use of public procurement as a demand-side instrument to induce innovation; this policy area continues to draw attention due to its theoretically powerful role. Public procurement represents a large share of final demand in many OECD countries, and many countries have committed to using it as a powerful, demand-side driver of innovation (OECD, 2017[4]). Yet despite widespread commitments to using public procurement to drive innovation, assessments of its effectiveness are more limited, which the European Commission duly noted in a recent report (European Commission, 2021[5]). Other research from the United States has suggested that firms actively invest in research in order to increase their chances of securing government procurement contracts, highlighting another channel through which governments can encourage research within the private sector (Belenzon and Cioaca, 2021[6]).

Public procurement can provide targeted support for pre-commercial procurement. In pre-commercial procurement, public procurers buy research and development (R&D) services from competing suppliers to devise alternative approaches to challenges, adding directionality to the research undertaken in the private (or public) sector. This echoes the approach of the Defense Advanced Research Projects Agency (DARPA) in the United States, which solicits research proposals for specific technical challenges in areas ranging from material sciences to semiconductors. In this manner, the public sector can share the benefits and risks related to the intellectual property rights resulting from the R&D.1 This encourages the creation of new jobs and firm growth while inducing innovation in support of transitional goals which may not have otherwise occurred. The European Commission has increased the support available for pre-commercial public procurement through the Horizon Europe programme (European Commission, 2022[7]). In 2022, the European Commission is running several open pre-commercial procurement tenders, such as for profiling tumours at the molecular level and creating platforms for distance (tele-)rehabilitation services for patients in remote areas.2

11.1. Benchmarking Germany’s innovation performance in the transitional context

11.1.1. Technology specialisation in Germany

Based on the available patent and trademark data (Figure 11.1), Germany has consolidated technological competencies in several important domains for the sustainable and digital transitions. The German specialisation in environment-related technologies is approximately the EU average. However, with the exception of wind-related technology, the patent share related to this group of technologies has been falling, despite increased public support. Furthermore, a gap prevails between energy-related innovation on the one hand, and other environmental technologies on the other.

Box 11.1. Measuring sustainability innovation: Climate-change mitigation and adaptation technologies

Advantages and shortcomings to using patent and trademark data

As discussed in the benchmarking section in Chapter 3, using patents as an indicator of innovative output is an imperfect approach. Not all innovations in this area will be patented, and consequently captured. Conversely, not all patented inventions will comprise effective and sustainable innovation for the future. Moreover, moving towards more sustainable development largely depends on businesses’ adoption of those technologies. Such measures do not capture diffusion levels or the business-service innovation that will lead to the use of technologies.

Trademark data may capture some of the non-technological innovations that are also essential in this domain, since they reflect the commercialisation of research (Millot, 2009[8]). They are also rich in text and easily processed. Like patents, their metadata can provide additional insights into issues such as regional and socio-economic inclusion in innovation, collaboration and internationalisation of research, as well as tracking the commercialisation of emerging technologies. Importantly, trademarks are particularly important in the service sectors, where innovations are often non-technological.

In attempting to identify the direction of R&D and the intention of innovative output, the technological metadata in patents can give an indication of the potential contribution of innovation to sustainability goals, if not its viability. Patent data also allow international comparison of the sources of such innovation, providing insight into which sectors and industries are devoting R&D to technologies that can support the sustainability transition.

Climate change mitigation and adaptation technology patents and trademarks

The European Patent Office (EPO) has a dedicated classification scheme for climate change mitigation and adaptation technologies, the “Y02 tagging scheme” of the Cooperative Patent Classification, to identify relevant inventions in global patent databases such as the EPO PATSTAT global database (Angelucci, Hurtado-Albir and Volpe, 2018[9]). This classification system was developed by patent examiners at the EPO specialised in each technology, with the help of external experts. It classifies millions of patent documents across a wide variety of climate-change mitigation or adaptation technologies, including electric cars, renewable energy technologies, efficient combustion technologies (e.g. combined heat and power generation), carbon capture and storage, efficient electricity distribution (e.g. smart grids), hydrogen, energy-efficient lighting and energy storage (e.g. batteries and fuel cells). It has become a widely used international standard for monitoring progress in climate-related technologies across the world.

The Y02 tagging system for “Technologies or applications for mitigation or adaptation against climate change” comprises the following categories:

Y02A – technologies for adaptation to climate change

Y02B – climate change mitigation technologies related to buildings, e.g. housing, house appliances or related end-user applications

Y02C – capture, storage, sequestration or disposal of greenhouse gases (GHG)

Y02D – climate change mitigation technologies in information and communication technologies (ICT), i.e. ICT aiming at the reduction of their own energy use

Y02E – reduction of GHG emissions related to energy generation, transmission or distribution

Y02P – climate change mitigation technologies in the production or processing of goods

Y02T – climate change mitigation technologies related to transportation

Y02W – climate change mitigation technologies related to wastewater treatment or waste management.

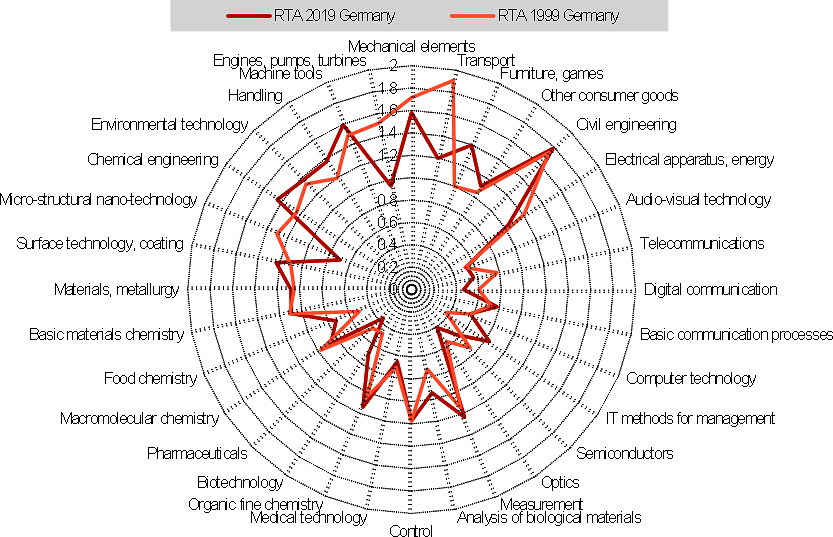

Figure 11.1 displays Germany’s level of revealed technological advantage (RTA) – an index of the relative specialisation of a given country across the World Intellectual Property Organization (WIPO) 35 technology domains. These include several that are relevant to the sustainability transition, such as transport, engines and machinery, owing to these industries’ contribution to emissions within and beyond Germany.3 Over the last decade, Germany’s technology profile has barely changed, although existing areas with relatively high levels of specialisation (i.e. transport, mechanical engineering, thermal processes and engines, pumps and turbines) have expanded.

Figure 11.1. Technology specialisation, EPO patent applications (2019)

Source: OECD Patent Data Indicators. The RTA index is computed according to the number of EPO patent applications, based on filing year and country of invention (fractional counting); it is obtained by dividing each economy’s share of patents in a technology with the global share of patents in the same technology.

The areas where Germany displays weak specialisation have not changed. These include telecommunications and digital communication technologies, computer technologies, IT methods for management and semiconductors. The relatively low levels of German technological specialisation in digital and related technologies (represented in Figure 11.1 by telecommunications, computer technologies, IT methods and semiconductors) are in line with the overall European region. By contrast, the RTA of Korea and Japan is much more concentrated in digital and related technologies; this is also the case in the People’s Republic of China (hereafter China), with an RTA of 2.9 in digital communication.

11.1.2. Technological specialisation in areas relating to sustainability

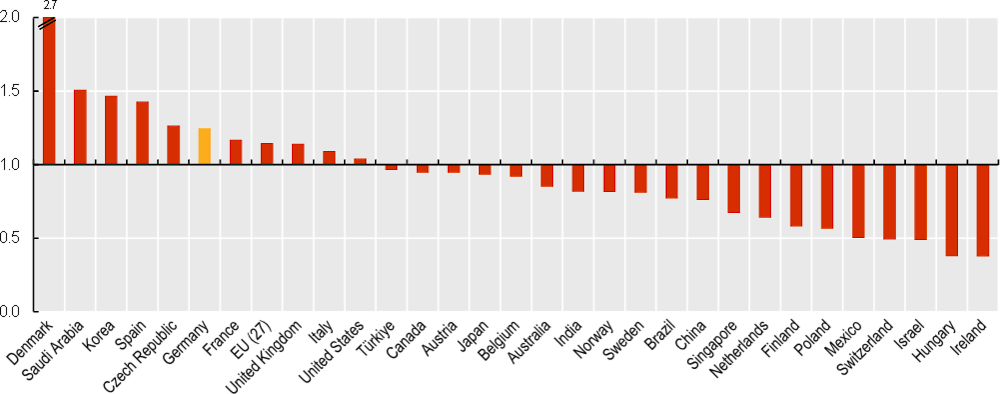

Germany has raised its level of specialisation in environmental technologies (from 1.23 to 1.44) over the past ten years, providing important opportunities for innovation and technological change in many economic sectors and fields. The German business sector also has a significant RTA in technologies related to climate-change mitigation and adaptation (see Box 11.1). As shown in Figure 11.2, Germany has the sixth-highest RTA globally (1.2) in these technology fields. As discussed in the following subsection, Germany also has a relatively successful commercialisation rate, as evidenced by the number of large patenting and trademarking firms in these fields.

Figure 11.2. RTA in climate-change mitigation or adaptation (2016-18)

Note: Data relate to economies in which at least 250 patents owned by the world's top R&D investors were invented in 2016-18. The revealed technology advantage is defined in World Corporate Top R&D Investors: Paving the way for climate neutrality (Amoroso et al., 2021[10]). Patents selected are defined as outlined in Box 11.1.

Source: European Commission, Joint Research Centre and OECD (2021[10]).

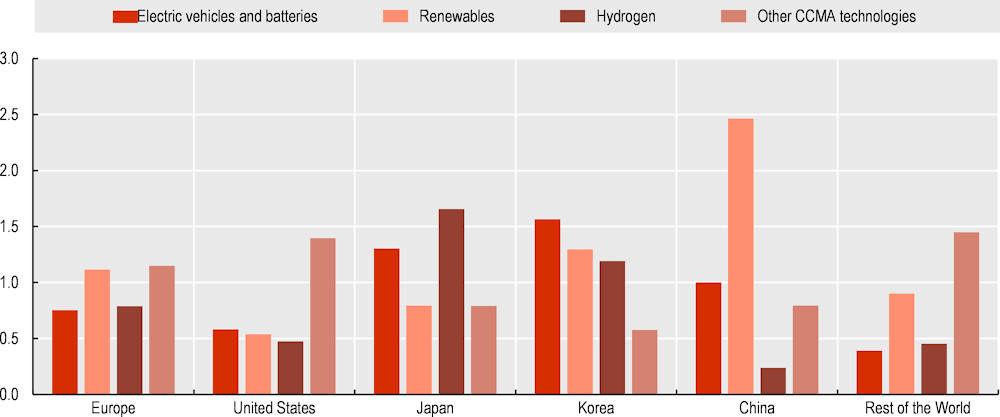

Germany also has a relatively high RTA in several technologies that are essential to the future competitiveness of leading industries, such as renewable energy, and the digital and sustainable transformation of the automotive sector (Figure 11.3). Yet while Germany has a higher RTA than the United States in a number of fields, the same is not true in comparison to Japan and Korea, two key hubs in the global automotive sector. Korea has a significantly higher RTA than Germany in electric vehicles, renewables and hydrogen, as does Japan for electric vehicles and hydrogen.

Figure 11.3. Revealed technological advantage of regions, by specific technology areas (2016-18)

Note: IP5: five IP offices, the name of a forum of the world’s five largest intellectual property offices; data refer to fractional counts of IP5 patent families in climate change mitigation or adaptation owned by the top R&D investors in 2016-18, according to the location of inventors. RTA is obtained by dividing each economy’s share of patents in a technology with the global share of patents in the same technology

Source: European Commission, Joint Research Centre and OECD (2021[10])

In terms of science-based enabling technologies (such as biotech and nanotechnologies), Germany displays competencies in micro-structural and nanotechnologies, where its specialisation index has risen over time (from 1.09 to 1.23); biotechnology remains at the same specialisation level, just above the average (1.03 in 2019) (Figure 11.1).

11.1.3. Benchmarking innovation capacities and performance for sustainability

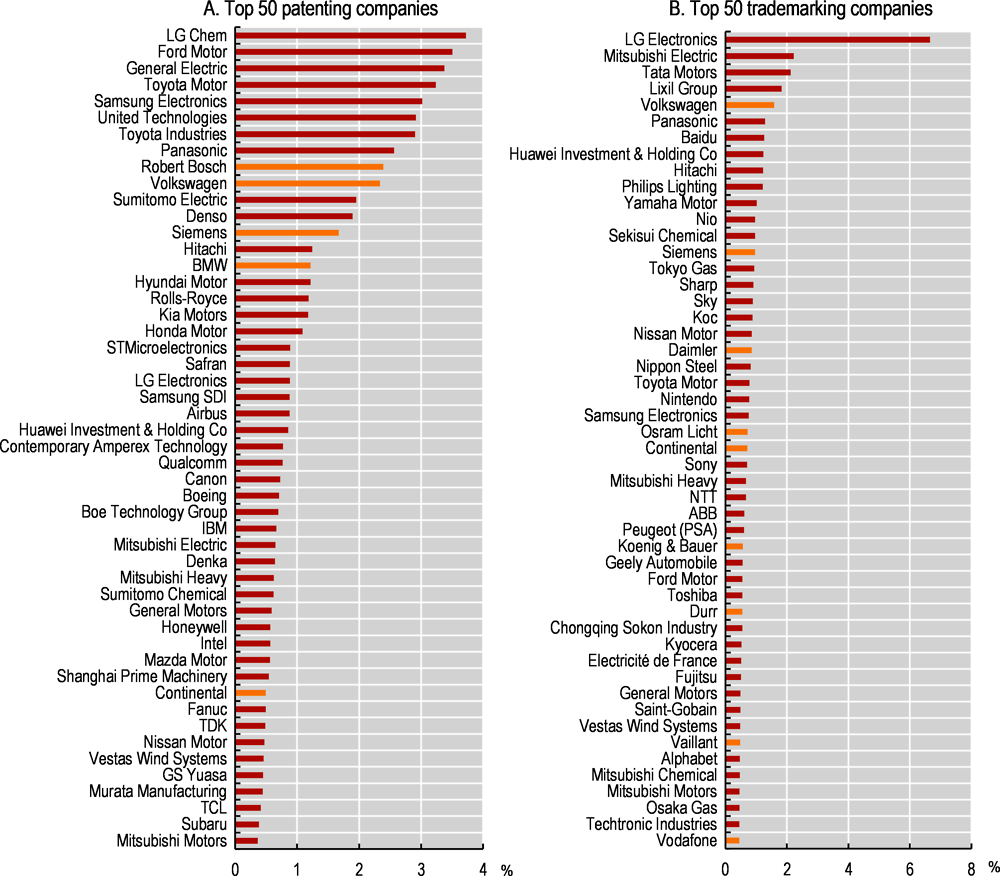

This subsection examines German innovation capacities and performance for environmental sustainability in two areas. The first is the presence of German firms among the top patenting and trademarking companies globally in fields related to climate-change mitigation and adaptation. Compared to other OECD countries, the trademarks and patents created by German firms are relatively more concentrated in fields related to climate-change mitigation and adaptation. The second is the intermediary output of German firms in these technology fields. A subsequent subsection discusses environmental sustainability-related innovation in the automotive sector.

As noted in the fourth edition of the OECD and Joint Research Council of the European Commission report on the top R&D corporations in the world, large and innovative firms play a significant role in achieving environmental sustainability goals. For example, the 2 000 surveyed firms, which account for 87% of global business expenditure on R&D, hold 70% of all patents in technologies related to climate-change management or mitigation and 10% of trademarks in the same fields (compared to 63% of all patents and 6% of all trademarks) (European Commission, Joint Research Centre and OECD, 2021[11]).

The German business sector plays an important international role in this regard, with several German companies figuring among the top patent and trademark holders in climate-change mitigation and adaptation. These include firms in the transport equipment and machinery sectors, which generally spend the most on R&D and are also global leaders in trademark and patent creation related to sustainability (Figure 11.4).

Figure 11.4. Top 50 patenting or trademarking companies in climate change mitigation and adaptation (2016-18)

Note: Data relate to the share of the patents (respectively trademarks) related to climate change mitigation and adaptation owned by companies in total patents (respectively trademarks) in that domain owned by the top 2 000 corporate R&D sample in 2016-18. Yellow bars indicate German companies.

Source: Amoroso et al. (2021[10])

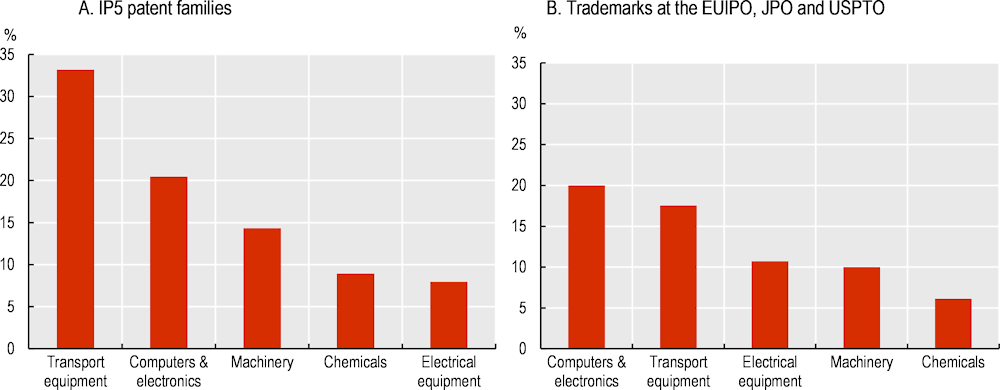

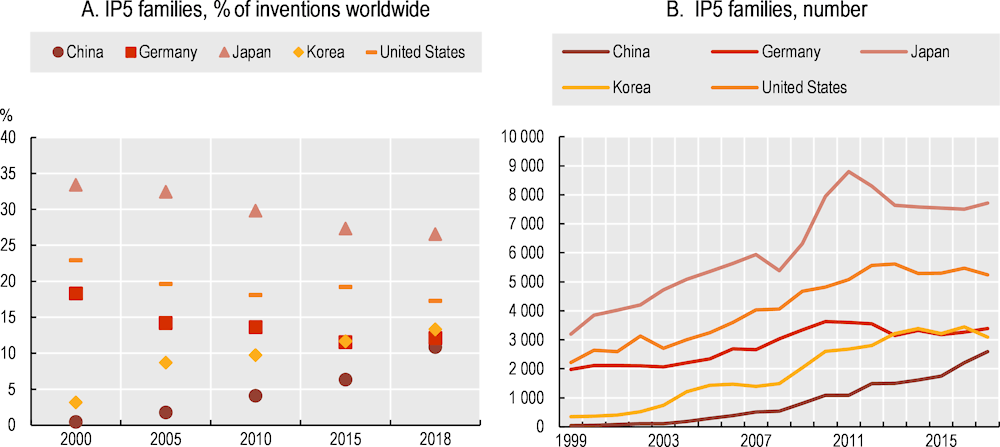

The German economy is also among those with the strongest overall specialisation in trademarks and patents in the sustainability field. Compared to other OECD countries, the trademarks and patents created by German firms are relatively more concentrated in fields related to climate-change mitigation and adaptation. Among countries with the highest R&D output, only China and Korea show a higher trademark specialisation in sustainability, and only Korean innovators produce relatively higher numbers of patents in this field (Figure 11.6). Many of the industries in which Germany is the most competitive are also responsible for the highest level of climate-related patenting activity. For example, the top five sectoral contributors to IP5 patenting in climate-related technologies are transport equipment, computers and electronics, machinery, chemicals and electrical equipment, all of which are important sources of German innovation and competitiveness (Figure 11.5). This indicates that key innovative sectors – and contributors to GHG emissions – are increasingly directing R&D towards technologies that will maintain competitiveness in the sustainability context. This, in turn, could accelerate the development of innovations that will support the transition towards greater socio-economic and environmental sustainability.

Figure 11.5. Top five sectors with patents or trademarks for climate change mitigation or adaptation technologies (2016-18)

Note: EUIPO: European Union Intellectual Property Office; JPO: Japan Patent Office; USPTO: United States Patent and Trademark Office.

Source: Amoroso et al. (2021[10])

While Germany’s relative contribution to the total number of annual patenting in environmental technologies has fallen since 2000, it nevertheless remains the largest single contributor in this area, accounting for 23.4% of all environmental technology patents in 2018 (Figure 11.6). As in the other top patenting countries, output has been falling precipitously since 2016. In each of these countries, this decline in output has been accompanied by a similar decline in scientific publication output in related technology areas such as energy, environmental sciences, material sciences and chemistry (OECD, 2022[12]). Germany is therefore well placed to build competitive advantages in many of the technologies that will support decarbonisation and the broader push towards more sustainable economic models.

Figure 11.6. Environment-related technology patenting (2000-18)

Note: IPC: International Patent Classification (WIPO). Environmental technology relates to the relevant WIPO technology classification.

Source: OECD (2022[13]) "Patents by main technology and by International Patent Classification (IPC)", OECD Patent Statistics (database), https://doi.org/10.1787/data-00508-en (accessed on 21 May 2022).

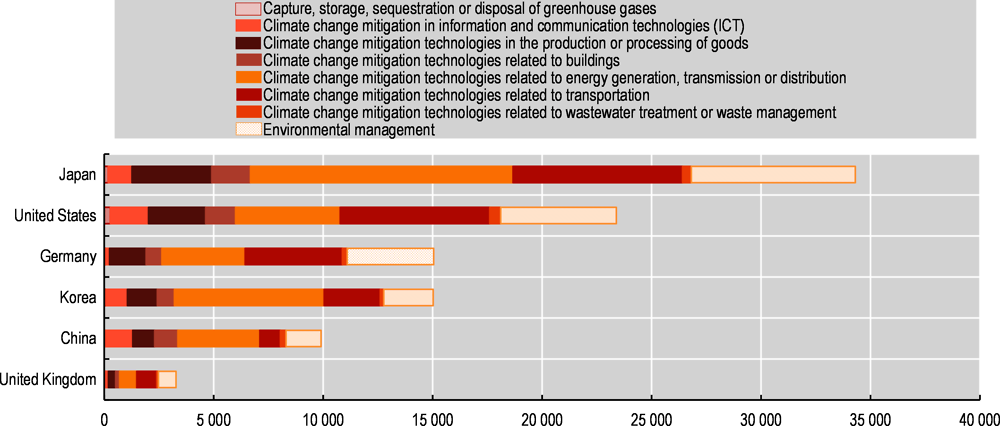

Germany is also a leading global innovator in many of the advanced technology fields that will be necessary to succeed in decarbonising industry and transitioning towards a more sustainable socio-economic model. The country is the third-largest contributor to global patenting in several of these technological fields, with particular strengths in energy transmission, generation and distribution; transportation-related environmental technologies; and environmental management technologies (Figure 11.7). These innovative capabilities augur well for the future competitiveness of the German economy, although this will largely depend on developing strengths in the key enabling technologies necessary for scaling and implementation.

Figure 11.7. Patenting relating to climate mitigation and environmental management (2015-2018)

Source: OECD (2022[13]), "Patents by main technology and by International Patent Classification (IPC)", OECD Patent Statistics (database), https://doi.org/10.1787/data-00508-en (accessed on 21 May 2022).

11.2. Industrial transformation for the sustainability transition: The German automotive sector

The automotive industry – Germany’s largest – provides a clear indication of the structural challenges and opportunities for the business sector in the context of the sustainability transitions. Challenges ranging from the decarbonisation of energy to the implications of decarbonising private-vehicle usage itself, or the labour-force implications of electric vehicle production and the complications of sustainably procuring enabling technologies, also illustrate the “systemic” nature of the challenges and opportunities implicit in the sustainability transition.

Three interrelated issues are at play:

First, and as in other areas of manufacturing, the core value in many cars will likely be digital or derived from new technologies (such as batteries and fuel cell design), where Germany’s economy does not enjoy the same competitive advantage as it does in more traditional areas of manufacturing. Similarly, Germany lags behind many other competitor economies in terms of competencies in the design and production of enabling technologies, such as semiconductors required for autonomous driving and the rollout of the 5G networks necessary for their safe functioning.

Second, the issue is not simply one of competitiveness. The decarbonisation of the automotive industry is also linked to social well-being. The industrial and transport sectors remain two of Germany’s largest sources of carbon emissions; the state of Baden-Württemberg, a major location for the country’s automotive industry, accounts for 0.3% global carbon emissions alone. The example of the Netherlands, while ambitious and in many respects successful, demonstrates the difficulty of reaching carbon neutrality while maintaining competitiveness, often in energy-intensive industries (i.e. mitigating demand-side policy instruments, such as carbon taxes, to encourage industrial decarbonisation with overlapping subsidies to industry) (OECD, 2021[14]). Product innovation will need to be accompanied by a broader structural reorganisation of industrial and economic processes.

Third, changes in mobility patterns are likely to affect the role and use of – and demand for – private cars, particularly in cities. Recent work by the International Transport Forum (ITF) outlines a number of trends that are likely to shape urban mobility, including shared mobility services and autonomous driving, both powered by digital technologies. Despite continuous growing demand for private cars globally, the ITF estimates that between 2015 and 2030, shared mobility will contribute the strongest growth (15%) in urban transport demand (passenger-kilometres) in the OECD region. The speed and extent of these transformations remains unclear, particularly because it will likely be a highly heterogeneous process at the global level. The trend is nevertheless clear, and the future of Germany’s automotive sector and competitiveness of its exports will be highly influenced by digitalisation and decarbonisation in the decades to come, necessitating radical innovation and change throughout the industry.

The automotive industry is therefore facing one of the most drastic transformations in the German economy – not only in terms of the product themselves, but also in terms of the production process and new consumer patterns, such as the shift to mobility services or increased regulation of carbon emissions (Paunov and Planes-Satorra, 2019[15]). Electromobility, autonomous driving, mobility services and the integration of new technologies (i.e. internet of things) represent major innovation challenges for both automobile manufacturers and their supply chain. Shifts in global markets add to the changes affecting the industry.

The shift to electrical vehicles is a major component of this transformation, driven by new and stricter European regulations on CO2 emissions. Increasing global competition from both global manufacturers and new competitors, such as Tesla and global tech companies, are further pressuring German firms to change. The market penetration of electric vehicles remains dependent on infrastructure, consumer incentives, emission regulations and carbon prices. As these factors develop, the share of electric vehicles will likely rise significantly and could represent the majority of new vehicles sales by 2035 (PwC, 2021[16]).

Although the industry took some time to commit to such a change, the pace of the transition to electrical vehicles has accelerated sharply in recent years. In principle, according to trends in R&D and patenting, German automobile industries seem well positioned to compete under this innovation paradigm. Both R&D and patenting have grown significantly, especially since 2015. Most of the large automobile manufacturers have started producing electrical versions of their mainstream models, with the commitment to convert their entire production to electric vehicles in the coming years.

The sector must overcome other important challenges, which will determine its success in transforming itself. One is the innovation in the supply chain, a critical component of the transition. Suppliers may struggle to adapt to new industry trends after producing equipment for traditional internal combustion engines for decades. They must move from a concept of product innovation towards a hybrid model linking product innovation with service innovation, and provide integrative smart services with transport mobility. Additionally, service provision based on software solutions, AI and interconnectivity will make a real difference in future value generation, which will entail adopting new organisational and business models integrating digital solutions.

In addressing the shift to electrical vehicles, a major weakness of large manufacturers in Germany (and Europe) is lagging capacity in battery innovation, where American and Asian manufacturers already have an advantage. According to a study by the IEA on international patenting, Japan leads the battery tech race with one- third of patent filings, followed by Korea (IEA, 2020[17]).4 Over 2000-18, Japanese companies made up 7 of the top 10 applicants, but Korea’s Samsung Electronics was the most prolific individual filer, with 4 787 inventions. Tesla supplier Panasonic came in second (4 046 inventions), followed by LG Electronics (2 999) (IEA, 2020[36]). This results in Germany’s and Europe’s dependence on Asian manufacturers and fewer opportunities for a reduction in the CO2 impact of production using green electricity from Europe. The considerable share of batteries in the production value chain of electrical vehicles is a major incentive to invest more in this sector. Faced with the challenge of ensuring a reliable battery supply, leading firms such as Volkswagen have recently announced a commitment to battery production for electric vehicles and to establishing several “gigafactories” in Europe by the end of the decade.

As demonstrated by (Dechezleprêtre, A. et al., Forthcoming[37]), the share of patents linked to technologies for the green and digital transformations in automotive innovation attests to their growing importance for the sector. Though plateauing since 2010, the number of annual patent applications for electric vehicle-related technologies has been greater than patent applications for combustion engine-related technologies since 2007. The number of patent applications for autonomous vehicle-related technologies has also increased dramatically in the last decade, surpassing both the number of patent applications for combustion engines and electric vehicles. Patents related to automotive technologies have increased steadily over the last two decades (Ibid).

In 2016-19, Germany has the third-highest combined number of automotive patents, behind only Japan (first) and the United States (second), and ahead of Korea (fourth) and China (fifth) (Dechezleprêtre, A. et al., Forthcoming[37]). Germany also has the third-highest global share of patents relating to autonomous driving, but is significantly behind the United States (first) and Japan (second) in this regard, evidencing these two countries’ significant relative advantage in digital technologies. Germany, Austria, France and Japan have a strong RTA in a range of automotive technologies. China, Korea, the United States, the Netherlands and Switzerland, on the other hand, tend to be under-specialised in these technologies. However, these countries have significantly reduced the gap with leading economies over the last 20 years (Ibid).

RTAs vary significantly by technology (Dechezleprêtre, A. et al., Forthcoming[37]). Germany has the highest (1.7) RTA in automotive technologies globally, although it has dropped somewhat from the 2000-03 levels. By contrast, several economies, such as Korea, the United States and China, have improved their RTA in automotive technologies, although they nevertheless remain below 1. For several European economies (particularly France, Sweden and Italy), the RTA is above 1, mainly for combustion engines. In Germany and Austria, the RTA is also driven by hydrogen and electric engines. In Germany’s case, this is an indication of its increasing strengths outside of innovation in internal combustion engines. Germany does have a relatively strong RTA in battery technology (1), but it remains significantly behind Korea (2.2) and Japan (1.7). Germany does, however, account for over half of European patenting in electricity storage technologies (IEA, 2020[36]).

11.3. Technological readiness of solutions for industrial sustainability

The decarbonisation of industry is a major component of Germany’s push towards carbon neutrality. As noted in the 2020 Energy Policy Review of Germany, the industrial sector was the largest energy consumer in the country in 2017, accounting for 80 million tonnes of oil equivalent (Mtoe – a unit of energy equivalent to the amount of energy released by burning one tonne of crude oil) in 2017 (IEA, 2020[24]). Hydrocarbons dominate the energy mix in industry, accounting for 29% (natural gas) and 28% (oil). The chemical and petrochemical industry accounts for the largest share of industrial energy consumption; steel and mineral industries are other major consumers.

Decarbonising Germany’s industries – and society more broadly – will require accelerating the development and diffusion of new technologies. Many of these technologies already exist, but are at an early stage of technological readiness. As noted by the IEA, integrating these technologies into industry will be key for the country to reach its sustainability goals (IEA, 2020[24]). The issue facing German industry is therefore less what technology can do, but how quickly it can do it. Demand-side instruments (such as carbon taxes, as well as regulation and standard-setting) are an integral part of accelerating the commercial attractiveness of technologies that remain underdeveloped or prohibitively expensive. The application of carbon capture technologies to an industrial plant, for example, requires a bespoke retrofitting that can may not be economically viable if the cost of continued pollution is not priced into the firm’s calculations.

In November 2021, the IEA launched its “Energy Technology Perspectives (ETP) Clean Energy Technology Guide”, an interactive portal presenting information on over 400 individual technology designs and components across the whole energy system, all of which play a role in achieving net-zero emissions. The ETP platform provides a range of information for each technology, including the level of technological readiness – ranging from 1 (initial idea) to 11 (mature); the technology’s importance (moderate, high or very high) in achieving net zero; and background on leading players in the given field.

The various technologies are assigned to five areas – buildings, energy transformation, transport, CO2 infrastructure and industry. Notably, Germany is a “key” country in only three technologies – a battery technology, a direct air-capture technology that removes CO2 from the atmosphere and an electrolyser technology necessary for industrial hydrogen (IEA, 2021[38]). None of these technologies are beyond the pre-commercial demonstration level of technological readiness. By contrast, the United States is key in 121 technologies, the United Kingdom in 38 technologies, and Sweden in 29.

The findings from the ETP platform illustrate several challenges affecting German industry and the ability of the Federal Government to reach its sustainability objectives. First, many of the technologies necessary for decarbonising remain at a low level of technological readiness, impeding the ability of industry (and the housing, transport and energy sectors) to decarbonise. Second, many of the technologies that may eventually be crucial for this process are not proprietary to German firms. By contrast with the deep integration of German industries (such as machinery and electrical components), Germany’s historically central position in global industrial value chains does not seem as secure.

11.4. National strategies and policy support for the sustainable transition

The government aims to support the development of innovative and productive competencies in a range of key emerging technologies that are of central importance not only to the future competitiveness of extant industries, but also to the ability of new industries and firms (including in services) to emerge and remain in Germany. As failure to remain at the forefront of these technologies may have serious implications for German competitiveness and socio-economic well-being, German policy makers may be required to take a more systemic – and at times directional – approach to STI policy.

The government has created a number of strategic documents to support promote key enabling technologies. These strategies outline approaches to support innovation in a range of technological areas (such as hydrogen and quantum computing), as well higher-level guidelines for directing these technologies towards achieving transitional goals, such as industrial decarbonisation and the greening of the German economy. These technological capacities are also relevant to resilience and global value chains, as discussed in Chapter 15.

This section introduces three areas where innovation will be key to success in the environmental sustainability transition: energy, hydrogen technologies and battery technologies. This is not an exhaustive survey of key enabling technologies for the sustainability transition, but rather an overview of a selected group that are vital to the country’s industrial transformation. Further technology-specific policy programmes that do not directly relate to the sustainability transition are also discussed in Chapter 5.

11.4.1. Energy sector

The Federal Government has an overarching approach to the transformation of the energy sector in Germany called the Energiewende. Led by the Federal Ministry for Economic Affairs and Climate Action (BMWK) together with the Länder, this large, multidisciplinary strategy emphasises the role of innovation in achieving the transformation of the energy sector and the overall economy. The Energiewende therefore has significant overlaps with STI policy, given the importance of developing and commercialising technologies that can support both the decarbonisation of the German economy and the future competitiveness of the German private sector in this decarbonised context (EC, 2018[39]). The Federal Ministry of Education and Research (BMBF) also funds a large Energy Research Programme (currently the seventh edition in a long series). However, BMWK relies on a wider range of policy instruments beyond those traditionally available to STI policy makers, such as procurement, investment support, infrastructure policies, energy-market policy and a range of other “downstream” instruments, which by their nature are not available to a research ministry.

The Energiewende is a national effort to decarbonise energy supply and use in Germany, in line with Germany’s obligations under the Paris Agreement on climate and periodic developments within the Conference of the Parties, and to shut down nuclear electricity production. The strategy’s legal basis was set in 2000 through the Renewable Energy Act and firmed up in the Energy Concept of 2010, which states that with the Energiewende, “Germany is to become one of the most energy-efficient and greenest economies in the world while enjoying competitive energy prices and a high level of prosperity. At the same time, a high standard of supply security, effective environmental and climate protection and economically viable energy provision are necessary for Germany to remain a competitive industrial base in the long term.”

A succession of BMWK-funded national energy programmes feed into the Energiewende. Governments periodically modify targets without necessarily resorting to legislation, a process that depends upon agreement among the governing political parties. A dedicated “think tank”, Agora Energiewende, was established in 2012. It is an independent, non-profit organisation funded by a mix of public and private sources, advising – but still under the control of – the government. The Energiewende governance was centralised under BMWK (then the Federal Ministry for Economic Affairs and Energy [BMWi]) in 2014. The budget derives from various federal ministries and the Länder, and is sufficiently opaque that it appears difficult to arrive at a reliable total figure (Kuittinen and Velte, 2018[40]). The Federal Government publishes a progress report every three years. Progress in reaching energy targets is monitored by the lead ministry – BMWK – together with an expert commission of four professors in energy technology and policy, and is reported to the parliament and the government.

The co-ordination structure of the Energiewende’ has changed and become more formalised since BMWK took over in 2014. Nonetheless, the multilevel governance may reduce the coherence of the effort. For example, Länder decisions can conflict with the overall design of the initiative. As discussed in Chapter 9, Russia’s war in Ukraine has given a renewed impetus to Germany’s energy diversification programme, and by extension, importance of STI contributions to the expansion of renewable energy in total energy supply.

11.4.2. Hydrogen technologies

BMWK published the National Hydrogen Strategy in 2020 (BMWi, 2020[42]). This cross-ministry strategy is managed by a committee of state secretaries. The strategy has not been costed, but operates within an envelope of EUR 7 billion for hydrogen rollout and a further EUR 2 billion for international hydrogen co-operation. It builds on significant investments in hydrogen R&D, including EUR 700 million (euros) for the National Programme on Hydrogen and Fuel Cell Technology from 2006 to 2016, and a commitment to spend a further EUR 1.4 billion over 2016-26. In parallel, substantial investment of EUR 510 million is planned through the Energy Research Programme, as well as a EUR 600 million investment planned in regulatory sandboxes, and several programmes funding the development of hydrogen applications across a range of industries.

The strategy notes that many technological aspects of the hydrogen transition are maturing, and that it is therefore appropriate to move towards implementation. This involves 38 national measures, such as developing a national roadmap; market formation and regulation; new business models for electrolysis operators; funding for electrolyser development; co-operation on foreign offshore wind farms and markets to access enough electricity; regulation; national and international standard harmonisation; subsidies for investments by users to stimulate demand; cross-ministerial and international R&D initiatives; developing a hydrogen refuelling infrastructure; developing fuel cell industries; supporting the development of industrial applications; ensuring links to the development of infrastructure for natural gas distribution; and education and vocational skills. International measures include co-operation in developing an EU hydrogen roadmap; R&D collaboration; standard development; and developing international hydrogen markets. The National Hydrogen Strategy contains most of the elements discussed in the literature as being necessary to develop a new technological innovation system (Bergek, Hekkert and Jacobsson, 2007[43]) (Hekkert et al., 2007[44]).

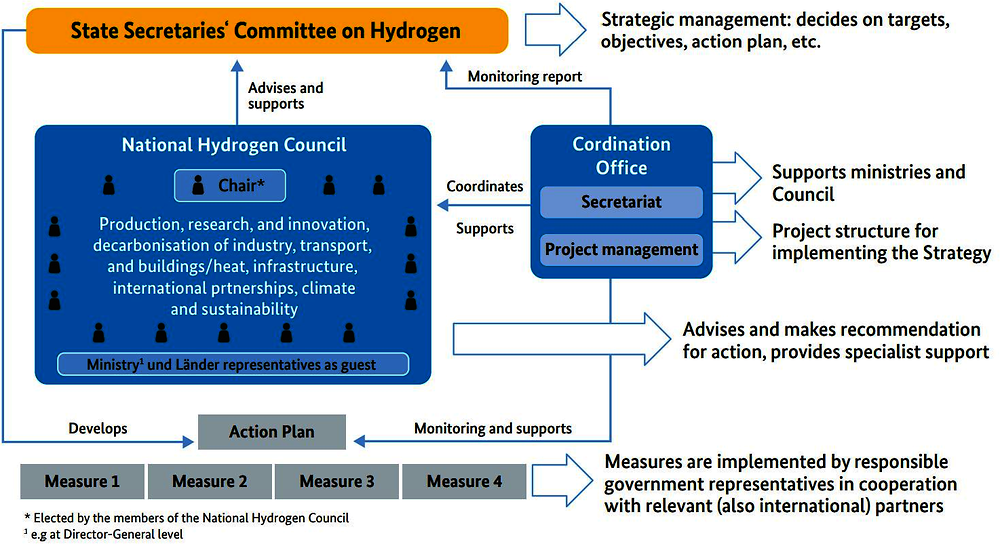

Figure 11.8 shows the strategy’s governance, headed by the State Secretaries’ Committee on Hydrogen (one of several committees convened for a range of cross-ministerial policy purposes), which sets overall targets and (in principle) links the strategy to the individual ministries’ activities. The committee also appoints a National Hydrogen Council, which meets every six months to review the strategy and its progress. Two Länder representatives attend as guests, to ensure a link with the various regional hydrogen activities occurring in parallel. A co-ordination office provides project management and monitoring of the strategy’s implementation.

The strategy is thus implemented using an intra-governmental platform connecting it to broader government policy. While BMWK has the lead in practice, there is no overall “referee” or “owner” in government, and the actual pace of implementation depends on decentralised decisions by individual spending ministries. There are no specific, measurable goals, nor is there a timetable – the roadmap from 2019 contains some broad goals tied to an approximate timeline, but these do not appear binding. The strategy does not discuss strategy-wide evaluation. This is an area of weakness in German governance, where individual programmes are conscientiously evaluated, but there is no practice of conducting a portfolio-wide evaluation and reflection to support systemic development and change. The government could consider an evaluation model that provides independent, systemic feedback that is not tied to the responsible ministries.

Figure 11.8. Governance of the National Hydrogen Strategy

11.4.3. Battery technologies

As discussed in Section 2 of this chapter, battery technologies are essential to the future of the automotive industry. They are central to the sectors’ ability to decarbonise and meet consumer’s rising demand for more powerful batteries in their electric vehicles.

BMBF funds several programmes supporting the development of battery technologies, focusing on both advancing the latest battery systems (e.g. lithium-ion batteries) and those at an earlier stage of technological readiness. As early as 2014, BMBF initiated a call for research into battery technologies through the “Battery materials for future mobile and stationary applications – Battery 2020” programme. The second call came in February 2016, followed by the third in October 2017. The programme has funded 44 research projects (BMBF, 2020[45]).

BMBF initiated the “Lithium-ion batteries (LIB 2015)” funding programme in 2007 with the aim of developing one of the most important key technologies contributing to low or zero CO2 emissions. Since then, BMBF has provided about EUR 600 million (around EUR 60 million per year) to battery R&D, to build a broader battery community and gain knowledge along the battery value chain, from materials research to battery applications.

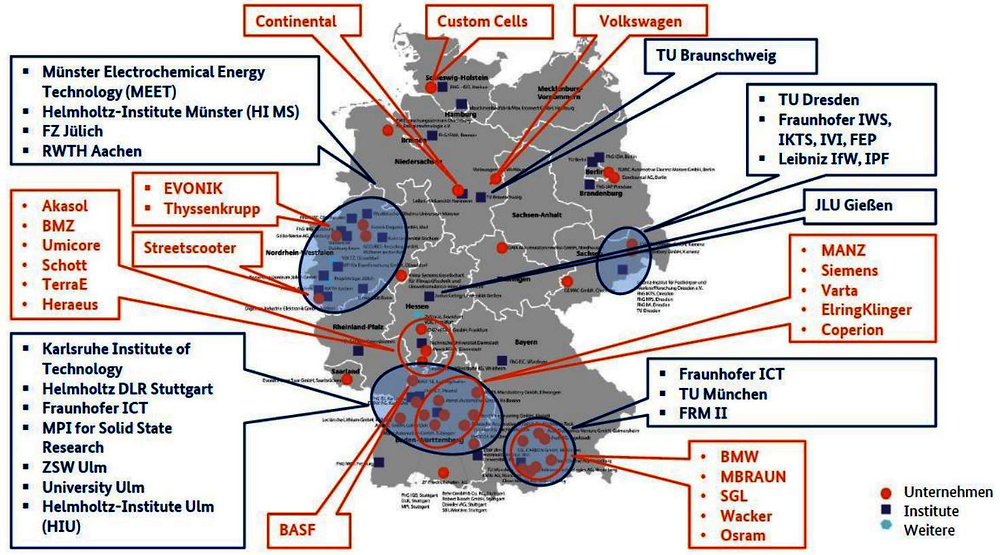

To transfer excellent research to an industrial scale, BMBF decided in 2018 to newly align its battery funding by combining past and ongoing funding activities and programmes under the umbrella of the “Dachkonzept” (“umbrella concept”) (BMBF, 2019[46]). The goals of the “Dachkonzept Forschungsfabrik Batterien” (“Umbrella Concept Research Factory Batteries”) are to support battery research, building battery cell production capacity in Germany and a more efficient transfer from research results into applications. The program will be developed further and financial support enhanced by BMBF. One component of the Dachkonzept is the Fraunhofer Research Institution for Battery Cell Production FFB, which is being built in Münster and funded with EUR 500 million.

The Dachkonzept combines the following measures with mission-oriented and thematic aspects (BMBF, 2020[47]):

factory modules: material development and characterisation: technology development and digitisation of cells and processes; battery cell production and automation

cross-cutting activities: analytics and quality control; battery lifecycle

accompanying measures with regard to research and networks: international activities, young researcher programme, “Battery 2020” research programme, industry initiatives.

Figure 11.9. Important actors within the German Dachkonzept Forschungsfabrik Batterie

Source: BMBF (2019[26]), Batterieforschung und Transfer stärken – Innovationen beschleunigen: Dachkonzept „Forschungsfabrik Batterie“, https://www.bmbf.de/bmbf/shareddocs/downloads/files/bmbf_dachkonzept_forschungsfabrik_batterie_handout_jan2019.pdf?__blob=publicationFile&v=1 (accessed on 12 May 2022).

All parts of the Dachkonzept (Figure 11.9) work together to bring research results to the next level along the value chain. The concept is intended to create synergies with the European Green Deal and the Important Projects of Common European Interest (IPCEI) on batteries, which are co-funded by BMWK.

Unlike BMBF, BMWK focuses its funding and support on building competitive large-scale battery cell manufacturing, with the aim of establishing a competitive, innovative and sustainable battery value chain in Germany and Europe. BMWK is providing around EUR 3 billion in funding to two IPCEI projects (BMBF, 2020[47]).

Besides BMBF and BMWK, other ministries and agencies in Germany (e.g. the Federal Ministry for Digital and Transport (MMVD), the Federal Ministry for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection (BMUV) and its German Environment Agency (UBA)), as well as regional funding agencies (e.g. emobilBW), actively support research and innovation along the battery value chain.

At the European level, activities are bundled under the umbrella of the European Battery Alliance and co-ordinated by Batteries Europe under the aegis of the European Technology and Innovation Platform. Batteries Europe released the “Batteries Europe Strategic Research Agenda” in late 2020 (Batteries Europe, 2020[48]). All 27 EU Member States are participating and represented in these networks to support the goals formulated by the national government and ministries.

The funding measures and support initiated over the past decade have helped build a German research community and industrial network. With respect to research activities, the share of German publications on batteries has developed from under 5% to well over 5% (Fraunhofer ISI, 2018[49]).The share of German patent applications has remained stable at over 10%, although this highly competitive field is dynamically expanding with both established and new market players (ibid.).

Battery production is the missing link and an identified gap in Germany and Europe. By 2020, Germany still did not have a significant share of battery cell production capacities compared to the global installations amounting to over 400 gigawatt hours (GWh). During the next decade (i.e. until 2030+), battery cell production capacities of 400-800 GWh have been announced in Germany and 800-1 800 GWh in Europe. Compared to the announced production increases from 4 terawatt hours (TWh) to almost 8 TWh globally, this would mean that 10% of global battery cell production capacities would be located in‑ Germany and 20% or more in Europe (VDMA, 2018[50]).

The demand for battery cells from German original equipment manufacturers (OEM) has increased from 0% to over 5% percent in the past decade and is expected to reach 10% by 2030 (Fraunhofer ISI, 2018[49]). If the announced production capacities are realised in this time frame, a European battery value chain would be created in the coming decade. This value chain will consist of not only European but also Asian and other global market players, since at least half of European battery cell production capacities will be built by Chinese, Korean and Japanese companies.

11.4.4. Other areas of critical policy support

The green transition relies on several innovation policy actions:

Succeeding in the sustainability and digital transitions will require progress in radical and breakthrough technologies, rather than only incremental improvements to existing technologies. Promoting innovation entails a different approach that allows and supports more cross-disciplinarity, greater use of data, and more experimentation in policy and regulation. As discussed in Chapter 15 on policy agility, the Federal Government can do much more in this regard. The establishment of the Federal Agency for Disruptive Innovation (Agentur für Sprunginnovationen), or “SPRIND”, is an important step towards expanding the policy and institutional support for breakthrough innovation. As discussed in Recommendation 3, however, these efforts can be significantly expanded (see Chapter 15).

Uneven capacities across different actors in the economy may limit the diffusion of technologies. Addressing co-ordination failures – between the public and the private sectors, but also within those sectors – is another major challenge for policy makers. The co-ordination challenges involved in transforming the automotive sector are a salient example (see Section 2 of this chapter). As discussed in Chapter 13 on knowledge transfer and its Recommendation 5 on improving multidisciplinary transfer and co-operation, overcoming these challenges requires more effective diffusion of new technologies and knowledge, particularly when they are interdisciplinary.

Insufficient infrastructure development is another area where policy support is critical. Achieving the green transition means developing a supportive infrastructure allowing industry and consumers to push in the same direction. The automotive sector is again telling in this regard, with a growing share of electric vehicle sales largely dependent on key infrastructure, such as charging stations. The public sector therefore has an important role to play, as it can invest – or support private investment – in areas of infrastructure that will increase the attractiveness and viability of greener approaches.

Policies that create demand-side incentives for “green” over “brown” products and approaches are also important. Demand-side policy interventions can be enacted through taxation (such a carbon taxes), as well as regulatory interventions that mandate, for example, the use of certain low-carbon heating technologies in construction; a similar logic can be extended to the infrastructure necessary for electric vehicles, such as requiring new developments to have charging sockets. For example, the introduction of carbon taxes and gradual increase of carbon prices will make energy from renewable sources more appealing than hydrocarbon fuels, increasing end-user demand for such solutions. Similarly, tax rebates applied to the purchase of an electric vehicle rather than a car with an internal combustion engine may encourage more people to switch to electric mobility, increasing demand and therefore investment in the technologies necessary to further lower the cost of such technologies. An important instrument in this regard is public procurement.

11.5. Public procurement to support innovation

Public procurement can be a powerful tool to induce innovation supporting transitional goals, such as economic sustainability and digitalisation. This is particularly true of pre-commercial procurement, where public procurers purchase research on specific challenges rather than specific technological solutions, adding a level of directionality to public- or private-sector research. One example of this approach may be a German procurement agency soliciting a tender for the best solutions to decarbonise railway infrastructure, rather than procuring a specific technical solution (such as carbon capture). In this way, public procurement can act as a powerful demand-side driver for innovative solutions, lowering the risks inherent to investment in novel areas of research and eventually creating new markets for products or services that can support overarching policy objectives. Expanding the use of public procurement can be done by introducing mandatory public procurement criteria or targets in national sectoral legislation (though from a coordination perspective this encounters challenges linked to fragmentation over different administrative levels); creating an observatory or library of different products and services with a ”sustainability” focus; imposing mandatory annual reporting on the environmental aspects of public procurement, which would also improve transparency and data collection; providing training on public procurement for sustainability to contracting authorities and the private sector; and engaging environmental protection agencies in the implementation of public procurement (European Commission, 2021[26]).

Germany is one of the first European countries to revisit its public procurement framework to improve the contracting of innovation and R&D services. New rules were adopted with the Procurement Law Amendment Act in 2009. In 2011, innovation procurement programmes were launched at the federal and regional levels by ZENIT, a public private partnership and the agency for innovation and European affairs of North Rhine-Westphalia. In 2013, BMWK (then BMWi) launched the Competence Centre for Innovation Procurement (KOINNO) to support capacity-building, information and guidance, and best practices.

However, public procurement of innovation remains underutilised in Germany. Germany invests in innovation procurement with the same intensity (10%) as the EU average (9.37%) (European Commission, 2021[51]). In general terms, it features in the group of moderate achievers in innovation procurement, both in terms of policy frameworks and investments. Its numbers are even smaller for R&D procurement (0.68%) and far from the EU target (3%). Public procurement of innovation still faces important barriers to uptake in Germany. These include strong risk aversion (i.e. especially when solutions need to be developed and co-financed) and resistance to change at public agencies; difficulties in engaging with external actors (i.e. for market consultation and competitive dialogue); budgetary restrictions; and difficulties in implementing and managing pre-commercial procurement (e.g. launching a competition) (OECD, 2017[52]). A major challenge is building the skills of a large procurement staff to enable procuring agencies to apply increasingly complex criteria, as is the case with strategic procurement (e.g. green procurement and innovation procurement).

Yet the potential to expand use of public markets for innovation is large, as evidenced by the effectiveness of innovation procurement in driving firm innovation and performance, as well as private investment. A 2016 study estimated that innovation procurement could apply to approximately 12-15% of Germany’s public procurement, representing approximately EUR 40-50 billion (Eßig and Schaupp, 2016[53]).

Germany has no targets related to the allocation of innovation procurement or R&D-related procurement. Other EU Member States have taken action in this area, setting quantitative targets. These include Finland (5% target for innovative public procurement), France (2% of procurement for innovative SMEs), the Netherlands (2.5% of procurement for innovation) and Spain (3% new investment for innovation procurement) (OECD, 2017[32]). In 2021, the Lithuanian government also increase its target for the share of innovation in total public procurement as part of the National Progress Plan for 2021-30 (OECD, 2021[34]). Encouraging contracting authorities to adopt a strategic perspective to innovation procurement is also fundamental, as is collaboration with different actors around public needs.

References

[10] Amoroso, S. et al. (2021), World corporate top R&D investors: paving the way to carbon neutrality, Publications Office, https://doi.org/10.2760/49552.

[9] Angelucci, S., J. Hurtado-Albir and A. Volpe (2018), Supporting global initiatives on climate change: The EPO’s “Y02-Y04S” tagging scheme, World Patent Information, No. 54, OECD.

[28] Batteries Europe (2020), Strategic Research Agenda for batteries, European Technology and Innovation Platform, https://ec.europa.eu/energy/sites/ener/files/documents/batteries_europe_strategic_research_agenda_december_2020__1.pdf (accessed on 31 May 2022).

[6] Belenzon, S. and C. Cioaca (2021), Guaranteed Markets ad Corporate Scientific Research, NBER Working Papers, No. Working Paper 28633, NBER, https://doi.org/10.3386/w28644.

[23] Bergek, A., M. Hekkert and S. Jacobsson (2007), Functions in innovation systems: A framework for analysing energy system dynamics and identifying goals for system-building activities by entrepreneurs and policy makers, RIDE/IMIT, Chalmers.

[25] BMBF (2020), Batterie 2020, Federal Ministry of Education and Research (BMBF), https://batterie-2020.de/english/.

[27] BMBF (2020), Richtlinie zur Förderung von Projekten zum Thema „Batteriematerialien für zukünftige elektromobile, stationäre und weitere industrierelevante Anwendungen (Batterie 2020 Transfer)“ im Rahmen des Dachkonzepts „Forschungsfabrik Batterie“, Federal Ministry of Education and Research (BMBF), https://www.bmbf.de/bmbf/shareddocs/bekanntmachungen/de/2020/09/3130_bekanntmachung.html (accessed on 2022).

[26] BMBF (2019), Batterieforschung und Transfer stärken – Innovationen beschleunigen: Dachkonzept „Forschungsfabrik Batterie“, Federal Ministry of Education and Research (BMBF), https://www.bmbf.de/bmbf/shareddocs/downloads/files/bmbf_dachkonzept_forschungsfabrik_batterie_handout_jan2019.pdf?__blob=publicationFile&v=1 (accessed on 12 May 2022).

[22] BMWi (2020), The National Hydrogen Strategy, BMWi, Berlin, https://www.bmwi.de/Redaktion/EN/Publikationen/Energie/the-national-hydrogen-strategy.html.

[1] BReg (2021), Klimaschutzgesetz 2021 - Generationenvertrag für das Klima, Federal Government of Germany (BReg), https://www.bundesregierung.de/breg-de/themen/klimaschutz/klimaschutzgesetz-2021-1913672.

[18] Dechezleprêtre, A. et al. (Forthcoming), The automotive sector and its industrial ecosystem: Impact of the green and digital transitions,, OECD Publishing, Paris.

[20] EC (2018), Case Study Report: Energiewende, https://ec.europa.eu/info/sites/default/files/mission_oriented_r_and_i_policies_case_study_report_energiewende-de.pdf.

[33] Eßig, M. and M. Schaupp (2016), Ermittlung des innovationsrelevanten Beschaffungsvolumens des öffentlichen Sektors als Grundlage für eine innovative öffentliche Beschaffung, BMWK, Berlin, https://www.koinno-bmwi.de/fileadmin/user_upload/publikationen/Ermittlung_des_innovationsrelevanten_Beschaffungsvolumens_des_oeffentlich...__3_.pdf.

[7] European Commission (2022), Pre-Commercial Procurement, European Commission, https://digital-strategy.ec.europa.eu/en/policies/pre-commercial-procurement.

[5] European Commission (2021), Implementation and best practices of national procurement policies in the Internal Market, European Commission, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=COM:2021:245:FIN&rid=3.

[31] European Commission (2021), The strategic use of public procurement for innovation in the digital economy, EC, Brussels, https://wbc-rti.info/object/document/21611/attach/KK0221251ENN_en_1_.pdf.

[29] Fraunhofer ISI (2018), Energiespeicher-Monitoring 2018 Leitmarkt- und Leitanbieterstudie: Lithium-Ionen-Batterien für die Elektromobilität, Fraunhofer Institute for Systems and Innovation Research (Fraunhofer ISI), https://www.isi.fraunhofer.de/content/dam/isi/dokumente/cct/lib/Energiespeicher-Monitoring_2018.pdf (accessed on 12 May 2022).

[24] Hekkert, M. et al. (2007), “Functions of innovation systems: A new approach for analysing technological change”, Technological Forecasting & Social Change, Vol. 74, pp. 413-432.

[19] IEA (2021), ETP Clean Energy Technology Guide, IEA, Paris, https://www.iea.org/articles/etp-clean-energy-technology-guide.

[3] IEA (2020), Energy Policy Review: Germany 2020, Energy Policy Reviews, IEA, Paris, https://iea.blob.core.windows.net/assets/60434f12-7891-4469-b3e4-1e82ff898212/Germany_2020_Energy_Policy_Review.pdf.

[17] IEA (2020), Innovation in Batteries and Electricity Storage, International Energy Agency (IEA), Paris, https://www.iea.org/reports/innovation-in-batteries-and-electricity-storage.

[21] Kuittinen, H. and D. Velte (2018), Mission-oriented R&I policies: In-depth case studies Case Study Report Energiewende, European Commission.

[8] Millot, V. (2009), “Trademarks as an Indicator of Product and Marketing Innovations”, OECD Science, Technology and Industry Working Papers, No. 2009/6, OECD Publishing, Paris, https://doi.org/10.1787/224428874418.

[13] OECD (2022), “Patents by main technology and by International Patent Classification (IPC)”, OECD Patent Statistics (database), https://doi.org/10.1787/data-00508-en (accessed on 16 August 2022).

[12] OECD (2022), STI Scoreboard, OECD, Paris, https://www.oecd.org/sti/scoreboard.htm.

[34] OECD (2021), Improving the Effectiveness of Lithuania’s Innovation Policy, OECD Science, Technology and Industry Policy Papers, OECD, Paris, https://www.oecd-ilibrary.org/science-and-technology/improving-effectiveness-of-lithuania-s-innovation-policy_a8fec2ee-en;jsessionid=Ugo1HRqC26MBubRxFn3dypB5.ip-10-240-5-88.

[35] OECD (2021), Policies for a Carbon-Neutral Industry in the Netherlands, OECD, Paris, https://doi.org/10.1787/6813bf38-en.

[14] OECD (2021), Policies for a Carbon-Neutral Industry in the Netherlands, OECD Publishing, Paris, https://doi.org/10.1787/6813bf38-en.

[11] OECD (2019), Skills Matter: Additional Results from the Survey of Adult Skills, OECD Skills Studies, OECD Publishing, Paris, https://doi.org/10.1787/1f029d8f-en.

[4] OECD (2017), OECD Reviews of Innovation Policy: Finland, OECD.

[32] OECD (2017), Public Procurement for Innovation: Good Practices and Strategies, OECD Public Governance Reviews, OECD Publishing, Paris, https://doi.org/10.1787/9789264265820-en.

[15] Paunov, C. and S. Planes-Satorra (2019), “How are digital technologies changing innovation? : Evidence from agriculture, the automotive industry and retail”, OECD Science, Technology and Industry Policy Papers, No. 74, OECD Publishing, Paris, https://doi.org/10.1787/67bbcafe-en.

[16] PwC (2021), Global Top 100 Companies by Market Capitalisation, PwC, UK, https://www.pwc.com/gx/en/audit-services/publications/assets/pwc-global-top-100-companies-2021.pdf.

[2] SPD, Bündnis 90/Die Grünen und FDP (2021), Mehr Fortschritt wagen - Bündnis für Freiheit, Gerechtigkeit und Nachhaltigkeit, https://www.bundesregierung.de/resource/blob/974430/1990812/04221173eef9a6720059cc353d759a2b/2021-12-10-koav2021-data.pdf.

[30] VDMA (2018), Roadmap Battery Production Equipment 2030, VDMA, Frankfurt.

Notes

← 1. A list of open tenders solicited by DARPA can be found at the following link: https://www.darpa.mil/work-with-us/opportunities

← 2. Tenders for pre-commercial procurement can be found at the following address: https://digital-strategy.ec.europa.eu/en/related-content?topic=61

← 3. The RTA is defined as a country’s share of patents in a particular technology field, divided by the country’s share in all patent fields. The index is equal to zero when the country holds no patent in a given sector; it is equal to 1 when the country’s share in the sector equals its share in all fields (no specialisation); and it is above 1 when a positive specialisation is observed. Data are drawn from the OECD Patent Database.

← 4. In 2018, Japan published 2339 international patent applications for 2339 inventions related to batteries, almost twice as many as the second-ranked South Korea (1230). China ranked fourth in patent filings, followed by the US in fifth.