Germany has a well-established network of knowledge transfer and co-creation between science and industry, which has helped ensure that German firms are at the cutting edge of technology. Yet the digital and sustainable transitions require more cross-disciplinary and cross-sectoral efforts in the transitional context. This chapter begins with a recommendation on improving cross-disciplinary and cross-sectoral knowledge transfer. It introduces the key actors and institutions involved in knowledge and technology transfer in the German innovation system. It proceeds with an analysis of how knowledge transfer between science and industry can support breakthrough innovation. Finally, it discusses constraints to and public policies supporting knowledge transfer in the German science, technology and innovation system.

OECD Reviews of Innovation Policy: Germany 2022

13. Technology and knowledge transfer for industry innovation and transformation

Abstract

Introduction

Knowledge transfer and co-creation between research, industry and other stakeholders are important drivers of innovation. Increasing their effectiveness and frequency of use is therefore a key component of German science, technology and innovation (STI) policy. Knowledge transfer promotes industrial competitiveness and addresses societal challenges by transforming scientific knowledge into new products and services, whereas co-creation is the joint production of innovation between stakeholders (Kreiling and Paunov, 2021[1]).

Knowledge transfer is particularly important to the innovative capacities of the small and medium-sized enterprises (SMEs) that comprise the German Mittelstand. While large corporations may be able to dedicate significant investment to research and development (R&D), the same is not always true of smaller firms. Hence, the ability to engage jointly in – and learn from – high-quality research conducted in the broader STI system can markedly improve the innovation capacity of SMEs. Collaborative innovation is even more important in the transitional context, where new knowledge and technology that are often not widely diffused in the business community may be required to innovate successfully. A major challenge for policy makers is to accelerate the transformation of ideas from science into successful innovations, which requires exploiting existing and newly developing competencies in the broader STI system. Germany’s strong research capacity and scientific leadership in numerous disciplines are a source of strength and resilience as firms innovate in the sustainable and digital transitions.

Supporting knowledge and technology transfer from research and scientific institutions to the private sector remains a key policy priority for the Federal Government. The Federal Ministry for Economic Affairs and Climate Action (BMWK)’s flagship innovation policy, “From the Idea to Market Success”, explicitly seeks to accelerate the transfer of ideas, research and technology into marketable solutions, ensuring that German firms are equipped to commercialise and apply the most promising research. However, most programmes are shaped by – and oriented towards – the country’s large manufacturing sector. While the transfer of knowledge and technology between research and historically strong innovative industries must remain high on the innovation policy agenda, policy makers must also keep in mind that new forms of transfer may be necessary in the context of the sustainability and digital transitions.

The challenge for German policy makers is to strike a healthy balance between supporting formal and informal channels of exchange between industry and research to maintain current industrial competencies, while allowing the emergence of new firms and ideas. Ensuring that Mittelstand contribute to this end remains essential.

This chapter of the Innovation Policy Review begins with a recommendation on improving cross-disciplinary and cross-sectoral knowledge transfer. It then assesses key aspects of the country’s knowledge and technology transfer ecosystem, and reviews in detail the policy options available to improve it.

Recommendation 5: Improve cross-disciplinary and cross-sectoral knowledge transfer and collaboration

Overview and detailed recommendation

Extensive and inclusive knowledge exchange and collaboration across institutions, disciplines and sectors, as well as multidisciplinary open innovation approaches, should become cornerstones of German STI policy. Success in this area would have other positive spillover effects on inclusivity in STI, such as engaging in innovation activities a wider share of the population with skills beyond STEM. Germany’s traditional innovative strengths have generally been intra-sectoral, so that knowledge is created, and technology transferred and applied, within a particular cluster and industry. In a digital world, however, knowledge and technology transfer increasingly occurs at the intersection of digital technologies and “analogue” sectors. In addition, the type of innovation necessary to succeed in the sustainable development challenge is – and will continue to be – disruptive. This requires significant breakthroughs, which are achieved through effective knowledge transfer and industry-science collaborations, and based on open innovation approaches and industry-science collaborations across all sectors of the economy. The support for knowledge transfer and collaboration should transcend traditional innovative sectors. The success of the government’s recent pilot phase of the Innovation Program for Business Models and Pioneering Solutions (IGP) programme (see Section 2 of this chapter) also demonstrated the potential of government-supported programmes to promote non-technical and multidisciplinary innovation in areas ranging from digital platform design to social impact.

R5.1 Improve universities’ engagement with industry and support research institutions in playing a leading role in the transitions required to achieve the “Germany 2030 and 2050” vision. Part of the vision should consist in reframing the relationship between research institutions and industry, so that it supports knowledge transfer and innovation collaboration in areas of future importance, as well as an “ecosystem” approach to innovation. In this light, ensuring that innovation actors contribute to knowledge transfer and collaboration could become a formal pillar of German research organisations’ responsibilities, with a training and information campaign accompanying this change. This strategy would benefit from incorporating these objectives into performance-based funding and developing a set of metrics, including qualitative measures, to improve the visibility of related programmes. The “Germany 2030 and 2050” vision could also establish a formal mechanism, encompassing the forum proposed in R1, the policy laboratory and the higher education system, to engage research institutions in Germany’s transformational processes, including by contributing to environmental development objectives.

R5.2 Encourage and facilitate the development of university proof-of-concept funds to support academic spin-offs and start-ups. Through its direct funding of higher education R&D, the government should encourage the establishment of proof-of-concept funds within universities, which could be complemented by industrial contributions. These funds would help accelerate technology transfer commercialisation. The government should explore regulatory channels that would allow (and make it simpler for) universities to engage directly with external finance actors, such as VC firms and the banking system more broadly, as happens in Belgium, Denmark and the United Kingdom. Moreover, the government should take a long-term approach to monitoring and assessing the development of proof-of-concept programmes within higher education – a luxury that the private sector (particularly SMEs) cannot afford.

R5.3 Reinforce incentives for academics to engage in innovation. Policy makers and universities need to improve incentives for academics to pursue innovation activities, and address relevant barriers. Establishing clear performance evaluations that take into account knowledge transfer and collaboration at the institutional and researcher levels will be important in this regard. This entails raising entrepreneurial awareness and knowledge among students and faculty, encouraging academic staff to support students who approach them with ideas, or indeed to develop and pursue their own ideas. Academics should be encouraged to avail themselves of industry secondments. At the same time, the government and the higher education system should address financial incentives (such as equity participation and licensing revenues) or barriers to university-based start-ups.

R5.4 Support multidisciplinary and entrepreneurship training across the entire education system to promote entrepreneurialism, as well as spin-offs and spin-ons. Training efforts should also be inclusive and involve groups throughout society. The government should encourage under-represented groups, such as women and migrants, to engage in innovation activities, from participating in academic spin-offs to contributing to knowledge transfer and collaboration. Academic “spin-ons”, which connect researchers with entrepreneurs, can be an effective way to exploit complementary skills to drive innovation, rather than attempting to transform all researchers into savvy entrepreneurs.

R5.5 Enhance accountability and develop a framework for performance metrics. The government should promote the creation of a core set of knowledge-transfer metrics and consistent reporting mechanisms, conducted on an annual basis. This requires strengthening measurement at the institutional level, by establishing reporting cultures and related processes, as well as collecting more holistic metrics, including qualitative measures (e.g. pathways and examples) and new approaches to evaluate the impact of knowledge transfer.

R5.6 Increase opportunities for open innovation and co-creation. German SMEs could benefit from further open innovation and co-creation initiatives. These include joint innovation labs (and joint/shared infrastructure and equipment); digital innovation hubs; open innovation platforms; open fab-labs; and testing/demonstration platforms, living labs and hackathons. Co-creation and innovation labs can take the form of digital platforms and virtual laboratories allowing research and data sharing, as well as the co-design and co-creation of solutions, and their piloting and testing. This pooling of diverse competencies would significantly reduce infrastructure and research costs, and accelerate development.

Relevant global experience

International experience has shown there exist multiple ways to facilitate knowledge transfer between science and research on the one hand, and industry and entrepreneurs on the other. While these approaches are varied, they feature a number of recurrent themes, which are outlined below.

Improving networks and mobility between STI actors is important to promote effective collaboration. This can be done by better balancing demand-oriented research with curiosity- (or supply‑) driven research at public research institutions (PRI). Formal consultation mechanisms between universities and industry/SME stakeholders and universities’ involvement in regional/national innovation/competitiveness agendas can help define research priorities and agendas. So can facilitating researcher mobility across sectors (i.e. academia, industry and government) and towards SMEs through collaborative projects, industry secondments and sabbaticals, and recognising researchers’ efforts in career and research evaluations. Moving back and forth between industry and academia through industry secondments, joint R&D projects and sabbaticals must become easier and more attractive for researchers.

A practical example is the “Knowledge Transfer Partnership Programme” from the United Kingdom. Knowledge transfer partnerships enable businesses to tap into academic expertise by bringing them together with a suitable partner university. In this manner, the business can access knowledge, technology or skills within the university to resolve a strategically important business or technical issue, while academics can test apply and translate their research into industry. Typically, a suitably qualified graduate or postgraduate student is employed to conduct the strategic project under the guidance of funded by the government; businesses make a financial contribution that is matched by an Innovate UK grant. The company receives a full-time staff member of staff (a knowledge transfer partnership associate) and the ongoing support of two academics with relevant expertise to guide progress. The knowledge transfer partnership associate remains employed by the university, but is wholly or partly based at the firm (working under its terms and conditions) to ensure that new knowledge and innovation are embedded in the company.

Easing the interfaces between business and research actors can facilitate transfer and collaboration. It is important to develop user-friendly interfaces, improve the research community’s communication with SMEs, and enhance the visibility of research competence and outputs (e.g. through digital platforms). Likewise, helping intermediation structures (i.e. universities) adapt to a broader innovation engagement, and matching suitable partners, should further exploit knowledge transfer opportunities (e.g. clusters/regional platforms, regional innovation and cities/government). Examples include Interface, the knowledge connection hub from the University of Edinburgh, and the strategic network of the University of Barcelona, where strategic network units (i.e. cluster-focused knowledge transfer units) drive connectivity through mobility linkages, matching partners, and linking with innovation networks or clusters, and government (i.e. regional governments, cities, living labs, open innovation platforms and hackathons).

In the context of transitional challenges, it is particularly important to promote multidisciplinary and cross-sectoral collaboration. In Germany, as in other OECD countries, there exists a need to facilitate more interdisciplinary and multidisciplinary collaboration in knowledge transfer and, more broadly, research. If current operating models for knowledge and technology transfer do not facilitate multidisciplinary collaboration, then barriers must be addressed, encouraging increased participation by actors from new sectors and regions. Practical examples from industry show that inter-sectoral linkages provide complementarity gains – especially when addressing complex challenges – enhance the cross-fertilisation of ideas (e.g. Montresor and Quatraro (2017[2])).

The number of cross-sectoral innovation platforms and programmes has been increasing in OECD countries. In the United Kingdom, the Cross-Sector Battery Systems Innovation Network is a collaborative community of technology developers and end-users from multiple sectors. The Cross-Sector Innovation Programme in Defence, for its part, supports the alignment and exploitation of knowledge between the defence and other sectors to expand the UK defence supply chain by generating “exploitation pathways”. Using an open innovation platform, the programme aim to create opportunities for the co-development and co-application of new technologies to address future export performance in the sector. At the European level, the GreenOffshoreTech (Horizon 2020) programme aims to support innovation in SMEs and the development of “blue economy” industries by promoting cross-sectoral and cross-border value chains addressing common challenges through new technologies. Cross-border collaboration between clusters, firms and cities are also flourishing, to address common innovation issues.

Policy makers must improve incentives for academic spin-offs. In addition to raising awareness of entrepreneurial opportunities among academic staff, higher education institutions (HEIs) and public research institutions should promote more flexible career paths for their researchers and academics. Academics often require greater incentives to become involved in knowledge transfer, particularly where it is not their institution’s mission or mandate. Clearly defining and highlighting knowledge transfer activities in the evaluation framework for scientists, researchers, teachers and their institutions may create more incentives to participate in such activities.

A strong network of intermediation infrastructures underpins knowledge transfer. Firms and research-performing organisations often rely upon intermediaries, in the form of knowledge transfer offices, to facilitate funding and information for knowledge transfer activities. These knowledge transfer offices and other intermediaries often face a range of challenges in attracting, retaining and training knowledge transfer professionals. Improving the attractiveness of such institutions for professionals, including through better training and accreditation programmes, could underpin more effective co-ordination between different actors in the knowledge transfer system.

As discussed in Chapter 7, it is necessary to improve pre-seed and intermediate stage funding to support technology transfer. Many of the projects involved in knowledge transfer are often pre-commercial. Therefore, better alignment between private and public funding and the goals of knowledge transfer programmes could accelerate and increase the commercialisation of high-potential research into products.

Encouraging open innovation and co-creation is particularly important for innovation in the context of the sustainability and digital transitions. Several programmes in OECD countries have increasingly focused on an open and co-creative approach to knowledge creation. These include the Catapult Centres in the United Kingdom (e.g. the “digital and high value manufacturing” and “advanced assembly” Catapult Centres, which focus strongly on technology transfer by SMEs) and the Italian (Emilia-Romagna region) Open platform for advanced technological services in the machine-tool manufacturing sector.

13.1. An introduction to knowledge transfer in Germany

13.1.1. Overview

While knowledge transfer is a broad concept, the goal is generally singular: ensure that the STI system facilitates the transformation of promising research into meaningful socio-economic innovations. In achieving this, German policy programmes and interventions must address a number of interrelated questions, such as: how can more firms be encouraged or enabled to participate in knowledge transfer? How can policy makers best support the commercialisation of public research, increase the contribution of HEIs to knowledge transfer and measure the influence of knowledge transfer on innovation (Box 13.1)?

Box 13.1 Measuring knowledge transfer

Measuring the effectiveness and performance of knowledge transfer, like other areas of the STI system, is complicated. While this section of the review primarily maps the current channels of knowledge transfer in Germany, some indicators of its performance – for example, in collaborative research output – can be found in Chapter 4.

When measuring the impact of knowledge transfer, researchers tend to use a combination of the following metrics:

survey data and case studies

patent data

publications data

labour force and university graduate survey data.

Each of these approaches has advantages and disadvantages. A full discussion of these strengths and weaknesses can be found in earlier OECD work, such as the 2019 OECD STI report on knowledge transfer from universities to industry, University-Industry Collaboration: New Evidence and Policy Options (OECD, 2019[3]).

Source: OECD (2019[4]), University-Industry Collaboration: New Evidence and Policy Options, https://doi.org/10.1787/e9c1e648-en.

German policy makers have created policy programmes and initiatives to facilitate knowledge transfer. As of 2022, Germany had 60 ongoing publicly funded policy initiatives, equivalent to 26% of all German STI policy initiatives listed in the EU-OECD STIP Compass database (OECD, 2022[5]). As in other areas of the STI policy mix, Germany’s knowledge transfer policy programmes are well-resourced. Of the 60 initiatives mentioned above, 7 have a budget of EUR 50-100 million (euros), 4 have a budget of EUR 20-50 million, and nearly half of the programmes (28) have budgets of EUR 1-20 million (OECD, 2022[5]). By way of international comparison, France, the second most industrialised country in the European Union, has 27 initiatives, of which 1 has a budget of EUR 100-500 million (the 2005 French cluster initiative), 6 have budgets of EUR 50-100 million, 2 of EUR 20-50 million, and 4 of EUR 1-20 million.

The most recurrent instruments in the German policy mix for knowledge transfer are project grants for public research and grants to the private sector for business R&D; networking and collaborative platforms for knowledge transfer are the third most frequently used instrument. Many of the instruments outlined above are administered through Germany’s mature and well-developed institutional framework for knowledge transfer, whose main contours are outlined below.

13.1.2. The institutional framework for knowledge transfer in Germany

Germany has a well-developed and large network of research organisations, which often work in collaboration with industry associations to support research and knowledge transfer to industry through several channels (Box 13.2). Five main groups of actors and institutions are involved in knowledge transfer, whose key characteristics are given below.

Universities of technology (TUs)

Germany numbers around 20 technical universities (Technische Universitäten). These institutions differ from general universities primarily through their role in knowledge transfer. They operate large engineering faculties, which generally focus on applied research. By training engineers who generally move into industry after graduation, these institutions typically have close links with the private sector. In addition, a professorship in a TU generally requires industrial experience, which implies experience in private-sector R&D. These faculties are often financed by industry R&D contracts, including joint supervision of academic theses by industry and faculty. Lastly, TU professors are often involved in a particular type of academic entrepreneurship called ”An-Institute”, which perform R&D contracts independently from the faculty.

Universities of applied sciences

Universities of applied sciences (Fachhochschulen) have been a feature of the German knowledge transfer system since the 1960s, when they were created through the upgrading of existing secondary schools focusing on engineering or industrial domains (Ingenieurschulen, Fachschulen). After reunification, a large number of universities of applied sciences were established in the former East Germany. Their main mission is to equip the business sector and other public or private instructions with sector-specific skills. The majority focus on engineering, information technology and management skills, with their graduates subsequently employed in a range of firm departments, including R&D. The federal funding arrangement for universities of applied sciences is designed to develop applied science, knowledge and technology transfer, and promote student education.

In line with the Framework Act for Higher Education, which defined “knowledge and technology transfer” as a third task for HEIs in 1998, both TUs and universities of applied sciences have an explicit commitment to this mission. In fact, most universities of applied sciences operate separate institutes or companies (e.g. institutes for applied research) dedicated to knowledge transfer activities.

Fraunhofer-Gesellschaft

The Fraunhofer Society is explicitly dedicated to technology transfer and is the most important public research institutions (PRI) in the German knowledge transfer system. It is also Europe's largest and most successful organisation for applied research and technology transfer. Like the Max-Planck-Gesellschaft and Helmholtz-Gemeinschaft, Fraunhofer enable companies to outsource expensive fundamental research, reducing the financial risk associated with the development of new products and decreasing R&D costs. Chapter 4 discusses these institutions’ governance and funding.

Fraunhofer-Gesellschaft comprises more than 80 research units (institutes), each specialising in a specific technology field. It has grown significantly over time, with around 19 200 people in full-time employment in 2019, compared to 7 300 in 2000. Around one-third of its annual budget of EUR 2.8 billion comes from institutional funding (90% from the Federal Government and 10% from the Länder), one-third from contracted research for industry, and the remaining from other funding programmes such as Zentralen Innovationsprogramms Mittelstand (ZIM) or EU-level initiatives.

Like the Leibniz-Gemeinschaft discussed in Chapter 4, Fraunhofer primarily serves SMEs (65% of its private-sector clients), giving these firms access to top-quality research (Fraunhofer-Gesellschaft, 2021[6]). Over 2015-18, 77% of Fraunhofer’s industry partners in publicly funded projects were SMEs, another 11% were medium-sized businesses with 500-5 000 employees, and only 3% were large firms with over 5 000 employees (Frietsch et al., 2022[7]). Collaboration between Fraunhofer institutes and industry – and SMEs in particular – is supported by public R&D programmes. In most federal technology programmes that finance co-operative R&D projects (Verbundforschung), Fraunhofer institutes (together with TUs) are the most frequent scientific partners.

Industrial co-operative research institutes

Although co-operative research institutes are not formally part of the science system, they play an important role in the knowledge transfer system. These institutions conduct science-based applied research (similarly to PROs) and are represented by two umbrella organisations.

The first is the German Federation of Industrial Research Associations (AiF), which was founded in 1954 as an industry initiative to promote branch-specific R&D supporting innovation activities by SMEs. Today, the AiF numbers 100 member organisations, each focusing on a branch or area of application (often outside the high-tech industries, e.g. on certain materials). Some have their own research institutes, while others act as umbrellas to co-ordinate R&D projects within their area of expertise. The R&D activities of AiF member organisations are mainly financed through the Industrial Collective Research (IGF) federal programme. In 2020, IGF provided EUR 201 million to R&D projects (AiF, 2021[8]).

The second umbrella organisation is the Deutsche Industrieforschungsgemeinschaft Konrad Zuse (Zuse Association [ZA]). A relatively recent addition to the knowledge transfer system in Germany, ZA was founded in 2015 by private-sector, non-profit research institutes specialised in sector-specific industrial R&D. ZA focuses on contract R&D for SMEs and pursues a nationwide approach, although many of its founding members are regionally concentrated in eastern Germany, like most institutes emerging from the R&D units of publicly owned enterprises and branch research organisations of the former German Democratic Republic. While the AiF focuses on managing (through the IGF programme) its member organisations’ R&D projects, ZA is more policy-oriented, promoting its members’ common interests in policy circles. The founding institutes of ZA have been supported by special R&D programmes of the Federal Government since 1990, to maintain a knowledge infrastructure in eastern Germany supporting innovation in SMEs. The “INNO-KOM” funding programme (see Chapter 5 for further details) is still running and was extended beyond east Germany in 2017 to support non-profit industrial R&D institutes in western German regions with structural problems (as defined by the Gemeinschaftsaufgabe Verbesserung der regionalen Wirtschaftsstruktur [Joint Task Improvement of the Regional Economic Structure]). The programme provides about EUR 75 million per year for R&D projects and R&D-related investments. Knowledge transfer takes place through contract R&D for SMEs and other firms, based on the knowledge and technologies obtained through the publicly funded projects.

Intermediary organisations.

The above organisations and institutions are complemented by private independent service providers (e.g. Ascenion GmbH, Atrineo AG PROvendis GmbH and TransMit) and industry associations). These organisations assist SMEs and industries in linking with research partners, as well as with other needs related to technology transfer. A large network of technology transfer offices located within universities assist researchers with the process of patenting, contracting and commercialising technology. Knowledge transfer offices were created at German universities during the 1980s and 1990s when the discussions on knowledge transfer intensified. Since the reform of patent-based technology transfer at HEIs in the early 2000s (abolishing the so-called “professors' privilege”), an increasing number of organisations and infrastructures has evolved to facilitate the transfer of technology and research findings between public research and firms. However, substantial challenges across the broader university system remain (i.e. providing incentives for researchers and management of technology transfer offices, and sustainability), and most transfer activities still originate from individual chairs and institutes rather than faculties or chancelleries. In addition to dedicated knowledge transfer service providers, two important knowledge transfer associations exist in Germany: Transfer Allianz and Forschungs- und Transfermanagement e.V. (FORTRAMA).

13.1.3. Knowledge transfer channels used by German firms

Universities and PROs play a key role in national innovation ecosystems as sources of scientific knowledge and new breakthrough technologies that can be transferred to industry to support innovation. Knowledge and technology transfer can take many forms; among the most frequent approaches are researcher mobility and training, collaborative R&D, contract R&D and patent licensing. Knowledge transfer can also take informal forms, such as accessing scientific and technical publications or industry meetings and exhibitions (Box 13.2).

Germany also has a strong presence of researchers (PhDs) employed in the business sector. According to data from OECD STI Scoreboard 2021, about 62% of total researchers were employed in private companies in 2019, compared to the OECD average of 50% (OECD, 2022[9]) This intensity is similar to that reported by France, Austria and Denmark, while countries such as Sweden, Japan and Korea display rates superior to 70%.

Box 13.2. Channels of knowledge transfer

1. Collaborative research refers to research projects carried out jointly by public researchers and private firms, which can be fully or partly funded by industry, and can range from small-scale projects to strategic partnerships with multiple stakeholders (i.e. public-private partnerships).

2. Contract research is research that a private firm commissions universities or public research institutions to perform, generally involving the creation of new knowledge in line with the specifications or goals of the client, and frequently more applied than collaborative research.

3. Academic consultancy denotes research and advisory services provided by public researchers to industry clients.

4. Intellectual property transactions cover the licensing and selling of intellectual property generated by universities and public research institutions to industry.

5. Research mobility refers to both university researchers working in industry and the converse, including temporary assignments.

6. Academic spin-offs denotes the entrepreneurial route to commercialising knowledge developed by public research.

7. Labour mobility refers to university graduates that join industry.

Informal channels of science-industry knowledge transfer include the following:

1. Public research is published in scientific journals and other specialised media.

2. Public researchers and industry actors interact and network at formal conferences or dissemination events, but also in more informal settings (e.g. at meetings of former classmates employed in public research and industry sectors).

3. Networking facilitated by geographic proximity denotes informal interactions between public research staff and industry researchers, which might be facilitated by locating science parks near university campuses or firms’ laboratories within university campuses.

4. Industry and public research share facilities (e.g. laboratories and equipment).

5. Universities provide courses and continuing education to enterprises, and industry employees give lectures at universities.

The advantages of assessing channels 1-8 is that they are traceable, as these interactions produce outputs (e.g. contract agreements, patents, human resources) that demonstrate the presence and extent of collaboration. By contrast, informal linkages are much more difficult to measure, although their importance is significant.

Source: OECD (2019[4]), University-Industry Collaboration: New Evidence and Policy Options, https://doi.org/10.1787/e9c1e648-en.

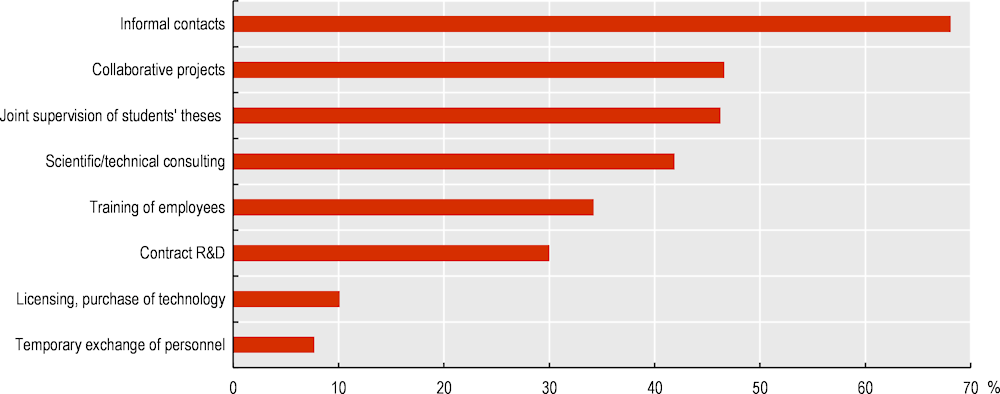

The Mannheim Innovation Survey, which interviews a representative sample of firms, indicates that 68% of all collaborating firms globally rely on informal exchanges for knowledge. A substantial share (47%) also engage in collaborative projects; the most frequent forms of collaboration with research institutions are joint supervision of students’ MA and PhD theses (46%), followed by scientific and technical consulting (42%) (Figure 13.1, Figure 13.2). As in other countries, the most widespread form of collaboration with public research institutions are informal contacts; licensing or purchasing of technology derived from science (10%) and temporary exchange of personnel (8%) are infrequent.

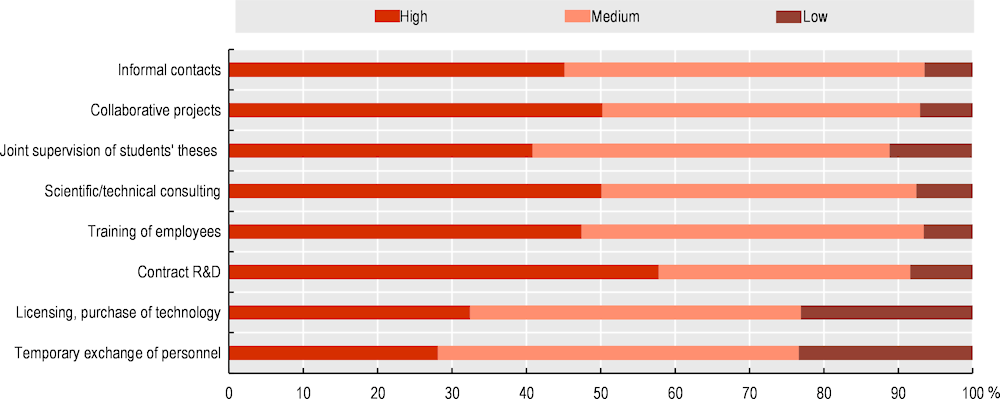

In terms of their effectiveness in providing access to science organisations’ knowledge, collaborating firms consider rate contract R&D as highly effective, followed by collaborative projects, scientific and technical consulting, and employee training (Figure 13.1 and Figure 13.2). The few firms that use licensing or purchasing of technology from science and temporary exchange of personnel do not consider these types of collaboration very effective in this regard.

Figure 13.1. Types of collaboration with science (2015-17)

Figure 13.2. Importance of different types of science collaboration for accessing the knowledge of science organisations (2015-2017)

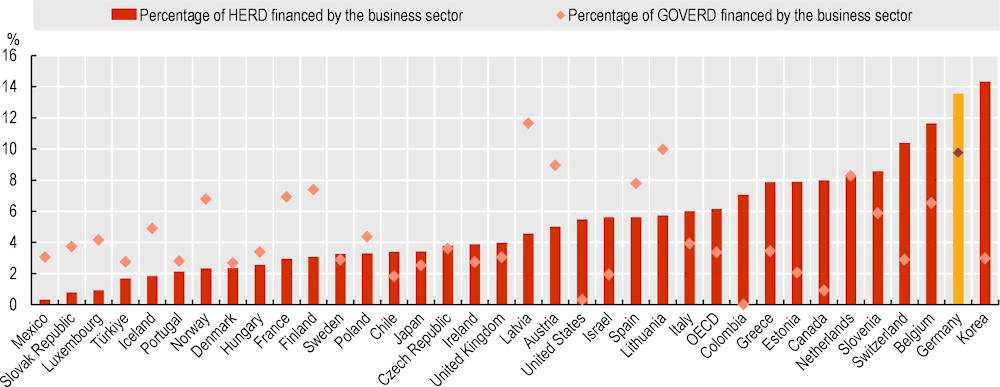

13.1.4. Research contracting and collaboration

Germany ranks high in terms of private-sector funding of R&D performed at HEIs and PROs. At HEIs, 13.5% of R&D is funded by the private sector (one of the highest figures registered in the OECD region), and in government research institutions 10% of R&D is financed by the private sector (Figure 13.3). In addition to HEIs, many PROs, such as the Steinbeis Centres and the An-Institutes, have strong financial links with industry through contracted and collaborative R&D. At TUs, faculty positions are traditionally financed in large part by industry R&D contracts, including joint supervision of theses by faculty and enterprises.

Figure 13.3. Industry funding of R&D in HEIs and government institutions (2019)

Source: OECD (2022[11]), "Main Science and Technology Indicators", OECD Science, Technology and R&D Statistics (database), https://doi.org/10.1787/data-00182-en (accessed on 22 May 2022).

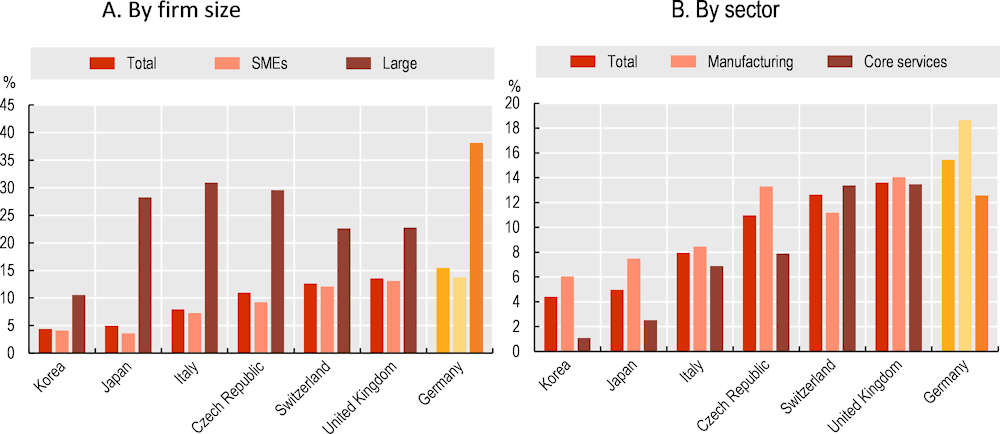

The high levels of co-operation do not, however, mean that all firms – particularly smaller ones–engage in knowledge transfer activities. According to the 2021 Mannheim Innovation Survey, the propensity of German firms to collaborate with research institutions stands at about the OECD average: 7.2% of all surveyed firms reported undertaking some type of collaborative R&D or other innovative activities with either HEIs or PROs between 2016 and 2018 (ZEW, 2021[10]). About 38% of innovating large firms conduct collaborative research with HEIs or PROs, compared to only 17.5% of innovating SMEs (Figure 13.4).

Moreover, manufacturing firms in Germany engage more frequently in collaborative R&D with HEIs and PROs compared to service firms; there is less of a sectoral bias for firms in the United States and France. In contrast, start-ups appear to have closer linkages with PROs than other firms. According to one survey (PWC/Bundesverband Deutsche Startups/net Start, 2021[12]), nearly 80% of all start-ups report good or very good access to universities, and 55.4% co-operate actively with universities or PROs.

Figure 13.4. Firms co-operating on innovation activities with universities or other higher education institutions

Source: OECD, based on the Business Innovation Statistics and the Eurostat’s Community Innovation Survey (CIS-2018), https://www.oecd.org/sti/inno-stats.htm, April 2022

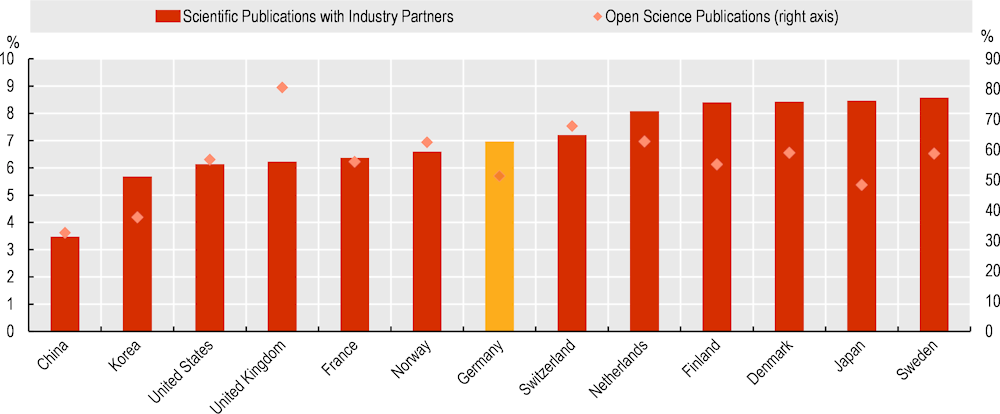

Regarding research collaborations as indicated by co-publication activity with private-sector partners, Germany’s three-year average percentage of co-publications increased from 6.6% in 2006-09 to 6.97% during 2015-18. Countries such as Denmark, Finland, Japan and Sweden reported slightly higher shares of publications co-authored by universities and industry partners (Figure 13.5). The low numbers indicate the generally low propensity of universities to engage in joint research with the private sector, which is a global phenomenon.

Figure 13.5. Co-publication with private-sector entities by HEIs and open-science publications

Note: The ranking includes 1176 universities worldwide. These universities have been selected based on their number of Web of Science indexed

Source: CWTS Leiden Ranking (2020[13])

13.1.5. Licensing and patenting: Opportunities for partnerships

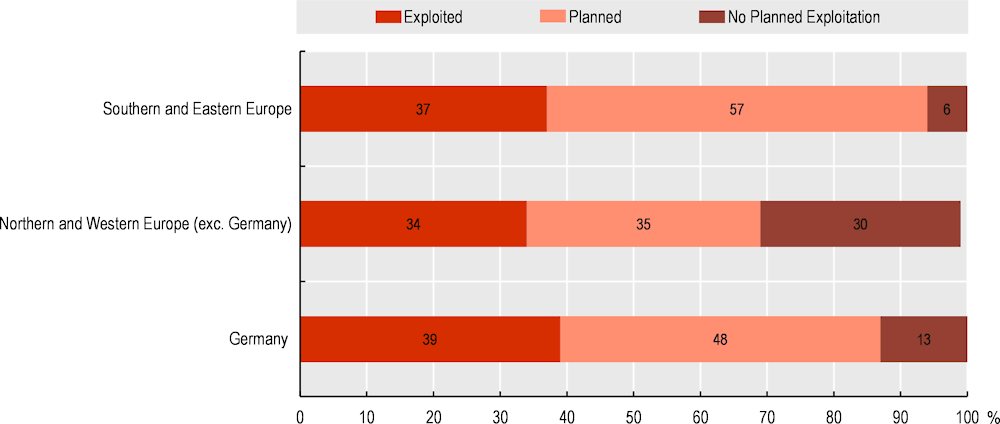

According to a recent survey by the European Patent Office (EPO) of a sample of patents from PROs, German public institutions exploit about 39% of their inventions within two years of registering a patent with the EPO, a figure slightly higher than the average reported by other western European countries (Figure 13.6) (European Patent Office, 2020[14]). As in other countries, licensing is by far the most preferred commercialisation channel in Germany (84% of interviewees), followed by patent sales (26%); only 7% of German interviewees planned exploiting patents to engage in R&D co-operation, compared to 23% in other western EU countries.

However, the rate of unexploited patents remains substantial. For about half (48%) of the total inventions considered for patent protection in the surveyed period, commercialisation is planned but not yet achieved; 13% have no exploitation plan at all. The need to increase the commercialisation of research, such as through patent licensing, is one focus of the “idea to market” approach of the Federal Ministry for Economic Affairs and Climate Action (BMWK) (see Chapter 5 for a comprehensive review).

Figure 13.6. Stage of Exploitation of Patented Inventions by Geographical Region

Note: Number of interviews (unweighted) N=633; of which 1% do not know or gave no statement.

Source: European Patent Office (2020[14]), Valorisation of scientific results Patent commercialisation scoreboard: European universities and public research organisations, https://documents.epo.org/projects/babylon/eponet.nsf/0/f90b78b96b1043b5c1258626006cce35/$FILE/Valorisation_of_scientific_results_en.pdf.

Patenting activity at PROs has slowed in recent years, which carries a risk that technology transfer through patent licensing will concomitantly decrease in the short and medium term. Data for the four largest PROs and HEIs showed a clear shift from patenting towards more publications between 2005 and 2018. This trend stems from the expansion of R&D resources in the public science sector in Germany since 2006, which occurred in the context of strengthening research excellence and therefore strongly focused on increasing research quality and output, rather than increasing knowledge transfer and application-oriented development of new technology.

13.1.6. Academic spin-offs and science-based start-ups

Despite an increased emphasis on academic entrepreneurship, the number of academic spin-offs (Box 13.3) remains relatively low. A 2021 study found that intellectual property-based spin-offs from German PROs grew by 7.3% annually between 2011-19, with Fraunhofer showing a higher rate (12.7%) (Fraunhofer/ZEW, 2021[15]). As with other areas of the German STI system, academic entrepreneurship is highly concentrated in few cities and regions, with Berlin, Karlsruhe and Munich making the biggest contributions (Fraunhofer/ZEW, 2021[15]).

The growth in German academic spin-offs is broadly similar to growth at elite universities and PROs in other EU countries and the United States. German PROs produced 58 spin-offs in 2019, compared to 102 for the University of California and 95 for the French National Centre for Scientific Research (CNRS) (Fraunhofer/ZEW, 2021[15]). At the institutional level, most German PRO spin-offs originate from Fraunhofer and Helmholtz; in 2017-19, researchers from these two institutions formed 81 (Fraunhofer) and 61 (Helmholtz) intellectual property (IP)-based spin-offs, compared to 287 from the University of California, 273 from the CNRS, 117 from the University of Texas and 86 from MIT (Fraunhofer/ZEW, 2021[15]). The expansion of academic spin-offs in Germany is supported by a range of policy programmes, the largest of which is Existenzgründungen aus der Wissenschaft (EXIST). Chapter 5 provides more details on these programmes.

Box 13.3. Overview of academic spin-offs

Academic spin-offs can take a number of forms. The following is an overview of the most common forms of spin-offs and the avenues for their creation, based on a 2021 report by ZEW and Fraunhofer (Fraunhofer/ZEW, 2021[15]).

Forms of academic spin-offs

1. Spin-offs based on IP. The main purpose of these spin-is to commercialise IP generated at the PRI, based on an IP contract between the PRO and the spin-off. PROs may take a share in the company, or sell (or license) the IP to the company. These spin-offs can be entirely owned by the PRO or joint ventures.

2. Spin-offs based on research. These are start-ups by researchers from PROs aiming to commercialise R&D. This type of spin-off does not involve an IP contract between the spin-off and the institution.

3. Spin-offs based on expertise. These are spin-offs where researchers commercialise their capabilities and competencies. They do not necessarily follow from a particular project or piece of research, but rather stem from the cumulative experience of their founders.

4. Student or graduate start-ups. These are start-ups founded by students or graduates not employed at their university. They can occur in any sector, but are more common in services. Such start-ups rarely emerge directly from research activities, but nevertheless utilise the knowledge and skills obtained from experience within research or academic institutions.

5. Funded start-up projects. Researchers or graduates fundraise for these start-ups from PRIs or government programmes, often complemented by their own private contributions. EXIST (see Chapter 5) is an example of a programme that facilitates this type of spin-off.

6. Alternative forms. Spin-offs may take many other forms. For example, researchers may launch a start-up that is not explicitly linked to a particular piece of research, but nevertheless indirectly facilitates the transfer of knowledge through their experience and competencies.

Source: Fraunhofer/ZEW (2021[15]), Spin-Offs from Public Research Organisations in Germany: A Comprehensive Analysis based on Bibliometric, Patent, Website and Company Register Data, https://www.isi.fraunhofer.de/content/dam/isi/dokumente/cci/2021/Report_Allianz-Studie_final.pdf.

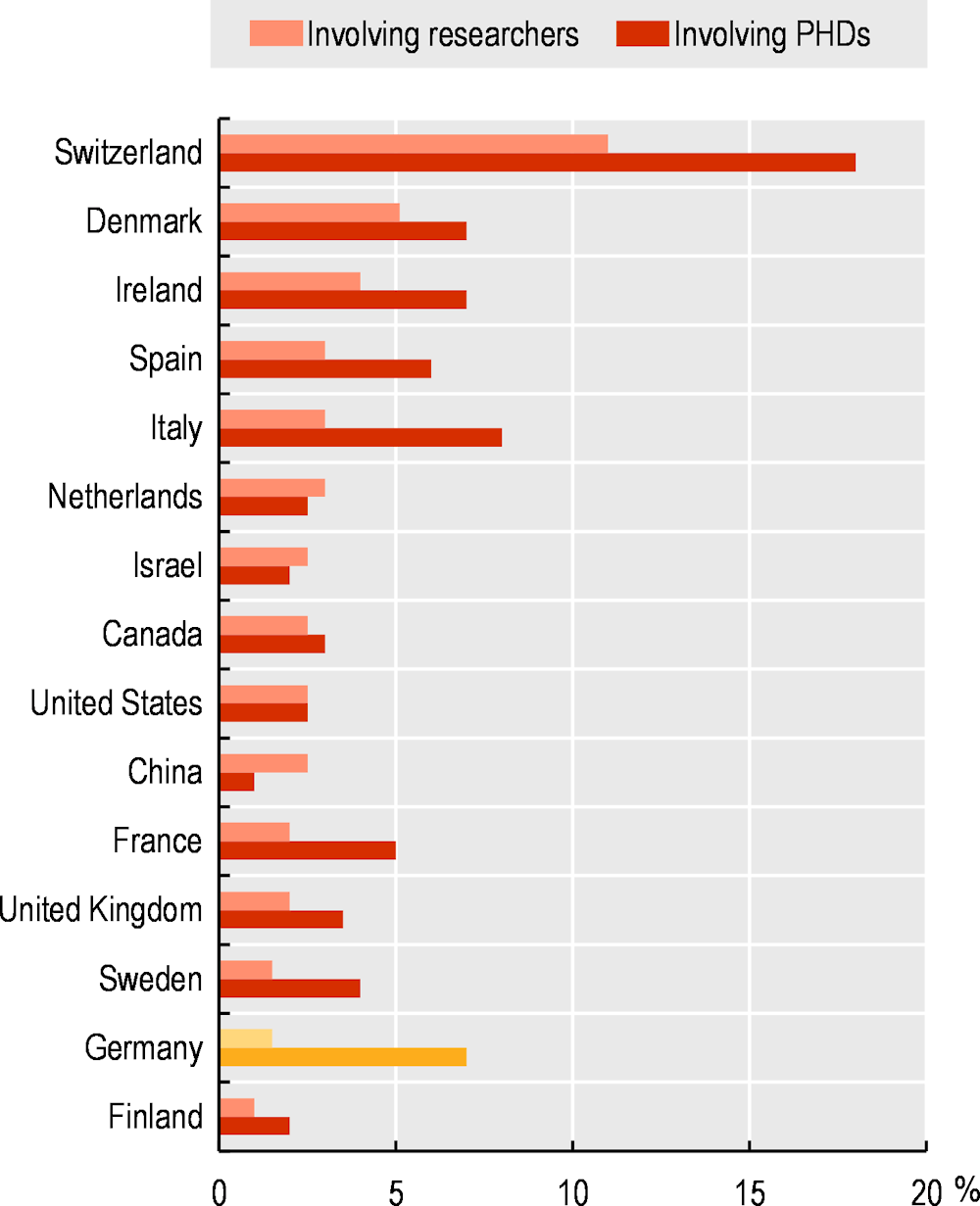

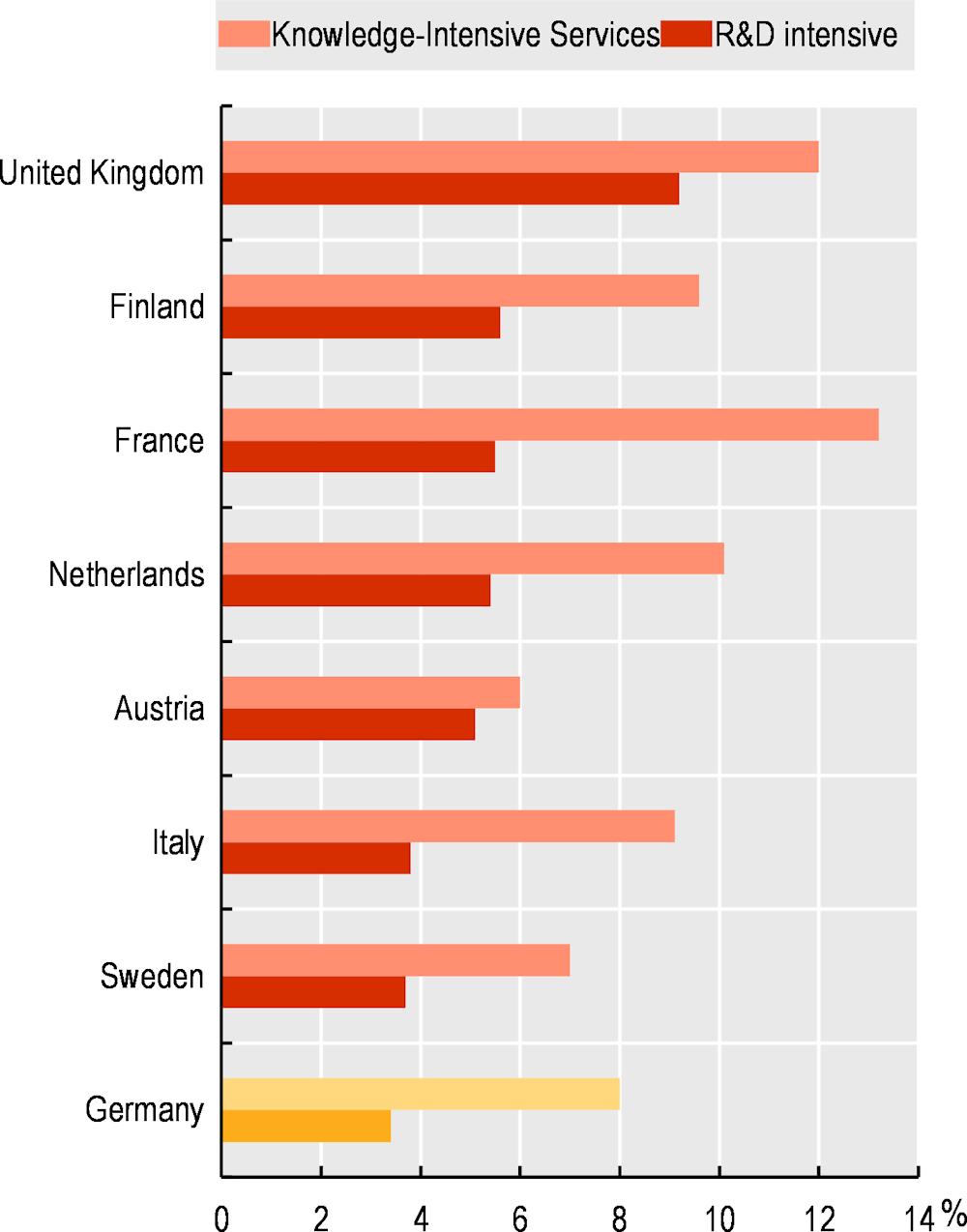

According to an OECD study based on Crunchbase data, German start-ups featured on Crunchbase involving researchers comprised 1.5% of all start-ups that received VC investment (Figure 13.7) whereas the share of VC firms involving PhDs is 7% (Breschi, Lassébie and Menon, 2018[16]). Evidence also shows that the rate of new firm creation in R&D intensive sectors in Germany is lower than in other European countries, including for knowledge-intensive services (KIS) – a measure that can be used as a proxy for academic business creation (Figure 13.8). Ongoing work by the OECD has shown that government VC funds are significantly more likely to target new technology-based firms that have close ties to academic research, and that such academic-linked firms are more likely to produce radical innovations.

Figure 13.7. Share of academic start-ups in Crunchbase, by country and type (2018)

Note: The sample is limited to companies created after 2001 and having received at least one VC investment.

Source: Breschi, Lassébie and Menon (2018[16]), "A portrait of innovative start-ups across countries", https://doi.org/10.1787/f9ff02f4-en, for OECD, based on Crunchbase.

Figure 13.8. Rate of new firm creation in R&D intensive sectors (2017)

Source: From Kulicke (2021[17]) based on Business Demography Statistics (Eurostat) and Mannheimer Unternehmenspanel. ZEW calculations in Bersch and Gottschalk (2019[18]) and EFI (2020[19]).

Moreover, a low rate of spin-off creation is also reported in PRIs, although important efforts have been deployed to enhance spin-off creation and support innovative start-ups through accelerator programmes (Lambertus, Schmalenberg and Mathias, 2019[20]). Fraunhofer and Helmholtz Centres have established spin-offs support programmes (e.g. Fraunhofer Venture) which have proved very effective in enhancing the technology transfer rate, and improving firm survival and funding. Such programmes are similar to the Start-up Unit of the French Alternative Energies and Atomic Energy Commission; Eurecat’s Valorisation Area (Spain); Tecnalia Ventures (Spain); the Technology Transfer team at the TNO (Netherlands); and VVT Ventures (Finland). FDays® have become the flagship programme of Fraunhofer Venture and one of the most prominent high-tech accelerators in Germany (Box 13.4). A total of 55 such new companies were created at the 4 largest PRIs in 2016, followed by 51 in 2017, 64 in 2018, 58 in 2019 and 56 in 2020, with most emerging from the Fraunhofer Society, Max Planck and the Helmholtz Centres (GWK, 2021[21]). Since 2013, Leibniz, Helmholtz, Fraunhofer and Max Planck have teamed up every year to offer Start-Up Days, two-day workshops facilitating networking between budding entrepreneurs and industry professionals. To date, Fraunhofer has spawned more than 350 companies involving more than 150 shareholdings, while Max Planck Innovation has supported 160 spin-offs.

Box 13.4. Innovative start-up support at PRIs: Fraunhofer Venture

Fraunhofer Venture was created as a dedicated department in 2001 with the purpose of providing comprehensive support for Fraunhofer spin-off projects. Today, the aim of Fraunhofer Venture is to activate and maximise the transfer potential of the Fraunhofer-Gesellschaft by actively connecting IP and technologies, entrepreneurs, investors and industry partners. The Fraunhofer spin-off support system has been helping de-risk spin-off projects internally before spinning them off. It does so with a team of 25 people comprising venture managers, lawyers and company-building experts. The spin-off support system consists of four phases (Business Ideation, FDays®, FFE and FFM) and three key components: programmes, coaching and funding. The deliberate interplay of these three components paves the way for technology transfer via spin-offs on a larger scale.

FDays® have become the flagship programme of Fraunhofer Venture and one of the most prominent high-tech accelerators in Germany. Two factors probably lead to these results: first, Fraunhofer Venture serves as the central hub of spin-off expertise and can support projects going through the funnel. Second, the strong ties between Fraunhofer institutes and industry lead to the generation of high-quality business ideas, since technology development projects are often rooted in real market insights. To date, Fraunhofer has spawned more than 350 companies, involving more than 150 shareholdings.

Source: Lambertus, Schmalenberg and Mathias (2019[15]), Case study on programmes to promote spinoffs at Fraunhofer-Gesellschaft, Germany. Contribution to the OECD TIP Knowledge Transfer and Policies Project, https://stip.oecd.org/assets/TKKT/CaseStudies/16.pdf

13.2. The use of science in fostering breakthrough inventions

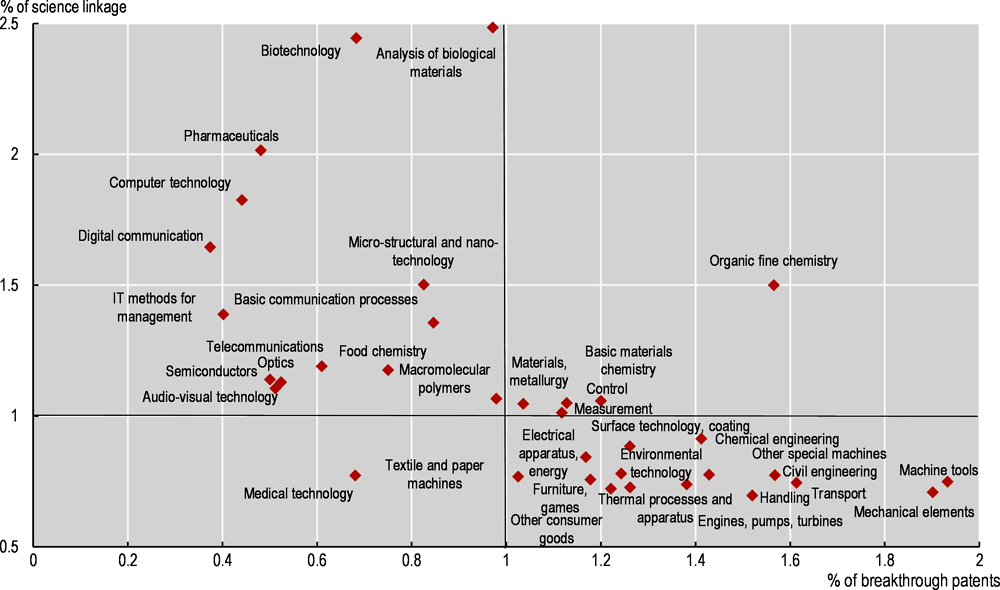

Science has been at the origin of many technological breakthroughs in history. The use of scientific knowledge for innovation has increased over time due to growing complexity in technological innovation, although its importance differs across economic sectors and technology areas (Narin, Hamilton and Olivastro, 1997[22]). However, an analysis of patent indicators suggests that breakthrough developments by German inventors are only weakly related to science, as measured by their references to research papers. Science linkage refers to the number of references patents makes to non-patent literature such as peer-reviewed scientific papers, conference proceedings or databases relative to the maximum number of references to non-patent literature by other patents in a given field and year. For example, patents that are normalised relative to the average display a lower-than-average science linkage (Figure 13.9). In other words, fields with more intense breakthrough invention display lower-than-average science content (bottom-right square), whereas fields known for science intensity, where the science linkage is higher (top-left square), show a lower-than-average propensity to generate breakthrough inventions compared to the average propensity across fields. Chapter 11 discusses breakthrough innovation in more detail.

Figure 13.9. Breakthrough patenting by Technology Field (WIPO 35 classes) (2012-15)

Note: Breakthrough inventions refer to the top 1% of the most cited patents (field-year distribution) within the first five years after publication (Squicciarini, Dernis and Criscuolo, 2013[23]); the indicator on the y-axis refers to the average intensity of citations to non patent literature (scientific publications) relative to the average in the same field-year of filing; the indicator on the horizontal axis displays the relative specialization (Revealed Technological Advantage) in breakthrough patenting (i.e., the share of breakthrough patents in country total relative to the average share in the world).

Source: Own calculations based on patent data from the OECD Patent Quality Indicators Database based on Squicciarni, Dernis and Criscuolo (2013[23]); "Measuring Patent Quality: Indicators of Technological and Economic Value", OECD Publishing, Paris, https://doi.org/10.1787/5k4522wkw1r8-en

13.3. Constraining factors for knowledge and technology transfer

Several barriers hinder knowledge and technology transfer through patenting, licensing, academic spin-offs or informal channels. These exist both on the side of firms, and researchers and their institutions.

13.3.1. Constraints faced by firms

Technology readiness and development funds

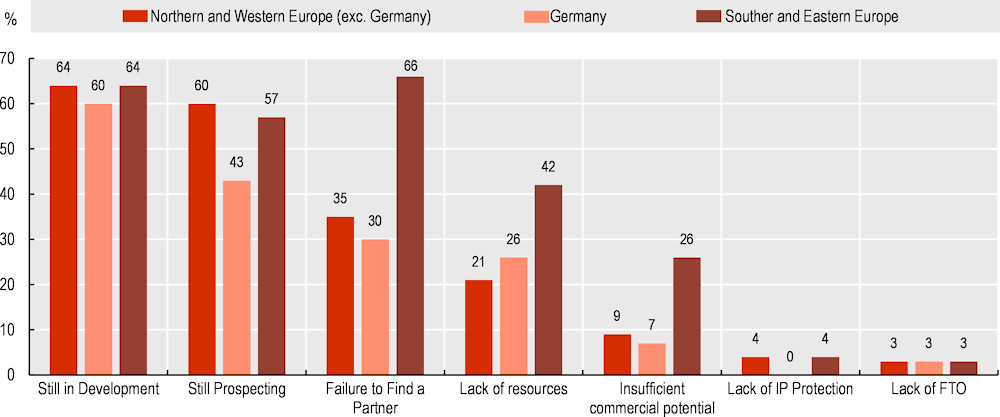

A major handicap to improving technology transfer through research commercialisation at HEIs and PRIs is the lack of technology readiness of research discoveries and clear market applications (see earlier findings from the 2021 EPO survey (European Patent Office, 2021[24]). The most important reason given by respondents to the EPO survey was the innovation’s lack of technological maturity (60% of German interviewees, compared to 64% on average for respondents in Northern and Western Europe), followed by lack of prospecting (43% vs. 60%); about one-third of respondents in Western Europe highlighted difficulties in finding a partner as a major reason for the lack of commercialisation of patents (Figure 13.10). This is also the case because most public funding at HEIs targets basic research and first stages, whereas funding for development and product applications, as well as long-term support for knowledge transfer offices, are missing.

Figure 13.10. Reasons for no-exploitation by region (planned exploitation and no-exploitation)

Note: Number of interviews unweighted N=400, of which <1% do not know and <1% no statement.

Source: European Patent Office (2020[14]), Valorisation of scientific results Patent commercialisation scoreboard: European universities and public research organisations, https://documents.epo.org/projects/babylon/eponet.nsf/0/f90b78b96b1043b5c1258626006cce35/$FILE/Valorisation_of_scientific_results_en.pdf.

Absorptive capacities: Human capital and skills for knowledge transfer

Successful knowledge transfer depends on the provision of human capital from the higher education system (HEIs) to the economic system, and the formation of new skills within the labour force. In Germany important policy efforts over the last two decades have aimed to maintain the supply of highly qualified labour to industry. Concomitant to changes in labour markets and the emergence of new industries, the HEI system experienced an important expansion in both resources and outputs.

The number of first-time university graduates in the population has increased steadily since 2002, especially after the shift from a diploma-based to a BA/MA system (2009), and peaked in 2015. The share of higher education graduates in the total population of the same age expanded from about 17% in the early 2000s to 32% in 2019, and has continued at this rate ever since (OECD, 2019[4]). However, this expansion has been accompanied by a steady decline in the number of graduates in vocational training and education (VET), an issue which has led to calls for greater policy attention for achieving a sustainable balance in the skill mix (OECD, 2021[25]).

STEM graduates are particularly key to addressing new technological and societal challenges, and industry transformation. The share of STEM university graduates in Germany is higher than in almost all other comparator countries except Japan (OECD, 2022[26]). Moreover, the number of MA and PhD graduates in STEM fields has been increasing faster than the total number of graduates.1 In terms of doctorates and the placement of researchers in the business sector, Germany also stands high in international comparisons. Roughly 29 000 graduate students complete a doctorate in Germany every year, far more than in any other EU Member State (OECD, 2022[26]). In total, Germany’s share of population with a doctoral degree (1.6% in 2020) is above the OECD average (1.3%); it is similar to that of Australia, Norway and the United Kingdom, but lower than the United States (2.0%) and leading countries like Switzerland (3.0%) or Slovenia (5.2%) (OECD, 2021[27]).

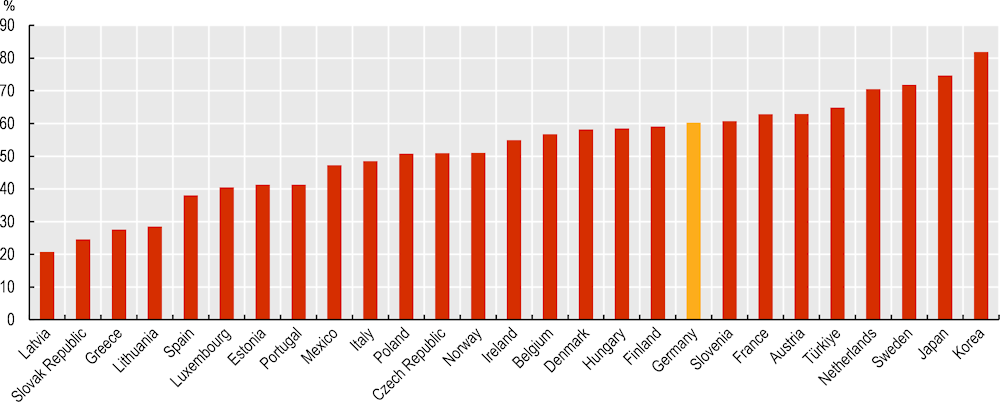

Germany also displays a strong presence of researchers employed in the business sector. In 2019, about 62% of total researchers were employed in private companies, compared to the OECD average of 50% (Figure 13.11). It is similar to the intensity reported by France, Austria and Denmark, but lower than in Sweden, Japan and Korea (over 70%).

Figure 13.11. Percentage of researchers in the business sector as percent of total national

Note: Provisional data for the following countries: Austria, Belgium, Czech Republic, Denmark, France, Germany, Greece, Ireland, Italy, Lithuania, Luxembourg, Netherlands, Poland, Slovenia, Spain

Source: OECD (2022[11]), "Main Science and Technology Indicators", OECD Science, Technology and R&D Statistics (database), https://doi.org/10.1787/data-00182-en (accessed on 22 May 2022).

Yet the emergence of new technological paradigms and skill needs poses a critical challenge for knowledge transfer from German HEIs and PRIs to the private sector. To some extent, the HEI system remains strongly anchored in traditional industry’s structure and needs. Although curricula have evolved, changes may not been sufficiently rapid to address pressing innovation needs in the private sector, especially regarding the development of new industries and skills (e.g. digital skills).

There exist indications of growing labour shortages in key areas for future German competitiveness, such as information and communication technology (ICT), digital skills and new technology fields (e.g. artificial intelligence). It is estimated that by 2023, German firms will need around 700 000 more people with technological skills (e.g. related to complex data analysis and user-centric design) than were available in 2019 (Kirchherr et al., 2020[28]). The same survey study also predicts a shortage of 2.4 million workers with cross-disciplinary skills, who will have to be retrained in key skills such as agile working, digital learning and collaborative methods (Kirchherr et al., 2020[28]). These skill and labour-market pressures will have an impact on the effectiveness and strength of the country’s knowledge and technology transfer institutions.

Moreover, as evidenced in several surveys, both academics and HEI institutions consider the weak innovation (and absorption) capacity in SMEs as a major barrier to eliciting partnerships with research institutions (Davey et al., 2018[29]).

Use of intellectual property

SMEs require help with and knowledge about protecting and exploiting their own IP, as well as licensing IP from academia. Sectoral differences prevail regarding expertise and professionalism in handling IP issues. For example, engineering companies are less likely to engage in knowledge transfer involving IP than pharmaceutical firms.

13.3.2. Constraints facing research institutions

Intermediation support capabilities in HEIs

While the technology transfer departments in PRIs (especially Fraunhofer institutions) have well-established operating models, university knowledge transfer offices face operational difficulties. Although most of the larger TUs have effective knowledge transfer offices that are increasingly staffed with experts in diverse fields, challenges across the broader university system remain substantial, both in terms of operations and governance. In addition, most knowledge transfer activities still originate from individual chairs and institutes, rather than from faculties and chancelleries.

According to a 2020 study of 39 German HEIs, 89% included knowledge transfer within their mission, and their knowledge transfer offices had 10.6 full-time employees on average (Roessler, 2020[30]). However, knowledge transfer support units in many German universities suffer from several limitations related to financing, infrastructure and incentives. In terms of funding, there currently exists no top-down directive requiring HEIs to dedicate a specific share of their budget to knowledge transfer activities. It is common for only 50% of the staff in German knowledge transfer institutions to be base-financed. The other half depends on project and other time-bound funding, so that transfer structures and their knowledge assets and social capital (networks, contacts, etc.) are highly volatile and prone to high staff turnover. Moreover, the implementation of the third mission is not considered a criterion for success in the German academic system and therefore does not influence careers or result in additional career opportunities for shaping the future at the management level. There exist some exceptions, like Fraunhofer-Gesellschaft, where knowledge transfer and the third mission are a more integral part of performance appraisal and career paths.

HEIs are increasingly concerned with finding ways to improve their impact on society through social innovation that produces sustainable solutions. This calls for multidisciplinary collaboration and resource mobilisation, such as through open-access policies (e.g. free licensing and open-source software) and open innovation approaches. It should be noted that knowledge transfer offices focus mostly on hard technologies (i.e. high-technology projects) at the expense of other academic fields with social impact and more multidisciplinary projects tackling broad innovation challenges (e.g. involving social sciences in environmental innovation projects). In the same vein, there is scope for knowledge transfer processes to become more open and involve other societal actors (co-creation partnerships).

Another challenge for knowledge transfer offices is attracting and retaining talent, including through accreditation and continuous training to improve professionals’ awareness of new trends. Learning from peers is another form of education, hampered by the lack of established international knowledge transfer mentoring structures in Europe.

Other constraints for HEIs and PRIs

PRIs have raised a number of issues related to formal and informal knowledge transfer:

1. Researchers do not always have insufficient incentives to engage and support knowledge transfer activities due to research evaluations that focus on publications. This affects research commercialisation as they remain dependent on the interests of the research groups. The extent to which incentives are weak varies, however, strongly across Germany’s research-performing institutions. Among the PRIs in particular several have set up very effective schemes.

2. Interviews conducted by the OECD pointed to the lack of IP culture in academia as major issue hampering patent exploitation.

3. Certainty among researchers about the legal status of IP is necessary to embed long-term investments and knowledge transfer needs more systematically within the missions of HEIs and PRIs.

4. The tripartite division of royalties from licensing (one-third to universities, one-third to inventors and one-third to agencies) is not sufficiently attractive for some universities.

The following barriers have been identified with regard to academic spin-offs:

1. The lack of spin-offs and science-based start-ups is strongly rooted in the limited incentives (both at the individual and institutional level) and funding for intermediate stages (i.e. validation and readiness).

2. Regulatory and bureaucratic issues hinder business creation at universities. This is also due to unfavourable structures in the science and funding system for academic entrepreneurship.

3. The lack of an entrepreneurial mind-set prevents researchers (and graduates) with the potential for technology and expertise transfer to engage in spin-offs.

4. The lack of alternative entrepreneurship strategies, such as bringing in external entrepreneurs to act as firm founders, also hinders academic spin-offs.

13.3.3. Common challenges for knowledge transfer

Lack of metrics and indicators on the state of knowledge transfer practices

There exists no comprehensive and consistent national metric about knowledge transfer activities at HEIs and PRIs in Germany, although most PRIs do report knowledge transfer activities and commercialisation indicators in their annual reports. The resulting lack of visibility on the national (and regional) level complicates steering and capacity-building. Examples of established national knowledge transfer surveys and metrics used in other countries include Réseau Curie (France), RedOTRI (Spain), Research England (United Kingdom), Netval (Italy) and AUTM (United States). It must be said, however, that the complex reality of knowledge transfer and commercialisation processes is not easily expressed in metrics, and that the types of engagement (i.e. the knowledge transfer strategy) can differ across universities and regions according to their specialisation, strengths and innovation demands. While PRIs report their knowledge transfer and innovation activities more consistently, information from HEIs is sparse and seldom published. New knowledge transfer indicators are also required to track broader types of engagement and new forms of interaction (e.g. open data, open innovation labs, co-creation).

Bureaucracy and regulatory hurdles

A 2016 survey of 992 German HEIs identified several barriers to university-business collaborations (Davey et al., 2018[29]). Respondents indicated that industry-science linkages are obstructed by bureaucracy related to collaboration with industry and by universities granting insufficient work time to academics for university-business collaboration. Additionally, academics perceive that university-business collaboration conflicts with their teaching and research responsibilities. From the industry side, the key deterrents to firms collaborating with academia remain differing time horizons and motivations to conduct research, followed by bureaucratic barriers.

13.4. Policies in support of knowledge transfer

The Federal Government supports the transfer of knowledge and technology between research institutions and SMEs through a variety of programmes and initiatives, including start-up funding for developmental stages, R&D funding and collaboration support. The largest and most prominent are the IGF) and the “Central Innovation Programme for SMEs” (ZIM), both of which are discussed in Chapter 5. The following provides a brief overview.

13.4.1. Policies and projects under ZIM

ZIM aims to help SMEs gain access to state-of-the-art knowledge and new technology development. The ZIM module for co-operation is its largest and most popular module, promoting R&D co-operation projects between SMEs, and between SMEs and RTOs. ZIM is open to all technologies and sectors. It has been administered by the Federal Ministry for Economic Affairs and Energy (now Federal Ministry for Economic Affairs and Climate Action [BMWK]) since 2008, when it was launched as a merger of a few different predecessor programmes. ZIM includes funding opportunities for (1) R&D projects in individual enterprises, (2) collaborative R&D projects (between SME or between SMEs and research organisations), and (3) co-operation networks between six or more enterprises in projects that are market-oriented, innovative and risky. By 31 December 2021, about 37 400 R&D co-operation projects with a funding volume of approximately EUR 5.5 billion had been initiated (AiF, 2022[31]).

According to a recent evaluation (Kaufmann et al., 2019[32]), SMEs consider the ZIM programme a valuable instrument thanks to its extensive experience, funding support and network advantages. Yet the evidence indicates room for improvement. Although ZIM is in principle inclined to incentivise R&D projects in less R&D-experienced firms, the eligibility criteria, the projects’ innovation threshold and the amount of investment required have in practice made it more applicable to existing SMEs with experience in R&D (Kaufmann et al., 2019[32]). A reform of the ZIM funding guidelines in 2020 addressed these findings by (among other improvements) easing access for first-time-innovators and strengthening the incentives for innovators from economically underdeveloped regions. Continued efforts to promote inclusivity and interdisciplinary or cross-sectoral activities will help promote innovation and technology diffusion.

13.4.2. Other policies and projects for knowledge transfer

Under IGF, industry associations organise pre-competitive collective research projects and provide comprehensive service support on R&D matters, helping SMEs to address shared innovation and technological challenges. In 2020, AiF reported that almost 25 000 SMEs were involved in the 1 876 projects funded by IGF in 2020 (amounting to about 13 SMEs per project).2 The “Research Campus” programme (Forschungscampus) and the “Leading-edge Clusters” programme have also been major strategies addressing the need for more strategic and longer-term approach to research partnerships. Research Campus was unique in its ambitions of having companies and universities pursue a joint research agenda “under one roof”, which resulted in new forms of knowledge exchange between university and industry researchers.3

New support measures for non-R&D innovation and innovation management in SMEs have recently been introduced, including the “Innovation programme for business models and pioneering solutions”, and innovation assistance programmes for the recruitment of young academics. Among other issues of concern, the rules and eligibility criteria of funding programmes have sometimes challenged inter-disciplinarity and cross-sectoral collaboration. In addition, the KMU-NEtC programmes of the Federal Ministry of Education and Research (BMBF) promote ambitious R&D and innovation collaborations through networks and clusters, with significant participation of SMEs.

Other examples of federal programmes include WIPANO (supporting the identification, legal protection and exploitation of IPR by universities and non-university research institutions); VIP+ (to test and demonstrate the innovative potential of research results, and explore application areas); GoBio (supports researchers in life sciences with innovative ideas to connect with business); EXIST (promotes university spin-offs); Digital Hubs (helps build digital ecosystems with SMEs, start-ups, corporations and research institutions); and specific funding for sub-areas of (among others) knowledge transfer and infrastructure development.

Since the later 1990s, entrepreneurship and spin-off activities at higher education and non-university research organisations are supported by the programme “EXIST - University-based Business Start-Ups”, under the auspices of BMWK. The programme supports up to 240 projects each year through monthly stipends, mentoring, and covering personnel and material expenses up to EUR 250 000 in the early funding phases. A second instrument focuses specifically on promising pre-seed, pre-market projects that often lack the necessary infrastructure and funding for implementation. Following the example of the Defense Advanced Research Projects Agency in the United States, the German Federal Government established the Federal Agency for Disruptive Innovation (Agentur für Sprunginnovationen [SPRIND]) in 2019, funded with EUR 1 billion. Based in Leipzig, SPRIND funds pre-market phase projects selected through regular innovation challenges and does innovation scouting. Given the prevailing constraints related to government administration and procurement regulations currently inhibiting its operability, it remains to be seen whether the agency’s funding and setup are sufficient, and the supported projects result in market-ready products.

The Federal Government established the Hightech-Gründerfonds (“High-tech start-up fund”) as a powerful, platform-based structure for start-up support. As a platform with its own investment managers, it combines funding from different public and private sources. While not primarily science-oriented, the fund can also support the best and most relevant ideas from science. The “High-Tech Strategy 2025” further promotes innovation partnerships with the concept of innovation clusters and networks. Its central goals are to boost the number of new, more open forms of co-operation between companies, civil-society stakeholders and scientific institutions.

Launched in 2019, the “Transfer Initiative” of BMWK supports companies’ innovative and collaborative activities. The initiative’s central aim is to identify barriers to science-industry collaboration among businesses that have not previously participated in scientific collaboration and to increase their innovation activities. It consists of a series of public events on innovation-related issues, including discussions with representatives from business, science, associations, project management and government, and nationwide roadshows with local chambers of commerce and industry.

In the context of SMEs, practice shows that successful knowledge transfer requires professionalised support for both the definition and implementation of technology and knowledge transfer projects. Recently launched policy actions to improve SMEs’ innovation capacity, technology adoption and participation in innovation partnerships are moving in this direction, but the programmes’ funding and scale should be strengthened. Improving knowledge transfer opportunities for SMEs goes hand in hand with improving SMEs’ entry into R&D, and enabling them to access and retain advanced human capital and new skills. This objective can be supported by enhancing funding for R&D projects (with project preparation assistance), placing advanced human capital (i.e. through a two year co-financing of salaries), or linking SMEs with supportive researchers and technologists at public institutions.

Overall, the government’s commitment to improving the translation of scientific research into new products and innovative solutions in markets is reflected in the different policy strategies and funding programmes for start-ups, industry-science collaboration and technology commercialisation. Yet the relationship between science and innovation policies has suffered somewhat from ineffective co-ordination and divergent goals. The lack of a meaningful change in the intensity of knowledge transfer in a context of improved framework conditions for research and science suggests that past research policies, despite achieving meaningful results in terms of research quality did not translate into innovations.

References

[31] AiF (2022), ZIM-Kooperationsprojekte, https://www.aif.de/foerderangebote/zim-kooperationsprojekte.html#:~:text=ZIM%20%2DKooperationen%20stark%20nachgefragt&text=Dezember%202021%20wurden%20ca.,Euro%20auf%20den%20Weg%20gebracht. (accessed on 3 May 2022).

[8] AiF (2021), Aif at a Glance, German Federation of Industrial Research Associations (AiF), https://www.aif.de/.

[18] Bersch, J. and S. Gottschalk (2019), Unternehmensdynamik in der Wissenswirtschaft in Deutschland 2017: Gründungen und Schließungen von Unternehmen, Gründungsdynamik in den Bundesländern, internationaler Vergleich, Wagniskapital-Investitionen in Deutschland und im internationalen Vergleich, Commission of Experts for Research and Innovation (EFI), Berlin.

[16] Breschi, A., J. Lassébie and C. Menon (2018), A portrait of innovative startups across countries, OECD Science, Technology and Industry Working Papers, No. 2018/02, OECD, Paris.

[13] CWTS Leiden Ranking (2020), Leiden Ranking 2020, CWTS, https://www.leidenranking.com/ranking/2020/list.

[29] Davey, T. et al. (2018), The State of University-Business Cooperation in Europe (Final Report), Publications Office of the Euroepan Union.

[19] EFI (ed.) (2020), Report on research, innovation and technological performance in Germany 2020, Commission of Experts for Research and Innovation (EFI), Berlin, https://www.econstor.eu/bitstream/10419/224979/1/1734025387.pdf.

[24] European Patent Office (2021), Future patent filings - applicant survey 2021, EPO, https://www.epo.org/service-support/contact-us/surveys/patent-filings.html.

[14] European Patent Office (2020), Valorisation of scientific results Patent commercialisation scoreboard: European universities and public research organisations, EPO, https://documents.epo.org/projects/babylon/eponet.nsf/0/f90b78b96b1043b5c1258626006cce35/$FILE/Valorisation_of_scientific_results_en.pdf.

[15] Fraunhofer/ZEW (2021), Spin-Offs from Public Research Organisations in Germany: A Comprehensive ANalysis based on Bibliometric, Patent, Website and Company Register Data, Fraunhofer/ZEW, Karlsruhe and Mannheim, https://www.isi.fraunhofer.de/content/dam/isi/dokumente/cci/2021/Report_Allianz-Studie_final.pdf.

[6] Fraunhofer-Gesellschaft (2021), Programm »KMU akut«, https://www.fraunhofer.de/de/forschung/leistungsangebot/technologietransfer/kmu-akut-programm--forschung-fuer-den-mittelstand-.html.

[7] Frietsch et al. (2022), microeconomic perspective on the impact of the Fraunhofer-Gesellschaft. Fraunhofer ISI publications, Fraunhofer ISI, https://www.fraunhofer.de/content/dam/zv/de/forschung/leistungsangebot/Report-Microdata-2022.pdf.

[21] GWK (2021), Pakt für Forschung und Innovation - Monitoring-Bericht 2021 (Band I), Joint Science Conference (GWK), https://www.gwk-bonn.de/fileadmin/Redaktion/Dokumente/Papers/PFI-Monitoring_2021_Band_I.pdf.

[32] Kaufmann, P. et al. (2019), Evaluation des Zentralen Innovationsprogramms Mittelstand (ZIM), KMU-Forschung and IHS, Vienna.

[28] Kirchherr, J. et al. (2020), Future Skills: Which Skills are Lacking in Germany, Stifterverband für die Deutsche Wissenschaft e.V., Essen, Germany, https://www.stifterverband.org/medien/which-skills-are-lacking-in-germany.

[1] Kreiling, L. and C. Paunov (2021), “Knowledge co-creation in the 21st century: A cross-country experience-based policy report”, OECD Science, Technology and Industry Policy Papers, No. 115, OECD Publishing, Paris, https://doi.org/10.1787/c067606f-en.

[17] Kulicke, M. (2021), Fostering innovative startups in the pre-seed phase, Bertelsmann Stiftung, Gütersloh, Germany, https://www.bertelsmann-stiftung.de/fileadmin/files/BSt/Publikationen/GrauePublikationen/Study_NW_Fostering_innovative_startups_in_the_pre-seed_phase_2021.pdf.

[20] Lambertus, T., J. Schmalenberg and K. Mathias (2019), Case Study on Programmes to Promote Spinofs at Fraunhoffer-Gesselschaft, Fermany. Contribution to the OECD TIP Knowledge Transfer and Policies Project, OECD, Paris, https://stip.oecd.org/assets/TKKT/CaseStudies/16.pdf.

[2] Montresor, S. and F. Quatraro (2017), “Regional Branching and Key Enabling Technologies: Evidence from European Patent Data”, Economic Geography, Vol. 93/4, pp. 367-396, https://doi.org/10.1080/00130095.2017.1326810.

[22] Narin, F., K. Hamilton and D. Olivastro (1997), “The increasing linkage between U.S. technology and public science”, Research Policy, Vol. 26/3, pp. 317-330, https://doi.org/10.1016/s0048-7333(97)00013-9.

[11] OECD (2022), “Main Science and Technology Indicators”, OECD Science, Technology and R&D Statistics (database), https://doi.org/10.1787/data-00182-en (accessed on 20 September 2022).

[26] OECD (2022), OECD Education at a Glance Database, OECD, Paris, https://stats.oecd.org/Index.aspx?DatasetCode=RGRADSTY#.

[9] OECD (2022), STI Scoreboard, OECD, Paris, https://www.oecd.org/sti/scoreboard.htm.