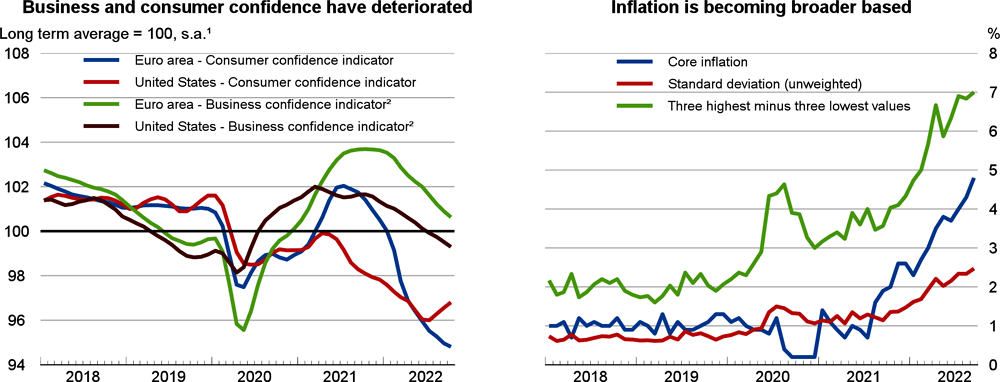

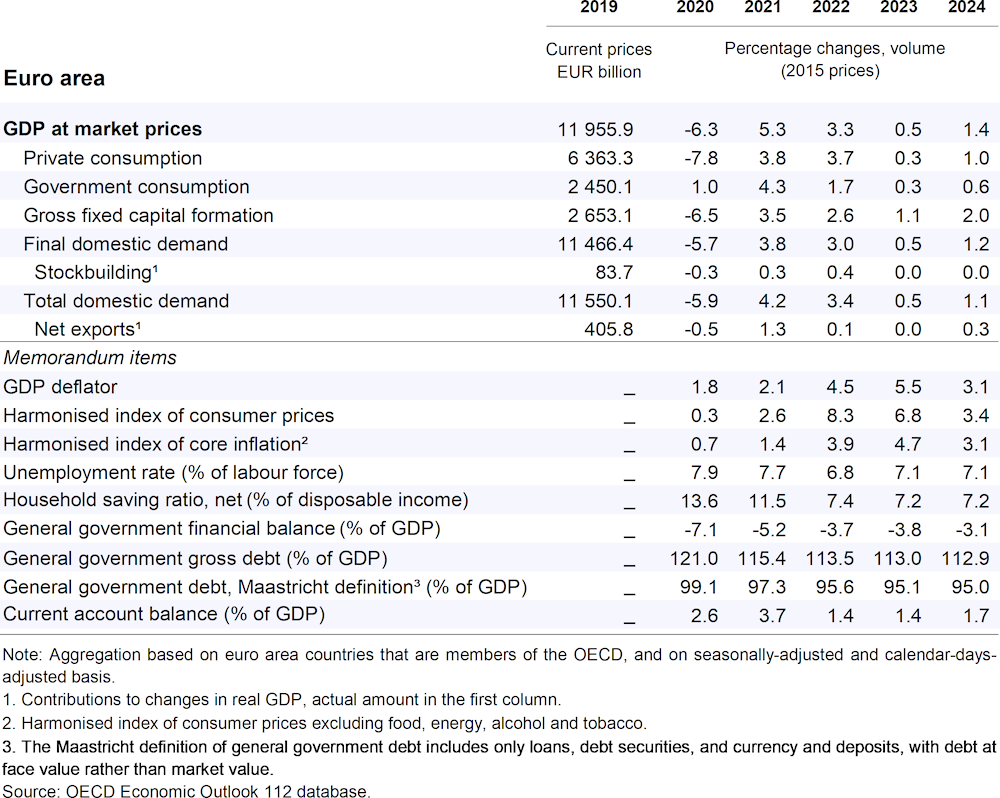

After a strong first half of the year, real GDP growth is projected at 3.3% in 2022 and only 0.5% in 2023 owing to Russia’s war of aggression against Ukraine, monetary policy tightening and the global slowdown. Growth is projected to rebound to 1.4% in 2024 as consumption and investment pick up. Inflation is set to decline only gradually, remaining above target in 2024, fuelled by elevated energy prices and tight labour markets. Risks remain tilted to the downside as cold winters and further disruptions in energy supply would hit growth while pushing inflation higher.

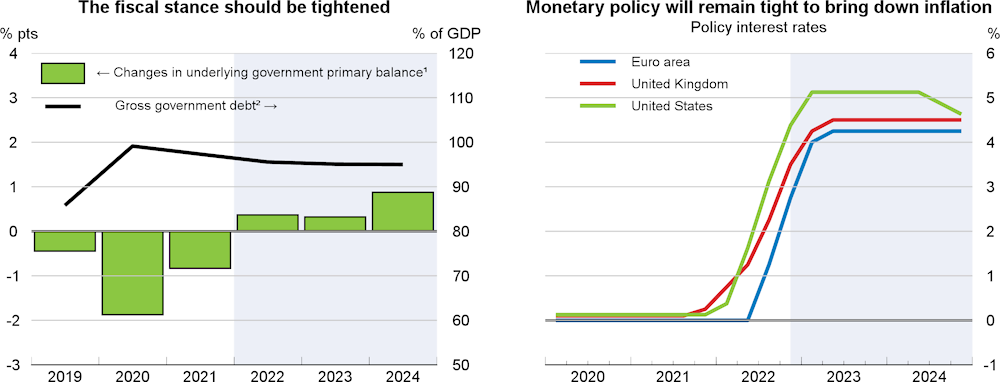

High uncertainty, declining real incomes and increasingly widespread inflationary pressures require careful and coordinated policy actions. Fiscal measures to shield households and companies from surging energy and food prices need to avoid providing fiscal stimulus at a time of high inflation. They should be well targeted on the most vulnerable and avoid distorting price signals. Monetary policy should act decisively to bring inflation down, while using all margins of flexibility when reinvesting the proceeds of maturing bonds on the ECB balance sheet to limit financial fragmentation.