This chapter covers recent tourism trends, and associated developments in tourism governance and policy, set against the backdrop of the COVID-19 pandemic and Russia’s war in Ukraine. It is based on policy and statistical inputs from OECD member and partner countries. The chapter outlines the economic and social consequences of the tourism crisis triggered by the pandemic and examines the key recovery challenges and outlook ahead, including in the context of increasingly uncertain economic and geopolitical context. The role of governments in supporting a sustainable, resilient and inclusive tourism recovery is set out, and tourism policy priorities, reforms and developments are analysed with examples of country practices highlighted.

OECD Tourism Trends and Policies 2022

Chapter 1. Tourism trends and policies for recovery

Abstract

Tourism trends in times of crisis and recovery

Tourism is being seriously challenged by the depth and duration of the crisis triggered by COVID‑19. Restrictions on the movement of people hit the tourism economy at its core, leading to a near-complete cessation of tourism activity around the world at the height of the pandemic. The combined economic and health impacts made this a crisis like no other in terms of the size of its impact and duration. The consequences have been devastating for local communities, regions and tourism businesses, 85% of which are SMEs.

Just as the tourism economy was starting to rebound from the pandemic, Russia’s war in Ukraine has dealt a fresh blow to recovery prospects. This is creating new uncertainties for the tourism recovery. With the impacts of the pandemic still lingering, the war is dragging down growth and putting additional upward pressure on prices amid tightening labour markets. Already fragile tourism businesses are faced with rising energy, food and other input costs, and the cost-of-living crisis is putting pressure on consumer spending power, with discretionary items like tourism on the front line of potential cuts.

The strong bounce in tourism seen in many countries in 2022 was built on the back of pent-up demand but shows signs of faltering. The economic and geopolitical climate is putting stress on the sector, creating a very uncertain outlook. As tourism navigates these challenges, existing and new structural weaknesses are being aggravated, while large-scale social, economic, political, environmental and technological trends continue to impact the sector.

As governments address these critical challenges, transformative policies are needed to set tourism on a path to a more resilient, sustainable and inclusive future. Co‑ordinated, forward-looking action across all levels of government, and with the private sector, is needed more than ever to support a sustainable recovery of tourism businesses and destinations across the tourism ecosystem. Action is also needed to prepare for future shocks, stay ahead of the digital curve, support the low-carbon transition, and promote the structural transformation needed to build a stronger, more sustainable tourism economy.

COVID‑19 crisis highlighted tourism’s role as a driver of economic prosperity

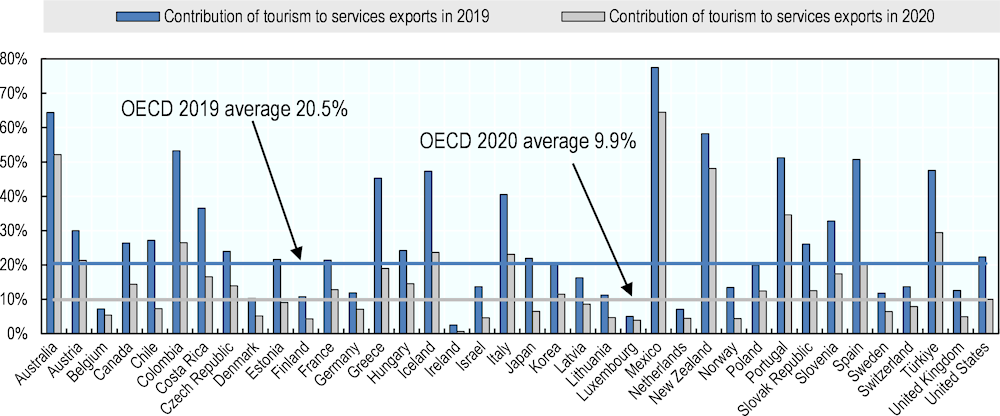

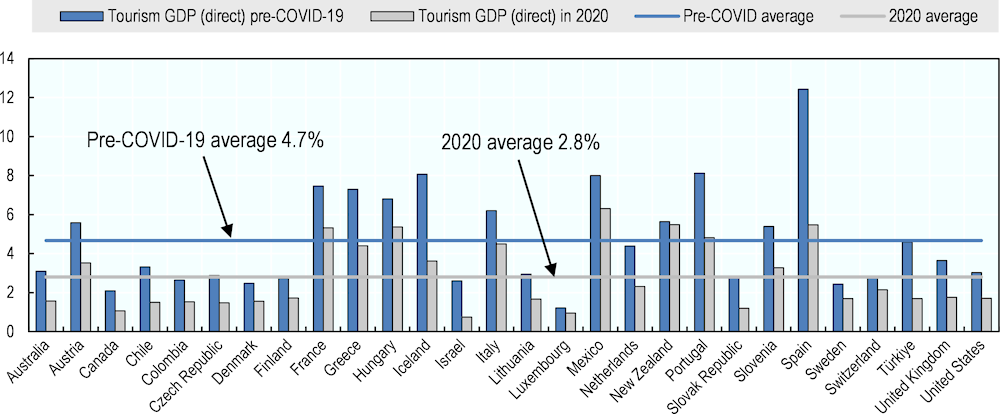

Tourism is a driver of economic prosperity, and the crisis has been an important reminder of the vital role tourism plays in global, national and local economies. Before the pandemic, the tourism sector directly contributed 4.4% of GDP and 6.9% of employment, and tourism generated 20.5% of service-related exports in OECD countries, on average. The sector is a key part of a growing services economy, generating income and foreign exchange, creating jobs, stimulating regional development, and supporting local communities. In many countries, tourism was growing at a faster rate than the national economy before the pandemic.

The unprecedented shock from COVID‑19 saw the average direct contribution of tourism to GDP fall to 2.8% in 2020 across OECD countries with data available1. This equates to an average decline of 1.9 percentage points compared to pre-COVID-19 (Figure 1.1).

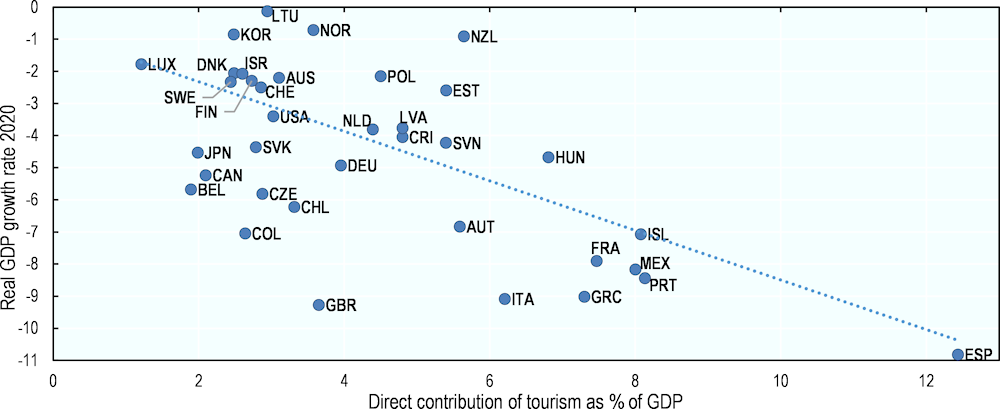

The direct economic impact of the tourism sector is far-reaching and has knock-on consequences for the wider economy. Countries with a sizeable tourism sector pre-COVID-19, such as Iceland (8.1% of GDP), Mexico (8.0%) and Portugal (8.1%), have experienced some of the biggest declines in the sector’s direct contribution to GDP, and in overall GDP (Figure 1.2). OECD analysis shows that the pre-pandemic size of the tourism sector better explains cross-country differences in GDP impacts in 2020 than exposure to any of the other sectors considered most vulnerable to COVID‑19, or the average stringency of wider country lockdown measures during 2020 (Rustelli and Turner, 2021[1]). These impacts are also highly localised. Places where tourism is a large part of the local economy are particularly adversely impacted, such as Corsica in France, the Ionian Islands in Greece and the Balearic and Canary Islands in Spain, as well as the Algarve region in Portugal (OECD, 2022[2]; OECD, 2020[3]).

Figure 1.1. Direct contribution of tourism to selected OECD countries, pre-COVID-19 and 2020

Note: Tourism Direct GDP is the preferred indicator. Pre-COVID-19 is 2019, or latest available pre-pandemic year.

Tourism Direct GVA data is used for Canada, Colombia, Denmark, Finland, Greece, Hungary, Israel, Italy, Lithuania, the Netherlands, New Zealand, Portugal, Switzerland, Türkiye, United Kingdom and United States.

Spain includes direct and indirect effects.

France refers to Internal Tourism Consumption as a percentage of GDP; data is based on constant price shares.

Source: Tourism Statistics (Database)

The indirect impacts of tourism are also significant, owing to linkages to upstream sectors. OECD estimates from before the pandemic indicate that more than one-third of value added generated in the domestic economy through tourism comes from indirect impacts, reflecting the breadth and depth of linkages between tourism and other sectors (e.g. food production, agriculture, transport, business services) (OECD, 2019[4]).

Job retention schemes helped mitigate the impact of the pandemic on tourism employment, but labour shortages and skills gaps risk constraining the recovery. Tourism’s share of total employment fell to 4.3% in 2020 across reporting OECD countries2 that prepared a Tourism Satellite Account, down 0.8 percentage points across this group of countries compared with pre-COVID-19, on average. However, these supports did not reach all workers, including some self-employed workers such as tour guides and informal workers in the sector. The disruption in the sector also led many workers to seek more stable employment opportunities in other sectors. In the first quarter of 2022, employment in accommodation and food services was, on average, 9.0% below its pre-COVID-19 level (OECD, 2022[5]).

Figure 1.2. Correlation between the direct contribution of tourism pre-COVID-19, and GDP growth in 2020, selected OECD countries

Note: Tourism Direct GDP is the preferred indicator. Pre-COVID-19 is 2019, or latest available pre-pandemic year.

Tourism Direct GVA data is used for Canada, Colombia, Denmark, Finland, Greece, Hungary, Israel, Italy, Lithuania, the Netherlands, New Zealand, Portugal, Switzerland, Türkiye, United Kingdom and United States.

Spain includes direct and indirect effects.

France refers to Internal Tourism Consumption as a percentage of GDP; data is based on constant shares.

Source: OECD Tourism Statistics (Database) and OECD Economic Outlook (Database)

Recent rebound in international tourism raised hope of a demand-driven recovery

International tourism was decimated by the crisis, with the recovery in 2022 driven by pent-up demand and the lifting of travel restrictions in most countries. The closure of international borders and introduction of travel restrictions saw international tourist arrivals worldwide plummet by 72% to 409 million in 2020, with only a marginal improvement in 2021 (UNWTO, 2022[6]). This dramatic drop in international tourism flows followed six decades of consistent growth. The latest available data indicates that globally, international tourism flows recovered to almost 60% of pre-pandemic levels by July 2022. International tourist arrivals almost tripled during the period from January to July 2022 compared with the same period in 2021. Europe and the Middle East led the recovery (with arrivals reaching 74% and 76% of 2019 levels, respectively), followed by the Americas and Africa. Arrivals in the Asia Pacific region, however, remained 86% below 2019 levels by July 2022 (UNWTO, 2022[6]).

OECD countries are playing a driving role, but the recovery varies significantly across countries as governments adopt different approaches to reopening. International tourist arrivals to OECD countries fell by 68% in 2020 to 262 million, on average – slightly below the fall globally. The small improvement recorded in 2021 (up 16% to 303 million) outpaced the global average (up 9%), and available evidence indicates this has continued into 2022. OECD countries welcomed two out of every three international tourist arrivals in 2021 (68%, up from 57% in 2019). This reflects the different response measures taken by governments and the earlier reopening of cross-border tourism in Europe in particular. The accelerated roll-out of vaccinations in most OECD countries also played a key role. Countries in the Asia Pacific region adopted tighter cross-border travel policies, and these are still being unwound. For example, Japan reopened fully to international tourists on 11 October 2022.

Table 1.1. International tourist arrivals in OECD and partner countries, 2019-21

|

Type of indicator |

2021 |

Growth rate 2019 to 2020 |

Growth rate 2020 to 2021 |

Growth rate 2019 to 2021 |

|

|---|---|---|---|---|---|

|

|

Thousand |

% |

|||

|

Australia |

Visitors |

246 |

-81% |

-87% |

-97% |

|

Austria1 |

Tourists |

12,728 |

-53% |

-16% |

-60% |

|

Belgium1 |

Tourists |

2,313 |

-73% |

28% |

-66% |

|

Canada |

Tourists |

3,062 |

-87% |

3% |

-86% |

|

Chile |

Tourists |

190 |

-75% |

-83% |

-96% |

|

Colombia |

Visitors |

2,123 |

-69% |

52% |

-53% |

|

Costa Rica |

Tourists |

1,347 |

-68% |

33% |

-57% |

|

Czech Republic |

Tourists |

3,768 |

-73% |

-4% |

-74% |

|

Denmark |

Tourists |

7,047 |

-60% |

19% |

-52% |

|

Estonia |

Tourists |

801 |

-69% |

-22% |

-76% |

|

Finland1 |

Tourists |

807 |

-73% |

-10% |

-75% |

|

France |

Tourists |

48,395 |

-54% |

16% |

-47% |

|

Germany1 |

Tourists |

11,688 |

-69% |

-6% |

-70% |

|

Greece |

Visitors |

15,246 |

-78% |

106% |

-55% |

|

Hungary |

Tourists |

6,973 |

-58% |

5% |

-56% |

|

Iceland |

Tourists |

698 |

-78% |

44% |

-68% |

|

Ireland2 |

Tourists |

2,700 |

-78% |

29% |

-71% |

|

Israel |

Tourists |

397 |

-82% |

-52% |

-91% |

|

Italy |

Tourists |

26,888 |

-61% |

7% |

-58% |

|

Japan |

Visitors |

246 |

-87% |

-94% |

-99% |

|

Korea |

Visitors |

967 |

-86% |

-62% |

-94% |

|

Latvia |

Tourists |

478 |

-67% |

-25% |

-75% |

|

Lithuania |

Tourists |

948 |

-67% |

1% |

-67% |

|

Luxembourg1 |

Tourists |

756 |

-50% |

44% |

-27% |

|

Mexico |

Tourists |

31,860 |

-46% |

31% |

-29% |

|

Netherlands1 |

Tourists |

6,248 |

-64% |

-14% |

-69% |

|

New Zealand |

Visitors |

207 |

-74% |

-79% |

-95% |

|

Norway1 |

Tourists |

1,435 |

-76% |

3% |

-76% |

|

Poland1 |

Tourists |

9,722 |

-60% |

15% |

-54% |

|

Portugal |

Tourists |

6,345 |

-76% |

51% |

-63% |

|

Slovak Republic1 |

Tourists |

576 |

-65% |

-33% |

-77% |

|

Slovenia1 |

Tourists |

1,832 |

-74% |

51% |

-61% |

|

Spain |

Tourists |

31,181 |

-77% |

65% |

-63% |

|

Sweden |

Tourists |

.. |

-74% |

.. |

.. |

|

Switzerland 1 |

Tourists |

4,390 |

-69% |

19% |

-63% |

|

Türkiye |

Tourists |

29,925 |

-69% |

88% |

-42% |

|

United Kingdom |

Visitors |

6,194 |

-73% |

-44% |

-85% |

|

United States |

Tourists |

22,100 |

-76% |

15% |

-72% |

|

Brazil |

Tourists |

.. |

-66% |

.. |

.. |

|

Bulgaria |

Visitors |

7,188 |

-60% |

45% |

-43% |

|

Croatia1 |

Tourists |

10,641 |

-68% |

92% |

-39% |

|

Indonesia |

Tourists |

1,546 |

-74% |

-61% |

-90% |

|

Malta |

Tourists |

968 |

-76% |

47% |

-65% |

|

Montenegro1 |

Tourists |

1,554 |

-86% |

343% |

-38% |

|

Morocco |

Tourists |

3,722 |

-79% |

34% |

-71% |

|

Peru |

Tourists |

444 |

-79% |

-50% |

-90% |

|

Romania1 |

Tourists |

841 |

-83% |

85% |

-69% |

|

Saudi Arabia |

Tourists |

3,477 |

-76% |

-16% |

-80% |

|

Serbia1 |

Tourists |

871 |

-76% |

95% |

-53% |

|

South Africa |

Tourists |

2,256 |

-73% |

-19% |

-78% |

|

EU27 |

218,512 |

-66% |

21% |

-59% |

|

|

OECD members |

302,829 |

-68% |

16% |

-63% |

|

|

World3 |

446,000 |

-72% |

9% |

-70% |

|

Notes: For more information, please see the country profiles.

Tourists: International tourist arrivals (excluding same-day visitors).

Visitors: International visitor arrivals (including same-day visitors).

1Data from supply side surveys.

2Data for Ireland is estimated for 2020 and provisional for 2021.

3UNWTO data (World Tourism Barometer, Statistical Annex, September 2022).

Source: OECD Tourism Statistics (Database).

The shock has been unprecedented even in countries that saw the smallest falls in international arrivals in 2020, with inbound tourism remaining significantly below 2019 levels through 2021. For example, international tourists to Mexico declined by almost half (46%) in 2020, despite an open border strategy and the third-highest number of arrivals among OECD countries. Australia, Canada, Israel, Japan and Korea saw declines of more than 80% in inbound arrivals in 2020, with Australia, Chile, Japan and New Zealand recording further declines of more than 80% in 2021. Canada saw a slight improvement in arrivals in 2021 (up 3%), while several other countries, including Greece (up 106% in 2021), Spain (65%) and Türkiye (88%), experienced a stronger rebound during 2021, and into 2022. A breakdown of international tourist arrivals to OECD member and selected partner countries is provided in Table 1.1.

Many OECD countries have seen a strong recovery in 2022 driven by demand coming into the northern hemisphere summer, but this recovery is uneven. In January 2022, international tourism remained 54.6% below the same period in 2019 across reporting OECD countries, on average. This improved month-on-month, reaching 19.9% below 2019 levels in July 2022. In Europe, Denmark, Greece, Luxembourg, Portugal, Slovenia and Spain recorded arrivals in excess of 2019 levels in this month. This contrasts strongly with countries bordering Russia and Ukraine, where arrivals remain significantly down, including Estonia (down 30%), Finland (32%), Latvia (33%) and Lithuania (44%). Tourism to countries in the Asia Pacific region was also at least 40% below pre-pandemic levels in July 2022, including Australia (down 44%), Japan (95%) and New Zealand (44%).

The top tourism destinations and markets have shifted around the world, reflecting the uneven impact and recovery across countries. International tourist arrivals to Mexico and Türkiye overtook the United States, and together with France, Italy and Spain, these five destinations received almost 38% of worldwide arrivals in 2021 (UNWTO, 2022[6]). The People’s Republic of China also dropped out of the top five destinations, and at the time of writing, remains closed to international tourists. Outbound travel similarly remains restricted from China, previously the world’s largest outbound market and a powerhouse of the global tourism economy.

The drop in international tourism spending has been less pronounced than the drop in visitor flows. However, this should be interpreted with caution, as it may be influenced by a range of factors, including exchange rates, purchasing power and long-stay visitors already in market. Tourism was the fifth-largest traded services sector globally in 2019. In 2020, international travel receipts fell by 63.0% to USD 548 billion, down from almost USD 1 483 billion in 2019, and remained 58.1% below pre-COVID-19 levels in 2021 (USD 621 billion) (UNWTO, 2022[6]). OECD countries accounted for two-thirds (67.2%) of global travel receipts in 2020, up from 61% in 2019. Table 1.2 provides a summary of international travel receipts (exports), expenditure (imports) and the travel balance for OECD and partner countries.

Table 1.2. International travel receipts and expenditure in OECD and partner countries, 2019-20

USD, Millions

|

Travel receipts |

Travel expenditure |

Travel balance |

||||

|---|---|---|---|---|---|---|

|

2019 |

2020 |

2019 |

2020 |

2019 |

2020 |

|

|

Australia |

45,709 |

25,822 |

35,989 |

6,766 |

9,720 |

19,056 |

|

Austria |

22,941 |

13,848 |

11,602 |

4,483 |

11,339 |

9,365 |

|

Belgium |

8,908 |

6,608 |

18,758 |

13,011 |

-9,850 |

-6,403 |

|

Canada |

29,776 |

13,506 |

35,349 |

12,081 |

-5,573 |

1,425 |

|

Chile |

2,303 |

413 |

2,459 |

540 |

-157 |

-128 |

|

Colombia |

5,682 |

1,568 |

4,935 |

1,358 |

747 |

210 |

|

Costa Rica |

3,989 |

1,328 |

1,036 |

243 |

2,953 |

1,085 |

|

Czech Republic |

7,303 |

3,628 |

5,889 |

3,423 |

1,414 |

205 |

|

Denmark |

8,652 |

3,965 |

10,038 |

5,630 |

-1,386 |

-1,665 |

|

Estonia |

1,744 |

591 |

1,546 |

598 |

197 |

-7 |

|

Finland |

3,726 |

1,264 |

5,680 |

1,677 |

-1,955 |

-412 |

|

France |

63,508 |

32,564 |

50,542 |

27,777 |

12,966 |

4,787 |

|

Germany |

41,806 |

22,080 |

93,243 |

38,868 |

-51,438 |

-16,788 |

|

Greece |

20,351 |

4,933 |

3,072 |

906 |

17,279 |

4,027 |

|

Hungary |

7,305 |

3,205 |

2,749 |

1,157 |

4,556 |

2,048 |

|

Iceland |

2,678 |

659 |

1,572 |

524 |

1,105 |

135 |

|

Ireland |

6,478 |

1,879 |

8,256 |

2,366 |

-1,778 |

-487 |

|

Israel |

7,600 |

2,500 |

8,154 |

1,804 |

-554 |

696 |

|

Italy |

49,595 |

19,797 |

30,338 |

10,939 |

19,257 |

8,858 |

|

Japan |

46,054 |

10,701 |

21,265 |

5,501 |

24,790 |

5,200 |

|

Korea |

20,867 |

10,276 |

32,739 |

16,092 |

-11,872 |

-5,816 |

|

Latvia |

1,015 |

432 |

749 |

303 |

267 |

129 |

|

Lithuania |

1,493 |

579 |

1,389 |

542 |

104 |

37 |

|

Luxembourg |

5,785 |

4,797 |

3,631 |

2,764 |

2,155 |

2,033 |

|

Mexico |

24,573 |

10,996 |

9,881 |

3,475 |

14,692 |

7,521 |

|

Netherlands |

19,729 |

10,016 |

23,124 |

8,175 |

-3,394 |

1,841 |

|

New Zealand |

10,533 |

5,751 |

4,300 |

1,444 |

6,233 |

4,307 |

|

Norway |

5,855 |

1,564 |

16,513 |

3,700 |

-10,658 |

-2,135 |

|

Poland |

14,013 |

8,199 |

9,286 |

5,266 |

4,727 |

2,933 |

|

Portugal |

20,476 |

8,812 |

5,736 |

3,133 |

14,740 |

5,679 |

|

Slovak Republic |

3,203 |

1,292 |

2,589 |

1,269 |

614 |

24 |

|

Slovenia |

3,183 |

1,370 |

1,679 |

820 |

1,504 |

551 |

|

Spain |

79,709 |

18,506 |

27,778 |

8,650 |

51,931 |

9,856 |

|

Sweden |

9,193 |

4,373 |

14,366 |

6,172 |

-5,173 |

-1,799 |

|

Switzerland |

17,950 |

9,064 |

18,753 |

9,557 |

-803 |

-494 |

|

Türkiye |

29,813 |

10,221 |

4,108 |

1,040 |

25,705 |

9,181 |

|

United Kingdom |

52,724 |

18,822 |

70,616 |

21,601 |

-17,893 |

-2,780 |

|

United States |

198,982 |

72,481 |

132,271 |

34,159 |

66,711 |

38,322 |

|

Brazil |

5,995 |

3,044 |

17,593 |

5,394 |

-11,599 |

-2,350 |

|

Bulgaria |

4,287 |

1,624 |

1,826 |

1,039 |

2,461 |

585 |

|

Croatia |

11,773 |

5,238 |

1,763 |

763 |

10,010 |

4,475 |

|

Indonesia |

16,911 |

3,312 |

11,308 |

1,653 |

5,603 |

1,658 |

|

Malta |

1,897 |

417 |

530 |

128 |

1,367 |

289 |

|

Montenegro |

1,224 |

166 |

58 |

30 |

1,166 |

136 |

|

Morocco |

8,187 |

3,848 |

2,176 |

1,113 |

6,010 |

2,735 |

|

Peru |

3,819 |

794 |

2,818 |

744 |

1,001 |

50 |

|

Romania |

3,578 |

1,431 |

6,001 |

3,026 |

-2,424 |

-1,595 |

|

Saudi Arabia |

16,431 |

4,036 |

15,140 |

8,533 |

1,292 |

-4,497 |

|

Serbia |

1,604 |

1,245 |

1,806 |

1,115 |

-201 |

130 |

|

South Africa |

8,390 |

2,607 |

3,141 |

928 |

5,249 |

1,679 |

|

EU27 |

424,911 |

182,135 |

343,794 |

153,581 |

||

|

OECD |

905,203 |

368,408 |

731,979 |

267,810 |

||

|

World1 |

1,483,000 |

548,000 |

1,483,000 |

548,000 |

||

Note: For more information, please see the country profiles.

1UNWTO data (World Tourism Barometer, Statistical Annex, September 2022).

Source: OECD Tourism Statistics (Database).

Tourism accounted for 77c of every USD 1 of lost revenue from the decline in service exports in OECD countries in 2020. This increases to 90c in every USD 1 when passenger transport receipts are included. Tourism’s share of services exports for OECD countries fell from 20.5% in 2019 to 9.9% in 2020 on average. All OECD countries experienced a decline, but this was more pronounced in countries like Colombia, Greece and Spain. Luxembourg, Belgium, the Netherlands and Ireland have been relatively less impacted, as tourism accounted for less than 10% of services exports pre-pandemic (Figure 1.3).

Figure 1.3. Contribution of tourism to service exports, 2019-20

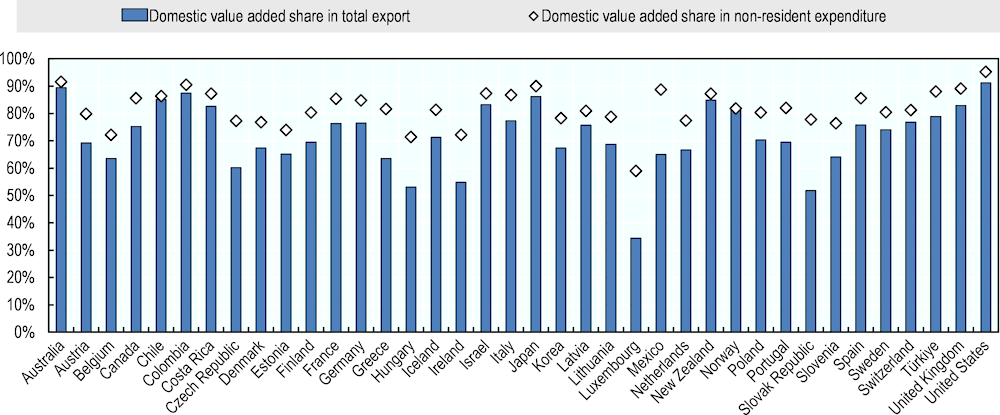

Tourism exports are economically important, as they generate value added in the economy, directly and indirectly. Analysing tourism from a trade in value added approach shows that tourism expenditure (using non-resident expenditure as a proxy) generates bigger impacts on the domestic economy than overall exports. Data from the OECD Trade in Value Added (TiVA) data base show that on average across OECD countries 89% of tourism exports reflect domestic value added in OECD countries, compared with 81% for overall exports.

Figure 1.4. Domestic value added generated by tourism expenditure in OECD countries

Note: Non-resident expenditure as a proxy for tourism expenditure.

Source: OECD Inter-Country Input-Output, 2019

Domestic tourism has helped sustain the sector, but cannot compensate for the loss of international tourism

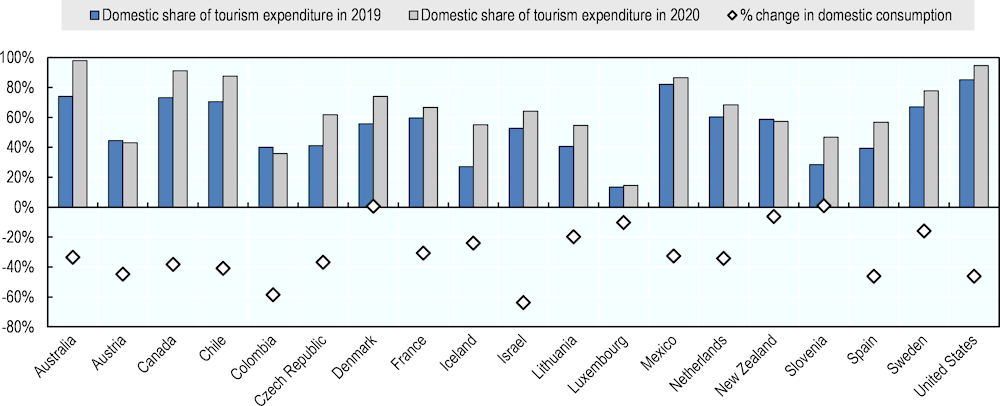

Domestic tourism was also hard hit by the pandemic but has fared better than international tourism. The easing of localised and domestic restrictions in the middle of 2020 saw domestic tourism activities resume earlier than international tourism in many countries. This led to a pick-up in domestic tourism, in part reflecting restrictions on international travel. It also led to a renewed focus on domestic tourism and recognition of its importance, as destinations and businesses looked to mitigate the loss of international markets. This has been supported by increased domestic marketing, travel vouchers and subsidies to stimulate domestic tourism demand.

Long an important driver of tourism, domestic demand has provided a lifeline to many jobs and businesses since the start of the pandemic but does not compensate for the loss of international markets. Even as recent as 2021, domestic overnight trips were still 19.1% below pre-COVID-19 levels among OECD countries with data3. Indeed, only Denmark, Iceland, Luxembourg, Norway, Sweden and Switzerland saw increases in domestic overnight trips in 2020. In 2021, domestic tourist trips exceeded 2019 levels in Belgium, Finland, Lithuania and Slovenia. In all other OECD countries, domestic trips remained below pre-pandemic levels.

The importance of domestic tourism varies considerably by country, and with it the exposure of destinations and businesses to the loss of international visitors. Domestic tourism is the main stay of the sector in most OECD countries. Before the pandemic, residents were responsible for 75% of tourism expenditure, on average. However, this share is significantly lower in countries like Estonia, Hungary, Iceland, Luxembourg and Slovenia, where domestic tourism represented less than 30%, leaving the tourism sector in these countries more exposed to drops in inbound visitor flows. This compares with countries like Australia, Canada, Chile, Germany, Japan, Mexico, the United Kingdom and the United States, where domestic tourism represented over 70% of internal tourism consumption before the pandemic.

The generally lower impact on domestic tourism saw its share of total tourism consumption increasing in most OECD economies (Figure 1.5). In the case of Australia, Canada and the United States, domestic tourism increased to more than 90% of total tourism expenditure during the pandemic.

Figure 1.5. Domestic tourism consumption in selected OECD countries, pre-COVID-19 and in 2020

Uncertain outlook for tourism recovery brings new challenges

The tourism recovery in 2022 has exceeded expectations for many countries. Based on a survey of OECD and partner countries on the latest tourism performance and recovery outlook to inform the preparation of this chapter, almost half of responding countries reported that tourism has performed better than expected in 2022, with many of these countries recording strong domestic results. A rapid return of domestic tourism, pent-up demand, pre-bookings and unused travel vouchers helped to boost recovery prospects for 2022. However, in most of these countries tourism performance remains below (three-fifths of countries) or significantly below (one-fifth) 2019 levels.

The lifting of sanitary restrictions and intra-regional travel boosted the strong tourism performance in Europe, supported by exchange rate fluctuations. The comparatively weaker Euro against the US dollar made European destinations more attractive to visitors from the United States in the lead-up to the peak European summer tourism period, helping to boost demand. In the first six months of 2022, on average across EU countries with data, arrivals at accommodation establishments were 17.5% below the same period in 2019, improving month-on-month as international tourism demand returned (Eurostat, 2022[7]). This contrasts with countries like Australia, Korea and New Zealand, where international tourism remains relatively low.

Expectations for the tourism recovery in many OECD countries have been delayed, with domestic tourism now expected to recover by 2023, and international tourism taking up until 2025 or beyond. While more than half of responding countries reported that domestic tourism has already fully recovered, or is expected to recover by the end of 2022, more than a third do expect a return to 2019 levels until 2023. Two countries expect the full recovery of domestic tourism to take until 2024 or 2025 due to the uncertain economic outlook. International tourism recovery is expected to take longer. Just over one third of countries expect international tourism to fully recover by 2023, while another third do not expect recovery until 2025 or beyond. Of OECD countries, Denmark, France and Türkiye report or anticipate a full recovery in 2022. Croatia also reports a full recovery to 2019 levels in 2022.

The OECD survey of recent tourism performance and outlook for recovery highlights the shift in focus as the tourism sector faces many challenges, beyond the pandemic, with countries in particular highlighting the impact of global inflation and price rises on tourism businesses and tourist spending. Economic insecurity, energy constraints and labour shortages are also barriers to the recovery. While travel restrictions are lifting, geopolitical uncertainty and the absence of key source markets due to COVID‑19 and Russia’s war in Ukraine is also expected to impede the tourism recovery in some countries. The restart of international tourism also brings unforeseen challenges which risk constraining the recovery, including for example, processing backlogs for visas and travel documentation.

Russia’s war in Ukraine has dealt a blow to the economic recovery, as the impacts of the pandemic still linger, with significant consequences for tourism. Recent macroeconomic estimates show that global GDP growth is projected to remain subdued in the second half of 2022, before slowing further in 2023 to 2.2% (OECD, 2022[8]) The war has also triggered a cost-of-living crisis, affecting people worldwide. Inflationary pressures are now broadening beyond food and energy, with businesses throughout the economy passing through higher energy, transport and labour costs to consumers. This is sapping growth and will impact real incomes and curb spending, weighing down on the tourism sector’s nascent recovery from the pandemic (OECD, 2022[8]).

Countries neighbouring Russia and Ukraine have seen a slower recovery in 2022 compared with elsewhere in Europe, and the war is casting a shadow over the tourism outlook. Estonia, Finland, Latvia and Lithuania all reported remaining below or significantly below 2019 levels in 2022. Domestic tourism has already recovered in Estonia and Finland, but for international tourism is not expected until 2024 or 2025 for all four countries. Beyond the loss of tourist flows, tourism businesses in these and other countries have been stepping in to provide accommodation and jobs for Ukrainians fleeing the war. Countries such as Poland are also experiencing labour shortages as Ukrainians working in the tourism sector have returned to Ukraine.

Inflationary pressures are likely to further impact the aviation sector. ForwardKeys, which tracks air travel booking patterns, estimated that intra-European flight bookings were 5% lower during the summer of 2022 due to disruption in the aviation sector, including through labour shortages (ForwardKeys, 2022[9]). Total employment in the sector is expected to remain below pre-pandemic levels for some time. Oil and fuel price inflation is exacerbating these challenges, as well as eroding consumer purchasing power.

Governments must continue to closely monitor this situation amid growing concerns of a ‘false dawn’, as there is a risk that recovery may stall rather than consolidate in the coming months. European countries are expected to be hardest hit by the economic crisis, with greater exposure to the war through energy imports (OECD, 2022[10]). The full impacts are yet to play out as winter approaches. Airline financial performance is expected to improve in all regions in 2022, but North America is the only region expected to return to profitability this year (IATA, 2022[11]). At the same time, the opportunity to optimise the strength and quality of the recovery should not be missed, including to accelerate the green and digital transitions.

Recovery plans bring opportunities for more resilient, sustainable and inclusive tourism

The crisis triggered by COVID‑19 presents a unique opportunity to rethink tourism policy and take steps so the measures put in place today can shape a more resilient, sustainable and inclusive tourism economy for the future. This includes tackling the consequences for and of climate change and the depletion of natural capital; the energy crisis could help to accelerate the transition to more sustainable models of energy consumption and rethink tourism infrastructure to ensure it can adapt to climate change and natural disasters. More needs to be done also to enable all tourism stakeholders to benefit fully from digital opportunities and deliver more equitable and inclusive benefits to everyone engaged in and impacted by the sector, including through providing decent work opportunities in the sector.

This calls for the mainstreaming of sustainability into the strategic direction for tourism, supported by effective policies and implementation structures to develop and manage tourism sustainably, across all levels of government. Many sustainability issues are best tackled at the local destination level to address diverse and specific needs, with broad stakeholder engagement and involvement of local tourism communities. Co‑ordinated multi-level and multi-stakeholder policy approaches are needed to support this, along with improved capacity of government at all levels, and the private sector.

Securing a robust and stable tourism sector in uncertain times can promote a job-rich recovery, support fragile tourism businesses, particularly SMEs, and benefit local communities. The pandemic has led to a greater focus on the resilience of tourism. This comes at a time when shocks are becoming more frequent, and businesses and governments are required to continually respond. Chapter 2, Building Resilience in the Tourism Ecosystem, analyses policy approaches to support the recovery and enhance the resilience of the tourism economy for the future. It considers actions to boost tourism recovery prospects, tackle the long-term consequences of the crisis, and better prepare for future shocks, while encouraging the shift to more resilient, sustainable and inclusive models of tourism.

Sustained and transformative action is needed to promote a green tourism recovery, if the sector is to play its part in climate action. The halt in tourism at the height of the pandemic has allowed the sector to rethink the tourism offer. Governments, businesses, tourists and communities have been provided with an opportunity to consider the environmental impact of tourism and how it might be mitigated. Chapter 3, Promoting a Green Tourism Recovery, examines policy approaches to support the recovery of the tourism economy in a green and environmentally sustainable way, while delivering benefits to local communities and economies.

Continued progress is needed to improve the evidence base for tourism planning, policy and decision-making, to move to more sustainable, resilient and inclusive models in the future. Governments need to commit to these principles through future-focused and evidence-based policies. Effective policy making, planning and management all rely on the availability of robust evidence, preferably in the form of reliable and timely data that is sufficiently disaggregated and comparable. The pandemic has reinforced the urgency to have new tourism data measures and complementary data sources to react quickly under uncertainty, and this will be more evident as governments look to measure new sustainable policies.

Identifying critical uncertainties to mitigate possible issues and take advantage of opportunities will be important for governments and businesses as tourism recovers. Ongoing changes and external forces will continue to influence travel behaviours. Considering the different critical uncertainties can inform decisions on the supports the sector may require to rebuild stronger, fairer and greener. For example, price impacts could see the trend to go local consolidated as people look to reduce transport costs. They could also amplify existing issues, including seasonality and lack of dispersal as the number of trips are reduced, and visitors look to make their limited holidays count in the summer or winter months and at ‘bucket list’ destinations. Some critical uncertainties for tourism are presented in Box 1.1, including the impacts of long-‑term trends like the digital and green transitions.

Box 1.1. Critical uncertainties for shaping a resilient and sustainable tourism future

Recent and ongoing crises are significantly impacting consumer preferences and business structures, accelerating existing trends (e.g. digitalisation) and leading to the emergence of new behaviours (e.g. momentum around domestic tourism). Strategic foresight approaches that consider the ‘known unknowns’ can help policy makers to better understand and better prepare for the future. Key questions to consider include:

Will Russia’s war in Ukraine have long-lasting impacts on tourism?

Will the energy crisis and higher fuel costs lead to long-lasting changes in travel patterns?

Will social trends toward sustainability accelerate the greening of tourism businesses and consumer behaviours?

Will climate action create winners and losers in tourism, and who will they be?

Will tourism destinations return to a growth-at-all-costs model, or shift to more sustainable models of tourism?

Will labour shortages and skills gaps continue to hinder the tourism recovery?

Will business travel return to previous levels, and what will it look like in the future?

Will city tourism return amid the newfound desire for nature-based experiences?

Will tourism businesses of all sizes benefit from digital opportunities, or will the gap continue to widen with tourism SMEs left behind?

How will technological advances shape tourism experiences and behaviours in the future (e.g. long-haul travel, space tourism, virtual tourism)?

Will access to tourism experiences broaden for a more inclusive and accessible sector?

Strengthening the governance of tourism to respond and support recovery

The COVID‑19 crisis has been a call to action to governments, at all levels, and to the private sector, to respond in a co‑ordinated way, and has highlighted the importance of integrated tourism policy approaches to support recovery. Governments at all levels, and the private sector, need to be better prepared and have the capacity to react and adapt quickly. This requires more robust risk assessment and crisis response mechanisms, and closer co‑ordination across government and with the private sector, to ensure general measures address the needs of the tourism sector (or, at a minimum, do not unnecessarily adversely affect the sector) and that specific measures are well targeted. The pandemic has also brought about a need to co‑ordinate with health authorities, a relatively new area of engagement for tourism.

Governments were required to take unprecedented steps to mitigate the impact on the economy, including tourism, while responding to the health crisis. Delivering well-targeted and accessible support as quickly and efficiently as possible to tourism businesses, workers and visitors has been vital for the recovery of the tourism economy. This has required policy makers and the private sector to move quickly and adapt to the changed operating environment. The increased recognition of the importance of tourism at the highest levels of government, as well as the importance of international co‑operation, has supported the response.

Specific governance arrangements vary across countries, depending on factors including the system of government. In most OECD countries, responsibility for tourism at the national level is situated within the economic development or trade and industry ministries. Other common partnerships include those with regional development, culture or sport. Responsibility for tourism has recently moved to the Ministry of Labour and Economy in Austria, for example, while in Iceland, the tourism portfolio recently moved to the Ministry of Culture and Business Affairs. Perhaps recognising the importance of the tourism economy, Italy created a dedicated new Ministry of Tourism in 2021.

In general, the changes in tourism governance arrangements since the start of the pandemic have not been structural but have taken place instead through the development of ad hoc taskforces and other frameworks to increase collaboration and co‑ordination across government, levels of government, and with the private sector. Countries should seek to build on these experiences and take forward the approaches successfully used during the pandemic to tackle future challenges facing the tourism sector. This will provide momentum for more innovative and integrated approaches to tourism development in the future and support the sustainable development of tourism and ensure the sector is better prepared for future crises.

Strengthening co‑ordination and capacity across government for agile, targeted policies

Tourism presents an interdependent ecosystem of industries. This creates additional complexity in the policy making process requiring strong co‑operation between multiple government actors. The wide and varied nature of the tourism ecosystem means the quick and effective provision of sectoral support from the start of the pandemic required strong collaboration across government, both horizontally and vertically. This has been particularly essential to respond to the pandemic, and now in the face of the cost-of-living crisis, to ensure that new policies aligned with existing and planned economy-wide measures, and that targeted support measures were adequate for the needs of the tourism economy.

It also means that tourism policy makers have had to co‑ordinate with health colleagues to a far greater extent than in the past, and in many cases for the first time. This has required quick upskilling, creating new networks and building trust. In Italy, for example, tourism policy makers worked closely with health colleagues to promote the tourism recovery, providing information to support the tourism experience and developing “Covid-free tourist corridors”. Malta collaborated with the Ministry for Health to understand the COVID‑19 situation and the policy initiatives to address it. The Czech Republic worked with the Ministry of Health in the design of enabling conditions for tourism services to operate during the pandemic and will maintain this relationship to promote medical tourism.

Greater recognition of the importance of co‑operation has led to many countries to formalise these ad hoc communication structures for horizontal and vertical co‑ordination moving forward. The main purpose of these groups is to integrate tourism into broader national strategies and policy frameworks and ensure that tourism issues are addressed more broadly. However, some structures have been developed to address specific longstanding issues within the sector.

Germany created the national platform “Future of Tourism” as a central instrument for further developing a national tourism strategy (Box 2.6). This is to be overseen by a steering committee with high-ranking members of the relevant ministries responsible for developing the key points for the national tourism strategy and agreeing on a working programme for the Federal Government. The platform will expand to include representatives of the sixteen federal states and stakeholders of the tourism sector early in 2023.

The Czech Republic has taken an issues-based approach. The new Tourism Development Strategy 2021‑30 supports greater co‑ordination of tourism development and integration of tourism issues into other national strategies and policy areas. This includes a range of bilateral meetings and thematic working groups on key issues like visas and transport, economic diplomacy, financial support mechanisms, cultural and heritage tourism and sustainable tourism. The Czech Republic has also introduced a co‑ordination platform to aid inter-ministerial and interdisciplinary co‑ordination, which also allows for the collection of regional feedback on marketing activities and product development.

Greece has concentrated on preparedness rather than reaction by developing, within the framework of the UNWTO Technical Assistance Programme, a Tourism Crisis Management Plan and a Crisis Communication Strategy covering a wide range of potential crises that can impact tourism, including health, environmental, economic, and societal crises. These plans aim to increase the effectiveness and agility of the Greek tourism sector in responding to future challenges.

Enhancing engagement with the private sector

The private sector is a key stakeholder in tourism policy making. There was already a growing recognition of this before the pandemic. However, the fragmented nature of the tourism economy, made up of different branches with sometimes competing interests, makes it a challenging sector for policy makers to engage with. Since the beginning of the pandemic there have been many good examples of close co‑operation between government and the private sector, and with civil society – at local, national and international levels. The opportunity now exists to bring forward these experiences, to tackle future tourism policy challenges.

Box 1.2. Taking forward public-private sector co‑operation – selected country approaches

Estonia: The Tourism Advisory Board consists of the Ministry of Economic Affairs and Communications and Ministry of Culture, the Tourism Board, professional tourism associations, destinations and major gateways, which will meet twice annually. It was developed after the success of a regular roundtable during COVID‑19, which has also been continued as an informal meeting style.

Finland: A High-Level Working Group on Tourism was established in September 2021. Chaired by the Ministry of Economic Affairs and Employment, it comprises relevant ministries, regional councils, state administrations, regional tourism organisations, travel companies, research and educational institutions and organisations. The Working Group will serve as an expert advisory body on strategy related to tourism development through 2028. It will also monitor and assess the sector’s operating environment and current phenomena and support the preparation of tourism policy measures.

Ireland: The Hospitality and Tourism Forum was created in October 2020 to provide structured engagement between the private sector and relevant government departments. Its purpose is to allow key issues of relevance to the sector to be discussed, with a view to identifying practical (national or local) government and private sector action.

Netherlands: A national taskforce on leisure and tourism was formed to strengthen the co‑operation between national government and industry stakeholders. The short-term objective of the task force was to respond to the COVID‑19 crisis and restart tourism. Medium and long-term objectives include a robust co‑operation for a resilient and sustainable tourism and hospitality sector. The Taskforce is also responsible for progressing the joint action agenda on Perspective 2030, the national tourism strategy.

Poland: The Tourism Experts Council is a continuation of the Council of Experts, developed in 2021. Council tasks are to: identify and provide advice on tourism issues; propose systemic solutions; present proposals and provide advice on legislative initiatives; and initiate activities to enhance sustainable development, competitiveness and innovation. It will also provide inputs for the new medium and long-term programmes related to the transformation and development of tourism.

Switzerland: An advisory group consisting of tourism stakeholders, entrepreneurs, government officials, tourism associations, the cantons and the academic community will oversee the implementation of Switzerland’s federal tourism strategy. This will ensure the tourism strategy is implemented in a targeted and group-oriented manner.

Many countries set up tourism taskforces or advisory groups consisting of both public and private sector actors. In Morocco, for example, public and private actors came together at national and regional levels to establish a joint plan to revive the tourism sector for 2020‑22. The Tourism and Morocco Post COVID‑19 Plan includes 21 measures to adapt to new market realities, anticipate changes in the consumption patterns of tourists and take advantage of new opportunities.

The increased level of constructive co‑operation between the public and private sectors may be one of the positive legacies to emerge from this crisis (OECD, 2020[11]). Many countries are now building on the legacy of collaboration during the pandemic by formalising longer-term collaboration structures. These government and private sector groups are being utilised to drive strategic direction, create action plans for national strategies, and provide advice on programmes for long-term development in the sector. Several country-specific examples are set out in Box 1.2.

At the international level, the International Civil Aviation Organisation Council Aviation Recovery Taskforce, for example, brought together public and private representatives, including public health authorities, to provide practical, aligned guidance to governments and industry operators to support a co‑ordinated restart of the international air transport sector (ICAO, 2021[13]). Events like the OECD Global Forum on Tourism Statistics, Knowledge and Policies are also providing a platform for the tourism community to work together to support recovery and develop a common transformation agenda for the tourism economy.

The private sector has also taken the lead in this area, with one international example being the World Travel and Tourism Council Tourism Recovery Taskforce created to bring together policy makers and the private sector on a global scale. The recent creation of an Informal Tourism Contact Group by Business@OECD is a further example that is feeding into OECD work on tourism.

Trust and collaboration between government, the private sector and civil society are essential to tackle resilience and sustainability challenges (OECD, 2021[14]). It is important to learn from and build on these innovations, to take this forward to respond to future tourism challenges. This will also be key in the shift to a greener, digital tourism economy.

Promoting international and multilateral co‑operation to boost recovery

The crisis has highlighted the complexity and interdependence of the global tourism system. Solid multilateral co‑operation and institutions have never been more important. Countries need to work together, as the actions taken by one government have implications for travellers and businesses in other countries, and for the global tourism system. Countries need to develop collaborative systems across borders to safely resume travel, restore traveller and business confidence, stimulate demand and accelerate tourism recovery. More efficient international co‑ordination systems are also needed to respond to future shocks.

During the pandemic there were many examples of increased bilateral co‑ordination, for the establishment of safe travel corridors between countries. Estonia, Latvia and Lithuania introduced the Baltic ‘travel bubble’ in 2020, allowing free movement without any self-isolation obligations of citizens and residents between the three countries, as infection rates in the three neighbouring countries were similar. Regional co‑operation is also playing a role, including through more formalised groups.

Reflecting the increased recognition of the importance of tourism at national level, tourism is high on the global agenda. There has also been increased attention on tourism at the multilateral level, including at the highest levels in the OECD and other international institutions. The OECD, United Nations, World Bank, World Trade Organisation and others issued calls for action to support the tourism recovery and take the opportunity to shift to more sustainable, inclusive and resilient models of tourism for the future (OECD, 2020[11]; UN, 2020[14]; World Bank, 2020[15]; WTO, 2020[16]). The first High ‑Level Thematic Debate on Tourism at the UN General Assembly took place in May 2022.

There have also been additional efforts to co‑ordinate across these international institutions and countries, through for example the OECD Initiative on International Safe Mobility (Box 1.6). The UNWTO-led Global Tourism Crisis Committee brought together representatives from countries and international institutions, including the World Health Organisation, OECD, ICAO, International Maritime Organisation, the European Commission, as well as private sector representatives from International Air Travel Association (IATA) and Cruise Lines International Association.

The creation of a formal G20 Tourism Working Group under the G20 Saudi Arabia Presidency in 2020 has further spurred co‑ordinated action at the international level, and has continued under the Presidencies of Italy in 2021 and Indonesia in 2022 (e.g. G20 Rome Guidelines for the Future of Tourism, G20 Bali Guidelines for Strengthening Communities and MSMEs as Tourism Transformation Agents), with commitments secured in subsequent G20 Leaders Declarations to support tourism recovery. Other international institutions have also expanded their work and collaboration on tourism, including Asia Pacific Economic Cooperation (APEC), Association of South East Asian Nations, the Asian Development Bank and the European Union. The APEC Tourism Ministers, for example, recently endorsed Policy Recommendations for Tourism of the Future: Regenerative Tourism (APEC, 2022[18]).

Ensuring strong collaboration across these groupings and maintaining the momentum of tourism work streams, even in times of ‘normality’, provides important avenues and momentum to advance work to build a resilient and sustainable global tourism ecosystem. The European Commission is seizing this opportunity through a collaborative co-creation process to develop and secure action commitments to support the Transition Pathway for Tourism - a plan for the tourism ecosystem detailing key actions, targets and conditions to achieve the transition and long-term resilience of the sector (Box 1.3).

Box 1.3. Toward a green and digital transition of tourism in the European Union

The European Commission’s Transition Pathway for Tourism, launched in February 2022, was developed through a co-creation process with tourism actors, incorporating workshops, stakeholder meetings and a survey (which included responses from 200 stakeholders from 24 EU Member States plus Norway and the United Kingdom) into the design process. The Transition Pathway for Tourism followed the updated European Commission's Industrial Strategy of 2021.

The tourism transition pathway aims to accelerate the green and digital transition and to increase the long-term resilience of the tourism sector. The transition pathway calls on the whole tourism ecosystem to implement measures, targets and conditions in 27 areas, including to:

Invest in circularity to reduce energy, waste, water and pollution, and at the same time to better meet the increasing demand for sustainable tourism.

Enhance data sharing practices to allow for new innovative tourism services and improve the sustainable management of destinations.

Invest in skills to ensure the availability of a qualified workforce and attractive careers in the ecosystem.

The European Commission has now moved to implementation and invited tourism stakeholders to present their commitments to the transition for tourism. The objective is to encourage all stakeholders in the tourism ecosystem to play their part in the initiative. Collaboration processes are designed for co-implementation and monitoring of measures facilitated by an online stakeholder collaboration platform.

Source: EC Transition Pathway for Tourism (European Commission, 2022[19]),

Developing strategies amid uncertainty to shape a sustainable and resilient recovery

Before the tourism crisis triggered by COVID‑19, OECD work highlighted the importance of implementing a long-term and sustainable vision for tourism, supported by forward-looking strategies and action plans. As tourism recovers, governments face the challenge of balancing short-term recovery needs with longer-term strategic objectives. While the pandemic highlighted weaknesses (new and existing) in the tourism ecosystem, the slowdown it precipitated also presented an opportunity to address these in the recovery, and for the longer term. Policy interventions now must already take this into account as the sector navigates the recovery from COVID‑19 while addressing new challenges arising from the changed economic and geopolitical environment, if the opportunity is not to be missed.

The development of new tourism strategies in countries provides an important chance to address this. Many OECD countries were in the process of creating or updating their long-term tourism strategies at the beginning of the pandemic. While the pandemic led to some strategies being delayed, countries have also considered it an opportunity to reshape their new and existing strategies to reflect the new operating environment and optimise the strength and quality of the recovery. Some countries, including the Czech Republic, Italy, Japan and Latvia, have responded to the uncertainty by implementing shorter-term recovery strategies or action plans, typically covering two-to-three-year timeframes.

Many countries have also adopted long-term strategies during 2022, typically spanning to 2027 or 2030. In the United States, the National Travel and Tourism Strategy 2022 focuses on promoting the United States as a premier destination grounded in the breadth and diversity of its communities, and fostering a travel and tourism sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability (Box 1.4). Other countries that have recently introduced, or are developing, new long-term tourism strategies include Australia, Croatia, Denmark, Finland, France, Greece, Hungary and Israel.

There is also evidence of countries seeking to incorporate a more flexible approach to strategic tourism planning and development. The United Kingdom, for example, adopted a two-pronged approach, with the first aim to recover back to 2019 levels, while longer-term, strategic aims include objectives to encourage greater regional spread, support the business events sector, build greater sector resilience, and increase accessibility and sustainability. Hungary developed a revised Tourism 2.0 Strategy in 2021, incorporating the impacts of COVID‑19 and the lessons learned through the first three years of the National Tourism Development Strategy 2030.

Sustainability remains a strategic pillar and strong focus for tourism policy development. There is evidence of an increased focus on climate change mitigation and adaptation in countries like Italy and the United States. Italy is currently developing a new Strategic Plan for Tourism 2023-27 and is exploring the use of behavioural insights to encourage more sustainable and environmentally friendly behaviours for tourists and businesses, and better match the product offer to tourists. Switzerland, launched a new three-year “Swisstainable” Strategy in 2021, aiming to become the world’s most sustainable tourism destination.

Portugal has developed a comprehensive 2020‑23 Sustainable Tourism Plan, with a practical focus on encouraging sustainable actions by tourism businesses. These include reducing energy consumption and adopting circular economy solutions, relevant training and skills development, support for sustainable construction techniques and improved water efficiency at golf courses. The Estonian Tourism Strategy 2022‑25 includes a vision that ‘Estonia is a smart and green destination that offers an integrated visitor journey and a sustainable tourism product.’ Sustainability programmes have also been developed in Belgium, with Flanders adopting the Travel to Tomorrow: Recommendations for Tourism Policy 2019‑24 plan, and Romania developing a Strategy for Ecotourism Development.

Box 1.4. National Travel and Tourism Strategy 2022 in the United States

The National Travel and Tourism Strategy 2022 aims to support broad-based economic growth in travel and tourism across the United States, drawing on engagement and capabilities from across the Federal Government. The Federal Government will work to implement the Strategy under the leadership of the Tourism Policy Council and in partnership with the private sector, aiming toward an ambitious five-year goal of 90 million international visitors spending approximately USD 279 billion annually by 2027.

The Strategy follows a four-point approach:

Promoting the United States as a travel destination: Leverage existing programmes and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

Facilitating travel to and within the United States: Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

Ensuring diverse, inclusive, and accessible tourism experiences: Extend the benefits of tourism by supporting the development of diverse products, focusing on under-served communities and populations. Address travel and tourism businesses’ financial and workplace needs, supporting destination communities as they grow their tourism economies. Deliver world‑class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

Fostering resilient and sustainable travel and tourism: Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that protects natural resources, supports the tourism economy and ensures equitable development.

Recent strategies also consider the idea of value over volume, digitalisation, and workforce issues. These are key drivers in the implementation of Austria’s Plan T - Masterplan for Tourism, which was developed before the pandemic with a focus on quality rather than quantity and a culture of co‑operation. Australia’s THRIVE 2030 strategy includes an ‘industry led, government enabled’ action plan that works towards a resilient, sustainable, innovative, and competitive visitor economy, with a focus on unique and high-quality products and growing a secure and resilient workforce.

As existing recovery strategies expire and countries develop new long-term strategies, these will need to be under-pinned by concrete action plans and resources for implementation.

Resourcing response and recovery efforts

Delivering on the ambition and strategies for tourism requires resources. Tourism both contributes to government revenues and benefits from government expenditure. The complexity of the sector means it is challenging to precisely identify the level of public funding supporting the sector – this has been amplified since the start of the pandemic with the wide-scale introduction of whole-of-economy measures and support for SMEs (OECD, 2020[19]).

Box 1.5. Multifaceted support to respond to the COVID‑19 pandemic – selected country approaches

Australia: In addition to economy-wide assistance, targeted visitor economy support included Business Events Grants (AUD 56 million) to reinvigorate the business travel sector, the Consumer Travel Support Programme (AUD 258 million) to assist businesses including travel agents, inbound tour operators and outbound tour operators, and support for nine regions highly reliant on international tourism via the Recovery for Regional Tourism programme (AUD 50 million). The Tourism and Aviation Network Support programme was introduced to support the aviation sector and drive domestic tourism.

Austria: The tourism sector was supported with several measures administered by the Austrian Bank for Tourism Development including guarantees for bridging loans (cap: EUR 1.6 billion), support for event organisers (cap: EUR 300 million), support for package travel organisers (cap: EUR 300 million) and EUR 10 million to incentivise hospitality businesses to invest in open-air seating. Furthermore, there was support for landlords of private accommodations and farms that offered accommodation services, and a tax relief package, including VAT reductions for accommodation food and drink tax reductions (to 5%). A restart bonus supported part-time employment caused by lower occupancy to top‑up salaries in the visitor economy.

Canada: Tourism businesses received an estimated CAD 23 billion in emergency support. In addition to broad programmes such as the Canada Emergency Response Benefit and the Canada Emergency Wage Subsidy, multifaceted COVID relief programmes such as the Tourism and Hospitality Recovery Programme, the Hardest Hit Businesses Programme, the Local Lockdown Programme, and the Canada Recovery Hiring Programme were implemented with supports to tourism business extended until May 2022.

Morocco: Support to employees of tourist companies and guides was provided through a monthly flat-rate allowance, tax exemptions on additional remuneration of employees and the establishment of social cover for tourist guides. Morocco also postponed social security contributions and debt repayments for tourism businesses and provided a partnership agreement to accelerate the development of tourism SMEs in the Souss-Massa region.

Slovak Republic: Established a framework through their Tourism Support Act for the creation of state aid schemes and minimum aid for the tourism sector (totalling EUR 100 million). Offering aid to tourism businesses who suffered revenue losses of 40% or more in 2020, the aim was to maintain employment and ensure the competitiveness of tourism businesses.

Slovenia: Ten packages and a special intervention law were implemented to mitigate the effects of the pandemic, preserve jobs and alleviate corporate liquidity problems. The measures included cash transfers, grants, tax relief, payroll support, loan guarantees for SMEs and tourist vouchers for citizens to boost domestic tourism. Approximately 3.7 million vouchers were redeemed across 2020 and 2021, valued at almost EUR 393 million.

The tourism sector has benefited significantly from these wider economic support measures as well as substantial sector-specific support, such as business grants and loans, regional support, support for niche products and programmes to boost consumer demand. Canada estimates that from the onset of the pandemic to April 2022, the tourism and hospitality sector received an estimated CAD 23 billion in support through federal emergency programmes. Examples of other programmes introduced by governments in response to the COVID‑19 pandemic are presented in Box 1.5.

During the pandemic, international marketing budgets were frequently cut or diverted to domestic marketing, and operating budgets for some tourism authorities were impacted by the loss of tax revenues (e.g. tourist, bed and passenger tax). In Greece, a “Tourism for All” programme introduced in 2020 aimed to boost domestic tourism demand, through subsidised stays in hotels and other accommodation. In total, EUR 100 million has been allocated to finance the programme between 2020 and 2025.

For the 2020-21 budget cycles, many countries reported an increase in their core tourism operating budgets. In addition to tourism business supports, marketing is a key driver of this increase in the short-term. In 2021, Visit Sweden’s budget allocation included an additional SEK 20 million for domestic marketing, while Destination Canada received CAD 100 million for marketing initiatives in 2021. The United States is providing USD 250 million in relief funding to Brand USA for the fiscal year 2022 to fill a gap in the funding stream due to reduced international visitors. The Estonian Tourist Board funding for development activities has increased from EUR 2.0 million in 2021 to EUR 11.5 million in 2022.

Some countries also invested funds to increase internal capacity. In the 2022/23 budget New Zealand provided an additional NZD 8 million for tourism data and policy, for example, while Australia earmarked AUD 4.8 million to improve tourism data and analysis.

In the European Union, countries are also being supported by additional funds, including within the frame of the Recovery Plan for Europe and the Next Generation EU. Poland for example has tourism specific projects funded by EU structural funds, including the EU Green Deal in the period 2021‑27. In Slovenia, the tourism sector is also benefitting from NextGen EU and React EU funds. Under the Tourism Flagship projects, the EU Technical Support Instrument 2022 is supporting the recovery and reform agenda in seven countries – Croatia, Greece, Italy, Malta, Portugal, Slovenia and Spain – to build more sustainable, resilient and digital tourism ecosystems. These projects are focusing on reforms and improvements, including to tourism data and statistics with a focus on the tourism satellite accounts, the development sustainable tourism indicators, governance and destination management tools, and SME supports and digitalisation of the tourism ecosystem.

Many budgets, especially those at the regional and destination level, remain uncertain. Amid the uncertain outlook for tourism, the sector is likely to require ongoing support through this period to ensure that it not only survives but can align to the future strategic objectives for the sector.

Tackling policy priorities for the tourism recovery

The recovery of the tourism sector comes with new and existing challenges. The pandemic led to severe declines in tourism, exposing underlying weaknesses in tourism development models and the wider tourism economy. Initial priorities to encourage and facilitate recovery began with restoring consumer confidence and the operating capacity of businesses, together with restoring the safe mobility of people and supporting businesses financially. A further priority is to address severe workforce shortages to meet the return of tourism demand, and the need for renewed investment in the sector to attract visitors. While these are essential for the sector to rebuild, it is important to consider where the sector should be in the future, ensuring that it builds back better. Governments and businesses must act now so that the short-term actions for recovery have long-term strategic benefits for the sector.

Ensuring safe and seamless mobility, to restore traveller confidence and demand

Tourism depends on the mobility of people. Providing the right conditions to facilitate travel is both a short and long-term requirement, involving measures to foster traveller confidence and enable safe and seamless mobility. Providing seamless and safe travel experiences was already an issue high on the tourism policy agenda before the pandemic and is an integral part of a resilient and inclusive tourism recovery, while also addressing the sustainability agenda.

Travel restrictions put in place to prevent the spread of COVID‑19 effectively shut down the tourism system. Recent experience has shown the complexity of lifting these restrictions and getting the interdependent parts of this system back up and running smoothly, especially in a complex sector like aviation. Building visitor confidence in these actions has been needed to encourage people that it is safe to travel, and assure recipient countries, communities and workers that it is safe to receive travellers (OECD, 2021[21]).

A key issue has been virus testing and vaccine recognition, through a co‑ordinated approach to ensure that measures do not unnecessarily impede or create obstacles for travellers or remain in place longer than strictly necessary. The return to travel through opening borders and lifting restrictions has been facilitated through the administration of health certificates and vaccination monitoring. Countries have implemented this through vaccination passports for travellers, safe tourism certification programmes for businesses and safe travel zones for cities and countries.

For example, Türkiye introduced the Safe Tourism Certification Programme, which defines and advises an extensive series of measures to be taken regarding transport and accommodation. In Morocco, the Welcome Safely label was set up in collaboration with the health authorities. This includes an online platform to assist accommodation operators in Morocco in adhering to compliance measures. Greece introduced the Health First certification label to certify the compliance of tourist accommodation establishments with the mandatory government-issued health protocols against COVID‑19.

Indonesia launched the Cleanliness, Health, Safety and Environmental Sustainability protocol which provided training and certification to prepare for the reopening of the tourism sector post-pandemic. The protocol developed into several handbooks ranging from hotel safety protocol to specific destination models that can be applied to tourism businesses. There is also a certification programme which is renewed annually and has certified almost 12 000 tourism businesses.

The EU Digital COVID‑19 Certificate is valid in all EU countries and 49 non-EU countries at time of writing (European Commission, 2022[22]). This allows for the safe crossing of borders, as well as the use of hospitality services in many countries, by showing proof of recent vaccination or recovery from COVID‑19. Online platforms like the EU Reopen map and UNWTO/IATA dashboard have also provided information to travellers on travel restrictions and health requirements to facilitate mobility. These schemes remain in place as waves of the pandemic continue. It will also be important to take forward the learnings and experiences from the COVID‑19 response to prepare for future health events.

Experience during the pandemic has underlined the need for transparency, consistency and clarity in decision-making and communications about travel. This requires close engagement and co‑ordination between governments, tourism, health experts and transport bodies, together with the private sector. The multinational dimension of travel also requires co‑operation between countries in tackling safe mobility issues (OECD, 2021[21]). Co-ordinated action and collaboration on agreed standards and the interoperability of systems and technology can help to improve the traveller experience whilst enhancing safety and security, which are especially critical in times of crisis (OECD, 2020[23]).

This has been the driving force behind the OECD Initiative for Safe International Mobility, endorsed by OECD Ministers, which has sought to co‑ordinate the work across governments at the national level, between international organisations and with the private sector during the pandemic (Box 1.6). A High‑Level Meeting on Safe International Travel brought together both health and tourism decision makers to discuss and identify areas where action could be taken to accelerate safe international travel, facilitate and sustain the return of cross-border travel to pre-pandemic levels and improve preparedness against future global crises.

Extending the focus beyond the safe reopening of travel, and the wider tourism system, to consider the importance of seamless mobility is important for the recovery, and for the future, facilitated by digital technologies. Seamless travel provides a smooth, efficient, safe and enjoyable travel experience from a traveller’s point of origin to a destination, within the destination, and back again (OECD, 2020[24]). Restoring consumer confidence in the reliability of the system and integrating digital solutions at borders to simplify travel remain key areas of consideration.

Box 1.6. OECD Initiative for Safe International Mobility