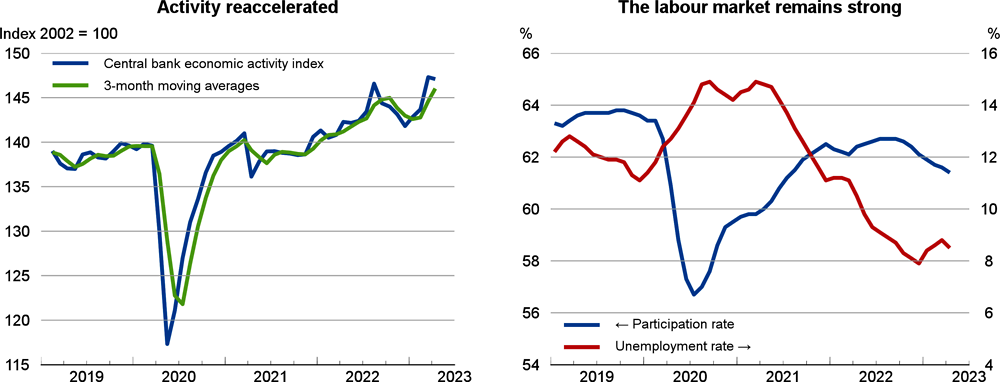

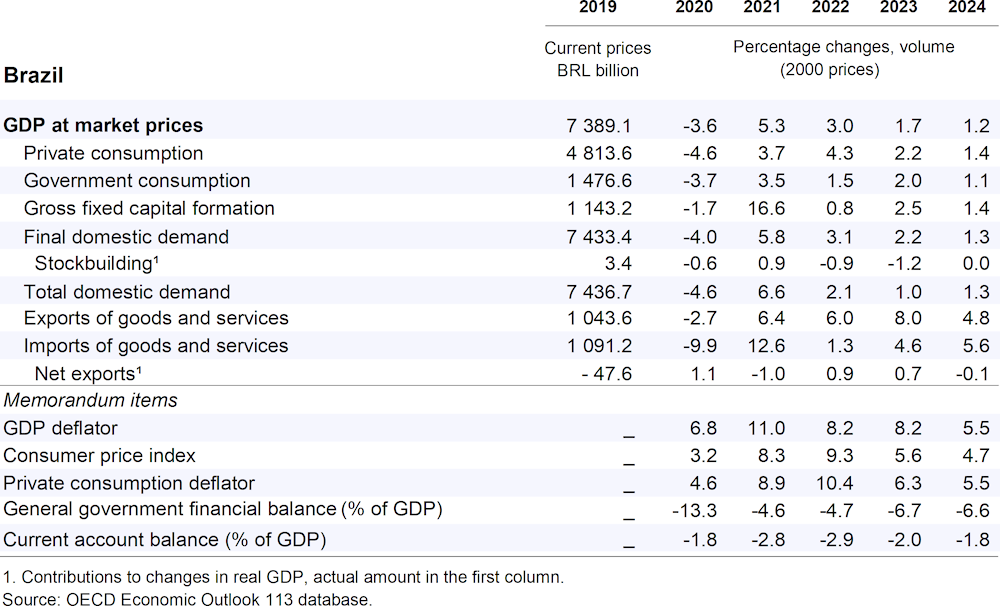

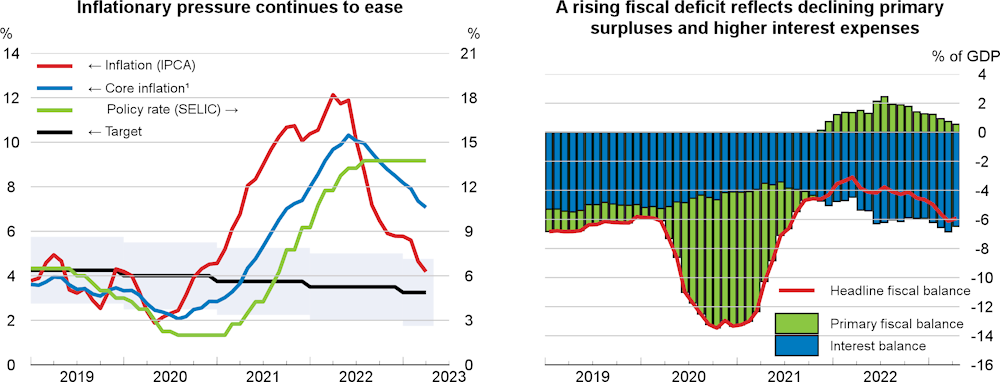

Economic activity is slowing due to weaker private consumption and exports. Real GDP is projected to grow by 1.7% in 2023 and 1.2% in 2024. Lower employment growth, still high inflation and tighter credit conditions will limit household spending capacity despite higher social transfers. Private investment will continue to rise but at a slower pace. Exports will be affected by lower commodity prices and subdued global demand. Inflation has declined markedly over 2022 but will remain above the target band during 2023.

Monetary policy is expected to remain restrictive, with the policy rate staying at 13.75% until at least the third quarter of 2023, after which room for monetary easing may emerge. Fiscal policy remains expansionary for now, but gradual consolidation should start in 2024. Implementing a credible medium‑term fiscal framework will help to restore confidence and achieve a more consistent macro‑economic policy mix. Better managing public infrastructure investment, simplifying indirect taxes and more effective social transfers could boost potential growth and social inclusion while improving public finances. Stronger sustainability incentives for the agricultural sector and an end to illegal deforestation would make growth more sustainable.