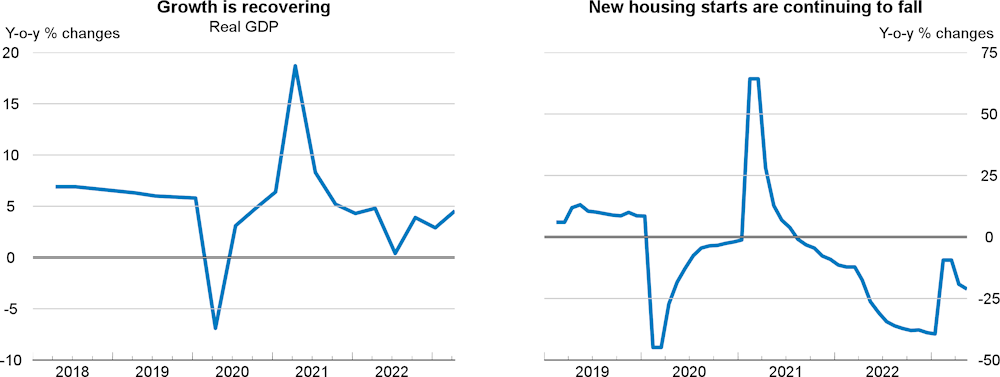

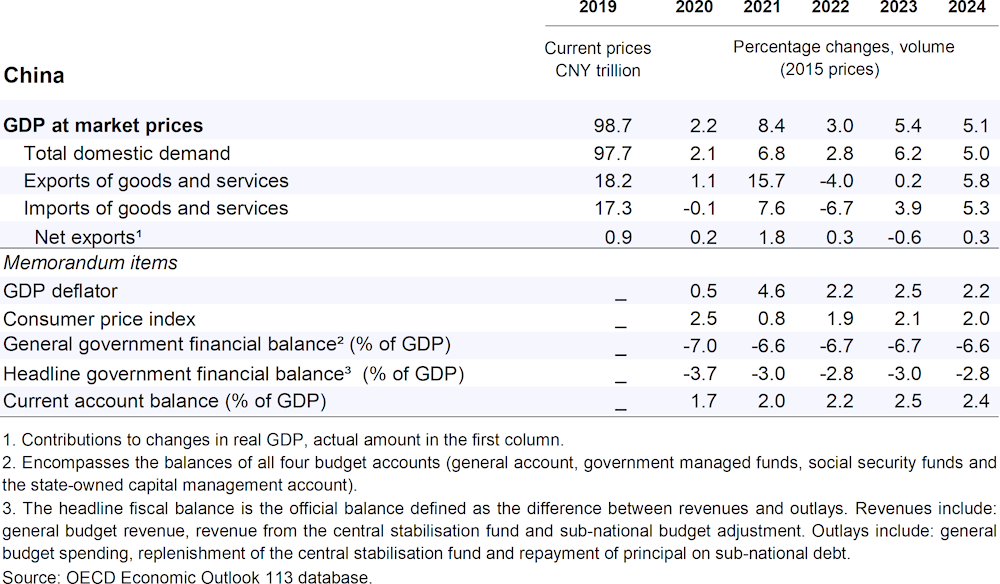

Economic growth will rebound to 5.4% in 2023 and 5.1% in 2024. Lifting zero-COVID restrictions has released pent‑up demand for in-person services, increasing revenues in services industries hard hit by lockdowns such as tourism or entertainment. Easing of housing-related prudential regulations and lower mortgage costs have stabilised property sales. Carryover of sizeable infrastructure projects from the previous year will fuel a construction boom. Export growth will be tempered by weak global demand. Consumer price inflation will remain benign due to a moderate recovery of domestic demand.

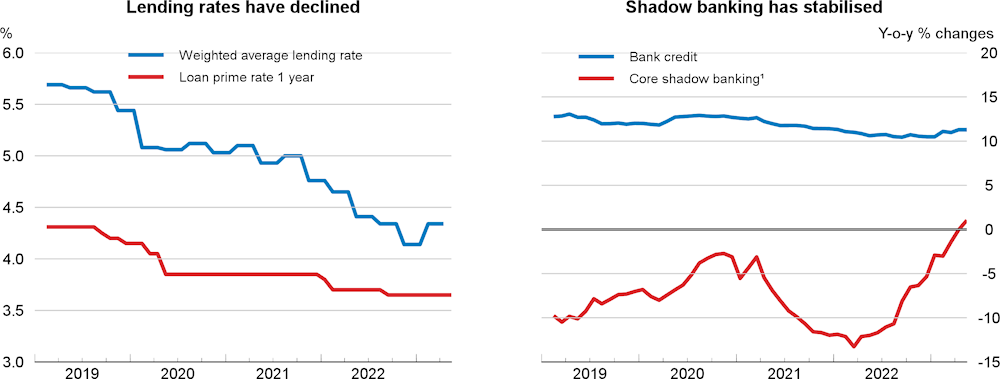

Monetary policy has become more supportive with a series of interest rate and reserve requirement cuts. The capital outflows and significant currency depreciation seen in 2022, have started to reverse since the reopening of the economy. Tax and user charge deductions and exemptions for targeted groups will provide some support, in particular for small and micro firms. The recovery in the housing sector will boost budgetary revenues. While demand support is needed until the recovery firms, measures should be subject to cost-benefit analysis. Structural reforms to ensure a level playing field should be stepped up to foster the recovery of private firms. Strict implementation of equal pay laws and affirmative action where needed would reduce the gender wage gap and allow women to realise their potential.