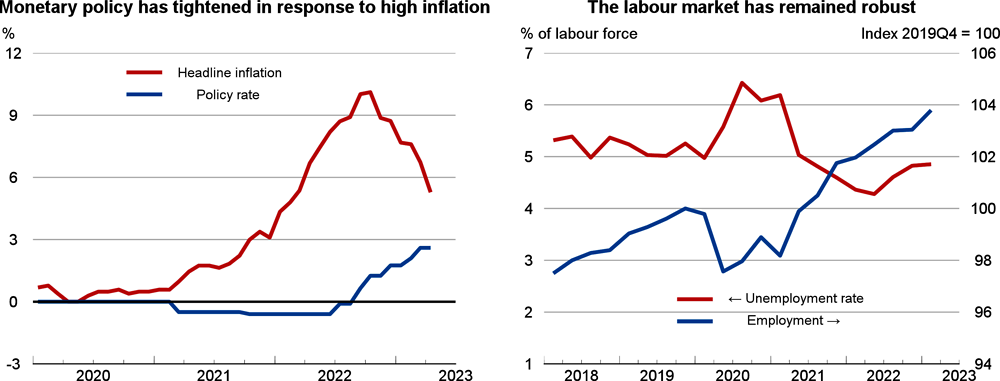

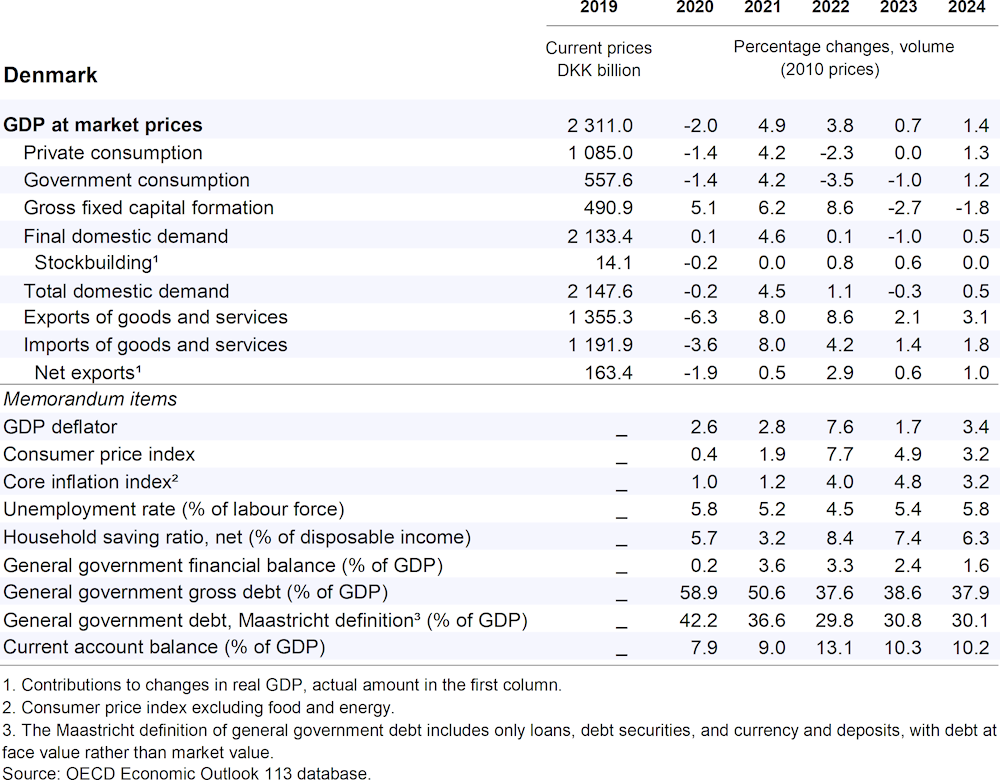

After slowing to 0.7% in 2023, economic growth is projected to recover to 1.4% in 2024. A strong labour market and large excess savings will support private consumption. By contrast, increasing borrowing costs and high uncertainty will weigh on housing and business investment. Inflation will recede from 4.9% in 2023 to 3.2% in 2024 on the back of falling commodity prices. The main risks to the outlook include stronger price and wage growth than projected. By contrast, a steeper fall in house prices would negatively affect economic activity.

Raising interest rates in line with the euro area to support the currency peg will help to stabilise inflation by dampening domestic demand. Fiscal policy will remain prudent with government budget surpluses in 2023 and 2024. Nevertheless, if inflationary pressures turn out stronger than expected, some fiscal tightening would be required next year. Structural policies facilitating international recruitment and reducing effective labour taxation would help to support labour supply. Moving ahead with plans to strengthen emissions pricing and accelerating the implementation of infrastructure projects would help to sustain investment and the green transition.