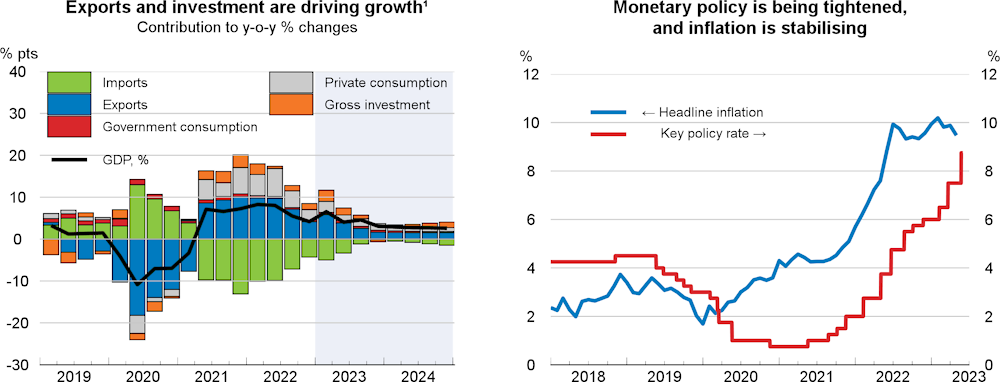

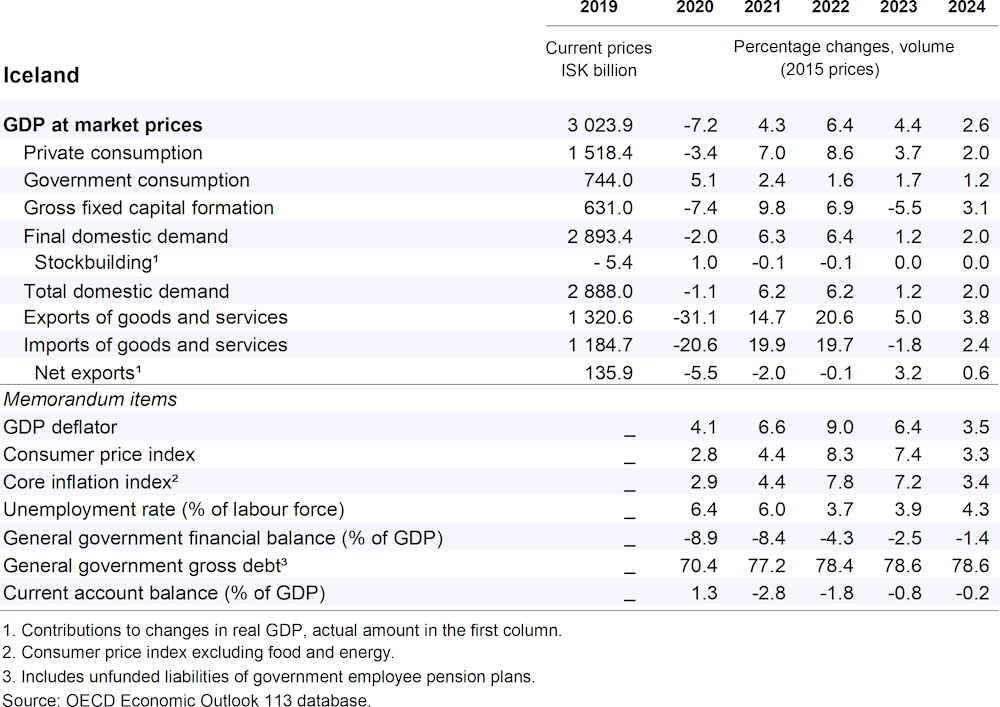

Economic growth will come down to 4.4% in 2023 and 2.6% in 2024. Private consumption will slow as wages moderate. So will business investment as financial conditions continue to tighten, and public investment will barely grow. In contrast, residential investment will pick up in the near term to work off pent-up demand. Export growth will slow given only modest growth in major trading partners. The unemployment rate will gradually rise towards 4.5% by the end of 2024. Headline inflation is expected to decline from around 10% in early 2023 to around 3% by late 2024.

In May, the central bank lifted the policy rate to 8.75%, the thirteenth increase since tightening started in May 2021 at 0.75%. The policy interest rate could be raised further to re-anchor inflation expectations and bring back inflation towards the 2.5% target. The fiscal consolidation planned for 2023-24 is appropriate to reduce inflationary pressures and maintain fiscal space. To foster sustainable productivity growth and help diversify the economy, innovation should be strengthened further, and the gender balance should become more equal across sectors.