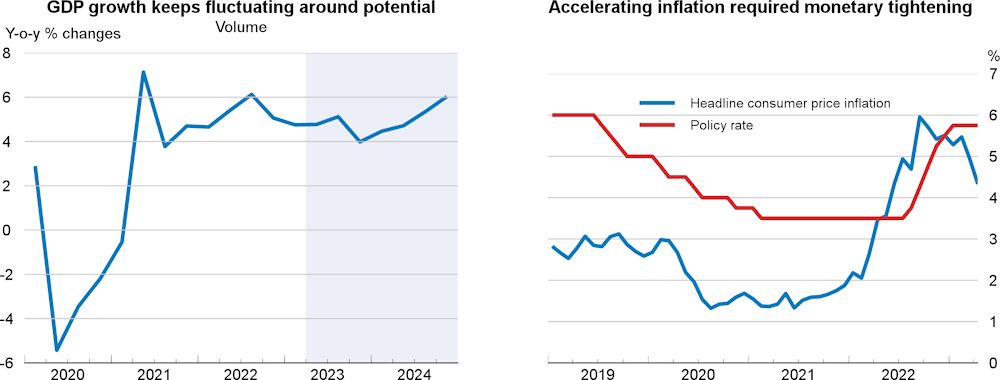

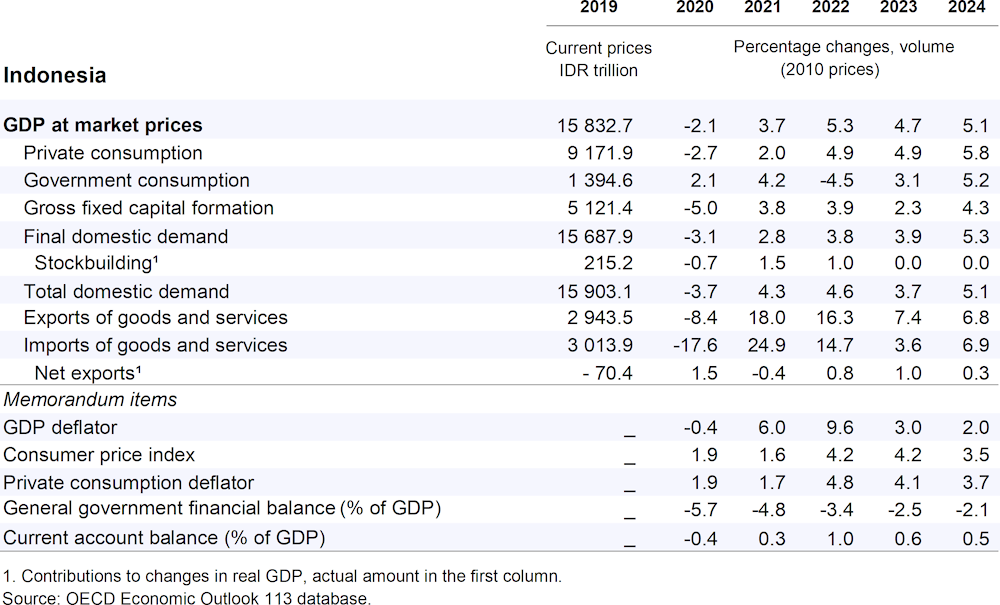

Real GDP growth will slow to 4.7% in 2023 and then reach 5.1% in 2024, once the impact of monetary tightening fades away and uncertainty about the 2024 elections abates. The economy has benefitted from strong commodity prices and will be sensitive to mounting global headwinds, including geopolitical tensions, slowing trade growth, and financial volatility. Low real wage increases and a soft labour market are holding back household consumption.

Monetary policy has become more restrictive since mid-2022, with the policy rate rising from 3.5% to 5.75%. Credit growth has weakened. Fiscal policy will become less supportive following the reinstatement of the 3%-of-GDP limit for the budget deficit. The incoming administration after the February 2024 elections should prioritise structural reforms to increase productivity and international competitiveness, while monitoring the impact of industrial and trade policies and adjusting them in case of disappointing results.