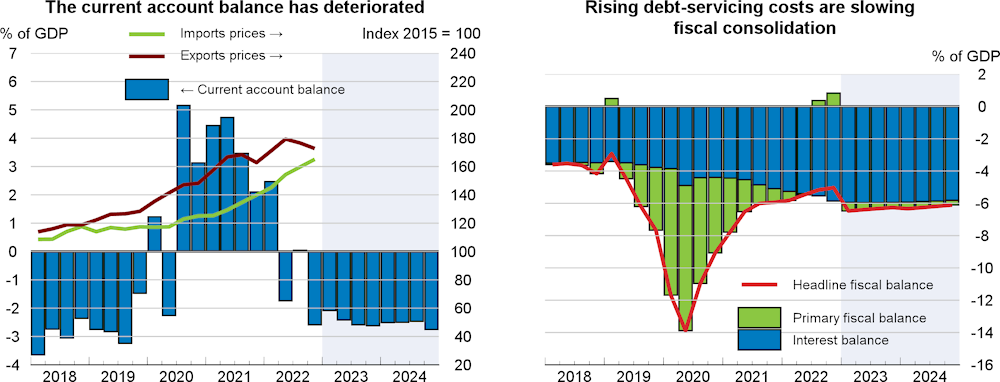

GDP growth is projected to slow to 0.3% in 2023 before picking up to 1% in 2024. Investment will become a much-needed driver of growth as the energy crisis requires additional power generation capacity. Higher interest rates and inflation are denting consumption, while electricity outages and lower global growth are weighing on exports. Investment will boost imports and, together with declines in the terms of trade, widen the current account deficit. Inflation will respond slowly to tighter monetary policy, with significant risks around the pace of this decline.

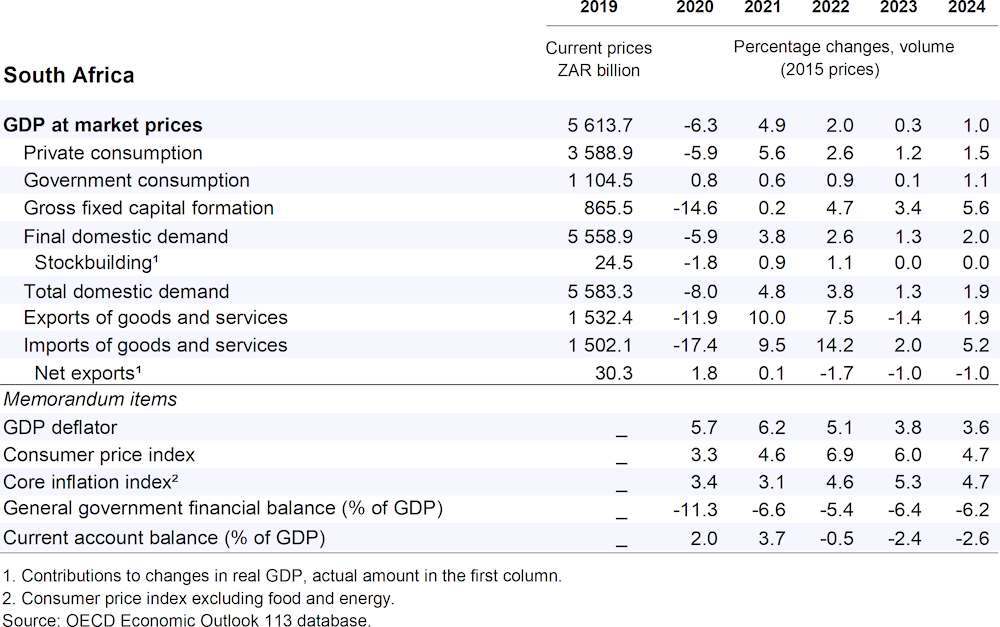

The energy crisis will slow the pace of fiscal consolidation as necessary public support to the sector results in additional expenditures. Falling commodity prices and slower growth will lower revenues. Broadening the income tax base and raising property and environmental taxes would help to offset this decline and improve equity. Monetary policy should stay the course to bring inflation down. The ongoing restructuring in the electricity market should be used to improve the quality of energy infrastructure and diversify energy sources, boosting productivity and resilience.