In 2020, on average across OECD countries, 84% of the funding for primary to tertiary educational institutions came directly from government sources, 15% from private sources and 1% from non-domestic (international) sources.

On average across OECD countries, upper secondary education relies more on private funding (11%) than lower secondary education (8%) and primary education (7%). Private sources contribute a similar share of the funds for upper secondary general and vocational programmes (11% and 10% respectively).

On average across OECD countries, households provide 9% of the total funding for upper secondary general programmes and other private sources (e.g. companies and non-profit organisations) provide 2% of the total funding. In upper secondary vocational programmes, households account for a lower share of funding (5%) while funding from other private entities (5%) is relatively more important than it is for general programmes.

Education at a Glance 2023

Indicator C3. How much public and private investment in educational institutions is there?

Highlights

Context

Today, more people than ever before are participating in a wide range of educational programmes offered by an increasing number of providers. Many governments increased their funding for education to provide the necessary resources to support this increased demand for education through public funds alone. At the same time, advocates of private funding argue that those who benefit the most from education – the individuals who receive it – should bear at least some of the costs. Both government and private funding are in competition to finance countries’ education systems; as a result the overall balance of public and private sources has been relatively stable in the long term.

Government sources dominate much of the funding of primary and secondary education, which is compulsory in most countries. Across OECD countries, the balance between public and private financing varies the most at the pre-primary and tertiary levels of education, where full or nearly full government funding is less common. At these levels, private funding comes mainly from households, raising concerns about equity in access to education. The debate is particularly intense over funding for tertiary education. Some stakeholders are concerned that the balance between public and private funding might discourage potential students from entering tertiary education. Others believe that countries should significantly increase public support such as student loans or grants to students, while others support efforts to increase the funding provided by private enterprises. By shifting the cost of education to a time when students typically start earning more, student loans help alleviate the burden of private spending and reduce the cost to taxpayers of direct government spending.

This indicator examines the proportion of government, private and non-domestic (international) funding allocated to educational institutions at different levels of education. It also breaks down private funding into funding from households and other private entities. It sheds some light on the widely debated issue of how the financing of educational institutions should be shared between public and private entities, particularly at the tertiary level. Finally, it looks at the relative importance of government transfers provided to private institutions and individual students and their families to meet the costs of tertiary education.

Other findings

At upper secondary vocational level, households receive the large majority of government transfers, which reach more than USD 3 000 per student annually in Germany and the Netherlands (Figure C3.3). Government transfers to other private entities are sizeable in Norway.

In all the OECD and partner countries with data, governments make financial transfers to the educational institutions where the school-based component of their main Vocational Education and Training (VET) programme takes place. Most countries also transfer funds directly to students and households as well as to the companies that host the work-based component of VET.

On average, the share of private expenditure on primary to tertiary educational institutions remained stable since 2012 and the COVID-19 pandemic did not have a major effect on private funding either. Two-thirds of countries observed a slight decrease in the relative importance of private funds in the first year of the COVID-19 crisis, but this was often due to an increase in public funding instead of a decline in private funding.

Government transfers to the private sector (e.g. to support payment of tuition or to subsidise companies offering apprenticeships) increase with education levels: they average 2% for upper secondary vocational education, 3% for post-secondary non-tertiary programmes, 4% for short-cycle tertiary education and 5% for bachelor’s, master’s and doctoral degrees combined.

Analysis

Share of government and private expenditure on educational institutions

The largest share of funding on primary to tertiary educational institutions in OECD countries comes from government sources, although private funding is substantial at the tertiary level. Within this overall OECD average, however, the shares of government, private and international (non-domestic) funding vary widely across countries. In 2020, on average across OECD countries, 84% of the funding for primary to tertiary educational institutions came directly from government sources and 15% from private sources. In Finland and Romania, private sources contribute 2% or less of expenditure on educational institutions whereas they make up over one-third of educational expenditure in Chile. International sources provide a very small share of total expenditure on educational institutions. On average across OECD countries, they account for 1% of total expenditure, reaching 4% in Estonia (Table C3.1).

Government funding dominates non-tertiary education in all OECD countries. In 2020, private funding accounted for only 9% of expenditure at primary to post-secondary non-tertiary levels on average across OECD countries, although it exceeded 20% in the Republic of Türkiye. In most countries, the largest share of private expenditure at these levels comes from households and goes mainly towards tuition fees (Table C3.1). The share of private expenditure on educational institutions varies across countries and according to the level of education. On average across OECD countries, 7% of expenditure on educational institutions at the primary level and 8% at the lower secondary level comes from private sources. At lower secondary level, private expenditure accounts for less than 10% of total expenditure in over two-thirds of OECD countries for which data are available. In contrast, it reaches 20% or more in Australia and Türkiye (OECD, 2023[2]).

Upper secondary education relies more on private funding than primary and lower secondary levels, reaching an average of 11% across OECD countries. Private sources contribute a similar share to the funding for general and vocational programmes (11% and 10% respectively). However, in Germany and the Netherlands, the share of private funding for vocational upper secondary education is at least 30 percentage points higher than for general education. In Germany, private companies have a long tradition of being involved in the provision of dual training (combined school- and work-based programmes), helping to improve the availability of skilled individuals needed in the labour market. In contrast, in Türkiye, the share of private funding of general programmes exceeds that of vocational programmes by 37 percentage points (OECD, 2023[2]). In several countries, the share of government funds currently devoted to vocational programmes is the result of national policy developments on vocational education designed to improve the transition from school to work. For example, in the 1990s, France, the Netherlands, Norway and Spain introduced financial incentives to employers offering apprenticeships to secondary students. As a result, programmes combining work and learning were introduced more widely in a number of OECD countries (OECD, 1999[3]).

Most private expenditure on primary to post-secondary non-tertiary levels of education comes from households. At upper secondary level, households and other private entities each provide 5% of the total funding for vocational programmes: private entities other than households (e.g. companies and non-profit organisations) make a significant contribution to the financing of vocational programmes in some countries. This is the case in the Netherlands where 34% of total expenditure for upper secondary VET comes from private sources other than households. The situation is slightly different for general programmes at the same level, where households account for a larger share on average (9%) and other private entities contribute only 2%. The average for general programmes is driven by a larger share of household funding in a few countries, especially in Australia, Chile, Hungary and Türkiye (Table C3.2).

Private expenditure on educational institutions often finances private institutions: on average 53% of private funds for primary to tertiary education go towards the financing of government-dependent or independent private institutions (Table C3.4). The share of private funding for private institutions is even higher at upper secondary level but there is not a large difference between general (88% of private expenditure) and vocational programmes (85%). However, private funding figures may have been underestimated and this is especially the case for vocational programmes, which rely more on private institutions and (public or private) companies. For example, apprentices’ remuneration is a relevant component of VET expenditure but is excluded from official statistics on education expenditure (see Indicator C1 on coverage of private expenditure).

Government transfers to the private sector

A large share of government spending goes directly to educational institutions, but governments also transfer funds to educational institutions through various other allocation mechanisms (tuition subsidies or direct public funding of institutions based on student enrolments or credit hours) or by subsidising students, households and other private entities funding education through scholarships, grants or loans. Transfers to the private sector include those made directly to students, households or other private entities. Channelling funding for institutions through students increases competition among institutions and pushes them to improve their effectiveness.

At the non-tertiary levels of education, the share of government transfers to the private sector is very small. In 2020, on average across OECD countries, government transfers represented less than 1% of the total funds devoted to primary and lower secondary education as well as those for upper secondary general programmes. Government transfers become more relevant for education levels that are closer to the labour market or academia: average transfers reach 2% of total funding for upper secondary vocational education, 3% for post-secondary non-tertiary programmes, 4% for short-cycle tertiary education and 5% for bachelor’s, master’s and doctoral degrees combined (Figure C3.2). A few countries are driving up the overall average, in particular Australia, Ireland, New Zealand and the United Kingdom, while Chile, Italy and Korea are also making significant transfers at tertiary levels (Table C3.2).

Although there is no single allocation model across OECD countries (OECD, 2017[4]), private expenditure is largely backed by government financial transfers in some countries, where they play an important role in financing vocational programmes and tertiary education (Figure C3.2), and are seen as a means of expanding access for lower income students. While government transfers to the private sector may seem small, they form a substantial share of the overall amount of private funding. For example, government transfers represent over half of the private sector’s expenditure in Australia (from upper secondary vocational to short-cycle tertiary programmes), Norway and the United Kingdom (upper secondary vocational and short-cycle tertiary).

Government transfers to households cover two categories of transfers: government scholarships and other grants, and government student loans. Transfers also include special transfers (e.g., linked to specific spending for transport, medical expenses or study material), family or child allowances contingent upon student status, and government loans to students and/or households contingent upon student status. Government transfers target the purchase of educational core and peripheral goods and services both within and outside educational institutions. Government transfers to other private entities relate to the provision of training at the workplace as part of combined school and work-based programmes (including apprenticeship programmes). They also include interest rate subsidies or default guarantee payments to private financial institutions that provide student loans.1

Figure C3.2. Government transfers to the private sector as a share of total expenditure on educational institutions by ISCED level and country (2020)

Source: OECD/UIS/Eurostat (2023), Table C3.2. For more information see Source section and Education at a Glance 2023 Sources, Methodologies and Technical Notes (OECD, 2023[1]).

Types of government transfers

When looking at how households spend the transfers received, they can either use them as payments to educational institutions or finance other expenses like study material or students’ living expenses. This latter type of transfers that are not attributable to educational institutions needs to be excluded from the analysis of how much public and private sectors contribute to finance educational institutions. However, the average amount per student of transfers that are not spent on educational institutions can be quite substantial in some countries.

At upper secondary vocational level, households receive the large majority of government transfers, which total more than USD 3 000 per student annually in Germany and the Netherlands (Figure C3.2). The majority of government transfers received by students and households are not attributable to educational institutions. In other words, beneficiaries do not have to spend them on educational institutions (through tuition fees, for example) but can use them to finance students’ living costs or learning materials, equipment (e.g. computers or learning software) and extra learning activities. Transfers to other private entities are sizeable in Norway, reaching almost USD 2 800 per student, due to large government subsidies to private companies for VET apprenticeships.

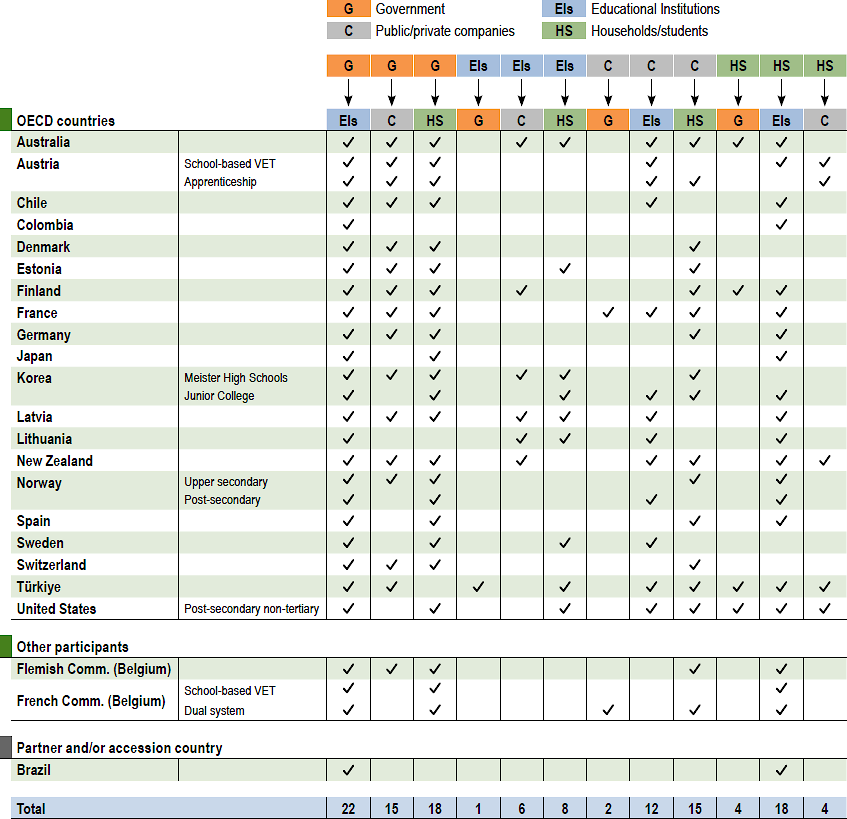

Figure C3.3 shows the funding flows related to VET. Most of the 22 countries with data available report making financial transfers to the vocational educational institutions where the school-based component takes place. A large majority of countries report that government transfers are also made to students and households as well as to the companies that host the work-based component of VET. Central, regional and local government transfers generally finance school-based VET by supporting educational institutions’ overall expenditure, rather than earmarking funding for specific activities, while transfers to companies, students and households are usually more tightly targeted. For example, transfers might contribute to paying teachers’ salaries in the company (e.g. in Korea and Latvia) or be used to pay apprentices either directly (e.g. in Latvia) or indirectly through the company (e.g. in Denmark).

The most common type of transfer from students and apprentices is to educational institutions, mostly to cover tuition and other education-related fees. In addition, countries reported that students may make transfers to pay back educational institutions or companies if they take student loans or if companies advanced other costs (e.g. ancillary services). Educational institutions generally only receive transfers rather than make them, with a few exceptions. In a few countries, they cover at least some of the cost of apprentices’ remuneration or specific expenditure items like hardware and software (e.g. in Lithuania). Public and private companies transfer funds in about half of the responding countries, often to cover a portion of educational institutions’ cost of training (e.g. in Australia and New Zealand) or provide generic funding for a programme (e.g. in Austria, Latvia and Lithuania). In the United Kingdom, a universal levy is applied to companies, and employers who pay the levy to the government are topped up with a 10% contribution from the government, contingent on the offer of apprenticeships to 16-18 year-olds (Kis, 2020[5]). In about two-thirds of the responding countries, companies directly finance trainees or apprentices’ remuneration, although the terminology used may differ across countries (i.e. wage, compensation, stipends or salaries) (see Box C3.1).

Figure C3.4. Financial transfers to support vocational education and training programmes (2023)

Note: The survey responses refer to the main VET programmes in each country, which may be classified at different levels of education.

Source: OECD (2023). For more information see Source section and Education at a Glance 2023 Sources, Methodologies and Technical Notes (OECD, 2023[1]).

Box C3.1. Government transfers to companies offering work-based learning

Many countries offer support to companies that offer work-based learning in the context of VET. The details of implementation vary considerably as do the amounts and underlying rationales. Funding mechanisms include universal subsidies (available to all companies offering work-based learning) and/or targeted subsidies (e.g. companies that host apprentices with certain characteristics). For example, in Australia, Austria and France financial incentives are offered to encourage companies to offer work-based learning, with both universal and targeted incentives. Switzerland has a large apprenticeship system without universal subsidies offered to employers, although some professional sectors have established a levy. In addition, cantons provide funding towards in-company trainers and branch courses (sector-specific training courses offered to apprentices). The Norwegian model is based on the idea that companies bear the burden of educating young people and therefore receive the equivalent of the cost of one year of school-based education and training. The Danish approach is based on employer contributions, with a bonus system for companies that host enough apprentices (paid for by companies that miss the targets). Further details on some systems are provided below.

Australia

VET funding is a joint responsibility of the Australian Government (Commonwealth) and State and Territory governments (states). The Commonwealth provides funding to states, which are responsible for the allocation of funding within their own systems using a combination of Commonwealth funding and their own resources. In addition, the Commonwealth also directly funds and administers some relatively small programmes and provides income contingent loans to eligible ISCED 5 students towards tuition fees.

The Commonwealth provides financial incentives to employers of Australian apprentices to help improve apprentice completion rates and address current and future skills gaps. The Australian Apprenticeships Incentives System commenced in July 2022, replacing the Australian Apprenticeships Incentives Program. The new Incentives System includes targeted subsidies, such as the Priority Wage Subsidy offered to employers who take on apprentices in priority occupations, and the Disability Australian Apprentice Support Wage which aims to encourage employers to provide Australian Apprenticeship to people with a disability. Employers of Australian apprentices in occupations that are not priority occupations may also be eligible for a hiring incentive.

Denmark

Companies that host an apprentice and pay them wages during time spent in school-based settings receive a subsidy (wage reimbursement) from the Employers’ Education Contribution (AUB). According to estimates, after the reimbursement companies bear 10-19% of the total cost of VET (including a mostly school-based one-year basic course and the main course delivered through apprenticeship).

The AUB is an independent institution, established in 1977 (under the name AER), designed to encourage the provision of work-based learning in VET. The AUB is managed by a board of 16 social partner representatives, and a chairman who is not connected to employer or employee organisations. It manages various schemes in relation to VET. To encourage the provision of apprenticeships, a "target training ratio” per skilled employee was established through a tripartite agreement. Companies that meet their training ratio receive an additional subsidy (student grant) as a bonus. The bonus is funded by contributions from companies that fail to meet their target (DKK 27 000 per “lacking apprentice”) (Ministry of Children and Education, 2023[6]).

Norway

The main apprenticeship model involves two years at school and two years spent entirely with an employer. The two years spent at a company are estimated to involve work half of the time and training half of the time. The financing scheme is based on the intention that government funding should cover the costs of education and training (both at school and in work-based learning), while employers should pay apprentices in compensation for the value of their work.

The national government provides a lump sum grant to counties. Counties then use this grant to finance subsidies to companies that provide work-based learning to apprentices. The subsidy is a fixed sum per apprentice and contributes to the cost of hosting an apprentice (e.g., the wages of trainers). In line with the underlying rationale (employers provide about one year of training, which should be covered by public funding), the subsidy is approximately equivalent to the cost of one year of education in school-based settings. In addition, there used to be an earmarked grant that targeted apprentices that are "difficult to employ", which is now transferred to regional government.

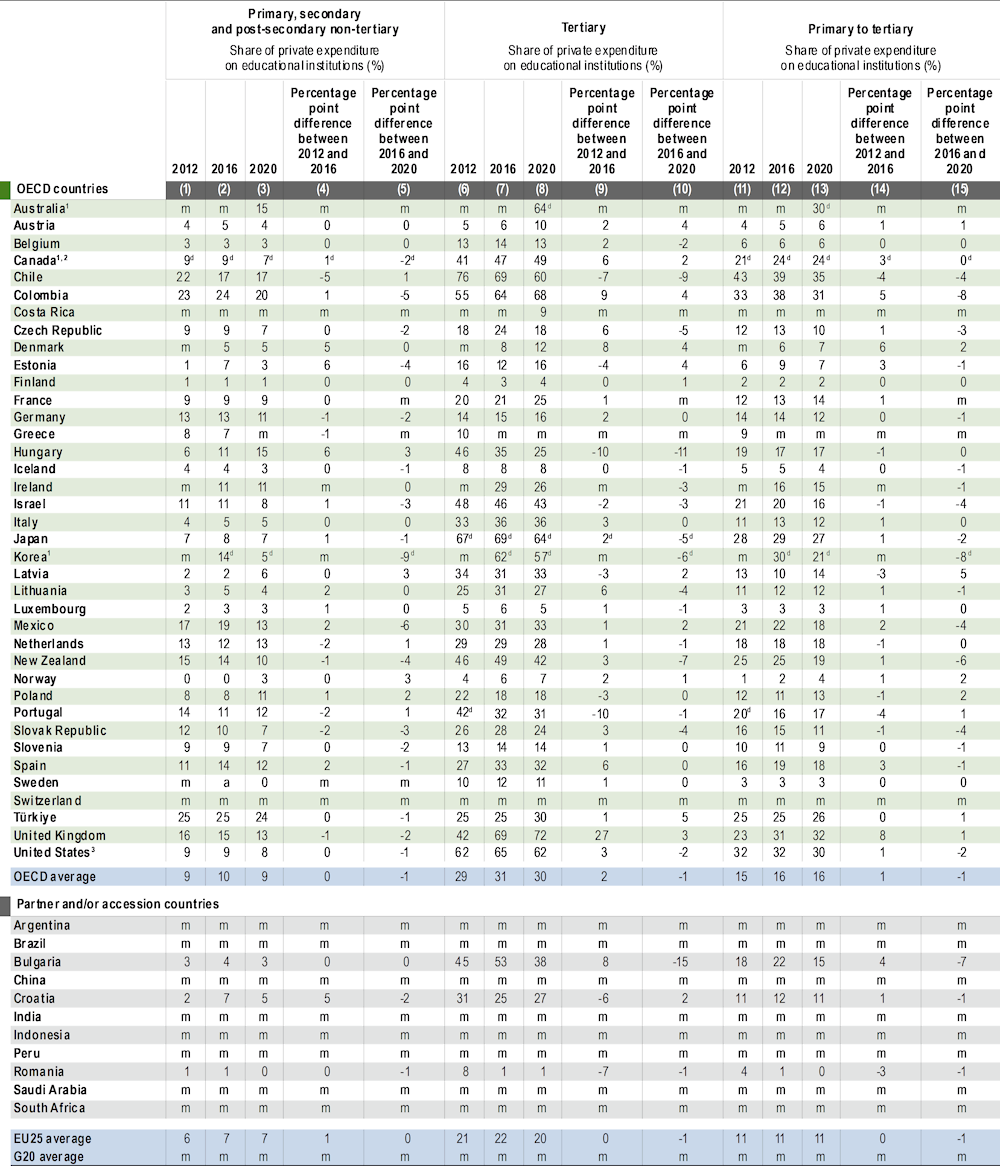

Trends in the share of government and private expenditure on educational institutions

The average shares of government and private expenditure on primary to tertiary educational institutions have tended to be stable over time across the OECD, but these averages disguise changes at the country level. Almost half of OECD countries saw increases in the share of private funding between 2012 and 2020, with the United Kingdom showing the largest rise (9 percentage points, mostly between 2012 and 2016). In contrast, Chile experienced the largest fall in the share of private spending (8 percentage points) between 2012 and 2020, balanced by an equivalent increase from government sources (Table C3.3).

Despite this longer-term stability, some countries observed a decrease in the share of private funds in 2020 (Figure C3.5). The share of private funds for primary to tertiary education remained at 16% in 2019 and 2020. Two-thirds of countries with available data observed a slight decrease in the relative importance of private funds in the first year of the COVID-19 crisis, partly due to increased support to education from government funding. In Israel, Korea, Mexico and New Zealand, the share of private financing was at least 4 percentage points lower in 2020 than in 2019, while private funding grew in relative importance in Ireland and Norway. Provisional figures for 2021 are available for a smaller number of countries and they indicate the share of private funding has remained similar to 2020 overall, with a few exceptions: the share increased by 1 percentage point in Croatia, Denmark and Türkiye but continued to decline in Spain, by 1 percentage point, and in New Zealand, by 2 percentage points (Figure C3.5). In New Zealand, a significant reduction in fee revenue from international students due to the COVID-19-related border closure was also a factor in the reduction of the share of private funding in 2020 and 2021.

Between 2012 and 2020, the share of private funding fell slightly at non-tertiary levels (by 1 percentage point on average across OECD countries) and increased slightly at tertiary levels (1 percentage point). The largest increases at non-tertiary level were in Hungary (9 percentage points) while at tertiary level they were in the United Kingdom (30 percentage points). The largest falls at non-tertiary level were observed in New Zealand (6 percentage points) and in Hungary at the tertiary level (21 percentage points). A large portion of New Zealand’s drop in the share of private funding was at upper secondary level, mostly for vocational programmes (19 percentage points between 2012 and 2020) rather than general programmes. The share of private funding for upper secondary general programmes increased by 18 percentage points in Hungary and by 10 percentage points in Latvia, but this was not markedly the case for vocational programmes (Table C3.3).

Definitions

Initial government (public), private and international (non-domestic) shares of educational expenditure are the percentages of total education spending originating in, or generated by, the government, private and non-domestic sectors before transfers have been taken into account. Initial government funding includes both direct public expenditure on educational institutions and transfers to the private sector, and excludes transfers from the non-domestic sector. Initial private funding includes tuition fees and other student or household payments to educational institutions, minus the portion of such payments offset by government subsidies. Initial non-domestic funding includes both direct expenditure for educational institutions from non-domestic sources (for example, a research grant from a foreign corporation to a public university) and transfers to governments from non-domestic sources.

Final government (public), private and (non-domestic) international shares are the percentages of educational funds expended directly by government, private and non-domestic purchasers of educational services after the flow of transfers. Final government funding includes direct purchases of educational resources and payments to educational institutions by the government. Final private funding includes all direct expenditure on educational institutions (tuition fees and other private payments to educational institutions), whether partially covered by government subsidies or not. Private funding also includes expenditure by private companies on the work-based element of school- and work-based training of apprentices and students. Final non-domestic funding includes direct international payments to educational institutions such as research grants or other funds from non-domestic sources paid directly to educational institutions.

Households refer to students and their families.

Other private entities include private businesses and non-profit organisations (e.g. religious organisations, charitable organisations, business and labour associations, and other non-profit organisations).

Government subsidies include government and non-domestic transfers such as scholarships and other financial aid to students plus certain subsidies to other private entities.

Methodology

All entities that provide funds for education, either initially or as final payers, are classified as either government (public) sources, non-government (private) sources, or international sources such as international agencies and other foreign sources. The figures presented here group together public and international expenditures for display purposes. As the share of international expenditure is relatively small compared to other sources, its integration into public sources does not affect the analysis of the share of public spending.

Not all spending on instructional goods and services occurs within educational institutions. For example, families may purchase commercial textbooks and materials or seek private tutoring for their children outside educational institutions. At the tertiary level, students’ living expenses and foregone earnings can also account for a significant proportion of the costs of education. All expenditure outside educational institutions, even if publicly subsidised, are excluded from this indicator. Government subsidies for educational expenditure outside institutions are discussed in Indicator C4.

A portion of educational institutions’ budgets is related to ancillary services offered to students, including student welfare services (student meals, housing and transport). Part of the cost of these services is covered by fees collected from students and is included in the indicator.

Expenditure on educational institutions is calculated on a cash-accounting basis and, as such, represents a snapshot of expenditure in the reference year. Many countries operate a loan payment/repayment system at the tertiary level. While government loan payments are taken into account, loan repayments from private individuals are not, and so the private contribution to education costs may be under-represented.

Student loans provided by private financial institutions (rather than directly by a government) are counted as private expenditure, although any interest rate subsidies or government payments on account of loan defaults are captured as government funding.

For more information, please see the OECD Handbook for Internationally Comparative Education Statistics 2018 (OECD, 2018[7]) and (OECD, 2023[1]), Education at a Glance 2023 Sources, Methodologies and Technical Notes for country-specific notes https://doi.org/10.1787/d7f76adc-en.

Source

Data refer to the financial year 2020 (unless otherwise specified) and are based on the UNESCO, OECD and Eurostat (UOE) data collection on education statistics administered by the OECD in 2022 (for details see Annex 3 at https://www.oecd.org/education/education-at-a-glance/EAG2022_X3-C.pdf). Data from Argentina, China, India, Indonesia, Peru, Saudi Arabia and South Africa are from the UNESCO Institute of Statistics (UIS).

The data on expenditure for 2012 to 2020 were updated based on the UOE data collection in 2022 and adjusted to the methods and definitions used in the current UOE data collection. Provisional data on educational expenditure in 2021 are based on an ad-hoc data collection administered by the OECD and Eurostat in 2022.

References

[5] Kis, V. (2020), “Improving evidence on VET: Comparative data and indicators”, OECD Social, Employment and Migration Working Papers, No. 250, OECD Publishing, Paris, https://doi.org/10.1787/d43dbf09-en.

[6] Ministry of Children and Education (2023), Apprenticeship-dependent AUB contribution, https://www.uvm.dk/trepart/trepartsaftale-om-tilstraekkelig-og-kvalificeret-arbejdskraft-og-praktikpladser/praktikpladsafhaengigt-aub-bidrag (accessed on 19 May 2023).

[1] OECD (2023), Education at a Glance 2023 Sources, Methodologies and Technical Notes, OECD Publishing, Paris, https://doi.org/10.1787/d7f76adc-en.

[2] OECD (2023), Education at a Glance Database, https://stats.oecd.org/.

[7] OECD (2018), OECD Handbook for Internationally Comparative Education Statistics 2018, OECD Publishing, Paris, https://doi.org/10.1787/9789264304444-en.

[4] OECD (2017), “Who really bears the cost of education?: How the burden of education expenditure shifts from the public to the private sector”, Education Indicators in Focus, No. 56, OECD Publishing, Paris, https://doi.org/10.1787/4c4f545b-en.

[3] OECD (1999), Implementing the OECD Jobs Strategy: Assessing Performance and Policy, The OECD Jobs Strategy, OECD Publishing, Paris, https://doi.org/10.1787/9789264173682-en.

Indicator C3 Tables

Tables Indicator C3. How much public and private investment in educational institutions is there?

|

Table C3.1 |

Relative share of government, private and non-domestic expenditure on educational institutions, by final source of funds (2020) |

|

Table C3.2 |

Relative share of government, private and non-domestic expenditure on educational institutions, by source of funds and government transfers to the private sector (2020) |

|

Table C3.3 |

Trends in the share of government, private and non-domestic expenditure on educational institutions (2012, 2016 and 2020) |

|

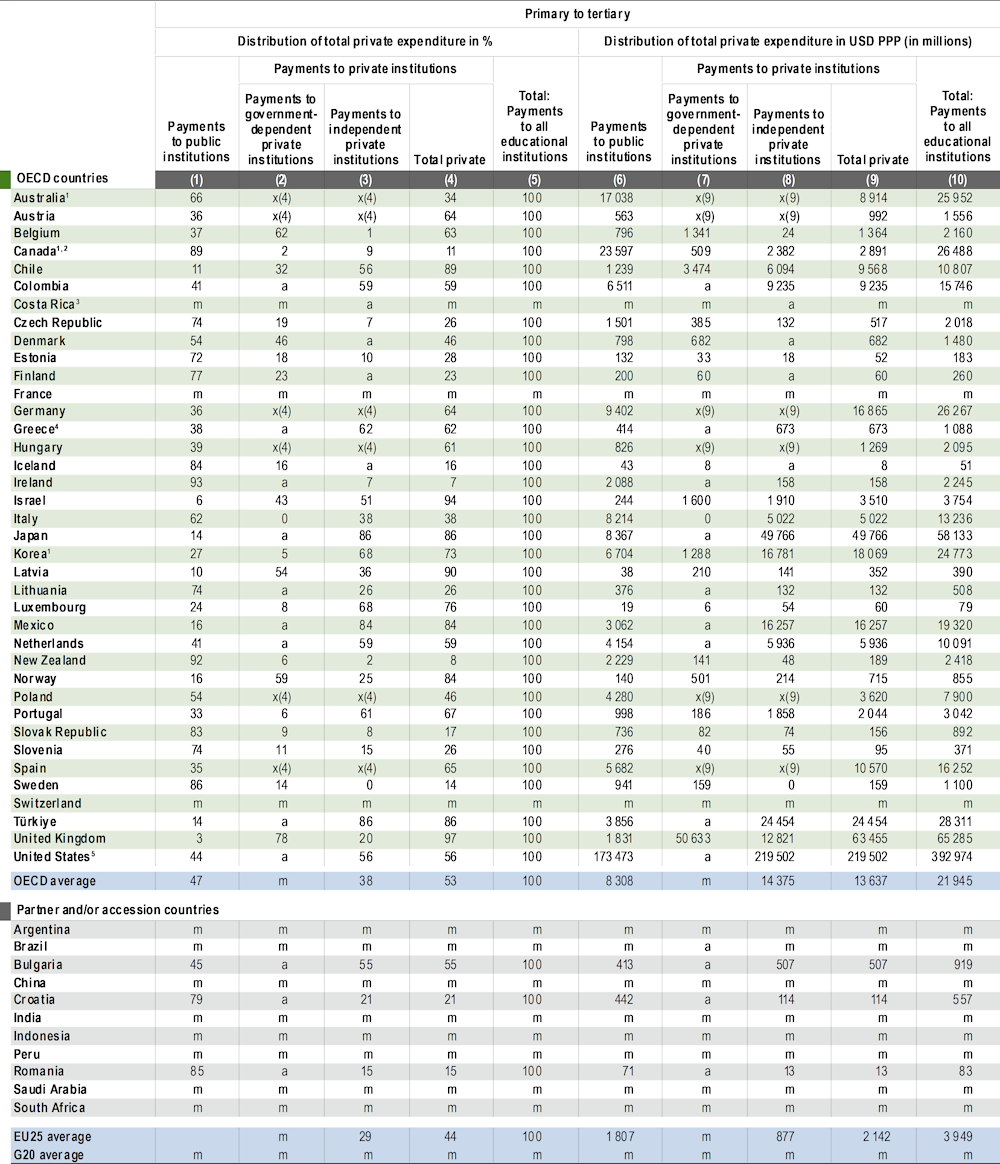

Table C3.4 |

Distribution of total private expenditure from primary to tertiary education (2020) |

|

WEB Table C3.5 |

Percentage of expenditure on educational institutions from private sources (2019 to 2021) |

Cut-off date for the data: 15 June 2023. Any updates on data can be found on line at http://dx.doi.org/10.1787/eag-data-en. More breakdowns can also be found at http://stats.oecd.org/, Education at a Glance Database.

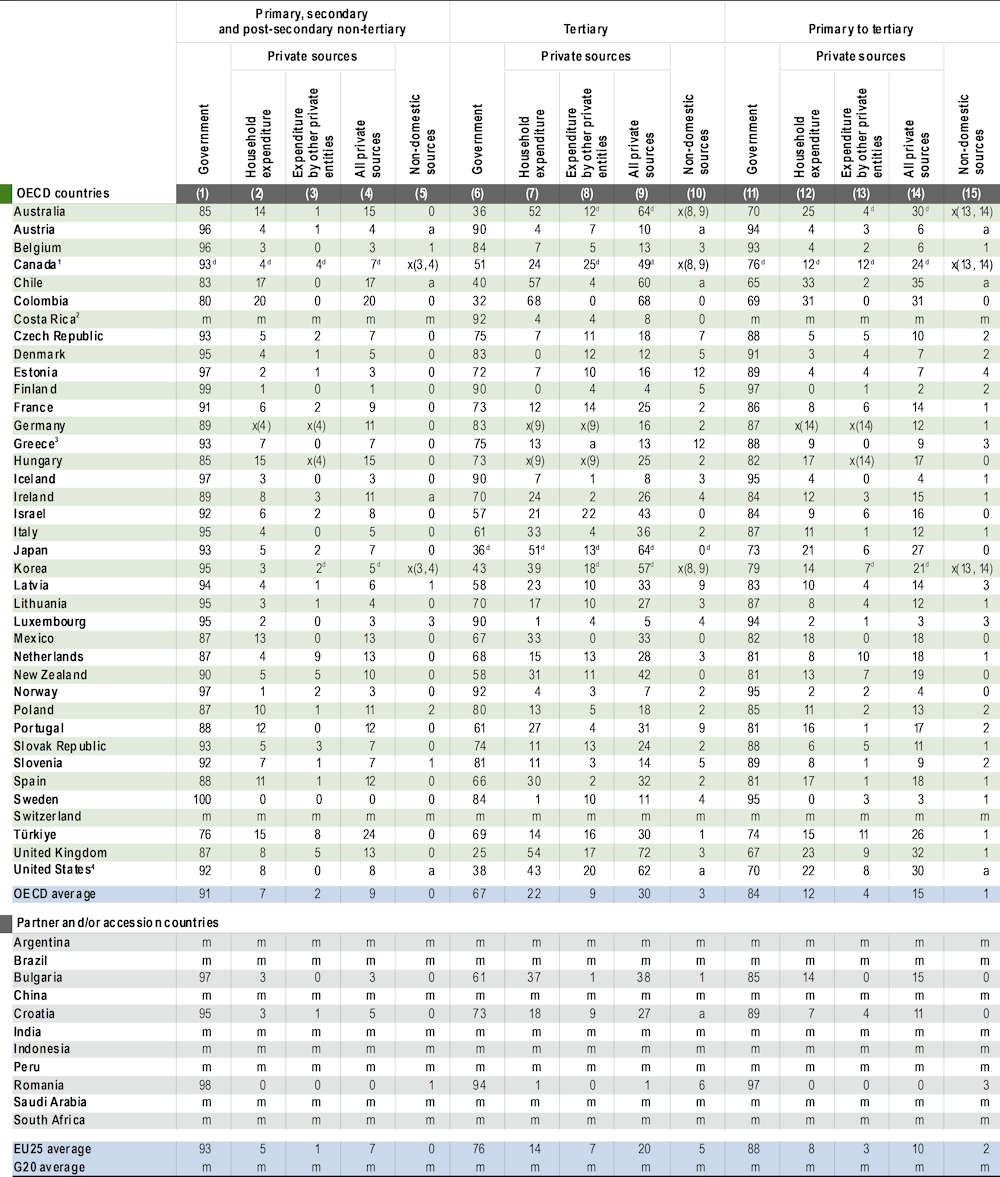

Table C3.1. Relative share of government, private and non-domestic expenditure on educational institutions, by final source of funds (2020)

After government transfers to the private sector, by level of education

Note: See StatLink and Box C3.2 for the notes related to this Table.

Source: OECD/UIS/Eurostat (2023). For more information see Source section and Education at a Glance 2023 Sources, Methodologies and Technical Notes (OECD, 2023[1]).

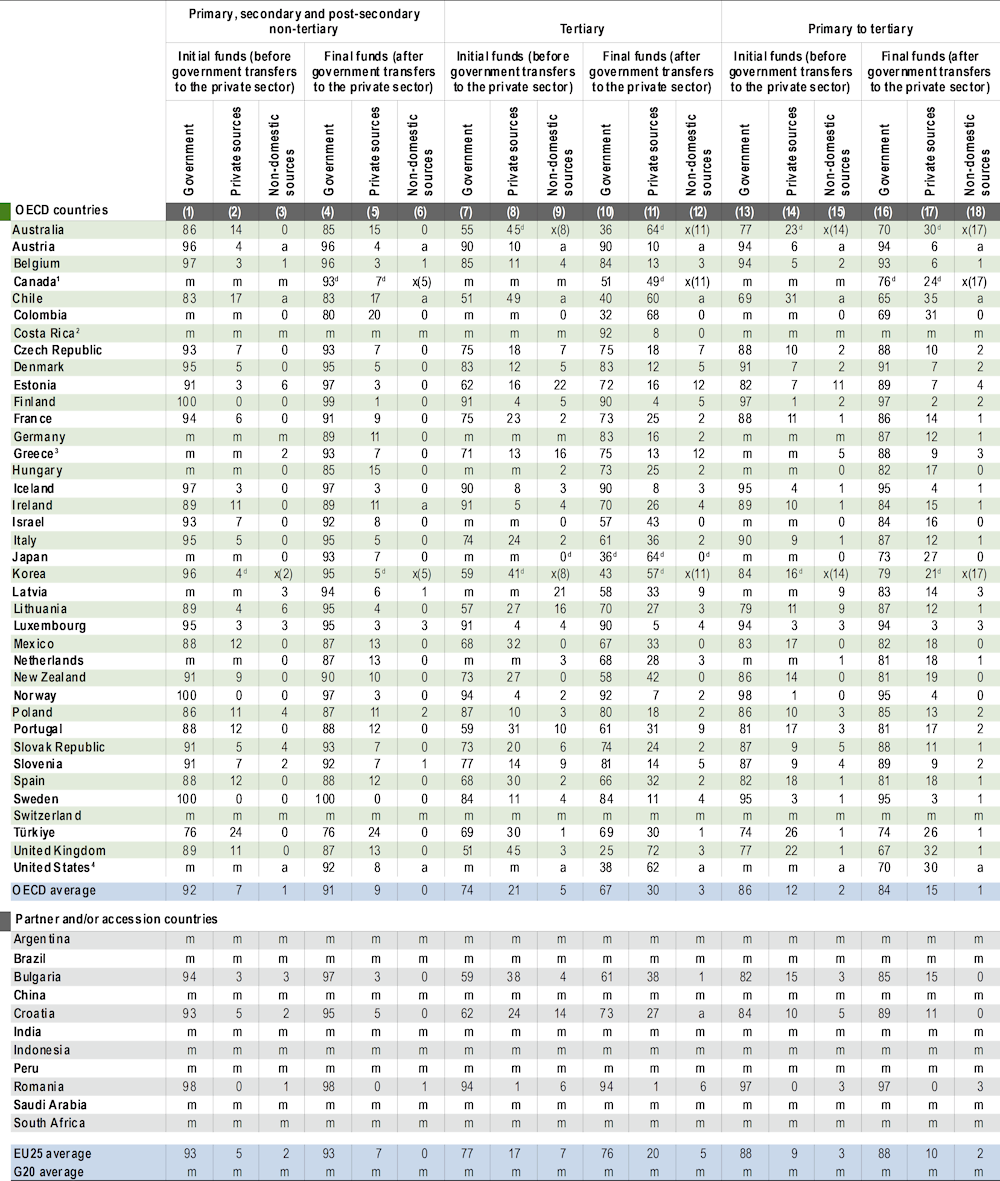

Table C3.2. Relative share of government, private and non-domestic expenditure on educational institutions, by source of funds and government transfers to the private sector (2020)

By level of education and source of funding

Note: See StatLink and Box C3.2 for the notes related to this Table.

Source: OECD/UIS/Eurostat (2023). For more information see Source section and Education at a Glance 2023 Sources, Methodologies and Technical Notes (OECD, 2023[1]).

Table C3.3. Trends in the share of government, private and non-domestic expenditure on educational institutions (2012, 2016 and 2020)

Final source of funds

Note: See StatLink and Box C3.2 for the notes related to this Table.

Source: OECD/UIS/Eurostat (2023). For more information see Source section and Education at a Glance 2023 Sources, Methodologies and Technical Notes (OECD, 2023[1]).

Table C3.4. Distribution of total private expenditure from primary to tertiary education (2020)

Final source of funds

Note: See StatLink and Box C3.2 for the notes related to this Table.

Source: OECD/UIS/Eurostat (2023). For more information see Source section and Education at a Glance 2023 Sources, Methodologies and Technical Notes (OECD, 2023[1]).

Box C3.2. Notes for Indicator C3 Tables

Table C3.1 Relative share of government, private and non-domestic expenditure on educational institutions, by final source of funds (2020)

Some levels of education are included with others. Refer to "x" code in Table C3.1 for details. Private expenditure figures include tuition fee loans and scholarships (subsidies attributable to payments to educational institutions received from government). Loan repayments from private individuals are not taken into account, and so the private contribution to education costs may be under-represented. Government expenditure figures presented here exclude undistributed programmes.

1. Primary education includes pre-primary programmes.

2. Year of reference 2021.

3. Year of reference 2019.

4. Figures are for net student loans rather than gross, thereby underestimating public transfers.

Table C3.2 Relative share of government, private and non-domestic expenditure on educational institutions, by source of funds and government transfers to the private sector (2020)

Public to private transfers at primary to post-secondary non-tertiary levels as well as at tertiary levels are available for consultation on line (see StatLink).

1. Primary education includes pre-primary programmes.

2. Year of reference 2021.

3. Year of reference 2019.

4. Figures are for net student loans rather than gross, thereby underestimating public transfers.

Table C3.3 Trends in the share of government, private and non-domestic expenditure on educational institutions (2012, 2016 and 2020)

Private expenditure figures include tuition fee loans and scholarships (subsidies attributable to payments to educational institutions received from government sources). Loan repayments from private individuals are not taken into account, and so the private contribution to education costs may be under-represented. Data on the share of government and non-domestic (international) expenditure are available for consultation on line (see StatLink). Government expenditure figures presented here exclude undistributed programmes.

1. Private expenditure includes international expenditure.

2. Primary education includes pre-primary programmes.

3. Figures are for net student loans rather than gross, thereby underestimating public transfers.

Table C3.4 Distribution of total private expenditure from primary to tertiary education (2020)

Private expenditure figures include tuition fee loans and scholarships (subsidies attributable to payments to educational institutions received from government sources). Loan repayments from private individuals are not taken into account, and so the private contribution to education costs may be under-represented. Data on the share of government and non-domestic (international) expenditure are available for consultation on line (see StatLink). Government expenditure figures presented here exclude undistributed programmes.

1. Private expenditure includes international expenditure.

2. Primary education includes pre-primary programmes.

3. Year of reference 2021.

4. Year of reference 2019.

5. Figures are for net student loans rather than gross, thereby underestimating public transfers.

For more information see Definitions, Methodology and Source sections and Education at a Glance 2023 Sources, Methodologies and Technical Notes (OECD, 2023[1]).

Data and more breakdowns are available in the Education at a Glance Database (http://stats.oecd.org/).

Please refer to the Reader's Guide for information concerning symbols for missing data and abbreviations.

Note

← 1. As a rule, data providers have to determine first if receiving entities should be classified as educational institutions or as private entities that are out of the scope of educational institutions as defined by UNESCO, OECD and Eurostat.