Peru's strong macroeconomic and institutional policy frameworks together with structural reforms, including trade liberalisation and opening to foreign investment, have contributed to strong economic growth and steep poverty reduction over the last two decades until 2019. This resulted in the country experiencing one of the strongest macroeconomic performances in Latin America, helping the country mitigate economic and social consequences of recent major shocks. However, Peru still faces high informality, regional disparities, and inadequate access to public services. Convergence to higher living standards has slowed down, making it of utmost importance to boost productivity and investment. The COVID-19 pandemic has worsened structural weaknesses in areas such as health, education, and social protection. To improve living standards for all Peruvians, ambitious structural reforms are necessary. These include improving regulation and competition, strengthening governance and the rule of law, providing universal social protection, and enhancing education outcomes. Although the planned fiscal consolidation ensures debt sustainability, a reform to increase spending efficiency and tax revenues is needed to address long-standing infrastructure and social challenges. A long-term agenda for implementing these reforms would reduce poverty, inequality, and promote income convergence with OECD countries.

OECD Economic Surveys: Peru 2023

1. Key Policy Insights

Abstract

Achieving higher living standards requires ambitious structural reforms

Peru's macroeconomic performance over the past two decades has been among the most robust in Latin America. During the 1980s, the country faced a severe economic crisis characterized by hyperinflation, fiscal imbalances, and mounting external debt (Box 1.1). However, in the 1990s, Peru implemented a comprehensive set of ambitious structural reforms, including liberalizing trade, opening to foreign investment, and developing key sectors such as mining, agriculture, and tourism. These reforms, supported by the adoption of a robust macroeconomic policy framework, including fiscal rules, an independent fiscal institution and Central Bank and a robust financial regulatory framework, played a pivotal role in fostering economic growth and maintaining macroeconomic stability. Peru’s participation in several regional and international trade agreements has strengthened trade relations, boosted exports, and enhanced competitiveness in global markets, capitalizing favourable global economic conditions and a commodity supercycle.

Box 1.1. A glance at Peru’s economic history

Peru has a long-standing history of economic dependence on commodities, which has led to a series of booms and busts before the broad-ranging macroeconomic and institutional reforms of the 1990s. The country's economy has relied on the export of various commodities such as guano, copper and other minerals such as silver, zinc, and tin. During boom periods, fuelled by high global demand and rising prices, Peru experienced rapid economic growth, leading to infrastructure development and increased investment. However, these periods of prosperity were often followed by abrupt downturns when international commodity prices collapsed or experienced significant fluctuations. Such busts resulted in economic crises, profound recessions, and increased social challenges.

The 1980s in Peru was a particularly intricate period marked by a severe economic crisis, often referred to as the "Lost Decade," characterized by a sharp decline in economic growth, a deterioration of living conditions, widespread poverty, and social unrest. The roots of this crisis can be traced back to the previous decades (1940s-1970s) when Peru accumulated a significant external debt to finance infrastructure projects and implemented import substitution industrialization policies to foster industrial growth. As the country became heavily dependent on foreign loans, the rise in global interest rates in the early 1980s made it increasingly challenging to service the debt. Additionally, a global economic recession led to a decline in international commodity prices, including copper and silver, which reduced export revenues and strained Peru's ability to generate foreign exchange. The combination of these factors, along with inflation reaching hyperinflationary levels due to expansionary fiscal policies, an overvalued currency, and money supply growth, further destabilized the economy. The situation was compounded by political instability, internal conflicts and the surge of terrorist groups led by the Sendero Luminoso and the Tupac Amaru Revolutionary Movement. The crisis persisted into the early 1990s, prompting the need for economic reforms to stabilize the economy, establish a robust macroeconomic framework and institutions, and lay the groundwork for subsequent liberalization measures. These reforms and stabilization measures implemented during this period (described in the previous paragraph) laid the foundation for subsequent economic growth and development (as described below).

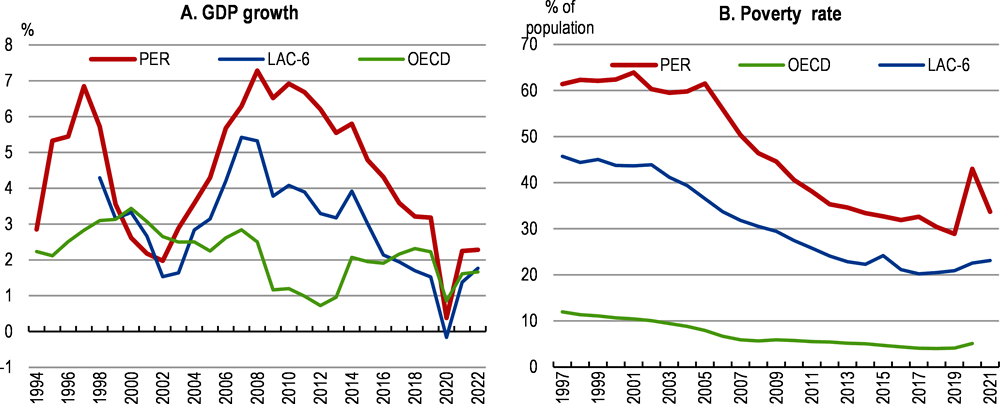

As a result, Peru emerged as one of the region’s fastest-growing and most stable and resilient economies in Latin America (Figure 1.1, Panel A). With an average annual growth rate of 5.1% between 2000 and 2019, Peru sustained its economic momentum for a long period, driving progress toward higher living standards. Public debt was substantially reduced to 26% of GDP in 2019, sustaining ample access to international capital markets, and large macroeconomic buffers were built. Within its credible inflation targeting framework, Peru achieved an average inflation rate of 2.6% over the two decades until 2019, the lowest among South American countries, while attracting substantial foreign direct investment. The sustained economic growth, coupled with the implementation of social programmes and improved access to education and healthcare, led to steep poverty reduction (Figure 1.1, Panel B). Most social indicators have seen significant improvements such as life expectancy, which rose from 70 years in 2000 to 76 years in 2019. Peru's experience serves as an example of how a strong macroeconomic framework, accompanied by structural reforms and investment in social programmes can contribute to sustained economic growth, poverty reduction, and improved social indicators.

Figure 1.1. Rapid economic growth was accompanied by notable social progress

Note: Panel A shows 5-year moving average. Panel B shows poverty headcount ratio at USD 6.85 a day (2017 PPP), LAC-6 is the unweighted average of ARG, BRA, CHL, COL, CRI, and MEX.

Source: BCRP, WDI- World Bank.

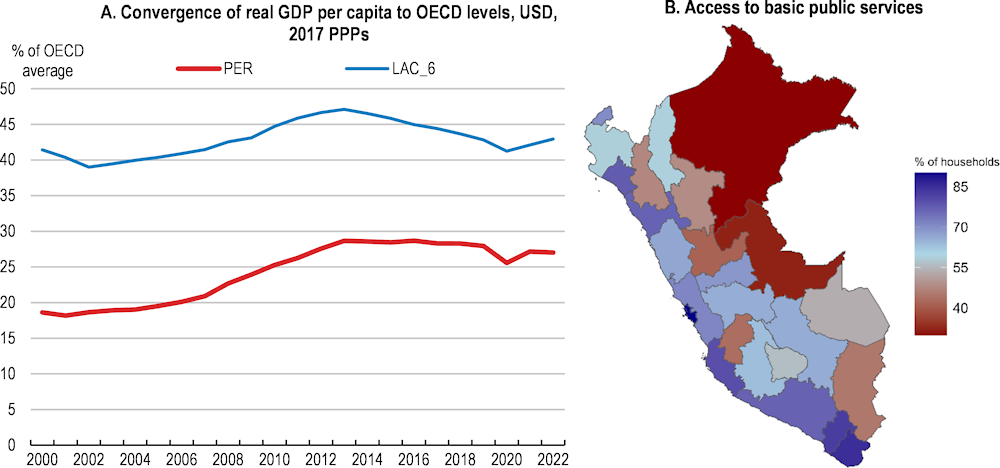

Despite these remarkable achievements, Peru still faces significant economic and social challenges. Convergence to higher living standards has decelerated after the commodity price boom ended in 2015 (Figure 1.2, Panel A). Since 2020, the Peruvian economy has faced multiple large shocks. The COVID-19 pandemic had a severe impact on both lives and livelihoods, resulting in higher excess mortality and a sharper economic contraction than most countries in the world. The pandemic also caused increases in poverty and widespread learning disruptions. However, thanks to strong policy support, the economy recovered rapidly in 2021, though strong domestic demand and supply chain disruptions pushed inflation above the target range for the first time since 2016. Further inflationary pressures, global supply chain disruptions and fertilizer shortages were caused by Russia’s war of aggression against Ukraine in 2022, with rising food and energy prices hitting hard many vulnerable families. Additionally, social unrest related to political uncertainty and severe weather conditions in early 2023 caused significant economic losses, adding to inflationary pressures and economic slowdown.

In its response to these major shocks the government used the fiscal space accumulated over the previous decades to prevent an even more profound impact and aftermath effects, while effective withdrawal of the pandemic stimulus package afterwards serves as additional evidence of Peru's robust macroeconomic framework and the resilience of its economy. However, the pandemic starkly revealed pre-existing structural weaknesses, such as a high share of labour and firm informality, with more than 75% of workers and 90% of firms with less than five workers, without any access to social protection mechanisms or savings or credit, including state-guaranteed, to fall upon. The pandemic exacerbated pre-existing gender disparities in the labour market, disproportionately impacting female workers. There are also stark differences in regional access to basic public services, such as electricity, water and sewerage, and infrastructure deficits, which contributes to high inequalities and leaves many Peruvians vulnerable to shocks (Figure 1.2, Panel B). Moreover, 1.4 million Venezuelan migrants and refugees live in Peru, many of whom have yet to finalize their migratory regularization process, hold informal jobs. Limited state capacity at the national and subnational levels hampers the delivery of quality public services and infrastructure and impairs the policy response while hampering spending and public investment efficiency. Weak public investment management, lack of coordination between different levels of government, and capacity gaps in the civil service are some of the key drivers. Political upheavals and frequent corruption scandals involving government officials and business leaders are major concerns for citizens and have eroded trust in government (INEI, 2022[1]). In addition, the country faces significant environmental challenges, as it is highly exposed to climate change and natural hazards.

Figure 1.2. Convergence has been slow and many lack basic public services

Note: LAC_6 shows the average of Argentina, Brazil, Chile, Colombia, Costa Rica and Mexico. Panel B shows % of households with access to electricity, water, and sewerage.

Source: WDI, World bank and INCORE statistics by region.

To tackle these challenges, it is essential for policymakers to work collaboratively across the political spectrum building consensus to restore confidence, foster political stability and step-up efforts to implement structural reforms aimed at enhancing potential growth and tackling poverty, inequality, and weaknesses in the education, health, and pension systems. However, the ongoing political crisis since 2016, characterized by several presidents and frequent changes in congress and ministries, has created significant political instability and impeded strongly-needed structural reforms to boost economic growth and social protection. Some countries have undergone political reforms aimed at enhancing citizen participation and fostering stability in their political system. These reforms often involve improving representation through electoral reforms and increasing transparency and governance through anti-corruption measures.

As part of the accession process to the OECD, Peru can develop a comprehensive long-term reform agenda to shape the future of its society and economy for years to come. This agenda must be based on clear prioritization and sequencing and all available evidence, both domestically and internationally, and should aim to preserve what has worked well in the past, such as the strong and well-functioning macroeconomic framework that has been a backbone of Peru's economic growth. Policy reforms that raise productivity and investment can generate the income and tax revenues necessary to advance Peru's path towards more widely shared prosperity. Strengthening governance and the rule of law should be a priority to reduce uncertainty and transaction costs for businesses, making it easier for them to operate and grow, and to reduce corruption and restore trust in government.

Pressing social needs require reforms to ensure the benefits of growth are broadly shared. The small size of Peru’s public sector and its low spending efficiency limit its ability to provide better public services and opportunities for all, and to reduce inequalities. A tax reform to raise revenues will need to be progressive and seek to reduce large regional inequalities. Reducing widespread informality is crucial to ensure universal access to quality social protection. Improvements in pension coverage and benefits are essential, especially after six extraordinary withdrawals of pension funds since 2020. Public education has significant scope for closing access and quality gaps. Seizing new opportunities, such as boosting renewable energy generation, while adapting and mitigating risks to climate change and natural hazards, will make the economy and society more resilient.

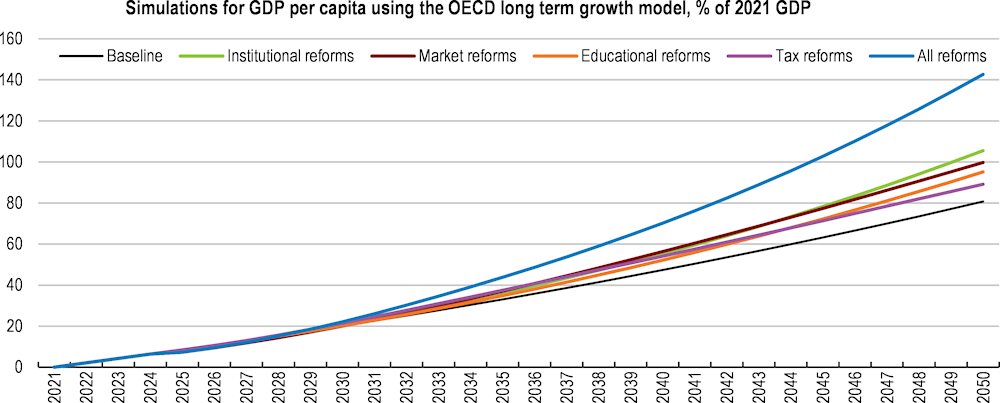

Structural reforms can significantly improve living standards. Simulations based on the OECD long-term growth model (Guillemette and Turner, 2018[2]) suggest that an ambitious reform package that would strengthen Peru’s institutional setup, improve domestic regulation and competition, improve education outcomes and reform taxes would be able to almost double GDP per capita by 2050 relative to a no reform scenario which implies maintaining the GDP per capita growth of the last decade (Figure 1.3). While there is considerable uncertainty around such simulations, these are large effects, and would be sufficient to return to a path of income convergence vis-à-vis OECD countries.

Against this background, the main messages of the Survey are:

The planned fiscal consolidation supports monetary policy to address high inflation and is key to maintaining debt sustainability, but increasing the efficiency of public spending and a comprehensive tax reform to gradually raise public revenues in a progressive way is needed to improve public services, close regional gaps, and provide better opportunities to all Peruvians.

Raising living standards and long-term growth will hinge on increasing productivity and investment by promoting competition, innovation, and export diversification, enhancing infrastructure, and improving governance and the rule of law. Addressing corruption and improving state capacity at both the national and subnational levels would facilitate the efficient delivery of quality public services.

To achieve more widely shared prosperity, it is necessary to strengthen incentives for formal job creation by reducing non-wage labour costs, relaxing regulation of permanent employment, gradually expanding access to high-quality education, healthcare and pensions and implementing deep changes to social security schemes. Political stability and consensus will be key to enable the implementation of a comprehensive structural reform agenda.

Figure 1.3. Structural reforms would lift growth and incomes substantially

Note: The “Baseline” projection depicts the trajectory of potential per-capita GDP in Peru according to current estimations of potential growth, without any reform effects. The “Institutional reforms” scenario includes reforms to strengthen institutions and make them more inclusive, through a gradual alignment of the Rule of Law index (Kaufmann, Kraay and Mastruzzi, 2015[3]) with the current first quartile of OECD countries by 2050, implemented gradually over time. The “Market reforms” scenario implies an improvement in product market regulations to make them more competition-friendly, as measured by the OECD PMR indicator, to the first quartile of OECD countries, and an increase in R&D expenditures to 1% of GDP, all by 2030. The “Education reform” scenario aligns student performance and educational attainments with the OECD average by 2060. The “Tax reform” scenario aligns business taxation with the top decile of OECD countries and the labour tax wedge with Chile’s.

Source: OECD calculations based on OECD Long-term growth model (Guillemette and Turner, 2018[2]).

The economy is resilient, but there are significant risks

Activity has slowed down and inflation remains high

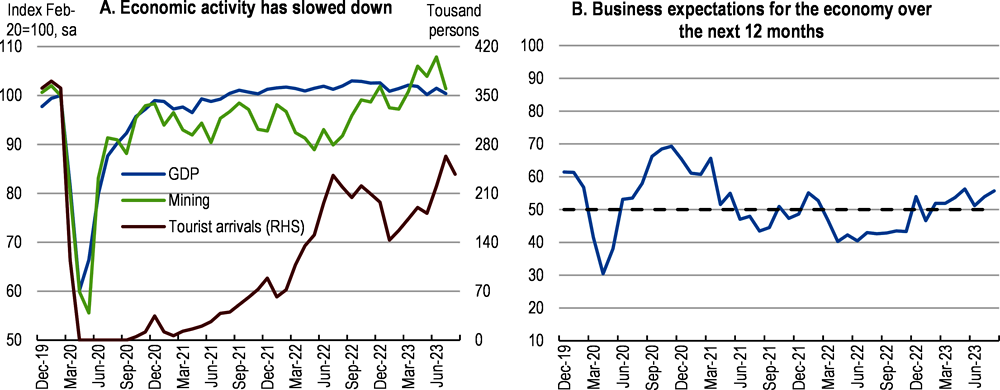

The economy decelerated after a strong bounce back from the COVID-19 pandemic (Figure 1.4). After a deep recession in 2020 when GDP fell by 11% due to the pandemic, the economy recovered strongly, growing by 13.3% in 2021. By the end of 2021, GDP surpassed pre-pandemic levels by 2%. In 2022, the economy grew at a modest 2.7%, below the average of 3.2% between 2016 and 2019. The deceleration was particularly strong in the second half of the year when the economy grew only by 1.7% because of high political uncertainty and inflation and slowing external demand caused by Russia’s war of aggression in Ukraine. The growth rate declined further towards the end of 2022 amid social unrest. Economic activity continued to fall, contracting by 0.4% in the first quarter and 0.5% in the second quarter of 2023 year-on-year.

The meagre growth of 2022 reflects the dissipation of the post-COVID rebound and social protests-related disruptions in the mining industry. Mining conflicts have been at the highest levels since 2017, paralysing construction and production in the sector. Low business confidence led to a decline of private investment. Household purchasing power was eroded by high inflation and rising financing costs, which held back private consumption, while a successful roll-out of the COVID-19 vaccination campaign with 85% of the total population fully vaccinated as of December 2022 and several rounds of private pension and unemployment funds withdrawals supported it. Other factors explaining the growth slowdown are the withdrawal of pandemic-related fiscal stimulus, fertiliser shortages and the erosion of large terms-of-trade gains and slowing external demand amid Russia’s war of aggression against Ukraine.

Social unrest, which lasted from late 2022 to early March 2023, has affected the economy resulting in damaged infrastructure, lower tourism and decreasing mining output. Furthermore, a cyclone in March caused economic losses due to heavy rainfall in the northern region, and El Niño, an extreme weather phenomenon, has negatively affected fisheries and agriculture in the second quarter of the year. The GDP contraction in the first semester of 2023 is explained by lower growth in private consumption (0.3% y-o-y) and a sharp decline in private investment (-9% y-o-y) in the absence of new mining megaprojects. The tourism sector, which accounted for 4% of GDP in 2019, was hit hard by the protests and has not yet recovered pre-pandemic levels. Agriculture, fishing and construction were also hard-hit in the first half of the year. Mining, which accounts for 10% of GDP, has also been affected, with some copper mines suspending operations in January and February. However, it has bounced back as social unrest and road blockades subsided and the new copper mine, Quellaveco, began its commercial operations. This resurgence is evident in the 12% increase the first semester of the year. A significant increase in central government public investment in the first half of 2023 has helped to mitigate the economic slowdown, despite the decline in subnational government investment. The decline in subnational government investment has been lower than in previous first years of government of new regional and municipal authorities.

Figure 1.4. Economic activity slowed down early 2023 amid social conflict and severe weather

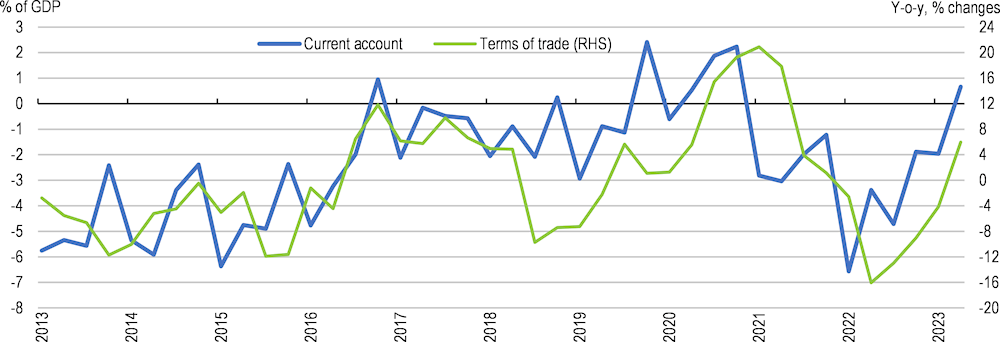

Inflationary pressures in 2022 were driven by high food and energy prices, exchange rate depreciation and global value chains disruptions, in line with global trends. The war in Ukraine exacerbated inflationary pressures, causing fertilisers shortages that harmed agricultural production and worsened Peru’s terms of trade (Figure 1.5). Consequently, the current account deficit widened, reaching 4% of GDP in 2022, surpassing historical levels. In early 2023, road blockades, social protests, heavy rainfall, and avian flu further increased inflationary pressures. However, the annualized inflation rate over shorter periods has decreased since mid-2022. Inflation hits the most vulnerable harder: extremely poor households experienced a price increase 5 percentage points higher than the average household (OECD et al., 2022[4]). To counteract the impact of rising energy and food prices and a slowing economy, the government has implemented several temporary broad-based and targeted measures since 2022 (Box 1.2).

Box 1.2. Measures to mitigate the impact of increasing food and energy prices and the growth slowdown

In 2022, the government implemented various measures to minimize the impact of inflation on consumers. These measures included extending the Fuel Price Stabilisation Fund for fuel products until December 2022 and increasing the value of the Energy Social Inclusion Fund vouchers for purchasing liquefied petroleum gas for domestic use on a temporary basis. Tax measures such as granting a three-month exemption on gasolines from the Selective consumption tax and exempting essential products from VAT were also implemented. As these measures were phased out, the coverage and benefits of cash transfer programmes were temporarily expanded. Additionally, to address the shortage and high cost of fertilizers, the government procured and delivered nitrogen fertilizers to agricultural producers nationwide.

Recently, the government launched a series of stimulus programmes called Con Punche Perú, worth 0.8% of GDP, with the aim to support the economy and contain the impact of high food prices, in the face of external headwinds, and political and social unrest. This is the second stimulus programme, with the first being launched in September 2022 under the name Impulso Perú. The Con Punche Perú, stimulus programme, launched in December 2022, and its updates in the first half of 2023 (Con Punche Emergencia-FEN and Con Punche Perú 2), focus on supporting low-income households, by providing temporary and targeted increases in benefits of certain social programs, and prevention of El Niño phenomenon. It also aims at boosting regional economies and revitalise hard-hit sectors such as tourism and agriculture. The bulk of the funding will be directed towards advancing public infrastructure projects such as irrigation, natural gas networks, hospitals, and schools. The programme aims to strengthen the naval industry, promote investment in ports and airports, as well as promoting sustainable public transportation. To support small and medium-sized enterprises (SMEs), the plan allows for delaying the payments of loans and the implementation of state-guaranteed credit programmes for micro and small firms. Authorities are also seeking to remove bureaucratic procedures that hamper private economic activity, particularly in the mining industry. To counter expected budget under-execution by new regional and local authorities, the central government is increasing technical assistance and hiring experienced project managers to improve project execution. The ministry of finance is currently working on further measures to foster public and private investment, such as simplifying processes for obtaining licences, promoting public-private partnerships, and updating the fiscal cadastre. Additionally, the government will extend certain tax exemptions, such as the VAT refund for international tourists and for the imports of goods for the Lima and Callao mass transport electric system project.

Figure 1.5. The current account widened amid deteriorating terms of trade

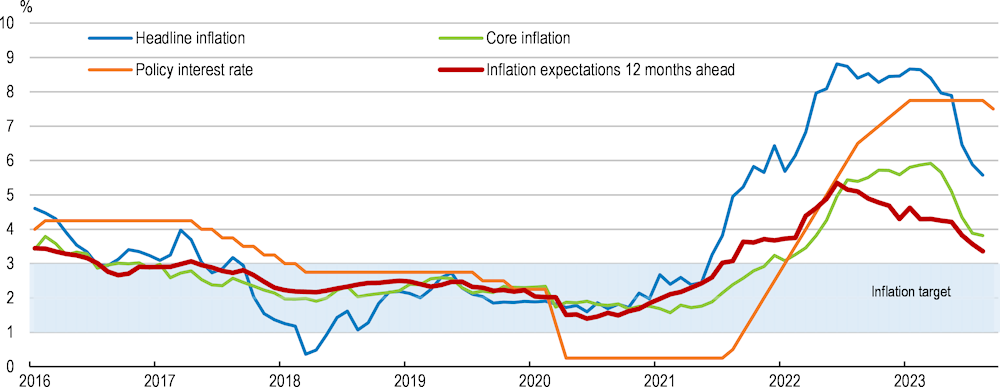

To counter inflationary pressures since the pandemic, monetary policy proactively increased interest rates between December 2020 and February 2023, resulting in a total of 725 basis points of rate hikes (Figure 1.6). These rate hikes substantially tightened financial conditions, leading to an increase in the ex-ante real interest rate from -0.1% in December 2019 to almost 2.8% in December 2022. Headline inflation has started to decline from its peak of 8.8% in June 2022 but is still above the target range at 5.6% in August 2023. The monetary authority cut the policy rate by 25 basis points in September 2023 to 7.5% after holding the rate steady for seven months, as inflation expectations eased and economic activity decelerated. Core inflation is also declining to 3.8% in August from its peak of 5.9% in March, with both goods and services prices edging down. Energy prices have declined and domestic factors such as the avian flu and fertiliser shortages are starting to dissipate. Twelve-month ahead inflation expectations are easing, at 3.4% in August, and the output gap remains negative. Looking ahead, policy rates should be kept high to bring inflation back to the target and to firmly anchor inflation expectations. Some modest policy easing can continue, provided inflation pressures firmly ease and inflation expectations return to the target.

Figure 1.6. Headline, core and inflation expectations are declining but remain above target

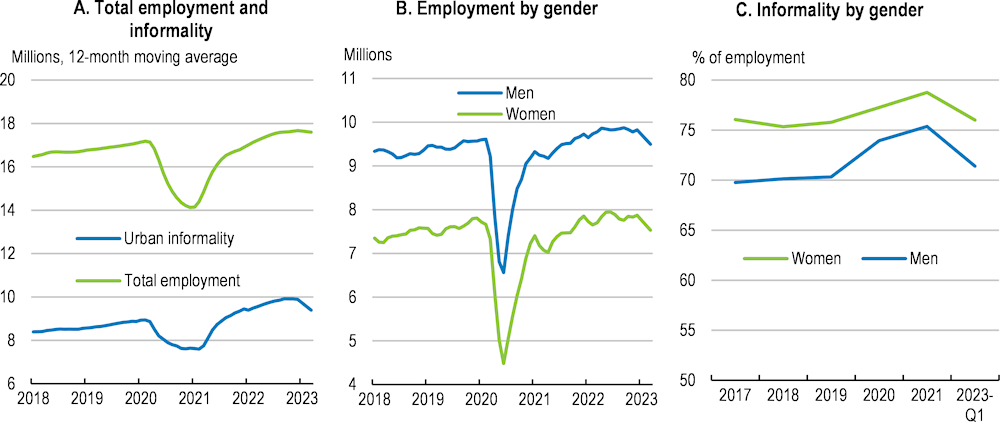

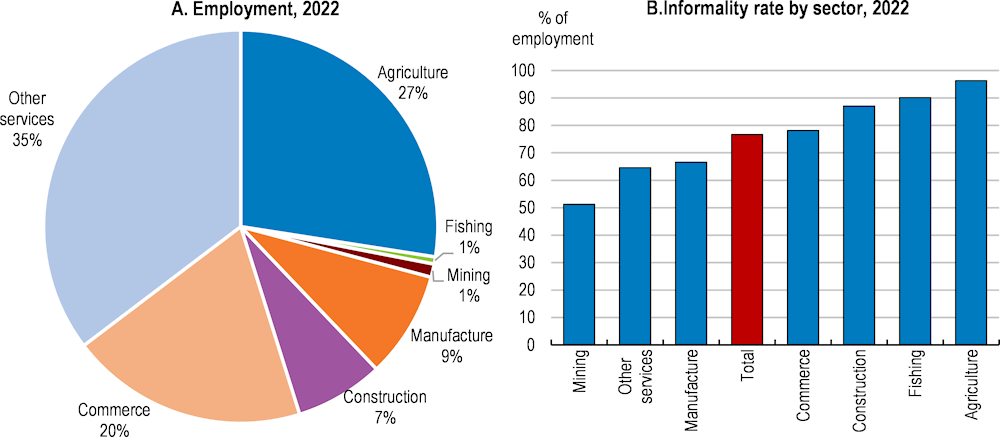

Employment has returned to pre-pandemic levels, but job quality has worsened with informality surpassing pre-pandemic levels (Figure 1.7, Panel A). The unemployment rate fell from 7.4% in 2020 to 4.3% in 2022 but is still above pre-pandemic levels. Employment of the youngest (up to 24 years) and among firms with more than 50 workers has yet to recover. Although female employment has recovered pre-pandemic levels, its growth has been slower compared to men and has been mainly in informal jobs (Figure 1.7, Panels B and C). One reason is that employment in the service sector, a major source of employment (Figure 1.8, Panel A), has not yet returned to pre-pandemic levels, especially for female workers. Another reason is that many women remain still outside the labour market after the large impact of the COVID-19 pandemic, when many female workers left the labour market because of long school closures and to take care of the elderly. Female labour force participation, though higher than in other Latin American countries, amounted to 63.5% in late 2022 compared to 79% for men and is still below the 2019 level of 65.6%. Limited access to quality childcare further restricts women's participation in the labour market. Although informality is prevalent across the workforce and sectors (Figure 1.8, Panel B), female workers are more likely to hold informal jobs, with a 7-percentage point higher informality rate compared to men.

Figure 1.7. Job creation has returned to pre-pandemic levels, but quality has worsened

Figure 1.8. Services account for a large share of employment and informality is prevalent across all sectors

Economic growth will remain weak in an uncertain environment

Economic growth is projected at 1.1% in 2023 and gradually pick up to 2.7% in 2024 (Table 1.1). Political uncertainty, extreme weather events, and high interest rates and inflation are constraining private consumption and investment. Government efforts to relaunch infrastructure investment and several announced PPP projects will support investment. Although public investment at the subnational level is expected to be limited due to high turnover following local elections, national government initiatives to provide training to local authorities will partly mitigate this effect. Inflation is expected to slowly converge within the 1-3% target range by early 2024 allowing for an easing of monetary policy and supporting household consumption and investment. The recovery of tourism and copper production will drive exports. This together with the improvement in the services account thanks to the normalisation of tourism and lower profit remittances from foreign companies due to lower metal prices will narrow the current account deficit.

Table 1.1. Macroeconomic indicators

|

National accounts (Percentage changes, volumes, 2015 prices) |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|---|---|---|---|---|---|---|---|---|

|

Gross domestic product (GDP) |

2.5 |

3.9 |

2.3 |

-10.8 |

13.3 |

2.7 |

1.1 |

2.7 |

|

Private consumption |

2.8 |

3.8 |

3.2 |

-9.7 |

12.3 |

3.5 |

0.8 |

2.1 |

|

Government consumption |

2.9 |

2.9 |

3.6 |

8.5 |

5.2 |

-0.9 |

2.6 |

1.2 |

|

Gross fixed capital formation |

1.1 |

4.8 |

2.9 |

-16.5 |

34.2 |

0.7 |

-5.0 |

1.8 |

|

Stockbuilding1 |

-0.3 |

0.2 |

-0.5 |

-1.7 |

-0.6 |

0.0 |

-3.2 |

0.1 |

|

Total domestic demand |

2.0 |

4.0 |

2.6 |

-10.6 |

15.2 |

2.3 |

-3.9 |

2.1 |

|

Exports of goods and services |

9.1 |

3.4 |

0.3 |

-16.3 |

19.1 |

6.0 |

13.5 |

5.7 |

|

Imports of goods and services |

7.1 |

3.6 |

1.6 |

-15.4 |

26.2 |

4.2 |

-2.8 |

2.6 |

|

Net exports1 |

0.5 |

-0.1 |

-0.4 |

-0.2 |

-2.0 |

0.4 |

4.6 |

0.7 |

|

Other indicators (growth rates, unless specified) |

||||||||

|

Unemployment rate (% of labour force) |

4.3 |

4.0 |

4.0 |

7.7 |

5.9 |

4.4 |

4.7 |

4.0 |

|

Consumer price index |

2.8 |

1.3 |

2.1 |

1.8 |

4.0 |

7.9 |

6.8 |

3.2 |

|

Consumer price index Q4-on-Q4 |

1.4 |

2.2 |

1.9 |

2.0 |

6.4 |

8.5 |

5.2 |

2.6 |

|

Core consumer price index |

2.5 |

2.1 |

2.4 |

1.9 |

2.2 |

4.7 |

4.6 |

2.9 |

|

Core consumer price index Q4-on-Q4 |

2.1 |

2.2 |

2.3 |

1.8 |

3.2 |

5.6 |

3.6 |

2.6 |

|

Current account balance (% of GDP) |

-0.8 |

-1.2 |

-0.6 |

1.1 |

-2.3 |

-4.1 |

-1.8 |

-1.6 |

|

Fiscal balance (% of GDP) 2 |

-3.0 |

-2.3 |

-1.6 |

-8.9 |

-2.5 |

-1.7 |

-2.4 |

-2.0 |

|

Primary balance (% of GDP) 2 |

-1.8 |

-1.0 |

-0.2 |

-7.3 |

-1.0 |

-0.1 |

-0.8 |

-0.3 |

|

Public sector debt (gross, % of GDP) 2 |

24.7 |

25.6 |

26.6 |

34.6 |

35.9 |

33.8 |

33.6 |

33.5 |

1Contribution to changes in real GDP.

2Forecast by the Ministry of Economy and Finance in its Report on Multiannual Macroeconomic Framework 2024-2027.

Source: OECD projections, OECD Economic Outlook Database, INEI, Central Bank, MEF- Informe de actualización de proyecciones macroeconómicas 2023-2026.

Short to long-term downside risks loom large

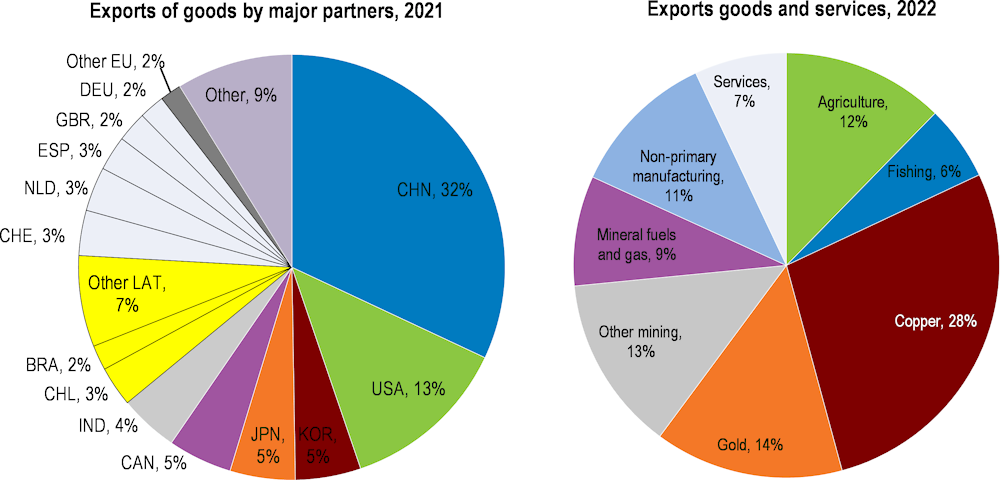

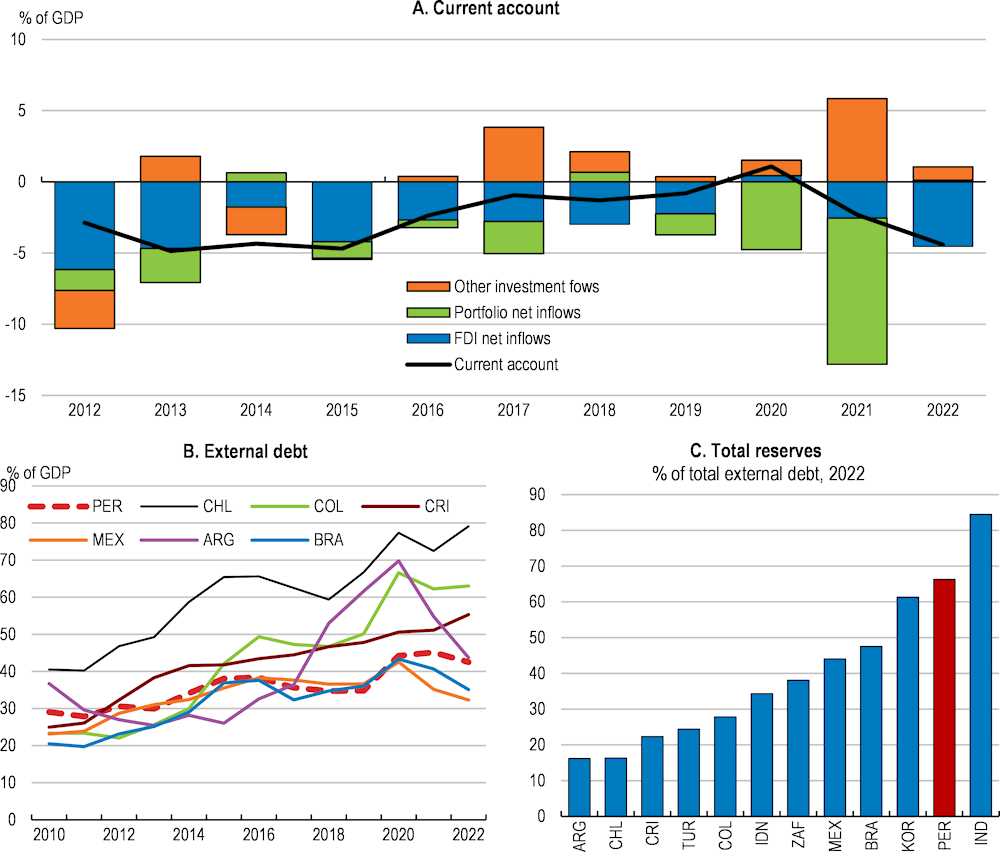

At the current juncture, both domestic and external risks are unusually high and tilted to the downside (Table 1.2). Externally, persistent inflationary pressures in advanced economies could require tighter financial conditions. Sudden sentiment changes in global financial markets, possibly related to surprises in the conduct of monetary policy in advanced economies or recent financial volatility, could limit financial inflows and increase financing costs for emerging market economies like Peru. Global geopolitical tensions could lead to further currency depreciation adding to inflationary pressures. A sharper slowdown in China, Peru’s main trading partner and the destination for around 30% of exports (Table 1.2; also Figure 1.9), is another risk to growth, and could lead to worse terms of trade, widening the current account, although largely financed by foreign direct investment (Figure 1.10, Panel A). Furthermore, external debt has significantly risen (Figure 1.10, Panel B), albeit from a low level, increasing vulnerability to global financial conditions. Peru’s exposure to sharp changes in copper and other mineral prices is another source of vulnerability, although long-term price declines are unlikely given that copper is a key input for the global energy transition towards electricity from renewable resources. These risks are mitigated by large currency reserves (Figure 1.10, Panel C), of around 71% of external debt or 30% of 2022 GDP, a resilient financial sector, ample access to international capital markets, and low public debt. These buffers are complemented by a two-year Flexible Credit Line arrangement with the IMF. Upside risks to growth are sustained higher commodity prices, faster global growth and faster recovery of China’s economy than anticipated.

Table 1.2. Potential major medium-term vulnerabilities

|

Uncertainty |

Possible outcome |

|---|---|

|

Natural disasters and environmental risks related to climate change. |

Extreme rainfall, droughts, floodings, transmission of viral infections, food and water insecurity, water rationing, infrastructure damage with negative impact on GDP per capita and fiscal sustainability. |

|

Protracted and intensified domestic political uncertainty and social unrest. |

Policy uncertainty could trigger reform paralysis, stifle private investment and generate capital outflows. |

|

Abrupt global slowdown or recession and slower economic growth in China. |

Lower export prices, falling terms of trade, and lower exports and growth. |

|

Heightened global financial stress. |

Capital outflows in a rush towards safety causing further currency depreciation and worsening the outlook for dollar denominated external debt and a sudden increase in risk premia. |

Figure 1.9. Mining and China play a significant role for Peru’s exports

Peru’s long-term domestic vulnerabilities for economic growth include protracted political instability and renewed flare-ups in social unrest. The weak economic outlook, high inflation and political fragmentation increase the risk of further social unrest and political confrontation. The country has been in a political crisis since 2016, with six presidents and frequent changes in congress and ministries. This has led to institutional weakness which could eventually lead to paralysis for much-needed structural reforms to foster economic growth and address deep-rooted social inequities. Persistent political instability can also lead to higher borrowing costs and worsen the debt outlook, as reflected by recent the debt outlook downgrades from Standard and Poors (December 2022) and Moody’s (January 2023). On the contrary, political stability could foster the building of consensus around much needed structural reforms, dissipate domestic policy uncertainty and lead to higher economic growth.

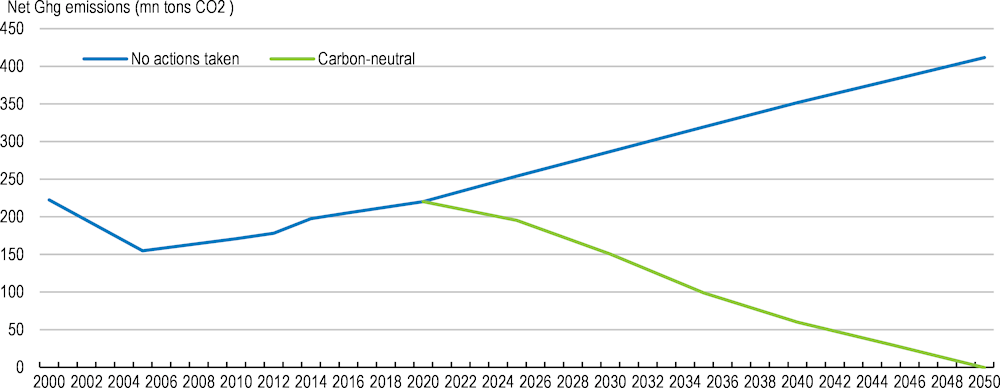

Peru is vulnerable to environmental risks, particularly related to climate change and natural disasters due to its diverse geographic conditions and ecosystems. Human activities such as deforestation, illegal mining, land degradation, and pollution have increased exposure to natural disasters such as flooding, landslides, and droughts. Between 2003 and 2021, Peru experienced over 61 000 natural-phenomena emergencies, including earthquakes, droughts, and landslides (MINAM, 2023[5]). El Niño, a frequent extreme weather condition, has increased flooding across the country and remains a key risk to the outlook. It currently looks as if the economic toll will be limited, as this year it is expected to be mild. Climate change also affects the availability of water, which is crucial for agriculture, human consumption, and energy production, as Peru is highly dependent on glacial meltwater. Low-income and rural households are more widely exposed to natural disasters and the impact of climate change, increasing climate-induced inequality (World Bank, 2023[6]).

Figure 1.10. Peru has buffers to face adverse external shocks

Climate change could lead to the disappearance of many species, increase vulnerability of forests and potentially large economic losses, negatively affecting the well-being of millions of Peruvians. Each degree increase in temperature is estimated to lead to a percentage point loss in the GDP per-capita growth rate each year (Chirinos, 2021[7]). Climate change will also impact asset valuations and is a significant contingent fiscal risk. For example, in 2017, a moderate El Niño subtracted around 1.7 percentage points from that year's economic growth, damaging roads, houses, bridges, farming areas, educational institutions, irrigation canals, rural roads, and health facilities (World Bank, 2022[8]). Potential water stress could also result in significant GDP losses (CIES, 2021[9]). Financial regulators should continue working on incorporating climate and natural hazard-related risks into its stress tests and financial stability monitoring tools. The Ministry of Finance should also quantify the fiscal impact and risks associated with climate change in its multiannual projections.

Financial stability risks seem contained

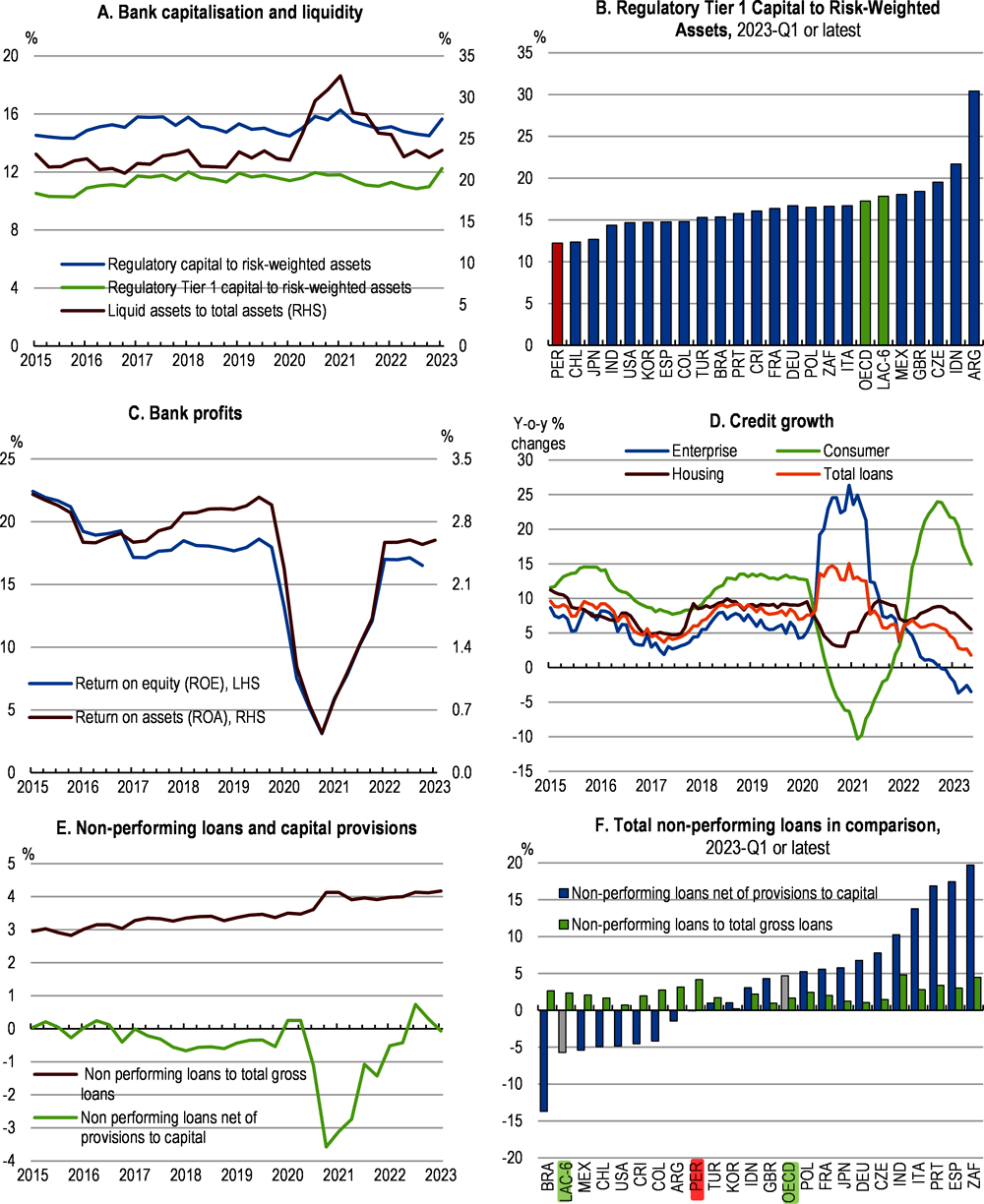

Despite global financial market challenges, including increased risks and volatility, domestic political uncertainty, and lower growth prospects, the Peruvian financial system has proven resilient due to its robust regulatory framework. While some macro-prudential measures were relaxed during the pandemic, higher provisioning and capital requirements have been reintroduced in the past two years to align with international standards such as Basel III. As of February 2023, the Tier 1 capital ratio was 12.9%, surpassing the 6% requirement, although lower compared to other emerging and advanced economies (Figure 1.11, Panels A and B). Bank profits have returned to pre-pandemic levels (Figure 1.11, Panel C) and stress tests indicate the Peruvian financial system can withstand severe scenarios (SBS, 2022[10]). A new capital structure for banks is in place since January 2023 including capital conservation and systemic risk buffers, in line with Basel III. In an environment of tightening financial conditions, however, the authorities should monitor bank portfolios and lending standards closely. Further steps could be taken to include enhanced supervision of financial groups, and requirements for resolution planning for domestic systemically important banks and financial groups.

Peru's banks are well capitalised and credit risks seem contained. The credit portfolio has rebounded, surpassing pre-pandemic levels. However, following the gradual withdrawal of borrower-based support measures that included extensive government guaranteed loans and flexible loan adjustment terms and monetary tightening, credit growth has decelerated rapidly and turned negative for enterprises (Figure 1.11, Panel D). Factors explaining this trend are low business confidence, rising debt costs and caution in the financial system. Non-performing loans (NPLs) have been increasing and at 4% are historically high, and above OECD average, especially for SMEs (above 8%). But provisioning is robust (Figure 1.11, Panels E and F), with the sector’s coverage ratio at 113% of NPLs at mid-2022 (SBS, 2022[10]). SMEs’ NPL rate and late payments by SMEs should not represent a major risk, as SMEs account for 26% of total loans. Rural microfinance institutions continue to have weaknesses including negative utilities, largely related to insufficiently diversified portfolios, and may require continued access to special lending facilities that have thus far contained risks (IMF, 2023[11]). Nonetheless, spillover risks are negligible, as micro institutions comprise less than 0.5% of total assets of the financial system.

Six extraordinary withdrawals from private pension accounts since 2020, equivalent to half of the pension system’s assets and around 10% of GDP, required pension funds to sell long-term assets, reducing the financial market depth and depleting households' pension savings. Chile has gone through a similar experience. The withdrawals were initially intended to provide support to households in the context of the COVID-19 pandemic. They indeed helped limit the contraction in domestic demand, but significantly reduced the value of assets held by pension funds. This, in turn, reduced the capacity of the local market to absorb government debt and finance fiscal deficits, and as a result the government has increased its borrowing from external markets and in foreign currency, worsening the composition of its debt. Local long-term interest rates have increased, and bond maturities issued by banks, firms, and the treasury shortened (BCRP, 2021[12]). Further withdrawals of pension funds could lead to an abrupt reduction in fixed income and equity asset prices, thus affecting the value of insurance companies, mutual funds, banks and Pension Fund Administrators, affecting the macro-financial stability of the country. Going forward, a comprehensive pension reform is necessary to address the system’s long-standing problems of very low coverage and adequacy, but limiting early pension withdrawals to specific cases outlined by law, as discussed in Chapter 3 of this Survey, will be key to enjoy the benefits of deeper financial markets.

Figure 1.11. Financial stability indicators

Note: LAC-6 is the unweighted average of ARG, BRA, CHL, COL, CRI, and MEX.

Source: Central Bank, CEIC, BIS.

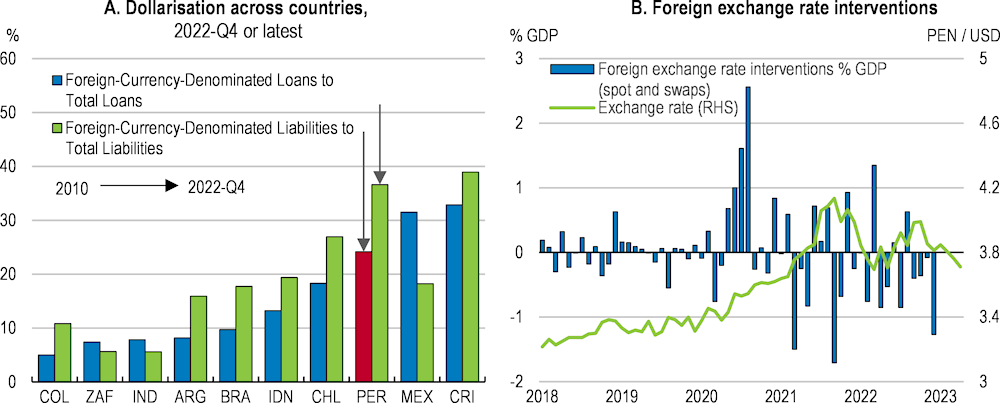

The financial sector is exposed to foreign exchange volatility due to a significant share of credit and deposits denominated in dollars, which is larger than in most emerging markets (Figure 1.12), although mitigated by large reserves requirements. Foreign currency loans accounted for 24% of total credit in November of 2022. Peruvian households and firms hold 17% and 142% foreign-exchange credit to deposit ratio. High dollarisation in the corporate sector is concentrated in the large and medium-sized firms (55% and 26%, respectively of total credits). However, they often have access to hedging instruments and the foreign exchange credit risk, which measures the degree of dollar credit granted to non-generators of dollars, amounted to 15% and 12%, respectively. Still, the hedged exposure varies across sectors. For example, the service, electricity, and water supply industries have greater unhedged exposures (IMF, 2023[11]). Despite substantial deposit dollarisation (35%), banks have adequate foreign exchange liquid reserves to hedge against currency depreciation.

Peru's financial regulators have implemented several de-dollarisation measures since the early 2000s to reduce direct foreign exchange risk in the banking sector (IMF, 2022[13]), and dollarisation has significantly decreased (Figure 1.12, Panel A). Factors that contributed to the de-dollarisation process include macroeconomic stability, the development of the local currency capital market, including issuance of long-term public and corporate debt denominated in soles, and macroprudential policies, including higher reserve requirements for dollar deposits (Garcia-Escribano, 2011[14]). In 2013, the Central Bank initiated a de-dollarisation programme that combined reserve requirements based on limits on foreign currency credit balances and new instruments to provide liquidity in domestic currency and a currency hedge to convert dollar into soles loans contributing to accelerate de-dollarisation (BCRP, 2019[15]).Total credit dollarisation dropped from 41% in December 2014 to 20% in December 2021. Household credit dollarisation declined significantly, with mortgage credit falling from 36% to 9% and vehicle credit dropping from 71% to 13% in the same period.

The lower but persistent dollarisation warrants frequent foreign exchange interventions by the central bank to avoid excessive volatility (Figure 1.12, Panel B), hampers the transmission of monetary policy and implies financial stability risks. Interventions respond to large shocks and the presence of frictions, such as shallow foreign exchange markets or substantial foreign exchange rate mismatches, which could otherwise jeopardize the central bank's goals of maintaining price and financial stability. The percentage of days in which the central bank intervened in the foreign exchange market has decreased since 2016, reaching a minimum of 4% in 2019. In recent years it has increased, reaching 59% in 2022 with swap interventions acquiring more relevance, in terms of volume, than spot interventions. Given the existing currency mismatches and shallow foreign exchange markets, Foreign exchange intervention is broadly appropriate under volatile market conditions, driven by global tight financial conditions, domestic political uncertainty, pension funds withdrawals. These interventions allow to reduce the risks inherent in financial dollarisation without affecting the real exchange rate trend and cementing the financial stability necessary for long-term growth (BCRP, 2021[16]). More recently, driven by the appreciating trend of Peruvian sol since June 2023, there has been an increased use of exchange rate interventions in the swap market. The exchange rate in Peru is the least volatile in Latin America and is among the most stable among emerging markets.

Gradually limiting interventions in the foreign exchange market to targeted and conditional events would allow economic agents to better internalize exchange rate risks and incentivize the development of local currency markets, reducing currency mismatches and encouraging de-dollarisation. Implementing fewer and more targeted interventions, particularly based on market conditions, and fostering a deeper market would encourage the private sector to develop hedging instruments (IMF, 2023[11]). Although many economic participants in Peru have natural hedges like dollar invoicing, a deeper forward foreign exchange market would benefit the majority who still require access to hedging options. This would allow the exchange rate to play a larger role as a shock absorber and strengthen the transmission of monetary policy. It would also contribute to export diversification, supporting growth in non-traditional exports (Adler, Magud and Werner, 2017[17]).

To facilitate the progress of hedging instruments and further de-dollarisation, it is important to develop a deeper foreign exchange and financial derivatives market. This can be achieved by establishing a regulatory framework that ensures the proper functioning of derivative markets and provides clear guidelines for market participants. Additionally, the development of trading platforms, clearinghouses, and settlement systems is crucial to facilitate derivative transactions, which have been increasing since 2014. Authorities can work with financial institutions and other stakeholders to create partnerships and initiatives that promote the development of the financial derivatives market, particularly for small and medium-sized enterprises (SMEs), for whom participation can be more costly. For example, the Brazilian Development Bank provides technical assistance to SMEs on risk management strategies.

Figure 1.12. Financial dollarisation remains large

Source: IMF,FSI; BCRP; Adler, Gustavo, Kyun Suk Chang, Rui C. Mano, and Yuting Shao. 2021. "Foreign Exchange Intervention: A Dataset of Public Data and Proxies," IMF Working Paper Series 21/47, International Monetary Fund, Washington D.C.

The macroeconomic framework could be further strengthened

Monetary policy in Peru has built up strong credibility with a robust track record in maintaining inflation expectations anchored with an inflation target of 2% and a tolerance range of 1 percentage points. The Central Bank's independence has been critical in ensuring macroeconomic and financial stability since its establishment in the 1990s and has played a critical role during the pandemic recession and the more recent shocks. It supported the recovery by lowering the monetary policy rate and by providing significant liquidity, which was key to safeguarded financial stability and facilitate credit provision. More recently, it has timely increased the monetary policy rate to contain inflationary pressures.

Although the Central Bank's governance generally adheres to international best practices and provides strong legal guarantees for operational autonomy and accountability, its autonomy could be further strengthened. The board of directors consists of seven members. The executive branch appoints four of them, including the president, subject to Congress approval, while the Congress selects three. All board members can only be removed for cause. However, the alignment of the appointment of the president and board directors with the presidential term poses a potential threat to the Bank's autonomy and exposes it to the risk of political interference, even though it has not occurred so far.

A sound fiscal framework, supported by fiscal rules and an independent fiscal institution (Table 1.3), has contributed to strong public finances, low public debt and ample fiscal space. Peru's current fiscal framework, established in 1999 to stabilize the economy and promote growth, is based on fiscal rules governing deficits, public spending, and public debt. These rules were enshrined in the Fiscal Responsibility and Transparency Law, which was updated in 2013 and has since been reinforced with transparency and accountability measures. A fiscal stabilization fund was created in 1999 allowing to create significant fiscal buffers during the commodity supercycle. A fiscal council was established in 2016 to ensure adherence to the framework. Peru's fiscal framework is considered a model of best practice in fiscal management and has helped establish the country as a leader in economic governance in Latin America.

Table 1.3. Current main elements of the Peruvian fiscal framework

|

Instrument |

Description |

|

|---|---|---|

|

Fiscal rules |

Non-financial public sector debt rule. Non-financial public sector deficit rule. General government non-financial expenditure rule. Current general government expenditure rule. Rules for regional and local governments. |

Public debt may not exceed 30% of GDP. In exceptional cases of financial volatility, and provided that the other rules are complied with, it may temporarily deviate by up to 4 percentage points of GDP. The fiscal deficit must not exceed 1.0% of GDP. The annual growth of general government non-financial expenditure is limited by the annual last 20-year real growth of the economy (15 previous years, current and 4 years of forecast) plus 1 p.p. The growth of general government current expenditure, without maintenance, is limited by the annual last 20-year real growth of the economy minus 1p.p. and cannot grow more than non-financial expenditure. Total debt stock ≤ annual average of total current revenues for the last 4 years; total current revenue ≥ non-financial current expenditure. |

|

Macroeconomic management |

Escape clauses. Fiscal Stabilisation Fund. |

In periods of national emergency or international crisis or when real GDP is declining, rules can be suspended or modified. To that end, the government must submit a bill to the congress that must explicitly contain the path of return to the regular parameters. The fund is funded by remaining resources in the Treasury accounts, after deducting contributions to the Secondary Liquidity Reserve, a share of income from concessions, and a share of privatization proceeds. Resources can be used to finance expenditure when lower revenue is projected, when real GDP is declining or under conditions of a national emergency or international crisis. |

|

Institutional framework, transparency and accountability |

Multi-annual Macroeconomic Framework including an explicit contingency assessment and fiscal risk analysis: a document in which the government is required to make public the macroeconomic projections underpinning the public budget for the current year and subsequent years. Update of the Multi-annual Macroeconomic Framework. Statement of Compliance of Fiscal Rules. Monitoring reports. Independent Fiscal Council. |

|

Source: OECD Secretariat.

The Fiscal Council plays a key and constructive role in supporting Peru’s fiscal framework since its inception (IADB, 2019[18]). The institution’s non-binding opinions on the fiscal strategy, compliance with the fiscal rules, the evaluation of budgetary forecasts and emerging fiscal risks are public, timely, and objective. Recent changes have strengthened the Council's independence, such as the recent addition of a requirement for the committee to be made up of five members with demonstrated technical abilities who are appointed by the Ministry of Economy and Finance based on a shortlist proposed by the Fiscal Council. The president of the fiscal council is chosen by the Fiscal Council members. The technical secretariat of the Council is now considered as the equivalent to a public regulatory body allowing it to pay higher wages to technical staff enhancing its technical capacity. However, there is still room for enhancing its operational independence. Consulting the Fiscal Council systematically when modifying fiscal rules and publicly responding to their opinions would promote transparency and accountability, as the deficit rule has been changed, suspended or emended by transitory ceilings frequently. The law requires the government to consult the Fiscal Council when formulating the multi-year macroeconomic framework prior to the approval of Congress. However, this requirement does not extend to subsequent update, for which the Fiscal Council can give its opinion after the publication. Seeking input before the publication of the update would be beneficial for strengthening public finances. Other OECD fiscal council experiences indicate that to further enhance operational independence, the Council could hold more regular hearings before the parliament and undergo external evaluation by local or international experts in line with OECD principles of independent fiscal institutions. With sufficient resources the Fiscal Council could also play a role in monitoring subnational fiscal rules. A good example of this is the AIReF, the Spanish Independent Fiscal Institution. AIReF is one of just a few IFIs that is charged not only with verifying compliance with general or central government rules, but also with subnational/regional rules. AIReF’s assessments of fiscal sustainability have a regional focus, as regions are subject to fiscal deficit targets given high fiscal decentralisation (OECD, 2020[19]).

Reforms are needed to increase efficiency of public finances

Fiscal policy should remain prudent and rebuild fiscal buffers

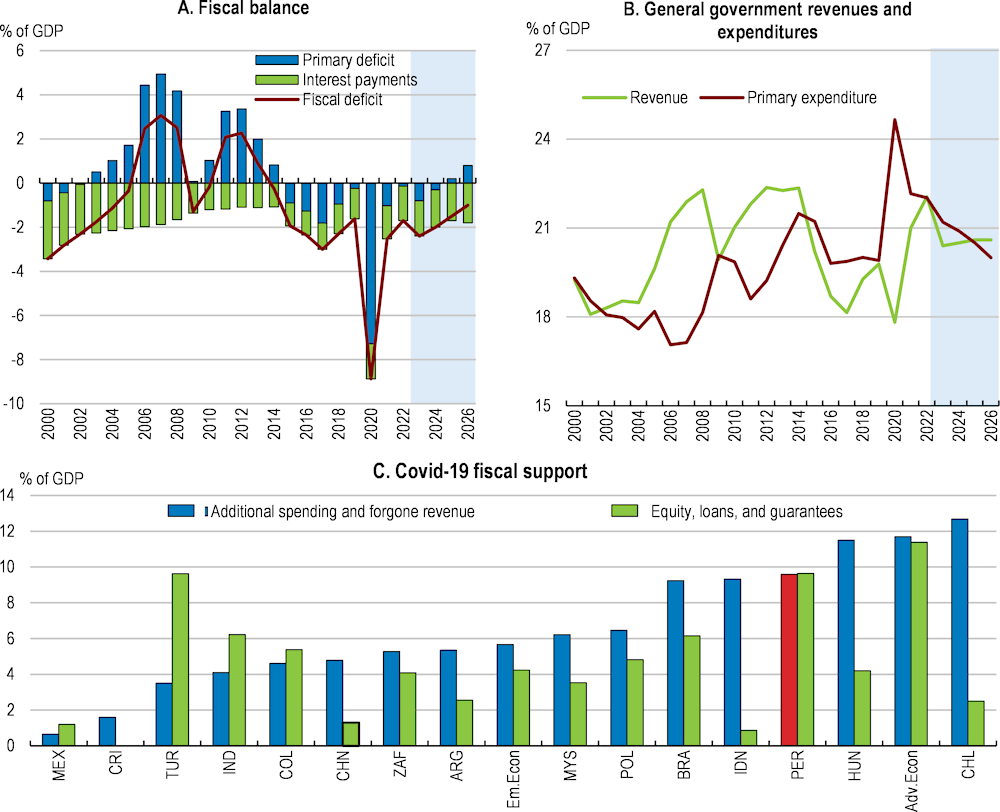

The sound fiscal framework enabled the government to provide a bold stimulus of 10% of GDP to support the economy during the COVID-19 pandemic. As pandemic-related spending was withdrawn and revenues increased driven by the recovery and high copper prices, the budget deficit decreased from 8.9% of GDP in 2020 to 2.5% in 2021 and 1.7% in 2022, with debt reaching 33.8% of GDP in 2022. Currently a gradual fiscal consolidation is envisaged to ensure fiscal sustainability in the medium term (Figure 1.13). Fiscal rules, which were reinstated with a transition period in 2022, after a two-year suspension, are expected to bring the debt to GDP ratio under 30% of GDP by 2030 and the fiscal deficit to 1% of GDP by 2026. The fiscal deficit is projected to reach 2.4% of GDP in 2023, in the limit foreseen in the fiscal rule (2.4% of GDP), implying a moderate fiscal impulse aiming to boost the economy, improve social cohesion and mitigate the impact of social protests. During 2024-26, the authorities’ fiscal strategy envisions a gradual fiscal consolidation of about ½ percentage points of GDP per year.

Figure 1.13. After bold stimulus during the pandemic, a gradual fiscal consolidation is taking place

Note: Shaded areas reflect government forecast as reflected in the Multiannual Macroeconomic Framework report 2024-2027.

Source: Central Bank of Peru; Ministry of Finance, Multiannual Macroeconomic Framework 2024-2027 (MMM, 2023[20]).

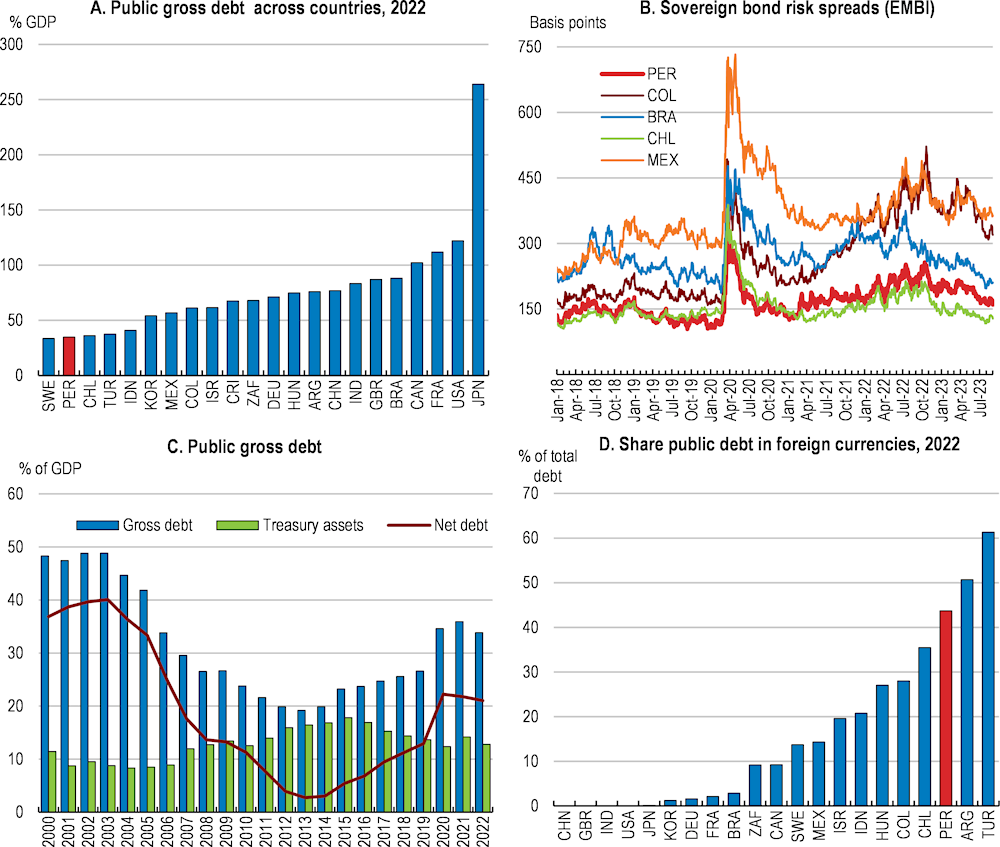

In comparison to other emerging market economies, Peru’s public debt remains low (Figure 1.14, Panel A), although tax revenues are also comparatively modest. Peru’s public debt has an average maturity of 13 years and market perceptions about Peruvian public bonds remain favourable relative to other countries in the region (Figure 1.14, Panel B), even if funding costs have increased because of tighter monetary policy. However, public debt has been increasing since 2013 (Figure 1.14, Panel C) and is more exposed to exchange rate risks, as Peru’s gross public foreign exchange debt has increased to 51.6% of total public debt in 2022 from 31.8% in 2019 (Figure 1.14, Panel D).

Figure 1.14. The public debt outlook remains healthy, but debt composition has worsened

Rebuilding the fiscal buffers will be key to provide space to fiscal policy during downturns and are necessary to protect Peru against the fiscal impact of natural disasters, commodity price shocks and the realisation of contingent liabilities in the future. The massive spending during the pandemic was financed by drawing on savings in the fiscal stabilisation fund, and new debt issuance, as gross debt rose by 9 percentage points of GDP between 2019 and 2021, to 35.9% of GDP. The size of the stabilization fund was only 0.6% of GDP in 2022, while before el Niño, a strong natural event, in 2017, it was at 4.5% of GDP. Contingent liabilities stem mainly from government guarantees in PPP contracts, estimated at 1.8% of GDP in 2021, and guaranteed loans enacted during the pandemic (0.6% of GDP).

One significant fiscal risk is the financial instability of Petroperu, a state-owned oil enterprise that supplies almost 50% of the local fuel market. Petroperu is the sole state-owned enterprise in Peru that does not fall under the jurisdiction of a fund called FONAFE, which exercises ownership rights over all other national state-owned enterprises. FONAFE management is generally aligned to OECD best practices. The government has recently approved a capital contribution of PEN 4 billion and a short-term debt operation of up to USD 500 million (0.2% of GDP) to ensure national energy security, constituting a direct contingent liability. However, long-term balance sheet issues remain a concern. Petroperu also faces challenges related to environmental concerns and governance, with allegations of political interference affecting its operations and management. Authorities should strengthen oversight, implement a strategy to restore the company's viability or divest state participation, and improve transparency, financial management practices, and environmental responsibility, in line with OECD Guidelines on Corporate Governance of State-Owned Enterprises and OECD Principles of Corporate Governance.

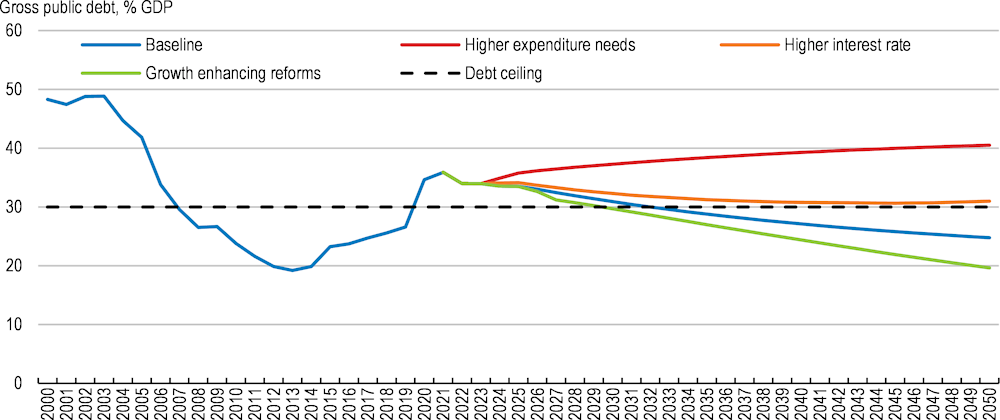

Over the medium term, the planned gradual fiscal consolidation is expected to stabilize the public debt-to-GDP ratio below the debt rule of 30% of GDP and preserve debt sustainability (Figure 1.15, blue line). Higher interest rates, possibly related to developments on global financial markets and domestic political uncertainty, would lead to a higher debt trajectory slightly above the debt ceiling of 30% of GDP (orange line). The impact of higher interest rates is relatively limited, as over 80% of public debt is contracted at fixed interest rates with an average duration of 13 years. Permanently rising spending, including due to the possibility of the passage of unfunded spending initiatives by congress, will require deeper reforms to increase revenues and preserve debt sustainability. Otherwise, the gross public debt would exceed 40% of GDP by 2040 (red line). Finally, the package of growth-enhancing structural reforms described in Figure 1.3 would raise growth and hence reduce the debt-to-GDP ratio visibly (green line), with a continuous decline in public debt that would reach 20% of GDP in 2050.

Figure 1.15. Public debt is sustainable in the baseline scenario, but there are risks

Note: The current government fiscal plans scenario assumes GDP growth as in Table 1.1 and 2.9% thereafter. Calculations include ageing related public spending on health and pensions. The higher spending needs scenario assumes additional 1% of GDP while revenue collection is maintained constant as % of GDP. The higher interest rate scenario assumes an additional 0.6 percentage points for the implicit interest rate on gross public debt. Finally, the higher growth scenario assumes an average long-term growth of 3.9% in 2025-2027 and 4.8% as of 2028, in line with the impact of all reforms in Figure 1.3.

Source: OECD calculations.

A comprehensive tax reform is needed to address long-standing challenges

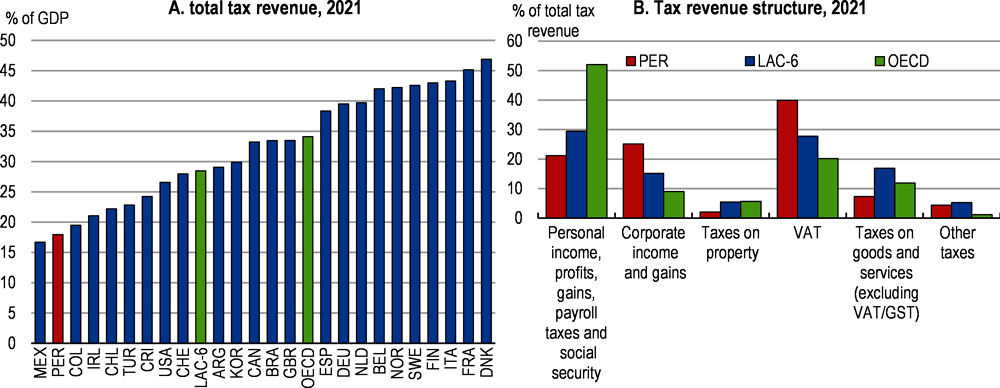

The tax system in Peru is characterized by a relatively low tax burden and a narrow tax base. The tax-to-GDP ratio is at 17% well below the OECD average of 34% and the Latin American average of 30% (Figure 1.16, Panel A), and insufficient to meet rising social needs and bolster necessary public investment in infrastructure, education, and health. As in other Latin American countries, the country relies heavily on indirect taxes such as the value-added tax, while higher-income OECD countries depend more on revenues from personal income taxes and social security contributions (Figure 1.16, Panel B). While the reliance on indirect taxes is beneficial from an economic-growth perspective, it leads to a low progressivity of the tax system (OECD et al., 2023[21]).

Figure 1.16. Tax revenues are low and the composition is tilted to indirect taxes

Note: The tax-to-GDP ratio measures tax revenues (including social security contributions paid to the general government) as a proportion of gross domestic product (GDP). Year 2020.for OECD panel B LAC6 is the simple average of ARG, BRA, CHL, COL, CRI, MEX.

Source: OECD, Global tax revenue database and OECD Revenue Statistics in Latin America and the Caribbean.

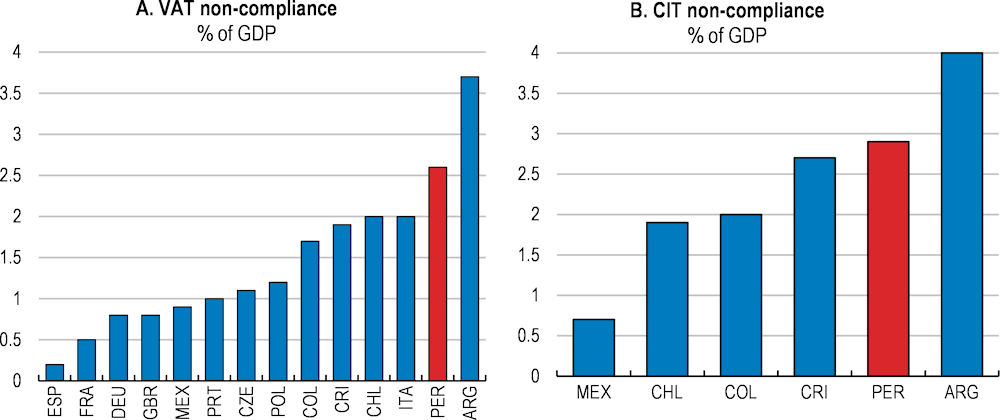

One of the main challenges associated with taxation in Peru is the narrow tax base. A significant number of businesses and individuals do not participate (or participate only partially) in the formal economy and the tax system, resulting in low tax compliance. Despite recent efforts to reduce tax evasion and improve the functioning of the tax administration, tax evasion remains high and costs Peru approximately 5.5% of GDP (Sunat, 2022[22]; Sunat, 2022[23]). VAT non-compliance amounts to over 2.6% of GDP, one of the highest shares in Latin America (Figure 1.17). Meanwhile, exemptions and reduced rates in the VAT cost 1% of GDP (Arias, 2021[24]), with an average VAT rate of 18%. Some goods and services are exempt from VAT, including books, newspapers, and magazines, as well as some agricultural products, the provision or use of services in the country; the first sale of real estate with a value of less than USD 47 000. A temporary reduced VAT rate of 10% for certain restaurants and hotels is in place until December 2024. Raising compliance and limiting the scope for exemptions and reduced rates while compensating the poorest households through the transfer system could increase VAT revenues, while reducing distortions and addressing equity concerns. Moreover, non-compliance with the corporate income tax is higher, reaching 33.1% of potential revenue in 2021 (Sunat, 2022[22]), exceeding the levels of Colombia, Chile and Mexico.

Greater revenues could be achieved by strengthening and modernizing Peru’s tax administration, starting with improvements in human capital, information systems and the use of advanced technologies, and the quality of the taxpayer registry, systematically cross-checking of information across different sources, while also continuing to improve and expanding electronic invoicing (Box 1.3). Full implementation of the 2022 reforms, such as the introduction of a digital tax registry, and leveraging on big data tools seem promising. To continue this progress, it is necessary to incorporate good tax practices into national regulations, particularly those related to combating domestic and international tax avoidance and evasion. For instance, Peru has joined the Inclusive Framework on Base Erosion and Profit Shifting (BEPS) in 2017 and the two-pillar solution to address the tax challenges arising from the digitalisation of the economy in October 2021.

Box 1.3. Strengthening the tax administration using innovative technologies and data collection

Some countries are adopting advanced data and automation techniques to improve their tax administration and taxpayers’ registration and identification. The Swedish Tax Agency launched an AI-based risk-evaluation service for business registration applications in May 2021. It categorizes applications using established risk factors and processes them accordingly.

Italy uses data analysis and machine learning to estimate the VAT Gap. Argentina has developed a Simple and Pro-Forma VAT Tax Return and implemented a digital VAT ledger, containing details of a company's incoming and outgoing invoices for each VAT period, to enhance compliance. France employs AI and aerial photographs to detect undeclared constructions.

Some countries have improved tax debt management strategies to prevent tax debt. Argentina’s SIPER system categorizes taxpayers based on risk factors to enable targeted collection measures and expedited judicial proceedings. Taxpayers are notified of their category and given the opportunity to rectify errors. In the USA, the IRS uses predictive models to streamline case management, predicting taxpayer behaviour and assessing payment likelihood, future compliance risk, and expected payment amounts.

Source: (OECD, 2022[25]).

Tax expenditures contribute to Peru’s low tax collection. Tax expenditures amounted to 2.0% of GDP in 2022 (MMM, 2022[26]). The largest tax expenditures include exemptions of agricultural products and imports and provision of educational services, VAT exemptions in the Amazon region, exemptions for CTS (a fund that mitigates the risk of employment termination for formal workers). Many of these tax expenditures are badly targeted, benefiting the wealthiest and failing to meet their objectives (Arias, 2021[24]). Conducting an in-depth evaluation of tax expenditures, retaining only those with positive and cost-effective impact towards well-defined policy objectives while phasing out the rest and replacing them, if needed, by targeted transfers to the most vulnerable population, could generate significant tax revenues. The VAT, personal income and capital gains tax regime could also be revised to eliminate numerous deductions and exemptions that hinder equity and tax collection, including VAT collection mechanisms for digital services (Schatan et al., 2021[27]; Arias, 2021[24]).

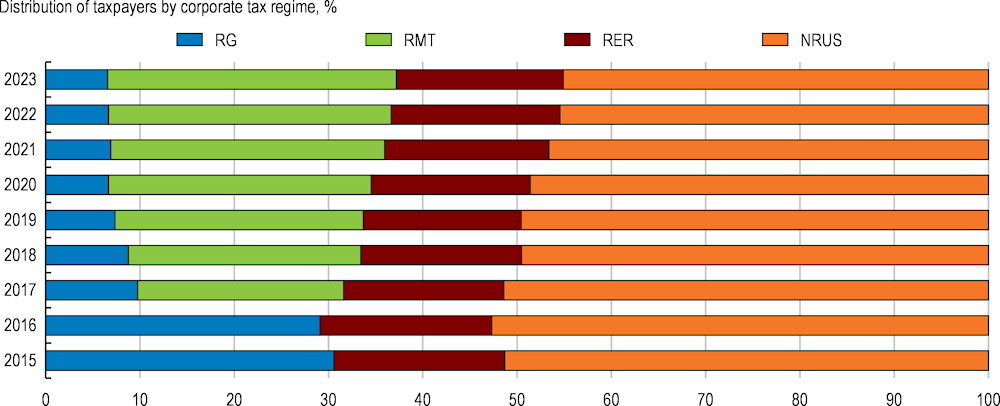

The existence and complexity of multiple corporate tax regimes in Peru has contributed to lower corporate tax collection, high evasion, high informality, and low productivity. Currently, there are three simplified regimes for small businesses with their own categories and tax burden based on the size of the enterprise (Table 1.4). These special tax regimes cover approximately 1.2 million active taxpayers, or 92% of the total, and bring in tax revenue amounting to barely 0.3% of GDP or 8% of total corporate income tax. While the small enterprises tax regime was designed to simplify and reduce tax compliance costs and allow small firms to formalize, it has created ample opportunities for arbitrage, artificial subdivision of businesses, misreporting, and tax evasion (Ardanaz et al., 2020[28]; OECD, 2016[29]). An example of the unintended consequences of Peru’s multiple corporate tax regimes is the 2016 reform that introduced the third small enterprises regime (RMT). This reform aimed to introduce progressiveness in taxation and improve incentives for formalization, but in practice, it has led to a migration out of the general regime (Arias, 2021[24]) (Figure 1.18). The regimes have also relatively high-income thresholds to belong to the regimes. This has resulted in the massification of small, low-productivity firms that concentrate a large amount of employment but have little incentives to grow.

Figure 1.17. High tax non-compliance hampers tax revenue collection

Note: For Peru, year 2021. Panel A: 2017, except CRI and MEX 2016. Panel B: ARG 2005, CHL 2009, CRI 2015, COL and MEX 2016.

Source: OECD Secretariat based on (Cepal, 2020[30]; Sunat, 2022[22]; Sunat, 2022[23]) and (OECD et al., 2022[31]).

Table 1.4. Tax regimes for business in Peru

|

Regime |

Coverage |

Threshold |

Payment |

Accounting obligations |

Other |

|---|---|---|---|---|---|

|

New Simplified Single Regime – Nuevo Regimen Unico Simplificado (NRUS). |

Natural persons selling merchandise or services to end consumers. |

Gross income or purchases below PEN 60 000 or 96 000 annually, equivalent to 2.5 and 4.0 times per capita GDP. |

Corporate tax and VAT as a single fee based on sales and purchases. PEN 20 or 50 (USD 5-13) monthly. |

None. |

Only monthly payment. Issues payment slips only, does not issue invoices for VAT purposes. |

|

Special Income Tax Regime – Regimen Especial del Impuesto a la Renta (RER). |

Natural or legal persons dedicated to extractive, industrial, trade, service or agricultural activities. |

Annual net income or purchases up to PEN 525 000 (USD 142 000) annually, equivalent to 21.7 per capita GDP. |

1.5% paid on net income and VAT. |

Purchase and sales registers only. |

Monthly declaration. Business costs and expenses, including payroll, not deducted. |

|

Micro and Small Enterprise Tax Regime -Regimen MYPE Tributario (RMT). |

Natural or legal persons. |

Annual net income below 1 700 UIT (PEN 7.8 million), equivalent to 294.7 per capita GDP. |

10% for the first 15 UIT of net income; 29.5% for marginal until 1 700 UIT and VAT. |

Purchase and sales registers, accounting journals, ledger, inventories and balance sheets. |

Monthly and annual declaration. |

|

General regime (RG). |

All. |

All. |

29.5% on profits and VAT. |

Purchase and sales registers, accounting journals, ledger, inventories and balance sheets. |

Monthly and annual declaration. |

Source: OECD Secretariat based on (Schatan et al., 2019[32]).

To reduce compliance costs and foster business formality, Peru needs to streamline the regimes for small businesses while preventing larger taxpayers from using the regime to avoid taxes. Tax regimes for small businesses must incentivize informal businesses to enter the formal economy and small formal businesses to grow into the regular tax regime (Mas-Montserrat et al., 2023[33]). Building on OECD good practice in the design of presumptive tax regimes, Peru could evaluate and redesign their regimes by, possibly, replacing the three regimes by one single (or possibly 2) regimes. The corporate tax system could also be based on net income, which could generate incentives to taxpayers to declare their costs and expenses, improving formalisation incentives. Simplifying the system would also allow for simplified control and verification and would increase tax collection, in particular if the reform would induce larger businesses to report profits under the general corporate tax regime, without considering positive effects on formalisation, productivity and growth.

Figure 1.18. Multiple tax regimes create distortions in the corporate tax system

Note: RG is the general regime, NRUS is the regime for micro and self-employed firms, while RMT and RER are the two intermediate schemes for SMEs. See table 1.4 for a description of regimes.

Source: OECD Secretariat based on Sunat data.

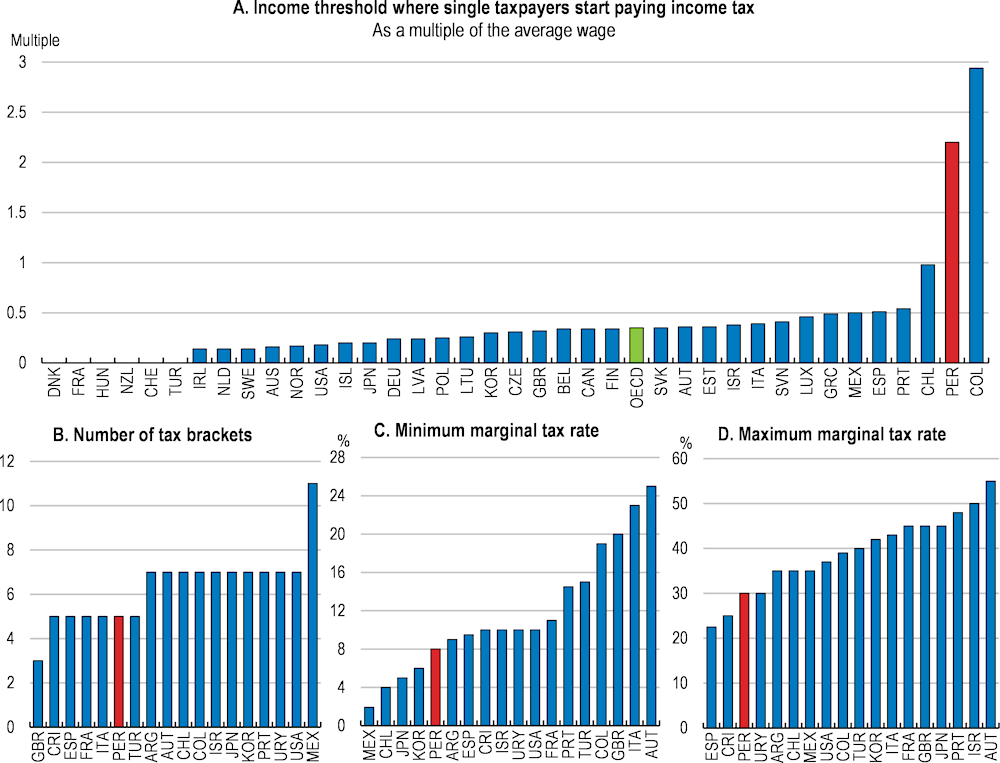

Peru’s low tax revenues can also be attributed to the country’s very low revenues from personal income taxes compared to OECD countries, a common issue across Latin American countries. Personal income tax revenues in Peru are over four times lower than the OECD average, limiting redistribution (Barreix, Bés and Roca, 2012[34]; Jaramillo, 2013[35]; Lustig, 2016[36]). There is significant potential to bring more people into the personal income tax system without affecting the bottom half of the income distribution. The high tax payment threshold on labour incomes (Figure 1.19) means that only 8% of workers pay personal income tax (World Bank, 2023[6]), with 78.2% of taxpayers declaring income subject to zero marginal tax and other 14% in the lowest marginal tax bracket in 2017, resulting in an effective tax rate of 5.6% across all taxpayers (IMF, 2020[37]). The basic personal income tax exemption could be lowered gradually over time, along with a reduction of the entry tax rate to make the system more progressive. Such reform would broaden the tax base and set a more progressive rate schedule.

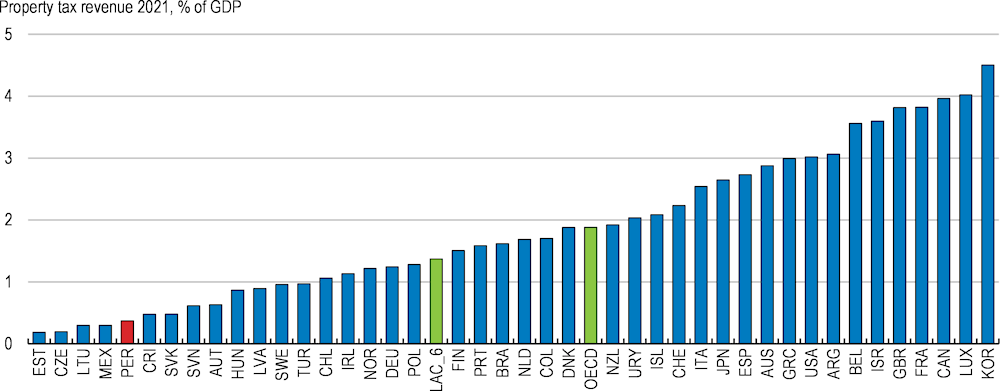

Low property tax collection is driven by the lack of an updated and complete property registry (Figure 1.20). Evidence suggests that property valuations used to establish tax obligations are up to 200-300% below market valuations (BCRP, 2019[38]). In 2021, only 15% of all municipalities had complete and updated cadasters (CPC, 2022[39]). The World Bank has provided technical support to selected municipalities in six cities with the largest tax generation potential to improve their urban cadasters. The government has plans to update and complete the cadastre gradually, with a goal to have an updated cadastre in 100 municipalities by 2023 and complete coverage throughout the country by 2030, but implementation progress has been slow. Further progress on setting up cadastres and a comprehensive review of cadastral values, would enable municipalities to strengthen their property tax collections. Experience in other countries shows that higher recurrent taxes on immovable property are likely to be met with public resistance given their high visibility. To increase their public acceptance, tax increases following a reassessment should be done gradually, and special property tax relief arrangements to reduce affordability constraints for people with low incomes or illiquid assets could also be considered.

Figure 1.19. Few Peruvians pay personal income taxes

Note: Calculations for Peru are based on a monthly average labour income PEN 1 327.5 at national level in 2021. The threshold to start paying personal income taxes is PEN 34 650 annually.

Source: INEI and OECD, Taxing Wages 2021, available at https://doi.org/10.1787/83a87978-en.

Figure 1.20. Property tax collection is relatively low

Note: LAC-6 is the unweighted average of ARG, BRA, CHL, COL, CRI and MEX.

Source: OECD Tax Revenue Statistics database.

Making public spending more effective by reforming subnational finances

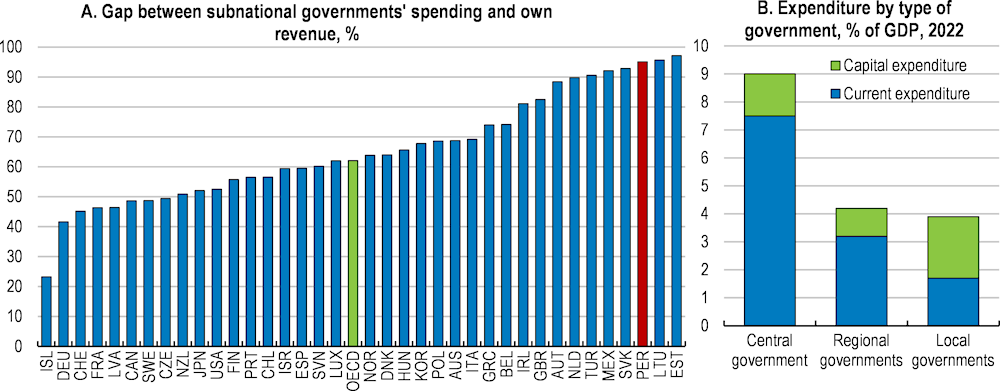

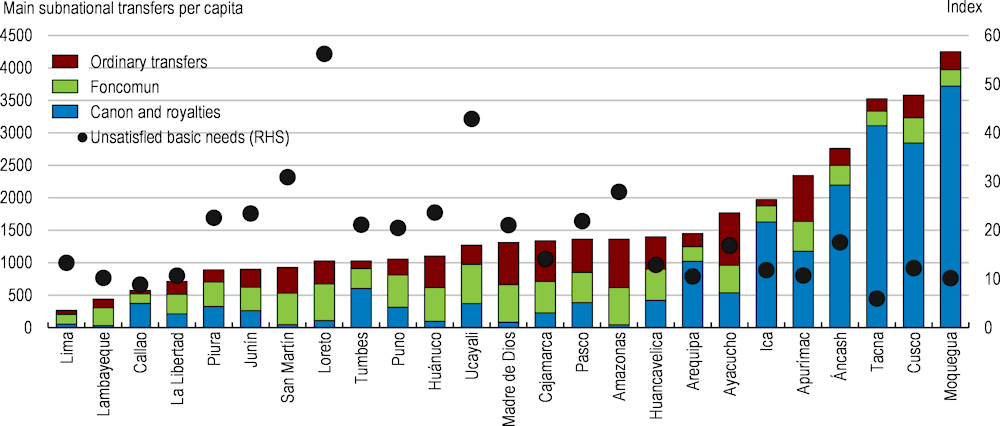

Peru’s incomplete fiscal decentralisation (Box 1.4.) has contributed to weak public spending and investment efficiency. As identified by the OECD (2016[40]), the decentralisation system suffers from two main challenges: a lack of clear delineation of spending functions between the national government, regions and municipalities and a distortionary system of financing subnational governments ultimately leading to deepening regional inequalities in terms of economic development, poverty and access to infrastructure, education, and healthcare. The coastal region, which includes the capital, Lima, is the most developed and prosperous area in the country, with a relatively high level of infrastructure, economic growth, and human development indicators. The highlands and the Amazon region, on the other hand, are less developed, with low levels of infrastructure and limited access to basic services (as shown in Figure 1.2, Panel B). The disparities are also reflected in income levels, with the coastal region having the highest GDP per capita. With significant spending needs and large economic disparities, Peru needs to spend wisely to address its human capital, health and infrastructure gaps and enhance its growth potential.

Box 1.4. The origins of the political and fiscal decentralisation in Peru

The country has a two-tier subnational system, with regions and district/provincial municipalities. The decentralisation reform has established politically and administratively autonomous regional governments, elected for a four-year term with a one-term limit for elected heads of local executives. Currently, there are 25 departments at the regional level, while the local level has two sub-levels: 196 provincial municipalities and 1,671 district municipalities. This two-level municipal system is uncommon in OECD countries.

Peru began its process of political and fiscal decentralisation in the early 2000s with the main objectives of increasing the efficiency of the public sector and enhancing democratic decision-making by strengthening regional and local governments. However, the implementation of Peru’s fiscal decentralisation process stalled in 2005 when the creation of macro-regions was rejected in a referendum. Under the original decentralisation plan, the 25 regional governments were to be consolidated into 12 macro-regions that would serve as an intermediate level of government. Furthermore, a new revenue sharing mechanism for income tax and value-added tax (VAT) could not be implemented, as it was conditional on the formation of the macro-regions. While there is no ideal degree of decentralisation, there is a broad consensus that the fiscal decentralisation process in Peru is incomplete (World Bank, 2017[41]; OECD, 2016[40]; IMF, 2016[42]; Contraloría General de la República, 2014[43]).

Source: OECD Secretariat based on (World Bank, 2017[41]).