This chapter discusses the definitions of the Internet of Things (IoT) in statistical surveys across countries, compares results on IoT uptake by businesses, households and individuals, and provides guidance for countries wishing to refine or introduce questions on the IoT in their surveys.

Measuring the Internet of Things

2. Information and communication technology usage surveys in OECD countries

Abstract

This chapter reports on the initiatives by national statistical offices in different OECD countries and Eurostat to measure Internet of Things (IoT) adoption by firms, households and individuals. Since there is no official internationally agreed definition of the IoT, the chapter discusses and compares the definitions and approaches used in the surveys across countries. The objective is to provide information on the comparability of the results as well as guidance for countries wishing to refine or introduce questions on the IoT in their surveys. In surveys on information and communication (ICT) Usage by Businesses, differences concern how the devices are defined, the examples provided and the questions about functions. As for the surveys on ICT Usage by Households and Individuals, differences concern the categories and examples provided. Results from these surveys are then discussed in detail for businesses, households and individuals.

IoT use by businesses: A comparative analysis of the statistical surveys

National statistical offices have recently introduced measures of IoT uptake by firms in official statistics, mostly in ICT usage surveys but also in innovation surveys and general business surveys, among others. This book focuses on surveys on ICT Usage by Businesses.1

The IoT statistical definitions (see Annex 2.A for the full definitions and Annex Table 2.A.1 for a summary) show some commonalities and differences in relation to some key aspects, as discussed in Box 2.1. Overall, definitions refer to devices that can be interconnected via the Internet and collect and exchange data. They do not specify the underlying criteria of the technical dimension of the network, i.e. the range of coverage (wide versus short range), the speed, the data flow and the energy consumption. Key differences in definitions concern how the types of devices are defined and their functions, as well as in the examples provided to respondents.

Box 2.1. How is the IoT defined in ICT usage surveys? An analysis of key aspects

1. Network and connection: All definitions include the ability to be interconnected via the Internet, with Japan additionally including local area networks (LANs) and other networks. Canada and Korea also specify that devices can connect to each other. All other countries point to the fact that devices can exchange or transfer data or information.

2. Type of devices: Definitions refer to devices, possibly associated with objects or systems, except for Japan and Korea. Those two countries specifically refer to the IoT as “a technology”. Korea additionally includes the concept of “service” (also included in the filter question on IoT usage). The types of devices range from a very broad approach (“various things” in Japan and Korea, “All devices and objects whose state can be altered via the Internet with or without the active involvement of individuals” for the OECD) to a more detailed description (“Computing devices embedded in everyday objects, electronic devices that can connect to each other and the Internet through a network” in Canada). Two definitions include the qualification of “smart” (Eurostat, Canada) and three definitions include “systems” (Australia, Eurostat and Korea). Australia includes not only computing devices but also “mechanical and digital machines, objects, animals or people that are provided with unique identifiers”.

3. Function(s): All definitions refer to function(s) associated with the devices. Those functions include data collection and exchange, the ability to be monitored and remotely controlled, or “digitalisation of their data for collection and accumulation” (Japan). Korea provides a more developed function with “dynamic communication of information between people and things, things and other things, things and systems” and “activity of recognition, monitoring, etc. through the physical sensing equipment […] and the accumulated data would be provided through the wire/wireless communication to be used in various fields”. Israel and the OECD specifically add “with or without the active involvement of individuals” and Australia “without requiring human-to-human or human-to-computer interaction”.

4. Example(s): With the only exception of Israel, all definitions include examples. Items range from computing end-user devices (e.g. laptops, tablets and smartphones) or infrastructure components (e.g. routers, servers, radio frequency identification [RFID] or Internet Protocol [IP] tags, sensors) to specific-purpose devices (wireless technology Wi-Fi-enabled security cameras, automatic car tracking adapters) or smart devices (smart thermostats, smart lamps or smart meters, smart televisions, smart speakers, home voice controllers) and finally expand to much broader and complex items or categories (e.g. office equipment, electrical appliances, industrial machines, cars, smart security systems, smart or connective factories). The diversity of examples mirrors the width of possible IoT usages and their continuous evolution, which also requires modifications over time in the definitions (Eurostat, OECD).

Source: Based on definitions in surveys (see Annex 2.A and Annex Table 2.A.1).

ICT usage surveys focus on various aspects of IoT adoption following different approaches, as shown in Table 2.1. Overall, IoT usage by firms is generally surveyed with a standard simple “yes/no” question but when it comes to devices and functions, the situation is much more heterogeneous across countries. In addition, issues related to reasons for using the IoT, perceived effects and impacts, and reasons for not using the IoT are raised in only three countries (Table 2.1).

Table 2.1. Overview of measurement of the IoT in ICT Usage Surveys by Businesses

|

Australia (2017-18; 2019-20) |

Canada (2019) |

Eurostat (2020) |

Eurostat (2021) |

Israel (2019) |

Japan (2017) |

Japan (2018) (both IoT and AI) |

Korea (2017-21) |

|

|---|---|---|---|---|---|---|---|---|

|

Extent of IoT importance (as digital technology) |

✓ (2017-18) |

|||||||

|

Use of the IoT (Y/N) |

✓ (2019-20) |

✓ |

✓ |

✓ |

✓1 |

✓ |

✓2 |

✓3 |

|

IoT devices |

✓ |

✓ |

✓ |

✓ |

✓2 |

|||

|

Detailed devices mixing end-use (e.g. security devices, healthcare equipment, industrial robots, cellular modules from automobiles) and technical (e.g. smart meters, non-contact integrated circuit cards, sensors, RFID tags, monitoring cameras, etc.) characteristics |

✓ |

✓2 |

||||||

|

Family of devices by technical type (e.g. smart meters, sensors, RFID or IP tags, etc.) associated with end-use functions (e.g. optimise energy consumption, improve customer service, track the movement of vehicles or products, etc.) |

✓ |

|||||||

|

IoT by function |

✓ |

✓ |

||||||

|

IoT by end-use function (e.g. production process, management of enterprises, logistics, ICT security, human resources management) associated with devices |

✓ |

|||||||

|

Mix of output (merchandise or services the enterprises produce and business process functions, e.g. production stages, transportation and distribution of merchandise, or end-use functions, e.g. oversight and tracking purposes) |

✓ |

|||||||

|

IoT by activities or end-user market/segments |

✓ |

|||||||

|

IoT (Internet-connected smart devices) by the end-use function associated with segments/markets (e.g. small, consumer market/industrial equipment/digital infrastructure) |

✓ |

|||||||

|

Reasons/purposes for using the IoT |

✓ |

✓ |

✓2 |

✓ |

||||

|

Reasons for not using the IoT |

✓ |

✓ |

✓2 |

✓ |

||||

|

Perceived level of efficiency/effectiveness of the IoT systems in the business |

✓2 |

✓ |

Notes: For details by country, see Annex Table 2.A.2.

1. Restricted to the following area: “for the products (goods or services), production of products and/or transportation of products”.

2. AI (artificial intelligence) and the IoT are considered together and not separately.

3. The question includes IoT “device and service”. In 2020 and 2021, the survey included only the question on the use of the IoT.

Source: Compiled from various official survey questionnaires.

IoT usage: IoT usage is mainly surveyed using the simple “Yes/No” question as an initial filter. Without covering IoT usage, Australia nevertheless inserted in 2018 a question on the importance of digital technologies for businesses, including the IoT. In its section related to the use of information technology (IT), the 2019-20 Business Characteristics Survey (BCS) (Australian Bureau of Statistics, 2021[1])includes a question on the various ICT used by businesses and the IoT is one of them. Introducing an initial filter question on IoT usage or asking direct questions on IoT devices or functions may produce different survey results. This may limit the comparability of results between countries (for the same year) or the same country (across years) if the option of using a filter question changes over time.

Devices and functions: Statistical offices do not provide lists of IoT devices but rather associate IoT devices with functions or domains of application. For instance, Canada refers to small devices in the consumer market, industrial equipment and digital infrastructures, whereas Japan refers to a mix of more detailed types of devices associated with technical characteristics. On the other hand, Israel focuses on business process functions such as production stages, transport and distribution or tracking purposes. Eurostat refers both to the type of device and its function. In the 2020 survey, the question focused on the type of device first (e.g. smart meters, sensors, RFID or IP tags) followed by the associated function (e.g. optimise energy, improve customer service, etc.). In contrast, the 2021 survey asked the above in reverse order.

Activities: IoT devices can also be qualified by mixing end-of-use functions and specific market segments, such as the consumer market, industrial equipment or digital infrastructures (Canada).

Reasons/purposes of use: Some countries are also asking respondents about the expected impacts of adoption. These include expected cost savings, productivity gains, improvements in decision making (Canada, Korea), improvements in business efficiency or in customer services (Japan), new business projects/management practices and expansion to new sources of profits through the creation of new products/services (Japan, Korea). Japan and Korea ask respondents to assess effects/impacts based on a scale of effectiveness.

Reasons for not using the IoT: Canada, Japan and Korea also ask respondents about reasons for not using the IoT, providing options such as no business needs, lack of knowledge, employees’ lack of skills, costs (of service, equipment or implementation), security or privacy concerns, or legal barriers or concerns. Questions also specifically address issues such as the insufficient communication infrastructure required for the introduction of the IoT (Japan), the incompatibility with existing equipment and software (Canada) or the lack of clarity of business models following IoT adoption (Korea).

IoT use by businesses: Survey results

IoT uptake by business

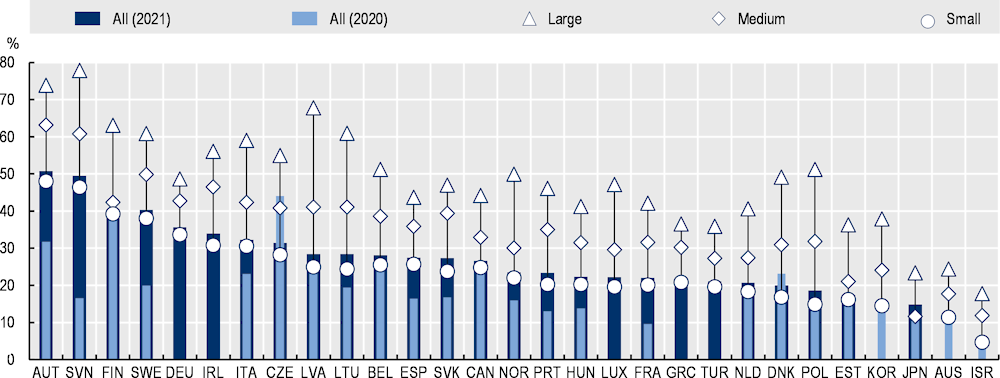

Uptake of the IoT by firms increased significantly between 2020 and 2021 (Figure 2.1), although with large differences among countries, the share of IoT-using firms ranging from 12% in Australia to 51% in Austria. The share of firms using the IoT reached 29% on average in European countries in 2021, an increase of close to 8 percentage points from the previous year. The observed differences in IoT uptake between European and non-European countries may reflect, to some extent, differences in the statistical methodology. Similarly, the decrease registered in two European countries, the Czech Republic and Denmark, might be due to a change in the survey – specifically the inclusion or deletion of a filter question – and to large uncertainty margins.

Large firms are more likely to adopt the IoT than small and medium-sized firms (Figure 2.1). The gap is above 20 percentage points in 20 OECD countries out of 29 and above 30 percentage points in Latvia, Lithuania, Poland and Slovenia. Data for Canada, Israel and Korea also confirm that the IoT adoption rate is much higher among large firms in all industries than in small and medium-sized ones. In those countries, large firms are on average more than twice as equipped with IoT devices compared to small firms. The IoT tends to be associated with complementary advanced technologies such as cloud computing (CC), big data analytics (BDA) or AI, the combination of which is more easily accessible to large firms (see below the section on the complementarity between the IoT and other digital technologies).

Figure 2.1. Enterprises using the IoT in selected OECD countries by firm size, 2021 or latest available year

Note: Data for Canada refer to 2019. Data for Australia refer to the 2019-20 reference period ending on 30 June 2020. Data for Israel and Korea refer to 2020. Data for Japan refer to businesses using both the IoT and AI and to businesses with 100 and more employees and are available for medium (100 to 299 employees) and large (300 and more employees) firms only. Data refer to businesses with ten or more employees for all remaining countries. Small: 10 to 49 employees. Medium: 50 to 249 employees. Large: 250 and more employees.

Sources: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022); and national official sources.

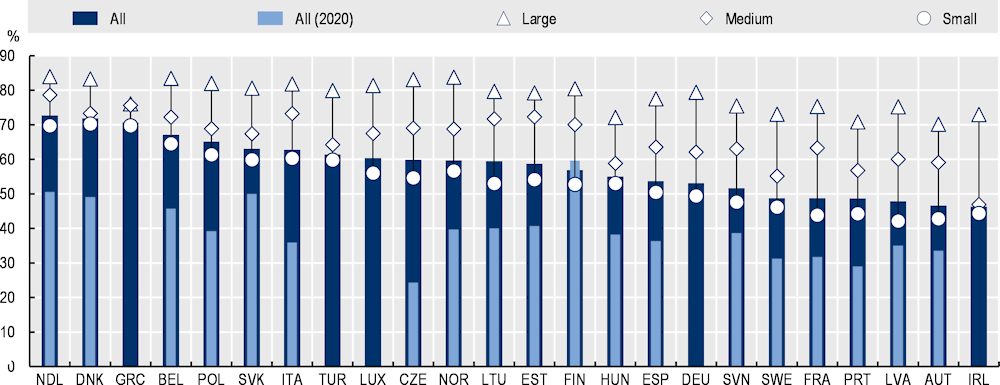

Among large firms, IoT usage is mostly multi-dimensional: in all countries, more than seven large firms out of ten are equipped with two or more different types of IoT functions/devices (Figure 2.2).

Figure 2.2. Businesses using two or more IoT devices or systems in selected OECD countries by firm size, 2021

Source: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

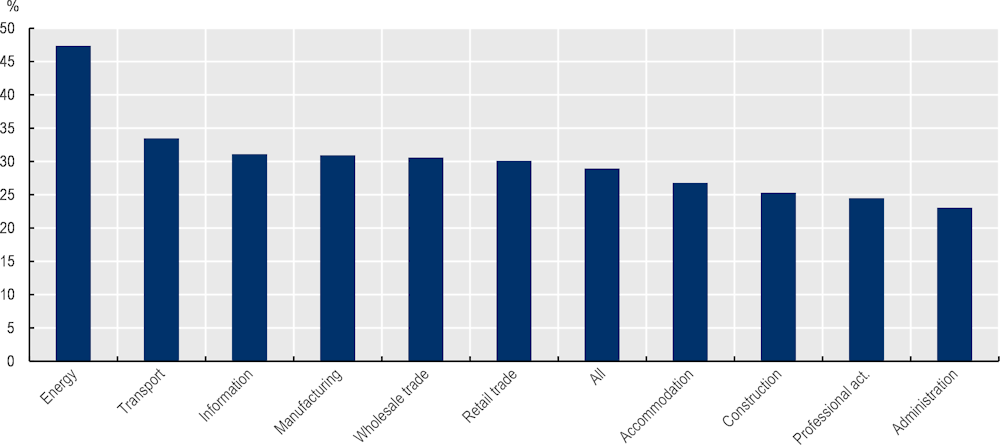

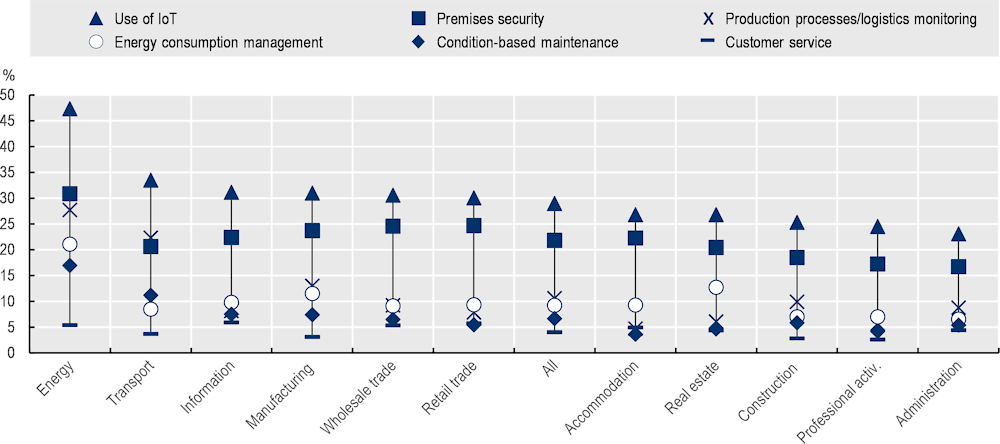

While the adoption gap by firm size is common across countries, detailed data by industries show different patterns of adoption by industry among countries. In 2021, the share of firms using the IoT in European countries ranged, on average, from 23% in administration to 33% in the transport and 47% in the energy industries. Close to one firm in three adopted the IoT in the manufacturing industry (Figure 2.3).

Figure 2.3. Enterprises using the IoT in selected European countries by industry, 2021

Note: Simple average of 23 European countries for which data are available, as shown in Figure 2.1.

Industries covered are the following: Energy = Electricity, gas, steam, air conditioning and water supply; Transport= Transportation and storage; Information = Information and communication; Manufacturing= Manufacturing; All = All industries (without financial sector); Wholesale trade = Wholesale and retail trade; repair motor vehicles and motorcycles; Construction = Construction; Retail trade = Retail trade, except motor vehicles and motorcycles; Administration = Administrative and support service activities; Accommodation = Accommodation and food and beverage service activities; and Professional act. = Professional, scientific and technical activities.

Source: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

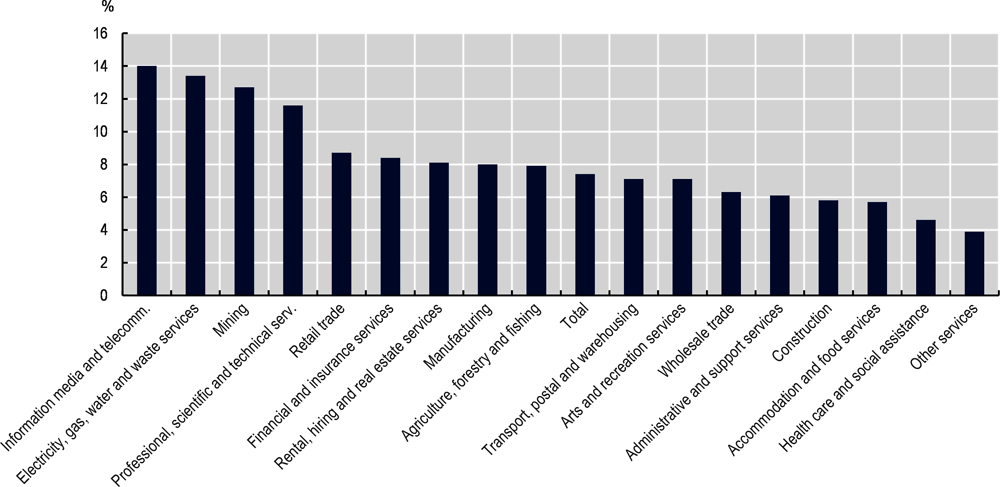

In Australia, IoT adoption by all firms – including those with fewer than 10 persons employed – is the highest in information media and telecommunication (14% in 2020) and energy industries (13.4%), while it is the lowest in healthcare, social assistance and other services (around 4%) (Figure 2.4).

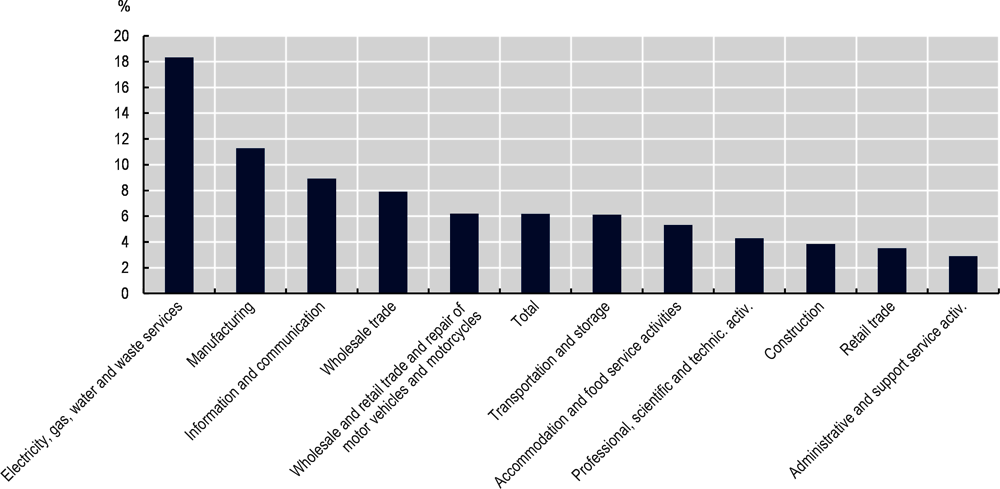

In Israel, 6.2% of firms used the IoT in 2020 (Figure 2.5). Energy industries show the highest rate of adoption (18.3%), followed by the manufacturing sector, although with about 7 percentage points’ difference. Construction, retail trade and administrative and support services are the sectors using the IoT the least (below 4%).

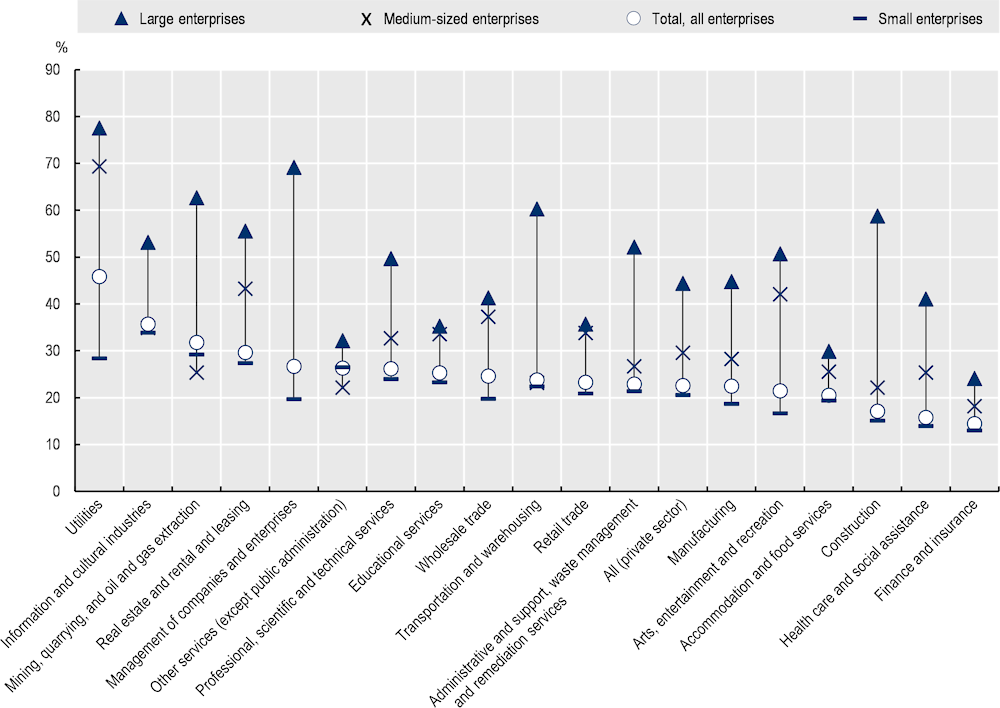

In Canada, IoT adoption is the highest – above 30% in 2019 – in the energy (utilities), information and culture, mining and real estate industries (Figure 2.6). In those industries, the share of firms using the IoT is around one-third among small firms (from 5 to 49 employees) and between 50% and 75% among large firms. Large firms are particularly keen to adopt the IoT in the management (approximately 70% and above), mining, transport and construction (approximately 60% and above) industries. On the other hand, IoT adoption rates are the lowest in the construction, healthcare, finance and insurance sectors.

Figure 2.4. Enterprises using the IoT in Australia, by industry, 2020

Note: Data by industries and for the total include all enterprise sizes. Data refer to the 2019-20 reference period ending on 30 June 2020.

Source: Australian Bureau of Statistics (2021[1]), Characteristics of Australian Business, https://www.abs.gov.au/statistics/industry/technology-and-innovation/characteristics-australian-business/latest-release#use-of-information-and-communication-technologies-icts-.

Figure 2.5. Enterprises using the IoT in Israel, by industry, 2020

Source: Israel Central Bureau of Statistics, 2022.

Figure 2.6. Enterprises using the IoT in Canada, by industry and size, 2019

Note: Large businesses have 100 or more employees except for Manufacturing (NAICS 31-33); medium-sized businesses have 20 to 99 employees except for Manufacturing (NAICS 31-33) and small businesses have 5 and 49 full-time employees. Utilities refer to industries providing electric power, natural gas, steam supply, water supply and sewage removal.

Sources: Based on Statistics Canada (2020[3]), Survey of Digital Technology and Internet Use: Data Tables 2019, https://www150.statcan.gc.ca/n1/daily-quotidien/210106/dq210106e-cansim-eng.htm; ad-hoc tabulations.

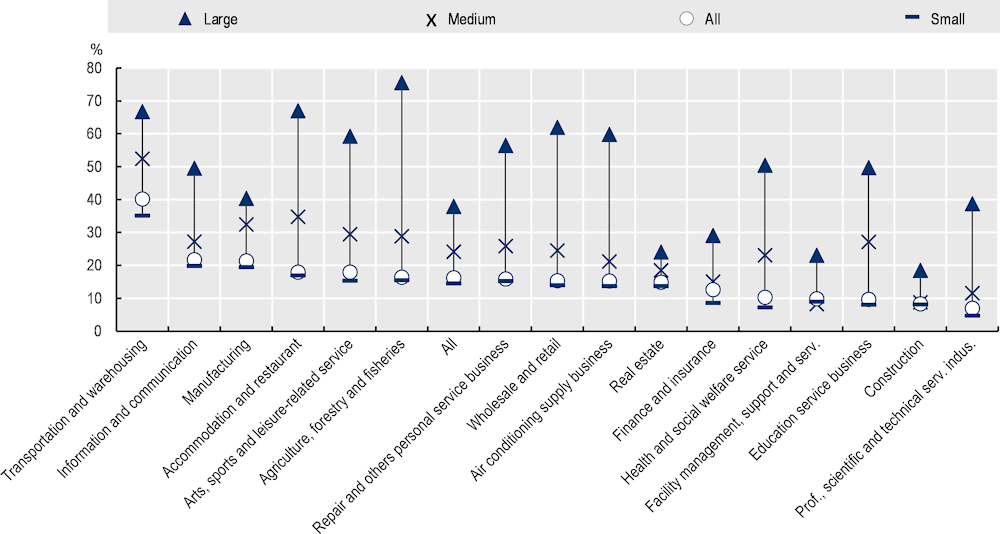

In Korea, the transport industry is by far the highest adopter of the IoT (40%) (Figure 2.7), while health facility management and construction industries display an average very low IoT adoption rate. Such figures, however, conceal differences among enterprises of different sizes. Overall, large firms have a much higher propensity to adopt the IoT than small and medium-sized firms. More than two large firms out of three use the IoT in the transport industry and in accommodation and restaurants, and more than three large firms out of four in agriculture.

Types of IoT devices used by Canadian firms

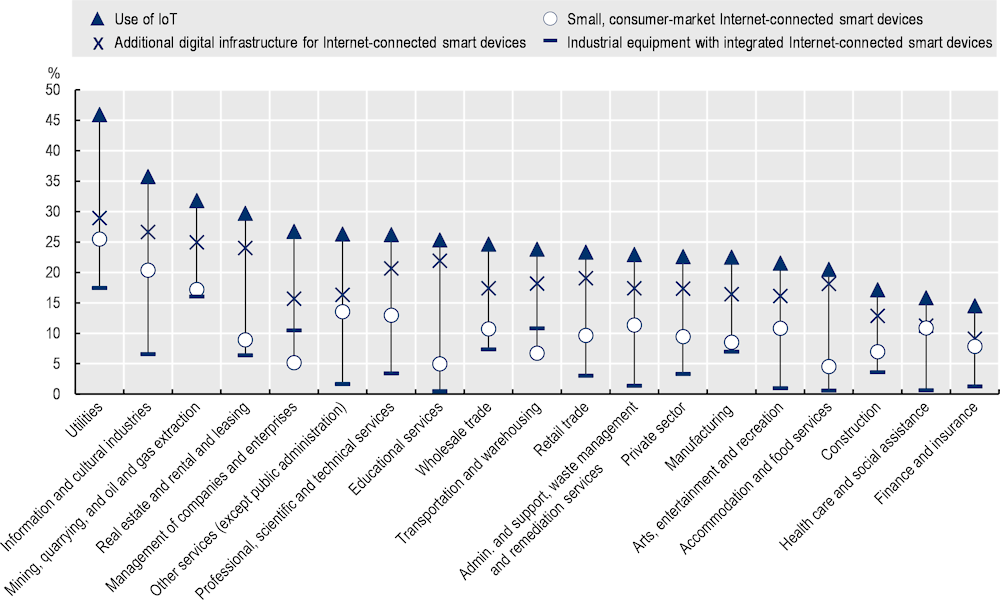

In Canada, small consumer market smart devices are by far the most used type of IoT device in all industries. In most industries, those devices are used by 16% to 20% of firms. In a few industries (energy, information and culture, mining and quarrying, and real estate), they are used by more than one firm out of four. More than 15% of utilities, mining and quarrying firms have industrial equipment with integrated Internet-connected smart devices and more than 10% of firms in the transport sector. Manufacturing firms show a relatively lower adoption at 7% (Figure 2.8).

Figure 2.7. Enterprises using the IoT in Korea, by industry and size, 2020

Source: NIA/Ministry of Science/ICT Korea (2022[4]), 2021 Yearbook of Information Society Statistics (in Korean), https://www.nia.or.kr/site/nia_kor/ex/bbs/View.do?cbIdx=62156&bcIdx=24143&parentSeq=24143.

Figure 2.8. Use of the IoT in Canada by industry and type of device, 2019

Sources: Based on Statistics Canada (2020[3]), Survey of Digital Technology and Internet Use: Data Tables 2019, https://www150.statcan.gc.ca/n1/daily-quotidien/210106/dq210106e-cansim-eng.htm; ad-hoc tabulations.

Types of IoT devices used by European countries

On average, European firms use the IoT mostly for premises security (21.8%) (Figure 2.9), monitoring production processes and logistics (10.6%), energy optimisation (9.2%) and, to a lesser extent, for condition-based maintenance (CBM, 7%) and to improve customer services (4%). CBM is a maintenance strategy that monitors the actual condition of an asset with sensors to decide what maintenance needs to be done, for example. CBM aims to monitor and spot upcoming equipment failure so that maintenance can be proactively scheduled when needed – and not before.2 European firms in the energy industry use all types of IoT devices more frequently than those in other industries. Firms in the transport sector use more sensors for managing logistics, e.g. for tracking products and vehicles or for the maintenance of machines or vehicles, while energy and real estate firms use more smart devices, e.g. meters, lamps and thermostats, to optimise energy distribution and consumption.

Figure 2.9. Use of the IoT in selected European countries by industry and type of device, 2021

Notes: Simple average of 23 European countries for which data are available, as shown in Figure 2.1.

Industries covered are the following: Energy = Electricity, gas, steam, air conditioning and water supply; Transport= Transportation and storage; Information = Information and communication; Manufacturing= Manufacturing; All = All industries (without financial sector); Wholesale Trade = Wholesale and retail trade; repair motor vehicles and motorcycles; Real estate = Real estate activities; Construction = Construction; Retail trade = Retail trade, except motor vehicles and motorcycles; Administration = Administrative and support service activities; Accommodation = Accommodation and food and beverage service activities; and Professional act. = Professional, scientific and technical activities.

Functions are described with the following examples of associated IoT devices: energy consumption management (e.g. smart meters, smart thermostats, smart lamps or lights); premises security (e.g. smart alarm systems, smart smoke detectors, smart door locks or smart security cameras); production processes (e.g. sensors or RFID tags, managed via the Internet, used to monitor or automate the process); managing logistics (e.g. sensors managed via the Internet for tracking products or vehicles or in warehouse management); and CBM (e.g. sensors managed via the Internet to monitor maintenance needs of machines or vehicles).

Source: Based on data from Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

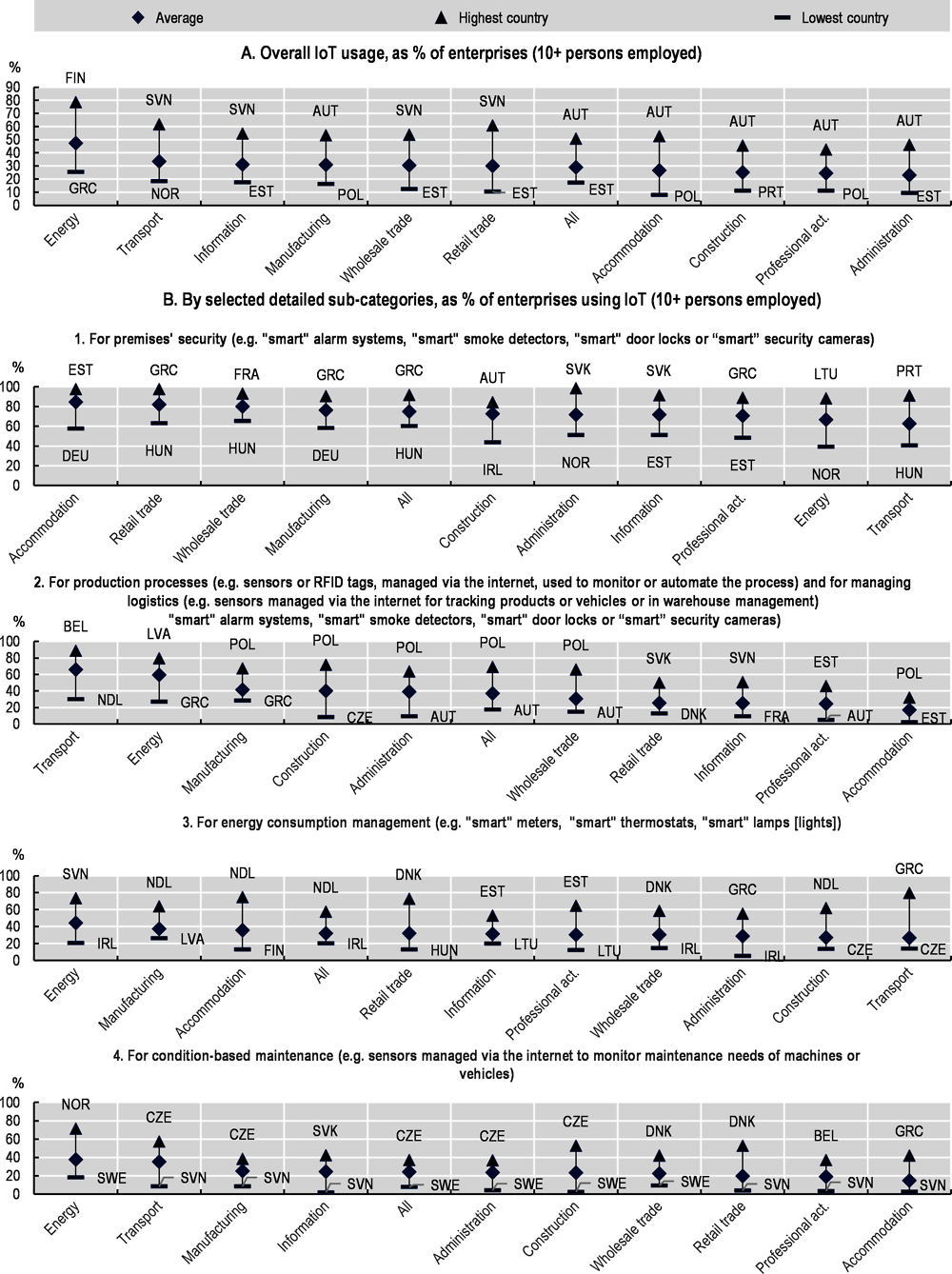

The following observations are based on more detailed data for each type of IoT device and associated functions in selected European countries (Figure 2.10).

Figure 2.10. Use of the IoT in selected European countries by industry and type of IoT device, 2021

Note: See note to Figure 2.9.

Source: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

IoT devices for premises security

The share of European firms using smart devices for premises security, e.g. alarm systems, smoke detectors, door locks or security cameras, ranges from 63% in transport to 85% in accommodation, with an average of 75% for all industries. This share is particularly high for firms in manufacturing in the Czech Republic, France, Greece, Lithuania and the Slovak Republic (above 85%), in accommodation and food in Estonia, Luxembourg and Portugal, in retail in the Czech Republic, France and Greece and in transport in Portugal (all above 90%).

IoT devices to monitor or automate production processes or manage logistics

The share of European firms using IoT devices to monitor or automate production processes or for logistics, e.g. tracking products or vehicles or in warehouse management, ranges from 17% in accommodation and food to 66% in transport, with an average of 37% for all activities. Such devices are also frequently used by firms in the energy industry, with an average share of 60%. In some countries, the share is also particularly high in specific sectors: in Hungary and Poland for administrative and support services (63%), in Belgium, Denmark, Poland and Slovenia for transport (above 85%), in Hungary, Latvia, Lithuania, Poland and Sweden for energy (above 72%), in Poland for manufacturing (67%), construction (72%) or wholesale and retail (66%) and in Sweden for construction (60%).

IoT devices to optimise energy

The share of European firms using smart devices to optimise energy distribution and consumption (e.g. meters, lamps, thermostats) ranges from 27% in transport to 44% in energy, with an average of 32% for all industries. This share is particularly high in transport in Greece (80%), accommodation and food in the Netherlands (75%) and retail in Denmark (73%).

IoT devices to track movement or offer CBM

In 2021, nearly 24% of European firms used sensors to monitor the maintenance needs of machines or vehicles. This share ranges from 15% in accommodation and food to 38% in energy. The share is particularly high in energy in Estonia (66%) and transport in the Czech Republic (57%).

Why are businesses using IoT devices? Insights from the Canadian survey

In Canada, firms are using IoT devices for various reasons: improvement of the work environment, productivity gains, cost savings, decision making, cybersecurity, etc. Overall, improvement of the work environment is the reason most frequently mentioned, followed by productivity gains and cost savings. Industries such as utilities or mining also mention improvement of the work environment and productivity gains as the main reasons for adoption. The reasons for using IoT devices not only depend on the industry but also on the size of companies. Among large firms, productivity gains and improvement of the work environment are the reasons most frequently mentioned, whereas small firms rank improvement of the work environment first, at a much higher level before productivity gains (Annex Table 2.A.3).

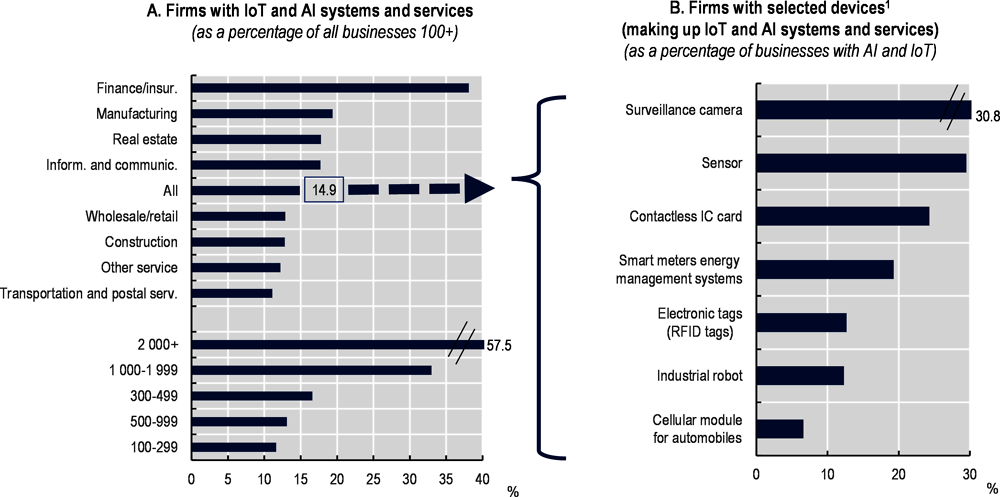

Adoption of the IoT by firms in Japan

In Japan, the introduction of IoT and AI systems and services within businesses are not measured separately from each other. In 2021, around 15% of businesses had adopted IoT and AI systems, primarily very large firms (over 1 000 employees) and firms with activities in the finance and insurance industries, as well as in the manufacturing, real estate, and the information and communication industries. Among businesses adopting AI and the IoT, the diffusion rate of devices ranges from more than 30% for surveillance cameras to less than 7% for cellular modules for automobiles. Moreover, they are not evenly spread across industries (Figure 2.11). Surveillance cameras, for example, are used mainly in the construction and real estate industries. Sensors and industrial robots are used mainly in the manufacturing industries. Contactless integrated circuit (IC) cards are used mainly in the information and communication and real estate industries. Smart meters are used primarily in the wholesale and manufacturing industries but also in the construction industries, while cellular modules for automobiles are heavily concentrated in the transport industry.

Figure 2.11. AI and IoT diffusion and selected associated devices in businesses in Japan, 2021

1. Physical security equipment and optical character recognition are not reported in the figure.

Source: Compiled from Japanese Ministry of Internal Affairs and Communications (2022[5]), Communication Usage Trend Survey 2021, https://www.soumu.go.jp/johotsusintokei/statistics/statistics05.html.

Complementarity between the IoT and other digital technologies

IoT devices are now diffused in all parts of the economy but their diffusion varies according to a few key factors: the size of the firm, the industry, the type of business functions in which the devices are integrated and the diffusion of other advanced technologies in the firm. IoT usage is generally integrated within business functions but can also be coupled more broadly with complementary technologies, whose combination significantly increases the strategic interest of the firm.

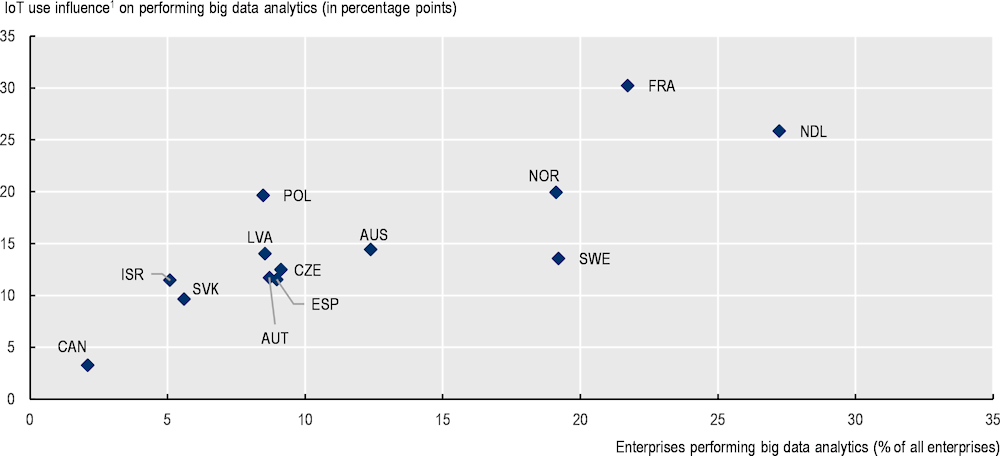

This section looks at the extent to which the IoT is complementary to technologies such as CC or BDA. The diffusion of IoT devices within firms generates an increasing amount of data, which needs to be treated through analytical tools (BDA); CC, with the associated infrastructures and storage solutions, also provides a useful complementary asset.

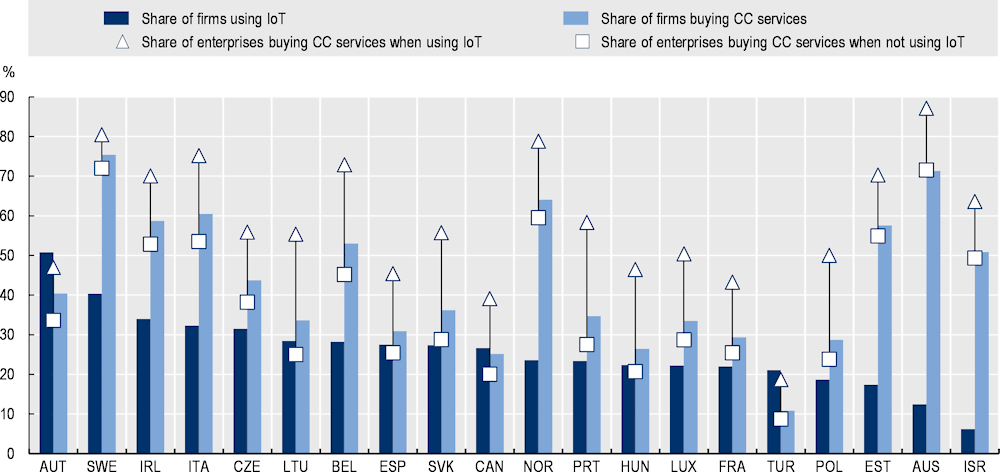

IoT and CC services

Considering the adoption of IoT and CC services separately, data show that, in 2021, enterprises have a significantly higher propensity to buy CC services than to adopt the IoT in all countries but Austria, Canada and the Republic of Türkiye (hereafter Türkiye) (Figure 2.12). However, without exception, firms using the IoT have a much higher propensity to buy CC services compared to firms not adopting the IoT. The average gap between the former and the latter is at least 8 percentage points in Sweden and above 10 percentage points in all countries. In 6 countries, the gap is above 25 percentage points and, in Lithuania and Portugal, above 30 percentage points. Enterprises buy CC services more than twice as often when using IoT devices in Hungary, Lithuania, Poland, Portugal and Türkiye. Overall, IoT and CC services display a significant complementarity.

Figure 2.12. Joint use of the IoT and CC by firms, selected OECD countries, 2021

Note: Countries are ranked by decreasing order of the share of enterprises using the IoT. For Canada, data relate to 2019 and for Israel to 2020. For Australia, data relate to the 2019/20 fiscal year.

Source: Based on ad-hoc tabulations provided by Statistics Austria, Statistics Canada, Israel Central Bureau of Statistics and Eurostat (2022).

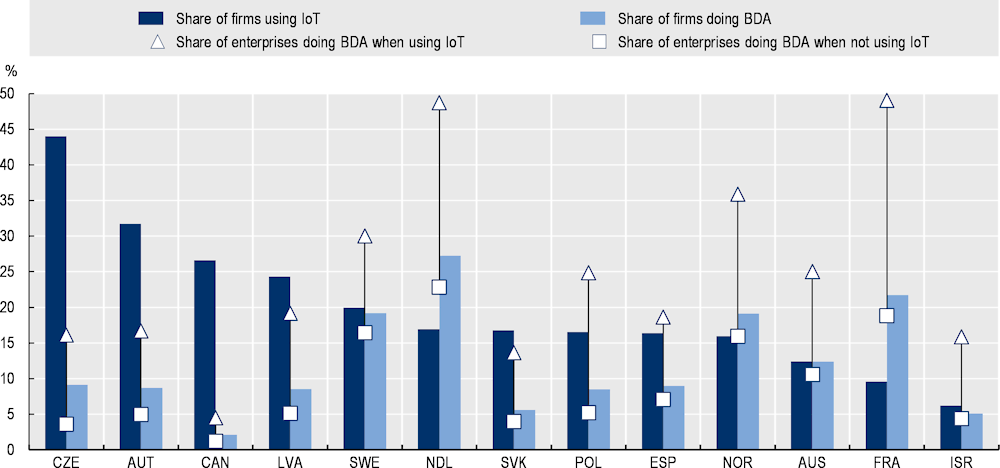

IoT and BDA

The share of enterprises performing BDA is significantly lower than those using IoT devices in most countries, whereas in Australia and Sweden, the adoption rates of these two technologies are very similar (Figure 2.13). By contrast, in France, the Netherlands and Norway, more enterprises perform BDA than use the IoT. As observed for CC services, those enterprises using the IoT have a higher propensity to perform BDA compared to firms which do not use the IoT. The average gap between the former and the latter varies across countries. In Canada, the gap is very small; in this country, performing BDA among small or medium-sized enterprises is rare (1% and 4.5% respectively). However, the gap is significant among large Canadian firms: 30% of those using the IoT perform BDA, while only 12% of those not using the IoT do so (not shown in the figure). In a majority of countries, the gap ranges between 10 and 15 percentage points. In 4 countries, the gap is even larger, reaching 20 percentage points in Norway and Poland, 26 in the Netherlands and more than 30 in France. The gap generally increases with the firm’s size.

IoT adoption is associated with a higher propensity to perform BDA in all industries, although this effect varies greatly across countries and industries. It is very large in most industries in France, where more than 1 enterprise out of 5 performs BDA, but relatively small in Canada, where on average, only 2% of the firms perform BDA. The effect in the 13 countries observed is comparatively more significant in industries such as information and communication, energy, manufacturing, transport or retail. Overall, for a given industry, the higher the share of firms performing BDA, the higher the frequency of association BDA-IoT, and the lower the share of firms performing the IoT without BDA (Annex Figure 2.A.1).

Figure 2.13. Joint use of the IoT and BDA by firms, selected OECD countries, 2021

Note: Countries are ranked by decreasing order of the share of enterprises using the IoT. For Canada, data relate to 2019 and for Israel to 2020. For Australia, data relate to the 2019/20 fiscal year.

Source: Based on ad-hoc tabulations provided by Statistics Austria, Statistics Canada, Statistics Sweden, and INSEE (France).

IoT use in households and by individuals: The measurement framework

Official household and individual survey questionnaires ask about IoT uptake using different approaches, as summarised in Table 2.2. They generally do not use the expression Internet of Things (see Annex 2.A for details on the approach by country) but rather include an introductory sentence describing the devices. The questionnaires inquire about IoT use in the following broad domains: household equipment or appliances, wearables, cars and health.

Table 2.2. Measurement of IoT use by households and individuals, an overview

|

Canada |

Eurostat |

Korea |

United States |

|

|---|---|---|---|---|

|

Interaction with household equipment/appliances |

2019 |

2015, 2017, 2019, 2021 |

||

|

Use of smart home appliances/devices |

||||

|

Group of items (e.g. robot vacuums, fridges, ovens) |

2018, 2020 |

2020, 2022 |

2019-20 |

|

|

Group of items by function (e.g. energy management, security, safety) |

2020, 2022 |

|||

|

Detailed items |

2018, 2020 |

|||

|

Use of smart TV/Internet-connected TV |

2018, 2020 |

2020, 2022 |

2016-20 |

2015, 2017, 2019, 20211 |

|

Use of speakers |

2018, 2020 |

|||

|

Smart speakers |

2018, 2020 |

|||

|

AI speakers |

2018-20 |

|||

|

Internet-connected home audio systems, smart speakers |

2020, 2022 |

|||

|

Use of wearable devices |

||||

|

Group of items (e.g. watches, glasses) |

2020 |

2020, 2022 |

2016-20 |

2015, 2017, 2019, 2021 |

|

Detailed list of items |

2016-18 |

|||

|

Functions used |

2016-20 |

|||

|

Use of car-related IoT |

2016-20 |

|||

|

A car with a built-in wireless Internet connection |

2020, 2022 |

|||

|

Connected vehicle devices |

2020 |

|||

|

Use of health-related IoT |

20202 |

2020, 2022 |

2016-203 |

2015, 2017 (H), 2019 (H), 2021 (H) |

|

Use of AI |

||||

|

A virtual assistant in the form of a smart speaker or of an application (app), such as Amazon Alexa/Echo/Computer, Bixby, Cortana, Google Assistant, Google Home, Siri |

2020, 2022 |

|||

|

AI voice recognition services |

2019-20 |

|||

|

Use of other devices4 |

2020, 2022 |

|||

|

Reasons for not using: |

||||

|

Smart home devices |

2020 |

|||

|

Interconnected devices or systems |

2020, 2022 |

|||

|

Problems encountered when using Internet-connected devices or systems |

2022 |

|||

|

Security and/or privacy concerns |

2020 |

2022 |

||

|

With smart speakers |

2020 |

|||

|

With Internet-connected wearable smart devices |

2020 |

Notes: For IoT devices details by country, see Annex Table 2.A.4. Questions asked at the household level are flagged with (H).

1. Included with games, video systems or other devices that connect to the Internet and play through a TV.

2. Included with wearables (and listed in the examples).

3. Question included within the functions used (see previous line).

4. Includes toys, game consoles, home audio and smart speakers.

Source: Compiled from various official survey questionnaires.

Household equipment or appliances can be split according to several possible dimensions. They are measured:

1. As a group of items without further specification (e.g. fridges, coffee machines, ovens, robot vacuums) in Canada, Korea and European countries.

2. As a group of items according to specific functions in the house, e.g. energy or security management in European countries or the United States.

3. As a group of detailed items (e.g. cameras, smart doors or window locks, smart plugs and lights, smart thermostats) in Canada.

4. With separate entries for smart TV and smart speakers. The latter can be associated with AI (in Korea). AI is also measured separately in questions related to virtual assistants (in European countries) or voice recognition services (in Korea).

Household equipment or appliances are also measured through indicators aggregating various groups of IoT devices. Eurostat provides aggregates for two distinct groups: i) a group of devices or systems for energy management, security/safety management, Internet-connected appliances and virtual assistants, which relates, therefore, to home automation; ii) a group including Internet-connected TV, game consoles, home audio systems and smart speakers, which therefore relates to home entertainment items. Canada, in contrast, aggregates under one only group (“Smart home devices used in primary residence”) a mix of IoT devices that could belong either to the domain of home automation (e.g. video cameras connected to the Internet, smart doors or window locks, smart thermostats, smart switches or lights, smart large appliances) or to home entertainment (e.g. smart speakers, smart TVs). The diversity of measurement approaches described reflects the several dimensions of IoT uses in everyday life at home, as they cover several entertainment and automation areas and perform different functions and processes.

Wearables form a distinct, fairly well-defined cluster and are measured as a group (in Canada, European countries or the United States), with several examples of applications or detailed items (in Korea). The Korean questionnaire surveys these devices in detail, with focused questions on selected wearables (e.g. watch type, band type, safety tracker for children, glasses) and the functions for which they are used (e.g. making/receiving text messages or phone calls via smartphone connection, managing health such as heart rate and calorie tracking, tracking trips and distances, enjoying virtual and augmented reality).

The wearables category partially overlaps with the one on health, a domain where IoT devices are also diffusing. Canada and Korea include questions on health monitoring within the item on wearables, whereas Eurostat’s survey has a specific question on health-related Internet-connected devices, and so does the United States (in this country, the question concerns use within the household, not by the individual).

The IoT in cars is measured through questions related to connected vehicle devices (Canada) or cars with built-in wireless Internet connections (European countries).

Finally, Canada and European countries also ask questions about security and/or privacy concerns and problems encountered when using the devices. Both countries also enquire about the reasons for not using Internet-connected devices or systems (Eurostat) or smart home devices (Canada).

IoT use in households and by individuals: Results

Introduction

An increasing number of “things” embed Internet connectivity and are able to perform functions which touch upon multiple and varied aspects of individuals’ everyday lives. This section offers a review of results from these surveys using two approaches. The first part is organised around the domains of use, providing a comparative overview across countries of adoption of selected devices. Two levels are considered: first, the two large categories of home automation and home entertainment IoT devices; and second, a focus on home appliances, smart TVs, wearables and health-related IoT devices. It is important to remember that, except for smart TVs, questions do not include identical lists of goods in the different surveys. For example, home appliances relate to slightly different goods (and/or associated illustrating examples) in the Canada, Eurostat and United States surveys. The second part provides detailed results for selected OECD countries. Finally, the last section discusses the demand-side factors hindering IoT use by individuals in their everyday life, based on available survey results.

Focus on the devices and their functions

Home automation and home entertainment IoT devices

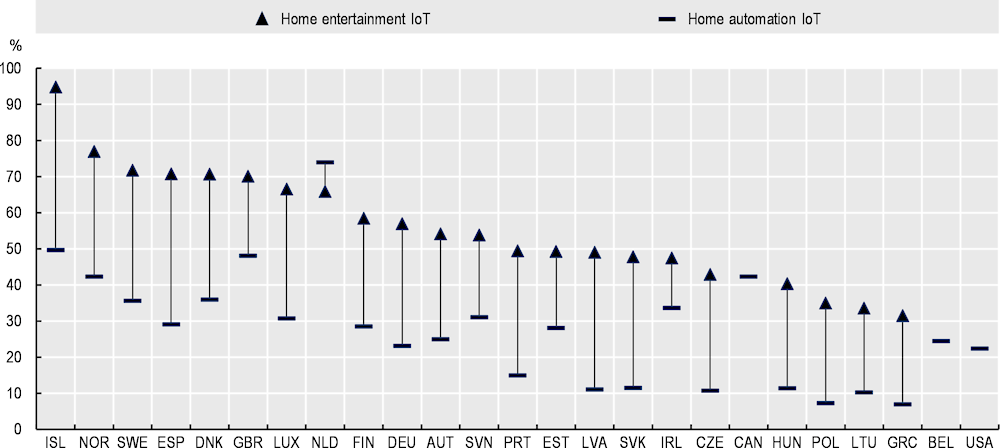

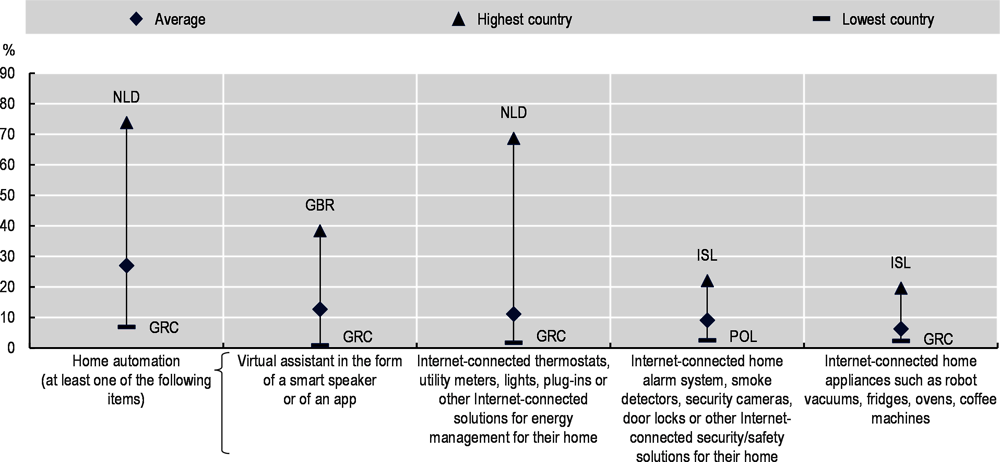

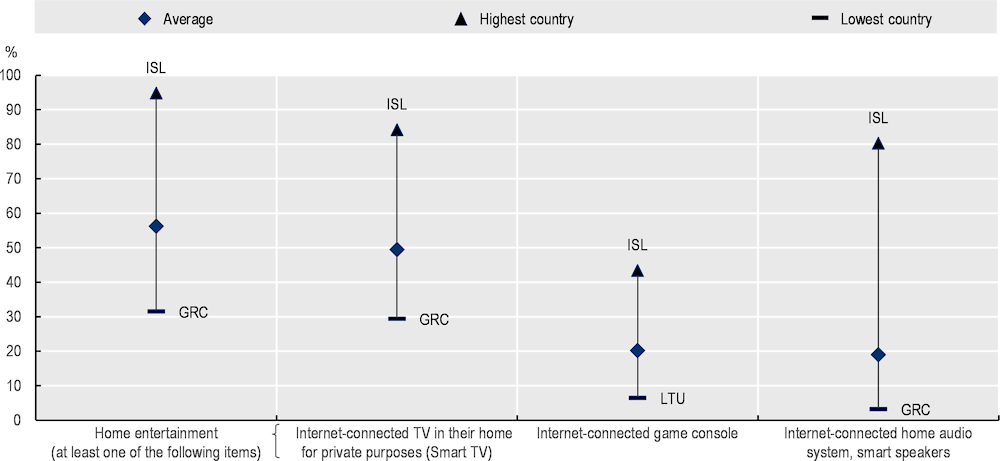

Eurostat divides IoT devices into two main groups: devices or systems for energy management, security/safety management, Internet-connected appliances and virtual assistants, namely home automation IoT devices; and Internet-connected TVs, game consoles, home audio systems and smart speakers, namely home entertainment IoT devices. Canada and the United States also survey the use of home automation devices. Overall, individuals use home entertainment IoT devices (e.g. smart TVs) much more than home automation IoT devices (Figure 2.14). For both groups, there is a large disparity between countries.

Figure 2.14. Individuals using Internet-connected devices or systems (IoT) for private purposes in selected OECD countries, 2021 or latest available year

Note: Data refer to 2021 for the United States and 2020 for the other countries. Individuals aged 3+ in the United States, 15+ in Canada and 16 to 74 in European countries. Home entertainment IoT relates to Internet-connected TVs, game consoles, home audio systems and smart speakers, and data are unavailable for Belgium, Canada and the United States. Home automation IoT relates to the following Internet-connected devices or systems for private purposes: devices or systems for energy management, security/safety management, Internet-connected appliances and virtual assistants. For Canada, home automation IoT relates to smart home devices used in the primary residence and include devices such as smart speakers, video cameras connected to the Internet, smart doors or window locks, smart thermostats, smart switches or lights, smart large appliances, smart TVs, etc. For the United States, home automation IoT relates to household equipment or appliances that are connected to the Internet, such as connected thermostats, light bulbs or security systems.

Sources: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022); Statistics Canada (2020[3]), Survey of Digital Technology and Internet Use: Data Tables 2019, https://www150.statcan.gc.ca/n1/daily-quotidien/210106/dq210106e-cansim-eng.htm; and NTIA (2022[6]), Digital Nation Data Explorer, https://www.ntia.gov/data/explorer#sel=internetUser&disp=map (accessed on 20 May 2022).

Home appliances

Comparing the use of IoT home appliances across countries is not entirely straightforward, given the differences in surveys of the examples or groups of items given to respondents. In most OECD countries, less than 10% of individuals use Internet-connect home appliances, except in Iceland, Slovenia and the United States. In Korea, data relate to the percentage of households (not individuals) and are therefore not comparable with the above countries. In 2020, 9.9% of households in Korea owned smart home appliances.

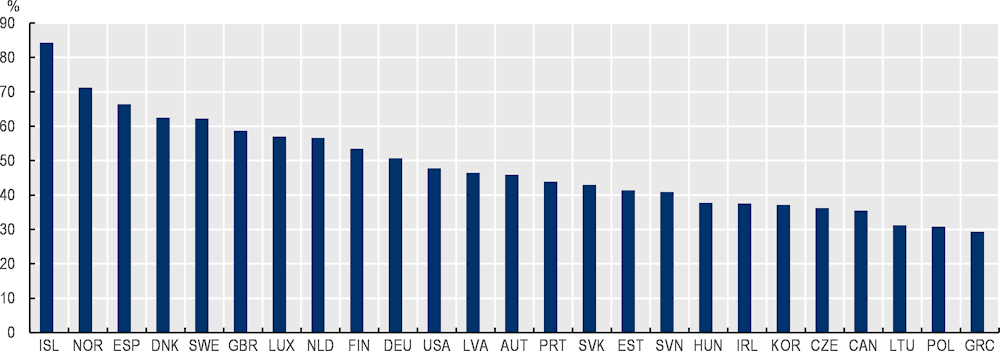

Combining the advantages of an Internet connexion with the convenience of a TV set, smart TVs had in 2020 a fairly high level of uptake by individuals. It ranged from 30% in Greece to about 85% in Iceland. It was above 50% in Germany, Luxembourg, the Netherlands, the Nordic countries, Spain and the United Kingdom (Figure 2.16).

Figure 2.15. Diffusion of Internet-connected home appliances in selected OECD countries, 2021 or latest available year

Note: Individuals aged 3+ in the United States, 15+ in Canada, and 16 to 74 in European countries. For Canada, data refer to smart appliances (e.g. fridges, stoves, dishwashers, coffee makers and toasters). For the United States, data refer to 2021 and to household equipment or appliances that are connected to the Internet, such as connected thermostats, light bulbs or security systems. For the other countries, data refer to 2020 and to Internet-connected home appliances such as robot vacuums, fridges, ovens and coffee machines.

Sources: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022); Statistics Canada (2020[3]), Survey of Digital Technology and Internet Use: Data Tables 2019, https://www150.statcan.gc.ca/n1/daily-quotidien/210106/dq210106e-cansim-eng.htm; and NTIA (2022[6]), Digital Nation Data Explorer, https://www.ntia.gov/data/explorer#sel=internetUser&disp=map (accessed on 20 May 2022).

Figure 2.16. Use of smart TV in selected OECD countries, 2021 or latest available year

Note: Individuals aged 3+ in the United States, 15+ in Canada, and 16 to 74 in European countries. Data for the United States refer to 2021 and to 2020 for the other countries. For Canada, Korea and the United States, data relate to smart TVs and for the other countries to Internet-connected TVs. For Korea, data are expressed as a percentage of all households having a smart TV to access the Internet.

Sources: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022); Statistics Canada (2020[3]), Survey of Digital Technology and Internet Use: Data Tables 2019, https://www150.statcan.gc.ca/n1/daily-quotidien/210106/dq210106e-cansim-eng.htm; NTIA (2022[6]), Digital Nation Data Explorer, https://www.ntia.gov/data/explorer#sel=internetUser&disp=map (accessed on 20 May 2022); and NIA/Ministry of Science/ICT Korea (2022[4]), 2021 Yearbook of Information Society Statistics (in Korean), https://www.nia.or.kr/site/nia_kor/ex/bbs/View.do?cbIdx=62156&bcIdx=24143&parentSeq=24143.

Wearables

The adoption rate of wearables is highly variable (Figure 2.17), ranging from less than 4% in Korea to 72% in Iceland, although differences in surveys limit comparability. The rate is the highest (about 25% or above) in the Czech Republic, Estonia, Luxembourg, the Nordic countries, the Slovak Republic and Slovenia. The low rate observed in Korea may be due to the type of question raised, which asks about ownership rather than use (see note to Figure 2.17).

Figure 2.17. Use of wearables devices connected to the Internet by individuals in selected OECD countries, 2021 or latest available year

Note: For Canada, the question refers to Internet-connected wearable smart devices and includes examples such as smartwatches, Fitbit or glucose monitoring devices. In the United States, the question refers to a “wearable device that is connected to the Internet, such as a smartwatch or fitness band. Examples include an Apple Watch or Fitbit”. For European countries, Norway and the United Kingdom, wearables refer to a group of Internet-connected devices, including “a smart watch, a fitness band, connected goggles or headsets, safety-trackers, Internet-connected accessories, Internet-connected clothes or shoes”. For Korea, the question refers to ownership of portable ICT devices, one of the items proposed being “Wearable device (watch/band type, children and elderly device, [virtual reality/augmented reality] VR/AR device)”. Individuals aged 3+ in the United States, 6+ in Korea, 15+ in Canada and 16 to 74 in the other countries. Data for the United States refer to 2021. Data for the European countries refer to 2020.

Sources: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022); Statistics Canada (2020[3]), Survey of Digital Technology and Internet Use: Data Tables 2019, https://www150.statcan.gc.ca/n1/daily-quotidien/210106/dq210106e-cansim-eng.htm; NTIA (2022[6]), Digital Nation Data Explorer, https://www.ntia.gov/data/explorer#sel=internetUser&disp=map (accessed on 20 May 2022); and NIA/Ministry of Science/ICT Korea (2022[4]), 2021 Yearbook of Information Society Statistics (in Korean), https://www.nia.or.kr/site/nia_kor/ex/bbs/View.do?cbIdx=62156&bcIdx=24143&parentSeq=24143.

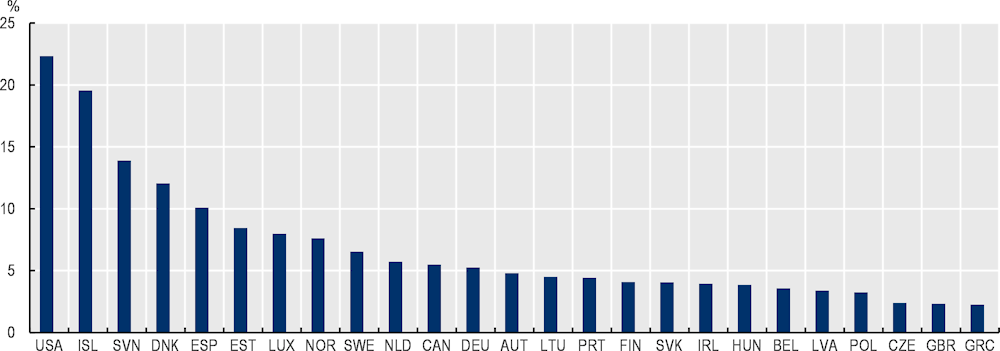

Health-related IoT devices

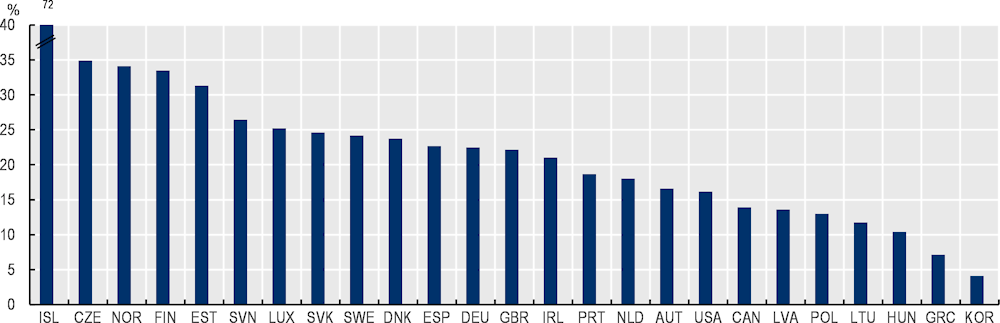

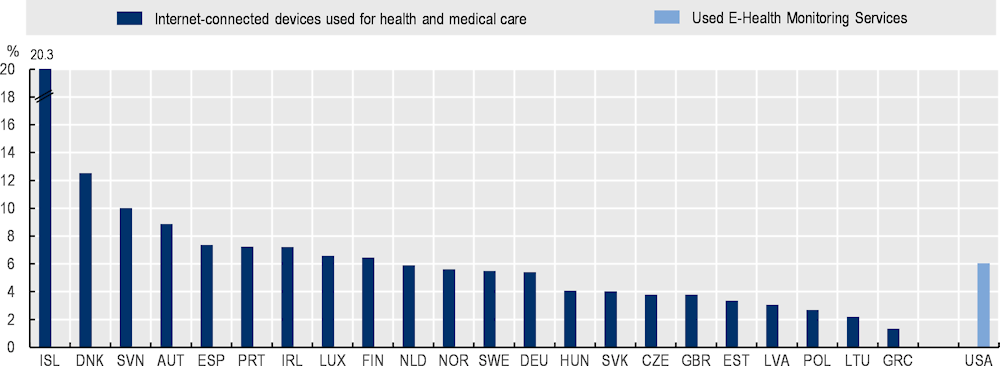

The uptake of health-related IoT devices is still relatively low among individuals. In the European Union, several initiatives have been recently taken to foster the development of an IoT ecosystem closely linked to the healthcare sector.3 The share of Internet-connected devices used for health and medical care by Internet users ranged in 2020 from 1.3% in Greece to 20.3% in Iceland (Figure 2.18). In the United States, 8.7% of Internet-using households used e-health monitoring services in 2021, up from 4.3% in 2017. This share is likely to have been influenced by the growth of telehealth usage during the COVID-19 pandemic.4 In Korea, around 4.1% of the population owned wearable devices in 2020 and close to 60% of those owners used them frequently for managing health (e.g. heart rate and calorie tracking). Nearly 13% of Korean households are using IoT services at home. In Canada, in 2020, 1 individual out of 4 aged 15 and older had tracked fitness or health on line; this share was 35% among those aged 25-34.

Figure 2.18. Uptake of health-related IoT devices or services in selected OECD countries, 2021 or latest available year

Note: Data for the United States relate to 2021 and are expressed as a percentage of Internet-using households. Data for the European countries relate to 2020 and are expressed as a percentage of Internet users aged 16 to 74.

Sources: Based on Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022); NTIA (2022[6]), Digital Nation Data Explorer, https://www.ntia.gov/data/explorer#sel=internetUser&disp=map (accessed on 20 May 2022); ad-hoc tabulation.

Focus on diffusion by countries

Eurostat

IoT devices are currently diffusing more rapidly in the living room than in the kitchen. Looking more closely at each component of those groups reveals the following patterns:5

Virtual assistants are the most used IoT devices within “home automation”, followed by IoT devices for energy management or security/safety purposes. Home appliances are much less diffused (Figure 2.19), possibly due to a lower level of perceived utility or the limited supply of attractive solutions on the market.

Smart TVs are used on average by one individual out of two in European countries, Internet-connected game consoles, home audio systems and smart speakers by one individual out of five (Figure 2.20). The diffusion of each of these devices varies greatly from country to country: they are relatively scarce in Greece but almost universal in Iceland.

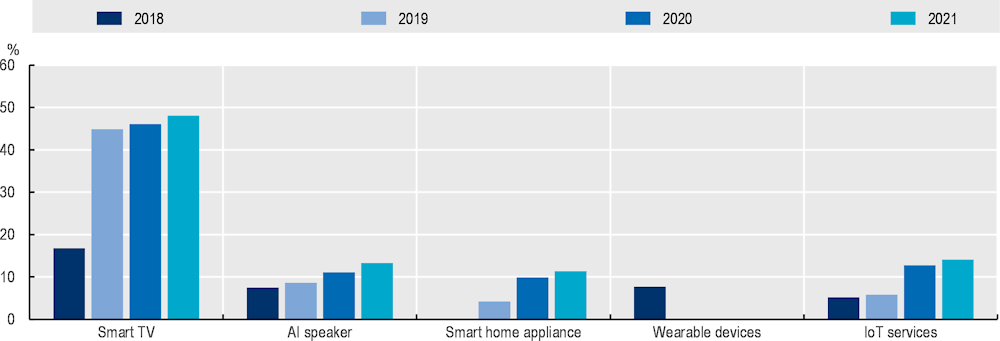

Korea

In Korea, close to one household out of two owns a smart TV, while other IoT goods and services are only at an early stage of diffusion (Figure 2.21). Nevertheless, individuals are increasingly using AI voice recognition services. In 2021, 31% of the individuals (aged 6+) were using an AI voice recognition service, up from 25% in 2019. Around four out of ten individuals aged between 20 and 40 were using such a service, and nearly one out of ten among individuals aged 60 or older.

Figure 2.19. Diffusion of home automation IoT in selected European countries, 2020

Note: Home automation IoT includes the following items: a virtual assistant in the form of a smart speaker or an app; Internet-connected thermostats, utility meters, lights, plug-ins or other Internet-connected solutions for energy management for their home; Internet-connected home alarm system, smoke detectors, security cameras, door locks or other Internet-connected security/safety solutions for the home; and Internet-connected home appliances such as robot vacuums, fridges, ovens, coffee machines. Simple average of the 23 European countries for which data are available, as shown in Figure 2.12.

Source: Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

Figure 2.20. Diffusion of home entertainment IoT in selected European countries, 2020

Note: Use of the Internet on one of the following home entertainment items: an Internet-connected TV, game console, home audio system and smart speakers. Simple average of the 23 European countries for which data are available, as shown in Figure 2.12.

Source: Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

Figure 2.21. Uptake of selected IoT goods and services in Korea

Note: IoT services include the use of remote-control functions for closed-circuit television (CCTV), lighting, gas, cooling and heating, etc., LG IoT@Home, SKT SMART HOME, KT GIGA IoT, etc.

Source: NIA and Ministry of Science and ICT, Survey on the Internet Usage, various years.

United States

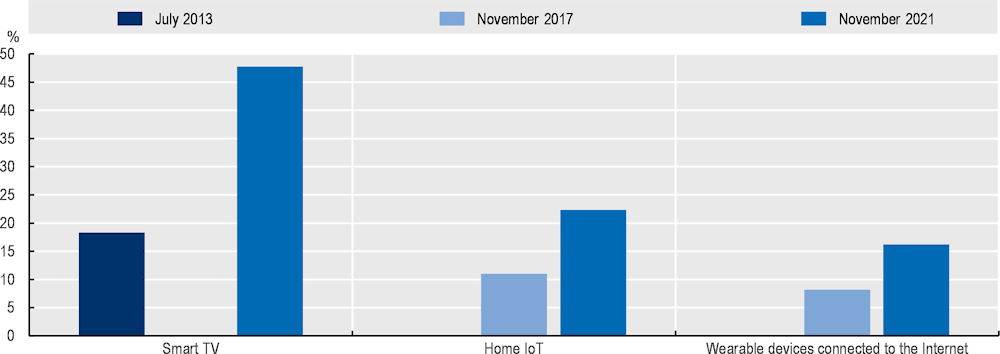

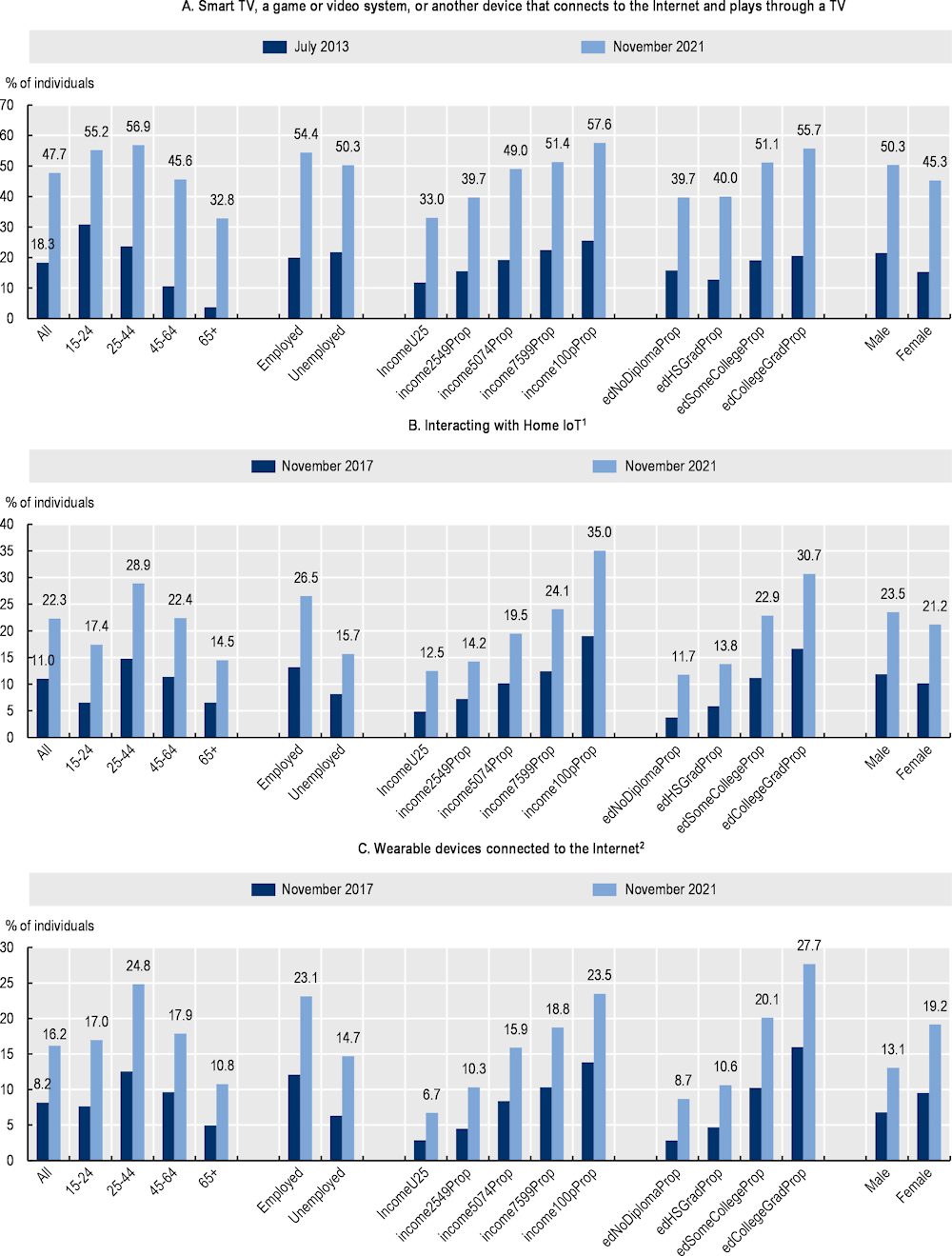

In the United States, as similarly observed in Korea, smart TVs are increasingly used as an Internet entry point: in 2021, 47% of individuals had smart TVs, up from 18.3% in 2013 (Figure 2.22). The share of individuals interacting with home IoT devices (household equipment or appliances connected to the Internet) is also growing significantly, reaching 22.3% of individuals in 2021. Finally, wearable devices were used by 16.2% of individuals in 2021, up from 8.2% in 2017. More detailed data by socio-economic breakdowns show that IoT device usage is generally much more widespread among younger generations, and increases with income and educational attainment level (Annex Figure 2.A.2).

Figure 2.22. Use of selected IoT goods by individuals in the United States

Note: Individuals aged 3+. Smart TVs also includes games or video systems or other devices that connect to the Internet and play through a TV. Home IoT refers to household equipment or appliances that are connected to the Internet, such as connected thermostats, light bulbs or security systems. Wearable devices connected to the Internet refer to devices such as smartwatches or fitness bands (examples include Apple Watch or Fitbit).

Source: Based on data from NTIA (2022[6]), Digital Nation Data Explorer, https://www.ntia.gov/data/explorer#sel=internetUser&disp=map (accessed on 20 May 2022).

Canada

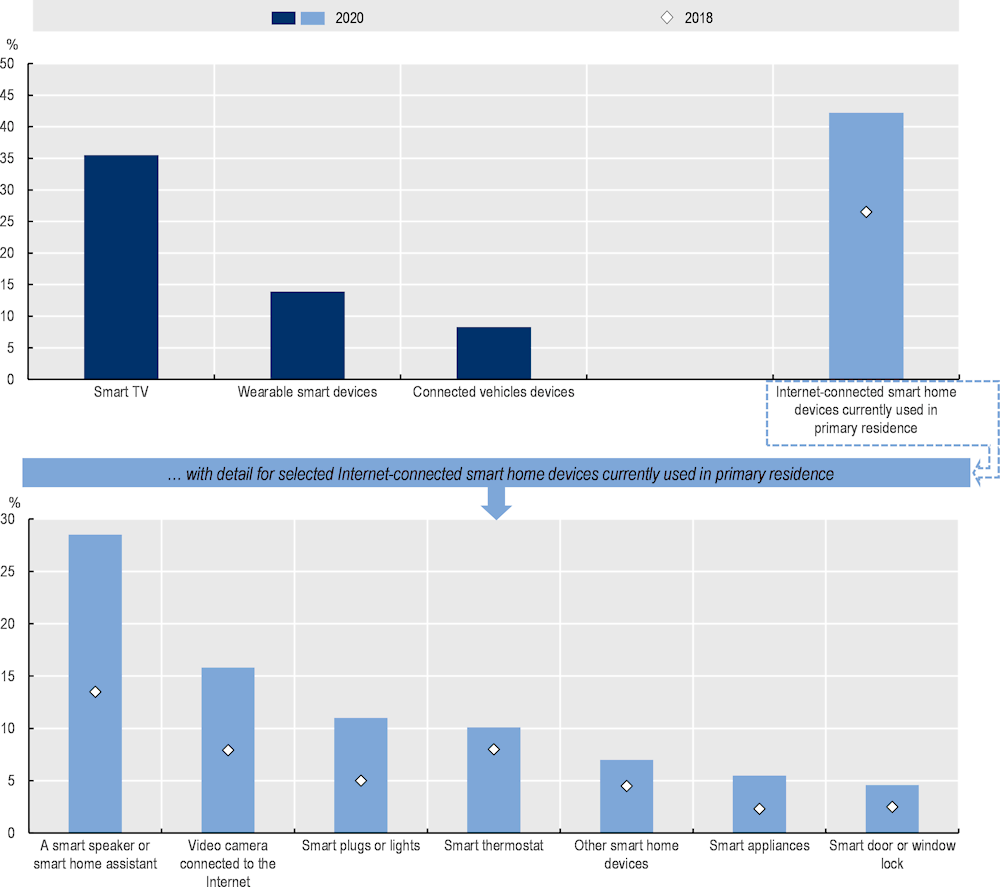

In 2020, the share of Canadians using smart TVs (35%) or wearable smart devices (14%) was similar to the United States (Figure 2.23). In addition, over 42% of individuals were using Internet-connected smart devices in their primary residence, reflecting a significant diffusion of IoT devices in everyday life. Overall, the uptake of Internet-connected smart home devices strongly increased between 2018 and 2020, particularly of smart speakers and video cameras connected to the Internet. On the other hand, the diffusion of home automation devices is an early stage. Several factors may explain the low diffusion of home automation devices (see the section on obstacles to the use of the IoT by individuals below).

Figure 2.23. Use of selected IoT devices in Canada

Source: Based on Statistics Canada, custom tabulation, Canadian Internet Use Survey, 2018 and 2020.

Obstacles to the use of the IoT by individuals

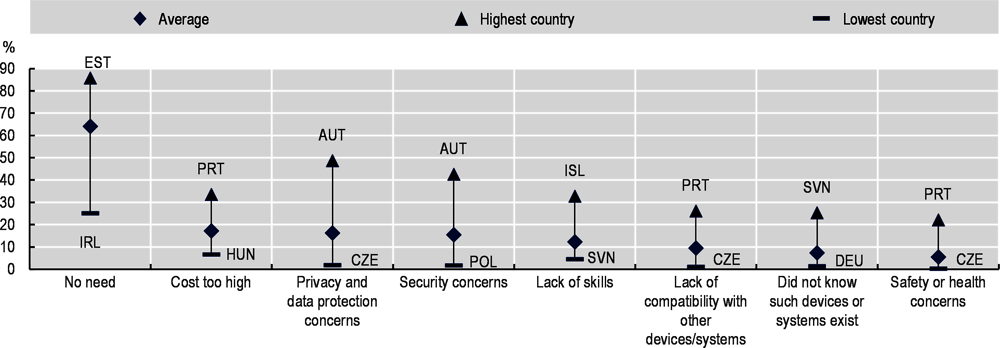

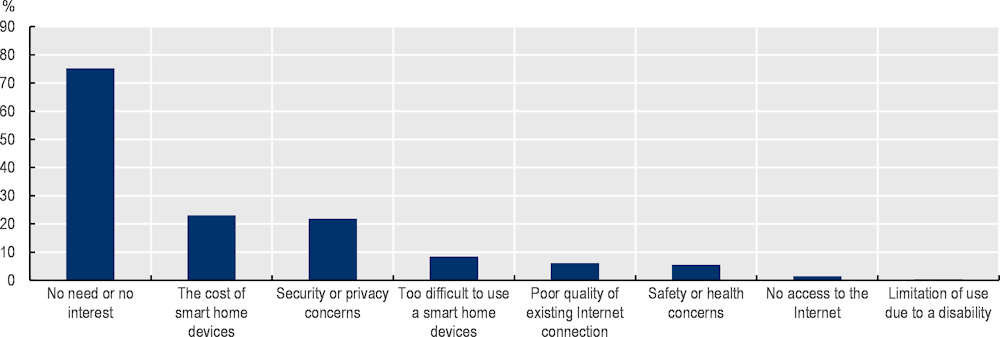

A number of factors prevent individuals from using IoT devices in everyday life: cost of the devices, perceived lack of skills, concerns around data protection, privacy and security, as well as safety and health (Figure 2.24). While all of these factors negatively impact IoT adoption, results from Canada and Eurostat surveys show that the primary reason for not using any of those devices is simply and above all the lack of perceived need: this is the case for nearly two out of three in European countries6 and for three individuals out of four in Canada (Figure 2.25). Cost is the second reason provided for not using IoT devices, followed by privacy and data protection and security concerns. Lack of skills or difficulties in using such devices only come in fourth in Canada and fifth in European countries. Compatibility between different systems is also an issue in Europe. In Canada and European countries, safety and health concerns are put forward only by 5% of IoT non-users. In European countries, only a small share (7%) of individuals did not know that IoT devices exist.

Figure 2.24. Reasons for not using the IoT in selected European countries, 2020

Note: Simple average of the 23 European countries for which data are available, as shown in Figure 2.12.

Source: Eurostat (2022[2]), Comprehensive Database, https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/comprehensive-database (accessed on 1 February 2022).

Figure 2.25. Reasons for not using the IoT in Canada, 2020

Source: Based on Statistics Canada, custom tabulation, Canadian Internet Use Survey, 2020.

Conclusions

Surveys undertaken by national statistical offices have started shedding light on the use of the IoT by firms, households and individuals. Although these surveys share common features, they vary in their definitions and scope, thus limiting cross-country comparability. Therefore, further efforts by the international statistical community are needed to develop common definitions and methodologies in order to monitor the adoption of the IoT.

In addition, further measurement of the IoT should be more clearly oriented towards policy objectives, e.g. promoting the IoT in healthcare or energy-saving IoT applications. As the information and communication technology surveys, from which most IoT statistics are drawn, cannot cover all IoT fields of applications that are relevant for policy, it is important to identify the most suitable survey tools among the existing ones (e.g. health surveys, advanced technology surveys) and develop specialised IoT modules within these surveys.

Annex 2.A. IoT statistics in the ICT usage surveys

Businesses

OECD

The OECD revised its previous – broader – IoT definition and proposed the following “overarching IoT definition”:

“The Internet of Things includes all devices and objects whose state can be altered via the Internet, with or without the active involvement of individuals. While connected objects may require the involvement of devices considered part of the “traditional Internet”, this definition excludes laptops, tablets and smartphones already accounted for in current OECD broadband metrics.” (OECD, 2018[7])

Eurostat (ICT Business Survey)

In the 2020 questionnaire, the module starts with the following definition:

“The IoT refers to interconnected devices or systems, often called “smart” devices or systems. They collect and exchange data and can be monitored or remotely controlled via the Internet. Examples of usage are:

- Smart thermostats, smart lamps or smart meters;

- Radio Frequency Identification (RFID) or Internet Protocol (IP) tags applied or incorporated into a product or an object in order to track them;

- Sensors for tracking the movement or maintenance needs of vehicles monitored over the Internet.” (Eurostat, 2020[8])

In 2021, the following sentence was added before the examples:

“Please exclude plain detection and sensors (e.g. motion, sound, temperature, smoke, etc.) and RFID tags that cannot be monitored or remotely controlled via the internet). Internet of Things may include various types of network connections via WAN, Wi-Fi, LAN, Bluetooth, ZigBee, Virtual Private Networks (VPN), etc.”

Australia (Business Characteristics Survey [BCS], part on Business Use of IT)

The IoT7 refers to the system of interrelated computing devices, mechanical and digital machines, objects, animals or people that are provided with unique identifiers and the ability to transfer data over a network without requiring human-to-human or human-to-computer interaction. Examples of IoT devices include: universal remote controls, smart power plugs, smart light switches, home voice controllers, e.g. Google home voice controller.

Canada (ICT Business Survey)

The IoT refers to the interconnection via the Internet of computing devices embedded in everyday objects, enabling them to send and receive data. Examples include smart televisions, Wi-Fi-enabled security cameras, automatic car tracking adapters, Canary smart security systems, the Cisco Connective Factory, Phillips Hue smart bulbs and August smart locks. Internet-connected smart devices are electronic devices that can connect to each other and the Internet through a network. These devices are designed to automatically send and receive information from the Internet on a constant basis.

Israel (ICT Business Survey)

The IoT refers to the Internet interconnection of computing devices embedded in machines, devices and everyday objects, enabling them to send and receive data and/or affect their operation, with or without human intervention.

Japan (ICT Business Survey)

The IoT8 here means a technology that connects various things (including computers, smartphones, tablets and other information and communications equipment, as well as sensors in general, office equipment, electrical appliances, industrial machines, cars, etc.) with the Internet, LAN and other networks to digitalise their data for collection and accumulation.

Korea (ICT Business Survey)

The IoT is the intellectual technology or service that links various things with the Internet to allow dynamic communication of information between people and things, things and other things, things and systems. This implements the activity of recognition, monitoring, etc., through physical sensing equipment such as radio frequency identification/ubiquitous sensor network (RFID/USN), etc., and the accumulated data would be provided through the wire/wireless communication to be used in various fields. E.g. smart factory that can be remotely controlled, smart building that controls indoor temperature, a heartbeat monitoring device for patients with arrhythmia, etc.

Annex Table 2.A.1. Overview and comparison of IoT definitions in official surveys

|

Network and connection |

Things (type of device) |

Characteristics |

Functions |

Examples |

||

|---|---|---|---|---|---|---|

|

D, S, O or T |

Smart |

|||||

|

OECD (2015) |

Can be altered via the Internet |

D and O |

|

|

||

|

OECD (2018) |

|

|||||

|

Eurostat (2020)1 |

Interconnected |

D or S |

✓ |

|

|

|

|

Eurostat (2021) |

|

|||||

|

Australia2 |

Systems of interrelated /…/ devices /…/ with /…/ the ability to transfer data over a network |

D or S |

|

|

||

|

Canada3 |

Internet interconnection |

Computing devices |

|

|

|

|

|

Internet-connected |

D |

X |

|

|

||

|

Israel4 |

Internet interconnection |

Computing devices |

|

|

||

|

Japan5 |

Connects /…/ with the Internet, LAN and other networks |

T |

|

|

||

|

Korea6 |

Links /…/ with the Internet |

Intellectual technology or service |

|

|

||

Note: Device (D); System (S); Object (O); Technology (T). Based on definitions in surveys. For Korea, the definition stays unchanged for the years 2017 to 2020.

Sources: 1. Eurostat (2020[8]), “ICT usage and e‑commerce in enterprises, Survey year 2020, version 1.3”, https://circabc.europa.eu/faces/jsp/extension/wai/navigation/container.jsp; 2. Australian Bureau of Statistics (2021[1]), Characteristics of Australian Business, https://www.abs.gov.au/statistics/industry/technology-and-innovation/characteristics-australian-business/latest-release#use-of-information-and-communication-technologies-icts-; 3. Statistics Canada (2019[9]), Survey of Digital Technology and Internet Use (SDTIU), https://www23.statcan.gc.ca/imdb/p2SV.pl?Function=getSurvey&Id=1250752; 4. CBS (2020[10]), ICT Usage Survey 2019 in Enterprises, Statistics Netherlands; 5. MIC (2018[11]), Communications Usage Trend Survey Form, https://www.soumu.go.jp/johotsusintokei/tsusin_riyou/data/eng_tsusin_riyou01_2018.pdf; 6. NIA/Ministry of Science/ICT Korea (2019[12]), 2018 Yearbook of Information Society Statistics, https://eng.nia.or.kr/site/nia_eng/ex/bbs/View.do?cbIdx=31975&bcIdx=20512&parentSeq=20512 and NIA/Ministry of Science/ICT Korea (2022[4]), 2021 Yearbook of Information Society Statistics (in Korean), https://www.nia.or.kr/site/nia_kor/ex/bbs/View.do?cbIdx=62156&bcIdx=24143&parentSeq=24143.

Annex Table 2.A.2. IoT-related questions in the ICT Usage Survey questionnaires

|

Australia (2017-18) |

Canada (2019) |

Eurostat (2020) |

Eurostat (2021) |

Israel (2019) |

Japan (2017) |

Japan (2018) (both IoT and AI) |

Korea (2017-20) |

|

|---|---|---|---|---|---|---|---|---|

|

Use of the IoT? (Y/N) |

✓ |

✓ |

✓ |

✓1 |

✓ |

✓2 |

✓ |

|

|

Extent of IoT importance |

✓ |

|||||||

|

Devices |

✓ |

✓ |

✓2 |

|||||

|

1. Smart meters, energy management systems |

✓ |

✓ |

||||||

|

2. Physical security devices |

✓ |

✓ |

||||||

|

3. Image authentication control |

✓ |

.. |

||||||

|

4. Systems or services using GPS, mobile phone or any other localisation function |

✓ |

.. |

||||||

|

5. Computer management with wearable devices |

✓ |

.. |

||||||

|

5. Sensors (temperature, pressure and other sensors) |

.. |

✓ |

||||||

|

6. Healthcare equipment (X-ray or supersonic) |

✓ |

.. |

||||||

|

7. Electronic tags (RFID tags) |

✓ |

✓ |

||||||

|

8. Non-contact IC cards |

✓ |

✓ |

||||||

|

9. Equipment with additional network functions (network cameras, sensors, etc.) |

✓ |

.. |

||||||

|

10. Smart lighting equipment |

✓ |

.. |

||||||

|

11. Industrial robots |

✓ |

✓ |

||||||

|

12. Monitoring cameras |

✓ |

✓ |

||||||

|

13. Cellular modules for automobiles |

✓ |

✓ |

||||||

|

14. Drones |

✓ |

.. |

||||||

|

15. Others |

✓ |

✓ |

||||||

|

a) Smart meters, smart lamps, smart thermostats to optimise energy consumption in enterprise’s premises (warehouses, production sites, distribution sites) |

✓ |

|||||||

|

b) Sensors, RFID or IP tags* or Internet-controlled cameras to improve customer service, monitor customer activities or offer them a personalised shopping experience (targeted and relevant discounts, self-checkout) |

✓ |

|||||||

|

c) Movement or maintenance sensors to track the movement of vehicles or products, to offer CBM of vehicles |

✓ |

|||||||

|

d) Sensors or RFID tags to monitor or automate production processes, to manage logistics, to track the movement of products |

✓ |

|||||||

|

e) Other IoT devices or systems |

✓ |

|||||||

|

The IoT by function |

✓ |

✓ |

||||||

|

a) for energy consumption management (e.g. “smart” meters, “smart” thermostats, “smart” lamps (lights)) |

✓ |

|||||||

|

b) for premises’ security (e.g. “smart” alarm systems, “smart” smoke detectors, “smart” door locks or “smart” security cameras) |

✓ |

|||||||

|

c) for production processes (e.g. sensors or RFID tags, managed via the Internet, used to monitor or automate the process) |

✓ |

|||||||

|

d) for managing logistics (e.g. sensors managed via the Internet for tracking products or vehicles or in warehouse management) |

✓ |

|||||||

|

e) for CBM (e.g. sensors managed via the Internet to monitor maintenance needs of machines or vehicles) |

✓ |

|||||||

|

f) for customer service (e.g. “smart” cameras or sensors managed via the Internet to monitor customer activities or offer them a personalised shopping experience) |

✓ |

|||||||

|

g) for other purposes |

✓ |

|||||||

|

15.2.1. In merchandise and/or services the enterprise produces |

✓ |

|||||||

|

15.2.2. In the production stages (e.g. smart assembly lines, production machinery, etc.) |

✓ |

|||||||

|

15.2.3. In transportation and distribution of merchandise and services (e.g. vehicles with Internet connectivity, GPS devices, etc.) |

✓ |

|||||||

|

15.2.4. For oversight and tracking purposes (e.g. with sensors, surveillance cameras, smart locks, etc.) |

✓ |

|||||||

|

15.2.5. Other |

✓ |

|||||||

|

The IoT by market segment |

✓ |

|||||||

|

1: Small, consumer market Internet-connected smart devices |

✓ |

|||||||

|

2: Industrial equipment with integrated Internet-connected smart devices |

✓ |

|||||||

|

3: Additional digital infrastructure for Internet-connected smart devices |

✓ |

|||||||

|

4: Other |

✓ |

|||||||

|

Reasons/purposes for using the IoT |

✓ |

✓2 |

✓ |

|||||

|

(Usage purpose of collected and accumulated data) |

✓ |

|||||||

|

Improvement of existing business operations |

✓ |

|||||||

|

Development/deployment of new products/services |

✓ |

|||||||

|

1. Improvement of business efficiency/operations |

✓ |

|||||||

|

2. Business continuity |

✓ |

|||||||

|

3. Overall optimisation of business operations |

✓ |

|||||||

|

4. New business projects/management |

✓ |

|||||||

|

5. Improvement of customer services |

✓ |

|||||||

|

6. Others |

✓ |

|||||||

|

1: Lack of an alternative |

✓ |

|||||||

|

2: Cost savings |

✓ |

|||||||

|

3: Productivity gains |

✓ |

|||||||

|

4: Decision making |

✓ |

|||||||

|

5: Cybersecurity |

✓ |

|||||||

|

6: Improvement to the work environment |

✓ |

|||||||

|

7: Other |

✓ |

|||||||

|

✓ |

||||||||

|

1. Cost cutting |

✓ |

|||||||

|

2. Increase efficiency |

✓ |

|||||||

|

3. Increase productivity and information sharing |

✓ |

|||||||

|

4. Reinforcement of information security |

✓ |

|||||||

|

5. Improvement of the work environment |

✓ |

|||||||

|

6. Expansion of new sources of profits and the creation of product (service) |

✓ |

|||||||

|

7. Other |

✓ |

|||||||

|

Reasons for NOT using the IoT |

✓ |

✓ |

✓2 |

2017-19 |

||||

|

1: Lack of knowledge of available technologies |

✓ |

|||||||

|

2: No business needs identified |

✓ |

|||||||

|

3: Cost of service or equipment |

✓ |

|||||||

|

4: Employees lack the skills, training or experience |

✓ |

|||||||

|

5: Security or privacy concerns |

✓ |

|||||||

|

6: Incompatibility with existing equipment or software |

✓ |

|||||||

|

7: Other |

✓ |

|||||||

|

1. Insufficient communication infrastructure for the IoT introduction |

✓ |

✓ |

||||||

|

2. We do not know laws, regulations or rules for using or introducing the IoT |

✓ |

✓ |

||||||

|

3. Business models after the IoT introduction are unclear |

✓ |

✓ |

||||||

|

4. IoT introduction and operation costs |

✓ |

✓ |

||||||

|

5. No human resources available for using the IoT |

✓ |

✓ |

||||||

|

6. We do not know what the IoT is |

✓ |

|||||||

|

6. Systems or services to introduce are not decided |

.. |

✓ |

||||||

|

1) Burden of economic expenses |

✓ |

|||||||

|

2) Consideration of security |

✓ |

|||||||

|

3) Complexity of service (technology) |

✓ |

|||||||

|

4) Lack of capability of operation personnel |

✓ |

|||||||

|

5) Insufficient compatibility |

✓ |

|||||||

|

6) Insufficient basic equipment |

✓ |

|||||||

|

7) Immature IoT market |

✓ |

|||||||

|

8) Miscellaneous (please specify): |

✓ |

|||||||

|

Perceived level of efficiency/effectiveness of the IoT systems in the business |

✓2 |

2017-18 |

||||||

|

Q8 (4) Have systems or services chosen (1) been effective for attaining the purposes of their introduction? |

✓ |

|||||||

|

1. Very effective |

✓ |

|||||||

|

2. Somewhat effective |

✓ |

|||||||

|

3. Unchanged |

✓ |

|||||||

|

4. Negative effect |

✓ |

|||||||

|

5. No idea about any effect |

✓ |

|||||||

|

How would you score the level of effectiveness through the usage of IoT devices and services in your company? |

✓ |

|||||||

|

(absolutely no effect/no effect/normal/some effects/very effective) |

||||||||

|

Cost cutting |

✓ |

|||||||

|

Increase of efficiency |

✓ |

|||||||

|

Increase in productivity and information sharing |

✓ |

|||||||

|

Reinforcement of information security |

✓ |

|||||||

|

Improvement of the work environment |

✓ |

|||||||

|

Expansion of new sources of profits and the creation of products (services) |

✓ |

|||||||

|

Other |

✓ |

1. Restricted to the following area: “for the products (goods or services), production of products and/or transportation of products”.

2. AI and the IoT are considered together and not separately.

.. : Data not available.

Source: Compiled from Eurostat and national sources.

Annex Figure 2.A.1. Influence of the use of the IoT on performing big data analytics in selected countries, 2021

Notes: For Canada, data relate to 2019 and for Israel, to 2020. For Australia, data relate to the 2019-2020 fiscal year.

1. Measured as the difference, in percentage points, between firms using the IoT and performing BDA, and firms not using the IoT and performing BDA.

Source: Based on ad-hoc tabulations provided by Statistics Austria, Statistics Canada, Israel Central Bureau of Statistics and Eurostat (2022).

Annex Table 2.A.3. Reasons for using the IoT devices in Canada, by firm size and industry, 2019

As percentage of firms using the IoT

|

NAICS |

Cost savings |

Productivity gains |

Decision making |

Cybersecurity |

Improvement to work environment |

|

|---|---|---|---|---|---|---|

|

All businesses |

||||||

|

Private sector |

24.2 |

36.6 |

15.4 |

19.7 |

49.3 |

|

|

Mining, quarrying, and oil and gas extraction |

21 |

44.0 |

46.9 |

36.7 |

12.9 |

48.2 |

|

Utilities |

22 |

29.7 |

44.5 |

35.4 |

20.8 |

45.1 |

|

Construction |

23 |

33.3 |

51.0 |

23.5 |

21.8 |

61.5 |

|

Manufacturing |

31-33 |

30.3 |

48.0 |

21.5 |

14.1 |

55.6 |

|

Wholesale trade |

41 |

26.9 |

43.8 |

24.6 |

13.6 |

46.9 |

|

Retail trade |

44-45 |

26.7 |

31.8 |

11.0 |

12.1 |

51.7 |

|

Transportation and warehousing |

48-49 |

23.1 |

40.3 |

28.2 |

8.6 |

34.1 |

|

Information and cultural industries |

51 |

32.4 |

55.0 |

21.3 |

31.4 |

59.6 |

|

Finance and insurance |

52 |

19.1 |

55.0 |

17.7 |

31.3 |

58.7 |

|

Real estate and rental and leasing |

53 |

15.6 |

27 3 |

17.2 |

8.8 |

46.3 |

|

Professional, scientific and technical services |

54 |

23.9 |

48.6 |

15.7 |

23.1 |

58.0 |

|

Management of companies and enterprises |

55 |

28.5 |

63.2 |

37.4 |

11.2 |

42.2 |

|

Administrative and support waste management and remediation services |

56 |

35.3 |

45.4 |

16.3 |

17.6 |

73.4 |

|

Educational services |

61 |

31.5 |

33.7 |

1.1 |

5.2 |

67.7 |

|

Health care and social assistance |