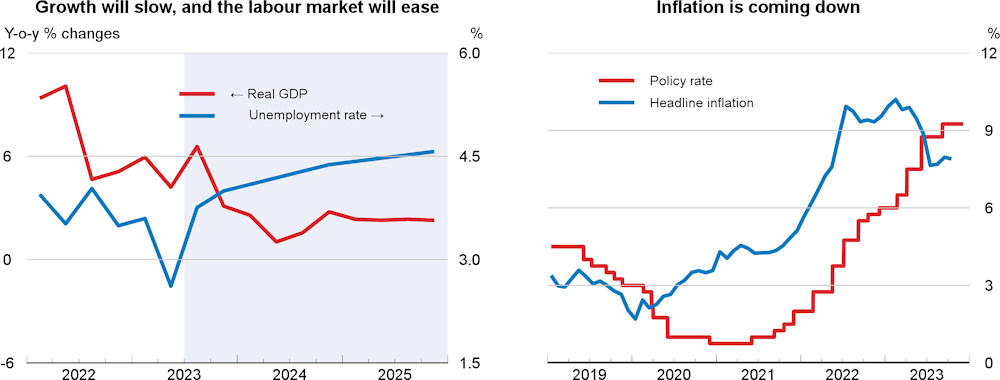

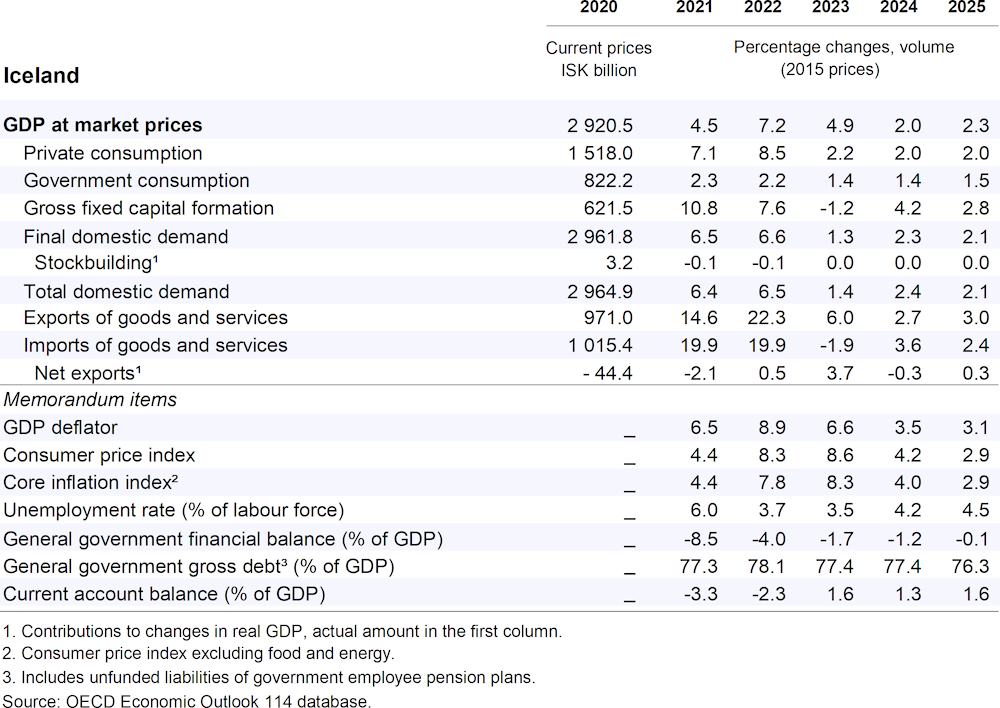

Economic growth will drop to 2.0% in 2024 and edge up to 2.3% in 2025. Private consumption will ease as real wage growth is modest. Business investment will moderate as financial conditions continue to deteriorate and confidence remains lacklustre. Despite tighter financial conditions, housing investment will pick up to satisfy pent-up demand. Public investment will decline in 2024 and remain subdued in 2025. Goods exports and foreign tourism will slow. The unemployment rate will rise gradually to around 4.5%.

In August, the central bank lifted the key policy rate to 9.25%. Consumer price inflation is declining but still at around 8%. It is expected to fall further but remain above target until well into 2025. Fiscal policy is already contractionary and is projected to be tightened further, as planned by the government, to help reduce inflationary pressures and maintain fiscal space. A new tourism strategy should help increase productivity of the tourism sector and reduce pressure on infrastructure and the environment.