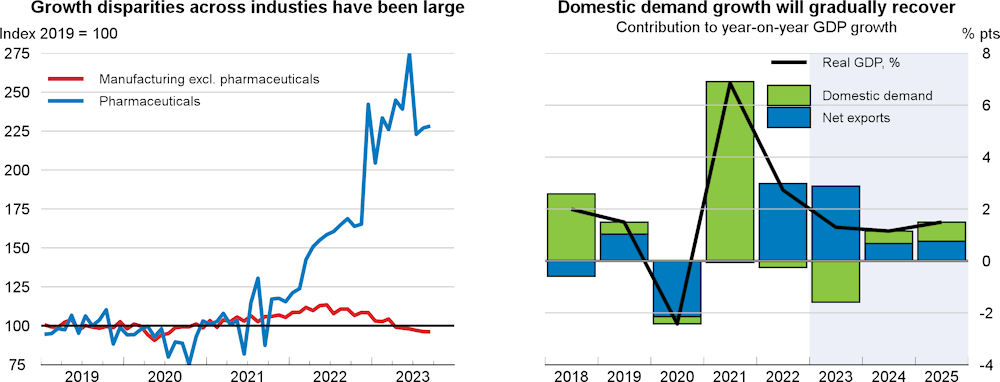

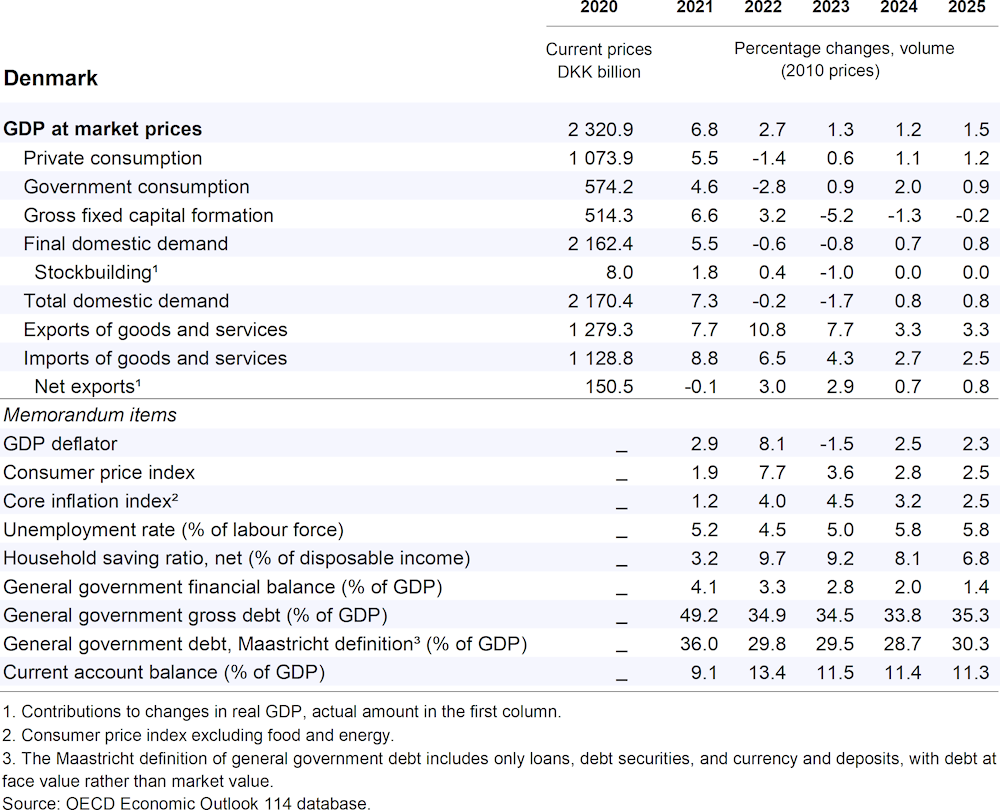

GDP growth is projected to slow to 1.2% in 2024 before recovering to 1.5% in 2025. After a large surge since mid-2022, the growth of the pharmaceutical sector is expected to moderate and exports will lose momentum despite improving foreign demand. Tight financial conditions and weak economic prospects will keep investment low. Nominal wage growth will strengthen, supporting consumption and keeping core inflation above 2% into 2025. Unemployment will increase as firms adjust to higher labour costs and weaker demand. Key risks include a more severe correction in housing and real estate markets and the inflationary impact of labour market developments.

The central bank is expected to keep the interest rate high in line with the euro area to maintain the currency peg. Fiscal policy is projected to be broadly neutral in 2024 and 2025. If inflationary pressures persist relative to the euro area, the government should restrain public spending, for instance on public employment services and business support, while maintaining planned investment in priority areas, notably health, education, and energy infrastructure.