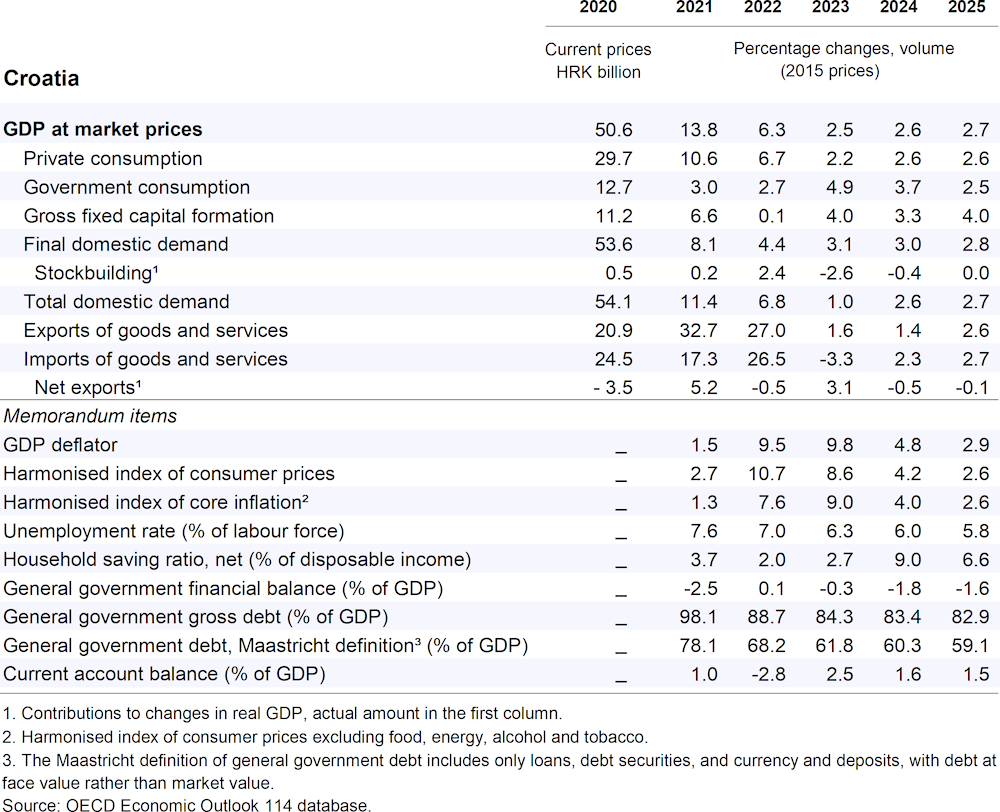

Output growth is expected to remain broadly resilient, picking up slightly from 2.5% in 2023 to 2.6% in 2024 and 2.7% in 2025. Rising public sector investment and resilient private consumption are projected to support demand, offsetting subdued exports. Inflation, which remains high, will decline gradually as labour inputs and excess capacity will remain relatively scarce.

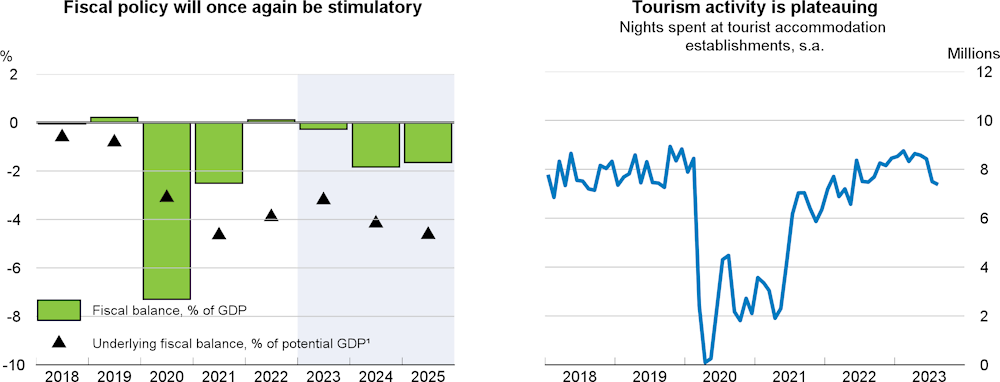

Tighter euro area monetary policy is tempering lending growth and raising interest rates. A small government budget deficit is expected in 2023 but plans for tax cuts and higher spending on investment, wages and pensions are expected to contribute to a wider deficit in 2024. Rising revenues are projected to enable a modest improvement in the budget balance in 2025. Public debt is expected to fall below 60% of GDP by 2025. Ending poorly-targeted price caps and energy and home loan subsidies would help growth to remain sustainable, improve the economy’s efficiency and build fiscal buffers for future shocks.