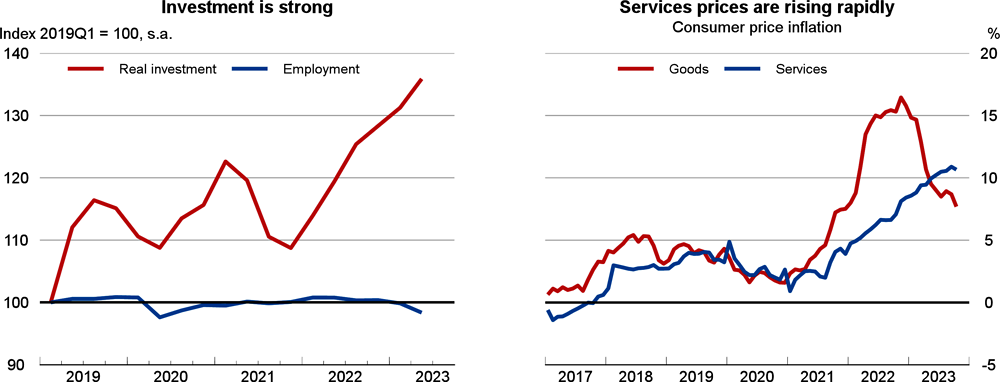

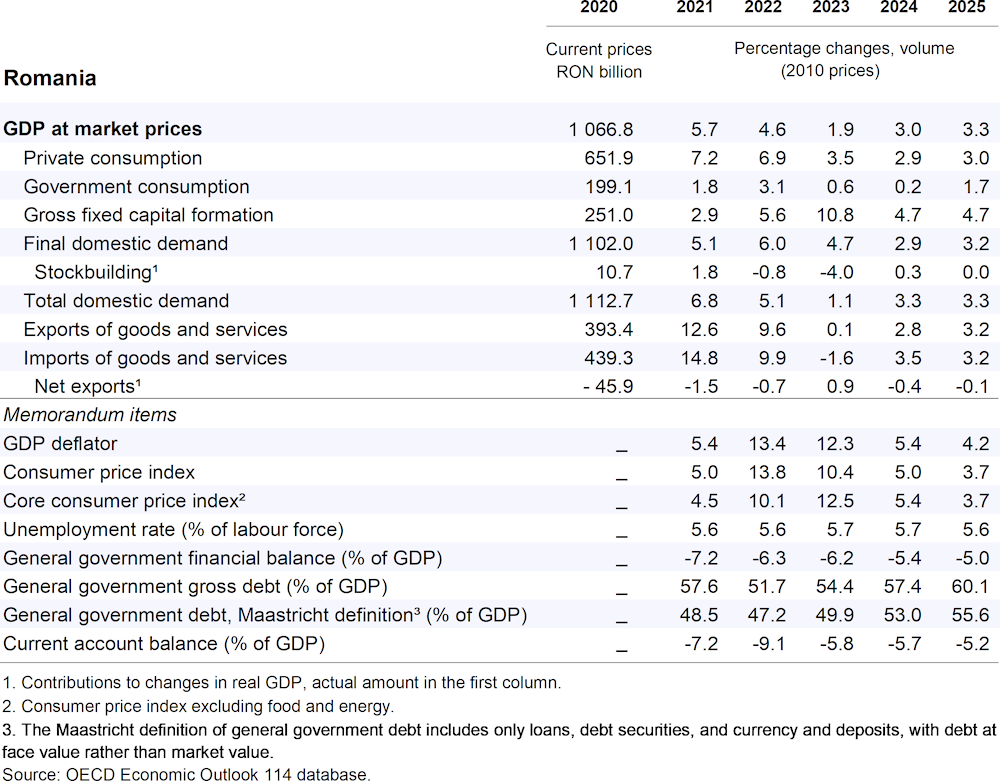

Real GDP growth will decline to 1.9% in 2023, remain below potential at 3% in 2024, and pick up to 3.3% in 2025. High borrowing costs and slower income growth will weigh on private spending. Reduced job creation will see unemployment remain above pre-pandemic rates. Major infrastructure spending will support activity while exports recover due to better international conditions. With spare capacity in the economy, inflation will fall to 3.5% by the end of 2025, the top of the target band. Sustained cost pressure could, however, cause core inflation to stay higher for longer.

Monetary policy must remain tight in 2024 to cool demand and tame high inflation. Higher taxes and spending restraint will reduce the fiscal deficit. However, revenue shortfalls will remain large, requiring comprehensive tax reform to stabilise public debt. To improve the business environment, efforts to strengthen institutions must be matched by policy stability. Carbon pricing can complement building retrofits to reduce emissions while limiting distortions to activity.