This chapter provides an overview of investment promotion agencies (IPAs) in SADC Member States and on their main priorities and efforts to attract sustainable investment. It also draws on the experience of other regions to provide lessons on better targeting FDI to support sustainable development and sharpening the indicators used for this purpose.

Sustainable Investment Policy Perspectives in the Southern African Development Community

3. Promoting sustainable investment

Abstract

Governments prepare investment promotion strategies to support the achievement of national development objectives through the promotion and facilitation of foreign direct investment (FDI). As these strategies are designed to influence the kind of investments that are attracted, governments focus on certain types of investments over others by selecting priority sectors, countries and investors (OECD, 2018[1]). This prioritisation takes place because some types of FDI, with certain characteristics, are considered to make more of a contribution to a host country’s development than other types (Sauvant and Mann, 2017[2]). In particular, the issues of sustainability, inclusiveness and the contribution to the sustainable development goals (SDGs) have become increasingly important and have led some agencies to redefine their priorities. This chapter provides an overview of investment promotion agencies (IPAs) in SADC Member States and on their main priorities and efforts to attract sustainable investment. It also draws on the experience of other regions to provide lessons on better targeting FDI to support sustainable development and sharpening the indicators used for this purpose.

Promoting and facilitating investment in SADC

The role of national investment promotion agencies

IPAs are the key point of contact between the government and investors, providing tailored services that aim at ensuring a simplified, clear and engaging experience for private sector stakeholders to do business within the country. IPAs also implement national investment promotion strategies by attracting firms in priority sectors with potential for growth and spillovers (OECD, 2018[1]). In the SADC region, all Member States have well-established IPAs, dating back to the Lesotho National Development Corporation founded in 1967 (later reformed to consolidate investment promotion and facilitation functions in 1990 and 2000) until the establishment of the Zimbabwe Investment Development Corporation in 2020. Half of SADC Member States’ IPAs were originally established as individual agencies while the other half were born from mergers of several bodies responsible for investment, trade and commerce to create dedicated authorities on tailored investment promotion, facilitation and retention services.

Experienced and inclusive governance of IPAs, typically exerted by a Board of Directors, can help ensure transparency, accountability and efficiency in carrying out their mandates (OECD, 2021[3]). Despite differences in institutional arrangements, all SADC IPAs comprise of Boards with the objective to oversee and approve the activities of the agency. The composition of directors, as mandated by their respective legislations, requires the inclusion of both private and public sector representatives in the Democratic Republic of the Congo (DRC), Eswatini, Lesotho, Madagascar, Mauritius, Namibia, Seychelles, Tanzania, Zambia, and Zimbabwe. Including private sector actors ensures that the interests of businesses are considered which can play a role in streamlining administrative processes and procedures. However, the inclusion of other institutions such as research, academia and civil society actors is not mandatory for all countries, with the exception of Zambia which requires the inclusion of sector-specific representatives and civil society organisations. Most others have positions that may be filled based on specified qualifications concerning characteristics such as ownership stake and corporate management experience at the discretion of the chairman or director. Some IPAs include additional supervisory roles in addition to the Board of Directors to oversee specific functions more extensively, such as audit or technical committees that focus on financial and accounting issues.

Investment generation efforts are at the centre of IPAs’ role in attracting investors and using FDI to advance national economic and strategic goals. Operating regional and foreign branches can help spread awareness about location-specific advantages and instil greater investor confidence. International branches have the added benefit of proximity to potential investor targets and can execute proactive approaches to engage with local companies (Knoerich and Vitting, 2021[4]). Branch offices remain uncommon for IPAs in SADC, with only a handful of countries, including Botswana, Comoros, Malawi, South Africa and Tanzania are holding regional offices. Botswana also operates foreign branches in India, the United Kingdom and South Africa, while Mauritius operates eight units that manage investment promotion efforts in France, South Africa, India, Japan, Kenya, Singapore, China and the United Arab Emirates (UAE), the only countries in the region to manage international offices outside of embassy and consular functions.

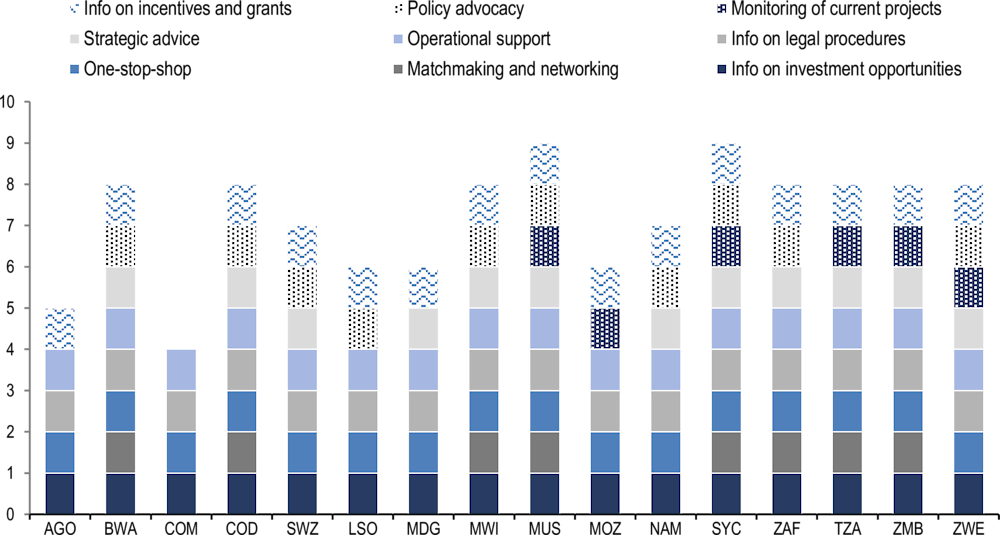

All SADC IPAs operate one‑stop shops that facilitate the incorporation of businesses, helping them navigate sometimes cumbersome and complex regulatory systems. In addition to clerical assistance for obtaining permits, business licenses, tax and other business procedures to start or expand operations, the IPAs’ one‑stop-shops provide information on the legal framework for investment, investment opportunities, incentives and grants. Twelve of the region’s 16 agencies also provide investors with adapted strategic advice while ten agencies advocate for investor needs with policy makers (Figure 3.1). Less common are business to business matchmaking events and forums that promote partnerships and local linkages for value chain integration offered by eight agencies, and monitoring of ongoing investment projects offered by only six countries.

Figure 3.1. Main services provided by SADC IPAs

Source: OECD compilation based on IPAs’ websites [accessed in March 2023].

Digitalisation of IPA services

While some IPAs continue to carry out services physically through in-person offices, many amenities provided by SADC IPAs have been digitalised through online one‑stop-shop services for administrative registrations and procedures. While the mobility restrictions caused by the COVID‑19 pandemic prompted IPAs to change their priority actions and ways of working (OECD, 2020[5]), several SADC IPAs further expanded their e‑services much like the IPAs of OECD countries. The IPAs of Mauritius, Botswana and Zambia moved substantial parts of their investment promotion activities online, participating in virtual trade exhibitions and seminars to facilitate engagement between investors and businesses while promoting local manufacturers in place of traditional business forums and business to business meetings. During 2020, the Zambian Development Agency implemented a total of 14 virtual inward and outward investment-oriented missions with international partners as well as 4 virtual local business to business forums while continuing to conduct 130 industrial visits throughout the year. IPAs with offices abroad remained active through participation in online conferences, dissemination of promotional material and virtual outreach meetings with potential investors. The international offices of Mauritius’ Economic Development Board (EDB) organised and took part in several webinars with foreign partners in Africa and Asia to support the ratification of free trade agreements while the international offices of Botswana’s BITC used various digital platforms to conduct virtual outward missions with potential investors from South Africa, Poland, Germany and India.

Although the use of digital one‑stop-shops and online business services promotes wider coverage and simplified administrative procedures, it also raises additional issues connected to the condition of the overall digital ecosystem and access to such services for less electronically linked communities. One‑stop-shop services also depend on the reliability of systems related to data submission, data exchange, electronic signature systems, information sharing, and potential delegation of responsibility.

Promoting investment at the regional level

SADC Member States have sought to integrate investment policies to better serve regional development efforts since 2006 through the adoption of the SADC Protocol on Finance and Investment.1 The Protocol emphasises the importance of regional co‑operation in the area of investment promotion and facilitation to ensure economic and social development of the region as a whole (SADC, 2006[6]). It specifically encourages Member States’ IPAs to:

carry out their national investment promotion activities in line with regional development priorities;

advise and include neighbouring governments, the private sector and other stakeholders in the formulation and review of policies and procedures that affect investment and trade; and

increase awareness of national investment incentives, opportunities, legislation, practices, major events affecting investments and other relevant activities with regional peers through regular exchange of information.

Priority sectors and sustainability in SADC

SADC prioritise the promotion of key sectors for investment based on factors such as the profitability of projects in certain industries, socio‑economic growth models and alignment with national development plans. The agriculture and tourism and hospitality sectors are the most frequently promoted sectors, prioritised by every IPA in the region, followed by energy, manufacturing and technology and communication services (Table 3.1). While the objectives of promoting tourism are diverse, the prioritisation of the agriculture industry in SADC is exclusively aimed at ensuring food security and increasing the self-sufficiency of food production, including the development of relevant infrastructure and facilities. While the IPAs from Mauritius and South Africa promote the largest array of sectors on their websites or within their strategies, those from Mozambique and Zambia are the most selective agencies.

Table 3.1. Main sectors promoted by SADC IPAs

|

AGO |

BWA |

COM |

COD |

SWZ |

LSO |

MDG |

MWI |

MUS |

MOZ* |

NAM |

SYC |

ZAF |

TZA |

ZMB |

ZWE |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Agriculture / forestry |

||||||||||||||||

|

Construction / infrastructure |

||||||||||||||||

|

Education |

||||||||||||||||

|

Energy |

||||||||||||||||

|

Incl. renewable energy |

||||||||||||||||

|

Finance / insurance |

||||||||||||||||

|

Fishing / Blue economy |

||||||||||||||||

|

Health |

||||||||||||||||

|

Manufacturing |

||||||||||||||||

|

Mining |

||||||||||||||||

|

Technology / Communication |

||||||||||||||||

|

Tourism / hospitality |

||||||||||||||||

|

Transportation / logistics |

Note: Information on Mozambique may not be up-to-date due to website inaccessibility.

Source: OECD compilation based on IPAs’ websites.

Capitalising on renewable energy opportunities

SADC agencies are moving focus towards investment in sustainable development, with almost two‑thirds of their IPAs promoting specific opportunities for renewable energy projects either in their investment promotion or national development strategies, or directly on their IPA websites. Some agencies have achieved a further level of drawing attention to sustainable investment opportunities in their countries. Tanzania recently launched the SDG Investments Tanzania Platform that provides specific data and insights on indicative returns, investment and market timeframes, range of required investment amounts and regional prospects for SDG-aligned investment opportunities. Some countries have also moved towards promoting investment in niche clean energy sectors. Namibia’s IPA is focusing efforts on maximising investment in projects concerning green hydrogen and green ammonia production to pursue its long-term goal of climate neutrality under the Harambee Prosperity Plan II (2021 – 2025), going as far as the establishment of an additional Inter-Ministerial Green Hydrogen Council in 2021.

IPAs can also assist investors by streamlining the information and regulatory process for environmentally and socially sustainable projects. For example, the IPAs of Lesotho, Madagascar, Namibia, Tanzania and Zambia provide feasibility studies for potential sites of activity based not only on financing considerations, but also on variables such as adequate existing natural resources and rural settlement patterns. Madagascar’s IPA has streamlined and simplified its authorisation and concession schemes for renewable energy investments and reformulated its planning and pricing principles related to these projects in line with the green objectives of the New Energy Policy (2015) and New Electricity Code (2017).

In an effort to avoid, minimise and mitigate any negative ecological outcomes of large‑scale projects, the majority of SADC regulatory frameworks also require the submission of environmental impact assessment (see chapter on Green Investment), the process of which can be supported by IPAs. As part of its promotion and facilitation services, the Lesotho National Development Corporation assists new investors in the preparation of project briefs necessary for environment impact assessments. Co‑ordination of IPAs with other key ministries that handle sustainability-related sectors is also crucial in providing a coherent approach to ensuring investors meet sound environmental standards. Mozambique’s AIPEX is responsible for smooth co‑ordination with the Ministry of Environment to swiftly enable the issuance of environmental licenses to those projects that do not violate maximum effluent emission limits.

IPAs can also connect sustainability priorities when it comes to renewable initiatives, promoting integration of domestic value chains and upskilling opportunities for domestic labour forces. Invest South Africa (InvestSA) leverages FDI in renewable power generation to promote domestic manufacturing of equipment used for renewable energy projects. It does this by initiating effective consultations with other government agencies to develop an understanding of the potential for localisation through inter-institutional feasibility studies and continuous collaboration with relevant ministries on technical matters, leaving the IPA with reliable information to demonstrate the benefits and practicality of localisation to potential investors. IPAs can also help upskill the country’s labour force to incentivise foreign investors to employ domestic workers with specific knowledge or training needed for the relevant industries. Zambia’s ZDA offers several training programmes for entrepreneurs looking to open or expand businesses in the country, as well as agriculture business trainings and corporate governance trainings. IPAs can also encourage the upskilling of the domestic labour force by foreign investors through incentives, as is the case in Botswana whereby education and training grants are provided for investors to invest in the domestic workforce.

Promoting the preservation of the region’s environment

Given the significant economic contribution of the ocean sectors and the impact climate change has on island nations, the IPAs of Comoros, Mauritius and the Seychelles have geared a large part of their environmental efforts to marine and blue economy. These represent various opportunities for investment, in addition to renewable energy solutions, in sectors such as fishing, coastal tourism, aquaculture, maritime services and waste management. The three agencies play an essential role in promoting the ocean economy, managing dedicated webpages that provide resources on and promote concrete blue investment opportunities. The EDB of Mauritius has a dedicated team responsible for well-established as well as emerging maritime activities to ensure sustainable use of ocean resources. The Seychelles Investment Board works closely with the Department of Blue economy to ensure that all investment and business activities within the ocean territories, including sustainable fisheries, eco-tourism, port development and renewable energy, are in line with the sustainable use of marine sources outlined in the Seychelles Marine Spatial Plan and the Blue Economy Strategic Framework and Roadmap (2018‑30).

SADC puts a strong emphasis on investment promotion in the agriculture sector at a regional level, stressing the importance of promoting sustainable management of the environment and natural resources and highlighting opportunities at both the national and regional level for agricultural and non-agricultural value chain development. The SADC Secretariat works with national IPAs to encourage private sector and international investment in agricultural value chains by providing essential information and showcasing Member States’ opportunities. At the national level, all IPAs promote the agricultural sector as a strategic priority for investment, showcasing specific opportunities that bring innovation, sustainability and growth in agribusiness. Lesotho’s IPA, in co‑operation with the Lesotho Diaspora Investment Group, launched a fresh produce trading platform for local farmers to enable greater access to markets and finance, allowing them to transition for subsistence to commercial farming. In addition to sectors with high potential for industrial development, InvestDRC actively promotes agricultural sectors of socio‑economic importance for grassroots communities while Madagascar’s EDBM is promoting opportunities to better the quality of several growing produce sectors and reduce harmful horticultural practices, particularly for palm oil extraction.

A focus on entering novel agricultural markets is also emerging in the region, as several IPAs begin to launch the promotion of agriculture opportunities in cannabis production. Hemp is an eco-friendly plant that uses a fraction of the water needed to grow cotton, absorbs more carbon dioxide per hectare than other crops and most trees, and can be used for numerous renewable products including food products, paper, biofuels, textiles and even building materials. The crop also has significant potential as a sustainable source for natural health industries as every part of the plant can be used for various medical, industrial and nutritional uses (UNCTAD, 2022[7]). Malawi, South Africa and Zimbabwe have been active in legalising and promoting large‑scale farming of cannabis plants for medicinal use. Malawi passed the Cannabis Regulation Act in 2020, legalising the cultivation and processing of medicinal cannabis and industrial hemp, and subsequently inaugurated the Cannabis Regulatory Authority which co‑ordinates closely with the MITC on licensing and one‑stop-shop registration services. The MITC is actively promoting the sector, focusing on the opportunity the industry presents to open numerous domestic value chains and employment opportunities due to the wide variety of products can be produced from industrial and medicinal cannabis such as sustainable foods, textiles, paper, building materials, biofuels, plastic composites, pharmaceutical products. Zimbabwe’s ZIDA facilitates investments into medicinal cannabis cultivation, processing and value addition, which are considered special investments under the Investment Stability Agreement, allowing them to benefit from an array of monetary and fiscal incentives. ZIDA not only plays a co‑ordination role between the ministries of health, security, finance and agriculture to ensure smooth licensing and registration procedures through its one‑stop-shop, but also raises industry awareness, promotes smaller out-growers and encourages localisation of investment value chains in the cannabis sector.

Forestry services are being further promoted by IPAs in SADC to not only manage and meet the needs of forest resources, but to rebuild environments already damaged by harmful practices in the industry. The IPA of the DRC promotes specific investment opportunities to restore lost forests and combat climate change, with ambitious project goals such as planting approximately 3 million hectares of forest by 2025 under afforestation and reforestation programmes. Malawi’s MITC is promoting projects for forest management, replanting Pine and Eucalyptus Trees for controlled and sustainable wood processing with the aim of developing a workforce with forest management skills while contributing to the country’s zero-carbon target and climate change mitigation goals. InvestSA offers several opportunities for sustainable investment in forestry including re‑afforestation and new afforestation, bio-refinery and transformative technologies and R&D for packaging design and development. It also focuses on supporting skills development in agriculture and forestry sectors through partnerships with national universities, research institutions and the Department of Environment, Forestry and Fisheries.

IPA commitment to social initiatives and inclusive projects

Botswana’ BITC identifies opportunities and initiatives that address issues such as gender-based violence, Inspiring the Girl Child and renovating the Monarch Destitute Centre in Francistown through its corporate social responsibility programme. Mauritius’ EDB provides training to women-led businesses, coaching those owning or considering opening businesses in marketing strategies through international trade fairs as well as market-related soft skills trainings in communication and buyer negotiation. Madagascar promotes opportunities in sustainable sectors that typically employ women, for example, in the fashion business like raffia where women-run businesses and production facilities corner a majority of the world’s market.

InvestSA is refocusing the strategic orientation of part of its aftercare services to include supporting multinational enterprises in facilitating the participation of disadvantaged populations based on race, gender, disability and rural communities while prioritising re‑investments with strong possibilities for sustainable impact. The agency has been active in facilitating partnerships between foreign enterprises and local marginalised communities. InvestSA has also begun to integrate gender-related indicators into their client relations management systems to be able to include them when evaluating investment leads. Zambia’s ZDA monitoring and evaluation impact assessments of enterprises assess their developmental impact and contribution to corporate social responsibility. Similarly to InvestSA and ZDA, SADC IPAs would be well inspired to use their aftercare services to better promote responsible business conduct amongst the existing business community and encourage investors to comply with sustainability-related laws more systematically, as well as to embrace responsible practices in their business operations (see chapter on Responsible Business Conduct).

Promoting sustainable investment: experience from other regions

How IPAs can use FDI to support the SDGs

When governments design investment promotion strategies, they prioritise certain sectors, countries or investors, either because they have a higher probability of being realised or because they may bring certain benefits to the host economy (OECD, 2018[1]). Prioritisation strategies can be motivated by a series of different factors, depending mostly on the country’s national development objectives, local assets and international context. These strategies allow countries to specialise and target their FDI attraction efforts towards specific government priorities.

As SADC IPAs recognise their role in attracting and boosting investment in support of the SDGs, benchmarking their efforts against those from other regions can allow them to make their investment promotion strategies more effective and to better prioritise investors that are more likely to generate sustainable development impacts. Findings from the OECD survey on IPA Monitoring & Evaluation and Prioritisation, covering member countries from the OECD and the Association of Southeast Asian Nations (ASEAN) show the importance that the SDGs can play – to varying degrees – in these countries’ investment promotion strategies.

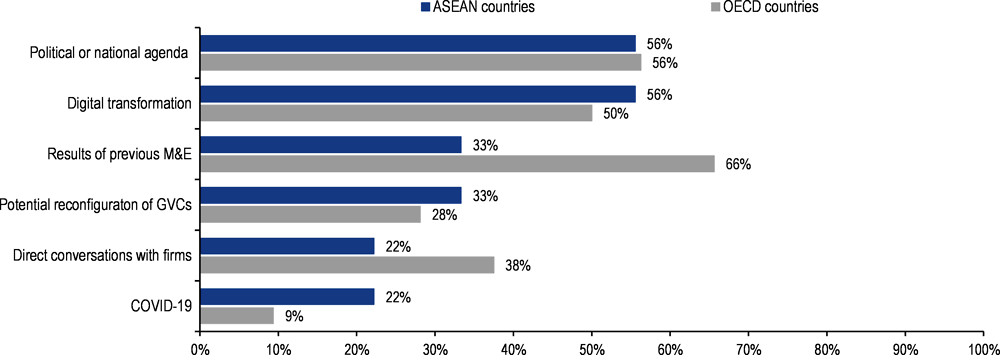

When asked about top factors influencing their investment promotion priorities, 56% of ASEAN IPAs have selected contributing to the SDGs, the highest share together with the political/ national agenda and digital transformation (Figure 3.2). This share is higher than in the OECD (44%), where agencies adopt a rather pragmatic approach and select the results of previous monitoring and evaluation (M&E) as the most important factor. The overall political or national agenda, which is also deemed important in both ASEAN and OECD countries, can underpin other factors as well, such as digitalisation and sustainability (OECD, 2023[8]). Conversely, the COVID‑19 crisis is considered as a top factor by much fewer agencies. Although the pandemic has had a strong immediate effect on FDI flows and investment promotion activities around the world, it has not shifted their main concerns beyond key priorities such as sustainability and digitalisation. It has rather prompted governments and IPAs to accelerate their response to these global imperatives as a way to reinforce economic resilience.

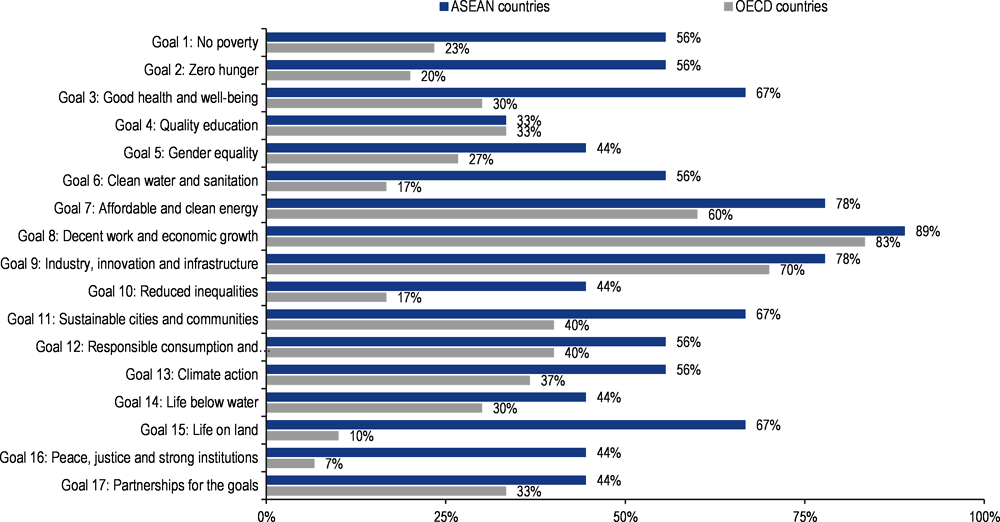

As IPAs are increasingly targeting sustainable investment, they can contribute to some SDGs more than others. In both ASEAN and OECD countries, the SDGs relating to promoting economic growth and employment (Goal 8); ensuring access to modern and clean energy (Goal 7); and supporting resilient infrastructure, industrialisation and innovation (Goal 9) are mentioned by most IPAs (Figure 3.3). This is not a surprising result since these objectives correspond most closely to IPAs’ usual tasks. ASEAN IPAs also consider contributing to a large extent to sustainability-related goals, particularly good health and well-being, sustainable cities and communities and life on land, while climate action is selected by 56% of ASEAN agencies and 37% of OECD.

Figure 3.2. Top factors motivating IPAs’ current priorities in ASEAN and OECD countries

Source: OECD survey on IPA Monitoring & Evaluation and Prioritisation (OECD countries, 2021; ASEAN countries, 2022).

Figure 3.3. The SDGs to which IPAs in ASEAN and OECD contribute

Source: OECD survey on IPA Monitoring & Evaluation and Prioritisation (OECD countries, 2021; ASEAN countries, 2022).

This reflects that ASEAN IPAs seem to contribute more to the SDGs than those in the OECD, which could be explained by the fact that IPAs in ASEAN are more often integrated in the ministry in charge of investment or have a broader economic role, which can thus give them a wider field of action on key aspects related to the SDGs (OECD, 2023[8]). IPAs in the OECD are often more specialised and autonomous, focusing on selected tasks and priorities, which are hence related to fewer SDGs. IPAs in SADC tend to have a more similar profile to OECD rather than ASEAN agencies and could have therefore similar trends.

Indicators to prioritise and measure the sustainability outcomes of FDI

A key question is the way and the degree to which IPAs can track their contribution to the SDGs, beyond the actual sectors they target. A closer look at their key performance indicators (KPIs) is necessary to understand and evaluate the extent to which investment promotion strategies contribute to attracting and facilitating sustainable investment. IPAs need to rely on specific and consistent indicators to ensure that they attract the right investments and the attracted FDI generates sustainability outcomes.

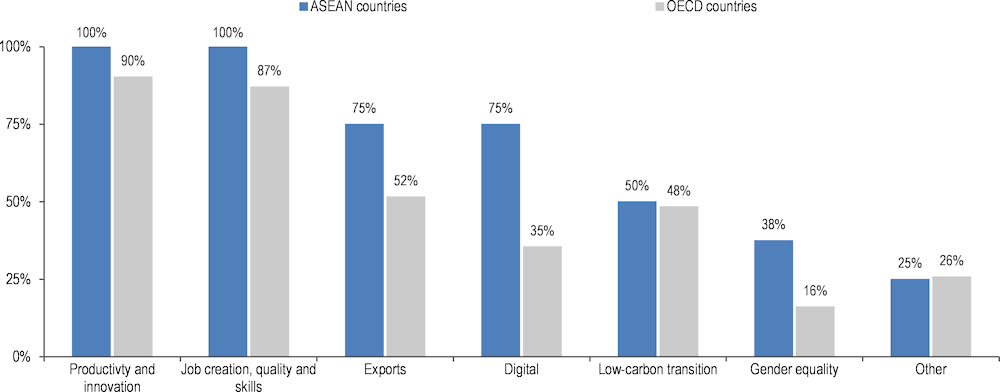

To select priority firms and guide their decision on whether to assist a particular investment project, IPAs rely on KPIs related to outcomes, which can be grouped into several categories. The most used KPIs in both ASEAN and OECD countries are those relating to productivity and innovation, and on job quantity and quality (Figure 3.4). This is likely to be the case in SADC as well, as these are the prime objectives of IPAs.

Figure 3.4. Types of KPIs used for FDI prioritisation by ASEAN and OECD agencies

Source: OECD survey on IPA Monitoring & Evaluation and Prioritisation (OECD, 2021; ASEAN, 2022).

IPAs can also use KPIs that are related to other SDG-related categories. For example, the Philippines use indicators to prioritise investment projects that have a positive impact on nature conservation and the protection of sea and coastline. Indonesia uses an indicator relating to the geographical dispersion of FDI which measures the value of investment realisations outside Java (OECD, 2023[8]). Promoting investment in support of regional development has also become a high priority in OECD countries. As 92% of agencies have the mandate to promote and facilitate FDI in support of regional development, 69% use FDI distribution across regions as a KPI (OECD, 2022[9]).

KPIs related to the low-carbon transition are used by approximately half of the agencies for FDI prioritisation in ASEAN and OECD countries. Indicators to prioritise low-carbon FDI can be very diverse from one agency to the other – depending on the priorities but also the resources and capacities of these agencies – and are often still in development. Several more sophisticated mechanisms are emerging and increasingly used, however (Box 3.1).

Box 3.1. Environmental sustainability KPIs for prioritisation in selected ASEAN and OECD IPAs

Different indicators have been developed and are used differently by IPAs. Many of them set a target and track the number of attracted and realised projects according to their target sectors and countries.

IDA Ireland has set a target to win 60 environmental sustainability investments in 2021‑24. In identifying priority investments, IDA has developed an approach guided by the six sustainable activities set out in the European Union taxonomy on sustainable investment and by an analysis of the sustainability opportunities which align with Ireland’s core strengths, and which are deemed to present the greatest opportunity to win FDI.

Business Sweden has embraced the long-term national ‘Pioneer the Fossil Free’ initiative, by setting clear objectives to accelerate green investments to Sweden to become fossil free by 2045. The agency identifies companies, solutions and expertise that can support reducing CO2 emissions in Sweden and monitors and adapts its investment promotion priorities and activities accordingly.

The Malaysian Investment Development Authority targets companies that adopt green technologies and the reuse and recycling of activities, as well as projects applying the circular economy model (e.g. pollution and waste management) to prioritise investment. The Philippine Board of Investments uses indicators to prioritise investors with green processes and the use of modern and clean technology.

Some agencies are also developing sustainability scoring mechanisms. For example, Germany Trade & Invest developed an integrated scoring model, where FDI projects are assessed and scored against a set of qualitative and quantitative indicators for sustainability. The agency then adjusts its promotion and advisory services to investors accordingly. Similarly, Invest in Canada has recently introduced a scoring mechanism to prioritise investment opportunities based on two dimensions: FDI impact and investment potential. The former evaluates the likelihood that the investment will benefit Canada and one variable focuses on social and sustainable development. The agency uses Bloomberg terminal and its scoring system to measure Environmental, Social and Governance (ESG) related impact.

Source: OECD survey on IPA monitoring & evaluation and prioritisation (OECD countries, 2021); direct interactions with IPAs.

To ensure that prioritisation is effective, it is important to have a strong M&E system with relevant indicators. While it is key to prioritise certain investments over others to respond to sustainability objectives, it is equally important to understand and track their contribution to the desired outcomes. Integrating sustainability indicators in IPA M&E systems – going beyond metrics relating to the number and value of investment projects or on the number of jobs created (which is still predominantly the case in IPAs) – is necessary to measure the results of the agency and the effective contribution of assisted companies to sustainable development (Sztajerowska and Volpe Martincus, 2021[10]).

In their efforts to achieve the SDGs through FDI, SADC Member States need to ensure that the actual indicators used by their IPAs to prioritise investments and to measure their outcomes are aligned with the overarching investment promotion priorities. Effective sustainable investment promotion strategies require granular indicators and measurements. Additionally, KPIs used for M&E should ideally be aligned with those used for prioritisation to ensure consistency between the set targets and the desired outcomes.

References

[4] Knoerich, J. and S. Vitting (2021), The distinct contribution of investment promotion agencies’ branch offices in bringing Chinese multinationals to Europe, Journal of World Business, https://doi.org/10.1016/j.jwb.2020.101187.

[8] OECD (2023), “Enabling sustainable investment in ASEAN”, OECD Business and Finance Policy Papers, No. 23, OECD Publishing, Paris, https://doi.org/10.1787/eb34f287-en.

[9] OECD (2022), “The geography of foreign investment in OECD member countries: How investment promotion agencies support regional development”, OECD Business and Finance Policy Papers, No. 20, OECD Publishing, Paris, https://doi.org/10.1787/1f293a25-en.

[3] OECD (2021), Middle East and North Africa Investment Policy Perspectives, OECD Publishing, Paris, https://doi.org/10.1787/6d84ee94-en.

[5] OECD (2020), Investment promotion agencies in the time of COVID-19, OECD Publishing, https://read.oecd-ilibrary.org/view/?ref=132_132715-6ewiabvnx7&title=Investment-promotion-agencies-in-the-time-of-COVID-19.

[1] OECD (2018), Mapping of Investment Promotion Agencies, OECD Publishing, https://www.oecd.org/investment/investment-policy/mapping-of-investment-promotion-agencies-in-OECD-countries.pdf.

[11] OECD (2015), Policy Framework for Investment, 2015 Edition, OECD Publishing, Paris, https://doi.org/10.1787/9789264208667-en.

[6] SADC (2006), Protocol on Finance and Investment, https://www.sadc.int/sites/default/files/2021-08/Protocol_on_Finance__Investment2006.pdf.

[2] Sauvant, K. and H. Mann (2017), Towards an Indicative List of FDI Sustainability Characteristics, https://ssrn.com/abstract=3055961.

[10] Sztajerowska, M. and C. Volpe Martincus (2021), Together or Apart: Investment Promotion Agencies’ Prioritisation and Monitoring and Evaluation for Sustainable Investment Promotion, OECD Investment Insights, Paris, https://www.oecd.org/daf/inv/investment-policy/Investment-Insights-Investment-Promotion-Prioritisation-OECD.pdf.

[7] UNCTAD (2022), Commodities at a glance: Special issue on industrial hemp, UNCTAD, https://unctad.org/system/files/official-document/ditccom2022d1_en.pdf.

Note

← 1. In collaboration with the OECD, a SADC Investment Policy Framework was developed in 2012 to answer the call for specific regional guidance to facilitate co‑ordinated approaches on investment frameworks in support of regional development integration. The Framework, inspired by the internationally recognised principles of the OECD Policy Framework for Investment (OECD, 2015[11]), provides country experiences and international good practices to encourage regionally co‑ordinated strategies on investment legislative frameworks, promotion and facilitation.