This chapter sets out the framework to develop recommendations to promote high-quality broadband connectivity in Southeast Asia. First, it examines the region's geographical, demographic and socio-economic conditions, which not only condition network deployment and adoption but also illustrate the future challenges and opportunities in the region for which high-quality connectivity is a key driver. Second, it analyses the connectivity situation in the region through key indicators of broadband infrastructure and services, the structure and evolution of communication markets, the institutional frameworks employed across the region, and broadband policies. Finally, the chapter describes the methodology used to develop tailored policy recommendations. This methodology builds on the OECD Council Recommendation on Broadband Connectivity. It considers regional diversity by identifying groups of similar countries and conducting a detailed analysis of one representative country from each group (Cambodia, Indonesia, Singapore, Thailand and Viet Nam).

Extending Broadband Connectivity in Southeast Asia

1. Setting the scene for broadband policy recommendations for Southeast Asia

Abstract

1.1. Southeast Asia and its broadband framework conditions

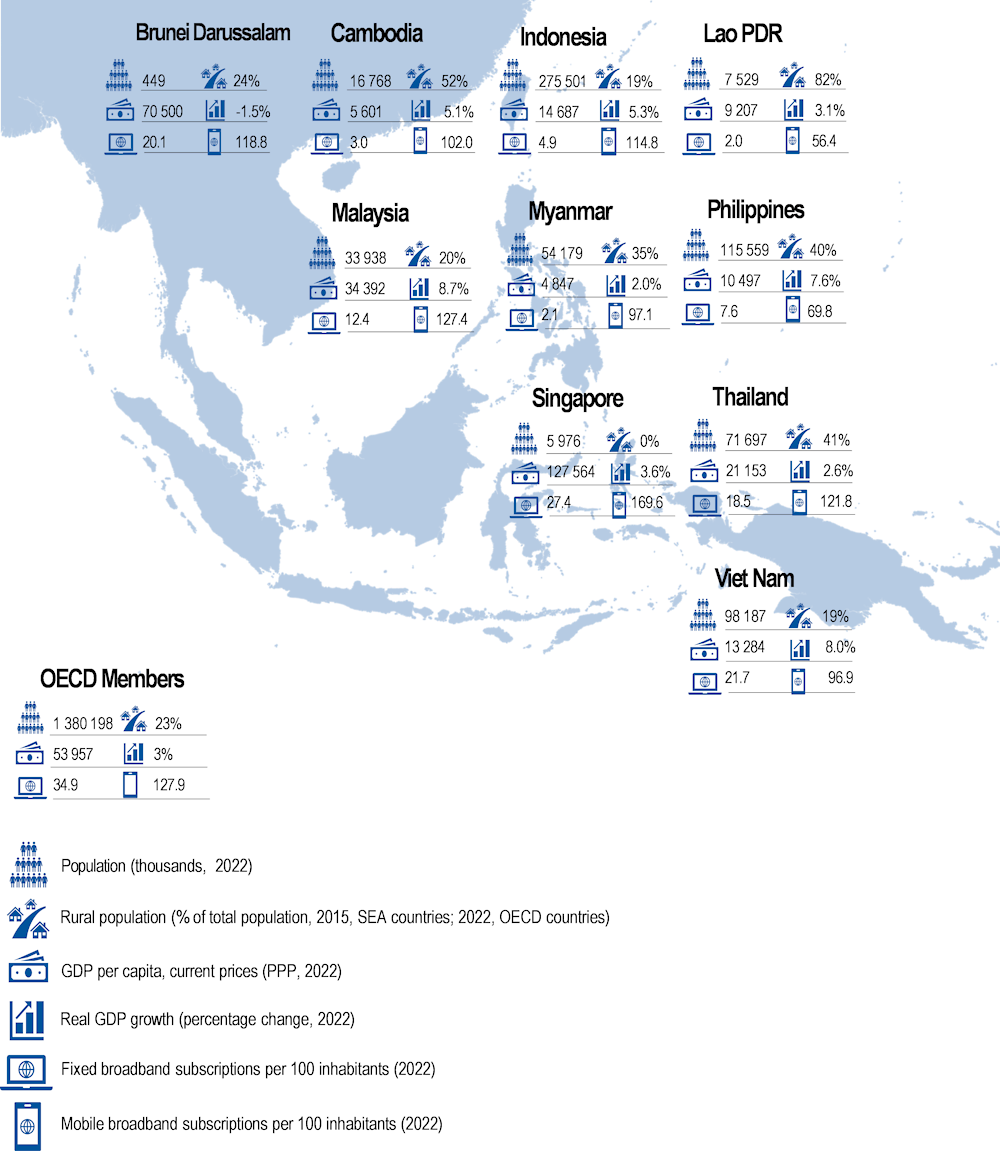

Figure 1.1. Southeast Asia at a glance

Note: Population figures for the OECD reflect the total population of all 38 member countries. For the metric “percentage of the population living in rural areas”, for Southeast Asian countries, rural areas are defined as grid cells of 1 square kilometre with a density below 300 inhabitants per square kilometre and other grid cells outside urban clusters or centres (European Commission, Joint Research Centre, 2015[1]). For OECD countries, rural population is the percentage of the population living in predominantly rural regions, based on the OECD classification of small regions (territorial level 3). For more information, see OECD (2018[2]), “Defining regions and functional urban areas”, in OECD Regions and Cities at a Glance 2018, OECD Publishing, Paris. For gross domestic product per capita, current prices, the unit is purchasing power parity; international dollars per capita. For real gross domestic product (GDP) growth (percentage change), data for Myanmar relate to the 2022 fiscal year. For mobile broadband subscriptions per 100 inhabitants, data for Indonesia and Lao PDR are from 2021.

Sources: [Population] For SEA countries: UNDESA (2022[3]), World Population Prospects: the 2022 revision, https://population.un.org/wpp/ (accessed on 8 November 2023); For OECD: OECD (2023[4]), OECD.Stat database, "Historical population: OECD – total (2022)", https://stats.oecd.org/ (accessed on 28 August 2023).

[Rural Population] For SEA countries: European Commission, Joint Research Centre (2015[1]), Country Fact Sheets based on the Degree of Urbanisation, Global Human Settlement Layer (GHSL), https://ghsl.jrc.ec.europa.eu/CFS.php; For OECD: OECD (2023[5]), OECD.Stat (database), "Regions and cities: Regional statistics: Regional demography: Demographic indicators by rural/urban typology, Country level: OECD: share of national population by typology", https://stats.oecd.org/ (accessed on 28 August 2023).

[GDP per capita, current prices, PPP] For SEA countries: IMF (2023[6]), World Economic Outlook Database, April 2023, www.imf.org/en/Publications/WEO/weo-database/2023/April (accessed on 22 June 2023); For OECD: OECD (2023[7]), Gross domestic product (GDP) (indicator), https://doi.org/10.1787/dc2f7aec-en (accessed on 28 August 2023).

[Real GDP growth, percentage change] For SEA countries: OECD (2023[8]), Economic Outlook for Southeast Asia, China and India 2023: Reviving Tourism Post-Pandemic, OECD Publishing, Paris, https://doi.org/10.1787/f677c529-en; For OECD: OECD (2023[9]), Real GDP forecast: Total annual growth rate (OECD – Total, 2022) (indicator), https://doi.org/10.1787/1f84150b-en (accessed on 28 August 2023).

[Fixed and mobile broadband subscriptions per 100 inhabitants] For SEA countries except Singapore: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023); Singapore: Data provided by IMDA; For OECD: OECD (2023[11]), Broadband Portal, December 2022 update, www.oecd.org/sti/broadband/broadband-statistics/ (accessed on 28 August 2023).

1.1.1. Geographical and demographic conditions

Southeast Asia (SEA) is defined in this report as the ten member countries of the Association of Southeast Asian Nations (ASEAN), namely, Brunei Darussalam, Cambodia, Indonesia, Lao People’s Democratic Republic (hereafter “Lao PDR”), Malaysia, Myanmar, the Philippines, Singapore, Thailand and Viet Nam.1

Located in the heart of the Asia-Pacific region, SEA strategically straddles the maritime passage between East Asia and the Middle East and the Mediterranean world. This location has helped define its worldview and foster the distinctive fusion of different cultures of the region, framed by the Middle East, Europe, the People’s Republic of China (hereafter “China”) and India.

SEA is split between mainland and island countries. Cambodia, Lao PDR, Myanmar, Thailand, Viet Nam and Singapore at the southern tip of the Malay Peninsula constitute mainland SEA. The archipelagic countries of Indonesia and the Philippines, together with Brunei Darussalam on the island of Borneo, form island SEA. Malaysia is both mainland and island, with a western portion on the Malay Peninsula and an eastern part on the island of Borneo.

SEA falls within the warm, humid tropics, and its climate is generally monsoonal (i.e. marked by wet and dry periods), although the region has a high degree of climatic variation. Shallow seas (the Sunda Shelf, from the Gulf of Thailand to the Java Sea) and extensive waterways (the three largest systems, the Irrawaddy, Salween and Mekong rivers) have facilitated communication and trade. In so doing, they have shaped forms of settlement, as well as political and economic patterns (Britannica, 2022[12]).

SEA is one of the most at-risk regions in the world for adverse climate events such as droughts, floods, typhoons, rises in sea levels and heat waves. The effects of the climate crisis exacerbate this. Indeed, climate-related disasters affecting the region have become four times more frequent over the past 40 years, with the Philippines, Indonesia and Viet Nam among the most exposed countries (OECD, 2023[13]). Climate change could wipe out over 35% of the region’s gross domestic product (GDP) by the middle of the century. It can severely impact key sectors such as agriculture, tourism and fishing along with human health and labour productivity (Renaud, 2021[14]). Recognising these challenges, public and private infrastructure investment should prioritise climate change adaptation and mitigation (OECD, 2023[13]).

As of 2022, SEA comprised 680 million people (UNDESA, 2022[3]) spread over 4.5 million square kilometres across 20 000 islands and landmasses. This geographical setting has led to a variety of economic, social and cultural differences. The region is home to over 1 000 languages, with several hundreds of those related to ethnic minorities and all the world's major religions, along with local beliefs.2 Demographically, the population in 2022 across SEA countries varies from 0.4 million in Brunei Darussalam to 275.5 million in Indonesia. More than 40% of the region’s total population resides in Indonesia; the Philippines is the second most populous country in the region with 115.5 million people (UNDESA, 2022[3]).

Similarly, the degree of urbanisation varies greatly among SEA countries. Beyond the unique case of Singapore, with a 100% urban population, the variation ranges from Brunei Darussalam and Malaysia, with around 80% urban and 20% rural, to Cambodia and Lao PDR with over 50% rural population (2015) (European Commission, Joint Research Centre, 2015[1]).

The growth of urban areas is, however, a common trend in SEA countries, which includes an increasing number of mega-cities with more than 10 million inhabitants and their secondary cities. This growth has been unprecedented in recent years and has been coupled with more people living in slums (ASEAN, 2021[15]).3 Estimates suggest that in 2020, one in three urban residents lived in slums in Cambodia and the Philippines, and more than one in two in Myanmar (UN-Habitat, 2020[16]). Access to basic infrastructure is often lacking in slums, which can make it challenging to access quality connectivity, especially fixed communication service.

Another relevant demographic pattern observed in SEA is the rapidly ageing population, shifting the distribution towards older age groups. The speed of ageing is particularly fast in Brunei Darussalam, Singapore, Viet Nam and Thailand, which are expected to move from an ageing to an aged society in 20 years or less. Having enjoyed the benefits of a young workforce for decades, this dramatic demographic shift may strain the countries’ welfare system and hamper economic growth (ESCAP, 2022[17]).

1.1.2. Socio-economic conditions

The evolution of indicators for the Sustainable Development Goals for 2016-20 shows that, overall, most socio-economic outcomes have improved in SEA (ASEAN, 2022[18]). Taking a broad view of human development, which includes not only economic growth but also health and educational attainment, all SEA countries have reached at least a medium level of development (UNDP, 2022[19]).

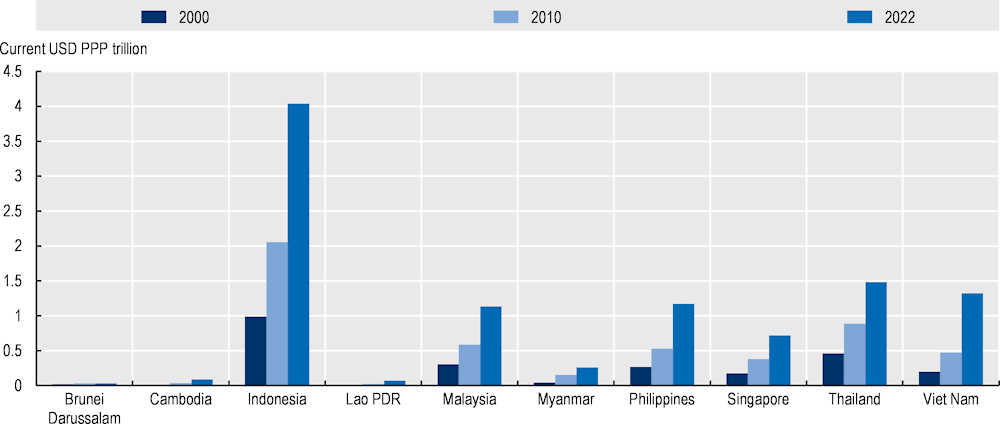

From an economic standpoint, SEA economies have performed well over the last two decades (2000‑22). The region’s total combined GDP in 2022 (USD PPP 10.3 trillion) grew more than fourfold from 2000 (USD PPP 2.5 trillion) (IMF, 2023[6]). Indonesia is the region’s largest economy, accounting for 39% of GDP (in USD PPP) followed by Thailand (14%), Viet Nam (13%), the Philippines and Malaysia (11% each) and Singapore (7%), as of 2022 (IMF, 2023[6]). The group of Brunei Darussalam, Cambodia, Lao PDR and Myanmar together account for the remaining 4.4% of the region's GDP (in USD PPP, 2022) (IMF, 2023[6]) (Figure 1.2).

Figure 1.2. Gross domestic product, 2000, 2010, 2022

Note: 2022 data include estimates for Brunei Darussalam, Cambodia, Lao PDR, Malaysia, Myanmar and Thailand.

Source: IMF (2023[6]), World Economic Outlook Database, April 2023, www.imf.org/en/Publications/WEO/weo-database/2023/April (accessed on 22 June 2023).

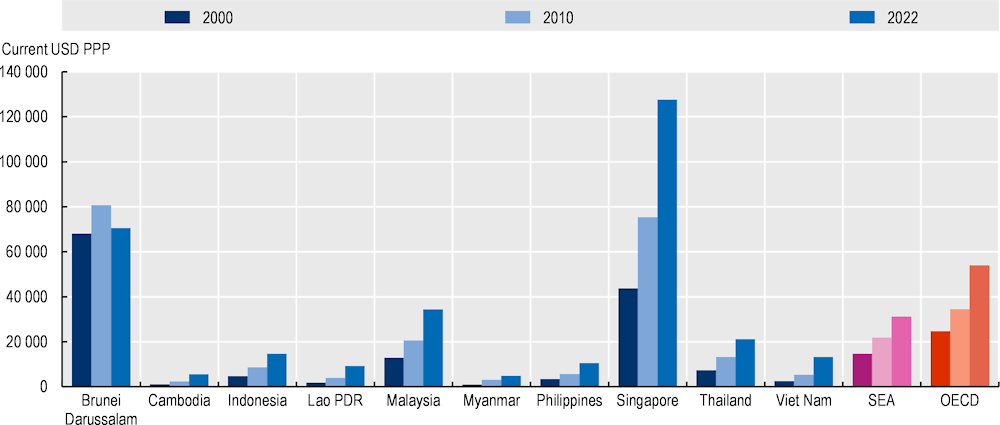

A similar trend was observed for the average GDP per capita for the region, which reached USD PPP 31 173 in 2022, doubling its 2000 value (USD PPP 14 672) (Figure 1.3) (IMF, 2023[6]). Cambodia and Viet Nam reported the largest growth over 2000-22, with their respective 2022 GDPs per capita (USD PPP) 5.3 times greater than in 2000 (IMF, 2023[6]). Lao PDR and Myanmar also recorded similar patterns, with 2000 GDP per capita growing by a factor of 5.0 and 4.9, respectively, to reach 2022 figures (IMF, 2023[6]). This implies some degree of economic convergence within the SEA region. Today, all SEA countries are classified as middle-income economies except for Singapore and Brunei Darussalam, which are high income (World Bank, 2023[20]).4

Figure 1.3. Gross domestic product per capita in 2000, 2010 and 2022

Note: 2022 data include estimates for Brunei Darussalam, Cambodia, Lao PDR, Malaysia, Myanmar, Thailand, Viet Nam and SEA.

Source: For SEA countries: IMF (2023[6]), World Economic Outlook Database, April 2023, www.imf.org/en/Publications/WEO/weo-database/2023/April (accessed on 22 June 2023); For OECD: OECD (2023[7]), Gross domestic product (GDP) (indicator), https://doi.org//10.1787/dc2f7aec-en (accessed on 28 August 2023).

Economic trends shown in Figure 1.2 and Figure 1.3 seem likely to continue with SEA’s real GDP forecasts indicating solid and steady growth. After the region set out on the path to economic recovery in 2021 and experienced strong growth in 2022, average real GDP growth was projected to increase by 4.6% in 2023, followed by a 4.8% expansion in 2024 (OECD, 2023[8]). Individual country growth rates projected for 2023 range from 2% in Myanmar to 6.4% in Viet Nam. These rates show some differences but reflect a smaller range than in 2022 (low of -1.5% in Brunei Darussalam to a high of 8.7% in Malaysia in 2022) (OECD, 2023[8]).

Despite forecasts of continued growth, the region could be negatively affected by challenges such as rising inflation, economic slowdowns in the global economy and disrupted supply chains (OECD, 2023[8]). While most Southeast Asian countries had less consumer price inflation than the OECD average of 9.2% in March 2023, consumer prices are increasing in some countries (OECD, 2023[8]). In particular, Lao PDR and Myanmar reported high consumer price inflation rates of 41.3% (December 2021) and 19.5% (July 2022) (OECD, 2023[8]). Consumer price inflation in March 2023 in other countries in the region ranged from 1.5% in Brunei Darussalam to 8.6% in the Philippines (OECD, 2023[8]).

Nevertheless, SEA’s economic climate has benefitted from foreign direct investment (FDI), which it has attracted successfully as part of an export-led development strategy. For example, SEA was among the greatest recipients of FDI among emerging regions. It has also managed to maintain and even slightly increase its share of FDI at a time when emerging market economies worldwide have started to embrace a more liberal approach (OECD, 2019[21]). This openness to FDI may have benefitted the region beyond higher investment stocks through higher productivity and competitiveness (OECD, 2023[13]).

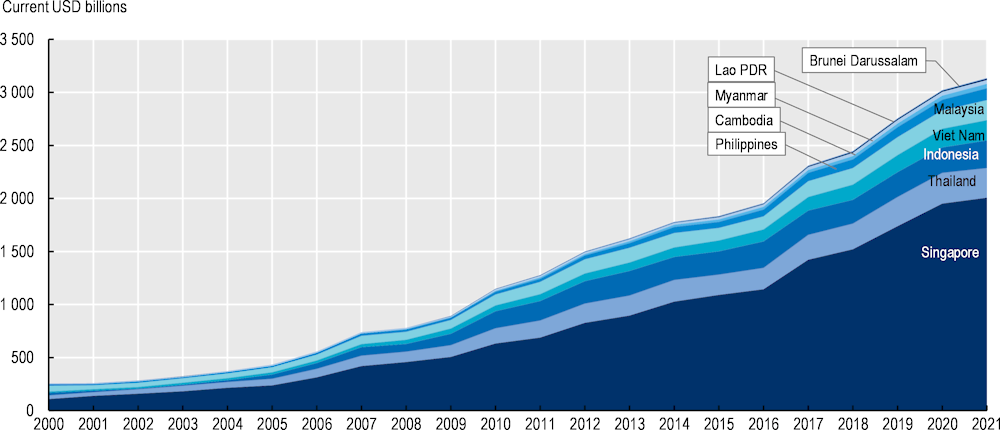

All ASEAN countries have made significant improvements to enable investment, but the pace of change has varied considerably. Some countries remain relatively restrictive to FDI, such as the Philippines and Indonesia (OECD, 2023[13]). The upward trend in FDI has continued over the last two decades (2000-21, Figure 1.4), with the annual inward stock increasing by a factor of 12 over this period. Singapore is far and away the largest recipient of FDI, with 64% of inward stock in 2021 – well ahead of the next largest recipients (Thailand with 9% and Indonesia with 8%) (UNCTAD, 2022[22]). In that same year, the countries with the lowest share of inward stock in the region were Brunei Darussalam (0.2%), Lao PDR (0.4%), Myanmar (1.2%) and Cambodia (1.3%) (UNCTAD, 2022[22]). In 2022, FDI inflows to SEA increased by 5% to USD 223 billion, the highest level ever recorded. Singapore, the largest recipient, registered another record with an increase of 8% in FDI inflows (UNCTAD, 2023[23]).

Figure 1.4. Foreign direct investment, annual inward stock, 2020-21

Source: OECD elaboration based on UNCTAD (2022[22]), FDI/MNE database, https://unctad.org/fdistatistics (accessed on 10 January 2023).

Services are the leading sector in the ASEAN economy, accounting for 50.6% of GDP in 2020, followed by manufacturing at 35.8% and agriculture at 10.5%. The services sector covers trade, government activities, communication services, transportation, finance and other economic activities that do not produce goods (ASEAN, 2021[24]). Travel, transport and other business services generally dominate the export and import of ASEAN services. Travel services dominate ASEAN exports, while transport services dominate its imports.5 At the country level, services are the most important sector for all but one ASEAN country. The exception is Brunei Darussalam, where the manufacturing sector leads, contributing 64.2% of GDP. However, the economic structure differs between countries. The share of the service sector was highest in Singapore, reaching 74.1% of the country’s total GDP, followed by the Philippines (60.7%), Thailand (59.8%) and Malaysia (54.9%). On the other hand, agriculture remains an important sector for Myanmar (22.0%), followed by Cambodia (17.3%), Lao PDR (13.9%), Viet Nam (13.6%) and Indonesia (12.4%) (ASEAN, 2021[24]).

Given SEA’s strategic location, merchandise trade is particularly important for all ASEAN countries. With the exception of a drop in 2020, both merchandise exports and imports have been increasing over the past two decades, with ASEAN’s total merchandise trade increasing by almost 3.5 times. Singapore was the largest exporter and importer of the region in 2020 with a share of 27.6% and 26.7%, respectively. It was followed by Viet Nam, a leap from its fifth position in 2010. China was the largest external market for ASEAN exports in 2020 with a 15.7% share, followed by the United States (15.2%), EU-27 (9.4%) and Japan (7.2%). China is also the region’s most important importer with a share of 23.5%, followed by Japan (7.8%), United States and Korea with similar shares (7.7%) and EU-27 (7.6%) (ASEAN, 2021[24]).

The degree of integration of ASEAN countries into global value chains (GVCs) is relatively high by international standards. The share of GVC participation varies across countries, but regional supply chains play a key role in all ASEAN members. In 2020, in most cases, integration with other Asian countries accounted for more than half of value added through GVCs (OECD, 2022[25]). The Regional Comprehensive Economic Partnership trade agreement, signed in November 2020 between the ten ASEAN countries and China, Japan, Korea, Australia and New Zealand, is likely to strengthen regional linkages in Asia. In this context, digitalisation to facilitate trade and regional integration is seen as a strategic priority for the region (ASEAN, 2019[26]). Digitalisation could also create new opportunities for small and medium-sized enterprises by facilitating their integration into regional and global markets through GVCs and their operations into foreign markets (OECD, 2022[25]).

From a broader perspective, the region’s development faces more structural challenges. Some studies find that certain SEA economies face the challenge of transitioning from a growth model based on inputs to one based on productivity, and graduating from middle-income to high-income economies. Although investment (infrastructure) will continue to be important, innovation is expected to play a central role to increase productivity (Estrada et al., 2017[27]). The combined impact of changing demographics (ageing population) and climate change in the region may hamper this transition. Issues such as investment in human capital (to compensate for the decline in the labour force) and infrastructure resilience may become more important to face these challenges. This, in turn, can help countries shift to more productivity-based growth and achieve high-income status.

Box 1.1. Southeast Asia and the OECD

For over two decades, the OECD and Southeast Asia (SEA) have enjoyed a mutually beneficial relationship. In addition to fostering policy dialogue, the relationship has disseminated good practices and mutual learning in areas such as investment, education, inclusiveness, sustainable infrastructure, good governance, access to markets and fiscal policy. The OECD SEA Regional Programme, launched in 2014, has been instrumental in strengthening OECD co‑operation with this dynamic region. Its structure is designed to encourage a systematic exchange of experiences to develop common solutions to regional and global policy challenges.

Today, Indonesia is a key partner of the organisation and the Thailand Country Programme was established in 2018. All ten ASEAN countries participate in OECD committees, working groups, peer reviews and studies. The region contributes to data collection and international benchmarking exercises such as the Programme for International Student Assessment and Investment Policy Reviews. Countries adhere to a range of international standards and norms developed by the OECD.

The ASEAN-OECD Investment Programme promotes dialogue and exchange of experience between OECD countries and SEA economies on issues related to the business and investment climate. The programme achieves its objectives through regional policy dialogue, country investment policy reviews and training seminars.

In recent years, two more specific initiatives have been developed in the field of the digital economy. The 2019 OECD study “Southeast Asia Going Digital: Connecting SMEs”, for example, proposes a set of policies to encourage SME connectivity. The present, broader study recommends policies to expand and improve the quality of broadband connectivity in the region.

1.2. Broadband in Southeast Asia

1.2.1. Infrastructure and services

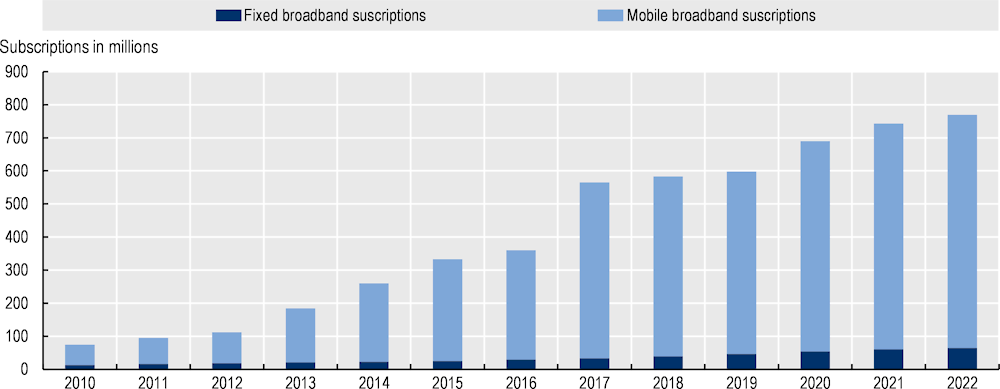

The SEA region has actively embraced digital technologies in recent years, leading to unprecedented growth in broadband connectivity. By 2022, the region reached 769 million broadband subscriptions, more than ten times the 74 million subscriptions in 2010 (ITU, 2023[10]). Mobile subscriptions represent over 90% of total broadband subscriptions (2022), after strong year-on-year growth rates averaging 25% (2010-22). These followed annual growth rates of 75% from 2012-13 and 61% from 2016-17 (ITU, 2023[10]). Fixed broadband subscriptions have grown more steadily over the same period (2010-22), with annual (year-on-year) growth averaging 15% over the period (ITU, 2023[10]) (Figure 1.5).

Figure 1.5. Broadband subscriptions in SEA, 2010-22

Note: 2022 total mobile broadband subscriptions data includes 2021 data for Indonesia and Lao PDR. 2022 total fixed broadband subscriptions data includes 2021 data for Lao PDR.

Source: SEA countries except Singapore: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023). Singapore: Data provided by national authorities.

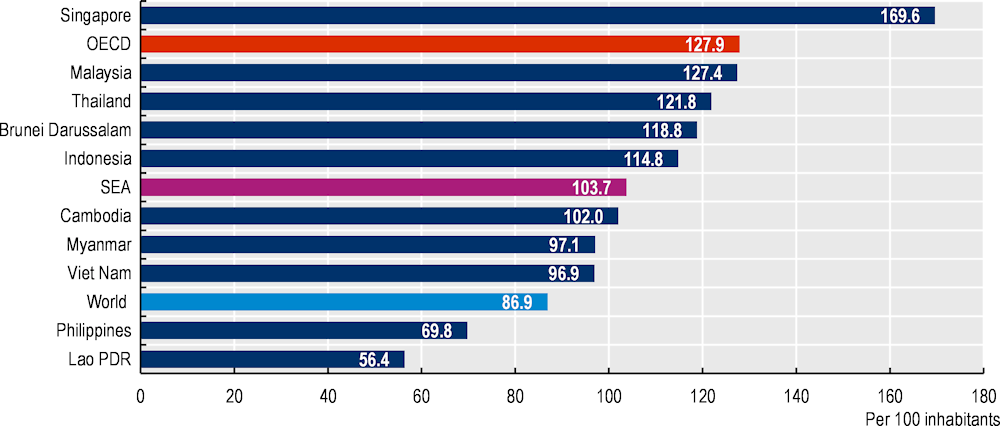

The explosive growth of mobile connectivity in the region can also be seen in the average mobile broadband subscription rate of 103.7 subscriptions per 100 inhabitants in 2022 (Figure 1.6) (ITU, 2023[10]). There is still uneven progress in uptake of mobile broadband services. Subscription rates around the region range from Lao PDR (with 56.4 mobile broadband subscriptions per 100 inhabitants) to Singapore (with an over-subscription rate of 169.6 per 100 inhabitants) (ITU, 2023[10]). Six of the ten countries exceed 100 subscriptions per 100 inhabitants in 2022, including countries with low fixed broadband penetration like Cambodia and Indonesia (ITU, 2023[10]). This confirms the clear dominance of mobile technologies for broadband access in the region.

Figure 1.6. Mobile broadband subscriptions per 100 inhabitants, 2022

Note: Data for Indonesia and Lao PDR are for 2021.

Source: For SEA countries except Singapore: OECD elaboration based on ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023). Singapore: Data provided by national authorities. For OECD: OECD (2023[11]), Broadband Portal, July 2023 update, www.oecd.org/sti/broadband/broadband-statistics/ (accessed on 28 August 2023).

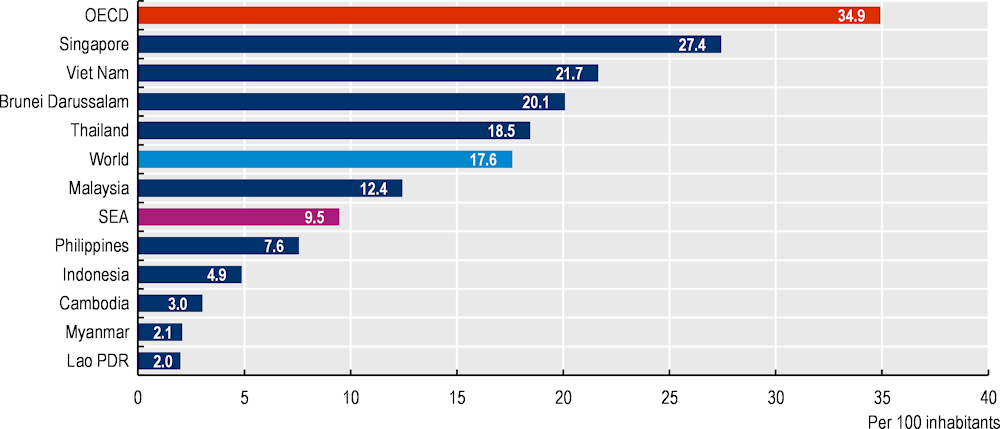

The number of fixed broadband subscriptions per 100 inhabitants shows significant differences between countries (Figure 1.7). While Singapore reports 27.4 fixed broadband subscriptions per 100 inhabitants, Cambodia, Lao PDR and Myanmar do not surpass 3 subscriptions per 100 inhabitants (ITU, 2023[10]). On average, the region has a subscription rate of 9.5 subscriptions per 100 inhabitants (ITU, 2023[10]). This is significantly lower than the OECD average (34.9 subscriptions per 100 inhabitants) (OECD, 2023[11]).

Figure 1.7. Fixed broadband subscriptions per 100 inhabitants, 2022

Note: Data for Lao PDR are for 2021.

Source: For SEA countries except Singapore: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), https://www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023). Singapore: Data provided by national authorities. For OECD: OECD (2023[11]), Broadband Portal, July 2023 update, https://www.oecd.org/sti/broadband/broadband-statistics/ (accessed on 28 August 2023).

Alongside variations in broadband penetration between countries, disparities also exist within countries. Internet usage data demonstrates marked discrepancies dependent on the geographic and socio-economic circumstances of users. For countries in Southeast Asia, with the exception of Singapore and Brunei Darussalam where the entirety of the territory is urban or suburban available date shows that the proportion of individuals utilising the Internet reached 22.5 percentage points lower in rural areas compared to urban areas (ITU, 2023[10]).6 Gender-wise, the usage of the Internet by women is generally lower compared to men in all countries (ITU, 2023[10]). With regard to age, the proportion of the population using the Internet is notably lower among older individuals, with differences reaching 61 points lower for those aged 75 and above compared to the next age group, 25-74 (ITU, 2023[10]).7 These digital divides stem from insufficient coverage in some cases, as well as unaffordable broadband services, inadequate digital skills, gender-related biases, or perceived lack of usefulness.

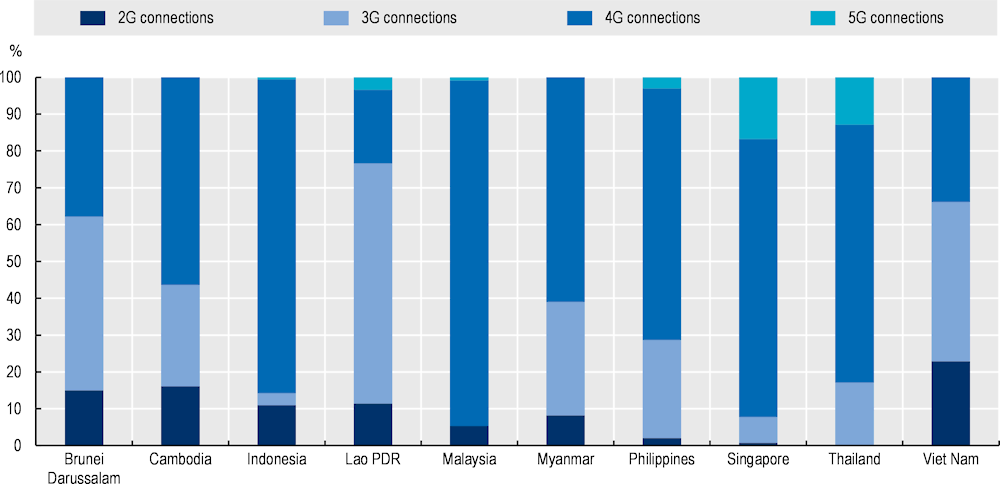

In terms of network infrastructure, 3G and 4G networks cover the highest percentages of the population. All SEA countries have 3G networks with a population coverage of 90% or above, except for Malaysia, which completed the switch-off of its 3G network in 2022. 4G networks in most SEA countries covered at least 90% of the population in 2022 (GSMA Intelligence, 2023[31]). Six of the ten countries in the region had deployed 5G networks as of 2022, Indonesia, Lao PDR, Malaysia, the Philippines, Singapore and Thailand (GSMA Intelligence, 2023[31]). At the time of writing, Viet Nam had piloted 5G service in certain cities. Singapore was the leader in the region for 5G coverage in 2022, with 97%, followed closely by Thailand with 85% and the Philippines with 66% of the population covered (GSMA Intelligence, 2023[31]).

Despite the extensive coverage of high-quality mobile broadband networks, the uptake of mobile technologies varies between countries (Figure 1.8). While the percentage of 4G connections was 20% in Laos and 34% in Viet Nam, it exceeds 80% in Indonesia and Malaysia (GSMA Intelligence, 2023[31]). The adoption of 5G likewise varies across countries and is highest in Singapore, with 17% of total mobile connections, followed by Thailand with 13% (2022) (GSMA Intelligence, 2023[31]). Beyond network coverage, these differences may be explained by consumers' readiness to use the mobile Internet, which is influenced by various factors including the accessibility of a compatible mobile phone, fundamental skills, and societal factors like gender bias (GSMA, 2021[32]).

Figure 1.8. Percentage of mobile connections by technology, 2022

Note: A mobile connection is defined by GSMA Intelligence as “a unique SIM card (or phone number, where SIM cards are not used) that has been registered on a mobile network. Connections differ from subscribers in that a unique subscriber can have multiple connections” (GSMA, 2022[33]).

Source: GSMA Intelligence (2023[31]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

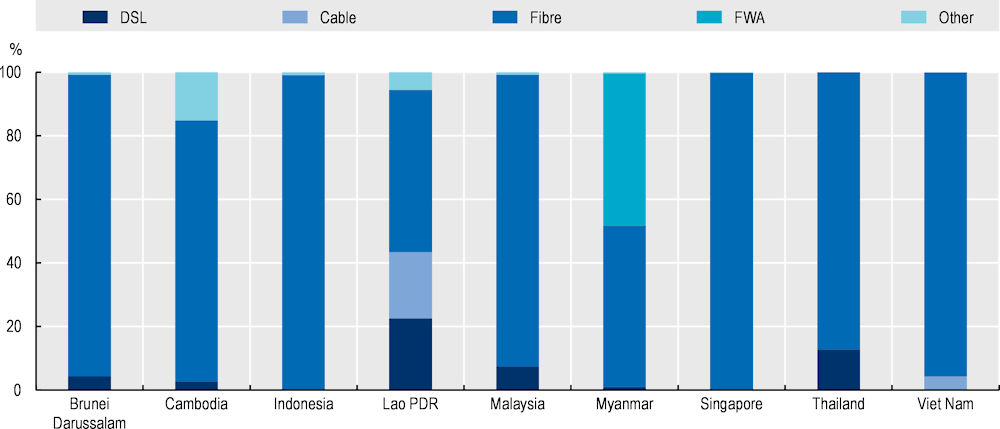

Fibre-to-the-Home (FTTH) is the most commonly used fixed broadband technology, reaching over 80% in most countries except Lao PDR and Myanmar, which still account for over 50% of subscriptions (2021) (ITU, 2023[10]). The low subscription percentage for copper-based technologies (DSL and cable) in all countries may indicate the region's widespread access network upgrade to fibre, as well as fibre's preference for new deployments (ITU, 2023[10]).

Figure 1.9. Fixed broadband subscriptions by technology, 2021

Note: Data are from 2021, except for Brunei Darussalam (2020), Lao PDR (2017), and Singapore (2022). No data available for Philippines.

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

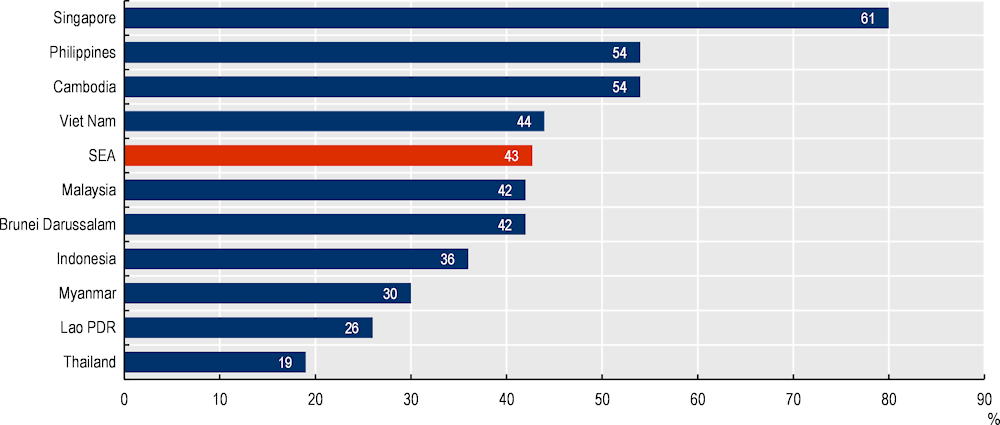

For backbone networks, fibre is used for virtually all links, with microwave links used only rarely (ITU, 2023[34]). The extension of these networks varies considerably between SEA countries. In Singapore, 80% of the population is within at least 10 km of a transmission node (2020) (ITU, 2023[34]).8 Conversely, only 19% of the population in Thailand is within this distance (2020) (ITU, 2023[34]). The SEA average is 43% of the population, which is in line with most countries (2020) (ITU, 2023[34]) (Figure 1.10). The extension of the backbone network influences the length of backhaul/middle-mile networks and the access/last mile network that needs to be built to reach the end user. This, in turn, informs the level of investment required to extend broadband coverage, especially in rural areas that are not densely populated.

Figure 1.10. Proportion of population within 10 km of a transmission node, 2020

Note: Data for SEA represent a simple average.

Source: OECD elaboration from ITU (2023[34]), ITU Broadband Map, https://bbmaps.itu.int/bbmaps/ (accessed on 6 March 2023).

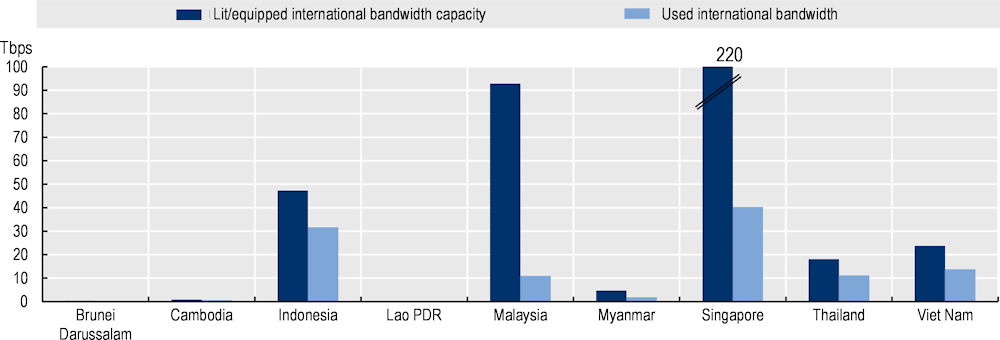

The increase in broadband users and the growth in data-intensive applications and services have led to a growing demand in SEA for connectivity to the rest of the world. Total international Internet used bandwidth in the region has seen exponential growth in the last period, reaching 111 terabits per second (Tbps) in 2022 (ITU, 2023[10]). Equipped capacity has kept pace, although distribution across countries is uneven (Figure 1.11). Singapore has by far the largest installed capacity (220 Tbps in 2022) (ITU, 2023[10]). At the same time, the country uses only 18% of its installed capacity (40 Tbps) (ITU, 2023[10]), attesting to Singapore’s role as a hub for Internet traffic in the region. Malaysia holds the second highest installed capacity in the region with 93 Tbps, using only 11% of it, followed by Indonesia, which uses 67% of its installed capacity of 47 Tbps (2021) (ITU, 2023[10]).

Figure 1.11. International bandwidth in the SEA region, 2022

Notes:

1. Lit/equipped international bandwidth capacity refers to the total lit capacity of international links, namely fibre-optic cables, international radio links and satellite uplinks to orbital satellites in the end of the reference year (expressed in Mbit/s). If the traffic is asymmetric (i.e., different incoming and outgoing traffic), then the highest value out of the two should be provided. Average usage of all international links, including optical fibre cables, radio links and traffic processed by satellite ground stations and teleports to orbital satellites (expressed in Mbit/s). The average is calculated over the twelve-month period of the reference year. If the traffic is asymmetric (i.e. different incoming and outgoing traffic), then the highest value out of the two should be provided. All international links used by all types of operators, namely fixed, mobile and satellite operators should be taken into account. The combined average usage of all international links can be reported as the sum of the average usage of each link (ITU, 2020[35]).

2. Data for Lao PDR are for 2021, and used international bandwidth data for Singapore is for 2021. The Philippines is not in the graph because equipped international bandwidth capacity data is not available since 2015 and used international bandwidth since 2018.

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

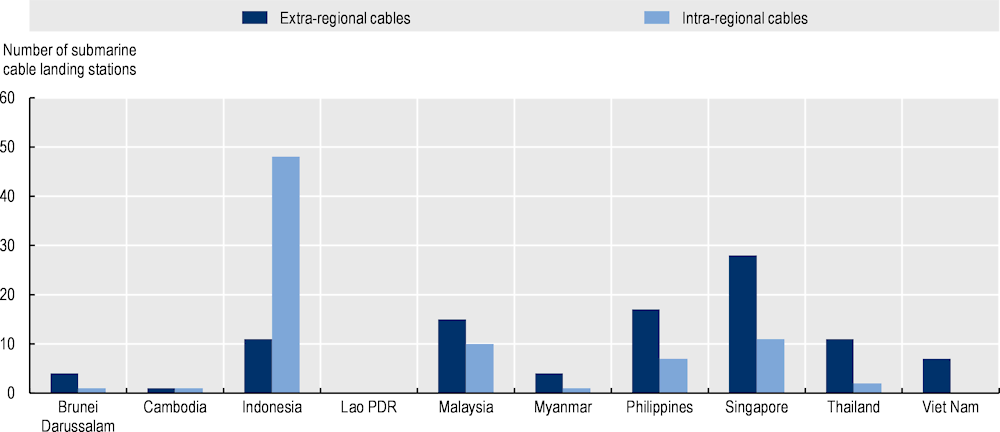

In the SEA region, as in the rest of the world, submarine cables provide the vast majority of international broadband links to meet demand. This is due, in part, to their lower failure rate compared to terrestrial cables (OECD, 2014[36]). The region has landing stations for 96 submarine cables. Most of these cables (59) are connecting SEA countries, and 37 reach other regions of the world. SeaMeWe-3 has the longest reach, connecting nine subregions (North Africa, sub-Saharan Africa, Eastern Asia, Southern Asia, Western Asia, Northern Europe, Southern Europe, Western Europe, Australia and New Zealand). This cable also has landing stations in virtually all SEA countries (except Cambodia and Lao PDR). Other notable submarine cable systems connecting the region are FLAG Europe-Asia, which connects seven subregions, and Asia Africa Europe‑1 (AAE-1), PEACE Cable and SeaMeWe-4, 5, 6, which connect five or more subregions.

All SEA countries, except for landlocked Lao PDR, have submarine cable landing stations, although they vary considerably (Figure 1.12). Indonesia has the highest number of intra-regional cable landing points (48), followed by Singapore at a distant second (11) and Malaysia (ten). Singapore has the highest number of extra-regional cable landing points (28), followed by the Philippines (17) and Malaysia (15). At the other extreme, Cambodia has only two cable landing points in total (intra- and extra-regional), followed by Brunei Darussalam and Myanmar with five and Viet Nam (seven). Singapore, together with Hong Kong China, concentrates most of the points of presence of the global Internet providers in the region (OECD elaboration based on TeleGeography) (2023[37]).

Figure 1.12. Number of landing stations of submarine cables

Note: Extra-regional cables indicate the landing stations in a given country of submarine cables that connect to other regions of the world. Intra-regional cables indicate landing stations in a given country, of submarine cables confined to the SEA region. This includes cables under construction, which are expected to be ready for use in 2023-26.

Source: OECD elaboration based on TeleGeography (2023[37]), Submarine Cable Map, www.submarinecablemap.com/ (accessed on 22 February 2023).

Such disparities could be reduced by building infrastructure to share the region's international connectivity capacity between countries. To this end, some initiatives propose the construction of cross-border terrestrial networks connecting national Internet Exchange Points (IXPs), in particular for Cambodia, Lao PDR, Viet Nam and Thailand (CLVT) (ESCAP, 2022[38]).9 These links, together with the co‑ordination of routing policies (BGP), would make the international connections (e.g. submarine cable landing stations) of the connected countries potentially reachable from all of them. This network topology could also improve the resilience of the region’s international connectivity by providing alternative routes to international traffic. Ultimately, this could increase the quality of service to users through, for example, lower latency and higher bandwidth.

Overall, the expected growth of the digital economy in the region is sparking the interest of many market players. They are keen both to deploy new submarine cables and to create multiple avenues to connect the region. For example, the region is laying 12 new submarine cables that are expected to be put in service in 2023 and 2024. These are financed by a range of communication operators, as well as other players, such as content providers (e.g. Meta and Google). Several submarine cables came, or are expected to come, into service in 2023 to connect various SEA countries. These include the Asia Direct, Biznet Nusantara Cable System-1 (Indonesia only), India Asia Xpress, MIST, Philippines Domestic Submarine Cable Network (Philippines only) and the Singapore-Myanmar cables (TeleGeography, 2023[39]). The Apricot, Bifrost, Cambodia-Hong Kong, Echo, SEA-H2X and SEA-Japan 2 (SJC2) cables are planned for service by end of 2024 (Telegeography, 2023[40]).

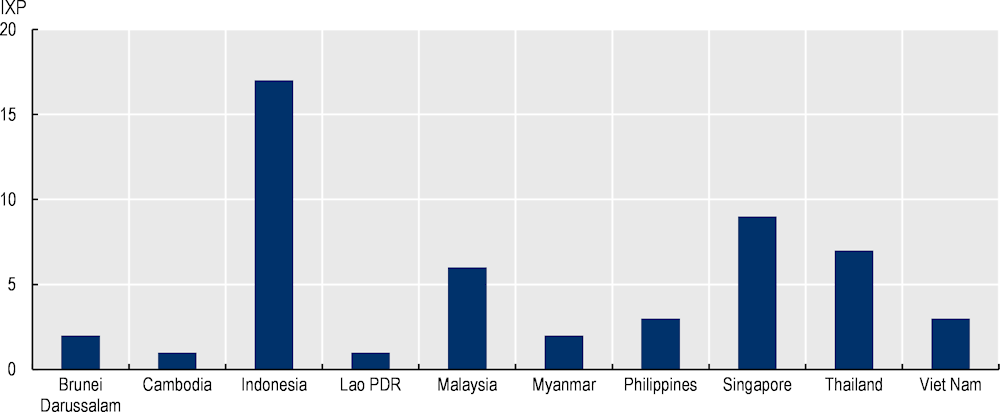

The number of IXPs in SEA has increased in recent years. Indonesia has strengthened its connectivity by increasing the number of IXPs and building submarine cables for inter-island connectivity. It has the highest number of active IXPs in the region with 17. This is followed by countries with high numbers of submarine cable landing stations, namely Singapore (9 active IXPs), Thailand (7 active IXPs), and Malaysia (6 active IXPs) (Figure 1.13) (PCH, 2023[41]). Viet Nam and the Philippines follow with 3 active IXPs, then Brunei Darussalam and Myanmar (2) and Cambodia and Lao PDR with one active IXP) (PCH, 2023[41]). IXPs create shorter routes for Internet traffic exchange, allowing networks to keep traffic local and provide faster connections with low latency and at lower cost. They also improve overall network performance and resilience. In addition, by creating a central point where cloud and content companies can interconnect with service providers, IXPs are likely to have a positive impact on other elements of the ecosystem (Internet Society, 2021[42]).

Figure 1.13. Internet exchange points, 2023

Source: PCH (2023[41]), Internet Exchange Directory, www.pch.net/ixp/dir (accessed on 5 December 2023).

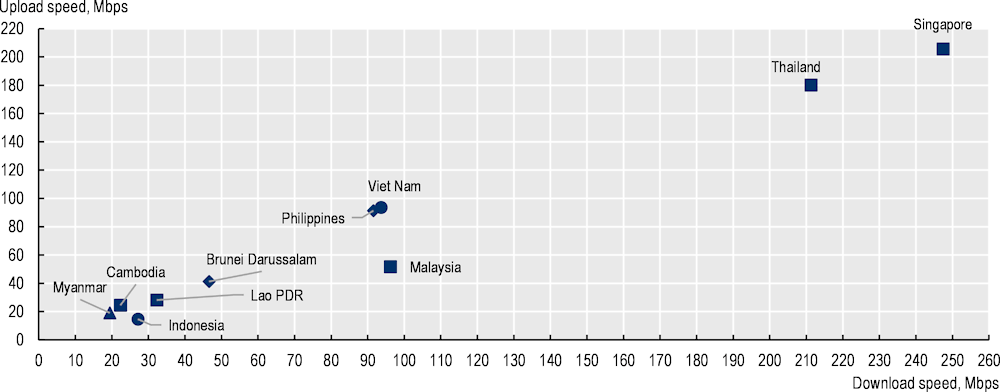

The variability of the infrastructures deployed in different SEA countries, as shown in the graphs above, translates into differences in the performance of the broadband services offered to users. The speed of fixed and mobile broadband connectivity – one aspect of performance – varies considerably across SEA countries. In terms of fixed broadband upload and download speeds, Singapore and Thailand remain at a considerable distance from other countries in the region (Figure 1.14). According to Ookla data as of July 2023, Singapore reached median fixed download speeds of 247 megabits per second (Mbps) and median upload speeds of 206 Mbps, while Thailand recorded 211 Mbps download and 180 Mbps upload (Ookla, 2023[43]) . With these speeds, Singapore earned the top spot globally for median fixed download speeds and Thailand was ranked fifth, both among the highest ranked globally (Ookla, 2023[43]). In the region, Malaysia followed with median fixed download speeds of 96 Mbps, followed by Viet Nam (94 Mbps), the Philippines (92 Mbps) and Brunei Darussalam (47 Mbps) (Ookla, 2023[43]). The remaining countries in the region have median fixed download speeds of less than 35 Mbps. Fixed broadband speeds are fairly symmetrical for all countries (i.e. similar download and upload speeds), which reflects the high share of fibre (Figure 1.14). Another aspect of quality is latency, which can be defined as the round trip time for information to travel between two devices across the network, also known as delay or ping rate.10 Fixed broadband latency ranges from 4-8 milliseconds (ms) between SEA countries (July 2023) (Ookla, 2023[43]).

Figure 1.14. Median fixed broadband download versus upload speed, July 2023

Note:Data collected and aggregated by Ookla’s Speedtest® Methodology (Ookla, 2023[44]).

Source: Ookla®, (2023[43]), Speedtest Global Index ®, www.speedtest.net/global-index (accessed on 22 August 2023).

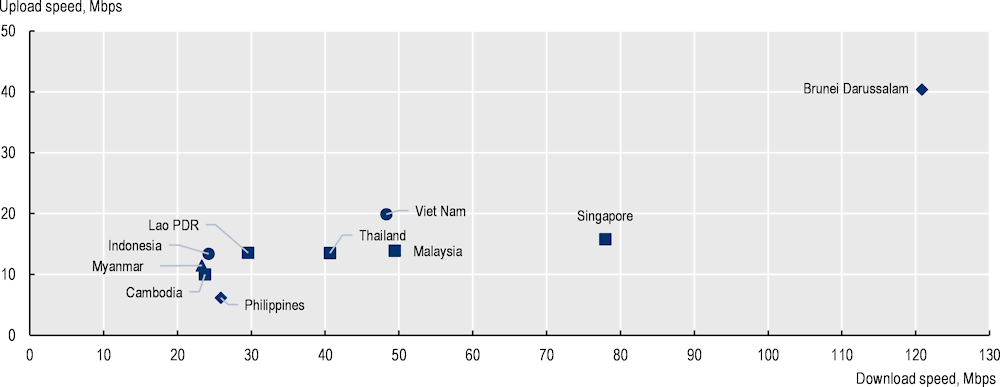

There are also clear differences between SEA countries in mobile broadband performance. In July 2023, Brunei Darussalam and Singapore stood out with median mobile download speeds considerably higher than the other countries: 121 Mbps (download)/40 Mbps (upload) and 78 Mbps (download)/16 Mbps (upload) respectively (Ookla, 2023[43]). Elsewhere in the region, download speeds ranged from 23 Mbps in Myanmar to 48 Mbps in Viet Nam and 49 Mbps in Malaysia (Ookla, 2023[43]). In all cases, mobile broadband connectivity is markedly asymmetric with download speeds between two and close to five times the upload speeds, although this is inherent to the technology and not unique to the SEA region (Figure 1.15). Mobile broadband latency is higher than fixed broadband, ranging from 15 ms in Brunei Darussalam to 27 ms in Indonesia (Ookla, 2023[43]).

Figure 1.15. Median mobile broadband download versus upload speed, July 2023

Note: Data collected and aggregated by Ookla’s Speedtest® Methodology (Ookla, 2023[44]).

Source: Ookla®, (2023[43]), Speedtest Global Index®, www.speedtest.net/global-index (accessed on 22 August 2023).

Beyond speed, the resilience of communication networks is a key element of the quality of connectivity. This is especially the case in SEA, which is vulnerable to natural hazards and expected to become even more vulnerable in the face of the climate crisis. According to the E-Resilience Monitoring Dashboard, fibre-optic cable infrastructure, understood as the backbone and middle-mile network, can strengthen “e-resilience” to overcome unexpected crises (ESCAP, 2021[45]).11 Some operators in the region are fortifying their networks in the face of adverse weather events. In the Philippines, for example, broadband service provider PLDT (historically, the Philippine Long Distance Telephone Company) announced a plan in 2022 to lay 600 km of submarine fibre optic cable, as well as underground inland cables. This will increase the resiliency of its network, particularly in areas often hit by natural disasters (Smart Communications, 2022[46]).

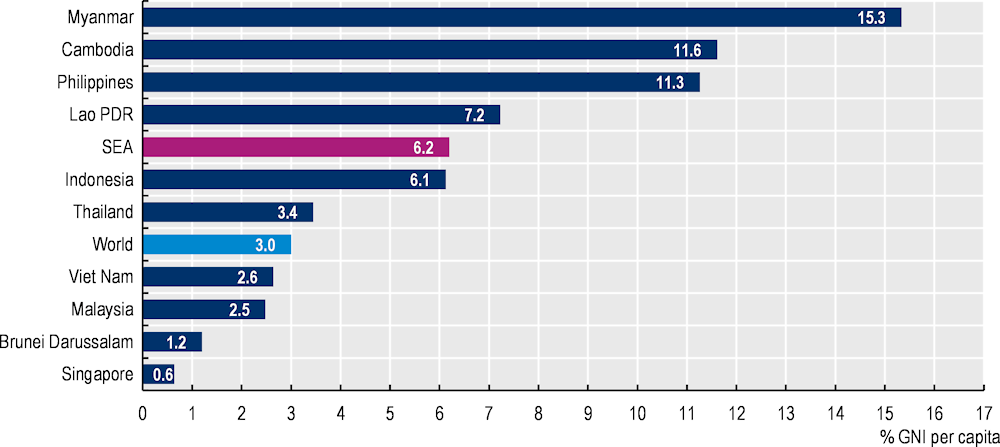

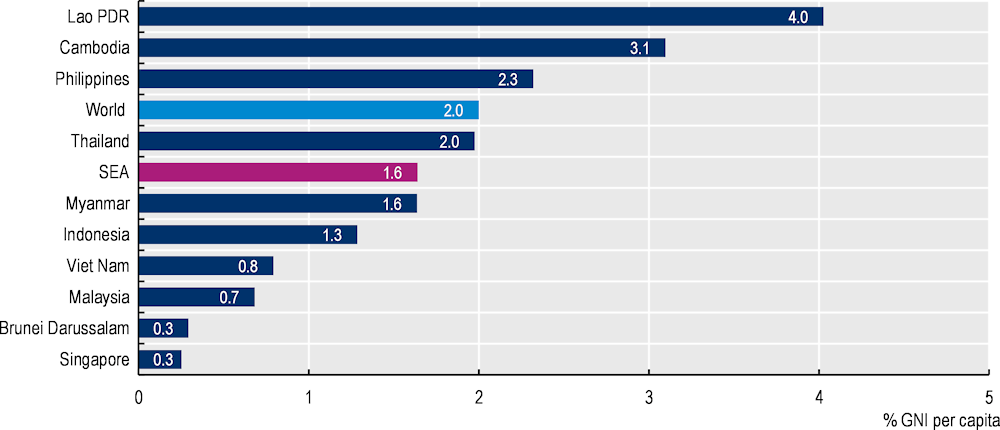

The take-up of broadband services, which varies widely between countries as shown above (Figure 1.6 and Figure 1.7), depends not only on how well they perform but also on how affordable they are. In this regard, fixed broadband prices remain expensive relative to purchasing power in the region, limiting broadband’s full potential to connect households. Only in Singapore and Brunei Darussalam are broadband services priced below 2% of monthly gross national income (GNI) per capita in 2022 (ITU, 2023[10]). The average for SEA countries is three times this threshold (6.2% of GNI per capita) (Figure 1.16) (ITU, 2023[10]). Mobile broadband prices are much more affordable in SEA countries, with a regional average of 1.6% of GNI per capita (Figure 1.17) (ITU, 2023[10]). Together with the greater coverage of mobile broadband networks, mobile broadband services’ relative affordability can help explain its high penetration.

Figure 1.16. Fixed broadband prices, percentage GNI per capita, 2022

Notes: The fixed broadband basket refers to the price of a monthly subscription to an entry-level fixed-broadband plan. For comparability reasons, the fixed-broadband basket is based on a monthly data usage of a minimum of 1 GB from 2008 to 2017, and 5 GB from 2018 to 2022. For plans that limit the monthly amount of data transferred by including data volume caps below 1GB or 5 GB, the cost for the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s. (ITU, 2020[47]). SEA data are a simple average of country values.

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed 22 on August 2023).

Figure 1.17. Mobile broadband prices, percentage GNI per capita, 2022

Note: The mobile broadband basket is based on a monthly data usage of a minimum of 500 MB of data, 70 voice minutes, and 20 SMSs. For plans that limit the monthly amount of data transferred by including data volume caps below 500 MB (low-consumption), the cost of the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s, relying on 3G technologies or above. The data-and-voice price basket is chosen without regard to the plan’s modality, while at the same time, early termination fees for post-paid plans with annual or longer commitment periods are also taken into consideration (ITU, 2020[47]). SEA data are a simple average of country values.

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

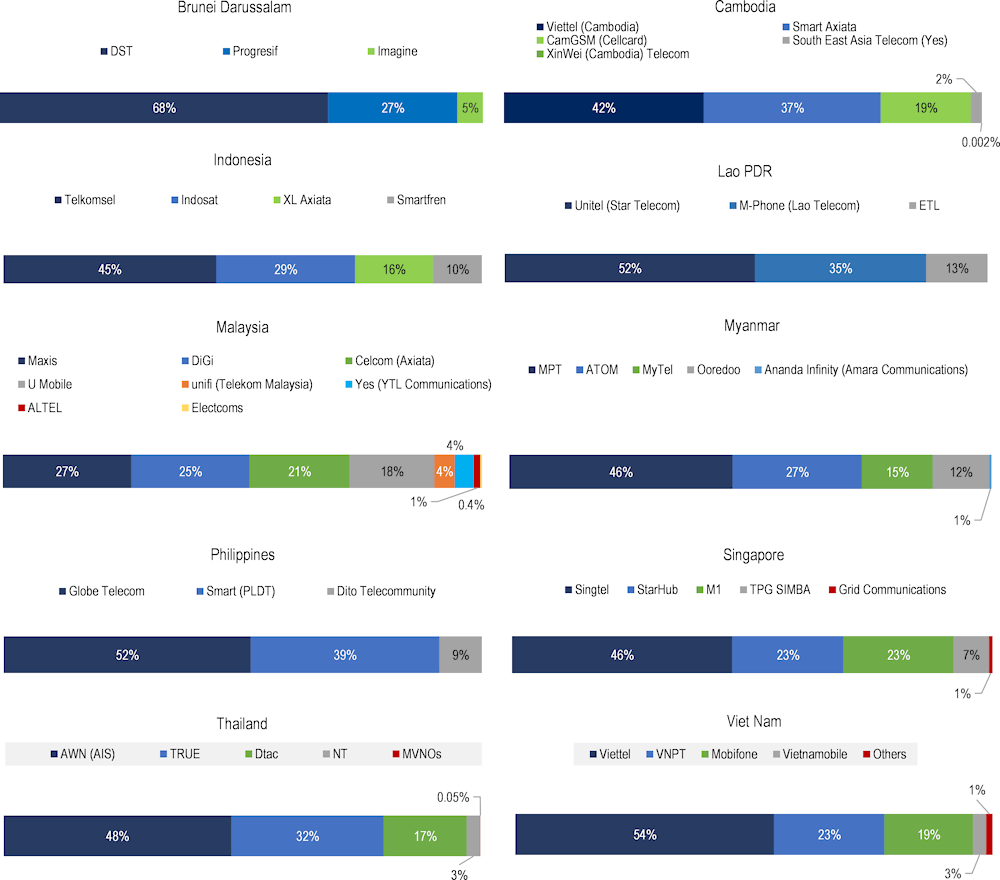

1.2.2. Market structure

Communication market structures and the level of competition among SEA markets varies considerably (see Figure 1.18). Considering available market share data for the mobile market (data unavailable for fixed market), SEA countries have at least three main mobile network operators (MNOs). Brunei Darussalam, Lao PDR and the Philippines have three MNOs; the rest have four or more, however some of these have small market shares (see Figure 1.18). In Thailand, Figure 1.18 reflects the situation prior to the 2023 merger of True and Dtac (see Table 1.1), which will change the market structure by moving from four main mobile operators to three. In addition to these main mobile operators, countries may have other smaller operators offering services, such as mobile virtual network operators (MVNOs).

The distribution of market shares also varies in the region. For example, the mobile market is more evenly split between operators in Malaysia, while Lao PDR, Philippines, and Viet Nam have operators with market shares over 50%, and in Brunei Darussalam it reaches 68% (Figure 1.18).

Figure 1.18. Mobile market shares in SEA countries

Note: Market shares for Cambodia, Thailand and Viet Nam reflect data as of Q4 2021. Together with Indonesia (Q4 2022), these four countries are based on national responses to the OECD questionnaire. Data for Cambodia and Viet Nam reflect mobile broadband subscriptions (data and voice, or data-only). Indonesia reflects the number of mobile broadband subscribers (contracting voice and data, or data-only plans) for Q4 2022. Thailand reflects total number of mobile subscribers (contracting data, voice or both) for Q4 2021. All other countries rely on GMSA Intelligence data (Q4 2022) on mobile connections, defined as “a unique SIM card (or phone number, where SIM cards are not used) that has been registered on a mobile network” (GSMA, 2022[33]). In Indonesia, “Indosat” refers to “Indosat Ooredoo Hutchison” following the 2022 merger between Indosat and 3 (CK Hutchison). Data for Thailand is prior to the True-dtac merger.

Source: [For all countries except Cambodia, Indonesia, Thailand and Viet Nam] GSMA Intelligence (2023[31]) Database, https://www.gsmaintelligence.com/data/ (accessed on 9 November 2023); [For Cambodia, Indonesia, Thailand and Viet Nam] OECD elaboration based on data from national sources.

When assessing the level of market competition, both the number of operators and the market power of players are important considerations. Competition is lower when the market is more concentrated in the hands of one or a few operators. The Herfindahl-Hirschman Index (HHI) is a common measure of market concentration, calculated by summing the squared market shares (represented as an integer) of all market players. An HHI can fall anywhere from 1 to 10 000. A lower HHI indicates a more competitive market. Conversely, a perfect monopoly, where one player captures all the market, would have an HHI of 10 000 (100 squared). According to guidelines from the United States Department of Justice (DoJ), unconcentrated markets are generally classified by an HHI below 1 500; moderately concentrated markets generally have an HHI between 1 500 and 2 500; and concentrated markets are usually those with HHIs above 2 500 (US DoJ, 2010[48]).

HHIs in SEA mobile markets range from around 2 000 in Malaysia to over 5 000 in Brunei Darussalam, according to GSMA Intelligence data for Q4 2022 (GSMA Intelligence, 2023[31]). Even Malaysia would be classified as “moderately concentrated” under the DoJ guidelines. However, that guidance is not specific to communication markets, which have high entry costs and require large investments both upfront and recurrently. Unlike in other markets, the level of required investment changes the economics for companies both to enter the market and to break even to recoup their investments.

The level of competition across SEA has been dynamic in recent years as several countries in the region have had mergers in both the fixed and mobile markets. Examples of recent mergers and acquisitions include Indonesia, Malaysia, Myanmar, Singapore and Thailand (Table 1.1). The region has previously seen mergers and acquisitions such as the sale of VimpelCom Holding Laos B.V. to the Lao PDR government in 2017 (VEON Ltd., 2017[49]). However, the past few years have seen a flurry of activity towards consolidation. Of course, the impact of each merger or acquisition depends on the characteristics of each market, including the level of concentration pre- and post-merger. Given the critical role of mobile networks in many SEA countries, consolidation in the mobile market may impact overall competition significantly. Consolidation thus requires careful assessment as competition helps drive innovation, affordability and increased quality-of-service.

Table 1.1. Examples of ongoing and recently completed mergers and acquisitions in the SEA region

|

Year |

Country |

Companies involved |

Market |

Description |

|---|---|---|---|---|

|

Ongoing |

Thailand |

Advanced Wireless Network (AIS subsidiary) and Jasmine International subsidiaries Triple T Broadband and Jasmine Broadband Internet Infrastructure |

Fixed |

Advanced Wireless Network announced plans to acquire 99.87% interest in Triple T Broadband and a 19% interest in Jasmine Broadband Internet Infrastructure in July 2022, but it is still pending at the time of writing. |

|

2023 |

Thailand |

True Internet Corporation Company Ltd (True) and Total Access Communication Public Company Ltd (dtac) |

Mobile |

The Thai regulator, National Broadcasting and Telecommunications Commission gave its approval for the merger, with conditions, in October 2022, and it was announced as complete in March 2023. |

|

2022 |

Indonesia |

Axiata Group Berhad and PT XL Axiata Tbk, and PT Link Net Tbk |

Fixed |

Axiata and its Indonesian subsidiary, XL Axiata, acquired 66.03% of shares of Link Net in June 2022. As of April 2023 Axiata and XL Axiata increased their shares of Link Net to 95%. |

|

2022 |

Indonesia |

CK Hutchison and Ooredoo Group |

Mobile |

Hutchison and Ooredoo Group merged to become “Indosat Ooredoo Hutchison”, according to certain merger conditions. |

|

2022 |

Malaysia |

Digi.Com Berhad (Digi Telecommunications Sdn. Bhd.) and Celcom Axiata Berhad |

Mobile |

The Malaysian regulator, the Malaysian Communications and Multimedia Commission, approved the merger, with conditions. |

|

2022 |

Myanmar |

Ooredoo Myanmar Ltd and Nin Communications Pte. Ltd. |

Mobile |

Ooredoo Myanmar sold its operations in the country to Nin Communications Pte. Ltd., whose owners include Link Family Office, based in Singapore, and U Nyan Win. |

|

2022 |

Myanmar |

Telenor Myanmar and M1 Group |

Mobile |

Telenor Myanmar sold its mobile operations in the company to M1 Group and a local partner (rebranded under Atom brand). |

|

2022 |

Singapore |

StarHub Online Pte Ltd and MyRepublic Broadband Pte Ltd |

Fixed |

StarHub took a majority interest (50.1%) in MyRepublic Broadband at the time of consolidation. |

|

2021 |

Thailand |

CAT Telecom + TOT |

Mobile/ Fixed |

State-owned operators CAT Telecom and TOT merged to become one state-owned entity, National Telecom (NT). |

Source: Thailand (Thai PBS World, 2023[50]; KPMG, 2022[51]; Inside Telecom, 2021[52]; Telenor Asia, 2023[53]); Indonesia (XL Axiata, 2022[54]; CK Hutchison Holdings Ltd, 2022[55]; Link Net, 2023[56]); Malaysia (Axiata Group, 2022[57]); Singapore (IMDA, 2022[58]); Myanmar (Ooredoo, 2022[59]; Zan, 2022[60]; Telenor, 2022[61]; Reuters, 2023[62]).

Unlike other SEA countries, the Philippines has moved away from consolidation. In 2019, the Philippines authorised a new mobile operator, DITO Telecommunity, to provide communication services (DITO Telecommunity, 2023[63]). This transformed the mobile market from a duopoly to a three-player market.

Another aspect shaping the structure of communication markets in the region is the degree of involvement of the government. Compared to many OECD countries, some SEA governments are more involved in the communication market. While many SEA countries have privately owned operators, some SEA governments have stakes in communication operators. This is the case, for example, in Brunei Darussalam, Indonesia, Thailand and Viet Nam. In Brunei Darussalam, the government owns all three communication operators through Darussalam Assets. It provides services from the Unified National Networks (UNN), which pools the assets of all three operators to create a wholesale network (UNN, 2022[64]).

In a different approach, Singapore’s regulatory body, the Infocomm Media Development Authority (IMDA), led development of the “Nationwide Broadband Network” (NBN), a nationwide shared fibre-based infrastructure upon which retail operators can offer end-user services (please see Chapter 4 for further details). The government provided funding to two selected companies to support the initial roll out of the NBN’s passive and active infrastructure (IMDA, 2009[65]).

In Malaysia, the Digital Nasional Berhad (DNB) is a government-owned, national wholesale network for 5G network infrastructure (DNB, 2021[66]). The DNB rollout has seen delays, with Malaysian operators criticising its price and raising concerns that it may become a government-run monopoly (Reuters, 2023[67]). In May 2023, the Malaysian Communications and Multimedia Commission (MCMC) announced that DNB will become a private entity once it had reached 80% coverage of populated areas (Developing Telecoms, 2023[68]). In July 2023, major operators in the country reportedly agreed to take shares in the DNB, although financial details of their ownership were unclear at the time of writing (Mobile World Live, 2023[69]). In addition, local news reported the government’s plans to launch a second state-run network once the DNB had reached its coverage targets to counter concerns (Developing Telecoms, 2023[70]).

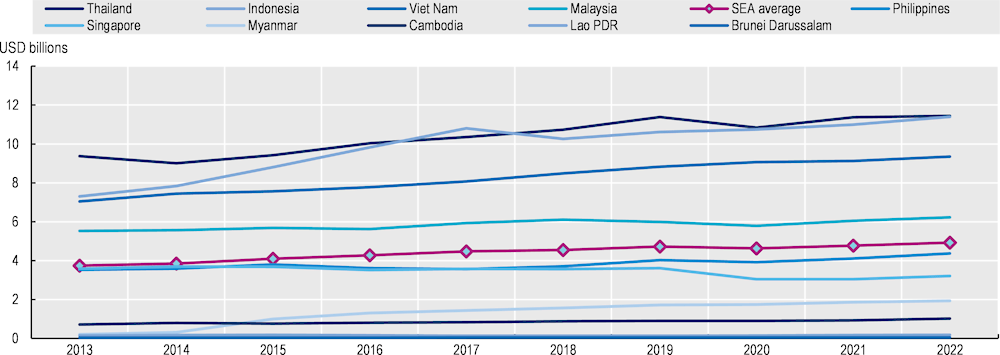

Over the past decade (2013-22), revenues for mobile services have steadily increased across SEA countries, in some cases dramatically. The examined revenue and investment data over this period contains nominal values converted to USD via spot rates from GSMA Intelligence data. For example, Myanmar saw an increase of 226% in mobile revenues in nominal terms from 2014-15, following liberalisation of the market (GSMA Intelligence, 2023[31]). The median percentage growth in revenues in SEA countries was around 30% over 2013-22, with Indonesia performing above the SEA median with an increase of 56% and Myanmar increasing by an astonishing 847% over the same period (Figure 1.19). Singapore is the only SEA country showing a slight decline, with an 10% decrease from 2022 mobile revenue compared to 2013. Thailand and Indonesia lead the region in terms of gross mobile revenues (nominal terms) in 2022, followed by Viet Nam and Malaysia (GSMA Intelligence, 2023[31]).

Figure 1.19. Mobile revenues in SEA countries, 2013-22

Note: The examined data contains nominal values converted to USD via spot rates from GSMA Intelligence data.

Source: GSMA Intelligence (2023[31]), Database, https://www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

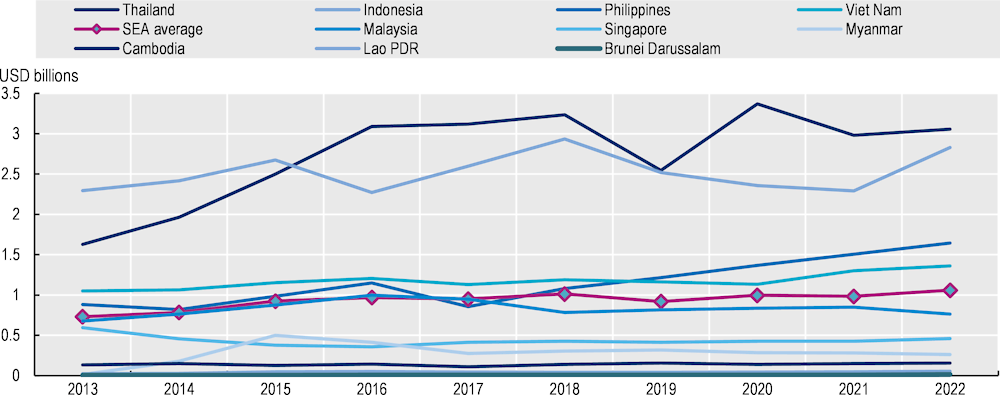

Investment in mobile networks also increased over 2013-22. The median percentage growth across the region of total mobile capital expenditure (Capex) investment over 2013-22 was close to 60% (GSMA Intelligence, 2023[31]). Thailand and Indonesia, the countries with the highest revenues (Figure 1.19), also had the highest amounts of investment (in nominal terms) in 2022 (Figure 1.20). The Philippines and Viet Nam followed with the third and fourth highest rates of mobile investment in 2022 (GSMA Intelligence, 2023[31]). From a percentage growth perspective, Myanmar showed the greatest increase over the 2013-22 period (1610%) (GSMA Intelligence, 2023[31]). This is unsurprising given market entry following liberalisation, although its gross Capex numbers are ranked seventh in the region. Lao PDR and Brunei Darussalam also showed strong increases, although gross Capex numbers (nominal terms) rank them the lowest in the region. Cambodia and Malaysia were relatively stable over the period, while Singapore showed a slight decline in 2022 Capex investment compared to 2013 figures (GSMA Intelligence, 2023[31]).

Figure 1.20. Investment in mobile networks (total Capex) in SEA countries, 2013-22

Note: The examined data contains nominal values converted to USD via spot rates from GSMA Intelligence data.

Source: GSMA Intelligence (2023[31]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

1.3. Institutional frameworks and broadband policies in Southeast Asia

1.3.1. Institutional frameworks

The regulatory and policy frameworks across the ten SEA countries vary, although there are some commonalities. At a high level, the ministries with remit over communication services in SEA countries usually develop policies and plans related to communication services and connectivity. These may include policies to promote the digital economy or digital transformation. Regulation of the communication sector broadly can be established through legislation to be the remit of an independent body outside of the ministry (“de jure” independent regulator), or as a unit within the ministry’s structure (OECD, 2021, p. 164[71]). However, de jure independence is also affected by the law’s application, the institutional culture and staff behaviour, which all contribute to the level of independence of the regulator in practice (“de facto independence”) (OECD, 2021[71]).

OECD recommendations for regulatory independence have relevance to SEA. Both the 2021 Broadband Recommendation on Broadband Connectivity and the 2012 Recommendation of the OECD Council on the Regulatory Policy and Governance advocate for regulatory independence and independent regulators in certain cases (OECD, 2021[72]; OECD, 2012[73]). These include where an independent regulator is needed to uphold public confidence; where governmental and private entities are subject to the same regulatory framework; and where regulatory decisions can have a significant economic impact on the regulated parties (OECD, 2012[73]). The communication sector clearly falls under this umbrella. Regulatory decisions can often have a significant impact on communication operators, including their ability to operate in the country or obtain critical spectrum resources. In addition, some operators, especially in SEA, have state ownership, which bolsters the call for independent regulators to uphold principles of competitive neutrality.

The region has both independent regulators, statutory bodies and ministerial regulators as defined by national legislation. In OECD countries, independent regulators are more common, with legislation defining 84% of communication regulators as independent (OECD, 2021[71]). Thailand provides an example of an independent sectoral regulator (Government of Thailand, 2010[74]). Cambodia established an autonomous body with remit over the communication sector (Government of Cambodia, 2015[75]). Nevertheless, the level of overall independence of the regulator in practice also depends on other aspects, such as appointment of top positions or budget allocation, which may introduce possible risks of political influence.

Myanmar is moving, in principle, towards creating an independent regulator. Article 86 of the 2013 Law on Communications requires the Myanmar government to establish an independent regulatory authority (Myanmar, 2013[76]). However, this has not happened yet, at the time of writing. In practice, the Department of Communications under the Ministry of Transportation and Communications supervises the sector (Department of Communications, Government of Myanmar, 2018[77]).

Singapore, Malaysia, the Philippines and Brunei Darussalam have varied statutory bodies to regulate the communication sector. In Singapore, the IMDA is a statutory board that regulates the communication and media sectors (Government of Singapore, 2016[78]), although it is subject to control by the Ministry of Communications and Information, its supervisory Ministry (IMDA, 2022, p. 74[79]). In Malaysia, the Malaysian Communications and Multimedia Commission (MCMC) is a “body corporate” tasked to regulate the communication and broadcasting sector (Section 4), however MCMC is responsible to the Minister of Communications and Digital (Section 18) (Malaysia, 1998[80]). In the Philippines, the National Telecommunications Commission (NTC) is defined as an “attached” agency of the Department of Information and Communications Technology (DICT), which is part of the Executive branch of government (Philippines, 2015[81]). The Authority for Info-communications Technology Industry of Brunei Darussalam is defined as a “body corporate” with the remit to regulate the communication sector, under the jurisdiction of the Ministry of Transport and Infocommunications (Brunei Darussalam, 2001[82]; MTIC, n.d.[83]).

Viet Nam, Lao PDR and Indonesia have ministerial regulators. The Viet Nam Authority of Telecommunications assists the Ministry of Information and Communications to monitor and regulate the communication sector (MIC, n.d.[84]). In Lao PDR, the regulatory authority is a body under the Ministry of Communications and Technology (World Bank, 2022[85]).12 Indonesia had a separate regulatory body, the Indonesian Telecommunication Regulatory Body (BRTI), which worked under and was responsible to the Ministry of Communications and Informatics (MCI) (ADB, 2020[86]). However, to streamline government, MCI fully assumed the regulatory functions when BRTI was disbanded in 2020 (MCI, 2020[87]; MCI, 2020[88]). The move to disband BRTI and further centralise regulatory functions in the ministry goes against OECD best practice for the communication sector, which supports regulatory independence, as noted above.

Some SEA countries have bodies that regulate both communication and broadcasting sectors. MCMC in Malaysia, IMDA in Singapore and NBTC in Thailand are examples of converged regulators, which have both sectors under their remit. The NTC in the Philippines has a mandate to “regulate and supervise radio and television broadcast stations, cable television (CATV) and pay television”, along with public telecommunications services (NTC, n.d.[89]).

1.3.2. Regional broadband strategies and plans

SEA economies have recognised the importance of connectivity, which underpins digital transformation, in achieving sustainable and inclusive growth. As a result, virtually all SEA countries have concrete plans and measures to expand and improve the quality of connectivity. In addition to these national plans, supranational initiatives for greater economic and social integration in the region prioritise connectivity improvement.

ASEAN has been adopting regional strategies to improve connectivity and accelerate technological innovation for decades. The ASEAN Digital Masterplan 2025 stresses the importance of regional connectivity and co‑operation. To that end, it seeks to increase the quality and coverage of fixed and mobile broadband infrastructure (DO2) through several concrete measures:

enabling and encouraging cross-border regional investment for network deployment

adopting best practices for granting permits and rights of way for network deployment

developing consistent regulation across the region, especially regarding spectrum allocation

ensuring adequate international Internet connectivity for the region

developing and measuring common metrics of telecommunication operators’ carbon footprint

establishing a regional centre of excellence for rural connectivity (ASEAN, 2021[90]).

The Asia-Pacific Information Superhighway (AP-IS), an initiative promoted by the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), has broader geographical scope. It aims to bridge digital divides and accelerate digital transformation by promoting digital connectivity, digital technologies and use of data in the Asia-Pacific region (ESCAP, 2022[91]). The Master Plan for the AP-IS (2019-22) (ESCAP, 2018[92]) has led, among other results, to feasibility studies and expert working group meetings to guide establishment of a common IXP. This aims to improve the efficiency of Internet traffic flow in Cambodia, Lao PDR, Myanmar and Viet Nam. The Master Plan has also inspired studies and pilot projects for the co‑deployment of ICT infrastructure with energy and road transport infrastructures, and development of an ICT resilience monitoring framework (e-resilience dashboard) (ESCAP, 2021[93]; 2022[94]). The AP-IS Master Plan for 2022-26 includes connectivity as one of its three pillars. It focuses mainly on enhancing regional broadband backbone networks and infrastructure for promotion of universal access to affordable and reliable Internet (ESCAP, 2021[93]).

1.4. Developing broadband policy recommendations for the SEA region

Authorities in the region recognise the importance of broadband as a key tool for digital transformation. In recent years, they have promoted policies and regulatory changes to foster deployment and adoption of broadband technologies. However, these policies must keep pace with the evolution of communication markets and networks. As economies and societies become more digital, communication networks must also adapt in tandem to offer high speed, low latency and resilient communication services that can support emerging technologies such as artificial intelligence and extended reality. Increasingly, they must consider the environmental sustainability of these communication networks as countries grapple with the effects of climate change.

In this context, the study aims to provide tailor-made recommendations for SEA countries to support the formulation of communication policies fit for the future. To this end, the study builds on the OECD Council Recommendation on Broadband Connectivity (hereafter the “Broadband Recommendation”) (OECD, 2021[72]). The Broadband Recommendation sets out overarching principles to extend connectivity and enhance the quality of broadband networks around the following pillars or targets:

Competition, investment and innovation in broadband development

Broadband network deployment and closing the digital divide

Quality of networks (resilience, reliability, security and high capacity)

Environmental impacts of networks

Regular assessment of broadband markets .

On this basis, the study analyses connectivity in the region to develop tailored recommendations based on the Broadband Recommendation. On the one hand, it examines the institutional framework of communication policy, complemented by a compilation of recent plans, and policy and regulatory measures. On the other, it analyses the state of connectivity and identifies areas for improvement in light of the pillars of the Broadband Recommendation. This is a data-driven analysis based on indicators selected to measure the degree of fulfilment of the objectives of the Broadband Recommendation pillars. The resulting tailor-made recommendations address the identified areas for improvement per pillar, while considering the current institutional framework and communication policies.

The OECD has extensive experience with such in-depth country studies, as well as regional studies (OECD, 2020[95]; OECD, 2019[30]; OECD, 2017[96]; OECD/IDB, 2016[97]). However, this study has a slightly different methodology, using a cluster analysis to account for the diverse set of countries in the SEA region. The cluster analysis groups countries according to conditions that can usually predict, or are closely related to, the level of broadband penetration. According to academic literature, these characteristics include the country’s economic output/wealth, population, level of human development (including longevity, education and income), degree of urbanisation, level of competition in communication markets and affordability of services (Cava-Ferreruela and Alabau-Muñoz, 2006[98]; Dwivedi and Lal, 2007[99]; Prado and Bauer, 2021[100]).

The analysis is conducted on a cluster basis, producing results for each country typology. In addition, one representative country was selected for each cluster to allow for in-depth analysis. The subsequent recommendations can be extrapolated to the other countries in the same cluster as they have a similar framework and macroeconomic conditions for broadband deployment. Overall, the study provides an overview of the region but with nuances that reflect its diversity.

The country clustering has been implemented through a statistical analysis13 of the aforementioned conditions14, along with fixed and mobile broadband penetration. This process has identified five clusters with the following distinctive features:

Cluster 1 comprises Cambodia, Lao PDR and Myanmar, and the selected representative country is Cambodia. The three countries all have a higher proportion of rural population than any others in the region.15 Other shared features are low educational attainment, low fixed broadband penetration and low per capita income, all of which are among the lowest in the region.

Cluster 2 (Thailand and Malaysia) and cluster 3 (the Philippines and Indonesia) share less rurality and better development and broadband indicators than cluster 1, but they have significant differences between them. Cluster 2 countries have comparatively fewer urban areas than cluster 3 countries.16 In addition, cluster 2 is characterised by higher income levels and higher broadband penetration, especially mobile broadband. The analysis selected Thailand as the representative country for cluster 2, and Indonesia for cluster 3.

Cluster 4 comprises Viet Nam. This country is similar to clusters 2 and 3 for most indicators. However, it has two significant distinguishing features: its high fixed broadband penetration, second only to Singapore, and its high urban cluster type of urbanisation, second only to Brunei Darussalam.17

Finally, cluster 5 formed by Brunei Darussalam and Singapore share complementary characteristics with cluster 1: low rurality, high education level, high per capita income and high fixed broadband penetration. However, Brunei Darussalam is mostly urban cluster-based and Singapore is urban centre-based. Given the significant commonalities, these countries were analysed as a single cluster and Singapore was chosen as the representative country.

According to the described methodology, the following chapters study each of the SEA country clusters, focusing on the chosen representative country, namely Cambodia (Chapter 3), Indonesia (Chapter 4), Singapore (Chapter 5), Thailand (Chapter 6) and Viet Nam (Chapter 7). Following an analysis of the situation of broadband connectivity in each country, each chapter includes tailored-made recommendations. These cluster studies, as well as the analysis at the regional level presented in this chapter, inform the key recommendations outlined in the executive summary.

References

[86] ADB (2020), How Better Regulation can Shape the Future of Indonesia’s Electricity Sector, Asian Development Bank, Mandaluyong City, https://doi.org/10.22617/TCS200427.

[18] ASEAN (2022), The 2022 ASEAN SDG Snapshot Report, Association of Southeast Asian Nations, Jakarta, https://www.aseanstats.org/wp-content/uploads/2022/08/The-2022-ASEAN-SDG-Snapshot-Report.pdf.

[15] ASEAN (2021), ASEAN Development Outlook: Inclusive and Sustainable Development, Association of Southeast Asian Nations, Jakarta, https://asean.org/book/asean-development-outlook/.

[90] ASEAN (2021), ASEAN Digital Masterplan 2025, Association of Southeast Asian Nations, Jakarta, https://asean.org/wp-content/uploads/2021/09/ASEAN-Digital-Masterplan-EDITED.pdf.

[24] ASEAN (2021), ASEAN Key Figures 2021, Association of Southeast Asian Nations, Jakarta, https://www.aseanstats.org/wp-content/uploads/2021/12/ASEAN-KEY-FIGURES-2021-FINAL-1.pdf.

[26] ASEAN (2019), ASEAN Digital Integration Framework Action Plan (DIFAP) 2019-2025, Association of Southeast Asian Nations, Jakarta, https://asean.org/asean2020/wp-content/uploads/2020/12/ASEAN-Digital-Integration-Framework-Action-Plan-DIFAP-2019-2025.pdf.

[102] ASEAN (2019), Trade in Services in ASEAN, Association of Southeast Asian Nations, Jakarta, https://asean.org/our-communities/economic-community/services/.

[57] Axiata Group (2022), “Transactions (Chapter 10 of Listing Requirements): Non Related Party Transactions”, 28 June, Axiata Group, Kuala Lumpur, https://axiata.listedcompany.com/news.html/id/2394012.

[12] Britannica (2022), “Southeast Asia”, webpage, https://www.britannica.com/place/Southeast-Asia (accessed on 29 August 2023).

[82] Brunei Darussalam (2001), Authority for Info-communications Technology Industry of Brunei Darussalam Order, 2001, http://www.agc.gov.bn/AGC%20Images/LAWS/Gazette_PDF/2001/EN/s039.pdf.

[98] Cava-Ferreruela, I. and A. Alabau-Muñoz (2006), “Broadband policy assessment: A cross-national empirical analysis”, Telecommunications Policy, Vol. 30/8-9, pp. 445-463, https://doi.org/10.1016/j.telpol.2005.12.002.

[55] CK Hutchison Holdings Ltd (2022), “Ooredoo Group and CK Hutchison create Indonesia’s second largest mobile telecoms company by completing the merger of their Indonesian businesses”, 4 January, Press Release, CK Hutchison Holdings Ltd, Doha and Hong Kong, https://www.ckh.com.hk/en/media/press_each.php?id=3380.

[77] Department of Communications, Government of Myanmar (2018), နောက်ခံသမိုင်းအကျဉ်, [Brief background history], Department of Communications, Government of Myanmar, webpage, https://ptd.gov.mm/AboutUs.aspx?id=uuP8hB8h/cFg6f0NW3Eeuw== (accessed on 29 August 2023).

[70] Developing Telecoms (2023), “Malaysia to build second 5G network”, 3 May, Developing Telecoms, https://developingtelecoms.com/telecom-business/telecom-regulation/14930-malaysia-to-build-second-5g-network.html.

[68] Developing Telecoms (2023), “Malaysia to sell off 5G wholesale company”, 9 May, Developing Telecoms, https://developingtelecoms.com/telecom-business/operator-news/14952-malaysia-to-sell-off-5g-wholesale-company.html.

[63] DITO Telecommunity (2023), DITO, website, https://dito.ph/corporate (accessed on 29 August 2023).

[66] DNB (2021), “FAQ”, webpage, https://www.digital-nasional.com.my/ (accessed on 29 August 2023).

[99] Dwivedi, Y. and B. Lal (2007), “Broadband policy assessment: A cross-national empirical analysis”, Industrial Management & Data Systems, Vol. 107/5.

[17] ESCAP (2022), Asia-Pacific Report on Population Ageing 2022, United Nations Economic and Social Commission for Asia and the Pacific, Bangkok, https://www.unescap.org/sites/default/d8files/knowledge-products/AP-Ageing-2022-report.pdf.

[94] ESCAP (2022), “e-Resilience Monitoring Dashboard”, webpage, https://www.unescap.org/projects/e-resilience (accessed on 29 August 2023).

[38] ESCAP (2022), Promoting ICT Connectivity through Internet Exchange Points in South-East Asia, United Nations Economic and Social Commission for Asia and the Pacific, Bangkok, https://www.unescap.org/kp/2022/promoting-ict-connectivity-through-internet-exchange-points-south-east-asia.

[91] ESCAP (2022), The Asia-Pacific Information Superhighway Platform, website, https://www.unescap.org/our-work/ict-and-disaster-risk-reduction/asia-pacific-information-superhighway-platform# (accessed on 29 August 2023).

[93] ESCAP (2021), Action Plan for Implementation of the Asia-Pacific Information Superhighway (2022-2026) Draft v4, United Nations Economic and Social Commission for Asia and the Pacific, Bangkok, https://www.unescap.org/sites/default/d8files/event-documents/Action%20Plan%20for%20Implementation%20of%20the%20Asia-Pacific%20Information%20Superhighway%20%282022-2026%29.pdf.

[45] ESCAP (2021), E-Resilience Readiness of ICT Infrastructure, E-Resilience Policy Brief Series, United Nations Economic and Social Commission for Asia and the Pacific, Bangkok, https://unece.org/sites/default/files/2021-10/10E%20E-resilience%20readiness%20of%20ICT%20infrastructure_1.pdf.

[92] ESCAP (2018), Master Plan for the Asia-Pacific Information Superhighway, 2019–2022, United Nations Economic and Social Commission for Asia and the Pacific, Bangkok, https://www.unescap.org/sites/default/files/ESCAP_CICTSTI_2018_INF1.pdf.

[27] Estrada, G. et al. (2017), “Asia’s Middle-Income Challenge”, ADB Economics Working Paper Series, Asian Development Bank, Mandaluyong City, https://doi.org/10.22617/wps179122-2.

[1] European Commission, Joint Research Centre (2015), Country Fact Sheets based on the Degree of Urbanisation, website, https://ghsl.jrc.ec.europa.eu/CFS.php (accessed on 18 October 2023).

[75] Government of Cambodia (2015), ច្បាប់ស្ដីពីទូរគមនាគមន៍, [Law on Telecommunications], Telecommunications Regulator of Cambodia, https://trc.gov.kh/wp-content/uploads/law/law-on-telecommunications.pdf.

[78] Government of Singapore (2016), Info-communications Media Development Authority Act 2016 (including amendments), Singapore Statues Online – Legislative Division of the Attorney-General’s Chambers of Singapore, https://sso.agc.gov.sg/act/imdaa2016.

[74] Government of Thailand (2010), พระราชบัญญัติองค์กรจัดสรรคลื่นความถี่และกำกับการประกอบกิจการวิทยุกระจายเสียง วิทยุโทรทัศน์ และกิจการโทรคมนาคม พ.ศ. ๒๕๕๓ และที่แก้ไขเพิ่มเติม, [Act on Organization to Assign Radio Frequency and Telecommunications services B.E. 2553 (2010)], National Broadcasting and Telecommunications Commission, Bangkok, https://www.nbtc.go.th/.

[33] GSMA (2022), The State of Mobile Internet Connectivity 2022, https://www.gsma.com/r/wp-content/uploads/2022/12/The-State-of-Mobile-Internet-Connectivity-Report-2022.pdf (accessed on 30 August 2023).

[32] GSMA (2021), Using the GSMA Mobile Connectivity Index to drive digital inclusion: Guidelines for policymakers, https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2021/07/Using-the-GSMA-Mobile-Connectivity-Index-to-drive-digital-inclusion.pdf (accessed on 30 August 2023).

[31] GSMA Intelligence (2023), “Database”, webpage, https://www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

[101] Hawkinson, J. and T. Bates (1996), “Guidelines for creation, selection, and registration of an Autonomous System (AS)”, Datatracker, Internet Engineering Task Force, https://datatracker.ietf.org/doc/rfc1930/.

[79] IMDA (2022), Architecting Singapore’s digital future: Annual report 2021/2022, IMDA, https://www.imda.gov.sg/-/media/Imda/Files/About/Resources/Corporate-Publications/Annual-Report/IMDA-Annual-Report-FY2021-2022.pdf.