Cambodia is located on the region's mainland, with a predominantly flat geography and a relatively high proportion of a rural population. Its economy continues to grow at pace, and the level of human development, including income, life expectancy, and education, is medium. Given that these features are shared with its regional peer countries of Lao People’s Democratic Republic and Myanmar, these countries are analysed as a cluster represented by Cambodia. The chapter outlines the geographic, economic and social conditions for broadband connectivity in Cambodia. It proceeds by examining the performance and structure of the market and reviewing Cambodia’s communication policy and regulatory framework, including broadband strategies and plans. It then reviews competition, investment and innovation in broadband markets; broadband deployment and digital divides; networks' resilience, reliability, security and capacity; and the country’s assessment of broadband markets. It offers recommendations to improve in these areas, which could be relevant for the other countries forming this cluster.

Extending Broadband Connectivity in Southeast Asia

2. Extending broadband connectivity in Cambodia

Abstract

Policy recommendations

1. Strengthen the regulatory independence of TRC by adopting measures to increase transparency in the selection process of top officials and in budgetary allocation.

2. Clarify areas of potential overlap with MPTC and TRC and consider whether TRC should receive further powers to enable it to carry out its mandate effectively.

3. Reduce regulatory uncertainty through active engagement with operators and clear communication on the timeline of regulatory changes.

4. Leverage the ongoing legislative processes to define SMP regulation and clarify the roles of TRC and the CCC on competition matters in the communication sector.

5. Undertake competition assessments once the Prakas on competition aspects comes into effect.

6. Consider fostering the wholesale market and monitoring wholesale prices.

7. Assess the impact the level of fees may have on operators’ investment decisions.

8. Support investment through expedient licensing processes.

9. Apply regulation impartially and clearly communicate upcoming changes to industry.

10. Support industrial efforts to deploy 5G networks.

11. Reduce barriers to broadband deployment by streamlining access to rights of way, public infrastructure and permits for network construction.

12. Promote co-ordination of civil works and passive infrastructure sharing between different networks, especially between communication and electricity networks.

13. Promote and invest in improving digital literacy.

14. Take actions to improve the affordability of communication services and access devices.

15. Leverage synergies between programmes to promote the provision and adoption of connectivity services.

16. Publish open, verifiable, granular and reliable subscription, coverage and quality of service data.

17. Promote measures to improve the quality of communication networks.

18. Promote measures to improve the resilience of traffic exchange infrastructures and international connectivity.

19. Assess the environmental impact of investment projects in communication networks, while promoting sustainable networks.

20. Encourage communication network operators to report regularly on their environmental impacts and initiatives.

21. Regularly assess the state of connectivity to determine whether public policy initiatives are appropriate, and whether and how they should be adjusted.

Note: CCC = Cambodian Competition Commission; MPTC = Ministry of Post and Telecommunications; SMP = Significant Market Power; TRC = Telecommunication Regulator of Cambodia. These tailored recommendations build on the OECD Council's Recommendation on Broadband Connectivity (OECD, 2021[1]), which sets out overarching principles for expanding connectivity and improving the quality of broadband networks. The number of recommendations is not an appropriate basis for comparison as they depend on several factors, including the depth of contributions and feedback received from national stakeholders. In addition, recommendations do not necessarily carry the same weight or importance.

2.1. Geographic, economic and social conditions for broadband connectivity

Geographically, Cambodia is in the southern part of the Indochina Peninsula, between Viet Nam in the east and Thailand in the west. Cambodia borders Lao People’s Democratic Republic (Lao PDR) to the north and has a coastline on the southwest with the Gulf of Thailand. A low-lying central plain surrounded by low mountains, the Tonle Sap (Great Lake) and the upper reaches of the Mekong River delta define Cambodia’s landscape (Britannica, 2022[2]).

Cambodia has a population of 16.8 million people as of 2022 (UN DESA, 2022[3]), and its capital Phnom Penh has a population of more than 2 million people (Ministry of Plannning, 2020[4]). Other urban centres of considerable size are Ta Khmau, next to Phnom Penh in the south; Battambang in the west; Serei Seophoan in the northwest; Siem Reap known for Angkor Wat and near the Tonle Sap; Kampong Cham on the Mekong River in the southeast; and Sihanoukville on the Thailand Bay in the southwest.

Cambodia is one of the most disaster-prone countries in Southeast Asia, affected by seasonal floods and droughts. Floods from the Mekong River and Tonle Sap Lake occur repeatedly during the rainy season. They often cause major disasters, as about 80% of the country’s population lives along the Mekong River (World Bank, 2021[5]). On the other hand, irregular or shorter monsoon rains often cause drought damage. In addition, sea-level rise could pose a significant threat to coastal areas already plagued by storm surges, coastal erosion and seawater intrusion. Cambodia has suffered great socio-economic losses due to these natural disasters (World Bank, 2021[5]).

Cambodia is the representative country of the cluster comprising Cambodia, Lao PDR and Myanmar. Key features of this group of countries include their predominantly rural nature. It also has relatively low educational attainment and low per capita income, both of which are among the lowest in the region (see Table 2.1). However, Cambodia, Lao PDR and Myanmar are all classified as having a “medium” level of human development, considering indicators including longevity, education and income (UNDP, 2022[6]).

With respect to gross domestic product (GDP) per capita, Cambodia was in the middle of the three with USD PPP 5 601 in 2022. Lao PDR’s position was higher at USD PPP 9 207 and Myanmar’s was slightly lower at USD PPP 4 847 (IMF, 2023[7]). These three countries occupy the bottom three positions among Southeast Asian countries. The 2022 populations of Cambodia, Lao PDR and Myanmar were 16.8 million, 7.5 million and 54.2 million, respectively (UN DESA, 2022[3]). They are the seventh, eighth and fifth most populous countries in Southeast Asia.

Cambodia, Lao PDR and Myanmar have similar geographic breakdowns between urban and rural areas. Around 99% of their land mass was classified as “rural”, with the remainder considered urban (“urban cluster”1 or “urban centre”2) (European Commission, Joint Research Centre, 2015[8]). In addition, the proportion of the population in rural areas is relatively high for the region.3 In Cambodia, 51.6% live in rural areas, while the figures are 82.5% in Lao PDR and 34.9% in Myanmar. They are ranked second, first and fifth in the region for rural population (European Commission, Joint Research Centre, 2015[8]).

Table 2.1. Human development (2021) and degree of urbanisation (2015), Cambodia, Lao PDR and Myanmar

|

|

Life expectancy (years, 2021) |

Expected years of schooling (children, 2021) |

Mean years of schooling (adults, 2021) |

Gross domestic product per capita (current prices, PPP, 2022) |

Population living in urban centres (%, 2015) |

Population living in urban clusters (%, 2015) |

Population living in rural areas (%, 2015) |

|---|---|---|---|---|---|---|---|

|

Cambodia |

69.6(6) |

11.5(8) |

5.1(10) |

5 601(9) |

18.3 |

30.1 |

51.6 |

|

Lao PDR |

68.1(8) |

10.1(10) |

5.4(9) |

9 207(8) |

8.5 |

9.0 |

82.5 |

|

Myanmar |

65.7(10) |

10.9(9) |

6.4(8) |

4 847(10) |

41.0 |

24.1 |

34.9 |

|

OECD Average |

80.0 |

17.1 |

12.3 |

53 957 |

48.8 (2022 data) |

28.11 (2022 data) |

23.11 (2022 data) |

Note: The numbers in parentheses refer to the simple ranking (i.e. no weighting) of SEA countries for each indicator. The OECD average for human development indicators is a simple average across OECD member countries. The urbanisation indicators for SEA countries refer to the population percentage in urban centres, urban clusters and rural areas, respectively. For the OECD, figures are given for the rate of the population living in predominantly urban, intermediate, and rural regions, respectively.

Source: [Human development indicators] UNDP(2022[7]), Human Development Report 2021/2022: Uncertain Times, Unsettled Lives: Shaping our Future in a Transforming World, www.undp.org/egypt/publications/human-development-report-2021-22-uncertain-times-unsettled-lives-shaping-our-future-transforming-world. [GDP per capita, SEA countries] IMF (2023[7]), World Economic Outlook Database, April 2023, www.imf.org/en/Publications/WEO/weo-database/2023/April (accessed on 28 June 2023). [GDP per capita, OECD] OECD (2023[11]), Gross domestic product (GDP) (indicator), https://doi.org/10.1787/dc2f7aec-en (accessed on 30 June 2023). [Urbanisation indicators for SEA] European Commission, Joint Research Centre(2015[9]), Global Human Settlement Layer (GHSL), https://ghsl.jrc.ec.europa.eu/CFS.php. [Urbanisation indicators for OECD] OECD (2023[9]), OECD.Stat (database),”'Regions and cities: Regional statistics: Regional demography: Demographic indicators by rural/urban typology, Country level: OECD: share of national population by typology”, https://stats.oecd.org/ (accessed on 28 August 2023).

Given the similarities in conditions for broadband deployment and use, recommendations for Cambodia may also be relevant for Lao PDR and Myanmar. The subsequent sections focus on Cambodia for further analysis.

2.2. Market landscape

2.2.1. Market performance

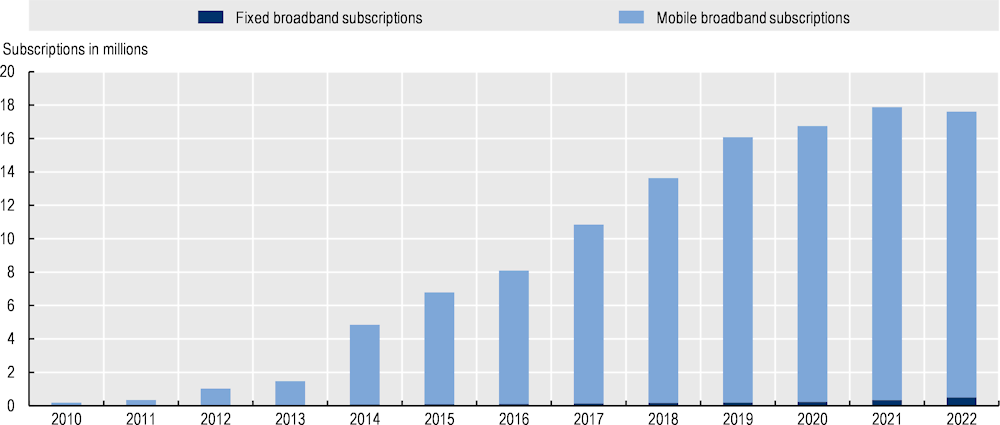

Broadband uptake has grown dramatically in the last decade (2010-22), led by mobile broadband connectivity (Figure 2.1). The total number of broadband subscriptions soared from 185 666 in 2010 to 17.6 million in 2022, of which almost all (97%) were mobile subscriptions (ITU, 2023[10]). Mobile broadband subscriptions grew at an annual rate of 62% between 2010 and 2022; the deployment of 4G networks led to a significant increase in subscribers from 2014 (Figure 2.9) (ITU, 2023[10]). However, year-on-year growth rates have been lower in recent years, even with a slight decline in 2022 (-2.5%) (ITU, 2023[10]). In terms of penetration, the number of mobile subscriptions exceeded Cambodia’s inhabitants in 2020, reaching 102.0 subscriptions per 100 inhabitants in 2022, slightly below the regional average (103.7 subscriptions) (ITU, 2023[10]).

Fixed broadband adoption is much lower, reaching only 509 830 subscribers in 2022 and growing at a slower pace. Year-on-year growth averaged 29% between 2010-22, although accelerating in 2021 and 2022 with rates of 44% and 52% respectively (ITU, 2023[10]). Cambodia has the third lowest fixed penetration rate in the region, with 3.0 subscriptions per 100 inhabitants (2022) (ITU, 2023[10]). This rate was just above Myanmar and Lao PDR, with 2.1 and 2.0 fixed broadband subscriptions per 100 inhabitants in 2022, respectively (ITU, 2023[10]).

Figure 2.1. Broadband subscriptions, 2010-22

Note: Fixed broadband subscriptions refer to fixed subscriptions to high-speed access to the public Internet (TCP/IP connection) at downstream speeds equal to, or greater than, 256 kbit/s. This includes cable modem, DSL, fibre-to-the-home/building, other fixed (wired)-broadband subscriptions, satellite broadband and terrestrial fixed wireless broadband. It includes fixed WiMAX and any other fixed wireless technologies. This total is measured irrespective of the method of payment. It excludes subscriptions with access to data communications (including the Internet) via mobile-cellular networks. It includes both residential subscriptions and subscriptions for organisations. Mobile broadband subscriptions (active mobile-broadband subscriptions in ITU Database) refer to the sum of active handset-based and computer-based (USB/dongles) mobile-broadband subscriptions that allow access to the Internet. It covers actual subscribers, not potential subscribers, even though the latter may have broadband-enabled handsets. Subscriptions must include a recurring subscription fee or pass a usage requirement if in the prepayment modality – users must have accessed the Internet in the last three months (ITU, 2020[11]).

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

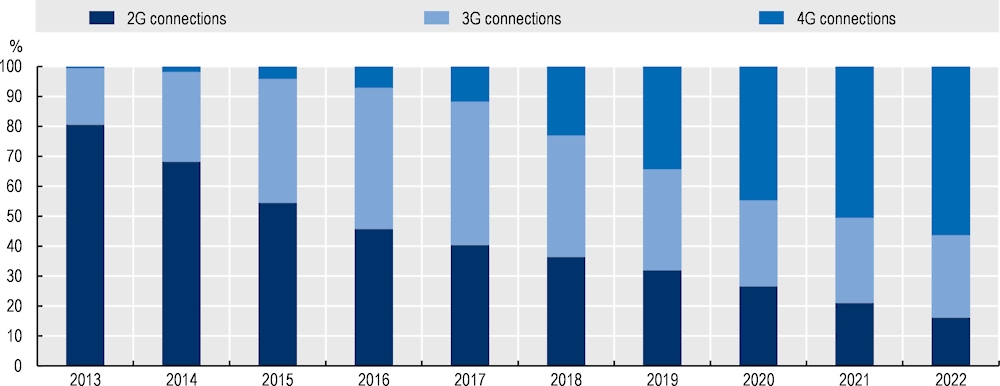

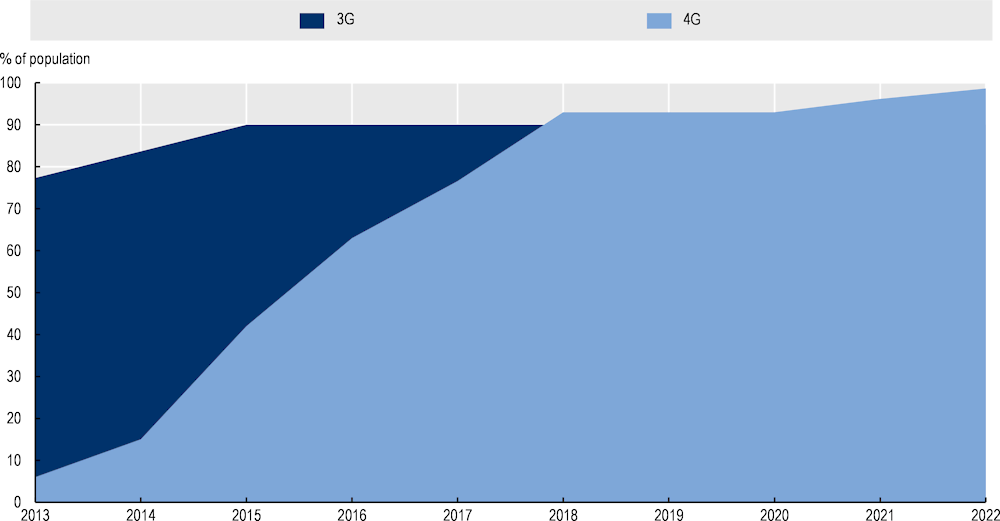

4G is the most common technology in Cambodia, accounting for 56% of mobile connections in 2022 (GSMA Intelligence, 2023[12]). It is followed by 3G with 28%, which has been in continuous decline since 2018. This decline coincides with the rollout of 4G networks, which reached 93% population coverage in that year. 2G still makes up 16% of mobile connections in the country, although it has been declining since 2013 (GSMA Intelligence, 2023[12]). Cambodia has not yet deployed 5G commercially, along with Brunei Darussalam, Myanmar and Viet Nam in the region (GSMA Intelligence, 2023[12]).

Figure 2.2. Percentage of mobile connections per technology, 2013-22

Source: GSMA Intelligence (2023[12]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

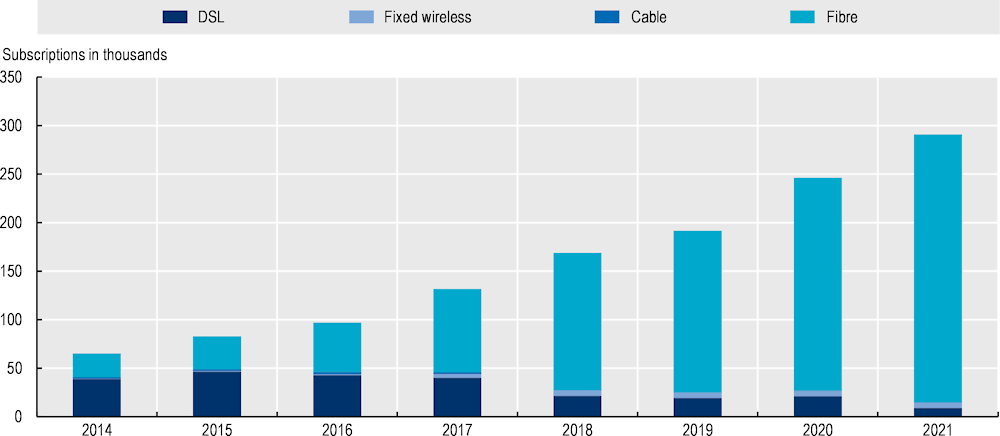

On the fixed side, Cambodia has seen a significant increase in the deployment and technological upgrade of its broadband networks over the last ten years, albeit from a low base. Fibre-to-the-home (FTTH) is the most widely used technology for fixed broadband in Cambodia, which overtook digital subscriber line (DSL) in terms of subscriptions in 2016. By 2021, 95% of fixed broadband subscriptions used FTTH technology, DSL reported 3% of total fixed broadband subscriptions, fixed wireless access accounted for 2%, and cable had only 0.1% (ITU, 2023[10]) (Figure 2.3).

Much of the fibre deployed is aerial fibre. This installation method is often faster and cheaper than laying fibre underground, but it has caused aesthetic and operational problems and is less resilient. This has led authorities to take steps to move to cables underground in major metropolitan areas. Operators report that FTTH networks are concentrated in densely populated areas, with much less geographic coverage compared to mobile networks. The low coverage area contributes to the low penetration rate of fixed broadband subscriptions (3 subscriptions per 100 inhabitants, 2022) (ITU, 2023[10]).

Beyond FTTH and DSL, the other technologies providing fixed access remained constant and at low levels, although fixed wireless access subscriptions increased since 2016 (ITU, 2023[10]). Interviews with operators suggest this technology has emerged to provide a fixed connectivity solution in areas where fibre is not available, mainly to business and government customers.

Figure 2.3. Fixed broadband subscriptions by technology, 2010-21

Note: Terrestrial fixed wireless broadband subscriptions for 2020 and 2021 are estimates.

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

In 2022, prices for entry-level mobile communication services in Cambodia (USD PPP 11.0) were around a quarter of those for entry-level fixed services (USD PPP 41.1) (ITU, 2023[10]). This follows regional trends, with the regional average for entry-level fixed broadband services at USD PPP 51.6 compared to USD PPP 15.5 for entry-level mobile services (ITU, 2023[10]).

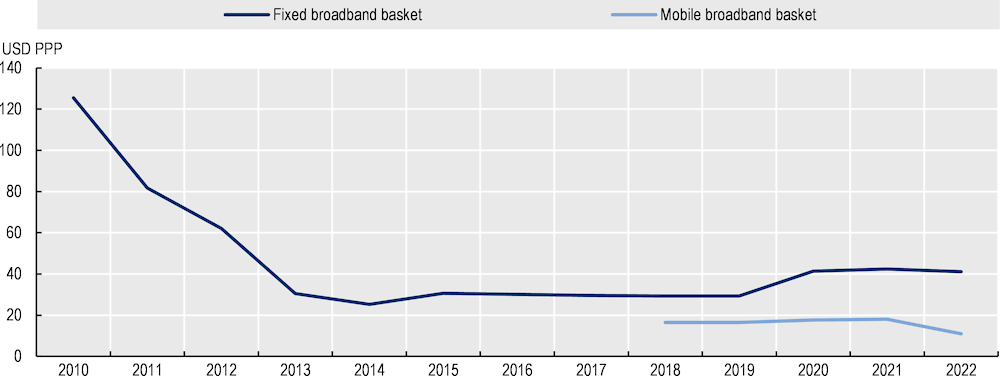

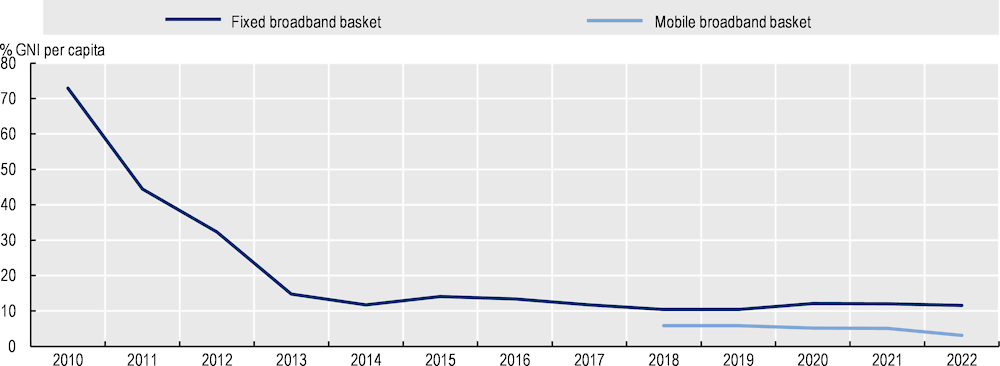

As Figure 2.4 shows, prices for entry-level fixed broadband services (5 GB monthly data usage) have fallen since 2010. They dropped sharply from USD PPP 125.4 in 2010 to USD PPP 25.3 in 2014 (ITU, 2023[10]). Prices were relatively stable after 2014 until 2020, when they increased to reach USD PPP 41.1 in 2022 (ITU, 2023[10]). Despite this uptick, Cambodia’s prices in 2022 for entry-level fixed services (USD PPP 41.1) ranked second best in the region. They were behind Viet Nam (USD PPP 22.8) and below the regional average of USD PPP 51.6 (ITU, 2023[10]).

For entry-level mobile services (monthly data usage of a minimum of 500 MB of data, 70 voice minutes and 20 SMSs), prices over the past four years have been relatively steady (mobile pricing data prior to 2018 are unavailable). They show a slight increase from USD PPP 16.5 in 2018 to USD PPP 18.1 in 2021, followed by a decrease to USD PPP 11.0 in 2022 (Figure 2.4) (ITU, 2023[10]). In 2022, entry-level mobile prices in Cambodia were third lowest in the region after Myanmar and Viet Nam (USD PPP 5.2 and 6.8, respectively). They were also below the regional average (USD PPP 15.5) (ITU, 2023[10]). Despite these low prices (in terms of USD PPP), the affordability of fixed and mobile services may pose a barrier to adoption (see section on Digital divides below). In terms of price as a percentage of gross national income (GNI) per capita, Cambodia’s prices are among the least affordable in the region. Cambodia’s fixed (11.6% of GNI per capita) and mobile broadband prices (3.1%) both rank second highest in SEA in 2022 (ITU, 2023[10]) (Figure 2.12).

Figure 2.4. Prices for entry-level fixed and mobile communication services, USD PPP, 2010-22

Note: The fixed broadband basket refers to the price of a monthly subscription to an entry-level fixed-broadband plan. For comparability reasons, the fixed-broadband basket is based on a monthly data usage of a minimum of 1 GB from 2010 to 2017, and 5 GB from 2018 to 2022. For plans that limit the monthly amount of data transferred by including data volume caps below 1GB or 5 GB, the cost for the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s. The mobile broadband basket is based on a monthly data usage of a minimum of 500 MB of data, 70 voice minutes, and 20 SMSs. For plans that limit the monthly amount of data transferred by including data volume caps below 500 MB (low-consumption), the cost of the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s, relying on 3G technologies or above. The data-and-voice price basket is chosen without regard to the plan’s modality, while at the same time, early termination fees for post-paid plans with annual or longer commitment periods are also taken into consideration (ITU, 2020[13]). Mobile basket prices are not available from 2010 to 2017.

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

2.2.2. Market structure

Cambodia’s mobile market structure has experienced vast change over the past decade. In 2012, there were eight active mobile operators, with a strong level of competition (Vong, Lee and Zo, 2012[14]). These eight operators operated in a market largely regulated through ad hoc legislation. This changed with the Law on Telecommunications (hereafter “Telecom Law”), adopted in 2015 (Vong, Lee and Zo, 2012[14]).

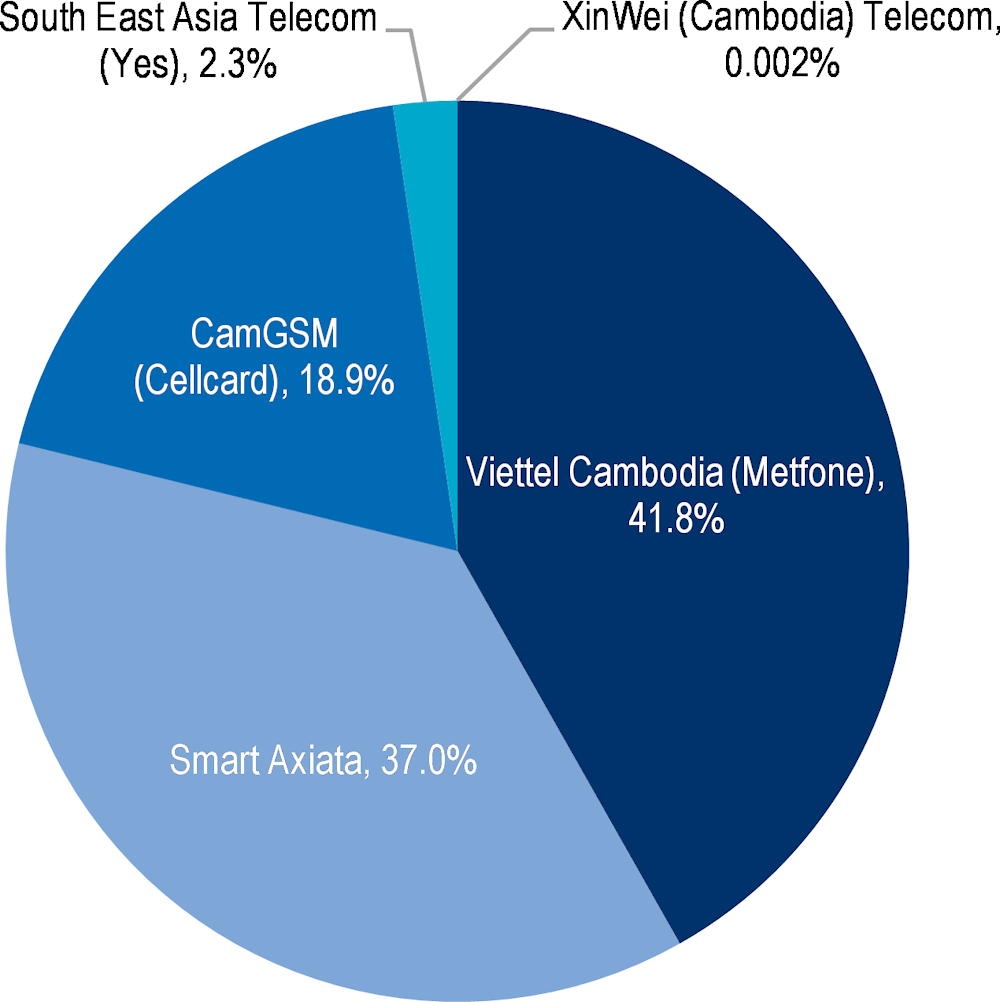

In 2021, five mobile operators remained, with the two largest players holding close to 80% of the market in terms of mobile broadband subscriptions (Figure 2.5). According to national authorities, Viettel Cambodia (Metfone) leads the mobile market with 41.8% of mobile broadband subscriptions as of the end of 2021, followed closely by Smart Axiata with 37% market share. CamGSM (Cellcard) is in third place with 18.9% of the market, and South East Asia Telecom (Yes) and XinWei (Cambodia) Telecom hold the remaining shares with 2.3% and 0.002%, respectively. These operators provide services mainly over their own networks. There are no mobile virtual network operators (MVNOs) present on the market, according to national authorities.

Figure 2.5. Mobile market shares based on mobile broadband subscriptions, Q4 2021

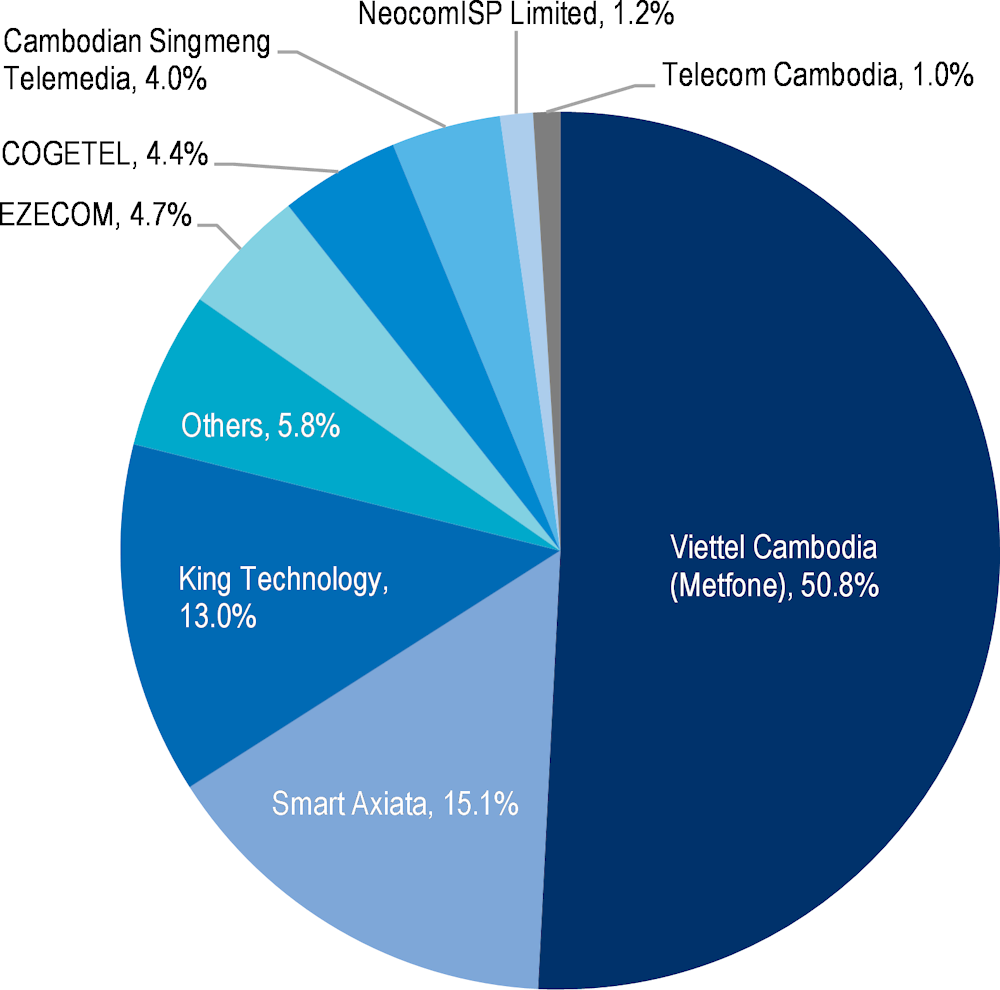

The fixed market in Cambodia, by contrast, has many operators offering services (Figure 2.6). Viettel Cambodia (Metfone) holds 50.8% of the market based on the number of fixed broadband subscriptions, according to information from national authorities. It is followed by Smart Axiata at a distant second with 15.1% of the market and King Technology in third with 13%. EZECOM, COGETEL and Cambodian Singmeng Telemedia hold 4.7%, 4.4% and 4%, respectively, while NeocomISP Ltd holds 1.2% and Telecom Cambodia holds 1%. The remaining 5.8% of the market is split between 30 Internet service providers (ISPs) that each hold less than 1% market share based on number of fixed broadband subscriptions. According to Cambodian authorities, only Telecom Cambodia owns and operates its own fixed network; all other operators provide services mainly over third-party infrastructure.

Figure 2.6. Fixed market shares based on fixed broadband subscriptions, Q4 2021

Note: “Others” includes ISPs with less than 1% market share each based on number of fixed broadband subscribers (30 ISPs make up this list).

Source: OECD elaboration based on data from Cambodian authorities.

There is some state ownership in the communication market. Namely, Telecom Cambodia is 100% state-owned, under the technical supervision of MPTC and the financial supervision of the Ministry of Finance and Economy (Government of Cambodia, 2005[15]). Among the largest players in both the fixed and mobile markets in terms of market shares, others have foreign state ownership. For example, Viettel Cambodia (Metfone) is part of the Viettel Group, which is under the management of the Vietnamese Ministry of Defence (MIC, 2018[16]). Smart Axiata is part of the Axiata Group Berhad, which has various stakeholders, with the largest being Khazanah Nasional Berhad (36.73%), Malaysia’s sovereign wealth fund, and Permodalan Nasional Berhad (18.39%), a Malaysian wealth management company (Axiata Group Berhad, 2022[17]). CamGSM(Cellcard) is majority-owned by Royal Millicom Co., Ltd (98.5% of shares), a joint venture of two investment firms (CamGSM, 2023[18]).

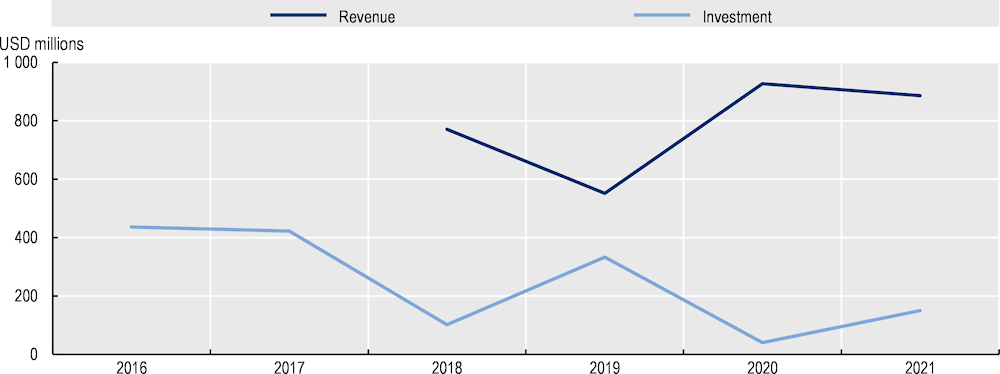

In Cambodia, data on investment in the communication sector (mobile and fixed networks) show a decline from 2016-21. Investment fell from USD 436 million in 2016 to USD 150 million in 2021, a decrease of 66% over the period (Figure 2.7) (ITU, 2023[10]). By contrast, revenues for the sector increased slightly from USD 771 million in 2018 to USD 886 million in 2021, a growth rate over the four-year period of 15% (Figure 2.7) (ITU, 2023[10]). The ratio of investment to revenues across the sector for 2021 was 17% (ITU, 2023[10]).

Figure 2.7. Revenue and investment in communication services, 2016-21

Note: Revenue data before 2018 are unavailable.

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

Due to data gaps for communication investments in both fixed and mobile networks, it is difficult to compare Cambodia’s figures to regional peers. However, a comparison across the region is possible for investments in mobile networks. GSMA Intelligence data show Cambodia’s investment in mobile networks (Capex) at a relatively stable growth rate of 16% over the period of 2013-22, from USD 134 million in 2013 and reaching USD 155 million in 2022, in nominal terms (GSMA Intelligence, 2023[12]).

By comparison, nominal revenues of the mobile communication sector in Cambodia have steadily increased between 2013-22. During that period, revenues had a growth rate of 42%, from USD 719 million in 2013 to USD 1 billion in 2022 (GSMA Intelligence, 2023[12]).

Cambodia ranks the third lowest in the SEA region in terms of both mobile revenues and investment (Capex) in nominal terms in 2022, ahead of Brunei Darussalam and Lao PDR (GSMA Intelligence, 2023[12]). Considering its ratio of investment to revenues in 2022, Cambodia with 15% is below the regional average of 21% (GSMA Intelligence, 2023[12]). This means that Cambodian mobile operators are investing slightly less in proportion to the revenues received than the average for the region .

2.3. Communication policy and regulatory framework

2.3.1. Institutional framework

The Telecom Law, adopted in 2015, defines the responsibilities of the Ministry of Post and Telecommunications (MPTC) (Government of Cambodia, 2015[19]). MPTC formulates policies and regulations over the communication sector. It can issue ministerial decisions, known as “Prakas”, related to specific issues such as licensing, interconnection, technical standards, numbering, radio frequency plans and competition. It issues Prakas as needed or upon the advice of the regulatory authority, the Telecommunication Regulator of Cambodia (TRC) (Government of Cambodia, 2015[19]). Article 7 of the Telecom Law gives MPTC broad latitude to order operators to take certain measures in “force majeure” events [unofficial translation] (Government of Cambodia, 2015[19]). MPTC also has competence over communication infrastructures and networks (Art. 24) (Government of Cambodia, 2015[19]). Further, MPTC appoints officials to monitor enforcement of the Telecom Law, although this seems to be more focused on the technical inspection of the network and equipment (Art. 70) (Government of Cambodia, 2015[19]).

The Telecom Law formally establishes TRC as an autonomous body with remit over the communication sector (Government of Cambodia, 2015[19]). TRC’s duties include regulating and monitoring the communication sector, resolving disputes, enforcing relevant regulation and making recommendations to the MPTC regarding regulation and the issuance of Prakas (Government of Cambodia, 2015[19]). TRC grants licences for operation of communication networks, as well as for the use of spectrum resources. TRC can undertake several enforcement actions in case of non-compliance (Art. 78), however MPTC has the authority to issue fines (Art. 79) (Government of Cambodia, 2015[19]).

The Ministry of Economy and Finance must approve TRC’s annual budget, which is described as an annex of MPTC’s budget (Government of Cambodia, 2015[19]). The TRC Chairperson, who is the head of the organisation, is selected by the Minister of Post and Telecommunications and proposed to the head of the Cambodian government for appointment (Government of Cambodia, 2015[19]). The Telecom Law contains few details regarding the selection process. It only mentions the Chairperson should hold a university degree, possess “appropriate qualifications” and have at least ten years’ experience in “telecommunications, information technology, law, public administration, economics, commerce” or other related fields [unofficial translation] (Government of Cambodia, 2015[19]).

The institutional framework set forth in the Telecom Law specifies that TRC has autonomy to perform regulatory functions and duties over the communication sector (Government of Cambodia, 2015[19]). However, the relationship between TRC and MPTC seems somewhat interlinked, with MPTC influence possible on TRC. First, MPTC selects the TRC Chairperson, through an opaque selection process, as the Telecom Law does not detail the steps to select an appropriate candidate (Government of Cambodia, 2015[19]). The Telecom Law only specifies broad qualifications, which may make it more difficult to ensure MPTC will select a Chairperson with the appropriate skills. This may introduce political influence in the appointment process and lead to appointment of political supporters or allies to top positions. This, in turn, could limit the amount of independence TRC holds in practice (also known as de facto independence). For example, the current TRC Chairperson was a former Secretary of State of MPTC, suggesting the possibility of governmental influence in the appointment process.

While some OECD countries follow a similar approach, OECD good practice recommends that such appointment processes be transparent, preferably involving an independent selection panel (OECD, 2021[20]), as opposed to the sectoral minister. This can help insulate the process from political influence and ensure candidates have the needed skills to fulfil the position.

Additionally, the Ministry of Economy and Finance approves TRC’s budget. This may introduce further political influence as TRC’s activities will depend on the ministry’s decision. Across the OECD, only 22% of communication regulators rely on budget allocated from the government (OECD, 2021[20]). Roughly half (46%) are funded through a mix of budget from the government and fees collected from industry. The remaining third rely only on industry fees (33%) (OECD, 2021[20]). OECD good practice recommends safeguards to reduce potential governmental influence on regulatory budgets. A transparent and clearly defined process to allocate multi-annual budgets, for example, can be less susceptible to short-term political pressures (OECD, 2021[20]).

The broad powers given to MPTC under Art. 7 are further cause for concern. They allow MPTC to order operators take certain actions in “force majeure” events. This power could infringe upon TRC’s regulatory mandate, depending on how often this article is used. The Telecom Law does not define “force majeure” events. Additionally, while TRC is granted certain enforcement powers, MPTC has the power to issue fines. This may impede TRC’s ability to regulate the communication sector effectively. Finally, Art. 24 lists communication infrastructures and networks as being under the remit of MPTC, which may blur the lines between the jurisdictions of the two entities (Government of Cambodia, 2015[19]).

Recommendations

1. Strengthen the regulatory independence of TRC by adopting measures to increase transparency in the selection process of top officials and in budgetary allocation. While the Telecom Law formally establishes TRC as an autonomous body with remit over the communication sector (Government of Cambodia, 2015[19]), influence from MPTC seems possible. Selection of the TRC Chairperson by the MPTC minister may introduce political influence in the appointment process. Cambodia could consider adopting measures to increase transparency in appointments. This could include clearly defining the selection process and establishing an independent selection panel to ensure that high-level TRC staff have relevant skills and experience. Additionally, the Ministry of Economy and Finance approves TRC’s budget. This may introduce further political influence as TRC’s ability to carry out its mandate depends on the ministry’s decision. OECD good practice recommends safeguards to reduce potential governmental influence on regulatory budgets. These include a transparent and clearly defined process to allocate multi-annual budgets, which can be less susceptible to short-term political pressures (OECD, 2021[12]).

2. Clarify areas of potential overlap with MPTC and TRC and consider whether TRC should receive further powers to enable it to carry out its mandate effectively. MPTC has certain powers that could overlap with TRC’s mandate. For example, MPTC has broad powers to order operators to take certain actions in “force majeure” events, which could infringe upon TRC’s regulatory mandate depending on how often these powers are invoked. Cases where MPTC takes action that overlap with the mandate of the TRC should be limited. TRC should clearly have the main responsibility to regulate the communication sector; Cambodia could consider revisiting legislation to clarify this where needed. Additionally, MPTC has the power to issue fines, not TRC, which may impede TRC’s ability to regulate the communication sector effectively. As an autonomous body tasked to regulate the communication sector, TRC should have the necessary tools to enforce regulation when necessary. Therefore, Cambodia should consider reviewing whether any changes to legislation are needed to enable TRC to carry out its mandate effectively (e.g. giving TRC the power to issue fines).

2.3.2. Regulatory framework

The Telecom Law is the main legislation governing the communication sector. The Law covers licensing, interconnection, quality of service, Universal Service Obligation (USO), spectrum management, tariff regulation and competition (Government of Cambodia, 2015[19]). Other laws support the communication regulatory framework on certain issues, such as the Law on Competition (Government of Cambodia, 2021[21]) and the Law on Investment (Government of Cambodia, 2021[22]).

In addition to the Telecom Law, governmental sub-decrees and ministerial Prakas provide more detailed regulation on several topics. Prakas No. 208, for example, defines approval requirements for communication equipment (MPTC, 2010[23]). Prakas No. 122 (2017) specifies further information on the licensing procedure (MPTC, 2017[24]). The Prakas on quality of service establishes certain quality requirements for operators (MPTC, 2022[25]). Sub-Decree No. 197 sets out the implementation of the USO Programme (Government of Cambodia, 2020[26]). Relevant regulations will be discussed in more detail in later sections.

In addition, according to information provided by the Cambodian authorities, an amendment of the Telecom Law and new regulations (including laws, sub-decrees and Prakas) are being drafted. However, these have not been published at the time of writing. These cover a range of important topics, such as spectrum management, consumer protection and competition in the sector, among other topics. Some of these have been explicitly noted in the “Cambodia Digital Economy and Society Policy Framework 2021-2035” (DESPF), such as those related to competition, infrastructure and spectrum management. This underscores the government’s high-level commitment to define such legislation (Government of Cambodia, 2021[27]). Given the breadth of topics, much of the communication regulatory framework may change once this draft legislation and regulations come into effect.

The Telecom Law defines the licensing framework. MPTC Prakas No. 122 (2017) provides further details on the “condition and procedure for granting, modifying, transferring and revoking permits, certificates or licences” [unofficial translation] (MPTC, 2017[24]). The Telecom Law stipulates that a person should apply for a licence from TRC to: i) construct and/or provide services to use communication infrastructure and networks; ii) provide communication services; or iii) other activities defined by MPTC Prakas (Government of Cambodia, 2015[19]).

Other activities require a permit from TRC, including Internet service business or the sale or repair of communication equipment, among others (Government of Cambodia, 2015[19]). Permits for Internet service business or to sell/repair communication equipment have the shortest duration (one year) (MPTC, 2017[24]). Licences to construct or provide services to use infrastructure and networks are valid for 30 years, with a possibility of review every 10 years (MPTC, 2017[24]). Licences to provide communication services are valid for 15 years, with a possibility of review every 5 years (MPTC, 2017[24]). Fees apply to obtain licences, including an application/registration fee, an initial fee and a licence fee that is a percentage of gross income for telecommunication operation licences and renewal fees (MPTC, 2017[24]).

There seems to be a potential overlap with the Internet service business permit and the licence to provide communication services. Further legal clarity regarding when an “Internet service business” permit is required would be welcome. If the Internet service business permit is required to provide fixed communication services in Cambodia, along with the licence to provide communication services, the one-year duration for a permit is short. It also would incur annual administrative costs to renew the licence. e.

If communication operators do not comply with licence conditions, TRC may take several actions, such as obliging operators to adhere to existing or additional conditions or restricting or suspending the licence (Government of Cambodia, 2015[19]). In cases of an operator’s non-compliance with the law or other related regulation, TRC may suspend or dismiss its senior leadership, or limit or stop its general activities (Government of Cambodia, 2015[19]). Certain offences may be subject to fines, which are applied by MPTC (Government of Cambodia, 2015[19]).

While the legislative framework defines licensing procedures, some implementation challenges seem to exist. As of late 2022, five operators were granted “optical cable network” licences (TRC, 2022[28]). Cambodian authorities confirmed that these are Cambodia Fibre Optic Cable Network (CFOCN), Angkor Data Infrastructure, Micromax, Telcotech and Telecom Cambodia, which are licensed to deploy fibre networks. Of these five fibre licensees, Cambodian authorities reported CFOCN, Telecom Cambodia and Telcotech as actively providing wholesale services (dark fibre, backhaul network and duct) on the market. Additionally, Cambodian authorities reported that CFOCN had 17 099 km of fibre and Telecom Cambodia had 2 180 km in 2022 (information unavailable for the other licensees).

As none of the five licensees are mobile operators, this may hinder efforts to upgrade and expand mobile networks. Fibre increasingly must be deployed deeper into networks to increase broadband performance, including for mobile networks (OECD, 2022[29]). Fibre is also needed to increase backhaul capacity, especially to support 5G networks (e.g. to connect mobile base stations). Some mobile operators mentioned challenges to obtain the appropriate licences to deploy fibre, or only obtaining a licence to connect a single base station with fibre, but not a general or “blanket” licence. It requires substantial time and resources for mobile operators to apply for a licence each time they want to deploy fibre to connect a base station and cannot be considered good practice.

In addition, the application of regulations seems to be changing according to recent local news reports. After years of no or relatively lenient enforcement measures, MPTC and TRC are now taking aggressive actions against operators not in compliance. This includes imposing fines and revoking licences. In October 2020, MPTC revoked or suspended the licences of 17 communication operators, mostly licensed as ISPs, although some provide Voice-over-Internet Protocol (VoIP) services (MPTC, 2020[30]). MPTC determined the operators were inactive, had no employees, failed to pay fees or meet other licence obligations, or submit required technical documentation (MPTC, 2020[30]).

Fibre installation, which has largely been above-ground in Cambodia, is another area where regulation has not been strict. However, according to local news sources, authorities have begun warning operators they need appropriate licences to install and maintain fibre. More drastically, authorities are cutting down overhead fibre lines to clean up installations (Turton, 2022[31]).

Enforcing regulations is a key role of any communication regulator. However, both the draft amendments in the communication sector, as well as the abrupt changes in the application and enforcement of the regulation, may introduce uncertainty for operators.

Recommendations

3. Reduce regulatory uncertainty through active engagement with operators and clear communication on the timeline of regulatory changes. Cambodia’s communication regulatory framework is in transition. It is drafting several laws, sub-decrees and Prakas on key aspects, including competition and spectrum management, with some amendments to the Telecom Law also being planned. These are critical topics; clear regulations will support Cambodia’s communication sector to clarify uncertainties in the current framework. Cambodian authorities should engage with operators to brief them about upcoming regulatory changes, as soon as possible, to lessen regulatory uncertainty and provide investment certainty. Transition periods could be established to grant operators sufficient time to bring operations into compliance.

2.3.3. Broadband strategies and plans

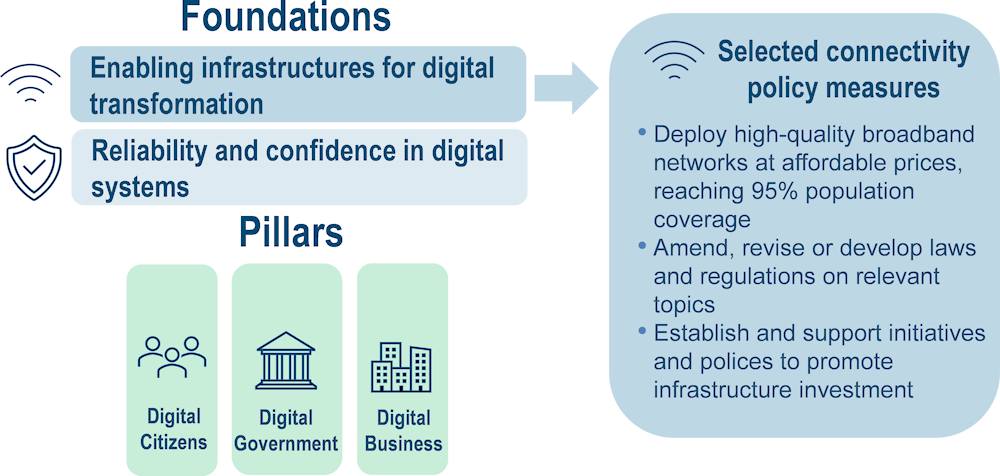

The Cambodian government published the “Cambodia Digital Economy and Society Policy Framework 2021-2035” (DESPF) in May 2021 (Government of Cambodia, 2021[27]). The DESPF 2021-2035 policy framework builds upon the 2016 “Telecommunication ICT Development Policy 2020” (Government of Cambodia, 2016[32]). The DESPF 2021-2035 has five components, divided into two foundations: i) developing infrastructures to enable digital transformation; and ii) building reliability and confidence in digital systems. It also has three pillars: i) digital citizens; ii) digital government; and iii) digital business (Figure 2.8) (Government of Cambodia, 2021[27]).

Figure 2.8. Cambodia Digital Economy and Society Policy Framework 2021-2035

Note: The diagram depicts only a few policy measures related to connectivity, although there are several others under the foundation “enabling infrastructures for digital transformation”. These measures have been selected and summarised for reasons of space.

Source: OECD elaboration based on Cambodia (2021[27]), Cambodia Digital Economy and Society Policy Framework, https://mef.gov.kh/download-counter?post=7116.

Several measures relate to connectivity under the foundation, “enabling infrastructures for digital transformation” (Figure 2.8). A key goal aims to accelerate development of high-quality broadband networks at affordable prices and to reach 95% population coverage of fixed and mobile broadband infrastructure (Government of Cambodia, 2021[27]).

Further measures include amending regulations related to digital infrastructure and regulatory functions to improve competition and openness, as well as developing regulations on spectrum management, as noted above (Government of Cambodia, 2021[27]). Promoting infrastructure sharing and putting in place various initiatives and tools to promote infrastructure investment are additional goals (Government of Cambodia, 2021[27]).

The policy framework also emphasises the fundamental role of a reliable power supply for communication networks, and thus the prioritisation of affordable and reliable electricity infrastructure for strategic digital assets (Government of Cambodia, 2021[27]).

MPTC was tasked with drafting the Cambodian Digital Government Policy 2022-2035 (MPTC, 2022[33]) to further define actions to support digital government, one of the DESPF’s pillars. One strategic goal relates to promoting development of digital government infrastructure, including broadband infrastructure (MPTC, 2022[33]). In addition, MPTC is drafting the “National Digital Development Policy 2030”, which presumably will align with the DESPF.

2.4. Competition, investment and innovation in broadband markets

2.4.1. Competition

Cambodia’s mobile market has been dynamic over the last decade, with the number of mobile operators dropping from eight to five between 2012 and the end of 2021. Now the market seems to be stabilising with roughly two market leaders, Viettel Cambodia (Metfone) and Smart Axiata. They held 41.8% and 37% market share based on mobile broadband subscriptions as of 2021, respectively, according to data from national authorities. CamGSM (Cellcard) is ranked third with 18.9% market share. South East Asia Telecom (Yes) and XinWei (Cambodia) Telecom round out the market as smaller players with 2.3% and less than 1% market share (0.002%), respectively (Figure 2.5).

According to Cambodian authorities, all mobile operators provide services mainly with their own networks. Since two players hold strong positions in the market, the Herfindahl-Hirschman index (HHI) for Cambodia’s mobile market is 3 482, despite the five-player market. Therefore, although the number of operators exerts a positive competitive pressure in the market, the strong positions of Viettel Cambodia (Metfone) and Smart Axiata increase market concentration. This may, in turn, increase the risk of possible anti-competitive behaviour.

The fixed market is much more diverse. More than 30 operators offer fixed broadband services, although many of these ISPs are small. Viettel Cambodia (Metfone) holds over half of the market in terms of fixed broadband subscriptions (50.8%), followed by Smart Axiata (15.1%), King Technology (13%), EZECOM (4.7%), COGETEL (4.4%), Cambodian Singmeng Telemedia (4%), NeocomISP Ltd (1.2%) and Telecom Cambodia (1%). Several other providers split the remaining 5.8% of the market (Figure 2.6). Largely driven by Viettel Cambodia’s (Metfone) substantial market share, the HHI for Cambodia’s fixed market is 3 041 based on these market shares. Compared to the mobile market, Cambodia’s fixed market is slightly less concentrated overall in terms of HHI. Several operators compete at the retail level, although Viettel Cambodia (Metfone) holds half the market.

As competition can be an effective lever to lower prices, retail prices can also be an indicator of the competitiveness of the retail market. From this perspective, competition in the retail mobile market seems to have been sufficient to lower prices to below regional averages. For entry-level mobile broadband services, Cambodia’s 2022 prices were at USD PPP 11.0, third lowest in the region and below the regional average of USD PPP 15.5 (ITU, 2023[10]).

The retail fixed market also seems to have benefitted from competitive pressure on prices. For entry-level fixed services, Cambodia’s prices are the second lowest in the region at USD PPP 41.1 in 2022, compared to the regional average of USD PPP 51.6 (ITU, 2023[10]). This suggests a positive competitive pressure from the several players in the fixed retail market. Nevertheless, as noted below, despite retail prices being lower than regional averages, some people in the country may not be able to afford services (see Figure 2.12).

On the fixed side, competition seems to be primarily taking place at the retail level. According to Cambodian authorities, all operators except one, Telecom Cambodia, provide their services mainly over third-party infrastructure. However, Telecom Cambodia only holds 1% of the fixed market share. This suggests it focuses on the wholesale market rather than on the retail market.

Consequently, there is strong competition for services at the retail level, but not for end-to-end infrastructure. As noted, Telecom Cambodia is the only operator providing services mainly with its own network. The lack of infrastructure-based competition in the fixed broadband market seems to have resulted in a significant shortfall in infrastructure investment in fixed networks. This has had two consequences. First, operators report that coverage of fixed broadband networks is concentrated in densely populated areas, suggesting low national coverage (see Broadband deployment section). Second, quality of services offered to end-users is low (see Quality of networks section). Promoting infrastructure competition is therefore key to improving the performance of fixed networks, boosting investment and thus the extension and improvement of network quality.

Considering the wholesale market in the country, according to Cambodian authorities, three operators provide hosting services on passive infrastructure (towers and masts): Camtower Link Communication, Edotco and Global Tower Corporation. Cambodian authorities further report that Telecom Cambodia, CFOCN and Telcotech offer wholesale services, including dark fibre products, backhaul network access and duct access. While not mentioned as offering wholesale services by national authorities currently, Angkor Data Infrastructure and Micromax are also licensed to deploy fibre infrastructure and therefore could offer wholesale services in the future. This could increase the supply and capacity of wholesale networks. Quantitative data on the wholesale market share of these operators are not available. However, informational interviews suggest that CFOCN is a prominent player in this market.

While wholesale offers exist, operators seem concerned about the price of such services and the insufficient supply in both mobile and fixed retail markets, but especially for fixed wholesale offers. There seems to be only a few wholesale offers, with many retail operators vying to contract wholesale services. This includes last mile for fixed networks, as many operators offer services mainly over third-party networks.

Competition in the communication sector is primarily governed through two laws. The 2021 Law on Competition is the overarching competition legislation across the economy and the 2015 Telecom Law is the sectorial regulation that contains certain competition provisions.

The Law on Competition, enacted in 2021, has a broad jurisdiction to uphold competition across the Cambodian economy (Government of Cambodia, 2021[21]). It regulates any activity that inhibits, limits or distorts competition (Government of Cambodia, 2021[21]). These regulations fall into three main categories: i) anti-competitive agreements (horizontal or vertical agreements); ii) abuses of a dominant position; and iii) anti-competitive mergers (Government of Cambodia, 2021[21]). However, the Law on Competition does not address its applicability to state-owned entities, such as Telecom Cambodia, although a broad interpretation would include it (Government of Cambodia, 2021[21]).4 More legal clarity in this regard would be welcome.

Furthermore, the 2021 Law on Competition establishes a new body, the Cambodian Competition Commission (CCC). The CCC is under the jurisdiction of the Ministry of Commerce with the remit to uphold competition (Government of Cambodia, 2021[21]). Hosting the CCC under this ministry is generally not considered best practice as it limits the independence of the competition authority.

Given the cross-cutting aspect of competition, the CCC interacts with other relevant ministries and agencies in their areas of competence. For example, an MPTC representative acts as a member of the CCC, along with other representatives from other competent ministries. In addition, TRC interacts with the CCC. TRC monitors and evaluates the state of competition in the communication sector (Government of Cambodia, 2015[19]). As the broad competition authority, the CCC works with TRC in matters related to the communication sector. Either TRC or the CCC can raise competition violations in the communication sector, and they can jointly rule on these violations. However, an additional Prakas is being drafted under the Telecom Law. This is expected to provide further details on co‑operation between the two bodies.

The Telecom Law requires all operators to adhere to the principle of fair competition and prohibits anti-competitive behaviour in the communication sector (Art. 61) (Government of Cambodia, 2015[19]). It further requires operators to interconnect; provide infrastructure and services; and allow shared use of networks, infrastructure and equipment, upon request and agreement (Art. 31-32) (Government of Cambodia, 2015[19]).

Agreements between operators for interconnection, use of infrastructure or services, or infrastructure sharing, should be on a non-discriminatory basis and at an affordable price (Government of Cambodia, 2015[19]). Indeed, discrimination or refusal to provide communication services to another communication operator without just cause is considered an abuse against free and fair competition (Art. 62) (Government of Cambodia, 2015[19]). In case operators cannot reach an agreement, TRC will mediate and decide on the agreement terms (Government of Cambodia, 2015[19]).

In addition to the competition provisions in the Telecom Law, Prakas 232 sets a price floor for off-net calls. This incorporates a termination charge, transit fee and a so-called “regulator fee”. Presumably, this intends to avoid unhealthy competition on price (e.g. where prices are set below the cost base) (Ministry of Economy and Finance and Ministry of Post and Telecommunications, 2009[34]).

The “regulator fee” mentioned in the Prakas is in addition to termination charges and transit fees. If these charges are passed on to consumers, they may artificially increase the price of voice services and decrease affordability. Given that Prakas 232 was passed in 2009 and focuses primarily on voice calling, it may be outdated, and its overall utility and impact should be reassessed.

On mergers and acquisitions, the Telecom Law outlines broad requirements, namely that TRC approval is required (Art. 63) (Government of Cambodia, 2015[19]). Sub-Decree No. 60, issued in March 2023, further defined the procedures for any business merger or acquisition that may impact competition in the country at a broader level (Government of Cambodia, 2023[35]). It stipulates that any business combination above a certain threshold must notify the CCC and receive approval. This may be tacit, if the CCC does not request further information or require a second review before the consolidation (Government of Cambodia, 2023[35]).

Mergers involving communication operators would fall under the “general merger classification” (Ministry of Commerce, 2023[36]). If any of the merging entities in the prior financial year had figures above certain thresholds, then the merging parties must notify the CCC and await its response before undertaking the merger (Ministry of Commerce, 2023[36]).5 Presumably, then, any merger in the communication sector above these thresholds would have to obtain approval from both TRC and the CCC. The legislation does not clearly define how this would work in practice and which body takes precedence in case of disagreement.

Building upon these provisions in the Telecom Law, MPTC is drafting a Prakas on competition. This is expected to clarify the classification of an operator with Significant Market Power (SMP) and the evaluation of dominance in the communication sector. This Prakas had not been passed at the time of writing. Under the current framework, there are no regulatory tools related to functional or structural separation of incumbent or SMP players.

As evidenced by recent and planned legislative action, Cambodia is seeking to strengthen the competition regulatory framework. The 2021 Law on Competition and the newly-established CCC put in place a robust framework to consider competition across the economy. However, while the mobile and especially fixed retail markets have several players, those with strong market shares may limit the overall level of competition. The Prakas being drafted on competition to define regulatory aspects may help in this regard. Early indications suggest beneficial changes (e.g. to clarify the determination of an SMP operator). Defining other ex ante regulatory tools, which TRC could apply to regulate SMP or dominant operators, may also be useful. This could include asymmetric wholesale access obligations. Further, the Prakas being drafted is expected to clarify how TRC and the CCC will interact on competition issues occurring in the sector. This would also be welcome to define each body’s role and how they will co‑ordinate.

Recommendations

4. Leverage the ongoing legislative processes to define SMP regulation and clarify the roles of TRC and the CCC on competition matters in the communication sector. Cambodia is developing regulation on several topics, including a Prakas that is expected to clarify competition aspects. This Prakas could define the assessment criteria to define whether an operator has SMP. This will be an important component of Cambodia’s competitive framework, especially considering the strong position of certain players (e.g. Viettel Cambodia in the fixed retail market). It would also be beneficial for the regulation to clarify the interaction between, and mandates of, the CCC and TRC regarding competition in the communication sector (e.g. on mergers). In addition, MPTC could consider whether to include additional tools to regulate SMP in the Prakas (e.g. asymmetrical wholesale access obligations, the possibility to mandate functional/structural separation).

5. Undertake competition assessments once the Prakas on competition aspects comes into effect. There are strong players in both the retail fixed and mobile markets in terms of market share. Once the Prakas on competition comes into effect (which is expected to include SMP designation), competition analyses could identify evidence of any operator with SMP and the need to apply any ex ante regulation on any operators designated with SMP.

6. Consider fostering the wholesale market and monitoring wholesale prices. Wholesale supply has been reported to be low, especially for fixed wholesale services. Cambodia could consider fostering entry and competition in the wholesale market, including by providing necessary licences to any eligible operator wishing to offer wholesale services. As wholesale prices may be high, Cambodia could regularly assess the wholesale market, including geographic segmentation and whether capacity meets demand, and monitor prices for wholesale services. Based on this assessment, Cambodian authorities could consider ex ante regulatory remedies. Such measures should be designed to ensure a level playing field and encourage new entrants to the market and the deployment of wholesale network infrastructure and services, without discouraging investment.

2.4.2. Investment

Sufficient investment in high-quality communication networks is a necessary and critical component to meet connectivity goals. Cambodia’s regulatory framework has several measures to promote investment. One of its most distinctive features is its lack of foreign capital or ownership restrictions. The Telecom Law does not restrict who may apply for licences, allowing foreign companies to enter the market freely. The Law on Investment prohibits discrimination against foreign investors based on their nationality but has restrictions on land ownership (Chapter 5) (Government of Cambodia, 2021[22]). In state-owned entities such as Telecom Cambodia, the state must own, directly or indirectly, at least 51% of capital or voting rights (OECD, 2022[37]; Government of Cambodia, 1996[38]). Despite these few limitations, this framework has greatly benefitted the communication sector by allowing the entry of foreign players. In fact, foreign communication operators occupy a large share of the market. Viettel Cambodia (Metfone) and Smart Axiata are both foreign-owned operators, as noted above. They rank in the top two in both the fixed and mobile markets based on market shares in terms of subscriptions (see Figure 2.5 and Figure 2.6).

In addition to the openness of the market to foreign players, the Telecom Law also has measures to facilitate and promote infrastructure sharing, which may help lower costs of infrastructure investment. For example, Art. 32 directs network operators to allow the shared use of infrastructure, network and equipment with other operators (Government of Cambodia, 2015[19]). Private operators can negotiate sharing agreements directly and must inform TRC once an agreement has been reached. According to Cambodian authorities, infrastructure sharing of passive elements is most common in Cambodia and active infrastructure sharing is yet to be seen.

In addition, fixed network operators can invest jointly in network infrastructure (co-investment). Although not set out in the Telecom Law, according to Cambodian authorities the government may mandate fixed operators to jointly invest to deploy network infrastructure according to terms agreed between the operators. In 2020, MPTC asked TRC to explore the option of joint investment for deployment of 5G networks (Chan, 2020[39]).

However, despite these regulatory measures, investment in communication networks in Cambodia is low. Total investment numbers from the International Telecommunication Union (ITU) for mobile and fixed networks reported a 66% decline over 2016-21 (see Figure 2.7) (ITU, 2023[10]). Considering investment in mobile networks in particular, mobile network investment (Capex) in Cambodia has been relatively stable, with an 16% growth rate over 2013-22 (GSMA Intelligence, 2023[12]). However, Cambodia’s 2022 mobile investment (Capex) in nominal terms (USD 155 million) was lower than the regional average (USD 1 billion) and the third lowest in the region (GSMA Intelligence, 2023[12]).

In contrast, both sources report revenues growing at a positive rate. Total revenues from both mobile and fixed markets grew 15% over 2018-21 (ITU, 2023[10]). Mobile revenues grew 42% over 2013-22 (GSMA Intelligence, 2023[12]). Positive revenue growth should help fuel investments, but investments do not seem to be keeping pace.

These low levels of investment may stem from several causes:

First, fees levied on operators may hinder investment. Operators must pay fees to obtain licences (application/registration fee, initial fee, a licence fee [which may be set as a percentage of annual gross income], renewal fee, fees for additional service and other fees as determined by TRC) (MPTC, 2017[24]). In addition, operators must contribute to USO (2% of gross annual revenues) and the capacity building, research and development (CBRD) fund (1% of annual revenues) (Government of Cambodia, 2015[19]). According to Cambodian authorities, communication operators also must pay a percentage of their annual gross revenue according to their respective licensed operations, called a “revenue share”. Spectrum and numbering fees also apply.

These fees may place a burden on investment. Contributions to the USO and CBRD funds together account for 3% of annual revenues, even without counting the other fees, including the percentage-based “revenue share”. In addition, according to local news, MPTC conducted audits in 2021 and concluded some operators had miscalculated their percentage-based fee contributions (Khmer Times, 2021[40]). Those operators with insufficient contributions were required to pay the remaining balance, as well as compounded interest over the years in which contributions were miscalculated. For some operators, this could result in a substantial amount due, which may delay any investments in the near term.

Second, the level of investment may be impeded by implementation of the licensing framework. As noted above, operators have pointed to delays in receiving the required licences to install and deploy fibre in the country. In addition, operators note requirements to obtain individual licences to connect one base station with fibre at a time instead of a general license. This increases operators’ administrative burden and likely delays deployment plans. These are clear barriers to investment. Operators wanting to install and deploy these networks should be able to obtain the required licences quickly.

Third, operators’ uncertainty over application of regulation may also hinder investment decisions. For example, the regulation of fibre installation seems to be changing. Local news sources report Cambodian authorities cutting down overhead fibre lines to clean up installations (Turton, 2022[31]). These moves are likely motivated by aims to organise overhead fibre lines. However, cutting them down represents a sunk investment cost for operators. This may hinder investment if operators fear their fibre lines will be cut before they can recoup investment. Therefore, a clear regulatory framework and application would be conducive to investment and give operators more certainty. This could include, for instance, clear requirements on how and where to build fibre, preferably in consultation with industry and considering local market conditions.

Recommendations

7. Assess the impact the level of fees may have on operators’ investment decisions. To further strengthen its regulatory framework to foster investment, Cambodia could assess the level of fees applying to communication operators. It could ensure fees are reasonable, do not hinder investment, nor result in operators passing on fees to consumers to meet operators’ financial obligations. When enforcing adherence to the regulatory framework to pay fees, authorities should consider the potential impact on investment. For instance, longer periods to pay fines may allow operators to meet their mandatory financial obligations while still making it possible for them to invest.

8. Support investment through expedient licensing processes. Delays to receive needed licences pose an unnecessary but real barrier to investment. In cases where licences are required to install or deploy infrastructure, for instance to deploy and maintain fibre, TRC should provide the required licences to all interested operators meeting required criteria on a non-discriminatory and timely basis. Further, TRC could consider decreasing administrative barriers, such as by providing a general licence to lay fibre to support mobile networks. Licences terms can clearly specify for what purposes this fibre can be laid and where.

9. Apply regulation impartially and clearly communicate upcoming changes to industry. In cases where regulatory approaches may be changing (e.g. regarding fibre installation), authorities should clearly communicate their plans to industry and discuss how to balance regulatory objectives with operator’s costs and investment plans. Additionally, the regulatory framework should be applied consistently and impartially to all market players. Clear instructions on how and where to build fibre would provide clarity to market players. Such actions would be conducive to investment.

2.4.3. Innovation

Innovation can expand end-user choice through the introduction of new technologies and services in the market. Cambodia’s 5G deployment can shed some light on the ease of introducing new technologies and services. CamGSM(Cellcard), Smart Axiata and Viettel Cambodia (Metfone) all launched trials in 2019, and South East Asia Telecom (Yes) launched a trial in 2020 (Cellcard, 2019[41]; Smart Axiata, 2019[42]; Viettel, 2019[43]; Vannak, 2020[44]).

Thus, the four biggest mobile operators in the country have shown interest in testing new 5G services, presumably for future 5G network deployment. However, despite these successful trials, news outlets report TRC later withdrew the licences used to test 5G services, expressing concerns over “inefficiency” if all operators deployed their own 5G networks (Barton, 2021[45]).

Furthermore, the government has not yet released its 5G plans at the time of writing, including on spectrum release, which is stalling deployment progress. In addition, operators seem to be delaying their 5G deployment plans until they receive appropriate licences to operate 5G networks and hear further information from the government. At the time of writing, no commercial 5G services were available in the country.

The government should announce its 5G policy and spectrum release plans in the short term to provide clarity to operators considering their 5G deployment plan. They should also provide the necessary licences (e.g. 5G licences) to facilitate deployment of new technologies and services.

Despite the 5G delays, aspects of the regulatory framework in Cambodia seek to promote innovation. As noted above, TRC assigned licences to the four mobile operators to test 5G services, although these licences were later withdrawn (Barton, 2021[45]). Granting trial licences enables innovation by allowing operators to test new services in a relatively risk-free environment. In this case, the stated reason for TRC’s withdrawal of the 5G trial licences relate more to investment and deployment decisions, which are normally for the operators to decide. Moving forward, TRC should continue to issue trial licences to operators wanting to test new technologies and services and allow operators to make their own decisions regarding their deployment.

The Telecom Law, in addition, establishes the CBRD Fund to promote capacity building and research and development (R&D) in the communication sector (Art. 43-46) (Government of Cambodia, 2015[19]). MPTC supervises and evaluates the fund’s activities, which are sponsored by operator contributions (1% of annual gross revenues) (Government of Cambodia, 2015[19]). The fund seeks to build infrastructure and promote R&D to support innovation in the sector, providing ICT skills training and sponsoring programmes to foster R&D and entrepreneurship (Government of Cambodia, 2020[46]). Operators can apply to receive up to 20% of their contributions for projects that support the CBRD Fund’s objectives (Government of Cambodia, 2020[46]). According to local news sources, in 2017 the fund raised USD 4.5 million to support capacity building and training projects, as well as for research projects on topics such as Internet of Things, data science and Khmer language processing (Chan, 2018[47]). Other projects through the fund focused on building infrastructure for R&D in the information and communications technology sector, including the establishment of laboratories (Chan, 2018[47]).

The effectiveness of the CBRD Fund should be monitored to ensure it meets the stated objectives. Cambodia should only collect fees from industry that are necessary to perform innovation activities efficiently. The benefits should also be weighed against the financial contributions levied on operators and their potential impact on investment decisions, a key ingredient to deploy innovative new technologies and solutions.

Apart from funding to support R&D, the regulatory framework itself can foster innovation by adopting a technology-neutral approach. Such an approach focuses on outcomes rather than on technologies for regulations, licences and policies. In this way, it allows new and non-traditional solutions to emerge. In Cambodia, the regulatory framework is often not technology-neutral. For instance, spectrum licences and licences to offer services are often tied to a certain technology. However, the USO Programme technically adopts a technology-neutral approach by focusing on broad outcome-based targets without specifying technologies (Government of Cambodia, 2020[26]).

Recommendation

10. Support industrial efforts to deploy 5G networks. TRC should issue licences to operate 5G networks to eligible operators as soon as possible. In addition, the government’s delays to outline its plans to assign additional spectrum for 5G creates disincentives for operators to invest in 5G. To support operators’ deployment plans, the government should quickly issue its spectrum release plans and provide more information to operators on its 5G plans (e.g. roadmap/policy). More generally, and to support future innovation, TRC should continue to issue trial licences to help operators test new technologies and services.

2.5. Broadband deployment and digital divides

2.5.1. Broadband deployment

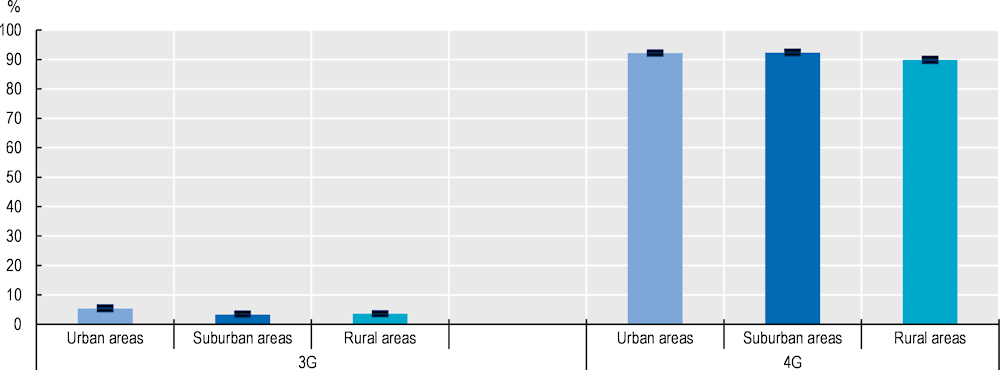

For mobile broadband, a combination of factors such as initially high levels of competition and the country's relatively flat geography has favoured extensive 3G and 4G network coverage. 3G networks reached their maximum coverage of 90% of the population in 2015 (GSMA Intelligence, 2023[12]). 4G networks, launched in 2013, reached 93% of the population in five years by 2018, and 99% of the population by 2022 (GSMA Intelligence, 2023[12]) (Figure 2.9). As mentioned above, 5G technology has not yet been deployed in Cambodia.

Figure 2.9. Mobile broadband coverage, 2013-22

Source: GSMA Intelligence (2023[12]), Database (2023), www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

In terms of backbone/long-haul networks, Cambodia has 59 702 km (route km) of fibre from Telecom Cambodia, CFOCN (HyalRoute), Telcotech, Viettel Cambodia and the Greater Mekong Subregion IHN (ITU, 2023[48]).6 Cambodia’s backbone network coverage is among the best in SEA, second only to Singapore, with 54% of the population within 10 km of a node (SEA average 43%). The network is not overly dense; high coverage may be explained by the high concentration of the population in urban areas and low population density outside these areas.

In almost all backbone links, at least three different operator cables share the same route, and in many cases, four or even five. This contrasts with the secondary branches of the backbone network that do not mesh with each other and are also usually implemented by a single operator: CFOCN (HyalRoute) (ITU, 2023[48]). This seems to confirm the prominent role of CFOCN in the backbone segment to reach the secondary population centres, which operators also mentioned in informational interviews.

However, Cambodia's surplus of backbone infrastructure contrasts with the limited availability of backhaul networks to connect high-quality broadband access networks (e.g. FTTH, 4G/5G). Moreover, operators report difficulties obtaining licences to deploy networks, creating additional barriers to expanding and upgrading their networks.

On the other hand, operators report some shortcomings in the wholesale market. These shortcomings include a lack of capacity, limited availability of backhaul networks, high prices of wholesale products and poor quality of wholesale services.

These wholesale market failures can hurt downstream broadband networks and services. Cost overruns can reduce the affordability of services and hinder the building and upgrade access networks. This is especially true in areas with low or limited profitability, such as rural areas. This, in turn, may contribute to widening the digital divide. Therefore, it is crucial to address these wholesale inefficiencies decisively by taking measures to ensure a level playing field and incentivise investment (see recommendations).

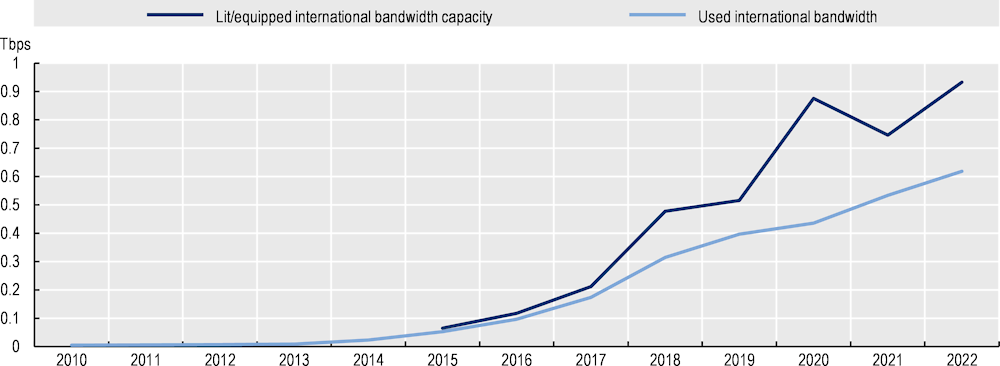

In terms of international connectivity, as of 2022 Cambodia had an equipped bandwidth capacity of 0.9 terabits per second (Tbps) (Figure 2.10) (ITU, 2023[10]). At this level, Cambodia is the third lowest in the region, above only Brunei Darussalam (0.5 Tbps) and Laos (0.2 Tbps) (ITU, 2023[10]). Since 2015, international connectivity capacity was scaled up to meet the expected increase in Internet traffic demand from users of newly deployed 4G networks. The data show that international bandwidth usage indeed increased significantly over these years. In 2022, it reached 0.6 Tbps, two-thirds (66%) of the equipped capacity (Figure 2.10) (ITU, 2023[10]).

Figure 2.10. International bandwidth, 2010-22

Note: Lit/equipped international bandwidth capacity refers to the total lit capacity of international links, namely fibre-optic cables, international radio links and satellite uplinks to orbital satellites in the end of the reference year (expressed in Mbit/s). If the traffic is asymmetric (i.e., different incoming and outgoing traffic), then the highest value out of the two should be provided. Average usage of all international links, including optical fibre cables, radio links and traffic processed by satellite ground stations and teleports to orbital satellites (expressed in Mbit/s). The average is calculated over the twelve-month period of the reference year. If the traffic is asymmetric (i.e. different incoming and outgoing traffic), then the highest value out of the two should be provided. All international links used by all types of operators, namely fixed, mobile and satellite operators should be taken into account. The combined average usage of all international links can be reported as the sum of the average usage of each link (ITU, 2020[11]).

Source: ITU (2023[10]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

Cambodia is connected to two submarine cable systems. The long-distance Asia-Africa-Europe-1 (AAE-1) connects the country to south and west Asia, north Africa, and south and west Europe (Table 2.3) and Table 2.3). For its part, the regional Malaysia-Cambodia-Thailand (MCT) cable system connects it within the region (Table 2.2).

Of the non-landlocked countries in the region, Cambodia is connected to the least number of submarine cables with 2. It is behind other mainland SEA countries such as Malaysia (25 cables), Thailand (13), Viet Nam (7) and Myanmar (5). Cambodia is connected to Malaysia, Myanmar, Thailand and Viet Nam, but not to Singapore, one of the main international connectivity hubs in the region (Table 2.2). However, a direct submarine cable between Cambodia and Hong Kong, China, the other major hub in the region, is being developed to improve international connectivity through this node. It is expected to come into service in 2024 (Khmer Times, 2023[49]).

Table 2.2. Cambodia’s connections to other SEA countries via submarine cables

|

Cable system |

Brunei Darussalam |

Indonesia |

Lao People's Democratic Republic |

Malaysia |

Myanmar |

Philippines |

Singapore |

Thailand |

Viet Nam |

|---|---|---|---|---|---|---|---|---|---|

|

Asia-Africa-Europe-1 (AAE-1) |

x |

x |

x |

x |

|||||

|

Malaysia-Cambodia-Thailand (MCT) Cable |

x |

x |

Source: OECD elaboration from TeleGeography (2023[50]), Submarine Cable Map, www.submarinecablemap.com/ (accessed on 22 February 2023).

Table 2.3. Cambodia's connections with other regions via submarine cables

|

Cable system |

Northern Africa |

Sub-Saharan Africa |

North America |

Eastern Asia |

Southern Asia |

Western Asia |

Northern Europe |

Southern Europe |

Western Europe |

Australia and New Zealand |

Micronesia |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Asia-Africa-Europe-1 (AAE-1) |

x |

x |

x |

x |

x |

x |

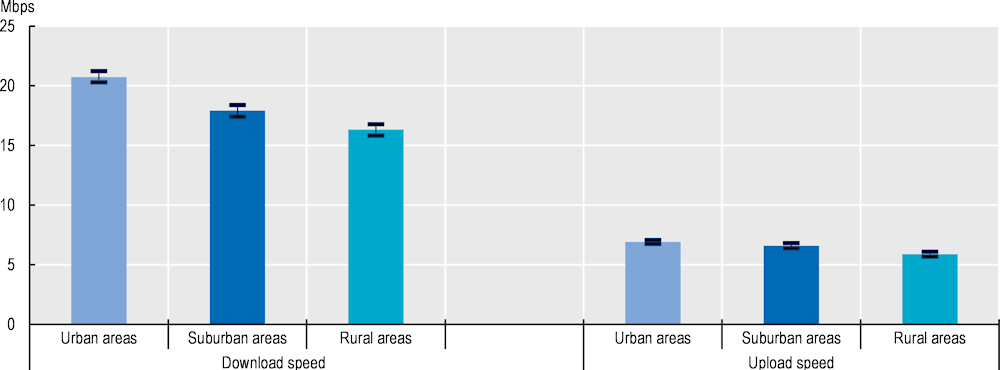

Source: OECD elaboration from TeleGeography (2023[50]), Submarine Cable Map, www.submarinecablemap.com/ (accessed on 22 February 2023).