Indonesia is the largest country in Southeast Asia, with more than 18 000 islands and islets. More than half of the population, the largest in Southeast Asia, lives on the island of Java. The economy grows at pace, and the level of human development, including income, life expectancy, and education, is high. Indonesia shares similarities with the Philippines in the geographic distribution of population, as well as in human development indicators. These two countries are analysed as a cluster represented by Indonesia. The chapter outlines the geographic, economic and social conditions for broadband connectivity in Indonesia. It proceeds by examining the performance and structure of the market and reviewing Indonesia’s communication policy and regulatory framework, including broadband strategies and plans. It then reviews competition, investment and innovation in broadband markets; broadband deployment and digital divides; networks' resilience, reliability, security and capacity; and the country’s assessment of broadband markets. It offers recommendations to improve in these areas, which could be relevant for the other countries forming this cluster.

Extending Broadband Connectivity in Southeast Asia

3. Extending broadband connectivity in Indonesia

Abstract

Policy recommendations

1. Establish an independent regulatory body with remit over the communication sector.

2. Consider conducting a competitive neutrality review in the communication sector.

3. Consider undertaking a competition assessment in the sector, leveraging KPPU’s “Guideline on Competition Policy Assessment Checklist”.

4. Consider further measures to decrease restrictions on foreign entry, including those applied more generally across the economy.

5. Foster deployment of middle and last mile networks in unserved areas.

6. Consider amending Indonesia’s spectrum framework and assigning additional spectrum quickly to support 5G deployments.

7. Reduce barriers to broadband deployment through simplified procedures for obtaining permits, access to public infrastructure and rights of way.

8. Consider leveraging international connectivity infrastructure.

9. Leverage synergies between programmes to promote provision and adoption of connectivity services.

10. Publish open, verifiable, granular and reliable subscription, coverage and quality of service data.

11. Promote measures to improve the quality and resilience of international connectivity.

12. Support and promote smart and sustainable networks and devices and encourage communication network operators to periodically report on their environmental impacts and initiatives.

13. Regularly assess the state of connectivity to determine whether public policy initiatives are appropriate, and whether and how they should be adjusted.

Note: These tailored recommendations build on the OECD Council's Recommendation on Broadband Connectivity (OECD, 2021[1]), which sets out overarching principles for expanding connectivity and improving the quality of broadband networks. The number of recommendations is not an appropriate basis for comparison as they depend on several factors, including the depth of contributions and feedback received from national stakeholders. In addition, recommendations do not necessarily carry the same weight or importance.

3.1. Geographic, economic and social conditions for broadband connectivity

Indonesia, located in the Indian and Pacific oceans, is the largest country in Southeast Asia (SEA). It shares a border with Malaysia in the northern part of Borneo and with Papua New Guinea in the centre of New Guinea. Indonesia comprises some 18 110 islands and islets, of which around 6 000 are inhabited (Ministry of Foreign Affairs, n.d.[2]). Its five main areas are the islands of Sumatra, Kalimantan (two-thirds of the island of Borneo), Papua (western part of New Guinea island), Sulawesi and Java (Ministry of Foreign Affairs, n.d.[2]).

Indonesia has a population of more than 276 million people, as of 2022 (UNDESA, 2022[3]), largest in Southeast Asia followed by the Philippines with 116 million (UNDESA, 2022[3]).

The distribution and density of the population in Indonesia vary considerably from region to region. More than half of the population lives on Java, which hosts the capital Jakarta. The island of Sumatra is a distant second in population, followed by Sulawesi, Kalimantan and Papua.

Indonesia is one of the most disaster-prone countries in the world, frequently exposed to a range of hazards. More than 60% of Indonesia’s districts have a high risk of flooding (World Bank, 2019[4]). Indonesia also faces a high risk of seismic, tsunami and volcanic activity, given its location in the Pacific Ring of Fire and its 127 active volcanoes (World Bank, 2019[4]). Disasters affect people, as well as the economy. Over the last 15 years, Indonesia has suffered losses of approximately USD 16.8 billion due to disaster events (World Bank, 2019[4]).

Considering the socio-economic and demographic conditions that are closely related to broadband development, Indonesia and the Philippines have been grouped together for this publication. The two countries share many commonalities, especially on macroeconomic metrics that influence broadband deployment. These include gross domestic product (GDP) per capita, population, geographic distribution and human development indicators.

Indonesia's economy continues to grow at pace, with real GDP growth at 4.9% in 2023 and expected to be 5.2% in 2024 and 2025 (OECD, 2023[5]). Indonesia had a GDP per capita of USD PPP 14 687 in 2022, placing it fifth highest in the region (IMF, 2023[6]). The Philippines was in seventh place at USD PPP 10 497 (IMF, 2023[6]).

Indonesia and the Philippines have similar geographic breakdowns between urban and rural areas, with around 96% of their land mass classified as “rural"1 (European Commission, Joint Research Centre, 2015[7]). However, the proportion of the population living in the remaining 4% of the territory (“urban centre” 2 and “urban cluster” 3) is high in both countries, at 81.5% in Indonesia and 59.5% in the Philippines (2015) (European Commission, Joint Research Centre, 2015[7]). Specifically in Indonesia, 57% of the population live in an “urban centre” (2015) (European Commission, Joint Research Centre, 2015[7]), a percentage second only to Singapore. Cities such as Jakarta have more than 10 million inhabitants. Other major cities on Java Island are Surabaya (the second largest city in Indonesia), Bekasi, Bandung, Depok, Tarangen and Semarang. The island of Sumatra has Medan, the third largest city in Indonesia, and Palembang.

Finally, Indonesia and the Philippines also show similarities in the Human Development Index. Both are in the middle to lower positions among SEA. The level of human development considers indicators across longevity, education and income (Table 3.1).

Table 3.1. Human development (2021) and degree of urbanisation (2015), Indonesia and Philippines

|

Life expectancy (years, 2021) |

Expected years of schooling (children, 2021) |

Mean years of schooling (adults, 2021) |

Gross domestic product per capita (current prices, PPP, 2022) |

Population living in urban centres (%, 2015) |

Population living in urban clusters (%, 2015) |

Population living in rural areas (%, 2015) |

|

|---|---|---|---|---|---|---|---|

|

Indonesia |

67.6(9) |

13.7(4) |

8.6(6) |

14 687(5) |

57.0 |

24.4 |

18.5 |

|

Philippines |

69.3(7) |

13.1(6) |

9.0(4) |

10 497(7) |

39.4 |

20.1 |

40.5 |

|

OECD average |

80.0 |

17.1 |

12.3 |

53 957 |

48.8 (2022 data) |

28.11 (2022 data) |

23.11 (2022 data) |

Note: The numbers in parentheses refer to the simple ranking (i.e. no weighting) of SEA countries for each indicator. The OECD average for human development indicators is a simple average across OECD member countries. The urbanisation indicators for SEA countries refer to the population percentage in urban centres, urban clusters and rural areas, respectively. For the OECD, figures are given for the rate of the population living in predominantly urban, intermediate, and rural regions, respectively.

Source: [Human development indicators] UNDP (2022[8]), Human Development Report 2021/2022: Uncertain Times, Unsettled Lives: Shaping our Future in a Transforming World, www.undp.org/egypt/publications/human-development-report-2021-22-uncertain-times-unsettled-lives-shaping-our-future-transforming-world. [GDP per capita, SEA countries] IMF (2023[6]), World Economic Outlook Database, April 2023, www.imf.org/en/Publications/WEO/weo-database/2023/April (accessed on 28 June 2023). [GDP per capita, OECD] OECD (2023[9]), Gross domestic product (GDP) (indicator), https://doi.org/10.1787/dc2f7aec-en (accessed on 30 June 2023). [Urbanisation indicators for SEA] European Commission, Joint Research Centre (2015[10]), Global Human Settlement Layer (GHSL), https://ghsl.jrc.ec.europa.eu/CFS.php. [urbanisation indicators for OECD] OECD (2023[11]), OECD.Stat (database),” Regions and cities: Regional statistics: Regional demography: Demographic indicators by rural/urban typology, Country level: OECD: share of national population by typology”, https://stats.oecd.org/ (accessed on 28 August 2023).

The following sections on Indonesia are less detailed than the other country chapters, due to a lower participation rate by national authorities to provide and validate information, as well as to review drafts. Therefore, the information presented relies more heavily on desk research and informational interviews with relevant stakeholders over the course of drafting.

3.2. Market landscape

3.2.1. Market performance

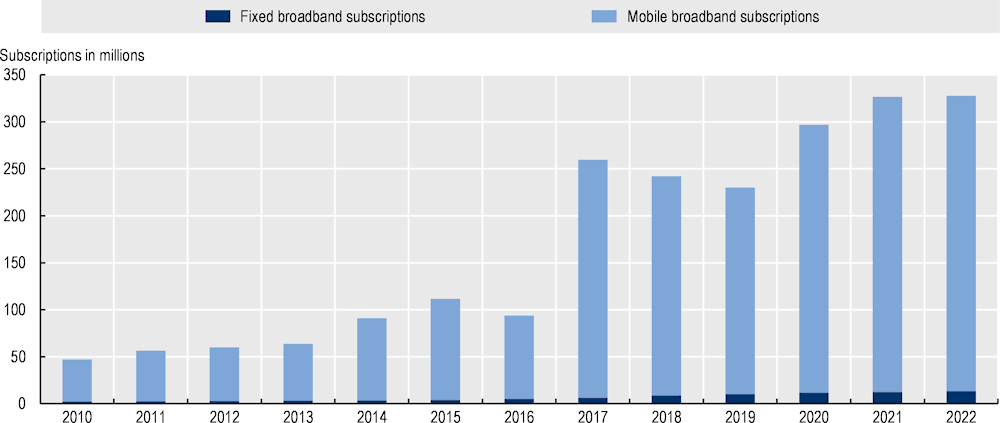

Indonesia’s broadband market, given its large population, accounted for 43% of the total broadband subscriptions in the SEA region in 2022 (ITU, 2023[12]) in terms of total subscriptions increased around sevenfold over 2010-22 compared to 2010 values (Figure 3.1) (ITU, 2023[12]). Mobile broadband subscriptions account for the majority of the total, as elsewhere in SEA, with fixed broadband subscriptions accounting for 4% in 2022 (ITU, 2023[12]).4

This distribution translates into penetration. Mobile broadband penetration in Indonesia ranks in the middle of the region, with 114.8 subscriptions per 100 inhabitants in 2021 (ITU, 2023[12]). However, fixed broadband penetration is among the lowest, with a rate of 4.9 subscriptions per 100 inhabitants, above only Cambodia, Myanmar and Lao People’s Democratic Republic in 2022 (Lao PDR) (ITU, 2023[12]).

Figure 3.1 shows steady growth in fixed broadband with an average annual growth rate of 16% over the last decade (2010-22) (ITU, 2023[12]). However, the steady growth resulted in fixed broadband subscriptions growing from 2.3 million (2010) to 13.4 million in 2022 (ITU, 2023[12]). Considering the growth of mobile broadband, Indonesia’s growth trend is not as linear as observed in other countries in the region. In 2017, the number of mobile broadband subscribers almost tripled (from 89 million in 2016 to 253 million subscribers in 2017), a spike that coincided with the rollout of 4G. This was followed by a slight decline in 2018-19 before rebounding in 2020 (ITU, 2023[12]).

Figure 3.1. Broadband subscriptions, 2010-22

Notes:

1. For mobile broadband subscriptions in 2022, data from 2021 has been used.

2. Fixed broadband subscriptions refer to fixed subscriptions to high-speed access to the public Internet (TCP/IP connection) at downstream speeds equal to, or greater than, 256 kbit/s. This includes cable modem, DSL, fibre-to-the-home/building, other fixed (wired)-broadband subscriptions, satellite broadband and terrestrial fixed wireless broadband. It includes fixed WiMAX and any other fixed wireless technologies. This total is measured irrespective of the method of payment. It excludes subscriptions with access to data communications (including the Internet) via mobile-cellular networks. It includes both residential subscriptions and subscriptions for organisations. Mobile broadband subscriptions (active mobile-broadband subscriptions in ITU Database) refer to the sum of active handset-based and computer-based (USB/dongles) mobile-broadband subscriptions that allow access to the Internet. It covers actual subscribers, not potential subscribers, even though the latter may have broadband-enabled handsets. Subscriptions must include a recurring subscription fee or pass a usage requirement if in the prepayment modality – users must have accessed the Internet in the last three months (ITU, 2020[13]).

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

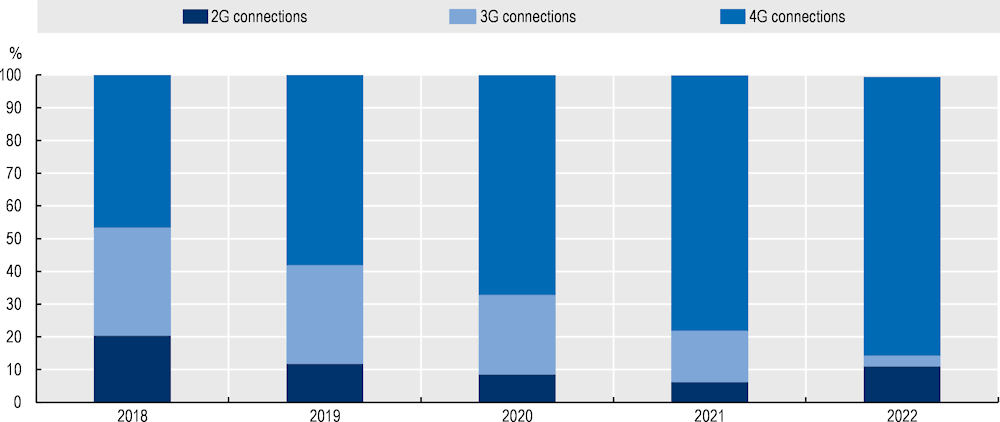

The most widely used mobile technology in Indonesia is 4G, which accounts for 85% of connections in 2022, surpassed in the region only by Malaysia (94% of connections), benefiting from wide 4G network coverage (97% of the population in 2022 (GSMA Intelligence, 2023[14]) and the affordability of mobile broadband services. The share of 4G connections has increased in recent years to the detriment of 3G and 2G technologies (Figure 3.2), which accounted for 3% and 11% of connections, respectively, in 2022 (GSMA Intelligence, 2023[14]). Although 5G networks covered 10% of the population in 2022 (Figure 3.9) (GSMA Intelligence, 2023[14]), the technology has not reached a significant penetration in 2022 (GSMA Intelligence, 2023[14]).

Figure 3.2. Percentage of mobile connections by technology, 2018-22

Source: GSMA Intelligence (2023[14]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

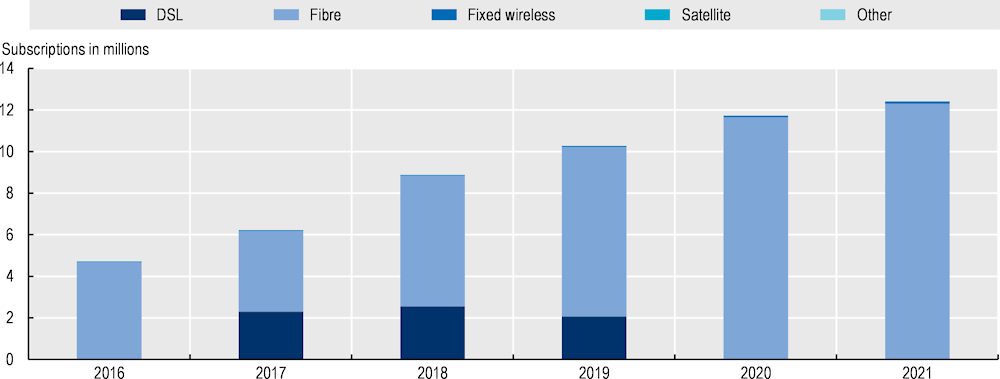

While only representing a small proportion of total broadband subscriptions in the country, fixed broadband subscriptions are dominated by fibre technology (Figure 3.3) (ITU, 2023[12]). In 2021, fibre accounted for 99% of fixed broadband subscriptions, while the remaining 1% was from fixed wireless access and satellite. Fibre is predominant across the region, accounting for 50% or more of fixed subscriptions in 2021 in all SEA countries in which data are available (ITU, 2023[12]).5

Figure 3.3. Fixed broadband subscriptions by technology, 2016-21

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

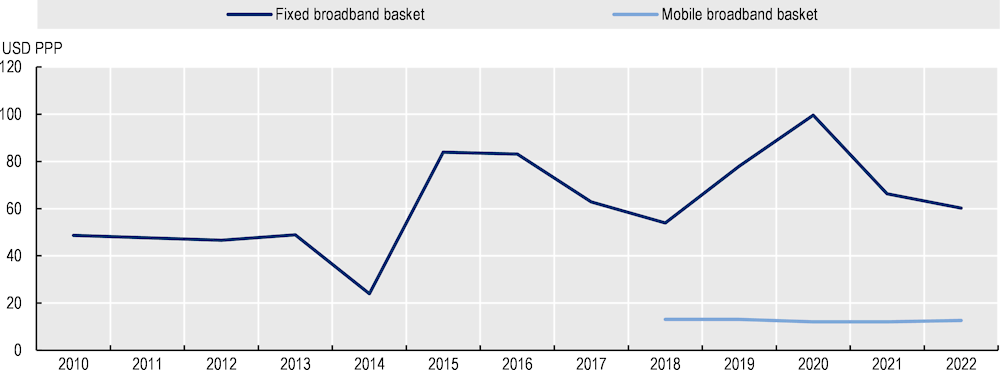

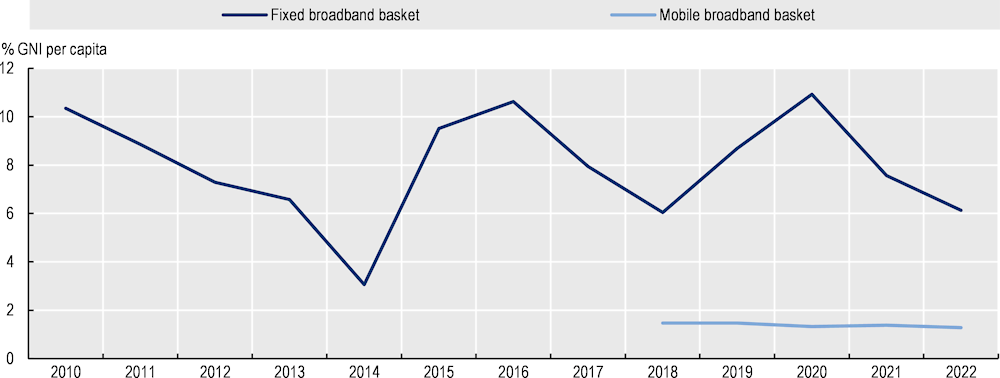

Prices for entry-level fixed communication service baskets (5 GB) are higher than entry-level mobile service baskets (70 min + 20 SMS + 500 MB), as in other SEA countries (Figure 3.4). Prices increased from USD PPP 48.7 in 2010 to USD PPP 60.2 in 2022, an increase of 24% over the period (ITU, 2023[12]). Regionally, Indonesia has the second highest price after the Philippines (USD PPP 84.4) and above the regional average of USD PPP 51.6 in 2022 (ITU, 2023[12]).

Mobile communication prices for entry-level service baskets are less than one-fourth of fixed service baskets at USD PPP 12.6 in 2022 (ITU, 2023[12]) . Prices have been stable since 2018, with prices between USD PPP 12‑13 over that period (Figure 3.4). Indonesia ranks fourth lowest regionally, and below the regional average of USD PPP 15.5 (ITU, 2023[12]).

Figure 3.4. Prices for entry-level fixed and mobile communication services, USD PPP, 2010-22

Note: The fixed broadband basket refers to the price of a monthly subscription to an entry-level fixed-broadband plan. For comparability reasons, the fixed-broadband basket is based on a monthly data usage of a minimum of 1 GB from 2010 to 2017, and 5 GB from 2018 to 2022. For plans that limit the monthly amount of data transferred by including data volume caps below 1GB or 5 GB, the cost for the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s. The mobile broadband basket is based on a monthly data usage of a minimum of 500 MB of data, 70 voice minutes, and 20 SMSs. For plans that limit the monthly amount of data transferred by including data volume caps below 500 MB (low-consumption), the cost of the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s, relying on 3G technologies or above. The data-and-voice price basket is chosen without regard to the plan’s modality, while at the same time, early termination fees for post-paid plans with annual or longer commitment periods are also taken into consideration (ITU, 2020[15]). Mobile basket prices are not available from 2010 to 2017.

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

3.2.2. Market structure

Indonesia liberalised its communication market in the late 1990s. Prior to liberalisation, two operators under state control dominated the market: PT. Telkomunikasi Indonesia (Persero) Tbk (Telkom Indonesia) for domestic services and PT Indosat Tbk for international services (Rasyid, 2005[16]). The government began privatising these state-owned operators with initial public offerings of Indosat in 1994 and Telekom Indonesia in 1995 (Rasyid, 2005[16]). Later, in 2002, the government divested a share of around 42% in Indosat. However, the government has not fully privatised either of these two entities, as discussed below.

In 1995, in keeping with the government’s privatisation actions, private entities were allowed to provide cellular (mobile) services and value-added services, such as Internet access and Voice over Internet Protocol, allowing further competition to the market (Rasyid, 2005[16]). While liberalisation has allowed for the entry of additional market players, the historic incumbents still play an important role in both the fixed and mobile markets (Figure 3.5 and Figure 3.6).

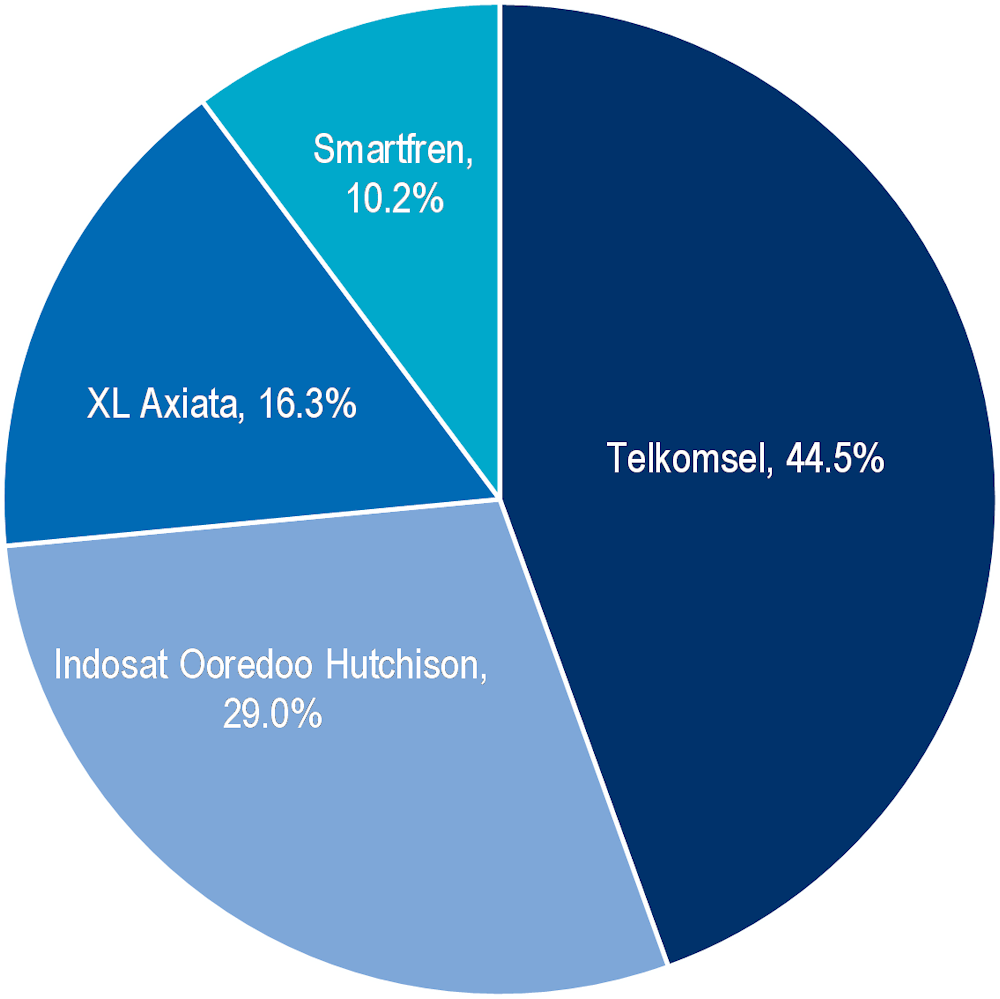

There are four main mobile operators in Indonesia. According to national authorities, PT Telekomunikasi Selular (Telkomsel) led the market with 44.5% market share based on mobile broadband subscribers in Q4 2022. It was followed by PT Indosat Tbk (trading as Indosat Ooredoo Hutchison following the recent merger) with 29%, PT XL Axiata Tbk (XL Axiata) with 16.3% and PT Smartfren Telecom Tbk (Smartfren) with 10.2% (Figure 3.5). National authorities did not report any mobile virtual network operators on the market.

Figure 3.5. Mobile market shares based on mobile broadband subscribers, Q4 2022

Note: Mobile broadband subscribers refer to the mobile broadband subscribers that contracted services including voice and data plans, and data-only plans.

Source: OECD elaboration based on data from Indonesian authorities.

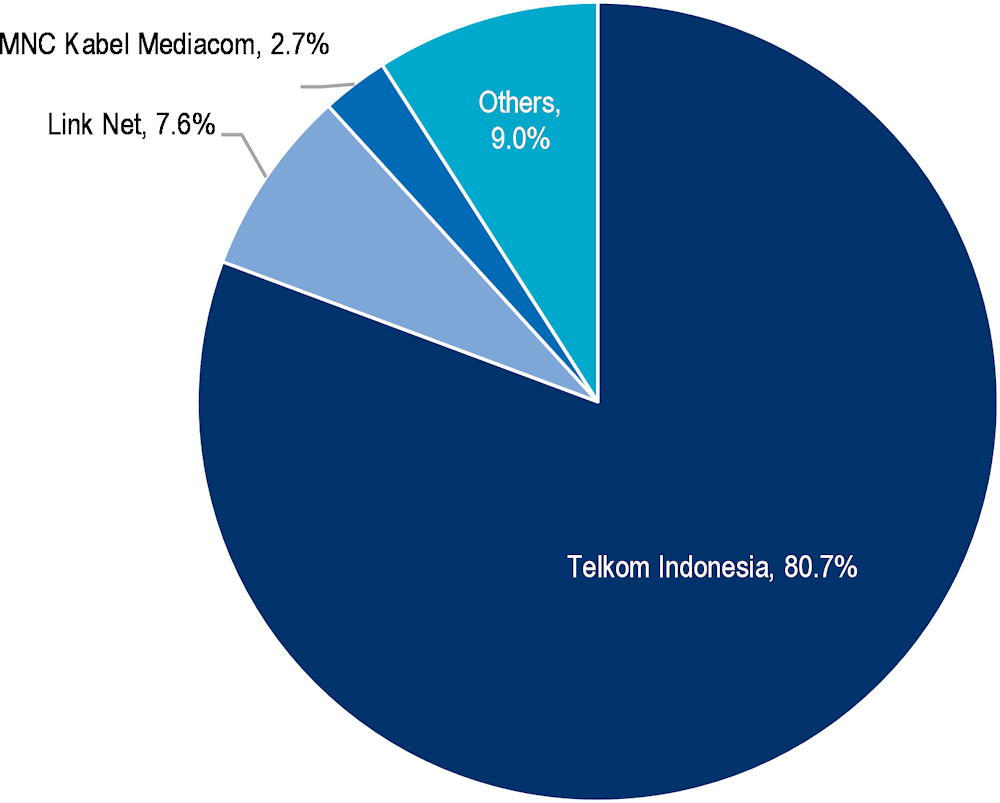

In the fixed broadband residential market (B2C), according to data provided by national authorities as of Q4 2021, Telkom Indonesia holds 80.7% of the market based on subscribers. Link Net Tbk (Link Net) is a distant competitor with 7.6%, followed by MNC Kabel Mediacom with 2.7% (Figure 3.6). More than 500 fixed providers collectively hold the remaining 9% of total fixed broadband subscribers. These are likely small providers offering services on a local level, given the geographical challenges of offering fixed service nationwide.

In the fixed broadband business market (B2B), according to national authorities as of Q4 2021, Telkom Indonesia accounts for 89.7% of subscribers. It is followed by Supra Primatama Nusanta at 1.4%. More than 500 other small operators collectively hold the remaining 8.9% of total business fixed subscribers. In the wholesale market, unsurprisingly, Telkom Indonesia is also the largest company providing network wholesale services, according to national authorities. Other wholesale providers include PT Mora Telematika Indonesia, PT Aplikanusa Lintasarta, PT Indonesia Comnets Plus, PT Tower Bersama Infrastructure Tbk and Link Net.

Figure 3.6. Fixed market shares based on fixed broadband subscribers (B2C), Q4 2021

Note: Fixed broadband subscribers refer to the number of subscribers of fixed broadband plans in the consumer (business-to-consumer) retail market. The “Others” category includes over 500 fixed operators, none of which have a market share greater than 2% (based on fixed broadband subscribers).

Source: OECD elaboration based on data from Indonesian authorities.

There have been recent mergers in both the fixed and mobile markets in Indonesia. In the fixed market, Axiata and its Indonesian subsidiary, XL Axiata, together acquired 66.03% of shares of Link Net, a fixed provider, in June 2022 (XL Axiata, 2022[17]). Axiata (Axiata Investments (Indonesia) Sdn. Bhd.) and XL Axiata increased their shares in Link Net to collectively hold over 95% as of April 2023, with the remaining held by treasury stock and the public (Link Net, 2023[18]). Axiata was required to issue a mandatory tender offer to acquire the remaining shares (XL Axiata, 2022[17]).

In the mobile market, Ooredoo Group and CK Hutchison (“3”) completed the merger of their Indonesian businesses in January 2022. In so doing, they became the second largest mobile operator in the country under the merged name, “Indosat Ooredoo Hutchison” (CK Hutchison Holdings Ltd, 2022[19]). The merged entity is jointly controlled by Ooredoo Group and CK Hutchison, which together hold 65.6% of shares (CK Hutchison Holdings Ltd, 2022[19]). As of December 2022, other stakeholders comprise PT Perusahaan Pengelola Aset (Persero) with 9.6%; PT Tiga Telekomunikasi Indonesia (8.3%), the government of Indonesia holding one “Series A” share (explained in more detail below); and other public stakeholders holding the remaining 16.4% (Indosat Ooredoo Hutchison, 2023, p. 86[20]).

The Minister of Communications and Informatics approved the merger in January 2022, with conditions (MCI, 2022[21]). As its first condition, the merged entity must build at least 52 885 sites by 2025, an increase of 11 400 sites compared to previous requirements (MCI, 2022[21]). The second condition requires expanding coverage to at least 7 660 additional villages and sub-districts. This would expand the total area covered by Indosat Ooredoo Hutchison’s mobile services to at least 59 538 villages and sub-districts by 2025 (MCI, 2022[21]). In addition, the quality of service must increase by 12.5% (download throughput) and 8% (upload throughput), respectively (MCI, 2022[21]). Finally, Indosat must return 5 MHz of spectrum (1 975-1 980 MHz/2 165-2 170 MHz) within one year (MCI, 2022[21]).

Following the merger’s completion in January 2022, the merging entities notified the competition authority, the Commission for the Supervision of Business Competition (KPPU). Based on KPPU’s initial assessment that the merger would result in a Herfindahl-Hirschman Index (HHI) rating of over 2 500 and a change in HHI of more than 150 points, it subsequently conducted a comprehensive review of the merger (KPPU, 2022[22]). Following this review, Indosat reported receiving KPPU’s positive evaluation that the merger would be unlikely to result in monopolistic practices or unfair competition in September 2022 (Indosat, 2022[23]).

There is some state ownership of key players in the fixed and mobile markets, primarily in Telkom Indonesia and its subsidiary, Telkomsel. The Indonesian government acts as the controlling shareholder with 52.09% of Telkom Indonesia’s shares (including one “Series A” share), as of Q4 2022. The remaining 47.91% is divided between 37.4% foreign ownership and 10.51% local ownership, although the government is the only shareholder with more than 5% ownership (Telkom Indonesia, 2023, p. 72[24]). Telkomsel is a direct but not fully owned subsidiary of Telkom Indonesia. Telkom Indonesia owned 65% of Telkomsel (as of Q4 2022) (Telkom Indonesia, 2023, p. 76[24]). The Singtel Group owned the remaining 35% (as of 31 March 2023) (Singtel, 2023, p. 5[25]). However, in June 2023, Telkom Indonesia and Telksomsel agreed to integrate Telkom Indonesia’s fixed business-to-consumer unit, IndiHome, into Telkomsel (Telkomsel, 2023[26]). Telkomsel will fully manage IndiHome, while Telkom Indonesia will focus on the fixed business-to-business market (Telkomsel, 2023[26]). Following the integration, Telkom Indonesia owns a 69.9% stake in Telkomsel, while Singtel owns 30.1% (Telkomsel, 2023[26]).

The government also owns one “Series A” share in Indosat Ooredoo Hutchison (Indosat Ooredoo Hutchison, 2023, p. 86[20]). In addition, PT Perusahaan Pengelola Aset (PPA) holds a 9.6% stake in the merged entity (Indosat Ooredoo Hutchison, 2023, p. 86[20]). PPA is “a state-owned asset management company with specialisation in [state-owned enterprise, or SOE] restructuring and revitalisation” as well as “SOEs asset management activities and advisory” (PPA, n.d.[27]). State influence, therefore, seems possible in Indosat Ooredoo Hutchison.

Of particular interest is the single “Series A” share the government owns in both Indosat Ooredoo Hutchison and Telkom Indonesia. No other shareholder holds this share type in either company. As a Series A shareholder, the government has special rights, as described below for Telkom Indonesia:

The company issued only 1 Series A Dwiwarna share which is held by the Government and cannot be transferred to any party, and has a veto right in the General Meeting of Stockholders of the Company with respect to election and removal of the Boards of Commissioners and Directors, issuance of new shares, and amendments of the Company’s Articles of Association. (Telkom Indonesia, 2023, p. 404[24])

Similar rights are outlined under the Series A share issued by Indosat Ooredoo Hutchison. These include veto rights in cases of mergers or acquisitions, bankruptcy and amendments to the rights of series A shareholders, among others (Indosat Ooredoo Hutchison, 2023, p. 350[20]). The Series A shareholder also has the right to “appoint one director and one commissioner of the Company” (Indosat Ooredoo Hutchison, 2023, p. 350[20]). This suggests the government retains influence over some of Indosat Ooredoo Hutchison’s key business decisions, despite having a lower percentage of shares compared to Telkom Indonesia.

In contrast, the Indonesian government does not seem to own shares in XL Axiata (although the Malaysian government owns shares in its parent company, Axiata Group) (XL Axiata, 2023[28]).6 The Indonesian government similarly does not seem to have ownership in Link Net, as XL Axiata’s subsidiary (Link Net, 2023[18]).

Overall, the state has clear ownership in one of the three main players in the fixed market (Telkom Indonesia) and in two of the four main players in the mobile market (Telkomsel and Indosat Ooredoo Hutchison). These operators have the largest market shares in their respective markets (leader in both markets and the second in mobile).

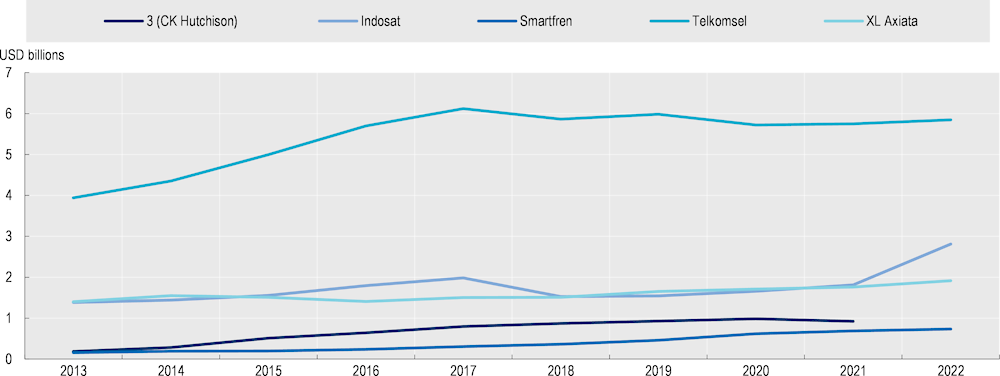

In terms of market revenue, while data on revenues and investment are unavailable for the fixed market, estimates for the mobile market show steady growth. Total revenues of the mobile sector in the country have increased steadily from 2013-22, growing by 56% over that period (GSMA Intelligence, 2023[14]).

Indonesia was second in the region in terms of mobile revenues (nominal terms) in 2022, just behind Thailand and followed by Viet Nam (GSMA Intelligence, 2023[14]). By operator, Telkomsel is the clear leader in terms of nominal revenue, unsurprising given its market position. It is followed by Indosat (Indosat Ooredoo Hutchison), XL Axiata and Smartfren, in 2022 (Figure 3.7) (GSMA Intelligence, 2023[14]). Revenues from 3 (CK Hutchison) are reported only until 2021, as the entity merged with Indosat to become Indosat Oordeoo Hutchison in 2022. Similarly, data from Indosat from 2013-21 are prior to the merger.

Figure 3.7. Mobile revenues by operator, 2013-22

Note: In 2022, Indosat merged with 3 (CK Hutchison) Indonesia to become “Indosat Ooredoo Hutchison”. Revenue data for 2013-21 for Indosat and 3 (CK Hutchison), respectively, are pre-merger. Revenue from Net1 was omitted due to company’s cease in operations in November 2021 (Detikinet, 2021[29]).

Source: GSMA Intelligence (2023[14]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

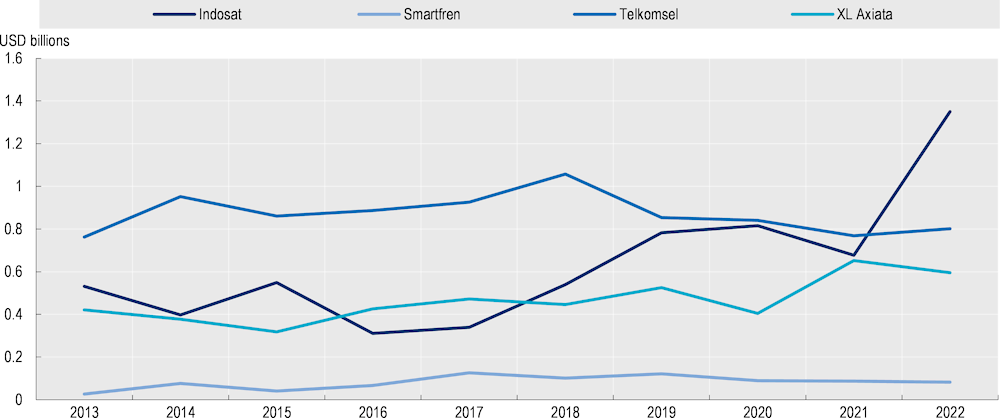

Coupled with the strong growth in revenue in the mobile market, investment in mobile networks (capital expenditure (Capex)) also grew over 2013-22, although at a lower rate of 23% (GSMA Intelligence, 2023[14]). The level of mobile investments in 2022 (nominal terms) put Indonesia in second place in the region, just behind Thailand (GSMA Intelligence, 2023[14]). By operator, Indosat (Indosat Ooredoo Hutchison) surpassed Telkomsel as the leading investor in 2022 in nominal terms with an investment of USD 1.3 billion (Figure 3.8). This almost doubled Indosat’s Capex figure in 2021 (USD 677 million), prior to the merger with CK Hutchison (pre-merger investment data for CK Hutchison not shown in graph). The increase may be due in part to the coverage, rollout and quality of service requirements set by the ministry as merger conditions.

The combined entity is clearly investing heavily, with its 2022 Capex-to-revenue ratio at 48% (GSMA Intelligence, 2023[14]). XL Axiata also has a relatively high ratio, with investment accounting for roughly 30% of its revenues in 2022 (GSMA Intelligence, 2023[14]). Although Telkomsel is second in terms of investment in nominal terms in 2022, its Capex ratio is lower at 14% in 2022 (GSMA Intelligence, 2023[14]). Smartfren had a similar Capex ratio at 11% in 2022 (GSMA Intelligence, 2023[14]).

Figure 3.8. Investment in mobile networks (total Capex) by operator, 2013-22

Note: In 2022, Indosat merged with 3 (CK Hutchison) Indonesia to become “Indosat Ooredoo Hutchison”. Investment data from 2013-21 for 3 (CK Hutchison) are not shown in the graph. Data from 2013-21 for Indosat are pre-merger. Revenue from Net1 was omitted due to company’s cease in operations in November 2021 (Detikinet, 2021[29]).

Source: GSMA Intelligence (2023[14]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

3.3. Communication policy and regulatory framework

3.3.1. Institutional framework

The Ministry of Communications and Informatics (MCI) has the main responsibility over the communication market in Indonesia, covering both the communication and broadcasting sectors (MCI, n.d.[30]). It also regulates the communication sector, taking over from the Indonesian Telecommunication Regulatory Body (BRTI) when it was disbanded in 2020 due to a governmental decision to streamline functions (MCI, 2020[31]; MCI, 2020[32]). During its operation, BRTI regulated the communication sector but worked under and was responsible to the ministry (ADB, 2020[33]).

The move to disband BRTI and further centralise regulatory functions in the ministry goes against OECD Recommendations and good practice, which support independent regulatory bodies, especially over the communication sector. The 2021 OECD Broadband Recommendation calls for regulatory decisions in the communication sector to be made, “in an independent, impartial, objective (evidence- and knowledge-based), proportionate, and consistent manner” (OECD, 2021[1]). Similarly, the 2012 Recommendation of the OECD Council on the Regulatory Policy and Governance advocates for regulators to make objective, impartial and consistent decisions, avoiding conflicts of interest (OECD, 2012[34]). The Annex to the Recommendation suggests consideration of independent regulators where regulatory decisions can have a significant economic impact on regulated parties (OECD, 2012[34]). This clearly applies to the communication sector.

Separating regulatory and policy-making functions is vital to promote independent, impartial and objective regulatory decisions, which are based on evidence and insulated from political influence. Across the OECD, this is standard practice, with 84% of communication regulators in OECD member countries established by legislation to be independent (OECD, 2022[35]).

An independent regulatory body is even more important in cases where the government owns shares in communication operators, as is the case in Indonesia. For example, the government retains ownership in Telkom Indonesia, Telkomsel and Indosat Ooredoo Hutchison, including Series A shares that denote specific rights to the government. Among these, Telkomsel and Indosat Ooredoo Hutchison are two of the main players, collectively holding almost three-quarters of the mobile market (Figure 3.5). Meanwhile, Telkom Indonesia is the leading operator in the fixed market with over 80% market share (Figure 3.6). Under the current institutional framework, the government acts as both policy maker and regulator.

Recommendation

1. Establish an independent regulatory body with remit over the communication sector. There is no independent regulator in the country, as MCI acts as both the policy-making entity and regulator. An independent regulator, equipped with the tools to monitor and enforce regulation over the communication sector, is considered good practice across the OECD. This is even more important in cases with state ownership in communication operators, as in Indonesia. Therefore, Indonesia should establish an independent regulatory body for the communication sector to strengthen its institutional framework, in line with OECD Recommendations (OECD, 2012[34]; OECD, 2021[1]).

3.3.2. Regulatory framework

Law Number 36 of 1999 on Telecommunications (Telecoms Law) is the main law in the communication sector (Government of Indonesia, 1999[36]). Accompanying this are several relevant Government Regulations (GR) and Ministry of Communications and Informatics Regulations (MR). One such implementing regulation is GR 46/2021 on Post, Telecommunications and Broadcasting, which details regulation regarding operation of communication networks, provision of service and spectrum use (Government of Indonesia, 2021[37]).

To operate communication networks or offer services in Indonesia, operators must obtain the relevant licence from MCI. Licences are required for communication network operation, communication services operation, special communication operation (Government of Indonesia, 1999[36]). Communication network operation comprises both fixed and mobile network operations, while communication service operation comprises basic telephony service operations; telephony value-added service operations; and multimedia service operations (Government of Indonesia, 2021[37]). Special telecommunication operations are conducted for personal or state purposes (Government of Indonesia, 2021[37]). The Telecoms Law requires licensed network operators and service providers to pay a fee based on a percentage of revenue, as well as contribute to universal service (Art. 16 and 26) (Government of Indonesia, 1999[36]).

3.3.3. Broadband strategies and plans

MCI released its strategic plan for 2020-24 in 2021, which sets out its main objectives and work plan until 2024. It focuses on advancing digital transformation across business, society and government, enhancing provision of communication infrastructure throughout Indonesia, and increasing transparency in public information and communication management (MCI, 2021[38]).

MCI set ten strategic targets to develop the communication and informatics sector for 2020-24 (Table 3.2). Three aim to extend connectivity in the country: increasing the coverage of high-speed and affordable broadband networks, promoting deployment of national next generation broadband connectivity and increasing availability of radio frequency spectrum (MCI, 2021[38]).

Table 3.2. Strategic targets for MCI’s 2020-24 strategic plan

|

No |

Strategic targets |

|---|---|

|

1 |

Increase coverage of high-speed and affordable broadband networks. |

|

2 |

Increase coverage of digital broadcasting. |

|

3 |

Increase coverage of postal services. |

|

4 |

Promote national next generation broadband connectivity. |

|

5 |

Increase availability of radio frequency spectrum and improve the management of public services in the post, communication and informatics sectors. |

|

6 |

Increase the use of ICT services by business. |

|

7 |

Develop a “Digital Intelligent Society”. |

|

8 |

Support the digitalisation of government. |

|

9 |

Increase the quality of information management and public communications. |

|

10 |

Promote good governance. |

Source: OECD elaboration based on MCI (2021, pp. 85-86[38]), Strategic Development Plan Ministry of Communications and Informatics Year 2020-2024, www.kominfo.go.id/content/detail/35108/rencana-strategis-kementerian-kominfo-2020-2024-untuk-percepatan-transformasi-digital-nasional/0/pengumuman.

Each strategic target includes goals to be achieved over 2020‑24. For example, the target related to increasing the coverage of broadband networks puts in place specific goals related to 4G and fibre coverage, adoption of fixed broadband services, capacity of national satellites, and the affordability of fixed and mobile broadband services (MCI, 2021[38]). The target to promote next generation broadband connectivity defines specific 5G deployment goals, while the target related to spectrum seeks to increase the amount of spectrum available, among others (MCI, 2021[38]).

3.4. Competition, investment and innovation in broadband markets

3.4.1. Competition

As evidenced by the market structure presented above, several players operate in Indonesia’s communication markets. However, some hold relatively more market shares than others, changing the competitive landscape. In the mobile market, Telkomsel leads with a 44.5% share in 2022, based on mobile broadband subscribers, according to national authorities. It is followed by Indosat Ooredoo Hutchison with 29%, XL Axiata with 16.3% and Smartfren with roughly 10% (Figure 3.5). Based on these data, the HHI is 3 191, driven largely by Telkomsel’s market share. However, the newly merged entity, Indosat Ooredoo Hutchison, trails in market share by only roughly 15%. Meanwhile, the other two operators have non-negligible market shares (XL Axiata with 16% and Smartfren with 10%). This suggests there is some competitive pressure on Telkomsel. Nevertheless, the two leading operators have state ownership and were incumbents prior to liberalisation through Telkom Indonesia (Telkomsel) and Indosat (Indosat Ooredoo Hutchison).

The fixed market is less balanced than the mobile market. In the fixed residential market (B2C), Telkom Indonesia holds 80.7% of the market based on fixed broadband subscribers as of Q4 2021. It is followed distantly by Link Net with close to 8% and MNC Kabel Mediacom with close to 3%. The remaining 9% is split by more than 500 smaller fixed providers (Figure 3.6). Based on these market shares, the HHI for the fixed residential market is 6 590, driven by Telkom Indonesia’s share. While there are many more fixed providers compared to mobile providers, the strong position of Telkom Indonesia and the comparatively small market shares of other competitors suggest a much more concentrated market. The recent acquisition of Link Net by mobile operator XL Axiata may help increase competitive pressure on Telkom Indonesia. For their part, XL Axiata and Link Net seem intent on expanding their fixed footprint and increasing their market share. They have announced goals to pass one million homes with fibre by 2024, and an additional five million homes in the next five years, including outside of the most populous island, Java (Link Net, 2023[39]).

With respect to the fixed business market (B2B), Telkom Indonesia holds an even higher percentage of fixed business subscribers (close to 90%). Smaller providers hold the rest of the market (around 10%). Telkom Indonesia similarly is the largest provider in the wholesale market according to national authorities, which is unsurprising given its leading position in the fixed retail markets. This suggests that it holds the largest fixed network footprint across the country. National authorities also report five other wholesale providers, although no market shares were provided. Nevertheless, Telekom Indonesia – the incumbent – seems to dominate both fixed retail (B2C, B2B) and wholesale markets.

The regulatory framework governing competition is primarily defined through the Competition Law, which covers the broad economy (Government of Indonesia, 1999[40]). The Telecoms Law and associated ministerial regulations also contain provisions that aim to uphold competition. However, the Telecom Law states that the Competition Law and its implementing regulation are the prevailing laws to uphold fair competition in the communication sector, as stipulated in the “elucidation” section regarding Art. 10 (Government of Indonesia, 1999[36]). The Commission for the Supervision of Business Competition (KPPU) upholds the Competition Law. KPPU’s duties include reviewing government policies related to monopolistic practice or unfair competition, investigating allegations of violations, assessing business activities and imposing sanctions (Government of Indonesia, 1999[40]).

KPPU is established through the law as an independent body, although its members are appointed by the president, upon approval of the legislature (Government of Indonesia, 1999[40]). Its budget is allocated by the state (Government of Indonesia, 1999[40]). Government influence may be possible through the appointment of high-level positions, as well as through its budget appropriation. Putting in place additional measures can help insulate KPPU from government influence. Such measures could include long-term budget allocations and a transparent selection and appointment process for KPPU leadership. Ensuring the body with the remit to uphold competition in the communication sector is independent of political influence is especially important given the state’s ownership in key market players (e.g. Telkom Indonesia, Telkomsel, and to a lesser degree, Indosat Ooredoo Hutchison).

Under the Competition Law, an entity is found to have a dominant position if it holds a share of more than 50% in a particular market. Similarly, two or three entities shall be found dominant if they hold more than 75% of the market share (Art. 25) (Government of Indonesia, 1999[40]). The law prohibits business actors from using their dominant position either directly or indirectly to i) influence the market to hamper consumer choice of competitive goods or services; ii) restrict development of technology or the market; or iii) hinder business entry (Government of Indonesia, 1999[40]).

Market share under the Competition Law is based on the “percentage of the sale or purchase value of certain goods or services controlled by a certain business actor in the relevant market within a certain calendar year” (Art. 1[13]) (unofficial translation) (Government of Indonesia, 1999[40]). While this differs from mobile subscribers, the subscriber market shares in Figure 3.5 and Figure 3.6 are likely still probative. Under these criteria, Telkom Indonesia would clearly hold a dominant position in the fixed residential (B2C) and business (B2B) markets, with over 50% market share. However, Telkomsel and Indosat Ooredoo Hutchison would not be considered as holding dominant positions as together in the mobile market they hold just under 75% of the market.

Another aspect to consider is the degree of competitive neutrality of the regulatory framework, which is especially important considering state ownership in key players in the communication sector. Competitive neutrality ensures that all players (e.g. public, private, Indonesian or foreign) face the same set of rules and compete on a level playing field (OECD, 2021[41]). However, entities with state ownership may receive treatment that could give them an edge over private competitors. In this regard, Indonesia could consider conducting a competitive neutrality review in the communication sector to assess the current level of competitive neutrality and identify ways to improve it to encourage greater competition.

The Competition Law further stipulates that business entities must notify KPPU of any mergers or acquisitions above a certain monetary threshold. It prohibits consolidation where it may “cause monopolistic practices and or unfair business competition” (Art. 28) (Government of Indonesia, 1999[40]). KPPU has put in place several guidelines and implementing regulation related to mergers. These include the 2020 Merger Guidelines (KPPU, 2020[42]) and the updated KPPU Regulation No. 3 of 2023, promulgated in March 2023 (KPPU, 2023[43]). Unlike merger regulation in other countries, the KPPU’s review process occurs after the merger has taken place. Merging entities must notify the KPPU within 30 business days after the merger “legally comes into effect” (KPPU, 2020[42]). Despite this notification scheme after the legal closure, Art. 47 of the Competition Law asserts that KPPU can annul mergers or acquisitions if they violate Art. 28 (Government of Indonesia, 1999[40]).

Although KPPU can prohibit mergers or acquisitions, it has not done so in recent years (The Law Reviews, 2023[44]). Nevertheless, empowering the competition authority to approve or prohibit mergers or acquisitions due to impacts on competition is considered OECD good practice. While KPPU has not undertaken this right in recent years, the regulation covering mergers seems to give it this power without legislative changes.

In the recent merger of the Ooredoo Group and CK Hutchison, the merging entities notified KPPU. KPPU conducted a comprehensive merger review based on its initial assessment of market concentration and impact resulting from the merger (i.e. an HHI over 2 500, resulting in an HHI change of more than 150) (KPPU, 2022[22]). The companies reported KPPU’s decision that the merger would be unlikely to result in monopolistic practices or unfair competition (Indosat, 2022[23]).

At the sectoral level, the Telecoms Law broadly prohibits monopolistic behaviour and unfair competition among communication operators (Art. 10) (Government of Indonesia, 1999[36]). Further, it establishes that all communication network operators have the right to interconnect (Art. 25) (Government of Indonesia, 1999[36]).

MR 5/2021 provides more detailed provisions on operation of communication networks, including on interconnection (MCI, 2021[45]). It also includes provisions regarding wholesale services, which must be offered on a “fair, reasonable and non-discriminatory” basis (Art. 37) (MCI, 2021[45]). Additionally, MR 5/2021 empowers MCI to regulate pricing of certain network operation and service tariffs to uphold competition and protect public interest (Chapter IX) (MCI, 2021[45]). Most recently, MR 576/2022 established evaluation guidelines to determine the upper and lower limits for communication network operation and service tariffs (MCI, 2022[46]).

As noted above, KPPU has the power to review governmental policies regarding competition provisions, which could include competition provisions in sectoral regulations. For this purpose, KPPU developed the “Guideline on Competition Policy Assessment Checklist”, (KPPU Regulation No. 4/2016), reportedly based off the OECD’s Competition Assessment Toolkit (OECD, 2021[41]). The OECD Competition Assessment Toolkit is a checklist which aims to help governments identify unneeded restrictions on market activity to lower barriers to competition while still upholding policy aims (OECD, n.d.[47]). The OECD Competitive Neutrality Reviews: Small-Package Delivery Services in Indonesia recommends encouraging a wider use of the KPPU’s checklist (Regulation No. 4/2016) by ministries, for example by making it mandatory when establishing new recommendations (OECD, 2021, p. 55[41]). KPPU’s checklist, as well as the OECD’s toolkit, could be a helpful guide to conduct a competition assessment in the sector to identify whether there are regulatory restrictions which could hinder market competition in the communication sector. This could be especially helpful to assess for the fixed market given Telkom Indonesia’s current market shares in both residential and business fixed markets.

Recommendations

2. Consider conducting a competitive neutrality review in the communication sector. Given state ownership in key players in the communication sector, Indonesia could consider conducting a competitive neutrality review to assess whether changes to the regulatory framework may help to ensure all players compete on a level playing field.

3. Consider undertaking a competition assessment in the sector, leveraging KPPU’s “Guideline on Competition Policy Assessment Checklist”. Indonesia could undertake a competition assessment to identify whether there are regulatory restrictions which could hinder market competition in the communication sector. Such an assessment would be particularly pertinent for the fixed market, given Telkom Indonesia’s market shares. In this regard, KPPU’s Guideline on Competition Policy Assessment Checklist”, (KPPU Regulation No. 4/2016), as well as the OECD’s Competition Assessment Toolkit could be helpful.

3.4.2. Investment

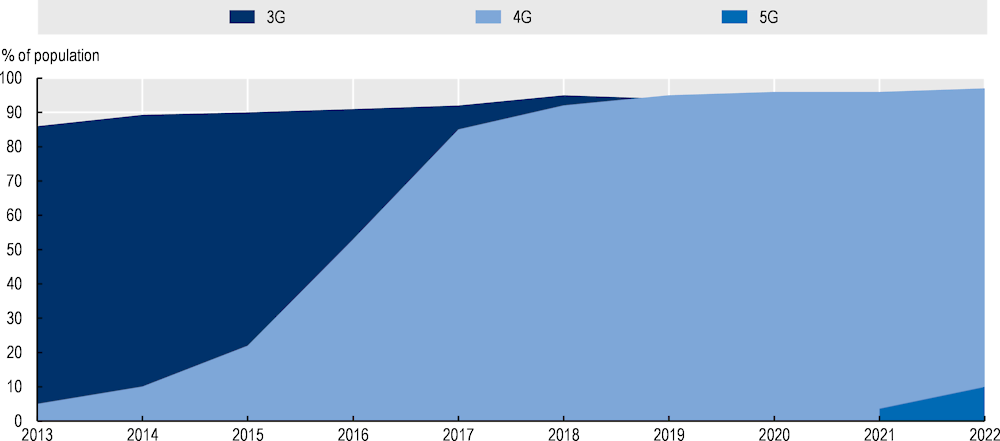

Extending communication networks and improving their quality depends on sufficient investment. Indonesia’s geography may increase the investment burden, above those of contiguous countries. These circumstances must be duly assessed when considering the level of investment in communication markets in the country. With respect to investments in mobile networks (Capex), Indonesia is the second highest in the region in nominal terms, behind Thailand, as of 2022 (GSMA Intelligence, 2023[14]). Indonesia’s mobile investment (Capex) has shown stable growth from 2013-22, at a rate of 23% over that period, from USD 2.3 billion to USD 2.8 billion (GSMA Intelligence, 2023[14]). 4G mobile coverage by population reached 97% in 2022 (Figure 3.9), suggesting that operators have invested sufficiently to reach almost all of the country’s population with 4G technology (GSMA Intelligence, 2023[14]). 5G coverage in 2022 reached 10% of the population, suggesting continued investment is needed to extend 5G coverage (GSMA Intelligence, 2023[14]).

Looking at fixed networks, Indonesia ranks fourth lowest in the region with only 4.9 fixed broadband subscriptions per 100 inhabitants (ITU, 2023[12]). Some of this may be due to coverage and, relatedly, low levels of investment to deploy fixed networks. While no information on fixed network investment is available, Indonesia’s non-contiguous landscape likely increases the investment burden required to deploy fixed networks in the country. According to interviews with operators, much of the fixed network footprint is concentrated in the larger and inhabited islands, such as Java. Therefore, extending fixed network territorial coverage in particular likely entails connecting to other islands, which may be more financially burdensome compared to expanding coverage in a contiguous country. It is especially important in Indonesia as an archipelago with around 6 000 inhabited islands and islets (Ministry of Foreign Affairs, n.d.[2]). Additionally, other infrastructure, such as roads and electricity grids, may be less developed outside of the most populous islands. This may pose an additional financial burden to overcome to deploy networks in these areas.

In addition to the cost of network deployment, fees levied on operators may influence investment decisions. These fees include an annual “telecommunications operations rights fee” (telecommunications BHP) of 0.5% of operators’ gross revenues and an annual universal service contribution of 1.25% of operators’ gross revenues (Art. 188) (MCI, 2021[45]). Spectrum fees also apply (Art. 59) (Government of Indonesia, 2021[37]).

Some aspects of Indonesia's regulatory framework aim to promote infrastructure investment, namely related to lowering foreign investment requirements and allowing infrastructure sharing. PR No. 10 of 2021, as amended by Presidential Decree No. 49 of 2021, established important changes to Indonesia’s investment regime. They moved the country from a “negative list” for investment regulation to a positive one (OECD, 2023[48]). This “positive investment list” is generally open by default, whereby business sectors have no foreign investment restrictions unless specified (Medina, 2023[49]).

The new investment rules lifted foreign equity requirements in the communication sector (OECD, 2023[48]). This is a welcome move towards liberalisation, supporting promotion of investment in the sector. However, according to the OECD Services Trade Restrictiveness Index (STRI), despite these improvements, communication sector remains one of the most restricted service sectors in Indonesia. Its classification as one of Indonesia’s most restrictive sectors is largely driven by barriers to competition, namely due to state ownership of communication players (OECD, 2023[48]). Other general regulations that apply to all economic sectors may also play a role. These include land ownership restrictions by foreigners; requirements that Indonesian nationals hold certain management positions; or commercial or local presence requirements (OECD, 2023[48]).

Nevertheless, Indonesia also has put in place other measures to encourage investment. Infrastructure sharing, for example, is a welcome measure. GR 46/2021 stipulates that business entities owning passive infrastructure (e.g. ducts, towers, poles, manholes) must open access to their infrastructure on a fair and non-discriminatory basis (Art. 25) (Government of Indonesia, 2021[37]). Furthermore, MR 5/2021 allows active infrastructure sharing at the initiative of private players and driven by business decision. Such agreements must be reported to MCI Minister (Art. 34-5) (MCI, 2021[45]).

Recommendation

4. Consider further measures to decrease restrictions on foreign entry, including those applied more generally across the economy. While recent legislative action to decrease foreign equity requirements in the communication sector is commendable, other economy-wide regulation appears to pose barriers to foreign actors to participate in the market. These include land ownership restrictions, requirements for Indonesian nationals to hold certain management positions, or commercial or local presence requirements, as outlined by Indonesia’s STRI 2022 country note (OECD, 2023[48]). Lowering these regulatory barriers may help encourage foreign players to participate in the market, which could stimulate competition with incumbent operators to further invest to expand their networks. In addition, the existence of state ownership of communication players may pose another barrier. Indonesia could consider possible reforms of state ownership, notably of Telkom Indonesia, to make Indonesia’s communication sector more conducive to foreign players and stimulate further competition in the market.

3.4.3. Innovation

To support innovation, Indonesia has emphasised its goal to promote next generation services and networks. For example, MCI’s strategic plan for 2020-24 promotes next generation broadband connectivity as a strategic target (MCI, 2021[38]). Indonesia has also eased certain regulatory requirements to facilitate testing and trials. For example, GR 46/2021 grants an exemption to mandatory certification of compliance with technical standards for equipment and devices used for research and development and technology trials (Art. 35) (Government of Indonesia, 2021[37]). Similarly, spectrum fees are waived in cases of research, technology trials, or non-commercial testing of devices or equipment. However, this only applies to trials by government institutions or by Indonesian education and training organisations (Art. 62) (Government of Indonesia, 2021[37]).

To launch any new technology in their networks (e.g. 5G), mobile operators must undergo tests and receive a certificate of “operational worthiness” from MCI to certify that their facilities and infrastructure under the new network technology are fit for operation (Art. 4) (MCI, 2021[45]). In 2021, Telkomsel and XL Axiata announced receiving this certificate to launch 5G services (Telkomsel, 2021[50]; XL Axiata, 2021[51]). Indosat Ooredoo (now Indosat Ooredoo Hutchison) similarly reported launching 5G service in 2021 (Ooredoo Group, 2021[52]). This suggests a healthy industrial appetite to deploy new services and the necessary regulatory support to obtain legal requirements for 5G deployments.

However, 5G deployment appears to be limited thus far. As of September 2023, 5G has been deployed in 49 cities in Indonesia (MCI, 2023[53]). This limited deployment is also reflected in the low coverage of 5G service as of 2022 (Figure 3.9). The limited availability of spectrum appears to be one cause of the limited deployment, with some operators forced to repurpose existing spectrum for 5G. For example, XL Axiata announced using dynamic spectrum sharing on its spectrum holdings in the 1.8 GHz and 2.1 GHz bands for its 5G service (XL Axiata, 2021[51]).

Indonesia has promoted policies that show support for innovative new services, such as 5G, and its regulatory framework does not appear to be hindering their deployment. However, the government’s delay to assign sufficient spectrum appears to be holding 5G deployment back, as discussed in the Spectrum management section below.

3.5. Broadband deployment and digital divides

3.5.1. Broadband deployment

Indonesia made significant progress in mobile broadband development over the past decade. 3G coverage, which has exceeded 90% of the population since 2015, stands at 94% (GSMA Intelligence, 2023[14]). The 4G rollout took place mainly between 2013 and 2017, contributing to a near tripling of mobile subscriptions (Figure 3.9). In 2022, 4G coverage will reach 97% of the population (GSMA Intelligence, 2023[14]). 5G rollout in Indonesia is at an early stage, with coverage reaching 10% of the population in 2022 (GSMA Intelligence, 2023[14]). This will be an important next step to extend high-quality connectivity.

Figure 3.9. Mobile broadband coverage, 2013-22

Source: GSMA Intelligence (2023[14]), Database, www.gsmaintelligence.com/data/ (accessed on 9 November 2023).

Although no data are available on coverage of fixed broadband networks, the penetration of services is one of the lowest in the region with 4.9 subscribers per 100 inhabitants (2022) (ITU, 2023[12]). Several factors could cause such a low rate: insufficient coverage; the relatively high price for fixed services; lack of digital literacy; or low household computer penetration. Lack of competition in the fixed market is a further concern. Local actors also report other factors limiting fixed deployment. These include difficulties in setting fees and in obtaining permits due to lack of harmonised procedures between island and local administrations.

In terms of backbone/long-haul networks, Indonesia has a total route length of 237 934 km (route km) of fibre.7 On the more populated islands, most connections are offered by multiple operators. These include Telkom Indonesia, Biznet Networks, PT Excelcomindo Pratama, PT Indonesia Satellite Corp, Moratelindo, and PT Perushahaan Gas Negara Tbk (ITU, 2023[54]). However, on less populated islands such as Borneo, Sulawesi or Papua, the number of operators with backbone infrastructure is much smaller. In many cases, there is only Telkom Indonesia fibre and the government-funded Palapa Ring Project (ITU, 2023[54]).

The backbone networks in Indonesia have a significant proportion of submarine cable segments. These cables connect remote islands but also connect nodes distributed along the coast. In total, 16 submarine cable systems only interconnect Indonesian islands (Table 3.3). In terms of technology, most of the backbone links are fibre-based. However, unlike in other countries, Indonesia has a significant proportion of microwave-based links, 8 231 km in total (ITU, 2023[54]). These are mainly on the islands of Borneo, Sulawesi, Papua, Bali, and Nusa Tenggara. Most are redundant links to other fibre links along the same path (technology diversity). Others provide alternative paths for other fibre routes (path diversity e.g. on Sulawesi). However, on Papua, they provide the only backbone connection to the interior.

Indonesia’s backbone network coverage is relatively low with 36% of the population within 10 km of a node (SEA average 43%) (ITU, 2023[54]). This means that long-distance backhaul networks will need to be built to connect broadband access networks and reach end-users. This can be a barrier to extending coverage in areas of low commercial interest, such as sparsely populated areas.

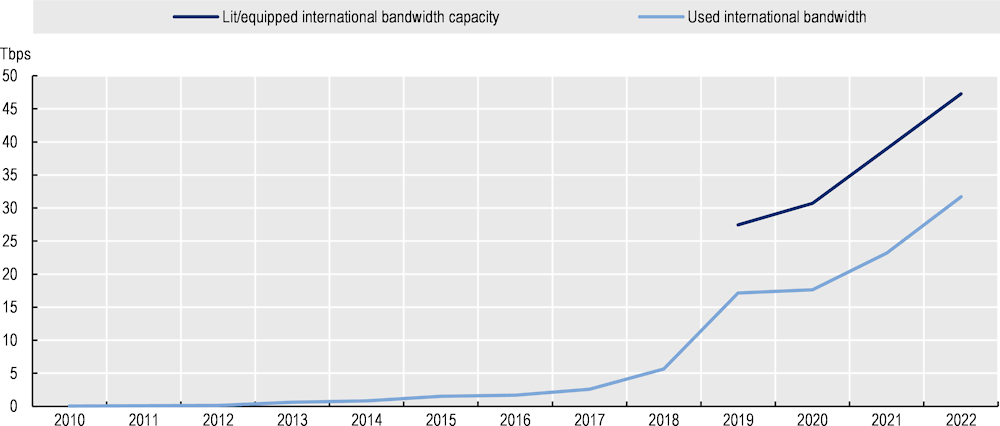

Indonesia has the third largest international bandwidth capacity, 47.3 terabits per second (Tbps) (2022) (ITU, 2023[12]) representing 12% of the regional capacity. This makes it third in the region behind the 54% of international connectivity capacity provided by Singapore and the 23% provided by Malaysia (2022) (ITU, 2023[12]). However, Indonesia’s used capacity represents 67% of the installed capacity. This means the country uses its capacity for its own traffic rather than acting as a router for international traffic. In contrast, the used capacity in Singapore and Malaysia represents less than 20% of installed capacity (ITU, 2023[12]). This is also reflected in the rapid growth in the use of international bandwidth from 2018 onwards, which is linked to the large increase in mobile broadband penetration in these years (Figure 3.10).

Figure 3.10. International bandwidth, 2010-22

Note: Lit/equipped international bandwidth capacity refers to the total lit capacity of international links, namely fibre-optic cables, international radio links and satellite uplinks to orbital satellites in the end of the reference year (expressed in Mbit/s). If the traffic is asymmetric (i.e., different incoming and outgoing traffic), then the highest value out of the two should be provided. Average usage of all international links, including optical fibre cables, radio links and traffic processed by satellite ground stations and teleports to orbital satellites (expressed in Mbit/s). The average is calculated over the twelve-month period of the reference year. If the traffic is asymmetric (i.e. different incoming and outgoing traffic), then the highest value out of the two should be provided. All international links used by all types of operators, namely fixed, mobile and satellite operators should be taken into account. The combined average usage of all international links can be reported as the sum of the average usage of each link (ITU, 2020[13]).

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).

Indonesia's international connectivity is provided by a remarkable number of submarine cables. Indonesia has the largest number of submarine cable connections in the SEA region, 48 in total. Of these, 32 are the domestic inter-island connections mentioned above; 16 are cable systems connecting countries in the region; and 11 are long-distance cables connecting various regions on a global scale (inter-regional cables) (TeleGeography, 2023[55]). The regional systems connect Indonesia mainly with Singapore (ten cables) and Malaysia (seven cables), while one cable connects with Thailand (Thailand-Indonesia-Singapore cable). However, considering all submarine cable connections, Indonesia is connected to all SEA countries except Cambodia and the landlocked Lao PDR (Table 3.3).

Indonesia is also connected by submarine cable to virtually all regions of the world (Table 3.4) through long-distance systems such as SeaMeWe-3 and 5 (TeleGeography, 2023[55]). Most connections are with Micronesia (six cables) and North America (five cables), as well as with Australia and New Zealand (four). The high number of connections to the regional submarine cable systems (16 landing stations, the highest in the region), coupled with its significant international connectivity to long-distance cables, puts Indonesia in a good position to potentially leverage this infrastructure to become a regional hub for content and applications, as well as international connectivity.

Table 3.3. Indonesia’s connections with other SEA countries via submarine cables

|

Cable system |

Brunei Darussalam |

Cambodia |

Lao People's Democratic Republic |

Malaysia |

Myanmar |

Philippines |

Singapore |

Thailand |

Viet Nam |

|---|---|---|---|---|---|---|---|---|---|

|

Apricot |

x |

x |

|||||||

|

Asia Connect Cable-1 (ACC-1) |

x |

x |

|||||||

|

Australia-Singapore Cable (ASC) |

x |

||||||||

|

B2JS (Jakarta-Bangka-Batam-Singapore) Cable System |

x |

||||||||

|

Batam Dumai Melaka (BDM) Cable System |

x |

||||||||

|

Batam Sarawak Internet Cable System (BaSICS) |

x |

||||||||

|

Batam Singapore Cable System (BSCS) |

x |

||||||||

|

Batam-Rengit Cable System (BRCS) |

x |

||||||||

|

Bifrost |

x |

x |

|||||||

|

Dumai-Melaka Cable System |

x |

||||||||

|

East-West Submarine Cable System |

x |

||||||||

|

Echo |

x |

||||||||

|

Hawaiki Nui |

x |

||||||||

|

INDIGO-West |

x |

||||||||

|

Indonesia Global Gateway (IGG) System |

x |

||||||||

|

JAKABARE |

x |

||||||||

|

Jakarta-Bangka-Bintan-Batam-Singapore (B3JS) |

x |

||||||||

|

JASUKA |

x |

||||||||

|

Kumul Domestic Submarine Cable System |

|||||||||

|

Matrix Cable System |

x |

||||||||

|

Moratelindo International Cable System-1 (MIC-1) |

x |

||||||||

|

PGASCOM |

x |

||||||||

|

SeaMeWe-3 |

x |

x |

x |

x |

x |

x |

x |

||

|

SeaMeWe-5 |

x |

x |

x |

||||||

|

SEA-US |

x |

||||||||

|

SEAX-1 |

x |

x |

|||||||

|

Thailand-Indonesia-Singapore (TIS) |

x |

x |

Source: OECD elaboration from TeleGeography (2023[55]), Submarine Cable Map, www.submarinecablemap.com/ (accessed on 22 February 2023).

Table 3.4. Indonesia's connections with other regions via submarine cables

|

Cable System |

Northern Africa |

Sub-Saharan Africa |

Latin America and the Caribbean |

North America |

Eastern Asia |

Southern Asia |

Western Asia |

Northern Europe |

Southern Euproe |

Western Europe |

Australia and New Zealand |

Melanesia |

Micronesia |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Apricot |

x |

x |

|||||||||||

|

Asia Connect Cable-1 (ACC-1) |

x |

x |

|||||||||||

|

Australia-Singapore Cable (ASC) |

x |

||||||||||||

|

Bifrost |

x |

x |

x |

||||||||||

|

Echo |

x |

x |

|||||||||||

|

Hawaiki Nui |

x |

x |

x |

||||||||||

|

INDIGO-West |

x |

||||||||||||

|

Kumul Domestic Submarine Cable System |

x |

||||||||||||

|

SeaMeWe-3 |

x |

x |

x |

x |

x |

x |

x |

x |

x |

||||

|

SeaMeWe-5 |

x |

x |

x |

x |

x |

x |

|||||||

|

SEA-US |

x |

x |

Note: According to TeleGeography (2023[55]), the following cable systems will be ready: Apricot 2024, Asia Connect Cable-1 2025, Bifrost 2024, Echo 2023 and Hawaiki Nui 2025.

Source: OECD elaboration from TeleGeography (2023[55]), Submarine Cable Map, www.submarinecablemap.com/ (accessed on 22 February 2023).

In addition to its extensive international connectivity infrastructure, Indonesia also has an elaborate Internet traffic exchange infrastructure with 17 IXPs (Table 3.5) (PCH, 2023[56]). Most of them, 13, are located on Java, the most populated island and therefore the one with the most Internet traffic. Of the 13, 8 are in Jakarta, responding to its high population and therefore traffic demand. Another IXP is located on the island of Batam, responding to the high number of submarine cable landing points in this location. Of the remaining three, two are on Bali (Denpasar) and one is on Sumatra (Bandar Lampung). Despite this high number, there are no local IXPs on three of the main islands, Kalimantan (Borneo), Sulawesi and Papua (New Guinea). This could disadvantage local traffic as local ISPs have to use inter-island links to exchange traffic.

Table 3.5. Internet exchange points, 2023

|

Name |

City |

Island |

|---|---|---|

|

IIX-Lampung |

Bandar Lampung |

Sumatra |

|

IIX-Jabar |

Bandung |

Java |

|

Batam Internet Exchange |

Batam |

Batam Island |

|

Bali Internet eXchange |

Denpasar |

Bali |

|

cloudXchange |

Denpasar |

Bali |

|

Biznet Internet Exchange |

Jakarta |

Java |

|

Matrix Cable System Internet Exchange |

Jakarta |

Java |

|

Indonesian Internet Exchange |

Jakarta |

Java |

|

Jakarta Internet Exchange |

Jakarta |

Java |

|

OpenIXP Internet exchange Point |

Jakarta |

Java |

|

Batam Internet Exchange - Jakarta |

Jakarta |

Java |

|

NEX Internet Exchange |

Jakarta |

Java |

|

Cyber 2 Internet Exchange |

Jakarta |

Java |

|

IIX Jawa Timur |

Surabaya |

Java |

|

CitranetIX |

Surabaya |

Java |

|

Universitas Negeri Yogyakarta Internet Exchange Point |

Yogyakarta |

Java |

|

CitranetIX |

Yogyakarta |

Java |

Source: PCH (2023[56]), Internet Exchange Directory, www.pch.net/ixp/dir (accessed on 5 December 2023).

3.5.2. Digital divides

Despite positive developments in mobile broadband penetration, Internet usage in Indonesia is among the lowest in the region. At 62% of individuals, it is only above Cambodia, the Philippines and Myanmar) (2021) (ITU, 2023[12]). There are also significant differences or divides depending on several factors. The geographical divide between urban and rural areas using the Internet is 23 percentage points (49% in rural areas compared to 72% in urban areas as of 2021) (ITU, 2023[12]). The age gap is also wide in Indonesia. While 92% of those aged 15-24 use the Internet, only 56% of those aged 25-74 do so, and the rate drops to 5% for those aged 75 and over (2021) (ITU, 2023[12]). The differences in Internet usage by gender are also pronounced, with a 6 percentage point difference in favour of men. This is surpassed by Myanmar with a 10 percentage point difference (2021) (ITU, 2023[12]).

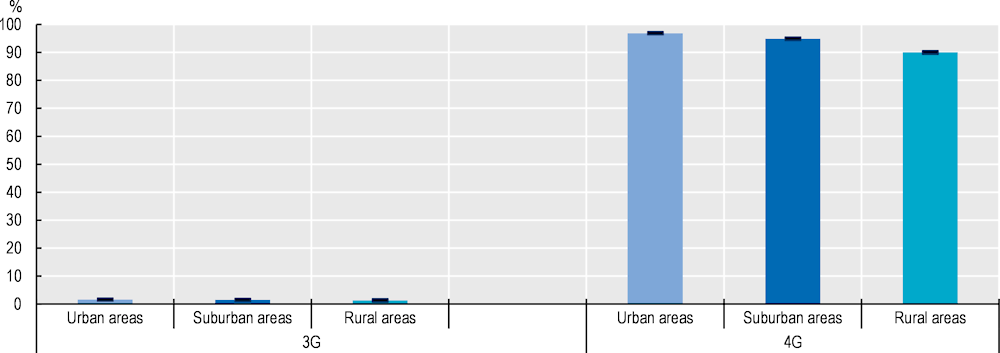

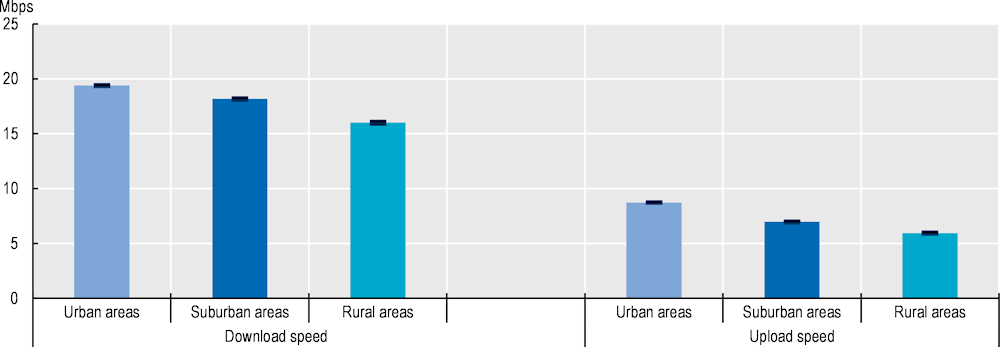

There are several reasons behind these divides on the supply side. Looking further at the supply-side reasons, mobile broadband mobile network availability, understood as the proportion of time users have a 3G and 4G connection (Opensignal, 2023[57]), shows some differences between urban, suburban and rural areas (Figure 3.11). According to Opensignal, mobile broadband availability is lower in rural areas (7 percentage points lower than in urban areas for 4G networks). Even so, availability in rural areas is still high at 90% (4G networks) (Opensignal, 2023[58]).8 Despite the high level of mobile network availability, the lower quality of mobile broadband services in rural areas may contribute to the geographical divide (Figure 3.13).

With regard to fixed broadband, data disaggregated by degree of urbanisation are not available. However, interviews with local stakeholders indicate that network deployment is concentrated in the urban centres of the most populated islands, particularly in Java around Jakarta. This may limit connectivity for some users such as small and medium-sized enterprises and public administrations, which need the performance generally offered by these networks (e.g. higher upload speed and reliability).

Interviews for this study identified two main obstacles to network deployment in non-densely populated areas: lack of infrastructure in the backhaul section; and the long delays and administrative burdens in obtaining network construction permits. Regarding the first aspect, local stakeholders indicate that initiatives such as the Palapa Ring and other private initiatives are enabling the availability of inter-island backhaul links. However, there is a lack of infrastructure to connect the landing stations of these submarine cables to medium and small towns, i.e. there is a deficit in terms of backhaul and terrestrial backhaul networks. The cost of building this infrastructure can make a network deployment project unviable for a given area, especially without high demand, as is the case in rural areas. In terms of administrative barriers, the problem is exacerbated outside major cities by lack of uniform rules at island and local level. This greatly increases the uncertainty and complexity of obtaining construction permits, or the excessive and costly nature of obtaining construction permits for network rollout works.

Figure 3.11. Network availability, percentage of time (3G, 4G), December 2022 – February 2023

Notes:

1. Data was collected by Opensignal from its users over 90 days (1 December 2022–28 February 2023).

2. 3G availability shows the proportion of time that all Opensignal users had a 3G connection. 4G availability shows the proportion of time Opensignal users with a 4G device and a 4G subscription – but have never connected to 5G – had a 4G connection. 5G availability shows the proportion of time Opensignal users with a 5G device and a 5G subscription had an active 5G connection (Opensignal, 2023[57]).

3. Confidence intervals (as represented by error bars) provide information on the margins of error or the precision in the metric calculations. They represent the range in which the true value is likely to be, considering the entire range of data measurements.

4. The results for urban areas, suburban areas and rural areas have been obtained by averaging, in each of these categories, the results of the users’ tests in geographical locations classified as “urban centres” for urban areas, “dense urban areas”, “semi-dense urban areas” and “suburban areas” for suburban areas, and “low density rural areas”, “rural areas” and “very low density rural areas” for rural areas. This territory classification has been taken from the Global Human Settlement Layer Dataset (European Commission, Joint Research Centre, 2022[59]). This applies the definitions of degree or urbanisation established in the methodology developed by the European Commission, Food and Agriculture Organization, UN-Habitat, International Labour Organization, OECD and World Bank (European Commission, Eurostat, 2021[60]).

Source: © Opensignal Limited - All rights reserved (2023[58]), http://www.opensignal.com.

Mobile broadband prices in Indonesia are relatively affordable in terms of purchasing power. Prices are below the target of less than 2% of gross national income (GNI) per capita for entry-level broadband services set by the Broadband Commission in support of the Sustainable Development Goals (UN Broadband Commission for Sustainable Development, 2022[61]) over the past few years (Figure 3.12) (ITU, 2023[12]).9 Mobile handset prices are also relatively affordable in Indonesia. According to Tarifica, the benchmark price of entry-level internet-enabled handset account for 7.74% of average monthly income (2022) (Tarifica, 2023[62]). Of the countries surveyed, only Singapore has more affordable prices, where the reference price is 0.39% of monthly income (2022) (Tarifica, 2023[62]).

However, fixed broadband prices are significantly above this threshold, reaching 6.1% of GNI per capita in 2022, at the SEA average (ITU, 2023[12]). These data suggest that, at least for mobile broadband, the price of broadband access does not appear to be a determining factor in the digital divide between different socio-economic groups. However, it could be an important factor for fixed broadband, which can have long-term consequences on fostering an inclusive, high-quality access to broadband services.

Figure 3.12. Prices for fixed and mobile broadband services (percentage GNI per capita), 2010-22

Note: The fixed broadband basket refers to the price of a monthly subscription to an entry-level fixed-broadband plan. For comparability reasons, the fixed-broadband basket is based on a monthly data usage of a minimum of 1 GB from 2010 to 2017, and 5 GB from 2018 to 2022. For plans that limit the monthly amount of data transferred by including data volume caps below 1GB or 5 GB, the cost for the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s. The mobile broadband basket is based on a monthly data usage of a minimum of 500 MB of data, 70 voice minutes, and 20 SMSs. For plans that limit the monthly amount of data transferred by including data volume caps below 500 MB (low-consumption), the cost of the additional bytes is added to the basket. The minimum speed of a broadband connection is 256 kbit/s, relying on 3G technologies or above. The data-and-voice price basket is chosen without regard to the plan’s modality, while at the same time, early termination fees for post-paid plans with annual or longer commitment periods are also taken into consideration (ITU, 2020[15]). Mobile basket prices are not available from 2010 to 2017.

Source: ITU (2023[12]), World Telecommunication/ICT Indicators Database 2023 (27th edition/July 2023), www.itu.int/en/ITU-D/Statistics/Pages/publications/wtid.aspx (accessed on 22 August 2023).