This chapter takes stock of the vulnerabilities of medicine and medical device supply chains, making a case for the importance of enhancing their resilience. First, it provides insight into the complexity and variability of the organisation of these global supply chains and presents trade statistics. It then explores the growing issue of medical product shortages, which pre‑dated the COVID‑19 pandemic, including potential causes of disruption. Finally, the chapter discusses additional strain that is placed on supply chains in times of severe crises.

Securing Medical Supply Chains in a Post-Pandemic World

1. Vulnerabilities of medical supply chains

Abstract

Key findings

Medical supply chains are complex and have become increasingly internationalised over time. Supply chains, in the context of this report, refer to the flows of goods and services needed from production to distribution, and ultimately to final consumption (or use) of a medical product – medicine or medical device – by patients, health professionals or healthcare institutions.

The production of medicines involves complex transnational supply chains, generally beginning with raw materials that are transformed into active pharmaceutical ingredients (API) at primary manufacturing sites, with secondary sites producing the finished pharmaceutical products. Global trade in pharmaceuticals has increased 10‑fold over the past 30 years, and now accounts for about 4% of total trade by value. About half the movements of goods (by value) concerned intermediate inputs (such as APIs) in 2022. The share of traded intermediate inputs in the value of final pharmaceutical products peaked at 25% in 2015 and has been declining since.

Medical device supply chains are even more varied and, and in some cases more complex, than those of medicines, with some bearing a closer resemblance to supply chains for non-medical products such as clothing or electronics. Medical devices span a huge range of products, and their supply chains are highly product-dependent, with manufacturing reliant on a large number of suppliers of individual components that may be specific to individual devices or commonly used by non-medical manufacturers. Over the past 30 years, global trade in medical devices has increased 7‑fold in value, to reach a total amount of USD 700 billion in 2022, with one‑third in intermediate goods, one‑third in final products and about one‑third in capital goods (durable equipment).

Medicine shortages were already widespread prior to the COVID‑19 pandemic. Although shortage definitions and notification rules vary widely across countries and regions, multiple studies have reported steady increases in the prevalence of shortages in various contexts.

These studies show that shortages predominantly affect older, off-patent medicines. However, one study looking at 20 countries in the European Economic Area (EEA), found that these medicines do not necessarily have a higher probability of being in shortage. The most commonly affected medicine types varied across countries and periods. Central nervous system, cardiovascular and anti‑infectives medicines were among the most commonly affected classes, with injectables more likely to be in shortage than oral dosage forms.

Manufacturing and quality issues are by far the most frequently reported causes of medicines shortages (50‑60%). “Commercial reasons” are also often cited (25% in one study of 20 EEA countries). Market dynamics have been identified as an important root cause in the United States, where competitive pricing pressures on off-patent multi-source products can be very intense. For other countries, empirical evidence on root causes of shortages is lacking.

The contribution of the nature of distribution chains in local or national shortages has not been established empirically.

Some medicinal products face specific challenges arising from unique features of their supply chains. These include vaccines (which are subject to exceptionally rigorous requirements, notably with regard to quality controls and testing), plasma-derived medicines (dependent on plasma collection) and radio-pharmaceuticals (whose production costs are subsidised by manufacturing countries).

Prior to the pandemic, shortages of medical devices received less attention than shortages of medicines, likely due in part to differences in notification requirements. Experts and industry representatives have nevertheless identified several risks to the future supply of medical devices. These pertain to long-awaited reforms in medical device and in-vitro-diagnostic regulation in the European Union; competition with other larger industrial sectors for the acquisition of raw material and electronic components used as intermediate inputs; possible changes in the regulation of certain chemical substances; and, more recently, significant inflation in the costs of inputs. Data on the occurrence and evidence of the causes of shortages of medical devices and in-vitro diagnostics are, however, very scant.

The resilience of medical product supply chains in the face of severe crises has been tested on several occasions. For example, large surges in demand occurred with the H1N1 and COVID‑19 pandemics, and in the latter, these were coupled with significant disruptions in manufacturing and trade restrictions, together exacerbating the pre‑existing issues. Despite being severely stressed during these periods and facing several shortages, medical product supply chains demonstrated considerable resilience.

Chapter 1 takes stock of the vulnerabilities and particularities of medical product supply chains. Supply chains, in the context of this report, refer to the flows of goods and services needed from production to distribution, and ultimately to final consumption (or use) of a medicine or medical device – by patients, health professionals or healthcare institutions (Section 1.1). A supply chain failure is said to occur when supply is unable to meet demand for a product marketed in a given country. While shortages of medical goods were increasing in frequency prior to the pandemic of COVID‑19 (Section 1.2), the crisis demonstrated the critical importance of securing supply chains of medical goods to address future severe health crises (Section 1.3).

1.1. Understanding the complexity of medical product supply chains

Medical product supply chains are complex and often fragmented, with many different stakeholders involved globally. The term “medical products” itself encompasses a wide variety of items and substances used in healthcare, including pharmaceuticals (i.e. medicines), vaccines, medical devices (i.e. products or equipment intended for a medical purpose), biological products, blood and tissue products, diagnostic tools and tests, personal protective equipment (PPE), and medical consumables (e.g. disposable items such as blood collection tubes, syringes) etc. Medicines may also be used in combination with medical devices, further adding to the complexity. It is important to note that regulatory oversight, manufacturing processes, and safety standards for these products can vary widely depending on their type, intended purpose, and the level of risk they pose, as well as by jurisdiction. For example, while regulatory authorities authorise medicinal products (including medicines, vaccines, plasma products, etc.) by assessing their safety, efficacy, and quality they may have different and distinct regulatory responsibilities for medical devices.1 The sections below describe some of the specifics of supply chains of medicines (Section 1.1.1) and medical devices (Section 1.1.2) for human use.

1.1.1. Pharmaceutical supply chains are complex and internationalised

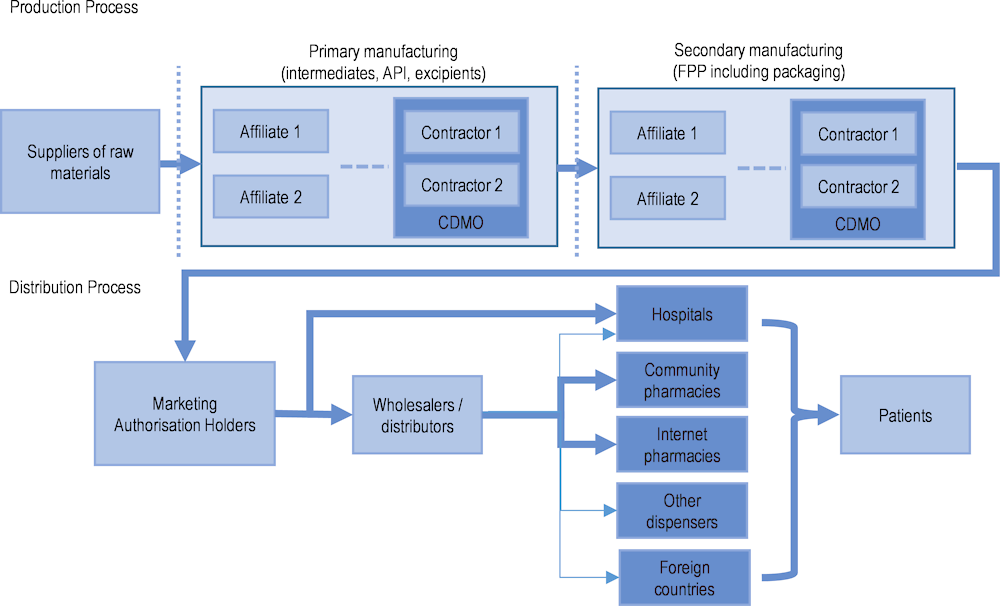

Figure 1.1 offers a basic schematic of pharmaceutical supply chains, as described by Chapman, Dedet and Lopert (2022[1]). The production of medicines involves complex transnational supply chains, with the organisation often driven by cost containment practices and the structures of production processes. They can involve multiple stakeholders across different facilities and countries. For example, small-molecule (non-biological)2 medicine production starts with raw materials transformed into active pharmaceutical ingredients (APIs) at primary (often specialised) sites, while secondary sites turn these APIs into finished pharmaceutical products (FPPs). Marketing authorisation holders (MAHs), i.e. the companies or legal entities with authorisation to market the products, often also use contract manufacturers. Medicines are then supplied by manufacturers to distributors (i.e. wholesalers) and to retail dispensing points, with hospitals in some places bypassing wholesalers and being supplied directly by MAHs. Disruptions in manufacturing and production processes may have a global impact on the availability of medicines, while problems in distribution processes are more likely to have localised effects (e.g. local or national).

Figure 1.1. The complexity of pharmaceutical supply chains

Note: Dotted vertical lines represent the possibility of an international border. API: active pharmaceutical ingredient; FPP: finished pharmaceutical product; CDMO: contract development and manufacturing organisation.

Source: Adapted from Chapman, S., G. Dedet and R. Lopert (2022[1]), “Shortages of medicines in OECD countries”, https://doi.org/10.1787/b5d9e15d-en.

Trade in pharmaceutical products has increased, especially for intermediate products

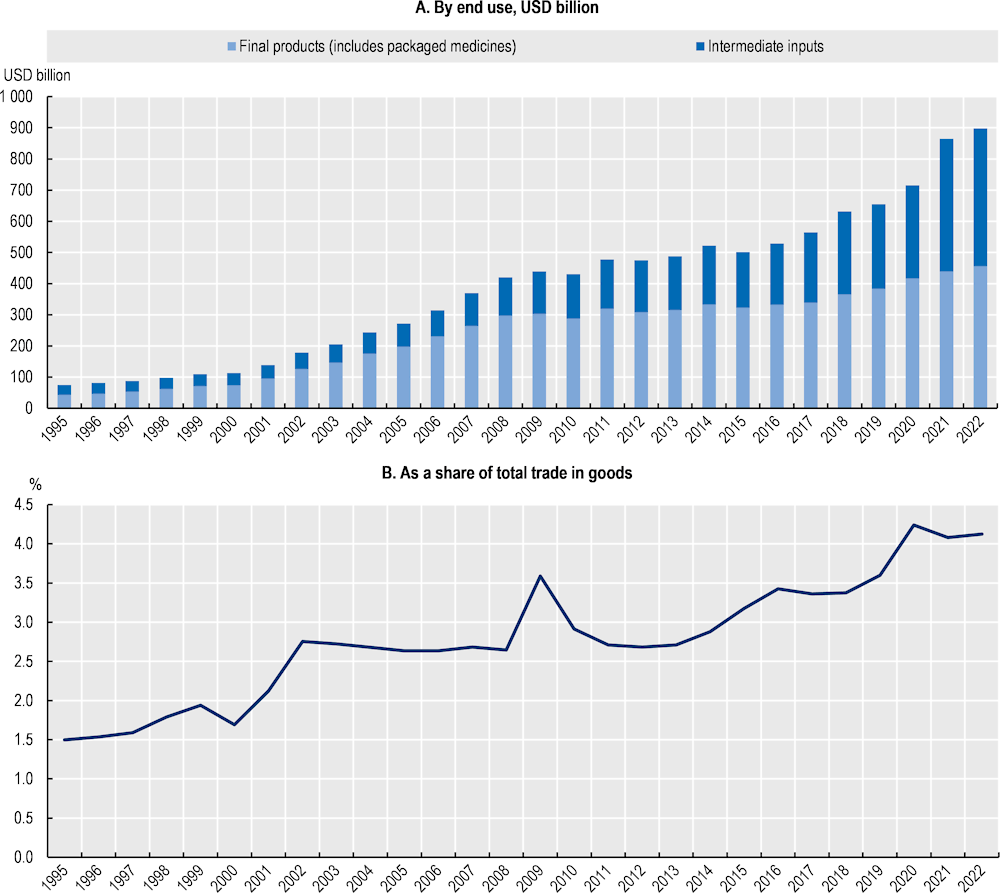

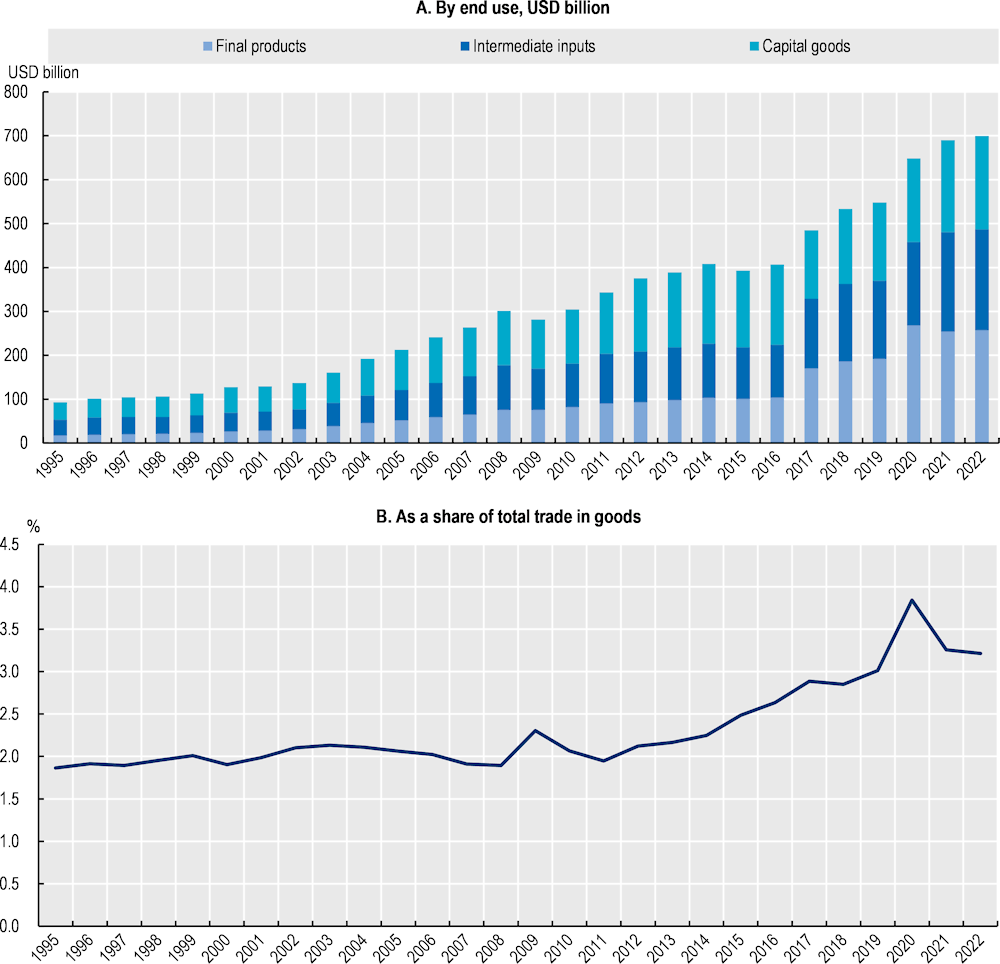

Since 1995, there has been a remarkable increase in trade in pharmaceutical products, with a notable surge in the second half of the 2010s, and a further acceleration following the COVID‑19 pandemic (Figure 1.2, Panel A). This can be attributed to several factors, including advancements in pharmaceutical research and development, and increased global demand for healthcare products. It is also explained by the expansion of global supply chains, as highlighted by the increasing share of trade in intermediate inputs (such as APIs) in Figure 1.2. In addition, the share of pharmaceutical products in total world trade by value has been steadily increasing (Figure 1.2, Panel B). This trend is indicative of the growing importance of the pharmaceutical industry in the global economy.

Higher values for trade in pharmaceutical products during the pandemic are partially explained by higher prices. However, they also illustrate how trade in pharmaceuticals outpaced the overall growth in merchandise trade in recent years, as well as the role played by trade to address pandemic-related disruptions and shortages. While there is some granularity in trade data,3 it remains challenging to analyse trade flows for specific products (such as face masks during COVID‑19) and trade statistics do not allow for a full analysis of supply chains when not coupled with input-output data.

Figure 1.2. World trade in pharmaceutical products (1995‑2022), by value

Note: Pharmaceutical products as defined by the WTO Pharma Agreement (HS Chapter 30, and headings 2936, 2937, 2939, 2941). Data prior to 2017 are based on older versions of the HS classification and may not accurately reflect the list of products.

Source: BACI (CEPII) (2023[2]), BACI Trade data, www.cepii.fr/CEPII/en/bdd_modele/bdd_modele_item.asp?id=37; and Drevinskas, E., E. Shing and T. Verbeet (2023[3]), Trade in medical goods stabilises after peaking during pandemic, www.wto.org/english/blogs_e/data_blog_e/blog_dta_23may23_e.htm.

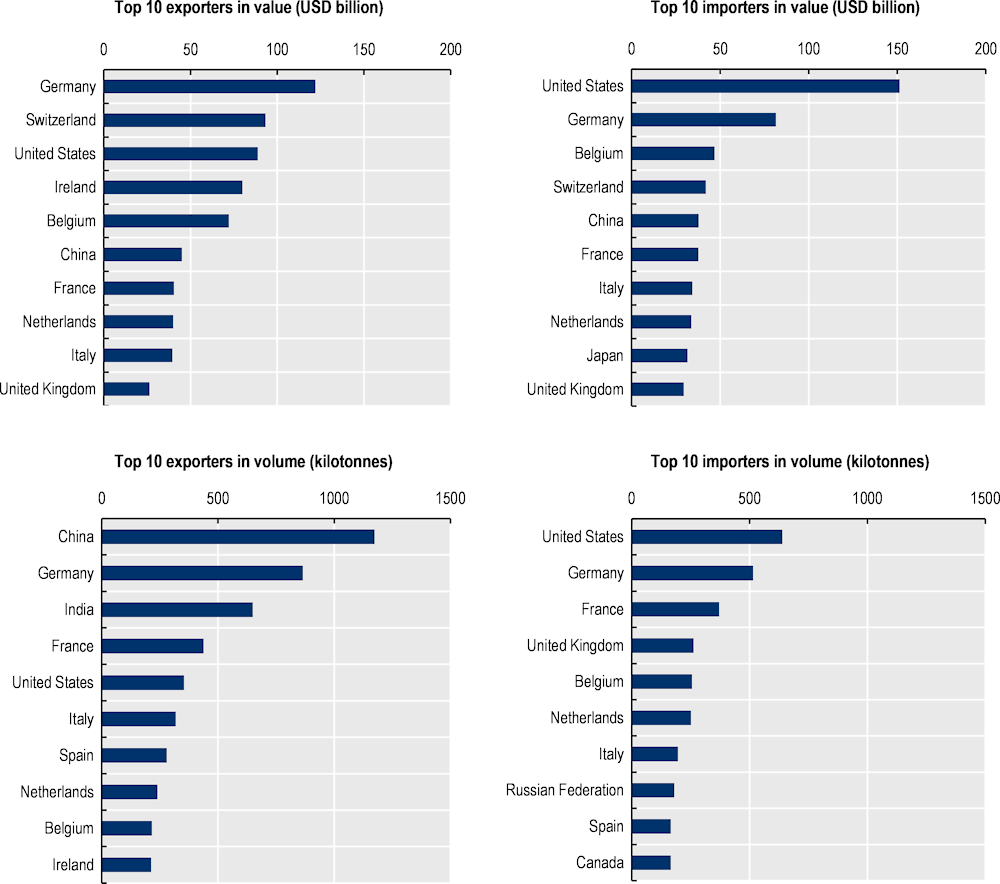

Germany, Switzerland and the United States are the top exporters of pharmaceutical products by value, reflecting their strong positions in high-value, research-intensive pharmaceutical activities. In contrast, the People’s Republic of China (hereafter “China”) and India are among the top 3 exporters by volume, signifying their roles in the mass production of APIs and off-patent medicines (Figure 1.3). Germany stands out as a top exporter and importer in both volume and value, suggesting that the country plays a role upstream in pharmaceutical supply chains, while also being the largest consumer market in the European Union (EU). The United States stands as the top importer of pharmaceutical products in both volume and value, driven by its large consumer market and high per capita healthcare spending. Belgium and Switzerland have small domestic markets but are both major exporters and importers of pharmaceutical products (by value). This is another illustration of how pharmaceutical supply chains have become global with specialised economies acting as key hubs for the transformation and distribution of pharmaceutical products.

Figure 1.3. Top exporters and importers of pharmaceutical products (2021), by value and volume

Note: Pharmaceutical products as defined by the WTO Pharma Agreement (HS Chapter 30, and headings 2936, 2937, 2939, 2941). Data prior to 2017 are based on older versions of the HS classification and may not accurately reflect the list of products.

Source: BACI (CEPII) (2023[2]), BACI Trade data, www.cepii.fr/CEPII/en/bdd_modele/bdd_modele_item.asp?id=37; and Drevinskas, E., E. Shing and T. Verbeet (2023[3]), Trade in medical goods stabilises after peaking during pandemic, www.wto.org/english/blogs_e/data_blog_e/blog_dta_23may23_e.htm.

Sourcing of pharmaceutical products has become increasingly internationalised

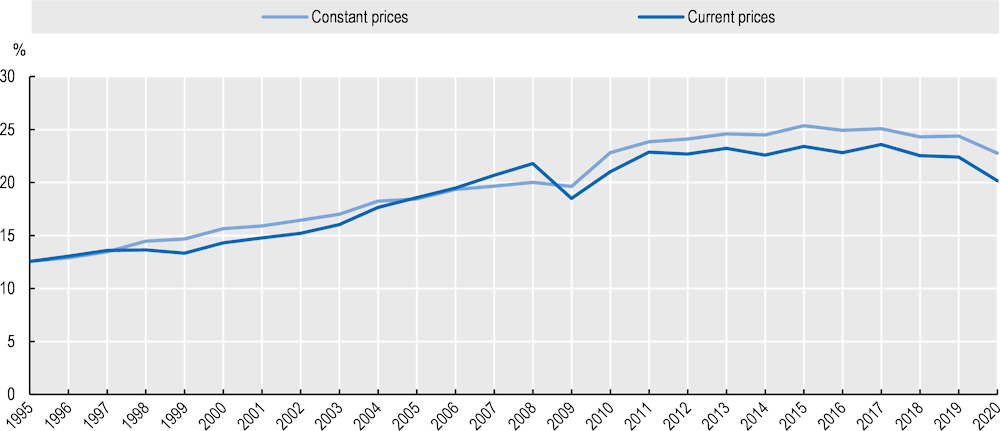

When using input-output data (such as the OECD Inter-Country Input-Output tables), the internationalisation of pharmaceutical supply chains becomes even clearer (Figure 1.4). These data lack any granularity beyond the specification of the pharmaceutical industry (identified through ISIC code 21 corresponding to “manufacture of basic pharmaceutical products and pharmaceutical preparations”). However, the data indicate that when looking at the world output of pharmaceutical products (i.e. all intermediate and final products produced by firms belonging to the pharmaceutical industry), the share of output corresponding to all the intermediate inputs traded upstream in their supply chains (from any country and industry) steadily increased between 1995 and 2015. In 1995, there were only 12 cents of trade intermediate inputs for each 1 dollar of output in the pharmaceutical industry; in 2015, there were more than 25 cents of trade in intermediate inputs (in constant prices).

Figure 1.4. Import intensity of pharmaceutical production (1995‑2020)

As a share of world gross output of pharmaceutical products (%), in value

Note: The import intensity of production indicates for each dollar of final output in the pharmaceutical industry the share of value corresponding to all trade in intermediate inputs upstream in the value chain. Data for the world are estimated via an average weighted by final demand in each country and masks substantial heterogeneity across countries and products. Data in previous year’s prices.

Source: OECD (2023[4]), OECD Inter-Country Input-Output Database, http://oe.cd/icio.

From Figure 1.4 it can be seen that 2015 was the “peak year” in the globalisation of the pharmaceutical industry, with a trend towards more domestic supply chains in 2017‑20 (i.e. a lower share of traded intermediate inputs in final output). While this trend began prior to the pandemic, 2020 should be regarded as an exceptional year in which the import intensity of production was lower due to disruptions in international trade. Trade data post 2020 indicate an important surge in trade of pharmaceutical products (Figure 1.2) that may be associated with more foreign inputs trade and higher import intensity of production. It remains to be seen whether the pandemic has also triggered a restructuring of pharmaceutical supply chains with a re‑shoring of inputs manufacturing. Such a trend would take time to materialise into actual shifts in trade flows and a change in the input-output structure. Importantly, Figure 1.4 shows average figures that belie significant heterogeneity across buyers, and suppliers, as well as across products.

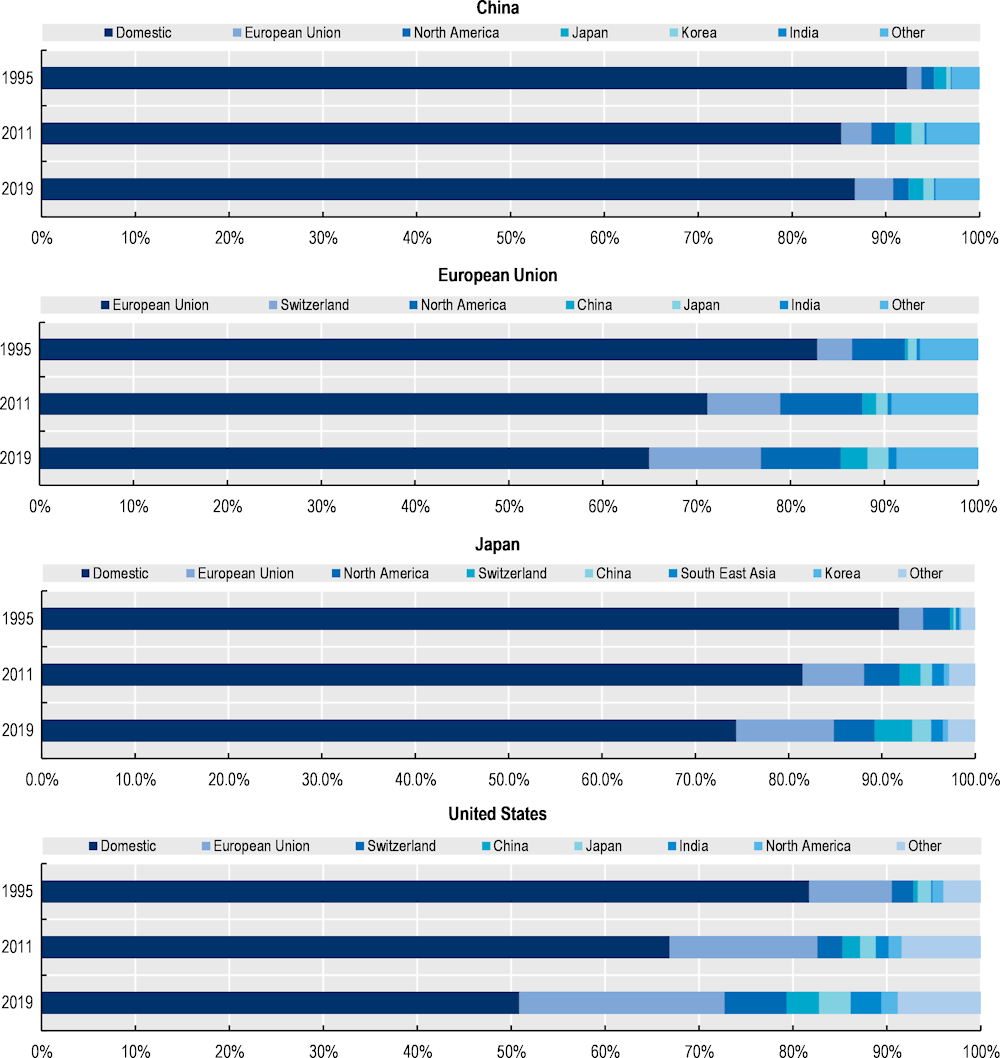

Some country and region-specific results are shown in Figure 1.5, highlighting not only a shift in the overall use of foreign inputs but also changes in the geographical distribution of suppliers. In the European Union, Japan and the United States, pharmaceutical products have been produced with a smaller share of domestic value‑added4 over the years (and there has been no decline in the import intensity of production for these economies). China is the only country in this sample for which pharmaceutical supply chains became more domestic between 2011 and 2019.

While as suppliers of inputs, China and India have benefited from the internationalisation of EU, Japanese and US supply chains, more foreign value added is actually coming from other OECD economies. Most of the increased foreign value‑added in US and Japanese pharmaceutical supply chains is the result of growth in sourcing in the EU, and in Switzerland, while EU supply chains rely more on Switzerland and North American suppliers (i.e. Canada, Mexico and the United States). There is an increase in the value added coming from China in EU, Swiss an US supply chains, but relatively small. While these results are for all pharmaceutical products, they are not inconsistent with more product-specific assessments identifying a high level of sourcing from India and China (but concentrated in certain off-patent medicines and specific APIs). In addition, data on the origin of value‑added in final consumption do not reflect the magnitude of countries’ contributions to final consumption in terms of quantities.

Figure 1.5. Origin of value added in final consumption of pharmaceutical products (1995, 2011 and 2019)

Note: Based on a decomposition of final demand for products of the pharmaceutical industry (ISIC code 21 – manufacture of basic pharmaceutical products and pharmaceutical preparations) identifying the country of origin of value added.

Source: OECD (2023[4]), OECD Inter-Country Input-Output Database, http://oe.cd/icio.

Distribution of medicines takes variable forms across countries

Post production, the distribution of medicines follows a range of different pathways, depending on the country, the type of medicine and the final intended use (administration in inpatient care, dispensing in retail pharmacies, etc.). Medicines dispensed by retail pharmacies to patients are generally supplied by wholesalers, subject to different regional or national regulations and obligations. Adapting to market conditions, wholesalers adopt a variety of organisational structures. In the United States, there are ~33 500 wholesale distributors and third-party logistics providers (FDA, 2023[5]). Across Europe, the number of wholesalers and warehouses vary significantly. For example, in 2021, Germany counted 9 full-line wholesalers5 with 106 warehouses, while Poland had 122 full-liner wholesalers with 190 warehouses. In Germany, 2 413 authorisations had been issued for wholesalers (including those who only distribute a sub-set of medicines) compared with 421 in Poland (GIRP, 2022[6]).6 In some cases, however, generic manufacturers may choose to bypass wholesalers and gain direct access to pharmacy shelves by offering financial or in-kind discounts or complementary services. The effect of this high variability in wholesale activity on reliability of supply is unknown.

In the EU, medicines dispensed or administered in hospitals are mainly purchased directly from manufacturers. In 2021, manufacturers delivered 7% of their products directly to retail pharmacies and 35% to hospitals, with the remainder 58% delivered to wholesalers for distribution to retail pharmacies (52%) and hospitals (6%) (GIRP, 2022[6]).7

Flows and practices in the distribution chains may lead to local shortages. Within the European Economic Area (EEA), so-called “parallel-trade” is often cited as a possible cause of national shortages. This type of trade consists of purchasing medicines in a country where (often regulated) prices are low, and reselling them in a country with higher prices, without the consent of the manufacturer. The practice is consistent with the principle of free movement of goods within the EEA and enables savings in recipient countries. According to the association of companies engaged in parallel trade, Affordable Medicines Europe, parallel trade imports accounted for 2.8% of the total EU pharmaceutical market in 2020. At that time, Germany, the United Kingdom and the Netherlands were the 3 top importers, with respectively 51%, 14% and 10% of EU parallel imports by value. Denmark, the Netherlands and Sweden had the highest shares of parallel imports in their national markets, with 25%, 10% and 10% respectively. According to members’ responses to a survey by the association, 50‑60% of imports in these countries originated from high-income countries. France and Germany were the largest exporters in terms of global sales (Aguiar and Ernest, 2021[7]).

Individual pharmaceutical product supply chains are unique: Some examples

While each pharmaceutical product supply chain is unique, some general insights can be gained from examining the supply chains of selected product categories. Chapter 11 of Ready for the Next Crisis? (OECD, 2023[8]) includes several detailed case studies:

Propofol (an intravenous anaesthetic) has a complex manufacturing process, requiring the API to be part of a stable emulsion (i.e. a mixture of two non-miscible substances such as oil and water). Propofol’s API (2,6-diisopropylphenol) has a relatively diversified supply in India, Italy, Switzerland and the United States, but the overall number of suppliers remains fewer than 10. Secondary manufacturing of propofol is a controlled and sterile process that involves creation of the emulsion and preparation of the final product. It is generally outsourced to either a subsidiary of the brand manufacturer or an independent contract manufacturer. Testing and packaging generally take place in locations separate from manufacturing. There are several manufacturers of propofol, but only a limited number are authorised to sell in each market.

Low-molecular-weight heparins (LMWH – a class of anticoagulants, with a case study based on the example of enoxaparin) are biologicals2 derived from unfractionated heparin, most of which originates from porcine (pig) intestines. China plays a crucial role as a producer, supplying 60% of the crude heparin utilised in the United States for the production of heparin sodium in 2010 (US Congress, 2018[9]). After purification in a laboratory, heparin extracts are transformed into heparin sodium, with capacity in China, Singapore and the United States. Subsequently, full length heparin is converted into smaller LMWH fragments through depolymerisation, a process requiring sophisticated techniques to ensure product stability and quality. This step is conducted by the brand manufacturer or a specialised contract manufacturing firm. Exports of heparin increased significantly during the COVID‑19 pandemic.

Macrolide antibiotics (a class of antibiotics, using the specific example of azithromycin) require specialised production processes that are currently highly concentrated. Fermentation to produce the intermediate ingredient, erythromycin, takes place in several geographical locations in China. This technique requires clean water, a favourable environment, and adequate infrastructure. Primary manufacturing of the azithromycin API from erythromycin requires several intermediate (chemical) steps that can be split across countries and companies, although interviewees suggested that this step generally occurs in Asia. The formulation stage is more geographically diverse. However, few companies market azithromycin.

The OECD has also analysed the supply chains of plasma-derived medicines and vaccines, both of which are classified as biologics.2 Box 1.1 and Box 1.2 outline some of the supply chain characteristics of these products.

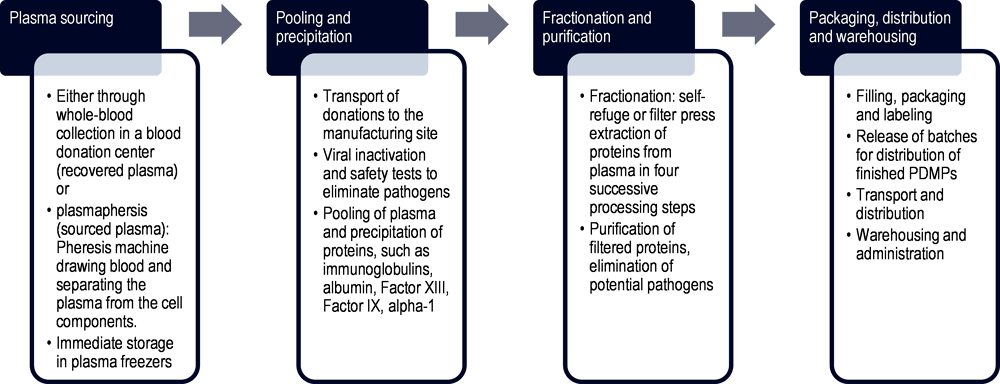

Box 1.1. Plasma-derived medicinal product supply chains at a glance

Plasma-derived medicinal products (PDMPs) are essential for preventing and treating a range of conditions that include immune deficiencies, autoimmune and inflammatory conditions, and bleeding disorders, and they are also indicated in certain infectious diseases and critical situations such as septic shock and severe burns (Strengers, 2023[10]; Strengers, 2017[11]; Brand et al., 2021[12]; Schmidt and Refaai, 2022[13]). They are classified as biologicals, manufactured from human blood plasma through a process called fractionation. This technique involves separating, purifying, and concentrating different types of proteins found in blood plasma into therapeutic doses (see Figure 1.6). A range of PDMPs serve critical functions in healthcare, including in particular albumin (the major plasma protein responsible for regulating blood volume), coagulation factors (essential for blood clotting, used to treat genetic bleeding disorders and surgical bleeding) and immunoglobulins (essential for defence against infectious agents and the regulation of the immune system). Currently around 20 different therapeutic proteins can be purified from plasma, and PDMPs are licensed for the treatment of many diseases and disorders (Schmidt and Refaai, 2022[13]). In most jurisdictions, PDMPs are regulated as prescription medicines, subject to particularly rigorous regulation, testing, and controls. Their importance is underscored by the inclusion of several PDMPs in the World Health Organization’s Model List of Essential Medicines (WHO, 2023[14]).

The PDMP manufacturing process starts with the collection of blood plasma from healthy donors, which is a resource of human origin (PPTA, 2022[15]). Plasma can be obtained either through whole blood donation (recovered plasma) or directly by apheresis (plasmapheresis or sourced plasma). Most PDMPs are primarily sourced from plasmapheresis, a method by which whole blood is collected and centrifuged, plasma separated, and red blood cells returned to the donor (Strengers, 2023[10]). Compared to whole blood donation, which only takes 10‑20min, plasmapheresis is a longer and more laborious process, taking around 60‑90 min, but is more efficient as it generates two to three times more plasma per donation.

Figure 1.6. Schematic of plasma manufacturing process and supply chain

Note: The stages depicted in this schematic are intended to provide a general overview of plasma production and are not comprehensive.

Source: Authors’ elaboration based on Kluszczynski, T., S. Rohr and R. Ernst (2020[16]), Key economic and value considerations for plasma-derived medicinal products (PDMPs) in Europe.

As the sourced plasma must conform to the highest safety standards, it is subject to viral removal processes, pathogen elimination, and multiple inactivation steps. In a second step, multiple donations are pooled in large manufacturing vessels. As depicted in Figure 1.6, proteins are first precipitated from the plasma. Each plasma contains valuable proteins that are extracted, such as immunoglobulins, albumin, Factor VIII, Factor IX, alpha‑1 antitrypsin, and many more (Kluszczynski, Rohr and Ernst, 2020[16]). The harvest is obtained either through self-refuge of the plasma while the proteins are in motion or through filter press extraction. This process is also described as fractionation as it separates the plasma into four successive processing steps, so-called fractions, where different protein types are obtained for the final product (Strengers, 2023[10]). In the case of immunoglobulins, the plasma pool has to be large and geographically diverse, containing at least a thousand donations that in some jurisdictions may be sourced from all over the world (Kluszczynski, Rohr and Ernst, 2020[16]). Geographic diversity is important to ensure that the final product contains a wide spectrum of antibodies to fight against various pathogens. The filtered proteins are then purified, and potential pathogens eliminated before they are filled, packed and batches of finished PDMPs released for distribution.

The demand for PDMPs, such as intravenous immunoglobulins (IVIg), which are polyvalent and without an alternative or recombinant version, is growing at a rate of 6‑8% per year globally, likely due to expanded access to medical care, the development of new products and advanced diagnostics (Schmidt and Refaai, 2022[13]; Strengers, 2023[10])1. Immunoglobulins are essential in the body’s immune defence against foreign agents such as viruses and bacteria. Furthermore, the increasing number of patients with immunodeficiencies caused by oncology treatments and the growth in off-label use of IVIg are contributing to the increasing demand (correspondence with experts, 2023; (Schmidt and Refaai, 2022[13])).

Despite decades of effective therapeutic use, these treatments still face serious patient access challenges due to an uneven plasma donation landscape across countries, lengthy manufacturing processes taking up to 7‑12 months under strict safety procedures, and complex regulatory frameworks that impede the collection and manufacturing of plasma (Kluszczynski, Rohr and Ernst, 2020[16]). The key challenges appear upstream in the value chain, beginning with the collection of the raw material, i.e. plasma, which can only be sourced from eligible and healthy human donors.

1. Latest research demonstrates that consumption in Europe alone is projected to increase by one‑third from 50.5 tonnes in 2017 to 67.5 tonnes in 2025 (Marketing Research Bureau, 2023[17]). The plasma collected in this region meets 63% of the demand and the rest is mainly supplied by the United States (Kluszczynski, Rohr and Ernst, 2020[16]).

Source: Authors as cited and from consultations with experts in 2023.

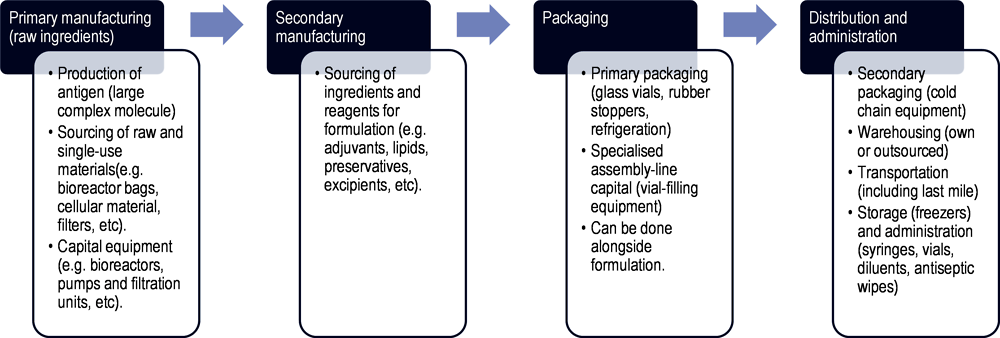

Box 1.2. Vaccine supply chains at a glance

Vaccines are biological medicines intended to stimulate immunity to a particular infectious disease or pathogen and may be deployed as part of population-based immunisation strategies as well as in response to seasonal and emergency outbreaks. Although the precise stages and inputs needed for the production of a given vaccine vary depending on the technology platform (e.g. inactivated vaccine, live attenuated vaccine, viral vector-based, recombinant protein, messenger ribonucleic acids (mRNA) etc.), vaccine supply chains can be broadly described as in Figure 1.7.

Figure 1.7. Schematic of vaccine manufacturing process and supply chain

Note: The stages depicted in this schematic intend to provide a general overview of vaccine production and are not comprehensive.

Source: Author’s own elaboration based on OECD (2021[18]), Using trade to fight COVID‑19: Manufacturing and distributing vaccines, https://doi.org/10.1787/dc0d37fc-en; Bown, C. and T. Bollyky (2021[19]), “How COVID‑19 vaccine supply chains emerged in the midst of a pandemic”, https://doi.org/10.1111/TWEC.13183; OECD (2023[8]), Ready for the Next Crisis? Investing in Health System Resilience, https://doi.org/10.1787/1e53cf80-en.

Primary manufacturing consists of the initial production steps to create the vaccine’s active ingredient i.e. the antigen, which is responsible for inducing an immune response. The process and type of production facility needed for this vary according to the type of vaccine being produced. Typically, it includes culturing and propagating the target organism (e.g. virus or bacteria) in bioreactors, inactivating or attenuating the pathogen, and purifying the antigenic components – to create what is often known as “bulk antigen” or “bulk vaccine”.

Secondary manufacturing involves the formulation of the vaccine, by combining the vaccine’s active ingredient with all other components and mixing them uniformly in a single vessel. Here, stabilisers, adjuvants, and preservatives may be added. Additional ingredients in the production or packaging of a vaccine may require separate mini supply chains.

For packaging, vaccine formulations are transferred to a separate facility in order to “fill” (squirt doses into vials) and “finish” (cap the vials with stoppers and then label and package) the vaccine. This requires specialised assembly-line capital equipment, in addition to inputs such as glass vials and stoppers. In some cases, the formulation and fill and finish take place in the same facility. Stringent quality controls are taken at this stage.

Finally, vaccines doses must be transported at appropriate temperatures, and delivered while maintaining the cold chain. The cold chain is interconnected with refrigeration equipment; while most vaccines can be kept between 2°C and 8°C, some require temperatures as low as ‑20°C or ‑70°C.

The three main manufacturing stages described above can take place in different factory buildings, as well as across several countries. Each step also involves rigorous quality controls and testing, which represent up to 70% of the manufacturing time (Vaccines Europe, 2020[20]). On average, the entire manufacturing process is long and can take up to two years, with differences according to the technology platform.

According to the World Health Organization’s 2022 Global Vaccine Market Report, the vaccine supply base is highly concentrated geographically and at firm level (WHO, 2023[21]). In 2019, an estimated 76% of vaccine production took place in Europe, followed by North America (13%), Asia (8%) and the rest of the world (3%) (Vaccines Europe, 2019[22]). In 2021, excluding COVID‑19 vaccines, 10 manufacturers alone provided 71% of vaccine doses globally. When looking at individual vaccines, often only two or three suppliers provide more than 80% of supply (WHO, 2023[21]).

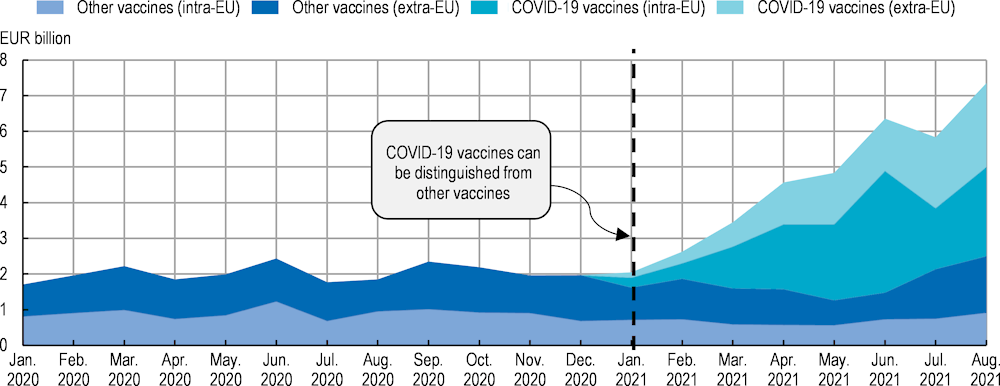

The geographical concentration of the manufacturing base underscores the role of trade. As of 2019, vaccines were imported by 209 economies and exported by 90 economies. Cao, Du and Xia (2023[23]) found that vaccine trade links remain highly concentrated within developed countries in Europe and the United States, a pattern largely in line with the WHO’s assessment (WHO, 2023[21]). In 2021, the EU was the largest exporter of vaccines, with Belgium as the top exporter by both value and volume, accounting for 16% of global volume exports, followed by the United States (14%) and China (12%)1. Export volume rankings differ from value rankings, revealing heterogeneity in unit prices across suppliers. In relative terms, imports are less concentrated in both value and volume, although the top 20 importers represent 52% of global import volumes (72% in value)1.

As mentioned above, production of vaccines relies on several ingredients. For example, the manufacture of pertussis-containing pentavalent vaccine requires approximately 160 different ingredients. Using 2017‑19 UN COMEXT trade data for 20 vaccine ingredients and items needed to distribute vaccines, Evenett et al. (2021[24]) found that the EU was a net importer of only three vaccine ingredients and distribution items. China and the United States were identified as key non-EU sources of vaccine inputs, followed by Switzerland and Japan (Evenett et al., 2021[24]).

1. OECD calculations using trade data from the BACI database, 2023.

Source: Authors as cited and from consultations with experts in 2023.

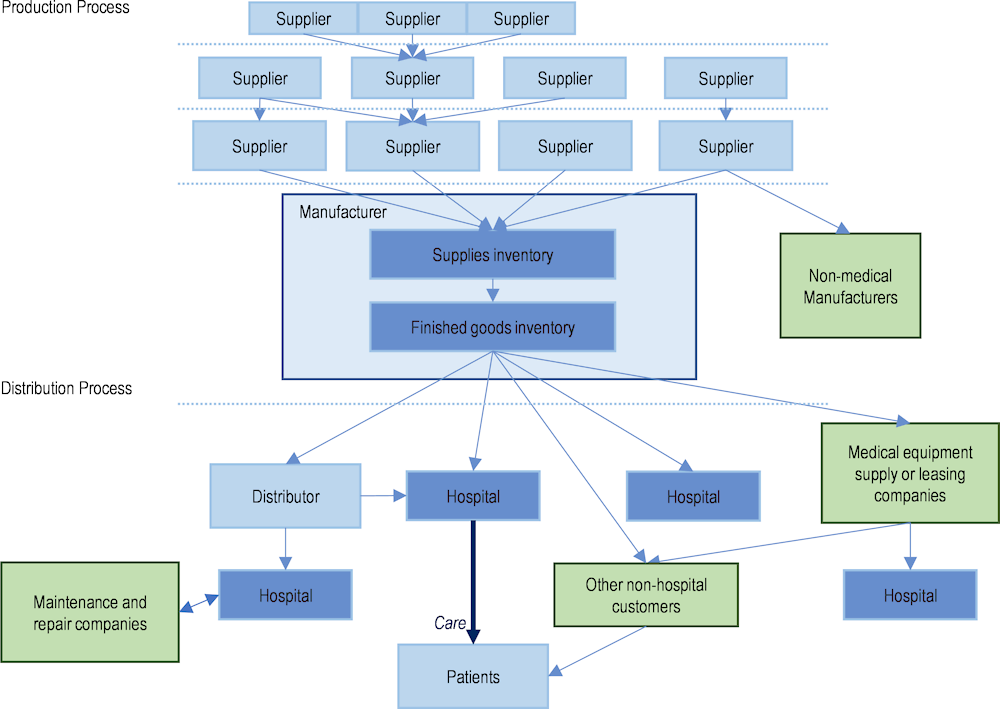

1.1.2. Medical device supply chains exhibit even more variability

Medical device supply chains exhibit even more variability, and in some cases more complexity, than pharmaceuticals, with some bearing a closer resemblance to supply chains for non-medical products such as clothing or electronics. According to the WHO (2023[25]), medical devices “include all the health technologies (except for vaccines and medicines) required for prevention, diagnosis, treatment, monitoring, and palliation”; countries also have their own definitions. Such broad definitions mean that medical devices cover a huge range of goods, from simple tongue depressors to complex ventilators with many associated parts (e.g. semi-conductors, other bespoke consumables). Medical device manufacturing is highly product-dependent, and a linear process flow is not adequate to capture their complexity. Like medicines, there may be multiple steps in several countries, however, some components of medical devices (e.g. chips) may be produced for both health and non-healthcare markets (OECD, 2023[8]). The perceived simplicity of a product may belie complexity in its supply chain.

Figure 1.8 depicts a basic schematic of a supply chain for a medical device, based on Chen et al.’s (2021[26]) analysis in a 2021 report prepared for the United States Government. Manufacturers source individual components or devices from the suppliers who produce them, who in turn source individual components or parts (raw materials) to make certain components from other suppliers, and so on. The number of suppliers can be vast, and suppliers also provide many of these same components to non-medical manufacturers (e.g. for electronics). However, there are instances in which components (e.g. a pressure regulator) are specific to a particular medical device (e.g. a ventilator), and there may be limited sources for these components. Once the manufacturer assembles the final product, it may require sterilisation (often by a contract steriliser, which is another type of supplier), before being ready to be sold to customers. Customers vary according to the type of device, but can include hospitals, physician practices, pharmacies (where patients may purchase the product directly), other medical supply stores, or even consumers in other non-health industries such as mining and construction. Hospitals typically purchase either from distributors (i.e. wholesalers) or directly from manufacturers. In some countries, group purchasing organisations (GPOs) may play a role in the movement of goods from manufacturers to hospitals and be involved in the purchasing process. Some medical devices also require maintenance and repair through various types of contracts; this involves additional components, services and providers.

Figure 1.8. The complexity of medical device supply chains

Note: Solid blue arrows depict flow of goods; dotted blue lines represent the possibility of an international border; green boxes depict examples of particularities to some medical device supply chains. This schematic is not intended to be exhaustive.

Source: Adapted from Chen, P. et al. (2021[26]), Medical Device Supply Chains: An Overview and Description of Challenges During the COVID‑19 Pandemic, https://aspe.hhs.gov/reports/medical-device-supply-chains.

Trade in medical devices has also been on the rise, with increasing diversity of leading exporters and importers

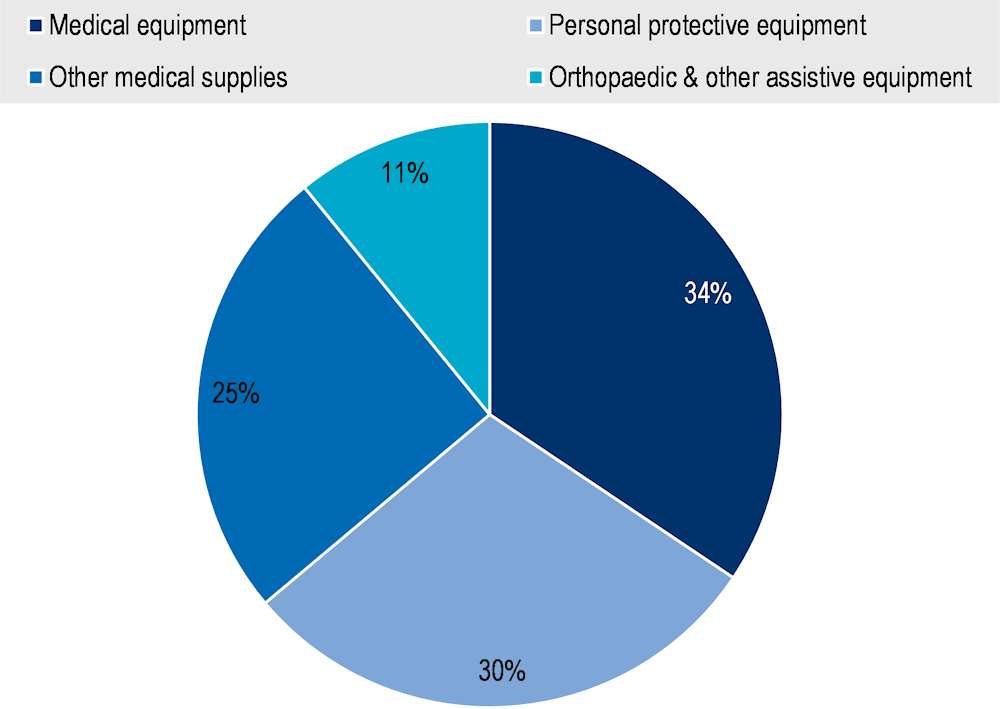

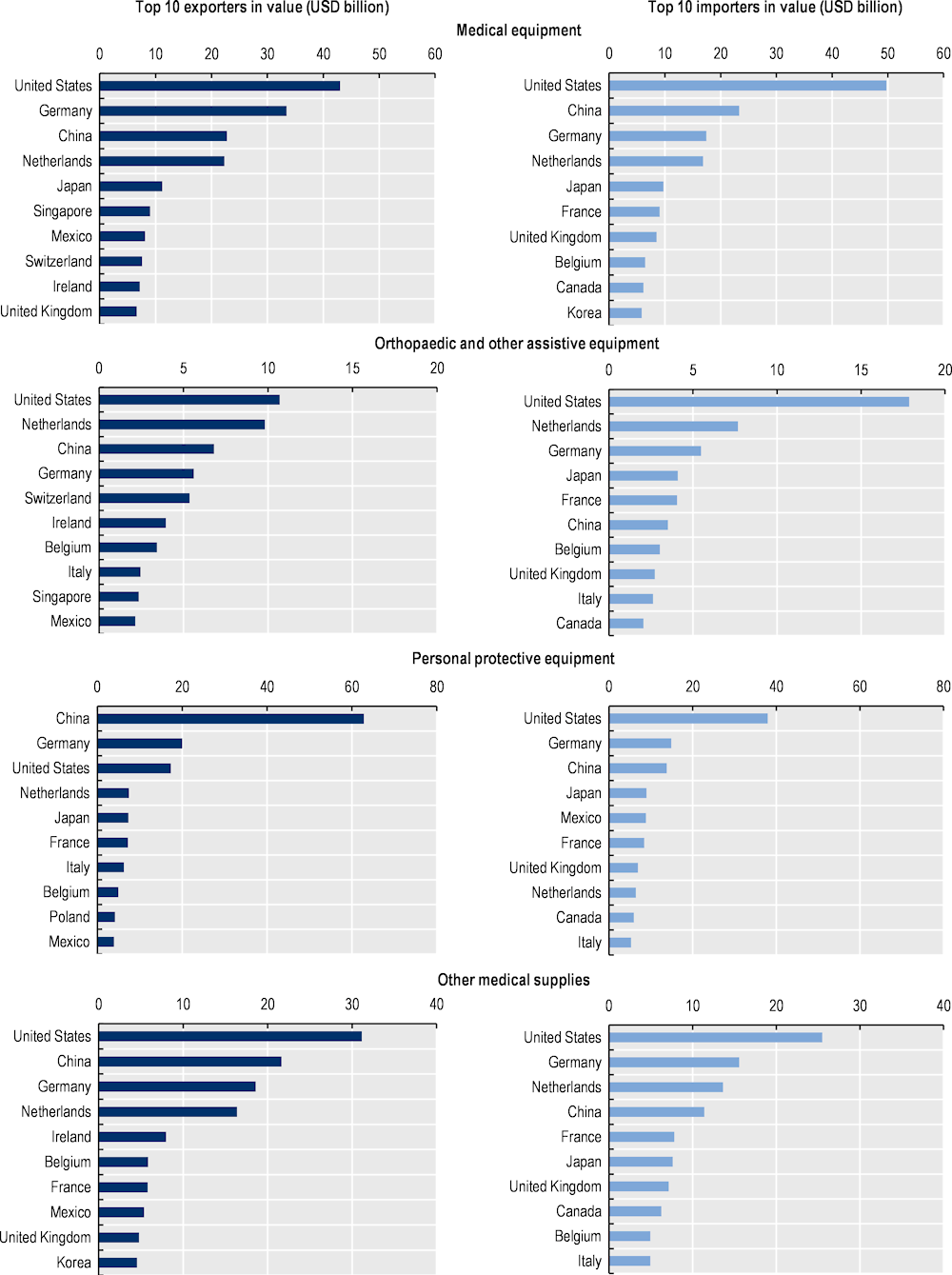

Trade statistics for medical devices (as defined by the WTO in its work on the identification of medical products in trade statistics) suggest trends similar to those of pharmaceutical products, with increasing trade flows and an internationalisation of supply chains (Figure 1.9). Medical devices also include capital goods, i.e. machines and devices that are used repeatedly to provide health services or used to manufacture other medical goods. Trade in medical equipment accounts for the largest share of trade in medical devices by value (34% in 2022) followed by personal protective equipment (30%) and other medical supplies (25%), with the smallest share observed for orthopaedic and other assistive equipment (11%) (Figure 1.10).

Figure 1.9. World trade in medical devices (1995‑2022), by value

Note: Based on WTO list of medical equipment and machines (majority of products in HS90), orthopaedic devices, personal protective equipment and other medical supplies. Data prior to 2017 are based on older versions of the HS classification and may not accurately reflect the list of products.

Source: BACI (CEPII) (2023[2]), BACI Trade data, www.cepii.fr/CEPII/en/bdd_modele/bdd_modele_item.asp?id=37; and Drevinskas, E., E. Shing and T. Verbeet (2023[3]), Trade in medical goods stabilises after peaking during pandemic, www.wto.org/english/blogs_e/data_blog_e/blog_dta_23may23_e.htm.

Figure 1.10. Composition of world trade in medical devices (2022), by value

Note: Medical equipment = Medical equipment and machines (majority of products in HS Chapter 90) including magnetic resonance imaging apparatus, X-ray tubes and operating tables; Orthopaedic and other assistive equipment = items such as wheelchairs, spectacles, hearing aids and artificial teeth; Personal protective equipment = Equipment and single‑use items, such as gloves and face masks (excluding protective garments, as HS classifications largely overlap with products for non-medical use); other medical supplies = Hospital and laboratory inputs and consumables, such as syringes.

Source: Drevinskas, E., E. Shing and T. Verbeet (2023[3]), Trade in medical goods stabilises after peaking during pandemic, www.wto.org/english/blogs_e/data_blog_e/blog_dta_23may23_e.htm.

The heterogeneity of medical devices traded and the variability of their supply chains lead to an even more geographically diverse array of leading exporters and importers than for medicines (Figure 1.11). The United States is the leading importer of all types of medical devices by value due to its large market and high level of health spending. With the exception of personal protective equipment, the United States is also the top exporter of medical devices. However, some Asian economies are specialised in the production of medical devices. China is the leading exporter of personal protective equipment and among the top three exporters in other categories of medical devices. Singapore is also among the leading exporters of medical and orthopaedic equipment.

Figure 1.11. Top exporters and importers of medical devices (2022), USD billion

Note: Medical equipment = Medical equipment and machines (majority of products in HS Chapter 90) including magnetic resonance imaging apparatus, X-ray tubes and operating tables; Orthopaedic and other assistive equipment = items such as wheelchairs, spectacles, hearing aids and artificial teeth; Personal protective equipment = Equipment and single‑use items, such as gloves and face masks (excluding protective garments, as HS classifications largely overlap with products for non-medical use); other medical supplies = Hospital and laboratory inputs and consumables, such as syringes.

Source: Drevinskas, E., E. Shing and T. Verbeet (2023[3]), Trade in medical goods stabilises after peaking during pandemic, www.wto.org/english/blogs_e/data_blog_e/blog_dta_23may23_e.htm.

Individual medical device supply chains are unique: Some examples

As already mentioned, the term “medical devices” encompasses a broad range of products and product types, each with a unique supply chain. To illustrate these differences, some examples are described below:

Ventilators are a form of durable equipment, although their use involves various disposable items (Chen et al., 2021[26]). They consist of durable machinery responsible for air pressurisation, valves to manage pressure regulation, and electronics that monitor and control the delivery. Plastic tubes connecting the patient to the ventilator are disposable components. Ventilator supply chains involve medical equipment companies, maintenance repair companies, and repair service contractors. While supply chains of the disposable components are fairly simple, ventilators can consist of more than 1 500 parts, involving many different suppliers. Some individual components may be common to other types of devices manufactured by companies in both the health and non-health sectors, while others may be specific to a particular application or care setting. While consumables, such as disposable ventilator circuits, are often sold through distributors, ventilators are sold directly to hospitals or healthcare organisations or leased through medical equipment companies (Chen et al., 2021[26]).

Facemasks, a form of disposable personal protective equipment (PPE), are generally made from nonwoven fabric made of synthetic fibres (primarily polypropylene, a polymer derived from oil) that are melted (or “melt-blown”) to create a filtration system that can trap small particles (Chen et al., 2021[26]; OECD, 2020[27]). They are an example of a device supply chain that includes both non-medical manufacturers and non-hospital end users. Facemask production is a relatively complex process with different types of inputs and assembly of various parts, requiring specialised machinery. They generally consist of three layers of different materials, in addition to nose strips made from metal, and ties or loops that need to be manufactured separately. Masks then need to be sterilised prior to testing and packaging. While the manufacture of polypropylene non-woven fabric is widespread, as the input is used by non-medical manufacturers (e.g. as crop cover, for air filters, diapers, personal care products etc.), the melt-blown process is concentrated among a limited number of companies. The primary constraint in facemask production has been linked to a shortage of propylene non-woven fabric, the key input. Before the COVID‑19 pandemic, China was the main producer of masks, accounting for around half of global production (OECD, 2020[27]). The sourcing of facemasks has since become diversified with additional suppliers emerging in other countries (OECD, 2022[28]).

Testing supplies and equipment are the components required to conduct clinical laboratory testing for disease diagnosis, screening, and surveillance. Required components depend on the specific type of test, each with its own manufacturing processes. As an example, COVID‑19 tests (including polymerase chain reaction – PCR – and antigen tests) are composed of various components, nearly all of which can be used for other types of tests. The supplies and equipment include nasal swabs, blood collection kits, chemical laboratory reagents, transport media (i.e. packaging that aids transfer to laboratories without contamination), testing machinery, and simple plastic consumables such as micropipettes, among others (Chen et al., 2021[26]; OECD, 2020[27]). Consumable testing components such as the pipettes, swabs, reagents etc., have similar supply chains to that shown in Figure 1.8, and are typically sold through distributors. However, testing machinery, such as PCR machines, have more complex supply chains that involve laboratory equipment leasing companies, third party maintenance companies, and service maintenance contracts (Chen et al., 2021[26]).

To inform this report, the OECD also analysed the supply chain of continuous positive airway pressure (CPAP) devices more closely, described in Box 1.3.

Box 1.3. Continuous positive airway pressure (CPAP) device supply chain at a glance

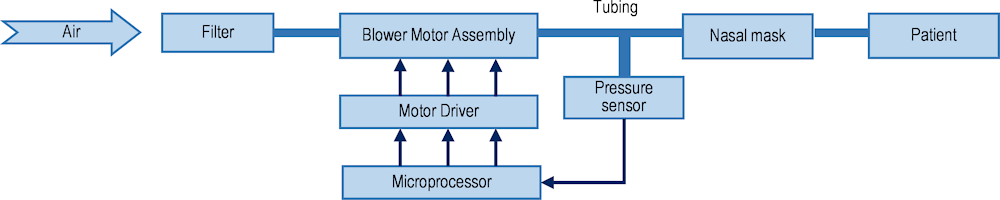

Continuous Positive Airway Pressure (CPAP) ventilation is an important therapeutic modality in respiratory medicine. CPAP machines provide non-invasive positive pressure ventilation to patients through a tight-fitting nasal mask, face (oro-nasal) mask or helmet to improve oxygenation and reduce the work of breathing (see Figure 1.12 for the device setup). They are generally used to treat obstructive sleep apnoea, although they can also be used as respiratory support in certain medical conditions including COVID‑19. While CPAP devices assist in keeping airways open via a constant flow of air, they differ from the traditional invasive mechanical “ventilators” in critical care that can take over the entire breathing process to provide respiratory support to intubated patients who cannot breathe on their own. Many ventilators can support multiple methods (or modes) of ventilation1, including CPAP; however, this is part of the broader functionality of the ventilator itself, and is not a standalone CPAP device.

Figure 1.12. Block diagram of the CPAP device setup, showing the different components

Source: Reproduced from Chen, Z., Z. Hu and H. Dai (2012[29]), Control system design for a Continuous Positive Airway Pressure ventilator, https://doi.org/10.1186/1475-925x-11-5 (CC BY 2.0).

While Bilevel Positive Airway Pressure (BiPAP) offers dual pressure levels catering to inhalation and exhalation, and invasive ventilators cater to more acute patients, CPAP remains a critical component in this spectrum, ideal for conditions such as COVID‑19. CPAP devices were included in the WHO priority list of medical devices in the COVID‑19 response (WHO, 2020[30]). Their fundamental role in enhancing oxygenation, coupled with the potential ability to avert the need for invasive intubation and ventilation, underscores their value, especially when planning for future respiratory health crises.

CPAP devices have long and complex global supply chains. The most important components of a CPAP device are the electronic board and the blower. The electronic board or printed circuit board (PCB) is responsible for controlling the functionality of the device and the communication chips necessary for running the board, from regulating airflow to adjusting pressure settings based on the user’s needs. The PCB’s design and manufacturing require precision engineering, often involving advanced electronic manufacturing services from different parts of the world. The communication chips, integral to the PCB, enable the board’s functionalities. These chips ensure that different parts of the CPAP machine communicate effectively with each other. They also allow for data logging and, in some modern devices, enable remote monitoring of patient usage and device functioning through wireless connectivity. The blower or turbine is another crucial component, responsible for generating a consistent and controlled flow of air. The quality and reliability of the blower are vital for the effectiveness of CPAP therapy, as it needs to maintain a steady air pressure regardless of external factors like voltage fluctuations or varying breathing patterns of the patient. Apart from these main components, there are various other elements often built into a CPAP device, depending on its functionality and purpose. These elements include different kinds of gas supply systems, oxygen blender, separate oxygen and air flowmeters, tubing systems, humidifier, bacterial and viral filter, a mask, as well as various other plastics.

1. Other modes of ventilation (i.e. methods of inspiratory support) supported by ventilators include Pressure Control, Volume Control, Pressure Regulated Volume Control, Pressure Support, and BiPAP (Bilevel Positive Airway Pressure) which is another form of non-invasive ventilation.

Source: Authors as cited and based on consultations with experts in 2023.

1.2. Growing issue of medical product shortages pre‑dated the COVID‑19 crisis

A shortage occurs when demand for an approved medical product exceeds its supply, making it inaccessible to patients in need. Shortages may be local, national, or global; they may last a few days, months or even years. Not every reported shortage will impact patients, but a shortage can become a public health issue if no appropriate alternative exists. Even when alternatives are available, shortages may incur costs to health systems, because of the time spent by health professionals to adapt treatments and source alternatives. Furthermore, shortages of different types of medical products (e.g. diagnostics) may interfere with the appropriate use of others (e.g. certain medicines). Country definitions of shortages vary widely (see Box 1.4 for an example).

Medical product shortages can have multiple causes. They may arise because of a sudden, unanticipated surge in demand, for example during exceptional outbreaks of seasonal infections. Most often, they occur due to disruptions in the supply chain although disruptions do not necessarily result in shortages if appropriately managed. Shortages may also be due to market exit from the manufacturer.

While COVID‑19 highlighted vulnerabilities in supply chains, shortages of medical products had become increasingly common in a number of countries prior to the pandemic. The following text summarises available information on shortages of different types of medical products and highlights some of the related causes. It does not address COVID‑19 specific shortages, which are discussed in Section 1.3 of this chapter.

Box 1.4. Medicine shortage definitions vary from country to country

Formal definitions of “medicine shortages” vary widely, and these have been discussed extensively elsewhere in the literature (e.g. (World Health Assembly, 2017[31]; WHO, 2017[32]; Acosta et al., 2019[33]; Troein et al., 2020[34]). In general, OECD countries consider a medicine shortage to exist when supply is insufficient to meet demand at national level, and may include both temporary and permanent discontinuations (i.e. withdrawal from the market). Some countries also include a minimum duration of supply disruption in their shortage definitions.

For the purposes of this report, a “medicine shortage” is referred to as “any supply disruption or sudden change in the supply-demand equilibrium of a marketed pharmaceutical product that leads to an actual or anticipated lack of stock on the shelf for patients”, as per the definition used by (Chapman, Dedet and Lopert, 2022[1]). These include both temporary and permanent supply discontinuations; the latter sometimes referred to as “availability issues”. This definition does not include situations of “non-availability” or “unavailability”, where a product has not been marketed in a particular jurisdiction.

As medicine shortage definitions vary widely from country to country, so do reporting methods and requirements and, as a consequence, so does the content of national shortage notification databases. For example, some notification databases capture temporary supply disruptions at pharmacy or wholesaler level, while others only include notifications from marketing authorisation holders of shortages resulting from upstream factors for those medicines deemed most critical to the country’s health system. This lack of harmonisation renders cross country comparisons of shortage notification data particularly challenging.

The “non-availability” of a medicine, which is not considered as a shortage in this report, may nevertheless be matter of significant concern for public health. For example, a number of countries report the absence of paediatric formulations for tuberculosis treatment in their domestic markets (WHO, 2023[35]). While products exist globally, they are not approved for sale in these countries and must be imported from others. In Europe, for example, the relatively low prevalence of tuberculosis means that some manufacturers consider the market too small to launch their products. Low prices and high regulatory standards discourage some companies from producing, registering, and supplying their products in these markets, preferring instead to focus on markets with higher disease burden and potentially greater returns (Chorba, 2023[36]; Edwards et al., 2023[37]).

1.2.1. Shortages of pharmaceuticals have gained increasing attention in recent years

Previous OECD work published in 2022 found that, in a sample of 14 OECD countries, the number of shortage notifications increased by 60% over the period 2017 to 2019 (Chapman, Dedet and Lopert, 2022[1]). Differing stakeholder perceptions and a lack of a standardised definition of a shortage, however, make their quantification challenging. Studies have examined medicine shortages at international, hospital, and community pharmacy levels. A 2020 analysis across 11 EU countries revealed that cardiovascular medicines were most severely affected by active shortages between January and August 2019, accounting for 27% of shortages, followed by nervous system medicines at 25% (Troein et al., 2020[34]). Shortages affected a diverse range of products and manufacturers in different countries (ibid.). Hospital pharmacists reported increasing problems with shortages, with antimicrobials consistently the most frequently affected, followed by oncology medicines and anaesthetic agents. Community pharmacies also faced shortages across all medicine classes, with cardiovascular medicines being the most severely affected. Overall, shortages primarily involved older, off-patent medicines, with injectables and generics featuring prominently (Chapman, Dedet and Lopert, 2022[1]).

These findings are generally consistent with a 2022 study analysing the situation in 20 EEA countries between 2008 and 2020 (Jongh et al., 2021[38]). Over the entire period and for the full sample, the medicine classes featuring most prominently in shortage notifications were central nervous system (22% of notified shortages), cardiovascular system (14%), general anti‑infectives (12%), alimentary tract and metabolism (10%) and antineoplastic and immunomodulating agents (7%). These shortages impacted both retail and hospital pharmacies. Nearly half (45%) of all reported shortages affected tablets, and around a quarter (23%) injectables or infusions. However, the latter had a higher probability of being in shortage (+32% vs. +26% for tablets). One‑third of medicines reported in shortage are listed in the World Health Organization Model List of Essential Medicines (WHO EML). Although 97% of medicines in shortage were off-patent and rather old products, statistical analysis shows that patent status and time since launch were not significantly associated with the probability of being in shortage. Around 76% of all shortages involved multisource products for which alternatives existed, while the product in shortage likely represented the only available version for the remaining 24%. The duration of shortages was highly variable from 1 day to 13.5 years, and the average duration across all notifications was 137 days. Two-third of all notifications were resolved within the first three months. Longer durations were reported for shortages arising from commercial reasons.8

The total number of shortages across the 20 EEA countries increased rapidly over the whole period, but this partly reflected an increase in the number of countries reporting shortages. The average number of notified shortages per country grew more modestly. The number of notified shortages in 2019 varied widely, from 13 in Greece to more than 6 500 in Portugal, partly reflecting differences in notification systems and their date of implementation (e.g. Greece had just implemented a notification requirement in 2019) (Jongh et al., 2021[38]). A more recent analysis of shortage notifications in eight EU countries (Belgium,9 Croatia, Finland, Germany, Norway, the Slovak Republic, Slovenia and Sweden) between January 2020 and November 2022 counted 17 250 temporary drug shortage notifications, with the highest numbers observed in Finland, Sweden and Norway. For the same period, 1 737 notifications for permanent drug product withdrawals were counted in Slovenia, the Slovak Republic and Belgium (Ravela, Airaksinen and Lyles, 2023[39]).

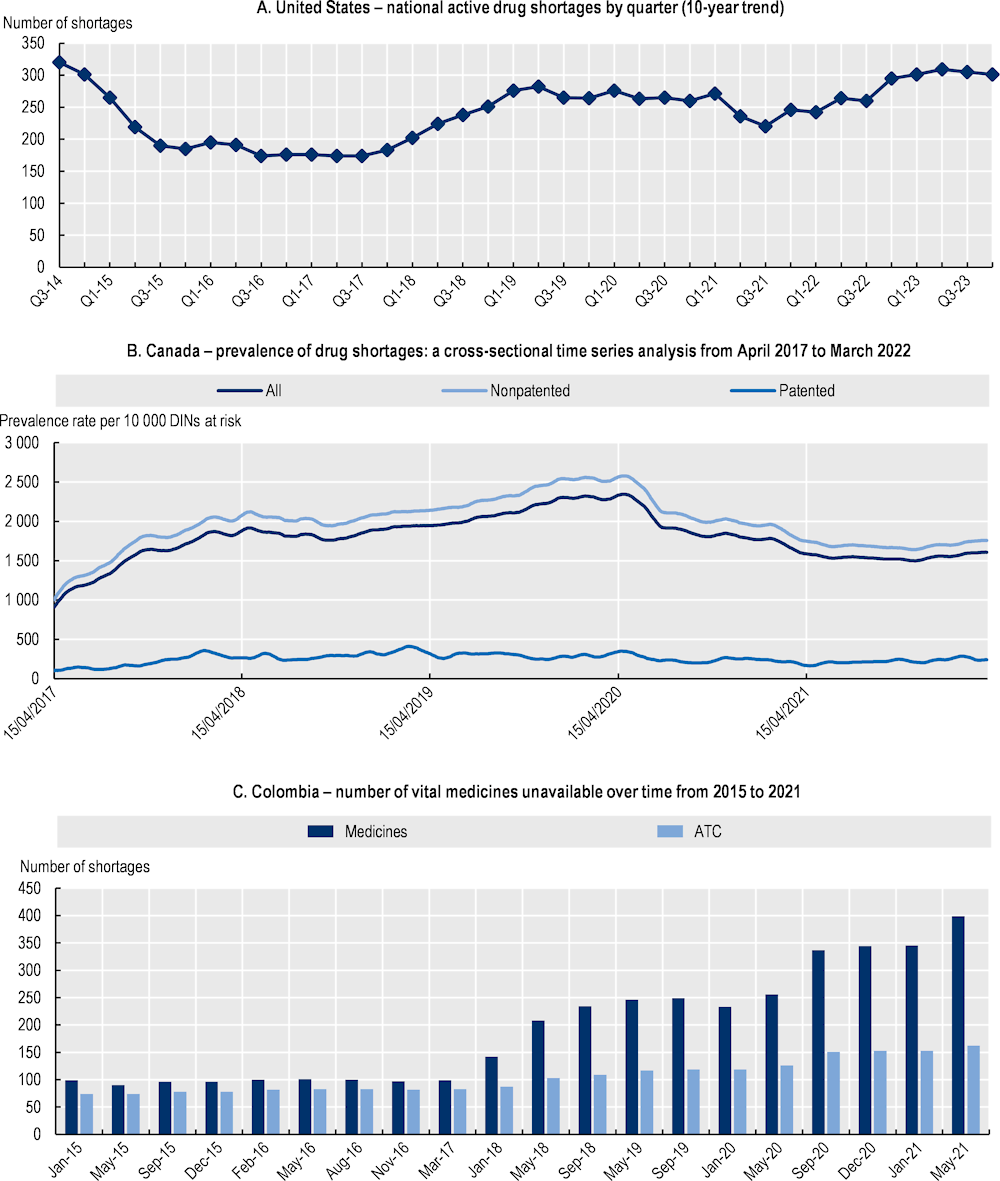

Recent statistics for North American countries show varying trends across countries (Figure 1.13). Although the quarterly number of active shortages in the United States had been steadily increasing from 2017 to 2019, it stabilised during the pandemic, decreased slightly in 2021 and began increasing again in 2022 (ASHP, 2023[40]).10 In Canada, the prevalence rate of shortages was increasing until spring 2020; it then declined during the pandemic, before seeing a slight increase in 2022 (Lau et al., 2022[41]). In Colombia, shortages increased steadily prior to May 2021 (Sabogal De La Pava and Tucker, 2022[42]).

Figure 1.13. Recent trends in national shortages of medicines in 3 countries

Notes: For the United States: Points indicate active shortages at the conclusion of each quarter. The underlying data are from the American Society of Health-System Pharmacists (ASHP) Drug Shortages website; ASHP commonly lists more shortages than US FDA as it includes shortages that do not meet criteria defined by US FDA (see end note 10). For Canada: DIN Drug Identification Number. For Colombia: ATC Anatomical Therapeutic Chemical classification.

Source: For the United States: Reproduced from ASHP (2023[40]), Drug shortages statistics, www.ashp.org/drug-shortages/shortage-resources/drug-shortages-statistics?loginreturnUrl=SSOCheckOnly; For Canada: Reproduced and adapted from Lau, B. et al. (2022[41]), “COVID‑19 and the prevalence of drug shortages in Canada: a cross-sectional time‑series analysis from April 2017 to April 2022”, https://doi.org/10.1503/cmaj.212070; For Colombia: Reproduced from Sabogal De La Pava, M. and E. Tucker (2022[42]), Drug shortages in low- and middle‑income countries: Colombia as a case study, https://doi.org/10.1186/s40545-022-00439-7 (CC BY 4.0).

Antimicrobials are among the most frequently reported shortages (Chapman, Dedet and Lopert, 2022[1]; Jongh et al., 2021[38]; Beraud, 2021[43]; EMA, 2023[44]). In particular, the 2022 winter season saw a spike in shortages of essential antibiotics in many countries (EMA, 2023[44]). As described in Section 1.1.1, previous OECD analyses highlighted the significant complexity of the manufacturing process for azithromycin (an example of a macrolide antibiotic), with a high concentration of API production in certain countries, albeit with manufacturing sites in different geographic locations (OECD, 2023[8]). Due to pressure on prices and low profitability of generic antibiotic production, there are few competitors at the different stages of the supply chain. A disruption at any stage can result in a shortage. Antimicrobial shortages are a worrying trend, particularly in the face of the wider threat of antimicrobial resistance (OECD, 2023[45]).

Root causes of medicines shortages are multifactorial, but difficult to identify

In many countries, shortage notifications made to regulatory agencies by manufacturers include information on their causes, often selected from a pre‑defined list of potential causes. These lists may differ across jurisdictions.

Shortages of medicines during routine circumstances tend to be attributed primarily to one of two main causes. Around 60% of manufacturer reported shortages are attributed to manufacturing and quality issues (FDA, 2019[46]; Benhabib et al., 2020[47]), such as production defects, input shortages, inventory management problems, temporary or permanent production suspensions due to technical problems or non-compliance with manufacturing standards, and site closures or relocations. The other reason often cited is market dynamics, where poor profitability and a lack of economic incentives make the production of older off-patent products in particular unattractive. Competitive public and private procurement processes often drive prices down to near the marginal cost of production, discouraging suppliers from maintaining surplus stock or investing in capacity and quality improvement. Finally, co‑ordination failures in transportation and delivery systems, including cyberattacks, can disrupt supply chains even when supply and demand are balanced (Chapman, Dedet and Lopert, 2022[1]; FDA, 2019[46]).

In the 2022 study on shortages in 20 EEA countries, available information on causes of nearly 7 000 shortages was reclassified into 7 categories (Jongh et al., 2021[38]). Between 2015 and 2020, 51% of shortages were due to quality and manufacturing issues, 25% to commercial reasons8, 9% to unexpected increases in demand, 8% to distribution issues, 4% to regulatory issues, 1% to unforeseen major events or natural disasters, and 1% to other issues. Over the period, however, the relative proportions of commercial and distribution issues varied inversely, suggesting a degree of overlap. Looking more closely at notifications in Portugal and Ireland, the study identified two major causes: changes in manufacturing site and increased demand in another country. Commercial reasons were further analysed, using stakeholder interviews: tendering practices, penalties for late delivery, and poor profitability were mentioned as influencing shortages in individual countries, but their respective contributions could not be estimated (ibid.).

More generally, empirical analyses of root causes are sparse. A 2021 systematic review identified only three studies (de Vries et al., 2021[48]). Among them, Yurokoglu, Liebman and Ridley (2017[49]) estimated the impact of a 2005 reduction in US Medicare reimbursement rates on shortages of injectable medicines, which had dramatically increased in the 2000s. Looking at a sample of 308 injectable medicines over 12 years, the authors estimated that a 50% cut in reimbursement rates had led to a reduction in manufacturers’ prices and increased the average duration of shortages by about 2 weeks (from an average duration of 59 weeks for the whole sample and the whole period). Since then, Frank, McGuire and Nason (2021[50]) presented empirical evidence on the link between generic prices, market entry/exit and shortages in the US market. Looking at markets for a large -albeit not representative‑ sample of 89 molecules-forms that lost patent protection between 2010 and 2013, the study showed very different patterns for oral and injectable markets, and for small and large markets in the 4 years following patent loss. For oral forms (66 molecule‑form “markets”), larger markets saw robust competition with multiple manufacturers and prices declining, while smaller markets attracted fewer manufacturers and saw prices increase. Shortages were reported in one‑third of these 66 “markets” and were more frequent in large markets (about 50%) than in smaller ones. Product recalls grew sharply in number over the period and affected larger markets (60% of recalls up to 2017) more than smaller ones. For injectable forms, markets are generally smaller, have fewer entrants and exhibit a significant degree of price volatility. Shortages were observed in 16 of 23 of these “molecule‑form markets” over the period, but were more frequent in smaller and medium sized markets (80%) than in larger ones (50%). Recall rates grew after 10 quarters to reach 65% (ibid.).

In a study of the US market, the IQVIA Institute examined market concentration (measured using the Herfindahl-Hirschman Index – HHI11) for medicines in shortage. Multi-source medicines in highly-concentrated markets (HHI 2 501‑9 999) accounted for 68% of shortages; single‑source medicines 27%, and multi-source medicines in moderately concentrated markets (HHI 1 500‑2 500) another 19% (IQVIA, 2023[51]). However, information on market concentration for medicines that are not in shortage is not presented in the report. The report also shows that the proportion of medicines in shortages increases when the price “per extended unit”12 decreases.

Only very limited information is available on (local) shortages due to misallocation in the distribution chain. A single study reports that in Italy, some cases of local shortages due to maldistribution were investigated and found to be the result from illegal behaviour by retail pharmacies (Di Giorgio et al., 2019[52]).

Example: Vaccines

Shortages of several key vaccines have occurred in recent years in OECD countries. However, published reports often group vaccines with antimicrobials, limiting insights about vaccine‑specific shortages. Nevertheless, there are some examples. In Europe, Filia et al. (2022[53]) found a total of 115 vaccine shortages/stock-outs reported in 19 of 21 European countries surveyed between 2016 and 2019, with a median stockout duration of 5 months (ranging from less than 1 month to 39 months). The most commonly affected vaccines were Dipetheria-Tetanus (DT)- and Td-containing combination vaccines,13 hepatitis B, hepatitis A, and Bacillus Calmette‑Guérin (BCG). Around 30% of shortage/stockout events for which information was available led to temporary changes in countries’ national immunisation programmes (e.g. alternative schedules, changes to the timing of doses or boosters, prioritisation of vulnerable groups) (ibid.). In the community pharmacy setting in Europe, 55% of responding countries reported vaccines to be in short supply in 2022, up from 44% in 2021, but well below the 88% reported in 2020 (PGEU, 2022[54]). The number of vaccine shortages reported by hospital pharmacists in the EU has been declining, with only 15% of survey participants reporting them as an issue in 2023 compared to 43% in 2018 (Miljković et al., 2019[55]; EAHP, 2023[56]). In the United States, a 2017 study found that there were 59 reported shortages of vaccine and immune globulin products in the period between 2001 and 2015, with half of these shortages involving paediatric vaccines (Ziesenitz et al., 2017[57]). They also found that the median number of new shortages reported annually to be 3, and a median shortage duration of 16.8 months (ibid.). In Australia, several “high” and “critical” impact shortages of different vaccines of variable duration were reported by manufacturers between 2014 and 2023, based on national medicine shortage data.14

The fluctuations in national vaccine shortages over time may reflect so called “global shortages or disruptions” of specific vaccines. For example, 2015 saw a shortage of pertussis-containing combination vaccines as a result of reduction in pertussis antigen production capacity (ECDC, 2016[58]). Fourteen EU Member States reported shortages of DT- containing vaccines in the period 2016‑19; which were mainly attributed to interruptions in production and supply (Jongh et al., 2021[38]; Filia et al., 2022[53]). Another example saw reported shortages of hepatitis A vaccine in several European countries (e.g. Austria, Denmark, Italy, Portugal, Spain and Sweden) as well as in the United States, linked to a spike in demand arising from an outbreak of hepatitis A, compounded by existing production issues (ECDC, 2017[59]; WHO, 2017[60]). Similarly, the BCG vaccine has been in shortage across multiple countries since 2012, also due to manufacturing quality problems and high demand (Filia et al., 2022[53]).

Causes of vaccine shortages are likely multifactorial. It is important to consider, however, that vaccines are different to other medicines, with lengthy production processes involving highly specialised facilities and equipment, and with additional quality controls and testing to ensure the safety and quality of these products that are administered to otherwise “healthy” populations. According to Filia et al. (2022[53]), the two most commonly reported causes of stockouts/shortages in 19 European countries surveyed between 2016 and 2019 were interruptions in production and/or supply due to quality issues or other reasons (n = 39; 33.9%) and global shortages (n = 35; 30.4%),15with higher-than-expected demand due to changes to vaccine schedules or targeted groups (7.0%), inaccurate forecasts (4.3%) or an outbreak/other reasons (4.3%) (Filia et al., 2022[53]). Other factors (13.9%) included delayed delivery, lack of suppliers, and issues at procurement level (e.g. delays, legislation, absence of reimbursement) (ibid.) In the United States, manufacturing problems were cited as the primary cause of vaccine shortages between 2001 and 2015 (50% of cases), followed by issues with supply and demand (7%) (Ziesenitz et al., 2017[57]). Reported reasons for shortages of vaccines in Australia between 2014 and 2023 included manufacturing issues (measles/mumps/rubella vaccine), seasonal stock depletion (influenza), and unexpected increases in consumer demand (e.g. rabies, hepatitis A, hepatitis B, and cholera vaccines), among others (TGA, 2023[61]).14

The challenges in vaccine supply chains stem from a range of issues linked to complexities of the manufacturing and quality control processes, regulatory factors, and uncertain demand. From the industry perspective, Vaccines Europe,16 an organisation representing 14 vaccine companies operating in Europe, identified several root causes of vaccine shortages in that region through consultations with experts from the four member companies with the largest portfolio of EU-marketed vaccines (GlaxoSmithKline, Merck Sharpe & Dohme, Pfizer, Sanofi Pasteur) (Pasté et al., 2022[62]). Industry experts highlighted the complexity of vaccine manufacturing, which involves intricate processes with necessary stringent quality controls, leading to lengthy production timelines that require contracts (with suppliers and health authorities) to be arranged well in advance. Complicating matters are unpredictable timelines due to independent lot releases by national control laboratories. Regulatory factors add further complexity, necessitating frequent post-approval changes to be submitted by manufacturers (e.g. due to improvements in facilities, equipment or processes; quality control; changes in suppliers etc), sometimes requiring submissions to over 100 regulatory agencies globally for a single change (ibid.). Nevertheless, these stringent requirements are necessary to ensure safety and effectiveness of vaccines, as well as compliance with good manufacturing practices.

Industry experts further highlighted that the diversity in vaccine presentations, and packaging and labelling requirements across countries results in the need to manufacture and distribute vaccines in smaller volumes, posing challenges for efficiency in production and inability to redistribute in the event of supply disruptions. Unpredictability in global demand, challenges in anticipating changes in vaccine recommendations, and difficulty in gaining accurate demand forecasts from health authorities were also cited by industry experts (e.g. due to development of national immunisation programmes, changes to existing guidelines, disease outbreaks etc). In addition, suboptimal vaccine budgets and procurement practices that do not take into account long lead times were mentioned (Pasté et al., 2022[62]). Other analyses cite similar vulnerabilities in vaccine supply chains, while also highlighting the added challenge of concentrated production with few global suppliers (Jongh et al., 2021[38]; WHO, 2023[21]).

Example: Radiopharmaceuticals

Since 2009, the High-level Group on the Security of Supply of Medical Radioisotopes (HLG-MR), established by the Nuclear Energy Agency, has been working on addressing shortages in the supply of certain radio‑isotopes. In the case of Technetium‑99m, used in 85% of nuclear medicine diagnostic scans performed worldwide – around 30 million patient examinations every year –, ageing production facilities and low prices have contributed to inadequate production capacity, making the supply of Tc‑99m unreliable. The current structure of the supply chain leaves some participants unable to increase the prices of their services to the levels needed to cover all fixed and variable costs of the required production capacity (OECD/NEA, 2019[63]).

Example: Plasma-derived medicinal products

In recent years, PDMP shortages have affected many regions across the world, particularly shortages of intravenous immunoglobulins (IVIg) for which there is no alternative broad-spectrum antibody. Following the onset of the COVID‑19 pandemic, blood product donations decreased due to social restrictions and health concerns and are only rebounding slowly (Covington, Voma and Stowell, 2022[64]). For example, one study reported that several OECD countries (the United Kingdom, France, Greece, Latvia, Lithuania and Portugal) have experienced shortages of intravenous and subcutaneous IVIg as a result of insufficient supply and market withdrawals over recent years (Strengers, 2023[10]). Even countries with significant sources of commercial plasma such as Germany, Czechia, Hungary and the United States have experienced shortages of IVIg. Another study focusing on the possible impact of COVID‑19 on plasma supply in the United States, reported a sharp drop in donations that is only rebounding slowly to pre‑pandemic levels (Covington, Voma and Stowell, 2022[64]).

The global supply of plasma is dominated by the collection of source plasma in the United States, which not only caters for the domestic market but is also exported (Strengers, 2023[10]). Pre‑pandemic data show that 67% of source plasma originated from the United States, whereas Asia-Pacific accounted for only 18%, and Europe 14% (Strengers, 2023[10]). In Europe, the majority of source plasma originates from four countries only. These are Austria, Czechia, Germany, Hungary. While on average, 14 litres are collected annually per 1 000 inhabitants in Europe, the United States collects roughly 113 litres per 1 000 inhabitants (Kluszczynski, Rohr and Ernst, 2020[16]).

Reasons for shortages are likely to be two‑fold: increasing numbers of patients eligible to be treated with plasma-derived therapies, and uncertainty in the supply of the raw material (i.e. plasma from human donors). The latter depends on eligibility requirements, the allowed frequency of donation, and different donation compensation policies in each jurisdiction. The COVID‑19 pandemic also impacted the volume of blood and plasma collected. Since it can take up to a year for plasma to be processed, the effect of a downturn in donations may remain unnoticed for a long period of time and will not be experienced as acutely as that of whole blood or red cells. In addition, disruptions in source plasma may not be readily perceived by transfusion services, which primarily focus on the collection of red cells and platelets (Covington, Voma and Stowell, 2022[64]).

PDMP manufacturing is challenging as it is affected by variations in the volume of donations, complex regulations, strict safety procedures to ensure purity and eliminate potential viruses and bacterial contamination, as well as lengthy manufacturing processes that can take 7‑12 months (Hess, 2010[65]). The most difficult challenge is in the collection of raw material, i.e. plasma, which can only be sourced from human donors. Finding potential donors is the first and most relevant hurdle to mitigate supply shortages. Beyond eligibility requirements, varying donation frequency and compensation schemes, donations are highly vulnerable to the effects of bad weather, health crises, geopolitical tensions, that can discourage even willing donors.

Demand for PDMPs is expected to increase at an annual rate of 6‑7% (PPTA, 2022[15]). Recent research suggests that consumption in Europe alone is projected to increase by one‑third, from 50.5 tonnes in 2017 to 67.5 tonnes in 2025 (Marketing Research Bureau, 2023[17]). The availability of plasma has become even more relevant than in recent years as research and diagnostics have evolved (Marketing Research Bureau, 2023[17]). According to data from the International Patient Organisation for Primary Immunodeficiencies (IPOPI), there are many patients who have not yet been diagnosed with diseases that require PDMP treatment (Strengers, 2023[10]).

1.2.2. Vulnerabilities in medical device supply chains have received less attention