Forms of sustainable finance have grown rapidly in recent years in Asia. These practices encompass instruments for issuers, third-party ratings, principles and guidance, as well as index and portfolio products to help channel financing to transitioning entities, and also to better price the risks and benefits of the green transition. This chapter provides an overview of the trends in corporate sustainable bonds in Asia with a specific focus on ASEAN economies and outlines relevant standards that have been developed. Further, it describes how key performance indicators (KPIs) and metrics underpin such bonds and support a broader monitoring of sustainable finance activities across the financial sector. It also presents policy considerations to support authorities’ efforts in the region.

Mobilising ASEAN Capital Markets for Sustainable Growth

4. Sustainable bonds: Trends and practices in ASEAN economies

Abstract

4.1. Introduction

Forms of sustainable finance have grown rapidly in recent years, as a growing number of institutional investors and investment funds now incorporate various sustainability factors into their investment strategies. The growth of sustainable finance, including the increasing array of financial products, has attracted the attention of investors, policy makers and civil society stakeholders due to its potential to deliver long-term risk-adjusted returns, align with societal values, and contribute to sustainability and climate-related objectives. In addition, Article 2.1c of the Paris Agreement acknowledges the financial sector’s importance in meeting international decarbonisation goals by “making financial flows consistent with a pathway towards low greenhouse gas (GHG) emission assets and climate-resilient development”.

Sustainable finance encompasses instruments for issuers, third-party ratings, principles and guidance, as well as index and portfolio products to help channel financing to transitioning entities, and also to better price the risks and benefits of the transition. These products, practices and tools have been developed to support issuers and investors in activities in line with the climate transition and to achieve long-term risk‑adjusted returns. If fit for purpose, they have the potential to improve information flow, price discovery, market efficiency, and liquidity in support of sustainability objectives and a low-carbon transition.

This chapter provides an overview of trends with respect to corporate sustainable bonds in Asia, with a focus on ASEAN countries, and outlines relevant standards that have been developed. Further, the chapter shows how key performance indicators (KPIs) and metrics underpin certain bonds within this category, namely “Sustainability-linked bonds” (SLBs), and support a broader monitoring of sustainable finance activities across the financial sector in Asia. It also presents policy considerations to support authorities’ efforts in Asia and the ASEAN region.

4.2. Overview of sustainable bonds in Asia

Within the landscape of sustainable finance practices in Asia, this chapter will focus on the key characteristics and trends of sustainable bonds in Asian markets. Sustainable bonds can be classified into two major categories (ICMA, 2022[1]). “Use of proceeds bonds” are bonds whose proceeds should be used to either partially or fully finance or re-finance new or existing eligible green, social or sustainable projects. In the case of “use of proceeds bonds” that are issued by financial institutions, the proceeds are typically allocated to finance or refinance the provision of loans for the development of eligible projects. These bonds can be labelled as green, social or sustainability-labelled bonds. “Sustainability-linked bonds” (SLBs), on the other hand, are bonds for which the issuer’s financing costs or other characteristics of the bond (e.g., its maturity) can vary depending on whether the issuer meets specific sustainability performance targets within a timeline, but whose proceeds do not need to be invested in projects with an expected positive environmental or social impact (OECD, 2024[2]).

The landscape of sustainable bonds encompasses various definitions and guidelines for such bonds and the use of capital raised. “Use of proceeds bonds” include green, social and sustainability bonds (GSS bonds). As their name suggests, the proceeds of green bonds must be applied to finance projects with expected environmental benefits, which may include, for instance, projects in renewable energy, clean transportation, biodiversity conservation, and wastewater management (ICMA, 2021[3]). In this classification, “blue bonds” and “climate bonds”, which focus on environmental issues related to the sea and climate change, respectively, would be classified as “green bonds”. The resources raised through social bonds must be invested in projects that aim to address or mitigate a specific social issue or seek to achieve positive social outcomes, including affordable housing, food security and the empowerment of minorities (ICMA, 2023[4]). Sustainability bonds are the bonds where proceeds are typically used to finance a combination of both green and social-eligible projects (OECD, 2024[2]).

The following sections analyse the key characteristics of both categories of sustainable bonds and their implications for companies and investors in Asia. However, one basic characteristic of sustainable bonds should be clear from the start. Sustainable bonds present the same rights and risks to their holders as with any other conventional bond, but they also create a commitment. In the case of the GSS bonds, the issuer ordinarily commits to having developed or to plan to invest in eligible sustainable projects with a value that is equal to or higher than the outstanding value of the GSS bonds it has issued. In the case of SLBs, the issuer commits to reaching sustainability performance targets, such as reducing its GHG emissions.

4.3. Trends in corporate sustainable bonds in Asia

This section provides an overview of the main trends in the sustainable bond market in Asia. Based on a sample of 4 457 corporate debt securities issued between 2016 and 2023, this section presents key figures and analyses relevant trends (see Annex A). Nonetheless, the section focuses on identified trends based on the issued bonds within the last five years (2019-2023) to ensure more representative data on the latest market developments.

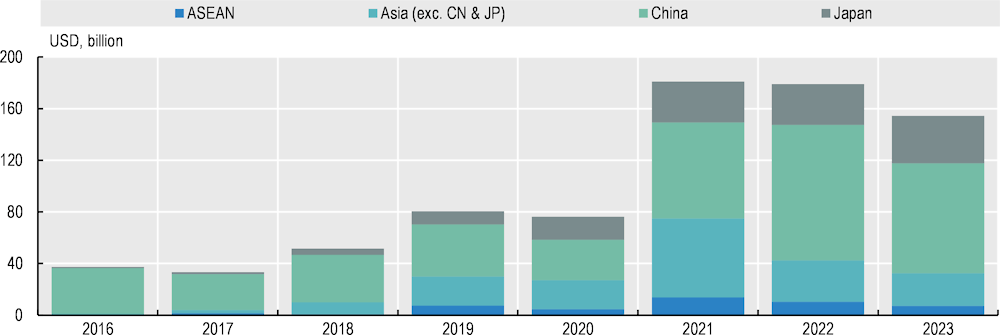

In the last eight years, there has been significant growth in the issuance of sustainable corporate bonds as an alternative to meet financing needs. Asian market participants have issued around USD 793.1 billion of sustainable bonds since 2016 – representing almost 8% of all issued corporate bonds in the region. While the market has shown an overall positive growth trend, it became particularly evident in 2021 when Asian corporations issued a record amount of USD 181 billion in capital through sustainable corporate bonds. This represented an increase of 138% in comparison to 2020. While the total issuance has decreased since 2022, sustainable bonds remained a significant source of capital with a total issuance amounting to USD 154.3 billion in 2023 – equivalent to almost 8% of all issued corporate bonds in the region.

Figure 4.1. Issuance of sustainable bonds by domicile, 2016-23

Source: OECD Corporate Sustainability dataset, LSEG.

Although corporations across Asia are increasingly issuing sustainable debt instruments to meet their financing needs, the market is highly concentrated in the People’s Republic of China (China) and Japan. Corporations domiciled in China have issued around USD 436 billion since 2016. This represents almost 55% of the total issuance in Asia between 2016-23. Corporates domiciled in Japan accounted for 17% of total issuance, estimated at USD 135.5 billion. Similarly, corporations domiciled in countries in the ASEAN region are increasingly offering sustainable bonds, with a total issuance standing at USD 45.4 billion – around 6% of total issuance. The remaining 22% of the total issuance, calculated at USD 176.3 billion, came from other countries in Asia.

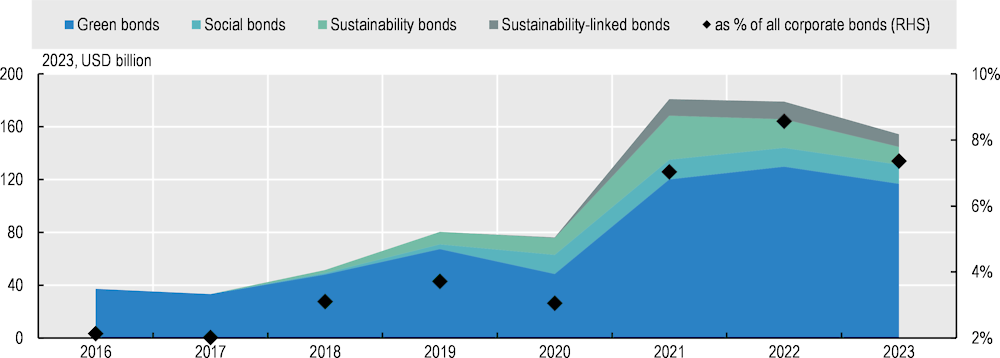

Figure 4.2. Issuance of sustainable bonds by instrument in Asia, 2016-23

Source: OECD Corporate Sustainability dataset, LSEG.

Green bonds remained the most important type of sustainable bonds despite a recent increase in the issuance of other types of sustainable bonds in Asia. Green bonds accounted for around 76% of the total issuance between 2016-2023, estimated at USD 601.7 billion (Figure 4.2). The second most common type of sustainable bond was sustainability bonds with almost 12% of total issuance worth USD 92.9 billion. Then, social bonds, equivalent to USD 62.6 billion, represent approximately 8% of the total issued amount. Finally, sustainability-linked bonds remained the least common sustainable financing alternative for regional corporations, calculated at USD 35.9 billion – around 5% of total issuance between 2016-2023.

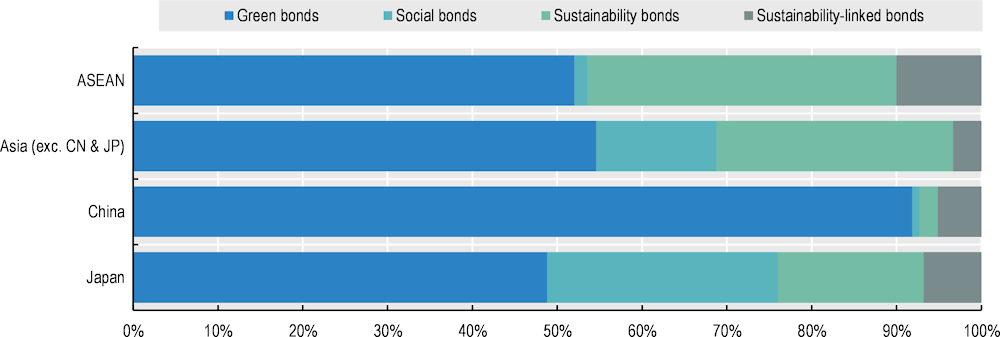

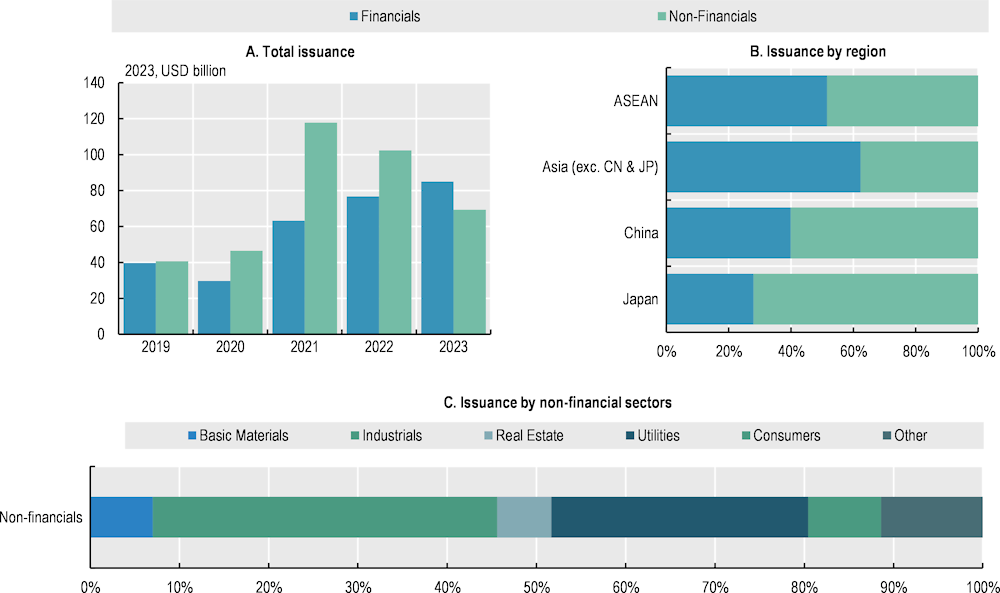

Figure 4.3. Sustainable bonds’ issuance by region and jurisdiction, 2019-23

Source: OECD Corporate Sustainability dataset, LSEG.

Over the past five years, the prioritisation of issuance of other sustainable bonds (other than green bonds) has varied across different jurisdictions. Social bonds, for instance, were the second most common type of sustainable debt instrument for the Japanese corporate sector. These bonds represented around 27% of Japan’s total issuance of sustainable corporate bonds within the period 2019-2023 (Figure 4.3). In fact, it is worth mentioning that Japanese corporations led the regional issuance of social bonds, offering around 57% of the total social bonds estimated at USD 61.6 billion. ASEAN countries prioritised the issuance of sustainability bonds, offering USD 15.8 billion (equivalent to 36% of their total offering of sustainable bonds). The data also indicates that ASEAN countries issued the highest number of sustainability-linked bonds relative to total issuance. Sustainability-linked bonds, valued at USD 4.3 billion, represented 10% of ASEAN’s total issuance of sustainable bonds. Finally, Chinese corporations have issued sustainable bonds other than green bonds to a very limited extent given that only 8% of the total Chinese issuance accounts for additional classes of bonds.

Around 56% of the total issuance between 2019 and 2023, estimated at USD 376.7 billion, was offered by non-financial corporates, mostly from the industrial sector (Figure 4.4). The industrial sector issued around 39% of the total amount offered by non-financial corporates. This is equivalent to USD 145.3 billion. Next, corporates in the utility industry offered approximately 29% of the non-financial corporates’ total issuance equivalent to USD 108.4 billion. The remaining USD 123.1 billion offered by non-financial corporates was issued by corporates involved in additional industries including basic materials, real estate, consumers and other sectors.

While non-financial corporations are the leading issuers of sustainable bonds in absolute amounts, this is only the case in China and Japan where most of the issuance is concentrated. China and Japan-domiciled financial corporations’ issuance constituted 40% and 28% of their respective total issuance (see Figure 4.4). Meanwhile, financial corporates in ASEAN and other Asian countries' share of total issuance amounted to 52% and 62% respectively. In total, financial corporates offered USD 294.2 billion between 2019 and 2023, issuing a record amount in 2023 equivalent to USD 84.9 billion. For the first time within the last five years, this value surpassed the amount issued by non-financial corporates in the region.

Figure 4.4. Issuance of sustainable bonds by sector for Asia, 2019-23

Source: OECD Corporate Sustainability dataset, LSEG.

Analysing the promised use of the proceeds of GSS Bonds, most of the issued bonds target “clean transport” and “energy efficiency” purposes – areas related to climate change. Conversely, activities related to “agriculture” and “waste management” benefited the least from the use-of-proceeds sustainable bonds. It is worth noting that both financial and non-financial corporates from all jurisdictions tend to follow a very similar trend while allocating the proceeds of GSS Bonds (Table 4.1).

Table 4.1. Percentage of GSS bond’s allocated proceeds between 2019-23

|

|

Asia (exc. China & Japan) |

ASEAN |

China |

Japan |

||||

|---|---|---|---|---|---|---|---|---|

|

|

Non-financials |

Financials |

Non-financials |

Financials |

Non-financials |

Financials |

Non-financials |

Financials |

|

Clean transport |

37% |

35% |

21% |

44% |

13% |

45% |

24% |

33% |

|

Energy efficiency |

18% |

5% |

36% |

7% |

16% |

10% |

11% |

38% |

|

Renewable energy projects |

11% |

6% |

7% |

<1% |

15% |

8% |

3% |

1% |

|

Eligible green projects |

9% |

5% |

7% |

0% |

34% |

12% |

5% |

0% |

|

Climate change adaptation |

8% |

4% |

9% |

11% |

5% |

15% |

12% |

0% |

|

Biodiversity conservation |

7% |

10% |

1% |

0% |

<1% |

<1% |

<1% |

2% |

|

Green construction/buildings |

3% |

1% |

3% |

1% |

7% |

5% |

5% |

6% |

|

Infrastructure |

3% |

19% |

9% |

30% |

4% |

<1% |

35% |

5% |

|

Social expenditures |

3% |

14% |

<1% |

2% |

1% |

1% |

2% |

5% |

|

General purpose |

1% |

1% |

6% |

4% |

3% |

2% |

3% |

9% |

|

Other |

<1% |

<1% |

<1% |

0% |

1% |

1% |

<1% |

<1% |

Source: OECD Corporate Sustainability dataset, LSEG.

Note: “Other” includes “waste management”, “water or wastewater management”, “agriculture”, and “sustainable development projects”.

Concerning SLBs’ key performance indicators (KPIs), GHG emissions tend to be the priority for regional issuers. As observed in Table 4.2, regional SLBs tend to focus mostly on reducing GHG emissions, using KPIs mostly related to Scope 1, and 2 emissions, while seldom referring to Scope 3 emissions. This is a trend observed across all jurisdictions except for China, where corporates issued the least SLBs addressing GHG emissions.

Table 4.2. KPIs in sustainability-linked bonds (2019-23)

|

KPI |

ASEAN |

Asia (exc. China & Japan) |

China |

Japan |

|---|---|---|---|---|

|

Carbon intensity |

25% |

19% |

6% |

<1% |

|

Scope 1 and 2 GHG emissions |

20% |

31% |

<1% |

51% |

|

Energy consumption and efficiency |

19% |

0% |

44% |

0% |

|

Renewable energy |

8% |

14% |

29% |

13% |

|

Emissions intensity |

3% |

0% |

0% |

0% |

|

Increase in women board members |

0% |

0% |

0% |

2% |

|

Scope 1, 2 and 3 GHG emissions |

0% |

0% |

<1% |

1% |

|

Scope 3 GHG emissions |

0% |

0% |

0% |

9% |

|

Other |

26% |

36% |

21% |

23% |

Source: OECD Corporate Sustainability dataset, LSEG.

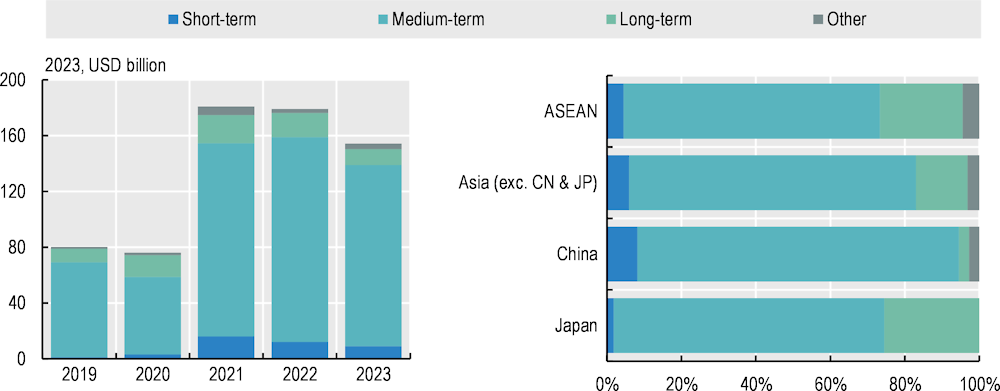

Corporate sustainable bonds in Asia have been issued mostly with a medium-term maturity (ranging from two to ten years). Since 2019, around 80% of bonds, with a total amount of USD 539 billion, have been offered with a medium-term maturity, as shown in Figure 4.5. Long-term maturity bonds (with a maturity in more than ten years after issuance) account for around 11% of total issuance, estimated at USD 74.1 billion. While bonds with a long-term maturity were the second most common form of issuance in the region, around 44% of these were offered by corporates domiciled in Japan. Concerning short-term bonds (with a maturity in less than two years after issuance), around USD 41.5 billion were issued, representing almost 6% of the sample. Yet 66% of short-term bonds were offered by corporates with a domicile in China, which is the country with the most issuance of short-term bonds relative to its total issuance.

Figure 4.5. Maturity of sustainable bonds in Asia, 2019-23

Source: OECD Corporate Sustainability dataset, LSEG.

Note: Bonds are classified as ‘short-term’ if their original maturity date is less than two years; “medium-term” if the maturity is between two and ten years; “long-term” if their maturity is in more than ten years; and ‘other’ if they are perpetual bonds or the maturity date is not specified.

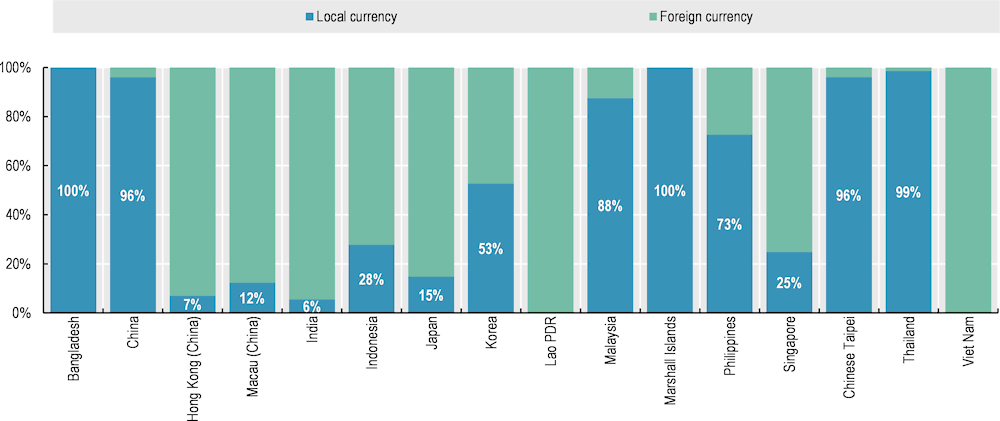

Although the number of countries favouring local over foreign currency was equal, the largest share of sustainable bond issuance was issued in a foreign currency. As seen in Figure 4.6, there were eight countries where the issuance of sustainable bonds was mostly in local currency and eight countries where corporates issued in foreign currency between 2019-2023. Nevertheless, issuance in a foreign currency outweighed issuance in a local currency. Corporates offered sustainable bonds amounting to USD 436.7 billion (around 88% of the total issuance) in foreign currencies, whereas only USD 60.5 billion were issued in one local currency.

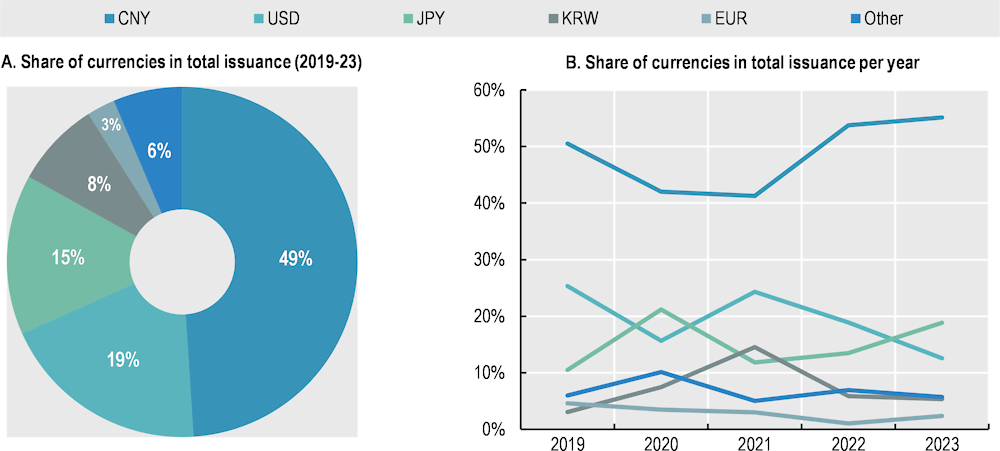

Over the last five years, the Chinese Yuan (CNY) has remained the most common currency for the issuance of sustainable bonds. Between 2019 and 2023, around 49% of the total issuance, equivalent to USD 328.33 billion, was offered in CNY. Nevertheless, around 98% of this amount is attributed to issuances of corporates domiciled in China, where most of the sustainable bond issuance was concentrated. Next, issuances in United States Dollars (USD) totalled USD 129.6 billion – 19% of the total issuance between 2019 and 2023. The Japanese Yen (JPY) was the third most common currency used, almost exclusively by Japanese corporates nonetheless, with an equivalent offering estimated at USD 99.2 billion – 15% of the total issuance. Next, USD 53.3 billion was issued in Korean Won (KRW) representing 8% of the total issuance. Finally, the remaining 9% of the issuance was issued in other currencies such as the Euro or other local currencies.

Figure 4.6. Currency composition of sustainable bonds issuance in Asia, 2019-23

Source: OECD Corporate Sustainability dataset, LSEG.

Figure 4.7. Currency composition of sustainable bonds issuance in Asia over time

Source: OECD Corporate Sustainability dataset, LSEG.

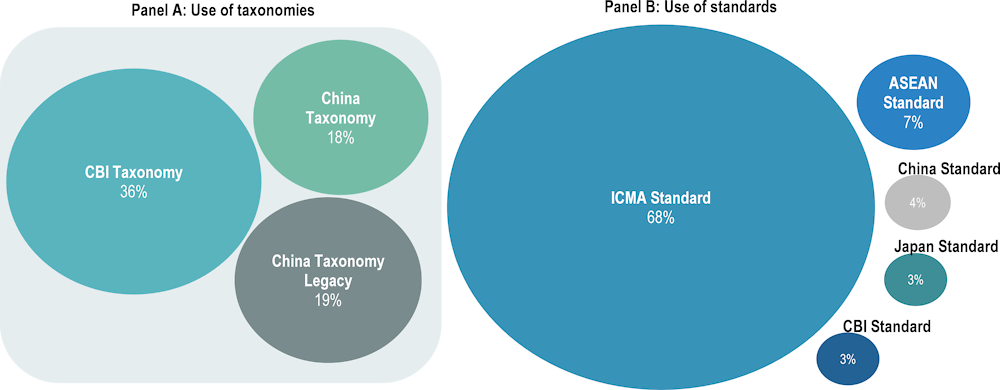

Regional issuing corporates acknowledge the relevance of sustainable finance guidance since more than 91% of sustainable bond issuance followed at least one relevant framework. Regional market participants rely mostly on the International Capital Markets Association’s (ICMA) Standard as 68% of the issued bonds cite such a document (Figure 4.8). In total, corporates domiciled in all analysed jurisdictions have issued bonds worth USD 428.5 billion referring to ICMA’s standard. With regards to the ASEAN Standard, this was also used mostly exclusively by corporates domiciled in Southeast Asia. While only 7% of total bonds in the sample refer to the ASEAN Standard, around 52% of sustainable bonds issued by corporates domiciled in the ASEAN region follow this Standard. However, since the ASEAN standard follows ICMA’s standard, issuers complying with the ASEAN Standard would also comply with the ICMA Standard.

Figure 4.8. Frameworks used in the issuance of sustainable bonds, 2019-23

Source: OECD Corporate Sustainability dataset, LSEG.

4.4. Assessment of standards, KPIs and metrics underpinning sustainable bonds in Asia

Standards, KPIs and metrics play a pivotal role in the issuance and evaluation of sustainable bonds, providing investors with valuable insights into sustainability-related performance, as well as more targeted performance in line with climate-related risks and opportunities.

This section assesses standards, KPIs and metrics that feed into sustainable bonds in Asia, encompassing both international and region-specific frameworks. The aim is to shed light on the robustness and relevance of these standards, KPIs and metrics in supporting market integrity in the issuance of sustainability-linked bonds in Asia. Additionally, the section discusses the challenges and limitations inherent in the development and application of sustainability KPIs and metrics, addressing key issues such as data availability, materiality, and regulatory fragmentation.

4.4.1. Overview of the use of proceeds’ stipulations and KPIs within sustainable bonds’ contracts

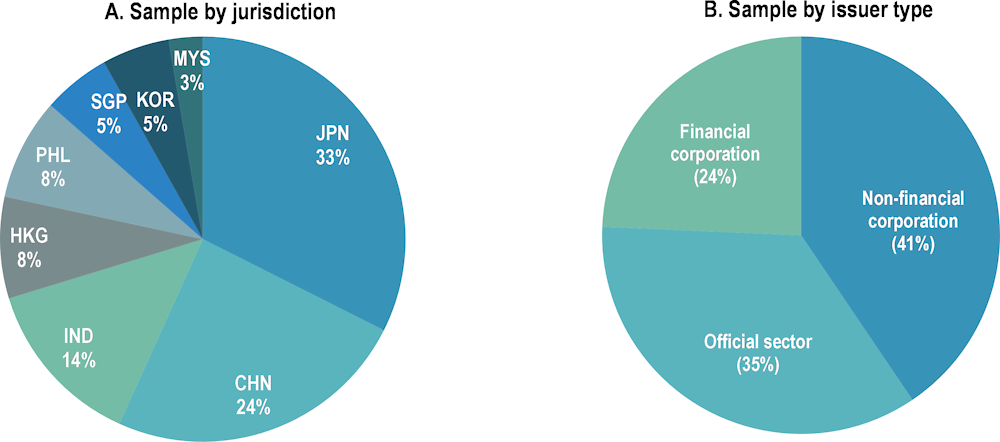

This sub-section investigates Asian market practices underpinning sustainable bonds by analysing the requirements within 37 prospectuses of bonds issued in Asian jurisdictions. This analysis explores the regulation of GSS bonds through the use of proceeds stipulations and SLB bond-related Sustainability Performance Targets (SPTs). This sub-section also examines the reporting obligations for both types of bonds. The sample is composed of 20 of the largest issuances and 17 randomly selected issuances that have their prospectuses accessible in Bloomberg in English for Asian and ASEAN jurisdictions. All bonds in the sample were issued between 2018 and 2022. Figure 4.9 outlines the composition of the sample by country and sector.

Figure 4.9. Composition of the sample of sustainable bonds’ contracts by country and issuer type

Concerning the use of proceeds of GSS bonds, no prospectus explicitly forbids refinancing existing eligible projects as allowed by the ICMA Use-of-proceeds Principles. The ability to refinance a qualifying asset may prompt the issuer to retain it instead of selling it. However, this does not lead to new investments since the asset already exists. In certain cases, it may even be detrimental to society to encourage a company, with access to the sustainable bond market, to hold onto an asset rather than selling it to another company. A new company might be more adept at operating the asset in a more efficient approach, but it may lack easy access to public capital markets (for instance, if the former is a listed company and the latter is not) (OECD, 2024[5]).

In addition, no prospectus refers to contractual penalty or default in case of non-compliance with the use of proceeds. More than one-third (39%) of the GSS bonds’ prospectuses mention that refinancing of existing eligible projects is allowed. In one case, when the funds raised are idle, they can be invested in money market instruments. In 32% of the issuances, the prospectus notes that non-compliance with the commitment to use proceeds for eligible projects would not be considered an event of default.

As for the reporting obligations of GSS bonds, there are different approaches in the sample. Almost half (54%) of the GSS bonds’ prospectuses establish that the issuer will provide an annual assurance of the “use of proceeds”, while one-third (32%) will provide an annual assurance of the impact of the projects financed. Issuers have opted for different approaches to disclose their progress. For instance, one issuer will publish a “periodic progress report”. In another case, the issuer will provide a post-evaluation report from the completion of the financed project. Furthermore, the assurance of the impact of another issuer will be provided by a third party. Nevertheless, in no case, failure to comply with these obligations is stated as an event of default. As a matter of fact, in almost one-fifth of the cases (17%), failure to comply with reporting obligations is explicitly excluded from the events of default.

The annual disclosure of the performance is a requirement by the ICMA Sustainability-Linked Bond Principles. While accounting and reporting on the issuer’s performance against relevant KPIs may be costly, in some cases the annual disclosure of this information – and not only when the target is supposed to be reached – may be material for investors. In Asia, the majority of SLB prospectuses in the sample have only one Sustainability Performance Target (SPT) and state that the issuer will provide an annual report on its performance against relevant KPIs. Only around one-third of the prospectuses have two SPTs. The SPT(s) is related to GHG emissions in two-thirds of the cases.

The penalty for not reaching the SPT(s) is an increase in costs either in the form of a higher coupon rate or a one-off payment. 55% of the issuers, will have to increase the annual coupon paid to investors by between 15 and 37.5 basis points. In the remaining cases except one, the penalty is a one-off payment worth between 10 and 25 basis points to fund eligible entities, green projects, or to buy carbon credits.

4.4.2. Overview of international and Asia-specific frameworks proposing relevant requirements for sustainable bonds

The accelerating threat of climate change raises the urgency of the global commitment to climate transition, including the important role of financial markets in aligning investment with net-zero objectives. This has attracted the attention of investors, policy makers, and civil society stakeholders, and has been a factor in the growth of sustainable finance and tailored financial products. As a result, countries have started developing guidelines for debt instruments, following in certain cases the frameworks set out by ICMA.

Table 4.3. Frameworks for sustainable bonds in Asia

|

Country |

Green framework |

Social framework |

Other guidelines |

|---|---|---|---|

|

China |

|||

|

Indonesia |

|||

|

Japan |

|||

|

Korea |

|||

|

Singapore |

|||

|

ASEAN |

Source: Countries’ websites, including securities regulators and ministries of finance.

Among the prominent international frameworks, the guidelines delineated by ICMA serve as a foundational reference point. The ICMA framework provides comprehensive guidance on structuring debt instruments to support sustainable initiatives and mitigate environmental risks.

In line with the global momentum towards sustainable finance, the Asia-Pacific region has witnessed the emergence of national and regional guidelines for classifying a bond as sustainable. Notably, countries within the region have advanced towards formulating frameworks that address both environmental and social dimensions of sustainability.

China has advanced efforts in sustainable finance with the establishment of the China Green Bond Principles, laying the groundwork for financing projects with significant environmental benefits. These principles underscore China's commitment to green finance and provide a framework for issuing green bonds aligned with international standards.

Japan has adopted a multifaceted approach to sustainable finance, as evidenced by the issuance of the Green Bond Guidelines; Social Bond Guidelines; Basic Guidelines on Climate Transition Finance. These guidelines reflect Japan's commitment to addressing climate change and promoting social inclusivity through innovative financial instruments.

Indonesia has delivered different sustainable finance tools including The Green Bond and Sukuk Framework to ensure the integrity of sustainable financial products. Aiming to hone its guidance, the government delivered the SDGs Government Securities Report. This Framework outlines areas of Sustainable Development Goals (SDGs) that can be financed or refinanced by Indonesia’s thematic bonds. These areas include projects or sectors that contribute to climate change mitigation and adaptation (green focus), the advancement of the blue economy (blue focus), and the generation of positive social outcomes (social focus).

Korea has embraced the principles of sustainable finance through the formulation of the Green Bond Guideline, signalling its intent to mobilise capital for environmentally beneficial projects. These guidelines underscore Korea's proactive stance towards addressing climate change and fostering green investments.

Singapore has emerged as a leading hub for sustainable finance in the Asia-Pacific region, bolstered by the implementation of the Singapore Green Bond Framework. This framework provides issuers with clear guidelines for issuing green bonds, thereby facilitating capital flows towards environmentally sustainable projects.

The Association of Southeast Asian Nations (ASEAN) has taken collaborative action to promote sustainable finance through the adoption of the ASEAN Green Bond Standards, the ASEAN Social Bond Standards, the ASEAN Sustainability Bond Standards and the ASEAN Sustainability-Linked Bond Standards (see Box 4.1). These standards provide a unified framework for promoting sustainable investment across the ASEAN region, thereby fostering economic resilience and environmental stewardship.

Box 4.1. ASEAN standards with respect to sustainable bonds

ASEAN Green Bond Standards

The ASEAN Green Bond Standards were introduced in November 2017, and have been developed in collaboration with the International Capital Market Association (ICMA) based on ICMA’s Green Bond Principles. The ASEAN Green Bond Standards are aligned and guided by four core components: use of proceeds, the process for project evaluation and selection, management of proceeds, and reporting. Key features include:

Eligible Issuers: to create a green asset class for the ASEAN region, the Issuer or issuance of the green bond must have a geographical or economic connection to the region.

Ineligible Projects: fossil fuel power generation projects are excluded from the ASEAN Green Bond Standards, so as to provide further guidance to investors and Issuers as to what qualifies as green in order to mitigate greenwashing of projects and protect the ASEAN Green Bonds label.

Continuous Accessibility to Information: the ASEAN Green Bond Standards further set out how investors are to be given access to information continuously by requiring the Issuers to disclose information on the use of proceeds, process for project evaluation and selection, and management of proceeds to investors in the issuance documentation, as well as ensuring such information is publicly accessible from a website designated by the Issuer throughout the tenure of the ASEAN Green Bonds.

Encourage More Frequent Reporting: in addition to annual reporting, Issuers are encouraged to provide more frequent periodic reporting which would increase transparency on the allocation of proceeds and investor confidence in the ASEAN Green Bonds.

External Review: the appointment of an external reviewer is voluntary under the ASEAN Green Bond Standards. However, considering the nascent stage of green bond market development in ASEAN, the ASEAN Green Bond Standards nonetheless require the external reviewers to have the relevant expertise and experience in the area that they are reviewing.

ASEAN Social Bond Standards

To support ASEAN’s sustainable development needs, the ASEAN Social Bond Standards complement the ASEAN Green Bond Standards and are based on ICMA’s Social Bond Principles. Key features include:

Eligible Issuers: to create a social asset class for the ASEAN region, the Issuer or issuance of the social bond must have a geographical or economic connection to the region.

Ineligible Projects: projects which involve activities that pose a negative social impact related to alcohol, gambling, tobacco, and weaponry are excluded from the ASEAN Social Bond Standards. Issuers are also encouraged to develop a list of additional ineligible projects for the issuance of their ASEAN Social Bonds, if applicable.

Continuous Accessibility to Information: the ASEAN Social Bond Standards further set out how investors are to be given access to information continuously by requiring the Issuers to disclose information on the use of proceeds, process for project evaluation and selection, and management of proceeds to investors in the issuance documentation, as well as ensuring such information is publicly accessible from a website designated by the Issuer throughout the tenure of the ASEAN Social Bonds.

Encourage More Frequent Reporting: in addition to annual reporting, Issuers are encouraged to provide more frequent periodic reporting which would increase transparency on the allocation of proceeds and investor confidence in the ASEAN Social Bonds.

External Review: the appointment of an external reviewer is voluntary under the ASEAN Social Bonds. However, considering the nascent stage of green bond market development in ASEAN, the ASEAN Social Bonds nonetheless require the external reviewers to have the relevant expertise and experience in the area that they are reviewing. The external reviewers’ credentials and the scope of the review conducted must be made publicly accessible from a website designated by the Issuer throughout the tenure of the ASEAN Social Bonds. Such disclosure will contribute towards awareness creation and increased investor confidence.

ASEAN Sustainability Bond Standards

The ASEAN Sustainability Bond Standards were developed based on the ICMA’s Sustainability Bond Guidelines and intend to provide guidance on the issuance of ASEAN Sustainability Bonds. ASEAN Sustainability Bonds are bonds where the proceeds will be exclusively applied to finance or re-finance a combination of both Green and Social Projects that respectively offer environmental and social benefits.

The Issuer of an ASEAN Sustainability Bond must comply with both the ASEAN Green Bond Standards (ASEAN GBS) and the ASEAN Social Bond Standards (ASEAN SBS). The proceeds allocated for the Project must not be used for Ineligible Projects specified by the ASEAN GBS (i.e., fossil fuel power generation projects) as well as the ASEAN SBS (i.e., projects which involve activities that pose a negative social impact related to alcohol, gambling, tobacco, and weaponry).

ASEAN Sustainability-Linked Bond Standards

In October 2022, the ASEAN Sustainability-Linked Bond Standards were developed to facilitate the role sustainability-linked bonds can play in funding companies that contribute to sustainability. The ASEAN Sustainability-Linked Bond Standards intend to enhance transparency, consistency and uniformity of ASEAN Sustainability-Linked Bonds which will also contribute to the development of a new asset class, reduce due diligence cost, and help investors to make informed investment decisions. (ICMA) Sustainability-Linked Bond Principles, as they are internationally accepted and widely used. Key features include:

Eligible issuers: to create a sustainable asset class for the ASEAN region, the Issuer or issuance of the sustainability-linked bond must have a geographical or economic connection to the region.

Continuous accessibility to information: the ASEAN Sustainability-Linked Bond Standards further set out how investors are to be given access to information continuously by requiring the Issuer to disclose information on the ASEAN Sustainability-Linked Bond’s KPIs, SPTs, bond characteristics, reporting and verification in the relevant pre- and post-issuance documentation, as well as ensuring such information is publicly accessible from a website designated by the Issuer throughout the tenure of the ASEAN Sustainability-Linked Bonds.

Encourage more frequent reporting: in addition to annual reporting, Issuers are encouraged to provide more frequent periodic reporting which would increase transparency and investor confidence in the ASEAN Sustainability-Linked Bonds.

Increased transparency on reporting timeline: issuers are encouraged to indicate the timeline in which reporting on the ASEAN Sustainability-Linked Bonds will be made available.

External review: issuers must appoint an external reviewer to review the Issuer’s Sustainability-Linked Bond framework. Considering the nascent stage of sustainability-linked bond market development in ASEAN, external reviewers should have the relevant expertise and experience in the area which they are reviewing.

Encourage alignment of KPIs with sustainable development goals: issuers are encouraged to align the KPIs of the ASEAN Sustainability-Linked Bonds with the Sustainable Development Goals (SDGs).

Source: ACMF (2018[6]) ASEAN Green Bond Standards, https://www.theacmf.org/images/downloads/pdf/AGBS2018.pdf; ACMF (2018[7]), ASEAN Social Bond Standards, https://www.theacmf.org/images/downloads/pdf/ASBS2018.pdf; ACMF (2018[8]), ASEAN Sustainability Bond Standards, https://www.theacmf.org/images/downloads/pdf/ASUS2018.pdf; ACMF (2022[9]) ASEAN Sustainability-Linked Bond Standards, https://www.theacmf.org/images/downloads/pdf/ASEAN%20Sustainability-linked%20Bond%20Standards.pdf

4.4.3. Analysis of metric methodologies and their robustness in tailoring products

Metrics serve as the cornerstone of sustainable bonds, providing investors with essential data to evaluate the environmental and social performance of investment projects. This section analyses the methodologies used to develop these metrics and assesses their robustness in tailoring financial products to meet sustainability objectives.

Quantitative metrics

Quantitative metrics are often derived from standardised reporting frameworks and publicly available data sources. These metrics provide investors with tangible data points to assess the environmental impact of investment projects. For example, the ASEAN Green Bond Standards recommends that Issuers use, where feasible, quantitative performance measures such as energy capacity, electricity generation, GHG emissions, and disclose the key underlying methodology and/or assumptions used in the quantitative determination.

Qualitative metrics

Qualitative metrics, including stakeholder engagement practices, corporate governance structures, and human rights policies, offer insights into the broader societal implications of investment activities. While these metrics may lack the precision of quantitative indicators, they provide valuable context for understanding the social and ethical dimensions of sustainable finance. Additionally, qualitative assessments can help capture nuances that quantitative metrics may overlook, enhancing the comprehensiveness of sustainability evaluations.

Methodologies to develop KPIs and metrics

The usefulness of metric methodologies for market participants lies in their robustness and transparency. The frameworks mentioned above highlight the importance of disclosing these elements. The Japanese Green Bond Guidelines, for example, indicate that issuers are recommended to disclose information on underlying methodologies and/or assumptions with the indicators used.

4.4.4. Challenges and limitations

Although significant progress has been made in developing metrics for sustainable bonds in Asia, several challenges and limitations persist, such as data availability and quality issues, limited transparency of methodologies, and evolving regulatory frameworks.

One of the primary challenges facing sustainable bonds in Asia is the limited availability of reliable and consistent data. In many cases, issuers may lack the infrastructure or incentives to collect and disclose relevant sustainability information, making it difficult for investors to assess the environmental and social performance and impact of investment projects. In many cases, market participants do not have access to enough quality data to measure the impact of their investment strategies, relying almost exclusively on qualitative indicators. Improving data availability and quality is essential for enhancing the credibility and transparency of sustainable bonds and facilitating informed investment decision-making.

Another challenge is the limited transparency surrounding the methodologies used to develop sustainability metrics. In some cases, issuers may not fully disclose the criteria and processes used to evaluate sustainability performance, making it difficult for investors to assess the robustness and reliability of sustainable bonds. Enhancing transparency in metric methodologies is crucial for fostering trust and confidence among investors and ensuring the integrity of sustainable finance initiatives.

Additionally, the evolving nature of regulatory frameworks presents additional challenges for sustainable bonds in Asia. Emerging regulatory requirements and reporting standards across jurisdictions can create uncertainty for issuers and investors, leading to the need for markets to adapt. Common standards can help foster a conducive environment for sustainable finance and facilitate the issuance and uptake of sustainable bonds in Asia.

4.5. Policy considerations

The growth of the sustainable bond market in Asia is reason for optimism. It signals a growing interest in the incorporation of sustainability considerations into financial market activities. Additionally, if proceeds of such bonds are invested in projects that support environmental, social and government risk management, this could support to deliver long-term risk-adjusted returns. However, this chapter finds that the regulatory environment and relevant institutions need to further guarantee that sustainable bond markets function in a way that upholds market integrity and protects the interests of investors. With this in mind, the following considerations are of relevance for policy makers in supporting the robust growth of the sustainable bond market segment:

Reinforcing how standards on green, social, and sustainability bonds could provide further transparency on the use of proceed stipulations to better understand financial obligations for not upholding outlined objectives.

Increasing the liquidity of the sustainable bond market. For example, allowing central banks and others to consider the purchase of sustainable bonds for foreign reserve management.

Exploring the extent to which GSS bonds’ proceeds could be used to refinance existing projects, where there could be potential to re-allocate this capital to support sustainability-related objectives. ICMA’s Use-of-proceeds Principles explicitly admit the use of proceeds to re-finance existing projects, and many GSS bonds do indeed allow such a practice.

Considering the extent to which the adoption of contractual penalties could be encouraged in cases where GSS bond proceeds are not invested in eligible sustainability-related projects. Explicit contractual penalties may provide a strong incentive for issuers not to deviate from their stated intent to invest in sustainable projects and reduce the risk of greenwashing.

Introducing additional measures to increase the interoperability of Asian-specific standards for sustainable bonds with internationally recognised standards. Currently, ASEAN standards follow ICMA standards that have been updated since their development, therefore continual discussions on how these should be updated are relevant to ensure that investors continue to invest in bonds issued by Asian entities.

Reflecting upon how reporting requirements on the performance against KPIs could be strengthened to ensure that metrics and methodologies are robust and decision-useful for SLBs.

Identifying tools that could support greater transparency and quality of data on sustainable bond issuance. For example, integrated systems for data and information flow that foster collaboration among relevant stakeholders and relevant market participants.

References

[9] ACMF (2022), ASEAN Sustainability-Linked Bond Standards, https://www.theacmf.org/images/downloads/pdf/ASEAN%20Sustainability-linked%20Bond%20Standards.pdf.

[6] ACMF (2018), ASEAN Green Bond Standards, https://www.theacmf.org/images/downloads/pdf/AGBS2018.pdf.

[7] ACMF (2018), ASEAN Social Bond Standards, https://www.theacmf.org/images/downloads/pdf/ASBS2018.pdf.

[8] ACMF (2018), ASEAN Sustainability Bond Standards, https://www.theacmf.org/images/downloads/pdf/ASUS2018.pdf.

[4] ICMA (2023), Social Bond Principles, https://www.icmagroup.org/assets/documents/Sustainable-finance/2023-updates/Social-Bond-Principles-SBP-June-2023-220623.pdf.

[1] ICMA (2022), Guidance Handbook, https://www.icmagroup.org/assets/GreenSocialSustainabilityDb/The-GBP-Guidance-Handbook-January-2022.pdf.

[3] ICMA (2021), Green Bond Principles, https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/green-bond-principles-gbp/.

[2] OECD (2024), Global Corporate Sustainability Report 2024, OECD Publishing, Paris, https://doi.org/10.1787/8416b635-en.

[5] OECD (2024), Global Debt Report 2024. Bond Markets in a High-Debt Environment, https://doi.org/10.1787/91844ea2-en.