From a policy perspective, identifying reforms can be a daunting task, especially when it is not sufficiently clear where reforms are most needed and what benefits these may bring to domestic firms and consumers. The STRI regulatory database and indices enable policy makers to identify services sectors where reform could be undertaken and simulate the potential impacts of such reforms on the index values. In turn, the simulated indices can be used in empirical analysis to understand the likely impact of a reform impact on key variables such as trade cost reductions or productivity increase in downstream industries. Two reform scenarios are explored below: a horizontal scenario assessing the scope for economy-wide reforms that affect all sectors, and a second which analyses the impact of sector specific reforms.

Revitalising Services Trade for Global Growth

3. Policy approaches to revitalise services trade: Reform scenarios

3.1. Description of the reform package

The first scenario lowers economy-wide barriers. Horizontal reform packages can be particularly impactful as they apply across all sectors in the economy with potential spill-over effects that go beyond services industries. As outlined in previous sections, common horizontal barriers include barriers that affect market entry and operations, barriers to the movement of natural persons, restrictions on access to public procurement markets, and barriers related to regulatory transparency. The objective of the scenario is not to liberalise all existing barriers, but to focus on those that affect most countries. Annex A lists the STRI measures considered for this scenario.

The second scenario considers the impact of easing sector specific barriers. As in the first scenario, the objective is not to assess the impact of removing all barriers recorded in the STRI in each sector, but to identify barriers that are common across countries or barriers that, if removed, could have a substantial liberalising impact. For the purposes of this scenario, several measures across each sector were identified where liberalisation is possible (Annex B). The outcomes are presented in an aggregate format covering the four main services clusters presented in Section 2.

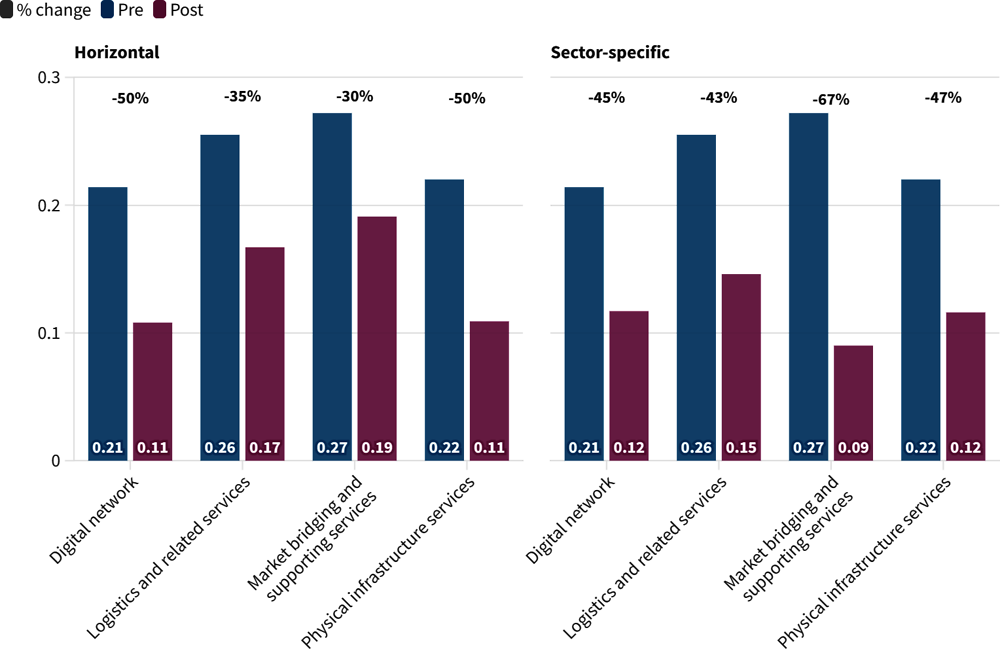

Figure 3.1 presents the changes in the STRI scores as a result of the horizontal and sector-specific reform scenarios. It shows that the horizontal reform scenario would lower the overall STRIs by -50% in the digital network and physical infrastructure services clusters, -35% in the logistics and supply chain services cluster, and -30% in the market bridging and supporting services cluster. The sector-specific reform scenario would add to the latter an additional reduction of -67%, the largest of all four clusters, followed by the other groups with an average of a -45% additional reduction.

Figure 3.1. Impact of the reform scenario on the STRI scores across clusters

Level and percentage change in STRI

Note: The sectors covered in the STRI can be broadly organised around four clusters: 1. Digital network services (telecommunications, computer services, broadcasting, motion pictures and sound recording); 2. Logistics and related services (transport, courier, logistics and distribution services); 3. Market bridging and support services cluster (commercial banking, insurance, accounting and legal services); and 4. Physical infrastructure services cluster (construction, architecture and engineering). For more details, see Box 2.2. Access the interactive version of the graph: https://public.flourish.studio/visualisation/18315944/

Source: OECD calculations based on Benz and Jaax (2020[24]).

3.2. Implementation of ambitious reforms could generate annual trade cost savings of USD 1 trillion

It is common to quantify the effects of services trade policies by converting indicators such as the STRI into ad valorem trade cost equivalents. This entails estimating the level of a tariff-like measure that would have a comparable impact on trade as a restriction. Ad valorem equivalents or AVEs are expressed as a percentage of the value of services provided abroad and provide an easy way to understand the quantification of restrictiveness. Estimates of STRI AVEs are obtained following the methodology applied in Benz and Jaax (2020[24]).

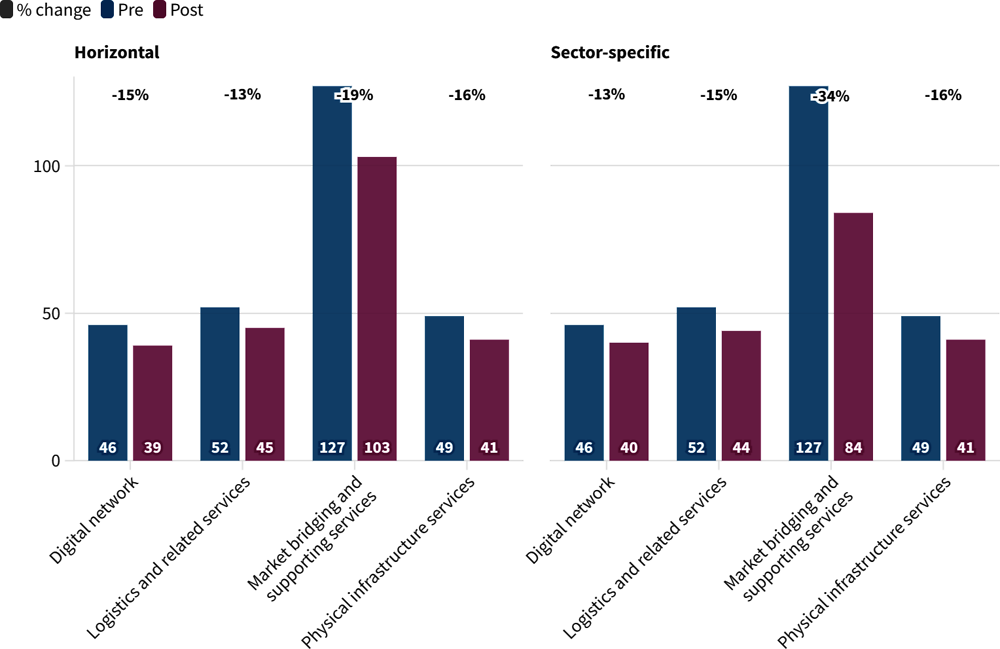

Figure 3.2 shows that market bridging and supporting services would have the most trade costs reductions under both the horizontal and the sector specific scenarios, -19% and -34% respectively. This would translate into substantial reductions in trade costs in financial services, legal, accounting, and auditing services. Physical infrastructure services would also benefit substantially with -16% reduction under both scenarios. Digital network services would have a reduction by -15% under the horizontal scenario, complemented by a further -13% in the sector-specific scenario. Logistics, transport, and other supply chains services would experience a -13% reduction under the horizontal scenario and slightly more, -15%, under the sector specific scenario. Data for distribution services, however, were not available, which means that the trade cost impacts of the reforms are likely to be higher in this cluster.

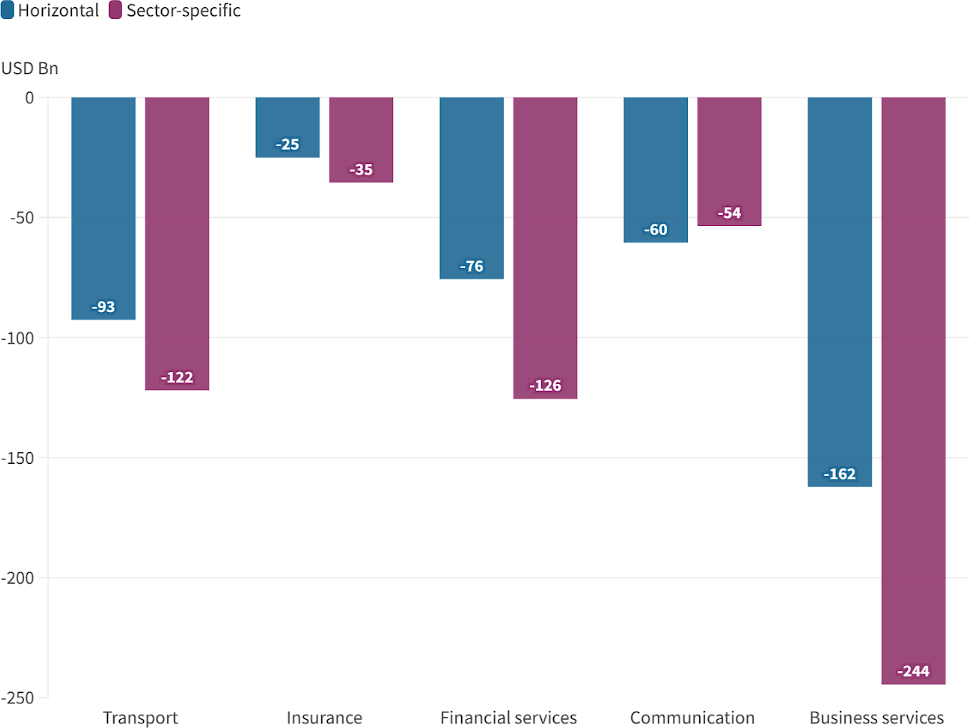

The implementation of these reform packages could bring substantial annual trade cost savings: the horizontal reform package could bring benefits in the range of USD 416 billion, while the sector specific could bring benefits in the range of USD 580 billion (Figure 3.3). Taken together, this would result in benefits in the range of USD 1 trillion (USD 996 billion), with important gains for business sectors, financial services, transport services, and communications services. To better contextualise, this represents close to 1% of global GDP and around 13% of the value of global services trade in 2023.1 The detailed methodology behind the calculations is provided in Benz and Jaax (2020[24]).

Figure 3.2. Trade costs effect of liberalisation emerging from the scenarios

Level and percentage change in ad valorem equivalent

Note: Percentage of export values. The sectors covered in the STRI can be broadly organised around four clusters: 1. Digital network services (telecommunications, computer services, broadcasting, motion pictures and sound recording); 2. Logistics and related services (transport, courier, logistics and distribution services); 3. Market bridging and support services cluster (commercial banking, insurance, accounting and legal services); and 4. Physical infrastructure services cluster (construction, architecture and engineering). For more details, see Box 2.2. The following sectors were not covered in the estimations due to lack of data: broadcasting services, construction services, distribution services, motion pictures and sound recording services. Access the interactive version of the graph: https://public.flourish.studio/visualisation/18319125/.

Source: OECD calculations based on Benz and Jaax (2020[24]).

Figure 3.3. Implementation of the scenario reforms means annual trade cost savings of USD 1 trillion

Annual trade cost savings from the horizontal and sector specific scenarios, USD billion

Note: Simple average of countries for which OECD STRI data are available. Trade data from the OECD-WTO Balanced Trade in Services dataset (BaTIS). Access the interactive version of the graph: https://public.flourish.studio/visualisation/18246543/.

Source: OECD calculations based on Benz and Jaax (2020[24]).

3.3. Reforms could lead to substantial productivity gains

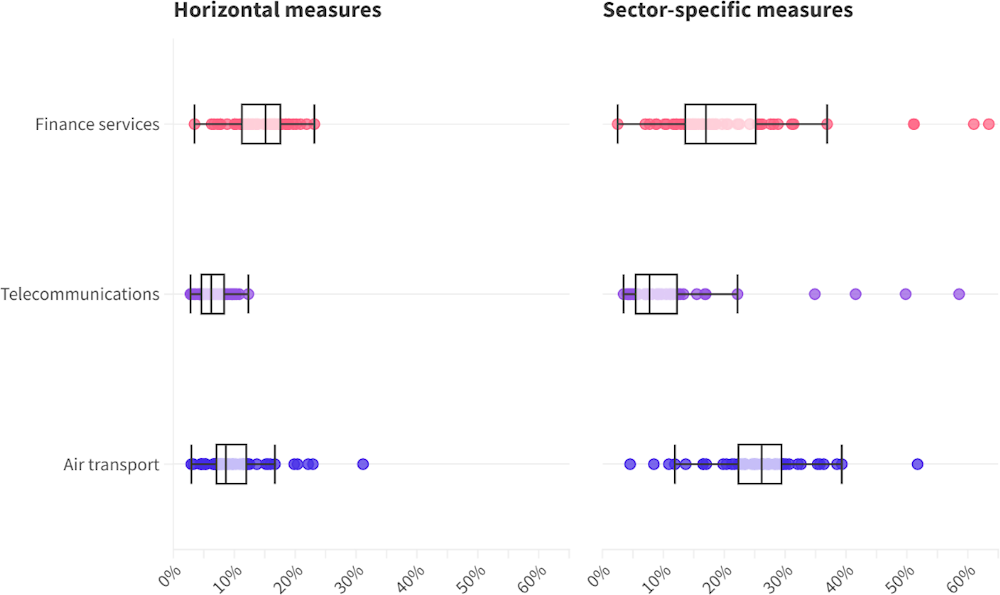

Reducing services trade costs can have far-reaching effects beyond just services. Because services play a crucial role as intermediate inputs across various manufacturing sectors, lowering these costs facilitates manufacturing firms’ access to international markets for essential inputs such as telecommunication, transport, logistics and financial services. Under the scenario analysis, estimated productivity increases for downstream sectors using these services as intermediate inputs are economically significant (Figure 3.4). Using the methodology developed in (Benz et al., 2023[25]), estimates show that lower barriers to trade in air transport, telecommunications, and financial services in the horizontal reform package are associated with an estimated average increase in labour productivity across manufacturing sectors by 10%, 7% and 14% respectively. Productivity gains could be as high as 26%, 12% and 21% in the sector specific reform package for air transport, telecommunications, and financial services. In some economies, productivity gains can exceed 30% in the horizontal scenario for air transport and 50% in the sector-specific scenario for the three services sectors.

The estimated productivity gains from comprehensive horizontal and sector-specific services trade reforms indicate a positive role for an open regulatory framework in promoting sustainable economic growth. However, these impacts are varied and the estimates are indicative, subject to the methodological caveats extensively discussed in the technical literature.

Figure 3.4. Downstream effect on productivity in STRI countries’ manufacturing sectors: Air transport, telecommunications and financial services scenarios

Note: This graph illustrates the estimated gains in manufacturing labour productivity under the horizontal and sector-specific reform scenarios involving trade in finance, telecommunications, and air transport services. The colour dot markers indicate the average expected increase in labour productivity over all the 17 manufacturing sectors included in the analysis for each of the 50 STRI countries. Access the interactive version of the graph: https://public.flourish.studio/visualisation/17847376/.

Source: OECD calculations based on Benz, S., et al. (2023).

Note

← 1. Global GDP was USD 100.88 trillion in 2022. See WB and OECD national accounts data: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD. Moreover, global services trade reached USD 7.54 trillion in 2023. See WTO Global Trade Outlook and Statistics: April 2024, https://www.wto.org/english/res_e/booksp_e/trade_outlook24_e.pdf.