This chapter describes market developments and medium-term projections for world biofuel markets for the period 2024-33. Projections cover consumption, production, trade and prices for ethanol and biodiesel. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world biofuel markets over the next decade.

OECD-FAO Agricultural Outlook 2024-2033

9. Biofuels

Copy link to 9. BiofuelsAbstract

9.1. Projection highlights

Copy link to 9.1. Projection highlightsEmerging economies lead the expansion in biofuel use

The continued increase in global biofuel use relies on two key factors: the rising demand for transport fuel1 and the sustained support from public policies. Overall, biofuels are expected to remain important renewable alternatives to fossil fuels within the transportation sector, with demand projected to increase by 1.2% annually over the coming decade. This growth rate is less than half that over the last ten years. The slowdown in demand growth is attributed to slower economic growth in high-income countries, where demand growth for biofuels is expected to decrease fourfold, dropping to 0.6% annually. This reduction is primarily due to the diminished demand for transport fuel, which is a result of the increasing prevalence of electric vehicles and improvements in vehicle efficiency. However, middle-income countries are expected to offset this decline by increasing their demand for biofuels, achieving an average annual growth rate of 1.9%. This increase is primarily driven by greater demand for transport fuels, growing energy security concerns, and objectives to reduce greenhouse gas emissions.

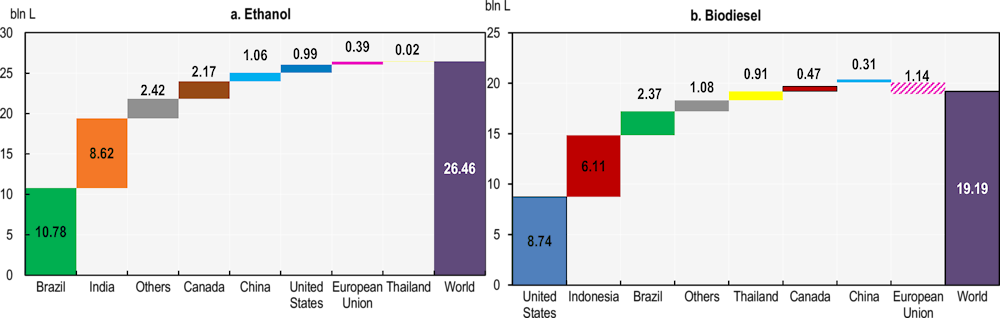

In the United States the focus is expected to shift towards biodiesel (including renewable diesel) over the next decade (Figure 9.1). Renewable diesel is similar to biodiesel but can be used as a drop-in fuel that does not need to be blended with petroleum diesel. This shift is driven by higher targets for renewable fuel programs and the extension of biomass-based diesel tax credits. Conversely, the European Union’s contribution to global biofuel use is expected to decline. The inclusion of sustainability criteria in its revision of the Renewable Energy Directive (RED III) has led the bloc to shift away from first-generation biodiesel by setting a maximum limit for biofuels from food and feed crops. Additionally, feedstocks with a high risk of land use change should not account to fulfill the biofuel targets anymore by 2030. Furthermore, the anticipated efforts towards encouraging the adoption of electric vehicles will limit the expansion of traditional transport fuels and, consequently, the use of biofuels.

Figure 9.1. Regional contribution of growth in biofuel consumption

Copy link to Figure 9.1. Regional contribution of growth in biofuel consumption2033 to base period

Note: panel b. for biodiesel includes renewable diesel

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Emerging economies, notably Brazil, Indonesia, and India, are anticipated to drive most of the new biofuel demand (Figure 9.1), as biofuels continue to serve as the primary decarbonisation option in these regions. All three countries have mandated biofuel shares, rising transport fuel demand, and abundant feedstock potential. Indonesia's biodiesel blending rate is assumed to stay above 30% (B30), with diesel type fuel use expected to rise. In other Southeast Asian nations, biodiesel use is expected to increase due to the growth in transportation fuel demand and industrial use. In India sugarcane-based ethanol is projected to contribute significantly towards the goal of achieving an ethanol blend rate of 15% by 2025, whereas the E17 target would be met by 2033.

First generation biofuels are projected to remain the dominant biofuel type, with maize and sugar products making up most of the feedstock for ethanol, while biodiesel production mainly relies on vegetable oils (soybean, rapeseed, and palm oil). With stronger support, advanced biodiesel production from used cooking oil is projected to gain importance in the European Union, United States and Singapore. Public policies related to production and mandated use usually result in self-sufficient domestic markets, leaving a small international market. The Outlook projects that by 2033, the amount of biodiesel traded internationally will decrease from 13% to 11% of total production, while the amount of ethanol traded internationally will remain the same around 8% of total production.

The price of both ethanol and biodiesel have eased in 2023 due to lower oil prices and ample feedstock supply. Thereafter a rise in nominal terms throughout the projection period is expected, with a slight decline in real terms for ethanol and a slight increase for biodiesel. Policies will continue to compensate the higher production cost of biofuels compared to fossil fuels.

The complexity of biofuel-related policies constitutes the primary source of uncertainty in projecting biofuel market developments. The priority focus shifts towards sustainability, making advanced biofuels or sustainable aviation fuel (SAF) increasingly appealing. However significant investments are still required to scale up production, manage the sustainable certification of feedstocks and enable marketing. Policies ensuring the supply of sustainable feedstocks are imperative, particularly as the focus on finding alternatives for the use of residues and byproducts of agriculture production grows to promote a circular economy approach in production of biofuels.

Without establishing more sustainable production and consumption systems by reusing waste and residue resources, there is a risk that renewable biodiesel will face a feedstock supply crunch if current trends persist. The Outlook projects increasing use of vegetable oils in the food sector, which may lead to a potentially increase in the supply of recycled oil; however, uncertainty remains regarding the development of countries’ capacity to collect recycled oil.

9.2. Current market trends

Copy link to 9.2. Current market trendsIn 2023, global biofuel consumption marked its third consecutive year of steady growth following the lows experienced in 2020. This growth was facilitated by easing biofuel prices worldwide, attributed to a combination of lower oil prices, which boosted demand for transport fuel, and decreased feedstock prices, consequently reducing the production costs of biofuels. These factors collectively sustained incentives for the ongoing adoption and potential expansion of biofuel usage.

Governments encourage the use of biofuels primarily to bolster energy security and to advance the reduction of GHG emissions. With the costs of producing biofuels still exceeding those of their fossil fuel counterparts, biofuel production has been made possible by public support policies and future growth is expected that it will continue to depend on them. While the implication for energy prices of the Russia’s war against Ukraine has underscored the significance of the energy security rationale, its impact on the biofuels markets remains limited. The expansion of biofuels aligns with their critical role in the global strategy for decarbonising the transport sector.

9.3. Market projections

Copy link to 9.3. Market projections9.3.1. Consumption and production

Asian countries are driving biofuel supply and demand

This Outlook expects a slower growth rate of biofuel consumption and production globally, both projected at 1.5% p.a. during the projection period. This is less than half the pace observed in the previous decade, primarily as result of reducing support policies in developed countries for conventional biofuels. With nearly two-thirds of the anticipated growth in biofuel demand expected to take place in emerging economies (Figure 9.1), notably in India, Brazil, and Indonesia, shifts in market shares are anticipated. In 2023, for ethanol, 55% of supply and demand is currently held by high income countries. However, it is anticipated that over the next decade, this share will decrease to 49%, with middle-income countries gaining prominence. For biodiesel, market shares are projected to remain relatively stable, with consumption slightly converging as middle-income countries gain a 4 percentage-point share over the next ten years, while their share in global production is expected to slightly increase.

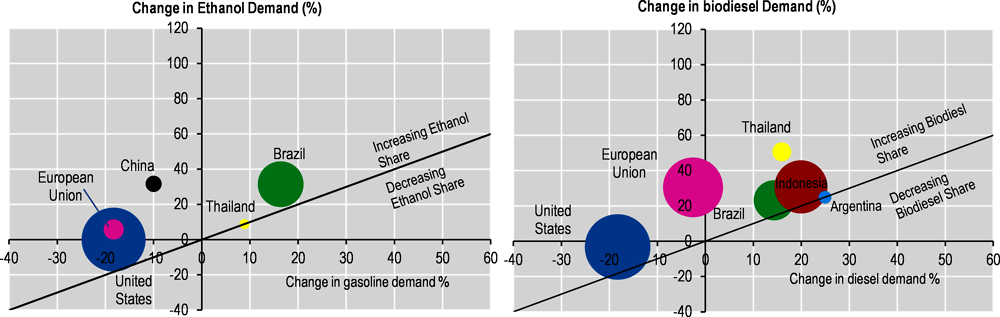

The IEA World Energy Outlook 2023 projects a decline in the total transport fuel use in both the European Union and the United States, suggesting limited growth potential for biofuel use. However, despite this trend, global demand for biofuels is anticipated to rise. This increase is attributed to developments in transportation fleets in certain countries where total fuel consumption is projected to grow, coupled with domestic policies favouring higher blends. As depicted in Figure 9.2, biofuel use is expected to expand faster than total transport fuel demand globally, signaling a rise in the biofuel share within total transport fuels.

Global ethanol and biodiesel production is projected to increase to 155 bln L and 79 bln L, respectively, by 2033. In 2023, ethanol’s total feedstock was made up of 59% maize, 24% sugarcane, 6% molasses and 2% wheat, with the remaining 9% being a mix of assorted grains, cassava, and sugar beets. Biodiesel’s total feedstock consisted of 65% vegetable oils (30% palm oil, 20% soybean oil, 11% rapeseed oil) and 27% used cooking oils, with the other 8% being made up of non-edible oils and animal fats.

Figure 9.2. Biofuel demand trends in major regions

Copy link to Figure 9.2. Biofuel demand trends in major regions

Note: Shares calculated on demand quantities expressed in volume. The size of each bubble relates to the consumption volume of the respective biofuel in 2023.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Despite the increasing scrutiny of the sustainability of biofuel production witnessed in many countries, and notwithstanding significant variations in feedstock composition (Table 9.1), conventional (or food-related) feedstocks are expected to remain predominant in the industry (Figure 9.3). While cellulosic feedstocks —such as crop residues, dedicated energy crops, or woody biomass — offer promising alternatives that avoid competition with food sources, these advanced feedstocks are not expected to experience a substantial increase in their share of total biofuel production.

United States

Biofuel policies in the United States revolved around the Renewable Fuel Standard (RFS) program and various state policies The program mandates a specific annual volume of renewable fuels to be blended into conventional transportation fuels. Current mandates were set for 2023 through 2025 by the Environmental Protection Agency (EPA). Despite an anticipated decline in gasoline consumption, largely due to better vehicle efficiency and an increase in the number of electric vehicles, ethanol production and consumption are expected to increase. This growth is attributed to the expected rise in the ethanol blend rate to 13% by 2033, although the standard 10% blend rate will persist. However, petroleum refiner preference for renewable diesel in meeting EPA mandates and infrastructure limitations will constrain the expansion in use of fuels with greater ethanol inclusion..

Maize is expected to continue as the primary feedstock for ethanol production, comprising 99% of production by 2033. Meanwhile, capacity for cellulosic ethanol production from non-food sources is assumed to grow gradually over the projection period, albeit from a low initial level. Despite the United States retaining its position as the largest ethanol producer globally (Table 9.1), its share is projected to decline from 46% to 41%. Biodiesel production is projected to increase by 2.2% p.a., to account for 25% of global production in 2033. This growth is propelled by increased consumption of renewable diesel, driven by rising targets in federal and state renewable fuel programmes, notably the low carbon fuel standard (LCFS) in California.

Table 9.1. Biofuel production ranking and major feedstock

Copy link to Table 9.1. Biofuel production ranking and major feedstock|

|

Production #ranking in 2021-2023 (market shares) |

Major feedstock used in base period 2021-2023 |

||

|---|---|---|---|---|

|

|

Ethanol |

Biodiesel |

Ethanol |

Biodiesel |

|

United States |

#1 (46.9%) |

#2 (19.2%) |

Maize |

Soybean oil, used cooking oils |

|

European Union |

#4 (4.9%) |

#1 (31.3%) |

Maize / wheat / sugar beet |

Rapeseed oil /Palm oil/ used cooking oils |

|

Brazil |

#2 (24.9%) |

#4 (11.7%) |

Sugarcane / maize / molasses |

Soybean oil / used cooking oils |

|

China |

#3 (8%) |

#5 (4.2%) |

Maize / cassava |

Used cooking oils |

|

India |

#5 (4.8%) |

#15 (0.3%) |

Sugarcanes / molasses / maize / wheat / rice |

Used cooking oils |

|

Canada |

#6 (1.5%) |

#12 (0.7%) |

Maize / wheat |

Used cooking oils / Canola oil/ soybean oil |

|

Indonesia |

#18 (0.1%) |

#3 (18.9%) |

Molasses |

Palm oil |

|

Argentina |

#8 (1%) |

#6 (3.1%) |

Maize / sugarcane/ molasses |

Soybean oil |

|

Thailand |

#7 (1.2%) |

#7 (2.6%) |

Molasses / cassava/ sugarcane |

Palm oil |

|

Colombia |

#15 (0.3%) |

#9 (1.3%) |

Sugarcane |

Palm oil |

Notes: #numbers refer to country ranking in global production; percentages refer to the production share of countries in the base period.

In the OECD-FAO Agricultural Outlook 2024-2033, biodiesel includes renewable diesel (also known as Hydrotreated Vegetable Oil or HVO), although these are different products.

Source: OECD/FAO (2024), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The European Union

The Renewable Energy Directive (RED) serves as the legal framework governing the advancement of clean energy across multiple sectors, including transportation, within the European Union. This directive has undergone two significant revisions: initially amended under Directive (EU) 2018/2001 (RED II), and subsequently under Directive (EU) 2023/2413 (RED III). Under the RED, specific targets are set for the share of renewable energy within total energy consumption of each European Member state, currently aiming for 29% by 2030. Regarding biofuels, the RED originally included mandates for the blending of biofuels into conventional fuels, aiming to reduce GHG emissions and dependency on fossil fuels. Since RED II, there are limits for using feedstocks from food and feed crops, which restricts the expansion of agricultural feedstocks to be used in biofuel consumption. Moreover, biofuels have faced stricter sustainability criteria in response to concerns regarding their indirect land-use change (ILUC) effects, with clear rules defined to categorise high-risk ILUC feedstocks. While palm oil is not explicitly mentioned and can be certified for low-risk ILUC, it is the only feedstock that falls under the high-risk category under the current regulation. Additionally, RED III has raised the target for advanced biofuels from 3.5% to 5.5% by 2030. Supporting measures to reach this target include limitations on certain feedstocks, such as food crops, while incentivising the utilisation of advanced biofuels derived from waste or residues.

The anticipated reduction in both diesel and gasoline demand, in line with the projections of the European Union Agricultural Outlook 2023-33 report, is expected to significantly dampen the growth of ethanol and biodiesel consumption. Projections indicate a marginal increase of only 0.4% p.a. for ethanol consumption and negligible decrease for biodiesel. The proportion of biodiesel within the total diesel fuel supply is expected to rise from its current level of 10% to 12%, while the share of ethanol in gasoline consumption is projected to climb to 8%, up from the current 6%. While biodiesel production will remain stable, there will be a notable shift in its feedstock composition due to the RED III. Specifically, the proportion derived from palm oil is projected to decrease from the current 17% to 7% by 2033, driven by sustainability concerns. Biodiesel production from used cooking oils is projected to increase by 2.8% p.a., albeit at a slower compared to the previous decade due to constraints in feedstock availability. As a result, its global production share is projected to decrease from 29% to 23% over the coming decade, with the United States surpassing its leading position as the foremost biodiesel producing region.

Brazil

Brazil has a large fleet of flex-fuel vehicles capable of operating on gasohol (gasoline-ethanol blend) or pure hydrous ethanol. The ethanol blend rate in gasohol varies between 18% and 27%, influenced by the price relationship between domestic sugar (the main feedstock) and ethanol. Since 2015, the mandated ethanol percentage stands at 27%. In 2022, fuel tax exemptions and declining gasoline prices led consumers to favor gasoline over hydrous ethanol, benefiting anhydrous ethanol inclusion. The biodiesel blending target decreased from 15% to 10% since 2021 but returned to 15% in 2023, a policy likely to persist until 2033 according to current projections by Brazil's National Energy Policy Council.

Unlike the United States and the European Union, Brazil is projected to witness an increase in total fuel consumption of gasoline and diesel over the next decade, suggesting potential growth in blending biofuels with these fuels. Brazil is expected to maintain its position as the world's second-largest producer and consumer of fuel ethanol over the next decade. Ethanol consumption and production in Brazil are both projected to increase by 2.1% p.a., driven by the National Biofuels Policy (RenovaBio) program. Launched in 2017, the program plays a pivotal role in fulfilling Brazil’s commitments under the Paris Climate Agreement. While sugarcane is anticipated to remain the primary feedstock for ethanol production, maize usage has surged in recent years, rising from below 0.5 bln L to over 4 bln L in 2023. The Outlook predicts maize will continue gaining ground in the feedstock mix, reaching nearly 7 bln L by 2033.

Indonesia

The implementation of B35 and B40 (Biodiesel 35% and 40% blend) aims at reducing the country’s dependency on imported fossil fuels, stabilising palm oil price, reducing GHG emissions and sustaining the domestic economy as it accounts for nearly half a million jobs in the country. In recent years, biodiesel production has steadily increased due to a national biodiesel programme, which provides support to biodiesel producers. This programme is financed by the crude palm oil (CPO) fund, which is sustained by levies imposed on CPO exports. In 2023 the CPO fund revenue from the export levy stood at around USD 2.5 billion. The CPO funds depend on the stablished reference price which changes often over time. In 2024, the reference price has been set around USD 750 per tonne. The Outlook assumes producer prices will stay above USD 1 000 per tonne in nominal terms, well above the current reference, thus allowing replenishment of the CPO fund which will continue to subsidize domestic biodiesel production. At the same time, the level of the subsidy relies to some extent on the cost of fossil fuels so oil prices increasing over the projection period will help to reduce the subsidy per unit of biodiesel.

Based on these assumptions, biodiesel production in Indonesia is projected to increase to nearly 18 bln L by 2033. While currently the blending rate stays slightly above 30%, the Outlook assumes it could reach around B35 in 2033. Achieving B40 would require increasing support to biodiesel producers. Such support can only be achieved by means of higher vegetable oil world prices and increasing exports.

India

India has accelerated its ethanol production aiming to achieve the ambitious target of E20 (Ethanol 20% blend) by 2025 rather than 2030. However, the Outlook foresees limitations on the feedstock supply to increase biofuel production to reach the target levels over the Outlook period. While the Outlook assumes molasses and sugar cane juice would remain as the primary feedstocks, other crops such as rice, wheat and other coarse grains will help to accelerate domestic production. In particular, sugar cane for which, aided by soft loans, sugar mills are investing and developing the capacity to produce ethanol from sugarcane juice. In 2023 it is estimated that about 35% of ethanol was produced by sugarcane, this share is projected to remain stable. However, given the accelerating gasoline demand, the blending target of E20 would be met only in 2032. Ethanol production is expected to reach nearly 15 bln L in 2033. The limited supply of vegetable oils, for which India is a net importer, combined with high international prices, will remain the main constraints on significantly increasing biodiesel production.

China

China's biofuel policies have experienced volatility in recent years, hindering significant consumption growth. Biofuels are not explicitly mentioned in the country’s pledge to achieve a peak in carbon dioxide emissions by 2030. This Outlook assumes that the ethanol blending rate which was around 1.6% in recent years will increase to 2.5% in 2033. This increase is anticipated to offset the projected decline in total gasoline usage, thereby sustaining a 1.1% annual growth in ethanol consumption over the next decade. Similarly, biodiesel consumption is projected to grow by 2% p.a. The Outlook assumes that most ethanol demand will be met by domestically produced feedstock.

Canada

The Canadian Clean Fuels Standard (CFS) which became a law in 2022 promotes biofuels use in Canada by increase incentives for the development and adoption of clean fuels, technologies, and processes. CFS aims at a 15% reduction (below 2016 levels) in carbon intensity of transport fuels by 2030. Effective January 2023, 10% renewable content in gasoline and 15% in diesel are requires.

Argentina

In Argentina, the Biofuels Law of 2021 mandated biodiesel blend rate with diesel at a minimum of 5% but can be reduced to 3% when prices of feedstock increase in such a way that is deemed to distort fuel prices. In June 2022, the government passed a resolution to increase the biodiesel mandate from B5 to B7.5 but allowing it to be temporarily increased as high as B12.5 to be able to react on diesel shortages. The Outlook assumes B7.5 as blending target. With limited additional export possibilities, biodiesel production is projected to increase only marginally over the next ten years.

The ethanol blending target has been maintained at 12% despite a push from bioethanol producers to have it increased to 15%. The Outlook assumes the rate will remain at this target and with total gasoline use projected to increase, ethanol fuel use is projected to increase by 0.7% p.a.

Thailand

Despite the targets set in the Alternative Energy Development Plan (AEDP) for sugar cane (and indirectly molasses) and cassava, limited domestic availability is expected to constrain biofuels production. In addition, stagnating demand for fossil fuels will limit increasing demand for ethanol. On average, blending is expected to be around 11% over the Outlook period and production is projected to remain stagnant around 1.5 bln L over the next decade. Biodiesel demand is expected to be supported by the mandatory blending. However, palm oil supply and high vegetable oil prices will constrain domestic supply and demand will increase to 2.5 bln L by 2033.

Colombia

Ethanol demand is projected to increase over the Outlook period in line with the recovery of gasoline demand. Over the medium term, the blending rate is projected to return to 10%. This Outlook assumes sugarcane will continue to be the main feedstock. By 2033 biofuels use will account for about 30% of sugarcane production against about 15% in the base period, thus consolidating ethanol as an important element in sustaining the Colombian sugarcane industry. The biodiesel blending rate has been above 10% and is expected to remain so over the projection period.

Other countries

Other relatively important producers of ethanol include Paraguay, the Philippines, and Peru, where production could reach nearly 1 bln L, 0.6 bln L and 0.2 bln L, respectively, by 2033. The blending rate in Paraguay is assumed to recover and reach 30% in 2033. Malaysia, the Philippines and Peru are also major biodiesel producers, where production could reach 1.4 bln L, 0.3 bln L and 0.3 bln L, respectively, by 2033. In Malaysia, blending is projected to remain around 9%, whereas in Peru and the Philippines it will be around 7% and 4%, respectively. Other Asian countries, in particular Singapore, could increase production to reach around 0.9 bln L of biodiesel from UCO in 2033. Unlike most countries where biofuels are domestically used to reduce GHG emissions and to reduce national dependency on imported oil, production of biodiesel in Singapore is largely for export.

9.3.2. Trade

Global biofuel trade is expected to remain constant

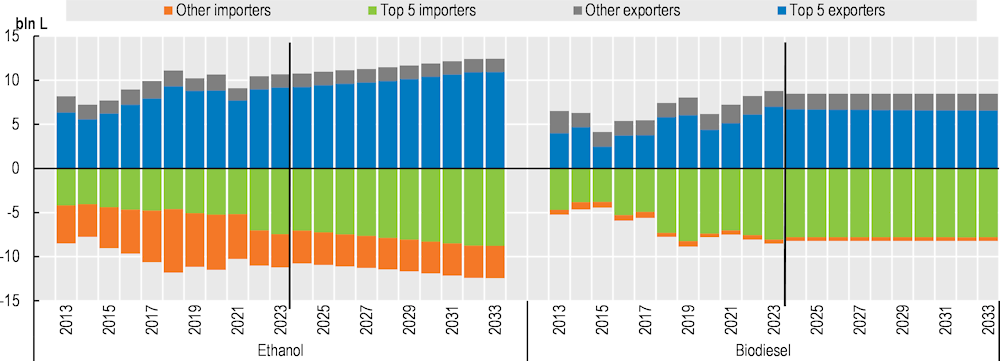

World ethanol trade is projected to increase from 10.7 bln L to 12.4 bln L by 20233, with its total share of production staying around 8% throughout the projection period. The United States and Brazil are expected to remain the main exporters of maize- and sugarcane-based ethanol. The export share of both countries together is expected to remain at about 75%, with the United States gaining some export shares from Brazil.

Globally, biodiesel trade accounts for 13% of production and is projected to decrease from 8.8 bln L to 8.4 bln L by 2033 reducing the share in production to 11%. Indonesian biodiesel exports fell dramatically in 2020 and have remained low since. Reflecting high domestic demand, the Outlook does not expect Indonesia to return to international markets with significant biodiesel exports. The top five exporters of biodiesel ̶ China, the European Union, the United States, Argentina, and Indonesia ̶ are projected to increase their market share from 75% in the base period to 78% in 2033 (Figure 9.4).

Figure 9.4. Biofuel trade dominated by a few global players

Copy link to Figure 9.4. Biofuel trade dominated by a few global players

Note: Top five ethanol exporters in 2033: United States, Brazil, European Union, Pakistan, Paraguay. Top five ethanol importers in 2033: Canada, European Union, Japan, United Kingdom, the Philippines. Top five biodiesel exporters in 2033: China, European Union, United States, Argentina, Indonesia. Top five biodiesel importers in 2033: European Union, United States, United Kingdom, China, Canada. Classification of biofuels by domestic policies can result in simultaneous exports and imports of biofuels in several countries.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

9.3.3. Prices

Prices in real terms are expected to decrease

Following their peak in 2022, nominal prices for both biodiesel and ethanol experienced a decline in 2023, a trend expected to persist into 2024 and primarily attributed to lower feedstock and oil prices. Subsequently, projections indicate a gradual increase in nominal biofuel prices up to 2033. However, in real terms, ethanol and biodiesel prices are anticipated to decrease over the next decade (Figure 9.5).

9.4. Risks and uncertainties

Copy link to 9.4. Risks and uncertaintiesEvolution of policies and relative prices are key

Uncertainties stem from the policy landscape, feedstock availability, and oil prices. Policy uncertainty includes fluctuations in mandate levels, enforcement mechanisms, investment in non-traditional biofuel feedstock, tax exemptions and subsidies for both biofuels and fossil fuels, as well as policies promoting electric vehicles (EVs) and sustainable aviation fuel (SAF) technology.

Fluctuations in fossil fuel prices directly impact the competitiveness of biofuels, often linked to subsidies for the sector. Volatility in oil markets tend to disrupt the biofuels market structure, potentially leaving long-lasting effects. Additionally, uncertainty surrounds feedstock supply, as countries typically prioritise surplus commodities for biofuel production to safeguard food availability and security. While blending mandates are anticipated to drive biofuel production in emerging economies, recent price surges in cereal and vegetable oil markets have reignited debates on the ethical implications of fuel versus food production. Exploring advanced biofuels presents opportunities beyond conventional crops, with cellulosic feedstocks like agricultural residues and energy crops offering potential for expanded production without compromising food supplies. Waste-based feedstocks like municipal solid waste and used cooking oil also offer sustainable alternatives, providing additional benefits for waste management.

The global EV stock has steadily risen since the mid-2000s, with over 20 countries committing to phase out internal combustion engine vehicle sales and eight countries plus the European Union pledging net-zero emission vehicles within the next 10-30 years. Governments worldwide have introduced EV deployment targets, purchase incentives, and supportive programs to boost EV adoption and research. However, EV are currently experiencing reduced sales in the Unites States compared to initial market reaction, possibly attributable to the slower than expected progress in infrastructure development. Moreover, recent discussions among countries concerning protection of domestic markets from imported EV to protect their domestic industry could increase the uncertainty about EV adoption. While SAF consumption and production are not modeled explicitly in the Outlook, any significant increase in their use in the long term may have important impact on the use of advanced feedstocks, contingent upon technological advancements and ambitious policies. Biofuels may also play an important role in the decarbonisation of the maritime industry. Technological advancements and regulatory changes in the transportation sector could significantly impact biofuel market projections. Countries are expected to implement policies promoting new technologies to reduce GHG emissions, introducing uncertainty into agricultural markets and influencing future biofuel demand. The private sector's response to these measures, particularly industries investing in EVs and SAFs, will shape biofuel usage trends over the coming decade and beyond.

Note

Copy link to Note← 1. Global transport fuel use in this Outlook is based on the IEA World Energy Outlook 2023.