This chapter describes market developments and medium-term projections for world sugar markets for the period 2024-33. Projections cover consumption, production, trade and prices for sugar beet, sugarcane, sugar, molasses, and high-fructose corn syrup. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world sugar markets over the next decade.

OECD-FAO Agricultural Outlook 2024-2033

5. Sugar

Copy link to 5. SugarAbstract

5.1. Projection highlights

Copy link to 5.1. Projection highlightsSugar consumption to grow further, maintaining dominance as the main sweetener

Sugar consumption growth is anticipated to double over the next ten years compared to the previous decade, mainly as a result of the faster economic growth projected in low- and middle-income countries across Asia and Africa. Per capita sugar consumption in these regions, is still expected to stay considerably below the level in high-income countries, as the consumption gap is only slightly narrowing. In other regions, encompassing countries across Europe and Oceania, where sugar intake is generally high but declining amid growing health concerns associated with sugar intake, the decline in per capita sugar consumption is projected to persist.

In the next decade, it is expected that sugar will continue to dominate the consumption of caloric sweeteners, accounting for 80% of global utilisation, despite ongoing efforts to find substitutes. Consumption of the main alternative caloric sweetener, high fructose corn syrup (HFCS), or isoglucose, is projected to maintain its share of around 8% of total consumption and will be primarily supplied domestically. Other caloric sweeteners, not covered by this Outlook, will be represented by other corn sweeteners such as glucose or dextrose and the less caloric High Intensive Sweeteners (HIS) such as saccharin, sucralose or aspartame.

Sugar production is expected to expand over the Outlook period by 14%. Sugarcane is projected to account for more than 85% of the total sugar crop output, with Brazil consolidating its position as the largest producer of sugarcane. Investment in Brazil has been steadily increasing in recent years and expansion mainly in area and yield is expected to rise over the next decade. Productivity gains, including varietal improvements and higher extraction rates, will drive sugar production growth in India and Thailand, with acreage projected to remain relatively fixed. In Africa, sugarcane production in the key producer country, South Africa, is anticipated to expand driven by government support measures to the sector, including financial assistance to sugarcane farmers and by support services provided by the South African Sugar Association (SASA). With regards to sugar beet, Europe is projected to remain the main producing region, although production increases are only expected in the Russian Federation (hereafter “Russia”). In the European Union, reduced availability of plant-protection products, the competition for land use by more profitable crops will limit production. In Egypt, the expansion of the sugar beet plantings and the adoption of higher-yielding seed varieties is expected to bolster sugar production over the next years, consolidating its position as the Africa’s largest sugar beet producer by 2033.

Over the next decade, the supply of sweeteners produced from sugar crops will continue to be challenged by competitive crops in key countries such as maize and soybeans in Brazil or cassava in Thailand. In addition, the production of ethanol from sugar crops will continue to influence sugar markets, depending on the profitability of sugar compared to ethanol. In Brazil, the built-in flexibility of the sugar sector allows for both sugar and ethanol production. However, market conditions are anticipated to favour export-oriented sugar production over the Outlook period. In some other countries, implementation of policies promoting the development of biofuels will also add some pressure to the availability of sugarcane for sugar production, especially in India, with the Ethanol Blended Petrol (EBP) Programme aimed at reaching a blending rate of 20% of ethanol in petrol (E20) by 2025/26.

In 2033, Brazil and India are foreseen to account for about 23% (46 Mt) and 19% (38 Mt) of the world's total sugar output, respectively. Better growth prospects are expected in Brazil, supported by profitable sales on the international market while in India, despite improving crop yields and extraction rates, the increase is projected lower given the diversion of sugarcane to ethanol production. Elsewhere, the largest significant increase in production, in absolute terms compared to the base period, is anticipated in Thailand (+ 4 Mt), which is expected to recover from the reduced level of the past few years.

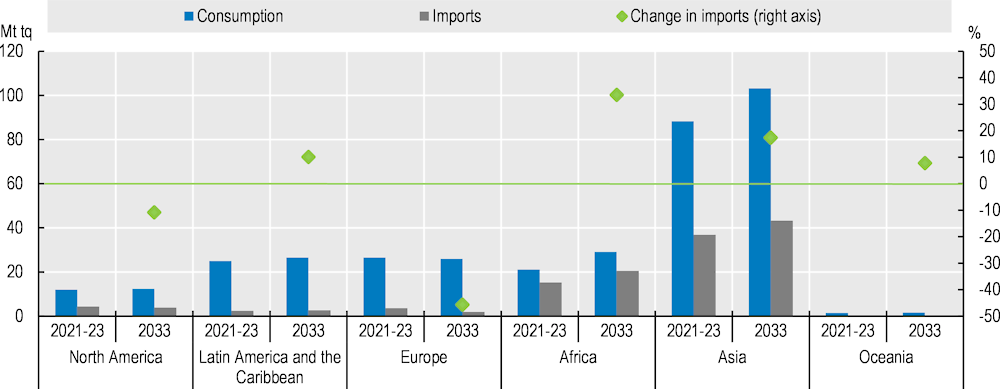

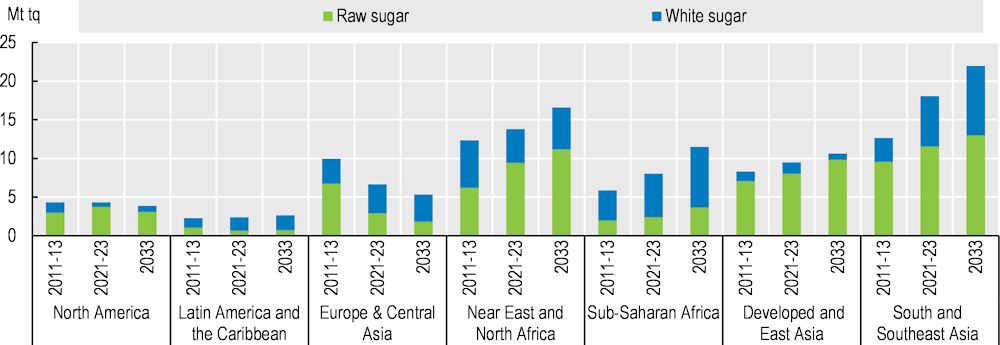

International trade will continue to grow, reflecting expanding demand from deficit regions in low and middle-income economies (Figure 5.1). In the current season, Brazil is foreseen to secure 50% of the global sugar trade, mainly in the form of raw sugar. Over the Outlook period, the global balance between shipments of raw and white sugar is expected to remain the same on average, with approximately 60% being raw sugar and 40% white sugar, as logistical challenges will persist and prevent significant changes in this distribution. In 2033, exports will originate from a handful of countries, with Brazil leading, followed by Thailand and India. Imports are anticipated to remain less concentrated. During the base period (October 2021-September 2024), major importing countries included the People’s Republic of China (hereafter “China”) and Indonesia as the top two, followed by the United States. Over the next ten years, the main increases in imports are projected in Asia and Africa, while the strongest declines are foreseen in the European Union, United States, and Russia on account of higher domestic production.

Figure 5.1. Evolution of sugar consumption and imports, by region

Copy link to Figure 5.1. Evolution of sugar consumption and imports, by region

Note: Data are expressed on a tel quel basis (tq).

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

International sugar prices in real terms are foreseen to fall from the current high levels, following an expected production recovery in India and Thailand, and then slightly decline over the Outlook period. However, the assumption of constant real international crude oil prices is foreseen to limit the downward pressure on prices, by encouraging the use of sugar crops for ethanol production. The white sugar premium (difference between white and raw sugar prices) was particularly high (on average USD 126 per tonne) during the base period due to concerns over tighter global supplies. Over the Outlook period, it is expected that the white sugar premium increases in nominal term due to stronger import demand for refined white sugar compared to raw sugar.

The dynamics of the sugar markets as presented in this Outlook are subject to many risks and uncertainties, including developments in the global macroeconomic context and implementation of new sugar-related policies. In addition, weather conditions, profitability of sugar vis-à-vis ethanol, and competition with other crops are sources of production uncertainty. On the demand side, shifts in the global economy impacting consumers’ purchasing power, consumers’ preferences and inflation levels are key factors that could modify the consumption patterns presented in this Outlook.

5.2. Current market trends

Copy link to 5.2. Current market trendsAfter reaching a multi-year high in September 2023, international sugar prices dropped later in the year driven by the strong pace of production and exports in Brazil, and slower demand. Prices rebounded in early 2024 amid concerns over the Outlook for the upcoming season in Brazil, prompted by below-average rainfall. Unfavourable production prospects in India and Thailand, resulting from prolonged drier-than-normal weather conditions, also contributed to the upward pressure on world sugar prices.

Overall, world sugar production in the 2023/24 season is anticipated to increase from last year, mainly driven by expectations of a large output in Brazil. In addition, production in Europe is forecast to recover from last year’s reduced level on account of both an increase in plantings and higher yields, while a rebound in production is also anticipated in China. On the demand side, despite high prices, world sugar consumption is foreseen to remain strong in 2023/24. The current production and consumption forecasts are expected to push the sugar market into a near balance situation. With larger exportable availabilities from Brazil more than offsetting lower shipments from Thailand and India, world sugar trade in 2023/24 is predicted to expand compared to the previous season. Global import demand is anticipated to increase mainly reflecting a recovery in purchases by China after the decline in 2022/23, and higher imports by India, driven byre-export returns.

5.3. Market projections

Copy link to 5.3. Market projections5.3.1. Consumption

Over the next ten years, growth in global sugar consumption is projected to expand by 1.2% p.a. and reach 198 Mt by 2033, driven by population and income growth. World average per capita consumption is expected to reach 22.8 kg/capita in 2033, up 4% from the base period.

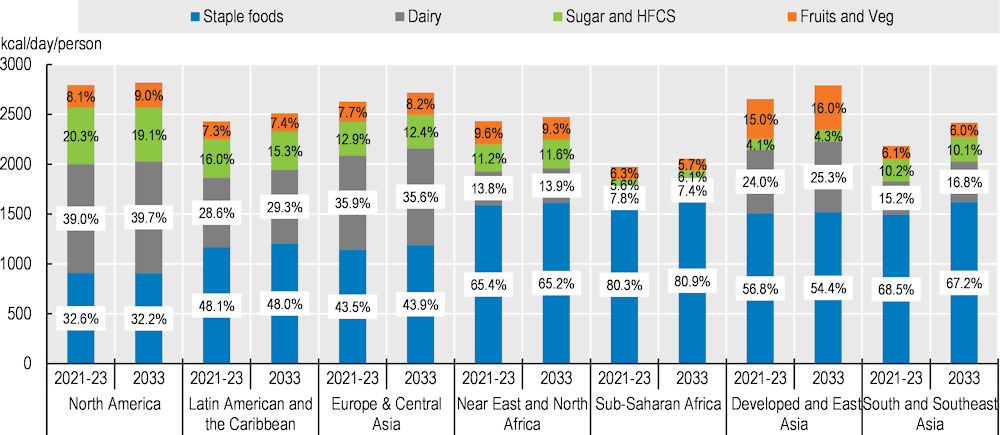

Sugar consumption is set to rise mainly in countries where the level of per capita intake is currently low. Sugar, a fibre-free carbohydrate, is a common ingredient in numerous food and beverage products and represents a key source of energy in the human diet. High levels of sugar consumption are associated with health concerns; WHO recommends reducing the intake of free sugars (i.e. sugar added to foods during production or cooking plus sugars found in honey, syrups, and fruit juices) to less than 10% of the total daily energy intake. As a result, in countries, where per capita consumption of sugar is already high, a decline is expected over the next decade (Figure 5.2).

Figure 5.2. Daily per capita food consumption of calories from the different group carbohydrate sources, in the different regions

Copy link to Figure 5.2. Daily per capita food consumption of calories from the different group carbohydrate sources, in the different regions

Note: Staple foods include cereals, roots and tubers, and pulses.

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Development prospects are stronger in Asia and Africa

Asia and Africa will be the regions that will contribute most to additional global demand compared to the reference period, accounting for 64% and 32% of the world total growth, respectively. Dietary shifts driven by urbanisation and increasing disposable incomes are expected to be key drivers of the increase in per capita consumption in these regions. However, despite the projected increase, per capita consumption by 2033 is anticipated to remain below the global average in both Asia and Africa.

In Asia, per capita consumption is foreseen to grow by 0.9% p.a. over the next decade compared with 0.5% in the last decade. It is expected that India, followed by China and Indonesia, will provide the largest contribution to the overall increase in sugar consumption. In India and Indonesia, population growth, although slower than in the past decade, and income growth associated with stronger demand for processed food and beverage products is expected to sustain the increase in overall sugar consumption over the next decade. In China, consumption has recently stagnated with the rise in prices. However, even if the population declines absolutely after 2023, demand is expected to resume growth during the Outlook period, mainly in second-tier, third-tier and lower-tier developing cities. Nevertheless, China per capita sugar consumption should remain well below the global average level in 2033 (12.8 kg/cap). Strong growth prospects are also expected in Least Developed Asian countries.

In Africa, Least Developed Sub-Saharan countries are foreseen to record the highest growth rate in per capita consumption across the region, primarily due to projected increases in disposable income associated with higher spending on processed foods and beverages. By contrast, in South Africa, the declining trend in per capita sugar consumption recorded in recent years amid government measures to discourage its use is expected to persist in the next decade; with many food manufacturers having already reduced their use of sugar, the decline is expected to be slower than in the past decade.

Over the coming decade, in terms of carbohydrate equivalents, Asia and Africa will remain the regions where the diet will include the greatest proportion of staple foods, (particularly Northeast and North Africa).

Downward trends will continue in other regions, high sugar consuming countries

Traditionally, the Americas, the Caribbean and European countries record the highest level of per capita sugar consumption, and caloric sweeteners represent at least 12% of carbohydrates in the diet, more than 20% in the United States. Since 2010 globally, in those countries, caloric sweetener consumption has trended down with adverse health effects being highlighted. Over the next decade, the decline is projected to continue, although at a slower pace.

In Latin America, the world’s largest sugar exporter, high per capita consumption levels have raised concerns about their negative effects on health. During the last decade, some countries, including Chile, Ecuador, Mexico, Peru and more recently Colombia, have introduced a tax on sugar-sweetened beverages in an attempt to reduce soft drink intake. Measures to limit the sale and/or the promotion of sugary drinks or sweet products to children under 18 years were also taken, and some countries such as Argentina have passed laws for mandatory front-of-package labelling with strict thresholds for healthier products. Over the next decade, per capita consumption is projected to weaken further in some countries, including Argentina, Brazil, Chile, Colombia, Mexico, and Paraguay, or to remain relatively stable.

During the last decade, Europe had the second highest sugar consumption among the seven regions considered in this Outlook, albeit far behind Asia. However, over the next ten years, it will be the only region that will experience a decline. For two decades, European countries have sought to take measures to avoid excessive consumption of sugar. Taxing sugar is among the measures implemented to encourage healthy eating habits, most recently introduced in Poland, and Russia. Food industries have also been looking for solutions to tackle the problem of obesity by changing the composition of their products. Per capita sugar consumption in Europe is expected to see a continuing decline, albeit at a slower pace than in the previous decade. In Ukraine, per capita consumption of sugar, after dropping markedly with the outbreak of the war in February 2022, is projected to recover over the next decade.

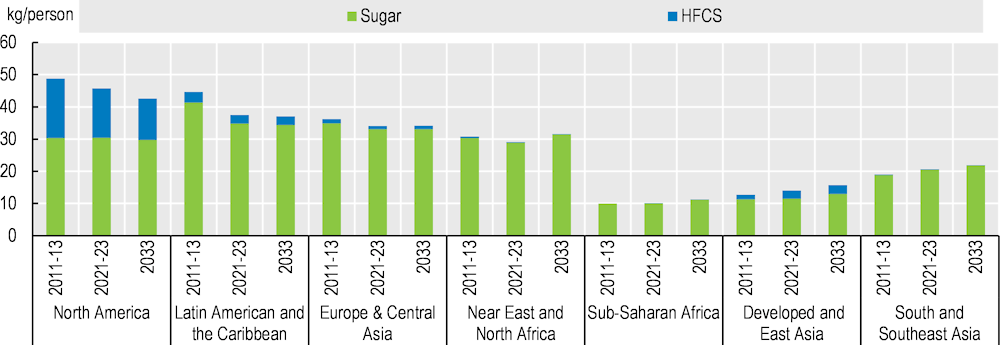

Among the other high sugar consuming countries, the level of consumption is projected to decline in Australia and New Zealand. This trend will also be visible in Canada and the United States (Figure 5.3). However, the United States, which has the highest per capita consumption of caloric sweeteners, 48.1 kg/capita during the base period, is expected to see an increase in the consumption of staple food or fruits and vegetables to the detriment of caloric sweeteners.

Figure 5.3. Per capita consumption of caloric sweeteners

Copy link to Figure 5.3. Per capita consumption of caloric sweeteners

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The High Fructose Corn Syrup market will grow slowly

High Fructose Corn Syrup, the other caloric sweetener, is used primarily in beverages as a substitute for sugar. Unlike sugar, it is a liquid product and therefore less easily traded. Global consumption will remain the domain of a limited group of countries with no major changes. The largest producer, the United States, will remain the main consumer but the debate surrounding whether HFCS poses a greater potential health risk than does sugar is expected to continue, and the downward trend that started in the mid-2000s is expected to continue; by 2033, HFCS is foreseen to represent 32% of the caloric sweetener consumption compared to 36% during the base period. HFCS production in the United States is projected to remain relatively stable at 7 Mt. Per capita, Mexico is the second largest consumer and the efforts of the government to reduce caloric sweetener consumption are expected to continue over the next ten years.

China, the world’s second largest producer, is expected to see the biggest changes as its per capita caloric sweetener consumption is very low compared to the rest of the world. Increasing corn prices since 2020 raised the costs of producing and consuming HFCS leading to some substitution by sugar or other alternative sweeteners in soft drinks (erythritol), depending on relative prices. Over the next decade, with more competitive corn prices, China HFCS production is projected to increase to meet some of the growth in domestic demand (2.8 kg/capita by 2033). No increase is foreseen in Japan and Korea with a consumption of about 6 kg/capita. In the European Union, HFCS will remain uncompetitive with sugar over the next decade, accounting for only 1.2 kg/capita in 2033.

5.3.2. Production

Sugar is a capital-intensive sector, which needs substantial input costs, including energy for sugar beet and fertilisers in both cane and beet to increase yield and sugar content. Over the coming decade, remunerative domestic prices are expected to continue supporting investments and developments, both in crops and in sugar factories. Global sugar production is expected to increase by 14% over the Outlook period.

Global sugar production is expected to increase

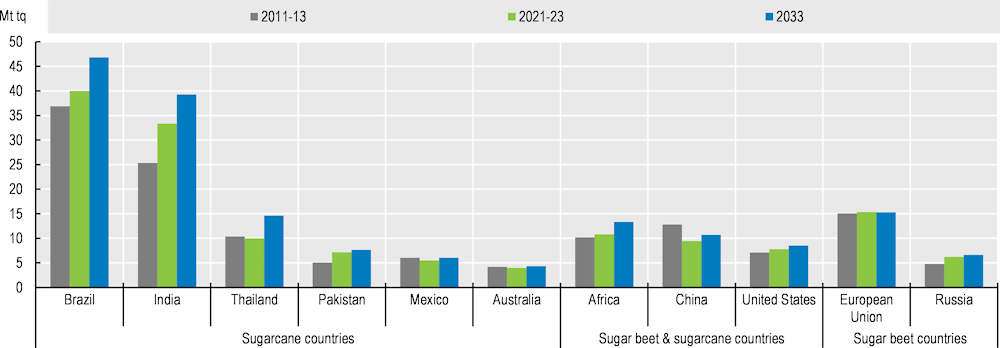

Global sugar production is expected to grow from 178 Mt during the base period to 202 Mt by 2033 with 50% coming from Asia, and 27% from Brazil.

Asia will remain the leading region producing about 41% of the world output in 2033. India and Thailand are expected to provide the largest shares of the region’s global sugar supply, increasing their sugar production by respectively 4.8 Mt and 4.4 Mt by 2033 compared to the base period (Figure 5.4). In Thailand, sugar production is expected to recover from the reduced level in recent years and to increase to a larger degree than sugarcane production thanks to higher sugar extraction rates. In India, the world’s second largest sugar producer, the growth rate in sugar production is expected to be lower than in the past decade, reflecting a slower growth in sugarcane production and greater diversion to ethanol.

Brazil, the world’s largest sugar producer makes Latin America the second largest sugar producing region. Higher investments in fields combined with better weather conditions helped the country’s industry to recover from a long financial crisis. Considering the profitability of international sugar markets, sugar production is expected to increase by 6.5 Mt over the next decade.

Africa is expected to increase its share of global production mainly on account of Sub-Saharan African countries, where government support measures and foreign investments are expected to contribute to increased sugar production. Suitable conditions for growing sugarcane, potential for area expansion and lower costs of production, are expected to underpin the increase in production.

Production in OECD countries is foreseen to continue to lose market share. In 2033, the region will represent 20.8% of the global market, compared to 22.3% in the base period. Although it will retain its position as the main producer of this regional market in 2033 (36%), the European Union's sugar production is expected to decline while higher supply is foreseen in the United States (+0.7 Mt) bolstered by several government policies that support the domestic industry.1

Figure 5.4. Main sugar producing countries/regions classified by sugar crops

Copy link to Figure 5.4. Main sugar producing countries/regions classified by sugar crops

Note: Data are expressed on a tel quel basis (tq).

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Sugarcane will maintain its position as the main sugar crop

Sugarcane will continue to account for more than 87% of sugar crops. Over the Outlook period, global sugarcane production is projected to grow by 1% p.a. and reach 2 016 Mt by 2033, with Brazil, India and Thailand anticipated to contribute the most to the change in global output volume (+135 Mt, +68 Mt and +18 Mt respectively). This mainly reflects relatively higher crop yields notably in India, Thailand and Philippines, while area expansion is mainly expected in Brazil with an additional 1.8 Mha.

Brazil is the leading sugarcane producer, but more than half is used to produce ethanol. In recent years, profitability has encouraged investments in cane fields and cane ratoons have improved. Over the next ten years, more sustainable sugarcane cultivation practices are expected to meet market needs. Some area expansion is foreseen, and the share of area cultivated with sugarcane in total arable land availability (12.0% during the base period) will increase to 13.5% in 2033. Little improvement in yields is foreseen due to drier climatic conditions. Sugarcane will continue to be used almost equally to produce sugar and ethanol.

In India, the growth in sugarcane production is projected to stem mostly from higher crop yields, as acreage is not expected to expand given competition from other agricultural crops. Government support measures, including remunerative prices paid to farmers, financial assistance to facilitate renovation and varietal developments, are expected to sustain sugarcane production over the next years. Similarly, in Thailand, sugarcane production over the next decade is also expected to come mainly from higher yields, while area is expected to remain relatively stable. In China, import tariffs will provide an incentive for authorities in the main producing regions to support farmers and millers in modernising and maximising their yields in the short term. However, only moderate growth is expected as rising input costs and competition for land with other crops will slow efforts and efficiency in the following years.

Prospects are less robust for sugar beet. Transforming this crop requires more energy and fertilisers to maximise yield and sugar content than the production of sugar from sugarcane and this negatively impacts profit margins. Only higher yields will help the crop keep market share, notably in the United States and China, where both sugar crops are cultivated, and beet accounts for 52% and 10% respectively of the totals. In the European Union, production is projected to decline mainly due to high input costs compared to other crops, and stricter environmental legislation of plant protection products; some farmers will turn to more profitable crops. Egypt, China, the United States, Türkiye, Ukraine, and Russia are expected to increase beet production.

In Egypt, remunerative procurement prices and a newly built beet factory are expected to boost plantings of sugar beet, while efforts are also being made to encourage the adoption of improved seed varieties. Government efforts to boost domestic agricultural production generally are expected to contribute to the overall increase in sugar beet area and crop yields and production is expected to increase by 6 Mt compared to the base period.

During the last decade, 81% of world sugar crops were used to produce sugar, but this share is expected to decline to 78% by 2033. In the major sugarcane producing countries, support for biofuel production will intensify competition between the main uses of sugarcane, sugar or ethanol, especially since factories often have the built-in option to switch from one to the other. By 2033, Brazil is expected to remain the main producer with 37% of the world's sugarcane, 23% of global sugar production and 81% of global sugarcane-based ethanol production.

5.3.3. Trade

Sugar trade to remain robust over the Outlook period

Sugar will remain a highly traded product. Although most trade will continue to be represented by raw sugar (59% in 2033), the share of white sugar imports will increase relatively faster (Figure 5.5).

Figure 5.5. Raw and white sugar imports, by regions

Copy link to Figure 5.5. Raw and white sugar imports, by regions

Note: Data are expressed on a tel quel basis (tq).

Source: OECD/FAO (2024), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Imports are foreseen to account for 37% of global consumption in 2033 with Asia and Africa remaining the major importing regions, representing respectively 60% and 27% of global imports. In Africa, efforts to boost domestic production capacities will reduce its share of dependence on imports, but these will still represent 69% of consumption in 2033. The growth in consumption in Least Developed Sub-Saharan countries is expected to drive an increase in the share of imported white sugar for direct consumption. In Asia no significant changes are expected in terms of dependence; imports of raw sugar will continue to increase, mainly driven by key buyers, China and Indonesia.

A continued decline in sugar imports is expected over the coming decade, mainly in the United-States, and Russia due to improving supply prospects while in Japan, this will be due to reduced population. The United States is traditionally a sugar-deficit country where national policies2 will continue to foster domestic production and limit import flows. Given the relatively higher sugar prices in the United States, Mexico will continue to export its sugar primarily to fulfil United States needs. In the European Union, sugar imports are foreseen to decrease to 1.1 Mt by 2033 because of lower demand.

On the export side, sugar markets are projected to remain highly concentrated, therefore reliant on market developments in limited number of countries. By 2033, the traditional three main sugar exporters are anticipated to account for about three quarters of the market: Brazil (64% of raw, 15% of white), Thailand (11% of raw, 14% of white), and India (5% of raw and 11% of white). In India and Thailand, exports of white sugar are projected to account for a larger share of their total sugar exports boosted by higher returns from the white sugar premium. Australia will follow with about 7% of the raw sugar market.

Brazil has initiated projects to develop its storage, port and vessel infrastructures, and gained importance during the blockade of Black Sea freight route. The country will remain the leading global supplier of sugar. Favourable returns for sugarcane-based ethanol production will continue to play a key role, but given the profitable prospects for sugar markets, Brazilian sugar exports are expected to increase by 6.5 Mt and reach 36 Mt in 2033, 19% of which in white shipments from 14% during the base period. The lack of structural whites supply from Brazil, which prioritises raw exports at bulk terminals and faces high competition for empty containers from other export industries in case of white sugar shipments, is expected to persist by 2033.

In Thailand, the world’s second largest sugar exporter, very little ethanol is produced directly from sugarcane (less than 2%) because molasses or cassava are mainly used. Thailand’s share of sugar exports is expected to increase from 10.5% with a volume of 7 Mt in the base period to 15% and reach 11.5 Mt by 2033. In India, sugar exports are not expected to grow significantly amid the government’s continued efforts to promote ethanol.

Box 5.1. Handling practices in raw and white sugar trade

Copy link to Box 5.1. Handling practices in raw and white sugar tradeRaw sugar is derived from sugarcane whereas white sugar can be derived from sugar beet or from sugarcane through refining processes. Raw sugar retains some of the natural molasses and impurities present in sugarcane, giving it a brown color and distinct flavor, it can still be refined into food-grade sugar through further processing steps including clarification, filtration, and crystallization to become white sugar. By contrast, white sugar from beet undergoes extensive refining to remove all molasses and impurities, resulting in its characteristic white color and neutral taste and it is a food-grade product. The quality of both sugars is often measured by the degree of polarization, with a higher value indicating a higher sucrose content and purity. A polarisation value of 100 indicates pure sucrose with no impurities. White or refined sugar, which is suitable for human consumption, typically has a degree of polarisation of at least 99.5. Sugar with a lower degree of polarisation, below 99.5, is often classified as raw sugar. Noteworthy, however, raw sugar that meets specific standards and criteria for purity and cleanliness is referred to as direct consumption raw sugar, or brown sugar, and is suitable for human consumption.

Common raw sugar is typically transported like any other bulk commodity, such as cereals and soybeans, in bulk form, meaning it is not packaged but rather loaded directly into trucks, rail cars, or the holds of ships destined for refineries.

White sugar as food product must be handled under strict hygiene protocols so as to maintain its quality. To ensure that white sugar remains a free-flowing commodity throughout all stages — storage, loading, transport, and delivery — it must be kept dry to prevent or limit clumping, ideally maintaining an ambient humidity level below 70%, and if possible, at a constant temperature. Refined sugar is typically transported in polypropylene bags, which provide protection against moisture and contamination during handling and transportation. For international destinations, white sugar can be loaded onto break-bulk cargo ships, but at a much slower load rate than raw sugar, or onto container ships. The same handling procedures used to transport white sugar also apply to brown sugar for direct human consumption, both being bagged at the time of production and shielded from contaminants during transportation.

Refineries are constructed not only in sugar producer countries but also in non-producer countries capable of capitalising on the white sugar premium by importing raw sugar to process it into refined sugar and thus meet national or regional demand. These countries have a comparative advantage in terms of costs, including freight, energy, processing expenses, and benefit, sometimes, from fiscal regimes and good port infrastructures, such as raw sugar storage capacities, particularly in regions like the Near East and North Africa (NENA) and India. In addition, some refineries are integrated into sugar beet and cane factories for utilisation during periods when the season concludes.

In Brazil, about three-quarters of sugar exports consists of raw sugar. Despite the global gradual transition of transportation methods from bulk vessels to containers over the last decade, bulk carriers for raw sugar continue to be dominant. This preference reflects logistical considerations, lagging refining capacity and trade regimes.

5.3.4. Prices

Sugar prices expected to fall in real terms

International sugar prices, in real terms, are foreseen to fall from the current high levels amid an improvement in global export availabilities and to decline during the projection period on account of productivity gains. The downward pressure on prices is expected to be partially offset by constant real international crude oil prices, as this would encourage the use of sugar crops for ethanol production.

The white sugar premium (difference between white and raw sugar prices), which was particularly high (on average USD 126/t during the base period) due to increasing energy costs and tightness on the white sugar market, is anticipated to increase slightly in nominal terms over the Outlook period, with the increase in the share of white sugar exports in total trade by 2033.

5.4. Risks and uncertainties

Copy link to 5.4. Risks and uncertaintiesThis Outlook assumes normal climatic conditions which gives favourable prospects for sugar crop production. However, unfavourable weather events, such as those linked to climate change, could have a marked impact on output and prices, considering the relatively high market concentration for export. A change in returns compared to alternative crops could also influence planting decisions.

New investments in research and development in the sector including in new breeding techniques such as gene editing, and new diversification opportunities including bioethanol, bioplastics and biogas could also influence the dynamics of the market and availability of sugar for export.

Sugar crops are perishable products that can lose their sugar content if not quickly processed into sugar after harvest. Factors such as ambient temperature, humidity and period of storage also contribute to the decline in sugar recovery. The transport of refined sugar products needs to be done under appropriate conditions to avoid risks such as risks of contamination. Any enhancements in food loss and waste management within the sector might have impacts on the market.

Country-specific market developments may also affect global projections. Sugar markets will continue to be potentially vulnerable to any disruption in Brazil which is expected to play a major role over the Outlook period by representing over 45% of the global trade. In India, sugar exports are only allowed with permission from the Department of Food and Public Distribution since June 2022 to ensure adequate domestic availabilities and keep prices in check. The European Union has increased its raw sugar imports for refining and processed product re-exports, benefiting from the Inward Processing Relief. In addition, availability of shipping containers at country level and freight costs are crucial factors that significantly impact sugar trade on the global market. Finally, any deviation of the white sugar premium from the assumed increase in this Outlook could affect country decisions regarding refining and delivery capacity.

Given that 22% of global sugar crops are used for ethanol production, including 53% of the domestic crop in Brazil, the fluctuation of crude oil vis-à-vis sugar relative prices remains a major source of uncertainty as it affects the competitiveness and profitability of sugar production versus sugar crop-based ethanol production. In Brazil, when ethanol price is less than 70% of the gasoline price, it is more profitable for the driver at the gas station to use ethanol rather than gasoline. In India, the implementation of policies promoting the development of biofuels will add pressure on the availability of sugarcane for sugar, with the Ethanol Blended Petrol (EBP) Programme aimed at reaching a blending rate of 20% of ethanol in petrol (E20) by 2025/26. Any further policy development promoting ethanol production could have a consequential effect on sugar production.

Consumption projections could be influenced by several factors including high price elasticity of demand in countries with high growth prospects, and the potential shift in consumer preferences towards healthier products due to growing health concerns. Additionally, government initiatives such as imposing taxes on sweeteners to promote moderation, investments in research for lower-calorie substitutes, and product reformulation by the food industry could also impact consumption patterns.

Notes

Copy link to Notes← 1. Including the Sugar Loan Program to supports prices paid to farmers; the Sugar Marketing Allotments for domestic production to cover up to 85% of domestic consumption; the Feedstock Flexibility Program to divert any sugar surplus to ethanol production, rather than sugar loan forfeitures to the USDA’s Commodity Credit Corporation; and trade barriers to limit imports to domestic needs (through tariff rate quotas, regional agreements, and the Suspension Agreements on Sugar with Mexico).

← 2. Tariff rate quota (TRQ) allocations under WTO or free trade agreements (FTAs), limited imports from Mexico due to the US Export Limit (set by the US Department of Commerce).