This chapter provides an assessment of Argentina. It begins with an overview of Argentina’s context and subsequently analyses Argentina’s progress across eight measurable dimensions. The chapter concludes with targeted policy recommendations.

SME Policy Index: Latin America and the Caribbean 2024

12. Argentina

Abstract

Overview

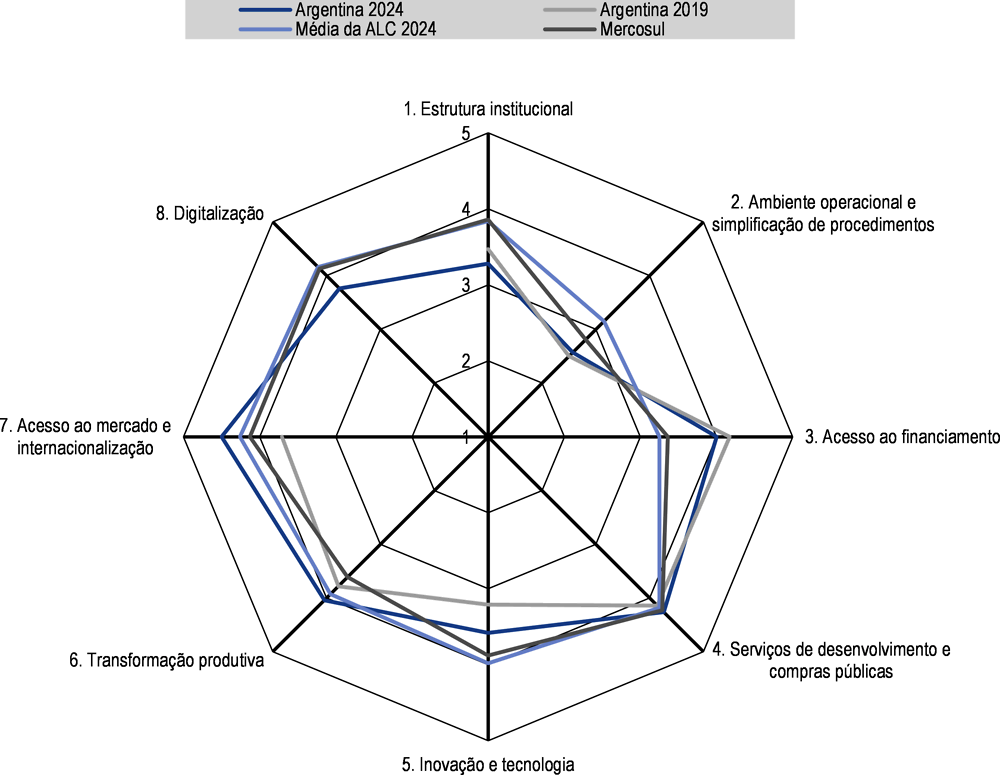

Figure 12.1. 2024 SME PI Argentina's score

Note: LAC average 2024 refers to the simple average of the 9 countries studied in this 2024 report. There is no data for the Digitalisation dimension in 2019 as the 2019 report did not include this dimension.

The second OECD SME Policy Index assessment of Argentina highlights the country’s extensive array of programmes and initiatives aimed at fostering SME development. These efforts encompass various support schemes for SMEs and entrepreneurs, offering a wide range of business development services and measures to enhance access to public procurement opportunities. Additionally, Argentina provides a robust suite of financing supports designed to enable and encourage SME innovation. As a well as a plan that promotes the integration of SMEs into supply chains, aiming to transform the country’s productive and technological structure.

Since the 2019 assessment, Argentina has intensified its efforts to facilitate international business through the establishment of the Consejo Público Privado para la Promoción de Exportaciones (Public-Private Council for the Promotion of Exports, CPPPE) in 2020. This council has been instrumental in promoting business rounds, trade missions, and technology offer workshops. Specific programmes such as Export Challenge, Argentina to the World, Argentina Projects, SMEs to the World, and Training to Invest and Export have been implemented to support SMEs in their internationalisation efforts.

As noted in the 2019 edition, Argentina continues to perform strongly in the area of access to finance (Figure 12.1). The country has made notable strides in developing processes to handle SME bankruptcy and insolvency. It has also expanded alternative financing options for SMEs, including asset-based lending (ABL) schemes and capital investment instruments, supported by a specific regulatory framework.

Despite these advancements, Argentina faces ongoing challenges in its SME institutional framework, primarily due to unclear strategic directions and a lack of policy continuity. These issues have been exacerbated by the COVID-19 pandemic and the progressive deterioration of the macroeconomic environment. To address these challenges, Argentina could structure and review current and new efforts in light of cross-cutting strategic objectives. This approach will help optimise synergies among existing actions and integrate them into a cohesive strategic plan for SMEs.

Argentina continues to grapple with a complex regulatory system and high administrative burdens. However, the new administration is actively engaged in efforts to streamline regulatory processes. These initiatives aim to simplify the regulatory environment, thereby reducing administrative burdens and fostering a more conducive environment for SME growth and development, the creation of quality jobs, and increased investment and exports.

Context

After experiencing a negative growth rate of 9.9% in 2020 due to the COVID-19 crisis, Argentina rebounded strongly with a growth of 10.7% in 2021, attributed to the rapid progress in the implementation of booster doses of COVID-19 vaccines (BCRA, 2022[1]). In 2022, the economy expanded by 5%, returning to the levels of output of 2017 (OECD, 2024[2]). However, starting from September of that year, many productive sectors lost momentum, influenced by a reduced wheat harvest compared to the exceptional results of the previous season and contractions in sectors such as construction, trade, and some industrial branches (BCRA, 2023[3]). This occurred within the backdrop of high inflation and increased financial uncertainty, both locally and internationally. By the fourth quarter of 2023, activity contracted by 1.4%, for 2024, GDP is expected to contract by 3.3%, before growing by 2.7% in 2025 (OECD, 2024[4]). One of Argentina's main macroeconomic imbalances is inflation. Annual inflation reached 288% in March, but monthly changes in prices have started to moderate (OECD, 2024[4]).

In the fourth quarter of 2022, the employment rate reached 44.6%, marking a 1 percentage point increase in year-on-year terms, resulting in a decline in the open unemployment rate to 6.3% by the end of that year. The growth in the employment rate was primarily driven by an uptick in the number of informal wage earners. However, real wages remained below 2019 levels (OECD, 2022[5]). By 2023, the unemployment rate further decreased to 5.7%, and formal employment continued to experience steady growth in non-agricultural sectors (BCRA, 2023[6]).

Furthermore, Argentina has been integrated into international trade mainly in the Latin American region, the process of registering new businesses and tax filing is average compared to countries in the region, and the country offers a good market access to financing for SMEs. Beyond Latin American, Argentina has established trade agreements with the Southern African Customs Union, Israel, India, and Egypt (Government of Argentina, n.d.[7]) The Secretariat of Industry and Productive Development within the National Ministry of Economy underscores the significance of SMEs in the Argentinean economy, constituting 99.4% of the total companies and employing 64% of registered workers. Additionally, data from the Undersecretariat for Small and Medium-Sized Enterprises reveals that SMEs generated 140,000 jobs in the first quarter of 2023 (Ministry of Economy Argentina, 2023[8]).

Dimension 1. Institutional Framework

Argentina has an overall score of 3.28 in the SME Policy Institutional Framework dimension, slightly lower than the 2019 assessment (3.47). This decline is attributed to persistent inconsistencies in the policy framework, unclear strategic directions, and a lack of policy continuity, influenced by the COVID-19 pandemic and the progressive deterioration of the macro-economic framework, along with methodological changes in the evaluation.

The reduction in the overall score compared to the 2019 assessment is also influenced by a decrease in the score within the SME definition sub-dimension. Argentina adopts an SME definition primarily based on total annual turnover, with thresholds updated once a year. The SME population is segmented in four categories: micro, small, and two sub-categories of medium-sized enterprises (medianas tramo 1 and medianas tramo 2), varying turnover and employment thresholds by sectors. SMEs must register with the SME Register managed by the Ministry of Economy to benefit from incentives. The registration process is a one-time requirement, with subsequent renewals occurring automatically. This marks a notable shift from the 2019 evaluation when re-registrations were handled manually. Argentina obtained a score of 4.00 in this sub-dimension, primarily attributed to methodological adjustments in the individual weighting values assigned to the assessed elements.

In 2022, the Ministry of Economy absorbed the Ministry of Productive Development, transforming it into the Secretariat of Industry and Productive Development within the Ministry. Additionally, the Ministry of Agriculture, Livestock, and Fisheries was also incorporated as a Secretariat under the Ministry of Economy.

Argentina has yet to formulate a specific strategy for the development of the SME sector. However, in 2023, the government approved a medium-term plan named Argentina Productiva 2030 Plan de Desarrollo productivo, industrial y tecnológico (Argentina 2030 Plan for Industrial and Technological Productive Development). This plan outlines strategic directions and objectives across eleven policy areas, encompassing export development, the green economy, digital transformation, industrial modernisation, the tourist sector, and supply chain development. Notably, the plan prioritises the development of sectors predominantly led by large enterprises, such as the oil and mining sectors. Despite this overarching focus, a section of the plan is dedicated to the integration of SMEs into supply chains, fostering linkages with large enterprises, and introducing the Factura de Crédito Electrónica MiPyME (SMEs Electronic Credit Invoice, RFCEM) as a tool akin to factoring. This tool aims to provide financial support to SMEs seeking integration into value chains. The plan's execution is overseen by the Ministry of Productive Development, with monitoring conducted by the Council of Monitoring and Competitiveness.

SME policy measures are introduced in response to sector requests or economic emergencies. The election of a new President in November 2023 supporting an economic laissez-faire approach may lead to a significant revision of the interventionist approach, impacting the country's SME policy. The sub-dimension score for the Strategic Planning, Policy Design and Coordination is 2.89.

Furthermore, in 2021, a total of one hundred and forty-five local chambers and federations joined forces to create the National SME Confederation, aiming to enhance SME involvement in Public-Private Partnerships (PPPs). This collaborative initiative is mirrored in Argentina's score of 2.77 for the public-private consultation (PPCs) sub-dimension. Nonetheless, PPCs occur relatively frequently, although they are not consistently regular. The government engages in consultations with the private sector when new legislation affecting private companies is introduced, or in response to lobbying efforts by private sector organisations, particularly industry bodies. On the other hand, in the sub-dimension of measures to address informality, Argentina demonstrates a marginal increase in the score, reaching 3.82 compared to 3.76 in 2019. The government has concentrated its efforts on reducing informal labour, mainly through the establishment of the Public Registry of Employers sanctioned for non-respecting labour regulations. Additionally, there has been a reduction in social contributions for individual entrepreneurs and micro-enterprises.

The way forward

Revise and simplify the current SME definition by incorporating additional parameters, such as employment and total assets, alongside the existing criterion of total annual turnover. Ensure uniform application of the definition across all public administration levels, including local authorities and the national statistical office. Include an independence clause to ensure that SMEs are not controlled by large enterprises. Eliminate the annual SME registration requirement with the Ministry of Economy. Grant the Ministry the authority to confirm SME status by accessing data from the public company registry, tax administration, and manpower registry.

Define medium-term objectives for the SME sector within the context of the country's recent economic recovery measures. Formulate an executive group tasked with developing a medium-term SME/enterprise development strategy to achieve the defined objectives. Include key public institutions, private sector representatives, local authorities, international institutions, and SME experts in this working group. Evaluate the impact of the country's economic recovery measures on the SME sector and review the existing institutional framework and incentives in light of the new strategy.

Formalise and broaden PPCs, ensuring the meaningful representation of young entrepreneurs, women entrepreneurs, start-ups, and enterprises in emerging sectors. Conduct regular enterprise surveys, with the collaboration of business associations and local authorities, covering diverse enterprise types. Identify and address significant obstacles to enterprise development based on survey findings.

Address the high level of informality by evaluating its consequences on both labour conditions and enterprise development. This includes examining the impact of informality on unfair competition, potential distortions in enterprise growth caused by tax and labour regulations, and barriers to accessing formal external financing. By identifying these challenges, we can develop measures to mitigate the negative effects of informality and promote a fair and conducive environment for both established and new enterprises.

Dimension 2. Operational environment and simplification of procedures

Argentina has a complex regulatory system and high administrative burdens. The previous LAC SME Policy Index report highlighted that company registration and tax filing procedures were complex and time-consuming. This was also reflected in a low overall performance in the 2017 OECD Product Markets Regulations Indicators report. At that time the government acknowledged the need to proceed with regulatory reforms and legislative simplification, and established a Productive Simplification Secretariat with what was then the Ministry of Production and Labour. It enacted several legislative reforms, including amendments to the Company Law, and took steps to apply more systematically Regulatory Impact Analysis (RIA) during the process of elaboration of new legislative and regulatory acts.

During the 2019-2023 administration, legislative simplification and regulatory reform stalled. This is partly due to the impact of the COVID-19 pandemic on legislative activity and partly to the deterioration of the macro-economic framework, which forced the government to react to economic emergencies and limit its engagement in pursuing regulatory reforms. However, there was progress in the provision of e-government services, as reflected in the overall score of 2.57 for the Operational Environment and Simplification of Procedures.

Until October 2023, the government did not have a strategic plan for conducting legislative simplification programmes and regulatory reform. RIA remained optional and is conducted only for the most important legislative acts, and the reports were not made public. Argentina's score for the Legislative Simplification and Regulatory Impact Analysis sub-dimension remains at the same level as in 2019, at 1.63. Nevertheless, the new administration is actively engaged in efforts to streamline regulatory processes. It has recently declared its intention to present a bill to Congress aimed at abolishing 160 regulations. On 15 December, the State Simplification Secretariat was created within the Chief of Cabinet of Ministers, which, among its functions, includes collaborating in the design of the policy for simplification and streamlining of procedures and processes in the National Public Sector, provincial, in the Autonomous City of Buenos Aires, and municipal, coordinating actions with areas with specific competence.

For the company registration sub-dimension Argentina's score is 2.54. This is attributed to its relatively complex nature, involving a high number of procedures. Completing the registration process formally takes 15 days, as it requires sequential completion of each step. While only some procedures can be conducted online, the overall cost of the registration process is relatively low. There is no single-window One-Stop-Shop (OSS); instead, a multiple-windows system is in place. Companies receive two registration numbers, one from the Registry of Commerce Número de Inscripción en el Registro Público (Public Register Registration Number) which is a number specific to each provincial registry and one from the Administración Federal de Ingresos Públicos (Federal Administration of Public Revenues, AFIP) Clave Única de Identificación Tributaria (Unique Tax Identification Code, CUIT) which is used on a national level.

Since 2019, the government implemented two tax measures relevant to SMEs: an extension of the monotributo applied to micro-enterprises and individual entrepreneurs, and the introduction of a "bridge" to promote the transition from the monotributo to a full corporate tax regime. As a positive step, responding to the needs generated by the COVID-19 pandemic, the tax administration has expanded the range of services provided online. This change is reflected in the increase of its score compared to 2019 from 2.33 to 2.50. However, the administration procedures for filing taxes by private enterprises are complex and time-consuming. The main weaknesses of the tax administration system are related to the number of hours required for tax filing and the total tax and contribution rate (% of profit). The tax system is further complicated by the tax autonomy given to provincial governments.

Argentina's greatest strength in this dimension lies in its e-government services, demonstrated by a score of 4.08 for this sub-dimension, following the trend of other Latin American countries assessed. The first programme promoting the digitalisation of public administration and the provision of e-government services was developed in 2015. The programme was reinforced with the launch of the Agenda Digital Argentina (Argentine Digital Agenda) in 2018 by the Decree 996/2018, which sets the strategic directions for the digitalisation of public administration. At the national level, the main e-government service is the Trámites a Distancia platform (Distance Procedures, TAD), which currently provides 2456 links with public-administration entities. The range and diffusion of e-government services have significantly expanded, also in response to the increased demand for online services during the COVID-19 pandemic. One of the most important applications for SMEs is the Legajo Único Financiero y Económico (Single Financial and Economic Record, LUFE), which allows the centralisation of all financial and personal data. Its objective is to facilitate and streamline the procedures for SMEs with various stakeholders in the financial system and public administration in general.

The way forward:

Argentina should embark on a comprehensive review of its laws and regulations to enhance the operational environment for private enterprises, unlocking the country's entrepreneurial potential and fostering market contestability by:

Establish an inter-ministerial task force operating under high governmental authority, tasked with identifying key obstacles to private enterprise growth and proposing a reform agenda. To ensure inclusivity and balanced perspectives, the task force should be complemented by a consultative committee, including representatives from the private sector, particularly those advocating for new enterprises and those operating in high-growth sectors. This approach aims to counterbalance the influence of well-established and well-connected enterprises.

Prevent the introduction of ineffective laws and regulations, implementing a systematic application of RIA for all new legislative measures impacting business activity. This entails officially endorsing state-of-the-art RIA methodology, appointing a governing body to oversee RIA application and ensure analysis quality, designating the authority responsible for conducting RIA exercises, and mandating the publication of all RIA reports, thereby facilitating public consultations. This approach enhances transparency and effectiveness in regulatory decision-making.

Enhance the business environment, conducting a thorough review and simplification of registration procedures for all types of enterprises. Implementing an OSS for physical registration and introducing online registration procedures. This approach would significantly streamline the process, fostering a more efficient and business-friendly environment.

Conduct a comprehensive assessment of the total effective tax rate applied to various categories of SMEs. Identifying potential distortions in the tax system that hinder or distort enterprise growth. Moreover, simplifying and reviewing tax administration procedures can contribute to creating a more transparent and supportive tax environment for SMEs.

Dimension 3. Access to finance

Argentina achieves an overall score of 4.00 in the Access to Finance dimension, the highest in the region. The country has made notable strides in developing processes to handle SME bankruptcy and insolvency. It has also expanded alternative financing options for SMEs, including ABL schemes and capital investment instruments, supported by a specific regulatory framework.

Argentina scores 3.87 in the sub-dimension of the legal, regulatory, and institutional framework, above the LA9 regional average, mainly due to strong development in the regulation of the stock market and asset registration, and relatively lower weighting in SME guarantees.

The development of the legal framework for access to finance is primarily driven by government provisions in the stock market to help SMEs meet listing requirements and have a separate section or market for low-cap SMEs. SMEs can open their capital by listing on the stock market, with a simplified reporting regime, no obligation to establish audit committees or apply International Financial Reporting Standards (IFRS), no oversight or control fees, or Comisión Nacional de Valores (National Securities Commission, CNV) issuance fees, and can only be acquired by qualified investors.

The country's overall score in this sub-dimension is slightly affected by lesser development in the regulation and institutionalisation of the registration of tangible and intangible assets. Although movable property is widely accepted as collateral in the country and the cadastre is accessible online to the public, the registration of security interests in movable property does not have the same accessibility.

On the other hand, Argentina achieves the second-highest score in LA9 for the indicator of diversification of financing sources for companies, with a score of 4.57, thanks to its wide range of financial products available to SMEs. Among this range are products designed to support the internationalisation initiatives of SMEs, such as export credits from Banco de la Nación (National Bank, BNA) and Banco de Inversión y Comercio Exterior (Bank for Investment and Foreign Trade, BICE), guarantees provided by public funds (FOGABA and FOGAR), and other schemes that include specific commercial and technical advisory services for SMEs. Furthermore, in April 2024, the Cupo MiPyME Mínimo, a simplified incentive scheme to encourage credit assistance based on the reduction of reserve requirements, came into force by the Banco Central de la República Argentina (Central Bank of Argentina Central Bank of the Argentine Republic, BCRA).

Additionally, Argentina has consolidated various alternative financing options for SMEs, including ABL schemes, as well as capital investment instruments, for which there is a specific regulatory framework. Furthermore, the country has made efforts to modernise its regulatory framework concerning crowdfunding schemes for debt or peer-to-peer (P2P) lending, under Communication “A” 7406 from the BCRA, which came into effect on January 3, 2022.

In the Financial Education sub-dimension, Argentina scores 3.15. The National Financial Inclusion Strategy (NFIS) includes a National Financial Education Plan (NFEP) aimed at enhancing the financial capabilities of users of financial products and services, promoting access and quality use across the entire population, with particular focus on the most vulnerable sectors. Recognising the need for a personalised approach tailored to diverse realities, the NFEP targets specific population segments with a social and federal perspective, taking into account gender and diversity. These segments include older adults, beneficiaries of social programmes, migrants, young people, and the SME sector. For SMEs, the NFEP outlines a strategic action to develop campaigns that disseminate suitable financial instruments specifically designed for them.

As in all LA9 countries, financial education and entrepreneurship programmes are integrated into the school curriculum and are mandatory in Argentina. Additionally, the BCRA conducts financial knowledge assessments as part of its programmes. Participants in these programmes include individuals who lead SMEs, both as instructors and as beneficiaries. Furthermore, Argentina excels in its monitoring and evaluation efforts. With support from international organisations such as CAF, Argentina has developed monitoring and follow-up schemes, including the financial capacity measurement survey, and has implemented evaluation initiatives using randomised control groups. These actions underscore the importance the country places on the financial education of SMEs.

Furthermore, Argentina stands out among the countries participating in the study by obtaining the highest score in developing processes to handle SME bankruptcy and insolvency, reaching 4.42 points. This score represents a significant improvement compared to the 2019 measurement, where it scored 3.05 points. The country has a regulatory framework and other established procedures for companies in insolvency conditions, which are widely applied and based on internationally accepted principles, also applicable to state-owned enterprises.

Finally, Argentina has early warning systems for insolvency situations, the option to resort to extrajudicial agreements less burdensome than bankruptcy declarations and cramdown regulated by article 48 of the law on insolvency and bankruptcy. The country also reports the existence of special registers to store company data and procedures to lift restrictions imposed after a company declares bankruptcy. These registers are available to the public, and companies declared bankrupt are removed from the register after obtaining full discharge.

The way forward

While Argentina excels with an overall good performance in this dimension, it is important to continue deepening improvements to the legal framework for secured transactions, especially concerning the ability of secured creditors to enforce their security after reorganisation, as well as developing support mechanisms for entrepreneurs to take advantage of second chances or recover lost businesses. Some actions that could be taken by Argentina are:

Establish a standard definition of guarantee and review the percentage of guarantees required for medium-term loans to SMEs.

Free up credit allocation to SMEs and create mechanisms for the active use of guaranteed certificates from Mutual Guarantee Societies (MGS) and guarantee funds, so that not only SMEs with international links benefit.

Conduct specific surveys to measure the financial capabilities of SMEs in order to design financial education programmes more in line with their context and needs.

Design and implement training programmes for second chances, targeting individuals who have had their businesses go bankrupt.

Implement processes that allow for automatic removal from the national credit blacklist after full discharge.

Dimension 4. SME development services and public procurement

Several programmes and measures supporting the development of SMEs and entrepreneurship exist in Argentina, including an array of business development services and measures to access public procurement opportunities. Reflecting this, Argentina registers a score of 4.26 in the overall dimension. The strongest performance in this area is in the sub-dimension of support services for entrepreneurs (4.34), followed by public procurement (4.20), and business development services (4.23). Key strengths in the overall dimension are in the implementation area, with weaker points concerning planning and design, and monitoring and evaluation.

Argentina’s flagship BDS initiatives are encompassed in the Programa de Apoyo a la Competitividad, PAC), financed by a loan from the Inter-American Development Bank (IADB) and administered by the Ministry of Economy, through the Secretariat of Industry and Productive Development and its Sub-Secretariat for Entrepreneurs’ Development. The PAC provides Aportes No Reembolsables (Non-Refundable Contributions, ANR) to finance projects such as the digitalisation of enterprise functions, certifications (e.g., environmental, quality, etc.), and accessing domestic and foreign markets. The modalities include technical assistance, the acquisition of equipment, studies, etc. Support is delivered through convocatorias or calls for projects.

Entrepreneurship development services are delivered through the programme Escalar (roughly to grow or to escalate) which provides financial assistance, including interest free loans, and the programme Emprendimientos Dinámicos (Dynamic Ventures), which consists of grants (ANRs) for projects with the potential to become competitive SMEs and that are sponsored by certified Entidades Especializadas de Apoyo al Emprendedor (Specialised Entities for Entrepreneur Support, EEAE) such as incubators, accelerators, and entrepreneurs’ networks.

Argentina had the second-best performance in public procurement in the 2019 edition of the SME PI. Such performance was mainly driven by an effective planning and design in this area, in particular the existence of laws and regulations allowing the splitting of tenders into smaller lots, the formation of consortia of SMEs, and mandating timely payments for goods and services, among others. In this edition, Argentina continues to display good policy performance, with a score of 4.20, also driven by strong planning and design and implementation, although with a relatively weak monitoring and evaluation. Key laws regulating and fostering the participation of SMEs and cooperatives in public procurement include Law 25.300 and Law 27.437, which provide a legal framework for the development of national industry and the purchase by the State of domestic goods and services. They allow for:

A partial bidding option for SMEs ranging from 20-35% of the total category value.

The possibility of breaking tenders into smaller lots so that SMEs can participate in bids.

Framework agreements giving SMEs the possibility to participate in tenders for which they meet the conditions to participate.

A preference for national over imported goods if the price of national goods does not exceed the offer price of imported goods by 15%, and a preference of 5% for goods produced by SMEs over imported goods or goods of large enterprises.

In addition, Law 13.064 related to the Nuevo Régimen de Obras Públicas (New Public Works Regime) includes regulations for the timely payment of SME suppliers to the State, in particular a 30-day deadline for payment after the reception of an invoice. However, there are instances of late payments of up to two years by the State.

In terms of e-procurement, Argentina benefits from two platforms: comprar.gob.ar for the purchase of goods and services by the State, and contratar.gob.ar, for public works. The first platform, also known as compr.ar, allows government agencies to publish procurement opportunities and manage the entire procurement process for all levels of the government, from the national government to municipalities. contrat.ar is used for the purchase of construction services such as roads, bridges, and buildings at national level. The Argentinian e-procurement systems allow public institutions to publish procurement opportunities, suppliers to submit bids, and contracting authorities to evaluate those bids and award contracts. It is designed to promote transparency, efficiency, and accountability in public procurement.

Argentina also implements a registry of suppliers, known as Sistema de Información de Proveedores (Supplier Information System, SIPRO), which is a database registering suppliers’ contact information, financial and technical qualifications, history of compliance with contracts and laws, and any sanctions or penalties imposed on the suppliers. SIPRO is not a mandatory requirement for suppliers to participate in procurement procedures, but it can be a useful tool for suppliers to participate in government contracts.

The way forward

Overall, Argentina has a solid performance in Dimension 4, with a variety of business development services and support for the participation of SMEs in public procurement. Nevertheless, Argentina could further improve by:

Adopt a specific, multi-year strategy for SME development, with concrete objectives and responsibilities.

Strengthen public-private dialogue for the design, implementation, monitoring, and evaluation of such SME strategy. Indeed, the information collected for this assessment shows that there is little widely available evidence on the effectiveness of support for SMEs through BDS and access to public procurement.

Assess the sustainability of the delivery model of BDS, which currently relies on loans from the IADB, instead of aiming to build a self-sustained market of BDS, including through the provision of those services by private sector actors.

Dimension 5. Innovation and technology

Argentina has an overall score of 3.58 in the Innovation and Technology dimension, marking a sizeable improvement on the score of 3.21 registered in 2019. Argentina’s relatively strong performance in this dimension is driven by its cohesive and well-co-ordinated policy framework and a robust offering of financing support to enable and encourage SME innovation.

The national system for science, technology and innovation is structured around the framework established by Law 25 467 of 2001, which created the Gabinete Científico y Tecnológico (Scientific and Technological Cabinet, GACTEC) within the Ministerio de Ciencia, Tecnología e Innovación (Ministry of Science, Technology and Innovation, MINCYT). MINCYT is the designated responsible entity for developing the Science, Technology and Innovation Strategy (Plan CTI 2030), which was launched in 2022. Meanwhile, the Consejo Federal de Ciencia, Tecnología e Innovación (Federal Council of Science, Technology, and Innovation, COFECyT) and the Consejo Interinstitucional de Ciencia y Tecnología (Interinstitutional Council of Science and Technology, CICyT) work to co-ordinate innovation policies across government. Innovation policy is also integrated within other government strategies in the areas of SME policy, industrial policy, education/skills policy, and science policy, pointing to a mainstreaming of innovation policies and considerations across government. These factors contribute to Argentina’s score of 4.01 in the Institutional Framework sub-dimension. Argentina’s score in this sub-dimension is, however, brought down by a relatively weak performance in the monitoring and evaluation component, reflecting areas of opportunity in the monitoring of the implementation of the innovation strategy.

Argentina has a score of 2.64 in the Support Services sub-dimension. While there are initiatives to link innovative SMEs with research institutions, as well as a strong network of incubators and accelerators, appropriate monitoring and evaluation arrangements are not systematically in place. A stronger element of Argentina’s innovation policy is the financing supports provided to SMEs. Argentina’s score of 4.08 in the Financing for Innovation sub-dimension is underpinned by a strong range of policy supports including grants through the Fondo Tecnológico Argentino (Argentine Technology Fund, FONTAR), research and development tax incentives, and the innovative public procurement instrument of the National Agency for Promotion of Research, Technological Development, and Innovation.

The way forward

Define key performance indicators and targets at the strategic level to monitor the implementation progress and overall effectiveness of the innovation strategy.

Develop a framework for the monitoring and evaluation of major innovation policies and programmes, which should include reliable evaluation methodologies with control groups of firms that did not participate in the programmes.

Dimension 6. Productive transformation

Argentina achieves an overall score of 4.04 in the Productive Transformation dimension, reflecting a substantial positive change from the score of 3.78 in 2019. As highlighted in the Institutional Framework dimension, the nation is actively enhancing measures to increase productivity through its medium-term plan denominated Argentina Productiva 2030 Plan de Desarrollo productivo, industrial y tecnológico (Argentina 2030 Plan for Industrial and Technological Productive Development), approved in 2023 (see Dimension 1. Institutional Framework). This plan champions the integration of SMEs in supply chains, aiming to reshape the country's productive and technological structure. It serves as a roadmap to sustainably enhance the quality of work, incorporate new technologies into productive activities, bolster competitiveness, improve productive sectors and expand exports through 11 defined objectives (misiones) and 60 thematic areas (proyectos) reflected in a robust score of 3.71 in the Strategies to enhance productivity sub-dimension. Nevertheless, Argentina Productiva 2030 is a key policy effort to contribute to the country's productive transformation, including specific measures focused on SMEs remains the main challenge.

The robustness of the measures to improve productive associations in Argentina persists, attaining a score of 4.57, mirroring its 2019 performance. This is largely attributed to the effectiveness of the specific cluster component within the IADB's PAC programme, implemented through calls for proposals, which offer co-funding to establish new clusters or to strengthen existing ones. Furthermore, Argentina conducts in-depth studies on existing business networks and clusters, developing strategies to support them. Since 2017, the National Industrial Parks Programme has maintained a Registro Nacional de Parques Industriales (National Register of Industrial Parks, RENPI), providing financial support, including credits and non-refundable contributions, to registered parks for conducting studies and installing productive infrastructure. This programme also features an Observatorio Nacional de Parques Industriales (National Observatory of Industrial Parks, ONPI) which provides a space for collaboration and knowledge exchange to strengthen regional industries by leveraging local experiences. While the country has established mechanisms to monitor and evaluate these policies, and adjustments have been made based on results, Argentina could benefit from the use of key indicators and performance statistics for more informed decision-making.

Argentina has a score of 3.96 in the Integration into Global Value Chains sub-dimension. Under the National Secretariat of Industry and Productive Development, the Undersecretariat for SMEs administers the Directorate for the Development of Value Chains, implementing a targeted strategy to reinforce them, while the plan Argentina Productiva 2030 includes a specific section focused on integrating SMEs into supply chains.

The way forward

While Argentina has shown improvement in this dimension, there are opportunities to enhance its strategic and programmatic approach. Key recommendations include:

Implement monitoring and evaluation measures with clear, time-bound indicators for better decision-making and assessing the effectiveness of policies.

Strengthen efforts in promoting information on existing measures and programmes. Utilise the Argentina 2030 website to provide comprehensive details, serving as a mechanism for monitoring the plan progress.

Dimension 7. Access to market and internationalisation of SMEs

Argentina scores 4.50 in the Access to Market and Internationalisation dimension, primarily supported by advances in internationalisation support programmes and the benefits derived from regional integration processes. The country has strengthened its efforts to facilitate international business through the CPPPE, created in 2020. This council formulates annual trade promotion plans in collaboration with the public and private sectors, promoting business rounds, trade missions, and technology offer workshops. Additionally, specific programmes for SMEs, such as Export Challenge, Argentina to the World, Argentina Projects, SMEs to the World, and Training to Invest and Export, have been implemented in collaboration with the Agencia Argentina de Inversiones y Comercio Internacional (Argentine Investment and International Trade Agency, AAICI).

The AAICI plays a crucial role in the export strategy and investment attraction, providing technical assistance, training, market intelligence, and support to SMEs. Programmes like Export Challenge have provided technical assistance with tangible results in export promotion. The programme consists of three phases: Diagnosis, Technical Assistance in Export Plan, and Assistance in International Promotion. As part of the actions carried out for the promotion of exports and the internationalisation of SMEs, the Ministry of Foreign Affairs, International Trade, and Worship developed the “SMEs for the World” programme, which offers training, technical assistance, and financing lines. In this context, a series of meetings called “SMEs for the World Cycles” have been held (SIDP, 2023[9]). The government has also implemented initiatives like Potencia PyMEX, offering non-refundable financing for innovation projects in manufacturing companies. This programme has benefited a significant percentage of SME exports.

Furthermore, the Ministerio de Desarrollo Productivo (Ministry of Productive Development, MDP) has implemented the Federal SME Export Development Plan to boost SME exports. This plan includes actions such as strengthening local agencies and service centres, involving universities in the production system, training in export skills, providing comprehensive technical assistance and financing, reviewing the tariff regime, and promoting products in the external market (AAICI, 2020[10]). These measures have led Argentina to score 4.91 in this area. According to the SME Industrial Products Export Monitor, Argentine SMEs exported $1.714 billion in the first half of 2023, representing 6.8% of the national total, with Brazil as their main destination (18.2%) (CAME, 2023[11]).

In the trade facilitation sub-dimension, Argentina scored 4.36. The MDP has implemented various initiatives to simplify exports, such as the ABC to Export and the Exporta Simple 2.0 platform, which facilitates export operations for small producers through Operadores Logísticos Exporta Simple (Simple Export Logistic Operators, OLES). Additionally, ExportArgentina, a federal directory of exportable supply, has been created. The country also has Single Windows for Foreign Trade and Vuce Nodes in 11 provinces. However, Argentina could improve the inter-operability between these tools and Customs to maximise their benefits by developing web services linking both entities (ALADI, 2023[12]).

Regarding the Authorised Economic Operator (AEO) programme, the regulations were updated in November 2021 to comply with World Customs Organisation (WCO) standards. However, this programme has not yet been seen to grant specific rights to Argentine SMEs. Argentina has signed three Mutual Recognition Agreements (MRAs) and is in the process of other significant agreements. Although Argentina surpasses the LA9 average in three of the four Trade Facilitation Indicators (TFI) categories, it falls below the average in the document category (ARG: 1.125; ALC: 1.591).

Argentina also scores relatively high in the e-commerce sub-dimension (3.66). According to the Global Payments Report 2023 (FIS, 2023[13]), Argentina is the third-largest e-commerce market in Latin America, with an annual growth projection of 21%. The Argentine e-commerce market is expected to grow from $19 billion in 2022 to $41 billion in 2026, driven mainly by mobile transactions, which accounted for 60% of the total value in 2022. Regarding training and financing in digital transformation for SMEs, in 2023 the MDP launched the Digital Transformation PyMEX contest, with support from the IADB, offering non-refundable contributions of up to 25 million pesos per project to cover 70% of the cost. These projects aim to drive the digital transformation of exporting SMEs towards Industry 4.0, including process improvements, technological solution development, and digital strategies. Additionally, Digital Transformation Units (UTD) have been established, funded by the Secretariat of Industry and Productive Development, providing technical assistance and training to SMEs in their digitalisation process.

Moreover, Argentina scores 4.32 in the quality standards sub-dimension, an improvement over its 2019 performance, primarily influenced by the fundamental role of IRAM and ISO standards as strategic allies for SMEs. These standards have proven to be effective tools for knowledge transfer, bringing together results from technological research and development. Through the SME Experts programme, training is offered to improve the productivity and competitiveness of companies, facilitating access to professional technical assistance in specific areas, including quality tools.

In the integration sub-dimension, Argentina scored 4.60. Within Mercosur, policies have been established to support SMEs, including the creation of a Guarantee Fund to back credit operations in productive integration activities. However, although these initiatives have been implemented, there are currently no public records available on the use of the funds or the number of beneficiary SMEs.

The way forward

To enhance Argentina's performance in this dimension, the following actions could be considered:

Expand AAICI's reach at the regional level through the creation of regional offices, with the objective of increasing SMEs' access to training opportunities and other benefits derived from the different programmes.

Strengthen the integration of AEO training into AAICI programmes and explore additional support measures to facilitate AEO certification for SMEs, as well as improving the dissemination of the benefits of AEO certification.

Strengthen the visibility of public sector support for quality certifications, capitalising on existing efforts and programmes.

Generate and integrate the strategy for the promotion of e-commerce into SME sector development plans, with measurable objectives, in order to achieve better coordination and follow-up of the policies implemented.

Promote sub-regional integration and benefits for SMEs through standardisation and collaboration in trade promotion and internationalisation programmes. As well as strengthening the institutional framework established in Mercosur for the design, implementation and monitoring of SME programmes.

Dimension 8. Digitalisation

Argentina attains an overall score of 3.76 in the Digitalisation dimension, and its relatively robust performance is underpinned by a cohesive and well-coordinated National Digitalisation Strategy, coupled with a sturdy broadband connectivity infrastructure.

The country's digital transformation is propelled by the National Digitalisation Strategy (NDS), specifically the Federal Programme for Digital Public Transformation. It is supported by various regulations and initiatives, including the State Modernisation Plan, the Gestión Documental Electrónica (Electronic Document Management System, GDE), and the Argentine Digital Agenda. This initiative prioritises the digitalisation of small businesses, streamlining government services, and imparting digital literacy education. More than just a vision, the NDS is a tangible force shaping Argentina's inclusive digital society implemented through the Secretariat for Public Innovation and the Ente Nacional de Comunicaciones, (National Communications Agency, ENACOM). Coordination mechanisms include the Consejo Federal de la Función Pública (Federal Council of the Public Function, CoFeFuP) and its working groups. The commitment to digital governance ensures universal access to government services, promoting inclusivity. Argentina leverages efficient digital solutions to enhance public services, stimulate economic growth, and empower its citizens, culminating in a score of 4.13 in the National Digital Strategy sub-dimension. However, this score is tempered by a weak performance in monitoring and evaluation, reflecting inadequate oversight of the strategy's implementation.

Argentina excels in the Broadband Connectivity sub-dimension with a score of 4.11. The Connectivity Plan, designed to provide internet access even in remote areas, fosters social inclusion and economic development. Substantial government investments in building a robust digital infrastructure guarantee seamless connectivity nationwide. The recognition of reliable and affordable internet access's pivotal role in education is evident in initiatives that equip schools with high-speed internet, enriching the learning experience and preparing young peoplefor a digital future.

However, Argentina's digitalisation policy encounters a hurdle in the Digital Skills sub-dimension, where it scores 3.03. Efforts to empower citizens with digital skills include integrating technology into school curricula, adult education programmes aiding older generations in adapting to the digital world, and workshops and training sessions in local communities to enhance digital literacy among adults. These initiatives aim to enable people to access online services, apply for jobs, and connect digitally, fostering a more inclusive and digitally proficient society in Argentina.

The way forward

Strengthen its monitoring and evaluation mechanisms for SME digitalisation initiatives. By implementing a robust framework, the government can systematically assess the impact of ongoing policies, identify areas of improvement, and ensure the effective utilisation of resources.

Adopt a comprehensive approach to digital skills development.

References

[10] AAICI (2020), Plan integral para el Desarrollo Federal Exportador PyME, https://www.argentina.gob.ar/sites/default/files/11_nov_plan_de_desarrollo_federal_exportador_pyme_-vf.pptx_.pdf.

[12] ALADI (2023), Relevamiento del estado de situación de las VUCE en los países miembros de ALADI, https://www2.aladi.org/SitioAladi/documentos/facilitacionComercio/Relevamiento%20Estado%20de%20Situaci%C3%B3n%20de%20las%20VUCE%20en%20los%20pa%C3%ADses%20miembros%20de%20la%20ALADI.pdf.

[3] BCRA (2023), Informe de política monetaria, https://www.bcra.gob.ar/Pdfs/PoliticaMonetaria/IPOM0423.pdf (accessed on 11 March 2024).

[6] BCRA (2023), Informe de política monetaria, https://www.bcra.gob.ar/Pdfs/PoliticaMonetaria/informe-politica-monetaria-03-trim-2023.pdf (accessed on 11 March 2024).

[1] BCRA (2022), Informe de política monetaria, https://www.bcra.gob.ar/Pdfs/PoliticaMonetaria/IPOM0322.pdf (accessed on 11 March 2024).

[11] CAME (2023), Monitor de Exportaciones Pymes de Productos Industriales, https://www.redcame.org.ar/advf/documentos/2023/07/64b98987aeb70.pdf.

[13] FIS (2023), The Global Payment Report 2023, https://www.fisglobal.com/-/media/fisglobal/files/campaigns/global-payments%20report/FIS_TheGlobalPaymentsReport_2023.pdf.

[7] Government of Argentina (n.d.), Acuerdos internacionales concluidos, https://www.argentina.gob.ar/produccion/acuerdos-internacionales/conoce/tlc/vigentes (accessed on 11 March 2024).

[8] Ministry of Economy Argentina (2023), Las PyMEs argentinas generaron 140.000 puestos de trabajo en el primer trimestre, https://www.argentina.gob.ar/noticias/las-pymes-argentinas-generaron-140000-puestos-de-trabajo-en-el-primer-trimestre (accessed on 11 March 2024).

[4] OECD (2024), OECD Economic Outlook, Volume 2024 Issue 1: Preliminary version,, OECD Publishing, https://doi.org/10.1787/69a0c310-en.

[2] OECD (2024), Real GDP forecast (indicator), https://doi.org/10.1787/1f84150b-en (accessed on 13 March 2024).

[5] OECD (2022), Argentina Economic Snapshot, https://www.oecd.org/economy/argentina-economic-snapshot (accessed on March 2024).

[9] SIDP (2023), Ciclos Pymes para el Mundo, https://www.youtube.com/playlist?list=PLyy3c-xBFUSbaB19PEjcAjDpCP_jMDuBM.