This chapter assesses the circular economy policy framework and initiatives in North Macedonia, emphasising critical economic aspects and environmental impact related to energy production, emissions, material use and waste management. Challenges persist in areas such as energy intensity, fossil dependency, circular material use and waste recycling. This chapter pinpoints key policy areas essential for North Macedonia’s shift towards a circular and carbon-neutral economy. By identifying gaps in both policy formulation and implementation, and incorporating further analyses, the chapter provides insights for prioritising areas in future circular economy policy documents.

A Roadmap towards Circular Economy of North Macedonia

2. State-of-play of the circular economy in North Macedonia

Abstract

North Macedonia’s key economic features and their relevance to the circular economy

North Macedonia has made significant economic progress over the past three decades, having navigated through a post-conflict economic reconstruction. It has moved from a low-income economy to an upper middle-income European Union (EU) candidate country, with gross domestic product (GDP) per capita PPP (constant 2017 international dollars) rising from 9 867 in 1992 to 17 129 in 2022 (World Bank, 2024[1]). While unemployment remains high (14.5% of the population aged 15-64 compared to 7% in the European Union), it has been on a decreasing trend over the past 15 years (European Commission, 2023[2]). North Macedonia’s economy has grown at moderate levels for almost a decade, averaging 2.2% between 2012 and 2022 (World Bank, 2023[3]). Since 2020, North Macedonia’s economic growth has been impacted by external shocks, starting with the COVID pandemic. The subsequent energy crisis and inflation, induced by the war in Ukraine, dampened its economic recovery (Box 2.1).

Box 2.1. Impact of recent crises on North Macedonia’s economic growth

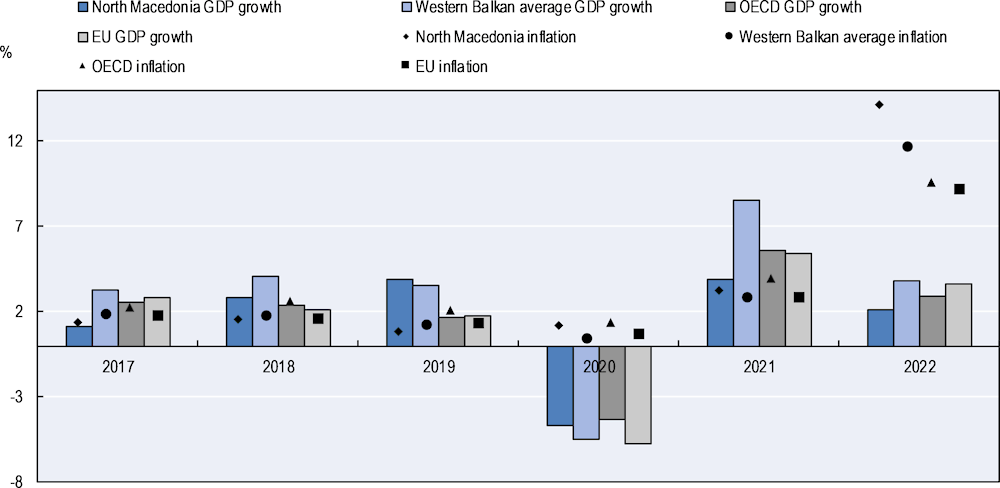

In 2020, the COVID-19 pandemic had a strong impact on North Macedonia’s gross domestic product (GDP), resulting in a year-on-year decrease of 4.7% (Figure 2.1).

Fast and determined responses from the government and the central bank softened the negative impacts of the pandemic and helped maintain macroeconomic and the financial sector’s stability.

While lower than that of its neighbours in the Western Balkans, North Macedonia’s GDP growth rebounded to 3.9% in 2021, fuelled by strong recovery in the production of automotive components, recovery of private consumption and implementation of government support measures.

Nevertheless, the economy lost steam throughout 2022, as domestic demand weakened and GDP growth dropped to 2.1%. The inflation rate climbed to close to 20% in October 2022, averaging 14% throughout the year, mainly driven by an increase in food and energy commodity prices, disproportionately affecting poorer households and small and medium-sized enterprises. This economic downturn was further exacerbated by the Russian Federation’s ongoing war in Ukraine.

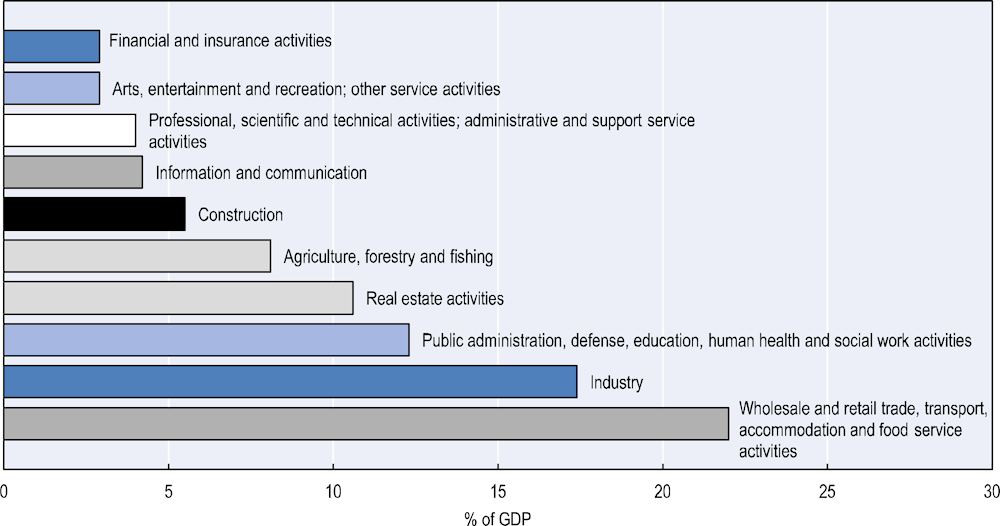

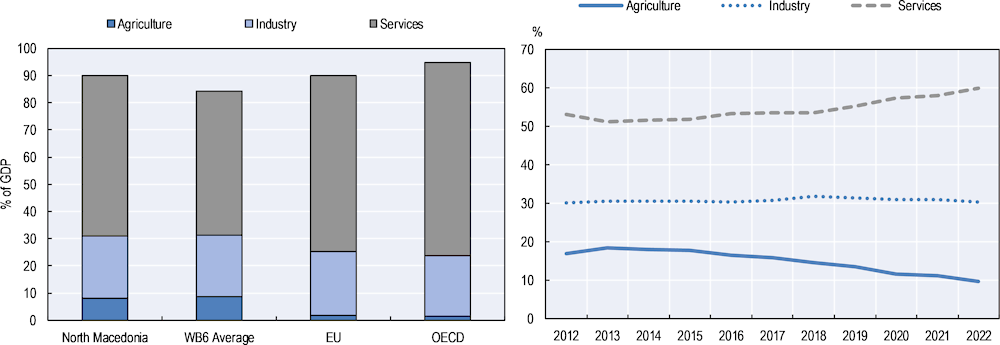

North Macedonia’s value added by economic activity shows that the economy is particularly reliant on wholesale and retail trade, followed by industry (Figure 2.2).

Figure 2.2. Value added by economic activity in North Macedonia, 2022

Service sector

North Macedonia’s economy is dominated by services, which accounted for 56.9% of GDP and 58% of employment in 2021 (Figure 2.3). Exports of services have increased considerably in the past decade but still account for only 25% of total exports (OECD, 2021[7]). This is the case despite the strong potential for the development of services linked to manufacturing and food processing global value chains (e.g. transport logistics, packaging), the rapidly growing domestic ICT sector and the tourism sector (OECD, 2021[7]).

Wholesale and retail trade (including tourism)1 account for the largest share of services in North Macedonia (amounting to 22% of total GDP in 2022). A transition towards a circular economy has the potential to enhance new trading opportunities for services, such as waste management, recycling, refurbishment and remanufacturing, reuse, and repair, as well as new business models and product service systems (OECD, 2018[8]). Introducing standards that would reduce services trade barriers for such activities could serve as a basis of circular economy policies (e.g. ecodesign, eco-labelling, green public procurement) and play a key role in facilitating the uptake of circular efforts in international trade (Yamaguchi, 2022[9]). Moreover, while tourism has been severely impacted by recent economic shocks, its recovery offers unique opportunities to redesign the sector in a sustainable and resilient way in line with a circular economy model, intentionally regenerative of natural, human and social capital, operating within the local destinations’ sustainable boundaries (Einarsson and Sorin, 2020[10]).

Figure 2.3. Value added by grouped activity, 2022, and share of employment by economic activity in North Macedonia, 2012-2022

Notes: WB: Western Balkan; EU: European Union. Industry includes construction, energy, mining and manufacturing. The value added shares presented in the World Development Indicators for agriculture, industry and services may not add up to 100% due to financial intermediary services indirectly measured and net indirect taxes.

Sources: World Bank (2022[11]); OECD (2024[12]); ILOSTAT (2023[13]); Eurostat (2023[6]).

Industry sector

Industry, including construction, has expanded over the past decade. In 2022, it accounted for 22.9% of GDP and 30.4% of employment (see Figure 2.3). The most notable expansion in the industrial sector has been the increase in manufacturing, representing 13% of GDP in 2022 (compared to 10% in 2013) and 22.5% of employment in 2022 (MAKSTAT, 2023[14]), on the back of significant inflows of export-oriented foreign direct investment (FDI) (Ministry of Labour and Social Policy, 2021[15]). North Macedonia has developed a more proactive and direct investor-targeting strategy through the establishment of special economic zones. Manufacturing FDI in special economic zones resulted in a significant increase in total exports, which accounted for 74.9% of GDP in 2022, the highest share in the Western Balkan region (World Bank, 2023[16]). North Macedonia’s main exports include automotive parts, textiles and basic metals (ferroalloys) (OECD, 2022[5]). While industry is the most resource-intensive and waste-producing economic sector, it shows tremendous potential for innovation, as the markets for new clean products and services keep growing. The increasing inflows of export-oriented FDI in North Macedonia, coupled with boosted links with local SMEs, could improve technical know-how and capacity to innovate and adopt new technology.

Mining and quarrying

Mining and quarrying accounted for 1.3% of GDP in 2018 in North Macedonia and have a long history in the economy (Macedonian Mining Association, 2021[17]). North Macedonia is rich in different materials – metallic minerals found in its territory include copper, silver, gold, zinc and lead; non-metallic minerals include bentonite, talc, gypsum, quartz and quartz sand; and energy materials include coal (lignite) (Macedonian Mining Association, 2021[17]). There are 201 business entities – mainly microenterprises – involved in mining and quarrying activities (or 0.3% of total active businesses), employing around 10 000 people. The sector accounts for 2.8% of total exports (Macedonian Mining Association, 2021[17]). It has been particularly backed by important FDI in the past decade due to lower restrictions on procedures for issuing permits and concessions. However, mining methods of extraction have resulted in long-lasting water and soil pollution,2 affecting biodiversity and the health of the local population. Recent legislative amendments nevertheless provide greater protection of the population’s health and of the environment. Improving circularity at the mining operations stage and the recovery of critical raw materials from extractive waste in current mining activities and from historical mining waste sites could ensure the sustainability of critical raw materials and protect the environment from toxic and hazardous elements.

Metallurgy

Metallurgy, or basic metals production (most exported products include ferroalloys, hot-rolled steel, coated flat-rolled steel, steel pipe and tubes, and steel bars) is one of North Macedonia’s largest industrial sectors. The sector is comprised of complex technical and technological stems for production as well as modern equipment and technologies for advanced processing of basic metals, making it significantly important and strategic for the economy (Invest North Macedonia, 2023[18]). Basic metals production represented 13.6% of exports in 2021, the vast majority of which was exported to the European Union, with iron and steel imports representing 8.9% of the European Union’s total imports from North Macedonia in 2022 (European Commission, 2023[19]). In addition to being easily recycled and reused, transitioning to circular production processes of metal products will be beneficial in light of the EU Carbon Border Adjustment Mechanism.3

Construction and building materials

The construction and building materials sector’s value added has stagnated between 5% and 7% in the past decade and accounted for 7.7% of the total number of active business entities in 2021 (MAKSTAT, 2022[20]) and 6.5% of total employment in 2022 (MAKSTAT, 2023[14]). However, the consequences of recent crises, namely disrupted supply chains and delayed construction projects, have had adverse effects on the sector and labour force (the number of employees in the sector decreased by 22.1% year-on-year in the third quarter of 2022) (MAKSTAT, 2023[21]). The production of building materials is based on domestic resources of non-metallic minerals (marble, gypsum, brick clay, sand, gravel) and related mining activities (imports of primary raw materials are almost negligeable). The main construction products produced in the economy are cement products, plaster, plasterboard, dry mortar, clay products and bituminous insulating materials. The production of construction products has undergone major changes in recent years with the introduction of new modern production lines and technological advancements (Economic Chamber of North Macedonia, 2021[22]). Nevertheless, the sector produces large amounts of waste that is not recovered and is largely deposited in wild dumpsites (EEA, 2021[23]). Overall, untapped potential remains in the production of sustainable construction materials, in particular through more resource-efficient mining operations and the use of industrial waste and reuse of construction materials (Joint Research Centre, 2021[24]).

Automotive industry

The automotive industry is of growing importance for the Macedonian economy, creating new jobs and attracting investments. Prior to the COVID-19 pandemic, the industry was booming, with automotive components exports amounting to EUR 117.5 million in 2020 (compared to EUR 9.7 million in 2015), in part due to the strong metallurgy sector (Invest North Macedonia, 2022[25]). In 2019, the 15 largest companies4 in the automotive industry generated total revenues of EUR 2.9 billion, representing one-fourth of North Macedonia’s GDP and 43% of total exports (Invest North Macedonia, 2022[25]). The strong recovery of the sector was also a key driver of the post-COVID economic rebound, with companies in the automotive industry responsible for 65% of the total exports in January 2021 (Invest North Macedonia, 2022[25]).

Through the increased production of automotive components, the Macedonian economy has become more integrated into global supply chains, with industrial exports increasingly composed of high value-added products, achieved through the importation of medium-value inputs. These intermediate inputs are then assembled and finished in North Macedonia, reflecting a strategic shift in the production process. Nevertheless, the global automotive industry is at the beginning of its deepest transformation since its rise, with electrification, digitalisation and decarbonisation requiring massive investments and attention. Optimising the full vehicle life cycle across the value chain, in line with circular business models, can help address these challenges and improve profitability, for instance through modular vehicle design, vehicle end-of-life treatment and material processing (World Economic Forum, 2022[26]).

While automotive companies in North Macedonia are not responsible for all stages of the vehicle life cycle (in particular vehicle conception and design), the circularity of the industry can be improved through better selection, collection and treatment of scrap and waste (in particular for metals and plastics) and by promoting production methods with lower environmental impact and waste generation. There are currently five permits for the waste management of end-of-life vehicles (dismantling and pre-treatment). Municipalities in Greater Skopje and the City of Skopje organise their collection and treatment, including the delivery to the collection point or treatment facility, in accordance with the law. Future long-term plans include defining measures for the reuse or restoration of components, establishment of a system for gathering relevant data, and the creation of an independent producer balancing body.

Textile industry

North Macedonia’s textile industry is the second largest industrial sector and one of the most developed and diversified in terms of industrial production, employment and export earnings, accounting for 10% of total exports and 13% of industrial GDP (Invest North Macedonia, 2022[25]). In 2019, the sector represented 7% of total employment (36 000 people), or around one-fourth of employees in manufacturing. More than 800 companies in the textile industry are actively involved in various levels of production, of which about 93% are export-oriented (Invest North Macedonia, 2022[25]). However, the industry is still characterised by landfilling (4.7% of total landfilled municipal solid waste) and low recycling, low reuse and fabric underutilisation, leading to considerable pressure on resources (Jordeva et al., 2018[27]; EEA, 2021[23]). The textile industry stands out as one of the most polluting and waste-generating sectors globally, contributing to 10% of total carbon emissions worldwide, a figure surpassing those of aviation and marine shipping (European Commission, 2020[28]). Furthermore, it accounts for 20% of global freshwater pollution and is associated with high rates of landfilling and burning.

Its associated carbon dioxide (CO2) emissions are projected to increase by more than 60% globally by 2030. A “new textile economy” based on a circular model will, therefore, be key in reaching climate-neutral targets (Design4Circle, 2021[29]). While North Macedonia’s textile companies are not involved in the production and design phase of fabrics, there is circular potential in sustainable textile production processes (manufacturing, treating and dyeing) and waste reduction in fabric usage. Digital tools, such as computer-aided design and computer-aided manufacture, can support such processes.

Agriculture

The contribution of agriculture, forestry and fishing to GDP has been declining continuously since the 1990s and the sector now accounts for 8.1% of GDP, slightly lower than the Western Balkan average (8.5%) but above EU and OECD averages (1.7% and 1.4%, respectively) (see Figure 2.3). Agriculture, however, still accounts for almost 10% of total employment and most jobs are low-skilled and low-wage, mainly due to the prevalence of subsistence farming. Exports of agricultural and food products in 2021 constituted 9.6% of total exports, mainly tobacco, lamb meat, fresh and processed vegetables and fruits, wine, and confectionery products (Invest North Macedonia, 2022[25]). Moreover, organic production has grown in recent years thanks to government support, with the agricultural area under organic farming having more than tripled in between 2015 and 2022, although it still represents less than 2% of total cultivated area (Eurostat, 2023[30]; MAKSTAT, 2023[31]). Agricultural productivity is very low (less than 25% of the EU average) and further development of the sector is undermined by its underdeveloped infrastructure (including for irrigation), fragmented land tenure (the average farm is 1.62 hectares), lack of skilled labour, and significant amounts of land and water required (Ministry of Agriculture, Forestry and Water Management, 2021[32]; OECD, 2021[7]).

In the pursuit of increased productivity and efficiency in the agricultural sector, circular economy principles can be used to decrease pressure on the living environment and use resources more efficiently, thus preventing further depletion and overexploitation of natural resources. Additionally, a circular transition could foster the resilience and economic profitability of the sector, such as through increased use of agricultural surplus and technological progress (OECD, 2019[33]).

SME sector

The SME sector accounted for the vast majority of enterprises (99.9% vs. 98.9% in the European Union) and employment (73.9% vs. 67% in the European Union) in 2021 (OECD, 2022[5]; European Parliament, 2023[34]). Services represent the main economic activity for more than 68.8% of SMEs in North Macedonia, with the largest share working in the distributive trade sector (31.9%), followed by other services (24.1%) and manufacturing (16.6%), the primary base of the economy’s industrial sector, with a focus on chemical products, basic iron, steel and ferroalloys, machinery, and textiles.

Considering that SMEs collectively contribute substantially to the environmental footprint, with small firms responsible for 50% of greenhouse gas (GHG) emissions worldwide (ICT, 2021[35]) and 63% in the European Union (European Commission, 2022[36]), it is crucial for North Macedonia to account for them in its environmental policy making. SMEs, like any other economic entity, encounter the repercussions of environmental degradation, presenting unique challenges to their sustainability and growth. The large share of SMEs in North Macedonia can be a key driver in achieving circular objectives, both due to their flexibility in adopting circular business models (“green performers”) and their contribution to developing new products, technologies and approaches that address environmental challenges (“green innovators”) (OECD, 2021[37]). However, only 15% of Macedonian businesses believe that their business models allow for a shift towards a circular economy, with added costs and the lack of government subsidies being the most significant impediments in this regard (RCC, 2023[38]).

Environmental trends and recent developments relevant to the circular economy

Energy use and emissions trends

North Macedonia is a Non-Annex-I signatory to the United Nations Framework Convention on Climate Change and its Paris Agreement and, as such, has set emissions reduction targets (82% of 1990 emissions levels by 2030). Moreover, in line with the EU ambition to become climate-neutral by 2050, North Macedonia has also committed to achieving carbon neutrality by 2050 by endorsing the Green Agenda for the Western Balkans.

CO2 emissions account for 80% of North Macedonia’s total GHG emissions, and an inventory of other pollutants is under preparation (Ministry of Environment and Physical Planning, 2021[39]). CO2 emissions reached 3.6 tonnes/capita in 2021, below EU and OECD averages (6.3 tonnes/capita and 7.1 tonnes/capita, respectively) and have been on a decreasing trend over the past decade (from 4.9 tonnes/capita in 2011) (Crippa et al., 2022[40]).

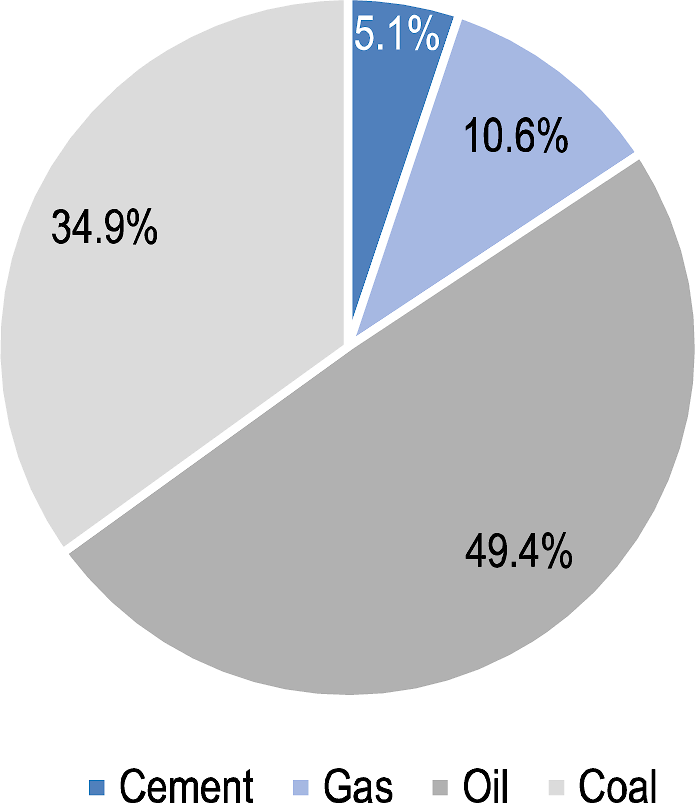

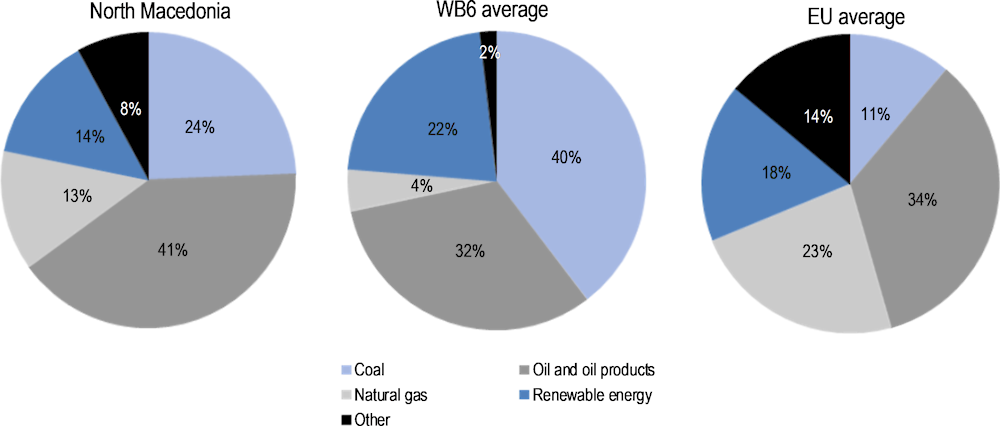

The largest sources of CO2 emissions in the economy are oil and coal, representing 49% and 35% of total CO2 emissions, respectively, in 2021 (Figure 2.4). Oil and coal also represent two-thirds of North Macedonia’s energy supply (Figure 2.5).

Figure 2.4. CO2 emissions by source in North Macedonia, 2021

Electricity and heat generation is responsible for over half of CO2 emissions in North Macedonia, which is mainly covered by coal (72%)5 (IRENA, 2022[42]). Transport, and in particular road transport, emits more than 25% of total CO2 emissions and is the most demanding oil sector in North Macedonia.

Natural gas’ share in North Macedonia’s energy supply has increased in the past decade (13% in 2021 compared to 3.2% in 2010) but in light of the energy crisis, the heavy reliance on Russian imports has led the economy to turn to fossil fuels.6

Figure 2.5. Energy mix in North Macedonia, the Western Balkans and the European Union, 2021

% of total energy

Notes: WB: Western Balkans; EU: European Union. Nuclear heat accounts for 12.8% of the European Union’s energy mix. The major types of renewable energy sources are biomass (wood and wood waste, municipal solid waste, landfill gas and biogas, biofuels), hydropower, geothermal, wind and solar.

Source: Eurostat (2023[43]).

Under its National Energy and Climate Plan, North Macedonia was the first economy in the Western Balkans with structural plans to phase out coal by shutting down all coal-fired thermal power plants by the end of 2027. Nevertheless, objectives have been postponed to 2030 to mitigate the effects of the energy crisis by reducing reliance on electricity imports (North Macedonia imported 7.7% of its electricity in 2020) (Eurostat, 2022[44]). North Macedonia has continued to feed dated power plants and launched negotiations to buy 3 million tonnes of lignite from Kosovo7 at the end of 2022. In this regard, the smaller coal power plant, Oslomej, was reactivated in 2021 after being dormant during 2020 and the Negotino fuel oil-fired power plant was reactivated after not being in use for 12 years (World Bank, 2022[45]).

Energy poverty remains an overarching concern in North Macedonia, with around one-third of households not being able to keep their home adequately warm, one of the largest shares in Europe (World Bank, 2022[45]). When facing higher energy prices, low-income households often switch to cheaper energy sources for heating, such as firewood or waste, thereby exacerbating concentrations of carbon monoxide (CO), presenting a significant threat to air quality and health (OECD, 2021[7]).

Renewable energy only accounts for 14% of North Macedonia’s energy supply, the lowest share in the Western Balkans. The total installed capacity of renewable power plants was around 2 117 megawatts (MW) in 2021, with nearly all renewable energy produced from hydro8 (Energy and Water Services Regulatory Commission of the Republic of North Macedonia, 2022[46]), despite the great potential for wind and solar generation. In particular, wind and solar potential together account for around 71% of the combined utility-scale wind, solar and hydro potential in North Macedonia (IRENA, 2019[47]). One of the National Energy and Climate Plan’s key pillars and strategic goals is to increase the share of renewables in final energy consumption to 38% by 20309 (Ministry of Economy, 2020[48]). Promisingly, renewable energy sources are developing more rapidly than before. Compared to the period 2017-20, the Energy and Water Services Regulatory Commission licensed almost twice as many solar photovoltaics projects, with a total capacity of 267 MW in 2022/23 alone (Energy and Water Services Regulatory Commission of the Republic of North Macedonia, 2023[49]).

North Macedonia’s energy intensity of GDP was almost three times higher than that of the European Union in 2020 (310 and 117 kilogrammes of oil equivalent per EUR 1 000, respectively), making its industries more vulnerable to rising energy prices. High energy intensity is the consequence of low-cost electricity supply based on lignite and hydro and the slow roll-out of investments in energy efficiency (Eurostat, 2020[50]).

Reducing CO2 emissions in North Macedonia will be dependent on the long-run sustainability of the energy sector. Phasing out coal from its energy mix taking into account underlying economic and social challenges will be a priority, by diversifying the energy mix through other renewable sources and curbing demand growth through energy efficiency measures. This will be particularly important, as energy-intensive economic sectors will be increasingly uncompetitive with the EU Carbon Border Adjustment Mechanism in place. For sustainable energy technologies to replace conventional coal-fired generators, critical metals will be needed (lithium, cobalt and rare earths), which can offer opportunities for mining companies (IEA, 2021[51]). Nevertheless, the mining of such metals presents sustainability and energy security10 challenges (Pennington, 2022[52]). Renewable material recycling and the use of secondary low-carbon materials will, therefore, be vital to support the clean energy transition. Moreover, introducing circular economy strategies into hydropower generation could ensure its sustainability, as hydropower plants and dams can create greater value, such as contributing to cleaning rivers with equipped trash racks and cleaning machines or improving water management services with water tracking devices. If environmental protection is ensured for hydro generation investments,11 designing durable and easily disassembled and recycled hydro plants (their lifetime can exceed 100 years) can be significant to long-term low-carbon electricity.

Materials use

North Macedonia hosts several natural resources, including a rich variety of minerals (zinc, lead, copper, chromium, iron, nickel, silver and gold), fossil energy materials (in particular low-grade lignite and gas), forests (around one-third of North Macedonia’s land is forested, providing important resources, such as timber and firewood), arable lands (with crops such as tobacco, vegetables and fruits) and water resources (several rivers and lakes).

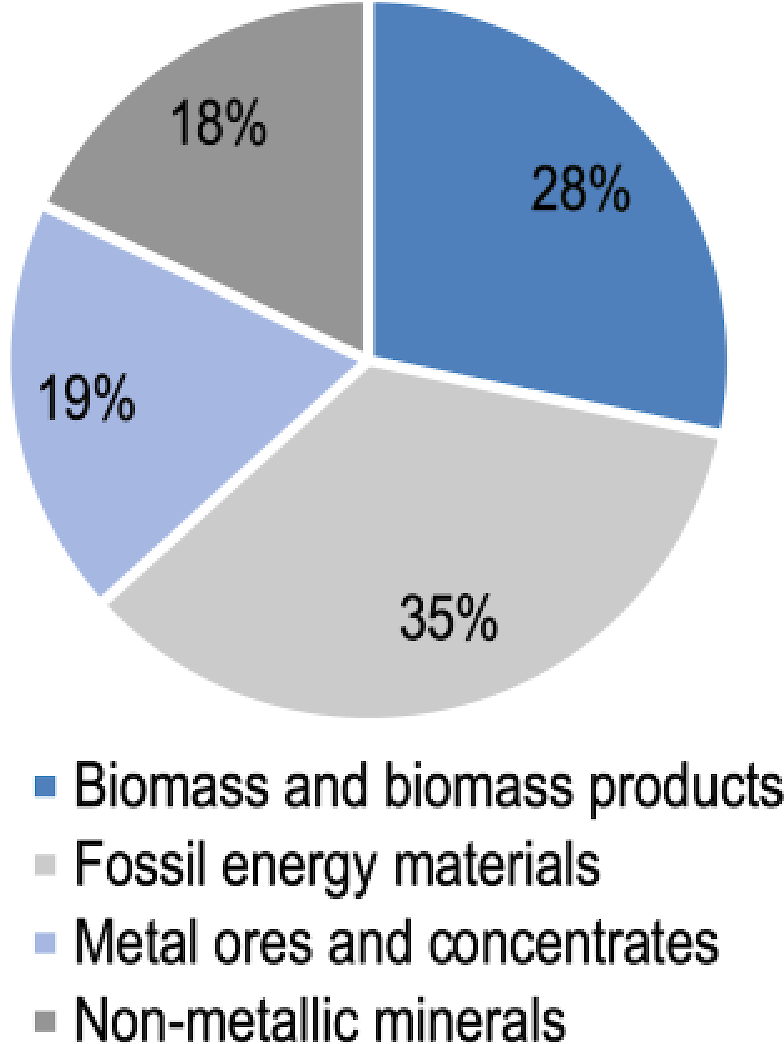

Domestic material consumption12 (DMC), or the total amount of materials directly used in North Macedonia, stood at 9 tonnes/capita in 2021, lower than the EU and OECD averages, which amounted to 14.1 tonnes/capita (in 2021) and 17.5 tonnes/capita (in 2019), respectively (MAKSTAT, 2021[53]; OECD, 2024[54]). North Macedonia’s DMC is dominated by fossil energy materials (35% of the total) and biomass (28.3% of the total) (Figure 2.6).

The share of fossil energy materials in North Macedonia’s DMC is much higher than in the European Union (35% vs. 18%, respectively (Eurostat, 2022[55])), due to North Macedonia’s high reliance on fossil fuels for its energy supply. Moreover, metal ores and concentrates represent 19% of North Macedonia’s DMC, more than three times higher than in the European Union (6% on average) (Eurostat, 2022[55]). Resource efficiency efforts in mining operations, smelting and refining through the processing of residues and secondary metals and materials will be important to reduce environmental impacts and ensure the sustainability of fossil and critical materials.

Biomass’ domestic consumption is also higher in North Macedonia than in the European Union (where it represents 23% of its total DMC) (Eurostat, 2022[55]) due to the important contribution agriculture makes to North Macedonia’s GDP and the use of firewood for various heating applications. The circular transition of biomass and the development of a circular bioeconomy13 could be significant in meeting climate targets and protecting the environment, through better policies guiding more resource-efficient and sustainable primary production, and waste management (composting and anaerobic digestion), and supporting the use of residues and waste in agricultural practices. Moreover, bio-waste conversion to energy could support North Macedonia’s climate targets by reducing its reliance on fossil energy materials.

Figure 2.6. Structures of domestic material consumption in North Macedonia, 2021

% of total

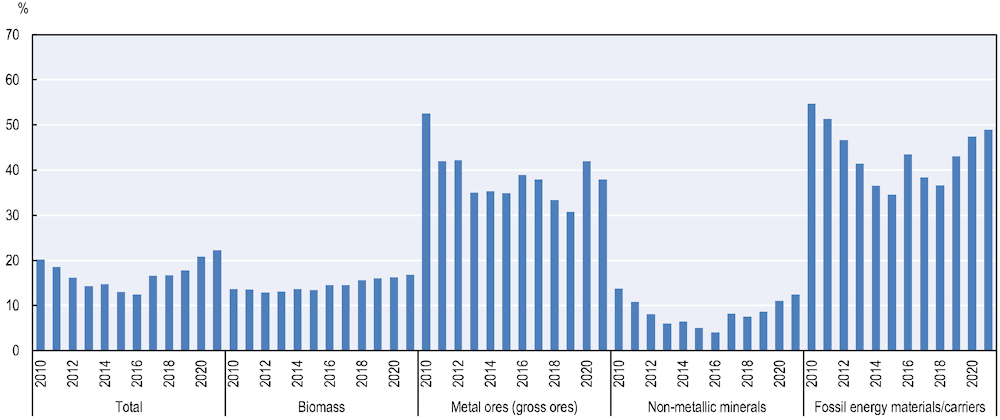

Between 2014 and 2021, while the DMC of fossil energy materials and biomass decreased by 24% and 9%, respectively, their import dependency increased by 29% and 17% (from 2014 to 2020). This trend can point to the depletion of stocks of non-renewable sources in the economy, in particular of coal reserves. North Macedonia is the most import-dependent on metal ores, whose rate has increased since 2017, reaching 60% in 2020, mainly due the low yield of its mines and the strong demand from the metallurgy and automotive sectors (Figure 2.7).

Figure 2.7. Import dependency in North Macedonia, 2010-2021

Notes: Import dependency is the ratio of imports over direct material inputs (DMI). DMI is calculated as the sum of domestic extraction of natural resources and imports of materials. Data for the year 2021 are provisional.

Source: Eurostat (2023[56]).

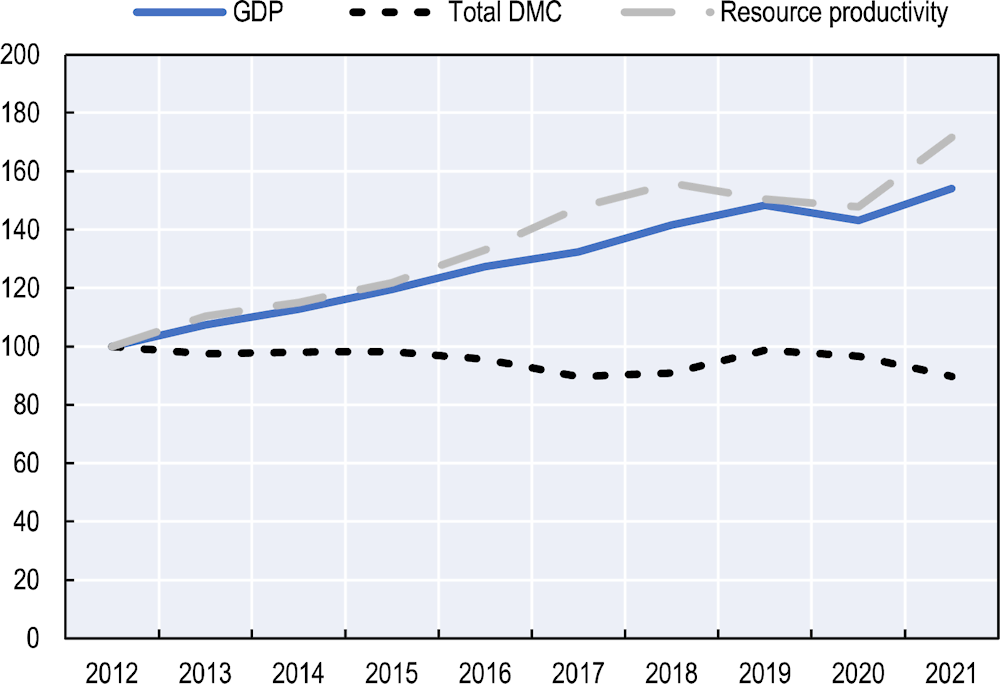

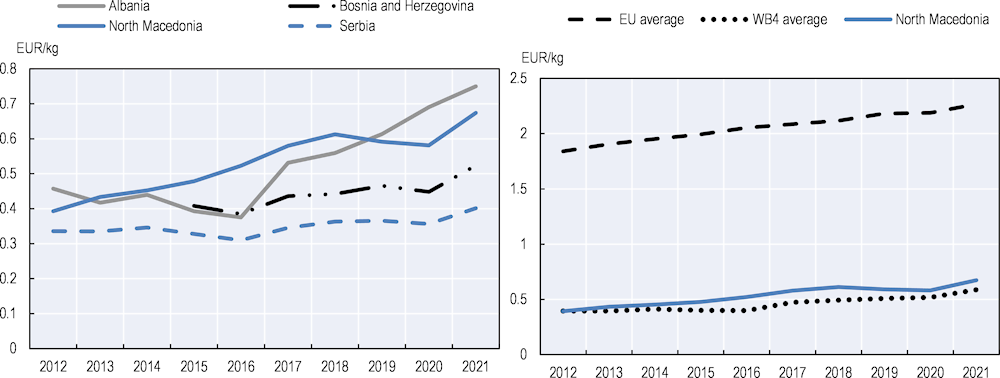

With North Macedonia’s DMC being on a slight decreasing trend since 2015 (when it was 9.2 tonnes/capita), resource productivity reached an all-time high in 2021 at 0.67 EUR/kg, marking a sharp increase from 2010, albeit falling short of the EU average (2.26 EUR/kg in 2021) (Eurostat, 2022[57]). While this trend can be interpreted as a first sign of decoupling of economic growth and consumption of natural resources, it has been slightly reversed since 2019 (Figure 2.8). Overall, further efforts are needed to decrease dependence on fossil energy materials, increase resource efficiency and productivity at all stages of the material life cycle (extraction, transport, manufacturing, consumption, recovery and disposal) and throughout its supply chain. A transition to a circular economy, through repair, reuse and recycle, would reduce material extraction levels, ensure the sustainable flow of resources and offer possibilities to reduce dependencies (OECD, 2021[58]).

Figure 2.8. Resource productivity in North Macedonia, 2012-2021

Notes: EU: European Union; WB: Western Balkans. The indicator presents gross domestic product (GDP) divided by domestic material consumption (DMC). DMC measures the total amount of materials directly used by an economy. No data are available for Bosnia and Herzegovina (before 2014), Kosovo, Montenegro, or Albania (2020). Resource productivity data for EU-27 are estimates; 2021 data for North Macedonia are provisional for all indicators.

Sources: Eurostat (2022[55]; 2023[59]).

Figure 2.9. GDP, domestic material consumption and resource productivity in North Macedonia, 2012-2021

Index 2012=100

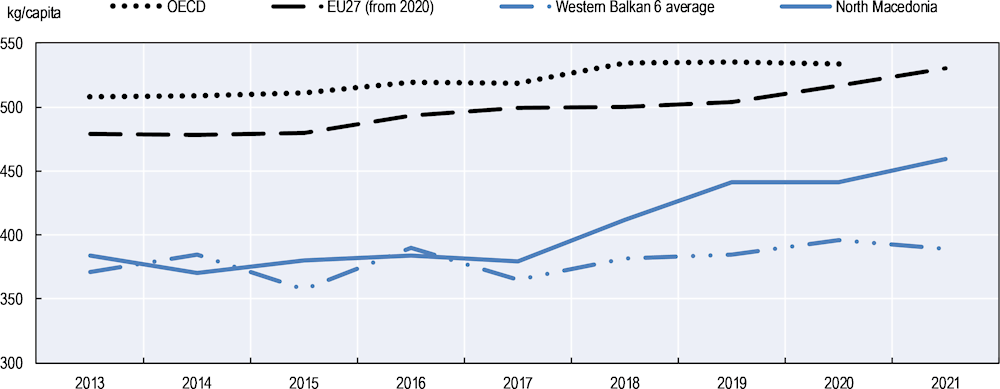

Waste-related trends

North Macedonia’s level of municipal waste generation is higher than that of its neighbouring economies and has been increasing over recent years (Figure 2.10). Municipal waste generation in North Macedonia increased from 786 000 tonnes in 2015 (corresponding to 380 kg/capita) to 916 000 tonnes in 2019 (corresponding to 441 kg/capita). However, there are no exact statistics for waste generation, as data and reports are based on estimations14 due to the lack of weighing equipment at landfills (with the exception of the Drisla landfill) and the extensive use of illegal dumpsites. Moreover, official data on recycling are based on reports received from only eight municipalities. A significant part of waste generated remains uncollected by the official system (Ministry of Environment and Physical Planning, 2021[60]).

Figure 2.10. Municipal waste generation, 2013-2021

Sources: Eurostat (2021[61]); data for OECD: OECD (2022[62]); data for North Macedonia: Ministry of Environment and Physical Planning (2021[60]).

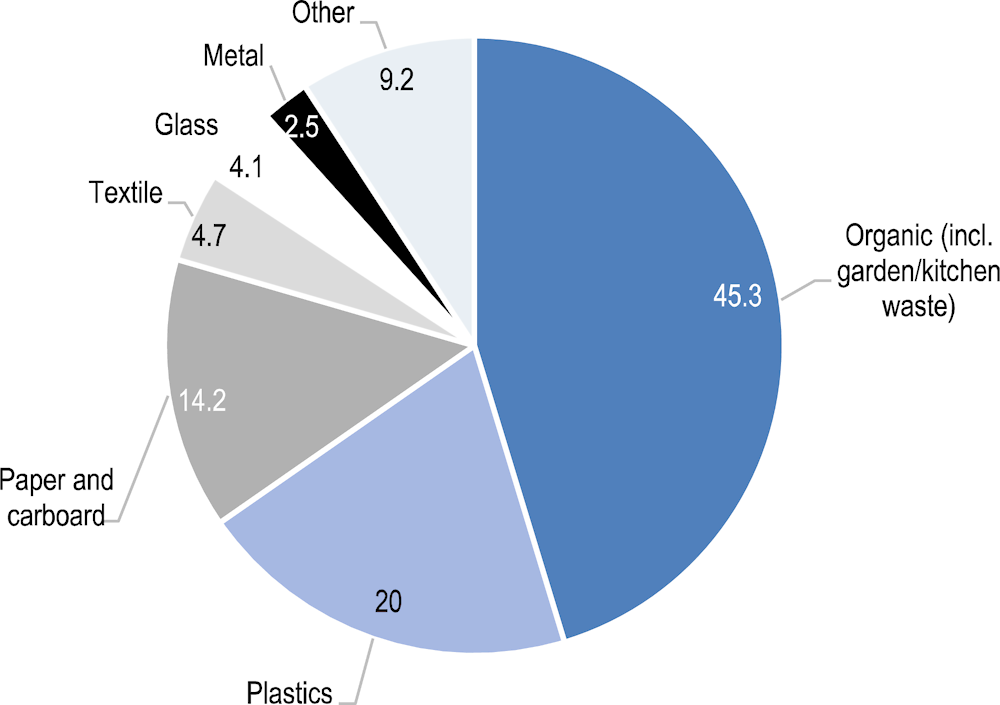

In 2020, 45% of estimated municipal waste produced in North Macedonia was organic (food, leaves), followed by 20% of plastics, and 14% of paper and carboard waste (Figure 2.11). When it comes to plastic waste, North Macedonia has one of the highest plastic leakage rates into the Mediterranean through rivers (contributing an estimated 3.2 kg/year/person), mostly due to the high surface runoff, population density in the vicinity of watersheds and a high proportion of mismanaged waste in particular (Boucher and Billard, 2020[63]).

More than 80% of the population in North Macedonia was served by waste collection services in 2022, mainly in urban areas. While the collection coverage has increased, from 72% in 2008 to 83% in 2022, it falls short of the EU average of 98%, and did not attain the government’s target of 90% by 2020 (MAKSTAT, 2022[64]; Eurostat, 2023[65]). Waste collection and treatment services are funded from waste management fees15 from households and private companies; however, the share of citizens paying those fees ranges from 45% to 90% across municipalities due to low penalties and enforcement mechanisms. Pay-as-you-throw schemes are rare due to the lack of measuring equipment in municipalities (EEA, 2021[23]). Low fees and deficient payment thus do not incentivise waste prevention or separate collection.

Figure 2.11. Municipal waste generation by category in North Macedonia (estimations), 2020

In %

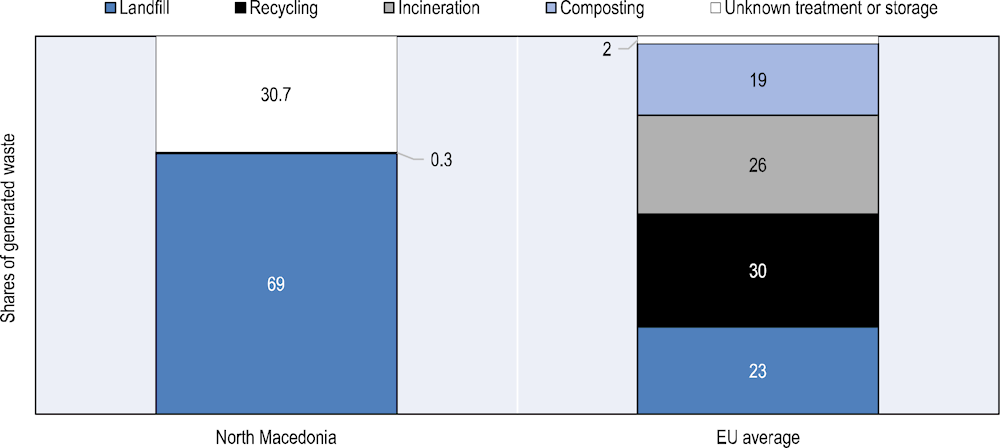

Municipal waste management remains a challenge. The main method of managing waste is disposal to landfills (69%); this share is significantly above the share in the European Union (23%) (see Figure 2.12). Recycling rates remain extremely low (0.3%) and around 31% of waste is not treated or unaccounted for. Composting rates dropped from 0.4% in 2015 to 0% in 2020 (Eurostat, 2021[61]).

Figure 2.12. Municipal waste treatment in North Macedonia vs. the EU average, 2020

In %

Notes: The unknown treatment or storage category is calculated as the difference between generated and treated waste. No data are available on incineration and composting in North Macedonia. Recycling data are reported by the European Environment Agency.

Sources: Eurostat (2023[67]); OECD (2022[62]); EEA (2021[23]).

With regard to recycling, municipalities do not organise separate collection of bio-waste or dry recyclables in North Macedonia. The main system for waste collection consists of “bring points” with containers for residual waste collection, where citizens take their waste for disposal. There are some small-scale recycling activities, with informal waste pickers collecting waste from dumpsites and bins and selling it to the recycling industry. Moreover, while a few municipalities are undertaking some pilot circular projects, these remain marginal, such as the conversion of waste and wastewater into compost and biogas in the municipality of Kocani and the establishment of composting stations in the municipality of Resen. Regarding plastic waste, three companies are registered for the management and pre-treatment of PET waste and one for polyolefin, before it is exported to the Republic of Türkiye for recycling (EEA, 2021[23]).

On the other hand, bring systems for packaging waste, regulated under the Extended Producer Responsibility Law, are established by the producer responsibility organisations (PROs) in agreement with municipalities and other entities included in the extended producer responsibility (EPR) scheme (EEA, 2021[23]). In 2021, the PROs reported that 40.9% of packaging waste placed on the market was recycled. However, these amounts are not included in the municipal waste data. PROs, such as Pakomak, have conducted some awareness-raising activities on the importance of separate collection of packaging waste.

Where no waste collection service is provided, waste is often dumped at roadsides or burnt in the open (OECD, 2021[7]). The Drisla landfill, serving the Skopje region, is the only landfill in North Macedonia that meets national legislative standards and is relatively well-managed (EEA, 2021[23]). However, it is estimated that less than 30% of the landfilled waste is currently disposed of at the Drisla landfill. In addition, there are 57 official municipal landfills, which are not compliant with national law, and approximately 1 000 illegal waste dumpsites. Illegal dumpsites have multiplied as a result of the lack of an organised waste collection service, in particular in rural areas (Ministry of Environment and Physical Planning, 2021[60]).

A total of around 1.5 million tonnes of industrial waste was generated in 2020 (latest available data), of which 72% was non-hazardous waste. North Macedonia’s long mining tradition comes with a high amount of mining waste. In 2020, more than one-third (approximately 521 000 tonnes, or 35%) of North Macedonia’s industrial waste was generated by the mining sector, of which 79% was hazardous, containing a large share of toxic contaminated mining waste that remains untreated (MAKSTAT, 2022[68]; Đorđević et al., 2019[69]). The manufacturing sector also accounts for one-third of total industrial waste, composed of 40% of non-hazardous metallic waste (mixed ferrous and non-ferrous) and 20% of combustion waste. According to official statistics, around 56 000 tonnes of construction and demolition waste (mainly mineral) was generated in 2020, representing 3.8% of total generated waste by economic sector (MAKSTAT, 2022[68]). However, structural lack of data due to high rates of informal waste collection in this waste stream makes these statistics less conclusive in an international comparison16 (Ministry of Environment and Physical Planning, 2020[70]). Industrial, construction and demolition wastes are also largely disposed in waste landfills or unmanaged and their collection, separation and recovery is almost non-existent. Sixteen landfills containing hazardous industrial waste have been identified across North Macedonia. These sites pose a serious threat to the environment, as industrial waste products have particularly dangerous properties, causing pollution in water, soil and crops. Additionally, the presence of naturally occurring radioactive material (NORM) in industrial waste adds to the potential hazards associated with these sites.17

Treating waste according to the waste hierarchy, through higher recovery and recycling rates of municipal and industrial waste, will be vital to align with EU waste legislation, including its recycling and landfill reduction targets. Large amounts of organic waste (see Figure 2.11) generated by municipal and agricultural waste could be turned into compost and used either as a resource for organic soil fertilisers or as a source of biomass to generate biofuels, thus reducing the cost of purchasing new raw materials or products. Manufacturing waste, in particular from metallurgical slags and thermal power plants (fly ash and bottom ash), present potential for reuse in the construction and building materials sector, such as for the production of cement, concrete, aggregates, adobe, brick and insulation material; in the construction of dams and roads; and in geotechnical applications. Moreover, mining waste could potentially be used as a commodity and provide solutions to limited metal supplies, such as to backfill mining voids; as a construction material for restoring old mining sites; and as aggregates in embankment, road, pavement, foundation and building construction (EIT Raw Materials, 2021[71]). Circular solutions are also necessary to reduce plastic pollution, generated by its untenable use and disposal of (single-use) plastic products, as it comes with several risks for the tourism sector, ecosystem and human health.

Existing policy landscape and initiatives relevant to the circular economy in North Macedonia

The transition to a circular economy has been gradually gaining momentum in North Macedonia, although no specific policy framework targets the circular economy. Some activities have been undertaken to promote a circular transition in the economy, primarily by international partners, civil society and academia, but they remain rather unco-ordinated and ad hoc.

Overview of the circular economy policy landscape in North Macedonia

The Ministry of Economy; the Ministry of Environment and Physical Planning; the Ministry of Finance; the Ministry of Agriculture, Forestry and Water Management; the Ministry of Transport and Communication; and the Ministry of Local Self-Government are the most relevant institutions for designing and implementing circular economy policies. The Agency for Promotion of Entrepreneurship of the Republic of North Macedonia (APPRM) and the Fund for Innovation and Technological Development can also play an important role in promoting circular business models, given their increasing responsibilities as providers of government business support services. Additionally, the State Statistical Office (MAKSTAT) is instrumental in supplying essential data and insights that facilitate informed decision making regarding the transition to a circular economy.

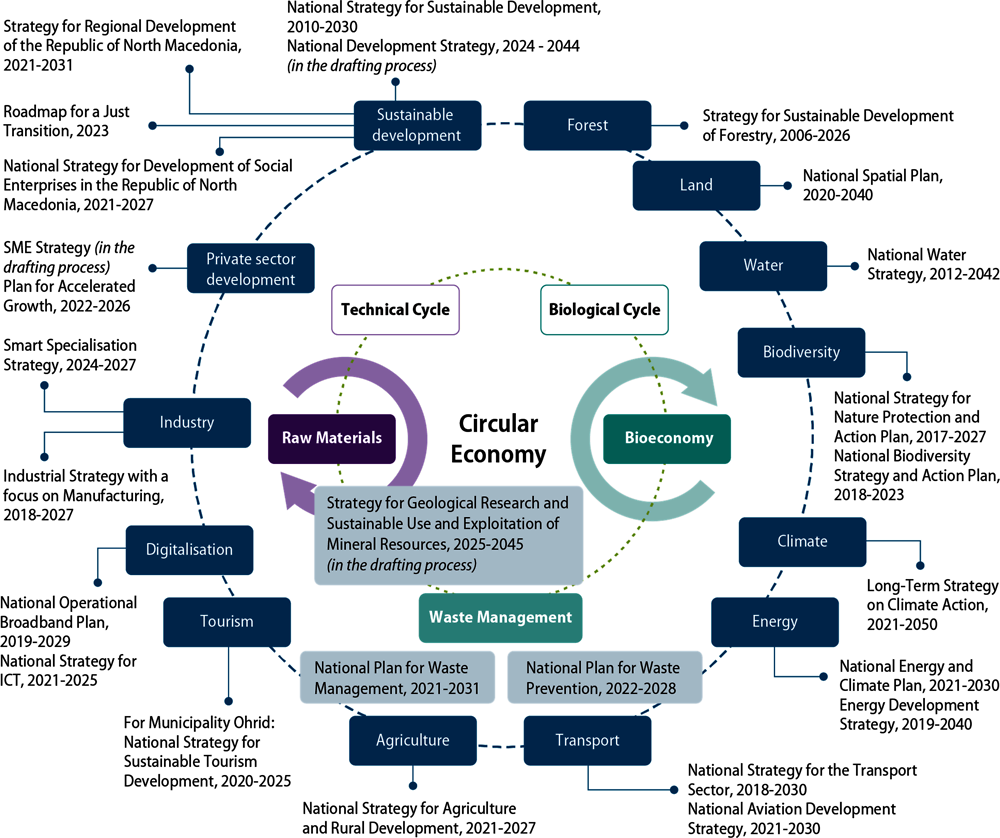

The current legal and policy frameworks, including national regulations, strategic documents and action plans, do not provide a solid basis for the transition to a circular economy. Nevertheless, strategies across a number of thematic areas are considered to be relevant to the transition to a circular economy (Figure 2.13).

Figure 2.13. Overview of North Macedonia’s policy landscape relevant to the circular economy

Notes: This policy analysis covered policy documents currently in place and identified across a number of thematic areas considered to be relevant for the transition to a circular economy. This thematic scope includes both technical and biological cycles in the circular economy as well as policy frameworks enabling this transition. The examples of relevant policies in the circular economy context are non-exhaustive.

North Macedonia lacks an umbrella policy framework on environmental protection, although a comprehensive Long-term Strategy on Climate Action was adopted in 2021, which includes a specific focus on promoting the circular economy. Stemming from Figure 2.13, Table 2.1 outlines policy documents relevant to circular economy, classified as “core” or “directly related”. Documents identified as ‘’core’’ directly reference the circular economy.

Table 2.1. List of overarching policy documents directly related to the circular economy in North Macedonia

|

Topic area |

Title (English) |

Time frame |

Qualitative goals relevant to the circular economy |

Quantitative targets |

|---|---|---|---|---|

|

Core policy documents |

||||

|

Overarching Green Agenda |

2020-2030 |

- Overarching green growth strategy for the Western Balkans, aiming at transitioning from a traditional economic model to a sustainable economy, in line with the European Green Deal - Alignment of the region with the European Union’s (EU) 2050 ambition to make Europe a carbon-neutral continent - Unlock the potential of the circular economy - Fight air, water and soil pollution - Promote sustainable methods of food production and supply - Exploit the tourism potential of the region, focusing on protecting biodiversity and restoring ecosystems For the circular economy specifically: - Improve the sustainability of primary production of raw materials - Apply an industrial ecosystem approach to attain environmentally sustainable, balanced economic recovery - Develop circular economy strategies looking at the entire life cycle of products - Make further progress in the construction and maintenance of waste management infrastructure for cities and regions - Design and implement consumer-targeted initiatives to raise citizens’ awareness on waste prevention, separate collection and sustainable consumption - Conclude and implement a regional agreement on the prevention of plastic pollution, including specifically addressing the priority issue of marine litter |

- Alignment with EU targets |

|

|

Waste |

2021-2031 |

- Strengthen the capacity of relevant institutions and inter-institutional co-operation - Enhance waste management infrastructure (establishment of regional landfills, closure of non-compliant landfills, establishment of infrastructure for recycling and the production of fuel from waste, improvement of waste collection transportation) - Improve financial structures (ensuring implementation of the “polluter-pays principle” and extended producer responsibility, establishment of a hazardous industrial waste management system) - Align legal framework with EU requirements and revise regional waste management plans - Improve data collection - Introduce a national campaign to raise public awareness of waste management |

- Increase the share of the population included in the waste collection system (currently about 70-80%) to 100% by 2024 - Increase the share of households connected to separate collection of waste (currently almost non-existent) to 65% by 2030 - Four awareness-raising campaigns - Increase municipal waste recycling to 45% by 2035 and 65% by 2045 Recycling targets for specific waste streams: - minimum 70% of packaging waste recycled by 2035 - 85% of paper and cardboard - 75% of glass - 70% of metals - 85% of plastics - 65% for lead acid batteries, 75% for nickel cadmium batteries and 50% for other batteries |

|

|

Waste |

2022-2028 |

- Reduce the consumption of materials, water and energy that cause the creation of larger amounts of waste by changing businesses’, households’ and the public sector’s habits and behaviour - Develop a collection and recycling system that determines the value of collected materials for recycling - Sort the remaining waste to extract additional materials that can still be recycled - Increase competitiveness and lower business costs by implementing programmes that stimulate resource efficiency and create a circular economy - Support sustainable development and employment in the “green” economy, including new jobs in reuse, recycling and manufacturing - Reduce the generation of hazardous waste through the development of more efficient industrial and commercial practices along with the use of safer alternatives - Increase awareness of the importance of waste prevention among citizens, businesses and the public sector |

Targets aligned with the National Plan for Waste Management Other targets: - Reduction in bio-waste sent to landfill (compared to 1995): 25% by 2026, 50% by 2031 and 65% by 2034 |

|

|

Climate |

2021-2050 |

- Alignment with the EU framework on environment and climate to meet Paris Agreement targets - Strengthen the capacity of relevant institutions and inter-institutional co-operation - Increase the resilience of North Macedonia’s society, economy and ecosystems to the impacts of climate change - Enable environment for climate investments - Build solid systems for the regular and periodic collection of data for the production and dissemination of scientific and technical knowledge - Promote a circular economy by reducing waste and promoting the reuse and recycling of materials. This will help reduce greenhouse gas (GHG) emissions, increase resource efficiency and create new economic opportunities |

- Reduce national net GHG emissions (including forestry and other land use and excluding memo items, i.e. emissions from aviation and electricity import) by 72% by 2050 compared to 1990 levels - Increase the share of renewable energy to 50% by 2050 Net GHG reduction targets by sector: - Energy sector: -64% (excluding MEMO items) - Agriculture: -34% - Carbon sink in forests and other land uses: +1 733% (the dramatic increase is due to statistical inconsistency of forest area reporting from 1990) - Waste sector: -2% |

|

|

Directly related documents |

||||

|

Sustainable development |

National Strategy for Sustainable Development of North Macedonia |

2010-2030 |

- First integrated planning approach, encompassing the economic, social and environmental dimension by 2030 - Enhance sustainable consumption and production - Improve pollution management (focus on waste and wastewater management, air pollution control, noise abatement, and research and development) - Improve the management and avoid the overexploitation of natural resources, recognising the value of ecosystem services |

- By 2030, North Macedonia to be in the top 20 sustainable countries in Europe and in the top 3 in the Western Balkan region |

|

Climate and energy |

2021-2030 |

- Steer socially acceptable decarbonisation efforts until 2030 and beyond, aligning with the ambitions of the European Green Deal - Integrate five dimensions of the Energy Union: energy efficiency, renewables, GHG emissions reductions, internal energy market, and research and innovation - Introduce a CO2 tax to accelerate the phasing out of conventional fuels |

Targets by 2030 (compared to 1990): - Decrease net GHG emissions by 82% with the following goals: 66% emissions reduction in the energy sector, 45% emissions increase in industrial processes and product use, 29% emissions reductions in the agriculture sector, 95% removals increase in forestry and other land use, and 21% emissions reduction in the waste sector - Share of renewables in final energy consumption is 38% with the following goals: 66% share in gross electricity production, 45% in heating and cooling gross consumption, and 10% in final energy consumption in transport - Energy efficiency: savings of 20.8% for the consumption of final energy and 34.5% for primary energy compared to the business-as-usual scenario - Lower energy dependence from 60% to 59% |

|

|

Private sector and industry |

2018-2027 |

- Renew industrial policy and refocus it on the sectors which offer the greatest potential to impact on productivity and growth - Promote industrialisation by stimulating the growth and development of the manufacturing sector to boost productivity, create good jobs, raise incomes and strengthen human capital while addressing the challenges of the circular economy - Green manufacturing as the core component of the transition to a circular economy - Boost demand for circular products through green public procurement - Awareness raising and training on the circular economy, green industry/ manufacturing, closed-cycle manufacturing, energy efficiency and clean production |

- Increase manufacturing as a percentage of gross domestic product from 12.2% in 2016 to 14% in 2027 - Increase manufacturing output value (from EUR 4.452 million in 2015 to EUR 8.000 million in 2027) - Share of manufacturing output value in green industrial zones in total manufacturing output to increase to 10% in 2027 (from 0% in 2017) |

|

|

Private sector and industry |

- Increase investment in the public and private sectors - Priority areas: green economy, digitalisation, innovation and technological development, development of physical infrastructure, and human capital - Enhance green projects financing in the post-COVID economic recovery through the establishment of two funds (Hybrid National Green and Digital Fund for SMEs, and Start-ups and Innovative Enterprises and Green Investment Fund) - Improved energy efficiency through green bonds and Energy Efficiency Fund - Accelerate investments in renewable energy sources and finance energy efficiency solutions through green financing instruments |

- Accelerate medium-term economic growth rates from 2.5% to 5% average growth - None directly related to the circular economy |

||

Waste management

North Macedonia adopted a new Law on Waste Management in 2021, which is expected to enable the establishment of a functional system for regional waste management, such as regional collection, transport, sorting and recycling of waste; the construction of new regional landfills; and the closing of all non-standard landfills – in accordance with circular economy principles (EEA, 2021[23]). A set of laws targeting specific waste streams and management schemes were adopted in 2021, in parallel to the Law on Waste Management. These include the Law on Management of Batteries and Accumulators and Waste from Batteries and Accumulators, the Law on Management of Electrical and Electronic Equipment and Waste from Electrical and Electronic Equipment (WEEE), the Law on Packaging and Packaging Waste Management, the Law on Additional Waste Flow Management, and the Law on Extended Producer Responsibility. These new laws fully transpose the EU Waste Framework Directive and the Landfill Directive and regulate EPR schemes for packaging, WEEE, batteries, waste oils and tyres, waste textile, and end-of-life vehicles.

Currently, a total of seven EPR schemes have been set up in North Macedonia: three for WEEE, one for batteries and three for packaging waste. The obligation to organise EPR schemes for other waste streams came into effect on 1 January 2024, in accordance with the 2021 laws on waste. These schemes are either organised by producers and importers independently or through an agreement with a PRO, which handles waste management on behalf of producers. PROs report annually to the Ministry of Environment and Physical Planning, and reports are monitored by the Department of Waste (EEA, 2021[23]). Nevertheless, deficiencies in the implementation of EPR schemes have been reported (European Commission, 2021[72]), mainly due to the poor collection services and the lack of awareness. Additionally, the division of responsibilities among various institutions, both at the central and local levels, adds complexity to the system and impedes the seamless implementation of EPR schemes. Progress is currently tangible only in the packaging waste scheme, with a recycling rate of 40% observed in 2021.

While North Macedonia has not transposed the EU Single-Use Plastics Directive, the government banned single-use packaging and plastics in public procurement as of 2020. Moreover, a rulebook was adopted in 2021 on managing plastic packaging bags placed on the market (Ministry of Environment and Physical Planning, 2021[73]).

The Ministry of Agriculture, Forestry and Water Management started the process of preparing a Law on Donating Surplus Food Waste in 2018 (OECD, 2021[7]). In May 2023, the working group, established for the development of this law, finalised the draft proposal. The aim is to establish an institutionalised system of food donation, promote sustainable food management, reduce food waste and raise awareness on poverty reduction (Ministry of Environment and Physical Planning, 2023[74]).

The National Plan for Waste Management (2021-2031) was adopted in 2021, along with a National Waste Prevention Plan (2022-2028). There have been no reports on the implementation of the previous National Waste Management Strategy (2008-2020), nor on progress towards achieving its targets. The process of establishing an integrated regional system for waste management faced delays due to insufficient administrative and financial resources. It also suffered from a lack of ownership (EEA, 2021[23]).

The recently adopted National Plan for Waste Management is expected to accelerate the circular transition by reducing waste production and increasing levels of reuse, recycling and recovery of products. Its main objectives are:

Organisational: establish a Waste Management Department, ensure effective co-ordination between ministries and regional bodies, increase government capacities at the national and local levels, and increase the efficiency of the environmental inspection.

Technical: improve regional collection, transport, selection and recycling of waste with specific targets (see Table 2.1), as well as its treatment and utilisation, produce fuels from waste and close non-compliant landfills, reduce illegal dumping.

Financial: ensure implementation of the polluter-pays principle and the EPR and co-finance hazardous waste management systems.

Legal: align legal and policy frameworks with EU requirements and revise regional waste management plans.

More specific measures in the National Plan for Waste Management include national campaigns to raise public awareness of waste management and circular economy concepts, and the introduction of the mandatory green public procurement criteria in procurement bids.

Moreover, the plan foresees the improvement of waste data collection, which has been one of the major concerns, as municipal waste generation is currently not measured but estimated.

The National Waste Prevention Plan (2022-2028) presents a co-ordinated approach to waste prevention (both municipal and industrial) and aims to enforce the waste hierarchy of the European Union, the principles of zero waste, a continuous approach of resource efficiency and EPR schemes. It also includes awareness-raising objectives. Guidelines to reduce waste are under preparation, in particular in the construction sector.

Waste management activities have also slowly started in several regions. While activities for the closure of non-compliant landfills commenced in the East Region, the launching of a regional waste-management system in the Northeast and East regions has been further delayed due to local governments’ resistance to host the central waste management facility (European Commission, 2023[2]). Municipalities have undertaken some ad hoc initiatives, such the “trash for cash” initiative introduced by the Centar Municipality, which encourages residents to get involved in the process of separate waste disposal.

Raw materials and mining sector

The mining sector is regulated by the Law on Mining (2012), whose aim was to lower restrictions on procedures for issuing permits and concessions. The law was amended in 2019 and 2022 to provide greater protection of the population’s health and of the environment, after citizens led protests against the quick increase of government-issued mining concessions. First amendments led to some discussion between environmental activists and the business sector, prompting the government to reassess the regulatory stance on mining. Therefore, in 2022, the government adopted new amendments aiming for a middle ground that addresses both sides of concern regarding the sector.

Moreover, the Strategy for Geological Research and Sustainable Use and Exploitation of Mineral Resources in the Republic of North Macedonia for the period 2025-2045 is under development, in close consultation with the Macedonian Academy for Science and Arts and the Mining Association.

Climate action

North Macedonia recently strengthened its climate action policy framework with the adoption of the Long Term Strategy on Climate Action in 2021. Moreover, the related Law on Climate Action underwent public consultation and is pending adoption. The strategy’s main objectives are relevant to the transition to a circular economy transition and include:

Reducing GHG emissions, including from the energy, industry, transport, agriculture and waste sectors.

Increasing the share of renewable energy by phasing out coal-fired power plants (with the aim to increase installed capacity of solar photovoltaics and hydropower, followed by wind).

Enhancing energy efficiency, in particular in buildings, industry and transportation. This includes promoting energy-efficient technologies and encouraging reduced energy consumption.

Strengthening adaptation to the impacts of climate change, such as increasing resilience to extreme weather events, improving water management and promoting sustainable land-use practices.

Promoting a circular economy by reducing waste and promoting the reuse and recycling of materials. This will help reduce GHG emissions, increase resource efficiency and create new economic opportunities.

North Macedonia submitted its enhanced Nationally Determined Contributions to the United Nations Framework Convention on Climate Change in 2021 and is one of the two economies in the Western Balkans (along with Albania) that has adopted its National Energy and Climate Plan in 2022 as mandated by the Energy Community. Both documents include climate mitigation and adaptation targets, such as for the phasing out of coal-fired power plants and the introduction of a carbon tax, in alignment with the Long Term Strategy on Climate Action.

Moreover, North Macedonia adopted a Roadmap for a Just Transition in June 2023 which aims at launching activities that will enable the transition away from coal, and further align with the EU policies for accelerated green growth. The roadmap includes measures on alternatives to conventional energy sources while mitigating impacts on coal workers and communities through the transition to new “green” jobs. The Roadmap for Just Transition is composed of four pillars: 1) the path for clean energy (modernisation and development of the energy sector); 2) the path for private investment and start-up support; 3) the path for green and smart infrastructure; and 4) the skills development path.

Private sector and industry

The legal and policy framework targeting private sector and industrial development in North Macedonia has recently been strengthened to accelerate economic growth and improve the business environment, with the transition to a circular economy being increasingly recognised in some strategic documents.

The Law on Public Procurement (2019) includes relevant provisions on green public procurement, including on life cycle costs. These costs cover parts or all of the following: costs borne by the contracting authority or other users (e.g. costs relating to acquisition or purchase); costs of use, such as consumption of energy and other resources; maintenance costs; end-of-life costs, such as collection and recycling costs; costs of eliminating the impact of the products, services or activities on the environment during their life cycle provided that their monetary value can be determined and verified, and which may include the cost of GHG emissions and of other pollutants, as well as other climate change mitigation costs. Application of life cycle costs as a criterion for tender is optional and the data to be provided by the tenderers and the method for determining life cycle costs should be indicated in the tender documentation. The Law on Energy Efficiency (2020) also introduces procurement requirements specifically in relation to energy efficiency. Additionally, the Public Procurement Bureau and the Energy Agency have developed guidelines on energy efficiency measures to be used in public procurement procedures.

The objective of these measures is to boost demand for resource/energy efficient, durable, recyclable, repairable products, and to promote new business models based on offering functionalities and services instead of selling products. Green public procurement also allows local, regional and national authorities to set examples and standards for businesses and industries to follow. However, the introduction of green public procurement measures in tenders has remained limited since the adoption of these laws.

North Macedonia has introduced environment management systems, green certification (of business practices) and eco-labels (of products) into its legislative framework to support the private sector in its greening efforts: the Law on Environment (2011), the Decree on Eco-design of Products (2011), the Law on Energy Efficiency (2020), and the Law on Management of Electrical and Electronic Equipment and Waste from Electrical and Electronic Equipment (2021). In addition to contributing to an increased demand for green business practices, certification of green practices could be useful for companies when dealing with business licensing and administrative requirements.

The Law on Industrial and Green Zones, adopted in 2013, is being amended to include new provisions for regulating the benefits and opportunities for zone users, unifying applicable provisions for industrial and green zones, and better defining the conditions for performing activity in these areas. The amendment law has a specific focus on carrying out activities in line with circular economy principles in the green and industrial zones.18

In addition, “supporting the industry for investments in the development of innovations for a circular and green economy and internationalisation of markets” is one of the key goals of the Decision of the Government on Determining the Strategic Priorities of the Government in 2024 for realising the strategic priority “Promotion of the energy transition, investment in energy efficiency and green development, reducing air pollution and the impact of climate change”.

On the policy side, the Industrial Strategy with a focus on Manufacturing (2018-2027) aims to strengthen industrial policy by stimulating the growth and development of the manufacturing sector to boost productivity and increase the number of higher quality and better paying jobs while addressing the challenges of the circular economy. One of the strategy’s key objectives is to “catalyse green industry and green manufacturing” by stimulating resource and energy efficiency and low-carbon production in the manufacturing sector. The main measures to achieve this are:

Undertake green regulatory reform – market interventions to stimulate the development of green manufacturing industry. Legal requirements are meant to improve energy efficiency and accelerate the use of best available techniques in industry. This will enable industries, including those operating in Technological Industrial Development Zones, to move towards closed-loop production through schemes for recycling, recovery and reuse of materials, including regulatory and control mechanisms to promote the polluter-pays principle and EPR.

Introduce green public procurement for high-impact goods and services. As public procurement accounts for about 12% of GDP in North Macedonia, it can facilitate the supply of green products and services if it works to foster environmentally sound developments.

Embed sustainability as a core business strategy for manufacturers to improve business performance to spur innovation and improve economic results. This measure will support the integration of sustainability within SMEs’ core business strategies through co-financing for technological development that supports energy efficiency improvements; environmental protection; and the preparation and establishment of waste management systems.

Support industry-led green manufacturing initiatives (greening value chains), through the promotion of environmental improvements. Such initiatives measure and inform customers about the environmental impact of products and organisations, and include ISO standards, environmental management systems, the EU eco-label, the Eco-Management and Audit Scheme, environmental footprint (PEF), and organisation environmental footprint. Manufacturers, especially SMEs looking to export to the European Union and elsewhere, will be supported through co-financing of consultancy and certification costs.

Develop the industrial and green zones with a manufacturing focus. Although industrial zones exist in North Macedonia, the ongoing discussion about their greening should centre on their transformation into environmentally friendly, climate-positive, innovative spaces. Policies aimed at achieving this goal should prioritise the promotion of sustainable practices, encouraging the adoption of clean technologies, enforcing stringent environmental regulations and fostering collaborations.

North Macedonia’s SME Strategy (2018-2023) had a special focus on environmental policies, and was aligned with the Small Business Act for Europe and translated Principle 9 (“Enable SMEs to turn environmental challenges into opportunities”). It included a set of measures on providing advice and guidance to SMEs, improving resource efficiency, and introducing financial incentives for SME greening. While the strategy did not specifically target the circular economy, the different instruments to support the development of green SMEs provided opportunities to boost circular business models. The development of the new SME Strategy started in 2024 with technical support from the European Union.

Moreover, the newly adopted Plan for Accelerated Growth (2022-2026) is expected to provide a stronger impulse to greening and circular measures in the post-COVID economic recovery with the introduction of several instruments to promote and finance green projects. The proposed financing instruments have yet to be established and include, among other elements, green bonds; a Hybrid National Green and Digital Fund for SMEs, Start-ups and Innovative Enterprises to invest in green and digital SMEs (with a total portfolio of EUR 27 million); an Energy Efficiency Fund (initial capital of EUR 5 million); and a Strategic Green Investment Fund (expected to be worth EUR 36.3 million) to accelerate investments in renewable energy sources and financing energy efficiency solutions.

The Smart Specialisation process started in 2018 and the strategy was adopted in December 2023. The strategy aims to foster development by enhancing research and innovation capacities, facilitating knowledge-driven transformation, promoting competitiveness through collaboration between academia and businesses, diversifying existing industries and services, fostering the growth of emerging industries and enterprises, and encouraging green and digital transitions. The strategy includes four vertical priority areas: 1) smart agriculture and food with higher added value; 2) information and communication technologies; 3) electro-mechanical industry – industry 4.0; and 4) sustainable materials and smart buildings. Energy and tourism were also identified as horizontal priority domains (Ministry of Education and Science, 2023[75]). The transition to a green and circular economy is envisaged in all sectors, and in particular through:

the reuse of agricultural waste to turn it into high added-value material

the application of new technological innovations in the electro-mechanical industry

more efficient use of natural resources in the production of construction materials and development of smart buildings, especially through their extraction and the development of innovative technologies enabling the production of construction materials from industrial waste

developing the sustainable energy sector by using renewable energy sources, including biomass and biogas.

The Fund for Innovation and Technological Development (FITD), which encourages innovation by providing additional resources for financing innovative activities, will include a Green Business Facility. The EUR 27 million budget will provide direct subsidies and grants to SMEs, as well as awareness-raising and advisory assistance for green projects. The Green Business Facility will stimulate investments in the areas of industrial innovation and the circular economy, green buildings, clean energy resources, sustainable mobility, and sustainable land use and nature. The facility is expected to be established in the first half of 2024; the grant to the FITD to financially support SMEs is expected in 2025. Moreover, the FITD was designated in 2022 to be accredited to access the Green Climate Fund and submitted its application in 2023 (results are expected in 2025). Both sources of funding will be incorporated into the implementation of the Smart Specialisation Strategy.

The Ministry of Economy has continuously implemented sectoral programmes targeting SMEs, such as the Programme for Supporting the Competitiveness of the Manufacturing Industry and Corporate Social Responsibility and the Programme for the Development of Entrepreneurship and Competitiveness of SMEs, implemented yearly. The programmes provide financial support for technical feasibility studies to selected companies pursuing circular economy projects as well as support for the training, implementation and certification of various horizontal standards, including environment and energy management systems (ISO 14001 and ISO 50001). However, there are almost no data on how many SMEs have adopted energy management systems or eco-labels in North Macedonia or if they have benefitted from such schemes.

Overview of circular economy initiatives and main non-government stakeholders in North Macedonia

A number of stakeholders have been involved in different circular economy-related activities and initiatives in North Macedonia. They focus on different aspects relevant for the circular economy – primarily, though, on waste management and awareness-raising activities. However, their work remains unco-ordinated, and synergies remain to be created between them. Figure 2.14 provides an overview of the main circular economy stakeholders in North Macedonia.

The international development co-operation community has been actively implementing various projects related to the circular economy in North Macedonia which provide financial and technical assistance to the government in diverse areas. Key collaborators and international development co-operation partners for North Macedonia include the European Union, the Austrian Environment Agency, Eidgenössisches Departement für auswärtige Angelegenheiten (EDA), Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), the World Bank, and the European Bank for Reconstruction and Development (see Annex B for an overview of projects). These projects primarily aim to enhance municipal and industrial waste management, incorporating improvements in infrastructure, waste prevention activities and the implementation of recycling programmes. While some initiatives involve grants and subsidies, private sector involvement has been limited, and there are often no clear phase-out processes.

Non-governmental organisations in North Macedonia have been actively engaged in promoting and increasing awareness of environmental and ecology-related concepts and practices (see Annex A). Some organisations have specifically undertaken projects focusing on the transition to a circular economy. Others have conducted studies on the circular economy in North Macedonia (Let’s do it Macedonia and the Macedonian Center for Energy Efficiency), have worked on raising awareness about circular economy concepts (Friends of the Earth Macedonia, Zero Waste Skopje, Youth Environmental Network, Go Green Skopje, In Vivo), have supported circular entrepreneurship (Organisation for Social Innovation ARNO, National Center for Development of Innovation and Entrepreneurial Learning), or have implemented projects on circular waste management (O-Krug, Pakomak, REDI Recycling) (see Annex C). However, there is often limited co-ordination among these initiatives and the government rarely provides strategic guidance for steering them toward the circular transition.

Figure 2.14. Overview of the main circular economy non-government stakeholders in North Macedonia

Note: The list is non-exhaustive.

Academia and research institutes have also been at the forefront of conducting analyses and developing solutions to increase the uptake of circular economy practices. Several courses introducing circular economy concepts are available in different faculties at the Ss. Cyril and Methodius University in Skopje and the topic is also explored in other universities across North Macedonia (see Annex C). Think tanks and research institutes offer similar educational courses (Institute for Research in Environment, Civil Engineering and Energy; Finance Think – Economic Research and Policy Institute; Sustainability Institute EKOS).

Private sector organisations, including chambers of commerce, export associations and sector-specific unions, are essential in reaching a wide range of businesses, in particular SMEs. Through awareness-raising activities, conferences and networking events, private sector organisations are increasingly influencing Macedonian companies in developing or transitioning to circular business models (see Annex C).

Several companies have circular business models in North Macedonia, promoting different ways of producing and consuming goods and services. The main circular businesses in North Macedonia focus on industrial waste management, material recovery and reuse of raw material used in manufacturing (particularly automotive, electronics and textiles) (see Annex C). While their contribution is required to transition to a more resource-efficient and circular economy, government measures have rarely supported them financially or technically. Moreover, as the vast majority of businesses are still not familiar with circular concepts, it remains difficult to map all the actors concerned.

References

[63] Boucher, J. and G. Billard (2020), The Mediterranean: Mare Plasticum, International Union for Conservation of Nature, Gland, Switzerland, https://portals.iucn.org/library/sites/library/files/documents/2020-030-En.pdf.

[40] Crippa, M. et al. (2022), “CO2 emissions of all world countries”, JRC/IEA/PBL 2022 Report, Publications Office of the European Union, Luxembourg, https://edgar.jrc.ec.europa.eu/report_2022.

[29] Design4Circle (2021), Circular Economy in the Textile and Footwear Industry: Skills and Competences for a Sector Renewal, https://design4circle.eu/wp-content/uploads/2021/04/CIRCULAR%20ECONOMY_IN_THE_TEXTILE_AND_FOOTWEAR_INDUSTRY_SKILLS_COMPETENCIES_FOR_SECTORAL_RENEWAL.pdf.

[69] Đorđević, T. et al. (2019), “Mineralogy and weathering of realgar-rich tailings at a former As-Sb-Cr mine at Lojane, North Macedonia”, The Canadian Mineralogist, Vol. 57/3, pp. 403-423, https://doi.org/10.3749/canmin.1800074.

[22] Economic Chamber of North Macedonia (2021), “Association of Civil Construction, Building Materials and Non-metal Industries”, https://www.mchamber.mk/Default.aspx?mId=13&id=6&lng=2.

[23] EEA (2021), Municipal Waste Management: Country Fact Sheet North Macedonia, European Environment Agency, Copenhagen, https://www.eea.europa.eu/themes/waste/waste-management/municipal-waste-management-country/north-macedonia-municipal-waste-factsheet-2021.

[10] Einarsson, S. and F. Sorin (2020), Circular Economy in Travel and Tourism: A Conceptual Framework for a Sutainable, Resilent and Future Proof Industry Transition, CE360 Alliance, https://circulareconomy.europa.eu/platform/sites/default/files/circular-economy-in-travel-and-tourism.pdf.

[71] EIT Raw Materials (2021), Roadmap of Actions for the Exploitation of RM Sector in ESEE Region: Executive Summary, European Union, https://reseerve.eu/upload/content/446/d6-4-final_executive-summary_web.pdf.

[49] Energy and Water Services Regulatory Commission of the Republic of North Macedonia (2023), In January, 6 New MW of Solar Energy from 26 Photovoltaic Plants, Energy and Water Services Regulatory Commission of the Republic of North Macedonia, https://www.erc.org.mk/odluki/18022023%20%D0%A1%D0%BE%D0%BE%D0%BF%D1%88%D1%82%D0%B5%D0%BD%D0%B8%D0%B5%20%D0%B7%D0%B0%20%D1%98%D0%B0%D0%B2%D0%BD%D0%BE%D1%81%D1%82_%D0%BB%D0%B8%D1%86%D0%B5%D0%BD%D1%86%D0%B8%20%D1%98%D0%B0%D0%BD%D1%83%D0%B0%D1%80%D0%B8.pdf.