Argentina has few policies oriented to risk management, mainly consisting of support derived from the Agricultural Emergencies Law and the plant and animal health services provided by SENASA. Several provinces have recently provided varying degrees of support to insurance. Disaster risk management policies are focused on ex-post assistance and could gain from refocusing on ex-ante prevention and preparedness. The significant policy and macroeconomic risk in Argentina and the underdevelopment of the financial sector creates a difficult environment for agricultural risk management. However, the focus of government policies on catastrophic risk has facilitated a remarkable development of technological innovations and market and contract strategies that have contributed to the resilience of the sector.

Agricultural Policies in Argentina

Chapter 8. Managing agricultural risks in a volatile environment

Abstract

8.1. Introduction

The agricultural sector has always been exposed to production variability and price volatility1. This is partly due to the reliance of production on natural conditions and weather, and partly to the low demand elasticity of agricultural commodities, which can lead to sharp price reactions to changes in supply. Disease outbreaks and adverse weather events, such as floods and droughts, contribute to supply volatility and can negatively impact producer incomes, markets, trade and consumers. In Argentina, as in many other countries, climate change is likely to increase the frequency of extreme precipitation on one hand, and desertification on the other (Ministerio e Medio Ambiente y Desarollo Sustentable de Argentina, 2016[1]; Secretaria de Medio Ambiente y Desarrollo Sustentable, 2015[2]).

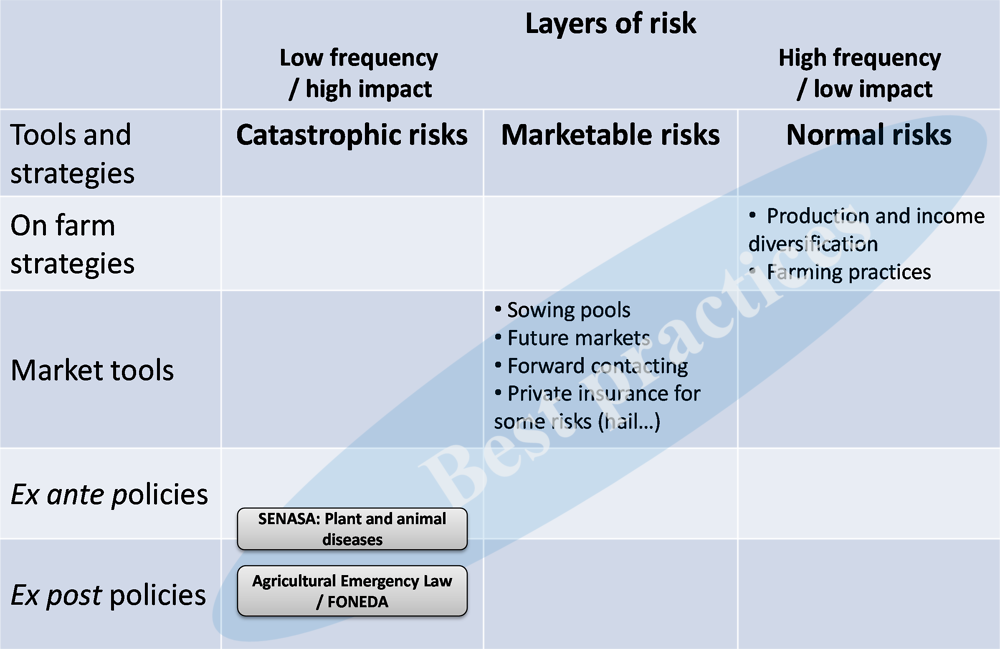

Risk management strategies need to be based on good information and risk assessment and follow a differentiated three-layer policy approach (OECD, 2009[3]; OECD, 2011[4]). Normal risk is frequent but not too damaging, and it is typically managed at the farm or household level, requiring no government policy. Catastrophic risks are infrequent but cause great damage for many farmers; the significant uncertainties associated with these events and the possibility of substantial systemic losses generate potential market failures that should be the focus of policy. Finally, between these two extremes, there is a category of risk that, because of its intermediate frequency of occurrence and magnitude of losses, is potentially insurable or transferable to other agents. The resilience capacity of farmers and the food system to manage agricultural risks crucially depends on their risk profiles, but also on the availability of a diversity of strategies and tools for the normal and market layers. A good policy-enabling environment, including agricultural risk management policies that cover only well-defined catastrophic risks, facilitates the development of these tools.

8.2. Risk assessment

Argentina’s great climatic and regional heterogeneity over a large territorial expanse has given rise to different agricultural production systems. The territory stretches almost 4 000 kms in length, from subtropical to sub-Antarctic regions. It has a significant latitudinal variation (33° of latitude) and altitudinal differences, from 48 m below sea level in Salina Grande in Peninsula Valdes to 6 959 metres above sea level in Aconcagua mountain. Therefore, there are two gradients of physical variability: one north-south and the other east-west.

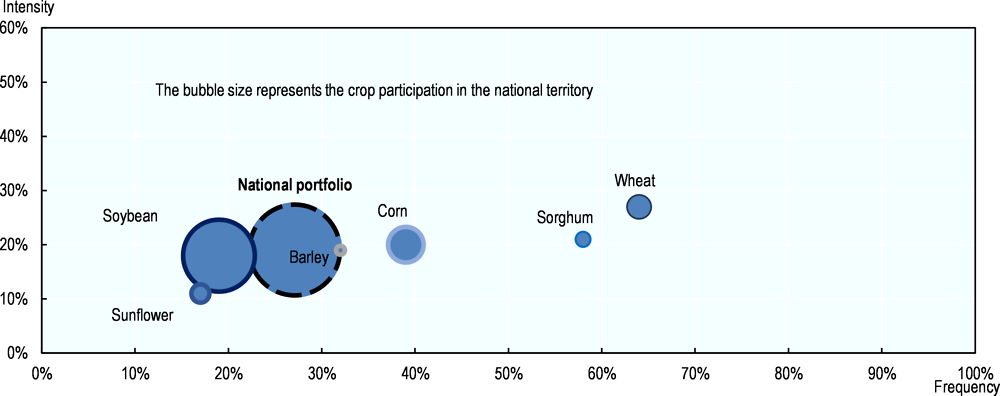

These gradients lead to a wide diversity of climates and land types that, at the same time, support a variety of biogeographical units (Bertonatti and Corcuera, 2000[5]; Burkart et al., 1999[6]). Two thirds of Argentina’s total area is arid or semiarid and the remaining third comprises wetlands, woodlands or subtropical forests, rainforests and grasslands. Argentina’s coastal area stretches along 4 725 kms from the mouth of the Río de la Plata river up to Tierra del Fuego (Bertonatti and Corcuera, 2000[5]). Figure 8.1 depicts the variability in precipitation and temperature.

Figure 8.1. Climatic map: Precipitation and temperature, average values (1981-2010)

Note: The left figure shows annual precipitation in millimetres. The right figure shows annual temperatures in Celsius degrees.

Source: Servicio Meteorológico Nacional.

In Argentina, most of the annual crops and some perennial ones are produced in an open field and are rain-fed, making weather risks particularly significant (Fusco, 2012[7]). The variability of yields at national level in Argentina, as measured by the coefficient of variation, is higher than in many OECD countries such as the United States, Germany, Italy and United Kingdom, but below the variability in Australia (Fusco and Barelli, 2018[8]; OECD, 2011[4]).

Precipitation and temperature regimes are among the main climatic adversities affecting agricultural yield. In this regard, rain and temperature patterns in South America and in many regions around the world are influenced by El Niño Southern Oscillation (ENSO). This phenomenon arises from recurring changes in the temperature of the tropical Pacific Ocean and has two extreme phases: El Niño, characterised by the warming of temperatures, and La Niña, with water temperatures lower than usual.

In the case of the Pampas region, El Niño is associated with a rise above average in precipitation and eventually floods, and La Niña means precipitation being lower than usual and in the extreme case, droughts. (Bert et al., 2006[9]). There is significant correlation between ENSO and the variability in precipitation patterns in Argentina in general and in the Pampas region in particular (Aceituno, 1988[10]), and between weather variability and crop yields (Podestá et al., 1999[11]; Amissah‐Arthur, Jagtap and Rosenzweig, 2002[12]). Podesta et al. (1999) have found a statistically significant relation between ENSO phases and crop yields in the Argentine Pampas region, even though it is not simple to deduce causality since there are multiple factors impacting yields (Ray et al., 2015[13]).

Sanitary risks are those risks which provoke a reduction in productivity due to plagues, diseases and epidemics in both animals and plants. These diseases or plagues can be of moderate or high impact as a result of either or both by a drop in production or by the closure of export markets. The Argentine beef sector is subject to several moderate-impact diseases that can be managed locally. Higher impact risks include foot-and-mouth disease (FMD), which affect bovine, ovine, caprine, porcine and bubaline production and exports. Since the outbreaks of 200/01, Argentina has significantly improved the control of the disease and since 2007 has been declared by the OIE free of FMD with vaccination in the Center North of the country and without vaccination in the Patagonia. Given the length and diversity of Argentinian borders (terrestrial and fluvial), the prevalence of sanitary risks in its neighbors, and the export orientation of production, sanitary risks are of primary importance.

Market risks can be measured by the variability of market prices. Argentina is an exporting country with most of its domestic markets fully integrated in world markets, and price volatility is linked to international price volatility. However, volatility in trade and domestic policies and macroeconomic instability has historically had a large incidence on price and revenue risk and uncertainty in Argentina. A main institutional and policy risk has been export taxes and restrictions, the levels of which have significantly changed with different administrations. Even if such measures were dismantled in 2016 (except for soybean) the risk of a future government reverting to them persists2. Another important institutional risk is derived from the weak implementation of the intellectual property regulations affecting plant seeds in particular (Trigo and Ciampi, 2018[14]; Fusco and Barelli, 2018[8]).

Macroeconomic and financial instability is an additional source of risk for the whole economy, not only the agro-food sector. It is particularly reflected in the inflation and exchange rates. Inflation was high for decades – often triple-digit – until it was contained during the peso-dollar parity in the 1990s. Inflation started to grow again at the end of the last decade and was still 26% in 2017. After a debt default in 2001 and restrictions on access to savings in the banks, the Argentinian peso started floating against other currencies in 2002. Since then the exchange rate with the dollar has depreciated significantly in different episodes from 1 peso per dollar in January 2002 to 28 in July 2018 and to 40 pesos per dollar in September 2018. Due to this recent history, the risk of macroeconomic and financial volatility is perceived as potentially highly relevant. Both institutional and policy risks and macroeconomic and financial instability contribute to Argentina’s poor ranking of 92nd position in the World Economic Forum Global Competitiveness index in 2017, behind other countries in the region like Brazil, Uruguay, Peru and Chile.

8.3. Farmers’ strategies and retention of risks at farm level

Farmer and other actors in the Argentinian agricultural risk management system have access to significant information to manage their risks. Public and private institutions generate and develop information, such as the Servicio Meteorológico Nacional on weather and climate, the provincial grain exchanges and other private associations on prices, the National Institute for Agricultural Technology (INTA), the Secretariat of Agroindustry and the universities. Although the volume and quality of information is significant, it is not currently systematised and unified, and there is no information on risk profiles at farm level.

Table 8.1. Main risk management strategies reported by farmers in Argentina

|

Source of risks |

On farm retention |

Risk transfer: Market / community |

|---|---|---|

|

Production |

Most spread and adopted: - Activity diversification. - No-till system. - Use of improved vegetable materials both for grain and fodder. - Changes in sowing dates; late sowing of corn. - Forage reserve by using silo bags and rolls. - Sanitary plan for livestock (basic). - Check climatic information. |

- Professional consultancy, both agricultural (through inputs/services supplier companies) and veterinary (mainly feedlots and dairy farms). - Technical plan and input level of the technological package according to the climate year, market and crop field, to a lesser degree due to institutional/macroeconomic risk. - Irrigated crops and complementary irrigation. - Insurance crop coverage and service. |

|

To a lesser extent and subject to restrictions: - Geographical diversification. - Incorporation of genetics through the purchase of male breeders and artificial insemination. - Per hour or rotative grazing (meat and dairy livestock). - Food supplements for livestock. - Strategic confinement (for cattle when finishing fattening phase). |

|

|

|

Market |

- Use of silo bag for grain stocking (schedule sales). |

- Futures contracts (mainly OTC), through a trade agent/stocking, or directly through exports/industry. |

|

- Crop rotation (portfolio diversification) |

- Integration for joint supply purchasing (mainly producers that are members of co-operative businesses). - Contract farming |

|

|

Institutional / macroeconomic |

- Participation in unions. |

|

|

Financial & other |

- Use of bank services, mainly the instruments for working capital (agricultural cards in local currency, cheque exchange and, to a lesser degree, financing in dollars, principally in agriculture) |

|

|

- Pools and associations: one participant provides capital and the other, labour; or both provide a portion of each. Co-operatives and mutual funds also provide risk management services. |

||

|

- Use of financial services from service companies (sale and/or exchange of supplies, stocking, among other) and co-operative businesses. |

Source: (Fusco and Barelli, 2018[8]) and interviews with farmers and experts.

Argentinian farmers implement a large diversity of risk management strategies based on this information. Table 8.1 presents the results of a set of interviews with farmers and experts and a literature review (Fusco and Barelli, 2018[8]), both of which show the diversity of strategies employed. These strategies include several on-farm practices such as diversification, or the use of silo bags for grain storage. But there are also a variety of instruments to transfer risk through markets or other institutional or co-operative agreements, such as contracts with other actors in the value chain, future markets or more comprehensive contracts and farming pools. Many Argentinian farmers, particularly in the Pampas region, manage their risk in an entrepreneurial manner.

Since the 1990s, investment and innovation have transformed Argentinian agriculture with a significant impact on producers’ management of risks. The technological package of no‑till farming and GM seeds improves chemical, physical and biological soil conditions, increasing their resilience. These high-productive crops are tolerant and resistant to an active principle, disease/plague or abiotic factors. As a result, larger surfaces were destined to agriculture and less to cattle breeding, and one crop, soybeans, increased participation in crop rotation. These movements implied a reduction in diversification activities in producers’ portfolio, affecting the resilience of farms that reduce their diversification that helps agricultural producers and cattle breeders to cope with risks (Barbieri and Mahoney, 2009[15]).

However, crop diversification continues to be a leading risk management strategy in Argentina (Table 8.1). Winter (wheat and barley) and summer (principally sunflower, corn, soybean and sorghum) crops are rotated with each other and with fodder (winter grass and summer forage crop and pastures) to manage risks and the sustainability of soils. But diversification activities in Argentina also include non‑traditional crops and agricultural practices such as organic or free-range pastures. Farmers also diversify their economic activities off‑farm, for instance, providing contract services to other farmers or through adding value by processing and packaging agricultural products.

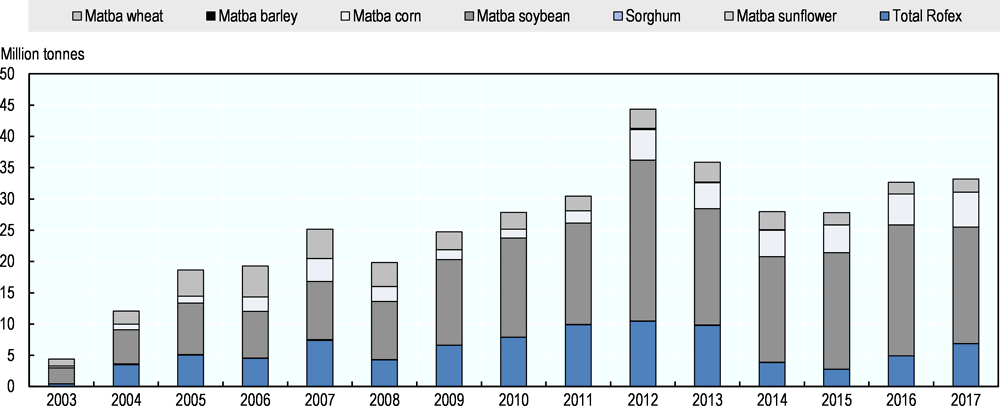

Figure 8.2. Intensity and frequency of not reaching the breakeven yield

The analysis of the variability of prices, yields and income from different crops in Argentina shows that the production of soybeans experiences lower levels of risk than other commodities, particularly corn and wheat (Fusco and Barelli, 2018[8]). Another perspective to measure the risk of different crops and the potential for diversification is to observe the relation between the crops’ average yield and the breakeven yield. The indicator of frequency F in Figure 8.2 conveys the percentage of years in which a crop’s average yield was lower than the expected breakeven yield, while the indicator of intensity I expresses the difference between the expected breakeven yield and the average yield in those years.

The calculations from data for the period 2004/05 to 2015/163 show that wheat presented the highest risks, with a negative frequency of 64% and an intensity of 27%. That is, in 64% of the years, the average yield was below the calculated breakeven yield by 27% on average. At almost the other extreme, soybean and sunflower had both frequency and intensity indicators below 20%. The combination of different crops diminishes the risk, although never below the soybean and sunflower option. Soybean is the least risky crop, which may have contributed to the expansion of its production.

The presence of cereals (wheat, sorghum, corn and barley) in the portfolio provides benefits that are not quantified in Figure 8.2. It allows grasses to be incorporated in the rotation, thus providing a higher degree of carbon fixation to the soil and a better vegetable coverage, which reduces wind and water erosion. This plays a crucial role in improving the resilience of the agricultural systems to external shocks (biotic and abiotic).

8.4. Risk transfer and pooling through markets and private arrangements

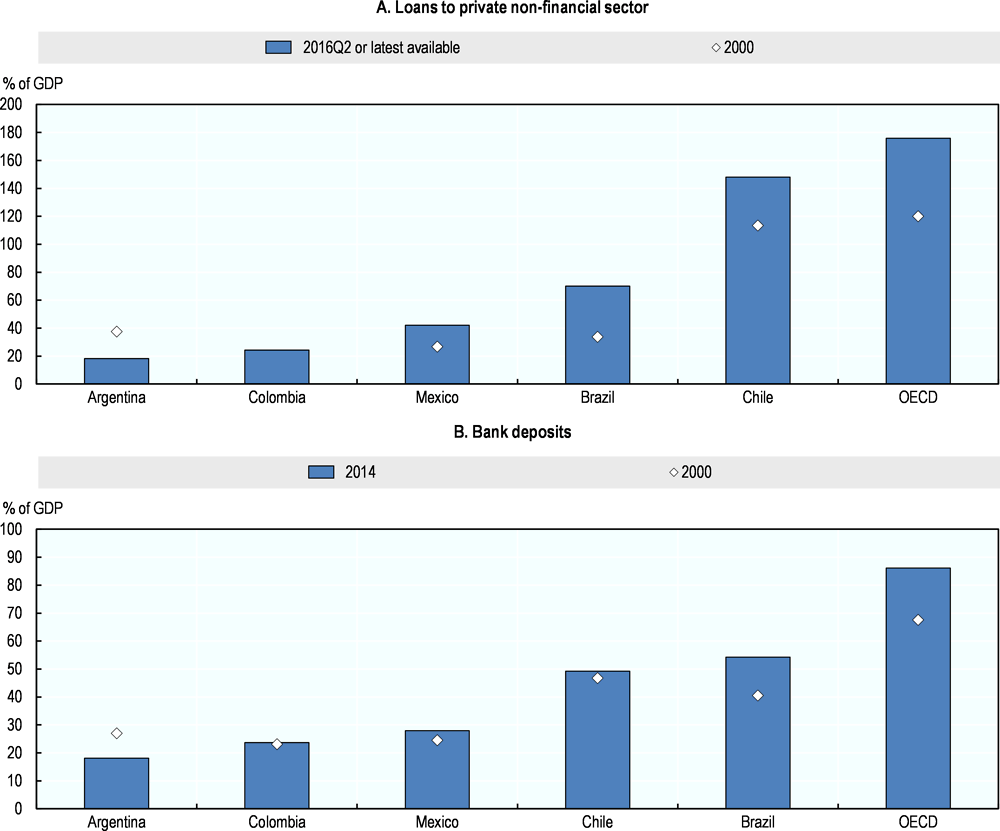

Argentina’s history of macroeconomic instability that has impacted the strength and dynamics of the local financial system. Countries with solid financial systems allow the economy in general and the agricultural sector in particular to generate and transfer funds inter-temporally through formal secure savings and credit. Argentina’s financial system did not evolve as consistently as in OECD or other Latin American countries. In OECD countries, the average ratio of domestic credit over GDP increased from 120% to 176% in the period 2000-16 (Figure 8.3). Mexico, Brazil and Chile also experienced increases up to 42%, 70% and 184% respectively. Meanwhile the ratio in Argentina fell from 37% to 18% and experienced minimum values around 10% in 2004. Bank deposits have also decreased as a share of GDP to 18% in Argentina, well below the OECD average and that of other Latin American countries like Brazil, Chile, Mexico or Colombia.

Disaggregating by activity, cereals and oilseeds production account for 36.1% of the debt stock of the agricultural sector. Other relevant actors are beef, agricultural services and industrial farming (such as grapes, tobacco, cotton and sugar cane), which account for 17%, 10.8% and 18.1% respectively. According to the central bank (BCRA), the remaining 18% is distributed among other activities such as dairy (2.3%), vegetables (2.4) or fruits (1.7%). Furthermore, the Argentinian rural sector is also financed with credit in other currencies, particularly dollars, adding exchange rate risk to the use of finance.

The absence of well-developed financial markets, is a handicap to financing agricultural investment and working capital and to using basic banking services to manage agricultural risks. Argentinian farmers often finance working capital through input and service providers rather than banks. Transferring funds over time through the banking system is a very efficient way of managing agricultural risks from different sources, but it is not a fully available strategy in Argentina.

The Secretariat of Agroindustry provides credit to producers at preferential conditions through FINAGRO. Support from the Secretariat compensates banks for the extra cost of keeping preferential financial conditions to producers of different commodities. It amounted to ARS 156 million in 2017. In 2017 a new fund, FONDAGRO, was created to provide credit to producers, in particular for regional economies (agricultural production systems outside of the Pampas region). It was initially funded with a maximum of ARS 1 700 million, but by the end of 2017 had a portfolio of ARS 750 million in credit (Ministerio de Agroindustria, 2017[17]).

In 2016, agricultural insurance in Argentina was provided by 25 insurance companies across the country: 22 offered coverage for cereals and oilseeds, 1 for tobacco, 1 for vegetables and 1 for fruits. As regards the type of coverage, 23 companies offered hail damage insurance, 22 offered hail and an additional type, and 4 offered multi-crop peril insurance. The market share of three agricultural-insurance companies with the highest sales (Segunda, Allianz and Sancor Seguros) represented 57% of the total (Superintendencia de Seguros de la Nación, 2017[18]).

The total volume of premiums in real terms and the number of insured hectares almost doubled in the period 2003-16, to cover almost 20 million hectares in 2014‑16. Hail insurance is the most frequent, but the producer might opt for contracting hail and additional insurance, such as strong winds, frost, or lack of land as a result of excess rain. Multi-peril crop insurance is offered by few insurance companies and includes other weather risks such as droughts and floods. An increasing share of the insured hectares is being covered by hail insurance, reaching 83% in 2016, compared with 17% for hail and other damage and 0.5% for multi-peril.

Figure 8.3. Financial markets are hardly developed

Source: Bank of International Settlements; World Bank Financial Development and Structure Dataset; and (OECD, 2017[19]).

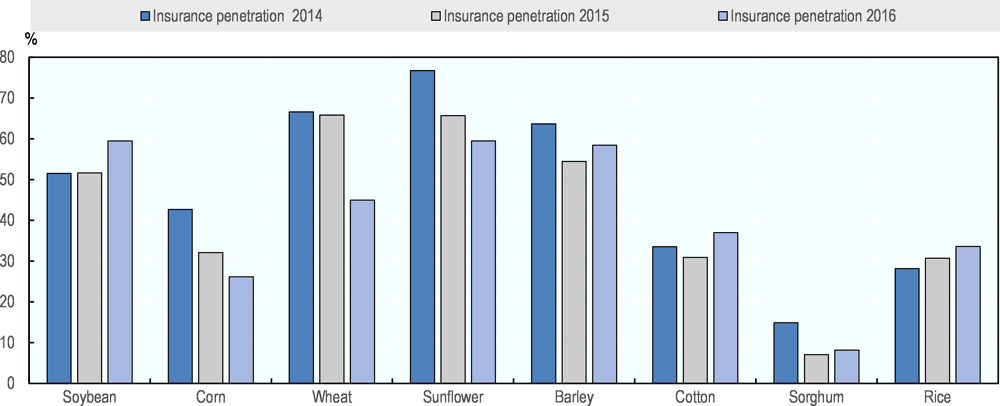

In terms of commodities, 92% of the volume of premiums corresponded to cereals and oilseeds in 2003-16, mainly soybean, corn, wheat, sunflower and barley. In relative terms, insurance penetration is calculated as the share of sowed hectares in the country that are insured (Figure 8.4). For the period 2014-16, the insured hectares over sowed area was on average: soybean 54.2%, wheat 59.1%, sunflower 67.3%, corn 33.7%, sorghum 11%, rice 32% and barley 58.8%. All insurance companies involved are fully private, and the ratio of claims paid over premiums was on average 83% in the period 2003-16.

In recent years, support programmes for the development of insurance for crops of strategic local importance have been undertaken in some provinces: Mendoza, Corrientes, Santa Fe, Jujuy, Río Negro and Neuquén. Most of these programmes are in the design or pilot phase. Some provinces are creating specific funds to provide assistance in the case of an extreme climatic events, others are subsidising the insurance premiums. Mendoza has designed insurance for the season 2017/18 as a public-private partnership; it covers frost and hail for grapevine, fruits, vegetables and fodder. This province also has an “Agricultural Compensation Fund” whose aim is to compensate producers and contractors participating in the programme for damages caused by climate contingencies, but the objective is to replace this fund with the insurance programme. Among the other provinces, Corrientes and Santa Fe have subsidised insurance for greenhouse horticulture since 2016.

Figure 8.4. Insurance penetration by crop

Source: (Fusco and Barelli, 2018[124]) based on Secretariat of Agroindustry and (Superintendencia de Seguros de la Nación, 2017[133]).

Some studies analyse the correlation between crops and different indexes, such as the average area yield index (cotton – Chaco province), Normalised Difference Vegetation Index (NDVI – Buenos Aires Southwest region) and precipitation index (corn – Entre Ríos and Santa Fe provinces). However, up to now none of these analyses have led to commercially available index insurance nor to index-based government or provincial programmes. Recently a market of climatic derivatives has started to develop based on the Normalized difference Vegetation Index (NDVI), allowing “over the counter” (OTC) operations to cover for drought and flood events. This product was developed by a private company and operates through the ROFEX derivatives market (see https://s4agtech.com/en/create/#s4-go). In 2018 the derivative reached USD 81 million of coverage, USD 55 million for drought and USD 27 million for floodings.

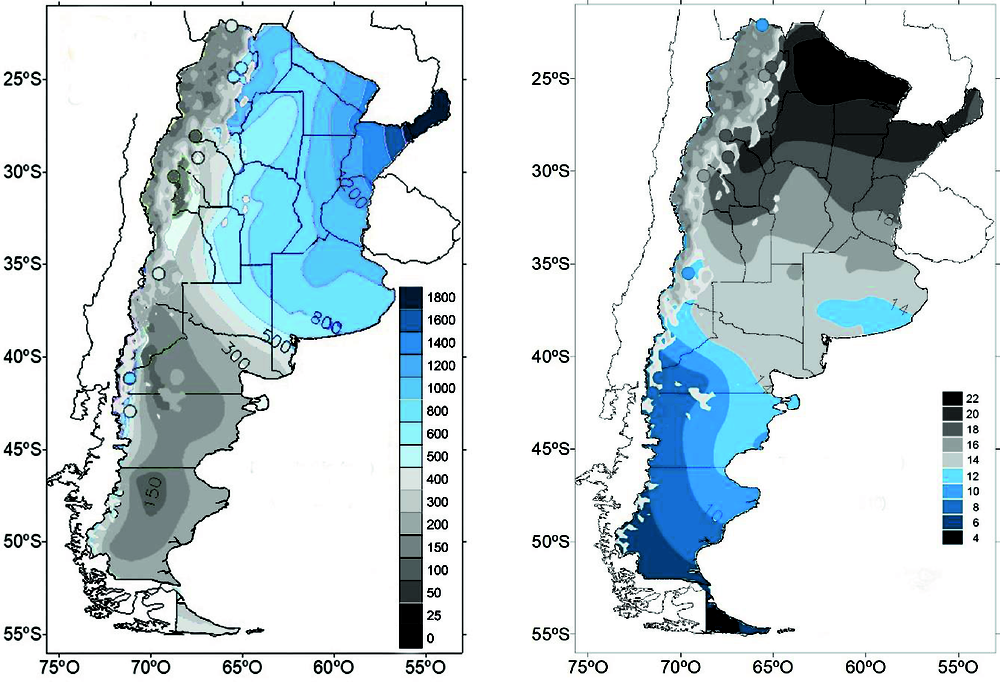

Well-developed institutionalised markets exist in Argentina. These include both spot markets, like the Bolsa de Comercio de Rosario, and futures and options markets, like the Mercado a Término de Buenos Aires (Matba) and Mercado a Término de Rosario (Rofex). Matba represents the highest share of the volume traded of agricultural products (Figure 8.5), while Rofex operates agricultural and livestock contracts, but is focused on financial derivatives. Matba has 13 different agricultural contracts.4

For its three main products (soybean, corn and wheat), Matba has an average volume of trade of 26% of the national harvest of soybeans for the seasons 2015/16 and 2016/17, 25% for wheat and 13% for corn (Fusco and Barelli, 2018[8]). Rofex, on the other hand, presents eight agricultural derivatives5. Through different initiatives, both entities are exploring their trade platforms’ interconnections in order to increase the amounts they operate in the market. Finally, a “Unified System of Compulsory Information of Grain Trade Operations” (SIO‑Granos) is conducted in the Argentine physical market to register and share grain purchase and sale operations, which constitutes valuable information for producers and relevant participants in grain commercialisation.

Figure 8.5. Volume traded in Argentinian futures markets

The Liniers market, located in the Autonomous City of Buenos Aires, concentrates beef cattle activities and is a reference for consumption. For the commercialisation of breeding, rearing and fattening cattle, there are several auctions in trade fairs, both in venues or remotely via the television or Internet (Rosgan and Meganar, among others) and through direct sales. Currently, the livestock producer counts on two instruments offered in the institutionalised markets (Rosgan calf index contracts and live steer contracts developed by Rofex) and diverse modalities of contracts for future delivery. SIO-Carnes is a unified information system for sales of livestock for meat, based on fiscal information from AFIP crossed with sanitary information from SENASA. For milk production, the main existent tool is the Integrated System for Milk Production Management in Argentina SIGLeA). This is a platform for information exchange between every link in the chain, and it allows, among other things, to know and compare the basic price per fat kg and protein kg. To date, there are no future price coverage tools for milk in institutionalised markets, and supply and price agreement contracts are not usual.

Producers also use alternative routes to the institutionalised markets (physical and futures, and options) through different types of contracts in order to commercialise and obtain coverage from price risk. Contract farming is and has been widely implemented within the Argentine agricultural sector so that the industry can assure the supply of goods. The principal sectors are aviculture, nuts, citric, berry fruits, horticulture, speciality crops (for instance popcorn), differentiated oilseeds production (shelled sunflower seeds), grains and selected bovine meat production. The following modalities of commercialisation contracts stand out in agriculture: payment on delivery operations (the parties establish the price and agree on the payment being made after the goods are delivered), advance payment operations and informal futures through forward business.

Pools are a way of organising the production which allows producers to share risks with their partners. Technically, pools are formal or informal associations where participants agree to contribute with different goods (seeds, capital, land, and supplies) or labour. At the end of the production process, benefits and risks are distributed according to the agreement. This methodology is widespread in Argentina as it allows production to be separated from ownership and facilitates access to finance, but there is no official data to quantify its importance. Pools in Argentina are not necessarily large investments – small and medium-sized contractors also exist. In Argentina the figure of "rural contractor" has been widely adopted as the owner of agricultural machinery (sowing, pulverisation, harvesting, etc.) and supplier of services. Producers do not need either to finance or buy the machinery.

According to data from the National Agricultural Information Network (RIAN), the national territory under lease was 34% of the surface and 4% in sharecropping (Barsky and Gelman, 2009[20]). Three forms of land leasing exist: paying a fixed value, a production percentage, or a combination of the two. The latter two options allow for the transfer of risk. Another form for reducing exposure to climate risk is leasing geographically diverse land, which reduces exposure to non-systemic risks.

Co-operatives and associations allows producers and businessmen from the agricultural sector to reduce risk exposure, to lower costs through economies of scale and to link their activities with the value chain. Joint actions such as input purchasing and product sales increase bargaining power. Some regional co-operatives like La Riojana offer insurance to their members. Co-operatives also offer financing of inputs, training, counselling and access to information. Co-operatives contain approximately 120 000 agricultural producers, representing 30% of Argentine producers. It is estimated that 91% of producers who are members of a co-operative have less than 500 hectares (Ressel, Silva and Martí, 2008[21]). Co-operatives are more relevant within regional productions where there are no institutionalised markets. Some important co-operatives are: the Agricultores Federados Argentinos (AFA), a first-level agricultural co-operative of 36 000 producers; the Asociación de Cooperativas Argentinas (ACA), a second-level co‑operative formed by 155 co-operative businesses; and the “Confederación Intercooperativa Agropecuaria” (CONINAGRO), a third-level institution formed by co‑operative federations (see Annex A for more details).

Due to the macroeconomic context and particularly the institutional conditions for this sector, farmers unions have also become important, in particular the Argentine Rural Society (SRA), the Argentine Rural Confederation, CONINAGRO, and the Argentine Farming Federation (FAA).

8.5. Coping with catastrophic risks

The Agricultural Emergency National Law 26,509 of 2009 defines the procedures for declaration of agricultural emergencies and disasters due to “climatic, meteorological, telluric, biological or physical factors which affect agricultural production significantly and/or the capacity of production, putting at risk the continuity of familiar or corporate exploitations affecting directly or indirectly rural communities”. The National Emergency and Agricultural Disaster Commission is composed of representatives from different Ministries including Finance, the Interior, Public Works and Agroindustry, and from the National Meteorological Service (SMN), INTA, the development public bank Banco Nación (BN), the central bank (BCRA), the Fiscal Agency (AFIP), the national agricultural sector and the provinces.

According to this law, the provinces take the initiative for an agricultural emergency or disaster request to the National Commission, after a provincial resolution defining the adverse effects of the event, the affected area, the start and end date, and the benefits that the declaration will bring about for the province. If the request is accepted, the Commission will propose to the national government through the Secretariat of Agroindustry a declaration of emergency for the area, defining the period of time during which the emergency will be in effect. The eligible producers will receive a certification after verification of damage by the province.

The law makes a distinction between emergency (losses of production capacity of more than 50%) and disaster or catastrophe (losses of more than 80%). The creation of a single registry of producers was foreseen to obtain detailed and specific information of producers, geographical location and impact of the catastrophe, but has not yet been created. The law creates an annual national fund for agricultural emergency and disaster mitigation (FONEDA) of ARS 500 million that cannot be cumulated from one year to the next. This amount of money has not been updated since the law’s promulgation in August 2009 and has lost significant real value. However, the total provisions of the fund were not exhausted in any of the years 2009-17 (Table 8.2). The law enables other ad hoc contributions from the national budget, but there is no record of such contributions.

Disaster assistance can include financial and tax benefits. Financial benefits are: special direct assistance to affected producers; debt consolidation with banks, 90-day suspension of trials and administrative procedures; credit lines with grace periods and reduction or preferential interest rates, 25% reduction for emergencies and 50% for disasters6; and payments and technical assistance sent from the Secretariat of Agroindustry to the provinces or local councils that will distribute the funds among producers. Tax benefits include extension for existing tax deadlines and full income tax deductions for benefits from forced liquidation of the farm and for duties on animals sold coming from areas declared under emergency or disaster.

In the period August 2009 to December 2017, there were 269 emergency and/or disaster resolutions, with several emergency resolutions per year often in a single province. The province of Buenos Aires accounts for the highest number of declarations (38), followed by Cordoba (24) and Rio Negro (21). While agricultural emergencies in Buenos Aires and Córdoba impact mainly on extensive agriculture and livestock (wheat, soybean, corn, sunflower, pasture), in Río Negro and Mendoza the affected productions are olive, grapevine, fruit production and ovine and caprine livestock. Table 8.2 shows that the most frequent events are droughts (38% of declarations) and floods (28%), followed by frost (12%) and hail (11%). The international database EM-DAT (www.emdat.be) records a drought in 2003 and a flood in 1998 as the main disasters in Argentina, with estimated impacts of more than USD 1 000 million each.

There is little correlation between large negative deviations of average yields with respect to trend, and the number of declared events or the expenditure by FONEDA (Fusco and Barelli, 2018[8]). This could be due to delays in the bureaucratic process, or to the incidence of non-systemic events that are not reflected in average yields, such as hail or frost and, to a lesser extent, floods.

Table 8.2. Emergency resolutions by year

|

Event |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

Total |

|---|---|---|---|---|---|---|---|---|---|---|

|

Biologic |

1 |

3 |

|

|

|

|

|

|

|

4 |

|

Volcanic ash |

|

|

6 |

1 |

|

|

1 |

|

|

8 |

|

Hail |

3 |

6 |

2 |

3 |

2 |

4 |

1 |

5 |

4 |

30 |

|

Frost |

2 |

5 |

6 |

2 |

3 |

7 |

|

4 |

3 |

32 |

|

Fire |

1 |

|

1 |

|

|

1 |

|

|

4 |

7 |

|

Flood |

1 |

6 |

4 |

3 |

|

20 |

5 |

19 |

18 |

76 |

|

Snow |

|

|

|

|

|

|

|

|

1 |

1 |

|

Drought |

26 |

16 |

30 |

9 |

10 |

7 |

2 |

1 |

2 |

103 |

|

Strong winds |

1 |

1 |

2 |

|

1 |

1 |

1 |

|

1 |

8 |

|

Total |

35 |

37 |

51 |

18 |

16 |

40 |

10 |

29 |

33 |

269 |

|

Expenditure by FONEDA (ARS million) |

146 |

426 |

436 |

73 |

147 |

212 |

326 |

437 |

399 |

2 601 |

Source: (Fusco and Barelli, 2018[8]) based on Secretariat of Agroindustry and on National resolutions of agricultural emergencies.

8.6. Managing plant and animal health

The National Service for Agro-food Health and Quality (SENASA) is a decentralised agency of the Argentine government, with economic-financial and technical‑administrative independence, and its own legal personality (see Chapter 3 for more details). It is in charge of implementing national policies on food safety, on animal and plant health, and on input control, verifying that producers take care of their responsibilities in plant and animal health and comply with in-force regulations. Since 2010 SENASA is organised in 14 regional centres that implement zoological and phytosanitary programmes in accordance with national protocols.

SENASA performs border controls through 131 border checkpoints (terrestrial, maritime, fluvial and aerial) and 69 port terminals where commercial cargo, passengers and luggage are controlled. Likewise, Argentina has zoological and phytosanitary controls in strategic locations, with 71 internal checkpoints where SENASA controls access to these zones. SENASA has an active role in prevention, contention, elimination and emergencies associated with plant and animal pests and diseases. It has more than 5 000 staff to implement its technical functions.

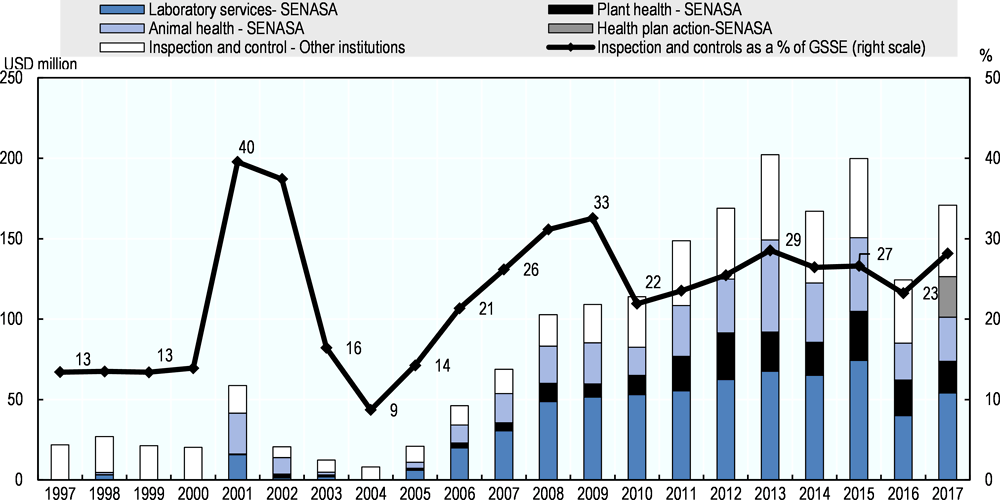

SENASA is funded from the national budget and from the fees that are charged on the services it provides to the sector. A 0.5% of the CIF value of imports is assigned by the budget to SENASA, and additional contributions could be provided by the Treasury if this revenue (together with the fees) were not enough to cover costs. SENASA expenditure represented almost 30% of all the general services provided to agriculture in Argentina in 2015-17 (Figure 8.6).

Figure 8.6. GSSE expenditures on inspection and control

Source: OECD (2018), "Producer and Consumer Estimates", OECD Agriculture Statistics Database.

8.7. Assessment and recommendations

The Argentinian agricultural risk management system has significant strengths, in particular regarding the institutions and the organisation of the sector. Most Argentinian farms are commercial entities with an entrepreneurial approach to farming, including the assessment and management of agricultural risks. They are organised in associations and co-operatives, or though the value chain by means of private contracts and pooling agreements. Agricultural spot and future markets are dynamic in Argentina. There are also strong public institutions providing research (INTA) and managing plant and animal health (SENASA). Information about market and weather risks is available and accessible.

Argentina’s production growth and innovation in the last decades has been very much focused on a single commodity, soybean. Soybean has increased its share of the Argentine production and export portfolio, displacing winter and summer crops. Its growth has conditioned and limited cattle breeding and milk production activities. This strong orientation towards a single crop has produced over time a decrease in diversification of farming activities, which may threaten the sustainability of productive systems and may increase exposure to different sources of production and market risk.

The main weaknesses of the Argentinian agricultural risk management system lie beyond the agricultural sector. One significant source of risk is policy and macroeconomic volatility. Improvements in policy predictability and the strengthening of the financial sector, in particular for agriculture and rural activities, could improve the management of agricultural risks. The underdevelopment of Argentinian financial markets is a major limitation to developing efficient strategies to manage agricultural risk, including basic tools which are widely used in other countries, such as secure and accessible saving accounts and credit. The weakness of the market for financial services is also a barrier for the further growth of more diverse insurance and derivatives products. The existing programmes for preferential credit to specific projects provided by the Secretariat of Agroindustry cannot substitute private credit and do not tackle the structural economy-wide deficiencies of the financial system.

Despite these difficulties, Argentina already has a well-developed private market for agricultural insurance, though one restricted to few risks and commodities. Insurance penetration reaches more than 50% of all agricultural land. The insurance sector still has the opportunity to explore the potentialities of index insurance and digital technologies to expand agricultural insurance. Index insurance can reduce the administration cost of insurance and eradicate moral hazard and adverse selection. These indexes can use meteorological, sensor and satellite information and digital technologies. If appropriate research and knowledge is developed to reduce basis risk, index insurance could be an option to increase insurance coverage and extend it to more commodities and locations.

The government has a limited role in managing agricultural risks in Argentina. The relatively low funding for the Agricultural Emergencies Law and existence of disaster declaration requirements prevents the crowding out of market instruments. This is reflected in the alignment of policies and strategies in Argentina with the best practices in risk layering (Figure 8.7). Improvements in the disaster assistance programmes should focus on increasing the predictability of their outcomes, the traceability of the beneficiaries and the measurement of its effectiveness.

Three measures may contribute to this end. First, developing a register of farmers (or at least a single database of beneficiaries) to follow up and monitor the reception of this support. Second, innovative ideas such as index-linking could be used to define the triggers of emergency and disaster declaration in areas affected by droughts or floods. These mechanisms can contribute to an efficient delivery through reducing the processing time for declarations and improving the predictability and transparency of the indemnities. Finally, FONEDA should be able to work with multiyear budgets; this would allow it to create incentives to save and spend the disaster assistance budget according to effective damage. This mechanism would allow the accumulation of emergency funds during the years in which there is no high-impact risk, and reserve them for years with high claims.

Disaster risk management policies in Argentina are focused on ex-post assistance. More policy effort should be concentrated on ex-ante risk management and prevention. One area for improvement would be in the diffusion of technologies and strategies to limit exposure to production risks. Policies could provide training on holistic risk management approaches, emphasising information and preparedness, adaptation to climate change and new risk environments, diversification of the risk portfolio and use of appropriate technologies. The Project on Integrated Management of Agro-industrial and Rural Risks (GIRSAR) announced in January 2018 is an attempt to move towards a more holistic approach that includes training, strengthening information systems, investing on risk reduction and improving disaster assistance.

There are private and public entities in Argentina (INTA, CONICEF, Universities, AACREA, AAPRESID, CRA, SRA, CONINAGRO and FAA) that could collaborate in partnerships and play an important role when increasing practices that allow the producer to incorporate risk management and sustainability strategies, focusing on technology adoption. Information will be crucial to develop preparedness strategies and practices, and information systems that are being developed for the sector (such as the census or surveys) should consider collecting individual characteristics and risks of farmers to improve risk assessment.

Figure 8.7. Main agricultural risk management strategies and policies

Note: This graph follows the holistic approach to risk layering in (OECD, 2009[3]).

Source: Adaptation by the authors.

References

[10] Aceituno, P. (1988), “On the functioning of the Southern Oscillation in the South American sector, Part I: Surface climate”, Monthly Weather Review, Vol. 116, pp. 505-524.

[12] Amissah‐Arthur, A., S. Jagtap and C. Rosenzweig (2002), “Spatio‐temporal effects of El Niño events on rainfall and maize yield in Kenya”, International Journal of Climatology, Vol. 22, pp. 1849-1860.

[15] Barbieri, C. and E. Mahoney (2009), “Why is diversification an attractive farm adjustment strategy? Insights from Texas farmers and ranchers”, Journal of Rural Studies, Vol. 25, pp. 58-66.

[20] Barsky, O. and J. Gelman (2009), Historia del Agro Argentino: Desde la Conquista Hasta Comienzos del Siglo XXI, Sudamericana.

[9] Bert, F. et al. (2006), “Climatic information and decision-making in maize crop production systems of the Argentinean Pampas”, Agricultural Systems, Vol. 88, pp. 180-204.

[5] Bertonatti, C. and J. Corcuera (2000), 2000. Situación ambiental Argentina 2000.

[6] Burkart, R. et al. (1999), Eco-regiones de la Argentina.

[16] CREA (2017), “Agricultura: Riesgo de actividad agrícola”, Informe-Microeconomico 52.

[7] Fusco, M. (2012), Riesgo Agropecuario: Gestión y Percepción del Productor e Incentivos Gubernamentales a Través de Políticas Públicas.

[8] Fusco, M. and E. Barelli (2018), Agricultural risk managment in Argentina, Background report for the OECD Review of Agricultural Policies in Argentina.

[17] Ministerio de Agroindustria (2017), Descripción del Sistema Financiero del Sector Agropecuario.

[1] Ministerio e Medio Ambiente y Desarollo Sustentable de Argentina (2016), Informe del Estado del Ambiente 2016.

[19] OECD (2017), OECD Economic Surveys: Argentina 2017: Multi-dimensional Economic Survey, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-arg-2017-en.

[4] OECD (2011), Managing Risk in Agriculture: Policy Assessment and Design, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264116146-en.

[3] OECD (2009), Managing Risk in Agriculture: A Holistic Approach, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264075313-en.

[11] Podestá, G. et al. (1999), “Associations between grain crop yields in central-eastern Argentina and El Niño–Southern Oscillation”, Journal of Applied Meteorology, Vol. 38, pp. 1488-1498.

[13] Ray, D. et al. (2015), “Climate variation explains a third of global crop yield variability”, Nature communications, Vol. 6, pp. 59-89.

[21] Ressel, A., N. Silva and J. Martí (2008), Estudio de las Cooperativas Agrarias en Argentina.

[2] Secretaria de Medio Ambiente y Desarrollo Sustentable (2015), Tercera Comunicación Nacional de la República Argentina a la Convención Marco de las Naciones Unidas sobre el Cambio Climático, Presidencia de la Nación Argentina.

[18] Superintendencia de Seguros de la Nación (2017), Los seguros en el sector agropecuario y forestal 2016.

[14] Trigo, E. and M. Ciampi (2018), Review of agricultural innovation policies in Argentina, Background report for the OECD Review of Agricultural Policies in Argentina.

Notes

← 1. This chapter is based on the consultant background paper (Fusco and Barelli, 2018[8]) which follows the OECD holistic approach for Agricultural Risk Management (OECD, 2009[3]; OECD, 2011[4]).

← 2. A temporary tax on all exports was introduced in September 2018 in order to raise revenue and reduce the fiscal deficit.

← 3. See the results in (Fusco and Barelli, 2018[8]) based on representative regional economic models developed by Agricultural Radar from the Argentine Association of Regional Consortiums for Agricultural Experimentation (AACREA). The national frequency and intensity indicators observed, disaggregated by crop and also calculated at national portfolio, are formed by the participating share that each crop shows in the season.

← 4. Matba currently offers: wheat contract and Chicago wheat, corn contract and Chicago corn, soybean contract and Chicago soybean, sorghum contract, sunflower contract, barley contract, and soybean oil contract.

← 5. Rofex currently offers: standard condition soybean contract, factory condition soybean, wheat contract, corn contract, Rosafé soybean index contract, Chicago soybean contract, Chicago corn contract and futures-based contracts.

← 6. For instance, the convention with Banco Nacion (BNA) and with Provincial Bank of Buenos Aires (BAPRO).