This chapter takes a closer look at South Africa’s tax system and the development of its tax mix over time.

South Africa’s tax base is relatively broad compared to most middle-income countries but is narrow by comparison with OECD countries.

South Africa’s tax system tends to increasingly rely on direct taxes and in particular on income taxes.

This reliance bears risks to the tax base and requires a well-functioning tax system that ensures compliance.

Assessing Tax Compliance and Illicit Financial Flows in South Africa

4. The tax system in South Africa

Key messages

Introduction

This chapter provides an overview of the South African tax policy environment. It discusses the overall tax system, how it compares to similar jurisdictions, focusing in particular on developments in the tax mix and the country’s strong reliance on direct taxes.1

An overview of the South African tax system

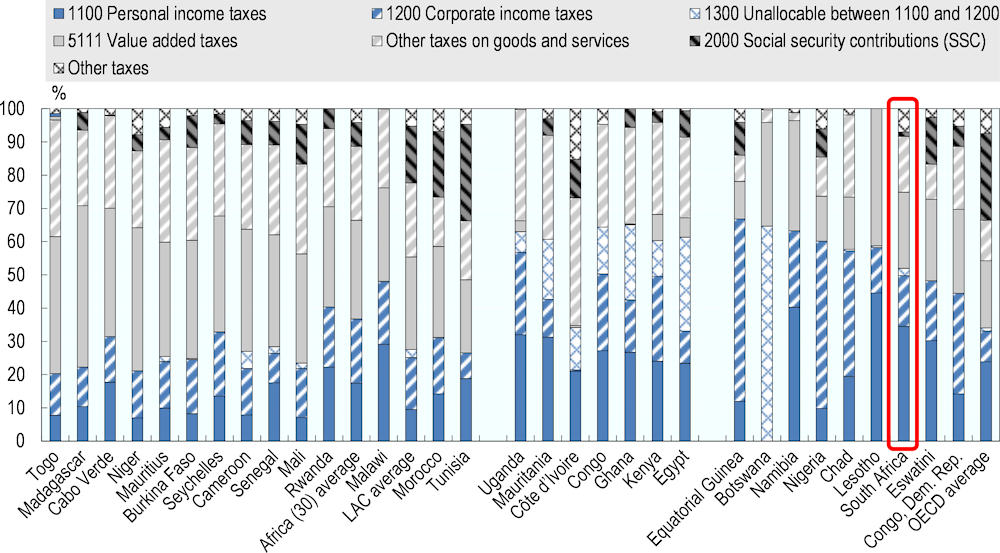

South Africa’s tax base is relatively broad compared to most other middle-income countries, but is narrow by comparison to the OECD average. Its composition of tax revenues resembles, to a certain extent, that of OECD countries (Figure 4.1). The country derives about 60% of its total tax revenue from direct taxes. Roughly two-thirds of direct taxes (34% of total taxes) come from personal income taxes. In contrast, personal income taxes tend to comprise a lower share of overall tax revenue in other African economies, reflecting the sizeable informal sectors and low capacity in many of these countries. Taxes on goods and services account for a larger share in most countries than in South Africa. The variation in social security contributions (SSCs) reflects the diversity of social security systems and contribution rates as many countries use a variety of systems to fund social security benefits. For instance, SSCs in South Africa are comparatively small, with a 2% contribution rate levied on wages to finance the Unemployment Insurance Fund. Other benefits, such as social assistance programmes covering old age, sickness and maternity, are financed by general revenues.

Figure 4.1. The tax mix in South Africa compared to African and OECD countries in 2018

Note: Figures include sub-national government tax revenues for Eswatini, Mauritania, Mauritius, Morocco, Nigeria (state revenues only) and South Africa for 2018. The Africa (30) average, the averages for LAC (25 Latin American and Caribbean countries) and the OECD (36 countries) are unweighted. The Africa (30) average should be interpreted with caution as data for social security contributions are not available or are partial in a few countries. See the country tables in Chapter 5 for further information. Botswana: The breakdown of revenue from income tax by personal income tax and corporate income tax is not available. OECD average: The data are for 2017 as data for 2018 are not available.

Source: OECD staff calculations based on data from (OECD/AUC/ATAF, 2020[1]), “Revenue Statistics in Africa: Comparative tables”, OECD Tax Statistics (database), https://dx.doi.org/10.1787/be755711-en.

Income taxes in South Africa

Since 2001, South African residents have been subject to income tax on their worldwide income and gains, and non-residents have been taxed on their South African sourced income and gains. The switch from a territorial to a residence-based tax system was aimed at broadening the country’s tax base. The tax period for income tax (year of assessment), is generally 1 March to the end of February of the subsequent year. The South African tax system is based on individual tax filings. All formal employees must be registered by their employer for personal income tax, which is then deducted at source. An employer is obliged by law to issue tax certificates (IRP5) to all its employees to complete their income tax return after payroll reports have been submitted to SARS. The IRP5 certificate contains all the remuneration (including allowances and benefits) provided by an employer to the employee during a tax year. Moreover, a separate tax certificate (ITR12) exists for income and certain tax source other than a single employment income. This certificate is required for employment income from more than one source, investment income above exempt thresholds and foreign capital income or if additional deductions to taxable income are claimed.2

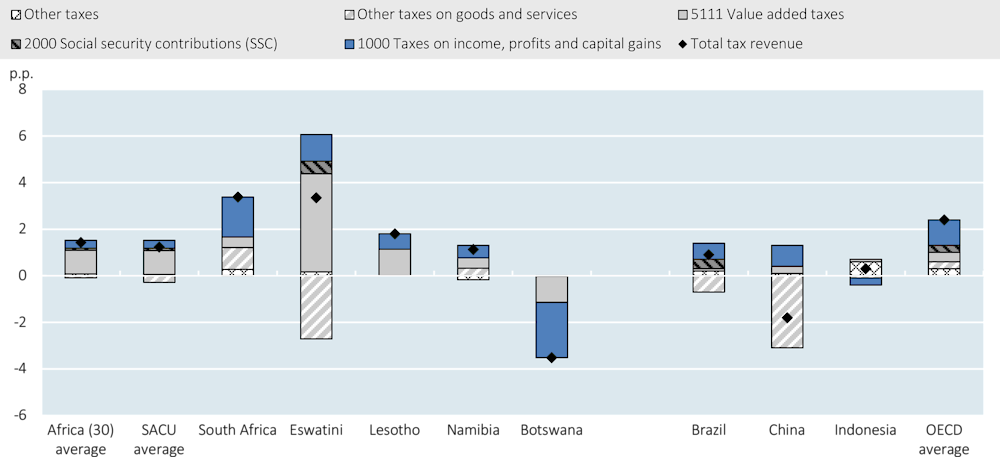

During the last decade, South Africa’s share of direct taxes in overall tax receipts has increased. Amid a rising tax-to-GDP ratio during 2010 to 2018, the contributing share of income, profit and capital gains taxes increased by 1.7 percentage points. This increase exceeded developments for other tax types and also outpaced the respective growth of direct taxes in other African economies (Figure 4.2). The relative increase in tax-to-GDP ratios across the BRICS and the OECD was also lower. While South Africa’s growing tax revenues can generally be considered positive given its challenging fiscal situation, the increasing reliance on direct taxes as the dominant source of revenue highlights the importance of supporting income tax compliance.

Figure 4.2. Net changes in tax-to-GDP ratios for South Africa and selected countries, 2010 - 2019

Note: Figures for African countries and the OECD average are based on 2018 data. Changes to the total tax revenue for China and Indonesia are shown exclusive of social security contributions.

Source: Calculations by OECD staff based on the OECD Revenue Statistics database.

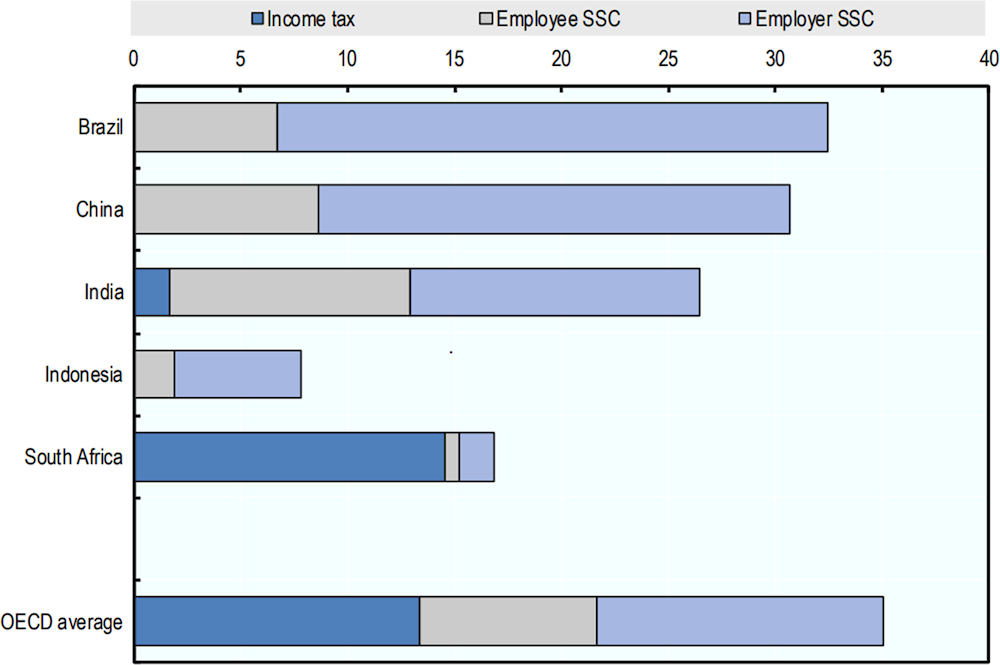

This trend is also reflected in South Africa’s relatively high contribution of income tax to the overall tax share in total labour costs (Figure 4.3). At around 14.5%, income tax as a share of total labour costs in South Africa far exceeds that of its emerging market peers (OECD, 2021[2]). In Brazil, China, India and Indonesia, employees at the average wage pay no or little income tax and employer SSCs, which account for between 50% to 80% of the tax wedge.3 While South Africa’s income tax share in labour costs is also larger than the OECD average, the difference of 1.2% is relatively small. Employee and employer SSCs, however, account for significantly larger shares across OECD countries. Given South Africa’s reliance on direct taxes, a well-functioning income tax system is therefore central to ensuring compliance and enabling reliable revenue collection.

Figure 4.3. Income tax plus employees' and employers' social security contributions, 2019

Note: Single individual without children at the income level of the average worker. The scenario for India includes SSCs only when payable. Payroll taxes are included where applicable.

Source: Adapted from “Taxing Wages in selected partner economies: Brazil, China, India, Indonesia and South Africa in 2019”, https://www.oecd.org/tax/tax-policy/taxing-wages-in-selected-partner-economies.pdf.

Individuals are taxed at progressive rates. As of 1 March 2022, income tax rates range from 18% on taxable income up to ZAR 226 000 with a maximum marginal tax rate of 45% on taxable income above ZAR 1 731 600. Trusts are taxed at a flat rate of 45% except for special trusts, which have been created for the benefit of a person with special needs and are taxed at the 18% - 45% progressive rate. A tax-free allowance below which no tax return needs to be filed has increased over time and currently stands at ZAR 91 250. This income tax allowance increases for taxpayers above the age of 65. In an effort to promote saving, interest income from a domestic source is tax-exempt up to ZAR 23 800 for taxpayers younger than 65 and up to ZAR 34 500 for an age of 65 and older. Individuals in receipt of income other than remuneration in excess of prescribed thresholds, trusts, and companies pay tax under a presumptive tax system. Dividends earned by individuals from South African companies are generally exempt from the progressive income tax, but a 20% dividends tax is withheld at the company level. Individual income from foreign dividends through shareholding in foreign companies is taxable at a rate of 20% at the personal level (SARS, 2022[3]).

Companies, both resident and non-resident, are currently taxed at a standard corporate income tax rate of 28%. Companies are considered resident if they are incorporated or if they have their place of effective management in South Africa. Non-resident companies that do not have their place of effective management in South Africa are subject to source-based income tax. Resident small businesses and micro firms are taxed at lower and progressive rates. Small business corporations are taxed at progressive rates, which, from 1 April 2022, range from 0% on taxable income up to ZAR 91 250 with a maximum tax rate of 28% on taxable income above ZAR 550 000 (SARS, 2022[3]). Micro firms are taxed at progressive rates on taxable turnover. From 1 March 2022, the tax rate ranges from 0% on taxable turnover up to ZAR 335 000 with a maximum tax rate of 3% on taxable turnover above ZAR 750 000. A qualifying micro firm’s turnover may not exceed ZAR 1 000 000, although discretion exists whereby SARS may permit a nominal and temporary excess. Tax is paid at the company level, and again at the shareholder level when profits are distributed, by means of the dividend withholding tax discussed above (SARS, 2022[3]).

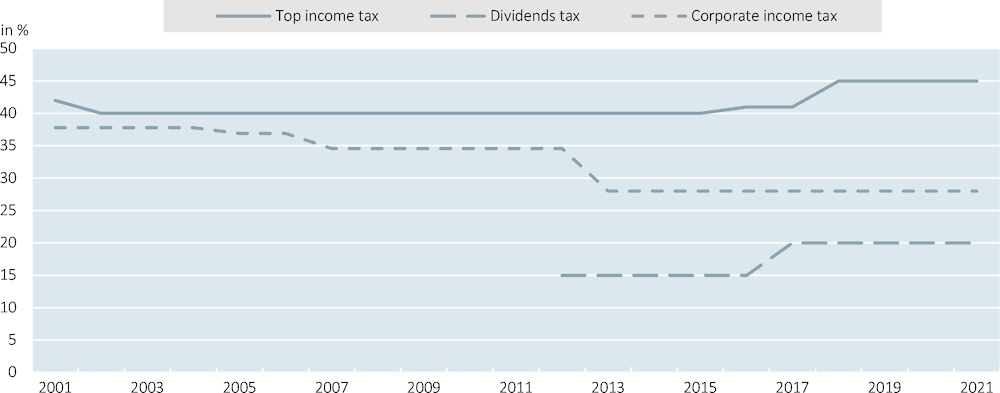

Recent developments have seen increases in top personal income taxes and declines in corporate income taxes. During recent years, these top personal income tax (PIT) rates have been adjusted upwards several times to finance tax reforms aimed at supporting low-income households (OECD, 2020[4]). In 2017, the top PIT rate was raised from 41% to 45% and below-inflation adjustments in the brackets and allowances have been made for a number of years (Figure 4.4). In addition, the dividends tax, introduced in 2012 at 15%, was increased to 20% in 2017. In contrast, the corporate tax rate has followed the global decline in rates and has been cut several times over the last two decades. Having stood at 38.5% in 2001, the rate was reduced to 28% in 2013 after a number of decreases in the intervening period.4 Instead of increasing the personal income tax further, the government seeks to broaden the tax base in the future through higher economic growth, increasing employment and better enforcement (National Treasury of South Africa, 2021[5]).

Figure 4.4. Tax trends in South Africa over time

Note: Dividends tax was first introduced on 1 April 2012. Maximum effective tax rate to capital gains is 18%. 40% of net capital gains are taxed at the normal income tax rates.

Source: SARS and SARB, 2021.

Due to South Africa’s high inequality and the tax-free threshold, only about 40% of South Africa’s working-age population (for adults of age 20 and above) are required to file income tax returns. These taxpayers tend to belong to the high-income segments of the income distribution. During the last decade, the number of officially registered taxpayers has grown annually by around 7.5% despite rising compulsory submission thresholds. Most taxpayers who are below the submission threshold are therefore not liable to file a tax return, but some may nonetheless do so to recover tax deducted (National Treasury/SARS, 2020[6]). Official estimates by SARS of expected returns submitted by registered taxpayers have, however, remained relatively stable over time (National Treasury/SARS, 2020[6]).

References

[5] National Treasury of South Africa (2021), Budget Review 2021, http://www.treasury.gov.za/documents/National%20Budget/2021/review/FullBR.pdf.

[6] National Treasury/SARS (2020), 2020 Tax Statistics, https://www.sars.gov.za/wp-content/uploads/Docs/TaxStats/2020/Tax-Statistics-2020.pdf.

[2] OECD (2021), Taxing Wages in selected partner economies: Brazil, China, India, Indonesia and South Africa in 2019, OECD Publishing, https://www.oecd.org/tax/tax-policy/taxing-wages-in-selected-partner-economies.pdf.

[4] OECD (2020), Tax Policy Reforms 2020: OECD and Selected Partner Economies, OECD Publishing, Paris, https://dx.doi.org/10.1787/7af51916-en.

[7] OECD (forthcoming), OECD Economic Surveys: South Africa 2022, OECD Publishing.

[1] OECD/AUC/ATAF (2020), Revenue Statistics in Africa 2020, OECD Publishing, https://doi.org/10.1787/14e1edb1-en-fr.

[3] SARS (2022), Budget Tax Guide 2022, https://www.sars.gov.za/wp-content/uploads/Docs/Budget/2022/Budget-Tax-Guide-2022.pdf.

Notes

← 1. South Africa’s tax policies are discussed further in the forthcoming OECD Economic Surveys: South Africa 2022 (OECD, forthcoming[7]).

← 2. These different forms of taxpayer filing will be discussed further in Chapter 5.

← 3. The tax wedge is defined the difference between total labour compensation paid by the employer and the net take-home pay of employees, as a share of total labour compensation.

← 4. The data are based on the combined corporate tax rate from the OECD Tax Database. For South Africa, these figures for the corporate tax rate include both South Africa’s statutory corporate tax rate as well as the Secondary Tax on Companies which in South Africa was converted to a dividends tax in 2012.