This chapter analyses unique tax data on foreign financial accounts exchanged under the CRS and provides an order-of-magnitude estimate of IFFs in South Africa.

Accounts in IFCs represent a significant majority of all foreign assets reported through the CRS, but account for less than half of all transmitted accounts.

South African non-compliant foreign wealth in IFCs is estimated to amount to between USD 40 billion and USD 54 billion in 2018.

This estimated stock of non-compliant foreign wealth suggests that between USD 3.5 billion and USD 5 billion in IFFs have left South Africa annually over the last decade.

While important progress has been made, the analysis suggests that matching CRS accounts with domestic tax records continues to be a challenge for South Africa.

The improvement of analytical capacities in the tax authority to make better use of available financial account information transmitted through the CRS should be a key priority, as should be the increased use of EOIR.

Enhanced collaboration and augmented data sharing across relevant authorities would further strengthen analytical and enforcement efforts in South Africa.

Assessing Tax Compliance and Illicit Financial Flows in South Africa

6. Assessing the size of undeclared foreign wealth and IFFs through the CRS

Key messages

Introduction

The objective of this chapter is to provide an assessment of the amount of previously undeclared foreign wealth held abroad by South Africans and to derive from it an order-of-magnitude estimate of IFFs in South Africa over recent years. The inability to directly quantify tax evasion, wealth hidden abroad and IFFs demands indirect approaches to estimation. Based on the data sources and the analysis discussed in the previous chapters, this chapter relies on several descriptive and quantitative approaches to estimate the extent of IFFs. Key to this is the use of statistics based on data received by South Africa under the CRS, which provides a first look at the foreign wealth holdings of South Africans, which may not have previously been reported. Given the uniqueness of the CRS data, a short overview of its coverage and the required data cleaning procedure is provided before further analysis of IFFs.1

Overview of South African CRS data

Data received by the South African authorities that has been automatically exchanged under the CRS provides the first account of such data for an emerging economy. Periodically exchanged between January 2017 and March 2019, the available data contains account information transmitted from a total of 85 different exchanging jurisdictions, with the country coverage increasing over time. Apart from the jurisdiction where each account was incorporated, the data contains information on individual account balances, account types and the payment type and payment amounts into these accounts per transmission period. All amounts are expressed in the denominated currency of the respective account and converted into ZAR by SARS.

The use of CRS data for analytical purposes is not straight forward and requires a careful cleaning process. Upon inspection of the dataset, many duplicate entries emerge across anonymised tax identification numbers, detailed account balances and transmitting jurisdictions, which limit the usefulness of the data analysis and may distort estimations. The exact matching of CRS data to taxpayer records suggests a high probability of multiple transmission through the CRS of the same accounts. This fact is well-known to users of the data transferred under the CRS given the reporting requirements and has also been confirmed by authorities in other jurisdictions. To account for these data issues, entries are removed from the dataset wherever they are duplicated simultaneously by all three of the following: i) the anonymised tax identification number; ii) the account balance; and iii) the transmitting jurisdiction. Accounts by the same taxpayer in the same jurisdiction and with similar balances but denominated in different currencies are retained to take into account the fact that several accounts could have been opened with different financial institutions. Accounts with zero and very low holdings are also removed.2 Payment flows, which sometimes are also transmitted multiple times for the same account, are separately cleaned for analysis to avoid double counting.3

Tables 6.1. and 6.2. provide basic summary statistics on the transmitted CRS accounts. During the period from January 2017 to March 2019, a total of six CRS transmissions took place between the South African authorities and exchanging jurisdictions, roughly falling into three consecutive tax years. The largest batches of accounts were exchanged always at the end of each year, respectively in December of 2017 and 2018. Smaller exchanges with relatively few accounts happened throughout this period. Overall coverage in terms of number of accounts, exchanging jurisdictions and total account balance shows an increasing trend, corresponding to enhanced commencement of AEOI by partner countries. A similar development is discernible for payments received for these accounts. Payments coverage, however, remains relatively patchy throughout the entire sample length.

Table 6.1. Summary statistics

|

Reporting period (aggregated per tax year) |

Total individual account balances by exchanged accounts (in ZAR) |

Total payments received by exchanged accounts (in ZAR) |

|---|---|---|

|

2016/2017 |

43 935 723 088 |

4 378 935 011 |

|

2017/2018 |

758 753 600 174 |

72 309 396 394 |

|

2018/2019 |

1 061 920 373 073 |

138 109 424 924 |

Note: Total account balances and total payments aggregate all reported balances and payments into these accounts for the respective reporting period. Account balances and payments are expressed in ZAR.

Source: National Treasury.

Table 6.2. Total payments received by type

|

Reporting period (aggregated per tax year) |

Interest (in ZAR) |

Dividends (in ZAR) |

Gross Proceeds / Redemptions (in ZAR) |

Other (in ZAR) |

|---|---|---|---|---|

|

2016/2017 |

25 037 689 |

925 476 406 |

1 418 339 247 |

2 010 081 668 |

|

2017/2018 |

2 221 279 909 |

1 850 131 570 |

59 109 022 944 |

9 128 961 970 |

|

2018/2019 |

2 417 951 360 |

2 761 639 171 |

120 142 664 863 |

12 787 170 530 |

Note: Payments by type into transferred accounts aggregated by reporting period. Payments are expressed in ZAR.

Source: National Treasury.

Due to the underlying data generation process determined by transmitting jurisdictions, data quality and information exchange requirements, the CRS data suffers from a few noteworthy limitations. Despite its broad geographic coverage, not all major jurisdictions participate in the CRS. This includes, for instance, the United States, which administers its own information exchange standard, FATCA. Moreover, account information is not always available, which may be due to poor quality documentation gathered by financial institutions or submitted to competent authorities. CRS data also reports only information on financial accounts; other forms of wealth storage such as real estate, art or crypto assets are currently outside its scope unless the proceeds of their sales have been deposited in a reported account. Information pertaining to these kind of investment activities outside the scope of CRS data could be cross-checked, for instance, with outflows data from the South African Reserve Bank (SARB).

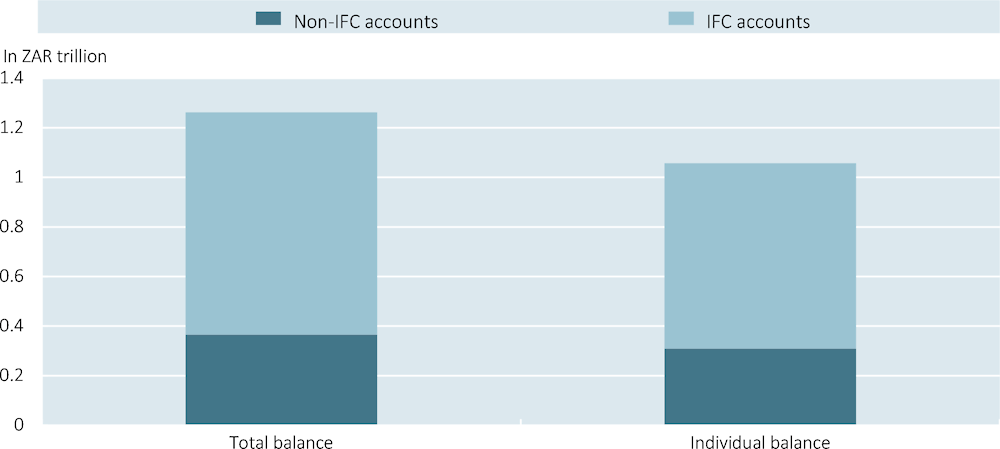

The importance of IFC accounts in South Africa’s CRS data

In December 2018, South Africans had over 585 000 accounts in 85 CRS-reporting jurisdictions abroad with a total account balance of about ZAR 1.26 trillion, an equivalent of about 20% of domestic GDP. The vast majority of these accounts, over 575 000, belonged to individuals (as opposed to entities). This means that individuals directly held about ZAR 1.06 trillion in financial assets offshore (Figure 6.1). IFCs accounted for less than half of all transmitting jurisdictions, but represent a majority of the balances of accounts exchanged. IFCs (37 jurisdictions total) reported about ZAR 897 billion (USD 67 billion) of South African assets from both individuals and corporates, corresponding to slightly more than 70% of all assets held by South Africans in foreign accounts exchanged under the CRS. When considering accounts owned by individuals only, the overall IFC balance reduces to about ZAR 748 billion (USD 56 billion), representing a similar share in all exchanged individual accounts. Total assets are highly concentrated among very few jurisdictions. In terms of total, individual and corporate account balances per jurisdiction, the top five IFC and non-IFC jurisdictions alone represent more than 80% of all assets in their respective group.

Figure 6.1. IFCs dominate account balances

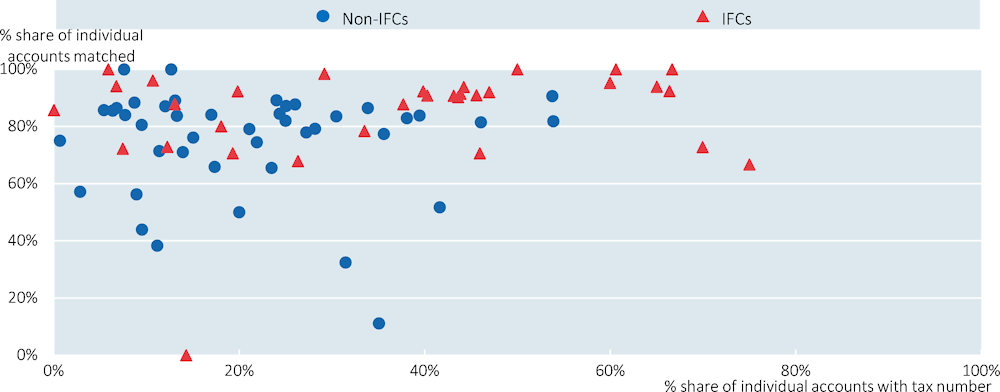

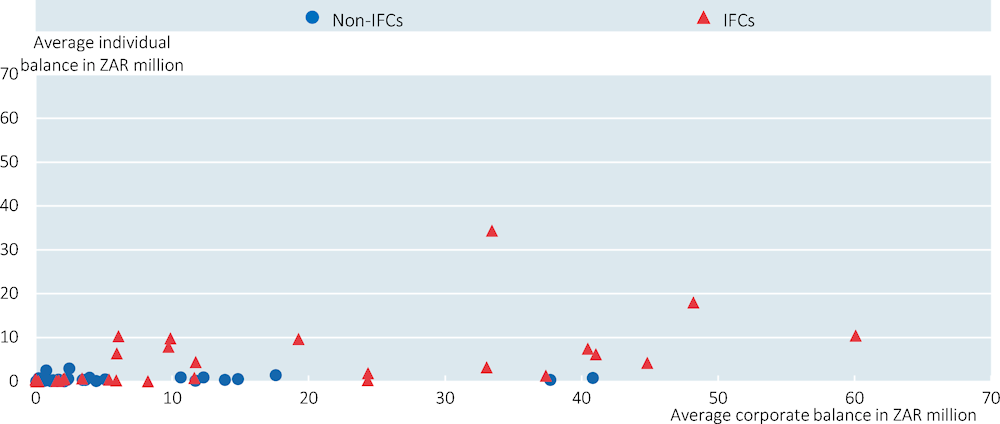

Despite hosting the vast majority of South African assets abroad that are reported through the CRS, IFCs only account for 42% of all accounts exchanged. While, for instance, some OECD countries lead the list for hosting the most accounts in individual jurisdictions, several IFCs occupy top positions in terms of account balances exchanged alongside major trading partner jurisdictions. This discrepancy between a minority share in total number of accounts reported and a strong majority in total account balances exchanged means that very large average balances for individual and corporate accounts are held in several IFCs (Figure 6.2). While most of the accounts in non-IFC jurisdictions exhibit relatively high corporate and low individual balances, IFC accounts on average appear to be more balanced and report in a few cases larger individual deposits than corporate deposits.

Figure 6.2. IFCs dominate account balances of individuals and corporates

Note: Kuwait and Ireland are suppressed due to very high average corporate account balances.

Source: National Treasury.

Average assets held by individuals and corporates in IFCs exhibit strong heterogeneity. Ranked by average account size for individuals, account balances range from more than USD 2.4 million (ZAR 35 million) at the upper end to below USD 100 (ZAR 1300), decreasing quickly among the top jurisdictions. Compared to total balances transmitted per jurisdiction, the order almost inverses, moving those with lower total balances but higher average balances to the top. A similar pattern emerges when only considering corporate accounts, with IFC jurisdictions confirming the more equal balance between individual and corporate account sizes. Interestingly, some of the top-ranked jurisdictions by account size have not played a major role as investment destinations in the SVDP, casting further doubt on the comprehensiveness of SVDP applications. Thus contrasting with expectations and theories on cross-border financial flow determinants (e.g. Fratzscher (2012[2])), the jurisdictions reporting the highest number of accounts and largest account balances do not necessarily coincide with country size, geographic proximity or economic integration with South Africa. Instead, they rather seem to point to capital flows to IFCs for tax non-compliance reasons (Casetta et al. (2014[3]), Haberly and Wójcik (2015[4])).

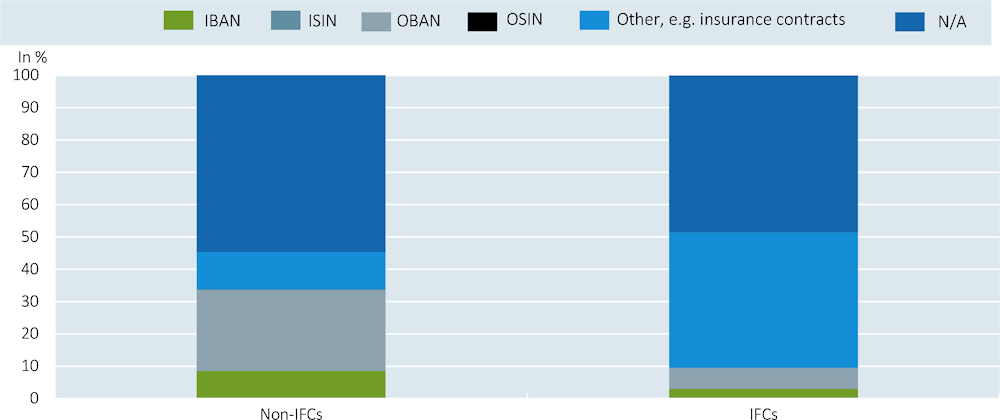

IFC jurisdictions seem to be the preferred destinations when for certain types of financial services. Apart from the almost equal share of unavailable account descriptions, IFCs predominantly transmitted accounts in relation to certain financial services such as, for instance, insurance contracts (Figure 6.3.). Non-IFCs in contrast provided the more mainstream banking services in form of deposits (IBAN/OBAN) or accounts and trusts for security investments (ISIN/OSIN), which together only make up about 10% of all accounts shared by IFCs. Account types in IFCs are thus different to declared offshore investments in the SVDP, where trusts and bank deposits dominate foreign accounts. These findings not only shed some light on IFC business practices but potentially suggest that the CRS data provides information on foreign accounts over and above what was disclosed by taxpayers in the existing VDP schemes.

Figure 6.3. Non-IFCs and IFCs differ in financial services provided

Note: The nomenclature of the CRS reporting messages refers to the different account descriptions respectively as IBAN (International Bank Account Number), ISIN (International Securities Information Number), OBAN (Other Bank Account Number), OSIN (Other Securities Information Number) and Other (any other type of account number. N/A refers to unavailable account descriptions.

Source: National Treasury.

Income tax compliance analysed through the CRS

Successfully linking CRS accounts with SARS income tax returns is an important step for ensuring taxpayer compliance and credibly increasing the risk that CRS information will lead to audits and penalties for non-complying taxpayers. Comparing the CRS data with income tax data from SARS shows that only about 43% of all accounts exchanged had a uniquely identifiable tax number for the 2018/2019 tax year. Perhaps surprisingly, IFC jurisdictions perform better in direct match rates compared to non-IFC jurisdictions. From those accounts with a tax number, around 86% can be directly matched with available income tax data from SARS. When only IFC jurisdictions are considered, around 56% of all accounts exhibit a corresponding tax number of which about 89% could be matched with SARS tax returns. As for non-IFC jurisdictions these percentage shares drop to around 35% for accounts with available tax numbers and 83% for direct matching rates. Assuming that all accounts exchanged under the CRS should theoretically correspond to taxpaying individuals, respectively only 37% of all foreign accounts and a bit less than half of all offshore accounts domiciled in IFCs could be easily assigned to South African taxpayers. There are a range of potential reasons why match rates may be low. They do not account for use of more advanced matching techniques such as fuzzy matching for example, which were not used as part of this project. Moreover, the CRS does not systematically require the reporting of tax numbers on foreign accounts whose existence preceded the introduction of the standard in the country, provided that reasonable efforts were undertaken to obtain them (OECD, 2021[5]).

Figure 6.4. Tax number availability and matching rates across jurisdictions

Despite these overall trends, jurisdictions display considerable heterogeneity in terms of individual tax number availability and matching rates with SARS data. Both diverge between IFCs and non-IFCs and vary between individual jurisdictions (Figure 6.4). Tax numbers are available for most IFC jurisdictions at relatively high percentage rates. Most IFCs also exhibit relatively high matching rates with SARS, for several jurisdictions match rates are at 100% of tax numbers available. In contrast, non-IFC jurisdictions exhibit in general a more heterogeneous picture. They range between less than 1% and slightly more than half of all accounts reporting assigned tax numbers, less than for some IFC jurisdictions. Resulting matching rates with tax returns are even more spread out and range from 13% with Estonia to 100% with Colombia, albeit for very few accounts.

VDP and SVDP applications can also be matched to CRS accounts. While all VDP applications achieved a matching rate with tax returns of close to 38%, the total of SVDP applications, successful or not, could be matched at a rate of slightly above 56%. The potential to achieve higher matching rates in collaboration with transferring jurisdictions and through use of more advanced matching techniques thus appears to be relatively large. Higher rates would thus not only increase transparency, but potentially also result in growing revenue collection. Although there is much room for improvement, the significantly higher matching rates between IFC accounts in CRS data and SARS tax returns are an encouraging sign for the efforts by tax authorities to trace foreign wealth back to its origin.

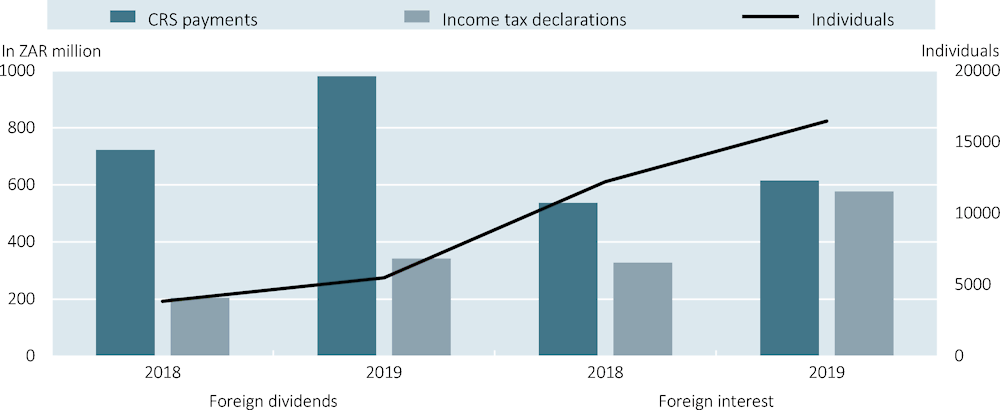

CRS account payments and income tax declarations

Matching tax returns with CRS accounts that received regular payments into these accounts complements the earlier analysis on taxpayer compliance. Of the 127 716 individuals with matching tax returns across all counterparty jurisdictions only 63 095 declared foreign capital income in the form of interest, dividends or capital gains. Considering income from dividends and interest declared, which would be taxable in South Africa after deducting any tax credits, the data suggest that around ZAR 530 million was identified through the CRS as being taxable in South Africa in the 2017/2018 tax year. In the subsequent tax year the amount of foreign interest and dividends identified in accounts exchanged with SARS rose sharply. Foreign dividends effectively declared increased from about ZAR 204 million to over ZAR 340 million and declared foreign interest rose from about ZAR 327 million to over ZAR 577 million.

A more detailed comparison between CRS payments and corresponding declared income taxes points to increasing compliance over time. There was a significant expansion in South Africa’s AEOI network between 2018 and 2019, which shows in a significant rise in transmitted individual accounts and corresponding payment flows between the tax years 2018 and 2019. At the same time declared total incomes in relation to foreign interest and dividends increased relatively more than reported CRS payments (Figure 6.5). The difference between reported interest payments through the CRS and the amount of interest declared in tax returns was approximately the same. At the same time, while CRS payments related to dividends (of matched taxpayers without income tax returns) increased in proportion to rising account numbers, payments related to interest earned decreased by 50%, despite an increase in reported accounts (these data not shown). These developments suggest that due to the increasing reporting through rising CRS transmissions and related overall public attention to tax transparency, taxpayers may have realised that their account information has been shared and started to comply with tax laws, particularly with regards to foreign interest income.4 However, the amount of matched but not declared accounts by taxpayers is still large and could point to non-compliance that may level off over time with increased detection risk.

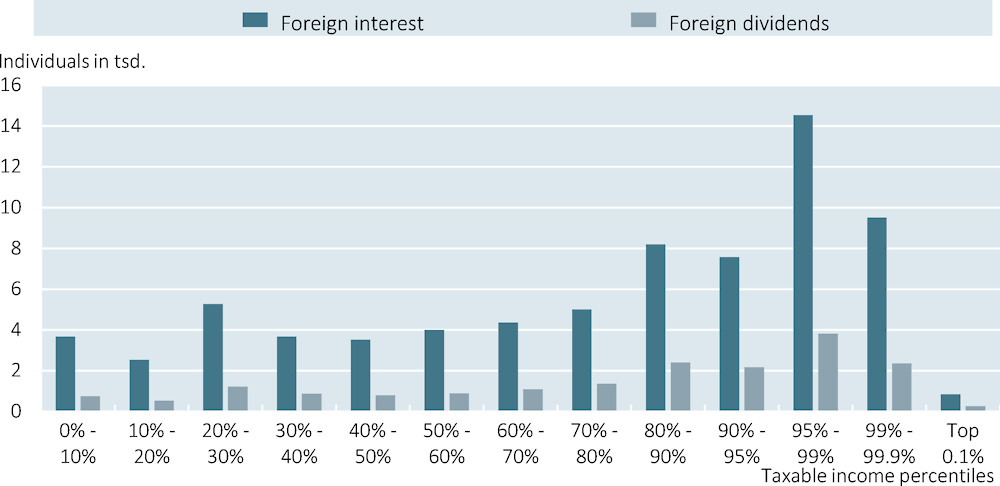

Figure 6.5. Comparison of foreign capital income declarations with CRS account payments

Findings in chapter 5 suggesting potentially ongoing non-compliance seem to be further corroborated by relating payment flows into CRS accounts with income tax declarations, ordered according to the taxpayer’s position in the income distribution. Relative to their position in the income distribution, a substantial share of taxpayers in the middle-high income segment seemed to declare foreign capital income from interest and dividend payments (Figure 6.6). Increasing over the lower income distribution percentiles, most declarations were submitted between the 80% and the 99% percentile. However, declarations within the top 1% and particularly for the 0.1% decline substantially. This pattern mirrors offshore wealth declarations by taxable income in the SVDP (see Figure 5.15). If we are to assume that these patterns of reducing foreign income are not a result of different asset preferences by taxpayers at the very top of the income distribution, this may again suggest non- or under-declaration of foreign capital income by the very top income recipients.

Figure 6.6. Middle-high income individuals predominantly declared foreign capital income

Note: Number of individuals that declared foreign capital income and appeared in the CRS data by taxable income percentiles.

Source: National Treasury.

Estimating past non-compliant offshore wealth and IFFs from tax data

The following section estimates previously non-compliant foreign wealth based on new income tax declarations and foreign account information transmitted under the CRS. Having adopted a definition of IFFs as cross-border financial flows that are illegal either in their origin, transfer or use, a key first step in understanding the amount of IFFs that have left South Africa illicitly involves estimating the amount of previously non-compliant foreign wealth. Owing to the different characteristics of the two data sources, estimations of non-compliant foreign wealth rely on two different methods: capitalising declared foreign income and estimating wealth from foreign financial account balances. After comparing the estimates from the two sources and evaluating their validity, the final step involves developing an estimate of the annual amount of IFFs derived from the non-compliant foreign wealth stock.

Capitalising declarations of foreign income

In general taxpayers’ wealth can be estimated from income tax data. There is a large economic literature that seeks to carry out such estimations. To gauge the wealth distribution of US households indirectly, Greenwood (1983[6]), later Bricker et al. (2016[7]), Bricker et al. (2016b[8]) and Saez and Zucman (2016[9]), rely on a model that “capitalises” taxable income into wealth. Chatterjee et al. (2020[10]) and Orthofer (2016[11]) apply the same approach for estimating South Africa’s wealth distribution. These models estimate financial wealth by inflating the different types of capital income from the underlying tax data by a general rate of return on assets associated with that income for a given year. Applied rates of return to the respective capital income category, for instance, can be estimated from annual market rates of return on different assets such as equity or Treasury bills. The resulting wealth estimates, however, are sensitive to taxable income definitions and model parameter selection. Careful consideration should thus be advised when interpreting any resulting estimates.

Given the availability of tax data on foreign income, this section approaches the estimation of undeclared South African foreign wealth by relying on the detailed and high quality data from the SARS-NT panel. The analysis gains in particular from the data on new tax report filings of foreign capital income peaking in 2017, as is shown in Figure 5.6 (Panel B). Past non-compliant foreign wealth is estimated from new tax declarations on foreign capital income derived from interest, dividends and capital gains as follows:

(1)

The estimated past non-compliant foreign wealth in South Africa is thus the sum of all individual foreign income streams k declared in new tax returns (interest, dividends, capital gains), capitalised by their respective asset-based rate of return r. By construction, raising the assumed rate of return would result in a respective lower amount of past non-compliant foreign wealth. While it is initially assumed that all underlying assets earn the same rate of return, the assumption could be relaxed later to allow for heterogeneous interest rates by investment type.56 Moreover, the detailed position of taxpayers within the taxable income distribution allows for a more targeted analysis of those taxpayers who may be considered more likely to engage in evasion, i.e. the highest-income segments of the income distribution (Alstadsaeter, Johannesen and Zucman, 2018[12]).

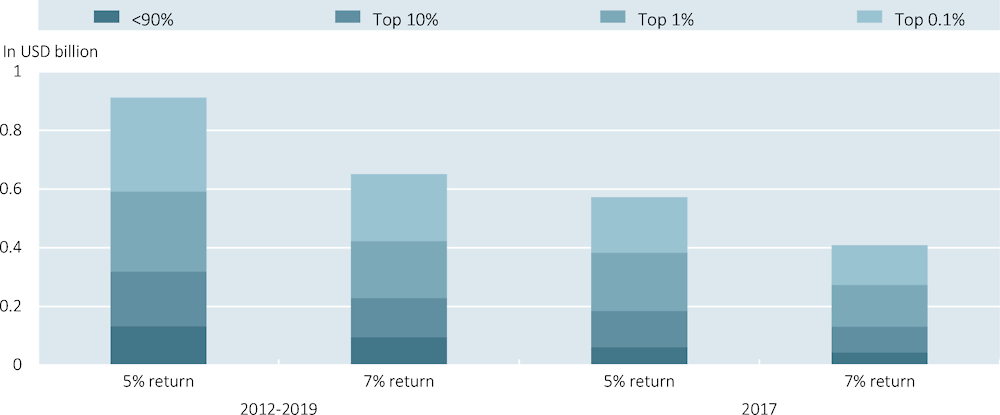

Despite the quality of the data it must be recognised that any amounts of foreign assets inferred by capitalisation are heavily dependent on model parameters and estimates can be sensitive to small deviations in assumed rates of return. To alleviate these concerns, some precautions have been considered in the model. First, the results are estimated across a range of plausible rates of return taken from the literature. In their study of Norwegian taxpayer wealth, Fagareng et al. (2020[13]) estimate an average return to financial wealth of about 5% for the 90th percentile in the wealth distributions over the period 2005 - 2015. Jordà et al. (2019[14]) report a long-term average real rate of return to equities of 7% across a number of advanced economies. Thus in this analysis a rate of return of between 5% and 7% is assumed. These rates are assumed to be homogeneous for foreign interests, dividends and capital gains. Moreover, the analysis of declared foreign capital income by new tax report filings has shown a peak in declared amounts for new tax reports in 2017, coinciding with the South African commencement of active information exchange under the CRS. Thus new filings around that time may have particularly responded to the increasing risk of detection and can be assumed to be related to previously undeclared foreign wealth.

Based on the assumptions taken above, capitalising foreign capital income as declared in new tax returns yields between USD 0.4 billion and USD 0.9 billion in past undeclared foreign wealth. Figure 6.7 also separates out the year 2017 because it is particularly interesting for the analysis. More than two-thirds of that total amount estimated from new tax returns during 2012 – 2019 was provided by tax filers who declared for the first time in 2017, likely as a response to AEOI commencement. Independent of the rate of return assumed, the top 1% of income earners accounted for close to 70% of the total amount, of which the top 0.1% claimed about half. The accumulated wealth of lower percentiles only made up a fraction. While the estimated total amount needs to be validated by other data sources below and may suffer from non- or under-declarations of income, it nonetheless provides again evidence on the increased detection risk by EOI and the related responsiveness particularly by top income receivers.

Figure 6.7. Previously non-compliant offshore wealth imputed from returns by new tax filers

Note: The income tax declarations were converted from ZAR into USD using annual average exchange rates from the OECD database.

Source: Authors’ calculations based on updated SARS-NT panel data (Ebrahim and Axelson, 2019[15]).

Estimating past non-compliant offshore wealth and IFFs from CRS data

The comprehensive foreign account information exchanged under the CRS provides arguably the strongest source for estimating previously non-compliant offshore wealth in South Africa. This is not only due to the detailed data coverage but also the process of how the dataset has been established, which offer important advantages over other data sources. For instance, account balances transmitted from foreign jurisdictions offer third-party confirmation of taxpayers’ financial wealth abroad. In contrast to self-declared taxpayer information such as, for instance, in income tax returns or the VDPs, data transmitted under the CRS has been reported to tax authorities and finance ministries by financial institutions. Therefore, despite potential inconsistencies or lack of diligence in reporting, especially in the early years of its implementation, the CRS data provides a very detailed picture of foreign assets owned by domestic taxpayers.

Despite the detailed coverage of foreign accounts, estimating previously non-compliant offshore wealth requires a number of important assumptions. The analysis is based on the key assumption that offshore wealth is predominantly located in IFC jurisdictions previously identified in O’Reilly, Parra Ramirez and Stemmer (2019[1]). Frequent reference to these jurisdictions in SVDP applications as preferred locations for undisclosed foreign assets lends further confidence to this assumption.

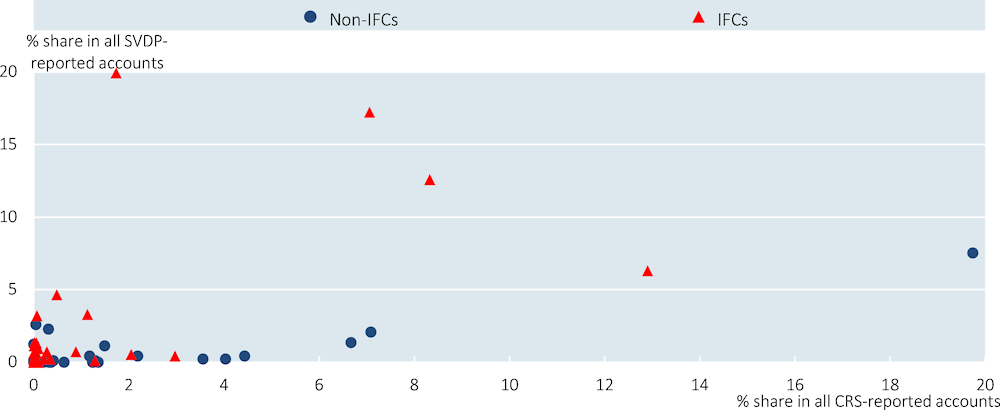

The appearance of IFC jurisdictions in SVDP applications and CRS data is similar. Across both datasets IFC jurisdictions show similar patterns in terms of individual jurisdictions appearing as well as their share of foreign accounts hosted relative to all reported SVDP and CRS accounts (Figure 6.8). The overall correlation of accounts reported in individual IFC jurisdictions stands at 0.6. For bank accounts alone, the most-referred-to investment category, the correlation is even higher, at 0.73. In contrast, most non-IFC jurisdictions only appear in CRS-exchanged data but do not tend to appear in the SVDP as shown by the blue dots on the x-axis. Non-IFC jurisdictions may have also facilitated taxpayer non-compliance at some point in the past. However, these jurisdictions have been more deeply embedded in multilateral regulatory frameworks and transparency initiatives that render such behaviour relatively less likely on an ongoing basis.

Figure 6.8. The high frequency of IFC jurisdictions in SVDP and CRS data

Note: Shares are calculated against total accounts reported in the SVDP or CRS.

Source: National Treasury.

Moreover, even though previous hidden offshore wealth is expected to be held in IFCs, assets invested in these jurisdictions may not necessarily have been non-compliant with tax laws. Assumptions on non-compliant shares of offshore wealth are thus based on existing evidence from the literature and compared to CRS matching rates with income tax returns and VDP/SVDP applications. Evidence from several countries on cross-border financial accounts reports estimates on non-compliance of assets invested in IFCs ranging from as low as 60% - 80% (Pellegrini, Sanelli and Tosti, 2016[16]) up to 85% - 95% (Alstadsaeter, Johannesen and Zucman (2019[17]); United States Senate (2014[18])).

Matching rates between CRS accounts and income tax returns by tax identification number do not necessarily provide direct evidence of past compliance of existing accounts. For instance, the transmission of tax identification numbers for accounts that existed prior to CRS implementation in the respective countries is not always required. However, successfully matched accounts may provide information on taxpayers that were already available to tax authorities at some point in the past, including accounts that may have already been declared. As described above, all CRS accounts received by South Africa exhibit an effective matching rate of around 37%, thus potentially up to 63% may have been unknown to SARS. The corresponding rate for IFC accounts is about 50%. Beyond successful matching, these rates may also include other information available to SARS on foreign accounts prior to information exchange. Against this background, an alleged non-compliance share of 85% - 95% on all foreign wealth suggested by some of the academic literature appears to be too high. As a result, all foreign wealth estimates are expressed under the assumption of past non-compliance rates of within bounds of 60% to 80% (the lower end of the estimates provided in the academic literature).

Despite the diligence in taking reasonable assumptions, the estimations are subject to a number of caveats that need to be considered. First, the transmitted account data is subject to a data cleaning process as described above, which could create the risk of mistakenly discarding observations. According to the applied process, simultaneous duplicates across the different account characteristics such as taxpayer identification numbers, reporting jurisdictions, account balances but also denominated currency and payment flows have been removed. Second, CRS reporting from financial institutions may not be comprehensive due to, for instance, technical capacity issues or limited data available to the institution on account holders, which may particularly occur with older accounts. This would result in an already incomplete dataset transferred to the South African authorities. Third, CRS avoidance cannot be taken into account and IFFs may have also left to non-IFC jurisdictions. However, the observed frequent reference to IFC jurisdictions both in the SVDP applications and CRS data makes their selection as potential destinations to hide non-compliant assets at least highly plausible. Fourth, wealth shifted out of South Africa due to IFFs may have been spent by taxpayers. Finally, wealth may be held overseas in forms of wealth not currently covered by information exchange agreements, such as art, real estate, or cryptoassets.

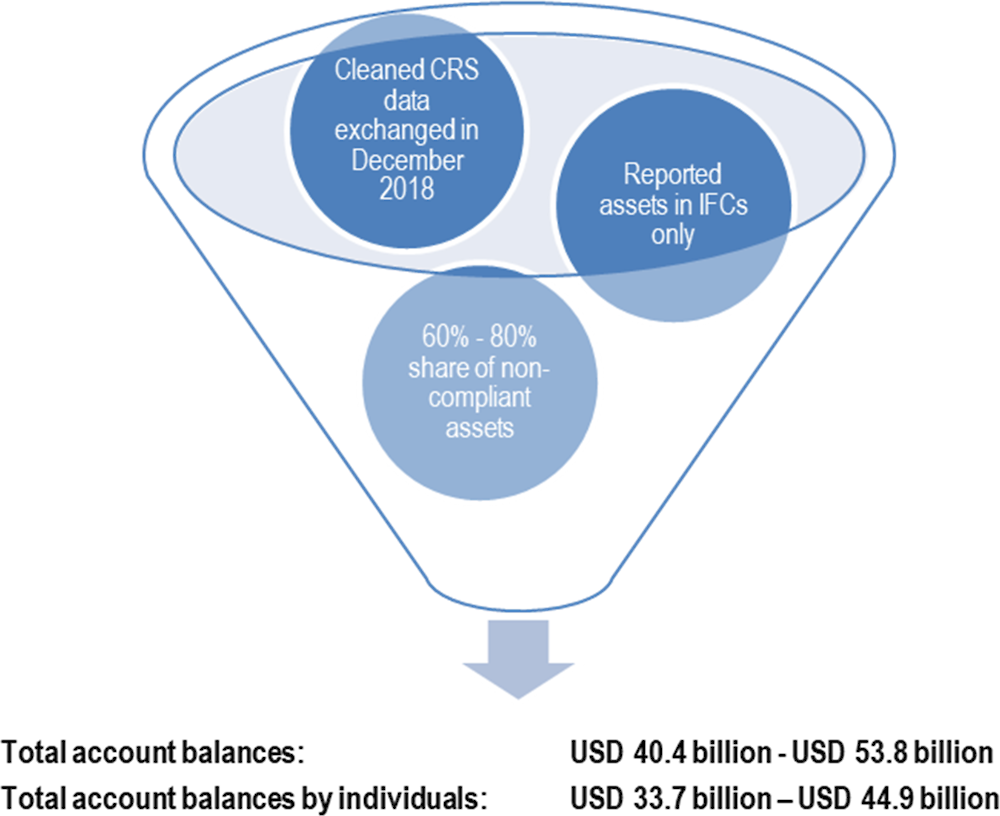

Estimating heretofore undeclared offshore wealth follows the process below, which is also schematically presented in Figure 6.9:

1 In a first step, reported total and individual account balances are assessed and cleaned. Simultaneous duplicated entries by anonymised identification number, account balances and transmitting jurisdictions are suppressed.7 Accounts by the same taxpayer in the same jurisdictions but denominated in different currencies are retained. Total account balances with positive asset holdings are aggregated per jurisdiction and converted from ZAR into USD.

2 The second step involves the aggregation of total and individual account balances from IFC jurisdictions only. Out of the 47 IFC jurisdictions identified in O’Reilly, Parra Ramirez and Stemmer (2019[1]), 37 report active accounts to South African authorities.

3 Third, the aggregated account balances from IFCs are multiplied by estimates of non-disclosure probability for offshore accounts of between 60% - 80% in accordance with evidence from the literature and SARS data.

Figure 6.9. Estimating hitherto undeclared offshore wealth from CRS accounts

Note: Account balances in ZAR have been converted into USD according to the average ZAR-USD exchange rate in 2018 (OECD, 2021).

Source: National Treasury.

According to exchanged CRS accounts in December 2018, historically non-compliant total assets invested offshore range between USD 40.4 billion and USD 53.8 billion, an equivalent of about 10% to 15% of South African GDP. Total assets held abroad only by individuals amount to between USD 33.7 billion and USD 44.9 billion.

Compared to estimations relying on new tax declarations, past non-compliant offshore wealth estimates through the CRS are about forty to fifty times larger. Previously undeclared foreign wealth based on capitalising foreign capital income from new tax declarations in the SARS-NT panel only ranges between about USD 0.4 billion and USD 0.9 billion. The differences in estimated size hail largely from the unprecedented detailed coverage of foreign account data in the CRS in terms of financial account balances and geographic reach, particularly of IFCs. The CRS data has been third-party validated and does not rely on self-declarations of foreign capital income or assets invested abroad. Discrepancies may further arise due to substantial non-declaration or underreporting of foreign income by taxpayers when largely relying on self-declared income tax data. This suggests that the CRS data may provide substantial additional data to tax authorities relative to existing data. Underlying technical differences in cleaning and assembling the income tax datasets based on varying matching parameters may also add challenges to the estimation process.

Given that the above estimate relies on unprecedented data from the CRS, the reported amounts need to be set into perspective relative to global estimates reported elsewhere in the literature. For instance, Alstadsaeter et al. (2018[12]) estimate, based on data from 2007, that around 11.8% of South African GDP is invested in undeclared assets in IFCs abroad. By relying also on tax data, more recent evidence from Colombia shows that around 15% of GDP as an upper bound was held in non-compliant offshore wealth (Londoño-Vélez and Ávila-Mahecha, 2021[19]). Both shares reported in the literature are remarkably similar to what has been found for South Africa based on CRS data. These findings imply that while the degree of tax non-compliance appears to have grown in the past relative to economic activity, South Africa’s experience with tax evasion and IFFs seems to be of a similar order or magnitude to other jurisdictions.

From non-compliant wealth stocks to illicit financial flows

Previously undeclared offshore wealth was likely the result of past financial outflows.8 The final step to use tax data to quantify annual IFFs thus requires linking the estimated stocks of previously undeclared offshore wealth to these flows in the past. The approach used in this analysis is different to the rest of the literature, largely owing to the unique CRS data available on the stock of financial assets in foreign accounts. While the rest of the literature assesses the aggregate flows directly, largely trade flows, and asks ‘what fractions are illicit’, this report examines offshore wealth stocks, estimates a fraction that is illicit and asks ‘what flows could generate this share’. This has the advantage of being agnostic as to the nature of the flows. The assumption here is that, regardless of the specific illicit method through which flows left South Africa (e.g. smuggling, trade mis-invoicing, or fraudulent payments, etc.), all the flows that left result in wealth that is not declared to tax authorities.9

Backing out annual IFFs from past non-compliant offshore wealth requires some final assumptions regarding the duration of yearly outflows and the rate of annual return to these flows abroad. As before, evidence from the literature and the present data analysis is used to generate these estimates. As to the nature of the underlying annual rate of return, this exercise relies as a baseline on evidence provided by Fagareng et al. (2020[13]) who report average real returns of about 5% to foreign assets that is used elsewhere in this chapter. Slightly higher real rates of return on equity of about 7% are reported by Jordà et al. (2019[14]). A change in the underlying return has, as will be shown below, only a marginal effect on the estimate of annual IFFs. Regarding the assumed duration of annual outflows, applications to the VDP/SVDP and periods of non-compliance declared therein provide a reasonable benchmark. Continued annual outflows over a period of 10 years (the average length of non-compliance provided in the SVDP data) is therefore the hypothesis used.

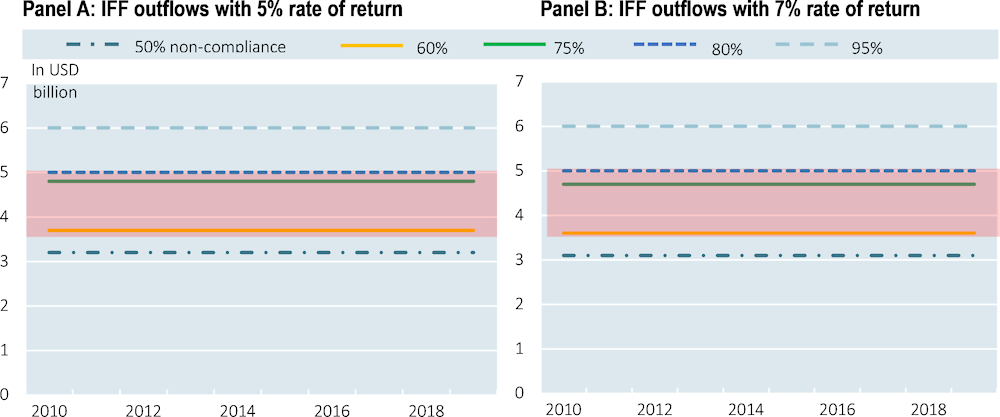

These assumptions applied to the previously estimated undeclared offshore wealth in the past result in IFFs in South Africa of between around USD 3.5 billion and USD 5 billion per year. The red-shaded areas in Figure 6.10 show the range of estimated annual IFFs taking into consideration the discussed share of 60% – 80% non-compliance in past undeclared offshore wealth and the 10-year period of consecutive outflows. To provide some initial robustness, different real rates of return to flows invested abroad have been applied. Panel A presents results for a 5% annual return to assets, Panel B for a 7% return to assets. The different horizontal lines outside the shaded area represent respectively lower (50%) or higher assumptions (95%) on non-compliance which can be considered less likely given available data. As Figure 6.10 also shows, increasing the assumed real rate of return from 5% to 7% alters the IFF trajectories only slightly by marginally decreasing estimated IFFs at the lower bound.

Figure 6.10. Estimates of annual IFF outflows

Note: The red-shaded area shows the likely range of estimated annual IFFs taking into consideration plausible shares of non-compliance in previously undeclared offshore wealth, real rates of return to flows invested abroad and the time period of consecutive outflows. The different lines represent lower or higher assumptions on non-compliance which are not confirmed by available data.

Source: National Treasury.

Figure 6.11 shows a more thorough sensitivity analysis of the IFF estimates. While the estimated amount of non-compliant wealth held offshore remains fixed, the heat map below provides more detailed projections of past annual outflows for different years of duration, rates of return and assumed degrees of non-compliance. Coloured from light green to dark red and increasing in size, the fields represent likelihoods of IFF outflows in line with and exceeding the identified data-driven assumptions. The green fields in the middle panel show the headline results presented above for annual IFFs ranging between USD 3.5 billion and USD 5 billion, assuming a 10-year duration of outflows, a 60% - 80% degree of non-compliance and 5% or 7% rates of return. All other green-coloured fields fall within this range of annual flows, even when considering, for instance, very high rates of return of 10% and continuous financial outflows for up to 15 years. The red-shaded areas can be considered to be less likely given the adopted parameter mix. The observed stability of the estimates for the identified IFF range of annual outflows across a wide range of parameters lends some confidence in the adopted estimation strategy and obtained results.

Figure 6.11. Sensitivity analysis to IFF estimates

Note: The robustness of IFF estimates is checked across different lengths of outflow duration, rates of return and degree of non-compliance in relation to foreign assets. The green-shaded cells fall within the previously identified range of annual outflows and can thus be considered as more likely in size than the red-shaded, higher estimates.

Source: National Treasury.

The IFF estimates based on CRS data in this report differ significantly, in some respects, from the amounts reported elsewhere in the literature and thus require some analytical qualification. For instance, annual IFFs for South Africa of USD 14 billion are reported by AU/ECA (2015[20]) and of USD 20 billion are reported by GFI (2021[21]). Both of these estimates are based on a totally different approach using trade statistics. The approach used in this report, based on newly-available data from the CRS, can be considered an important new complement to this research. While all estimates in this area are fraught with difficulty due to the inherently secret nature of IFFs, this research finds IFF estimates that are between 17% and 50% of previous estimates.

This supports claims elsewhere in the literature that trade-based estimates of IFFs may have produced inflated results. The reasons for these discrepancies arise largely due to differences in the data used, arbitrary assumptions, and estimation approaches applied. Most recent studies ( (AU/ECA, 2015[20]), (Global Financial Integrity, 2021[21]), (UNCTAD, 2020[22]), (Signé, Sow and Madden, 2020[23])) are based on aggregated trade data to estimate a total amount of IFFs having left the country or the entire Sub-Saharan region on an annual basis. These estimations, attempting to calculate trade mis-invoicing, rely on trade gap analysis by exploiting data mismatches in partner-country trade statistics. Sometimes residuals from balance of payments statistics are added as an additional factor to account for remaining potential outflows. Relying on such aggregated data may likely inflate results and leaves little analytical space for disentangling IFFs into their subcomponents, which is important in a country-specific context.

In contrast, the present analysis uses tax data to provide a new estimate of IFFs. For this report these IFFs constitute cross-border financial flows that have not been declared to tax authorities and are illegal either in their origin, transfer or use. Despite relying on data-driven assumptions, the analysis does not rely on data gaps in international statistics but on an important extension of them: a novel and unique form of tax microdata reporting foreign financial accounts. As a result of the defined focus of this report, other IFF components within the tax and commercial space such as smuggling or money laundering have not been separately assessed in detail. However, the CRS relates to all the different illicit outflows to a certain extent. Whenever IFFs or subsequent non-compliant investments from financial flows end up in foreign financial accounts and are invested in reportable assets by tax residents in the country of their origin, they will become subject to information exchange and could be detected.

Results and policy implications

This chapter has estimated annual IFFs based on the assessment of previously non-compliant offshore wealth. Detailed financial account data exchanged under the CRS between South Africa and foreign jurisdictions has provided the background for a careful analysis of previously non-compliant financial assets held abroad as well as preceding IFF outflows. Due to the comprehensive and detailed coverage of foreign financial accounts, estimations with CRS data have allowed for a broader picture to be provided of previously non-compliant foreign wealth. Based on data cleaning and well-founded assumptions based on the economic literature and other data used in this study regarding potential non-compliance and returns to foreign assets, it is estimated that past total undeclared foreign wealth of South Africans invested in IFCs amounts to between USD 40.4 billion and USD 53.8 billion. Over a period of ten years, this amount would result in preceding illicit financial outflows of approximately between USD 3.5 to USD 5 billion annually. While these flows are still substantial, the analysis suggests that some existing estimates of annual IFFs for South Africa may have produced inflated results and exceed the estimated yearly flows in this report by four to five times the amount.

The CRS enhances the scope of data analysis on tax non-compliance and brings increasing transparency to global hidden wealth. It also provides new insights into overall cross-border financial activity of a country’s taxpayers. In December 2018, South Africans held over 585 000 accounts in 85 jurisdictions abroad with a total account balance of about ZAR 1.26 trillion. This implies that the total amount of account balances held outside the country by taxpayers represents more than 20% of the country’s GDP. Less than half of these accounts were domiciled in IFCs but accounted for about 70% of all exchanged account balances.

Successfully linking CRS accounts with SARS income returns is a key step in credibly increasing both the risk for disclosure and revenue collection potential. Linking the CRS data with income tax data from SARS reveals that only about 30% of all accounts exchanged under the CRS had a uniquely identifiable tax number in tax year 2019. From those accounts with a tax number around 87% could be matched with available income tax data from SARS, resulting in effective matching of a little more than 35% of all accounts. In contrast, the effective matching rate with income tax returns for IFC accounts is slightly less than half of all transmitted accounts. These rates leave room for significant improvement with regard to effective assessment, which has the potential to result in revenue collection gains in the future.

A more detailed comparison between CRS payments and declared income taxes suggests increasing compliance over time. Between 2018 and 2019, declared total incomes in relation to foreign interest and dividends increased relatively more than reported CRS payments for interest and dividends. These developments suggest that amid rising account transmissions over time taxpayers may have realised that their account information has been shared and improved their tax compliance, particularly with regards to foreign interest income. Moreover, relative to their position in the income distribution, a substantial share of taxpayers in the middle-high income segment declared foreign capital income from interest and dividend payments. However, the number of matched but not declaring taxpayers is still large and points to non-compliance that may level off over time due to increased detection risk, presumably also driven by more declarations from high-income earners.

The analysis has proven that exchanged CRS information can provide new insights above and beyond other available data sources in terms of individual cross-border finance and can become an essential tool in the fight against tax evasion and IFFs. Its effective use, however, depends on the tax administration capacity to exploit the information transmitted. On the analytical side, this requires a strengthening of data processing capacity across agencies that allows them to increasingly link foreign account data with available tax returns. Moreover, the regulatory framework needs to be constantly revised and updated to enable a smooth transmission of foreign account information amid an enlarging multilateral AEOI network.

References

[17] Alstadsaeter, A., N. Johannesen and G. Zucman (2019), “Tax Evasion and Inequality”, American Economic Review, Vol. 109/6, pp. 2073-2103.

[12] Alstadsaeter, A., N. Johannesen and G. Zucman (2018), “Who owns the wealth in tax havens? Macro evidence and implications for global inequality”, Journal of Public Economics, Vol. 162, pp. 89-100, https://doi.org/10.1016/j.jpubeco.2018.01.008.

[20] AU/ECA (2015), Track it! Stop it! Get it! Report of the High Level Panel of Illicit Financial Flows from Africa, https://repository.uneca.org/bitstream/handle/10855/22695/b11524868.pdf?sequence=3&isAllowed=y.

[7] Bricker, J. et al. (2016), “Estimating Top Income and Wealth Shares: Sensitivity to Data and Methods”, American Economic Review: Papers & Proceedings, Vol. 106/5, pp. 641-645, http://dx.doi.org/10.1257/aer.p20161020.

[8] Bricker, J. et al. (2016b), “Measuring Income and Wealth at the Top Using Administrative and Survey Data”, Brookings Papers on Economic Activity, Vol. Spring, pp. 261-331, https://www.brookings.edu/wp-content/uploads/2016/03/brickertextspring16bpea.pdf.

[3] Casetta, A. et al. (2014), “Financial flows to tax havens: Determinants and anomalies”, Quaderni dell’antiriciclaggio, Vol. 1/March 2014, https://uif.bancaditalia.it/pubblicazioni/quaderni/2014/quaderni-analisi-studi-2014-1/Quaderno_Analisi_studi_1.pdf?language_id=1.

[10] Chatterjee, A., L. Czajka and A. Gethin (2020), “Estimating the distribution of household wealth in South Africa”, UNU-WIDER Working Paper 45, https://doi.org/10.35188/UNU-WIDER/2020/802-3.

[15] Ebrahim, A. and C. Axelson (2019), “The creation of an individual level panel using administrative tax microdata in South Africa”, UNU-WIDER Working Paper 661-6, https://doi.org/10.35188/UNU-WIDER/2019/661-6.

[13] Fagareng, A. et al. (2020), “Heterogeneity and Persistence in Returns to Wealth”, Econometrica, Vol. 88/1, pp. 115-170, https://doi.org/10.3982/ECTA14835.

[2] Fratzscher, M. (2012), “Capital flows, push versus pull factors and the global financial crisis”, Journal of International Economics, Vol. 88/2, pp. 341-356, https://doi.org/10.1016/j.jinteco.2012.05.003.

[21] Global Financial Integrity (2021), Trade-Related Illicit Financial Flows in 134 Developing Countries: 2009-2018, https://secureservercdn.net/50.62.198.97/34n.8bd.myftpupload.com/wp-content/uploads/2021/12/IFFs-Report-2021.pdf?time=1643653304.

[6] Greenwood, D. (1983), “An Estimation of U.S. Family Welath and Its Distribution From Microdata, 1973”, The Review of Income and Wealth, Vol. 29/1, pp. 23-44, https://doi.org/10.1111/j.1475-4991.1983.tb00630.x.

[4] Haberly, D. and D. Wójcik (2015), “Tax havens and the production of offshore FDI: an empirical analysis”, Journal of Economic Geography, Vol. 15, pp. 75-101, https://doi.org/10.1093/jeg/lbu003.

[14] Jordà, Ò. et al. (2019), “The Rate of Return on Everything, 1870–2015”, The Quarterly Journal of Economics, Vol. 134/3, pp. 1225–1298, https://doi.org/10.1093/qje/qjz012.

[25] Leenders, W. et al. (2020), “Offshore Tax Evasion and Wealth Inequality: Evidence from a Tax Amnesty in the Netherlands”, EconPol Working Paper 52, Vol. 4, https://www.ifo.de/DocDL/EconPol_Working_Paper_52_Offshore_Tax_Evasion.pdf.

[19] Londoño-Vélez, J. and J. Ávila-Mahecha (2021), “Enforcing Wealth Taxes in the Developing World: Quasi-Experimental Evidence from Colombia”, American Economic Review: Insights, Vol. 3/2, pp. 131-148, https://doi.org/10.1257/aeri.20200319.

[1] O’Reilly, P., K. Parra Ramirez and M. Stemmer (2019), “Exchange of information and bank deposits in international financial centres”, OECD Taxation Working Papers, No. 46, OECD Publishing, Paris, https://dx.doi.org/10.1787/025bfebe-en.

[5] OECD (2021), Global Forum on Transparency and Exchange of Information for Tax Purposes: Toolkit for the Implementation of the Standard for Automatic Exchange of Financial Account Information, OECD Publishing, https://www.oecd.org/tax/transparency/documents/aeoi-implementation-toolkit_en.pdf.

[11] Orthofer, A. (2016), “Wealth inequality in South Africa: Evidence from survey and tax data”, REDI3x3 Working Paper 15, http://redi3x3.org/sites/default/files/Orthofer%202016%20REDI3x3%20Working%20Paper%2015%20-%20Wealth%20inequality.pdf.

[16] Pellegrini, V., A. Sanelli and E. Tosti (2016), “What do External Statistics tell us About Undeclared Assets held Abroad and Tax Evasion?”, Bank of Italy Occasional Paper No. 367, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2917184.

[9] Saez, E. and G. Zucman (2016), “Wealth Inequality in the United States since 1913: Evidence from Capitalized Income Tax Data”, The Quarterly Journal of Economics, Vol. 131/2, pp. 519-578, https://doi.org/10.1093/qje/qjw004.

[23] Signé, L., M. Sow and P. Madden (2020), Illicit financial flows in Africa: Drivers, destinations, and policy options, https://www.brookings.edu/wp-content/uploads/2020/02/Illicit-financial-flows-in-Africa.pdf.

[22] UNCTAD (2020), Tackling Illicit Financial Flows for Sustainable Development in Africa, United Nations Publications, https://unctad.org/system/files/official-document/aldcafrica2020_en.pdf.

[18] United States Senate (2014), Offshore Tax Evasion: The Effort to Collect Unpaid Taxes on Billions in Hidden Offshore Accounts, https://www.hsgac.senate.gov/imo/media/doc/REPORT%20-%20OFFSHORE%20TAX%20EVASION%20(Feb%2026%202014,%208-20-14%20FINAL).pdf.

[24] Zucman, G. (2013), “THE MISSING WEALTH OF NATIONS: ARE EUROPE AND THE U.S. NET DEBTORSS OR NET CREDITORS?”, The Quarterly Journal of Economic, pp. 1321–1364, https://doi.org/10.1093/qje/qjt012.

Notes

← 1. OECD staff thanks the National Treasury, particularly Chris Axelson, for his analysis of South Africa’s CRS data.

← 2. There is a relatively small probability that not all transferred accounts belong to South African tax residents. For instance, some accounts may be dormant, as a change in residency by the account holder may have not been reported to the managing financial institution. Zero and low-balance accounts have thus been dropped to account for this potential issue in the transmitted data.

← 3. While observations that contain duplicated combinations of anonymised taxpayer identification numbers (TIN), reporting jurisdictions, and account balances are removed, double entries accounting for reported payments have also been assessed in a second step. All else equal, this would remove some payment line items into the same accounts but would not affect the total account balance used for the IFF estimation.

← 4. These trends are also reflected when attempting to calculate the tax loss by adding the non-declared amount to taxable income. Since it can only be estimated for linked records where income is declared as interest or dividends, the tax loss appears to be at a minimum around ZAR 770 million in 2018 and ZAR 540 million in 2019. These amounts, however, exclude the large categories for income of “Other” and “Gross proceeds/Redemptions”.

← 5. In contrast to Bricker et al. (2016b[8]) or Greenwood (1983[6]) the analysis does not aim to estimate total wealth but rather concentrates on the amount of foreign accumulated assets corresponding to the respective foreign income flows as declared in new tax returns. A variable that accounts for estimated non-financial wealth such as, for instance, housing wealth, is therefore not added.

← 6. A similar approach to gauge hidden wealth has been employed by Leenders et al. (2020[25]) who rely on taxes collected from disclosed offshore wealth. However, given the imprecise allocation of taxes and levies collected to the respective self-declared offshore assets, this report relies on the income capitalisation method following Bricker et al. (2016b[8]).

← 7. While duplicates of anonymised taxpayer identification number (TIN), reporting jurisdiction and account balance combinations are suppressed, double entries accounting for reported payments have also been assessed in a second step. All else equal, this would remove some payment line items into the same accounts but do not affect the total account balance used for the IFF estimation.

← 8. While the accounts abroad could have also been filled with capital inflows from elsewhere, these accounts have nonetheless been transferred to SARS as registered abroad by South African taxpayers. It can thus be considered as very likely that the initial flows generating these offshore assets also had their origin in South Africa.

← 9. Although related, the approach in this report takes the opposite direction of the wealth accounting framework used for instance in Zucman (2013[24]). There, past investment flows are cumulated to estimate wealth while valuation effects are accounted for. Here, new data on wealth is used to estimate past flows.