This chapter analyses taxpayer behaviour amid a variety of tax transparency initiatives implemented in South Africa.

Tax evasion is shown to have a long history and has been concentrated among the very wealthy and top income earners.

International financial centres (IFCs) have been the priority destinations for hiding non-compliant wealth abroad.

Taxpayers have responded to multilateral tax transparency initiatives such as the implementation of the Common Reporting Standard (CRS).

Strong increases in tax filings in relation to foreign capital income and previously undisclosed amounts of foreign capital income by new taxpayers are evidence of a strong CRS impact on tax revenues.

The responsiveness by taxpayers to domestic transparency initiatives such as voluntary disclosure programmes has also been triggered by the implementation of the CRS.

Improving the use of exchanged data, and the more effective use of bilateral information exchange treaties with IFCs should be key priorities.

Assessing Tax Compliance and Illicit Financial Flows in South Africa

5. Taxpayer responses to increasing tax transparency in South Africa

Key messages

Introduction

This chapter analyses tax evasion by assessing tax compliance amid a variety of tax transparency initiatives implemented in South Africa.1 It first provides an overview of the literature regarding the characteristics of cross-border tax evasion and undeclared offshore wealth. This review presents useful evidence from various countries for the subsequent data analysis by assessing the effectiveness of domestic tax transparency initiatives and by examining income and wealth characteristics of participants in these initiatives. The subsequent section introduces the different data sources in more detail. After outlining the different approaches of the quantitative analysis, the chapter embarks on an assessment of taxpayer responsiveness to tax transparency initiatives – based on tax return filings over time and an individual in-depth evaluation of South Africa’s VDP and SVDP programmes. A more detailed analysis of foreign financial account information exchanged under the CRS is provided in the next chapter.

How income distribution and foreign capital income matter for tax evasion and undeclared offshore wealth in South Africa

Cross-border tax evaders and holders of non-compliant offshore wealth tend to belong to the very top of the income and wealth distribution. Recent evidence across various countries shows that individual tax evasion increases with wealth and income levels. These stylised facts have largely been discovered through taxpayer responsiveness to VDPs. Colombian taxpayers, for instance, who have disclosed their hidden assets in the Colombian government’s VDP belong to the very top of the country’s wealth distribution. Moreover, the magnitude of disclosures appears to rise with the wealth level. While the top 0.5% confessed to hiding 28% of their wealth, the top 0.01% kept 37.5% of their net worth hidden abroad (Londoño-Vélez and Ávila-Mahecha, 2021[1]). In a similar vein, Alstadsaeter, Johannesen and Zucman (2019[2]) conduct an investigation into tax evasion for Scandinavian countries and find widespread evasion among those taxpayers with high wealth levels. In Norway and Sweden, the 0.01% richest households evade about 25% of their taxes owed. By assessing taxpayers’ responsiveness to a tax amnesty programme from the Dutch authorities, Leenders et al. (2020[3]) report a similar concentration of tax evasion at the top.

While domestic compliance initiatives provide an improved sense of cross-border tax evasion by well-off taxpayers and encourage the disclosure of hidden assets, some evidence nonetheless suggests that the wealthiest evaders can be less affected. Leenders et al. (2020[3]) document a muted reaction to the Dutch amnesty programme by high-income evaders, which was in part ascribed to sophisticated evasion schemes and little incentives to come forward in terms of attenuated fines. The analysis on US taxpayers by Johannesen et al. (2020[4]) puts VDP participants predominantly in the top 10% of the income distribution, while noting that they very rarely belong to the highest income percentiles. By relying on new data from random audits in the United States, Guyton et al. (2021[5]) report that detected evasion declines sharply at the very top of the income distribution, with only a trivial amount of evasion detected in the top 0.1%. Moreover, they find that random audits capture tax evasion through offshore accounts and pass-through businesses only to a very limited extent. These two channels are both quantitatively important for the top 1%. These results are consistent with the observations by Harrington (2016[6]) who reports that non-compliant offshore accounts held by high-income taxpayers are often held in IFC jurisdictions. A mere reliance on VDPs thus appears to distort estimates of offshore assets, leaving tax evasion by the most well-off often considerably underestimated.

Assessing capital income derived from assets held abroad can also be considered a viable strategy for analysing taxpayer responses to tax enforcement initiatives. Existing studies have shown that taxes on capital income may present higher tax evasion risks relative to other forms of income (e.g. Londoño-Vélez and Ávila-Mahecha (2021[1]); Leenders et al. (2020[3])). In gauging the response of capital income reporting to enforcement initiatives, Johannesen et al. (2020[4]) assess reported foreign capital income in the form of interest, dividends and capital gains from offshore bank accounts of US citizens residing abroad. The largest share of these accounts are located in IFCs. As shown by Guyton et al. (2021[5]), under-reporting detected through random audits in the United States particularly applies to interest, dividends and capital gains.

Higher income taxpayers tend to earn more capital income from abroad. The share of capital income from domestic and foreign investments in taxable income tends to rise with a taxpayer’s position in the overall income distribution. Financial capital income and business income, despite the limits of detection strategies, particularly gain importance as sources of income at the top (Guvenen, Kaplan and Song, 2014[7]; Guyton et al., 2021[5]). In South Africa, for instance, the capital share rises slowly from 15 to 20 percent between the 95th and 99th percentiles, before rapidly increasing to more than half of total income on average for the top percentile of the distribution (Bassier and Woolard, 2020[8]). Similar evidence has been found for the United Kingdom (Advani and Summers, 2020[9]). Recent evidence from Norway further shows that the dominant financial wealth components in the top percentiles are, among others, assets held abroad (Fagareng et al., 2020[10]). The concentration of foreign capital income at the top across countries thus suggests that an assessment of the size of tax evasion and the amount of non-compliant wealth held offshore is linked to an analysis of the relationship between income and wealth levels at the top and the contribution of foreign capital income to total taxable income.

Income and wealth is highly concentrated among the top percentiles in South Africa (Chatterjee, Czajka and Gethin, (2020[11]); Hundenborn, Woolard and Jellema, (2019[12])). Orthofer (2016[13]) reports a strong correlation between income and wealth in the highest income percentiles. There is also evidence of a widespread reliance on trusts and similar investment funds by the higher-income segment of the South African population as a means of investing in financial assets (Chatterjee, Czajka and Gethin, 2020[11]). For instance, more than half of total investment in bonds and stocks is held through trusts by the upper end of the wealth distribution.2 These patterns suggest that most of the assets held abroad and foreign income derived from these assets belong to the very top of the income distribution in South Africa. Undeclared foreign capital income can be considered as a product of the accumulation of foreign wealth by individual financial outflows in the past. For this reason, the analysis below will largely focus on tax data of foreign capital income from interest, dividends and capital gains and focus on the top segments of the income distribution in assessing the impact of compliance initiatives.

Data

The analysis in this report relies on anonymised South African taxpayer data.3 The data includes anonymised individual tax records comprising various sources of taxable income, tax returns on foreign investment income and detailed data from participants in the VDP and the SVDP, as well as data on information exchanged under the CRS.

Tax microdata has a couple of advantages compared to survey data in assessing tax compliance. Due to its administrative nature, this data usually covers the full tax-paying population. As it is not a sample, it identifies all individual taxpayers, which greatly increases the granularity of measured income flows. Because all individuals above a certain income threshold must file a return, tax returns are particularly well-suited to the study of the upper-end of the income distribution. These are advantages over survey data, which often suffer from small-sample biases or sampling errors (Webber, Tonkin and Shine (forthcoming[14]), Kennedy (2019[15])).

That being said, there are also a number of limitations with tax microdata which should be taken into consideration. The fact that the tax forms are self-assessed implies that there may be underreporting or no disclosure of income flows at all, especially if the likelihood of being audited by tax authorities is low. More importantly, tax microdata only cover forms of income that are useful for tax collection and deduction purposes, which implies that other forms of non-taxable income are not reported in these data. The different datasets used in this report are explored in more detail below.

Personal income tax data

The analysis relies on personal income tax data from the SARS-NT panel which has been compiled by Ebrahim and Axelson (2019[16]). The panel combines for the first time ITR12 and IRP5 tax records and thus provides a comprehensive picture of the taxable income distribution of taxpayers in the formal sector in South Africa. Disentangling tax records by source codes and the number of tax filers per year, the panel also contains, for instance, detailed income information on retirees receiving only income from pension funds and individuals who are self-employed and only submit ITR12 returns. More information on South Africa’s tax system can be found in Chapter 4.

Important for the purpose of this report is the availability of ITR12 data on foreign capital income by the source of the income. Disaggregation by source code allows the examination of income streams from interest, dividends or capital gains stemming from capital invested abroad and at home. The original dataset prepared by Ebrahim and Axelson (2019[16]) which covers tax years from 2011 to 2017, has been updated to tax year 2019.4 SARS has also provided detailed income tax data covering all taxpayers with an ITR12 report for the years 2017 to 2019.

Data from the Voluntary Disclosure and the Special Voluntary Disclosure Programmes

The anonymised VDP dataset provides a detailed overview of applications collected by SARS. The information gathered through the VDP application form discloses the exact date and time of applications for the period from 2017 to early 2020. The dataset encompasses a total of 4287 unique applications with some taxpayers having applied several times. Amounts of previously unpaid taxes disclosed during the submissions are not provided.

The data reports whether the applying entity is an individual or an organisation. By means of an indicator variable the submissions to the VDP are broken down by tax type – whether the application refers to unpaid excise duties, customs duties, personal income taxes, VAT, other income taxes or any other taxes. The data further includes whether applicants submitted anonymously to obtain an indication of the possible relief that may be granted. On this basis, SARS issues a non-binding VDP ruling indicating whether or not, and to what extent, the applicant would qualify for relief. Taxpayers also need to report any years of tax default in the past for which they seek relief through the VDP. This information may provide important insights into patterns of tax evasion over time.

The anonymised SVDP dataset provides an even more comprehensive account of all individual applications to the SVDP programme throughout its active period from 31 October 2016 to 31 August 2017. The information contained in the dataset stems from the SVDP application form that was provided to potential applicants by SARS and SARB through their website. Most of the following information was self-declared by applying taxpayers. The total number of individual SVDP applications is 3123. The total number of successful applications providing entries to most data fields, however, reduces to 375, which is mainly due to incomplete applications that could not be processed by the relevant authorities or were rejected because of ongoing investigations. More specifically, the dataset contains precise information on the date and time of the application to the SVDP and the declared total amount of assets abroad in the respective denominated currency. It further provides information on the corresponding fines applied by SARB in contravention of exchange control regulation relative to the declared amount of assets in both ZAR and original currency.

Moreover, the data shows several geographic indications relating to the “Statement of unauthorised foreign assets and structures as at 29 February 2016”, the deadline for filing tax returns for the 2016 tax year. The data discloses foreign locations of non-resident discretionary trusts, their place of effective management, the potential location of investments in other listed financial instruments as well as the locations of bank accounts for short-term deposits. In addition, three indicator variables declare the type of applicant (individual or company), whether the declared assets are vested,5 and indicate whether the applicant is a holder of a non-resident discretionary trust.

Data exchanged under the Common Reporting Standard

National Treasury has also access to aggregated financial account data received by foreign jurisdictions under the CRS.6 Exchanged several times during 2017 and 2019, the data provides unique evidence of financial accounts held by South African taxpayers abroad. Apart from the total amount of assets invested in these accounts, the dataset also contains information on the jurisdiction of account incorporation, the different account types such as bank deposits or investment accounts, and payments into these accounts per transmission period. A more detailed description of this dataset is provided in Chapter 6, followed by an in-depth analysis of the information available.

As has been shown, the different datasets used in the study do not only vary in terms of the taxpayer information included but also in their structure such as sample length and frequency of observations. For instance, while individual applications to the VDPs are registered on a daily basis, observations from the SARS-NT panel are included annually, aggregated per taxable income decile. In contrast, due to a different data-generating processes, data from the CRS, the VDPs and income tax returns can be matched per individual and by fiscal year if a corresponding taxpayer appears in all datasets. These characteristics limits the extent to which different data sources can be combined for analytical purposes. Any combined analysis of different datasets in the following sections will thus be clearly stated.

Methodology

This section assesses the responsiveness of taxpayers to various tax transparency initiatives over time through local and foreign capital income tax data. Participation in the VDP and the SVDP as well as the income and wealth structure of their applicants are discussed separately in a subsequent step. The analysis of CRS data as well as the methodology applied will be provided in Chapter 6.

Taxpayer behaviour around implementation dates of tax transparency initiatives can serve as a test of their effectiveness and may provide an indication of prior misconduct. The analysis of taxpayer responsiveness to policies in individual jurisdictions has increasingly been used to assess the impact on tax evasion of both domestic policies (Londoño-Vélez and Ávila-Mahecha (2021[1]); Johannesen et al. (2020[4]); Leenders et al. (2020[3])) as well as international initiatives (Johannesen, 2014[17]). Studies usually rely on variants of a difference-in-differences framework, where a treatment group with exposure to the implementation of a certain policy is compared with a control group whose members are unaffected by the same policy.

In the South African context, detailed aggregated annual data from the SARS-NT panel provide a basis for such an analysis in a more descriptive way. Relying on individual tax returns, total filings by local and foreign capital income derived from interest, dividends or capital gains are compared over time as a first step. In a second step, the trajectories of new tax filings on foreign capital income sources are compared with new domestic filings. Such comparisons can shed light on the perceived increases in detection risk for taxpayers by the implemented policies and may provide a first indication of the impacts of tax transparency in South Africa.

Evidence on tax compliance from tax returns data

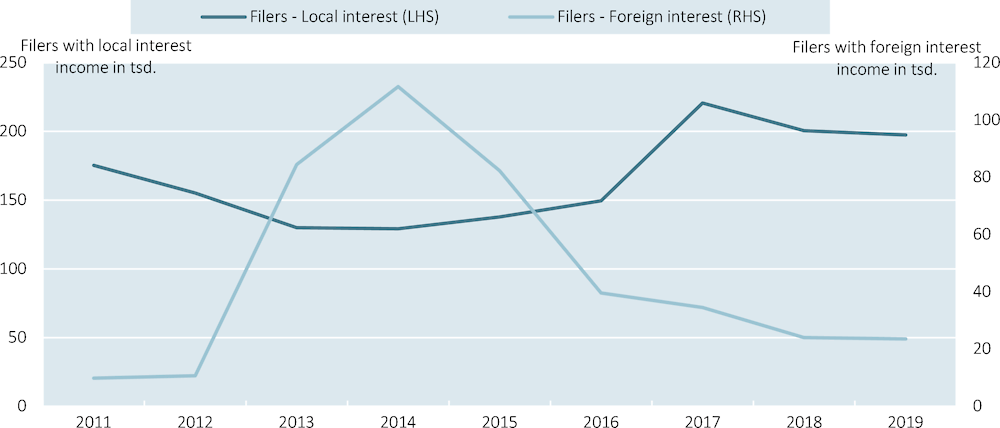

The total number of taxpayers reporting foreign interest income peaks in 2014 (Figure 5.1.). During the period from 2011 to 2018, total foreign interest filings are relatively stable at around 10 000 individuals per year in 2011 but started to sharply increase between 2012 and 2014. Foreign interest filings reached a high in 2014 with over 110 000 tax returns, an eleven-fold increase compared to previous years. Individual returns, however, declined relatively quickly thereafter and further flattened until 2019, offsetting the previous sudden surge. Foreign interest however stabilised at a higher level than before the implementation of AEOI at around 20 000 individuals per year. This development is contrasted with local interest income filings. There, tax returns were relatively stable over the period from 2014 to 2016, strongly increased in 2017 and declined again somewhat afterwards.

Figure 5.1. The number of individuals reporting foreign interest income peaks in 2014

Note: This figure shows the total number of submitted tax reports per year referring to income derived from local interest (source code 4201 in the South African tax code) and foreign interest (source code 4218 in the South African tax code). The tax year usually runs from 1 March to end of February the following year.

Source: OECD calculations based on updated SARS-NT Panel data (Ebrahim and Axelson, 2019[16]).

Both peaks in the contrasting trajectories occur around the implementation of major tax transparency initiatives. The fact that in 2014 foreign interest declarations surged while local interest declarations bottomed out suggests higher detection risk for tax evaders with offshore bank accounts following South Africa’s public commitment to AEOI and the entry into force of the MAAC in March 2014, as well as the expansion of South Africa’s EOIR network prior to that (see Figure 4.3). This may hold, in particular, given the ability through EOI for SARS to obtain information on capital income from assets abroad. From the mid-1990s onwards, the number of overall bilateral EOI agreements entering into force increased steadily, climbing from only a handful in 1995 to over 60 by the time of the global financial crisis. The following decade saw another surge in agreements due to the MAAC and the growth in bilateral agreements. In contrast, agreements entering into force with IFCs started to increase slower and took off later, with the largest increase happening between 2012 and 2015. The fact that the sharp increase in foreign interest filings from 2012 to 2014 could suggest the EOI relationships with IFCs (not EOI relationships overall) are key drivers of increased taxpayer reporting. These effects may have been further compounded by a general tightening of domestic tax enforcement in 2016 through, for instance, the introduction of the SVDP in addition to the already existing VDP. This environment of increasing tax transparency may have therefore induced more taxpayers with income from local interest to submit their tax returns.

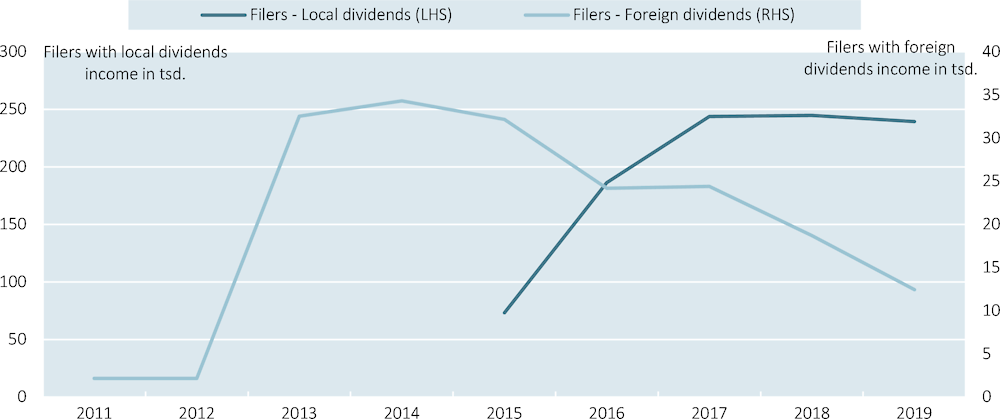

Total tax returns for taxable local and foreign dividend income mirror the trajectories of interest income returns. The number of returns for foreign dividends increased seven-fold from 2012 to 2013, surging from 2 170 to 32 555 (Figure 5.2). Subsequently, returns continued to increase slightly in 2014 and broadly decline afterwards. In contrast, returns on taxable local dividends experienced a three-fold increase between 2015 and 2017 and largely remained at that elevated level in the following years. These data also suggest a sharp increase in reported foreign wealth during the years of significantly expanded tax transparency. As is the case with respect to interest income, the increase in domestic capital income and the corresponding decline in foreign source income could suggest repatriation of some assets.

Figure 5.2. The number of individuals reporting foreign dividends income peaks in 2014

Note: This figure shows the total number of submitted tax reports per year referring to income derived from taxable local dividends (source code 4238 in the South African tax code) and foreign dividends (source code 4216 in the South African tax code). A domestic dividends tax was only introduced in 2014 and therefore data for the source code on taxable local dividends is only available from 2015 onwards. The tax year usually runs from 1 March to end of February the following year.

Source: OECD calculations based on updated SARS-NT Panel data (Ebrahim and Axelson, 2019[16]).

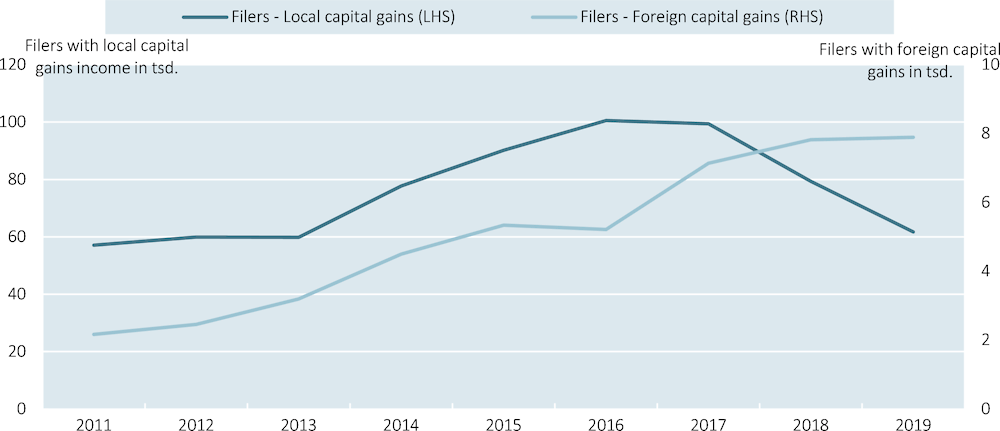

Figure 5.3. The number of individuals reporting foreign capital gains increases over time

Note: This figure shows the total number of submitted tax reports per year referring to income derived from local capital gains (source code 4250 in the South African tax code) and foreign capital gains (source code 4252 in the South African tax code). The tax year usually runs from 1 March to end of February the following year.

Source: OECD calculations based on updated SARS-NT Panel data (Ebrahim and Axelson, 2019[16]).

In contrast to interest and dividend incomes, total submissions for local and foreign capital gains exhibit a broadly increasing trend without the same sharp peaks over the 2012-2014 period (Figure 5.3). While the numbers of tax returns for local capital gains rose from 2013 onwards and declined after their peak in 2017, returns on foreign capital gains increased until 2015 and continued in 2017. The absence of a sharp increase for capital gains from 2012 to 2014, in contrast to the increase in interest and dividends, aligns with the fact that the expansion of tax transparency was principally over assets that earned interest and dividends (e.g. bank accounts) as opposed to assets that would earn capital gains (e.g. property). The more modest increase could also be a function of the fact that realisations of foreign assets may be more intermittent relative to payments of interest and dividends which are typically annual income.

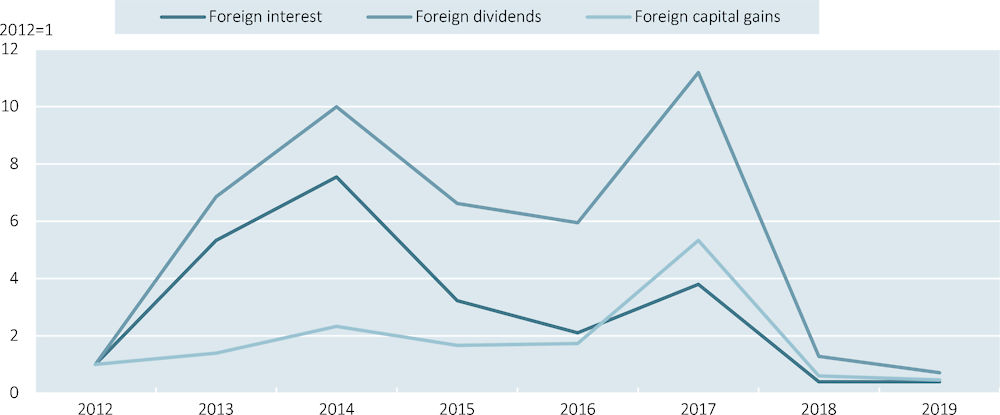

Figure 5.4. New tax reports for foreign incomes spike in 2014 and 2017

Note: All three series of new filers for foreign income streams are normalised to the base year 2012 (i.e. 2012=1). An increase of 1 in 2013 thus represents an increase of 100% relative to the number of new filers in 2012. The tax year usually runs from 1 March to end of February the following year.

Source: OECD calculations based on updated SARS-NT Panel data (Ebrahim and Axelson, 2019[16]).

Another important indication of taxpayer behaviour amid increasing tax transparency are new filings of tax returns per year relative to previous years. Normalised with respect to the tax year 2012, Figure 5.4 shows a dual-hump-shaped trajectory of new tax return filings, i.e. tax return from taxpayers previously unknown to tax authorities, for foreign interest, dividends and capital gains. New reports on all three capital income sources started to increase after 2012 and reached a first peak in 2014. New filings of foreign dividends and interest increased six and nine-fold respectively relative to the base year. In contrast, new tax returns on foreign capital gains only increased slightly during this period. Thereafter, all three foreign income categories experienced a decline in new tax filings. These spikes are consistent with the spikes observed in the amounts disclosed in Figures 5.1, 5.2 and 5.3, and suggest taxpayer responses to South Africa’s signature of the MAAC and commitment to exchange information automatically in 2014.

New foreign capital income reports spiked again in 2017. The number of new tax reports surged again in 2017, particularly for foreign capital gains and dividends. Relative to 2016, both income categories experienced a strong increase in new tax filings of over 150% and 80% respectively. This spike in 2017 can likely be attributed to the commencement of AEOI exchanges that year. Foreign interest filings, however, increased comparatively less. While both temporary surges around 2014 and 2017 indicate a responsiveness to South Africa’s initial public commitment to AEOI and the later commencement of active exchange, a differential effect over time and between income categories is discernible.

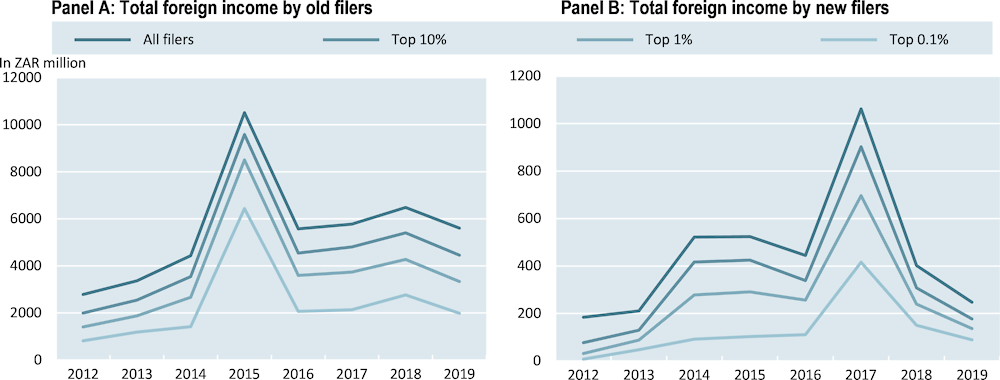

Disclosed amounts of aggregated foreign income by new tax filers suggest that the very top income receivers have tended to disclose more foreign income just before AEOI commencement. There were sharp increases in foreign income by new filers of all income levels as of 2014 followed by a sharp peak in amounts disclosed in 2017 (Figure 5.5, Panel B). The increase in declared foreign income in 2017 relative to previous years also rose with taxable income earned, particularly for the top income receivers. In contrast, foreign incomes disclosed by taxpayers with a history of submitting tax returns experienced a constant increase in revealed amounts (Panel A). Submitted amounts temporarily peak in 2015, drop in 2016 and continue to increase up until 2018. Relative to new filers, the amounts disclosed exhibit a more synchronised pattern across all income distribution fractiles. Significantly, more revenue gains were experienced by existing filers relative to new filers. This suggests that existing filers regularised their tax affairs when South Africa joined the MAAC and committed to AEOI, while a smaller group of new filers only came forward when AEOI commenced.

Figure 5.5. Total foreign income reporting is different for old and new tax return filers

Note: Foreign income aggregates all tax returns submitted in relation to source codes connected to foreign income streams. Old filers refer to taxpayers having filed tax returns in the past relative to the respective year in the sample for a given foreign income source code. New filers refer to taxpayers who have filed for the first time in the respective year relative to previous years in the sample. Old and new tax return filers either shown in their entirety or fractiles are expressed relative to their position in the taxable income distribution.

Source: OECD calculations based on updated SARS-NT Panel data (Ebrahim and Axelson, 2019[16]).

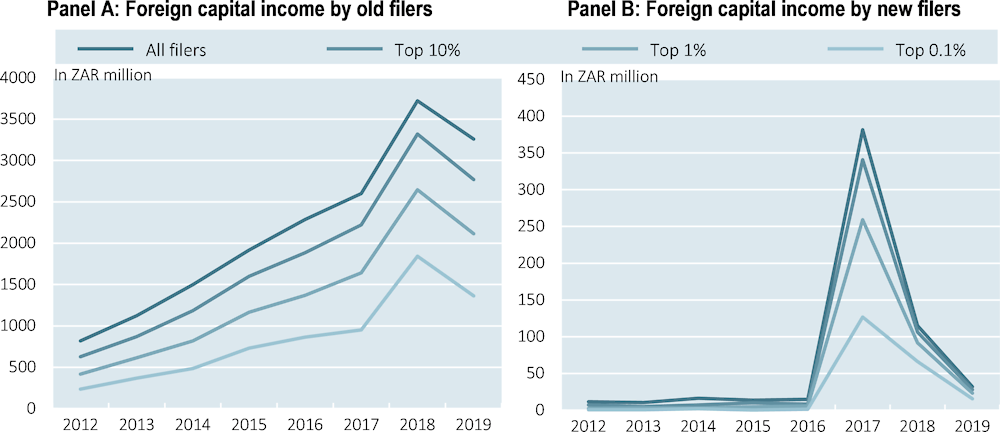

A similar pattern can be observed when only inspecting declared foreign capital income by new tax filers. While foreign capital income disclosed by old filers increased constantly over time, reported income by new filers spiked in 2017 (Figure 5.6, Panel B). The declared amount by the top 0.1% of income receivers in 2017 relative to 2016 was disproportionately high compared to lower percentiles. Whereas the increase for all new filers in income declared was about 25-fold relative to the previous year, the top 0.1% disclosed an overall amount close to a 100-times more. The declared share of foreign capital income in total declared income for 2017 was also higher for the very top income earners relative to the remaining segments of the income distribution. These observations provide strong evidence of a sizeable increase in the behavioural responses of the very top income receivers to the increased detection risk associated with the commencement of AEOI, particularly in relation to foreign capital income.

Figure 5.6. Reporting with respect to foreign capital income also shows a distinct pattern for new filers

Note: Foreign capital income aggregates all tax returns submitted in relation to source codes connected to foreign capital income streams. Old filers refer to taxpayers having filed tax returns in the past relative to the respective year in the sample for a given foreign capital income source code. New filers refer to taxpayers who have filed for the first time in the respective year relative to previous years in the sample. Old and new tax return files are either shown in their entirety or fractiles are expressed relative to their position in the taxable income distribution.

Source: OECD calculations based on updated SARS-NT Panel data (Ebrahim and Axelson, 2019[16]).

Old and new filers of foreign income not only exhibit differences in disclosed amounts but also seem to respond differently to tax transparency standards. Foreign incomes by new filers appear less linear but more responsive to AEOI commencement, while existing taxpayers appear more responsive to EOIR or to AEOI announcement. This may be because EOIR requires the tax authority to have knowledge of a taxpayer to gain access to additional data, and so those taxpayers most at risk from EOIR (where the network expanded sharply between 2012 and 2015) would be taxpayers already known to SARS. AEOI, by contrast, represented a new risk to taxpayers who may not have ever declared foreign income at all, which is consistent with the spike observed. These findings highlight the complementarity of EOIR and AEOI as enforcement tools in South Africa.

Taxpayer responsiveness to domestic tax transparency initiatives

While the previous data series have shown results from aggregated capital income tax returns, data from applications to both VDP and SVDP provide a more direct and more granular snapshot into tax evasion behaviour. Although self-declared and thus carrying certain risks in terms of accuracy, this data provides direct insights into the amounts of previously undeclared assets held abroad and capital incomes received from these sources. The following analyses SVDP and VDP applications by individual programme and examines taxpayer behaviour and income characteristics of those taxpayers that were discovered evading taxes through their participation in the programmes.

Evidence from the SVDP

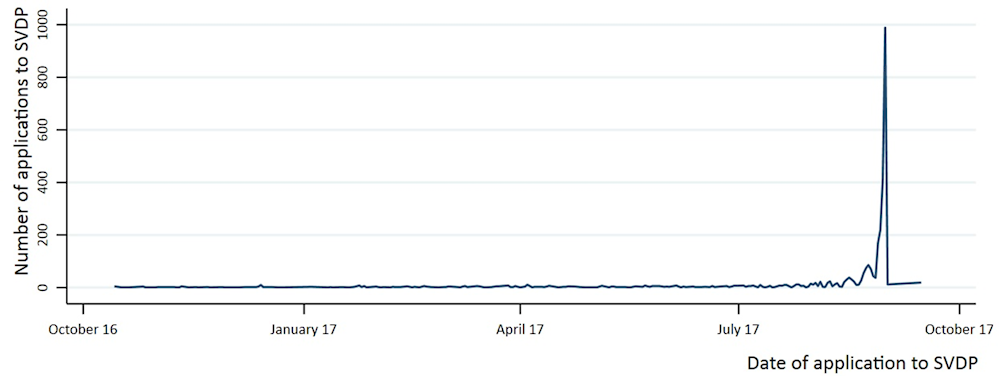

During the active application window from 1 October 2016 to 31 August 2017, a total of 3123 taxpayers submitted an application to the SVDP. Eventually 375 successful applicants disclosed offshore assets.7 While throughout most of the application window taxpayers showed relatively little interest in the SVDP, the number of applications rose quickly in late July and peaked just before the end of the programme which coincided with the commencement of AEOI on 1 September 2017 (Figure 5.7). Given the earlier announcement of the SVDP implementation by the finance minister on 24 February 2016, the strong increase in applications this late in the process seems nonetheless surprising.

Figure 5.7. SVDP applications peak before AEOI commencement

Note: The line presents the number of applications to the SVDP per day.

Source: OECD calculations based on SARS data.

This pattern observed in the South African data of surging applications towards the end of a VDP period follows patterns in other countries. Similar taxpayer behaviour, for instance, has also been reported for US programmes (Langenmayr, 2017[18]). Counterintuitively, suggestive evidence further hints at a potential increase in tax evasion through VDPs on the basis of expected leniency from tax authorities in the future. The long-standing existence of the permanent VDP in South Africa might reinforce such expectations by taxpayers. However, the sudden steep rise in applications despite the pre-existence of the VDP, the early announcement to launch the SVDP and the fact that the programme was explicitly implemented to target offshore wealth prior to AEOI commencement rather indicate a strong behavioural response by taxpayers to an increasing detection risk.

South African taxpayers reported a total of about USD 349 million (ZAR 4.6 billion) of previously undisclosed offshore wealth in the SVDP. The disclosures resulted in close to USD 30 million (ZAR 398.3 million) of additional tax revenues collected by the government through levied fines and taxes (Table 4.1.).8 This amount roughly equals 60% of the 2017 increase in declared total foreign capital income, relative to 2016, by all old and new tax filers in the previous section (Figure 5.6). The remaining ZAR 282 million or 40% of that increase could be considered as soft disclosures encouraged by overall tightening of tax transparency.

When only accounting for undeclared foreign wealth held in IFCs, the overall amount only reduces to close to USD 300 million (ZAR 3.9 billion), which suggests that South African tax evaders predominantly held undisclosed wealth in IFC jurisdictions.9 Levies applied to disclosures in the SVDP suggest that less than half of all offshore wealth was repatriated during the settlement process. However, offshore wealth disclosed in the SVDP falls short of amounts uncovered elsewhere. While similar programmes in the United States and Colombia revealed hidden wealth worth about 0.7% and 1.73% of national GDP respectively (Johannesen et al., 2020[4]); (Londoño-Vélez and Ávila-Mahecha, 2021[1]), South Africans only reported about 0.1% of GDP in 2017. This may suggest that South Africans held less non-compliant wealth offshore before the introduction of tax enforcement schemes, or it may suggest an expectation of reduced effectiveness of the schemes relative to other countries.

Table 5.1. Hidden offshore wealth declared in the SVDP

|

Number of successful applications |

Total amounts disclosed |

Additional revenues collected |

|

|---|---|---|---|

|

Across all asset locations |

375 |

USD 348.82 million |

USD 29.89 million |

|

Across IFCs only |

238 |

USD 298.96 million |

USD 25.71 million |

Note: Where denominated in another currency than USD, amounts have been converted to USD by the average annual exchange rate in 2017 (OECD, 2022[19]). The list of IFCs is taken from O’Reilly, Parra Ramirez and Stemmer (2019[20]).

Source: OECD calculations based on SARS data.

Considering only declared non-compliant offshore wealth suggests that the SVDP applicants are largely drawn from the wealthiest individuals in South Africa. As derived from Table 5.1, the average user of offshore accounts reports around USD 930 000 (ZAR 12.4 million) of net wealth abroad and the amount rises to about USD 1.2 million (ZAR 16 million) if only IFCs as account holding jurisdictions are considered. According to recently estimated wealth distribution data for 2017 from Chatterjee et al. (2020[11]), these offshore amounts alone place the average SVDP applicant in the top 10% of South Africa’s wealth distribution. Relative to the national average, the typical owner of offshore wealth holds more than 18 times abroad of what the average South Africans own in total.

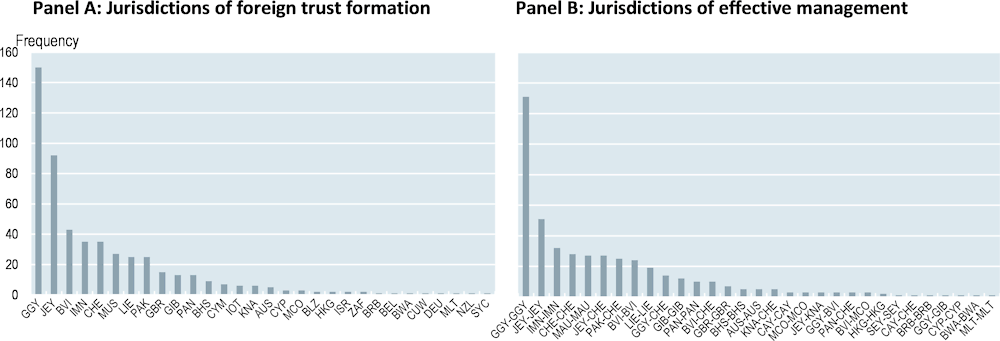

South African taxpayers historically held their previously undisclosed offshore wealth either in foreign trusts, through direct investments in financial assets such as shares or bonds, or as short-term deposits in bank accounts. Seventy-four out of the 375 SVDP applicants invested at least parts of their assets abroad in trusts. Guernsey and Jersey emerge as the predominant jurisdictions for the legal formation of investment trusts, followed by the British Virgin Islands, the Isle of Man and Switzerland. Other IFCs such as Mauritius or Liechtenstein also play an important role (Figure 5.8, Panel A).10 The established foreign trusts appear to be predominantly managed in the jurisdiction of their legal formation – if the jurisdiction belongs to the list of IFCs. Figure 5.8 (Panel B) shows that most of the foreign investment trusts formed in IFCs such as Guernsey, Jersey, the Isle of Man or Mauritius are also managed in the same jurisdictions. Where trusts are not managed in the same jurisdiction as they are incorporated, Switzerland emerges as the primary provider for wealth management services.

Figure 5.8. Jurisdictions of offshore trusts and their effective management

Note: Panel A shows the jurisdictions where foreign trusts were formed per number of appearance in SVDP forms. Panel B combines the jurisdictions of trust formation with their respective jurisdictions of effective trust management as indicated in the SVDP forms.

Source: OECD calculations based on SARS data.

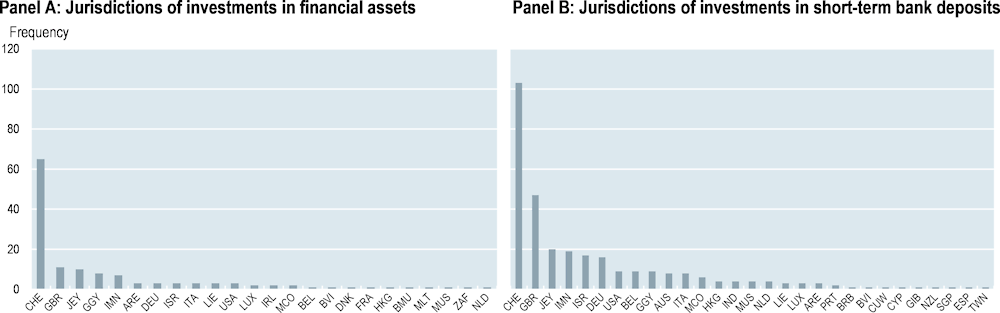

Direct investments in financial assets such as stocks and bonds and in rather short-term bank deposits offshore are also predominantly located in IFC jurisdictions (Figure 5.9). In contrast to foreign trusts where the Channel Islands were the dominating jurisdictions, tax-evading South Africans have hidden other investments foremost in accounts in Switzerland or the United Kingdom, followed by Jersey and the Isle of Man. Moreover, two-thirds of all SVDP applicants indicated the use of foreign bank accounts in the form of time and call deposits as part of their evasion strategy, making it the most widespread form of non-compliant investment abroad by frequency (Panel B).11

Figure 5.9. Offshore locations of investments in other financial assets

Note: The definition of financial instruments and short-term assets has been taken from the SVDP application form. Financial instruments refer to shares, stocks, bonds and debentured listed on recognised exchanges. Current and other short-term assets refer to bank accounts, call deposits or time deposits.

Source: OECD calculations based on SARS data.

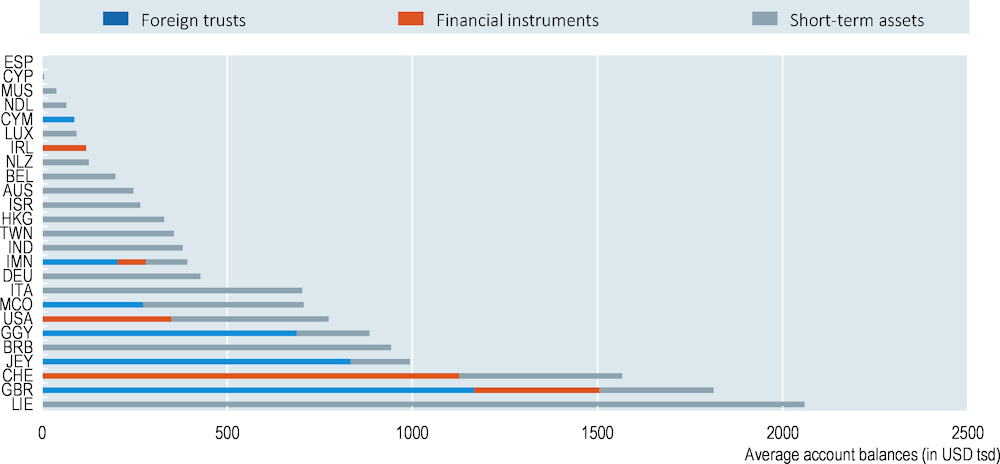

Disentangling disclosed offshore wealth by location and by average amount per asset class where possible reveals an even more detailed picture of taxpayer behaviour and asset location characteristics.12 While South Africans within the SVDP appear to have invested their funds across a broad range of jurisdictions, Liechtenstein, Great Britain and Switzerland attract on average the largest total amounts (Figure 5.10). The data suggest that sizeable amounts of capital have flowed into foreign trusts domiciled in Great Britain, followed by Jersey, Guernsey, Monaco, Isle of Man and the Cayman Islands. Switzerland, Great Britain, the United States and Isle of Man receive most of the direct investments in shares or bonds that were tax non-compliant. Investments into short-term assets and deposits in the SVDP are the most wide-spread geographically, led by high average deposits in Liechtenstein, Barbados, but also Italy and to a lower extent Germany and India. Reflecting the previous geographical pattern for the different investments, certain characteristics among jurisdictions arise: SVDP applicants reverted to Great Britain and the Isle of Man for investments in all asset classes. Switzerland and the United States were the dominant location for bank deposits and direct investments into listed assets. IFCs such as Liechtenstein, Barbados, Monaco or Hong Kong attracted on average the largest deposits. These observations further confirm previous findings by, for instance, O’Reilly, Parra Ramirez and Stemmer (2019[20]) and Harrington (2016[6]), who document a division of labour in services provided and a specialisation in business models among IFCs catering to the different needs of customers.

Figure 5.10. Average wealth hidden abroad per jurisdiction and asset class

Note: The definition of financial instruments and short-term assets has been taken from the SVDP application form. Financial instruments refer to shares, stocks, bonds and debentures listed on recognised exchanges. Current and other short-term assets refer to bank accounts, call or time deposits.

Source: OECD calculations based on SARS data.

EOIR agreements had been in place between South Africa and almost all IFCs listed as foreign investment jurisdictions before the launch of the SVDP. As shown before, the EOIR network has expanded particularly since the global financial crisis. While early agreements with Luxembourg and Switzerland entered respectively into force in September 2000 and January 2009, other relevant jurisdictions such as the Channel Islands followed shortly through the MAAC (OECD (2021[21]), Annex 2). The fact that large swaths of SVDP applications in respect of offshore wealth held in these jurisdictions were submitted as late as August 2017 raises the question of whether expansions in EOIR relationships were, in their own right, an effective deterrent to tax non-compliance, particularly for new tax filers. It may have been the case that tax authorities lacked the capacity or information to take full advantage of new EOIR relationships over this period. By contrast, commitment and commencement of AEOI seemed to exert strong detection pressure on non-compliant taxpayers resulting in a substantial increase in disclosure.13

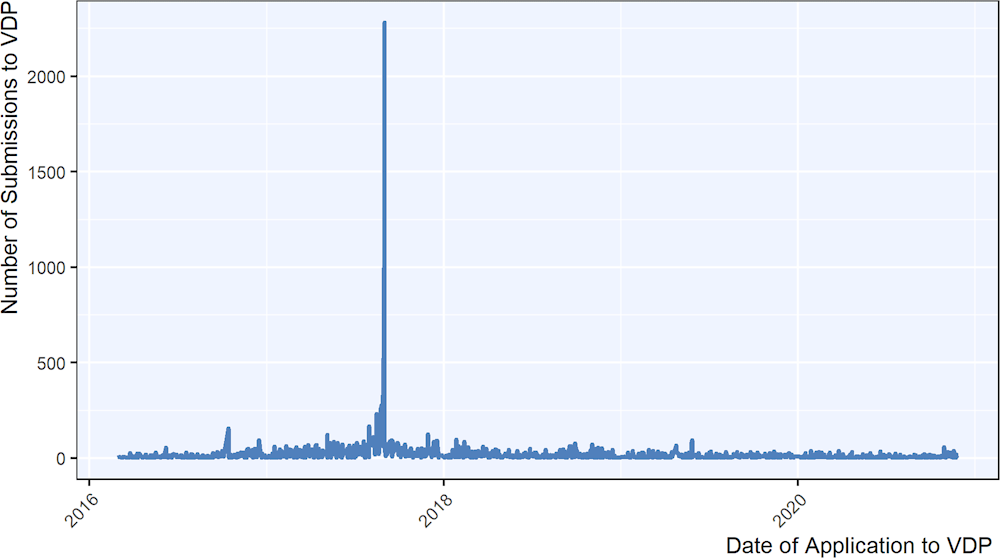

Evidence from the VDP

Like the SVDP, applications by taxpayers to the VDP strongly increased in August 2017 just before the commencement of active information exchange under the CRS in early September 2017. The numbers of submissions remained relatively stable throughout the sample period from March 2016 to November 2020 except for a peak in August 2017 (Figure 5.11). While on average 75 individual applications were submitted per month, the number rose to 348 on 31 August 2017 alone, a total of 948 in that month. After the AEOI commencement applications quickly fell again and remained subdued for the rest of the observation period. This sudden increase in applications prior to active AEOI on 1 September 2017 is suggestive of a large number of taxpayers applying to the VDP in response to an enhanced detection risk, albeit with a rather temporary effect. Similar temporary impacts of tax transparency agreements entering into force on VDPs have also been documented, for instance, by Andersson, Schroyen and Tosvik (2019[22]).

Figure 5.11. VDP applications over time

Note: The line presents the number of applications to the VDP per day.

Source: OECD calculations based on SARS data.

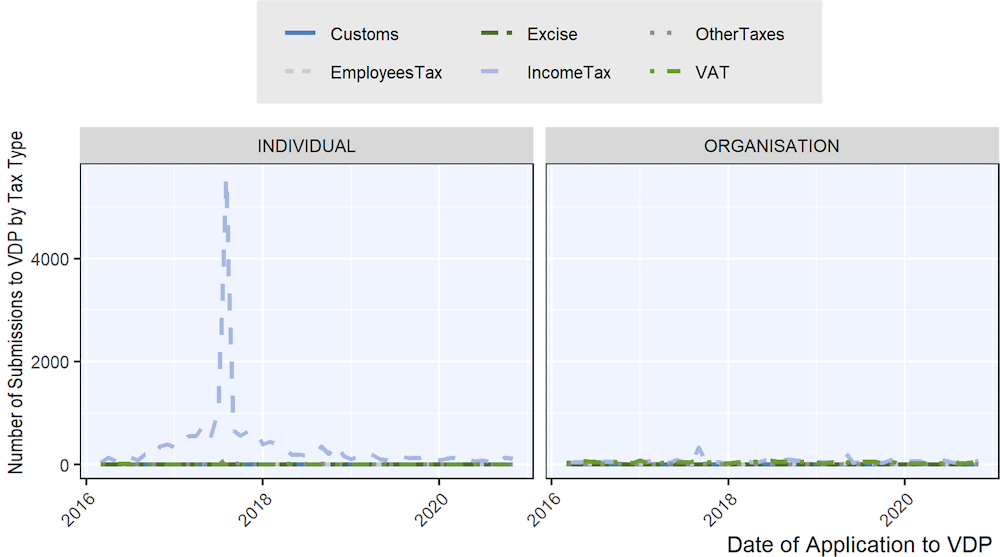

The strongest response can be observed for individuals who declared tax liabilities in relation to income taxes. When breaking down applications by tax and entity type in Figure 5.12, the rise in applications among individuals for income taxes (Panel A) reflects the developments previously shown for total applications. With 4271 out of 4287 applications involving income taxes other than salaries, declared tax defaults for income taxes have been the vast majority. A small fraction of taxpayers accumulated tax liabilities across several categories involving apart from income taxes also evasion of VAT, taxes from labour income or other unspecified taxes. Evasion of excise and customs taxes was not reported as neither of those categories were the subject of the VDP. The fact that no spike was observed in VDP applications for any other tax category other than personal income tax suggests that these developments were driven by the increased availability of information arising from the implementation of AEOI.14

The effect for organisations and entities has been rather subdued when compared to individuals. While around 2017 a small peak in income tax defaults is discernible for organisations, the scale and length of the surge in applications has been small compared to individuals (Figure 5.12., Panel B). Applications by organisations for other tax categories do not show major changes over time and remain much less frequent across the entire sample period. Despite encouraging voluntary compliance by both individuals and organisations, the VDP has thus shown to be much more attractive for individuals who had previously been evading income taxes.

Figure 5.12. VDP applications by tax type

Note: The chart shows the number of VDP applications by tax type over time, divided by individuals or organisations.

Source: OECD calculations based on SARS data.

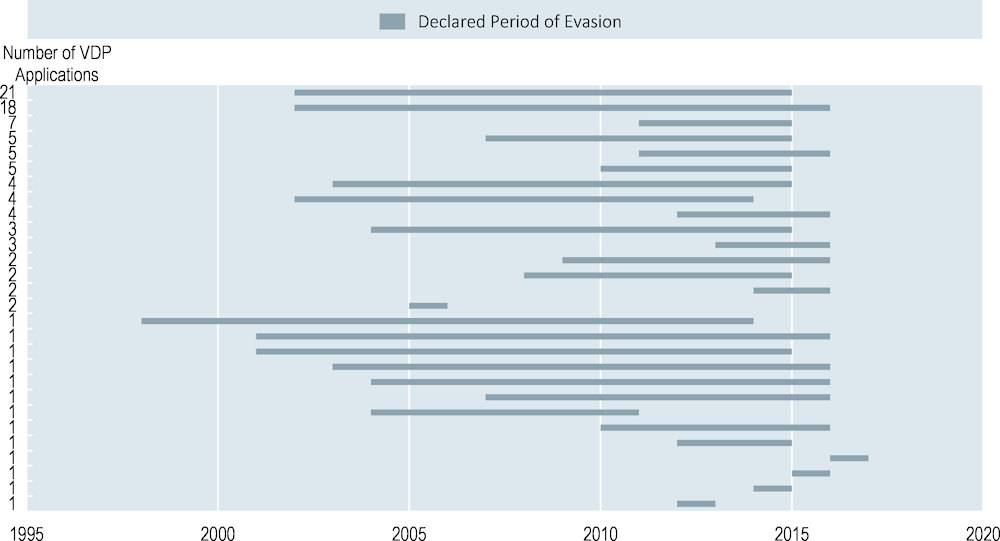

Of additional interest are the reported years of tax default in the past per VDP application, which in very few cases extend back to 1988. These applications not only precede the official introduction of the programme in 2012 but also its then retroactive eligibility as early as the 2002 tax year. Taxpayers reported on average a period of tax non-compliance for about 5 years with the majority of cases falling into the period from 2007 to 2017. Longer-term evasion on a continuous basis for more than 10 years can be detected for about every fifth applicant. Usually evasive behaviour is just stopped before the application to the programme. The duration of tax evasion revealed through the VDP shows that the notably long duration of non-compliance in many cases suggests that tax evasion is more systematic than a one-off occurrence.

Almost one half of all successful SVDP applicants also participated in the VDP. Compared to VDP-only applicants, these taxpayers exclusively filed for past income tax liabilities from other income than labour in the VDP. The same taxpayers disclosed on average more than double the amount of offshore assets under the SVDP compared to SVDP-only participants. While programme participants may have simultaneously evaded several taxes, this observation lends further confidence to a statement by SARS officials about the strong relation between VDP applications and undeclared foreign income (AU/ATAF/OECD, 2020[23]). Moreover, applicants to both programmes evaded their income taxes over multiple years as Figure 5.13 shows. While there is some evidence that larger offshore wealth implies longer periods of evasion, taxpayers having participated in both programmes declared on average non-compliance for about 8 years on average, more than 2 years on average longer than VDP-only applicants. The disclosures of more than 40% of these taxpayers evidence non-compliance over a period longer than a decade, sometimes documenting evasion as early as 1998.

Figure 5.13. Tax evasion over time by dual SVDP-VDP applicants

Note: The figure presents the declared duration of evasion of dual VDP – SVDP applicants over time, ranging from 1998 to 2017. Out of the total 144 SVDP participants who also applied to the VDP, 100 applicants declared evasion continuously for more than one year. 44 applicants not shown only declared one missing year or single years across the entire period.

Source: OECD calculations based on SARS data.

Overall the analysis above suggests that tax evasion has been a long-standing phenomenon for some taxpayers. South Africa’s participation in multilateral initiatives to increase global tax transparency such as the AEOI, however, appear to have positively impacted taxpayer compliance. Amid this heightened risk of detection, the VDP and the SVDP in particular have managed to encourage taxpayers with a longer history of tax non-compliance and with relatively large amounts of offshore assets to come forward. Both global and domestic initiatives can thus be considered important elements of South Africa’s fight against tax evasion and IFFs. This also implies that in order to accumulate even partially revealed offshore amounts in the past, capital must have illicitly flown out of the country for quite some time.

Characterising SVDP/VDP applicants

The amount of offshore assets declared in the SVDP is a key source of data on previously hidden wealth and the extent of IFFs pre-dating this period. While the overall amount of around USD 349 million that has been revealed by 375 applicants during the active period of the programme is in itself a success, these numbers need nonetheless be set into context relative to the entire population of taxpayers. Linking SVDP and VDP with income tax data thus allows for an assessment of whether the characteristics of SVDP and VDP applicants are representative of the entire sample of taxpayers in terms of income structure and the respective asset amounts hidden abroad.

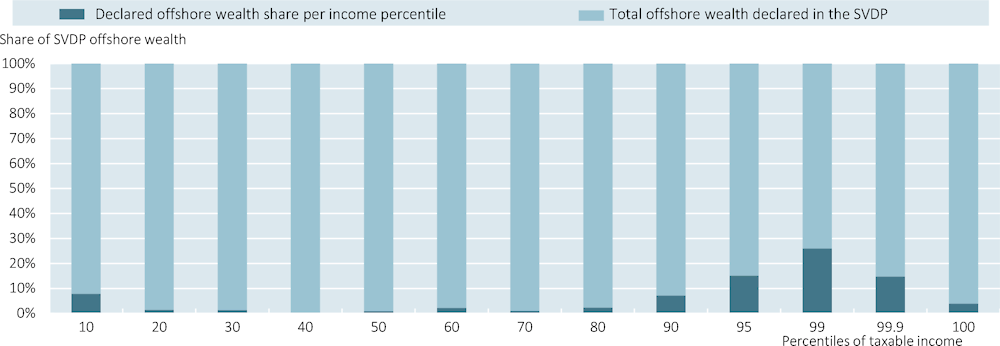

Figure 5.14. The top income levels hold a majority share of total SVDP offshore wealth

The top percentiles in taxable income represent the largest share in total offshore wealth declared in the SVDP (Figure 5.14). In line with expectations and the evidence from related literature on South Africa and other countries (e.g. Orthofer, (2016[13]); Londoño-Velèz and Ávila-Mahecha, (2021[1])), shares of total SVDP offshore wealth remain negligible for the lower income deciles, except for the lowest decile, and increase from the 7th decile onwards. The top 0.1% claims a share of about 25% of total declared wealth. Surprisingly, the share of assets held abroad shrinks to 17% for the top 0.01% and to a mere 4% of the total amount declared for the highest income bracket. The respective number of applications per decile mirrors the development in wealth shares. Applications in the lowest percentile were with 32 submissions relatively high, slowly increased to 87 in the 99th percentile and dropped to only 4 applications in the top percentile. These observations raise questions over whether all eligible foreign wealth owners applied and whether some of the wealthiest taxpayers declared less wealth through the SVDP because they remained confident that they would continue to be able to hide their wealth offshore.

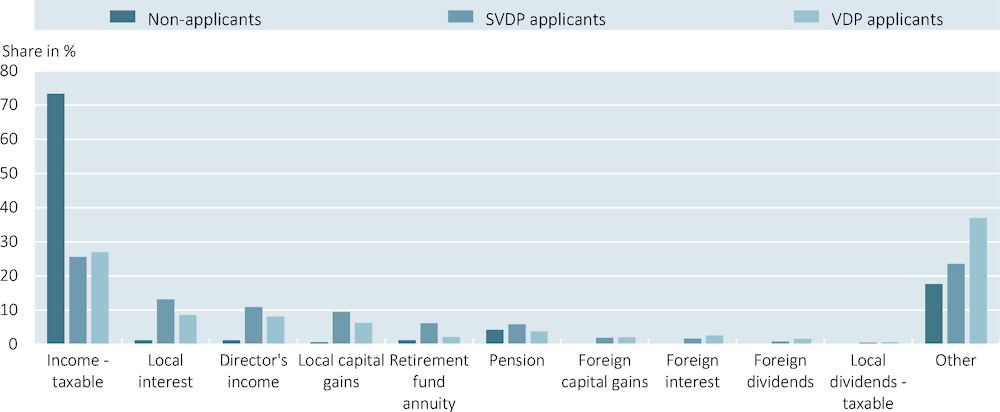

SVDP and VDP participants show a distinctive income pattern that contrasts with other taxpayers. While more than 70% of all taxpayers derive their main income from labour, only about 25% of SVDP and VDP applicants do so (Figure 5.15). Income from local capital income such as interest or capital gains provide the main income for about 10% to 13% of programme applicants. A similar share of participating taxpayers can rely on a director’s income. Income obtained from retirement funds or pensions, particularly among SVDP participants, may point to a higher age of these taxpayers. Partly in contrast to expectations from programmes implemented elsewhere, foreign capital income as the dominant source of income only plays a marginal role for SVDP and VDP applicants. While around 2% of successful applicants derive most of their income from assets abroad, the general taxpayer population, the non-applicants, seem to rely on other sources. Moreover, most taxpayers participating in either one of the programmes declare only one category of foreign capital income. However, the on average only marginally higher foreign income shares in total taxable income for VDP applicants relative to the general taxpayer population may raise doubts about the validity of VDP declarations, particularly given the steep increase in capital income relative to overall income and wealth levels as documented in Bassier and Woolard (2020[8]) and Chatterjee, Czajka and Gethin (2020[11]).

Figure 5.15. Main source of income for SVDP/VDP applicants and non-applicants

Note: The figure compares the main income source per source code of SVDP and VDP applicants to non-applicants for the tax year 2017.

Source: OECD calculations based on SARS data.

These findings by income category bear nonetheless strong resemblance with results from the amnesty programme in the Netherlands. There, VDP applicants earned significantly more often pension income, income from self-employment and to a lower extent director’s income and capital income than the general taxpayer population (Leenders et al., 2020[3]). Most participating taxpayers thus do not seem to derive a significant amount of their income from foreign investments; instead, they seem to have invested substantial shares of their regular taxable income abroad. Similar to the Dutch case, these results may suggest that VDP/SVDP applicants in South Africa do not necessarily belong to the best-off part of society or may have insufficiently declared foreign capital income in the past. Overall these findings signal that the VDP has incentivised individuals with incomes other than labour income – predominantly from foreign capital income - to declare past tax non-compliance. Given the timing of applications, commencement of active information exchange under the CRS appears to have encouraged non-compliant taxpayers to apply to the VDP.

Results and policy implications

This chapter has analysed by means of individual anonymised tax data the responsiveness of South African taxpayers to tax transparency initiatives and dissects the impact of the VDP and the SVDP. Tax evasion is shown to have a long history and has been concentrated among the very wealthy and top income receivers. However, results suggest that taxpayers have responded to tax transparency initiatives, particularly to multilateral ones that increase the global risk of detection. Moreover, domestic transparency initiatives (SVDP/VDP) have been successful in encouraging evaders to come forward, but taxpayer responsiveness appears to have been largely triggered by the commencement of AEOI under the CRS and potentially to the expansion of the EOIR network to several key IFCs. In contrast to bilateral EOIR relationships and corroborating findings about the impact of multilateral tax transparency elsewhere, the commencement of AEOI thus also appears to have strongly supported domestic policy initiatives (Andersson, Schroyen and Tosvik, 2019[22]). This can be seen in the strong taxpayer responses observed immediately before the implementation of AEOI shown above.

Assessed SVDP/VDP applications provide detailed insights into the evasion behaviour of taxpayers, their investment strategies and geographic reach. While evasion by the very top income recipients still appears to exist but is increasingly detected, the analysis also suggests that the VDPs have historically been attractive to individuals with incomes other than labour income and, in particular, those whose incomes are predominantly derived from foreign capital income. Fines charged as a result of application, together with constantly higher tax revenues collected from the top income earners due to strengthened compliance, may lead to a rise in effective tax progressivity as a result of these initiatives. The applications also highlight the relationship between the different IFCs such as their division of labour in services provided or the effective management of investment vehicles. Tax-evading South Africans invested on average the largest sums in bank deposits across a wide range of IFC jurisdictions. Investments in foreign trusts were also popular, with a preference for a small number of IFCs, such as the Channel Islands. Most of these trusts were also managed in the same jurisdiction as they were incorporated.

The implications for tax policy and tax administration are several-fold. Overall, continued use of EOI in South Africa is required. Increasing the more effective use of bilateral EOIR, particularly with well-known IFCs, should be a key priority. As will be discussed below, better domestic enforcement also demands an enhancement of inter-agency collaboration across the different relevant authorities to enable a comprehensive analysis of taxpayer data. The improvement in data access, for instance by pooling available data at one single location, may further help to increase data quality and ensure timely updates. Taken together, these policy initiatives will not only increase the potential for higher levels of revenue collection but may help support a fairer and more progressive tax system for all taxpayers.

References

[9] Advani, A. and A. Summers (2020), “Capital gains and hidden inequality”, Advantage Magazine: Austerity 10th Anniversary Special Summer, pp. 24-27, https://warwick.ac.uk/fac/soc/economics/research/centres/cage/news/03-06-20-advantage_magazine__summer/article-6/6._capital_gains_and_hidden_inequality.pdf.

[2] Alstadsaeter, A., N. Johannesen and G. Zucman (2019), “Tax Evasion and Inequality”, American Economic Review, Vol. 109/6, pp. 2073-2103.

[22] Andersson, J., F. Schroyen and G. Tosvik (2019), The impact of international tax information exchange agreements on the use of tax amnesty: evidence from Norway, https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID3463645_code1391513.pdf?abstractid=3463645&mirid=1.

[23] AU/ATAF/OECD (2020), Tax Transparency in Africa 2020 - Africa Initiative Progress Report, OECD Publishing, https://www.oecd.org/tax/transparency/documents/Tax-Transparency-in-Africa-2020.pdf.

[8] Bassier, I. and I. Woolard (2020), Exclusive growth? Rapidly increasing top incomes amid low amid low national growth in South Africa, Southern Africa - Towards Inclusive Economic Development (SA-TIED).

[24] Beer, S., M. Coelho and S. Léduc (2019), “Hidden Treasures: The Impact of Automatic Exchange of Information on Cross-Border Tax Evasion”, IMF Working Paper No. 19/286.

[11] Chatterjee, A., L. Czajka and A. Gethin (2020), “Estimating the distribution of household wealth in South Africa”, UNU-WIDER Working Paper 45, https://doi.org/10.35188/UNU-WIDER/2020/802-3.

[5] Chetty, R. et al. (eds.) (2021), “Tax Evasion by the Wealthy: Measurement and Implications”, NBER Working Paper No. 28542, http://www.nber.org/papers/w28542.

[14] Chetty, R. et al. (eds.) (forthcoming), Using Tax Data to Better Capture Top Incomes in Official UK Income Inequality Statistics, Chicago University Press.

[16] Ebrahim, A. and C. Axelson (2019), “The creation of an individual level panel using administrative tax microdata in South Africa”, UNU-WIDER Working Paper 661-6, https://doi.org/10.35188/UNU-WIDER/2019/661-6.

[10] Fagareng, A. et al. (2020), “Heterogeneity and Persistence in Returns to Wealth”, Econometrica, Vol. 88/1, pp. 115-170, https://doi.org/10.3982/ECTA14835.

[7] Guvenen, F., G. Kaplan and J. Song (2014), “How Risky Are Recessions for Top Earners?”, American Economic Review: Papers & Proceedings, Vol. 104/5, pp. 148-153, http://dx.doi.org/10.1257/aer.104.5.148.

[6] Harrington, B. (2016), Capital without Borders: Wealth Managers and the One Percent, Harvard University Press.

[12] Hundenborn, J., I. Woolard and J. Jellema (2019), “The effect of top incomes on inequality in South Africa”, International Tax and Public Finance, Vol. 26, pp. 1018-1047, https://doi.org/10.1007/s10797-018-9529-9.

[17] Johannesen, N. (2014), “Tax evasion and Swiss bank deposits”, Journal of Public Economics, Vol. 111, pp. 46-62, https://doi.org/10.1016/j.jpubeco.2013.12.003.

[4] Johannesen, N. et al. (2020), “Taxing Hidden Wealth: The Consequences of U.S. Enforcement Initiatives on Evasive Foreign Accounts”, American Economic Journal: Economic Policy, Vol. 12/3, pp. 312-346, https://doi.org/10.1257/pol.20180410.

[15] Kennedy, S. (2019), “The potential of tax microdata for tax policy”, OECD Taxation Working Papers, No. 45, OECD Publishing, Paris, https://dx.doi.org/10.1787/d2283b8e-en.

[18] Langenmayr, D. (2017), “Voluntary disclosure of evaded taxes — Increasing revenue, or increasing incentives to evade?”, Journal of Public Economics, Vol. 151, pp. 110-125, https://doi.org/10.1016/j.jpubeco.2015.08.007.

[3] Leenders, W. et al. (2020), “Offshore Tax Evasion and Wealth Inequality: Evidence from a Tax Amnesty in the Netherlands”, EconPol Working Paper 52, Vol. 4, https://www.ifo.de/DocDL/EconPol_Working_Paper_52_Offshore_Tax_Evasion.pdf.

[1] Londoño-Vélez, J. and J. Ávila-Mahecha (2021), “Enforcing Wealth Taxes in the Developing World: Quasi-Experimental Evidence from Colombia”, American Economic Review: Insights, Vol. 3/2, pp. 131-148, https://doi.org/10.1257/aeri.20200319.

[20] O’Reilly, P., K. Parra Ramirez and M. Stemmer (2019), “Exchange of information and bank deposits in international financial centres”, OECD Taxation Working Papers, No. 46, OECD Publishing, Paris, https://dx.doi.org/10.1787/025bfebe-en.

[19] OECD (2022), Exchange rates (indicator), https://dx.doi.org/10.1787/037ed317-en (accessed on 22 March 2022).

[21] OECD (2021), Global Forum on Transparency and Exchange of Information for Tax Purposes: South Africa 2021 (Second Round, Phase 1): Peer Review Report on the Exchange of Information on Request, Global Forum on Transparency and Exchange of Information for Tax Purposes, OECD Publishing, Paris, https://dx.doi.org/10.1787/fed716dd-en.

[13] Orthofer, A. (2016), “Wealth inequality in South Africa: Evidence from survey and tax data”, REDI3x3 Working Paper 15, http://redi3x3.org/sites/default/files/Orthofer%202016%20REDI3x3%20Working%20Paper%2015%20-%20Wealth%20inequality.pdf.

Notes

← 1. For the purposes of this and the following chapter, the terms ‘non-compliant offshore wealth’ and ‘undeclared foreign wealth‘ are used interchangeably and are used to describe wealth held in foreign jurisdictions that is associated with tax non-compliance.

← 2. The ownership of these assets is generally highly concentrated. The top 10% of the wealth distribution own more than 99% of all bonds and stock held in the economy and in general more than half of all forms of assets, including pension assets, housing wealth or business assets. The top 1% alone holds more than one-tenth of all forms of assets and as much as 90% of bonds and corporate shares (Chatterjee, Czajka and Gethin, 2020[11]).

← 3. This data has been provided by SARS to South African National Treasury and analysed jointly with South Africa National Treasury.

← 4. More information on the SARS-NT panel can be found in Ebrahim and Axelson (2019[16]).

← 5. Rights and interests arising from the legal ownership of the asset that cannot be taken away by any third party such as e.g. retirement plans or insurance contracts.

← 6. No data exchanged under the Common Reporting Standard was shared with the OECD in a disaggregated way due to confidentiality standards pertaining to data exchanged under the Common Reporting Standard.

← 7. The discrepancy between the total number of applications and successful applications either hails from tax authority investigations against the applicant already underway by the time of submission or incomplete documentation provided by the applying taxpayer.

← 8. In this section, USD amounts have been converted to ZAR by the average annual exchange rate in 2017 (OECD, 2022[19]).

← 9. O’Reilly, Parra Ramirez and Stemmer (2019) have identified the following list of IFC jurisdictions: Andorra; Anguilla; Antigua and Barbuda; Aruba; Bahamas; Bahrain; Barbados; Belize; Bermuda; British Virgin Islands; Cayman Islands; Cook Islands; Costa Rica; Curacao; Cyprus; Dominica; Gibraltar; Grenada; Guatemala; Guernsey; Hong Kong, China; Isle of Man; Jersey; Lebanon; Liechtenstein; Luxembourg; Macau, China; Malaysia; Malta; Marshall Islands; Mauritius; Monaco; Montserrat; Nauru; Niue; Palau; Panama; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; American Samoa; San Marino; Seychelles; Singapore; Switzerland; Turks and Caicos Islands; United Arab Emirates; Uruguay; and Vanuatu.

← 10. Non-IFC jurisdictions also feature prominently, including jurisdictions which are particular locations for the South African diaspora such as the United Kingdom and Australia.

← 11. Other than checking or savings accounts, call and time deposits offer higher interest rates for minimum balance requirements. Time deposits further demand a set period of time with interest rates rising the longer money remains deposited in the account.

← 12. SVDP applicants mostly disclosed the total amount of offshore wealth without precise allocation across the different investments. Thus only a fraction of previously undeclared offshore wealth could be uniquely assigned to a single asset class and jurisdiction.

← 13. Beer, Coelho and Léduc (2019[24]) and O’Reilly, Parra-Ramirez and Stemmer (2019[20]), for instance, document a generally smaller impact of EOIR on offshore bank deposits relative to AEOI.

← 14. The expansion in information was not, for example available for other tax categories such as excises of VAT.