Housing accounts for more than a quarter of CO2 emissions in OECD countries. Even if housing-related emissions have been trending downward, a step change is required to meet agreed net-zero emission targets by 2050. The burning of fossil fuels in homes will have to make way for carbon-free energy sources. This transformation will need to be accompanied by the decarbonisation of electricity generation. The energy efficiency of new as well as existing buildings will also need to improve through a mix of regulation, incentives and financial support. This chapter discusses the decarbonisation of the housing sector and reviews policy options to accelerate the transition to net-zero emissions.

Brick by Brick (Volume 2)

2. Decarbonising Housing

Abstract

Main policy lessons

Housing accounts for more than a quarter of CO2 emissions in OECD countries, placing the sector at the centre of efforts to decarbonise economies. Progress is under way. Over the past two decades, housing emissions shrank by 17% on average across OECD countries. Even so, a step change is needed. Currently implemented and firmly planned policies would only deliver one-sixth of the housing emission reductions required to achieve decarbonisation by 2050.

Policy options for more rapid decarbonisation of housing include:

Decarbonisation strategies should ensure consistent carbon pricing across sources, sectors and over time. Carbon pricing – including properly calibrated taxes on fossil fuels used in homes or emission trading – offers an effective and cost-efficient way of creating carbon-saving incentives. Carbon pricing is key to underpin the needed large-scale changes, including to avoid the “rebound” of emissions that can follow other measures if they are unaccompanied by pricing. Effective carbon rates are currently low in most countries, and rates differ across sectors. Not even one-half of OECD countries apply explicit carbon taxes to direct emissions from buildings, while excise taxes are often misaligned with the carbon content of fuels.

Various market imperfections specific to the housing sector call for going beyond carbon pricing with a well-coordinated mix of policies. This is the case, for example, of split incentives between landlords and renters to invest in energy efficiency improvements. Adjusting rent-setting rules to allow both landlords and renters to benefit from energy savings resulting from investments in energy retrofitting would strengthen incentives for renovation.

Regulatory measures are important complements to carbon pricing. Energy performance certification should be extended to all properties and cover not only those for sale and rental. Reliable information would raise awareness about the benefits of home improvements. Also, energy efficiency standards for appliances and new buildings should be strengthened further to ensure full alignment with the net-zero emission target.

Compensatory measures can be used to offset adverse effects on vulnerable social groups. Such transfers should maintain incentives to reduce greenhouse gas emissions, for instance by tying them to household income and property size while avoiding links to energy use.

Public support programmes for energy efficiency improvements should focus on retrofitting the least efficient housing units. Subsidies should be paid depending on the actual energy efficiency gains and be capped and means-tested while taking account of fiscal capacity. Countries should abolish the remaining subsidies on fossil fuel boilers.

Social housing can play a leading role. Building new and retrofitting existing social housing units according to high environmental standards would directly contribute to decarbonisation, reduce the risk of energy poverty for tenants, and help to develop capabilities and capacity in the retrofitting business sector.

Housing and environmental policies are highly decentralised in many countries. Reforms and resources are needed to align incentives and agendas across levels of government. Local-level regulations, spending power and resources must be consistent with national decarbonisation goals.

Track emission trends and the achievement of targets

In 2020, the residential sector accounted for more than a quarter of the total CO2 emissions in the OECD area. Emissions emanate from space and water heating, cooling, ventilation, lighting and the use of appliances and other electrical plug loads. Also, the construction of homes is emission-intensive, given the role of concrete and steel in current building technologies. A step change is needed to reduce emissions to attain the agreed net zero emission target by 2050. Apart from developing decarbonisation strategies, policy must go well beyond environmental matters and encompass economic, social, innovation, tax and spending policies, as well as governance arrangements, to drive transformational change.

This chapter identifies policy options to decarbonise the housing sector. It focuses on housing-specific aspects. Notably, two specific decarbonisation topics that are not covered in this chapter relate to questions raised by the energy-market turmoil that struck Europe in 2022 (discussed in Chapter 1) and issues related to green finance (addressed in Chapter 3). The chapter also abstracts away from mobility-related emissions and does not discuss urban policies aiming at integrating the spatial organisation of residential, commercial and industrial areas with a view to reducing commuting.

Housing accounts for a large share of emissions in OECD countries

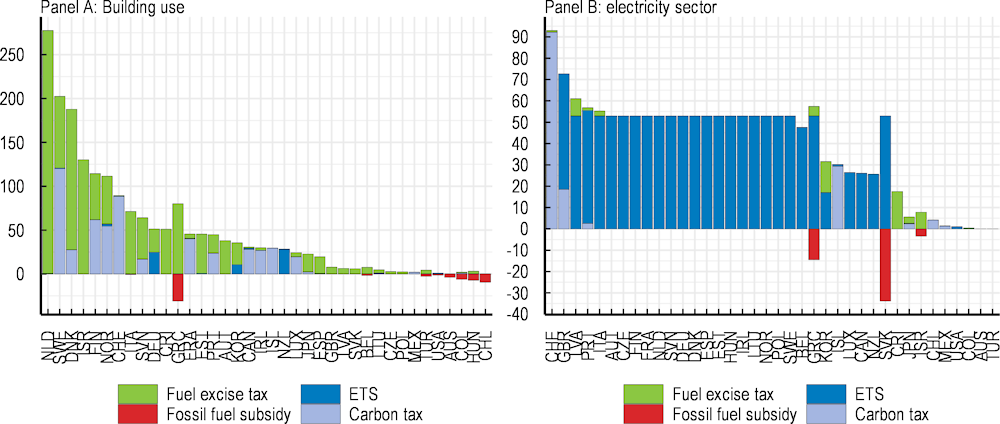

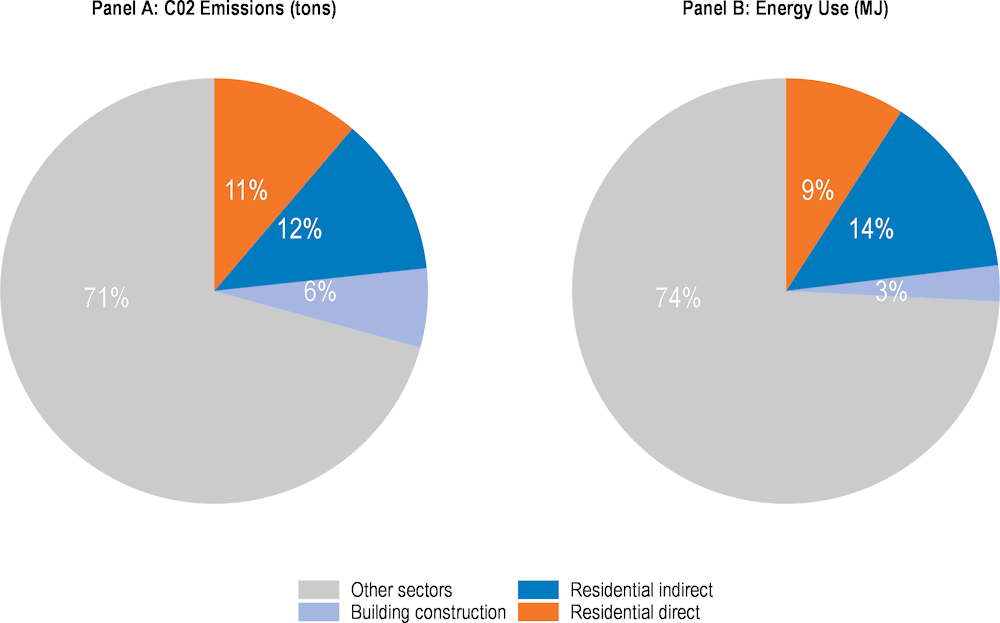

The residential sector accounts for nearly a quarter of overall CO2 emissions in OECD countries (Figure 2.1). Emissions vary considerably across countries, depending to a large extent on income, climate conditions, the country’s energy mix and the energy efficiency of buildings (Figure 2.2). Several high-income countries with high heating needs, such as the Nordic countries, have nevertheless achieved a low carbon footprint in their residential sector primarily through the electrification of energy use at home coupled with reliance on carbon-free electricity production.

Figure 2.1. Housing accounts for a large share of overall CO2 emissions

Note: Data are unavailable for four OECD countries (Colombia, Costa Rica, Iceland and Israel). 2019 data were used for 12 OECD countries (Argentina, Austria, Canada, Denmark, Estonia, Greece, Lithuania, Netherlands, Poland, Slovakia, Spain and Sweden). Building construction refers to the direct and indirect (embodied) emissions corresponding to the ISIC 41 sector classification. The residential sub-sector includes all energy-using activities in apartments and houses, including space and water heating, cooling, ventilation, lighting, and the use of appliances and other electrical plug loads. The breakdown between direct and indirect emissions is based on the proportion of final residential energy used from electricity and district heating. Indirect emissions are calculated as follows: Energy use *(pe+pdh)*EF where pe=proportion of energy generated by electricity, pdh=proportion of energy generated by district heating, and EF is the emission factor for electricity and district heating.

Source: Energy Efficiency Indicators database (IEA, 2021[1]), Emissions Factors database and OECD calculations.

Figure 2.2. Several countries have high home energy needs, but low CO2 emissions

Note: Residential energy use is measured on the right axis. Indirect and direct CO2 emissions are measured on the left axis. The breakdown between direct and indirect CO2 emissions is based on the proportion of final residential energy used from electricity and district heating. Indirect emissions are calculated in the following way: Energy use *(pe+pdh)*EF, where pe=proportion of energy generated by electricity, pdh=proportion of energy generated by district heating, and EF is the emission factor for electricity and district heating.

Source: Energy Efficiency Indicators (IEA, 2021[1]), Emissions Factors database (IEA, 2021[2]), and OECD calculations.

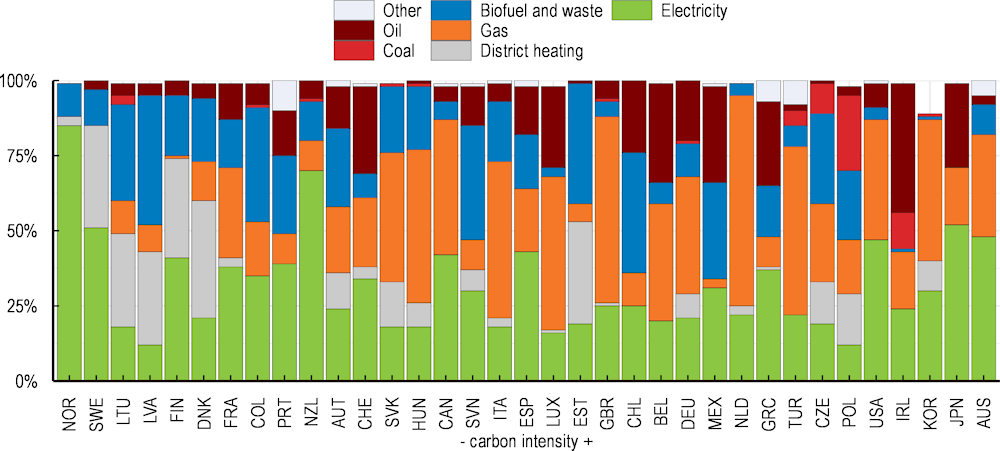

In 2020, around 25% of the final energy supply to the residential sector still originated from individual gas-powered systems, 10% from oil combustion, 3% from coal combustion and 15% from biomass and waste combustion. Biomass is renewable and does not contribute to climate change. Nonetheless, it can be an important source of local air pollution. As much as 40% of the residential sector’s energy use was supplied by electric power generation (30%) and district heating (less than 10%), generating no direct CO2 emissions. Differences across countries are considerable (Figure 2.3).

A few countries, such as the United States, the Czech Republic or Germany, combine high per capita energy use and extensive reliance on fossil fuels, resulting in high emissions per capita. The Nordic countries, in contrast, display low emissions despite high per capita energy consumption. Other countries, such as Australia, Japan and Korea, have relatively high emissions despite comparatively low energy consumption per capita. The discriminating feature is the carbon content of the energy used. Coal has the highest carbon content, followed by oil and gas.

In Norway and New Zealand, the residential sector, which is mostly electrified (around 70% of energy use), is carbon-free, mainly thanks to large-scale hydropower. While essential, electrification does not guarantee a low carbon footprint, as illustrated by Australia, Korea and the United States, where electricity is mainly produced by fossil fuels. Consequently, these countries display very high carbon intensity despite a high level of electrification (Figure 2.3).

Electrifying homes is central to decarbonising them but requires a parallel decarbonisation of power generation. Except for Estonia, countries with a high share of district heating show a low carbon intensity, reflecting the technology’s ability to use renewable energy sources when producing heat.

Figure 2.3. Carbon intensity depends on the extent of direct emissions and the energy mix

Note: 2019 data were used for 12 countries (Austria, Canada, Chile, Colombia, Denmark, Greece, Latvia, Lithuania, the Netherlands, Norway, Slovenia, and Spain). Countries ranked by increasing carbon intensity (emissions per unit of energy used).

Source: Energy Efficiency Indicators (IEA, 2021[1]) and OECD calculations.

Where and how are emissions trending down?

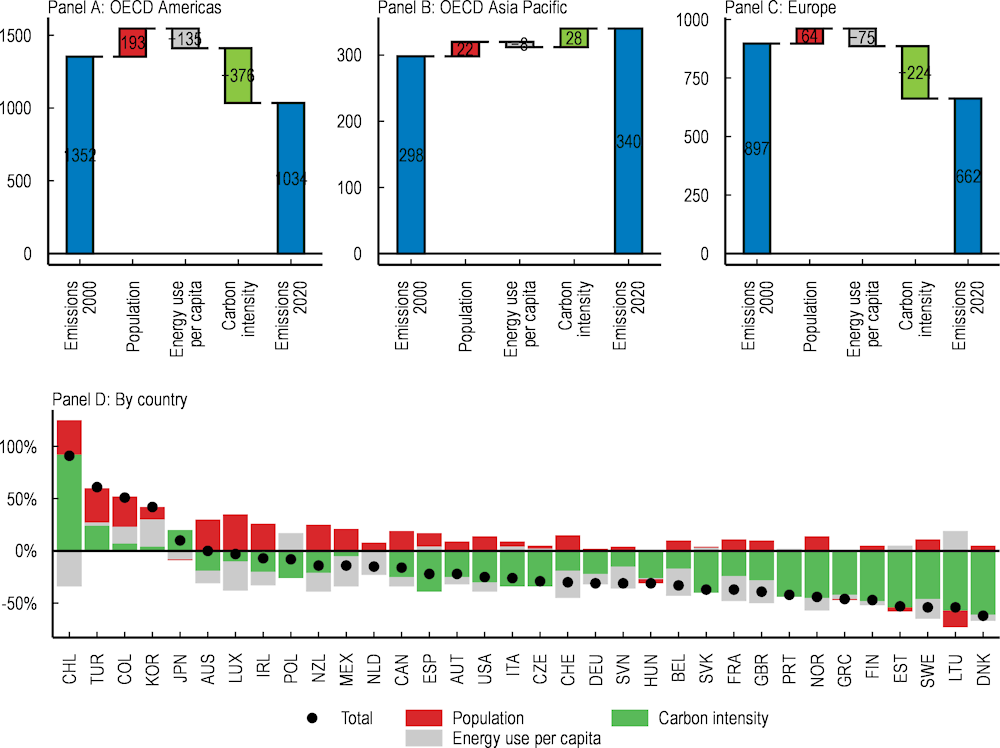

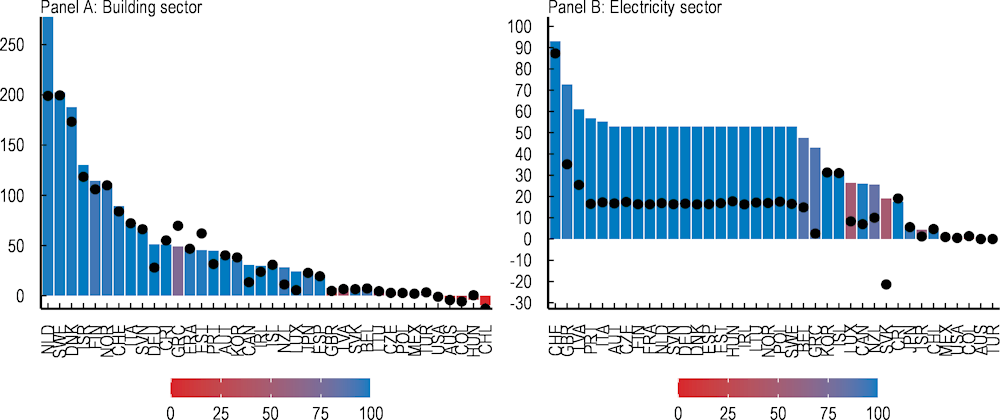

OECD-wide housing-related emissions have declined by 17% from 2000 to 2020, notwithstanding an increase in population and the number of dwellings (Figure 2.4). The energy efficiency of homes and appliances has improved, and many countries have successfully started to reduce the carbon content of the energy supplied. By contrast, in non-OECD countries, total CO2 emissions from the buildings sector have risen considerably (IEA, 2021[3]), reflecting strong economic growth, fast urbanisation and limited progress in reducing CO2 intensity, as coal and other fossil fuels remain central to the energy mix of many emerging-market economies, including the largest non-OECD member countries (Huo et al., 2021[4]).

The gentle OECD-wide average decline over the last 20 years hides a wide variation in cross-country performance. In Estonia, Lithuania, Sweden and Denmark, emissions have declined by more than 50%, while they have risen by more than 50% in Chile, Colombia and Türkiye (Figure 2.4, Panel D). Denmark exhibits the steepest decarbonisation of the residential sector (Figure 2.4, Panel D), thanks to a drastic reduction in carbon intensity due to a shift from coal and natural gas to carbon-free heat generation systems relying on electricity production via renewable resources such as wind power. Since the late 1990s, Denmark has also pioneered gas-powered district heating networks, recently upgraded at a relatively low cost to biomass and waste-powered primary energy sources. Chile, in contrast, displays the highest increase in residential CO2 emissions, mainly because of a rising carbon intensity due to the extensive use of oil, natural gas and coal combustion by households. In addition, wood and biomass combustion is still used by about ¼ of the households (Figure 2.3). Similarly, indirect emissions have tended to increase due to the fast expansion of coal-powered electricity plants. In addition to Chile, Australia, Colombia, Japan, Korea and Türkiye are the other OECD countries where emissions from the residential sector increased from 2000 to 2020.

Energy use per capita and carbon intensity – CO2 emissions per energy unit – have declined on average in the OECD area. The average fall in energy use per capita, however, masks that this variable increased in nearly half of the OECD countries. By contrast, the reduction in carbon intensity, which is determined by the CO2 content of the fuels used, has been more uniform.

Figure 2.4. The factors behind past housing emission reductions vary a lot across regions

Black dots represent the total CO2 emission change between 2000 and 2020. Carbon intensity refers to CO2 emissions per unit of energy used. Data are unavailable for three OECD countries (Costa Rica, Iceland and Israel). 2019 data were used for eight countries (Austria, Canada, Colombia, Denmark, Spain, Estonia, Lithuania, and the Netherlands).

The decomposition follows the additive index decomposition (LMDI) method pioneered by Ang (2015[5]), and is used in a similar context by (D’Arcangelo et al., 2022[6]).

Source: Energy Efficiency Indicators (IEA, 2021[1]), World Energy Outlook (IEA, 2021[7]), and OECD calculations.

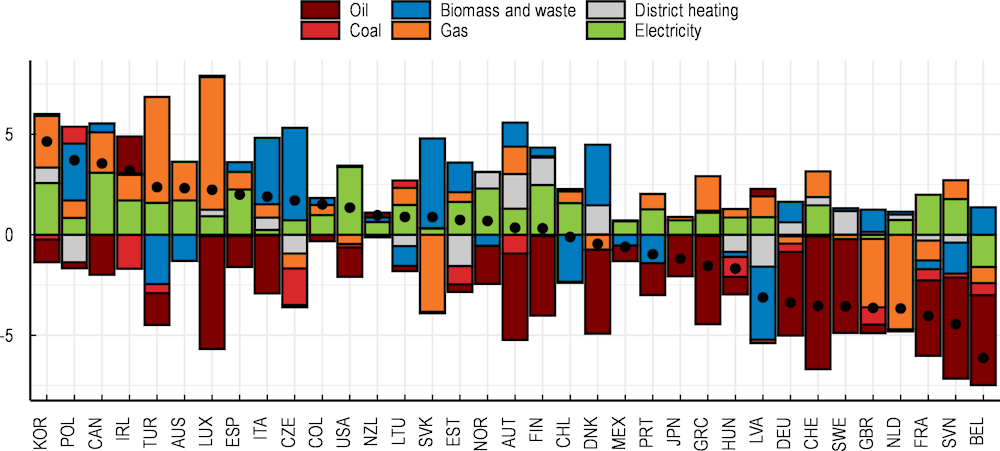

The decline in the direct use of coal by households, the most carbon-intensive fuel, has been minor in recent years in most countries because it had been largely phased out prior to 2000 (Figure 2.5). The use of oil, the second-most carbon-intensive fuel, has declined in all countries (except in Ireland), substantially so in many of them, and has been replaced by lower-carbon sources. The phase-out of oil boilers is partly policy-driven. A few countries, such as Austria, Finland, France and Spain, have mainly replaced oil products with less-carbon-intensive or carbon-free energy sources (electricity and district heating). In Belgium, the Czech Republic, Denmark, Italy, Slovakia and the United Kingdom, the substitution is mainly due to the more extensive use of biofuels and waste combustion. Canada, Luxembourg, Korea and Türkiye are countries that have switched from oil to gas, which reduces the carbon intensity at the margin but prolongs fossil fuel dependency and has been creating acute energy price pressures for households after the Russian invasion of Ukraine and the reduction of Russian gas deliveries to Europe.

Figure 2.5. The change in the residential energy mix has been far from uniform across countries

Note: Black dots represent the total change in energy use per capita.

Source: Energy Efficiency Indicators (IEA) and OECD calculations.

Achieving net-zero emissions will require strategies and policy reform

Most OECD countries have committed to achieving net-zero emissions by 2050, with a few countries having committed to reaching the target earlier. National climate plans differ in the detail they provide about measures for particular sectors, such as housing, and the specific requirements for sub-national entities (see final section), households or firms. 16 OECD countries have explicit climate targets and commitments for the housing sector.

An example of a national plan focussing on the buildings sector is Japan’s 2050 Carbon Neutral Goal, which focuses on better insulation, low carbon power generation and energy reduction by 20% in the residential sector and 50% in the commercial sector (Ministry of Economy, 2020[8]). Germany is another country that has set sector-specific targets in its Climate Action Plan. For the buildings sector, it has drawn up a roadmap to reach a virtually climate-neutral building stock and sets a goal to reduce emissions by two-thirds by 2030 compared to 1990. Among the measures to achieve this goal, Germany has introduced zero-emission standards for new buildings and for the existing building stock to undergo extensive retrofitting (BMUB, 2016[9]).

Housing-sector targets accompanied by policy strategies are important to provide guidance for developing implementation plans and strengthening accountability. However, the pace of emission reductions in the housing sector should be set, taking into account efforts made in other sectors and potential differences in the relative cost per ton of carbon abated across sectors. A reduction pace that entails a higher degree of effort per ton of carbon compared with other sectors would be cost-inefficient and imply lower greenhouse gas emission reductions than what could be achieved for the same cost with homogenous marginal costs (Blanchard and Tirole, 2021[10]).

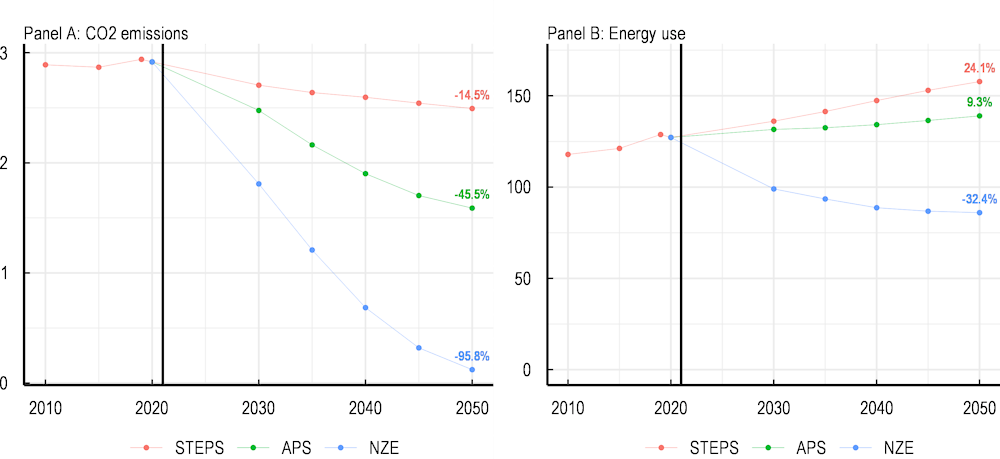

The IEA Net Zero Emissions (NZE) framework (IEA, 2020[11]) provides scenarios that draw a normative path for the emission reduction targets set in the Paris Agreement. Accordingly, under current policies, world CO2 emissions in the buildings sector would only decrease by 14.5% from 2020 to 2050 on the back of a 24.1% increase in energy consumption (Figure 2.6). In strong contrast, the reduction reaches 32% of energy use and 95.8% of CO2 emissions by 2050 in the IEA NZE scenario. Even already announced but not yet implemented policies would cut 2050 emissions only by nearly half from the 2020 level, showing the large gap separating current policy pledges from what is required to reach net zero by 2050.

Figure 2.6. Global IEA scenarios to 2050 underscore the magnitude of required changes

Note: World CO2 emissions and world energy use refer to the buildings sector only and includes residential, commercial, and institutional buildings. The Stated Policy Scenario (STEPS) projects energy consumption and emissions under currently implemented or firmly announced policies. It assesses on a sector-by-sector basis the different pledges made by governments. Some announced policies that are unlikely to be implemented in due time are not incorporated. The Announced Pledges Scenario (APS) is a variant of STEPS and assumes that all pledged policies are fully enacted into policies. Policies in countries that have not yet made a net-zero pledge are assumed to be the same as in the Stated Policies Scenarios. The Net Zero Emissions (NZE) scenario sets out a pathway for the global buildings sector to achieve net zero CO2 emissions by 2050. Variables are only available at the world level. No regional or country detail is provided by the IEA for the NZE scenario.

Source: World Energy Outlook 2021 (IEA, 2021[7]) and OECD calculations.

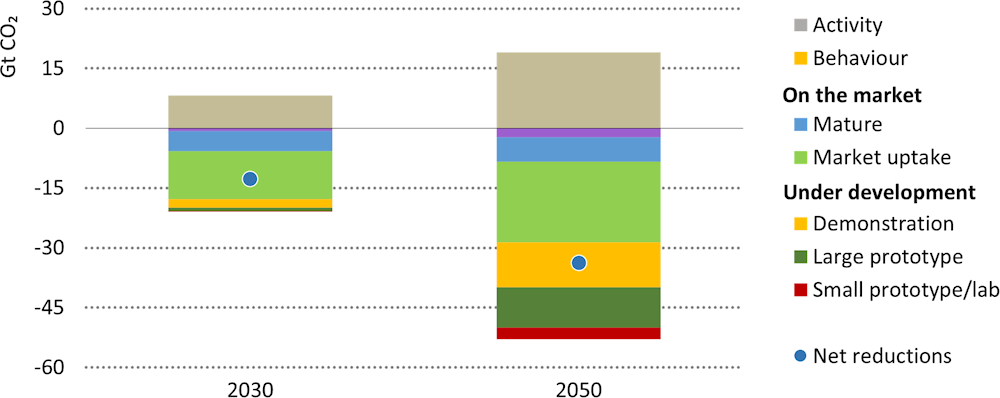

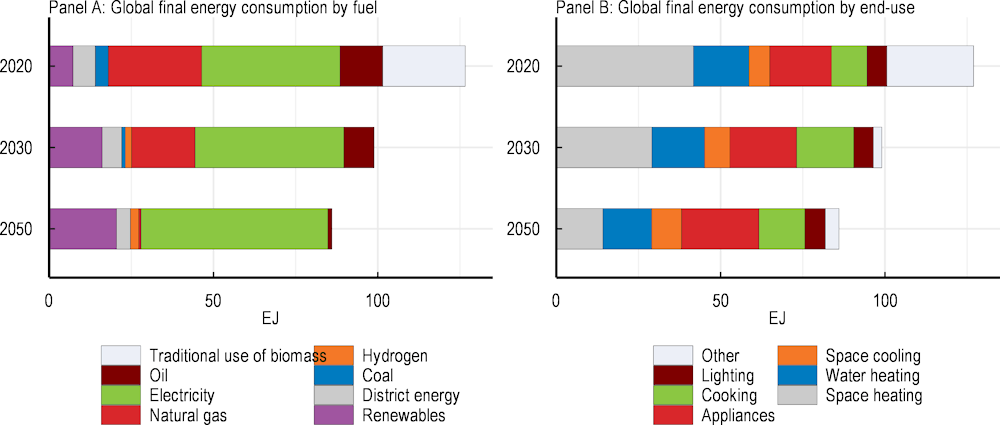

In addition to electrification and decarbonised power supply, around 40% of the reduction is expected to come from lower energy use (Figure 2.7). The reduction in energy use results from the higher environmental quality of new buildings, retrofits of existing buildings and more efficient technologies for appliances, supplemented to a lesser extent by behavioural changes, such as warmer target indoor temperatures in the summer and cooler ones in the winter (IEA, 2020[11]).

To nearly eliminate direct building-sector emissions by 2050, the IEA highlights the need to reduce carbon intensity drastically through a massive transition from fossil fuel combustion to the use of carbon-free electricity and renewables (e.g., rooftop solar panels) (Figure 2.8). In the NZE scenario, both oil and gas combustion in homes are phased out by 2050: this stands in stark contrast with current policies, under which fossil fuels would still represent around 40% of residential energy supply by 2050.

Figure 2.7. Decarbonising housing requires mass electrification and strong energy efficiency gains

Note: No OECD or country breakdowns are available for the IEA NZE scenario. Activity refers to change in energy service demand related to rising population, increased floor area and income per capita. Behaviour refers to change in energy service demand due to user decisions, e.g., changing heating temperatures. Avoided demand refers to change in energy service demand from technology developments, e.g., digitalisation.

Source: “Net Zero by 2050 – A Roadmap for the Global Energy Sector”, (IEA, 2020[11]).

Figure 2.8. The fuel mix will be dominated by electricity complemented by home renewables

Note: No OECD or country breakdowns are available for the IEA NZE scenario. Other includes desalination and the traditional use of solid biomass, which is not allocated to a specific end‐use.

Source: “Net Zero by 2050 – A Roadmap for the Global Energy Sector”, (IEA, 2020[11]).

Reflect housing and local specificities in decarbonisation strategies

Incentive mismatches and behavioural biases

Housing decarbonisation efforts are fraught with biases in behaviour. For example, people often overestimate the insulation efficiency of their homes, which discourages investment in energy retrofitting. This phenomenon is compounded by various demand-side behavioural biases, such as myopia and time inconsistencies, which also discourage investment from raising energy efficiency. Even where efforts are made to raise awareness about the importance of such investments through information campaigns, take-up of subsidised energy efficiency investments remains low, suggesting that non-monetary costs and rational inattention are major obstacles to home improvements.

Energy retrofitting efforts are also stymied by incentive mismatches along the tenure spectrum. For example, landlords have limited incentives to invest if the benefits of improved energy efficiency accrue to tenants in terms of greater home comfort and lower energy bills, and the costs of investment cannot be reflected in higher rents due to rental contract regulations. As for tenants, investment is discouraged if the associated costs cannot be shared, at least in part with landlords, or rental contracts are too short to allow for the amortisation of home improvement costs.1 Incentive mismatches also arise for multifamily dwellings, such as apartment buildings and condominiums, including those built and managed by non-profit housing associations (Box 2.1).

Policy can address some of these issues. For example, information campaigns are valuable tools to raise awareness about buildings' thermal characteristics, energy efficiency and the actual renovation process, including administrative help or financing options. Several local governments have implemented such campaigns, even though their effectiveness in changing behaviour is difficult to ascertain. Energy labelling is another policy intervention to raise awareness about energy efficiency, but it needs to apply to all properties, not only those for sale or rental, as is the case in most countries. Greater flexibility in landlord-tenant regulations can go a long way to allow for the sharing of energy retrofitting costs in a manner that better aligns incentives for investment. The provision of social housing based on state-of-the-art energy efficiency regulations and standards has the double benefit of addressing affordability considerations while reducing energy use in the residential sector.

Box 2.1. Multi-ownership, housing associations and CO2 abatement decisions

The tenure structure differs considerably across countries, regions and cities. In Paris, for instance, 95% of buildings are in multi-ownership, and housing associations own 30% of the Dutch housing stock. In the case of multi-ownership, typically, a building management company is charged with the maintenance and repair of common areas, the building envelope and utility installations while also coordinating decisions by the owners about energy efficiency improvements. While maintenance and repair decisions are usually paid out of an accumulated fund, other decisions need voting by the apartment owners on an investment proposal by the building management company.

In the Dutch case, for instance, 70% of the occupants need to agree on such a proposal, and then financing has to be secured, even though the rent may not exceed a certain threshold (Van Oorschot, Hofman and Halman, 2016[12]). However, subsidies from national and local governments exist for the retrofitting of apartments, including in the case of tenants who need to move out (de Feijter, van Vliet and Chen, 2019[13]).

Strict voting and financing arrangements also exist in many other countries (Table 2.1. ).Some countries have eased the voting rules recently: Belgium reduced the required voting shares from ¾ of the votes to a ⅔ majority, while Austria reduced a ⅔ majority to a simple majority or a ⅔ majority of the votes that cover at least ⅓ of the owners. Reducing the voting-right threshold may not be the only and sufficient pre-requisite for reducing obstacles to renovating multiapartment complexes. For loans granted to finance retrofitting, the bank would have to require high (perhaps higher than set in the country) agreement rates.

Table 2.1. Voting requirements to approve retrofitting of multi-owner properties

|

Maintenance |

Renovations |

Participation in vote |

|

|---|---|---|---|

|

Australia |

Simple majority |

Simple majority |

All management committee members |

|

Austria |

Simple majority |

Simple majority or two-thirds of a third of the owners |

The owners |

|

Belgium |

Not specified |

Communal parts: 2/3 majority Mandatory work to comply with standards: simple majority Other works: 4/5 majority |

Not specified, votes calculated on the basis of share values |

|

Finland |

No majority requirements |

Simple majority |

All property shareholders |

|

Germany |

Simple majority |

3/4 majority |

Not specified |

|

Netherlands |

70% majority |

70% majority |

All tenants |

|

Poland |

No majority requirements |

Unanimity or majority (depending on the community) |

All property shareholders, votes calculated on the basis of share values |

|

Portugal |

No majority requirements |

2/3 majority |

Not specified |

|

Romania |

Not specified |

2/3 majority |

Not specified |

|

Spain |

Simple majority |

Simple majority |

Members present at the meeting |

|

USA |

Differs by co-ownership |

Differs by co-ownership |

Differs by co-ownership |

|

China |

Not specified |

2/3 majority |

Not specified |

Note: Simple majority stands for 50% + one vote.

Source: European Commission and Joint Research Center (2018[14]), de Feijter, van Vliet and Chen (2019[13]), Matschoss et al. (2013[15]).

The German government pursues an innovative approach to overcome the split incentive problem. In 2021, Germany introduced a carbon tax on heating in the building sector. In 2022, the government announced that the carbon tax liability would be split between landlords and tenants depending on the building’s emission performance. Tenants in low-emission housing will bear most of the tax, while landlords will be liable for the majority of the additional tax for carbon-intensive rental dwellings. This measure reduces the carbon tax burden of tenants and encourages landlords to undertake investments to improve the emission performance of the homes they own while still providing incentives to tenants to reduce their carbon footprint. A key factor for the success of this measure is to ensure that landlords are not able to pass their higher tax burden onto their tenants (e.g., through higher rents) without making the associated investments (OECD, 2022[16]).

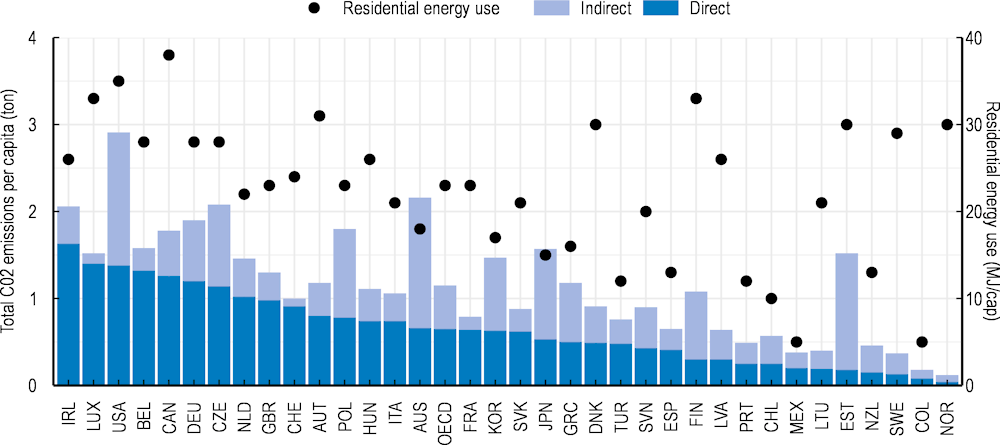

Pricing social costs explicitly using carbon taxes and emission trading schemes

Carbon pricing is a powerful tool to bring down emissions. However, effective carbon rates are low in the housing sector in the OECD area on average (Figure 2.9). In most OECD countries, housing-related emissions are priced through the taxation of fossil fuels, some of which are labelled carbon taxes as the rate is explicitly linked to the carbon content of the fossil fuels. On the other hand, emission trading is rare (Box 2.2).

Box 2.2. Effective carbon rates are low in most countries

Currently, several countries levy a carbon tax and almost all excise duties on fossil fuels. The EU emission trading scheme covers mainly large plants in industry and electricity generation. However, Austria and Germany have decided to extend emission trading to the heating of buildings from 2026 (D’Arcangelo et al., 2022[6]),2 and the EU is discussing including buildings in the EU emission trading scheme from 2026.

Net effective carbon rates (ECRs) on buildings are highest in Israel, the Netherlands and the Nordic countries. Only a few countries have so far achieved a net ECR above EUR 60, which is a mid-range estimate of current carbon costs (OECD, 2021[17]). In many countries, including Australia, the United States and many Eastern European countries, effective carbon rates are still at or close to zero. On the other hand, carbon pricing is more developed in the power generation sector, especially in Europe. This raises electricity prices and undermines the electrification of buildings.

Figure 2.9. Carbon rates are low and cover a limited share of housing emissions in many countries

Note: The net effective carbon rate is composed of emission trading prices, carbon taxes, fuel excise taxes minus fossil fuel subsidies. The height of the bars refers to net effective carbon rates in 2021, while the black dots denote net effective carbon rates in 2018. The colour of the bars indicates the share of emissions covered in 2021. The electricity sector refers to electricity generation, and the effective carbon rates do not incorporate electricity excise taxes.

Source: (OECD, 2022[18])

Apart from the low effective rates in many countries, excise taxes, rather than carbon taxes and emission trading prices, dominate the building sector (Figure 2.10). Excise taxes, which were historically mainly introduced for revenue-raising purposes, are often misaligned with the carbon content of energy sources. The tax base of excise taxes should be refocused to reflect the carbon content of fuels, which would provide better abatement incentives for given tax receipts. On the other hand, before the energy crisis, fossil fuel subsidies existed only in a few OECD countries: they were sizable only in the Greek buildings sector. Since the onset of the energy crisis, they have spread, especially in Europe: an important policy challenge will be to roll them back as energy prices normalise.

The effective carbon rates do not include electricity excise taxes paid by end-users. Such levies distort the pricing of energy products. First, as mentioned above, excise taxes are poorly targeted as they are not aligned with the carbon content of the energy product used to generate electricity. Second, electricity is already taxed at the production stage via emission trading systems, explicit carbon taxes and fuel excise taxes on the energy source used to generate electricity (Figure 2.10). The additional levy at the consumption stage makes electricity more expensive than natural gas for the end-user in some countries, notably Germany and the United Kingdom. This undercuts the installation of heat pumps, which need electricity (German Council of Economic Experts (2019[19]). In the United Kingdom, taxes and charges on electricity equivalent to a price of GBP 70-80 per tonne of CO2 are, in part, financing feed-in tariffs and other support policies for renewable energy products. In contrast, fossil fuels for heating are practically untaxed (OECD (2022[20]). Narrowing the gap between electricity and natural gas prices would accelerate the uptake of heat pumps in new buildings and foster deployment in existing buildings (IEA, 2021[21]).

Figure 2.10. Effective carbon rates are a long way from being similar across sectors or countries

Direct carbon pricing may have a limited effect on emissions in the housing sector. First, while some sectors are highly responsive to price signals, housing is not, mainly because direct emissions from coal, oil and gas for heating and cooling are more challenging to reduce. Second, long renovation cycles for housing, as well as incentive mismatches and behavioural biases discussed above, lead to underinvestment in energy retrofitting by households.3

The role of environmental standards, regulations and certification

Price signals can be strengthened or complemented with other policy interventions. This includes energy performance labelling/certification, as well as standards and regulations.

Labelling and certification facilitate the comparison of the energy performance among properties and appliances and thus allow price formation to reward investment in the improvement and maintenance of the thermal characteristics of buildings as well as the purchase of energy-efficient appliances. To be effective, labelling and certification need to apply to all properties, not only new ones and those for sale or rental, as in most countries where the system is available. Certification will become mandatory in France for multifamily properties, and the revision of the Energy Performance of Buildings Directive will extend the requirement for buildings undertaking large renovations in all EU countries (Box 2.3).

Box 2.3. The EU Directive on the Energy Performance of Buildings

In the European Union, energy performance certification currently only applies to new buildings and those for rental or sale. A colour-letter rating is used on a scale from A to G, where A is highly efficient, and G is highly inefficient. The ENERGY-STAR labelling programme is the main certification scheme in the United States. In Japan, the Energy Label Programme, which provides a five-star rating, is mandatory for many appliances. Similar systems exist in Australia and New Zealand. In the United States, energy performance certification is voluntary.

In December 2021, the European Union proposed a revision of the Energy Performance of Buildings Directive and the Energy Efficiency Directive. The objective of the amendment is to consolidate the three main objectives of the original directives: increase energy efficiency, in particular for low-income households; lower energy consumption and foster job creation in the green building sector.

The directive sets a common framework for emission reduction targets of at least 60% by 2030 in the buildings sector relative to 2015 and the achievement of climate neutrality by 2050. In addition, the directive highlights several intermediate milestones and strategies to change energy sources and increase the pace of renovations.

For the transition to renewable energy, three targets are set. Renewables in the buildings sector should account for 49% of energy use by 2030. The increase in the use of renewable energy in heating and cooling should be 1.1 percentage points per year. The increase in district heating and cooling is planned to be 2.1 percentage points per year. As a complement, the phase-out of fossil fuels should be completed by 2040 at the latest. The phase-out will be underpinned by a sunset clause for financial incentives that use fossil fuels in buildings to ensure that no remaining incentives are given to install boilers powered by fossil fuels from 2027 onwards.

Regarding the renovation of energy-inefficient buildings, the directive sets an objective of renovating at least 3% of the total floor area of all public buildings annually. The renovation plans for the private sector will focus on the most energy-inefficient buildings with the objective that the worst-performing 15% of the building stock will need to be upgraded from label G to at least F by 2030 (and at least E by 2033).

The tracking of the worst-performing properties will be ensured by the extension of mandatory energy performance certificates with increased reliability, quality and digitalisation for all public buildings, all buildings for rent or sale and all buildings undergoing a major renovation. A building renovation passport will be put in place, complementing the introduction of a legal requirement to put energy efficiency first in planning and investment decisions.

The coverage of mandatory minimum energy performance standards (MEPS) for appliances, such as lighting, refrigerators and space cooling, is nearly complete in the OECD (IEA, 2021[22]). Beyond coverage, the stringency of MEPS matters. In the European Union, for instance, new refrigerators now must be 75% more efficient than ten years ago, while comparative labels were rescaled in 2021 to help consumers identify the most efficient products. Progress remains limited in some areas. For example, lighting policies in many countries have not yet phased out halogen lamps, which are only about 5% more efficient than incandescent bulbs.

Energy efficiency standards matter for new buildings because of their long lifespan. Mandatory building energy codes are in place in most OECD countries, though they are voluntary in some US states and Canadian provinces. On the other hand, several US states have codes that are stricter than the national one. Codes in many countries have also become stricter over time. Standards embedded in building codes, because they have been locked in for several decades, need to be aligned with long-term climate objectives. In Europe, the revised Energy Performance of Buildings Directive aims at building only near-zero emission homes from 2030 (Box 2.3). Empirical evidence suggests that labelling/certification indeed supports price formation, with a premium in sale prices and rents associated with better-rated properties. This is also the case with standards (Box 2.4).

Box 2.4. Effects of labelling/certification and standards on price formation

Some studies find significant positive correlations between labelling/certification and house prices, while others argue that adequately controlling for other property characteristics wipes out that effect, except for upper-tier quality buildings (Marmolejo-Duarte and Chen, 2022[23]).

Evidence for the United States shows that zero-energy homes are more than 10% more expensive than standard homes but only 5% more expensive when taking into account federal and state financial incentives. Zero-energy homes also lead to heating energy cost savings and a higher resale price (Zero Energy Project, 2022[24]).

Building insulation standards bring far smaller savings on cooling energy costs as, even in well-insulated homes, many households open their windows at times during hot days, negating the benefits of insulation (Davis, Martinez and Taboada, 2020[25]). Also, the strictness of the near-zero emission standard will affect the affordability of new homes. The primary energy requirements for single-family houses varied by a factor of six among EU countries in 2021 (BPIE, 2022[26]).

Incentivising decarbonisation using subsidies and tax breaks

Raising the relative price of carbon can also be implemented through subsidies and tax incentives. These interventions can speed up the deployment of new technologies by overcoming upfront cost barriers since they directly fill an immediate financial gap. However, funding such subsidy schemes requires raising additional tax revenues elsewhere in the economy either currently or, if via borrowing, in the future. There are reasons for and against the use of debt to finance decarbonisation subsidies: on the one hand, emission reductions will benefit future generations that will have to repay the debt; on the other hand, the required fast pace at which emissions now need to be reduced stems from the lack of sufficient action by past and present generations. Another difficulty with decarbonisation subsidies is to determine the benchmark emissions against which reductions will be measured. Therefore, it is important to assess carefully the effectiveness of subsidies in emission reductions and avoid potential risks of distorting market developments and deadweight losses.

Bertoldi et al. (2021[27]) provide an overview of existing schemes in Europe.4 Some subsidy schemes and their characteristics are summarised in Table 2.2. In Germany, for instance, subsidies can only be obtained after prior advice from independent experts. In all the schemes shown in Table 2.2, subsidies partly fund the installation of new equipment up to a ceiling. Tax incentives for retrofitting are generally capped as a percentage of costs, up to a ceiling, and may take the form of a deduction or credit (OECD, 2021[17]). The most generous programme is probably the Italian Superbonus 110 scheme (110% tax credit for improvements raising the dwelling’s energy-efficiency level by at least two levels). The main criticisms of this scheme are the lack of evidence on the actual energy efficiency gains, and the risk that overpricing by construction firms may be tolerated because homeowners do not bear the intervention costs (Brugnara and Ricciardi, 2021[28]). In 2023, the programme has been extended for one year but scaled down to 90% of the costs and is henceforth subject to means-testing as only households with an annual income of less than 15.000€ are eligible.

Table 2.2. Characteristics of some subsidy schemes

|

|

Germany |

France |

United Kingdom |

Italy |

|---|---|---|---|---|

|

Name |

“Deutschland macht’s effizient“, KfW’s “Energy-efficient construction and retrofitting” |

“MaPrimeRénov”, now a part of “FranceRénov” |

“Green Deal” |

“Superbonus” |

|

What is subsidised? |

||||

|

- Energy advice |

Yes |

Yes |

No |

No |

|

- Energy efficiency improvements |

Yes |

Yes |

Yes |

Yes |

|

- Renewable energy |

Yes |

Yes |

Yes |

No |

|

- Other |

N/A |

N/A |

N/A |

Seismic improvements |

|

Energy performance and control |

Ex-ante and ex-post |

Ex-ante and ex-post |

Ex-ante |

Ex-ante and ex-post |

|

Subsidies provided |

Loans, grants, tax breaks |

Loans, bonuses, reduced tax rate |

Grants |

Tax deduction |

|

Subsidy rate |

Up to €25,000 for heating system improvement; Up to €120,000 for a complete renovation of a house |

€1,000 for heating system improvement; Up to €8,000 for the installation of solar thermal; €20,000 as standard maximum amount (insulation, heating, general works; €30,000 for extended retrofit works |

£5,000 as standard amount per household £10,000 for low-income households |

110% on the tax base of the retrofitting costs |

|

Does the subsidy rate depend on energy efficiency improvements? |

Yes |

Yes |

No |

Yes |

|

Does the subsidy rate depend on income? |

No |

Yes |

Yes |

No |

|

Possible rent increase after renovation |

8% |

N/A |

N/A |

N/A |

Note: The UK has a £3,500 cap on landlord participation in the financing of energy retrofits in rented properties, which means that the rest of the costs are borne by the renters or the state. The vouchers for the UK’s “Green Deal” cover up to ⅔ of any chosen improvement.

The effectiveness of subsidies in reducing emissions is often assessed to be higher by engineering studies than ex-post economic analysis. This is the experience of France (Blaise and Glachant, 2019[32]) and the United States (Allcott and Greenstone, 2012[33]; Gerarden, Newell and Stavins, 2017[34]), where the Weatherisation Assistance Program provides means-tested federal aid to low-income households. This means that subsidies can have a high cost in terms of a ton of CO2 abated. Reasons include the rebound effect (better insulation leads to higher inside temperature, eating up some of the savings), or that some of the investments, such as the triple glazing of windows, has only a limited effect on emissions (Allcott and Greenstone, 2012[33]; Gerarden, Newell and Stavins, 2017[34]; Levinson, 2016[35]). Subsidies also risk funding renovation work that would have been undertaken anyway: empirical estimates put the proportion of deadweight losses at 40 to 85% (Nauleau, 2014[36]).

To become more effective, subsidy schemes and tax incentives should focus on energy efficiency gains that can be achieved through renovation. This is the case in Germany, where rules have been tightened for new dwellings from mid-2022 and gas boilers will no longer be subsidised, and recently in France (MaPrimeRénov). Moreover, renovation packages should be assessed ex-ante by independent energy performance experts and also ex-post (Haut Conseil pour le Climat (2020[37])). An independent assessment raises awareness of the benefits of improved energy performance and trust in the accuracy of the advice. The French Haut Conseil pour le Climat (2020[37]) also suggested that the renovation of the worst-performing houses (F and G), where energy efficiency gains are largest, should become mandatory. The French Parliament recently decided that French apartments of the worst-performing category G could no longer be rented from 2023 and that energy performance requirements for landlords would be further tightened.

Finally, several countries still provide subsidies or tax incentives to install fossil-fuel-fired equipment, such as gas boilers. In the European Union, for instance, gas boilers were still subsidised by 19 of the 27 EU countries in 2021 (Vikkelsø, 2021[38]). The supply disruptions following Russia’s war of aggression against Ukraine have triggered the phasing out of such incentives in several countries. Thus, in April 2022, the Czech Republic and Slovakia, countries where the share of gas for the residential sector represents around 30% of energy use (Figure 2.3), have decided to stop subsidising the installation of gas boilers. They will, instead, subsidise the installation of heat pumps and solar panels.

Addressing trade-offs and policy interactions

Deploying multiple policy instruments risks sending incoherent and conflicting signals. The large variety of policy instruments is a potential source of complexity and inefficiency. For example, subsidising the development of solar and wind electricity in Europe is costly for the public purse, but it will have no effect on emissions, at least in the short run, since the electricity sector is covered by the EU-ETS system. These subsidies simultaneously reduce the demand for allowances by the electricity sector and the emission price. This mechanically generates an equivalent increase in emissions by the other sectors covered by the ETS (waterbed effect). In short, the solar and wind subsidies accrue at least in part to the cement and steel industries (Blanchard and Tirole, 2021[10]; German Council of Economic Experts, 2019[19]).

Another example is the taxation of electricity. Many countries levy electricity excise taxes, partly to fund the installation of solar energy and wind turbines. While that promotes the installation of solar panels, excise taxes are typically poorly aligned with the carbon content of the fuel used to produce the electricity. Moreover, they increase the price of electricity for the end-user, which undercuts the installation of heat pumps running on electricity.

On the other hand, housing decarbonisation policy strategies can take advantage of complementarities across measures. For instance, energy-efficiency standards are more effective when combined with price signals. Without appropriate pricing, higher energy efficiency is likely to lead to greater energy use, the so-called “rebound effect”. There have been examples where, in the absence of energy price changes, tighter insulation standards delivered much lower cuts in energy use than anticipated (Levinson, 2016[35]). Finally, there are policy interactions across levels of government, which are reviewed in the final section.

Deploy complementary policies

Identifying key technologies for the path to net-zero emissions

Space and water heating account for 75% of residential energy consumption. Stricter building codes and improved energy performance have allowed many countries to reduce energy consumption. However, a considerable share of heating consumption relies on fossil fuels via oil and natural gas boilers, with the exceptions of New Zealand and especially Norway, which have made good progress in electrifying heating systems (Figure 2.3).

District heating

District heating systems have a high potential to decarbonise buildings as they allow for the integration of clean energy mixes (Box 2.5). The share of renewable sources and decarbonised electricity in global district heat production increases from 8% in 2020 to 35% by 2030 in the NZE scenario, which alone reduces the heat-related direct CO2 emissions of buildings by one-third (IEA, 2021[39]). Electric heat pumps, assuming low-carbon electricity production, also contribute to reducing the carbon footprint of residential buildings. In 2020, only 7% of heating needs were satisfied by heat pumps. The NZE scenario assumes that globally installed heat pumps will increase by 233% in 10 years, from 180 million in 2020 to 600 million by 2030 (IEA, 2021[21]).

Box 2.5. The revival of district heating

District heating and cooling systems are powerful tools for decarbonising buildings. Modern networks with low operating temperatures can integrate up to 100% of renewable sources to supply energy-efficient buildings. District heating and cooling is particularly important in high-density areas where decentralised solutions would not allow for the direct integration of available clean energy sources or efficient operations, for example, due to space or infrastructure constraints (IEA, 2021[39]).

Many buildings and industrial sites rely on district heating and cooling, ranging from large urban networks in Beijing, Seoul, Milan and Stockholm to smaller networks, for instance, for university and medical campuses (IEA, 2021[39]). Central Stockholm has one of Europe’s largest district heating and cooling systems, with a distribution system of 3 000km. Close to 90% of the city’s buildings are connected to the district heating network, which uses several innovative energy sources, such as excess heat and wastewater.

The district heating technology, which has been in operation since the late 1870s, has evolved over time, giving rise to improved energy efficiency, lower operating temperatures, better storage and facilitated integration of renewable energy sources, such as geothermal heat or biomass. The latter makes district heating a particularly appealing ingredient of decarbonisation strategies. Not only does it reduce the upfront investment costs when switching to new, carbon-free energy sources, but it also helps scale up renewable energy production's use and lowers CO2 abatement costs.

A fifth generation of technologies, where exchanges between the central system and the final users would occur with heat feedback loops, is currently under development. At the core of these improvements is the interaction with individual heat pumps, the latter being used as boosters to adapt to demand and take advantage of new energy sources to power these networks. For instance, since 2019, a nearby closed coal mine has been used in the Mijnwater Heerlend project in the Netherlands as a way to store heat and cool before redistributing it to the network through an ultra-low temperature (10°C-30°C) network. This new way of thinking about district heating would allow for making the most of local heat sources, such as geothermal wells, dams, aquifers and even datacentres.

Rooftop photovoltaic panels

Solar photovoltaic (PV) generation is becoming the lowest-cost renewable energy source almost everywhere. However, the installation of solar PV on rooftops often faces regulatory obstacles and political economy headwinds. Sustained efforts will be necessary to ensure the sevenfold increase of solar PV capacities from 2020 to 2030 consistent with the NZE scenario. Currently, the rooftop market only represents less than half of the worldwide solar PV energy production capacity (IEA, 2022[40]).

Energy consumption for space cooling increases rapidly with rising living standards, particularly in areas with fast population growth. In 2020, around two billion air-conditioning units were deployed worldwide, accounting for almost 16% of the building sector's final electricity consumption (IEA, 2021[41]). The NZE scenario assumes a 50% increase in the energy efficiency of air-conditioning appliances.

Building energy codes

Most countries still lack mandatory building energy codes (IEA, 2021[42]). The NZE scenario requires worldwide coverage of such requirements by 2030 and also assumes an acceleration of retrofitting to increase the share of zero-carbon-ready buildings to around 20% by 2030 (Table 2.3).

Appliances

The share of appliances and electronic equipment in households' final energy consumption has risen globally, with significant regional differences. While in the emerging-market economies, there has been a sharp increase in the share of appliances in energy use, the opposite is true for the more advanced economies, thanks to the increased efficiency of refrigerators, washing machines or dishwashers (IEA, 2021[43]). The NZE scenario assumes global coverage of today's state-of-the-art technologies so that the increase in energy efficiency offsets the projected increase in the use of appliances.

Light bulbs

In 2010, incandescent light bulbs were still the norm, although their energy efficiency was already only a fraction of the newly emerging LEDs. Since then, the energy efficiency of the latter has continued to increase, together with the widespread deployment of LEDs amid increasing affordability (IEA, 2021[44]). The success of LEDs is a prime example of how the scaling-up of energy-efficient technologies can reduce their price and pave the way for the replacement of carbon-intense technologies. As a result, the lighting energy intensity per dwelling has declined by more than 30% from 2010 to 2019 on average across the OECD.

Smart buildings

Smart buildings, seizing the opportunities delivered by digitalisation through the connectivity of appliances and the automation of electricity demand, are the foundations for future "zero carbon-ready" residential structures. The NZE scenario requires retrofit rates for buildings to be "zero-carbon ready”5 to reach about 2.5% a year by 2030 in the advanced economies and 2% a year by 2030 in the emerging-market economies.

Smart grids

A major driver of decarbonisation in the housing sector is electrification coupled with carbon-free energy production. Nevertheless, some of the less carbon-intensive energy sources are intermittent and non-dispatchable, which poses challenges. Smart grid systems can help, but investments will have to triple during 2020-30, accounting for around 40% of all necessary capital investments in NZE scenario.

Table 2.3. Key milestones in the building sector on the road to net-zero

|

2020 |

2030 |

2050 |

|

|---|---|---|---|

|

Buildings |

|||

|

Share of existing buildings retrofitted to the zero-carbon-ready level |

<1% |

20% |

>85% |

|

Share of zero-carbon-ready new building construction |

5% |

100% |

100% |

|

Heating and cooling |

|

|

|

|

Stock of heat pumps (million units) |

180 |

600 |

1,800 |

|

Million dwellings using solar thermal |

250 |

400 |

1,200 |

|

Avoided residential energy demand from behaviour |

n.a. |

12% |

14% |

|

Appliances and lighting |

|||

|

Appliances: unit energy consumption (index 2020=100) |

100 |

75 |

60 |

|

Lighting: share of LED in sales |

50% |

100% |

100% |

|

Energy access |

|

|

|

|

Population with access to electricity (billion people) |

7.0 |

8.5 |

9.7 |

|

Population with access to clean cooking (billion people) |

5.1 |

8.5 |

9.7 |

|

Energy infrastructure in buildings |

|

|

|

|

Distributed solar PV generation (TWh) |

320 |

2,200 |

7,500 |

|

EV private chargers (million units) |

270 |

1,400 |

3,500 |

Source: “Net Zero by 2050 – A Roadmap for the Global Energy Sector”, (IEA, 2020[11]).

Supporting innovation in clean technologies

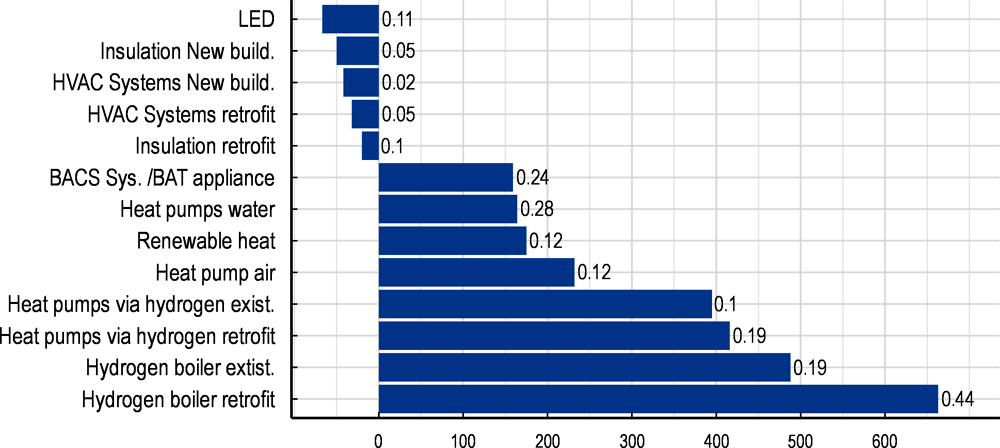

While the emission reductions in 2030 mostly rely on available technologies, those under development today account for almost one-half of the emission reductions needed in 2050, according to the NZE scenario (Figure 2.11). Striving for decarbonisation coupled with the increasing demand for energy, particularly in buildings, inevitably calls for continued investments in innovative technologies to bring buildings-related CO2 emissions on track to net-zero. Yet, after a sharp rise in patenting of low-carbon energy innovations in end-use technologies of buildings from 2000 to 2013, patenting activity has declined more recently (IEA, 2021[45]). Abatement costs are still too high for many technologies, especially those still at the demonstration or prototype development stage.

Figure 2.11. Clean technology innovations are critical for decarbonising buildings

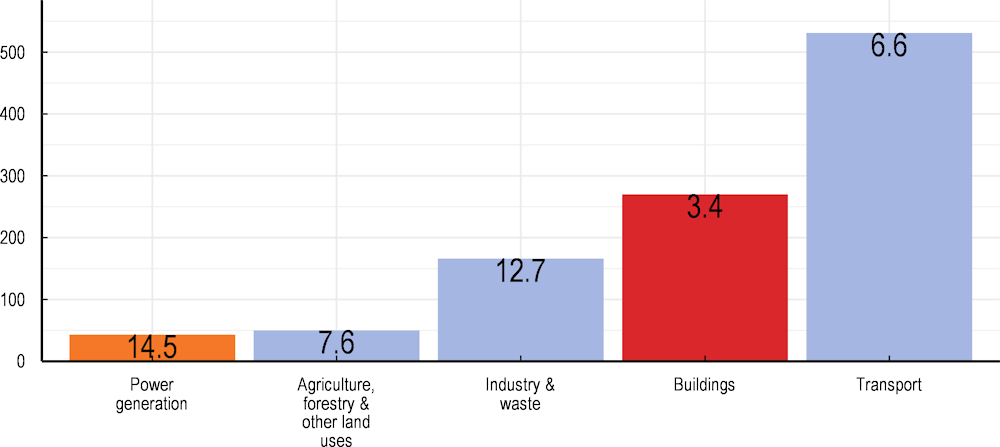

R&D investments in carbon-free technologies for the building sector not only make these technologies available but also help to make them more cost-efficient. An important benchmark for calibrating and evaluating policies that aim at reducing GHG emissions is to create standardised measures of the monetary costs of reducing a ton of CO2 for the deployment of alternative technologies (Blanchard and Tirole, 2021[10]). While there is considerable uncertainty around estimates of abatement costs, some indicate that direct emissions from the building sector are costly to abate (Figure 2.12).

Innovation is also important from the vantage point of reducing the abatement costs associated with the decarbonisation of buildings. Abatement costs are assessed to be high in the sector because of needed electrification and the installation of equipment to improve energy use, consumption and storage (Figure 2.13). Indirect emissions from power generation, on the other hand, are less costly to abate under appropriate carbon pricing and available technologies.

Figure 2.12. Abatement costs are high in the buildings sector

Note: The annotated numbers denote the abatement potential (in Giga tons of CO2 equivalent) for each sector.

Source: Goldman Sachs International (2020[46]).

Recent evidence shows the great potential of innovative solutions to reduce installation and maintenance costs. Goldman Sachs International (2020[46]) estimate that from 2019 to 2020 alone, the flattening of the CO2 abatement cost curves reduced the costs of abating 50% of global CO2 emissions by 20% and the costs of decreasing 70% of global CO2 emissions even by 30%. The challenge for direct emissions in the building sector is even more significant as abating the bulk of the emissions would require a carbon tax higher than $150 per ton of CO2, although recent developments have lowered that estimate (Figure 2.13).

Figure 2.13. There is little low-hanging fruit to reduce direct emissions from buildings

Note: The annotated numbers denote the abatement potential (in Giga tons of CO2 equivalent) for each sector. Abatement cost curves are based on technology and price assumption from 2020.

Source: Goldman Sachs International (2020[46]).

High upfront costs remain an obstacle to the renovation of electricity and heating systems in residential buildings. Subsidies for research and installing heat pumps or hydrogen boilers would accelerate the switch to clean technologies, create economies of scale, and spur competition and innovation. The resulting reduction in installation costs for clean technologies would reduce the energy transition's social costs and flatten the required forward path of carbon taxes.

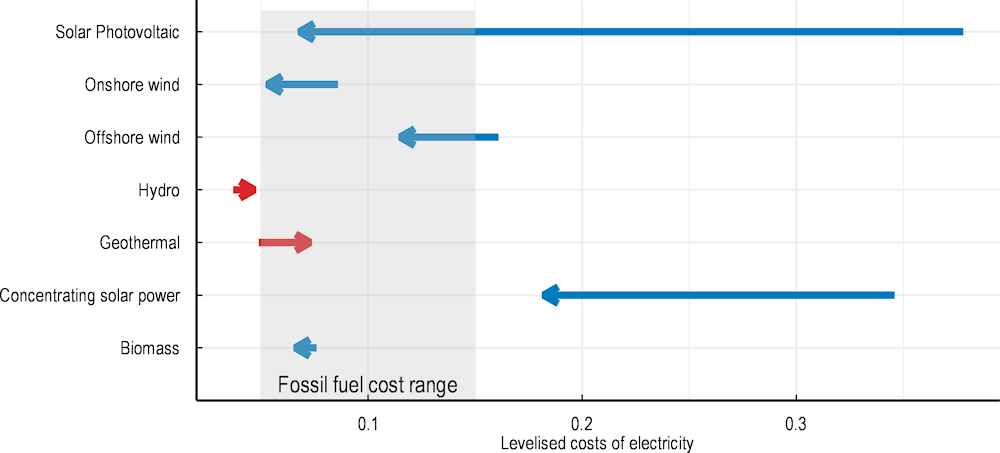

While not the most cost-efficient policy tool, feed-in tariffs and feed-in premia can encourage investment in low-carbon electricity generation technology and create positive externalities. Power generators receive a fixed price known in advance, reducing or eliminating uncertainty for investors. Reducing climate policy uncertainty can significantly increase firms’ investment activity, in particular in capital-intensive sectors that require long and stable planning trajectories for their investments. Solar PV is an example of the cost-reduction effect of innovation and scalability (Figure 2.14).

Public support is also important in the area of vocational education to ensure that enough workers are equipped with the skills necessary for housing decarbonisation. Retrofits and low-carbon construction, two labour-intensive activities, require specific skills.

Figure 2.14. Innovation has cut installation costs for many renewables including rooftop photovoltaic

Note: The arrow signals a change in levelised costs of electricity from 2010 to 2019. Blue (red) lines denote energy sources which installation costs have declined (increased) during the period 2010-2019. The grey area represents the range of costs of fossil fuels.

Source: (IEA, 2020[47]).

Design policies that limit adverse impacts on low-income households

Carbon taxes offer options to mitigate adverse distributional effects

Decarbonising housing involves costs, which can have adverse consequences for low-income households. Policy options are available to alleviate adverse distributional side effects from the taxation of housing CO2 emissions. In terms of design, taxes can be levied on direct emissions, thus pricing the carbon content of heating fuels and leaving the pricing of CO2 emissions from electricity to taxes or permit schemes applied to power generators. This has the advantage of reducing the regressive impact of electricity taxation while creating incentives to reduce CO2 emissions at the power generation stage. At the same time, the revenue from taxation can be used to finance transfers to adversely affected households. This consideration, taken together with the observation that impacts differ along other dimensions than income, such as the type of housing, suggests allowing room for space-based differentiation in compensation strategies.

Tradeable permits have similar effects to taxes

If auctioned, tradeable emission permits for housing emissions would have very similar distributional effects as residential carbon taxation. As carbon taxes, auctioned permits would have regressive effects before factoring in their large revenue potential, which offers ample scope to compensate adversely affected low-income households. One difference with taxes is that the price volatility inherent to emission trading systems entails a degree of cost uncertainty which would be particularly harmful to low-income households whose economic conditions are particularly unstable (Cournède, Garda and Ziemann, 2015[48]).

Costs of energy-efficiency standards weigh particularly on low-income households

Strict energy-efficiency standards on buildings and appliances have implications for costs, which are likely to weigh particularly on low-income households. A case can therefore be made for providing bridging loans and subsidies, as the subsequent annual energy savings can be low compared with the cost of renovation. An ex-post assessment of a programme undertaken in France over 2000-13 shows annual energy-bill reductions of EUR 8 per EUR 1 000 invested (Blaise and Glachant, 2019[32]). Mandatory renovations can work against social inclusion by contributing to so-called “gentrification” if they effectively push out low-income renters as rents increase in response to the improvement work to levels that they cannot afford (Anguelovski et al., 2019[49]).

Subsidies require appropriate targeting

Subsidies for emission reductions, even if beneficial to low-income owners living in high-emission-per-square meter dwellings, can bring large benefits to high-income owners. Countries could consider income-based eligibility criteria as well as the provision of refundable tax credits to overcome such concerns. Low-income owners may also struggle to finance up-front investments and may be sensitive to the time delay between the investment and reception of the tax benefit as well as the practical difficulties of living in a house under heavy renovation. The MaPrimeRénov programme in France, for instance, offers higher grants for retrofitting projects performed by lower-income households (up to EUR 10 000 per project) and an advance payment to undertake the renovations for the lowest-income households (OECD, 2022[16]). A 64% share of the demand came from lower-income households, a major improvement in terms of targeting compared to the previous scheme (Cour des Comptes, 2021[50]).

Information provision through mandates to certify the energy performance of dwellings implies small direct effects stemming from the certification cost. These costs may raise liquidity issues for low-income owners if they are required outside transactions or inheritance, an adverse effect that can be offset with targeted subsidies. The more targeted subsidies are, however, the greater will be the degree of administrative complexity.

Mobilise all levels of government

Housing and environmental policies are highly decentralised

Well-functioning governance arrangements will be needed to align housing decarbonisation policies and implementation across all levels of government. Both environmental and housing policies are highly decentralised in OECD countries (Box 2.6). While emission goals are set by national governments in international (e.g., Paris Agreement) or supranational fora (e.g., European Green Deal), environmental policy is usually carried out on a shared basis between national, regional and local governments. This is also the case for housing policies, which have an even more prominent local component.

Table 2.4 illustrates some examples of responsibility attribution for relevant policy areas regarding three policy functions: regulation, implementation and financing.

Box 2.6. The importance of cities and regions for decarbonising buildings

The share of emissions from buildings in total emissions is highest in large metropolitan regions and lowest in remote regions (OECD, 2022[51]). In addition, this share increases dramatically in large cities. CO2 emissions from buildings in London and New York account for 78% and 70% of total emissions, respectively (London City Hall, 2022[52]; NYC Mayor’s office of Climate and Environmental Justice, 2022[53])

Buildings within a country differ across regions. Climatic conditions affect the energy performance of buildings and also the property owner’s motivation for energy efficiency improvements. Also, the policy environment varies across cities and regions. Each local government has different capacities and policy priorities, including housing affordability, energy poverty and local employment (OECD, 2022[51]). Also, the building stock and locally available heating sources differ across cities and regions. For instance, cities that are close to data centres or industry sites can profit from residual heat and invest in district heating infrastructure.

Energy efficiency improvements in buildings bring benefits, including local job creation, better health outcomes because of improved indoor air quality, and lower energy bills. The OECD – EU Committee of the Regions (CoR) city survey revealed that 89% of cities and regions valued “Reduced cost of paying the energy bill for low-income households” as the most important benefit of energy efficiency improvements in buildings.

Collaboration across levels of government is fundamental in implementing effective measures. Policy tools such as the OECD checklist for Public Action to Decarbonise Buildings in Cities and Regions can help national and sub-national policymakers to align national and local actions towards building decarbonisation (OECD, 2022[51]).

Table 2.4. Responsibility allocation across government levels

|

Spain |

Canada |

France |

United States |

|

|---|---|---|---|---|

|

Carbon pricing (tax, ETS) |

Supranational and regional regulation and implementation |

Provincial regulation and implementation, with federal backstop |

Supranational and national regulation and implementation |

State-level regulation and implementation |

|

Housing planning and building standards |

Supranational, national and regional regulation, regional and local implementation and funded by all the layers |

Federal and provincial regulation, with local implementation |

Supranational and national regulation, with regional and local implementation and funded by all the layers Central government |

Federal and state (some also local) regulation and state (or local) implementation, funded by all the layers |

|

Energy efficiency (e.g. isolation, heating systems) |

Federal, provincial and local regulation, implementation and finance |

|||

|

Energy performance information (labelling) |

Supranational and national legislation, with regional implementation |

Federal and provincial regulation, with local implementation |

Supranational and national legislation, with national implementation |

State and/or local regulation and implementation |

Source: National, regional and local institutions’ online resources regarding law, planning and information.

Competencies in relevant fields are often shared vertically, even in unitary countries. While carbon pricing is usually centralised, with the exceptions of Canada, Spain and the United States, for housing planning and building standards (despite basic central regulation), legislation and implementation are usually in the hands of lower tiers of government. With respect to energy performance certification, regulation is often the responsibility of central governments, while sub-national entities usually carry out implementation. Finally, the largest contrast between federal (or heavily decentralised) and unitary countries is related to the governance of energy efficiency policies. While sub-national governments in decentralised countries can elaborate laws in this field, in unitary countries, lower tiers of government are limited to implementing centrally set legislation. A common practice is for sub-national governments to complement national policies with more ambitious targets or by adding additional funding.

Many policy instruments are under the purview of sub-national governments

Social housing is an important policy tool to address affordability and energy poverty challenges. Social housing comprises more than 28 million dwellings and about 6% of the total housing stock in OECD and non-OECD EU countries. There are significant differences across countries in the definition, size, scope, target population and type of provider of social housing. For instance, social rental housing makes up less than 10% of the total dwelling stock in most OECD and EU countries but more than 20% of the total stock in Austria, Denmark and the Netherlands. Social housing dwellings are often owned by sub-national governments, especially municipalities.

Regulation is often set centrally to ensure minimum standards among the different sub-national jurisdictions. In the absence of minimum nationwide standards, there is a risk of predatory competition among jurisdictions that could result in sub-optimal environmental outcomes, including in the housing sector. Carbon pricing in Canada is a clear example of the latter since the federal government established a minimum threshold (known as the federal backstop) that all provinces must reach (Snoddon and Tombe, 2019[54]). Provinces can still decide whether they use carbon taxes or emission trading systems to reach the yardstick and have room to determine the price of carbon emissions if it is higher than the federal backstop. Similar minimum standard-setting may be established (or strengthened in case it already exists) for buildings, electrification or energy savings. Importantly, the process to set them should consider sub-national governments’ views to facilitate their engagement and minimise risks of politicisation of environmental policy.

In addition, financial incentives can be used to encourage sub-national governments to align their priorities with nationwide decarbonisation strategies. This is the case, for example, of Ecological Fiscal Transfers (Busch et al., 2021[55]), which the central government pays to sub-national entities based on a multi-variate index of environmental policies, such as enhanced air quality and/or higher shares of land covered by natural protection areas. By doing so, the incentives to improve local government environmental performance can be boosted (Dougherty and Montes, 2022[56]). Inter-governmental policy alignment can also be achieved by making inter-governmental grants conditional on targets set in national or sectoral decarbonisation strategies. Furthermore, financial support for sub-national entities in priority areas would help prevent the creation of unfunded mandates, which arise when the central government creates new responsibilities for the sub-national governments based on its own policy agenda without providing them with the financial support necessary to implement the policy.

Finally, alternative non-regulatory mechanisms, such as soft-power tools, may be useful. Central governments could use their coordination capacity to support experimentation and pilot programmes of new innovative projects and may help sub-national governments learn from best practices used in other jurisdictions. Such policy laboratory and yardstick competition dynamics are characteristic of federations and one of the traditionally used arguments to support decentralisation.

Targets and climate action plans can be set at the sub-central level

Many cities have introduced targets and climate action plans. Currently, 142 cities worldwide have introduced Climate Action Plans compatible with the Paris Agreement target, with 118 of these cities located in the OECD (C40, 2022[57]). Table 2.5 illustrates some of these city-level policies. In a survey of OECD cities, 80% stated that they have energy efficiency goals that are more ambitious than that of the central government (OECD, 2021[58]). For example, in 2012, the city of Copenhagen set the aim in its Climate Plan to achieve carbon neutrality by 2025, 25 years ahead of the Danish national commitment (City of Copenhagen, 2020[59]). Notably, the city aimed to foster the energy efficiency of the existing building stock by encouraging the retrofitting of private homes and maintaining the renovation programme for social housing. For newly constructed dwellings, energy efficiency certificates should ensure the construction of energy-efficient new buildings and provide quantitative indicators to track CO2 emission reduction progress. Even if more ambitious than national strategies, city-level action plans can pose inter-governmental coordination challenges, especially when national and local targets differ and reflect different implementation strategies.

Table 2.5. Urban policies aimed at promoting energy efficiency in buildings

|

Copenhagen |

New York |

Vienna |

Paris |

Tokyo |

|

|---|---|---|---|---|---|

|

Taxes |

Emission trading scheme for buildings planned |

Emission trading scheme for buildings (industrial and commercial sectors only) |

|||

|

Subsidies and tax incentives |

“One-stop-shop” energy-saving packages to commercial and service companies Tax deduction for retrofit program abandoned in 2022 |

Low- or no-interest loans to finance energy efficiency improvements (Green Housing and Preservation Program) Green Roof Tax Abatement program Property tax exemptions for green buildings (LEED-certified) |

“Thewosan” support scheme: subsidies for new buildings achieving a low energy or passive-house-standard Additional subsidies for the installation of heat pumps, gas condensing boilers and access to district heating |

Subsidies for retrofits provided by Anah (L'Agence nationale de l'habitat) Tax credit for retrofits No-interest Eco Loan (Éco-prêt à taux zéro) Reduced VAT of 5.5% |

National and local subsidies for specific retrofits (e.g., Minato Ward, subsidy for window glazing) |

|

Standards and regulations |

Building regulations (revised in 2016) with mandatory energy efficiency requirements |

Proposed mandatory energy use limits for existing buildings Performance-based stretch-energy codes for new construction |

Low energy standards Passive-house-standards (voluntary) |

Mandatory energy efficiency standards for all buildings |

No strict standards; targets for zero emission house and zero emission buildings |

|

Provision of information (labels) |

Energy performance certificates |

Building Energy Efficiency Rating Labels |

Energy performance certificates |

Energy performance certificates Effinergie (low energy) labels for new construction |

Tenant Rating and Disclosure Program to reflect energy use (mandatory) Carbon Certification Program (voluntary) |

Source: City climate action plans (City of Copenhagen, 2020[59]), (The City of New York, 2019[60]), (Magistrat der Stadt Wien, 2022[61]), (City of Paris, 2020[62]), (Tokyo Metropolitan Government, 2019[63]).