Colombia has mainstreamed financial instruments for the creative economy extensively across government. Colombia’s direct public financing mechanisms build on good practice and reinforce the creative economy strategy. Subnational governments benefit from specific tax instruments and are the direct funders of cultural heritage, infrastructure and cultural activities. State-owned banks have grown their role. Financial instruments have been rapidly adjusted to support the creative economy through the COVID-19 crisis. A financial ecosystem is maturing around CoCrea, a Public Private Partnership (PPP), which is developing its role as a network coordinator and tax credit emitter.

Culture and the Creative Economy in Colombia

4. Colombia’s public financial ecosystem for the creative economy

Abstract

In Brief

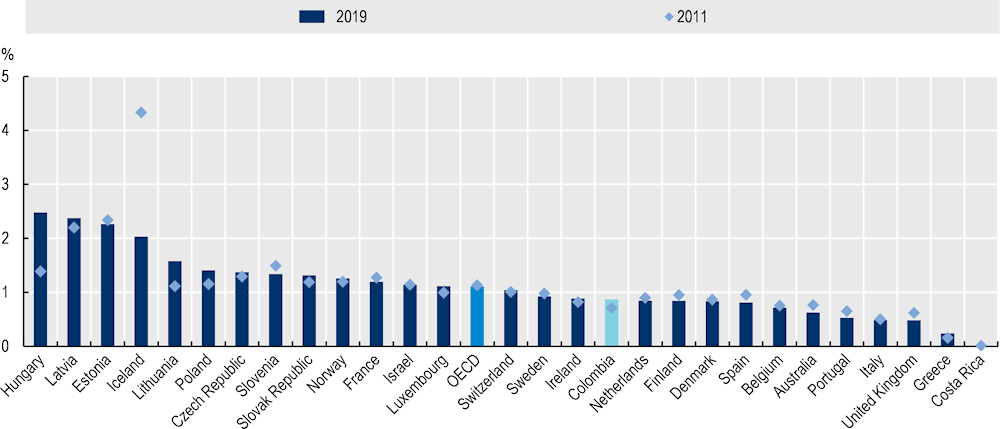

Between 2011 and 2019, spending on cultural services rose from 0.7% to 0.9% of total government spending in Colombia, while this figure stagnated on average in the OECD. This increase has brought the share of national government spending on cultural services closer to OECD average of 1.1%.

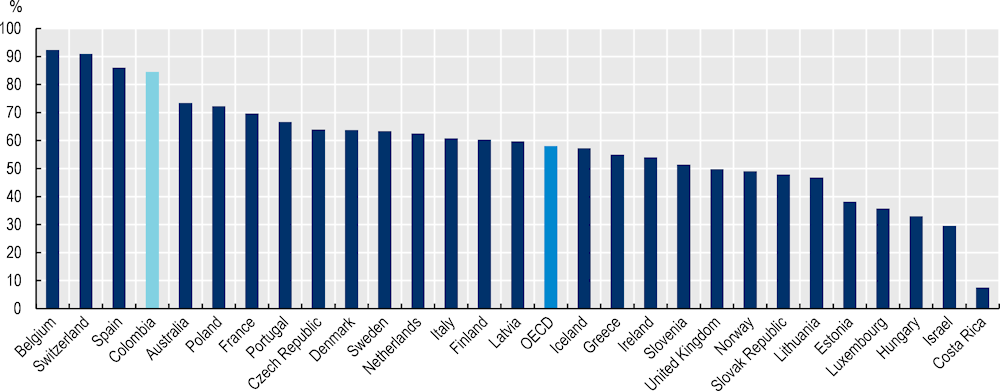

Colombia is among OECD countries with the highest share of spending on culture at the subnational level. In 2019, subnational governments in Colombia accounted for over 84% of total government spending on cultural services in the country (compared to OECD average of 58%). Diverse instruments support local government expenditure, such as national contributions, taxes, levies and local sources.

The Ministry of Culture’s Concertation and Stimulus competitive programmes provide grant-based funding for Colombian cultural and creative actors. Local government and sectoral grant programmes complement core funding provided by these programmes.

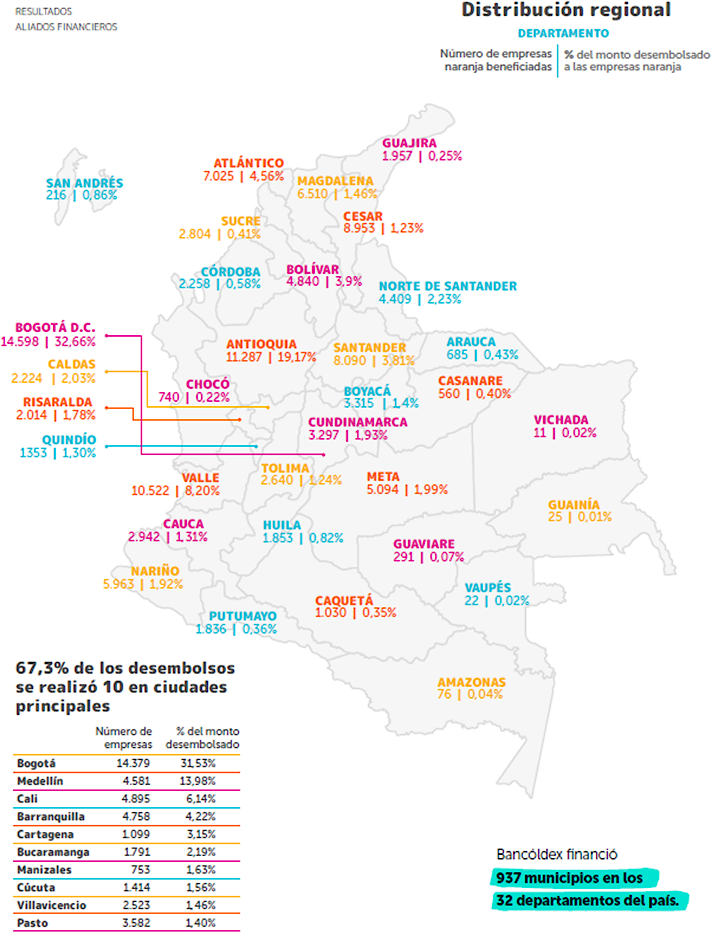

The National Council of the Orange Economy (CNEN) has helped mainstream financing instruments for culture across ministries. Some examples of creative economy support outside the Ministry of Culture include the National Training Service’s (SENA) Entrepreneurship Fund (Fondo Emprender), or the Ministry of Commerce, Industry and Tourism’s iNNpulsa. A state-owned business development bank, Bancóldex, finances a host of tailored credit lines for first-tier banks. Between August 2018 and December 2021, the public development bank invested over COP 3 500 billion in the creative economy, reaching nearly 120 000 firms.

In response to COVID-19, Colombia introduced ReactivARTE, a set of measures to re-launch the creative economy, including Foncultura, a new fund for direct financing of culture.

A multifaceted tax incentive system has developed for the creative economy. A tax incentive for investors (deducción en la renta) offers a deduction in an investors’ tax base equal to 165% of the value of investments made. Other tax incentives include a five-year income tax exemption (renta exenta) for creative economy entrepreneurs, run by the Ministry of Culture. CINA, run jointly by the Ministry of Culture and the Proimágenes public entity, works as a negotiable tax certificate for audio-visual investment. Colombia Crea Talento (CoCrea) is a public-private intermediary between actors and investors that approves projects for deduction in investors’ tax base (deducción en la renta).

The following policy consideration emerges as the financial ecosystem develops:

Tailored instruments have grown to fill a financing need, though technical capacity building instruments that could help a greater share of disadvantaged entrepreneurs benefit. Those projects without established investors face challenges to attract capital. Longer-term or targeted capacity building may help this group, such as through accompanying specific projects through the CoCrea process, or reinforcing coordination between the host of organisations providing capacity building to sectoral actors.

4.1. Financial ecosystems to support cultural and creative sectors

Cultural and creative businesses have difficulties in accessing finance for a number of reasons (OECD, 2022[1]). Firstly, businesses in cultural and creative sectors produce value which is largely intangible in nature, meaning that they typically have fewer tangible resources to secure against debt-based financing and are viewed as high risk by lenders and investors. Secondly, many cultural and creative businesses are unaware of the opportunities for public financing, or the full range of public support which may be offered by their country or region. This information gap significantly impedes businesses and organisations from taking full advantage of the financing opportunities available to them. Thirdly, those working in cultural and creative sectors often lack the skills, knowledge and competencies to produce robust business plans necessary to secure investment from the private sector. Similarly, securing grants, donations or subsidies from the public sector often requires significant time investment and skill. Finally, the vast majority of cultural and creative businesses are SMEs or micro enterprises, which further reduces the likelihood of such businesses having the expertise or resources to secure financing.

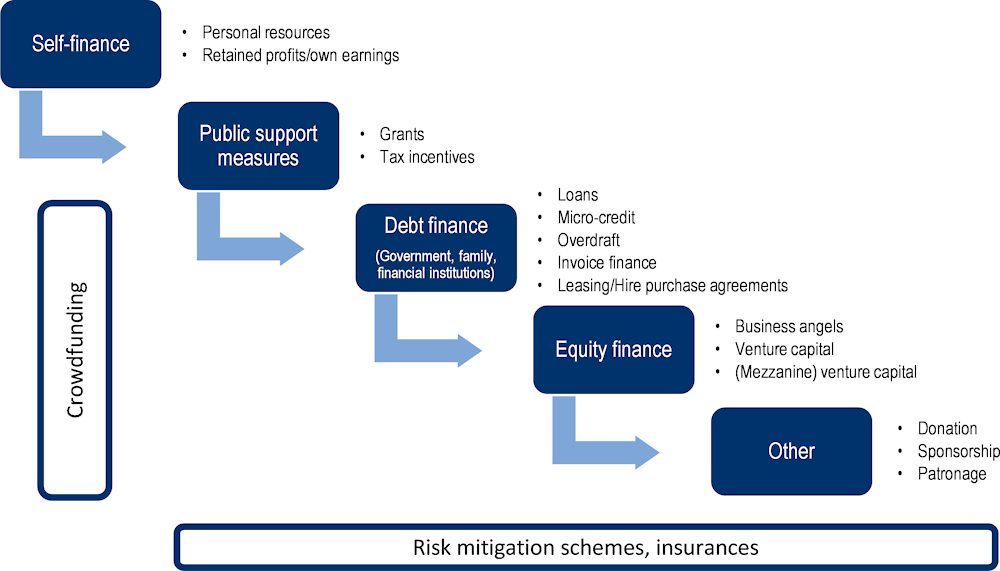

The diversity of cultural and creative sectors is reflected in the variety of potential funding sources within the financial ecosystem for the creative economy (OECD, 2022[1]). Indeed, cultural and creative sectors include non-for-profit (e.g. libraries, museums, cultural centres) and for-profit (e.g. design and architectural companies) organisations, institutions and firms with diverse business models, cost structures and financing needs. Moreover, cultural and creative organisations and firms increasingly adapt mixed business models and can pursue both for-profit and non-for-profit objectives, reaching out to diverse sources to finance their activities. Hence, a more complex ecosystem of financial support for cultural and creative sectors has developed across OECD countries, encompassing public, private and philanthropy funding and investment. Governments are transforming their participation from that of direct support, although it remains important, towards a more mixed model, with greater intermediation with the private sector and philanthropy. Partnerships and alliances (public-private, public-public and public-civic partnerships) are at the core of the emergence of new financial ecosystems for cultural and creative sectors.

Cultural and creative sectors rely on diverse sources of funding, from self-finance to public and private finance (see Figure 4.1). Broadly speaking, there are five main sources of finance for cultural and creative businesses and organisations:

1. Self-finance which for many start-ups and SMEs may include personal investment, and for more established organisations is likely to be the result of reinvestment of existing profits.

2. Public sector finance, in the form of either direct grants or in a range of potential tax incentives.

3. Debt finance, including both secured (where some form of collateral is offered if the loan is not repaid) and unsecured (where no collateral is offered) loan arrangements.

4. Equity finance, in which money is exchanged for part-ownership or shares in the company.

5. Sponsorship and patronage, where money is freely offered for communication, charitable or philanthropic reasons.

From this typology a number of key actors can be identified: the firms and organisations themselves, governments (both national and sub-national), financial institutions, business angels and venture capital investors and audiences, publics and communities.

Figure 4.1. Typology of CCS funding sources

Source: OMC (2016[2]), Towards More Efficient Financial Ecosystems, http://dx.doi.org/10.2766/59318.

4.2. Direct public financing for the creative economy in Colombia

4.2.1. Public spending on cultural services is growing in Colombia

Colombia’s financial ecosystem for the creative economy follows the growth of cultural policy in the country. Echoing the model of continental European countries, Colombian law recognises the state’s primary role in valorising the nation’s cultural heritage and supporting cultural processes, projects and activities (Republic of Colombia, 1997[3]; OECD, 2016[4]). Since 1991, multiple laws, decrees and administrative decisions have built the public financial infrastructure for the creative economy, positioning the Ministry of Culture as a central actor. However, Orange Economy polices have, to a certain extent, shifted the focus of cultural policy in Colombia towards the incorporation of more market-centred approaches. While cultural policy continues to support arts and heritage through direct grants and funding, a slew of new approaches to driving investment and market based growth of the creative economy has been adopted. By the end of 2021, the Ministry of Culture’s budget reached COP 615 billion, among the highest amount of resources assigned to the cultural portfolio in Colombia (Ministry of Culture, 2020[5]).

Colombian law allocates state revenues to operate cultural services across different levels of government. The 1991 Constitution, Law 60 from 1993 and other legislations define the base of public financing for culture in the country and the division of responsibilities in culture between different levels of government. Set out by the 1991 Constitution, and updated through laws in 2001 and 2007, the General System of Participation (Sistema General de Participaciones - SGP) sets out central tax revenue disbursed by the State to subnational governments, including for culture. The Procultura levy (Estampilla ProCultura) introduced in 1997, reformed in 2001 and 2003, allows local governments to create a local tax at their own initiative of between 0.5% and 2% to raise funds for cultural services. Local governments use Procultura levy revenue to fund cultural production, cultural activities, infrastructure and training (Republic of Colombia, 1997[3]). Other laws have complemented funding for specific cultural services. In 2010, for example, a public library system reform in Colombia updated funding sources for libraries throughout the country, including state resources and tax incentives (Republic of Colombia, 2010[6]).

A source of financing for culture also includes resources raised from the taxation of cellular phone services through the National Consumption Tax on Cellular Phones (Impuesto Nacional al Consumo Telefonía Móvil - INC). In 2012, Law 1607 dedicated 4% of taxes raised on cell phone services to social investment, including 25% of which are earmarked for municipal, district and regional (departamento) governments to use on cultural development and sport1 (Republic of Colombia, 2012[7]). Compared to the sectoral levies, cell phone tax revenues in Colombia can support a host of cultural services, including financing for the country’s national library system, the development of culture and artistic activities throughout the country and heritage policies. However, driven by rising use of data on smartphones, the relative importance of this source of financing has decreased as a result of declining use of cellular phone lines.

Specific levies also play a major role in reinforcing public revenues for culture in Colombia. In 2003, Law 814 on cinematography created a para-fiscal levy on different value chain actors, including those exhibiting cinematographic productions, distributors and feature film producers, amounting to 8.5%, 8.5% and 5% respectively on defined sales (Republic of Colombia, 2003[8]). Revenue raised is channelled to cinematographic producers through grant-based mechanisms (discussed below). In 2011, Law 1493 on Public Performances introduced a similar para-fiscal levy of 10% on the total value of ticketing sales for defined public performances (Republic of Colombia, 2011[9]). The law benefits from a strong territorial dimension, as revenues are collected by the Ministry of Culture, but disbursed directly back to those districts or municipalities where ticket sales occurred. Subnational governments use public performance revenues for public performance infrastructure, such as concert halls, as well as to support the production and circulation of performing arts. The reform also ushered in a tax relief mechanism of 100% on cultural infrastructure built for the performing arts.

Government spending on cultural services in Colombia has increased over the last decade. Tax mechanisms have raised new revenue streams for government support to cultural services. OECD data, based on national accounts, shows relative spending on cultural services in Colombia rose by 0.2 percentage points between 2011 and 2019, increasing from 0.7% of total government spending to 0.9%, compared to a net stagnation over this period of the OECD average (Figure 4.2).2 Among 27 OECD countries, Colombia ranks as the country with the fourth-highest relative increase in government spending on cultural services between 2011 and 2019, potentially reflecting the budgetary attention brought to this policy area through new tax mechanisms.

The increase in public spending has reduced the gap between Colombia and the OECD average for government spending on culture. In 2019, the share of government spending on cultural services in Colombia (0.9%) remained 0.2 percentage points below the OECD average of 1.1%. Government spending in this category, however, was higher than some advanced economies such as Spain (0.8%), Italy (0.5%) or the United Kingdom (0.5%).

Figure 4.2. Cultural services as a share of total government spending, 2011 and 2019

Note: Data for Israel in 2011 refers to 2013, data for Costa Rica in 2019 refers to 2017, and data for Costa Rica in 2011 refers to 2012.

Source: Drawn from (OECD, 2022[1]). Originally from OECD (2022[10]), National Accounts Statistics - Government expenditure by function (COFOG), http://dx.doi.org/10.1787/na-data-en.

Subnational governments play a primary role in administering the resources from these tax instruments. Colombia’s subnational governments have significant responsibilities for culture and the creative economy, such as support for artistic activities, valorising cultural heritage and making municipal culture strategies. The state’s funding structure for cultural services reflects this division of responsibilities. The state disburses a share of tax revenues, public budgets and special levies, discussed above, to subnational governments, while subnational governments can also draw on own revenues, such as those generated by the ProCultura levy (Estampilla ProCultura). The Orange Economy policy has also involved Colombia’s public territorial development bank, Findeter, in the financing of cultural infrastructure projects through loans to local governments (Box 4.1).

Colombia is among OECD countries with the highest relative share of spending on culture at the subnational level. In 2019, 84% of total government spending on cultural services in Colombia came from subnational governments (Figure 4.3). This represents the fourth-highest share in OECD countries for which data was available, and is 26 percentage points higher than the OECD average of 58%. This high share of cultural services spending at the subnational level may reflect the broader decentralisation of governmental structures in the country, and the tax instruments subnational governments can harness to finance their cultural spending. In a 2021 study, the Inter-American Development Bank suggested that the total culture budgets of subnational governments in Colombia represented 4.7 times the budget of the Ministry of Culture, compared to a proportion of 3.7 in Brazil, further suggesting the importance of subnational spending in Colombia (IDB, 2021[11]).

The share of subnational government spending on culture as a proportion of total government spending in this field has also risen over the last decade. The proportion of subnational government spending as a share of total government spending rose by 24 percentage points in the last decade, from 60% in 2010 to over 84% in 2019 (Figure 4.3). The increase may reflect the role of a new levies, such as the Public Performance Law of 2011, which has increased subnational revenues available to spend on culture.

Figure 4.3. Subnational government spending on cultural services as a share of total government spending on cultural services, 2019

Note: Israel data for 2010 refers to 2013; Data for Costa Rica in 2010 refers to 2012, and data for 2019 refers to 2017.

Source: Drawn from (OECD, 2022[1]). Originally from National Accounts Statistics - Government expenditure by function (COFOG), http://dx.doi.org/10.1787/na-data-en.

Box 4.1. Findeter, Colombia’s Territorial Development Bank, supports subnational governments with specific financing needs for creative economy infrastructure

The bank complements local government financing for culture

In 1989, Colombia created a public regional development bank (Findeter). The bank’s shareholders include the state, which holds 92.53% of shares, and thirty of the country’s regions (departamentos), holding 7.47% of shares. Amongst a host of instruments, Findeter functions as a second-tier credit-granting institution. The government identified Findeter as a national actor with strong potential to fill financing needs faced by the creative economy in Colombia.

Findeter’s role in the creative economy reflects its growing role in Colombia’s national development policy (PND). For example, the PND designates Findeter as an organisation to finance higher education infrastructure or the integration of green technology in Colombia’s industry. Findeter is traditionally active in infrastructure investment such as providing credit for energy sector investment. As part the country’s push for Orange Economy development, Findeter has opened new tailored credit lines for subnational governments to the develop or maintain cultural infrastructure. For example, in 2017, the government and Findeter established the “Reactiva Colombia” line, which includes a volley of funding for cultural and social infrastructure. The funding line started with over EUR 280 million (COP 1 200 billion) in potential credit for clients, a sum which has since grown.

Findeter also helped undertake tailored mapping studies of the creative economy in selected Colombia cities (see note below) Studies generated actionable quantitative and qualitative information on the sectors. For example, questionnaires were sent to local creative economy actors asking targeted questions on challenges, funding, market access and other subjects. Analytical findings were presented in a set of reports, which also led to recommended actions to help resolve local bottlenecks.

Note: Mappings conducted in Bucaramanga, Barranquilla, Manizales, Pereira, Cali, Pasto, Santa Marta, Cartagena, Medellín and Valledupar, Villavicencio, Ibagué, Popayán, Armenia, Cúcuta and Neiva.

Source: (DNP, 2018[12]), Plan Nacional de Desarrollo 2018 – 2022’; (La República, 2018[13]), Gobierno lanzó el programa 'Reactiva Colombia' para apoyar economía regional, https://www.larepublica.co/economia/gobierno-lanzo-proyecto-reactiva-colombia-para-reactivar-economia-regional-2771688.

4.2.2. The Colombian Ministry of Culture runs dedicated grant-based programmes for creative economy producers

The Ministry of Culture provides grant-based funding to cultural producers. Such direct state funding for cultural production often takes the form of selective applications for public grants. Primarily, this includes funding provided directly by the Ministry of Culture to creative economy producers. Since the country’s General Law on Culture was passed in 1997, the Ministry of Culture has run a cultural funding programme, the National Stimulus Programme (PNE).3 The PNE functions through Colombia’s National Cultural System (SNCu). The Fund grants three types of stimuli, including awards for cultural processes, recognition for cultural work and scholarships for developing or finishing a specific cultural project. In 2021, the PNE made COP 18 600 million available, as part of over COP 91 000 million in stimuli for the 2018-2022 period (Semana, 2021[14]). This type of competitive application echoes models introduced elsewhere in the OECD, such as Chile’s Cultural Funds (Fondos de Cultura), which have a sectoral focus with specific conditions or objectives (IDB, 2021[11]; Ministry of Cultures, Arts and Heritage of Chile, 2022[15]).

The PNE grants funds to Colombian artists, creators, researchers and cultural managers in three funding areas. First, a funding line supports training activities to promote artistic and cultural excellence, knowledge gathering and the protection and promotion of cultural heritage. Second, a funding stream is dedicated to supporting research and creation. Last, the PNE channels funds to strengthen circuits that distribute cultural and creative goods and services. When the annual call for application opens, candidates submit applications that are reviewed by the Ministry of Culture or relevant entities (Ministry of Culture, 2021[16]). In 2022, the PNE introduced a novel focus on supporting youth creative labs and value chain integration with non-cultural sectors. The PNE also benefits from a special focus on vulnerable groups, such as ethnic minorities, women, victims of the armed conflict in Colombia, cultural creators with special needs and displaced people.

The Ministry of Culture’s National Concertation Programme (PNC) also funds cultural projects directly. The Concertation programme also works through a competitive application process, but the PNC is only open to legal persons. Like the PNE, the grant-making programme works through the country’s SNCu, Colombia’s network of public and private actors in the field of culture. In 2022, the National University of Colombia led the selection programme. In 2022, applications were accepted along eight thematic categories, for a total sum of COP 49 900 million. In the 2018-2022 period, the PNC’s total budget amounted to COP 480 000 million. Compared to PNE grants, Concertation programme awards focus more specifically on cultural projects.4 The Concertation programme also benefits from a differentiated approach, in which vulnerable territories are given priority in funding selection. Finally, local governments further support cultural producers through complementary funding to the Concertation or the PNE. Cities such as Bogotá and Medellín, for example, have created their own grant programmes. Specific sectoral grant programmes, discussed below, also supplement funding provided across culture and the creative economy by the PNE and Concertation programmes.

4.2.3. A dedicated public body provides funding for Colombia’s film production

The Colombian film industry is supported by public funding for the creative economy. In 1997, the Colombian government created Colombia’s mixed fund for film development (Fondo Mixto de Promoción Cinematográfica), Proimágenes Colombia. Proimágenes is a non-profit public corporation. Colombia’s Film Law 814, passed in 2003, enabled the expansion of financial infrastructure for the cinematographic sector. Since 2003, Proimágenes benefits from a unique funding structure based on supplementary tax collection on the film industry to administer the corporation’s major film fund, the Fund for Cinematographic Development (FDC) (Republic of Colombia, 2003[17]). Other OECD countries have also chosen to create dedicated public bodies for cinematographic development. In Mexico, for example, the Mexican Institute for Cinematography (IMCINE) runs grant programmes and tax incentives for cinematographic development in the country.

The FDC is a competitive grant mechanism for domestic film production. The National Arts and Culture Council in Cinematography (CNACC) set the strategic directions of the FDC. The FDC finances not only film production, but also training, promotion, film heritage promotion, research, dissemination and access.

Proimágenes Colombia also supports funding for foreign film production in Colombia, reinforcing the country’s attractiveness for creative economy investments. These attraction initiatives are run by the Colombian Film Commission (Comisión Fílmica Colombiana), a joint initiative between Proimágenes, the Ministry of Culture and the Ministry of Commerce, Industry and Tourism. Proimágenes also administers the Colombian Film Fund (FFC). The FFC was created in 2012 through Law 1556 as a subsidy for foreign film production in Colombia (Proimágenes Colombia, n.d.[18]). The FFC reimburses 40% of the value of expenses made in Colombia and 20% of expenses incurred in accommodation, food and transport. In 2020, under the Orange Economy policy, Decree 474 created the audio-visual investment certificates (CINA) to further encourage foreign investment in audio-visual production in Colombia. Similarly to many OECD countries (see Box 4.2), the CINA, managed by Proimagenes, offers incentives to foreign producers who invest resources in the country for production or post-production. The nominal value of the certificate is equal to 35% of the value of investments made, and is applied to income tax after calculation.5

Box 4.2. Tax incentives to support film and TV in selected OECD countries and regions

Australia offers a range of tax incentives to support film and TV sectors, including a 30% tax rebate for non-feature projects; a 40% rebate for feature projects for Australian productions and Official Co-productions; a 30% tax rebate for productions who undertake post, digital and visual effects in Australia; and a 16.5% tax rebate on Qualifying Australian Production Expenditure for international productions filming in Australia.

California, USA, offers a 25% transferable tax credit for independent films and a 20% non-transferable tax credit for feature films and TV series that are made in California. It also uses tax credits as an incentive to move existing TV production into the region by offering a 25% non-transferable tax credit for TV series which had been filmed outside California, but relocate to the region.

France’s Tax Rebate for International Production (TRIP) supports non-French projects that are completely or partly made in France. The amount allocated comprises 30% or 40% of the film eligible expenditures incurred in France, and caps at EUR 30 million per project. The foreign producer needs to contract with a French company to handle the shoot in France or/and the making of the animation / VFX shots via a production service agreement.

In Germany, the German Federal Film Fund offers a grant of up to 20% of approved costs for feature, documentary or animated films which spend at least 25% of their production budget in Germany. Germany also offers grants and incentives for TV production in Germany, or with German partners for international TV productions.

New Zealand offers a screen production grant, which covers both film and TV production. It offers a 20% rebate for international productions filming in the country and a 40% rebate on qualifying expenditure for domestic productions.

Sources: (OECD, 2022[19]), Culture and the Creative Economy in Emilia Romagna, Italy, 10.1787/20794797; (ausfilm, n.d.[20]), Screen Tax Incentives, https://www.ausfilm.com.au/incentives/; (California Film Commission, 2022[21]), Application, https://film.ca.gov/tax-credit/application/; (German Federal Film Fund, 2022[22]), Welcome to the German Federal Film Fund (DFFF), https://dfff-ffa.de/en.html; (New Zealand Ministry of Business, Innovation & Employment, 2019[23]), New Zealand Screen Production Grant, https://www.mbie.govt.nz/business-and-employment/economic-development/screen-sector/new-zealand-screen-production-grant/; (French Film Commission, n.d.[24]), film France, https://www.filmfrance.net/v2/gb/home.cfm?choixmenu=taxrebate.

Proimágenes has also benefited from an increase in resources. In addition to the resources it receives from its dedicated tax levy, the Ministry of Culture added COP 7 000 million to the FDC under the Orange Economy policy. In 2020, FDC revenue was negatively affected by the temporary closure of the venue-based sector due to social distancing measures. In response, the Ministry of Culture added a sum equal to 47% of the FDC's budget in 2021.6

Direct public funding for the creative economy in Colombia has grown to the benefit of artistic and creative creation. Both funds provided by the Ministry of Culture and Proimágenes Colombia are based on competitive applications. These programmes are common across Latin America, such as the National Culture Fund in Brazil (1991), the Culture Fund in Chile (1992), or the Competition-based Funds for Culture in Uruguay (2020) (IDB, 2021[11]). Direct funding is a key part of the creative economy strategy in order to stimulate creative production. In the Southern Cone, the IDB has identified that countries such as Uruguay and Argentina have complemented their grant-making programmes with direct funds based on fixed criteria and expert assessment, outside of a competitive application process.

4.2.4. Direct creative economy funding has also grown through links with funding mechanisms from across government

Public policies have strengthened direct public funding through links with non-traditional sources. Colombia’s innovative policy links also reflect institutional reforms, such as the creation of the National Council of the Orange Economy (CNEN), and the growing strategic importance given to the creative economy across government. Access to new public funding sources reflects Colombia’s efforts to mainstream support to the creative economy across government ministries and entities. Few countries in the OECD benefit from a legally mandated inter-ministerial coordination body for culture. Initial research suggests the Orange Economy policy has had a particularly strong effect on resources devoted to culture in public institutions outside the Ministry of Culture, which are estimated to have increased resources devoted to culture five-fold in 2019 alone (IDB, 2021[11]).

Links with tourism have allowed the creative economy to benefit from funding mechanisms within the Ministry of Commerce, Industry and Tourism. In 2021, the Ministry released a Cultural Tourism Policy jointly with the Ministry of Culture, setting a complementary policy framework to develop cultural tourism in the country (Ministry of Commerce, Industry and Tourism, 2021[25]). The new policy introduces a broad set of actions to drive cultural tourism, including its environmental sustainability, competitiveness and capacity to include local communities. This collaboration echoes a new focus brought by the Ministry’s National Tourism Fund (FONTUR) for creative economy projects. FONTUR funding has been made available to local cultural infrastructure projects when proposals present the potential to increase tourism, such as through the restoration of cultural heritage sites. FONTUR advisors held roundtable discussions to review projects with municipalities, who are the administrators of FONTUR-funded projects. For example, in 2021, FONTUR funds helped the Chinchiná municipality in the Caldas department complete the first phase of a heritage restoration project of a historic coffee route.7 OECD countries promote such routes through dedicated programmes and certification (see the example of European Cultural Routes Box 4.3) which could be particularly useful to drive tourism to smaller municipalities and more remote regions.

Box 4.3. Cultural Routes of the Council of Europe Programme

The Cultural Routes programme, launched by the Council of Europe in 1987, promotes travel and discovery of the diverse heritage of Europe. Over 45 Cultural Routes cover a range of different themes, from architecture and landscape to religious influences, from gastronomy and intangible heritage to the major figures of European art, music and literature.

The networks implement activities on five main priority fields: co-operation in research and development; enhancement of memory, history and European heritage; cultural and educational exchanges for young Europeans; contemporary cultural and artistic practice; cultural tourism and sustainable cultural development. Through its programme, the Council of Europe offers a model for transnational cultural and tourism management and allows synergies between national, regional and local authorities and a wide range of associations and socio-economic actors.

The certification “Cultural Route of the Council of Europe” is a guarantee of excellence. In 2010, the Enlarged Partial Agreement on Cultural Routes of the Council of Europe (EPA) was established in order to strengthen the programme politically and financially. Cultural Routes are evaluated regularly by the EPA and are certified by the Council of Europe based on the following criteria:

involve a theme that is representative of European values and common to at least three countries in Europe;

be the subject of transnational, multidisciplinary scientific research;

enhance European memory, history and heritage and contribute to interpretation of Europe’s present-day diversity;

support cultural and educational exchanges for young people;

develop exemplary and innovative projects in the field of cultural tourism and sustainable cultural development;

develop tourist products and services aimed at different groups.

Source: (Council of Europe, 2022[26]), Cultural Routes of the Council of Europe programme.

The Ministry of Commerce, Industry and Tourism’s funds have also been mobilised beyond infrastructure to finance broader creative economy policy objectives. For example, FONTUR was mobilised to support tourism-linked competitiveness, such as through knowledge exchange and training events for the gastronomic sector. For example, after an official consultation yielded an agreement with the Movement of Indigenous Authorities of South Western Colombia (Movimiento de Autoridades Indígenas del Sur Occidente – AISO), the Ministry of Commerce, Industry and Tourism has worked with the Misak indigenous community to develop ecotourism and training courses in cultural tourism.8 FONTUR is one amongst multiple examples of Ministry mobilisation in favour of the creative economy. Indeed, the Ministry of Commerce, Industry and Tourism has been particularly active in integrating the creative economy across its portfolio, including ties to its entrepreneurship development bank, Bancóldex, and a host of innovation and business support agencies. These programmes are described in more detail in sections 4.2.6, 4.3.4 and 4.3.5.

The Ministry of Science, Technology and Innovation has also contributed to new sources of funding for cultural content, drawing on its expertise with innovation policy. The “Create Digital” (Crea Digital) programme with the Ministry of Culture, for example, introduced a new grant-based programme for creative production. The programme is reserved for enterprises registered in Colombia. Through this programme, the ministries deliver 58 grants to projects related to the cultural industries and the development of software and digital content. Specifically, Create Digital provides grants in complementary categories (including a category related to ethnic minorities), both for the development and execution of digital animation, video games and transmedia content. Between 2018 and 2021, 123 creators benefited from the programme, benefiting from COP 9 948 million. The Create Digital programme complements existing PNE and PNC competitive processes.

Box 4.4. Colombia anchors its creative economy policy internationally, both through the exchange of knowledge and practices and the management of economic resources for the cultural and creative industries

The Ministry of Culture engages internationally to strengthen its public policies in the field of culture, both by receiving and investing in technical cooperation and financial resources. Between 2018 and 2022, the Ministry's cooperation strategy managed technical and financial resources representing COP 62 394 million, of which 75% went to projects related to the creative economy.

One of the commitments and lines of work implemented to promote the Ministry of Culture's strategic initiatives and projects has been coordination with multilateral and regional integration organisations. Since 2019, Colombia, headed by the Ministry of Culture, held the pro tempore presidency of the Technical Group on Culture of the Pacific Alliance, the Inter-American Committee on Culture of the OAS and the Andean Community. It also promoted spaces for the exchange of experiences, knowledge and the development of consensus on issues such as the circulation of cultural goods and services, the safeguarding and protection of heritage, territorial development and the strengthening of cultural and creative industries, with organisations such as Mercosur, the Ibero-American General Secretariat, the IDB, the CAF and multiple UN Agencies, such as IOM, UNFPA, UNDP, WIPO, UNWOMEN and UNCTAD.

Colombia also created the International School of the Orange Economy to share best practices and public policies implemented around the Orange Economy with Latin American and international partners. The School is composed of two major initiatives. First, the Great Forum of Arts, Culture, Creativity and Technology (GFACCT). GFACCT is a space to foster strategic alliances and promote dialogue and consensus around the creative economy, present results and progress of public policies and private initiatives at the global level and advance the protection and promotion of the diversity of cultural expressions and the sustainable development goals. Second, the Open, Massive and Online Course (MOOC) Colombia Crea Valor, aims to provide concepts and practical tools for the strengthening and development of the capacities of cultural and creative organisations, public entities, governors, officials, agents of the ecosystem and the general public, both at the national and international level.

The Ministry of Culture has been particularly engaged with the UN system. Collaboration with UNESCO is carried out through a number of mechanisms, such as the governance instruments of UNESCO's cultural conventions. Colombia has made progress in implementing the 2005 UNESCO Convention on the Protection and Promotion of the Diversity of Cultural Expressions, to which it acceded in 2013. Colombia also hosted the 2019 intergovernmental committee of the UNESCO Convention for the Safeguarding of Intangible Cultural Heritage, the first time a Latin American and Caribbean country hosted the committee. Colombia also collaborated with UNDP, in projects such as the methodological strengthening of the Orange Entrepreneurship Route, for COP 1 005 million.

Colombia has also participated in bilateral cooperation around the creative economy. The Ministry of Culture helped organise binational cabinet meetings with peer countries such as Ecuador and Peru, and joint commissions for the transfer of knowledge on specific topics. Under this cooperation scheme, joint initiatives have been undertaken with Chile, Guatemala, Uruguay, Paraguay, Mexico and Panama, among other countries, on issues related to institutional strengthening in the field of cultural and creative economy. Likewise, the Ministry has been engaged in high-level dialogues with the United States, approving bilateral projects to promote the creative economy through innovation and creativity as a source of integration and inclusion.

Source: (Ministry of Culture, 2022[28]), Cooperación internacional para la economía creativa en Colombia, 2022.

Financing programmes have arisen across Ministries, mobilising new public resources for the creative economy’s different needs. The crosscutting dimension of the Orange Economy policy is described in further detail in Chapter 2. These collaborations have yielded new financial opportunities, such as the Ministry of Finance and Public Credit’s leverage of a territorial development bank, Findeter, to fund new infrastructure projects in Colombian territories (Box 4.1). The Ministry of Labour has also been particularly active in the creative economy through mobilisation of the National Training Service (SENA). Beyond its training offer, SENA also mobilised its Entrepreneurship Fund to provide capital to prospective creative economy entrepreneurs (see 4.2.6).

Colombia has also sought to mobilise resources from natural resource extraction for creative economy development. Colombia’s General System of Royalties (SGR) redistributes financial resources from mineral and natural resource attraction. Some of the specific objectives of the SGR include distributing resource to low income parts of the population, promoting regional competiveness and investing in socio-economic development in those territories where resource extraction occurs (DNP, n.d.[27]). To target a greater share of these resources towards creative economy development, the National Planning Department (DNP) tailored instructions for SGR funding to the Orange Economy policy. To help local governments, the Ministry of Culture also benefits from a dedicated royalties technical advisory group to liaise with subnational governments in their SGR applications. SGR funds are best adapted to cultural infrastructure projects. Between August 2018 and December 2021, 153 projects were approved by the SGR, amounting to a total investment of COP 523 857 trillion in 27 departments.9

4.2.5. In response to COVID-19, Colombia developed new financing instruments for culture, including through a reactivation law

The COVID-19 pandemic created an unprecedented shock to the creative economy across the OECD. The OECD has estimated that the creative economy has been amongst the sectors most affected by the pandemic, along with sectors such as tourism and food services and accommodation (OECD, 2020[29]). Across the OECD, support measures were put in place by many national and local governments to help support cultural and creative sectors through the pandemic (see Box 4.5).

In Colombia, support measures for the creative economy had to take into account the large share of informal workers in this sector. The Decree 475 (2020) introduced the Beneficios Económicos Periódicos (BEPS Naranja) programme, supporting the social security of creative workers (see Chapter 2) (Ministry of Colombia, 2020[30]). The decree also reoriented revenue originally destined to the performing arts to support the broader sector. The government also introduced flexibility into the calendars of artists benefiting from the Ministry of Culture’s Stimulus and Concertation programmes. Colombia also introduced targeted social protection programmes, reflecting an additional mobilisation of support based on creative workers’ specific socio-economic conditions. For example, this included the Solidarity Revenue Programme (Programa Ingreso Solidario) aimed at informal creative workers or those who cannot benefit from broader economic support, amounting to COP 4000 000 per household in its 2022 cycle (Department of Social Prosperity, 2022[31]).

The country also introduced programmes to support access to culture and sustain demand for creative production. In this field, the #MuseosEnCasa y #TuCasaesColombia campaigns provided a virtual offering for Colombia’s museums (Ministry of Culture, 2021[16]). The campaigns were also mobilised for the long-term objective of formalisation and institutionalisation of the country’s museum sector by encouraging those museums not registered for the Nacional Colombian Museum Information Museum System (SIMCO) to register. Training and education in the arts were also made virtual. For instance, the Music Plan (Plan de Música) was mobilised to help over 1 000 municipal music schools shift their courses on-line during the public health emergency.

At the end of 2020, the country built on initial support measures through ReactivARTE, a set of measures to re-activate the creative economy in the country. Introduced through Law 2070 (2020), one of ReactivARTE’s main policy innovations involved the creation of Foncultura, a new fund designed to disburse funds to the creative economy (Republic of Colombia, 2020[32]). CoCrea, the country’s public-private entity responsible for issuing tax relief certificates for creative economy projects, is responsible for Foncultura and its administration. Foncultura constitutes a notable addition to existing creative economy policies and is designed to cover multiple policy areas, echoing the Orange Economy’s cross-sectoral approach. Moreover, at least half of resources coming from Foncultura must be disbursed to Colombian municipalities with lower socio-economic indicators, known as category 4, 5 and 6 municipalities (Republic of Colombia, 2020[32]). Foncultura significantly expands the role of CoCrea (discussed below), expanding its role as a direct financer of cultural projects. Law 2070 (2020) defines the field in which Foncultura finances initiatives and projects as the following:

Those established in original legislation on cultural activity, Law 397 (1997);

Orange Economy projects, as defined in Law 1837 (2017);

Research, identification, social appropriation, protection, management, safeguard and cultural sustainability or the country’s cultural heritage;

Cultural and creative tourism and infrastructure;

Training and stimulus initiatives for creators, cultural producers and artists in need of resources;

Audio-visual projects as defined by Law 814 (2003);

Training, building capacity and accompanying creators, cultural producers and artists.

ReactivARTE also introduced a new tax relief measure. Since 2020, actors listed under the 27 activities with ISIC codes fully associated with orange economy activities benefit from a 4% reduction in withholding tax rate on fees, commissions and services (Republic of Colombia, 2020[32]). Upon passing ReactivARTE, the National Council of the Orange Economy (CNEN) announced the reactivation plan for culture would mobilise a total of COP 6.5 trillion in 2021 (Ministry of Culture, 2021[33]).

Box 4.5. COVID-19 related funding initiatives for cultural and creative sectors across the OECD

During 2020 and 2021, governments across the world implemented a range of policy initiatives to support cultural and creative sectors through the global pandemic. The table below shows the type of public funding offered by national governments to cultural and creative sectors as of September 2020. While a number of other types of support have been offered (e.g. employment support, deferral of payments and easing administrative procedures, etc.) and a number of regional administrations within these countries have also provided additional funding in these areas, the table demonstrates the range and scale of public investment from national governments around the world.

Table 4.1. Public funding measures to support cultural and creative sectors in response to COVID-19, as of September 2020

|

Country |

Grants and subsidies for cultural sectors |

Grants and subsidies for individual artists |

Compensation of losses |

Loan provision and guarantee |

Investment incentives |

|---|---|---|---|---|---|

|

Australia |

x |

x |

x |

x |

|

|

Austria |

x |

x |

x |

||

|

Belgium |

x |

||||

|

Canada |

x |

x |

|||

|

Chile |

x |

x |

|||

|

China |

|||||

|

Czech Republic |

x |

x |

x |

||

|

Denmark |

x |

x |

x |

||

|

Estonia |

x |

x |

x |

||

|

Finland |

x |

x |

x |

||

|

France |

x |

x |

x |

x |

|

|

Germany |

x |

x |

x |

||

|

Greece |

x |

||||

|

Hungary |

x |

||||

|

Ireland |

x |

x |

x |

||

|

Italy |

x |

x |

x |

x |

|

|

Japan |

x |

x |

x |

||

|

Korea |

x |

x |

x |

x |

|

|

Latvia |

x |

x |

x |

||

|

Lithuania |

x |

x |

|||

|

Luxembourg |

x |

x |

x |

||

|

Mexico |

x |

||||

|

Netherlands |

x |

x |

x |

x |

|

|

New Zealand |

x |

x |

x |

x |

|

|

Norway |

x |

||||

|

Poland |

x |

||||

|

Portugal |

x |

x |

x |

||

|

Slovak Republic |

x |

||||

|

Spain |

x |

x |

|||

|

Sweden |

x |

x |

|||

|

Switzerland |

x |

x |

x |

x |

|

|

United Kingdom |

x |

x |

x |

||

|

United States |

x |

x |

x |

Source: OECD (2020[29]), Culture shock: COVID-19 and the cultural and creative sectors”, https://read.oecd-ilibrary.org/view/?ref=135_135961-nenh9f2w7a&title=Culture-shock-COVID-19-and-the-cultural-and-creative-sectors.

4.2.6. Public agencies support entrepreneurs with seed funding, marketing and internationalisation assistance

Colombia’s entrepreneurship policies reflect the country’s transversal policy approach to support the creative economy. Colombia’s entrepreneurship policies are led by public entities such as iNNpulsa, a business innovation and entrepreneurship agency that works in tandem with the Ministry of Commerce, Industry and Tourism. Founded in 2012, iNNpulsa helps promising initiatives incubate and grow through financing and support. For example, for companies with a strong digital footprint, iNNpulsa collaborates with Starter Company to connect start-ups with investment, sources of financing and strategic visibility. iNNpulsa also runs Digital Entrepreneurship Transformation Centres (Centros de Transformación Digital Empresarial - CTDE) with the Ministry of Commerce, Industry and Tourism as well as the Ministry of Information Technology and Communications. CTDE helps microenterprises and SMEs integrate strategic technologies into their operations to raise their productivity and competitiveness. Colombia has driven iNNpulsa to build on these packages to develop tailored programmes for the creative economy, reflecting the Orange Economy’s transversal policy approach.

Colombia’s creative economy benefits from a comprehensive financing package for eight iNNpulsa programmes, known as “iNNpulso Naranja”. The programme was created to channel seed funding, incubation, acceleration and other support to creative economy start-ups and firms specifically. The effort has introduced a group of new creative economy tailored business support programmes in Colombia, such as the Orange Village (Aldea Naranja), which has helped creative economy entrepreneurs access strategic advice and links to financial capital (iNNpulsa, 2019[34]). The Orange Capital (Capital Naranja) programmes provide non-refundable seed capital to creative economy start-ups. The Mega-I Orange (Mega-I Naranja) targets medium and large companies to help them identify new market opportunities in the creative economy. Other Orange Economy policy actors, such as Bancóldex have provided technical support to implement multiple initiatives launched by the Ministry of Commerce, Industry and Tourism. iNNpulsa’s diverse programming for the creative economy build the sector’s capacity while providing direct financial services.

iNNpulsa has also been a focal point for innovation in creative economy finance. The Orange Road (Ruta Naranja) programme, for example, works with the state’s Sacúdete centres, which provide health, culture, sport, technology and entrepreneurship services. As part of the Orange Road, iNNpulsa teams travel to deliver training, consultancy and technical assistance for the development of creative economy projects. This practical way of bringing available strategic financing and business growth information to local communities expands the reach of creative economy support. The Ministry of Culture also collaborated with iNNpulsa and the Colombia Value Fund (Bolsa de Valores de Colombia - BVC) to launch a national crowdfunding platform for the creative economy (Box 4.6). The Orange Cluster programme (Clúster Naranja) helps local actors identify potential creative economy clusters in their region.

iNNpulsa cultural programming has also included a group of initiatives to organise entrepreneurship camps and workshops. The agency organises Colombia's Emprendetón and Heroes Fest (Héroes Fest) programmes, national workshops that mobilise speakers, mentors and networking to support business ventures across industries. iNNpulsa has devoted specific workshops to Colombia’s creative economy entrepreneurs within these annual programmes, with financial support from partners such as regional government or universities. Likewise, since 2019, the Emprendetón workshop devoted awareness raising and networking activities specifically to the creative economy.

The Ministry of Commerce, Industry and Tourism adapted programmes of its export support agency, Productive Colombia (Colombia Productiva), to the creative economy. For example, Colombia Productiva’s Buy from Us (Compra Lo Nuestro) programme provides digital marketing for creative economy firms. Colombia Productiva also directed its Productivity Factories (Fábricas de Productividad) programme to creative economy companies to drive their productivity, working with local actors such as Chambers of Commerce (Colombia Productiva, 2021[35]). These programmes complement existing seed funding programmes from the Ministry of Culture, such as Colombia’s Film Development Fund (FDC) or the Ministry of Culture’s Incentives Portfolio.

Colombia also mobilises existing creative economy programmes to support social economy enterprises in the sector. The Ministry of Culture’s Programa Nacional de Concertación Cultural includes dedicated funds to strengthen arts, cultural heritage and cultural and creative industries. The concertation programme supports those initiatives that seek to democratise access to different cultural goods, services and manifestations. Access to SENA training centres is also open to social entrepreneurs in the creative economy. Specific programmes for social enterprises in culture could not only reinforce the sector’s role in growing the creative economy, but also the opportunity to increase its social impact.

National Training Service (SENA) programmes have also been oriented to creative economy entrepreneurship. SENA’s Entrepreneurship Fund (Fondo Emprender) is a seed capital funding programme created in 2002 as part of Law 789 on employment and social protection. Before its additional emphasis on the creative economy, this SENA fund worked as an independent account exclusively destined to those attending or having attended state-recognised education or training, including SENA training courses (SENA, n.d.[36]). SENA accompanies applicants through the enterprise development process, including through registration and advice, business plan evaluation, funding and business development. As part of the Orange Economy strategy, Colombia reoriented part of the Fund’s resources specifically to Orange Economy initiatives. SENA’s rural entrepreneurship programme (Emprende Rural - SER), has also been adapted to and promoted amongst interested potential creative economy entrepreneurs.

Box 4.6. Crowdfunding in the creative economy

Crowdfunding presents an alternative form of financing for creative economy firms in Colombia

Crowdfunding raises money for creative economy projects through the collection of small or medium-sized contributions from different individuals. Crowdfunding reduces the number of intermediaries between a project and its financiers. Different crowdfunding models have arisen, including:

Equity-based in which investors contribute money for a share of equity in the project;

Lending-based in which investors provide debt-financing;

Reward-based and donation-based in which capital is offered on a philanthropic basis of for a non-monetary reward.

Crowdfunding offers multiple benefits for creative economy projects. This instrument can raise capital for creative economy projects which may struggle to raise find financing through intermediary institutions such as banks or public lending institutions. Indeed, funding for cultural and creative sectors across the OECD is often based on specific projects calling for smaller financial packages, rather than traditional firm-wide financing needs. Crowdfunding is also highly adaptable to the different value chain positions of creative economy firms, and can provide signalling value for those firms seeking traditional investment following or alongside crowdfunded capital. Crowdfunding, however, can also pose risks when competitors exploit publicly available ideas on crowdfunding platforms without adequate intellectual protection.

Colombia’s Orange Economy policy has identified the opportunities brought by crowdfunding. As such, Colombia helped develop a crowdfunding pilot for creative economy projects. The Ministry of Culture has worked with the Colombia Value Fund (Bolsa de Valores de Colombia – BVC) to connect creative economy firms to a2censo, a crowdfunding platform developed with iNNpulsa and BVC for SMEs across sectors. a2censo helps firms connect with investors and market their initiatives to a broader audience. In Colombia, crowdfunding may offer a particularly promising alternative financing mechanism due to the share of microenterprises and SME that may not meet the requirements of traditional lending institutions due to their lower capacity levels. Initial financial engagement with crowdfunding platforms may help Colombia’s creative firms build confidence with traditional lending institutions.

Across OECD countries, however, little data is available on the success of crowdfunding models in the creative economy. A study published in 2017 based on 75 000 crowdfunding campaigns in the EU suggests that around half reached their financing objectives. The study also reveals money raised for the sampled campaigns was also concentrated in donation-oriented contributions, rather than equity or debt finance-based giving.

Source: (OECD, 2022[1]), The Culture Fix: Creative People, Places and Industries, https://www.oecd.org/publications/the-culture-fix-991bb520-en.htm; (De Voldere and Zeqo, 2017[37]), Crowdfunding: Reshaping the crowd’s engagement in culture, Luxembourg: Publications Office of the European Union, 10.2766/011282.

4.3. Indirect public financing and support for private financing of the creative economy

4.3.1. Tax incentives have grown as a source of financing for entrepreneurial activity in the creative economy

Throughout OECD countries, growing awareness of the economic benefits of culture have contributed to diversifying the financial landscape. Governments have taken measures to diversify sources of funding. Tax incentives and debt finance, for example, have become more prominent as public policy seeks to support the sector in new ways, recognising its economic potential alongside its social impact (Figure 4.1). In Colombia, the growth of the Orange Economy strategy has ushered a host of new indirect financing mechanisms to support the sector’s financial sustainability and growth. Tax incentives have been at the forefront of strategy to draw private investment to creative economy.

Colombia grants income tax relief to creative economy companies to simulate entrepreneurship. In 2018, the government introduced new tax relief measures for creative economy companies, established by Law 1943 (Republic of Colombia, 2018[38])10. Those tax incentives aimed at the creative economy complement existing instruments developed to promote cultural activity on a sectoral basis. In 1993, for example, legislation introduced a tax incentive for book and literature editors, who can benefit from a twenty-year exemption from income and other forms of tax (Republic of Colombia, 1993[39]).

In 2020, Colombia introduced an exemption from income tax for creative economy companies to stimulate entrepreneurship in this area. Passed respectively in 2020 and 2021, decrees 286 and 1843 regulate the “income tax exemption” incentive (rentas exentas) for creative economy enterprises. The incentive functions as a five-year exemption from income tax for those firms fully included in the Orange Economy as part of 27 selected ISIC codes. Companies operating under these 27 codes receive this incentive upon meeting specific conditions.

Conditions have been tailored to best target a group of core creative economy entrepreneurs. Companies must create at least three jobs and invest a minimum of COP 151 million in their company. For companies to benefit from the tax measure, the Ministry of Culture also evaluates the financial sustainability of companies based on applications submitted by firms. In 2021, the Social Investment Law (2021) loosened certain conditions for creative economy tax benefits by removing minimum investment conditions for creative economy enterprises (Republic of Colombia, 2021[40]). The Social Investment Law of 2021 also expanded the reach of the Works for Taxes (Obras por Impuestos) incentive, which allowed for tax payment through public investment works in municipalities under Territorially-focused Development Programmes, PDETs (Programas de Desarrollo con Enfoque Territorial). Decree 1147 extended this mechanism to Orange Development Areas (ADN), the country’s system of creative districts (see Chapter 3). The regulation of this extension is in process at time of writing.

Tax relief is also granted to individuals who partake in cultural heritage protection and conservation. Owners of officially recognised Cultural Interest Goods (Bien de Interés Cultural - BIC), including real estate, can reduce 100% of spending made as part of Special (heritage) Protection Plans (PES) and cultural conservation activities. This approach reflects recent efforts to incentivise private owners of historical property and real estate to invest in cultural conservation efforts.

Under the Orange Economy policy, Colombia complemented its entrepreneurship-focused incentives with an investor incentives. Decrees 697 and 624, in 2020 and 2022 respectively, regulate the investment tax relief for investments or donations made in cultural and creative projects (Deducción en la renta por inversiones o donaciones a proyectos culturales y creativos). The National Development Plan (PND) ushered in this tax deduction on an investor’s taxable base corresponding to 165% of the value invested or donated for the taxable period in which the investment is made. The deduction is applied before tax calculations. The incentive is endowed through certificates, known as Certificates of Investment and Donation (CID), issued by the private public partnership corporation that acts as an intermediary between investors and projects, Colombia Crea Talento (CoCrea), discussed below. The tax incentive also applies to investments made within the country’s creative districts, ADNs. Incentives introduced across sectors complement the sector-specific cinematographic investment incentive introduced under the Orange Economy policy, CINA, discussed in 4.2.3.

4.3.2. A private-public body, CoCrea, coordinates the application programme for tax deductions for creative economy investment

Colombia Crea Talento (CoCrea) is an intermediary platform between entrepreneurs and investors that provides tax incentives for specific creative economy projects. The government created CoCrea as a non-profit public corporation with the mission of strengthening the ecosystem of creative economy actors across Colombia (Presidency of Colombia, 2020[41]). The Ministry of Culture, the Ministry of Commerce, Industry and Tourism, along with the Chamber of Commerce of Bogotá and Comfama, the family equalisation fund of Antioquia, launched CoCrea in 2020 (CoCrea, 2020[42]). Decree 697 (2020) allows CoCrea to review projects submitted through its application process and endows a special tax reduction certificate, the Creative Economy Investment or Donation Certificates (CID), to approved projects (Presidency of Colombia, 2020[43]). The CIDs allow those who invest in creative economy projects to benefit from the investor’s tax incentive discussed in 4.3.1. Projects that can apply include those in the following areas, meant to cover a wide range of actors across the creative economy’s value chains:

Orange Economy projects, including:

Arts and heritage;

Cultural industries;

Creative industries;

New media and content software;

Orange Development Zones (ADNs);

Special Safeguard Plans (Planes Especiales de Salvaguardia) for cultural manifestations registered as immaterial heritage;

Public performance and scenic art infrastructure projects.

Projects apply under three different CoCrea listing streams. The first stream is targeted at microenterprises or SMEs that bring forth projects with their own contributions, known as Projects with Own Contribution (Proyectos con Aportes Propios - PAP). A second stream is targeted at natural or legal persons who benefit from established third party investors, known as Projects with Identified Investor (Proyectos con Aportes de Terceros - PAT), while a third stream targets projects for natural or legal persons that submit projects without established investment, known as Projects without Identified Investor (Proyectos sin Aportante Identificado - PAI).11 In 2020, 89% of accepted projects (303 projects), were PAI projects, while 8% and 3% respectively were PAT and PAP projects (CoCrea, 2020[44]).

CoCrea has helped grow and stimulate investment in creative economy projects accepted after project approval. In 2020, CoCrea received 522 projects, of which 339 were approved for tax incentive and listed on the CoCrea website (CoCrea, 2020[44]). In the same year, cultural education, live music and audio-visual creation projects were among the most popular sectors approved, while 36%, 12% and 10% of projects respectively were concentrated in Colombia’s most populous regions, Bogotá DC, Antioquia and the Valle del Cauca. In April 2022, Colombia’s Minister of Culture announced that a total of 69 companies had received CoCrea’s tax exemption certificates for investing in the creative economy, generating over COP 17 000 million in investment for the country’s creative economy (CoCrea, 2022[45]). According to OECD field interviews, CoCrea has been particularly successful at accompanying CoCreemos projects, who benefit from pre-established investor ties, or coming from applicants with a high level of project conception capacity. Those projects lacking pre-defined investors or low capacity meet challenges to find funding through the listing process. CoCrea has taken steps to accompany candidate projects, such as through meetings with potential investors, promotional events and assistance through its website, webinars and meetings, though challenges remains to bridge applicant capacity differences (CoCrea, 2020[44]).

CoCrea is learning from its first call for projects to maximise the impact of its services within the creative economy ecosystem. In 2020, CoCrea drew extensive attention from creative initiatives seeking CoCrea’s tax deduction certification. Project applications, however, also revealed projects require a host of different needs, both in terms of financing and entrepreneurial capacity. CoCrea may not have the internal capacity or mission to provide tailored capacity building assistance to all those projects without established project financing partners. As such, there is an opportunity to guide those actors requiring greater assistance to organisations with capacity-building abilities, such as SENA, local governments, universities or entrepreneurship agencies. CoCrea is taking steps to modify its application process for PAI projects to a “portfolio system” in which a group of leading applicants receive tailored capacity building help, while a broader set of approved projects receive CoCrea’s networking support.

CoCrea faced diversity in its applicant pool. The high level of applications within CoCrea is a sign of policy uptake, though the high share of PAIs – 303 projects, or 89% of the total – also suggest CoCrea’s role as a market intermediary is met with need. Through its intermediary role, CoCrea supports uptake of its investment tax deduction instrument, reducing the potential complexity of using an investment tax instrument independently. In Chile, a comparable body, the Committee of Cultural Donations, plays a similar role as a project evaluator for tax incentives available as part of Chile’s Cultural Donations Law. According to published 2020 figures, 72% of projects within CoCrea were associated with businesses related to the arts and heritage, while on 14% and 12% respectively for the cultural and creative/new media industries, also revealing sectoral specialisation of projects around core artistic and cultural enterprises (CoCrea, 2020[44]). According to its 2020 annual report, CoCrea held a host of networking events to help connect projects with investors in 2020, such as 38 meetings with large firms, and 31 showcase events.

High candidate diversity can be a challenge for CoCrea staff in the face of different application needs. High applicant diversity also presents challenges to ensure those with less capacity and investor attraction potential can still benefit from the opportunity to access indirect financing opportunities.

CoCrea is also significantly expanding its role because of the resources it is gaining from a COVID-19 creative economy reactivation fund. In 2022, CoCrea’s applicants may be able to benefit from financing from Foncultura (Republic of Colombia, 2020[32]). Foncultura’s broad objectives, ranging from R&D, cultural tourism, infrastructure and cultural production, are likely to significantly support CoCrea’s ability to help those projects requiring direct links with financing. Credit lines are being developed with Foncultura to support specific categories of artists, such as adding a stronger territorial focus to CoCrea’s activities. Reflecting a growing focus on place-based policy, CoCrea is holding information sessions on its activities in remote areas of Colombia, such as Casanare, in the country’s east, where it has drawn interest from potential investors to finance a group of smaller or medium projects.

4.3.3. A public investment bank provides debt financing to the creative economy, filling a key financing need

Innovative indirect financing mechanisms have been created to strengthen the financial sustainability of Colombia’s creative economy actors. Across OECD countries, firms in the creative economy face specific obstacles to access financial capital to start or upscale their businesses. Microenterprises, freelance workers and SMEs all tend to be over-represented in the creative economy compared to other sectors, creating a barrier to access mainstream private debt instruments which may privilege larger companies that meet the financial requirements related to collateral or risk guarantees (OECD, 2022[1]). The OECD has highlighted that creative economy firms also often provide goods or services with high symbolic value, which are often viewed as high-risk investments. The intangible assets produced by the creative economy also lack widely available evaluation methods to properly assess their value for credit opportunities.

Colombia has strategically mobilised its state-owned banks to open new lines of credit for creative economy actors. Colombia’s use of state-owned commercial and development banks for the creative economy is a leading practice to help bridge the gap that exists between the needs of creative SMEs and open market-provided credit opportunities. Indeed, external finance plays an important role to help SME grow and fulfil essential entrepreneurial activities such as capital investment or employee training. In 2020, based on data on the financing needs of SMEs in Colombia, sub-sectoral data and current public banking investment, the IDB estimated that creative economy firms could reach USD 615 million per year (IDB, 2020[46]). Research also suggests external credit opportunities for SMEs contain a strong spatial component, with those SMEs in rural or peripheral areas, or those firms geographically far from financial centres, benefiting from far fewer financing opportunities (Zhao and Jones-Evans, 2017[47]; Brown, 2018[48]; Ughetto, Cowling and Lee, 2019[49]).

Colombia’s enterprise development bank, Bancóldex, is a pillar of Colombia’s creative economy financing strategy. To meet the need of the creative economy strategy, Bancóldex developed a dedicated multi-faceted strategy, involving four types of activities.

Bancóldex’s funding of the creative economy started with funding first-tier financial institutions through loans reserved for creative economy firms, as defined by the 103 ISIC codes associated with the Orange Economy.

Its activities complement funding with direct training and support for capacity building.

Bancóldex expanded its investment in venture capital, which begun across the economy in 2009, into creative economy capital funds. This action is meant to stimulate the funding environment beyond debt financing for the Orange Economy, which was evaluated not to meet sectoral needs (Bancóldex, 2021[50]).

The bank’s funding model evolved significantly with the introduction of Decree 468 in 2020, at the outset of the COVID-19 public health emergency in Colombia (Presidency of Colombia, 2020[51]). Decree 468 allows public banks to open credit lines directly to businesses without passing through first-tier credit institutions, expanding the bank’s role in tandem with the deployment of Foncultura within CoCrea, discussed in 4.3.2.

The bank’s strategy covers all stages of business growth - from pre-seed capital to business expansion - through these instruments (Table 4.2). To help ensure the uptake of loans among microenterprises and SMEs, Colombia has also associated Bancóldex to the management of certain national guarantee mechanisms, discussed below.

Table 4.2. Bancóldex’s activities help meet creative business needs throughout their growth cycle

Bancóldex activities for the creative economy

|

Business financing need |

Pre-seed |

Seed |

Early stage |

Scale up |

Consolidation |

Expansion |

|---|---|---|---|---|---|---|

|

Direct corporate credit |

||||||

|

Direct credit to SMEs |

||||||

|

Capital funds investment |

||||||

|

Traditional and targeted lines of credit |

||||||

|

Capacity-building and training |

||||||

Note: Table modified by OECD.

Source: (Bancóldex, 2021[50]), 5 hitos en el impulso a las industrias creativas y culturales.

4.3.4. Bancóldex has deployed tailored and traditional debt financing for creative firms, as well as entrepreneurship programmes

Bancóldex financing employs both traditional credit lines along with tailored financial instruments. Targeted credit lines are adapted to the financial specificities of the creative economy, such as progressive payment schemes, extended grace periods and beneficial interest rates (Bancóldex, 2021[50]). In addition to the deployment of additional capital, new credit instruments have sought partnerships with strategic actors within the creative ecosystem.

Major targeted credit lines have grown out of partnerships, such as local governments, national ministries or private sector actors. Synergies have been created with actors such as the Ruta N corporation in Medellin, the Popayán City Hall, the Cauca Chamber of Commerce, the Ministry of Commerce, Industry and Tourism, the Ministry of Culture, the Ministry of Information Technology and Communications, Bogotá’s Department of Development (Fitic) and the Huila regional government (gobernación de Huila). Credit lines developed with financial allies take the form of loans to first-tier financial entities, who in turn provide debt financing directly to creative firms.

The bank created a total of eight special credit lines to first-tier institutions with a host of tailored objectives, such as innovation, supporting capital investment, tourism, SME financing or territorially-focused financing. These special tailored credit lines represent 27% of investment made by the bank in these sectors, while the bank’s traditional credit lines represent 32% of investment made in the creative economy by the bank (Bancóldex, 2021[50]).12 These partnerships not only raise dedicated capital for the creative economy, but help raise awareness of the sector’s impact, financial needs and capabilities. Colombia’s push for driving debt financing in the creative economy through public investment banking can be found across OECD countries. In France, for example, the State’s public investment bank, Bpifrance, launched la French Touch, a host of favourable debt-financing instruments for the cultural and creative industries (bpifrance, 2021[52]).

Bancóldex also runs non-financial services such as training, capacity-building and technical assistance. These services help creative economy entrepreneurs build their capacity, as many actors in the creative economy are characterised by weaker or less traditional business structures. As part of this line of work, the bank introduced programmes such as the Orange Productivity Factories from 2019 to 2020, in partnership with the Ministry of Industry, Commerce and Tourism, the Productive Transformation programme and the Bogotá Chamber of Commerce. As part of the programme in the Cundinamarca region, 77 enterprises received up to 80 hours of tailored technical assistance (Bancóldex, 2021[50]). Other programmes included, for example, a financial education programme for crafts workers in 2020, organised with the crafts workers association of Colombia, Artesanías de Colombia, and Asobancaria, Colombia’s national association of banks and financial institutions. The programme organised four virtual modules on financial education for a total of 186 participants.