This chapter presents findings on how economic regulators receive and manage their financial resources, based on the 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators. It first identifies the different sources of funding for regulators and the procedures through which funding needs are identified and decided upon. The chapter then distinguishes the arrangements regarding funding through national budget appropriations and funding through regulatory fees. The sections on financial management and audit highlight the restrictions regulators may face in managing their funds and spending, as well as the mechanisms in place to scrutinise their spending. The chapter also explores the impact of the COVID-19 pandemic on regulators’ funding and illustrates how financial arrangements tend to differ for regulators overseeing multiple sectors.

Equipping Agile and Autonomous Regulators

3. Financial resources

Abstract

Main findings

|

Source of funding |

|

|

Funding procedures |

|

|

Funding through national budget |

|

|

Funding through fees |

|

|

Financial management |

|

|

Audit |

|

|

Impact of COVID-19 |

|

|

Multisector regulators |

|

Economic regulators rely on adequate funding to carry out their mandates and exercise their functions effectively. They are usually funded through fees, the national budget or a mix of both. However, it is not just the source or the absolute level of funding that is important. Other aspects of a regulator’s funding arrangements matter at least as much. The way in which funding needs are determined, budgets are decided and appropriated and the extent to which regulators can manage their funds autonomously together contribute to the good governance and performance of regulators.

Appropriate funding mechanisms should ensure that regulators receive sufficient funds for an effective and efficient execution of their activities, and should contain adequate safeguards that prevent undue influence in the work of regulators through the appropriation or restriction of funds. At the same time, procedures should be transparent, to support trust in public institutions. Moreover, arrangements should ensure sound financial management and enable accountability of a regulator for its spending, to show how the regulator delivers upon the policy objectives of governments.

Source of funding

There is no universal right or wrong in terms of what the source of funding of a regulator should be. The context in which the regulator operates may affect the appropriateness of different funding sources. When identifying the sources of funding, due consideration should be given to circumstances that could potentially compromise the integrity of the regulator, such as public ownership in the sector and expected market volatility (OECD, 2017[1]).

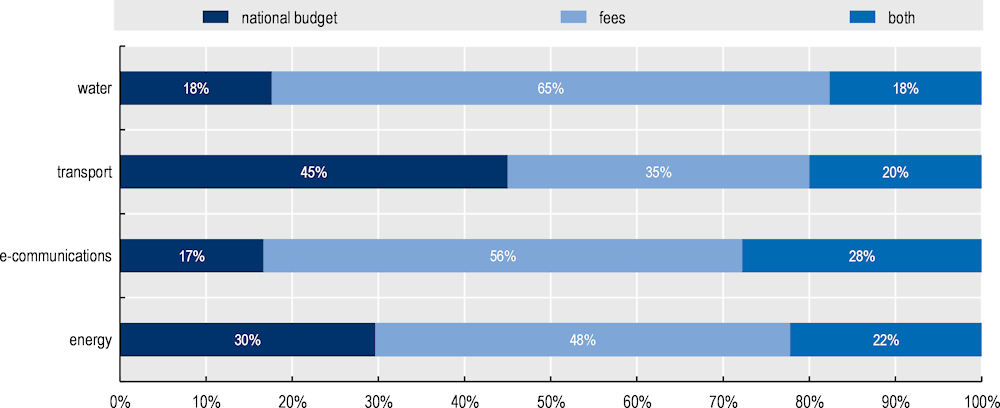

The source of funding is stated in the establishing legislation for most regulators. Half of all regulators are solely funded through fees, an arrangement that is especially common for water regulators. Twenty-eight percent of regulators are funded solely through national budget appropriations, whereas 22% are funded through a mix of both fees and national budget (Figure 3.1). Funding arrangements differ significantly, both across and within countries (Annex D).

Figure 3.1. Half of regulators are exclusively fee-funded, but fewer in the transport sector

Note: The Peruvian transport regulator Ositrán receives funding through fees, but in 2020 exceptionally received additional funding from the national budget following the enactment of an emergency decree related to COVID-19. For the purpose of this survey, the funding of Ositrán has therefore been classified as a mix of fees and national budget. Analysis is based on responses from 57 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

Different funding sources bring with them different types of risks. Regulators funded through the national budget report that the modification or reallocation of resources towards other entities or contingencies, as well as the uncertainty of resources, could pose substantial risks to their organisation’s funding. Regulators funded through fees identify risks related to the economic situation in the sector they oversee, such as the financial position of operators or a downturn in regulated revenues, as the main threats to their funding.

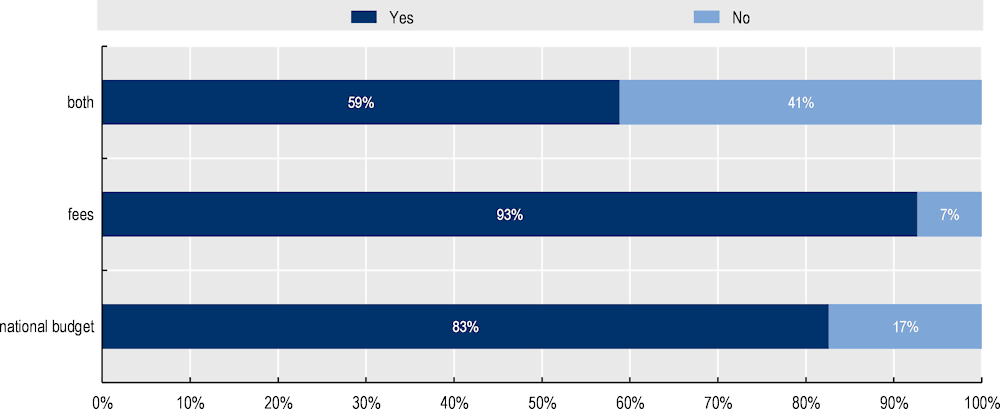

Moreover, looking at the regulators participating in the survey, there is a correlation between the type of funding and the share of regulators that report that they had sufficient funding over the last five years. Regulators that are funded through a mix of both national budget and fees are considerably more likely to report insufficient funding over the last five years, with 41% reporting that they did not have sufficient funding (Figure 3.2). This correlation does not necessarily need to imply that there is a causal relationship between the type of funding and the sufficiency of financial resources, and indeed for each type of funding a majority of regulators reported sufficient funding. However, the finding does raise the question of why funding deficiencies are perceived more frequently by regulators funded through a mix of funding sources.

Figure 3.2. Those funded through a mix of national budget and fees more frequently indicate lacking funds

Note: The chart shows the correlation between the type of funding and the reporting by the regulator whether it had sufficient funding, but does not provide evidence of a causal relationship. Analysis is based on responses from 56 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

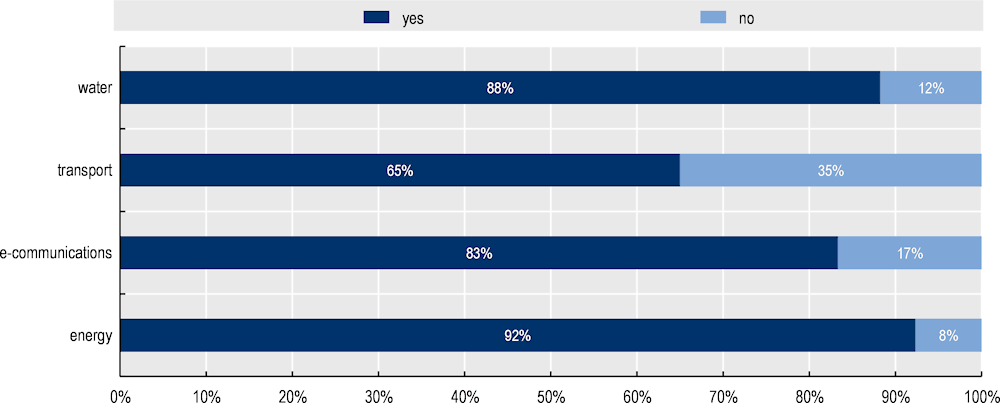

National budget funding is most frequently seen in the transport sector, where regulators are also more likely to report insufficient funding compared to other sectors. While 35% of transport regulators reported lacking funds to fulfil all duties over the past five years, this share was just 8% for energy regulators (Figure 3.3). Furthermore, multisector regulators less frequently report lacking financial resources, with only 8% reporting funding gaps (compared with 27% of single sector regulators).

However, in the interpretation of these findings, due consideration should be given to the timing of the survey, which was distributed in January 2021. During this period, some regulators felt the impact of the COVID-19 crisis on their funding model (OECD, 2020[2]). This affected the funding of some regulators due to a decrease in sector activity (for those funded through fees) or a reorientation of budgets towards the crisis response (for those funded through national budget) (see section on The impact of COVID-19). Especially in the transport sector, there was a drastic change in the use of different modes of transport (ITF, 2021[3]), which may have affected the high percentage of regulators in this sector reporting insufficient funds.

Figure 3.3. Lacking funds are most common for transport regulators, and least common for energy regulators

Note: Analysis is based on responses from 56 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

Funding procedures

A correct assessment of resourcing needs depends on the availability of clear and up-to-date financial information. For that reason, it is essential that the regulator provides adequate information to the legislature or relevant budget authority on the resources required to fulfil its mandate.

Most regulators indeed do so, with 91% submitting their costs and resources for approval to the legislature or relevant budget authority prior to each budget cycle (Figure 3.4). In other cases, in the absence of a requirement to obtain approval, some regulators nevertheless share information. For example, Ireland’s Commission for Communications Regulation still provides information to the government on its costs and resources, a practice that supports the accountability of the regulator.

Figure 3.4. Regulators usually submit their costs and resources for approval

Note: Analysis is based on responses from 56 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

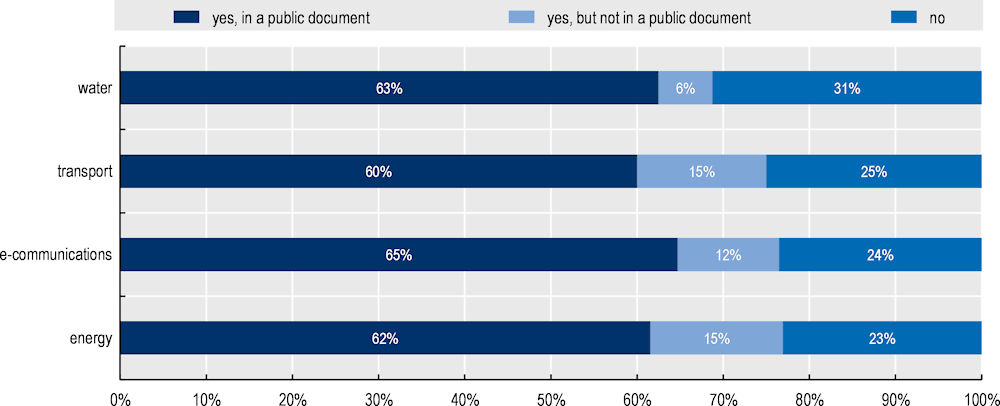

Budget decisions for economic regulators should be made through a transparent and clearly defined process. This requires the body deciding upon the budget allocation to disclose the budget decision and to provide an explanation. In practice, for three out of four regulators, budget decisions are substantiated by the responsible body. In most cases, this substantiation is made through a public document, supporting the accountability of the budget appropriation process (Figure 3.5).

Figure 3.5. Budget appropriations are publicly substantiated by the responsible body for 62% of regulators

Note: Analysis is based on responses from 54 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

For most regulators (90%), budgets are decided on an annual basis, whereas for the remaining 10% of regulators the length of appropriations is at least three years. This is a relevant aspect for the regulator’s financial independence, as the budget decision is a so-called “pinch-point” during the regulatory cycle where there is the greater potential for undue influence in the regulator’s work (OECD, 2017[1]). Annual appropriations can make it easier to influence the regulator than multi-annual appropriations, because shorter-term appropriations are more contingent to short-term shocks such as political imperatives. Therefore, especially for regulators funded through annual appropriations, due consideration should be given to the design of safeguards that could prevent undue influence, such as clear criteria, procedures as well as multiannual forecasts (Box 3.1).

Regulators may at times face the need for supplementary funding in situations where their responsibilities have increased beyond what is reflected in their initial budget allocation, or where shocks such as the COVID-19 crisis lead to additional expectations. Many regulators indicate that in such cases a temporary or ad-hoc request can be made, usually directed to the relevant budget authority. This mechanism can support the sufficiency and flexibility of resources to absorb changes in the regulator’s responsibilities. However, the use of temporary funding mechanisms could potentially be more problematic where they are used on a recurring basis. In particular, one regulator reports the use of supplementary funding allocations to compensate for a non-temporary increase in responsibilities for the organisation. In such cases, the use of temporary funding mechanisms could restrict the regulator to the use of temporary staffing arrangements. This may result in a more continuous rehiring of staff (“hiring treadmill”) and make it more difficult to draw up long-term resourcing plans or invest in staff capabilities.

Box 3.1. Multiannual budget programming in Peru

The Government of Peru makes use of a performance budgeting system for some government entities, including the country’s economic regulators. This system requires the budgets of Peruvian regulators to be aligned with the goals and objectives established by the institutions in their strategic plans and operational plans. Based on multiannual strategic and operational plans, a multiannual budget programme (for a three-year period) is approved by the Ministry of Economy and Finance (MEF). The budgets for departments within the regulator are allocated taking into consideration the prioritisation of the activities according to the operational plans and the historical performance.

The multiannual budget programming allows regulators to incur financial obligations beyond the period of one year. However, final budgets are still decided upon on an annual basis. Only the first year of the multiannual budget programme is set in an annual budget decision by MEF, whereas budget figures for subsequent years may still change based on macroeconomic conditions and government policies and priorities.

Source: Information provided by Ositrán, 2021; MEF (2021), Multiannual Budget Programming Report 2022-2024, https://www.mef.gob.pe/contenidos/presu_publ/pres_multi/Informe_Programacion_Multianual_2022_2024.pdf.

Funding through national budget

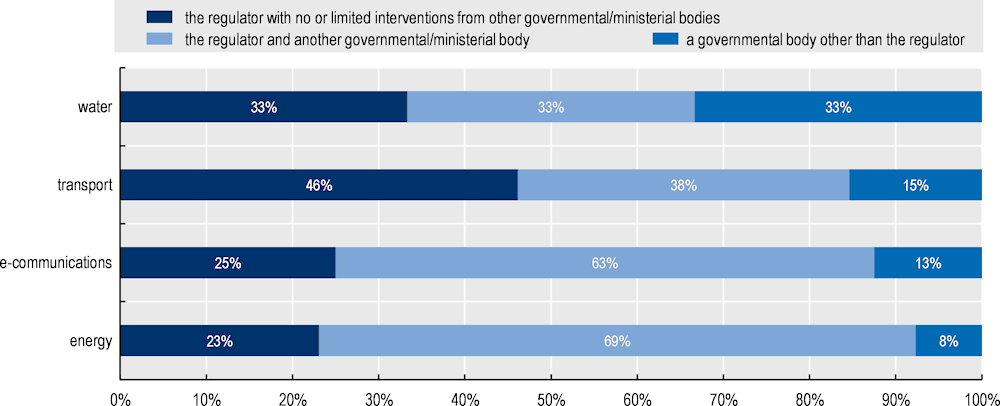

Where regulators are funded through national budget appropriations, they are usually involved in the discussion of their budget with the relevant budget authority. One in three regulators discuss their budget with no or limited involvement from other bodies, whereas another 53% is involved in the discussion together with another ministerial or governmental body. Only in a few cases is the regulator not directly involved in the negotiation of its budget; this appears to happen more frequently for regulators in the water sector (Figure 3.6).

Figure 3.6. Most national budget-funded regulators are involved in their budget discussion, but fewer in the water sector

Note: Analysis is based on responses from 29 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

Funding through fees

For most regulators funded through fees, fees are charged periodically based on the revenues or activity level of the entities in the sector. In a smaller number of cases (19%), the fee is charged for a specific activity by the regulator, such as processing a license application or taking a specific decision. Fourteen percent report another type of fee, for example where a fee is charged directly to consumers or where there is a more complex mix of fees used to fund the regulator (Box 3.2). Three in four fee-funded regulators independently collect fee revenues from the sector without involvement from an external body (Box 3.3). For most other regulators (17%), fee revenues are collected and distributed to the regulator by a ministerial or governmental body.

Box 3.2. Fee funding for the Belgian energy regulator (CREG)

Until the end of 2021, Belgium’s Commission for Electricity and Gas Regulation (Commissie voor de Regulering van de Elektriciteit en het Gas / Commission de Régulation de l'Électricité et du Gaz – CREG) was funded through federal electricity and gas contributions, which are surcharges levied respectively on the quantities of electricity and natural gas consumed by consumers in Belgium. In addition, the CREG also received relatively small fees for the assessment of the application for authorisations to supply natural gas on the Belgian market.

The federal electricity and gas contributions covered the costs of the functioning of the CREG, but also provided funding for other funds managed by the CREG that do not relate to the costs of operations of the CREG (such as funds related to denuclearisation of the electricity supply and the protection of residential consumers). The CREG set the level of the unit value of the fees (EUR/MWh or EUR/m3) autonomously, while taking into account global amounts yearly specified by royal decrees. The CREG published the annual fees on its website.

All final consumers in Belgium are liable to pay the federal contributions and had to pay these to the electricity and natural gas suppliers. The gas suppliers transferred the collected fees to the energy network operators, which in turn passed the collected amounts on to the CREG (principe de la cascade tarifaire).

Since 1 January 2022, the functioning costs of the CREG are covered by a special excise duty rate on electricity and natural gas levied by the Federal Public Service Finance and paid to the CREG, up to the budget approved by the Parliament.

Source: Information provided by CREG (2021); JUSTEL (2019), Law of 29 April 1999 concerning the organisation of the electricity market, http://www.ejustice.just.fgov.be/.

Box 3.3. Improving the collection of fee payments by the Albanian water regulator

The Albanian Water Regulatory Authority (Entit Rregullator të Ujit – ERRU) is funded through regulatory fees collected from entities in the water sector. To improve the payment of regulatory fees by entities, the regulator has looked for ways to avoid the rather lengthy court procedures foreseen in law in case of non-payment. The regulator organises meetings with the leadership of water utilities that have failed to pay regulatory fees, to establish a contract to define the conditions for the payments of regulatory fees that are due. Only in cases where this approach appears unsuccessful will the regulator address the missed payments through procedures at the administrative court.

Source: Information provided by ERRU, 2021.

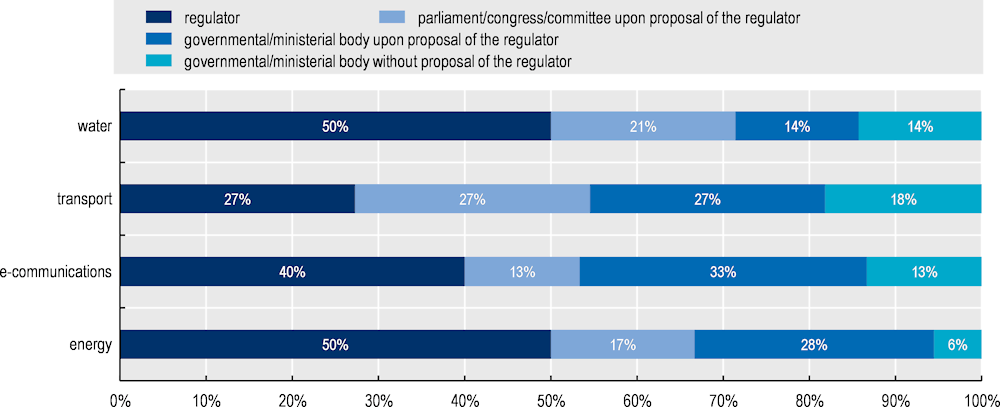

Care should be given to the process in which fees are set. Regulators should not set the level of their cost-recovery fees without arm’s-length oversight (OECD, 2014[4]). Moreover, where the minister or the cabinet sets the fee level, issues could potentially emerge in situations where governments hold a stake in companies in the sector (OECD, 2016[5]). Regulators funded through fees tend to be closely involved in the fee-setting process. Forty-three percent of regulators funded through fees are themselves in charge of setting the fee level. Another 45% of fee-funded regulators proposes the fee level, either to a parliament or congress (or a committee) or to a governmental or ministerial body. For just 12% of regulators, fees are set without any direct involvement of the regulator (Figure 3.7).

Figure 3.7. Fee-funded regulators tend to set fee levels themselves or propose the fee level

Note: Analysis is based on responses from 41 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

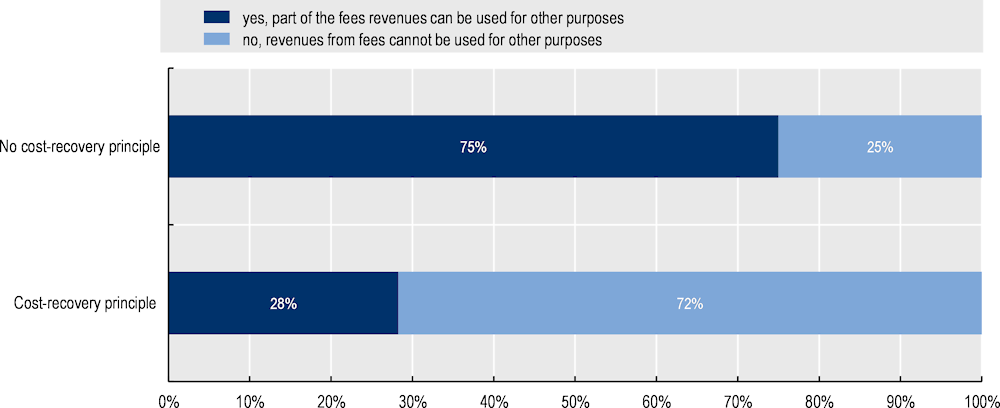

When a regulator is funded through fee contributions from the sector(s) it oversees, these revenues should be allocated to the regulator through an independent and accountable channel. An appropriate cost-recovery mechanism is essential to ensure fees are set at the “right” level and cover the costs of the regulator and nothing more. It can avoid a regulator from being underfunded, captured by industry or undermined by the executive (OECD, 2017[1]). This may be especially relevant in sectors with a relatively large share of public ownership. The survey finds that for four in five fee-funded regulators, fees are set according to a cost-recovery principle.

The survey finds that where fees are set according to a cost-recovery principle, fees are less frequently used for purposes other than the regulator’s budget (Figure 3.8). For 38% of the regulators funded through fees, fee revenues can also be used for other purposes than the regulator’s budget, usually towards the central government budget. A large majority of regulators for which fees revenues can be used towards other purposes reports that in practice this has happened multiple times during the last five years. In some cases, there are legislative provisions that determine the maximum share of revenues that can be diverted towards the central government budget. In the case of Greece’s National Telecommunications and Post Commission (EETT), there are strict legal provisions that prevent the use of administrative fee revenues collected from operators, subject to general authorisation, for any other purpose than the regulator’s funding. Similarly, for Portugal’s Energy Services Regulatory Authority (Entidade Reguladora dos Serviços Energéticos – ERSE), fee revenues cannot be used for purposes other than the regulator’s budget.

Figure 3.8. Where there is a cost-recovery principle for setting fees, revenues are less frequently used for other purposes

Note: The correlation between the two questions shows a correlation between the presence of a cost-recovery principle and the possibility fee revenues can be used for other purposes, but does not provide evidence of a causal relationship. Examples of other purposes include cases where fee revenues are redirected towards central government budget, or where these are used to fund certain sectoral funds. Analysis is based on responses from 41 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

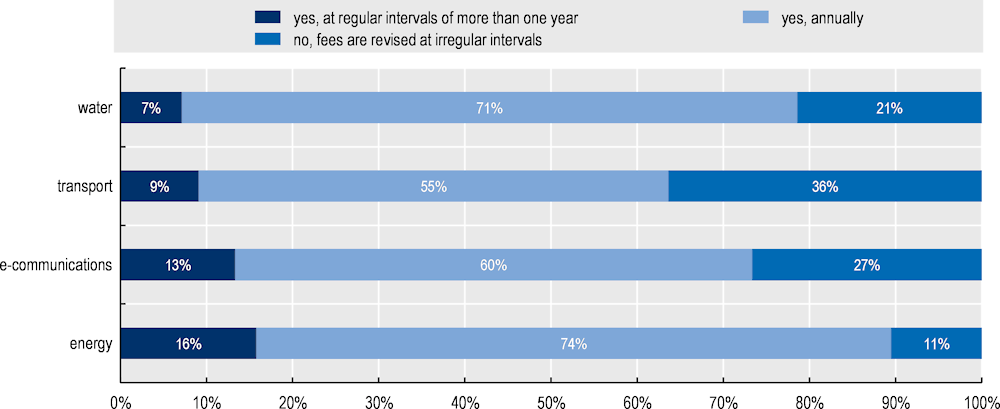

When cost-recovery fees are being used as a means to fund the operations of the regulator, these fees should be set in accordance with government policy objectives and applicable cost-recovery guidelines, and ideally for a multi-year period (OECD, 2014[4]). In deciding upon the period for which fees are set, a balance should be struck between the stability and predictability of fee levels for the regulator and fee-paying entities on the one hand, and a need to keep the fee level aligned with underlying costs on the other hand. For most regulators, fee levels are revised at regular intervals, usually yearly (Figure 3.9). Only for 22% of regulators are fees revised at irregular intervals.

Adequate procedures and criteria for fee revision should be in place to ensure an accurate fee level, especially where fees are revised irregularly. Without such provisions, fee revenues may end up being either insufficient or excessively high, especially where the sector is relatively dynamic or the regulator’s mandate is subject to change. A fee level that is too low could result in an underfunded regulator, which decreases the regulator’s effectiveness and ultimately harms market outcomes. Alternatively, a fee level that is too high could pose a disproportionately high financial burden on fee-paying entities.

Figure 3.9. In most cases, fee levels are revised annually

Note: Analysis is based on responses from 42 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

Financial management

Financial management is crucial to ensure regulators have appropriate and accountable autonomy in the spending of their budget (OECD, 2017[1]). Their spending should be in line with government rules of public spending and procurement, but they should not be unnecessarily restricted in their activities or the way they spend their budget. Interference in the regulator’s spending through the use of spending caps and political discretion on budget autonomy should not be allowed as long as regulators stay within general public spending rules.

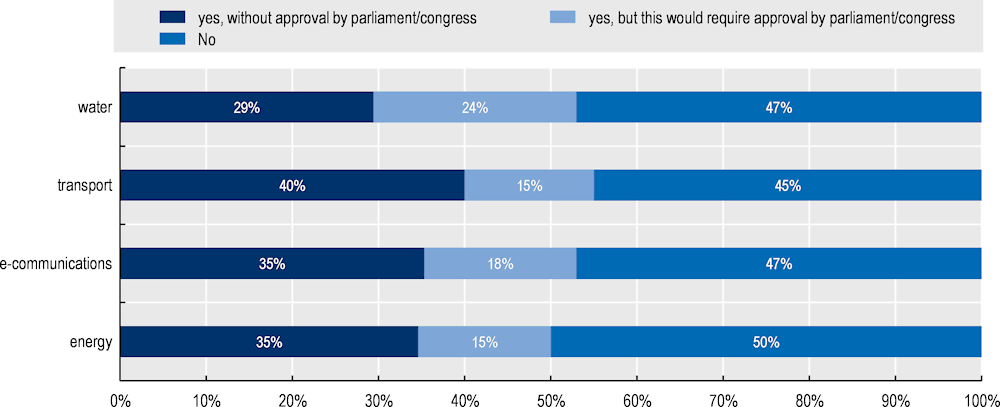

Indeed, in practice, all regulators that participated in the survey are required to adhere to rules on public spending and procurement. A small majority (53%) can experience controls on their spending, such as spending caps for specific cost categories or restrictions on costs related to travelling abroad. Such cases appear to be less common for multisector regulators, of which 43% can experience controls on their spending (compared with 63% of single sector regulators). In some cases, these restrictions require the approval of parliament of congress. However, one in three regulators may be subject to controls on their spending which do not require legislative approval, which could potentially harm the autonomy of these regulators (Figure 3.10).

Figure 3.10. One in three regulators can experience spending restrictions that do not require the approval of the legislature

Note: Analysis is based on responses from 55 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

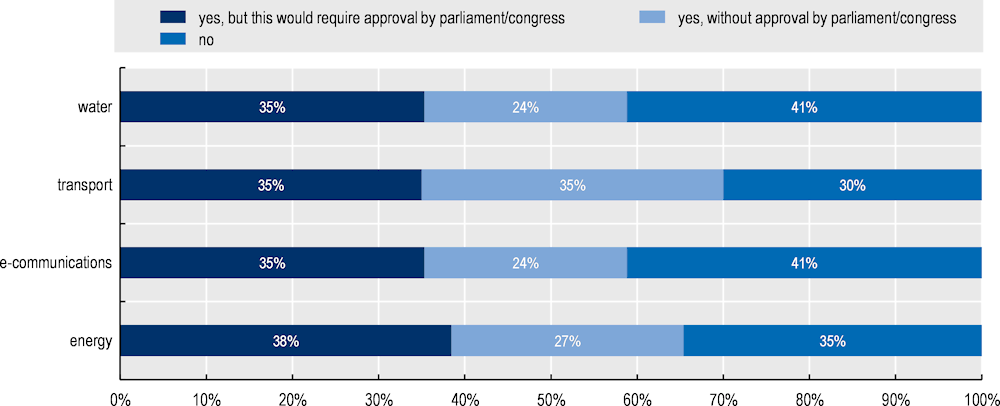

For many regulators there is at least a legal possibility of changes to their budget after initial approval, under certain circumstances. To improve the accountability, in most cases such changes require the approval by parliament or congress. However, for more than one in four regulators, the relevant budget authority can make changes to the initially approved budget without oversight by the legislature (Figure 3.11). This lack of checks and balances could open the door for potentially unpredictable or unwarranted changes to the regulator’s budget, which threatens the sufficiency and predictability of a regulator’s resources. Changes to the initially approved budget without oversight by the legislature are somewhat less common for multisector regulators (23%) than they are for single sector regulators (33%).

Figure 3.11. Where the regulator’s budget can be modified after initial approval, this usually requires approval by the legislative branch

Note: Analysis is based on responses from 55 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

Some regulators are allowed to carry over funds from one financial cycle to the next, although there are usually restrictions. Eleven percent of regulators can carry over funds without any restrictions, whereas 49% can do so only when certain conditions are met. By retaining unspent budgets in a reserve account, regulators can smooth revenues across financial cycles and improve the stability and predictability of their funding (Box 3.4). Safeguards could be put in place to prevent reserve funds from growing too large, for example by returning funds through fee cuts in case funds grow above a certain threshold.

Box 3.4. Carrying over funds across financial cycles

Latvia’s Public Utilities Commission (PUC)

Since 2017, the regulatory fee that funds the PUC’s operations is set directly in legislation. To account for any potential overpayments above the PUC’s budget as approved by Parliament, excess funds are deposited in the account of the regulator at the Treasury. These limited funds can serve also to avoid unexpected or transitory decreases in PUC’s income without revising primary legislation every year.

The regulator can use these funds to fund its operations in subsequent years, in accordance with its approved budget. In case the funds in the account exceed 25% of total fee revenues, the excess funds are returned to market operators through a deduction in fee payments in the respective year.

Ireland’s Commission for Regulation of Utilities (CRU)

The CRU is funded entirely through levy and licence fees from relevant electricity, gas, petroleum safety, and water industry participants. Levies from market participants comprise the bulk of the CRU’s income. The CRU sets its own budget without requiring government participation, and is defined annually on a cost-recovery basis in the fourth quarter of the year, on the basis of an estimate of CRU operating and capital budget required for the next year. There is no direct government contribution to the CRU budget and the regulator’s annual budget is approved by the Commission without approval or ex ante assessment by the Oireachtas.

Annual budgets for the electricity, gas, petroleum and water are allocated by the CRU to each sector. Revenues, expenses and capital expenditure directly incurred by each sector are recorded in the separate budgets of the electricity, gas, petroleum and water sectors. Shared costs are allocated to each sector in proportion to the staff numbers engaged in the relevant sector. Costs linked to shared administrative functions such as finance, HR, IT, and Communications are pooled for all sectors.

Where annual expenditures exceed revenue, the balance is offset against the levy income for the subsequent year. The balances for the electricity, gas, petroleum and water sectors are recorded in their respective accounts, and audited on an annual basis by the Office of the Comptroller and Auditor General, which reports to the Public Accounts Committee of the Oireachtas. The CRU also conducts an annual internal audit, which is outsourced to an audit company). Moreover, based on a risk assessment, a contingency fund is defined on a yearly basis to provide flexibility to deal with potential legal challenges or costs linked to safety cases or events. Any excess of revenue in the financial year is taken into account in determining the levy for the subsequent year per sector. The CRU can carry unspent funds over to the following year’s budget without review or approval from external government entities.

Source: Information provided by PUC and CRU, 2021.

Audit

Accountability mechanisms can give legitimacy to a regulator’s actions and bolster its reputation, by providing a mechanism to ensure responsible public spending. They do not entail a direct control on the regulator’s actions, but rather provide a set of complementary and overlapping arrangements to ensure checks and balances (Hüpkes, Taylor and Quintyn, 2006[6]).

Economic regulators, as public bodies at large, are under increasing pressure to deliver against growing mandates and expectations, and to find more efficient and less costly ways to do their work. While many regulators are independent bodies, they should not be exempt from scrutiny of their finances. In return for the higher level of financial autonomy many regulatory bodies enjoy, compared to other governmental bodies, there should be mechanisms to hold the regulator to account for their expenditure and performance. Like any government body, their expenses should therefore be reviewed for prudence and efficiency (Kelley and Tenenbaum, 2004[7]). The OECD Recommendation on Budgetary Governance recommends the evaluation and reviewing of public expenditure programmes in a manner that is objective, routine and regular, and to ensure the availability of high-quality performance and evaluation information (OECD, 2015[8]).

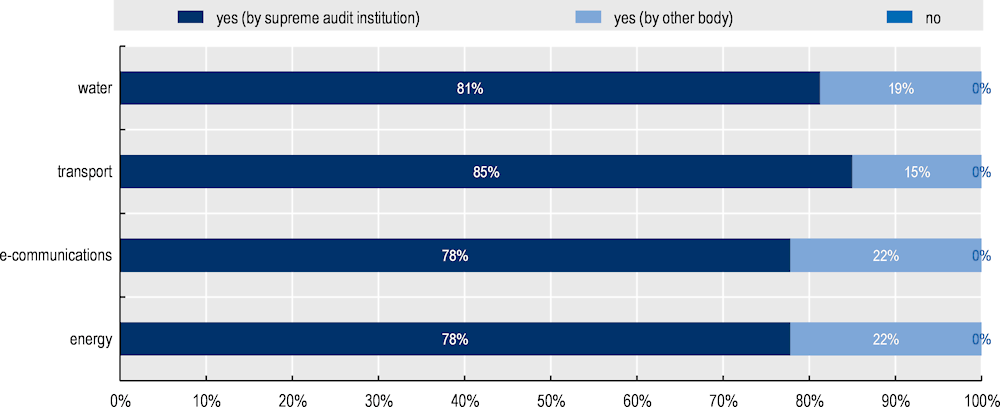

Nearly all regulators collect information on their financial performance, such as the costs of running the organisation, and this information is published for 86% of regulators. To hold regulators to account for the money they spend, many countries also require an external evaluation by another public body, usually the country’s supreme audit institution (Figure 3.12).

Figure 3.12. The spending of all regulators can be externally evaluated, usually by the supreme audit institution

Note: Analysis is based on responses from 56 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

The impact of COVID-19

The pandemic stress-tested the agility and flexibility of the financial resources of economic regulators. In some cases, it also highlighted certain vulnerabilities in existing arrangements, which could put the regulator’s way of working or the funding of its operations at risk. These risks could stem from changes within the regulator internally as well as external changes in the sector. Learning from this crisis experience could support regulators to build more resilient, robust, crisis-prepared and future-proof resourcing frameworks.

The COVID-19 pandemic affected the financial resources of many economic regulators, although the precise impacts differed largely across regulators. Some regulators saw little to no impact on their finances, whereas others saw significant impacts on their expenses and/or on their budgets. The sum of both impacts determines the overall financial impact of the pandemic on the regulator. As such, it could provide an indication of the financial risk or exposure that the regulator’s financial arrangements may be subject to in times of change.

The impact of the COVID-19 pandemic on regulatory budgets differed substantially across regulators. Following the direct impact of the pandemic, some regulators funded through national budget appropriations saw their budget decrease due to a reallocation of funds towards the crisis response. In other cases, regulators saw an increase in their budget appropriation to finance new pandemic-related tasks. Regulators funded through fees sometimes saw a downturn in their revenues due to a decrease in sector revenues or due to a weakened financial position of fee-paying entities in the sector.

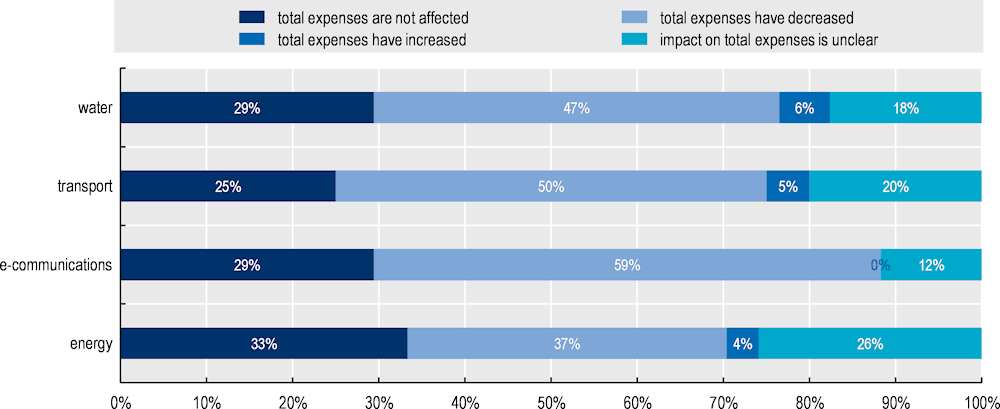

Expenses that were likely to increase in response to the pandemic relate to the cleaning of offices, the necessary adjustments to IT equipment and systems, as well as health expenses. Decreasing costs were linked most frequently to travel, inspections and office expenses. One regulator also reported a decrease in staff costs due to the postponement of staff recruitment. Overall, 47% of regulators reported a decrease in total expenses, whereas just 4% reported an increase. In other cases, expenses were either not significantly affected or the overall impact was still unclear (Figure 3.13).

Figure 3.13. Expenses usually either decreased or were unaffected by the COVID-19 crisis

Note: Analysis is based on responses from 56 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

Multisector regulators

Multisector regulators report certain efficiencies in terms of their financial resources thanks to their broader mandate. Frequently reported efficiencies relate to the sharing of administrative or support services across departments and sectors. The ability of staff to assist colleagues working on similar issues in other sectors is in one case also reported as a more cost-effective and efficient option than the contracting of external consultancy services.

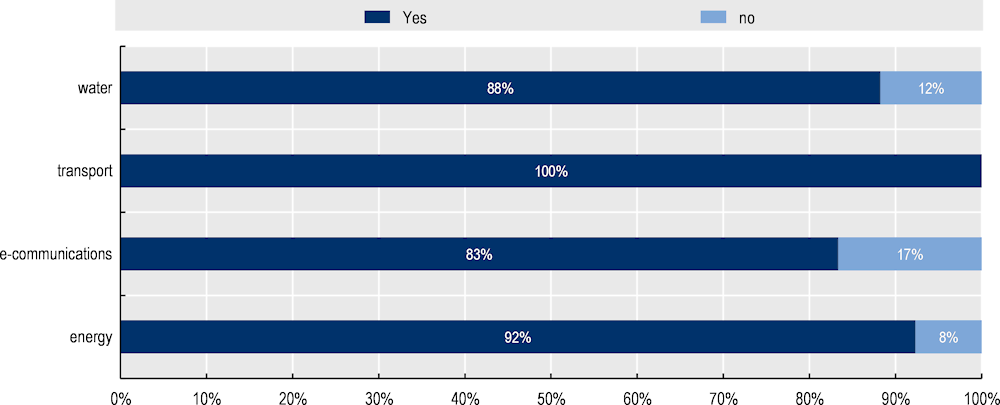

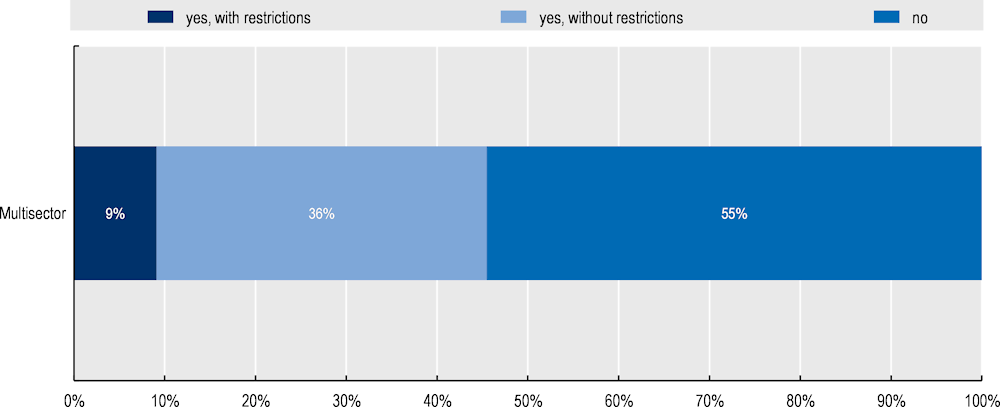

The existence of a single regulatory body overseeing multiple sectors does not necessarily mean that the type of funding is the same for all sectors overseen by the multisector regulator. For example, while the activities of the Australian ACCC in the energy, transport and water sector are fully funded through national budget appropriations, its e-communications activities are almost entirely fee-funded. Moreover, where multisector regulators are funded through fees, there are usually restrictions to use revenues raised in one sector to fund regulatory activities in other sectors. Only 36% of multisector regulators that are (fully or partly) fee-funded are free to distribute their budget across the different sectors without restrictions (Figure 3.14).

Figure 3.14. Multisector regulators usually face restrictions to redistribute fee revenues across the sectors they oversee

Note: Analysis is based on responses from 11 regulators.

Source: 2021 OECD Survey on the Resourcing Arrangements of Economic Regulators.

References

[6] Hüpkes, E., M. Taylor and M. Quintyn (2006), Accountability Arrangements for Financial Sector Regulators, IMF, https://doi.org/10.5089/9781589064775.051.

[3] ITF (2021), ITF Transport Outlook 2021, OECD Publishing, Paris, https://doi.org/10.1787/16826a30-en.

[7] Kelley, E. and B. Tenenbaum (2004), Funding of Energy Regulatory Commissions, https://documents1.worldbank.org/curated/en/817641468762588575/pdf/305250EnergyWorkingNotesNwsltr0no01.pdf.

[2] OECD (2020), “When the going gets tough, the tough get going: How economic regulators bolster the resilience of network industries in response to the COVID-19 crisis”, OECD Policy Responses to Coronavirus (COVID-19), OECD Publishing, Paris, https://doi.org/10.1787/cd8915b1-en.

[1] OECD (2017), Creating a Culture of Independence: Practical Guidance against Undue Influence, The Governance of Regulators, OECD Publishing, Paris, https://doi.org/10.1787/9789264274198-en.

[5] OECD (2016), Being an Independent Regulator, The Governance of Regulators, OECD Publishing, Paris, https://doi.org/10.1787/9789264255401-en.

[8] OECD (2015), Recommendation of the Council on Budgetary Governance, https://www.oecd.org/gov/budgeting/Recommendation-of-the-Council-on-Budgetary-Governance.pdf.

[4] OECD (2014), The Governance of Regulators, OECD Best Practice Principles for Regulatory Policy, OECD Publishing, Paris, https://doi.org/10.1787/9789264209015-en.