This chapter assesses productivity trends and the potential of FDI to enhance productivity and innovation performance in Jordan. Building on the stocktaking of Jordan’s competitive edge, the chapter presents the governance framework and policy mix that supports investment impacts on productivity – focusing on institutional arrangements and policies at the intersection of investment, innovation and SME development. The chapter applies the forthcoming OECD FDI Qualities Policy Toolkit (cluster on productivity and innovation).

FDI Qualities Review of Jordan

2. Boosting FDI impacts on productivity and innovation

Abstract

2.1. Summary

Foreign direct investment (FDI) was a key driver of aggregate productivity in Jordan in the 2000s but inflows of FDI have slowed considerably ever since. The bulk of FDI is concentrated in the capital-intensive energy and real estate sectors, jointly accounting for more than 70% of total greenfield FDI. Jordan’s labour productivity has been stagnant since the global economic slowdown in 2008, as well as ongoing conflicts in neighbouring countries that have cut off important trade corridors, led to a significant drop in demand for Jordan exports and a stark increase in energy prices. Reduced competitiveness in manufacturing influenced foreign manufacturers to engage less in knowledge‑based activities in Jordan. Due to this as well as the limited capacities of small and medium-sized enterprises (SMEs) (e.g. related to access to strategic resources such as finance and infrastructure), foreign firms are engaging less in business linkages with domestic firms, further reducing the opportunities for productivity spillovers. Future growth and productivity are likely to occur in tradable services (e.g. finance, transport, ICT and wholesale and retail services), which have experienced relative stability in FDI inflows in recent years and are less affected by continuous high energy prices and water scarcity compared to manufacturing.

The productivity opportunity in services, including through foreign investment and linkages with SMEs, is endorsed by Jordan’s vision 2025 for sustained social and economic growth and is supported by multiple national strategies whose governance is entrusted to several state bodies at various levels. However, at the implementation level, investment attraction efforts have not been focused on FDI projects with the greatest potential for productivity growth and innovation so far.

This chapter assesses Jordan’s competitive edge and future opportunities for FDI to positively impact productivity and innovation in Jordan. It then evaluates the governance framework and policy mix that support the positive impact of investment on productivity – focusing on institutional arrangements and policies at the intersection of investment, innovation and SME development. Key policy considerations are summarised below.

Policy considerations

National strategies linking investment, productivity and SME development policy issues could be further aligned and continuity of strategic orientations ensured. Strategies are introduced without cross-referencing those of other public institutions. Some sectoral strategies have reached the end of their applicability and have not yet been renewed. Information on strategies and plans could be centralised and made available online (including in English).

Policy co‑ordination across the investment, innovation and SME development policy areas does take place in Jordan; but high-level government councils could further ensure that public and private institutions from all relevant policy areas – i.e. investment, innovation and SME development – and all stakeholder groups (including foreign) are represented. Roles and mandates of various higher level horizontal co‑ordination bodies, which are putting development strategies in place, could be clarified.

At the policy implementation level, horizontal co‑ordination and inter-agency co‑operation on investment, innovation and SME support programmes could be further promoted. Joint programming is broadly absent. On the other hand, vertical co‑ordination mechanisms across levels of government are fairly well-established – e.g. as an investment promotion agency, the Ministry of Investment (MoI) is well-placed to transmit investor concerns to the Investment Council and can thereby provide important inputs to policy reforms at higher levels.

Removing regulatory restrictions to services would support the economic growth objectives defined in Jordan’s vision 2025 strategy, and contribute to productivity growth in other sectors, including manufacturing. Services liberalisation lags behind reform processes in other sectors. Beyond FDI restrictions, there are several ‘behind-the‑border’ regulatory aspects (e.g. intellectual property rights protection, as well as competition and labour market policy) that are influencing investment in services. The inclusion of Jordan in the OECD Services Trade Restrictiveness Index would allow to identify specific reform opportunities in these areas.

Jordan could consider enhancing the sectoral targeting of investment incentives to attract FDI in sectors with higher labour productivity (e.g. services) and in R&D- and skill-intensive activities, which can be supported by its increasingly skilled workforce and significantly internationalised SME sector. Investment attraction efforts have not been focused on FDI projects with the greatest potential for productivity growth and innovation so far. There is also a disconnect between investment promotion and innovation policies due to Jordan’s relatively nascent research and innovation support ecosystem, and the mandate of MoI, which does not cover innovation promotion.

Streamlining the regulatory environment for SMEs could contribute to further improving the business climate and thus enabling SME productivity growth through FDI spillovers. Jordan has made notable improvements in its business climate by issuing new regulations and streamlining others. Starting a business, dealing with construction permits and protecting minority shareholder rights remain key constraints for businesses in Jordan however. The planned new law on SMEs could help consolidate the regulatory environment in Jordan.

Facilitating access to finance and improving the quality of technical assistance, information and facilitation services provided to Jordanian SMEs could help them develop their innovation and R&D capacities and narrow performance gaps with foreign affiliates. The role and mandate of the recently established National Centre for Innovation (NCI) could be clarified vis-à-vis other institutions involved in the implementation of innovation policies to prevent duplication of services.

Investment facilitation and aftercare services could be improved and aligned with policy efforts to build value chain linkages between foreign and domestic firms. Policies supporting SME supply chain development appear to be disconnected from investment facilitation and aftercare activities. The lack of policy co‑ordination between the investment promotion and SME agencies can also increase information barriers and undermine efforts to align domestic SME absorptive capacities with the needs of foreign investors.

2.2. Productivity trends and challenges in Jordan

Productivity reflects a country’s stage of economic development, and its resulting competitive edge and economic structure. As an economy develops, its structure typically shifts from agriculture, to light manufacturing, to heavier manufacturing, and eventually to high technology manufacturing and services, reflecting increasing levels of productivity and innovation capacity. While productivity varies considerably across sectors, different value chain functions within sectors and the efficiency to conduct such activities involve varying levels of labour and capital intensity and thus productivity levels. Enhanced productivity and innovation are closely tied to better-paid and more stable jobs and greater human capital and skills (Chapters 3 and 4). Productivity and innovation capacity are also closely tied with the transition towards a low-carbon economy (Chapter 5).

2.2.1. Jordan’s labour productivity has been stagnant in recent years

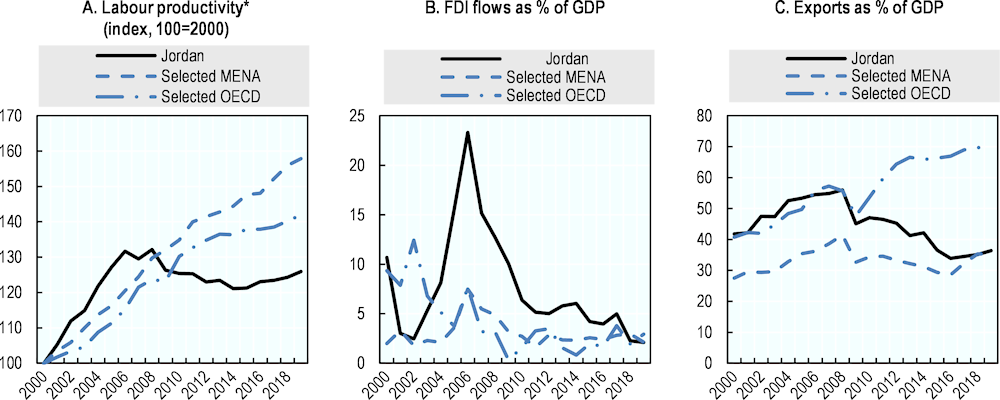

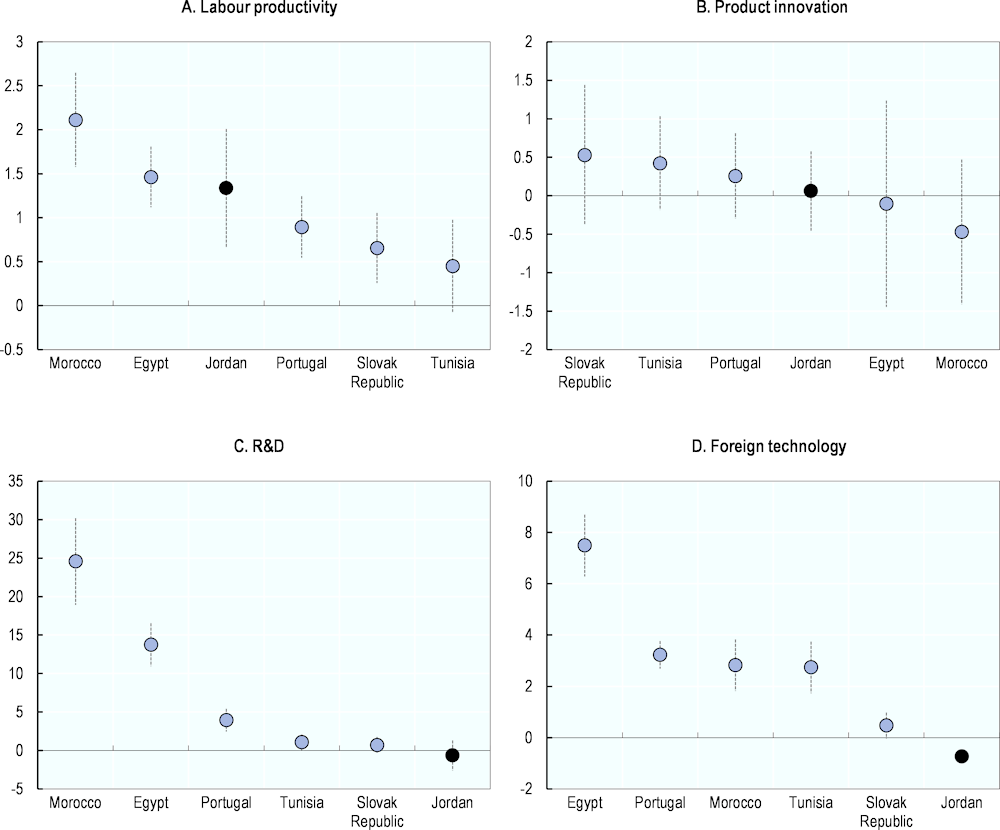

In the decade prior to the 2008 global financial crisis, labour productivity in Jordan accelerated faster than in peer countries such as Egypt, Morocco and Tunisia in the MENA region, and Portugal and the Slovak Republic in the OECD region (Figure 2.1, Panel A).1 Aggregate labour productivity improved by 30% between 2000 and 2006 in Jordan, compared to 20% in selected MENA and 10% in selected OECD countries. Productivity growth was enabled by an impressive period of macroeconomic performance (OECD, 2021[1]), with a sharp increase of FDI and a boost in exports of goods and services (Figure 2.1, Panel B and C). FDI inflows increased seven‑fold over 2003 and 2006, corresponding to an increase from 5% relative to GDP in 2003 to almost 25% in 2006. Manufacturing, real estate and construction received most FDI during this period and have driven economic growth and productivity (Hausmann et al., 2019[2]). The United Arab Emirates (UAE), Bahrain, Saudi Arabia and Kuwait accounted for 50% of total FDI. Exports increased three‑fold over the same period. Exports as a share of GDP increased from 40% in 2000 to 55% in 2008. Jordan’s garment, agriculture and chemical sectors have most significantly expanded global market shares, indicating raising competitiveness of these sectors in the 2000s.

A series of negative external shocks affected Jordan’s productivity and competitiveness in the late 2000s and the following decade – more than in peer economies. Over 2008‑14, labour productivity fell to levels seen in the early 2000s and have since stagnated (Figure 2.1, Panel A). Besides the global economic slowdown due to the 2008 global financial crisis, conflicts in neighbouring countries have cut off important trade corridors and led to a significant drop in demand for Jordan exports (OECD, 2021[1]). The share of exports in GDP dropped from 55% to 30% over 2008‑16 and has since stagnated (Panel C). FDI also fell considerably to less than 5% of GDP between 2010‑19 compared to an average above 12% in the previous decade (Panel B). Conflicts in neighbouring countries provoked massive inflows of migrants and refugees, increasing Jordan’s population by 50% over 2008‑17, putting further pressure on the economy. External instability also increased the cost of energy imports during a period of already expensive energy prices, making electricity-intensive manufacturing a less competitive activity in Jordan (Chapter 5).

In contrast, Jordan’s peers have continued to improve productivity during the past decade. MENA comparators have improved productivity, on average, by 25% over 2008‑19 (Figure 2.1, Panel A). Productivity growth in Portugal and the Slovak Republic has slowed during the post crisis recovery but remained positive; productivity levels were 15% higher in 2019 compared to 2008. Export shares in GDP also expanded further during this period: starting at Jordan’s level (55%) in 2008, Portugal and the Slovak Republic now report export shares in GDP of 70%. They received important FDI inflows in efficiency-seeking manufacturing during the 2008 crisis recovery (OECD, forthcoming[3]; 2022[4]).

Figure 2.1. Labour productivity, FDI and export trends in Jordan and its peers

Note: *Labour productivity = value added per person employed in constant USDs; Selected MENA = Egypt, Morocco, Tunisia; Selected OECD = Portugal, the Slovak Republic.

Source: OECD calculations based on World Bank’s World Development Indicators (Panel A and C) and UNCTADStats (Panel B).

2.2.2. Jordan has a large but relatively low productivity services sector

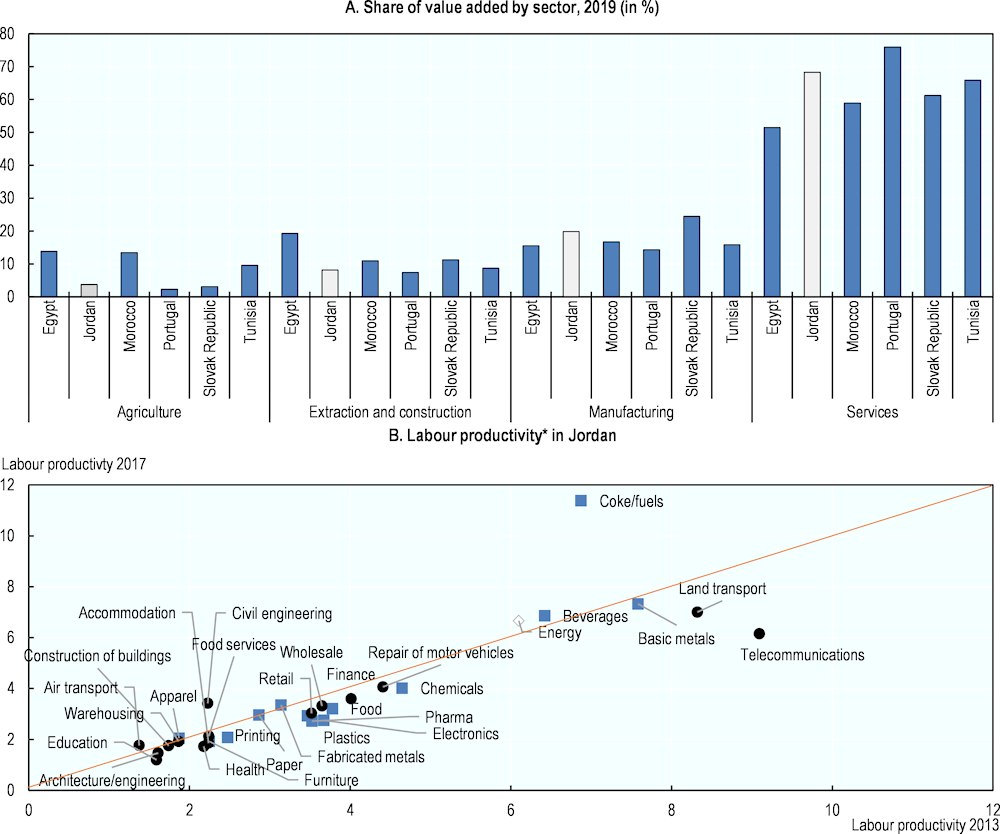

Jordan’s economy today is driven largely by services, comparable with some other countries in the region and OECD economies (Figure 2.2, Panel A). In recent years economic growth and exports have been driven in large part by services such as real estate, finance, transport, ICT and wholesale and retail services, compared to growth in the 2000s which was driven primarily by manufacturing exports (Hausmann et al., 2019[2]). Jordan’s economic structure is comparable with that of Morocco and Tunisia within the MENA region and Portugal and the Slovak Republic within the OECD. The services sector is larger than in MENA comparators and is responsible for almost 70% of GDP, compared to shares of around 60% in Morocco and 50% in Egypt. The contribution of agriculture to aggregate value added in Jordan is at less than 5%, comparable with that in Portugal and the Slovak Republic, while agriculture remains somewhat more important in its MENA peers (at least 10%).

The relatively strong growth performance in some services over the past decade has not contributed to improved labour productivity in Jordan (Figure 2.2, Panel B). Measuring labour productivity as value added per USD spent on labour compensation reveals that, unlike in other economies, many services activities in Jordan are less productive than low technology manufacturing such as furniture, paper and plastics production.2 This applies not only to lower paid services such as construction, warehousing or tourism (accommodation, food services) but also to typically highly advanced and better paid services such as architecture, engineering and finance. Moreover, most services and manufacturing activities in Jordan saw stagnant or slightly decreasing labour productivity levels over 2013‑17 (many sectors are positioned below the 45‑degree line in Panel B). Productivity levels in Jordan’s services, industrial and primary sectors compete with those of peers in MENA countries, but labour productivity across broad economic sectors remains two to three times below the levels in economies such as Portugal and the Slovak Republic, which are themselves at the lower end of the productivity ladder within the OECD.3

Figure 2.2. Economic structure and sectoral labour productivity

Note: *Labour productivity = value added / labour compensation ratio. This figure only reports the 15 manufacturing and 15 services activities (based on ISIC Rev.4 2‑digit sectors) with the highest levels of value added in Jordan.

Source: OECD calculations based on World Bank’s World Development Indicators (Panel A) and Jordan National Statistics (Panel B).

2.2.3. Growth and productivity are likely to occur in tradable services

A re‑boost in exports and foreign investment inflows should drive growth and productivity enhancement in Jordan. Fiscal and balance of payments constraints remain a challenge (Chapter 1). Despite fiscal adjustments, Jordan’s debt-to-GDP ratio has risen to above 90% since the 2008 crisis. Future growth can therefore neither depend on fiscal stimulus, nor can it be expected to come from fiscal discipline. The current account deficit is already large and thus growth cannot be led by an increase in domestic private demand for non-tradable goods given that this would require more imports and worsen the external balance. Jordan’s growth and productivity potential thus lies in exporting activities and foreign investment inflows, which will lower the current account deficit and have a multiplier effect on the non-tradable sector.

The immediate growth and productivity potential lies in services activities that are neither intensive in energy nor in water (Chapter 1). Jordan has the natural endowments to reduce the costs of electricity in the medium term through an acceleration of investments in renewable energy generation and leveraging new technologies to maintain grid stability (Chapter 5). This would also help Jordan’s green growth agenda more generally and create new opportunities for sustainably increasing water supply, which would also improve competitiveness in (energy- and water-intensive) manufacturing activities. The potential for productivity growth in services is supported by the growing workforce with tertiary education, including of women (Chapter 3 and 4).

2.3. FDI impacts on productivity and innovation in Jordan

FDI has been a key driver of aggregate productivity in Jordan in the 2000s but inflows have slowed considerably ever since and with that productivity has been stagnating (see above). Using OECD’s conceptual framework to asses FDI Qualities (OECD, 2022[5]), this section benchmarks key contextual factors – notably the characteristics of FDI and absorptive capacities of SMEs (i.e. in terms of access to skills, finance, knowledge assets) – that are enabling or constraining the contribution of foreign businesses to Jordan’s productivity and innovation enhancement (Box 2.1). The section further assesses the extent to which knowledge spillovers of FDI on productivity of the local economy and SMEs are at play in Jordan.

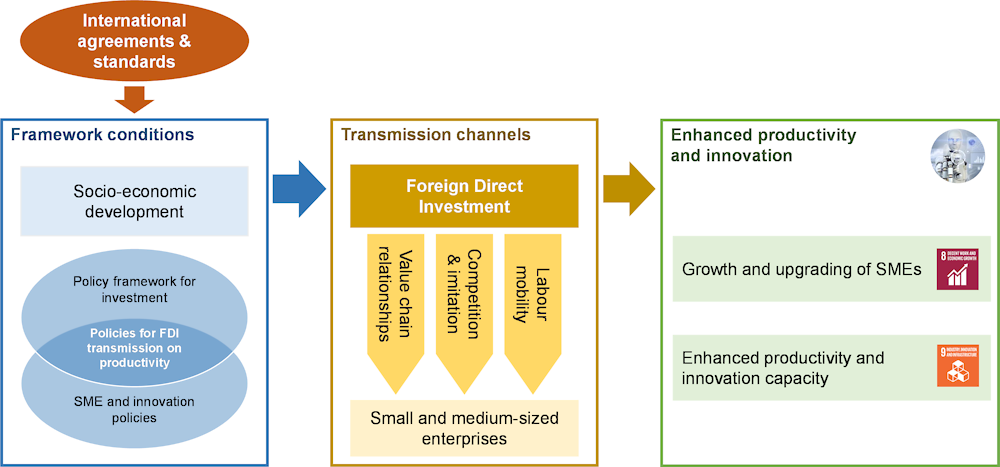

Box 2.1. Conceptual framework to assess the impact of FDI on productivity, innovation and SME development

This box summarises the conceptual framework developed for the productivity cluster of the OECD FDI Qualities Policy Toolkit (OECD, 2022[5]). The main body of this chapter uses this framework to benchmark the impact of FDI on productivity and innovation, and related policies and institutional arrangements in Jordan against peers in the MENA region and OECD countries.

FDI can, on the one hand, directly contribute to enhanced productivity and innovation and, on the other hand, involve knowledge and technology spillovers on small and medium-sized enterprises (SMEs), contributing to their upgrading and productivity improvement (Figure 2.3, green and yellow box):

FDI direct impacts: Foreign firms’ direct impacts relate to their own activities and how they contribute to aggregate and sectoral productivity and innovation. FDI directly relates to improved productivity and innovation at the industry or aggregate level if foreign firm activity is concentrated in sectors that are typically more productive and innovative. The opposite holds if FDI is concentrated in low value‑added, less innovative, sectors. FDI can thus shift the sectoral composition towards more or less productive or innovative activities. Additionally, FDI’s direct contribution to productivity growth is the result of foreign firms’ often observed productivity advantage over domestic firms. This is driven by their stronger access to technology, better managerial skills and more adequate resources for capital investment than domestic firms. Sise also matters, since foreign affiliates are usually larger than the average domestic enterprise and can therefore harness economies of scale – including through their relationship with the parent company – which are not available to domestic companies.

FDI spillovers: Due to foreign firms’ productivity premium relative to domestic firms, knowledge and technology spillovers of FDI are possible and can lead to increased productivity of domestic enterprises, including SMEs. SMEs can benefit from knowledge and technology spillovers through various transmission channels – such as value chain relationships (buy and supply linkages and strategic partnerships), labour mobility between foreign and domestic firms, as well as competition and imitation effects involving the exchange of tacit knowledge.

Figure 2.3. Channels through which FDI influences productivity, innovation and SMEs

Productivity and innovation impacts of FDI may not materialise automatically and depend on a number of specific contextual and policy factors (Figure 2.3, blue box):

Contextual factors: FDI impacts depend notably on the characteristics of FDI itself such as on foreign firms’ technological advantage, sectoral and geographic distribution as well as the types (greenfield vs. acquisitions) and motives of FDI. Impacts further depend on the capacities of SMEs to recognise valuable new knowledge and integrate it productively in their processes. These capacities are determined by firms’ access to strategic resources such as finance, knowledge capital and skills. FDI impacts are also determined by the broader economic and geographic context in which FDI takes place (e.g. related to infrastructure, natural resources, industrial clusters and skills).

Policy and institutional factors: Public policies and institutional arrangements play an important role in enabling FDI spillovers on productivity. Policies and institutions are also essential to avoid negative implications that may result from the presence of foreign businesses, such as crowding out of local SMEs and jobs and implications on the environment (also see Chapters 3‑5). Most policies are not specifically targeted to foreign firms; they treat foreign and domestic investors alike. Yet, the extent to which policies affect the two groups, and with that their outcomes on productivity and innovation, can vary. Some regulations directly affect foreign firms’ choice of location, influence specific types of foreign firms to invest and keep away others.

2.3.1. FDI in modern, ITC-based services can boost productivity in Jordan

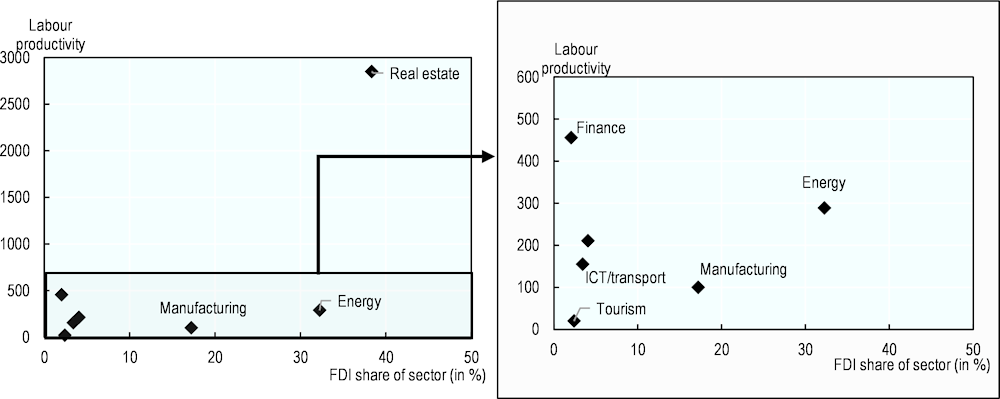

The contribution of FDI to aggregate productivity growth in Jordan (observed in the 2000s) was among other factors led by large (financial) investments in real estate development and energy (Figure 2.4, vertical axis) (Chapter 1). Both sectors employ comparatively few workers but involve disproportionately high capital investments. Investments and (measured) labour productivity in both sectors are primarily driven by global financial market dynamics of these assets and less by real economy value added and labour productivity enhancements.

The fairly high share of FDI stocks and value added in manufacturing is not bolstering aggregate productivity in Jordan. Manufacturing, on average, reports the lowest labour productivity level across all sectors in Jordan, with the exception of tourism activities (such as accommodation and food services). While manufacturing exports have been booming and global market shares increasing before 2008, particularly in chemicals but also in food and garments, competitiveness in most manufacturing sectors has since lapsed due to external factors related to energy prices, water scarcity and regional instability.

By contrast, relative stability of FDI inflows in a number of services activities in recent years can contribute to future growth in productivity – more than in some of Jordan’s peers. In Jordan, labour productivity levels in finance, ICT and transport are considerably higher than in manufacturing (Figure 2.4). Productivity in ICT and transport is 50% higher than in manufacturing; while that in finance is five times as high as in manufacturing. This productivity premium of services vis-à-vis manufacturing disappears when using labour productivity measured as value added per USD spent on labour (see Figure 2.2). This alternative measure of productivity removes the productivity bias for better paid activities.

Finance, ICT and transport still report low FDI shares, but Jordan tends to have higher productivity in these services (relative to manufacturing) than many of its peers (not in shown Figure 2.4). This is particularly the case in ICT/transport where Egypt, Qatar, Finland and Poland report productivity levels below those in manufacturing. Given the increasing comparative advantage – related to an increasingly skilled workforce relevant for ICT and finance – productivity has great potential to increase further in these tradable services. Many of these services are highly labour- but not energy-intensive, providing opportunities for more inclusive and green productivity growth compared to sectors that are currently driving FDI and productivity (i.e. energy and real estate).

Figure 2.4. Labour productivity (index, 100=manufacturing) versus FDI share by sector in Jordan

Source: OECD based on UNStats and FT’s fDi Markets database.

2.3.2. Foreign firms exhibit important productivity premia over domestic ones

In addition to the sectoral concentration of FDI, foreign investment is directly contributing to enhanced productivity in Jordan due to their productivity premia over domestic firms. Although the manufacturing sector is generally struggling due to high input costs (primarily energy and water), foreign firms contribute to relatively higher labour productivity than domestic manufacturers (Figure 2.5, Panel A). Foreign manufacturers are almost 1.5 times as productive as domestic peers in Jordan. This FDI productivity premium of foreign firms can be observed across all five peer economies; they are even higher in Egypt and Morocco and lower in Portugal, the Slovak Republic and Tunisia. The productivity premium reveals that foreign manufactures are generally better able to generate value added with available human resources, which may relate to their larger size, better processes and higher capital or technological intensity.4

Due to these performance premia of foreign firms in Jordan, knowledge and technology spillovers of FDI are possible and can lead to increased productivity of domestic enterprises, including small and medium-sized enterprises (SMEs). If productivity differences are excessive, however, it is unlikely that domestic firms can absorb such knowledge. Comparing productivity differences does not allow for conclusions on whether or not SME absorptive capacities are sufficient, but identifying differences in capacities allows to infer that the potential for spillovers exists. Capacities of SMEs to absorb foreign knowledge and use it productively in their own processes is assessed in the next sub-section.

Figure 2.5. Performance premia of foreign relative to domestic manufacturers are limited in Jordan

Note: See methodology in OECD (2019); Panel A: Labour productivity = average value added per person employed in foreign vs. domestic firms; Panels B-D: share of foreign vs. domestic firms that engage in product innovation and R&D and that licenced a technology from a foreign firm.

Source: OECD FDI Qualities Indicators based on World Bank Enterprise Surveys.

The lack of skills- and technology-intensive activities undertaken by foreign firms in Jordan reduces the opportunities for linkages with and spillovers on domestic peers. Unlike in Portugal, the Slovak Republic and several MENA economies, foreign manufacturers are generally not operating in Jordan to engage in innovation activities or in the use of frontier technologies from abroad (World Bank, 2019[6]). Domestic manufactures too are generally not engaging in R&D and product innovation in Jordan. In fact, domestic firms are more likely to apply licensed technologies from abroad compared to their foreign peers (Figure 2.5, Panels B, C and D). Foreign firms have been seeking the Jordan market for manufacturing production to engage in low-technology, standardised activities, which are often less likely to generate productivity spillovers than skills intensive activities (Keller and Yeaple, 2009[7]; Nicolini and Resmini, 2010[8]).

2.3.3. The comparatively large SME sector has limited capacity to benefit from FDI presence

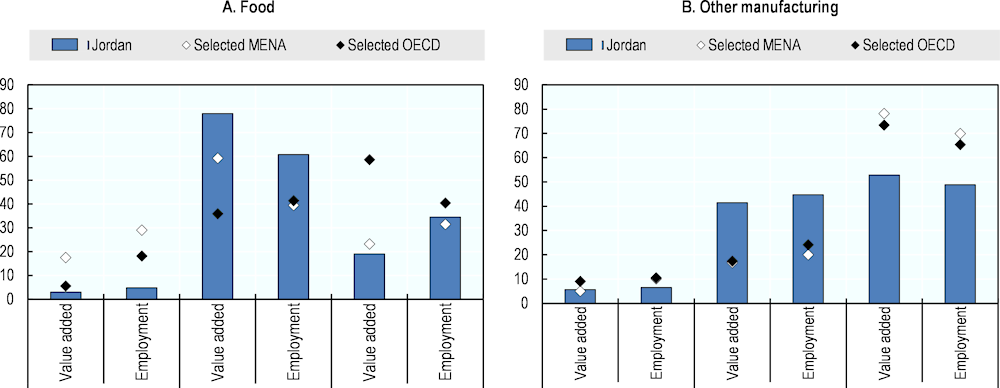

The SME sector is economically more important in Jordan than in selected MENA and OECD countries. This holds particularly true for medium-sized manufacturers with 20‑99 employees. In food production for example, medium-sized firms in Jordan are responsible for 80% of value added and 60% of jobs compared to average shares below 60% for value added and 40% for employment in comparator economies (Figure 2.6, Panel A). Medium-sized firms in other manufacturing sectors (particularly chemicals) are also contributing relatively more to value added and employment in Jordan compared to selected MENA and OECD countries (Panel B). On the other hand, large manufacturers with more than 100 employees have a larger economic weight in peer economies.

Figure 2.6. Distribution of value added and employment by firm size in manufacturing

Note: Sise categories: small (<20 employees), medium (20‑99 employees), large (>100 employees); selected MENA = Egypt, Morocco, Tunisia; selected OECD = Portugal, the Slovak Republic.

Source: OECD based on World Bank Enterprise Surveys.

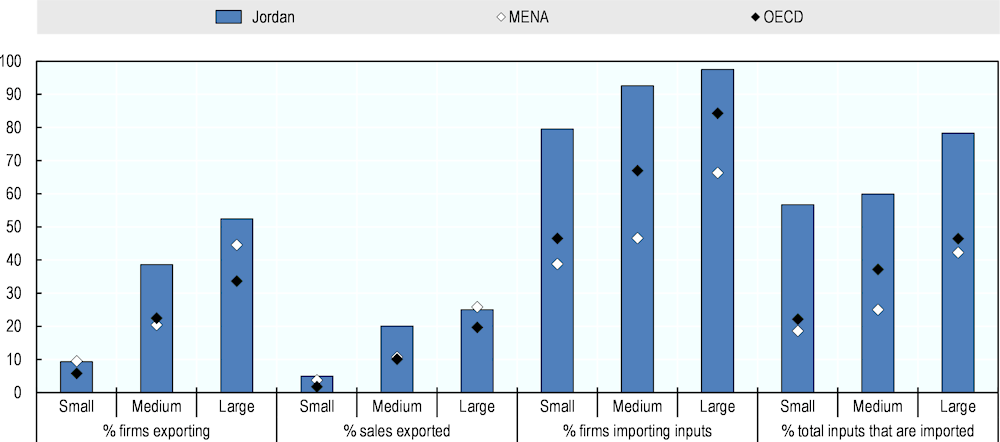

SMEs in Jordan are more internationalised than those in peer economies, which could signal their capacity to absorb knowledge from foreign firms through spillovers. Across all categories of firm size (small, medium and large), firms in Jordan are more internationalised than their peers in selected MENA and OECD countries (Figure 2.7). This holds across metrics such as (a) percentage of firms that export, (b) percentage of sales exported, (c) percentage of firms importing inputs and (d) percentage of total inputs that are imported. The ability of Jordan’s SMEs to internationalise through exports and imports and thereby to integrate in global value chains could signal SMEs’ potential to benefit from FDI spillovers as well.

Figure 2.7. Integration in global value chains by firm size group

Note: Sise categories: small (<20 employees), medium (20‑99 employees), large (>100 employees); selected MENA = Egypt, Morocco, Tunisia; selected OECD = Portugal, the Slovak Republic.

Source: OECD based on World Bank Enterprise Surveys.

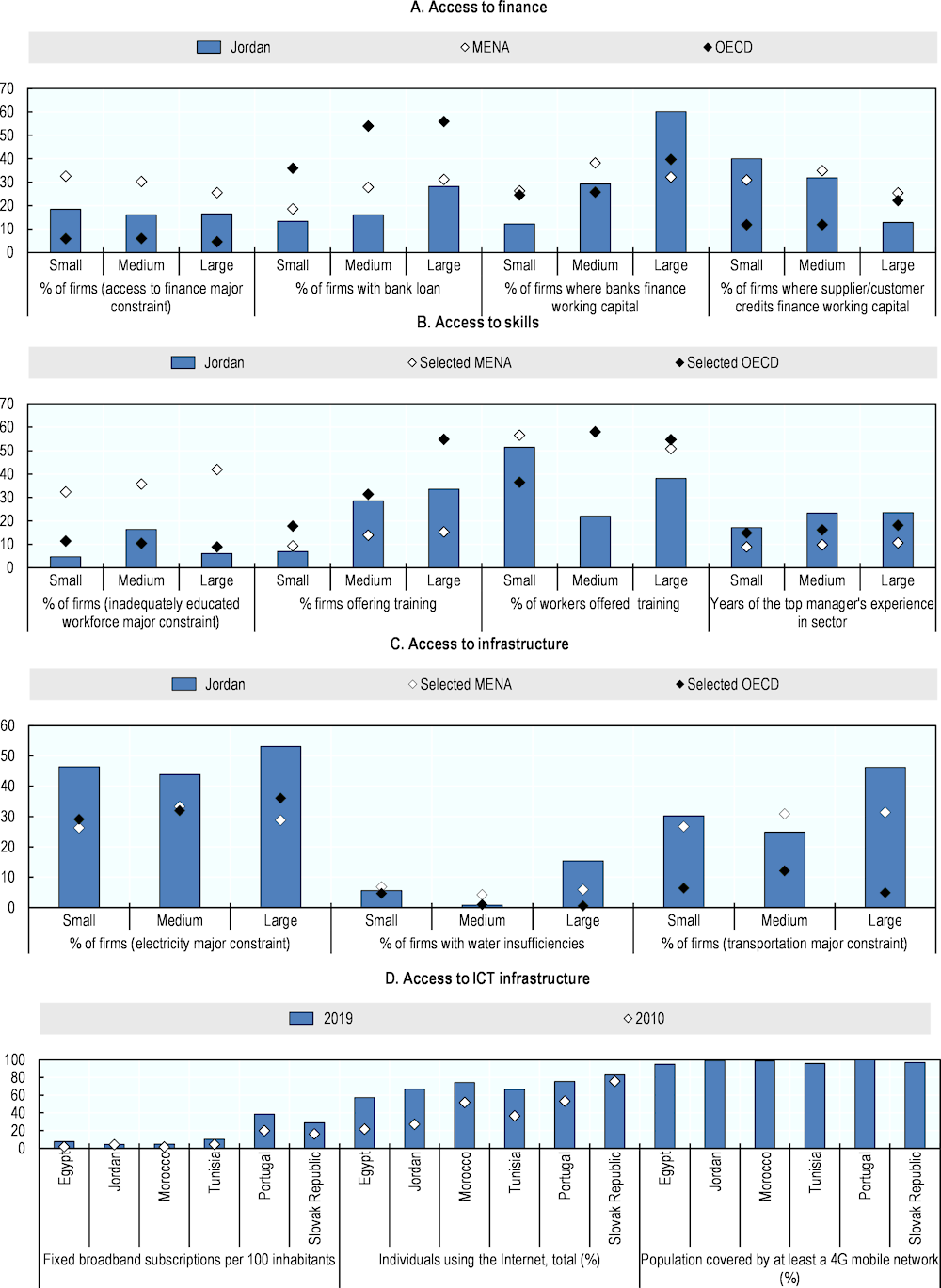

Yet, SMEs in Jordan have lower access to strategic resources such as finance and infrastructure compared to peers – while access to skills is less of a constraint (Chapter 3). These resources are critical for firms to tap on knowledge and technologies of foreign firms and thus their absence or limited availability constrains firms’ competitiveness in Jordan (Figure 2.8). For example:

In terms of finance, about 20% of SMEs and large firms in Jordan identify access to finance as a major constraint for their business operations (Panel A). These shares are much higher than in selected OECD countries (Portugal and the Slovak Republic).

In terms of skills, less than 15% of medium-sized firms and less than 5% of small and large firms in Jordan consider an inadequately educated workforce as a major constraint (Panel B). In fact, there is an important skills-mismatch and many workers are overqualified (Chapter 3).

Access to key infrastructure services (e.g. electricity, water and transport) is identified as a considerably higher constraint for businesses in Jordan as compared to its selected peers (Panel C).

Access to fixed broadband internet remains generally low in the MENA region, including in Jordan, while access to high-speed mobile internet networks (such as 4G) is guaranteed for the entire population in Jordan as it is in other economies (Panel D).

Figure 2.8. Access to finance, skills and infrastructure

Note: Selected MENA = Egypt, Morocco, Tunisia; selected OECD = Portugal, the Slovak Republic.

Source: OECD based on World Bank Enterprise Surveys and International Telecommunications Organisation.

2.3.4. Despite some local linkages with foreign firms, knowledge transmission to domestic SMEs is limited

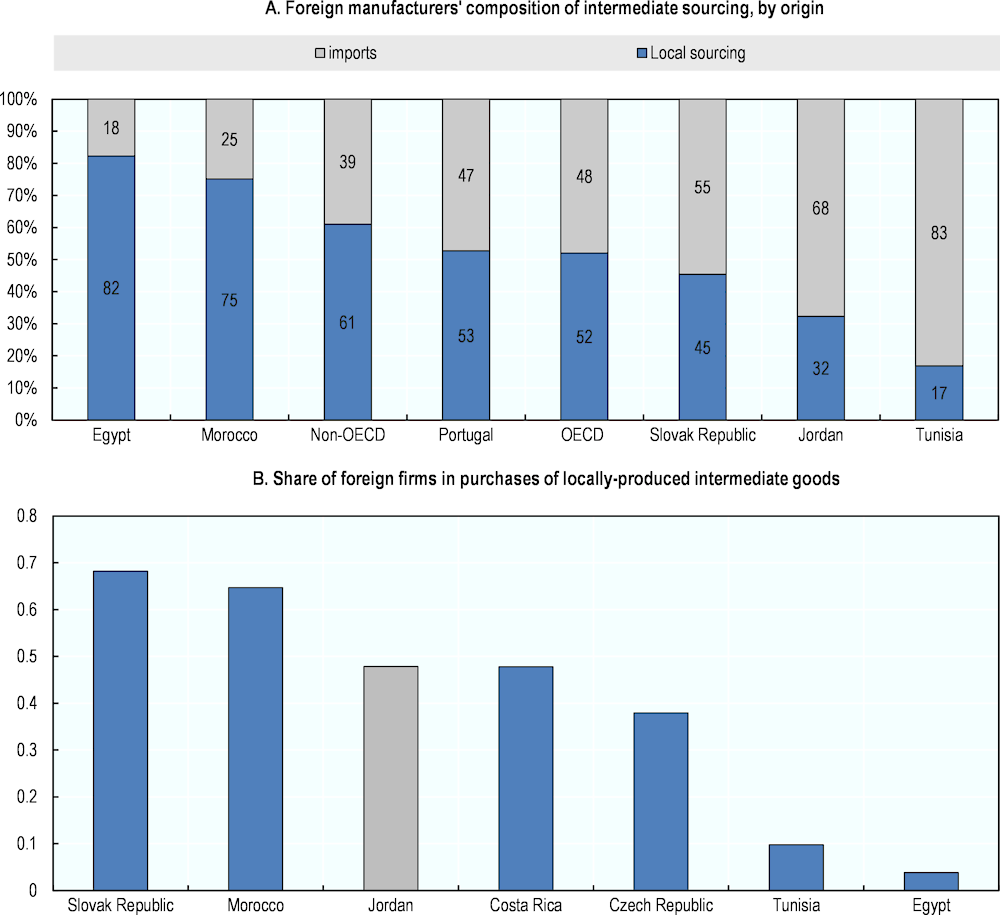

Linkages between affiliates of foreign firms and the local economy are well below the average for non-OECD countries. Unlike in Egypt and Morocco, foreign firms in Jordan source less than half of their inputs from firms (both domestic and foreign) that produce locally (Figure 2.9, Panel A). This sourcing share is higher than in Tunisia, however. Relatively lower shares of local sourcing are common among small open economies like Jordan and Tunisia. Small economies cannot develop a comparative advantage in all sectors and parts of supply chains and thus specialise in certain areas, while depending on imports for some goods and services. Overall, linkages between foreign manufacturers and local firms in Jordan involve mostly sourcing of low-value added and low-technology inputs, rather than strategic partnerships for R&D or knowledge activities (OECD, 2021[1]).

Figure 2.9. Local sourcing of foreign firms in Jordan, 2019

Source: OECD based on World Bank Enterprise Surveys.

Despite limited local sourcing, affiliates of foreign firms are a key source of revenue for local suppliers in Jordan but not necessarily SMEs. In Jordan, foreign firms buy more than half of the locally produced intermediates (Figure 2.9, Panel B), even more than in Morocco and the Slovak Republic, for example, where affiliates of foreign MNEs buy almost 70% of locally produced inputs. However, local sourcing in all three countries is mostly driven by foreign firms supplying intermediates to other foreign firms hosted in the same country (OECD, 2021[1]).

FDI has led to knowledge and technology transfers for some domestic suppliers in Jordan – particularly young and services firms. Research based on Jordan’s census data 2006 and 2011 shows that spillovers – measured by employment and capital growth – occurred particularly among younger firms (established after 1990) supplying foreign firms and companies supplying services (World Bank, 2015[9]). This type of domestic firms continued to grow after many foreign firms exited the Jordan market in the late 2010s due to the global crisis and regional conflicts. This shows that learning externalities for young and services suppliers appear persistent, that is, they continue even after FDI leaves and underlines the relative competitive advantage of services, as opposed to manufacturing, in Jordan.

On the contrary, domestic firms in the same sector in which foreign firms are operating experienced a crowding out effect of employment growth in the 2010s (Chapter 3). Domestic manufacturers and services firms that are directly competing with foreign firms, which are often more productive and have superior technology endowments, have experienced an employment growth decline. This finding is in line with existing research showing that productivity and employment growth spillovers occur rather among domestic firms in vertical relationships with foreign firms, as opposed to firms that are competing in the same sector (OECD, 2022[5]; Farole, 2014[10]).

2.4. The governance framework for investment, innovation and SME policy

Jordan puts high policy priority on investment as a driver for productivity, innovation and SME upgrading. Like many emerging economies in MENA and other regions, the Government of Jordan supports this ambition with various multi-year strategies and plans, governed by dedicated councils and committees, ministries and implementing agencies. This section provides an overview of government strategies and the institutional setup at the intersection of investment, innovation and SME policy and evaluates to what extent they are conducive with Jordan’s comparative advantage and opportunities for productivity and innovation growth.

2.4.1. Jordan has a coherent framework of national strategies to support FDI-driven productivity growth by linking investment, SME and innovation policies

Jordan’s vision for sustained social and economic growth targets sectors with significant investment, growth and productivity potential. Social and economic development ambitions are underpinned by the ten‑year Jordan 2025 blueprint (Box 2.2). This vision places emphasis on the role of private – particularly foreign – investment and takes a sectoral or cluster-based approach. It essentially aims to foster investment, productivity and growth in eight (mostly) services sectors, including: construction and engineering, transport and logistics, tourism and events, health care, life sciences, digital and business services, educational services and financial services. Despite a general investment slowdown in recent years, Jordan has continued to attract FDI in many of these services although shares of investment stocks remain low compared to less competitive manufacturing, for example (Section 2.3). The analysis in Section 2.2 further revealed that these services have the highest potential for further productivity growth in Jordan, supporting the appropriate choice of target sectors.

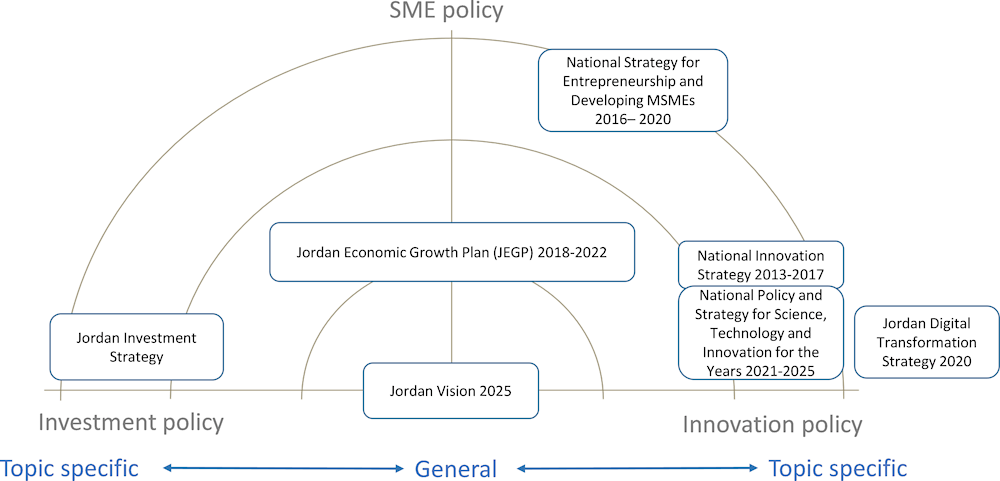

The implementation of Jordan’s overarching vision 2025, and particularly its ambition related to productivity, is supported by multiple national strategies (Figure 2.10). The vision is most directly implemented through numerous planned economic, fiscal and sectoral policies under the Jordan Economic Growth Plan (JEPG) 2018‑22, established by the Economic Policy Council. The plan intends to expand productivity and capacity in the eight Jordan 2025 target sectors. It recognises the importance of private investment, innovation, digitalisation and SMEs for Jordan to achieve sustained productivity and growth. Additionally, Jordan’s governance framework for investment driven productivity growth contains a number of strategies specifically focusing on investment, SMEs, innovation and digital policy and promotion – all based on and inspired by Jordan 2025 (Box 2.2).

The design and continuity of sectoral strategies for investment, SMEs, innovation and the digital economy could be further improved. While all sectoral strategies make reference to Jordan 2025, they are all introduced separately without cross-referencing to and alignment with strategies introduced by other government bodies. Some sectoral strategies have reached the end of their applicability, based on information available online in English, and have not yet been renewed (e.g. Jordan Investment Strategy 2016‑19; and National Entrepreneurship and SME Growth Strategy 2015‑19) or they were not immediately renewed (e.g. the National Policy and Strategy for Science, Technology and Innovation 2021‑25 was introduced after a 5‑year vacuum without an innovation strategy). Jordan’s governance framework based on multiple national strategies and action plans could further benefit from improved cross-referencing, alignment across strategies and continuity.

Information on these strategies could be centralised and be made available online in a consistent and timely fashion. While investment is critically important for productivity and development ambitions in Jordan, its investment strategy in English is not accessible online, for example. All other strategies are scattered across ministerial and agency websites. Having a centralised online platform for Jordan 2025 where all up-to-date national strategies, related laws, regulations and information on institutional governance are available would greatly help potential foreign and domestic investors as well as government agencies and ministry departments to navigate through policy ambitions and plans on interrelated policy areas relevant to FDI-driven productivity growth.

Figure 2.10. Key strategies for sustainable development, investment, SMEs and innovation

Source: OECD FDI Qualities Mapping (2021).

Box 2.2. National strategies supporting productivity and SME growth through investment

Jordan 2025, introduced in 2014 by the central government, is Jordan’s long-term vision and emphasises the role of foreign investment for Jordan’s competitiveness and productivity enhancement, including of SMEs. It adopts a cluster-based approach to expand existing industries that are performing well, while developing related or supportive clusters complementary to those industries. The plan identifies eight industrial clusters as having high potential for development: construction and engineering, transport and logistics, tourism and events, health care, life sciences, digital and business services, educational services and financial services.

The Jordan Economic Growth Plan (JEPG) 2018‑22, established by the Economic Policies Council, introduces almost one hundred economic, fiscal and sectoral policy actions, targeting growth and development of the eight sectors identified by the Jordan 2025 vision. Policy actions aim to expand industrial capacity and growth through effective partnerships of private and public sector actors, infrastructure development, new digital government services and reduction of red tape. The plan further recognises the importance of SMEs in Jordan and highlights the importance of fostering entrepreneurship and innovation, while supporting existing businesses to expand.

The Jordan Investment Strategy 2016‑19, developed by the Jordan Investment Commission (JIC) – now MoI, and introduced in 2016, further supports the implementation of development objectives under the Jordan 2025 vision. The strategy is not intended to be a wider national investment strategy. Instead it is primarily focused on MoI’s activities in attracting companies to directly set up and expand in Jordan. Yet, the strategy aims to not only boost the quantity but also the qualities of investment, particularly emphasising quality jobs for skilled workers, linkage opportunities for local businesses, deepening of Jordan 2025 industrial clusters and enabling productivity spillovers through investment. The strategy is currently being updated by MoI.

The National Innovation Strategy 2013‑17, established and implemented under the responsibility of the Higher Council for Science and Technology (HCST) has served to frame proactive policies in the area of innovation, research and development (R&D) with the objective of making Jordan an innovation-based economy. Under this overarching objective, it has put an emphasis on medical services and the pharmaceutical industry, ICT, clean technologies, architecture and engineering services, education and career guidance services, and financial services, in line with the sectoral focus of Jordan 2025.

While the previous innovation strategy was not immediately renewed, the government has approved the National Policy and Strategy for Science, Technology and Innovation (2021‑25) in April 2021. The new strategy puts emphasis on research and innovation that supports Jordan in addressing key climate‑related challenges shared with other economies in the MENA region, including water scarcity, sustainable agriculture, health and renewable energy. The strategy is closely co‑ordinated with the Union for the Mediterranean Regional Platform for Research and Innovation, co-chaired by the European Commission’s DG Research and Innovation and Jordan’s HCST.

The Jordan Digital Transformation Strategy 2020, established by the Ministry of Digital Economy and Entrepreneurship (MoDEE), outlines the changes and strategic requirements needed to keep up with the progress of the global digital transformation, and to improve government services and performance (MODEE, 2020). To translate this strategy into concrete actions, the government has launched REACH 2025 in 2016. With this action plan, Jordan aims to digitise the entire economy with emphasis on niche markets and global value chains. The plan includes objectives related to enhancing startups and entrepreneurship in the digital sector, development of digital skills and talent, and improving the business environment through digitalisation.

Realising the importance of SMEs in Jordan and the necessity of government support for them to grow, the National Entrepreneurship and SME Growth Strategy 2015‑19 has listed action plans for enhanced growth, productivity, innovation and internationalisation of domestic SMEs. The Strategy picks up overarching weaknesses of SMEs in Jordan, such as a weak entrepreneurial culture, lack of access to financing, lack of entrepreneurial and management skills and capacity, challenges in market access and lack of innovation and technology adoption and development (see Section 2.3). While the strategy does not make explicit reference to linkages between FDI and SMEs, addressing identified weaknesses would improve SMEs capacities to absorb knowledge and technologies from foreign investors. The strategy has not been renewed to date.

Source: OECD FDI Qualities Mapping (2021).

2.4.2. The governance of policies supporting FDI impacts on innovation, productivity and SMEs is entrusted to several government bodies at various levels

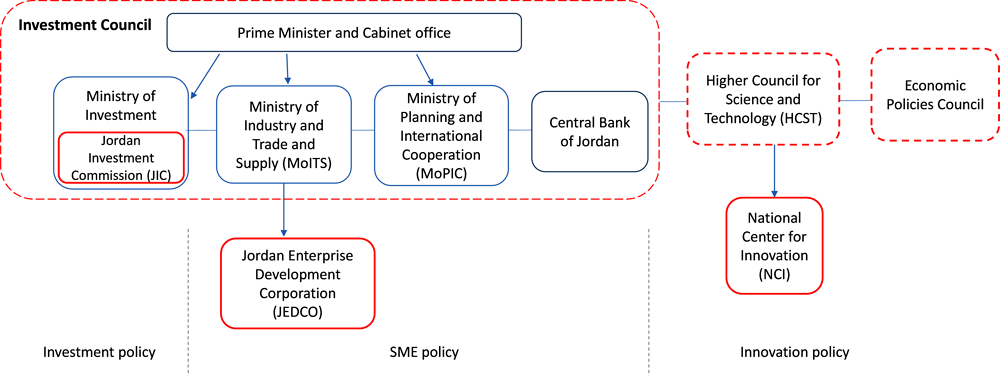

The institutional framework supporting FDI impacts on productivity and innovation is ensured at the highest level by three main inter-ministerial councils (Figure 2.11):

Directly under the King’s supervision, the Economic Policies Council (EPC) in charge of devising and implementing Jordan’s five‑year policy action plans to implement the 2025 vision was established in 2016. While the EPC covers the whole spectrum of public policies, it puts important weight on the role of private investment for boosting growth, productivity and innovation in Jordan (Economic Policy Council, 2017[11]).

The Higher Council for Science and Technology (HCST) is responsible for fostering business innovation and knowledge transfers. Unlike other high-level councils in Jordan, the HCST is not only designing but also implementing innovation policy initiatives. The HCST is overseen by the central government cabinet.

The Investment Council is overseeing the management and development of investment policies in general and those relevant for FDI transmission on productivity in particular. The Investment Council is headed by the Prime Minister and brings together several ministries (e.g. Ministry of Investment, Ministry of Industry, Trade and Supply, and Ministry of Planning and International Co‑operation), and the Governor of the Central Bank, chambers of commerce and industry and other representatives from the private sector. As per the 2014 Investment Law, members submit recommendations on investment strategies, policies and reforms directly to the IC.

Policy implementation at the intersection of investment, innovation and SME policy is devolved to three main agencies with complementary mandates:

The recently established MoI, which is responsible for investment promotion and facilitation. MoI has a wider range of mandates compared to many investment promotion agencies in the OECD area (OECD, 2019[12]). It engages in investment attraction and facilitation, on the one hand, and export promotion of domestic companies, on the other. This double mandate is an opportunity to devise coherent approaches for business linkages between foreign firms and domestic SMEs, supporting upgrading and internationalisation of the domestic economy. The consolidation of investment and export promotion into one agency was introduced with the establishment of JIC in 2014. Previously, investment promotion was under the former Jordan Investment Board and the export promotion department of JEDCO. This structural reform also gave JIC – now MoI – the mandate to regulate and oversee the Jordan Free and Development Zones Group.

The Jordan Enterprise Development Corporation (JEDCO) is overseen by the Ministry of Industry, Trade and Supply (MoITS) and primarily in charge of designing, implementing and evaluating support programmes for emerging businesses and SMEs with a strong focus on strengthening their innovation capacity. The capacity to innovate is key for SMEs to absorb knowledge and technologies from foreign investors. As mentioned above, the export promotion mandate is officially no longer entrusted to JEDCO but is now under the responsibility of MoI.

The National Center for Innovation (NCI) was launched in 2016 by the HCST to boost Jordan’s transition to an innovation-based economy. NCI is expected to function as a policy implementation body, which is currently still often done by the HCST itself. The NCI also serves as a national one‑stop information and referral hub for all activities related to innovation and private sector development by preventing duplication, inefficiency and co‑ordination in terms of implementing policies related to innovation. Implemented with a support of the EBRD in 2019, the NCI has introduced an online co‑ordination platform – the so-called Jordan Open Innovation Platform (JOIP).

In addition to the Ministry of Investment, the Ministry of Planning and International Co‑operation (MoPIC) supports FDI impacts on productivity and innovation through the implementation of programmes supported by development partners. As the recipient of funding from development partners, the MoPIC helps rolling out a significant number of policy programmes contributing to these three policy domains and their intersection (Box 2.3). Policy implementation in Jordan has often been constrained by limited financial resources and capacities and therefore the contribution of development co‑operation to policy implementation is fundamental for Jordan’s success in achieving these policy objectives (Economist Intelligence Unit, 2016[13]).

Figure 2.11. Public institutions supporting investment, productivity and innovation in Jordan

Note: In red frame are the main government agencies implementing policies that strengthen FDI diffusion on productivity and innovation. Blue arrows indicate which institutions are overseeing others.

Source: OECD elaboration.

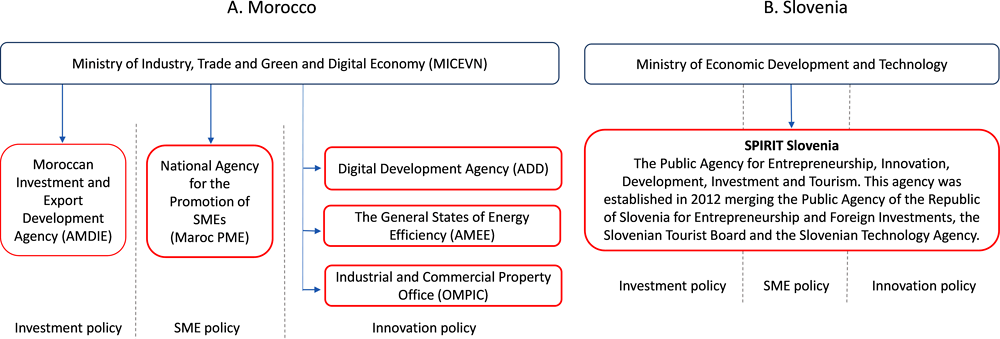

Jordan’s institutional framework across the investment, SME and innovation policy areas is comparable with that of Portugal. The institutional framework in Portugal is rather complex and represented by many state bodies. Policies that strengthen FDI impacts on productivity and innovation are designed and implemented through several ministries, task forces, advisory bodies and autonomous government agencies that operate at the intersection of investment promotion, SME development, innovation and regional development policy (OECD, 2022[4]). On the other hand, in other peer countries such as Morocco and Slovenia, all these policy domains are brought together under the responsibility of one ministry, which entrusts policy implementation to one or a small number of autonomous agencies (Figure 2.12). By design, the need for inter-institutional co‑ordination in such governance frameworks is limited, as coherence across policy domains needs to be achieved within a single supervising body.

More complex institutional settings in Jordan or Portugal may not be less effective in the implementation of policies that support FDI impacts on productivity and innovation as long as inter-institutional co‑ordination mechanisms are in place to overcome policy silos. Given the high transaction costs associated with the fragmentation of governance systems, the cost effectiveness of Jordan’s institutional setting should be ultimately weighed against the quality of co‑ordination and the potential benefits of a more centralised approach. An assessment of policy co‑ordination mechanisms is conducted in the next section, pointing towards weaknesses in inter-ministerial collaboration across the areas of investment promotion, innovation and entrepreneurship. On the other hand, co‑ordination approaches and instruments may vary depending on the context, country and policy area. In some cases, it is better to apply specialised agencies to each policy domain and ensure co‑ordination among them.

Jordan would also benefit from more clarity on the institutional roles and policy mandates entrusted to its implementing agencies to avoid potential overlaps or duplication of policy efforts. Although responsibility for trade promotion was transferred from JEDCO to JIC in 2014, the majority of technical and financial support programmes implemented by JEDCO still focus on strengthening the export capacities of domestic firms and supporting their upgrading in Global Value Chains (GVCs). On the other hand, the trade promotion mandate of JIC (now MoI) is limited to the organisation of promotional activities such as commercial events, product exhibitions and business missions in foreign markets. Clarifying the role that each agency plays in supporting the internationalisation of domestic firms and aligning it with the policies and programmes that they implement will help foster policy coherence and identify areas where synergies can be further developed. This is the case particularly for policies supporting FDI-SME linkages, where complementary expertise from both the investment and trade promotion policy areas is needed.

Figure 2.12. Institutional arrangements for FDI, SME and innovation policy in Morocco and Slovenia

Note: In red frame are the main government agencies implementing policies that strengthen FDI impacts on productivity and innovation. Blue arrows indicate which institutions are overseeing others.

Source: OECD elaboration.

Box 2.3. Foreign support in enhancing productivity, innovation and SMEs in Jordan

Jordan, as a lower middle income country, receives significant foreign assistance including for policy reform and implementation. The Jordan Compact was signed between the Government of Jordan and the international community in 2016 to cope with a massive number of refugees from neighbouring Syria and Iraq. Since then, Jordan receives international support and preferential trade terms with the condition to open its labour market to refugees (OECD/European Union/ETF, 2018[14]). The Ministry of Planning and International Co‑operation (MoPIC) is in charge of implementing the broader country development strategy and mobilising support from international actors including the Jordan Compact. The execution of specific projects is not only done by MoPIC but also allocated to line ministries and agencies specialised in the subjects. Two of these programmes are particularly relevant for SMEs:

Jordan Competitiveness Program (USAID)

The Jordan Competitiveness Program (JCP) supports both private and public sector actors with the objective to increase exports, promote investment, and improve the climate for doing business in Jordan. Concretely, the programme provides support to MoITS and MoI in their efforts to assist domestic firms accessing foreign markets. It also directly supports manufacturers in Jordan to access the EU market through the special simplified Rules of Origin arrangement under the Jordan Compact (USAID, 2019[15]).

Support to Research and Technological Development and Innovation Initiatives (EU)

The project aims to support applied scientific research focusing on the commercialisation of research results in business products of SMEs. The project also tries to accelerate the integration of Jordan into the European research development market. HCST and JEDCO are co-funding some of the activities implemented by the project. The implementation of this project is done in the form of grant assistance for the researchers as well as trainings delivered by experts from research centres and universities in Europe (HCST, 2021[16]).

2.4.3. Policy co‑ordination in the areas of investment, innovation and SME development does take place, but joint programming and inter-agency collaboration are limited

Actions to improve the impact of FDI on productivity and innovation need to be aligned with the objectives and strategies set by the Jordanian Government across different policy areas. This means that state bodies need to co‑ordinate their activities and maintain strong ties with institutions that operate in different parts of the government.

High-level government councils in Jordan could further ensure that public and private institutions from all relevant policy areas – i.e. investment, innovation and SME development – and all stakeholder groups (including foreign) are represented. The Investment Council gets closest to aligning policies across different domains. It is chaired by the Prime Minister and includes representatives from both the public and private sectors – including not only MoI on the investment side but also the MoITS overseeing the SME agency, JEDCO, the MoPIC rolling out development co‑operation programmes in the area of investment and the Central Bank. Yet, institutions responsible for policies to promote business innovation such as the HCST are not part of the Investment Council. The Investment Council is well positioned to co‑ordinate investment and business development concerns, with direct impact on the implementation of policy programmes through MoI and JEDCO, including those funded through development partners.

On the other hand, the Economic Policies Council, also chaired by the Prime Minister, is represented by parliamentary committees on investment and social issues as well as private sector stakeholders. Relevant ministries and implementation agencies have only an observer status in this council and may engage in dedicated working groups (The Jordan Times, 2016[17]). None of these councils include members or observers representing foreign investors. While full membership of foreign stakeholders could be problematic, including their voice as observers or in dedicated stakeholder consultations would be fundamental to address any challenges they may face with regard to engaging in knowledge‑intensive activities or collaborating with domestic firms.

Roles and mandates of various high level horizontal co‑ordination bodies, which put development strategies in place, could be also clarified. Key co‑ordination bodies and strategies are in place in Jordan, but there might be overlaps in their mandates and objectives, which could lead to uncertainty for existing and potential investors. The role of the Investment Council and that of the Economic Policies Council is currently not sufficiently differentiated, for example. This concern also relates to the need for a centralised and updated online information platform on national strategies, which was made earlier.

At the policy implementation level, horizontal co‑ordination and co‑operation on investment, innovation and SME policies are broadly absent in Jordan. The OECD FDI Qualities policy mapping conducted for this study revealed that only one policy initiative is jointly executed by two government agencies. Fostering greater inter-agency co‑ordination and co‑operation in the implementation of policies that span several policy areas will be crucial for Jordan to maximise the potential of FDI for productivity growth and innovation. In Portugal, for example, inter-agency collaboration is frequent. Horizontal co‑ordination mechanisms are primarily formalised by laws and regulations, which often describe the role and responsibilities of each institution, their internal management processes, and the policy areas where inter-institutional collaboration is required (OECD, 2022[4]). The Jordanian Government could encourage implementing agencies to engage in joint programming procedures on workstreams that require complementary expertise (e.g. FDI-SME linkages, innovation-oriented investment). Setting up dedicated inter-agency committees to monitor the implementation of jointly implemented policy workstreams could also ensure that bottlenecks in communication are resolved and resources from different parts of the government are pulled together for the implementation of targeted measures.

Vertical co‑ordination mechanisms across levels of government are fairly well-established in Jordan. Two-directional feedback mechanisms between policy design, implementation and evaluation agencies are key to communicate challenges policy beneficiaries (e.g. foreign investors or domestic SMEs) may face in given policy setups (OECD, 2018[18]). In Jordan, MoI is well-placed to transmit investor concerns to the Investment Council and can thereby provide important inputs to policy reforms at higher levels (OECD, 2019[12]). In the area of innovation policy, the HCST and NCI have more frequent interactions. The NCI is administratively attached to HCST’s head office in Amman. This proximity of the two institutions makes direct engagement and information sharing with private innovation actors easier (OHK Consultants, 2018[19]). The clear separation of policy making and implementation between MoITS and JEDCO leaves it unclear to what extent JEDCO has the leverage to engage in policy advocacy at higher levels.

2.5. The policy framework supporting the impact of FDI on productivity, innovation and SMEs

This section builds on the discussion of the institutional framework for FDI impacts on productivity and innovation and discusses challenges and opportunities of the broader climate for business and investment that could affect productivity growth in the future. The section also discusses the mix of policies that various implementing agencies in Jordan have put in place to support productivity through investment and SME growth.

2.5.1. Further opening services to foreign investors could support productivity growth in the economy as a whole

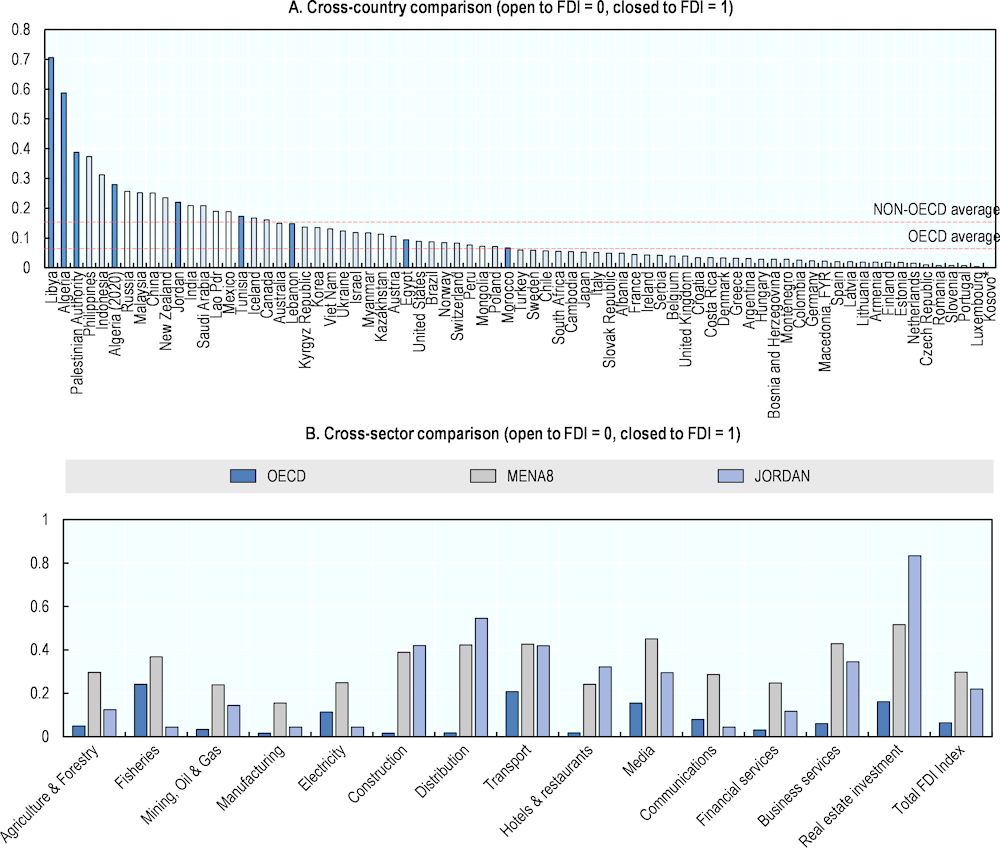

Jordan has made important strides in opening up to trade and investment, which supported productivity growth in manufacturing in the 1990s and early 2000s. Initiated in the late 1980s, trade liberalisation and structural reforms were supported by extensive programmes of the IMF and World Bank (Harrigan, El-Said and Wang, 2006[20]). The establishment of Qualified Industrial Zones (QIZ) in the mid‑1990s in partnership with the United States contributed to regional economic co‑operation in manufacturing production and provided Jordan direct access to the US market without tariff or quota restrictions, subject to certain conditions. Trade reforms were accompanied by reduced restrictions for the entry of foreign capital. According to the OECD FDI Regulatory Restrictiveness Index, FDI restrictions in Jordan are today lower than in many of its peers in the MENA region but remain fairly high compared to OECD economies (Figure 2.13, Panel A).

Reforming and opening services would support productivity objectives defined in Jordan’s vision 2025. Like in many MENA and OECD economies, services liberalisation – including a number of ‘behind-the‑border’ policy dimensions important for services development – is lagging behind reform processes in other sectors of the economy (OECD, 2021[21]). Restrictions in business services (e.g. legal, consulting, engineering and advertising, as well as R&D, data and computer services), distribution, transports and tourism remain fairly high in Jordan but are on par with the MENA region average (Figure 2.13, Panel B). As identified by the Jordan 2025 vision and the analysis in this chapter (Section 2.2), these economic activities have the highest potential for productivity growth in Jordan, but remaining investment restrictions are likely to constrain this potential.

The development of competitive services sectors has also great potential to enhance growth and productivity in other sectors in Jordan, including manufacturing. Besides providing productive job opportunities, services have major implications for the development and upgrading of Jordan’s manufacturing industries in the medium term, notably in the context of global value chains. Modern services can enable more efficient and resilient supply chains and play an increasingly important role as inputs into advanced manufacturing and innovation. The growing ‘servicification’ of manufacturing activities is reflected in the increasingly significant share of services inputs in manufacturing value added of advanced economies (OECD, 2021[21]). Thus, opening services to foreign investors would also help Jordan to regain a competitive edge in advanced manufacturing in the medium term.

Fairly open access for foreign investors in ICT services and electricity already involves important productivity opportunities for Jordan (Figure 2.13, Panel B). Yet, investment in both sectors remains far below potential, although their relative investment shares have improved compared to other sectors in recent years (see Section 2.3). Jordan’s ICT sector is expected to generate USD 18 billion worth of investment until 2040 (OECD, 2021[22]). In a world of digital transformation, the ICT sector and digital services in general will be critical to enable Jordan to maintain competitiveness in any economic activity. Jordan’s digital reform agenda REACH 2025 should therefore receive highest priority. Similarly, boosting investment in the electricity sector – notably in renewable electricity generation – can support Jordan’s ambitions to lower the carbon footprint of the economy (Chapter 5) and would help reduce electricity costs, still constraining productivity in manufacturing today.

Beyond FDI restrictions, there are several ‘behind-the‑border’ regulatory elements (e.g. intellectual property rights protection, as well as competition and labour market policy) that are influencing investment in services and thus Jordan’s potential for productivity growth (OECD, 2021[1]). A detailed assessment of these aspects goes beyond the scope of this chapter. The inclusion of Jordan in the OECD’s Services Trade Restrictiveness Index would allow to identify specific reform opportunities. Some directions are nonetheless provided. After constituting and amending several laws and regulations in compliance with international commitments to protect IPR in the 2000s, Jordan currently ranks fairly high in the World Economic Forum’s index of IPR protection (rank 35 out of 141 countries, or rank 8 in MENA region) (World Economic Forum, 2017[23]). In terms of competition policy, Jordan has made efforts to improve the level playing field for all economic actors since the adoption of the Competition Law in 2004 (Speelman, 2016[24]). A Competition Directorate was also established within the Ministry of Industry, Trade and Supply to formulate and implement product market regulations affecting the quality of competition. The 2011 amendment of the Competition Law further extended the mandate of the Directorate to conducting market research, examining complaints, and reporting violation to the judicial system. In terms of bankruptcy laws and regulations, the Reorganisation, Bankruptcy and Liquidation Law was approved in 2018, aiming to establish a legal framework for distressed companies (OECD/European Union/ETF, 2018[14]). Labour market regulations in Jordan are not identified as a major constraint for the private sector and are discussed in more detail in Chapter 3.

Figure 2.13. FDI regulatory restrictiveness

Note: MENA8: Algeria, Egypt, Jordan, Lebanon, Libya, Morocco, Palestinian Authority, and Tunisia.

Source: OECD FDI Regulatory Restrictiveness Index 2018‑19.

2.5.2. The business climate in Jordan is better than in some of its peers in MENA but some challenges remain

A conducive business climate is a pre‑requisite for growth and productivity and Jordan has made notable improvements in recent years by facilitating business procedures and streamlining regulations, particularly in the area of access to finance. In 2020, Jordan has most notably enhanced support for local SMEs in the area of access to finance with the establishment of dedicated funds and credit provision schemes (see discussion of targeted policies below). These efforts resonate with businesses on the ground, which consider access to finance less of a constraint compared to businesses in other MENA economies (see Section 2.3). However, starting a business in Jordan still involves complicated procedures and remains a key constraint for many businesses. In a first step, firms need to register at the Companies Control Department in the MoITS. Business owners are subsequently required to register the business in several different authorities (e.g. tax office, chamber of commerce, municipality office, and social security). Jordan could learn from streamlining efforts done by Tunisia in this area. Tunisia’s industrial and innovation promotion agency, Agence Nationale de la Promotion de l’Industrie et de l’Innovation, or APII, functions as a one‑stop-shop for business owners. Once business owners submit necessary documents and pay fees, all the administrative registrations, such as commercial registry, tax authority, social security or labour inspectorate are processed by APII.

Streamlining the regulatory environment for SMEs could also further improve the business climate and thus enable SME productivity growth. Jordan has issued several regulations to support SMEs, including the Ministry of Industry and Trade Law (1998), the Chamber of Industry law (2005), the Investment law (2004) and the JEDCO law (2008) which specifies the vision and mission of JEDCO as the national agency to support enterprise development. The 2015‑19 National Entrepreneurship and SME Growth Strategy aimed to foster job creation and income generation by promoting business start-ups and improving the performance and growth of existing SMEs, but it was never officially approved by the Cabinet (OECD, 2019[25]). Recently, the national five‑year plan, JGEP 2018‑22, also addressed this concern and included a dedicated chapter on SME development. Among several actions, the plan aims to accelerate regulatory reforms with an overarching new law on SMEs, which could help reduce fragmentation of the regulatory environment for businesses in Jordan. Recent analysis suggests that policy efforts may not suit the needs of business owners and could be improved through strengthened public-private dialogue in the policy making process (GIZ, 2019 and Section 2.4).

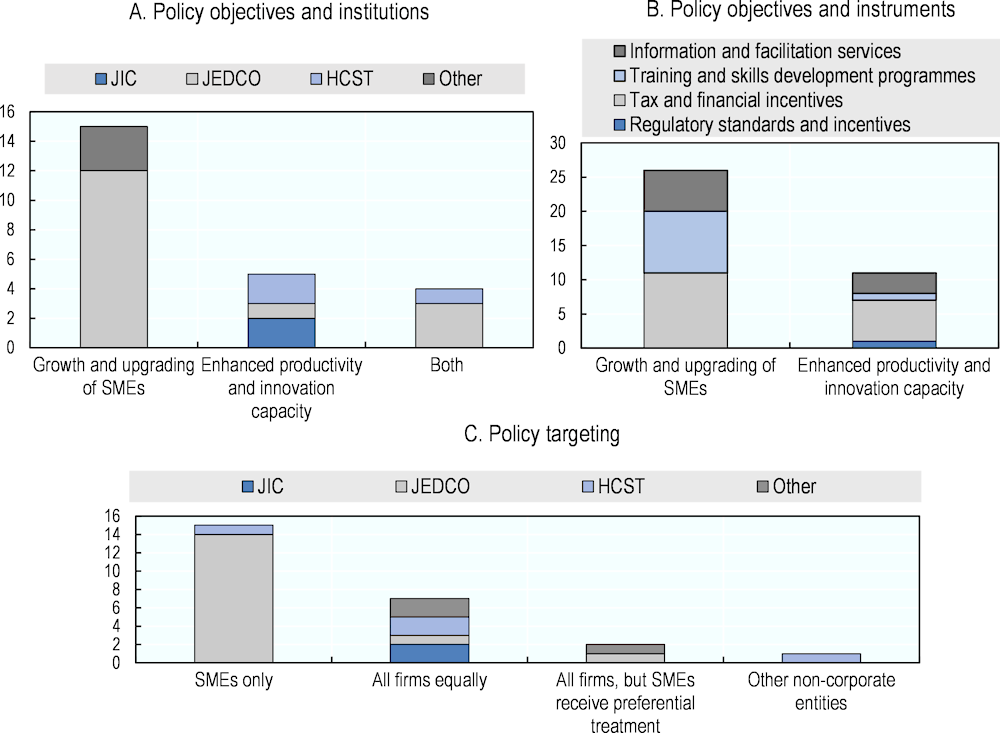

2.5.3. The upgrading of SMEs rather than FDI-driven productivity growth and innovation appears to be the main objective pursued by Jordan’s policy mix

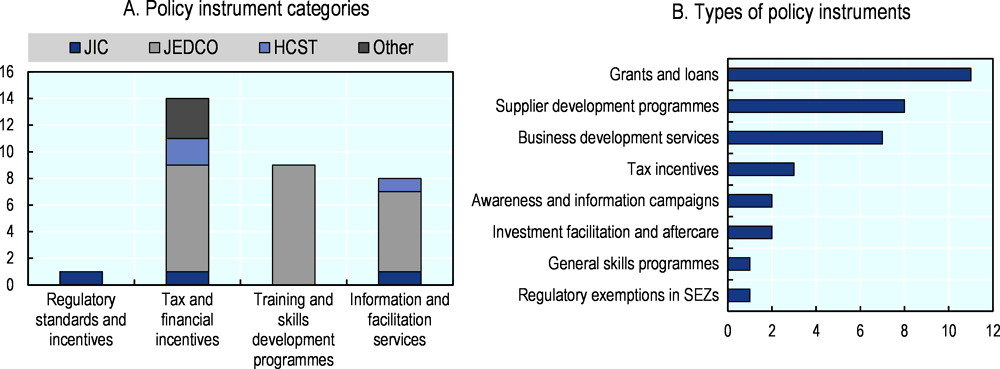

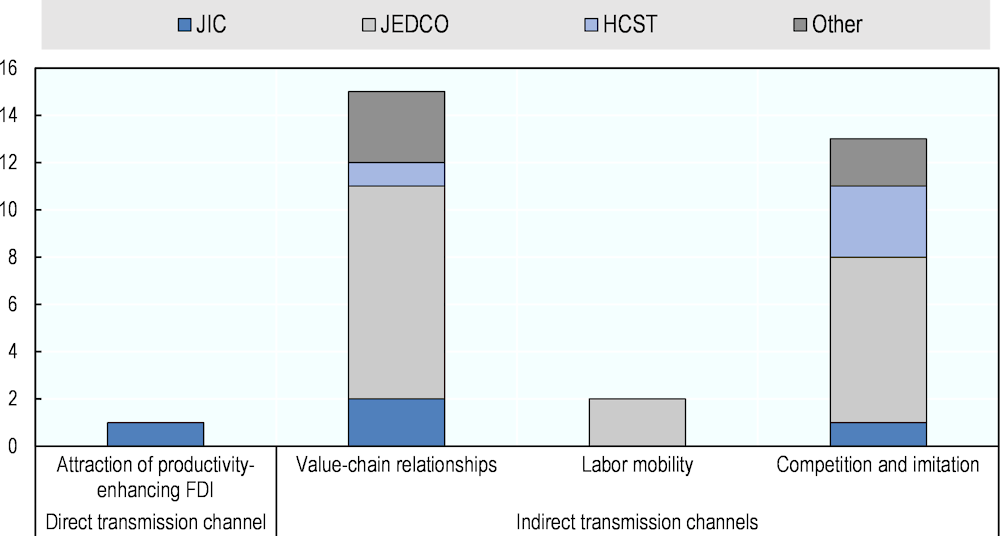

In Jordan, the policy mix relies mainly on programmes that aim to strengthen the growth and upgrading of local SMEs while less policy attention goes into enhancing productivity and innovation of the economy as a whole through FDI. As described in the next section, this is mainly due to the lack of policies that target productivity-enhancing and R&D-intensive investments, and the general disconnect between the investment promotion and innovation policy domains (see Section 2.4). In fact, more than 50% of policy initiatives implemented by MoI, JEDCO and HCST focus on strengthening the absorptive capacities of Jordanian SMEs through measures that aim to upgrade entrepreneurial skills, promote SME internationalisation activities and help SMEs become more competitive and productive (Figure 2.14, Panel A). The policy mix also presents a relatively high degree of selectivity with more than 70% of policy initiatives targeting SMEs only or providing preferential treatment to them in the form of additional financial support, more lax requirements and conditionalities, and prioritisation in their selection as recipients of public support (Figure 2.14, Panel C). Financial incentives as well as supplier development programmes are the most common types of policies used for that purpose, while information and facilitation services are also part of several initiatives that aim to raise SME awareness of internationalisation and business-to-business partnership opportunities (Figure 2.15, Panel B).

Figure 2.14. Main objectives pursued by Jordan’s policy mix per institution and type of policy instrument

Source: FDI Qualities mapping of policies and institutions in Jordan (2021).

Figure 2.15. Policy instruments used by Jordanian institutions to strengthen FDI impacts on productivity and innovation

Source: FDI Qualities mapping of policies and institutions in Jordan (2021).

Given its mandate to support entrepreneurship and the competitiveness of domestic enterprises, JEDCO implements the majority of policies that aim to strengthen the absorptive capacities of Jordanian SMEs, focusing in particular on improving their export capacities. The “Accelerate with JEDCO” programme provides business diagnostic and coaching services to help SMEs and start-up managers identify and address barriers to growth. Increased emphasis is also placed on providing technical and financial support to manufacturers and exporters of agricultural products in order to increase their integration into domestic and global value chains (GVCs). However, preliminary findings from the FDI Qualities mapping of policies and institutions show that several financial support schemes for SMEs have been discontinued in recent years as a result of the wider economic context in Jordan which has been highly affected by the large number of refugees coming from neighbouring Syria (OECD/European Union/ETF, 2018[14]). Some of JEDCO’s flagship support programmes such as the Jordan Upgrading and Modernisation Programme (JUMP), the Jordan Services Modernisation Programme (JSMP), and most recently the Governorate Development Fund (GDF) have been discontinued due to budget constraints.

Although the current policy mix remains oriented primarily towards SME growth and upgrading, efforts to consolidate Jordan’s research and innovation ecosystem have intensified in recent years. Emphasis has been placed on increasing the financial support allocated for R&D and enhancing access to finance for innovative SMEs. The National Fund for Supporting Small and Medium Enterprises (NAFES) and the Industrial Scientific Research and Development Fund (IRDF) support Jordanian industries to invest in science and technology and improve their productivity and innovation capacity. The Innovative Startups and SMEs Fund (ISSF) was also established in 2017 as a private sector managed fund supported by the Central Bank of Jordan and the World Bank to promote investments in innovative startups and early stage SMEs (Table 2.1).

Despite recent improvements in the availability of risk capital for entrepreneurs, more could be done to improve the provision of technical assistance, information and facilitation services to domestic firms that want to further develop their innovation and R&D capacities and serve as suppliers and partners of foreign affiliates. A more comprehensive approach to enhancing domestic innovation capacities could address issues that go beyond access to finance such as the availability of qualified human capital, the establishment of innovation networks and clusters, and the potential of the country’s knowledge transfer infrastructure (e.g. universities, research centres, etc.) to foster greater linkages between foreign R&D-intensive MNEs and the domestic research and innovation ecosystem.

Table 2.1. Funds available for entrepreneurs and SMEs in Jordan

|

Industrial Research and Development Fund (IRDF) |

National Fund for Enterprise Support (NAFES) |

Innovative Startups and SMEs Fund (ISSF) |

Governorate Development Fund (GDF) |

|

|---|---|---|---|---|

|

Affiliating institution |

HCST |

HCST |

Central Bank of Jordan / World Bank |

JEDCO |

|

Establishment |

1994 |

2001 |

2017 |

2012 |

|

Mandate |

Supporting Jordanian industry actors to invest in science and technology in production processes and industrial management, product quality and development, and eventually improve the competitiveness of Jordanian industries. |

Supporting Jordanian SMEs to become more efficient and competitive, through developing SMEs’ administration, financial and human capacities. |

Promoting entrepreneurship by providing early stage finance for innovative SMEs and by encouraging entrepreneurship through outreach to potential entrepreneurs across Jordan |

Improving the social development and enhancing the living conditions of the governorates by introducing financing tools and investing in income generated projects identified by the local community |

Source: Websites of each fund, the HCST and JEDCO.

Since its establishment in 2016, it has been unclear what role the National Center for Innovation (NCI) plays in the implementation of innovation promotion policies and how these policies are aligned with business innovation support programmes implemented by JEDCO. In 2021, the NCI launched its flagship Jordan Open Innovation Platform (JOIP), which aims to serve as the country’s main online technology platform. According to NCI’s founding objectives, the JOIP will provide information on Jordan’s innovation ecosystem, build connections and allow public and private sector stakeholders to identify opportunities for technology partnerships (JOIP, 2021[26]). It will also serve as a feedback mechanism to policy makers by collecting and making available data for monitoring and evaluating innovation activities and identifying market gaps and opportunities. The establishment of such a platform is a step in the right direction as it could address information barriers and bridge current gaps in the co‑ordination of innovation services and relevant policies. Ultimately, its effectiveness in stimulating knowledge‑intensive investments and forging business-to-business and science‑to-business linkages will depend on its uptake by public and private sector actors as well as the quality of the online services provided. As the platform is being operationalised in the first months of 2022, the NCI should ensure that it is sufficiently user-friendly and that relevant stakeholders, including foreign investors and local SMEs, are aware of its functionalities. Leveraging existing business networks managed by MoI and JEDCO to raise awareness of the platform could contribute to achieving more impact.

With recent policy efforts going into revamping Jordan’s institutional framework for STI policy, the interaction among different bodies in charge of innovation policy should be facilitated and the role and mandate of HCST and NCI vis-à-vis other institutions clarified. For instance, JEDCO already operates a network of incubators and innovation centres, which provide consulting services to entrepreneurs who want to benefit from technology transfer services, such as applying for patents, managing and implementing innovative projects and developing competences on the financial, legal and accounting aspects of technology adoption. It will be important to prevent duplication of services, reduce inefficiencies in providing support to the private sector and improve collaboration between new and existing innovation-focused entities (see Section 2.4).

2.5.4. Investment promotion policies are not conducive to attracting productivity-enhancing and knowledge‑intensive FDI

Investment promotion policies can play an important role in enhancing FDI impacts on productivity and innovation by focusing on attracting FDI in more productive and innovative activities and in sectors with high absorptive capacities and, therefore, greater spillover potential.

In Jordan, investment attraction efforts are broad and have not been focused on FDI projects with the greatest potential for productivity growth and innovation (Figure 2.16). Although financial incentives available to foreign investors target certain R&D-intensive industries such as the chemicals, pharmaceuticals and electronics sectors, their scope is focused exclusively on manufacturing activities, which exhibit, on average, the lowest labour productivity levels across all sectors in Jordan (see Section 2.3). In fact, a survey of 302 investors conducted by the World Bank and JIC in 2016 found that the sectors that received the highest number of investment tax relief between 2011‑15 were: food and beverages (17% of the total number of incentives received); chemicals and pharmaceuticals (15%); textile, clothing and leather (14%); and computer, electronics, machinery and metal products (13%) (JIC/World Bank Group, 2016[27]).

Box 2.4. Tunisia’s Start-up Act