This chapter assesses labour market challenges in Jordan and the potential of FDI to enhance job quality and skills development. The chapter presents the governance framework and policy mix that supports the impact of investment on labour market outcomes – focusing on institutional arrangements and policies at the intersection of investment, employment and skills development. The chapter applies the forthcoming OECD FDI Qualities Policy Toolkit.

FDI Qualities Review of Jordan

3. Strengthening FDI impacts on job quality and skills

Abstract

3.1. Summary

The Government of Jordan puts high policy priority on foreign direct investment (FDI) as a driver for quality job creation and skills development. The employment rate is low by international standards, with many people in informal and low-paid jobs, and many young graduates unemployed, particularly women (see Chapter 4). Insufficient job creation through private investment, combined with an increasing labour force and considerable skills imbalances, are the main structural challenges facing the labour market in Jordan – challenges that the influx of Syrian refugees and the COVID‑19 pandemic are exacerbating. The public sector is no longer absorbing a large number of new graduates, unlike in the past, but continues to offer more attractive working conditions than the private sector, thereby limiting labour mobility.

FDI in Jordan has advanced job creation, improved living standards and developed workers’ skills, but its impact has been limited and not all segments of the population have benefited equally. Over the last two decades, employment gains from FDI were largest for foreign workers in low-wage sectors such as construction, manufacturing or tourism and, since recently, for the highly skilled Jordanians working in better-paid sectors such as ICT and finance. Despite improving educational attainments, inconsistency between curriculas and evolving employers’ needs are preventing Jordan from reaping the benefits of FDI, including services FDI that digitalisation and recovery from COVID‑19 are likely to boost. Labour market gains from FDI remain off limits to low and medium-skilled Jordanian job seekers, who do not always have the incentives and skills to compete with foreigners on low-wage jobs in sectors with challenging, albeit improving, working conditions such as the apparel or chemicals industries, the country’s top export sectors.

Recognising the benefits that FDI can bring, the government has advanced meaningful reforms in the past decade that are conducive to investment (OECD, 2021[1]). While these reforms can influence the FDI entering the host country and its labour market implications, complementarity with labour and skills development policies is needed for investment to further support a job-led recovery – foreign firms in Jordan adapted faster than their domestic peers to new ways of working during the pandemic. This chapter provides an overview of government strategies, the institutional setup and policies at the intersection of investment, employment and skills development and evaluates to what extent they are conducive to enhanced and more inclusive labour market outcomes. Key policy considerations are summarised below.

Policy considerations

Align strategies and reforms on investment, employment and skills development, including the revision of the 2014 Investment Law and the forthcoming investment promotion and employment strategies, with priority sectors of Vision 2025 and other national plans, particularly high-wage, high-skill and labour-intensive sectors. Skills strategies should provide policy clarity by better linking education and employment priorities and how they jointly respond to employers’ skills needs, particularly in rapidly changing occupations and sectors such as ICT. Strategies should provide clear policy directions on how FDI can improve labour market outcomes, set explicit goals and clarify responsibilities across government bodies.

Strengthen inter-governmental co‑ordination and promote joint initiatives. No mechanisms are exclusively dedicated to co‑ordination between ministries dealing with labour and skills policies and the Ministry of Investment (MoI). Existing mechanisms such as the Investment Council (IC) could be adapted to fill this co‑ordination gap and ensure strategic alignment across the policy areas – the presence of the Minister of Labour should help achieve some policy coherence. Governing bodies of newly created committees or councils aiming at addressing labour and skills-related challenges could be more inclusive to support collaborative decision-making. At the impementation level, there is limited co‑ordination or joint policy programming between MoI and the main bodies delivering employment and training support.

Reassess existing restrictions on foreign investment against policy objectives of stimulating labour demand, particularly in the job-creating services sectors. Statutory restrictions on foreign ownership exist in business services, distribution, transport and logistics, and tourism sectors where FDI projects have the potential to create direct and indirect jobs for both the low and highly skilled Jordanian youth. Joint venture requirements can push foreign investors not to deploy their frontier technologies and best business practices, in turn limiting better-paid job creation. Pursuing wider pro-competition reforms will contribute to create a more dynamic private sector, allow for a better reallocation of resources and raise incomes.

Pursue labour market reforms that are conducive to investment and labour mobility and that promote a better working enviroment. This includes addressing wage‑setting distortions, simplifying regulations on the hiring of foreign labour and strengthening collective bargaining rights. Labour market segmentation by nationality (Jordanians or non-Jordanians), status (public or private jobs) and gender (Chapter 4) reduces mobility from public to private sector jobs, worsens informality and leads to inefficient labour reallocations following FDI entry. Furthermore, existing regulations prohibit union pluralism and prevent foreign workers from forming unions while they are a significant part of the workforce of foreign firms in Jordan.

Improve investment promotion and facilitation by providing clear information to investors on local labour market characteristics, labour regulations, available training programmes and employment incentives and, through the Investment Window, accompany them in getting the relevant work permits. Furthermore, set Key Performance Indicators (KPIs) to identify and prioritise investments of higher job quality and that can contribute to upskilling. Targets should be coherent with national strategies and realistically reflect the country’s skill base.

Raise awareness about international labour standards and incentivise companies to disclose their compliance with them. The National Contact Point (NCP) for responsible business conduct, hosted by MoI, has been been largely inactive. The government should strengthen the NCP capabilities to help him fulfill its mandate of, inter alia, disseminating guidance to MNEs on labour standards and due diligence in supply chains. The Amman Stock Exchange (ASE) developed a set of indicators to encourage listed companies disclose their ESG performance, including labour outcomes, but information is not yet fully available online.

Provide integrated active labour market policies (ALPMs) that are adapted to investors’ needs and support the most vulnerable. With FDI shifting from low-wage manufacturing activities to more skill-intensive services, ALPMs could be expanded to also support the high-skilled youth – ALPMs currently largely target the lower and mid-skilled. This includes upskilling the educated youth while retraining vulnerable groups working in sectors adversely affected by competition, providing more targeted job search services, including transport subsidies, and increasing their outreach, and favouring tax incentives based on companies’ labour market performance and promoting the transition of young graduates to a first-work experience.

Put in place robust labour market information and skills anticipation systems that involve investment actors to design evidence‑based employment and training policies and effectively monitor their impacts. Multiple initiatives exist but they are scattered across several institutions and provide partial information. They also do not involve MoI while this could help reduce the gap between the information produced and skills needs driven by FDI trends. MoI could bring forward its sectoral expertise to the newly established Sector Skills Councils and voice the concerns of investors in terms of skills shortages and future training needs.

3.2. Key challenges and opportunities for the labour market in Jordan

Jordan’s labour market faces daunting challenges that the regional security crisis and the COVID‑19 pandemic have exacerbated. The employment-to-population ratio went down from 36.5% to 32% between 2010 and 2020. It is one of the lowest rates in the world, including among MENA countries, and far below the OECD area ratio of 66%. The unemployment rate reached 18.5% in 2020, its highest level since the early 1990s (ILO, 2021[2]). The rate of youth unemployment is more than twice as high as the national average, and higher than the MENA average, while one‑third of unemployed young people hold university degrees. Many people are in vulnerable, informal and low-paid employment, particularly youth and women (see Chapter 4). For instance, one employee out of four was an informal worker in 2016 – nearly seven out of ten in the case of foreign workers (Assaad and Salemi, 2019[3]).

3.2.1. The private sector is not creating enough jobs to absorb a growing labour force…

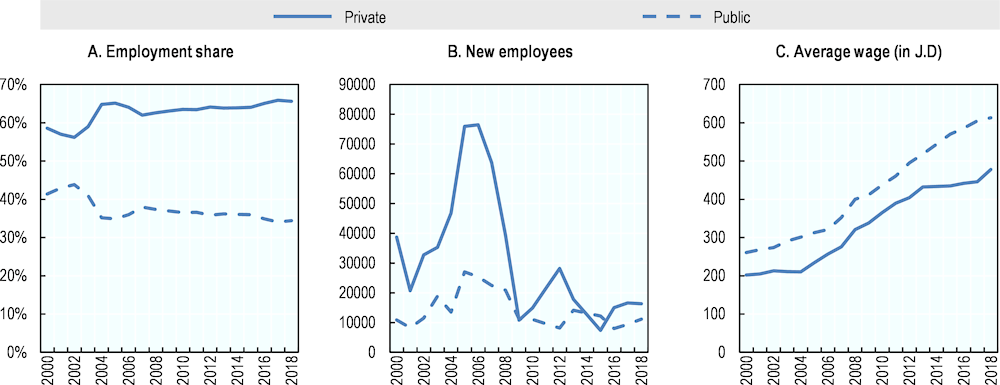

Insufficient job creation by the private sector, combined with an increasing labour force and considerable skills mismatches are behind the poor performance of the Jordanian labour market. In 2015, 39% of the employed population was working in the public sector, which is the highest rate in the MENA region and nearly twice as high as the OECD average (Assad and Barsoum, 2019[4]). While successive reforms reduced public sector employment, the private sector did not, and still has not, filled this employment gap. The ratio of paid employees in a formal private sector job hardly increased over the past decade, while growth in new job creation in the private sector has not improved since 2010 (Figure 3.1, Panel A and B). At the same time, the labour force nearly quintupled in 40 years due to high fertility rates and sustained immigration flows (OECD, 2018[5]). Conflicts in neighbouring countries provoked massive inflows of migrants and refugees, increasing Jordan’s population by 50% over 2008‑17. In 2019, legally registered foreigners represented 20% of the labour force according to Jordan’s Department of Statistics (JDoS).

Figure 3.1. Public and private sector labour market outcomes in Jordan, 2000‑18

Source: OECD based on Employment and Employees’ Compensations Survey, Jordan’s Department of Statistics (JDoS).

Developments in Jordan’s economy since the 1970s, which largely mirror those in the MENA region, explain why job creation could not keep pace with the growth of the labour force (OECD, 2021[1]). The bloated public sector and barriers to private sector development have hindered structural transformation of the economy. Structural change occurs when labour moves to the more productive sectors of the economy, so that the most productive industries gain a larger employment share at the expense of less productive activities. The opposite happened in Jordan as labour shifted from productive sectors to less efficient ones, notably construction, public and social services, while the share of employment in the relatively productive manufacturing sector decreased (Morsy, 2017[6]). As a result, negative structural change in Jordan reduced aggregate productivity growth (see Chapter 2) and limited the capacity of the private sector to raise incomes and improve living standards.

The inefficiencies in the allocation of resources across sectors have gradually shaped Jordan’s labour market characteristics. In 2020, manufacturing and relatively productive services such as business activities and the ICT sector employed fewer people than lower-productivity activities of the public or private sector (Table 3.1) – a trend that has not changed much over the past decade. Aside from public administration, the majority of Jordanians work in the wholesale and retail industry while registered foreigners are hired to execute household-related tasks, support services activities, and work in construction or manufacturing. Furthermore, the majority of the tertiary educated work in education, health, public administration and, to a much lower extent, in other high-skilled activities such as business and financial services or in the ICT sector. Another, albeit related, facet of the inefficient resource allocation in Jordan is the wage differential between public and private sector workers (Figure 3.1, Panel C). Non-competitive wages in the private sector, along with poor working conditions, have strongly limited labour mobility from public to more productive private sector employment (World Bank, 2016[7]).

Table 3.1. Employment distribution across sectors in 2020, by nationality and education level

|

All |

Nationality |

Education level (only Jordanian) |

|||||

|---|---|---|---|---|---|---|---|

|

Jordanian |

Foreign |

Less than secondary |

Vocational training |

Secondary |

Bachelor and above |

||

|

Agriculture |

3.3 |

1.7 |

5.4 |

2.7 |

0.4 |

0.9 |

0.3 |

|

Mining and quarrying |

0.4 |

0.6 |

0.2 |

0.7 |

1.1 |

0.6 |

0.6 |

|

Manufacturing |

9.1 |

10.4 |

7.3 |

13.3 |

19.8 |

9.8 |

6.2 |

|

Utilities (electricity, water, etc.) |

0.8 |

1.3 |

0.2 |

1.1 |

6.3 |

2.5 |

1.0 |

|

Construction |

7.3 |

4.8 |

10.5 |

6.9 |

10.0 |

3.9 |

1.9 |

|

Wholesale and retail trade |

10.5 |

14.4 |

5.4 |

18.4 |

24.0 |

15.0 |

7.8 |

|

Transportation and storage |

3.8 |

6.2 |

0.6 |

9.1 |

9.0 |

5.1 |

2.5 |

|

Tourism |

4.2 |

3.4 |

5.2 |

4.4 |

6.9 |

3.4 |

1.8 |

|

Information and communication |

1.0 |

1.6 |

0.2 |

0.3 |

0.3 |

1.2 |

3.9 |

|

Financial and insurance activities |

1.2 |

2.0 |

0.1 |

0.4 |

0.0 |

1.4 |

4.8 |

|

Professional, scientific & technical activities |

1.8 |

2.9 |

0.3 |

0.3 |

1.1 |

1.5 |

7.4 |

|

Administrative & support service activities |

10.6 |

1.7 |

22.2 |

2.1 |

0.5 |

2.1 |

0.7 |

|

Public administration and defence |

15.4 |

26.9 |

0.5 |

32.2 |

11.3 |

32.4 |

16.6 |

|

Education |

7.7 |

12.6 |

1.4 |

2.3 |

2.3 |

8.2 |

30.8 |

|

Human health and social work activities |

3.4 |

5.5 |

0.7 |

1.2 |

1.1 |

8.2 |

10.6 |

|

Other service activities |

3.0 |

3.2 |

2.7 |

4.0 |

5.8 |

3.1 |

1.9 |

|

Activities of households as employers |

15.7 |

0.3 |

35.6 |

0.3 |

0.0 |

0.5 |

0.0 |

|

Other |

0.9 |

0.4 |

1.6 |

0.2 |

0.0 |

0.2 |

1.0 |

Source: OECD based on the Employment and Unemployment Survey, Jordan’s Department of Statistics (JDoS).

3.2.2. …particularly for the highly skilled and young Jordanian workforce

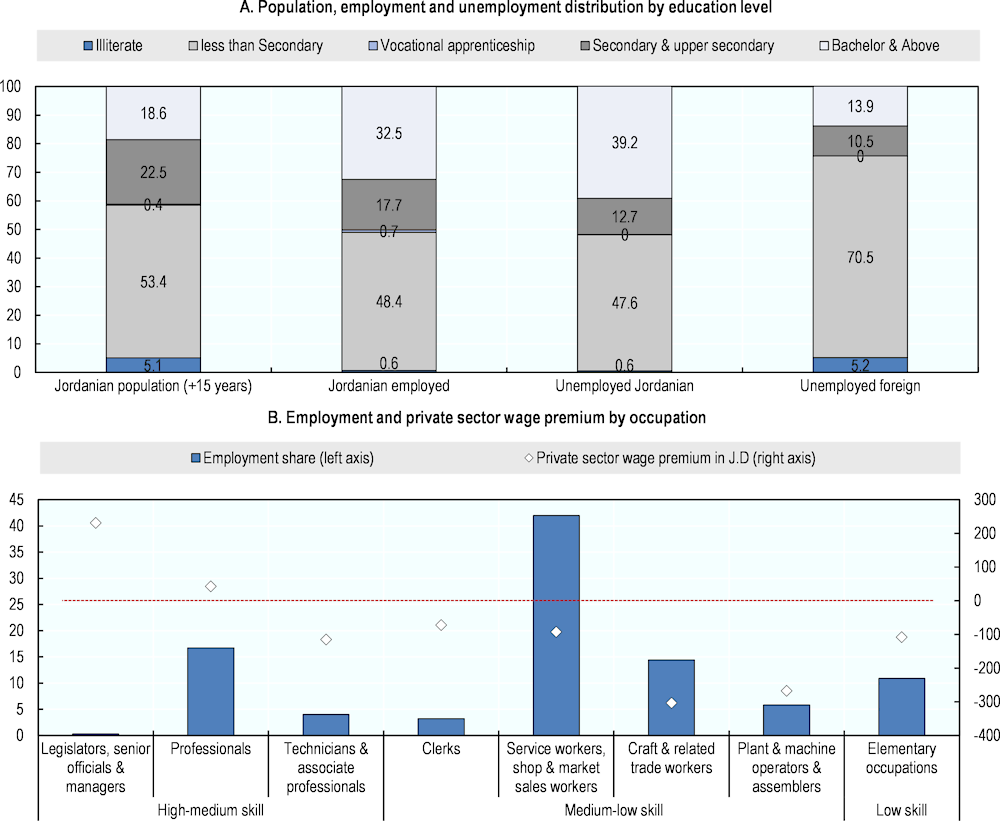

Notwithstanding the low level of job creation by the private sector, labour market outcomes in Jordan have also been constrained by considerable skills imbalances – a misalignment between the demand and supply of skills leading to skills mismatches and shortages. Jordan recorded massive progress in enrolment rates in tertiary education but the education system has not provided the skills in demand by employers. In 2020, nearly 19% of the Jordanian population had a bachelor degree or above but only 0.4% completed vocational education and half had less than secondary education (Figure 3.2, Panel A). In the OECD area, 39% of the population between 25 and 64 years had a tertiary degree, 26% completed vocational education and only 20% had lower secondary education or less. Jordan’s National Strategy for Human Resources Development 2016‑25 indicates that the labour market is characterised by an “oversupply of university graduates and an undersupply of skilled technicians to power Jordan’s key industries”. In other terms, labour demand for high-skill workers is lower than the number of graduates while demand is relatively strong for medium to low skills (OECD, 2018[5]).

Figure 3.2. Labour market indicators by education level and occupation type, 2020

Note: the private sector wage premium corresponds to the difference between private and public sector wages in 2018.

Source: OECD based on the 2021 and 2019 Employment and Unemployment Survey, Jordan’s Department of Statistics (JDoS).

The misalignment between the demand and supply of skills in Jordan has contributed to the rise of university graduates’ unemployment rate, which reached 28% in 2020 according to the JDoS, against 3.8% in the OECD area. University graduates also represented 32% of the total unemployed – 39% in the case of Jordanian citizens, which is the highest group after those with basic education (Figure 3.2, Panel A). Unlike in the 1990s, and similar to other MENA countries, the public sector is no longer absorbing the large number of young graduates. More than 300’000 people graduated from universities in Jordan between 2013 and 2018, whereas the public sector created less than 100 000 net jobs over the same period (Al-Manar Project, 2021[8]). Although the private sector is taking over as the main engine of employment growth, most available jobs require medium to low skills, often in retail and trade, construction or the textiles industry (OECD, 2018[5]). These jobs are often not attractive to the educated young Jordanians as related occupations tend to be less paid than similar jobs in the public sector (Figure 3.2, Panel B).

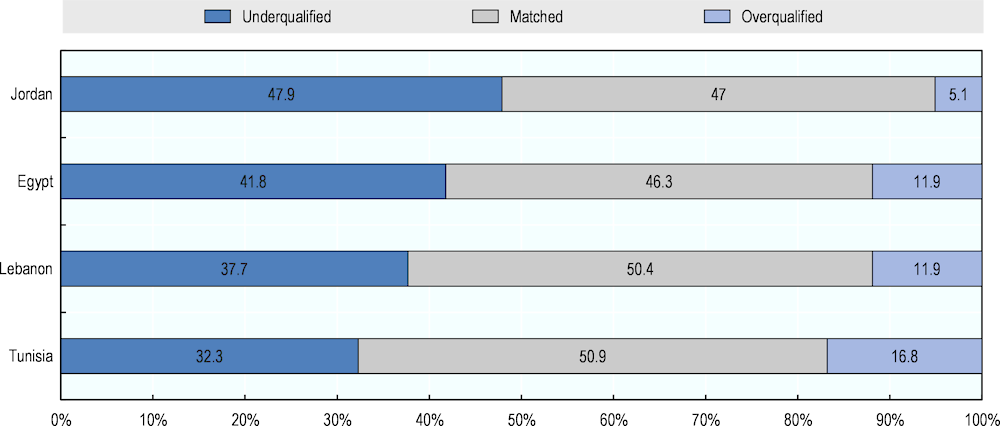

Skills imbalances in Jordan are also due to an undersupply of medium to low skilled workers. Among Jordanians in employment, most are shop, market sales, craft or trade workers but have education levels that fall short of those required for such technical job, which results in a skill mismatch (Figure 3.2, Panel B). According to an ILO survey, more than half of young workers in Jordan did not have the education levels that match their occupations – mostly young men with less than secondary education, a comparatively high share across developing countries, including within the MENA region (Figure 3.3). The level of skills mismatch of young women is lower, partly due to their higher level of education and lower labour force participation (OECD, 2018[5]) (Chapter 4). Skills mismatches lead to higher risk of unemployment, lower wages and lower job satisfaction. They are also associated with lower labour productivity through a misallocation of workers to jobs (Adalet McGowan and Andrews, 2015[9]).

Figure 3.3. Qualification mismatches of young workers in Jordan and other MENA countries, 2015

Note: Qualifications mismatch measures whether people have the level of education (ISCE category) corresponding to their occupation (International Standard Classification of Occupations category). See (ILO, 2019[10]) for further information on the methodology.

Source: (ILO, 2019[10]) based on School-to-Work Transition Surveys 2015, ILO.

Figure 3.4. Percent of firms identifying an inadequately educated workforce as a major constraint

Source: World Bank Enterprise Surveys.

Skills imbalances imply costs for the private sector as well. Skill shortages, which relate to a situation where employers are unable to fill vacant posts for lack of suitably qualified candidates, reduce firms’ productivity. In Jordan, relatively few firms identify an inadequately educated workforce as a major obstacle (Figure 3.4). However, skill shortages are more severe among foreign firms and in the non-retail services sector where competition to hire adequately skilled workers might be stronger. Other findings for the MENA region show that skill shortages are a concern for firms that grow rapidly or that rely on university graduates (EBRD/EIB/WBG, 2016[11]). In light of the large pool of tertiary educated in Jordan, skill shortages in firms relying on university graduates might reveal a mismatch between what students actually learn and job requirements, while shortages faced by fast-growing firms could be due to scarcities in well-trained technical workers. For instance, one survey of employers in Jordan shows that students graduating from technical streams do not meet the requirements for the jobs for which they are applying (ILO, 2019[12]).

3.3. FDI impacts on job quality and skills development

Foreign direct investment (FDI) is an important engine of private sector growth in Jordan – the FDI stock-to-GDP ratio exceeded 80% in 2020, which is high relative to other emerging economies (OECD, 2021[1]). Less is known about how FDI affects job quality and skills development in Jordan, although the operations of foreign firms can have widespread effects on host countries’ labour markets. Evidence from other countries shows that FDI has broadly positive impacts on employment, wages and skills development, but not all countries and all segments of the population benefit equally (OECD, 2019[13]). This section examines the impact of FDI on labour market outcomes in Jordan based on the FDI Qualities Policy Toolkit (Box 3.1).

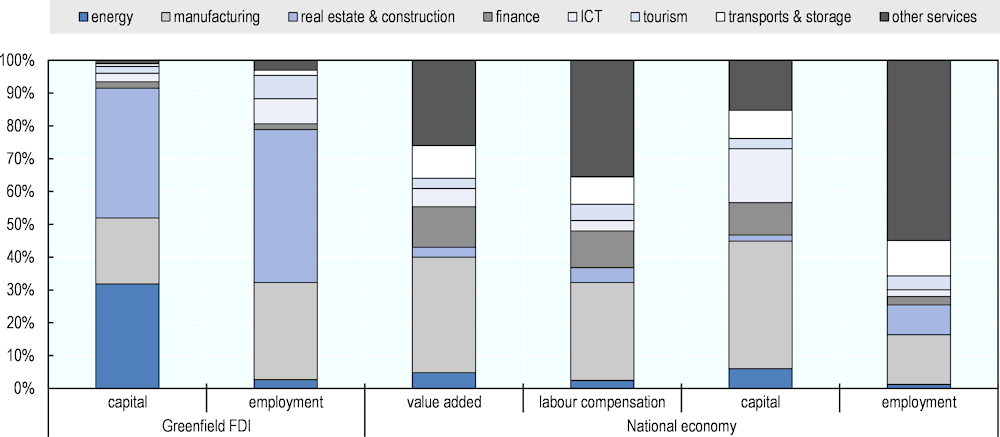

3.3.1. FDI in Jordan is skewed towards industries with limited job creation potential

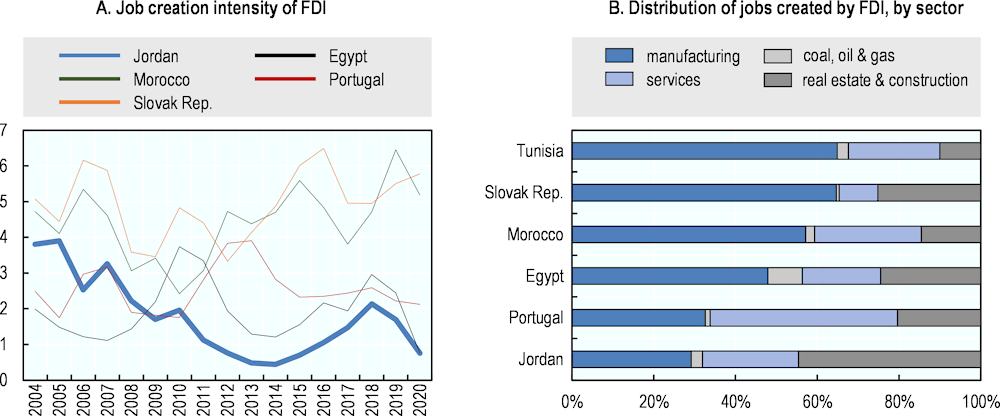

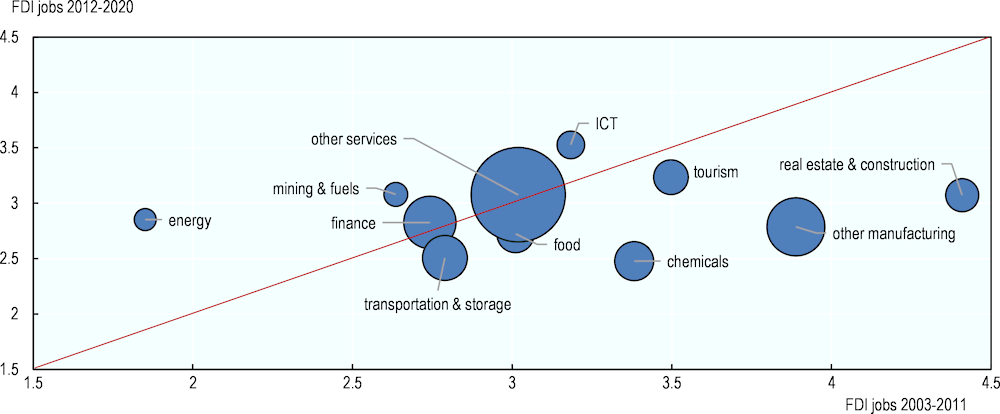

The operations of foreign firms are expected to impact labour market outcomes in different ways depending on the economic structure and comparative advantages of the host country. Greenfield investment in Jordan, which is the preferred mode of entry for foreign investors in the country, has long been concentrated in a narrow group of capital-intensive sectors with limited impact on job creation and skills development, similar to other MENA countries (OECD, 2013[14]; 2021[1]). Oil and gas-related power generation and construction have attracted 70% of announced greenfield FDI projects between 2003 and 2017 but accounted for less than 45% of jobs created (Figure 3.7). The other, more labour-intensive and skill-demanding sectors such as manufacturing, tourism and ICT hosted the rest of FDI-jobs, despite lower investment shares. The composition of FDI and its impact on labour demand differs from that of the wider economy. Manufacturing, energy, finance, transports, and market services such as wholesale and retail account for the greatest part of national value‑added, labour compensations and employment.

The number of jobs created by greenfield FDI declined over time and became gradually weaker than in comparator countries (Figure 3.7, Panel A). This decline is driven by changing FDI patterns across sectors. Countries that recorded strong industrialisation such as Morocco, the Slovak Republic and Tunisia saw increasingly larger effects of FDI on job creation than other countries like Jordan or Egypt that have not seen an increase in manufacturing FDI relative to other sectors in recent years (OECD, 2021[1]). Despite important liberalisation of trade and investment in Jordan and other MENA countries, instability in the region might have skewed the sectoral composition of FDI towards less risky capital-intensive sectors, thus limiting the creation of new job opportunities. The distribution of FDI-linked jobs by sector in Jordan shows that the majority of jobs have been created in construction, rather than in manufacturing, unlike in comparator countries (Figure 3.7, Panel B). The concentration of jobs created by FDI in Jordan’s services sectors, which has largely increased in the past years, is comparable with other countries, except Portugal.

Box 3.1. A conceptual framework to assess the impact of FDI on job quality and skills

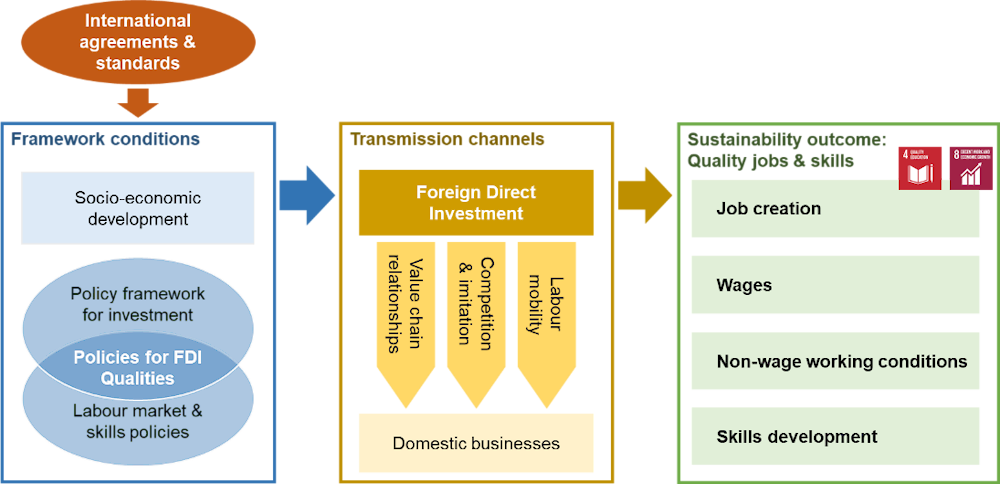

The entry and operations of foreign firms affect the demand for skilled and unskilled labour in the host country, with concomitant effects on employment and wages (Figure 3.5, green box). FDI can also affect non-wage working conditions, including job security and core labour standards. FDI effects on labour market outcomes involve several transmission channels (orange box). Outcomes can result from foreign firms’ direct operations (direct transmission channel), such as hiring new workers or firing incumbents following a foreign takeover or offering better or worse working conditions than domestic firms. Foreign firms’ direct operations have also spillover effects arising from: (1) their value chain relationships with domestic firms, whether buyers or suppliers; (2) market interactions through competition and imitation (or learning) effects; (3) and labour mobility between foreign and domestic firms.

Figure 3.5. Factors influencing FDI impacts on job quality and skills

The premise underlying the existence of FDI spillovers is that foreign firms are technologically superior and, in turn, benefits might spill over to domestic firms. Value chain relationships or labour mobility between foreign and domestic firms can create knowledge spillovers, and in turn raise productivity, wages and employment. FDI spillovers on labour market outcomes are often specific to certain segments of the workforce, industries, or locations. They are also not always positive if, for instance, foreign firms have irresponsible labour practices with their suppliers or if competition for talent crowds out domestic firms. The intensity of such adverse impacts depends on how fast the labour market adjusts to external shocks. For instance, FDI hardly increases the share of skilled workers and worsens wage disparities when skills shortages are severe and labour mobility is constrained.

The direction and magnitude of the combined direct and spillover effects of FDI on labour market outcomes ultimately depends on the economic structure of the host country and domestic firms’ characteristics (size, productivity level, skill-intensity, business and labour practices), labour market characteristics (employment levels, share of skilled labour, unionisation rates, etc.) and the policies and institutions in place (blue box). Whether FDI improves or undermines labour market outcomes depends also on the type of activity of foreign firms and the extent to which they export home country practices and norms or adopt instead those of the host country.

Source: OECD (2021[15])., FDI Qualities Policy Toolkit: Polices for improving the sustainable development, https://www.oecd.org/investment/investment-policy/FDI-Qualities-Policy-Toolkit-Consultation-Paper-2021.pdf.

Figure 3.6. Foreign and domestic investment, value‑added and labour outcomes, by key sector

Note: Greenfield FDI corresponds to announced capital expenditure (CAPEX). Number of jobs and CAPEX are partly based on estimates. Greenfield FDI variables cover the period between 2003 and 2017 and national economy variables cover the period between 2013 and 2017. Mining and fuels also covers oil and gas-related power generation. National economy data excludes “public administration and defence; compulsory social security” as defined by ISIC classification Revision 4.

Source: OECD calculation based on Financial Times fDi Markets and Jordan’s Department of Statistics.

Figure 3.7. Greenfield FDI contribution to job creation in Jordan and comparator countries

Note: Job creation intensity of FDI in Panel A corresponds the number of jobs expected to be created per USD millions of announced CAPEX. It is calculated as a 2‑year moving average value. Greenfield FDI in mining and fuels also covers oil and gas-related power generation.

Source: OECD calculation based on Financial Times fDi Markets, as of May 2021.

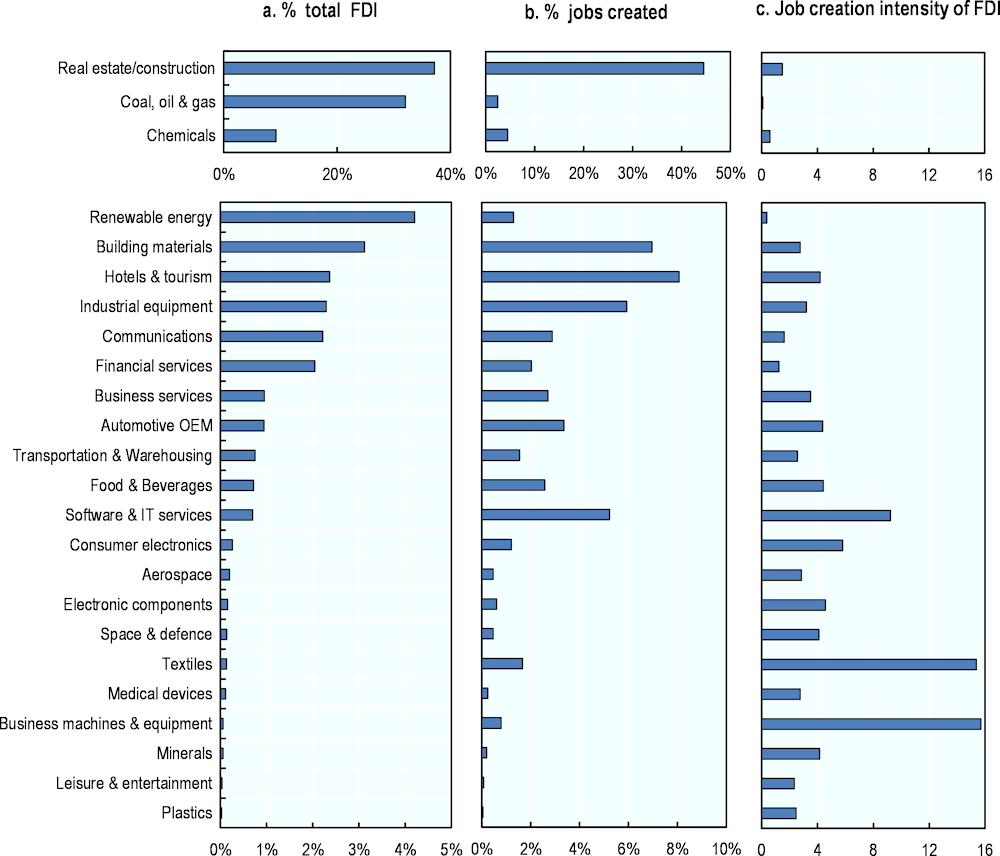

3.3.2. Emerging services sectors are attracting FDI with better labour market outcomes

While FDI improve labour market outcomes in Jordan, not all segments of the population benefit equally. Employment gains are largest for foreign workers in construction and in manufacturing and, since recently, for highly skilled Jordanians working in high-wage services sectors. Figure 3.8 provides the breakdown of greenfield FDI and its job creation intensity at the sectoral level and shows where FDI has most impact on employment. FDI in construction typically creates short-term jobs for unskilled workers and thus has limited scope for skill-related spillovers or generating employment effects beyond construction periods. In manufacturing, most FDI-related jobs are in light industries producing chemical products (largely fertilisers), building materials (cement), food, and electronic components (Panel B). These industries often require heavy and modern equipment and are moderately labour-intensive. It is FDI in textiles that has had the highest propensity to create jobs – every USD million invested created nearly 16 jobs (Panel C).

Figure 3.8. Greenfield FDI contribution to job creation in Jordan, by sector

Note: See Figure 3.5 and Figure 3.6.

Source: OECD calculation based on Financial Times fDi Markets, as of May 2021.

Despite declining FDI trends, the manufacturing sector continues to be relatively important in terms of its contribution to labour income (Figure 3.9). Foreign projects often are, however, in low-value added industries where wages are also relatively low, such as in food, textiles and the manufacturing of cement. This reflects in part the large presence of foreign workers earning less than Jordanians do, particularly in apparel where working conditions can be challenging (Box 3.2). However, the increases in labour demand that foreign manufacturing projects create within their sector of operation, and in other sectors through spillovers, could positively affect wages and increase the share of skilled workers. Jobs in the chemical industry (including fertilisers), which is Jordan’s top export sector, tend to be more skill-intensive and better paid, but FDI in the sector has declined over the past years. Export expansion in this sector would have large impact on direct and indirect job creation and on incomes in Jordan (ILO, 2022[16]).

Figure 3.9. Change in jobs created by greenfield FDI and labour compensation by sector

Note: “Other services” include, inter alia, business services, health care and education. The size of dots reflects the level of labour compensations. FDI jobs are in logarithmic values to improve the readability of the figure.

Source: OECD calculation based on Financial Times fDi Markets and Jordan’s Department of Statistics.

Box 3.2. FDI in textiles and working conditions of foreigners in Qualified Industrial Zones

FDI in the garment and textiles industry in Jordan has considerably affected labour market outcomes. The industry emerged in the 1990s following the establishment of large foreign firms in the Qualifying Industrial Zones (QIZs), which are areas providing duty-free access to the US market. The regulatory framework enabled firms to bring in qualified and competitive foreign labour from South Asia – projects are exempt from income tax on salaries and allowances of non-Jordanian workers. In 2020, QIZs hosted almost 10% of private sector employment. More than 75% of workers in QIZs are foreigners.

QIZs focused on attracting FDI and boosting exports without being considered by the government as tools that can also support sustainable development. Foreign firms in QIZs did not invest in upstream segments of the textile industry (e.g. R&D or clothing design), thereby limiting the value‑added generated from exports and the creation of better-paid jobs matching the supply of highly skilled Jordanians. The small profit margins associated with the garments and textiles industry also led to low levels of foreign firms’ embeddedness in the local economy, and thus to higher risks of divestments.

The lack of occupational safety and health at work dissuaded Jordanian job seekers from working in QIZs, thereby limiting zones’ contribution to reducing poverty and creating job opportunities for local populations. Migrant workers are not fully protected by national labour laws and lack access to social protection, which makes them highly vulnerable. Foreign workers often received lower wages than Jordanians. Furthermore, a wide range of violations of workers’ rights was recorded within the QIZ, and Jordan was placed on the US State Department’s List of Goods Produced by Child Labour or Forced Labour from 2009 to 2016. The government has recently undertaken several measures to improve working conditions in zones, also with the aim of attracting Jordanian job seekers.

Source: OECD (2020[17]), OECD Investment Policy Reviews: Egypt 2020, https://dx.doi.org/10.1787/9f9c589a-en; Azmeh (2014[18]), Labour in global production networks: Workers in the qualifying industrial zones (QIZs) of Egypt and Jordan, https://onlinelibrary.wiley.com/doi/10.1111/glob.12047; Ministry of Labour (2019[19]), Annual Report 2019, Government of Jordan.

Services sectors in Jordan host the greenfield FDI projects with the highest job creation intensity. FDI projects in services accounted for 23% of all jobs created by greenfield FDI although they attracted less than 10% of announced FDI between 2003 and 2020. Most of the jobs created in services were in tourism, ICT, finance and business services (Figure 3.8, Panel B). Furthermore, the number of FDI-jobs in services grew in 2012‑20 relative to 2003‑11, in contrast with manufacturing or construction (Figure 3.9). For instance, in the past decade, greenfield FDI in ICT – to a large extent in telecommunications – generated nearly twice as many jobs per million USD invested than the average sector. Other services such as health or education contribute significantly to aggregate labour income but attract little, albeit increasingly more, FDI. Aside from services, the energy sector also attracted more FDI in recent years (see Chapter 5). Direct job creation in this sector is limited, but the deployment of renewable power can support employment across the renewable value chains, particularly in remote and less developed areas (OECD, 2016[20]).

The contribution of greenfield FDI to labour market outcomes in services sectors is aligned with Jordan’s comparative advantages, which present opportunities for more rapid development of high-skill services (Hausmann et al., 2020[21])(Chapter 2). Jobs in the growing services sectors, which digitalisation and recovery from COVID‑19 are likely to accelerate, are often more skill-intensive than jobs in manufacturing and tend to be better paid, particularly in finance where more than 76% of workers held a tertiary degree in 2016 according to JDoS. Job seekers from the large pool of unemployed graduates should fill demand for these jobs, but in practice the strong mismatch between university curricula and employers’ needs observed in services sectors may prevent this from happening (Figure 3.4). In a context of skills shortages, foreign entrants increase competition for talent but can crowd-out skilled labour in domestic firms, at least temporarily. Evidence suggests that these mechanisms have been at play in Jordan’s ICT sector in recent years (OECD, forthcoming[22]). As the ICT sector has grown rapidly, there has been a lag to keep abreast of the latest skills needs and around 75% of employers have difficulties finding skilled staff leading many of them to send their staff abroad to reinforce and upgrade their skills base (World Bank, 2016[7]).

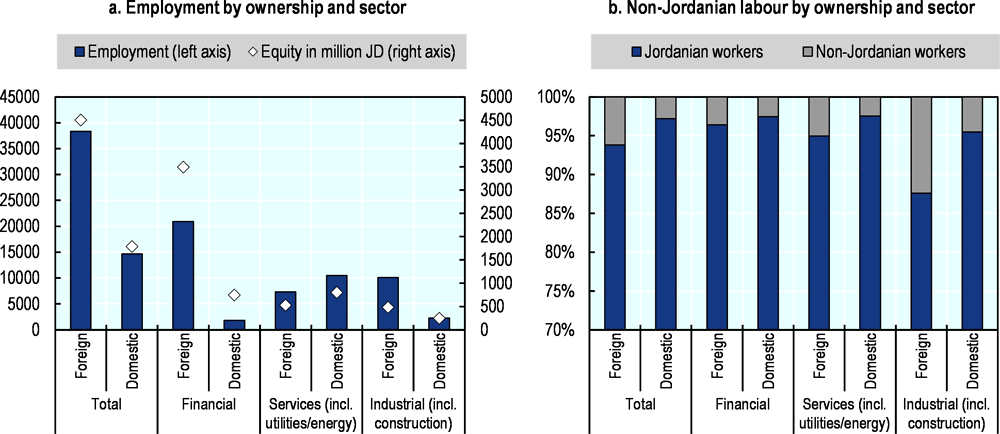

Trends in employment by foreign and domestic companies listed in the Amman Stock Exchange (ASE) sheds further light on the contribution of FDI to labour market outcomes in Jordan. Foreign companies – firms with 10% foreign ownership or more – account for 70% of ASE market capitalisation (shares owned by foreigners represent around half of market capitalisation) and 73% of employment by listed companies, which corresponds to nearly 39’000 jobs (Figure 3.10, Panel A). Foreign companies dominate the financial and, to a lower extent, industrial sectors, while domestic firms are more prevalent in services such as commercial activities or utilities. ASE market capitalisation accounted for 42% of Jordan’s GDP in 2020, a share that declined since 2010 but that is higher than in Egypt (11%), Lebanon (15%) or Tunisia (21%).

Figure 3.10. Employment by foreign and domestic companies listed in the Amman Stock Exchange

Note: Foreign-owned companies include listed companies with 10% foreign ownership or more.

Source: OECD calculations based on Amman Stock Exchange database.

If most jobs in ASE listed companies are in finance, the data confirms the earlier observations that investment in manufacturing has the highest job creation intensity, followed by non-financial services such as tourism. The data also reveals that foreign firms rely more non-Jordanian workers than domestic firms do, particularly in the industrial sector (Figure 3.10, Panel B). There is limited data on the contribution of listed firms to other labour market outcomes, but a positive step was the release of ASE 2018 “Guidance on Sustainability Reporting” that encourages listed companies to disclose ESG performance. The guidance includes indicators on child labour, human rights policy, workers’ injury rate, the wage gap between the CEO and median worker and the number of training programmes (Amman Stock Exchange, 2018[23]).

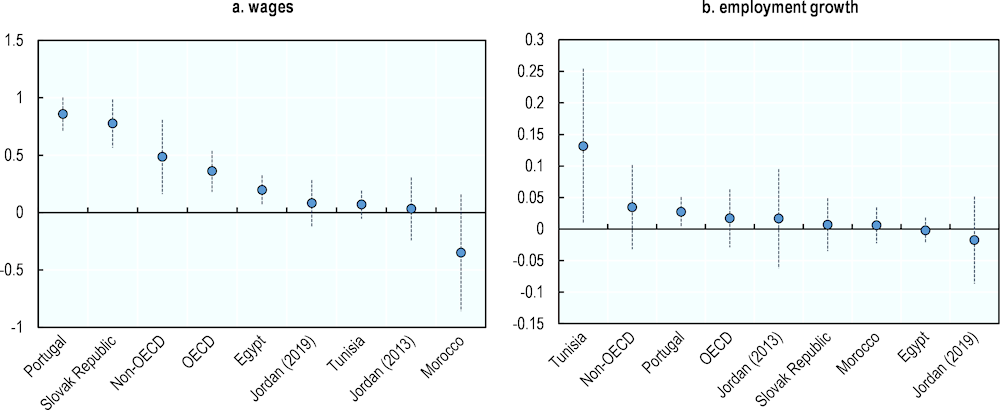

3.3.3. Foreign firms are more skill-intensive and provide more training

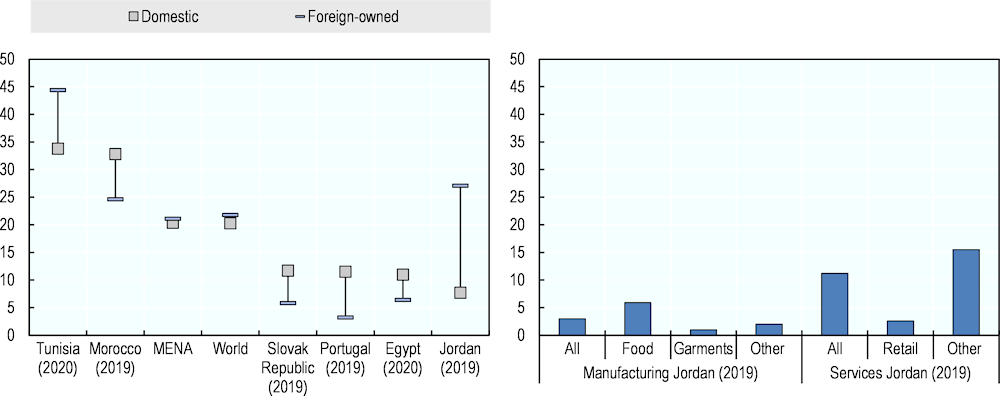

The previous section examined industry patterns, but firm-level features of investors also affect labour market outcomes. For instance, FDI concentration in less skill-intensive sectors is not an undesirable outcome if foreign firms operating in these sectors upgrade their workers’ skills and improve wage and non-wage working conditions. International evidence shows that foreign firms are larger, more productive and more skill-intensive than their domestic peers, and therefore pay higher wages (OECD, 2019[13]). Furthermore, firms that are more dynamic have higher employment growth rates than less productive ones.

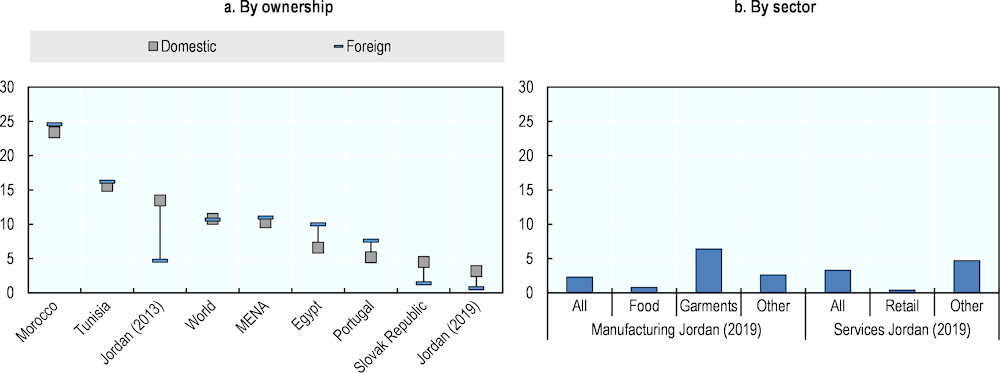

Foreign manufacturers in Jordan pay higher wages than domestic firms, but the premium is insignificant in comparison with other countries (Figure 3.11, Panel A). For instance, on average in non-OECD countries, foreign firms pay around 50% higher wages than domestic firms. The small wage premium in Jordan contradicts the fact that foreign firms are significantly more productive and larger (Chapter 2) – they employ 76 workers on average compared to 34 in domestic firms according to the 2019 World Bank Enterprise Survey of Jordan. This could be because the majority of foreign firms in the country operate in industries with low labour costs and high shares of foreign workers or are active in markets with little competition, which in turn can generate rents that do not entirely translate into wage gains for workers (OECD, 2019[13]). For instance, a survey of the garment and leather industry in 2020 shows that 74% of firms with more than 250 employees are foreign (ILO, 2020[24]). Furthermore, foreign firms in Jordan have not grown faster despite being more productive, an observation that is not unique to Jordan (Figure 3.11, Panel B).

Figure 3.11. Labour outcomes of foreign and domestic manufacturers in Jordan and comparators

Note: The figure shows the respective 95% confidence intervals. See OECD (2019[13]) for the methodology.

Source: OECD based on World Bank Enterprise Surveys.

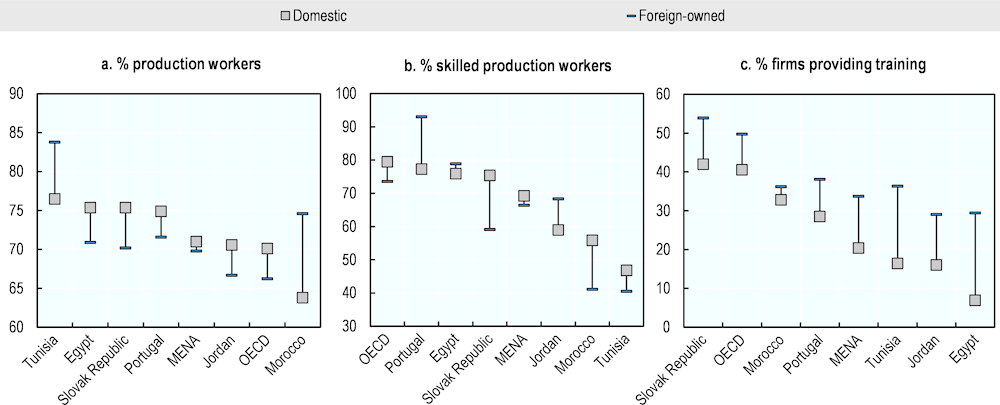

Low foreign wage premiums can also imply that foreign and domestic firms have similar shares of skilled labour. But foreign manufacturers in Jordan have larger shares of non-production workers, occupations that require higher skills than production jobs (Figure 3.12, Panel A). Even among the group of production workers, foreign firms employ higher shares of skilled workers relative to domestic firms (Figure 3.12, Panel B). The low wage premium in spite of higher skill-intensities reveals the structural dysfunctions of the labour market in Jordan, where the returns to skills in terms of higher wages are low in private sector jobs (Alshyab, Sandri and Abu-Lila, 2018[25]). This may deter labour mobility to foreign firms, while it is typically via this channel that FDI raises wages in the host country (Hijzen et al., 2013[26]). Low returns to skills could also be driven by the large presence of experienced migrant workers earning lower wages than Jordanians and working in FDI-intensive industries such as in garments and textiles (Azmeh, 2014[18]).

Foreign firms in Jordan can influence the demand for skilled labour, but they can also increase the supply of adequate skills by training their workers or those of their domestic suppliers. Furthermore, they may induce other firms to invest in human capital in response to rising competition or to imitate their more profitable business practices, including by training workers. Figure 3.12, Panel C, shows that the share of firms providing on-the‑job training in Jordan is higher among foreign-owned firms. While this implies that FDI contributes to skills upgrading in Jordan, it also confirms the earlier observation that foreign investors face stronger skills shortages than domestic firms, which may push them to provide more training to their workers in order to remain competitive. Overall, the share of firms providing training in Jordan is lower than in other countries, including within the MENA region. At the same time, this shows that there is ample room for progress, possibly through appropriate policy intervention.

Figure 3.12. Skill-related features of foreign and domestic firms in Jordan and comparators

Note: Percent of production workers out of total permanent workers; percent of skilled production workers (out of total production workers) in manufacturing.

Source: World Bank Enterprise Surveys (latest available country survey).

3.3.4. Foreign firms adapted faster to new ways of working during the COVID‑19 pandemic

The collapse of global FDI flows in 2020 has put a halt, at least temporarily, to the contribution of FDI to direct job creation in Jordan and in other host countries (OECD, 2020[27]). In 2020, less than 250 direct jobs were expected to be created by greenfield FDI projects in Jordan against a yearly average of 1 667 jobs between 2010 and 2019 – among which nearly 200 in the tourism sector only – according to the Financial Times fDi Markets database. While this number appears low in comparison with the total number of job losses during the pandemic, it adds strain to the ambition of Jordan to create jobs through FDI.

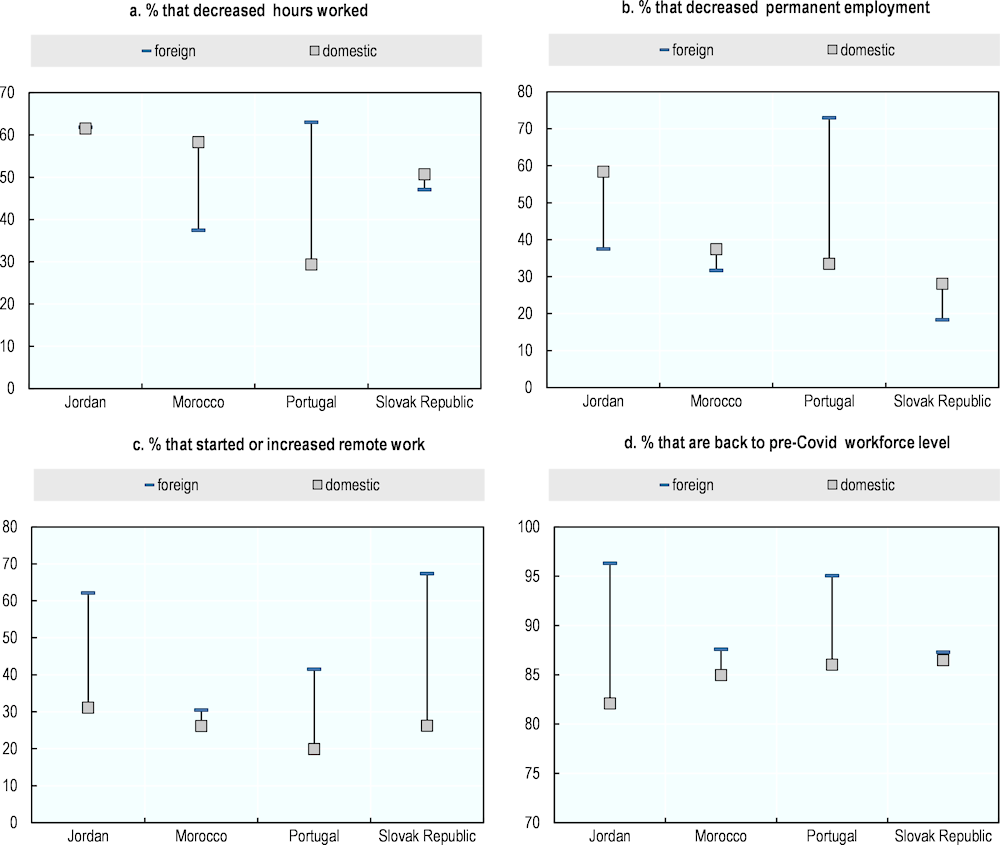

The pandemic is also causing abrupt reductions in the activity of foreign firms. This in turn affects workers, whose jobs and income are at risk. While some foreign firms have been able to shield their workforce from such impacts and are choosing to keep and pay employees during the suspension of their activities, many businesses have had to lay off workers or reduce their working hours. In Jordan, foreign firms have not been more resilient compared to domestic firms to reduce the number of hours worked but they were relatively less to lay off staff (Figure 3.13, Panel A and B). It is possible that, when facing downward pressures, foreign firms find it costly to reduce their workforce because of their higher skill-intensity, and thus larger efforts will be needed to find suitable candidates during the recovery (OECD, 2020[27]).

Figure 3.13. Foreign and domestic firms’ labour market adjustments during COVID‑19

Source: OECD based on World Bank Enterprise Survey “COVID‑19: Impacts on Firms” conducted on November 2020‑January 2021.

Foreign firms in Jordan and in other countries have managed relatively better than their domestic peers to adapt their modus operandi to the new work realities created by COVID‑19 crisis. In Jordan, they were twice more to start or increase teleworking compared to domestic firms since the outbreak of the pandemic (Figure 3.13, Panel C). Foreign firms’ greater adaptability to shocks can also support faster recovery in terms of workforce levels, thus potentially contributing to a job-led recovery (Figure 3.13, Panel D). Overall, differences in the ability to perform jobs remotely affects the impact of confinement on labour outcomes. Foreign firms may be well-placed to promote these new forms of work in Jordan through imitation effects and business relationships with suppliers. The intensity of remote work strongly differs across sectors, however, and the new jobs that foreign firms will create during the recovery will not be equal in terms of their teleworking feasibility. For instance, FDI in business or digital services have high propensities to create many jobs with high teleworking feasibility, in contrast with manufacturing or health care sectors that also generate numerous jobs but with tasks that can hardly be executed from home (OECD, 2020[27]).

3.3.5. Supply chain linkages and competition influence FDI spillovers on labour outcomes

Supply chain relationships between foreign firms and local suppliers are weaker in Jordan than in comparator countries (Chapter 2). Limited business linkages automatically reduce the scope for FDI-induced spillovers on labour market outcomes, which can be both positive and negative. Business linkages can generate employment and wage gains for local suppliers because of increased business activity. They can also have effects that are more permanent if foreign firms invest in the training of their suppliers’ workers to raise the quality of the sourced inputs. Furthermore, when foreign firms operate with high labour standards, they could positively affect the working conditions of their suppliers. Nonetheless, supply chain linkages involving foreign and domestic firms can also have adverse effects if foreign firms have irresponsible business practices, for instance if they cancel or delay their payment of orders.

FDI can also affect labour market outcomes through spillovers to domestic competitors in the same sector. Evidence from the 2011 establishment census shows that the operation of foreign entrants in Jordan led to employment contractions among domestic competitors but they had positive spillovers on their suppliers or buyers in terms of job creation – gains that outweighed the job losses in competitors (Sahnoun et al., 2014[28]). The magnitude of FDI spillovers on labour market outcomes hinged on specific characteristics of the Jordanian economy. Employment contractions due to competition effects affected small or old domestic firms that are often less productive, while the entry of foreign firms led to employment growth of suppliers that are young or operate in service sectors. FDI spillovers on labour market outcomes had a transitory nature, however, with employment growth falling after divestments for local suppliers while increasing for domestic competitors. This suggests that the impact of FDI on employment growth in domestic firms does not stem from permanent knowledge transfers that endure after a divestment (Davies, Lamla and Schiffbauer, 2016[29]).

Manufacturing suppliers in Jordan did not benefit from FDI spillovers in terms of employment growth, in contrast with those in services, possibly reflecting weak competition in the sector and limited supply chain relationships (Sahnoun et al., 2014[28]). For example, the pharmaceutical sector hosts several large foreign and domestic producers, but only 10% of inputs are sourced locally (ibid). Furthermore, additional evidence shows that local sourcing in Jordan is largely driven by foreign firms supplying inputs to other foreign firms in the country (OECD, 2021[1]). This could be occurring in higher-skilled industries such as the pharmaceutical sector where domestic suppliers face challenges in producing goods that are up to the foreign firms’ quality standards (see Chapter 2 for a discussion of SMEs’ absorptive capacities).

3.4. The governance framework affecting the impact of FDI on job quality and skills

Jordan puts high policy priority on investment as a driver for job creation and skills development. Like many emerging economies in the MENA and other regions, the Government of Jordan supports this ambition with various multi-year strategies and plans, governed by dedicated councils and committees, ministries and implementing agencies. This section provides an overview of government strategies and the institutional setup at the intersection of investment, employment and skills development policy and evaluates to what extent they maximise the benefits of FDI on labour market outcomes.

3.4.1. Strategic priorities at the intersection of investment, employment and skills development

Several strategies and plans define Jordan’s national priorities, goals and policies on investment, employment and skills development. Jordan Vision 2025, developed in 2014, and the ensuing Economic Growth Plan of 2018‑22, are the country’s national development strategies (Box 3.3). They include chapters on investment, education and human resource development and labour, thereby providing strategic direction across key policy areas where FDI can affect job quality and skills development. Objectives affecting FDI transmission channels (the ways in which FDI can have higher direct and indirect impact on labour market outcomes) include ensuring harmony between educational output and labour market needs, increasing labour market flexibility, improving the investment environment, and activating the role of the private sector as an engine of sustainable development and job creation. Both development strategies identify policy actions and investment opportunities to develop priority sectors with high value‑added or those that employ a high percentage of Jordanians, which often are in services sectors.

The 2011‑21 National Employment Strategy (NES) was devised as the most comprehensive response to rising unemployment and low participation rates, particularly among youth and women (see also Chapter 4). The strategy identifies FDI as a key driver of private sector growth in Jordan, yet indicates that most foreign investment created only short-term job opportunities (e.g. in construction) and few long-term effects on job quality and skills development. It also acknowledges that liberalisation reforms were not sufficient to reap the benefits of FDI in terms of creating more and better jobs, and must be combined with a range of policies aimed at encouraging exports, promoting innovation, and attracting FDI in particular sectors.

The NES includes broad objectives on investment policies that support more and better job creation. For instance, the strategy recommends aligning existing tax incentives and subsidies provided to private investors with the country’s goal of becoming a knowledge‑based economy. While including investment policy objectives in employment strategies should improve coherence across policy dimensions, it is not clear to what extent the recommendations of the NES were taken on board in ensuing investment plans and legislation such as the 2014 Investment Law. In Rwanda, for instance, the 2019 National Employment Strategy included specific goals on investment and, importantly, indicates the responsibilities of each institution as well as provides an estimated budget for achieving each goal.

Overall, the implementation of the NES faced challenges, including limited resources and lack of continuity driven by reshuffles in the government. It also did not include newer challenges such as the influx of Syrian refugees and the COVID‑19 pandemic. The government is currently preparing a new national employment strategy, which will be ready in 2022, but the Ministry of Labour has also been developing three‑year plans over the last decade. For instance, the 2017‑21 plan has the following strategic objectives:

1. Increase the number of Jordanian workers based on the principle of equal opportunities.

2. Reduce violations of the Law by strengthening the inspection, safety and occupational health apparatus.

3. Strengthen labour relations with social partners to reduce collective labour disputes.

4. Regulate the entry of foreign labour and substitute foreigner workers with Jordanian.

5. Strengthen partnerships with public, private and civil society agencies to improve the governance of the E‑TVET and implement the NSHRD.

6. Raise the quality of services provided by the ministry (e.g. public employment services).

Box 3.3. National strategies covering economic development, employment and skills

Jordan 2025 aims to revitalise the economy by targeting poverty, unemployment and the fiscal deficit, and boosting GDP growth. To bolster economic development, Jordan 2025 adopted a cluster-focused approach that seeks to expand existing industries that are performing well, while developing related or supportive clusters complementary to those industries. The plan identifies eight clusters as having high potential for development: construction and engineering, transport and logistics, tourism and events, health care, life sciences, digital and business services, educational services and financial services.

Jordan Economic Growth Plan (JEPG) 2018‑22 was issued in 2018 to supplement Jordan 2025. The plan lays out various economic, fiscal and sectoral policies that the government intends to implement in order to achieve sustainable social and economic growth. The plan was formulated with a sectoral focus, and it delineates specific interventions required by both the public and private sectors to achieve each industry’s vision. Planned interventions primarily pertain to enhancing the country’s competitiveness, improving the investment environment, easing bureaucratic red tape, digitalising government services, improving infrastructure and promoting sector-specific investments. Overall, the plan identifies 95 policy actions, including in the areas of investment, employment and skills development. Industries of focus are the same as the eight clusters of Jordan 2025.

The National Strategy for Human Resource Development (NSHRD) 2016‑25 is the main reference for most education- and training related interventions and projects. The strategy sets out elaborated recommendations for reforming the different echelons of the education sector in order to achieve sustainable economic, social and environmental development in the country. The areas of focus include governance, quality assurance, the status of teachers and educators, private sector providers, engaging employers, innovation and culture change. The NSHRD pays particular attention to reforming the technical and vocational education and training (TVET) sector. This involves strengthening the relevance of TVET, enhancing the quality of training and education in the sector, introducing private sector centred governance structures (e.g. Sector Skills Councils) and, finally, breaking the negative stigma around TVET in the country.

The National Employment Strategy (NES) 2011‑20 was devised as a response to rising unemployment rates and low economic participation rates, particularly among women and youths. The strategy presents the task of overcoming structural challenges in the Jordanian labour market as an endeavour that requires economic, education and social reform. The strategy is formulated on the basis of achieving progress over three time horizons, divided into the short, medium and long terms. The main goals to be achieved within these horizons include: (a) absorbing the unemployed, (b) bridging the skills mismatch and promoting the growth of micro, small and medium-sized enterprises, and (c) increasing productivity through human capital and economic restructuring. The third horizon includes the objective of developing industrial and investment policies towards growth with Job creation. Some labour market interventions highlighted in the strategy include adopting an effective foreign labour policy, scaling up active labour market programmes, scaling the transition from education to employment and reforming the TVET sector.

Source: OECD (2021[30]), FDI Qualities Mapping of Policies and Institutions in Jordan; ILO (2019[12]), State of Skills: Jordan https://www.ilo.org/wcmsp5/groups/public/--ed_emp/--ifp_skills/documents/genericdocument/wcms_754492.pdf

The government has also developed education and skills development strategies, at the forefront of which is the National Strategy for Human Resource Development (NSHRD) 2016‑25. Drawing on previous national initiatives, including Jordan 2025, the NES and the National Employment-Technical and Vocational Education Training (E‑TVET) Strategy 2014‑20, the NSHRD has identified wide‑ranging reform programmes and action plans to establish a human resource development system for all education levels to enable the country to meet its sustainable development goals. The NSHRD led to important achievements, including the establishment of a Technical and Vocational Skills Development Commission, the endorsement of a National Qualifications Framework, and the establishment of sector skills councils run by the private sector (ILO, 2019[12]). These actions aim at reducing skills mismatches and shortages, and thus should act positively on FDI transmission channels.

3.4.2. The institutional framework aims at addressing challenges that limit the benefits of FDI on jobs and skills but it could be more coherent and inclusive

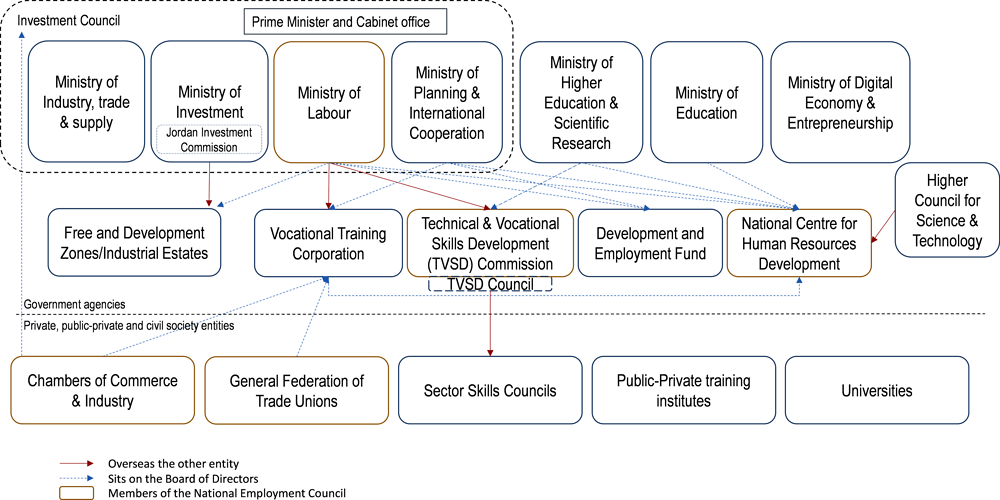

Governments often design and implement their investment and labour market policies in institutional silos, but strong co‑ordination is central for policy actions to achieve expected impacts. A large number of institutions in Jordan are involved in the design and delivery of policies and programmes enabling FDI to have a positive impact on job quality and skills development (Figure 3.14). The institutional framework includes ministries, public agencies, private sector representatives, trade unions, and training institutes, including universities. The mandate of public institutions is often enshrined in law, which also defines, albeit not always, governance relationships with other institutions. Given the multitude of actors with different interests, it is crucial that responsibilities are explicit, adequately funded and mutually understood by all.

Figure 3.14. The institutional framework for FDI impact on job quality and skills in Jordan

Note: The figure shows only the most relevant agencies for enabling FDI impacts on job quality and skills development.

Source: OECD elaboration based on OECD (2021[30]), FDI Qualities Mapping of Policies and Institutions in Jordan.

MoI – previously the Jordan Investment Commission (JIC) – is in charge of developing and implementing the government’s investment strategy with the aim of attracting and retaining investment and helping to realise its desired impact on economic growth and job creation. MoI also manages the 14 free and development zones of the country and has the mandate to promote exports. While MoI is not directly involved in employment and skills development policies, it still actively shapes potential impacts of FDI by promoting and facilitating investment in specific job-creating or skill-intensive sectors, granting tax incentives to investors as defined by the 2014 Investment Law and influencing the wider reform agenda through policy advocacy actions. Furthermore, MoI has the authority to sign memoranda of understanding with other institutions and to co‑operate on specific measures that can influence positively the contribution of FDI to labour market outcomes (e.g. training of workers).

Box 3.4. OECD Guidelines for Multinational Enterprises: Employment and Industrial Relations

MNEs should, within the framework of applicable law, regulations and prevailing labour relations and employment practices and applicable international labour standards:

Respect the right of workers employed by the MNE to establish or join trade unions and representative organisations of their own choosing.

Observe standards of employment and industrial relations not less favourable than those observed by comparable employers in the host country. Where comparable employers may not exist, provide the best possible wages and conditions of work, within the framework of government policies.

To the greatest extent practicable, employ local workers and provide training, in co‑operation with worker representatives and, where appropriate, relevant governmental authorities.

Take adequate steps to ensure occupational health and safety in their operations.

In considering changes in their operations which would have major employment effects, provide reasonable notice of such changes to representatives of the workers, and, where appropriate, to the relevant governmental authorities, and co‑operate to mitigate practicable adverse effects.

In the context of bona fide negotiations with workers’ representatives on conditions of employment, or while workers are exercising a right to organise, not threaten to transfer activity in order to influence unfairly those negotiations or to hinder the exercise of a right to organise.

The Guidance sets out practical ways to help businesses avoid potential negative impacts of their activities and their supply chains. It aims to bolster policy efforts to strengthen confidence between enterprises and the societies in which they operate, and complements both the due diligence recommendations contained in the UN Guiding Principles on Business and Human Rights and the ILO Declaration on Fundamental Principles and Rights at Work.

The implementation of the OECD Due Diligence Guidance for Responsible Supply Chains in the Garment and Footwear Sector can help to address challenges in the sectors. The garment sector is an important driver of growth in Jordan and provides an example of how the government and industry players can organise themselves and collaborate to promote RBC. Garment and footwear global supply chains are characterised by stages of labour-intensive production process spread across diverse countries, short lead times and short-term buyer-supplier relationships. These factors reduce visibility and control over a company’s supply chain and can create challenges for companies to meet their responsibilities in preventing and mitigating risks in their supply chains.

RBC challenges in Jordan are not limited to one sector and examples in the garment and footwear sector could be replicated and expanded to other industries, including those covered by other OECD sectoral due diligence instruments, including the OECD-FAO Guidance on Responsible Agricultural Supply Chains and the Due Diligence Guidance for Meaningful Stakeholder Engagement in the Extractive Sector.

Source: OECD (2011[31]), OECD Guidelines for Multinational Enterprises, 2011 Edition, https://dx.doi.org/10.1787/9789264115415-en.

MoI also hosts Jordan’s National Contact Point for Responsible Business Conduct (RBC), which is in charge of promoting the OECD Guidelines for Multinational Enterprises, and related due diligence guidance, and of handling cases tackled in the Guidelines as a non-judicial grievance mechanism. The Guidelines include several clauses calling on MNEs to promote good industrial relations, quality jobs and a decent working environment (Box 3.4). The Jordanian NCP does not include third-parties in its structure, in contrast with other NCPs such as in Tunisia. It has also been largely inactive as regards RBC promotion, which may partly be due to the low level of allocated resources (OECD, 2021[1]).

Together with MoI, the Ministry of Labour (MoL) is the other main institution that influences the impact of FDI on job quality and skills development in Jordan. The mandate of the ministry is to regulate the labour market, clarify industrial relations and develop active labour market policies, including skills development programmes, to tackle the main challenges of the labour market. The MoL performs its duties in accordance with the provisions of the 1996 Labour Law and its amendments. The mandates of the MoL are implemented in co‑operation with several public, private and civil society partners. The government recently established a National Employment Council, with the Prime Minister as the chair, the Minister of Labour as his deputy and with the participation of the social partners (Figure 3.14).

The MoL oversees two public bodies that play important roles in the institutional framework that affects how FDI impacts job quality and skills, which are the Vocational Training Corporation (VTC) and the Technical and Vocational Skills Development (TVSD) Commission. The VTC offers vocational training and apprenticeship programmes, including on-the‑job training programmes. It also offers ad-hoc programmes for upgrading the skills of current employees, based on the requests of employers. The negative stigma surrounding vocational training in Jordan, the outdated curricula used by the VTC and the poor infrastructure of training institutes make the VTC less attractive for young Jordanians (ILO, 2019[12]).

The TVSD Commission was established in 2019 in line with the recommendations of the NSHRD on streamlining the governance of the TVET system – the Commission brings under one umbrella different bodies supervising the field of TVET – and addressing persistent skills imbalances. The Commission accredits and supervises TVET providers and their programmes, as well as evaluating and controlling their performance (the Centre of Accreditation and Quality Assurance operates under the supervision of the Commission). It also hosts the TVET Support Fund, which finances TVET programmes and activities targeting the most vulnerable groups. This support is useful for a small open economy like Jordan because trade and investment flows can adversely affect or displace workers in less productive jobs. The Minister of Labour chairs the council that oversees the work of the TVSD but members are in their majority from the private sector. The General Federation of Trade Unions is not represented in the TVSD council, although workers’ voice is crucial to ensure that the TVET system remains human centred (ILO, 2019[12]).

The TVSD Commission also oversees the Sector Skill Councils (SSCs), which are managed by the private sector and are considered a major step to improve public-private dialogue on the TVET system. They cover main economic sectors, including agriculture, energy, garments, chemicals, tourism, ICT, and logistics – sectors that are also prioritised by MoI. The SSCs are expected to: develop, manage and maintain an effective labour market intelligence system; improve the matching of supply and demand for skilled workers in the labour market; advocate for and contribute to improvements in the TVET sector; and monitor and evaluate the progress and results of training provision and productive employment of skilled workers. The SSCs have started to operate, but the law limits them to having an advisory role. Considering carefully the guidance provided by the SSCs will improve the market relevance of TVET programmes, but also help to keep the SSCs engaged in the dialogue with the government (ILO, 2019[12]).

Other ministries involved in the institutional framework that influences FDI effects on job quality and skills include the Ministry of Planning and International Co‑operation (MoPIC), the Ministry of Higher Education and Scientific Research, the Ministry of Industry, Trade and Supply, the Ministry of Education, and the Ministry of Digital Economy and Entrepreneurship. MoPIC, for instance, co‑ordinates relationships with donors, among which several provide financial and technical support in the areas of employment and skills development, while the Ministry of Education defines the secondary level vocational education system – the Minister of Education established in 2021 a National Committee to conduct a comprehensive review of the vocational education system. The TVSD or the SSCs are not part of this newly created committee.

Other public agencies include the National Centre for Human Resource Development (NCHRD) and the Development and Employment Fund. The NCHRD reports to the Higher Council for Science and Technology (HCST) and benefits from a highly inclusive board membership. It provides policy advice, conducts studies, collects and publishes statistics on education and skills, and evaluates whether educational reform plans meet labour market needs. Together with the VTC, NCHRD is part of the National Committee reviewing the vocational educational system. Aside from the SCCs, private, public-private and civil society actors include the chambers of commerce and industry, the General Federation of Jordanian Trade Unions, training providers (universities, NGOs, private providers), and the donor community.

3.4.3. Co‑ordination takes place at strategic levels but less across implementing agencies

There are no mechanisms in Jordan exclusively dedicated to horizontal policy co‑ordination between ministries dealing with labour and skills development policies and those responsible for investment. Other existing mechanisms nevertheless could be adapted to ensure broader alignment across the policy areas. For instance, the Minister of Labour sits in the Investment Council (IC), which is the main co‑ordinating body overseeing the management and development of Jordan’s national investment policy (Figure 3.14). There are also several co‑ordinating committees that aim at addressing labour market or skills imbalances challenges, including the newly established National Committee on Employment and National Committee on Vocational Education. Their mandates could be more coherent to ensure complementarity of objectives and their governance structure be more inclusive to support collaborative decision-making, particularly to promote a TVET system that adequately responds to private employers’ needs.

The presence of the MoL in the IC signals the government commitment to policies that enhance the impact of FDI on labour outcomes. It is also particularly relevant as MoI oversees the Free and Development Zones where foreign labour is abundant. There is limited information on the extent to which the MoL and other members participate in the IC, however, and how they contribute to shaping the investment strategy. Nonetheless, it is reasonable to assume that the participation of the MoL in the IC helps in aligning strategic objectives and priorities that are at the intersection of investment, labour and skills development. The inclusion of the Ministry of Labour in IPAs’ boards or similar high-level investment bodies is not common across countries, although there can be important differences in the status and functions of bodies overseeing IPA’s work (OECD, 2019[32]). For instance, Egypt’s Supreme Investment Council, a high-level body that has similar functions to Jordan’s IC, does not include the ministry of labour.

It is more challenging to identify concrete co‑ordination mechanisms through which MoI can influence labour and skills development policies in Jordan. The MoL strategic plan for 2017‑21 classified JIC as a supporting partner with which the ministry co‑ordinates on technical issues to achieve reciprocal benefits (Table 3.2). The plan indicates that JIC contributes to achieving three out of the six strategic objectives of the MoL, including the objective of improving the governance of the TVET system and implementing the NSHRD. Co‑ordination with JIC involved informal mechanisms such as meetings and correspondence, but it remains unclear how JIC – now MoI – concretely supports the MoL in achieving its strategic objectives. Co‑ordination between the MoL and the Free and Development Zones, which MoI oversees, seems stronger than with the ministry itself. The organisational relationship between zones and the MoL is driven by the strategic objective of the ministry to regulate the entry of foreign labour and substitute foreigner workers with Jordanian citizens.

Co‑ordination between MoI and implementing agencies involved in labour policy and skills development seems to be less developed. MoI does not sit on the boards of directors of the VTC or the NCRD and is not part of the TSDV council (Figure 3.14). Nonetheless, this absence is likely to be common across countries. Furthermore, the voice of the private sector is represented in these different agencies, which should help in identifying the needs of the labour market in terms of skills, and adapt training programmes to these needs. Involving MoI in the decision-making of the SSCs could be still a relevant avenue to explore, however, as the ministry promotes and facilitates investment in the same industries and can bring forward its sectoral expertise and voice the concerns of the foreign investors in terms of skills shortages and training needs or provide feedback on labour market reforms under discussion. In Ireland, for example, the CEO of the Irish IPA is a member of the National Skills Council and is in charge of providing regular updates on sectoral investment opportunities and advice on skills availability (OECD, 2021[15]).

Table 3.2. The relationship of the Ministry of Labour with JIC and other selected institutions

|

Institution |

Type of relationship |

Strength of relationship |

Coordination mechanisms |

Contribution to strategic objectives |

|---|---|---|---|---|

|

Jordan Investment Commission |

Technical |

Supporting partner |

meetings, correspondence |

1,3 and 5 |

|

Free and Development Zones |

Organisational, Technical |

Supporting partner |

meetings, correspondence |

1, 3, 4 and 5 |

|

Ministry of Industry, Trade and Supply |

Organisational, Technical |

Key partner |

meetings, correspondence, reports |

1, 2, 3.4 and 5 |

|

Vocational Training Corporation |

Organisational, Technical, legal |

Key partner |

meetings, correspondence, reports |

1,5 |

Note: Organisational: it is not possible to complete the ministry’s operations and achieve its goals with the partner organisation. Technical: partnership relations to achieve reciprocal benefits and aims to provide its services to customers, transfer knowledge and expertise in specialised fields and improve performance. Legal: existing laws and regulations specify the type of relationship with the partner.

Source: Ministry of Labour Strategic Plan of 2017‑21, Government of Jordan.

3.5. The policy framework supporting the impact of FDI on job quality and skills

Improving the investment climate has long been a priority for the Government of Jordan, recognising the developmental benefits that FDI can bring. To this end, the government has advanced meaningful reforms in the past decade that are conducive to investment (OECD, 2013[14]; 2021[1]). These reforms should, however, be complemented with a wider set of policy interventions. This section reviews policies and programmes in Jordan that aim at improving the impact of FDI on job quality and skills development, including wider product and labour market regulations and more specific proactive policies and measures. The section also reviews Jordan’s internationally agreed principles that can help ensure, inter alia, higher labour standards in the operations of foreign firms.

3.5.1. Pro-competition reforms would support FDI to create high-skill jobs in services sectors

With the exception of restrictions on FDI, the wider regulatory environment in Jordan treats foreign and domestic investors alike. Nonetheless, the extent to which regulations affect the two groups of firms, and influence the respective ways they can impact labour market outcomes, can vary. Policymaking should take into consideration these differentiated effects on foreign and domestic business. For instance, product and labour market regulations directly affect foreign business location choice, characteristics and, in turn, labour market impacts. They also affect how labour markets adjust in response to FDI entry and spillovers on competitors and suppliers. FDI impacts on jobs, wages and skills are likely to be greater in settings where pro-competition policies allow for more efficient resource reallocation.

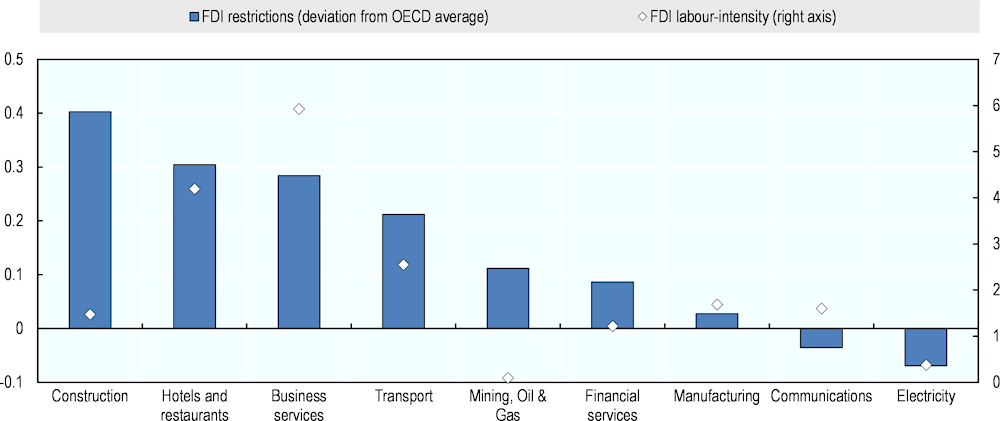

Discriminatory measures on investors’ entry and operations deter FDI and, in turn, related direct and indirect labour market gains. Reforms in Jordan have largely liberalised the manufacturing sector but many service sectors remain partly off limits to foreign investors (OECD, 2018[33]; 2021[1]). Restrictions on full foreign ownership exist in business services, distribution, transport and tourism, sectors where FDI has a strong job creation potential (Figure 3.8). Joint venture requirements in such skill-intensive sectors may also push foreign investors not to deploy their most advanced technologies and business practices, in turn limiting better-paid job creation and skills transfers to domestic owners (Moran, Graham and Blomström, 2005[34]). High FDI restrictions in the construction sector contrast with the large amounts of FDI injected in the sector in the last two decades. This however suggests that liberalisation reforms could lead to even higher FDI inflows and more job opportunities for the lower-skilled workers, albeit temporarily.

Figure 3.15. FDI regulatory restrictions and job-creating potential of greenfield FDI in Jordan

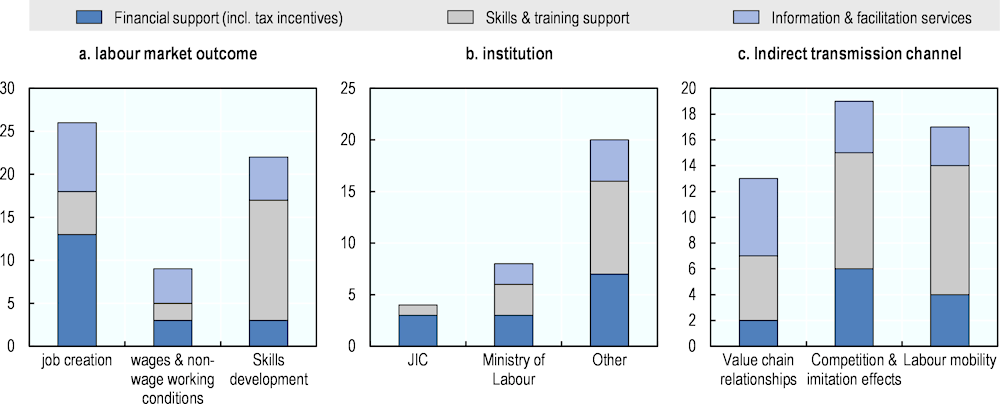

Source: OECD FDI Regulatory Restrictiveness Index and Financial Times fDi Markets.