This chapter provides an overview of the sustainable finance landscape for SMEs and focuses on the key challenges that these companies face in seeking out and accessing financing for the green transition. It also provides recommendations to strengthen the provision of financial and non-financial support for SME sustainability.

Financing SMEs and Entrepreneurs 2024

2. Sustainable finance for SMEs: Challenges and opportunities

Abstract

Glossary of Terms

Bridge loans refers to a financing instrument that allows SMEs to have capital until permanent or next stage financing can be obtained.

Carbon pricing is a pricing scheme where a tax is directly applied to the production of carbon emissions or fuels that release GHG gasses.

Environmentally sustainable finance is all finance that considers environmental performance as a criterion for the financing decision or for determining the financing conditions, regardless of the purpose of use of the funds.

ESG integration is an investment/financing strategy that considers environmental as well as social and governance impacts as factors of risk and opportunity in the financing and investment strategies of financial institutions and institutional investments, alongside maximizing financial returns.

Exclusionary screening is an investment/financing strategy that prohibits financing/investments in specific industries or activities (e.g. extraction of fossil fuels, agricultural activities associated with deforestation).

Green asset ratio is a metric used to assess the sustainability of a company or portfolio, calculated by dividing the total value of an entity's environmentally friendly assets by the total value of all of its assets.

Green equity refers to either Venture Capital or Private Equity aimed specifically at funding innovative solutions to address environmental challenges.

Green loans are a debt instrument committed exclusively to finance green projects.

Green revolving credit is a form of credit where the requested amount is available and once used and repaid, the credit replenishes. Only available for green projects (e.g. energy efficiency, renewable energy, etc.).

Green supply chain financing/green factoring involves a buyer approving its supplier invoices for financing by a bank when a product or service is provided. This type of financing helps the supplier get short-term credit and optimize working capital, while the buyer gets more time to pay off balances. Preferential rates are given depending on the sustainability performance of the supplier.

Green transition is a shift towards an economical model that allows for sustainable growth without negatively impacts on the environment.

Green washing a practice whereby sustainability related statements, declarations, actions or communications, do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial service. This practice may be misleading to consumers, investors or other market participants.

Hard-to-abate refers to firms that have emissions that are extremely costly or difficult to reduce with the currently available technologies.

Hybrid financing/hybrid instruments are instruments/investments that combine debt and equity.

Impact investing is an investment strategy that pursues or seeks to maximize environmental and social returns, even if they come at the expense of financial returns.

Nature positive refers to sustainable development outcomes that have a net positive impact on the natural world. This concept goes beyond net zero, focusing on actions that preserve biodiversity, improve natural capacity to absorb pollution, and decrease the vulnerability of natural ecosystems.

Net zero refers to the target of reducing greenhouse gas emissions to zero by balancing the amount released into the atmosphere with the amount removed and stored by carbon sinks. An entity can achieve net zero by reducing carbon emissions and offsetting any emissions that cannot be eliminated.

Non-financial disclosure/reporting is a form of transparency reporting whereby companies formally disclose information not related to their finances, including information on environmental impacts and human rights. For example, non-financial disclosures related to climate include information on carbon emissions. On the one hand, climate related non-disclosure requirements enable companies to demonstrate foresight in their consideration of climate issues. On the other hand, it helps inform investors to efficiently allocate capital towards a lower emissions economy.

Public Financial Institutions refer to government-owned entities that offer a host of financial services/products, such as direct financing and guarantees, to support SMEs’ access to finance.

Partnership for Carbon Accounting Financials (PCAF) Methodology is a methodology that enables financial institutions to measure and disclose GHG emissions for loans and investments.

Scope of emissions describe the three different levels by which the coverage of climate-related disclosure requirements differs. While Scope 1 and 2 emissions include GHG emissions that the company is directly responsible for (1) or indirectly produces through energy consumption (2), Scope 3 emissions encompasses all other emissions that are outside of the company’s control. The hard-to-measure scope 3 emissions stem from upstream activities such as commuting of employees or purchases goods as well as from downstream activities such as treatment of waste or operations of franchises.

Sustainable finance is finance that takes into consideration environmental, social and governance factors (ESG) in financing decisions.

Taxonomy is a framework to establish a common definition what activities are considered environmentally sustainable.

Overview

Financing SMEs’ transition to sustainability is an important priority to meet climate objectives. SMEs on aggregate account for about 40% of the greenhouse gas (GHG) emissions of the business sector; yet most are only at the beginning of the journey to net zero (OECD, 2023[1]). Likewise, few SMEs have developed transition plans or made commitments to reach net zero (OECD, 2022[2]). In the current context of high interest rates and more difficult access to finance for SMEs (see Chapter 1), these firms must nevertheless push ahead to drive the green transition and green their business practices.

Access to finance is an important constraint for SMEs’ net-zero action. In a recent survey of nearly 350 SMEs globally, 55% of respondents identified the lack of funds as a key reason for limited action on climate change and nearly 70% stated that they need additional funds to take action or accelerate their progress on emission reductions (SME Climate Hub, 2023[3]). Access to finance will likely represent an even bigger constraint for climate action, as financing conditions become increasingly dependent on sustainability considerations and as financial institutions (FIs) face non-financial reporting requirements, both of which place a reporting burden on SMEs. Ensuring that SMEs have access to tailored sustainable financing solutions to meet their net-zero investment needs is critical for the net-zero transition.

The supply of sustainable finance is growing rapidly in response to regulatory and stakeholder demand and management of risks in the net-zero transition. In a 2023 survey by the OECD Platform on Financing SMEs for Sustainability1, both public and private financial institutions (FIs) stated that they are increasingly integrating climate considerations in their operations, including in developing institutional objectives and plans and assessing some or all financing/investment opportunities. Some FIs are also providing dedicated financing programmes or more advantageous conditions for investments focused on green objectives. Most FIs are providing tailored financing solutions for SMEs’ investments in net zero and greening, including through medium- and long-term loans, short-term loans and factoring, credit guarantees, and other financing instruments.

However, SMEs may not be able to tap into this growing pool of sustainable finance. Financial institutions increasingly need and seek out granular data on their clients’ sustainability performance to manage risks, develop financing instruments and meet reporting requirements. Yet SMEs are not as well equipped to provide these data as large entities due to their relatively limited capacities to identify, measure and report on their environmental performance. This poses potential risks to SMEs’ ability to access financing in the future. SMEs also risk losing access to finance if they cannot advance (sufficiently rapidly) on the journey to net zero and/or cannot demonstrate credible transition plans. This is a particularly strong risk for SMEs in high-emitting and hard-to-abate sectors.

SMEs’ limited demand for sustainable finance is also an important challenge, which often stems from lack of information and awareness, as well as capacity and resource constraints. SMEs also face high technical, market and regulatory uncertainty. This has several important implications for policy and finance. SMEs need a stronger business case and external support to boost their investments in sustainability and to seek the related financing. In the absence of SME demand, public and private FIs have limited incentives to develop tailored financing solutions for financing SMEs’ net-zero and other investment needs. Furthermore, if they do not invest in improving their sustainability performance or cannot provide credible transition plans, SMEs risk losing access to finance even for other investment needs, as noted above.

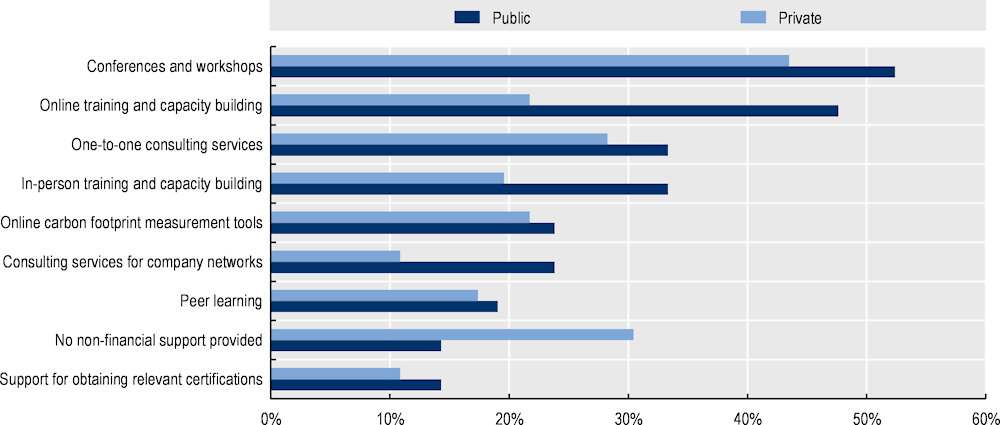

Public actors have an important role to play in establishing a stable and conducive regulatory and policy environment for sustainable finance and investment and providing relevant financial and non-financial support to enhance SME access to and uptake of sustainable finance. Financial support can entail the provision of direct financing through loans, equity, grants and other instruments; or it may entail the mobilisation of private financing through credit guarantees and other de-risking instruments. Public financial institutions can also help SMEs by facilitating their participation in capital markets and supporting financial innovation to foster the development of relevant digital financial solutions. Non-financial support may include information and tools to help SMEs in strengthening their awareness about the sustainability journey, the available technologies and resources they can tap into, and the ways in which they can measure and report on their sustainability performance.

Private actors, too, need to drive the transition. The large financing gap cannot be filled by the public sector alone. Private financial institutions, Fintechs, ESG intermediaries, such as rating agencies, accountants and other relevant stakeholders, all need to contribute toward creating a conducive ecosystem that provides the right information, incentives and conditions to drive SME investment in greening and their uptake of relevant financing instruments to meet these needs.

In order to help foster the provision and uptake of sustainable finance for SMEs, and to maximise the potential for private actors to the contribute to the transition, public institutions need to take into account the following considerations:

Understand SMEs’ diverse needs and pathways to net zero and nature positive;

Devise sustainability-related policies and regulations that take into consideration the impact on SMEs;

Strengthen the transparency and interoperability of sustainability-related data, definitions and standards;

Ensure that a stable, transparent and comprehensive policy and regulatory framework is in place to support investment and financing of the green transition;

Provide financial support to address challenges impeding SME access to sustainable finance;

Provide non-financial support for SMEs to foster their access to, but also uptake of sustainable finance;

Foster the sustainable finance ecosystem for SMEs by promoting dialogue and knowledge-sharing among the diverse actors.

This thematic chapter of the Scoreboard aims to shed light on timely issues and provide additional context and information to enrich the trends documented in this report. Following the 2022 edition, which analysed how COVID-19 and build-back-better support measures contributed to SME access to finance, this chapter provides information on the latest state of play in sustainable finance for SMEs, offering information on financial institution strategies and approaches, relevant financing support and technical assistance provided to small businesses and policy recommendations. It takes into account guidance provided in the OECD Recommendation on SME Financing and insights shared at the 2023 CSMEE meeting at Ministerial Level (OECD, 2023[4]), (OECD, 2022[5]). It brings insights from the 2023 survey “Financing SMEs for Sustainability – Financial Institution Strategies and Approaches” and builds on the 2022 report on “Financing SMEs for Sustainability: Drivers, Constraints and Policies”, developed by the OECD Committee on SMEs and Entrepreneurship and informed by the activities of the OECD Platform on Financing SMEs for Sustainability (OECD, 2023[6]) (OECD, 2022[2]) (OECD, 2023[7]).

Introduction

Financing the net-zero transition of millions of SMEs is an important priority for the coming decades. SMEs account for a significant share of the global greenhouse emissions: about 40% of business sector GHG emissions in EU countries, according to recent OECD estimates, and about 50% globally according to the International Trade Centre (ITC) (OECD, 2023[1]; ITC, 2021[8]). Despite this, SMEs have not been a strong focus for national and international climate policies, which have most often targeted larger firms. According to the International Energy Agency (IEA), as of mid-2021, less than 100 of more than 6 000 environmental and energy policy measures, concerned specifically SMEs and 150 start-ups and entrepreneurship (OECD, 2021[9]). Similarly, an OECD analysis of post-COVID national recovery and resilience plans from 91 countries suggests that SME-specific policies represent only about 5% of the total number of climate-related policies and about 2.4% of total allocated funding for the implementation of these policies (OECD, 2022[10]).

Furthermore, and in part as a result, SMEs themselves have also taken only limited actions toward the net-zero transition. For example, a 2023 survey of nearly 350 SMEs showed that while most SMEs (82%) recognise that the green transition is a high priority, the large majority have taken only elementary steps toward greening their business models, such as the introduction of energy efficiency measures and waste reduction (76%), reducing energy consumption (71%) and employee education (66%) (SME Climate Hub, 2023[3]). SMEs also have an important role to play in developing the innovative technologies, products and processes that advance the global net-zero agenda. For example, SMEs account for an estimated 70% and 90% of clean tech companies in the UK and Finland respectively (ETLA, 2015[11]) (Carbon Trust, 2013[12]).

Most entrepreneurs and SMEs cite access to finance as an important obstacle to their green and net-zero transition. In the above-mentioned survey, 55% of SMEs identified the lack of funds as a key reason for limited action on climate change and nearly 70% stated that they need additional funds to take action or accelerate their progress on emission reductions (SME Climate Hub, 2023[3]). Access to finance is likely to become an even bigger constraint as sustainability considerations are increasingly linked to financing decisions and as financial institutions (FIs) face non-financial reporting requirements that place a reporting burden on SMEs. Ensuring that SMEs have access to tailored sustainable financing solutions that can meet their net-zero investment needs is a critical factor for the net-zero transition.

However, ensuring that there is sufficient demand and uptake of sustainable finance among SMEs is also an important challenge. SMEs often lack awareness about the net-zero transition and the actions they need to take to reach net zero. A 2021 survey conducted by the UK Chamber of Commerce shows that only one in ten SMEs currently measure their GHG emissions (one in 20 for microenterprises). Moreover, 22% of SMEs do not fully understand the term ‘net zero,’ and almost a third have yet to seek advice or information to help them develop a net-zero roadmap or improve their environmental performance (British Chambers of Commerce, 2021[13]). Yet, even when they are aware of the importance of the green transition, SMEs may not see the business case for net-zero investments given that these investments often entail high upfront costs with uncertain long-term returns due to changes in the regulatory environment, varying consumer demand, technological progress and other factors. Lack of relevant knowledge and skills, time and other resources can also deter SMEs from taking action on climate change. Nearly 60% of SMEs globally have cited lack of skills and 44% lack of time as constraints to climate action (SME Climate Hub, 2023[3]). Similarly, survey data from Korea show that 31% of SMEs find the lack of information on the methods to reduce their carbon footprint to be a main constraint to achieving net zero (Korea Chamber of Commerce and Industry, 2021[14]). This means that even if tailored financing instruments and support are put in place, uptake can pose a challenge for SME clients. Non-financial support, therefore, has an important role to play in bolstering SME demand for net-zero financing and investment and supporting the effective financing of SMEs’ transition.

This chapter builds on the 2023 survey “Financing SMEs for Sustainability – Financial Institution Strategies and Approaches” and the 2022 report “Financing SMEs for Sustainability: Drivers, Constraints and Policies” of the OECD Committee on SMEs and Entrepreneurship and informed by the work of the OECD Platform on Financing SMEs for Sustainability (OECD, 2022[2]; OECD, 2023[15]) (OECD, 2023[6]). This chapter focuses specifically on the environmental angle of sustainable finance. It outlines the key challenges and opportunities in the provision and uptake of sustainable finance by SMEs and explores the role that regulations, policies as well as public financial and non-financial support can play in supporting SMEs as they tap into the growing pool of sustainable finance and mobilise investments towards net zero.

The chapter is divided into four sections. The first section explains what sustainable finance is and why it matters for SMEs. The second section explores how sustainable finance is changing the financing landscape for SMEs and what this implies for SMEs in terms of their ability to access finance and their incentives for greening their business models. The third section focuses on the challenge posed by SMEs’ limited demand for and uptake of sustainable finance. Finally, the last section elaborates on the importance of creating a conducive ecosystem for the provision and uptake of sustainable finance for SMEs. It focuses in particular on the role public actors, including regulators, policy makers and public financial institutions, can play in providing financial and non-financial support to drive and accelerate SMEs’ transition to sustainability.

Box 2.1. Green/sustainable taxonomies are being developed to define green and sustainable activities

Purpose and function of green/sustainable taxonomies

Green/sustainable taxonomies seek to provide greater clarity on the environmental sustainability of specific financing and investment activities by establishing clear criteria for what assets can be defined as green or sustainable.

The adoption of green/sustainable taxonomies helps mobilise resources to sustainable investments by providing a shared definition, reducing the incidence of greenwashing, and by incentivising firms to offer additional non-financial disclosures.

Examples of green taxonomies across the world

The EU green taxonomy defines six categories of environmental objectives: 1) climate change mitigation; 2) climate adaptation; 3) sustainable use of water and marine resources; 4) transition to a circular economy; 5) pollution prevention; 6) protection and restoration of biodiversity and ecosystems.

For an economic activity to be qualified as sustainable, it must contribute substantially to one or more of the above environmental objectives while doing no significant harm to any of the other listed objectives. Sustainable investments must also comply with minimum social safeguards, aligning with several international standards (ex: OECD Guidelines for Multinational Enterprises, UN Guiding Principles on Business and Human Rights, International Labour Organisation’s declaration on Fundamental Rights and Principles at Work, etc.). To facilitate the adoption of the above requirements, the EU has incorporated a set of guiding metrics, principles and online platforms to which firms can refer.

There are certain mandatory requirements, including requirements for providers of financial products to disclose which of their investments comply with the sustainability criteria of the taxonomy. Large enterprises and all listed companies must also disclose what share of their turnover and capital expenditure are sustainable in line with the taxonomy criteria.

The green taxonomy also has provisions that consider investments enabling green activities and transitional activities that are not sustainable but have lower carbon emissions (e.g. nuclear power and natural gas).

Colombia in 2022 launched its own green taxonomy plan, the first country in the Latin American region to do so. The national government used the EU Green Taxonomy as a baseline with many of the same environmental goals and guidelines. Additional technical criteria were introduced to adapt the policy to fit the socio-economic context of the country and align it with local environmental strategies.

In Korea, the government has developed a Korean Green Classification System (K-taxonomy). The taxonomy defines a subset of economic activities that can be considered green, including activities in the energy, industrial, and transportation sector. The taxonomy also makes additional classifications for transitional activities.

In Mexico, the sustainable taxonomy was launched in March 2023. The taxonomy covers both environmental and social activities, including climate change mitigation, climate change adaptation and gender equality.

In Singapore, the Green Finance Industry Taskforce has begun the development of a taxonomy that would be used by Singapore-based financial institutions which are also active in the ASEAN region.

In South Africa, the National Treasury launched in April 2022 its Green Finance Taxonomy (GFT) which builds on the technical content of the EU Sustainable Finance Taxonomy.

China has an informal taxonomy that is a combined set of regulations defining green credit and green bonds. These regulations offer lending guidelines with accompanying KPIs and require banks to report bi-annually on what percentage of their portfolio is green and their combined impact on emission reduction and water savings.

The UK Green Technical Advisory Group is advising the Government on the development of a UK taxonomy.

In Canada, the development of the so-called Transition Taxonomy has been led by the private sector (six major banks, pension funds and insurance companies). The government in 2021 began preparing recommendations for the establishment of a green and transition finance taxonomy, establishing a technical group from the Sustainable Finance Action Council to provide guidance.

Other countries that have taken steps to develop and implement green taxonomies include Chile, Georgia, Malaysia and Mexico.

Transition taxonomies

Transition taxonomies differ from traditional green taxonomies, focusing instead on providing finance to high-carbon emitting firms that intend to decarbonize their operations. Transition taxonomies help promote long-term strategic GHG emission reduction by establishing clear guidelines and reporting frameworks for decarbonization.

Several countries have begun to establish transition taxonomies to address these needs. In 2021, Japan published Basic Guidelines on Climate Transition Finance that require recipients of transition finance to develop and report on their transition progress to financial institutions and provides guidance on aligning reporting with international standards. Korea, as noted above also has additional clarifications within its green taxonomy defining transitional activities. Likewise, Canada’s taxonomy roadmap report establishes transition finance mechanisms for activities with viable decarbonization pathways.

Source: (OECD, 2020[16]), (European Commission, 2023[17]), (Reuters, 2022[18]), (bnamericas, 2022[19]), (IBK, 2023[20]), (Modern Mining, 2022[21]), (Green Finance Institute, 2023[22]), (Natixis, 2021[23]), (Lexology, 2022[24]), (OECD, Forthcoming[25]), (Canada, 2023[26]) (Gobierno de México, 2023[27])

What is sustainable finance and why does it matter for SMEs?

Sustainable finance takes into consideration environmental, social and governance factors (ESG) in financing decisions (OECD, 2020[28]), with the “E” pillar including all financing that considers environmental performance as a criterion for the financing decision or for determining the financing conditions, regardless of the purpose of use of the funds. Sustainable finance therefore goes beyond the financing of greening or environmentally sustainable investments/projects as defined by relevant green and sustainable taxonomies (Box 2.1). This chapter focuses on environmentally sustainable finance, and in particular on the climate/net-zero dimension.

The consideration of environmental factors in financing can take many forms. Exclusionary screening or divestment prohibits financing/investments in specific industries or activities (e.g. extraction of fossil fuels, agricultural activities associated with deforestation). ESG (environmental, social, governance) integration considers environmental (as well as social and governance impacts) as factors of risk and opportunity in the financing and investment strategies of financial institutions and institutional investors, alongside maximising financial returns. The active engagement approach targets companies with high emissions but a strong propensity for improvement in their ESG performance. On the other end of the spectrum, impact investing pursues or seeks to maximise environmental and social returns, even if they come at the expense of financial returns (OECD, 2020[29]) (Eurosif, 2016[30]) (Busch, Bauer and Orlitzky, 2016[31]; Busch, Bauer and Orlitzky, 2016[32]). Depending on the nature of their enterprise, FIs and (institutional) investors may employ one or more of these approaches or instruments when incorporating environmental factors in their operations.

Whatever the approach taken, the inclusion of environmental factors in financial institutions’ investment decisions and broader operations has important implications. One of the main implications is that financial institutions (FIs) increasingly need to obtain sustainability-related data on their clients for the purposes of making financing decisions, devising relevant tailored financing instruments, managing the risks of their financed portfolios and meeting emerging reporting requirements. Likewise, companies in high emitting sectors or sectors with a high and hard-to-abate environmental footprint face greater risks of being excluded from access to external financing, especially if they cannot provide credible transition plans to net zero or towards improved environmental performance (OECD, 2022[33]). The challenges are further exacerbated for the inclusion of considerations such as transition to nature positive and enterprises’ impacts on biodiversity and ecosystem services, which are even more difficult to identify and measure (OECD, 2023[34]).

The emergence of sustainable finance has even stronger implications for SMEs. Some of these implications, which will be further elaborated in the following sections, include:

SMEs that adopt green business models or improve their environmental performance could tap into a growing pool of finance to meet their investment needs. They could also benefit from financing at better conditions (e.g. lower interest rates, etc), if they are able to produce relevant data to demonstrate their sustainability performance. Conversely, SMEs could risk losing access to external financing if they cannot produce data on their sustainability performance, due to their relatively limited capacities to identify, measure and report on their environmental performance.

Similarly, while SMEs may increasingly face stronger incentives to green their business models, they may risk losing access to finance if they cannot advance (sufficiently rapidly) on the journey to net zero and/or cannot demonstrate credible transition plans. This is a particularly strong risk for SMEs in high-emitting and hard-to-abate sectors.

The evolution of the financing landscape requires SMEs to interact with an even wider range of ecosystem actors, including various ESG intermediaries and sustainability-related service providers that can support SMEs in measuring, reporting on and improving their environmental performance. This has implication for resources and their allocation within the SME (OECD, 2022[35]).

The supply of sustainable finance is growing…

Sustainable finance is growing rapidly in response to stakeholder demand

Sustainable finance has seen tremendous growth over the past decade. ESG integration now accounts for about USD 40 trillion in assets under management, and financial institutions around the globe are increasingly pledging to integrate ESG factors into their operations as well as to align their portfolios with net zero, the Sustainable Development Goals or other sustainability metrics (Global Sustainable Investment Alliance, 2020[36]) (BNP Paribas, 2021[37]).

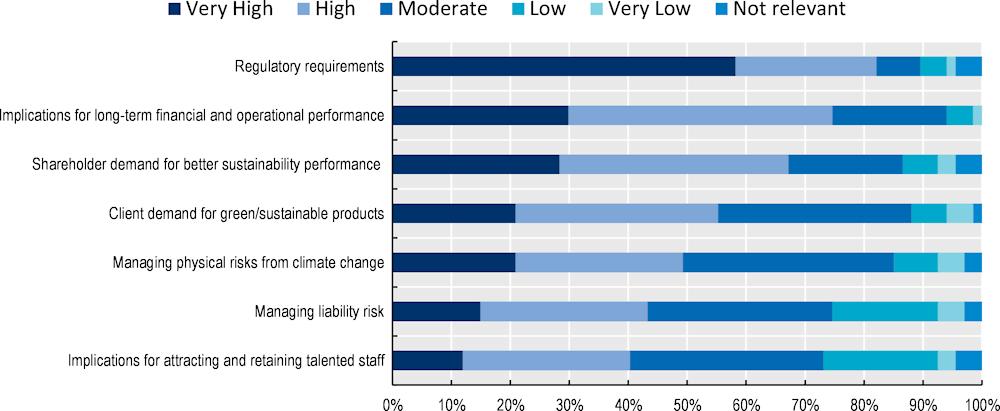

Emerging non-financial disclosure and other regulatory requirements for financial institutions and large enterprises are one of the key drivers for the growth of sustainable finance. In a 2023 OECD survey of public development banks and private financial institutions (Box 2.2), regulatory demand was identified as the most important driver of climate action (Figure 2.1). FIs in a growing number of countries need to disclose the sustainability of their own operations as well as the operations of their clients. These requirements can entail reporting on financed emissions, the share of the portfolio that is aligned with the nationally applicable taxonomy, a green asset ratio and other similar indicators, which creates incentives for FIs to allocate more financing toward green and sustainable activities.

The increase in the supply of sustainable finance has also been driven by investors,’ consumers’ and employees’ growing awareness of the importance and urgency of tackling the climate crisis and other environmental and social challenges. According to a 2022 poll, 88% of institutional investors place sustainability on par with operational and financial considerations when making investment decisions. Furthermore, 60% of respondents base their decision on where to work on their beliefs and values and 58% buy or advocate for brands that match their values (Edelman, 2022[38]). Shareholder and client demand were identified as important drivers for climate action in the OECD survey of financial institutions (Figure 2.1). In combination with increased sustainability reporting mandates for FIs and the associated reputational considerations, the changing investor and consumer preferences create increasingly powerful incentives for FIs to integrate sustainability considerations in financing decisions.

Besides growing awareness and value-based investment decision-making, purely financial considerations also drive investors’ and FIs’ growing allocation of financing toward sustainable or sustainability aligned activities. In the OECD survey, implications for the long-term financial and operational performance of the FI were the second most important driver of climate action (Figure 2.1). Other survey data show that 83% of early-stage investors in Europe prefer to invest in more environmentally sustainable start-ups, as they are likely to perform better when they have sustainability goals in their business models. Likewise, 59% of investors said that they have declined an investment opportunity in the last year due to sustainability concerns (SME guidance for business growth, 2022[39]).

Figure 2.1. Factors driving action on climate change in FIs

Please rate the importance of the following factors in driving action on climate/net zero in your institution (% of all respondents)

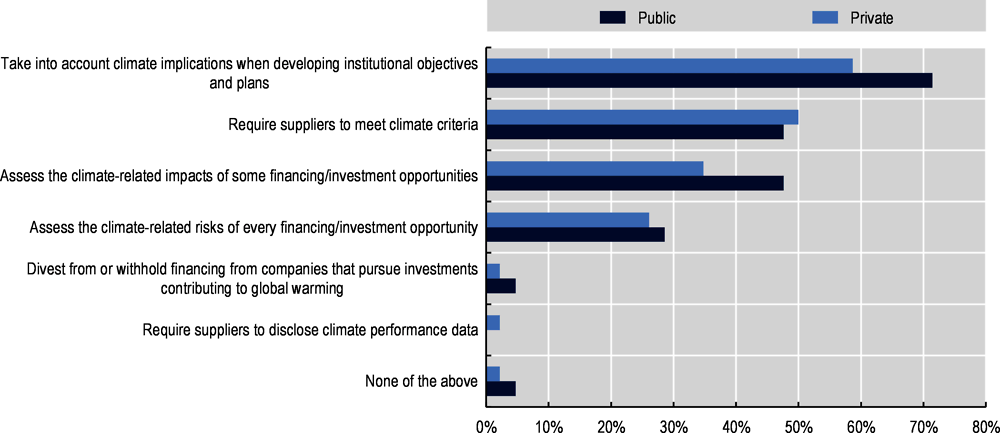

The OECD survey shows that financial institutions are taking steps toward integrating climate considerations in their SME and overall operations. Over 60% of FIs consider climate implications when developing strategies and business plans, and nearly half set climate-related criteria for their suppliers. Over 75% of public and 60% of private FIs also assess the climate related impacts of some or all of their financing/investment decisions (OECD, 2023[6]) (Figure 2.2).

Box 2.2. OECD Survey – Financial Institution Strategies and Approaches

The OECD Survey Financing SMEs for Sustainability-Financial Institution Strategies and Approaches, conducted in the spring and summer of 2023 by the OECD Platform on Financing SMEs for Sustainability under the aegis of the Committee on SMEs and Entrepreneurship, sought to understand the sustainability strategies of financial institutions and provide a snapshot of how they currently incorporate climate considerations in their SME operations. The survey was administered among both public development banks and private financial institutions serving SMEs on a voluntary basis. 67 FIs from across the globe responded to the survey, including 45 private banks.

The survey explored questions related to FIs’ climate strategies, targets and transition plans, their approaches and future plans with respect to the integration of climate considerations in SME operations, the financing instruments and non-financial support they use to enable SMEs’ net-zero transition, and feedback on how the regulatory environment is affecting SMEs’ access to and uptake of sustainable finance. The survey included both multiple choice and open-ended questions.

The results of this survey are intended for use by a variety of stakeholders (governments, financial institutions, etc). They provide a benchmark by which to measure future progress in this area.

Source: (OECD, 2023[6])

Figure 2.2. Most public and private FIs take climate considerations into account in their (SME) operations

How (if at all) does your institution integrate climate considerations in its financing/investment decisions? (% of respondents)

FIs are expanding their offer of green and sustainable financing products through a range of instruments

Environmental considerations can be integrated into financing products in different ways. As the typology in Table 2.1 illustrates, products can range from green debt or equity that are financing specific greening investment or sustainability-linked financing. The latter links financing – regardless of purpose – with the sustainability performance of the investment or investee (Table 2.1).

Table 2.1. Types of sustainable finance products

|

Instrument |

Type |

Actors involved |

Characteristics |

Environmental aspects of the instrument |

|---|---|---|---|---|

|

Green loans |

Debt |

PFIs, Banks |

Lending to finance SME greening can be enhanced through targeted SME lending portfolios or green credit lines. |

Green loans are committed exclusively to finance green projects such as those addressing climate change, natural resource depletion, biodiversity loss, and air, water and soil pollution. These instruments involve periodic reporting by the borrower to the lender of the actual use of proceeds, through qualitative or quantitative performance measures (e.g. electricity generation, or reduction of GHG emissions). |

|

Green concessional loans |

Debt |

PFIs, Non-Commercial banks |

As PFIs support governments to achieve policy goals, they are in a position to provide loans with favourable terms for SMEs, i.e. grace periods and low interest rates |

Green concessional loans are used specifically for environmental investments and granted with (substantially) more favourable terms compared to market loans (below-the market interest rates, longer grant periods or a combination of both). Such loans may be conditional on measures beyond regulatory requirements (e.g., use of best available techniques or best management practices). |

|

Bridge loans |

Debt |

PFIs, Investors |

Bridge loans can be crucial for the survival of green projects. Given the large risk of sustainable projects, this instrument allows the SME to have capital until permanent or next stage financing can be obtained. |

Bridge loans are particularly useful for green pioneer companies facing high upfront costs and risks in early-stage development phases and between funding rounds, (e.g. developing cutting-edge technologies in areas such as clean energy or mobility). |

|

Green revolving credit |

Debt |

PFIs, Banks |

Revolving credit gives flexibility to green SMEs as they can use funds when they need it. The requested amount is available, once used and repaid, the credit replenishes. |

Green revolving credits are often dedicated to fund energy efficiency, renewable energy, and/or sustainability projects that generate cost savings. A portion of the savings are used to replenish Green Revolving Funds allowing reinvestment in future similar projects. |

|

Green guarantees to banks |

Debt |

PFIs, Banks, Mutual Guarantee Societies |

PFIs and guarantee societies can incentivize bank lending by providing guarantees to green credit lines. Eco-credits are examples of loan guarantees to promote energy efficiency projects |

Green credit guarantees have specific eligibility criteria aligned with environmental objectives that can be based on the use of proceeds and/or on the characteristics of borrowers. Green guarantees may have monitor and evaluation frameworks to measure and report climate performance and disclose the carbon footprint of the guaranteed portfolio. |

|

Green supply chain financing/ green factoring |

Debt |

PFIs, Banks, Enterprises |

Financial institutions as well as enterprises can use this instrument to support SME greening in supply chains. |

Supply chain finance involves a buyer approving its supplier invoices for financing by a bank when a product or service is provided. This type of financing helps the supplier get short-term credit and optimize working capital, while the buyer gets more time to pay off balances. Green supply chain finance entails the provision of financing at preferential rates upon demonstrated sustainability performance. Such preferential rates can potentially improve along with sustainability scores. |

|

Grants for green projects |

Grants |

PFIs |

PFIs can channel governmental grants for green SME projects. Grants can include cash transfers as well as technical support. |

While green subsidies are specifically used to help firms offset high upfront costs related to the implementation of green technologies and/or processes, green grants can be used for a broader set of purposes (e.g. incentivize production of green products and services). |

|

Green equity |

Equity |

Impact Investors, PFIs, Venture capital funds |

Equity is one of the main instruments used by impact investors but it can also be used by PFIs and private financial institutions |

Green Equity includes both Venture Capital and Private Equity aimed specifically at funding innovative solutions to address environmental challenges (e.g. Green-tech, sustainability start-ups). Green VC typically fund the development of pilot-scale green projects where investments can have long funding periods. It has continuous monitoring and reporting, and investors are directly involved in corporate governance to ensure products and processes are aligned to climate objectives. PE fund green start-ups in advanced stages, and also incorporate green indicators to evaluate performance. |

|

Hybrid Financing |

Equity and Debt |

Impact Investors, PFIs |

Hybrid instruments combine debt and equity. It is useful for SMEs as they can convert outstanding debt into equity. |

Using hybrid financing instruments, PFIs are able to offer additional incentives for SMEs’ green transition. SMEs are likely to benefit more from green investments as compared to alternative investments because of favourable financing conditions (e.g. when a green loan is connected to a grant). For example, PFIs can provide a certain percentage of the green loan in the form of a grant if the company uses the grant for targeted green measures such as investment in renewable energies or energy efficiency. |

|

Mini-green bonds |

Capital Markets |

Banks, PFIs, Impact Investors |

They are smaller green bonds to allow the access of unlisted SMEs to capital markets. Mini bonds can complement large green bonds. The downside is that they are often perceived as risky investments, thus they are guaranteed by public institutions. |

Mini-green bonds are committed exclusively to financing environmental or climate projects. These bonds are issued by green start-ups or SMEs. They often cannot be traded and must be held until maturity, as they do not usually have a secondary market for investors to exit early. Green mini bonds are also less regulated and given their high perceived risk they offer higher returns compared to traditional bonds. |

|

Sustainability-linked instruments |

Debt, capital markets |

Banks, PFIs, Impact investors |

Loans or bonds whose financing conditions are tied to the sustainability/ESG performance of the issuer. |

Sustainability-linked loans have a dynamic interest rate linked solely to selected sustainability performance indicators, such as carbon emissions or a specific ESG target. Beneficial conditions are not tied to the use of proceeds (like in green concessional loans). ESG-linked bonds have coupons linked to sustainability performance targets (e.g. EU Taxonomy, UN Sustainable Development Goals related to climate change or environmental degradation). |

Source: (OECD, 2022[2]) based on (ASEAN, 2019[40]), (European Commission, 2017[41]), (European Parliamentary Research Service, 2021[42]), (FCA, 2022[43]), (KFW, 2022[44]), (McDaniels and Robins, 2017[45]), (OECD, 2015[46]), (Sustainalytics, 2022[47]), (The Montreal Group, 2016[48]), (Kim et al., 2022[49]), (US Department of Energy, 2021[50]), (World Bank, 2021[51]) and (Lin, 2022[52]).

FIs can use green or sustainable instruments to align their portfolios with national, supranational or individually defined taxonomies. This, in turn, can help FIs manage sustainability-related risks in their portfolios and improve portfolio alignment for the purposes of disclosure and managing reputational risks. It can also allow for the provision of more favourable financing conditions for such investments recognising their better long-term financial performance.

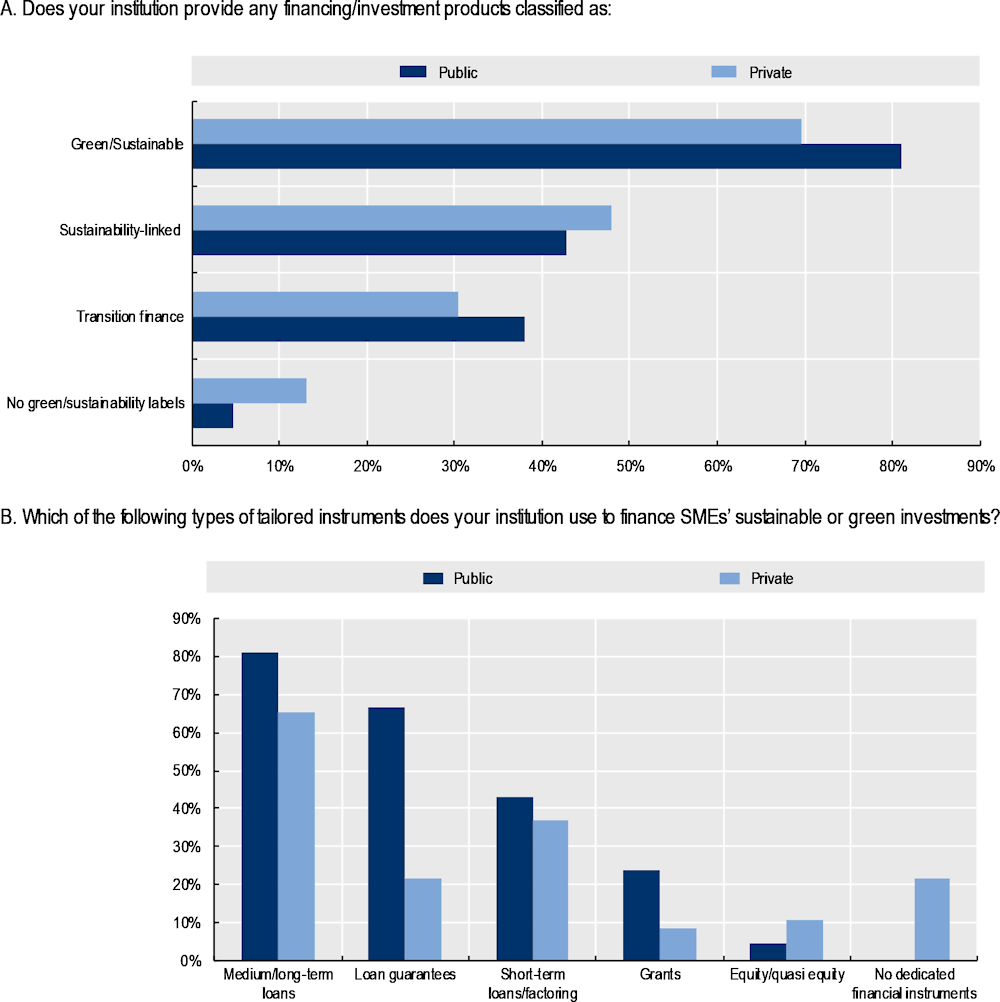

In the OECD survey of financial institutions, most FIs indicated that they offer tailored financing solutions to SMEs. Most banks have products labelled as green and sustainable, but fewer offer ESG-linked instruments or transition finance (Figure 2.3 Panel A).

Most FIs offer debt instruments – medium- and long-term debt and short-term loans and factoring – but equity and quasi-equity financing remain relatively limited. Loan guarantees are important instruments that public financial institutions use to mobilise financing for SMEs’ green and sustainable investments (Figure 2.3 Panel B).

The introduction and implementation of sustainable financing instruments requires regular monitoring of sustainability performance or pre-defined KPIs related to that financing (Table 2.1). Yet SMEs have limited capacities to provide such data, making it more difficult for them to benefit from these financing products. This in turn also makes financial institutions more reluctant to extend such tailored products for SMEs as they risk being labelled as greenwashing if they cannot produce relevant firm-level data. Demand-side constraints also limit SMEs’ ability to profit from this growing pool of tailored financing solutions.

Figure 2.3. Banks provide a variety of sustainability related financing products.

Data requirements have emerged as an important obstacle for financial institutions and SMEs to seize sustainable finance opportunities

FIs increasingly need data on clients’ sustainability performance, but SMEs have limited capacity to respond

Financial institutions increasingly need and seek out granular data on their clients’ sustainability performance in order to manage risks, develop financing instruments and meet reporting requirements (Box 2.3).

Box 2.3. What drives banks to collect sustainability-related data on SMEs?

Managing risks: FIs are increasingly taking into account the potential impacts of physical, transition and systemic risks stemming from climate change biodiversity loss and other environmental degradation in their SME-related assets and liabilities. The range of impacts is wide, from material damage related to increasingly severe weather events, which can impact the value of the FIs’ assets, to the risks posed by the green transition itself, including regulatory, technology, market and reputation-related risks. In the latest OECD survey, over 50% of private FIs stated that they have integrated climate considerations in risk management policies, and 78% stated that climate related risks are regularly evaluated at executive/board level meetings (OECD, 2023[6]). Comprehensive assessment of FIs’ exposure to climate and nature-related risks requires access to relevant data on the exposure of individual clients, including SMEs (OECD, 2023[6]).

Devising financing instruments: The net-zero and nature-positive transition of FIs also entails opportunities to develop new tailored financing products that can meet the transition-related financing and investment needs of SMEs. However, green and sustainability-linked financing instruments relate financing conditions with sustainability criteria or key performance indicators (KPIs), which means that they require some form of data collection on sustainability performance of clients. SMEs’ more limited knowledge, capacities and resources to collect and report on such data makes them less able to tap into available sustainable finance instruments. In turn, FIs are less inclined to developed tailored sustainable financing instruments for SME clients, because, in the absence of relevant client data, they can be labelled as engaging in “greenwashing.”

Meeting reporting requirements: In a growing number of OECD and non-OECD countries, financial institutions are subject to sustainability reporting requirements (see section Data requirements have emerged as an important obstacle for financial institutions and SMEs to seize sustainable finance opportunities). While these requirements often exempt non-listed SMEs, which account for the majority of enterprises in the economy, the reporting burden is increasingly transmitted to SMEs by the reporting entities, including FI, which have to disclose not only their direct environmental performance but also the performance of their clients (e.g. in the case of carbon emissions, FIs in many jurisdictions have to report on the so-called Scope 3 emissions which include the emissions of their supply chain as well as the financed emissions of their clients).

Source: (TCFD, 2017[53]) (TNFD, 2023[54])

Current regulations allow FIs and other reporting entities to use alternative methods of calculating the environmental performance of their financed portfolios. For example, in the case of carbon emissions, many entities use the method of the Partnership for Carbon Accounting (PCAF) which uses sector-based weights to estimate the carbon footprint of the SME portfolio without necessarily requiring any additional data from SME clients.

However, FIs also face challenges when they try to use alternative approaches that do not require collection of data from SME clients. These types of top-down approaches, which use sector-level data to estimate firm-level footprints, do not deliver sufficiently granular information to support decision-making. Where artificial intelligence is used, transparency presents an issue. FIs, therefore, have an incentive and do seek out sustainability related data from their SME clients to fulfil their various operational needs.

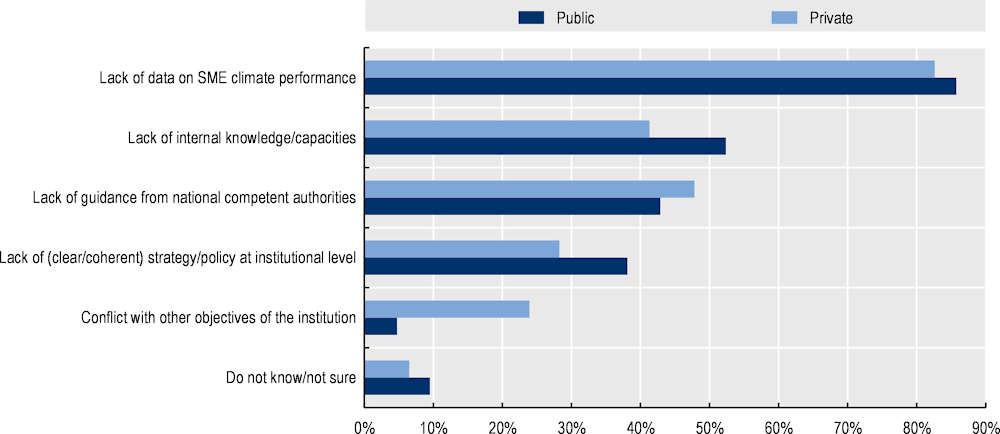

Survey results confirm that the lack of granular data on SME sustainability performance represents a critical challenge for most FIs. For example, around 85% of the surveyed public and private FIs in OECD countries cited the lack of data on SME climate performance as a barrier to the integration of climate considerations in SME operations (Figure 2.4). Most FIs also cited data challenges as the most important barriers to the development of net-zero targets and transition plans, reporting on financed emissions and taking overall action on climate change at an institutional level (OECD, 2023[6]).

Figure 2.4. Lack of granular data on SME climate performance is a challenge for most banks

What are the key challenges you face in integrating climate change considerations in financing/investment decisions regarding SME clients? (% of respondents)

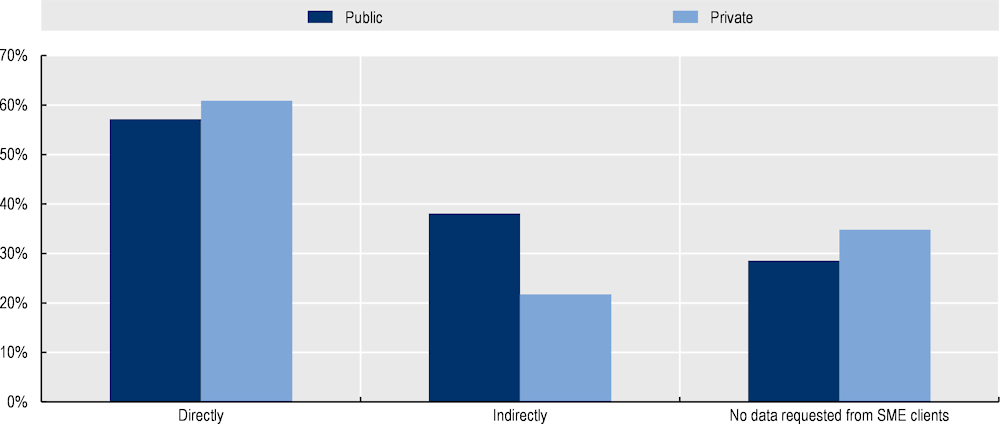

Currently most FIs ask for some type of sustainability-related data from their SME clients (Figure 2.5). These data can be collected through surveys or other means before the provision of financing and afterward, during the monitoring phase. The types of data requested can differ considerably across institutions as well as depending on the sector and size of the enterprise, the type of investment, the type of instrument used (e.g. asset-backed; sustainability-linked etc). Also, while some FIs use pre-defined frameworks to define the data requirements (e.g. EU green checker; ESG ratings), others are using or defining their own assessment/reporting framework (OECD, 2023[6]).

Figure 2.5. Most FIs ask for sustainability-related data from their SME clients

How is sustainability-related data obtained for small and medium-sized (SME) clients for the purposes of financing/investment decisions? (% of respondents)

There is currently no common approach in terms of the types of data asked from SME clients across institutions. Some examples cited in the 2023 OECD survey include data on GHG emissions; certificates/labels (e.g. energy performance, ISO on sustainability /waste management/water management etc.); ESG ratings (if any); ESG/sustainability strategy/commitments, audited integrated reporting, etc. During the monitoring or post-repayment stage, the data requirements can vary even further, with some FIs just asking for the same data as those requested prior to the provision of the financing and others asking only for data to verify the purpose of the financed activity. Some FIs also ask for proof of the achieved commitments or KPIs (e.g. energy savings), but this can vary from monitoring KPIs to only qualitative response to a questionnaire without further verification (OECD, 2023[6]) .

This current state of play presents many challenges for SMEs:

SMEs have more limited capacities to measure and report on their sustainability performance compared to large enterprises. SMEs are generally not required to report on their non-financial performance; in some countries only listed SMEs will have to provide such disclosure. Likewise, few ESG rating providers assess SMEs specifically, and SMEs are underrepresented in ratings among the major ratings providers (OECD, 2020[55]). And although voluntary reporting, certifications and other means of communicating SMEs’ environmental performance are on the rise, they are still employed by relatively few SMEs due to the associated costs. For example, despite representing over 99% of all businesses in OECD countries, only 10-15% of companies using the GRI Sustainability reporting standards are SMEs (ESG Investor, 2021[56]).

Relatedly, there are concerns about the quality and consistency of the data produced by SME clients for the purposes of aggregation and reporting for large enterprises, which can be a disincentive for the provision of financing for SMEs. Sustainability data and ratings rely mainly on data that is self-reported or proxy data that is not verified or audited, and this can raise questions about the objectivity, comparability and reliability of these data with largely negative implications for SMEs. In the current context, the quality of these data reflects to some degree the capacities of companies to adequately measure and report on their environmental performance and greening actions, and this likely disadvantages SMEs relative to large enterprises (OECD, 2022[35]).

The lack of a standardised framework for data requirement compounds the above challenges and further adds to the burden on SMEs. Results from the OECD survey confirm anecdotal evidence shared by SME associations and other stakeholders that there is a large variety of data points that SMEs are asked to report on for different entities, including different financing providers and large entities in their value chains (OECD, 2022[57])) (OECD, 2023[6]).

Financing enterprises in hard to abate sectors will come with additional demands, which are particularly strenuous for SMEs

Ensuring a just transition means that enterprises across all sectors, including those that are currently highly polluting and hard-to-abate, will need to continue to have access to so-called “transition finance” in order to reduce their environmental footprint. Yet financing the greening of highly polluting sectors can easily be subject to “greenwashing” if not accompanied by credible transition plans for the financed entities. This poses a critical challenge for SMEs as the production and/or certification of transition plans can be a very resource intensive endeavour that many SMEs cannot fulfil. The absence of simplified frameworks for development and verification of SME transition plans makes it difficult to see how SMEs can benefit from transition finance in the future and increases the risks that SMEs in certain sectors can lose access to external finance.

Implications for SME access to finance

The sections above highlight that the shift of the financial sector toward more sustainable investments, while generally a very welcome development, also raises concerns about SMEs’ access to finance. Data-related challenges, complexity and costs related to development of transition plans, and demonstrating improvements in sustainability performance, mean that SMEs may not be able to meet the emerging requirements that FIs will need to introduce to meet their own operational and reporting needs. This has implications for regulators, policy makers and other national and international public entities and calls for the development of effective solutions to help SMEs not only to navigate but also benefit from this evolution in the financial sector (see more in section Creating a supportive ecosystem to help SMEs navigate the transition).

Limited SME demand for sustainable finance poses an important challenge to further market development

In addition to the above-mentioned constraints to the provision of sustainable finance for SMEs, policy makers, public and private FIs, and other ecosystem actors need to tackle the challenge of SMEs’ limited demand for sustainable finance, which reflects awareness, knowledge and resource barriers.

Information and awareness related barriers are high among SMEs

A lack of information and awareness of opportunities, environmental regulations and support options can constitute a significant barrier for greening efforts by SMEs and entrepreneurs. They may lack knowledge of current and upcoming policy requirements, possibilities and opportunities to reduce resource use and available financial or advisory support measures to assist them. Lack of awareness and information represent a common barrier for SMEs across different policy areas, but receives particular emphasis in the environmental domain, in part because of its perceived technical and economic complexity. For instance, SMEs are often unaware of many financially attractive opportunities for environmental improvement. There is a widespread misperception that protecting the environment is associated with technical complexity, burdens and costs (OECD, 2018[58]).

Even when well-informed, often owner–managers of small firms are ‘struggling to bridge the gap between their environmental attitudes (aspirations) and their environmental behaviour (practices). While for many SMEs the business case for investing in the transition is clear, which makes them reactive to information on opportunities and obligations, for some (and potentially large) groups of SMEs, the business case may be less clear-cut. In this case, actions devoted to improve access to information may not be sufficient to change practices and incite investment.

SMEs also face high technical, market and regulatory uncertainty

Technical uncertainty often arises from questions about the technical feasibility of adopting new innovations and solutions, as well as their potential implications. SMEs often do not have technical expertise and have questions about the functionality, usefulness, or quality of new innovations for the performance of their own business. This uncertainty leads to an under-investment by SMEs.

Market uncertainty is frequently identified as one of the main barriers to greening in surveys of SMEs and entrepreneurs. SMEs often view environmental measures as reducing profits while simultaneously presenting uncertain market benefits even if there is considerable evidence to the contrary. For many SMEs, greening will likely have a net cost, which leads them to view “greening” with scepticism. In Korea, for example, 60% of SMEs and entrepreneurs consider that the net-zero transition would negatively impact their competitiveness over the near term, and 15% consider it even a threat to their existence (Korea Chamber of Commerce and Industry, 2021[14]). In the UK, about 30% of SMEs have cited feasibility as their top constraint to green investment, while in Canada SMEs cite their perceived inability to profitably provide affordable green products, services or processes as one of their top three obstacles for greening (British Business Bank, 2021[59]; Business Development Bank of Canada, 2021[60]). This obstacle is typically greater for SMEs than for large firms. It also represents a major hurdle for eco-entrepreneurs, since they typically need to build a market for a product that does not yet exist.

Policy and regulatory uncertainty can also be an obstacle to greening since policy volatility can contribute to market uncertainty. This is particularly true for innovation and entrepreneurship. Moreover, while regulation is considered a powerful driver for environmental innovation, environmental regulation is often more arduous for SMEs than for larger firms (Brammer, Hoejmose and Marchant, 2012[61]) since they have fewer resources to dedicate to navigating a complicated regulatory system that may require certifications and compliance inspections. For resource efficiency actions, complexity of administrative procedures is the most cited difficulty for European SMEs (34%) (European Commission, 2021[62]).

Capacity and resource constraints affect SME demand for sustainable investment and finance

SMEs willing and capable of adopting sustainable practices and seizing green business opportunities generally face skill deficits, size-related resource and technology constraints, and difficulties in obtaining government support (OECD, 2018[58]).

Even when SMEs are aware of the potential of better environmental performance to improve their competitiveness, a lack of appropriate skills and expertise commonly prevents these enterprises from acting upon win-win opportunities. In a 2023 survey, 58% of SMEs globally identified skills and knowledge as a barrier for taking action on climate (SME Climate Hub, 2023[3]). Managerial constraints have also been shown to limit SMEs’ ability to implement solutions, with stronger green management being linked to more drastic cuts to greenhouse gas emissions (De Haas et al., 2021[63]).

SMEs also face technological and resource constraints as a result of their size. For instance, SMEs may be less able to access environmental technologies than large firms due to pre-existing challenges in finding capital or due to the economies of scale needed to realise the environmental benefits of the solution. In a meta-analysis of the 50 most cited articles related to sustainability barriers for SMEs, resource-based barriers (lack of resources, high initial capital costs and lack of expertise) were found to be the most important (Álvarez Jaramillo, Zartha Sossa and Orozco Mendoza, 2019[64]).

Finally, SMEs face constraints in obtaining government support. Government agencies increasingly need data as a means of proving a programme’s effectiveness and showing progress towards environmental goals. As elaborated in previous sections, data provision is a challenge for resource-constrained SMEs. Additionally, the administrative costs of applying for and obtaining government support remain relatively fixed across firm size, hence affecting SMEs disproportionately. These challenges limit SMEs’ utilisation of government support and thus lead to an under-investment in sustainable technologies.

SMEs need to interact with a wider range of actors in the sustainable finance ecosystem

SMEs have to navigate an increasingly complex sustainable finance ecosystem with a growing number of actors. In addition to the traditional players including public and private financial institutions, accountants, policy makers, regulators and others, SMEs also need to interact with many ESG intermediaries including Fintech companies and other service providers that can enable them to measure and report on their sustainability performance as well as take actions to improve it. SMEs may also need to interact with various verification bodies to ensure that their reporting or transition plans are credible and aligned with the Paris Agreement and other relevant global benchmarks. This can also temper their demand for sustainable finance and investment.

Implications for SME sustainable finance

SMEs’ limited demand for sustainable investment and the related finance has several critical implications:

SMEs need a stronger business case and external support to boost their investments in sustainability and seek the related financing;

In the absence of SME demand, public and private FIs have limited incentives to develop tailored financing solutions for financing SMEs’ net-zero and other investment needs;

If they do not invest in improving their sustainability performance or can demonstrate credible transition plans, SMEs risk losing access to finance even for other investment needs as elaborated in the previous section.

A clear and transparent regulatory and policy framework is critical to limit regulatory and policy uncertainty and strengthen the business case for investing in net zero and greening. Financial and non-financial support aimed at strengthening SMEs’ awareness and capacities and incentives to invest in the green transition will also be critical going forward. Different actors in the sustainable finance ecosystem - both public and private - need to be mobilised in this effort (see section Conclusion and policy implications).

Creating a supportive ecosystem to help SMEs navigate the transition

Creating a supportive ecosystem is critical to the green transition of a broad and diverse population of SMEs. To increase SME demand for sustainable finance and to address the above-mentioned constraints, regulatory frameworks must provide a stable and clear path for transitioning. These frameworks should take into consideration the capacity of SMEs while being comprehensive enough to allow financial institutions to reward those undergoing the transition.

Regulatory and policy approaches

Clear, transparent and predictable regulatory and policy framework

Clear, transparent and predictable regulatory and policy framework is critical to strengthening the case for SME investment in greening. As noted above, SMEs’ demand for sustainable investments is constrained by the uncertain returns stemming in part from regulatory uncertainty. Governments must, therefore, ensure that they set a clear economy-wide transition path and a coherent regulatory and policy framework to support the private sector’s sustainable investments.

Comprehensive regulatory framework (e.g. carbon pricing; non-financial disclosure, etc) will also provide banks greater incentives to price in climate- and nature-related risks into their operations, with impact on financing decisions and financing conditions. The latter implies that FIs will be able to increasingly offer better financing conditions for enterprises with better financial performance. Currently, by most accounts, the premia for better environmental performance are relatively small i.e. FIs can only offer small discounts for financing of SMEs that have a better financial performance. A more comprehensive regulatory approach that incentivises the internalisation of environmental externalities and pricing of environment-related physical transition and systemic risk can foster better pricing of financing products. A clear and comprehensive regulatory framework also provides incentives for SMEs to invest in greening and helps to address the demand-side constraints to the growth of sustainable finance.

Governments should also take the SME dimension into consideration when designing regulations and policies. As elaborated in the previous sections, SMEs do not have the same resources and capacities as large enterprises to address regulatory requirements, particularly complex requirements such as non-financial disclosure in line with various existing national and international reporting standards. This does not have to mean necessarily exemption of SMEs from regulations; in fact, exemptions may produce unintended consequences, such as creating a threshold or barrier for firm growth (OECD, 2021[65]). Moreover, as discussed above, even if exempted, SMEs may be indirectly impacted by the requirements imposed on larger entities. Consideration of the SME dimension can, for example, include the introduction of regulatory requirements that are proportional to firm size and thus entail considerable simplification and lower resource intensity for smaller enterprises (OECD, 2022[35]). When determining what policy intervention to use, governments should consider the impact of the policy, the relevance of SMEs to the goals of the policy, and what subgroups of SMEs (sector, age, geographic location, etc.) are most likely to be affected (OECD, 2021[65]).

Many countries have begun introducing a variety of mechanisms to better account for SMEs, including: collecting granular data on key features and behaviours of various types of SMEs, undertaking ex post evaluations to assess the effectiveness of policies and programmes for specific populations of businesses, creating dedicated institutions to coordinate functions, incorporating the use of SME threshold testing to gauge the relevance of a policy to SMEs, and strengthening consultation processes to include voices that are less heard (OECD, 2021[65]). The different approaches and mechanisms to include the SME dimension need to be adapted to fit the countries’ specific institutional set-up (OECD, 2023[4]).

Sustainability reporting regulations

Many current and emerging regulations, notably regulations on sustainability disclosure, have been designed with large enterprises in mind and have largely exempted non-listed SMEs which account for the vast majority of SMEs. However, as elaborated above, SME are indirectly impacted by these regulations via the financing channel and/or their participation in the value chains. This means that reporting entities, including financial institutions, have to request a certain set of data points from their SME clients and translate them into relevant metrics to meet their own comprehensive reporting requirements. As noted, in the recently implemented survey by the OECD, some FIs use already existing frameworks for obtaining such data from SME clients, while others rely on their own assessments and methodologies. This creates a plethora of different approaches and data points that are being sought from SMEs, which further compounds the burden on these entities with limited capacities to measure and report on their sustainability performance.

The development of simplified reporting frameworks for SMEs can help take into account their relatively more limited capacities for measurement and reporting compared to large firms, as can the promotion of interoperability of these frameworks. Likewise, dialogue to explore how these requirements could be balanced or offset by using estimates can contribute to minimising the burden for both SMEs and financial institutions.

Some initiatives are already being put in place to address these challenges. The European Commission in 2023 introduced the SME Relief Package, which notes the difficulties SMEs have in accessing sustainable finance and commits to limiting disclosure requirements from trickling down through value chains and to adapting the Green Asset Ratio to improve incentives for SME financing (EU Commission, 2023[66]). Likewise, the European Financial Reporting Advisory Group (EFRAG), the EU advisory body that developed the European Sustainability Reporting Standards (ESRS), has been mandated to develop voluntary reporting standards for non-listed SMEs that can provide a common framework that FIs and SMEs can refer to. The IFRS is also developing guidance for SMEs (Box 2.3). The OECD Platform on Financing SMEs for Sustainability is also working to support this global effort for the development of a simplified SME reporting framework for FIs.

Box 2.3. Selected initiatives to limit the sustainability reporting burden on SMEs

IFRS

The International Financial Reporting Standards (IFRS) Foundation, which developed the International Sustainability Standards Board (ISSB) standards, has taken an initiative to streamline the ISSB standards for non-public SMEs. Compared to the full ISSB, these new accounting standards omit topics not relevant to SMEs, simplify the principles for recognising and measuring assets/liabilities/income/expenses, and require fewer disclosures. To ease readability, the streamlined offering is written in a clear, easily translatable language and some accounting choices are restricted to provide a simpler methodology. The initiative also limits the frequency of revisions to ISSB (once every 3 years) to further reduce the reporting burden for small businesses.

EFRAG

The European Financial Reporting Advisory Group (EFRAG) provides technical advice for the adoption of the European Sustainability Reporting Standards (ESRS) for listed SMEs. Their focus is to remove the reporting requirements that they deem are irrelevant to SMEs or are disproportionately burdensome. SMEs under the revised standards would have simplified disclosures for reporting on the roles/responsibilities of management as well as for sustainability impacts, risks and opportunities.

EFRAG has also begun to develop a Voluntary Sustainability Reporting Standard (VSRS) to be used by unlisted SMEs not covered under ESRS. Through VSRS, EFRAG aims to facilitate SMEs’ access to sustainable finance without substantially increasing the reporting burden for SMEs.

Transition finance frameworks

Current reporting frameworks focus strongly on sustainable or sustainability-aligned activities which creates limited incentives for FIs to invest in brown activities or hard-to-abate activities, even when entities have developed credible transition plans. This excludes entities that are responsible for a high proportion of emissions and crucial to decarbonization efforts (OECD, Forthcoming[25]).

Transition finance frameworks exist to facilitate the phased transition plans of brown and hard to abate firms. Currently there exists no internationally recognized agreements on transition finance but various governments have established their own initiatives to foster the participation finance of market players (OECD, Forthcoming[25]).

Transition finance is reserved for firms that can develop and prove the credibility of their transition plans (e.g. through relevant independent verifications), creating a barrier for SMEs with lower reporting capacity and limited financial resources. Simplified frameworks for SMEs should be developed, and non-financial support be given to aid SMEs in developing transition plans. Financial institutions engaging in transition finance should apply the principle of proportionality when requesting transition-related information from SMEs (OECD, Forthcoming[25]).

Frameworks for inclusion of biodiversity and nature-related risks and opportunities in non-financial reporting

Going beyond measures related to carbon neutrality and GHG emissions, public and private actors are increasingly incorporating concepts of biodiversity as they look to develop holistic measures of environmental performance. The inclusion of biodiversity impacts and exposure to nature-related risks in disclosure and other regulatory requirements for FIs and large enterprises also poses challenges for SMEs. Currently reporting frameworks are varied in methodology due to geographic factors and interrelatedness, heightening the complexity of establishing biodiversity-related dependencies and impacts. SMEs often lack a comprehensive understanding of how their activities impact their ecosystems, along with information about how climate change affects the ecosystems they depend upon; they may thus lack the capacity to develop sustainable land/ocean/forestry practices in line with emerging frameworks.

Efforts are also being taken to increase the ease of reporting on biodiversity related impacts and risks. The Taskforce for Nature-related Financial Disclosures (TNFD) is a market-led taskforce of financial institutions that aims to develop a risk management and reporting framework that captures nature-related risks. TFND does not aim to create new standards for biodiversity but instead aims to create an integrated framework that aligns disclosures, provides flexibility in reporting depending on the capacity of the organisation, encourages easy adoption of natural related disclosures and overtime provides a structured path to increasing disclosure ambitions (TNFD, 2023[54]). As these frameworks become standardised and nature-related disclosures become mandatory, action is needed to ensure that SMEs are not overburdened by additional reporting standards.

On the regulatory side, governments are beginning to mandate the disclosure of biodiversity impacts and the exposure of firms to nature-related risks, many of which are based on the TNFD framework. The European Sustainability Reporting Standards (ESRS), for example has two modules dedicated to biodiversity and nature related risks: “Water and Marine Resources” and “Biodiversity and Ecosystems”. Under both these modules entities are required to report their respective impact, mitigation efforts and material risks associated with the entity’s activity (OECD, 2023[34]). As mentioned in Box 2.3, EFRAG is working to streamline ESRS for the use of SMEs, although this does not currently include changes to the two aforementioned modules (EFRAG, 2022[69]). Indonesia also has established in its reporting obligations that entities disclose all conservation activities and report on their exposure to biodiversity related impacts (Indonesia Financial Services Authority, 2017[71]).

Given the complexity of understanding and measuring nature-related risks and impacts, standard setters and regulators need to make sure that simplified measurement and reporting frameworks are in places. Different public and private actors should also provide tools, training and other capacity building support to help SMEs understand their dependency and impact on biodiversity and ecosystem services.

Public support to mobilise sustainable finance for SMEs

SME access to sustainable finance is subject to considerable supply-side constraints that reflect not only traditional challenges in the provision of SME financing (asymmetric information, high cost relative to the size of loan, limited collateral, etc.) but also specific challenges related to the needs of sustainable finance instruments, most notably the measurement, monitoring and reporting on their sustainability performance. As elaborated in the section Data requirements have emerged as an important obstacle for financial institutions and SMEs to seize sustainable finance opportunities, in the absence of public support to mobilise financing from private FIs, SMEs will have limited access to tailored financing solutions for the green transition and may even lose access to finance altogether. Financing support can take many forms.

Direct financing