Pharmaceutical care is constantly evolving, with an increasing number of novel medicines entering the market every year. These may offer alternatives to existing treatments, and in some cases, the prospect of treating conditions previously considered incurable. However, the costs of new pharmaceutical drugs can be very high, with significant implications for health care budgets.

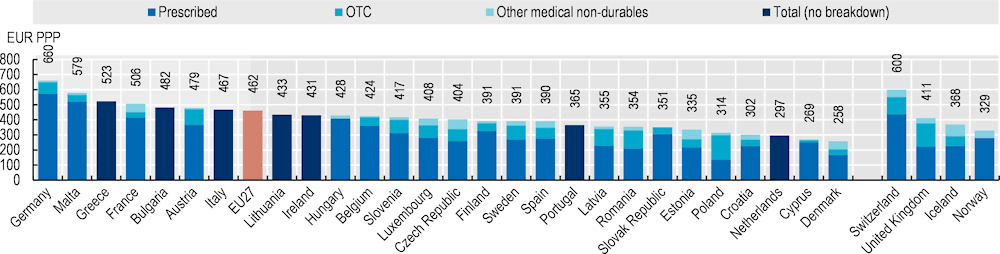

Spending on retail pharmaceuticals (including other medical non-durables) averaged EUR 462 per person across the EU in 2020 (Figure 5.15). With EUR 660 per capita, Germany spent by far the most on pharmaceuticals among EU member states – over 40% above the EU average. At the other end of the scale, Denmark and Cyprus had relatively low spending levels, more than 40% below the EU average.

Around three out of every four euros spent on retail pharmaceuticals (including other medical non-durables) goes on prescription medicines, with most of the rest on over-the‑counter medicines (OTC). OTC medicines are pharmaceuticals that are generally bought without prescription, and in most cases, their cost is fully borne by patients. The share of OTC medicines is particularly high in Poland, accounting for more than half of retail pharmaceutical spending, and stands at 30% or more in Romania, Latvia, and the United Kingdom.

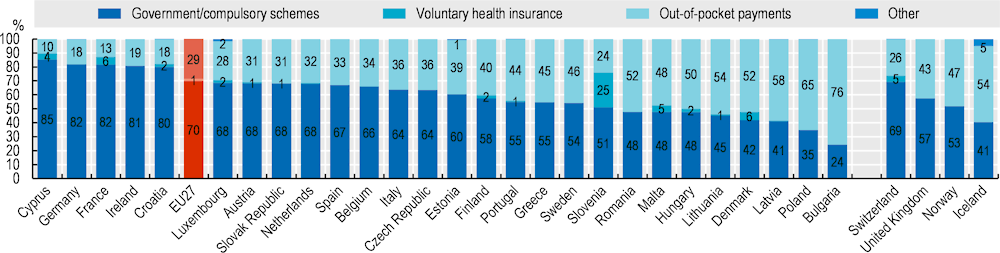

In most countries, the costs of pharmaceuticals (including other medical non-durables) are predominantly covered by government or compulsory insurance schemes (Figure 5.16). On average across EU countries, these schemes cover 70% of all retail pharmaceutical spending, with out-of-pocket payments (29%) and voluntary private insurance (1%) financing the remainder. Public coverage is most generous in Cyprus, Germany, France and Ireland, where government and compulsory insurance schemes pay for more than 80% of all pharmaceutical costs. By contrast, in eight EU member states, public or mandatory schemes cover less than half the amount spent on medicines.

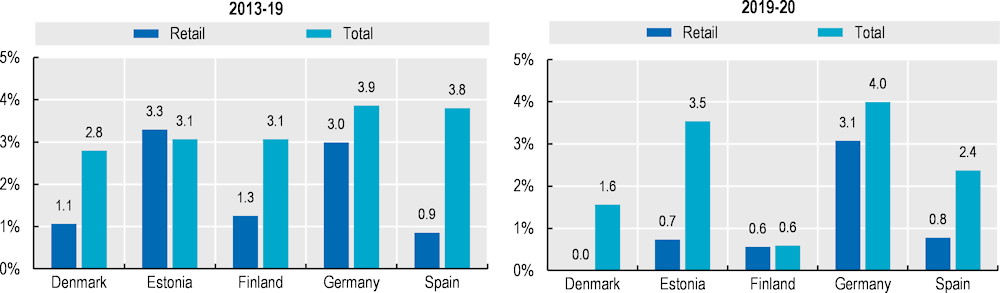

Between 2013 and 2019, spending on retail pharmaceuticals (including other medical non-durables) grew at a slower rate than other health care functions (see indicator “Health expenditure by type of good and service”). However, retail pharmaceuticals tell only part of the story since pharmaceuticals used during hospital care or in other health care settings can typically add another 20% to a country’s pharmaceutical bill (Morgan and Xiang, 2022[1]). Available data for a number of European countries suggest that total pharmaceutical spending growth has frequently outpaced that of retail pharmaceuticals between 2013 and 2019; a trend that is likely to have continued even in 2020 (Figure 5.17).