This chapter assesses progress in implementing the three priority reforms identified in 2020, namely streamlining legislation, simplifying the tax code and tax administration and ensuring predictable contract enforcement. It takes into account action to support business activity and economic growth during and after the COVID pandemic and in response to Russia’s war in Ukraine. Since 2020, the government has been taking measures to encourage business formalisation, facilitate interactions between the administration and firms through digitalisation, and provide tax incentives in priority sectors, such as tourism, high technologies, and creative industries. The chapter concludes with a series of policy recommendations.

Improving the Legal Environment for Business and Investment in Central Asia

3. Kyrgyzstan

Abstract

Table 3.1. Summary of priority reform implementation and updated recommendations

|

2020 |

2023 |

||

|---|---|---|---|

|

Challenges identified |

Recommendations |

Implementation assessments |

Way forward |

|

Streamline business-related legislation and ensure predictable enforcement |

➢ Create physical and online one-stop-shops for SME access to regulatory information ➢ Streamline and digitalise license and permit processes ➢ Legislative consolidation and streamlining |

➢ The government's digitalisation efforts have begun to bear fruit, but further streamlining of business-related legislation and predictable enforcement are needed |

Ensure consistent implementation of reforms, in relation to digitalisation and business inspections |

|

Develop tools to raise firms’ awareness of and ability to cope with regulatory changes |

|||

|

Simplify the tax code and tax administration |

➢ Further tax stabilisation is needed for business development as well as more support for the business community to comply with the legislation ➢ Revising tax regimes for small firms to address possible disincentives to their growth ➢ Improving the digitalization of the tax administration and increasing the uptake of e-filing |

➢ New amendments to the Tax Code, aimed at creating conditions to level the playing field for businesses, but tax administration and policy remain complex and unpredictable |

Simplify the tax system by developing a long-term strategy and paying attention to implementation challenges |

|

Close the implementation gap by developing a client-oriented approach |

|||

|

Ensure predictable, fair, and efficient contract enforcement |

➢ Further improve the justice and ADR systems ➢ Consider becoming a party of the ICSID Convention to provide an additional arbitration option to investors ➢ Strengthen the development of activities of the Business Ombudsman using good practices on transparency and efficient claim process |

➢ The judicial system is evolving, but further steps to ensure predictable, fair, and effective enforcement of treaties would be preferable |

Strengthen the general dispute resolution system to increase quality of justice, clarity of proceedings and business confidence |

|

Resume the functioning and independence of the Business Ombudsman Institute |

|||

Source: (OECD, 2021[1]), OECD analysis (2023).

Introduction

The economy has so far withstood the shocks of COVID-19 and Russia’s invasion of Ukraine

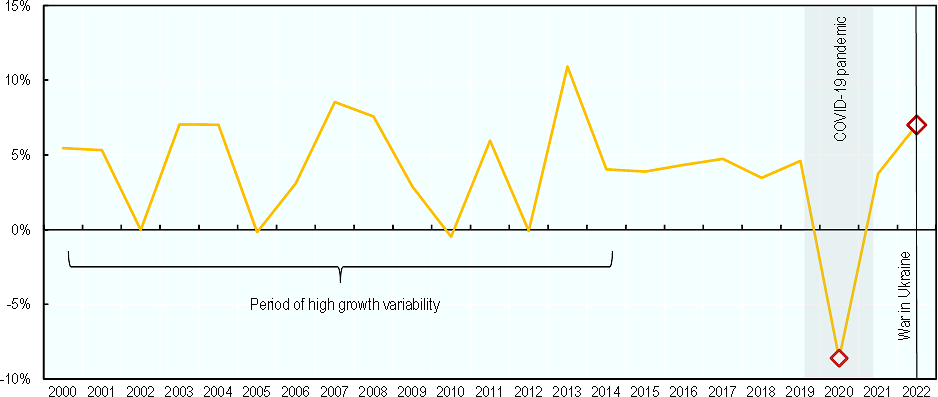

Kyrgyzstan has recorded average annual growth of 3.9% since the beginning of the 21st century, driven mainly by the export of gold and remittance inflows from migrant workers. However, this growth has not been uniform over time and the average rate hides two distinct trends in the development of the economy: from 2000 to 2013, growth was unsteady and fluctuated between 0% and 11%; from 2014 to 2019, less variability was observed (except during the pandemic) and the growth rate stabilised at around 4.2% (Figure 3.1). The COVID-19 pandemic disrupted this relative stability based on remittances and trade and GDP contracted by 8.6% in 2020, the biggest drop in Central Asia (IMF, 2023[2]). Nonetheless, the economy quickly recovered from the crisis and showed a certain resilience, despite the war in Ukraine and the sanctions against Russia, as growth reached 3.7% in 2021 and 7% in 2022 (EBRD, 2023[3]).

Figure 3.1. Kyrgyzstan's real GDP growth (2000-2022)

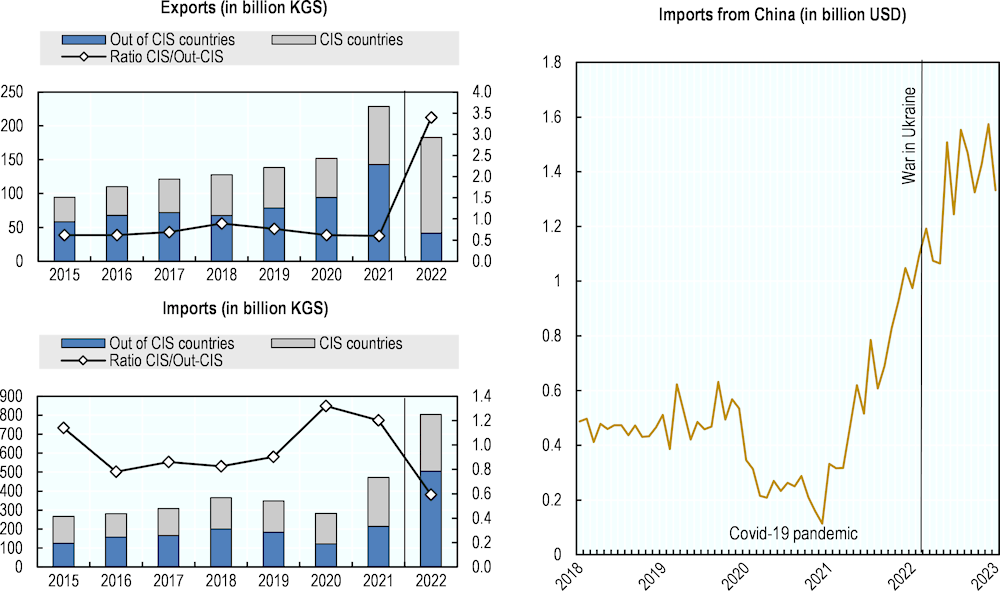

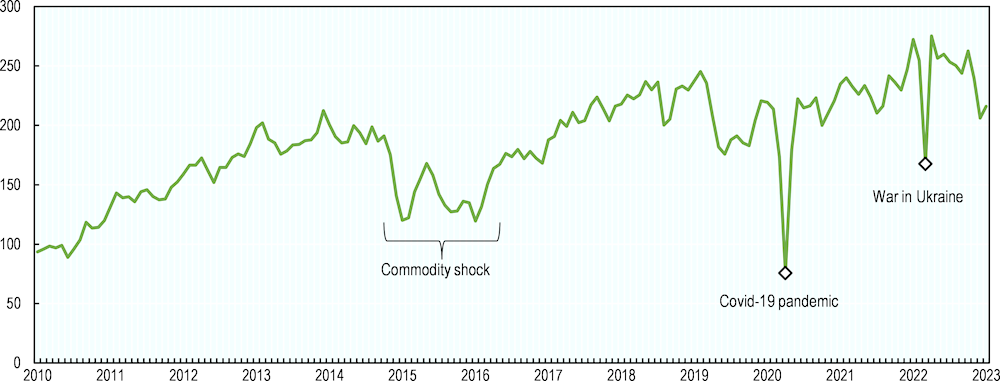

Remittances from labour migrants remain an important growth driver, particularly supporting household consumption. Between 2010 and 2019, they amounted to 29.2% of GDP on average (World Bank, 2023[4]), with approximately 80% originating from Russia (Central Bank of Russia, 2023[5]). Such a dependency on Russia’s needs for migrant labour increases Kyrgyzstan’s vulnerability, as shown during the 2014-15 crisis and the commodity shock’s impact on Russia’s economy (Figure 3.2). More recently with the beginning of the war in Ukraine, remittances dropped, but not as abruptly as during the COVID-19 pandemic. Going forward, the impact of sanctions on Russia’s economy could have a long-lasting effect on remittances inflows, and therefore negatively affect demand in Kyrgyzstan in the medium term, as there has been a decreasing trend in inflows since late 2022.

Figure 3.2. Inflows of remittances made through the money transfer system (2010-2023)

Note: Remittances made through the money transfer system are not exactly equal to total remittances, but account for a large enough share to infer on consequences of economic shocks on inflows.

In 2020, the COVID-19 pandemic shook the economy, and the government implemented anti-crisis measures. Public debt rose to 68% of GDP that year, the som depreciated by 19% against the US dollar, and inflation began rising, reaching 14.5% in April 2022 and 16.2% in February 2023 (National Statistical Committee of the Kyrgyz Republic, 2023[7]), driven by high global food and fuel prices (also as a consequence of the war in Ukraine due to supply chains disruptions). The government immediately restricted travel and trade in the country, hampering regional flows of people and goods, and drastically reducing economic activity. The closure of the border with China in 2020 led to a decrease in imports (Figure 3.3) as China is the main foreign supplier of the Kyrgyz economy. Remittances fell sharply but quickly recovered. Yet, the economy recovered relatively quickly and reached its 2019 GDP level in 2022, thanks to economic growth in 2021 and 2022, driven by trade (rebound in exports in 2021), agriculture and gold production.

The war in Ukraine disrupted the economy and considerably changed Kyrgyzstan’s trade patterns. Historically, Kyrgyzstan mainly exports gold, which accounted for 49.2% of total exports on average between 2015 and 2021 (Observatory for Economic Complexity, 2023[8]), in particular to Europe. During the same period, 53.8% of total imports came from China (mostly textiles) while 18.3% came from Russia (mostly oil). However, in 2022, because of the war in Ukraine, the structure of trade reversed (Figure 3.3). Both for imports and exports, the ratio of CIS/non-CIS countries inverted, meaning that Kyrgyzstan now exports more to CIS countries than to other countries, and imports more from non-CIS countries than from other countries. At the same time, imports from China, already high in the past, skyrocketed after the pandemic and reached record-high levels in 2023.

Figure 3.3. Recent developments of Kyrgyz trade

In 2022, a record number of companies with foreign participation were registered in Kyrgyzstan. The number of new companies with non-residents of the Kyrgyz Republic that were registered or re-registered in 2022 was 2,609, almost twice as many as in 2021. At the same time, 771 more companies with foreign participation were registered in January-March 2023 (Data Insider, 2023[11]). This increase is likely due to the significant inflow of Russian entrepreneurs resettling in Kyrgyzstan.

To help the government strengthen the business environment and create conditions to level the playing field between firms, the OECD conducted research in 2019-20 into the legal environment for business and pointed to the need for further structural reforms in three policy domains: the operational environment for businesses, the tax system and contract enforcement.

The 2020 OECD report identified a need for improved implementation of reforms in three priority areas

Streamline business-related legislation and ensure predictable enforcement

(OECD, 2021[1]) found that the number of licenses remained significant, and the licensing process itself had been complicated by the limited digitalisation of most procedures and the lack of a consolidated one-stop shop (OSS) for entrepreneurs. The government has worked to shift licenses and permits into an online format, supported by the Tunduk platform. Overall, it was recommended to consider codifying key regulations, permits and licenses, as was done in other Central Asian countries. For the SMEs in the country, business inspections also remained an important problem, with businesses calling for a moratorium on inspections during the pandemic their only relief.

Simplify the tax code and tax administration

In 2020, the tax system had already undergone significant reform since 2018 in order to modernise tax administration and harmonise the burden between businesses of all sizes. Whilst the government reduced the burden on businesses by postponing by six months the submission of tax declarations for businesses and removing tax penalties and sanctions, the tax system remained complicated and unpredictable. A simplified regime and patent system for small businesses supported entrepreneurs, but they have also discouraged businesses from growing and shifting to the normal regime. It was recommended to consider revising both regimes to incentivise businesses to grow. Additionally, digitalisation of the tax administration can be used as one of the ways to improve transparency and lower compliance costs for firms.

Ensure predictable, fair, and efficient contract enforcement

Procedures for dispute settlement for all investors, including SMEs and foreign investors, were clearly set out in the Civil Procedure Code, the Law on Investment and model law on international commercial arbitration of UNICTRAL. The Law on Arbitration Courts recognises alternative dispute resolution (ADR) mechanisms. Moreover, with the help of several donors, an International Arbitration Court was created.

However, the 2020 assessment found that the government had not established specialised economic courts, which made contract enforcement difficult and expensive for businesses. In addition, 95% tax disputes in courts were settled in favour of the authorities due to the lack of independence of the courts (OECD, 2021[1]). This problem was exacerbated by the low rate of digitalisation and constant changes in priorities regarding the development of court system.

To support the protection of business rights it was recommended to further strengthen the Business Ombudsman (BO) by the use of good practices on transparency and efficient claim process, and through the establishment of a mechanism to present the results of the work of BO to the Prime Minister and the Cabinet.

Assessing implementation progress since 2020

Since 2020, Kyrgyzstan’s reform efforts have mainly focused on advancing the digitalisation of public services and tax collection. Data digitisation is underway, the “Tunduk” portal has been launched, the principle of "single window" in interaction with business is being applied. Yet according to business associations and SME representatives who participated in the assessment process, the business environment has not been improving. There have even been some setbacks. After the pandemic, the government has had less fiscal room for manoeuvre, including for adequate support of business, while a deterioration of communication between the government and businesses did not contribute to a more targeted use of already limited funds. As a result, measures taken by the state in the field of taxation and business regulation have brought mixed results, and there remains much to do to ensure predictable, fair, and efficient contact enforcement.

The following sections of this chapter provide an overview of Kyrgyzstan’s progress with respect to the three priorities identified in 2020, and suggest ways forward, taking into account new priorities following the pandemic and the changed regional context (Table 3.1).

Priority 1: Digitalisation efforts have begun to bear fruit, but further streamlining of legislation and predictable enforcement are needed

Increased digitalisation of procedures has eased the administrative burden for firms

The government has established a one-stop shop to simplify business procedures

Positive changes can be observed in the operational environment for SMEs. By Order of the Cabinet of Ministers, in November 2021 the first one-stop shop (OSS) for entrepreneurs started to function in Bishkek. OSS have opened in Osh and Osh region since April 2023. This allows entrepreneurs to register their businesses, obtain licenses and permits and submit tax declarations in one place. In addition to the Tax Service, the OSS offer services from the Ministry of Justice, the Ministry of Transport, the Department of Precious Metals, the Financial Market Regulation and Supervision Service, services related to foreign trade and others (State Tax Service under the Ministry of Finance of the Kyrgyz Republic, 2021[12]). Moreover, the OSS provide entrepreneurs with consulting support through call centres.

“Tunduk” platform also continues to support the digitalisation of licensing and government services

Since 2020, in order to improve the quality of public services provided electronically, the state enterprise "Tunduk" has begun modernising the state portal of electronic services. New databases and information systems of governmental bodies are being integrated into it. Digital tools, such as a cloud-based electronic signatures or biometric passports, are now being used to access electronic services, the former being issued free of charge at public service centres. In addition, the mobile version of the application is now available, where services can be accessed online through a mobile device. The portal is accessible throughout the country, including in the regions remote from the capital. Within the framework of the development and implementation of the State Portal of Electronic Services, as well as to improve the quality of state and municipal services, "Тunduk" trained 120 employees and 83 managers of 50 government agencies to work on the new portal.

New enforcement mechanisms have started to function

Since 2021, the Business Protection Advisory Council has been created in partnership with the Business Ombudsman. It is chaired by the Attorney General, and the work of the Advisory Council is aimed at protecting the rights of entrepreneurs and investors, as well as at creating conditions for the development of businesses in the Kyrgyz Republic. Since its inception, the Prosecutor General's Office has worked with the business community and the OSCE Programme Office in Bishkek to develop new tools to protect businesses. In particular, the automated information system "Registration of inspections of business entities" was created to enable the registration of business inspections in an electronic format. Also, with the support of the Council, a mobile application "Protection of Business" was developed, which is aimed at eliminating unwarranted interference of law enforcement and tax authorities in business activities. Going forward, the Council plans to include all types of tax control in the list of inspections registered by prosecutors, as well as to work on ways to prevent the initiation of criminal cases on issues to be resolved with civil and administrative orders, and to fight smuggling.

Deteriorating business consultations and hasty implementation create complexity and unpredictability for firms

Businesses lack awareness of regulatory changes and opportunities to participate in policy consultations

The government is making efforts in the area of licensing, but they are not always carried out on the basis of public consultations with businesses nor are Regulatory Impact Analysis (RIAs) conducted. In 2022, a new draft law regulating public participation in the law-making process was published, reducing the review period for bills from 30 days to no less than 15 days (Jogorku Kenesh of the Kyrgyz Republic, 2022[13]). Such a reduction gives little time for businesses to get acquainted with, and provide comments on, draft laws. In addition, businesses have expressed concern about licensing decisions that were made without conducting a RIAs. Results of some regulatory impact assessments have not been considered in making a final decision, such as in the case of the creation of a state monopoly on ethyl alcohol production, which businesses opposed, arguing that it contradicts several existing laws, as well as international agreements in the field of competition, consumer protection, and investment.

Recently, there have been normative acts adopted without conducting an analysis of their regulatory impact. The legislative drafters refer to numerous exceptions to the rules, including that under conditions of force majeure, RIA is not carried out.

Business inspections are a key issue for implementation

Despite numerous moratoria on inspections, implementation issues remain a major concern for businesses. A three-year moratorium on inspections of business entities ended in 2021 and a temporary one was introduced in 2022, to run until December 2023. It is, however, difficult to say to what extent such measures are stimulating for businesses, as the latter are still subject to unscheduled inspections. Businesses have indeed repeatedly expressed concerns about the growth of inspections and the growing involvement of the prosecutor's office in tax policy. During the 2021 moratorium, the Law on Inspections only applied to scheduled inspections, which allowed state inspectors to conduct unplanned inspections, as well as tax audits. Since 2021, in addition to the State Tax Service, the Prosecutor's Office has the mandate to initiate scheduled and unscheduled tax inspections and other verification activities.

The frequent revision of legislation on inspections does not reduce the number of supervisory bodies, but in some cases increases it. In 2021, the State Inspectorate of Environmental and Technical Safety was restructured and its functions were transferred to sixteen different controlling bodies, which has sometimes resulted in a duplication of mandates: four government agencies are now responsible for environmental inspections (International Finance Corporation, 2021[14]). Thus, the increase in the number of inspections is mainly a problem of an overlap of functions across government agencies, with more than 800 different administrative procedures overseen by 25 government bodies (International Finance Corporation, 2021[14]).

Incomplete digitalisation requires a doubling of procedures in person

The number of licenses and permits that can be obtained online remains limited. The government has identified the optimisation and digitalisation of licensing and permits as one of the goals of the National Development Programme through 2026. By order of the government in 2021, a single electronic registry of permits was created. The latest available information states that only about 10 out of 190 licenses and permits can be obtained online (Ministry of Economy and Commerce of Kyrgyz Republic, 2022[15]). Weakness in promoting digitalisation may be due to lack of ownership among the government and the absence of a unified strategy for the digitalisation of public service provision. According to business associations, most of the services still require personal contact, which counteracts the state's efforts to reduce time spent dealing with administrative issues.

Further improving the operational environment for firms requires consistent implementation and better involvement of the private sector in the regulatory process

The government should focus on ensuring consistent implementation of reforms, in particular in relation to digitalisation and inspections

The priority should be set on significantly accelerating the digitalisation of all licensing and permits and widening the network of OSS for entrepreneurs in the country, especially in remote areas. The digitalisation of licenses and permits for SMEs could help reduce their exposure to excessive red tape, given their limited capacity to deal with public authorities’ differing opinions or interpretations of regulations when compared to large domestic or international businesses. The OECD indeed finds that administrative compliance costs per employee in some countries can be at least over five times higher for the smallest SMEs than for the largest companies (OECD, 2021[16]). OSS for entrepreneurs, which now operate in Bishkek, Osh and Osh region, should be rolled out across the country and strive to become the single point for all services for businesses, including licensing.

It would be useful for the government as a whole to monitor the implementation of regulations and policies and evaluate their effectiveness on an ongoing basis. Capacity building needs to be pursued through training of civil servants on changes in regulation, with on-the-job learning when possible. Some training in evaluation methods is useful for most staff members involved in policy or regulatory areas, since it can enhance their ability to identify and take into account various impacts and help avoid unintended consequences (OECD, 2020[17]). For instance, in Kazakhstan, in 2022 the National Chamber of Entrepreneurs Atameken together with the Ministry of National Economy conducted a series of trainings of civil servants on the changes introduced to the regulatory framework. In parallel, the government should also develop effective channels for firms on cases of non-compliance, for example ona dedicated section of Tunduk’s website, as well as a process for the authorised body to review these appeals on an ongoing basis.

Attention should be paid to conducting a functional analysis of government agencies before restructuring, with the aim of reducing and optimising the number of inspecting bodies. Ultimately, the government could consider reducing the number of inspection bodies and review the scope of their competences. As a result of the latest restructuring, the number of inspecting bodies has increased, which is a worrying factor for entrepreneurs. Strengthening the capacity of risk-based approaches in all areas of inspections, including tax controls, could help reduce the number of inspections and optimise the resources required for it. Moreover, there is need for the development of an online system for inspections which will be transparent so that business can access information regarding planned inspections.

The government should develop tools to raise firms’ awareness of and ability to cope with regulatory changes

Communication and consultation channels with the private sector could be improved by better publicising consultations and regulatory changes to businesses and business associations, for instance through a dedicated page of the websites of the competent authority and sectoral business associations. As deterioration of trust was one of the main concerns reported during OECD interviews with entrepreneurs and business associations in Kyrgyzstan, the government should pay special attention to involving SMEs in major regulatory changes. Engaging business associations and firms in a systematic and planned way can rebuild trust in the review process and give a sense of "ownership" of the outcomes. When allocating resources for public consultations, it is suggested to take into account the experience of OECD countries, which shows that the extent of consultation is generally greater in the later than the earlier stages of regulatory development, although the number of countries engaging with stakeholders at an early stage has increased (OECD, 2018[18]).

Competent authorities should also train and inform firms about new regulatory requirements and digital skills through outreach programmes and targeted and thematic trainings. OSS could provide a platform for the trainings for the SMEs. Moreover, government officials should actively participate in the events organised by international donors and international organisations who provide specific trainings for business, for example trainings for women entrepreneurs organised by the EBRD.

Priority 2. New amendments to the Tax Code level the playing field for businesses, but tax policy and administration remain complex and unpredictable

The government has taken steps to simplify the Tax Code and tax administration

Since the original OECD report in 2021, major changes have been made to the country's Tax Code. Positive aspects of the changes in the Tax Code (in force from January 2022) include better VAT offset and returns, digitalisation, and tax breaks for the green economy and several other sectors. At the time of writing, new amendments to the Tax Code have been introduced, which aim to further improve the conditions to level the playing field for businesses and reduce the shadow component of the economy. It seems that negotiations and consultations with the business community have borne fruit and some of the wishes of the business community have been reflected in the amendments (International Business Council, 2023[19]). For instance, among other important proposals of the International Business Council, the proposal for the exemption of the maintenance of cash registers from VAT services was adopted. Additionally, tax rates were reduced for tourist services to 2-4% (from 4-6%) and public catering (restaurants and cafes) to 2-6% (from 8%) to support the tourism sector. Several VAT exemptions were introduced on the purchase of equipment for tax administration purposes (cash registers, POS-terminals, devices with a software cash register with a built-in receipt printer, which is required by law).

Together with changes in the tax rates the government has also improved some aspects of tax administration

Electronic filing has been introduced to facilitate tax administration. A "single window" for taxpayers began operations in 2021 and is available in 52 tax authorities and four service centres, including the Taxpayers Service Centre in Bishkek (Ministry of Economy and Commerce of the Kyrgyz Republic, 2023[20]). This service has significantly reduced the time citizens require to fulfil their tax obligations and has also reduced physical contact between taxpayers and tax officials, which helps reduce corruption risks. According to those procedures, individual entrepreneurs, including those working by patent (- a document attesting that the company benefits from the simplified taxation system, provided its revenue does not exceed 8 million soms), must file declarations only electronically through a personal account on the website of the State Tax Service.

In accordance with the changes in tax regulations several projects are under implementation to improve the efficiency and digitalisation of the tax administration. With the assistance of the World Bank until 2025, the State Tax Service will be actively working on operational development, including the automation of business processes to improve the efficiency of tax administration and reduce the compliance burden on taxpayers (The World Bank, 2020[21]). Today there are six information systems in Kyrgyzstan for tax procedures: electronic invoices; a system of control over the movement of goods imported from the Eurasian Economic Union countries; labelling of goods; electronic completion of bills of lading; electronic cash registers, and e-patent, which allows users to generate a combined patent and insurance form. A special tax regime for e-commerce activities has also been introduced.

Attempts have also been made to support businesses and move from a punitive to a preventive approach to tax administration. This approach is welcomed by entrepreneurs, but at the same time more comprehensive explanatory work is required.

Box 3.1. Recent changes in the tax policy of the Kyrgyz Republic

The most recent amendments to the Tax Code were made on 3 April, 2023. Overall, the law provides for several measures to support businesses and investors by introducing special tax regimes and exemptions. For example:

To support small enterprises, it provides for an extension of the single tax-based regime without a limitation on revenue (previously up to 30 million soms, around 300k EUR), which will contribute to the expansion of activities without the need to "split the business" in order to remain in a special tax regime; an indefinite tax exemption for small entrepreneurs with annual revenues up to 8 million soms who fulfil requirements to use cash registers as a stimulus to formalise their activities; and the establishment of 0.1% tax for entrepreneurs in the markets, whose annual turnover does not exceed 100 million soms.

It also introduced a reduction of the single tax rate for trade from 4% for cash payment and 2% for cashless payment to: 0,5% - with annual turnover up to 30.0 million soms; 1% - with the turnover from 30 million soms to 50 million soms.

Residents of newly created Creative Industries Park are granted a special tax regime (in 2023 and 2024 - 0,5%, in 2025 and 2026 - 1%, from 2027 - 2%), while residents of the High Technologies Park are exempt from the payment of "Reverse VAT".

The new amendments also introduced remedies such as the postponement of the introduction of penalties for failure to use electronic waybills until 1 January 2024; to address issues with cash registers and insufficient preparation of businesses to use them, the law also provides for a reduction in fines:

for the first offense - a warning,

for the second - 500 soms for individuals and 5 thousand soms for legal entities, and

for the subsequent - 3 thousand soms for individuals and 13 thousand soms for legal entities.

Finally, if fines are paid within 30 days, the amount due is reduced by 70%.

In addition, the Code provides for the granting of exceptional tax provisions through ad-hoc investment agreements concluded between the Cabinet of Ministers and investors. However, such a measure might in practice add complexity and unpredictability to the tax system as it prevents the establishment of a level-playing field among firms and reduces incentives for the government to review the general tax framework for investors.

The business community is pressing for the introduction of measures to stimulate the non-cash circulation of money, to encourage the use of preventive measures over punitive ones; to exclude double liability for the non-use of invoices; and to adopt a classifier of products by type of economic activity for further differentiated regulation.

Fiscal policy has focused on digitalising services and providing incentives to the digital sector

To stimulate the inflow of highly skilled workers in the digital economy, the Digital Nomad project is being implemented in the country until the end of 2023. This status allows IT specialist “nomads” to be exempted from residence registration and from obtaining work permits. Such specialists also receive a personal individual number that allows them to carry out business activities for up to 12 months. The special status can be granted to those working in software development, information technology, export of media arts, including digital arts, animation, etc. from Armenia, Azerbaijan, Belarus, Kazakhstan, Moldova, and the Russian Federation. This status has already been granted to more than 1 000 citizens. If the digital nomads register in the High Technology Park, they are subject to a special favourable tax regime.

Tax policy and administration policy remain complex and unpredictable for firms

The amendments to the Tax Code have increased implementation challenges for SMEs in particular

As the government has repeatedly stressed, one of the main purpose of changes to the tax legislation is to widen the tax base and encourage private sector formalisation. In 2019, about 24% of firms surveyed reported informality as the top constraint to the development of their business, and 39% ranked it as a major constraint. While informality has decreased over time (from approximately 42% of GDP in 1993 to 24% in 2017) (World Bank Group, 2021[22]), the informal labour market still employs 71.8% of workers in such sectors as trade and services and construction (Friedrich-Ebert-Stiftung, 2021[23]). According to OECD interviewees, businesses are not optimistic about recent changes in tax legislation, which provide for lower rates, but do not provide incentives and measures to encourage entrepreneurs to formalise, as the different tax regimes do not decrease the complexity of navigating the tax administration.

Thus, despite several changes aimed at helping SMEs, small businesses face uncertainties and difficulties in adapting to the changes, which sometimes entails additional financial costs. The main obstacle relates to the lack of awareness of entrepreneurs and the lack of explanatory work on changes introduced. Changes to the Tax Code have been adopted without the broad participation of business and have lacked awareness-raising initiatives to facilitate implementation. For example, the mandatory introduction of cash registers for small businesses starting 2022 came as a surprise as it was immediately implemented and caused additional, unforeseen expenses for many businesses.

Businesses remain unaware of digital tax administration tools, while the implementation of reforms remains incomplete and sometimes inconsistent

Digitalisation, which should simplify the interaction of businesses with the tax authorities, is sometimes seen as a burdensome procedure, according to firms interviewed by the OECD1. Existing systems present difficulties for some taxpayers due to the duplication of information in different systems, as well as a lack of awareness of entrepreneurs about their existence and ways of use. As of 1 January 2023, the paper patent system was eliminated, and patents can only be received electronically via personal accounts on the State Tax Service portal. However, due to limited promotion efforts and lack of understanding of their tax obligations in the season of tax returns, many still come to the tax office in person. Tax officers must issue electronic patents to them via their computers. In addition, businesses still come to submit declarations in paper form due to insufficient information during the declaration period, except in some regions where there is no means of submission other than paper. The mobile application of the State Tax Service, which has the function of submitting tax declarations in the app experiences frequent disruptions and is underused, probably also due to a low awareness of the population about its benefits.

The administration still lacks a client-oriented approach when dealing with businesses

OECD interviewees report a persisting lack of client-oriented approach and transparency from the tax authorities. The Ministry of Finance and National Statistical Committee do not publish publicly available reporting on state budget expenditures and provide incomplete information on their websites (US Department of State, 2022[24]). Another important concern relates to the interpretation of tax law and its application. With the introduction of the new Tax Code in 2022, the Ministry of Economy and Commerce has been instructed to provide written explanations of the application of the Tax Code and tax legislation in general. Such a function is binding on tax officials, but in practice, the absence of an elaborated methodology to ensure uniform interpretation of the text has resulted in the issuing of various, and sometimes conflicting, directives by the tax authorities.

Further improving the tax system requires a long-term vision and greater attention to taxpayers’ concerns

Simplify the tax system by developing a long-term strategy

Further development of the tax system requires the drafting of a single policy document, which will set out the basic principles and objectives of the country's tax policy. Numerous changes in the Tax Code made in recent years have created confusion. The basic concepts and principles of the tax system are not formulated within the framework of state policy and are often adjusted for political and economic reasons. Despite the fact that the Strategy for the Development of the Tax Service under the Ministry of Finance for 2023-2025 indicates plans for the development of tax administration, it is insufficient, because the development of the tax system involves many other government agencies and it is necessary to have a common strategy for all (Ministry of Finance of the Kyrgyz Republic, 2022[25]). Therefore, it is important to have a document with a five to ten-year horizon setting out the main directions for tax reform. Moreover, in designing a long-term strategy, it is important to be clear on communication and engagement objectives. Such objectives are also helpful to evaluate the outcomes of the strategy. They could include objectives such as improving taxpayers’ understanding, building trust in the tax system, and making it easier to comply with (OECD, 2023[26]).

The government should better communicate changes to the Tax Code to reduce implementation challenges for entrepreneurs. Tax administrations may review the various available channels and their effectiveness, alone or in combination, at reaching the SME population and/or relevant sub-sectors. This could also include consideration of those in the SME segment that do not have online access or do not want to use it (OECD, 2023[26]). Among tools for the awareness-raising, text messages could be used in Kyrgyzstan, as mobile penetration in the country, even in the remote regions, is high and smartphones are the only technology some small firms have. Thus, short texts or recorded messages can be effective in garnering attention. It should not be overused, as it can cause frustration with some customers being susceptible to risks from fraudsters. For example, tax authorities in Uzbekistan have already been using social media such as a Telegram to relay information to SMEs. But at the same time, classic explanatory channels of communication, like the State Tax Service’s website and call centres, should remain the main source for more in-depth information on specific topics and, if necessary, provide links to other sources.

Close the implementation gap by developing a client-oriented approach

Improving the client-oriented approach when dealing with businesses can contribute to a better implementation of reforms. Given the size of the informal sector, the authorities should design targeted programmes to change behaviours and widen the tax base. Raising awareness of the societal benefits of public spending enabled by tax is an aspect to consider. In several countries, the targets of campaigns for formalisation are not informal businesses, but rather their customers. The aim is to change their behaviour by demanding tax receipts, thereby compelling sellers to adapt. When people avoid buying goods from the informal sector, sellers start to comply with tax laws (OECD, 2021[27]). A case in point is the introduction of a cashback system in Uzbekistan through the Soliq application, which has proved very useful in increasing the number of formal businesses (see chapter on Uzbekistan). Other campaigns could aim at incentivising customers to adopt desirable behaviours such as collecting receipts to receive tax deductions or participate in lotteries.

The tax authorities should conduct extensive consultations with the business community prior to developing changes to tax legislation. Preliminary consultations should become systematic, with the government providing full information on the additional net costs and burdens on taxpayers as a result of the changes. In order to receive the greatest number of comments, documents should be published with explanations if the language is too complex. Moreover, it is important to test new fiscal tools in a pilot phase for SMEs before implementation (e.g., cash registers). It is also important in this regard to provide ICT trainings for small entrepreneurs, especially in the markets (bazaars) taking into account the importance of their practicality and efficiency.

Finally, the government should introduce mandatory regulatory impact assessment (RIA) of new tax regulations, with a focus on the expected impact on SMEs. Thus, mandatory RIAs could be part of a comprehensive long-term tax strategy. It is worth keeping in mind that RIA alone will never be successful in improving the quality of regulation, unless coupled with additional regulatory reform tools such as the use of consultation, the adoption of a “policy cycle” approach with the use of monitoring and ex-post evaluation alongside regular reviews of existing legislation (OECD, 2020[28]).

Priority 3. The judicial system is evolving, but further steps are needed to ensure predictable, fair and effective enforcement of treaties

The government has introduced some reforms to the judicial system

To improve the quality of justice and create easy access to it for citizens, a system of remote proceedings in the Supreme Court of the Kyrgyz Republic will be introduced. Such a measure aims to remotely consider criminal, civil, economic, and administrative cases using technical means of communication, electronic proceedings, as well as simplified (written) consideration of cases in the court of cassation.

In 2022, one of the decisive steps in reforming the judiciary was the rotation of judges for the first time in the history of the country. Judges from the southern regions were rotated to and from the northern regions of Kyrgyzstan at the level of district, city and oblast judges. The rotation of judges is expected to promote independence from political pressure from certain institutions of power, especially the prosecutor's office and national security bodies (Supreme Court of the Kyrgyz Republic, 2022[29]).

In a move to improve the investment climate, in 2022, the new Tax Code created arbitration courts where tax disputes with the government can be resolved, rather than in a trial court. Previously, almost 90 percent of tax cases were decided in favour of the state under the trial court system. The hope of the arbitration court system is that it will be more independent and allow for disputes to be resolved faster (US Department of State, 2022[24]).

Economic and non-economic cases are now treated separately in courts

The resolution of economic disputes from inter-district courts was transferred to the jurisdiction of district and city courts in 2020. Inter-district courts, which have become administrative courts as a result of these changes, will only deal with administrative cases. Such changes aim to contribute to a more efficient resolution of economic disputes, as the courts have become "closer" to the population and to businesses with increased specialisation of courts. In general, the reform is aimed at optimising the functioning of the judicial system. It provides for the elimination of the practice of unjustified return of cases for a new trial and simplifies the procedure for the consideration of applications for actions of bailiffs. Recent changes in the Tax Code introduced the consideration of individual tax disputes by the arbitration court, while previously tax legal relations were regulated only by the tax authorities and the judiciary.

However, the judicial system remains a key obstacle for business development and investment

A justice system reform remains pending, while businesses suffer from undue pressures from some judicial bodies

Despite some attempts to reform the judicial system, it is difficult to trace the systematic nature of these changes. The long-awaited reform of the judiciary, one of the 2026 priorities of the National Development Programme of the Kyrgyz Republic is still pending. Despite the announced plans of the government, including the creation of a single investigative body combining the functions of investigation carried out by the relevant departments of the Ministry of Internal Affairs, the Prosecutor General's Office, and the State Committee for National Security, several problems in the process of interaction between business and law enforcement agencies remain unresolved. Businesses still report the unjustified initiation of pre-trial proceedings, subsequently terminated for lack of evidence, and unjustified seizures of property and the refusal to return it. The unlawful dissemination of information that discredits the reputation of businessmen, numerous arrests of entrepreneurs and the refusal of alternative measures of accountability and non-transparency of procedures carried out by law enforcement bodies do not increase trust between the government and business (Business Ombudsman Institute of the Kyrgyz Republic, 2023[30]).

Businesses, especially SMEs, remain poorly aware of available dispute resolution tools

SMEs have limited awareness of mediation or arbitration mechanisms. Despite the EBRD project to develop mediation, the latter remains popular for civil cases but not for commercial disputes (Anadolu Agency, 2022[31]). Instead of mediation, SMEs prefer to use arbitration mechanisms, which are more costly. Сhanges concerning the consideration of individual tax disputes by the arbitration court became one of the positive innovations of the Tax Code, but businesses are not satisfied with the remaining provision on the consideration of complaints against territorial bodies of the State Tax Service. Thus, they are being transferred to the central office of the State Tax Service. This is an inefficient mechanism, which contributes to a conflict of interest. Instead, it could be useful to centralise all tax-related appeals in the the Ministry of Economy and Commerce and consider them by a collegial mechanism with the participation of government agencies, business representatives and the expert community in a transparent way. For example, in Kazakhstan, in July 2021, e-Otinish, an online platform and mobile app was created to receive and process appeals of individuals against any government body (see chapter on Kazakhstan).

Further improving contract enforcement requires increasing trust in the judicial system through more dialogue and openness to innovation

Strengthen the general dispute resolution system to increase quality of justice, clarity of proceedings and business confidence

Introducing a clear distinction of cases in the courts to level out the categorisation of economic cases as general cases, could be a first step preceding the establishment of economic courts. Despite the government's attempt to segregate cases by court level, businesses still mostly resort to arbitration courts. It is therefore difficult to assess the effect of this reform on entrepreneurs.

The decriminalisation of economic cases in Kyrgyzstan requires introducing a transparent hearing procedure and pre-trial dispute resolution dispositions. The gradual decriminalisation of economic affairs could be implemented following the example of neighbouring Kazakhstan. For instance, the new Administrative Procedure Code of Kazakhstan shifted the burden of proof to the state body in disputes and allowed courts to examine all circumstances relevant to the case without limiting themselves to the evidence submitted by the parties.

In parallel with judicial reforms, the State needs to work on strengthening the dispute resolution system as a whole. Business confidence in arbitration courts is growing, which is a good sign, and this momentum should be used to stimulate this trend by developing clear methodologies describing which cases can be heard where. At the same time, it is proposed to develop mechanisms to encourage the use of existing and proven effective mediation and arbitration institutions.

In the light of recent developments regarding the BO, the government should maintain the functioning and independence of the BO

The government should re-establish the Business Ombudsman Institute. Given the role of the BO in building a dialogue between businesses and the State, as well as in helping business to understand the law and build cases in the courts, the BO office could be rebuilt as a part of existing business chambers (e.g., Kazakhstan, Uzbekistan). At the same time, it is vital that the independence and impartiality of the office is balanced through the law and source of funding.

Secondly, to maintain a relationship of trust with business it is important to preserve the existing roles of the BO in governmental advisory bodies. As it was indicated by the BO itself, the Business Protection Advisory Council aims to build an effective mechanism for interaction between the state and the business community in protecting the rights of entrepreneurs and investors, whereas the Monitoring group under the Supreme Court is a good initiative in bringing the voices of the business community in reforming the judicial system and law enforcement practice. These platforms have played an important role for businesses in many aspects.

References

[31] Anadolu Agency (2022), Mediation: Kyrgyzstan’s Experience in Resolving Disputes Without Court.

[30] Business Ombudsman Institute of the Kyrgyz Republic (2023), СИСТЕМНЫЙ ОТЧЕТ, https://boi.kg/media/pdfs/810f156f-f1aa-4629-a4c4-f09cc10272d4.pdf.

[33] Business Ombudsman Institute of the Kyrgyz Republic (2022), ОТЧЕТ БИЗНЕС-ОМБУДСМЕНА ЗА IV КВАРТАЛ, https://boi.kg/media/images/3f07adc6-420d-47da-a87f-e7ae5dfbf597.pdf.

[5] Central Bank of Russia (2023), External Sector Statistics, http://www.cbr.ru/eng/statistics/macro_itm/svs/.

[11] Data Insider (2023), Record number of companies with foreign participation appeared in Kyrgyzstan in 2022, https://www.osoo.kg/report/non-resindent-legal-entities-2022/.

[3] EBRD (2023), Regional Economic Prospects, EBRD, London, https://www.ebrd.com/what-we-do/economic-research-and-data/rep.html.

[23] Friedrich-Ebert-Stiftung (2021), ANALYSIS OF THE INFORMAL ECONOMY IN KYRGYZSTAN: Through social justice for workers, to sustainable development in the country, https://library.fes.de/pdf-files/bueros/bischkek/18022.pdf.

[10] General Administration of Customs People’s Republic of China (2023), Statistics, http://english.customs.gov.cn/statics/report/monthly.html.

[2] IMF (2023), World Economic Outlook Database, IMF, DC, https://www.imf.org/en/Publications/WEO/weo-database/2023/April.

[19] International Business Council (2023), Business recommendations to the draft amendments to the Tax Code discussed at the Economy Ministry, https://www.ibc.kg/en/news/ibc/6123_business_recommendations_to_the_draft_amendments_to_the_tax_code_discussed_at_the_economy_ministry_.

[14] International Finance Corporation (2021), Kyrgyz Republic – Inspection Reform: The Reform Process (2006-2019): What Can We Learn?, IFC, Washington DC, https://www.ifc.org/wps/wcm/connect/145985d8-d571-4661-b51b-75ac94f17e53/Inspection+Reform+Case+Study_KR.pdf?MOD=AJPERES&CVID=ntEi3ad.

[13] Jogorku Kenesh of the Kyrgyz Republic (2022), On the draft law “On Amendments to the Law of the Kyrgyz Republic ”On normative legal acts of the Kyrgyz Republic, http://kenesh.kg/ru/draftlaw/608581/show.

[15] Ministry of Economy and Commerce of Kyrgyz Republic (2022), A single electronic registry of permits will minimize contacts between government agencies and the private sector, https://mineconom.gov.kg/ru/post/8118.

[34] Ministry of Economy and Commerce of the Kyrgyz Republic (2023), JOGORKU KENESH.

[20] Ministry of Economy and Commerce of the Kyrgyz Republic (2023), On the new tax policy of the Kyrgyz Republic: the position of business and government, https://mineconom.gov.kg/ru/post/9086.

[25] Ministry of Finance of the Kyrgyz Republic (2022), Strategy for the Development of the Tax Service under the Ministry of Finance of the Kyrgyz Republic for 2023-2025, https://www.sti.gov.kg/docs/default-source/other/%D1%81%D1%82%D1%80%D0%B0%D1%82%D0%B5%D0%B3%D0%B8%D1%8F-%D0%B3%D0%BD%D1%81-%D0%BD%D0%B0-%D1%80%D1%83%D1%81%D1%81%D0%BA%D0%BE%D0%BC.pdf?sfvrsn=2.

[6] National Bank of Kyrgyzstan (2023), Statistics, https://www.nbkr.kg/index1.jsp?item=1785&lang=ENG.

[9] National Statistical Committee of the Kyrgyz Republic (2023), International economic activity, http://www.stat.kg/en/statistics/vneshneekonomicheskaya-deyatelnost/.

[7] National Statistical Committee of the Kyrgyz Republic (2023), Prices and tariffs, http://www.stat.kg/en/statistics/ceny-i-tarify/.

[8] Observatory for Economic Complexity (2023), Kyrgyzstan Country Profile, Observatory for Economic Complexity, Cambridge, MA, https://oec.world/en/profile/country/kgz.

[36] OECD (2023), Communication and Engagement with SMEs: Supporting SMEs to Get Tax Right, OECD Forum on Tax Administration, OECD Publishing, Paris, https://doi.org/10.1787/f183d70a-en.

[26] OECD (2023), Communication and Engagement with SMEs: Supporting SMEs to Get Tax Right, OECD Forum on Tax Administration, OECD Publishing, Paris, https://doi.org/10.1787/f183d70a-en.

[27] OECD (2021), Building Tax Culture, Compliance and Citizenship: A Global Source Book on Taxpayer Education, Second Edition, OECD Publishing, Paris, https://doi.org/10.1787/18585eb1-en.

[16] OECD (2021), Comprehensive redesign of the licensing system in Romania: Enhancing the business environment in Romania through industrial and manufacturing licensing simplification, https://www.oecd.org/economy/surveys/enhancing-the-business-environment-in-romania-through-industrial-and-manufacturing-licensing-simplification.pdf.

[1] OECD (2021), Improving the Legal Environment for Business and Investment in Central Asia, OECD Publishing, https://www.oecd.org/eurasia/Improving-LEB-CA-ENG%2020%20April.pdf.

[28] OECD (2020), Regulatory Impact Assessment, OECD Best Practice Principles for Regulatory Policy, OECD Publishing, Paris, https://doi.org/10.1787/7a9638cb-en.

[17] OECD (2020), Reviewing the Stock of Regulation, OECD Best Practice Principles for Regulatory Policy, OECD Publishing, Paris, https://doi.org/10.1787/1a8f33bc-en.

[18] OECD (2018), OECD Regulatory Policy Outlook 2018, OECD Publishing, Paris, https://doi.org/10.1787/9789264303072-en.

[12] State Tax Service under the Ministry of Finance of the Kyrgyz Republic (2021), One-Stop Shop in Bishkek since opening provided tax services to 1.3 thousand taxpayers, https://www.sti.gov.kg/news/2021/12/15/sop-v-bishkeke-so-dnya-otkrytiya-okazal-nalogovye-uslugi-1-3-tys-np.

[29] Supreme Court of the Kyrgyz Republic (2022), Rotation of judges is already bearing fruit - expert, http://sot.kg/post/rotatsiya-sudej-uzhe-daet-svoi-plody-ekspert.

[21] The World Bank (2020), Kyrgyz Republic to Improve Effectiveness of Tax Administration and Modernize Statistical System with Support from World Bank, https://www.worldbank.org/en/news/press-release/2020/02/28/kyrgyz-republic-to-improve-effectiveness-of-tax-administration-and-modernize-statistical-system-with-support-from-world-bank.

[32] UNCTAD (2022), Investment Dispute Settlement Navigator, https://investmentpolicy.unctad.org/investment-dispute-settlement/country/113/kyrgyzstan.

[24] US Department of State (2022), 2022 Investment Climate Statements: Kyrgyz Republic, https://www.state.gov/reports/2022-investment-climate-statements/kyrgyz-republic/.

[4] World Bank (2023), World Development Indicators, World Bank Group, Washington D.C., https://databank.worldbank.org/source/world-development-indicators.

[22] World Bank Group (2021), Creating markets in the Kyrgyz Republic: Unleashing the private sector to rebuild development success, https://documents1.worldbank.org/curated/en/099708108082242045/pdf/IDU01fc40efb0be3d04df90bc43088db3b9a9193.pdf.

[35] ZOiS (2021), “The Republic of Kazakhstan’s New Administrative Procedures Code”, ZOiS Spotlight 25, https://www.zois-berlin.de/en/publications/the-republic-of-kazakhstans-new-administrative-procedures-code.

Note

← 1. See Annex A