This chapter focuses on Turkmenistan’s progress and challenges in implementing the three priority reforms identified in 2020, namely the implementation of the investment law and access to information for investors; the streamlining of business registration and licensing, and the creation of a one-stop shop; and the simplification of the operational environment for firms. Taking into account the impact of the COVID-19 pandemic and that of Russia’s war in Ukraine, the chapter offers policy recommendations to improve the legal environment for investors and businesses.

Improving the Legal Environment for Business and Investment in Central Asia

5. Turkmenistan

Abstract

Table 5.1. Summary of priority reform implementation and updated recommendations

|

2020 |

2023 |

||

|---|---|---|---|

|

Challenges identified |

Recommendations |

Implementation assessment |

Way forward |

|

Investment regulation: Ensure the enforcement of the Law on Investment and improve information availability |

➢ Improve availability of legislation ➢ Consolidate body of by-laws ➢ Streamline, consolidate and publish all investment-related legislation on the legal database of the Ministry of Justice |

➢ The government has increased communication about changes in the law ➢ Reform efforts seem to have slowed down due to the COVID-19 pandemic |

➢ Create an Investment Promotion Agency (IPA) ➢ Improve contract enforcement ➢ Review the legal framework to encourage domestic investment transactions |

|

Business registration: Streamline business registration and licensing, and introduce a one-stop-shop |

➢ Create a one-stop shop for business registration ➢ Consolidate and harmonise legislation for licensing and permits ➢ Take into account connectivity and capacity constraints |

➢ The government has revised and simplified some procedures for business registration and licensing ➢ Procedures are still paper-based and cumbersome |

➢ Streamline the registration process, clarifying the key steps and timelines ➢ Limit State interventions to specified instances and create an independent reporting mechanism through a Business Ombudsman ➢ Improve access to information by regularly updating the government’s websites |

|

Operational environment for SMEs: simplify the operational environment |

➢ Dedicate attention to the needs of SMEs when simplifying the investment regulatory framework ➢ Develop SME-targeted public instruments ➢ Create a Business Ombudsman |

➢ The post-pandemic period has provided some relief to businesses ➢ The business environment remains difficult to navigate |

➢ Expand the range of available financial instruments ➢ Expand digital infrastructure ➢ Capitalise on the Middle Corridor’s renewed interest to facilitate trade |

Source: (OECD, 2021[1]), OECD analysis (2023).

Introduction

Turkmenistan’s growth has been positive but on a declining trend

The oil and gas sector has been driving economic growth

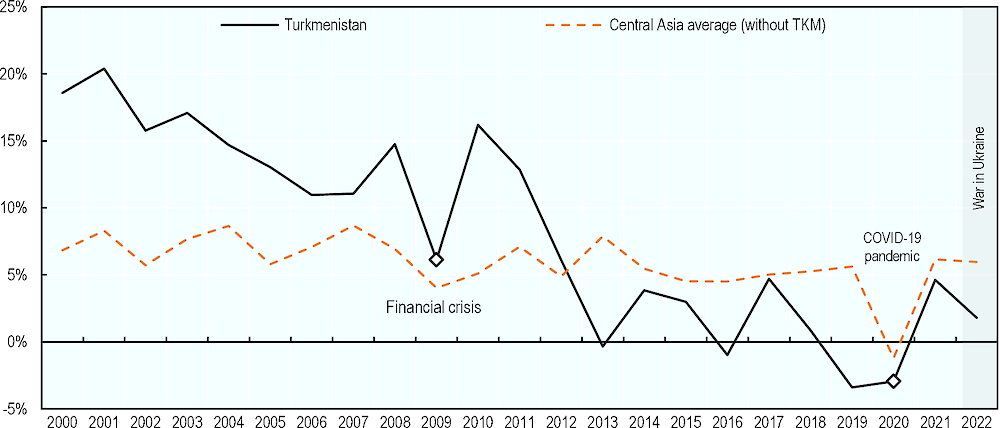

Turkmenistan’s economic growth has been driven chiefly by the extractive sector. The government has pursued an investment-led growth strategy underpinned by export promotion and import substitution policies and directed concessional lending (IMF, 2019[2]). Foreign direct investment remains largely limited to oil and gas extraction in the form of production-sharing agreements. Despite the government’s ambition to diversify the FDI base, foreign exchange controls, the absence of property rights in land, and the interference of the state in business matters have constrained such a diversification. The economy remains dominated by state-owned monopolies, including in the oil and gas, electricity, cotton, telecommunication, and manufacturing sectors (BTI Transformation Index, 2022[3]). Growth has been on a declining trend and below double digits since 2012 on IMF estimates. Whilst these estimates significantly diverge with government data, the latter informed the OECD of an upcoming Article IV consultation in 2024 during which this issue should be discussed.

Figure 5.1. Real GDP growth (2000-2022)

The economy was hit by COVID-19 but recovered in 2021

Whilst the government reported stable economic growth and no officially confirmed cases of COVID-19, restrictions on international and domestic travel as well as the closing of some businesses are reckoned to have resulted in negative growth in 2020. The economy quickly rebounded in 2021 and surpassed its 2019 levels, with a robust recovery in exports, although abnormally dry weather had a detrimental effect on agriculture and the production of staple goods (EIU, 2022[5]).

Reliance on exports to China has mitigated the trade disruptions caused by Russia’s war in Ukraine

Turkmenistan has felt little impact from Russia’s full-scale invasion of Ukraine due to its limited trade links with the two countries. It recorded growth of 1.6% in 2022 according to the IMF, driven by elevated global energy prices and higher-than-planned natural gas production and exports boosted by the opening of one of the world’s largest gas fields, Galkanysh (EBRD, 2023[6]). Turkmenistan has remained highly reliant on gas exports to China, with the latter accounting for 74% of exports in value terms in 2022 (EIU, 2023[7]). Gas exports to China rose to USD 10 billion, a 51% year-on-year increase. Construction, manufacturing, and services have been booming, while exports of tomatoes and footwear have also been on the rise (ibid). Expansion was spurred by greater domestic mobility, the re-opening of borders, the gradual resumption of international flights, increased trade and revitalised services in 2022 (ADB, 2023[8]).

The war increased trade with and transit through the Middle and Southern Corridors

The war in Ukraine and traffic reductions along the Northern Corridor going through Russia have led to a shift to alternative trade routes, increasing Turkmenistan’s trade with its neighbours. Its strategic positioning along the Trans-Caspian International Transport Route (TITR) (also called the Middle Corridor) and the Southern Corridor, connecting the region to the Indian Ocean via Iran, has made the country an important trade node. The seaport of Turkmenbashi recorded a 2.5-fold increase in transit cargo volumes in 2022 due to the increase in the transit of petroleum products, metals, machinery, food, spare parts, chemical cargo, and construction materials. Turkmenistan also intensified trade relations with Iran and operators have been more frequently using the road-based Southern Corridor to avoid bottlenecks along the Middle Corridor (EBRD, 2023[9]).

However, seizing these opportunities will require Turkmenistan to diversify trade and boost investment attraction and the competitiveness of its private sector

Looking ahead, significant downside risks, including a structural slowdown of China’s economy, require Turkmenistan to conduct structural reforms to diversify its export base. The government has yet to conduct structural reforms to improve its investment attractiveness, reduce the presence of the state in the economy, increase data and government transparency and unleash private sector development.

The OECD 2020 assessment had identified a need for improved implementation of business- and investment-related legislation, a streamlining of processes for business registration, and simplification of the operational environment for SMEs

Ensure enforcement of the Law on Investment and improve information availability

Turkmenistan’s Law on Investment (LoI) governs investment activity in the country and establishes equal rights for investors, their main rights and duties, the procedures for state investment, and protections against abrupt regulatory changes and expropriation. It also guarantees the investor’s right to claim compensation and the principle of non-discrimination between domestic and foreign investors and prevents officials and state bodies from interfering in investment activities except as provided by law (OECD, 2021[1]).

The LoI suffers from several weaknesses addressed in the initial assessment, chief among them are unclear protection against direct and indirect expropriation (Art.22), the lack of definition for the amount or method of compensation in case of expropriation, the unconsolidated body of laws governing investments, and the fact that there are two separate investment laws for domestic and international firms, despite the LoI stating that conditions for both should be the same. The OECD had recommended to enhance investment legislation and consolidate it into one act to improve access to information and ensure consistency and coherence (OECD, 2021[1]).

Streamline business registration and licensing, and introduce a one-stop-shop

The main obstacles to conducting business in Turkmenistan relate to long and complex registration, licensing and taxation, with personal connections perceived to play an important role in business success. Business registration is governed by outdated legislation and differs between domestic and international businesses. De jure timelines to complete registration are not respected, with domestic businesses reporting an average of six weeks for registration, and international businesses going through an opaque, and altogether different, process involving the Interdepartmental Commission for Protection from Economic Risks at the Agency for Protection from Economic Risks under the Ministry of Finance and Economy (MFE) and the Ministry of Foreign Affairs (MFA). At the time of writing, there was no one-stop shop (OSS) for business registration, although the MFE had initiated the development of a single-window registration platform (OECD, 2021[1]).

The OECD recommended to remove redundant and cumbersome business registration and licensing legislation, as part of a wider effort to simplify the investment-related regulatory framework and to articulate a dedicated SME strategy. In particular, the development of a digital OSS to inform businesses of all procedures, address requests and fulfil all procedures online was recommended, taking into account connectivity constraints and low internet access in Turkmenistan. To improve public-private dialogue, the OECD recommended the creation of a Business Ombudsman with oversight powers over inspection agencies and regulations (OECD, 2021[1]).

Simplify the operational environment for SMEs

Various forms of support to SMEs, including access to finance through state-owned banks, technology, training, and internationalisation are guaranteed by the Law on State Support for Small and Medium Enterprises (2009). The law also provides for simplified procedures for SMEs regarding accounting, taxation, insurance and guarantees regarding regulatory stability, allowing them to apply legislation for five years from the time of registration, regardless of any legislative changes that would lead to prohibitions or restrictions on their activities. A National Development Plan for 2018-2024 was approved to provide support to the development of SMEs, but its implementation remains to be assessed (OECD, 2021[1]).

In 2020, the OECD advised the creation of SME-targeted public instruments, for instance an entrepreneurship fund such as DAMU in Kazakhstan or a dedicated service centre such as the Georgian Innovation and Technology Agency to help SMEs and entrepreneurs access financing, infrastructure, and legal assistance (OECD, 2021[1]).

Priority 1: Legislation can be accessed online, but endeavours to strengthen the Law on Investment and improve contract enforcement would improve the investment climate

The government has increased communication about changes in the law

OECD interviewees reported that access to information has improved through the publication of laws, codes, and decrees on the Ministry of Justice’s official website, as well as communication on TV and the radio (Ministry of Justice, 2023[10]). The Ministry has also been conducting seminars with businesses on the topic of foreign investment. Latest amendments to the law date back to 2015, but some terminology was recently clarified according to interviewees. The government is also considering the drafting of a single act compiling provisions of foreign and domestic investment laws. As part of its accession process to the WTO, Turkmenistan has committed to translating into English and Russian laws related to trade and investment.

Efforts to improve the investment framework are taking time to materialise

Information related to legislation and investment conditions is difficult to access

OECD interviewees nonetheless reported the difficulty of accessing information related to legislation. Proposed laws and regulations are not generally published in draft form for public comment. Laws have frequent references to bylaws that are not publicly available and are rarely translated into English. Decrees are not categorised by subject, which makes it difficult to find relevant cross references. There is no information available on whether the government conducts any quantitative analysis of the impact of regulations, and regulations often appear to follow the government’s “try-and-see approach” to addressing issues (U.S. Department of State, 2022[11]).

More generally, informational support to investors is not provided. Turkmenistan does not have an investment promotion agency. It seems that the government could do more to incentivise foreign direct investment outside the oil and gas industry. As a result, foreign companies spend significant time conducting due diligence in Turkmenistan and can rely on a limited number of consultants to support them with their prospecting on the ground, with limited information and studies on specific sectors or markets.

Underdeveloped legislation limits opportunities for investment

According to OECD interviewees, existing legislation requires that upon the registration of a new business, the owner should declare a nominal capital figure, which cannot be amended. In case of a later-stage acquisition, the real cost of the company cannot be reflected, which implies that the seller cannot register a profit for his sale and must sell his company at the initial nominal figure. The law in place therefore does not encourage a company to formally invest in another one, which has resulted in investments taking place unofficially.

Contract enforcement remains an issue

Investment and commercial disputes involving Turkmenistan usually involve the non-payment of debts, the non-delivery of goods or services, and contract renegotiations, with the government justifying non-payment because of contract breach. Several cases of disputes between businesses and the government have been caused by the latter’s unwillingness to pay in freely convertible currency as contractually required. Contracts can be entirely reviewed and reconsidered following a change in leadership in the government agency that signed the contract, affecting profit distribution, management responsibilities, and payment schedules (U.S. Department of State, 2022[11]).

Enhancing the investment framework requires improving access to information, strengthening contract enforcement, and facilitating domestic investment

Create an Investment Promotion Agency

Turkmenistan should still consider the creation of an Investment Promotion Agency (IPA). Such an agency can be a powerful means to attract FDI and maximise its benefits, in the context of a broadly sound investment climate (OECD, 2020[12]). It can be used as a focal point in the institutional landscape to facilitate the establishment of new investors in the country and can serve to promote the country as an attractive investment destination, bring new investors, and help existing ones expand their activity. For instance, the Government of Kazakhstan reported that Kazakh Invest supported the implementation of 57 projects worth over $3.8 billion in 2021 with the creation of about 5 thousand jobs. The IPA also organised 190 visits of foreign investors to the regions of Kazakhstan with visits to production sites, during which negotiations were held with representatives of government agencies and local businesses (Kazakh Invest, 2022[13]).

IPAs can also play an advocacy role within the government and provide inputs in investment policy design, taking into account their field experience with foreign investors’ projects. In designing the agency’s role, the government of Turkmenistan could consider selecting priority sectors, countries, and investment projects. It should also ensure that the mandate of the institution is not too large and focuses on investment promotion and facilitation. A clear strategy with well-identified priority sectors and key performance indicators that would be outcome-oriented would optimise the agency’s role.

Improve contract enforcement

A first measure to consider includes the government’s meeting contract obligations notwithstanding institutional changes. Effective systems of domestic commercial arbitration, mediation, or conciliation matter to foreign investors, as high litigation costs and delays may discourage them from investing in a jurisdiction (World Bank, 2019[14]). In addition, the authorities could adopt a series of good practices to improve the quality, efficiency, and independence of the court system to reduce the time and cost needed to resolve a commercial dispute. For instance, introducing case management systems can improve record-keeping, reduce delays, and case backlogs. Case management intends to ensure the timely and organised processing of cases from initial filing through final outcome. The Ministry of Justice could introduce an electronic case management system by automating key components, such as access to laws, regulations and case laws, access to forms, the generation of a hearing schedule, and access to court orders and decisions (World Bank, 2019[14]). This would serve to improve the transparency of dispute resolution mechanisms.

Review the legal framework to encourage domestic investment transactions

The investment legislation should be reviewed and updated to support domestic investment. Such a review should allow to perform an asset valuation based on the real value of the firm to be invested in.

Priority 2: Administrative procedures for business registration have been revised, but business services could be further digitalised and harmonised among domestic and foreign firms

The government has revised and simplified some procedures for business registration and licensing

Several provisions were introduced by the government in 2022 and 2023 to ease administrative procedures for firms. With regards to licensing, the number of required documents was reduced. Information on how to register a business, registration fees, and an online payment option are now available on the website of the Ministry of Finance and Economy. Whilst a one-stop-shop has not yet been created, registration, licensing and tax procedures are all carried out by the Tax Department under the MFE. A mobile application is currently being tested in demo mode by the Ministry to allow entrepreneurs submit documents online. Customs procedures have also reportedly improved slightly (U.S. Department of State, 2022[11]).

However, procedures are still paper-based and cumbersome

Business registration is based on a lengthy process

Obtaining licenses and authorisations is cumbersome, as these need to be renewed every two years, an exception in the region. In specific sectors, licenses need to be renewed on a yearly basis, while fees charged also differ depending on the industry. OECD interviewees reported that obtaining these licenses is particularly difficult for firms in the pharmaceutical and oil and gas sectors. Under Turkmen law, all local and foreign entities operating in Turkmenistan are required to register with the Registration Department under the MFE. Before the registration is granted, an inter-ministerial commission that includes the Ministry of Foreign Affairs, the Agency for Protection from Economic Risks, law enforcement agencies, and industry-specific ministries must approve it.

Business registration is even more difficult for non-domestic companies. Foreign companies face an even stricter screening process, and encounter difficulties registering a local representative office. The commission evaluates foreign companies based on their financial standing, work experience, reputation, and perceived political and legal risks. Explanations are not provided when registration is denied (U.S. Department of State, 2022[11]).

While the Tax Committee has centralised registration, licensing, and tax payment procedures, as well as contributions to social security, these remain paper based. OECD interviewees reported that while the centralisation of procedures is a welcome step in principle, the Tax Committee has to handle many tasks beyond tax administration, which results in long waiting times and offline queues. Interviewees reported that the issuance of documents requires much more time than stated on paper and renewing a licence for a domestic business can take up to ten days, as tax officers must deal with several other tasks. The lack of online access to information also results in entrepreneurs relying on word-of-mouth to obtain information on financial incentives, programmes and amounts of social contributions.

Bid submission procedures are complex

According to OECD interviewees, companies face several obstacles related to bid submission in tenders. In the absence of digital procedures, interested organisations must submit originally stamped documents, sometimes in sealed envelopes. As such, international companies which do not have a representative office or a branch based in Turkmenistan are less likely to apply due to cumbersome administrative procedures. Local companies wishing to bid must be registered members of the Union of Industrialists and Entrepreneurs to participate in such tenders.

Firms remain subject to arbitrary interventions from the state

Investors complain that they have been discriminated against with excessive and arbitrary tax examinations, license extension denials, and customs clearance and visa issuance obstacles (U.S. Department of State, 2022[11]). In several cases, the government has insisted on maintaining a majority interest in joint ventures (JV), which firms have been reluctant to accept because of differing business cultures and conflicting management styles. Although there is no specific legislation requiring foreign investors to receive government approval to divest, in practice they are expected to co-ordinate such actions with the government. In addition, despite de jure equal treatment between domestic and foreign firms, the latter reportedly face higher tax rates than local companies (U.S. Department of State, 2022[11]).

The government should further simplify business registration procedures, and level the playing field between domestic and international firms

Streamline the registration process, clarifying the key steps and timelines

The authorities should clarify the key steps required for registration and licensing and provide those services online, including information about fees, procedures, and expected delivery. Announced waiting times for the obtention of documentation should, to the extent possible, be respected. The government should also consider reviewing the requirement to renew licenses every two years, as this is not a common practice and would significantly ease the administrative burden on firms and reduce stress on the public administration. Information could be published on the Ministry of Justice’s website as well as on the website of the Union of Industrialists and Entrepreneurs in Turkmen, Russian and English.

Improve access to regulatory information by regularly updating the government’s websites

Legislation previously available in Russian has been fully translated into Turkmen, which is a positive development since it has simplified navigation of the legal framework for local entrepreneurs. The Ministry of Justice also provided a clarification on some terms of the legislation. However, legislation should be more regularly updated online, and draft laws should be published for public consultation and comment.

Define the scope of business inspections

To improve the predictability of the operational environment for businesses, the authorities should define and restrict the number of inspections. Turkmenistan could take inspiration from Kazakhstan’s Entrepreneurial Code, which codifies allowed instances of unscheduled inspections and bans inspections motivated outside of the scope defined. The Law on the Ombudsman of Turkmenistan was adopted in 2016 and entered into force on 1 January 2017, but the office of the Business Ombudsman is still pending creation according to the government. The creation of the Business Ombudsman can help receive complaints from businesses about unfair treatment by public authorities, including repetitive audits or inspections, unreasonable fines and penalties, or threats and acts of retaliation by government officials (OECD, 2021[1]). Such complains could be integrated into an independent reporting mechanism to the authorities.

Priority 3: The operational environment for SMEs could be further boosted by trade facilitation reforms and the provision of a wider array of financial products

The post-pandemic period has provided some relief to businesses

Foreign trade has resumed thanks to the re-opening of borders

OECD interviewees mentioned the reopening of borders following the COVID-19 pandemic as a very positive development as it allowed firms to resume trade with their international partners. Borders were closed from March 2020 to spring 2022. Recent developments also show that Turkmenistan is increasingly integrating into regional trade. In August 2022, Turkmenistan agreed to jointly develop the international north-south corridor running through its territory, improve bilateral trade and transport connectivity, and simplify its visa regime (EBRD, 2023[6]). In addition, a new Trade Facilitation Portal was launched by the Ministry of Trade and Foreign Economic Relations and the International Trade Centre (ITC) in April 2023, to reduce the time and costs for trade across borders. The Portal guides businesses through import, export, and transit requirements; gives access to agreements, laws, regulations, forms, acts of inspections and other documents; as well as shares international trade statistics covering more than 25 product groups, with a focus on the agrifood sector. It should help exporting SMEs have a better access to information and support the government in its accession process to the World Trade Organisation (WTO). In addition, Turkmenistan was added to the Info Trade Central Asia Gateway which provides direct access to step-by-step guides on licenses, pre-clearance permits and clearance formalities for most goods traded within, to and from Central Asia (Info Trade Central Asia Gateway, 2023[15]).

Access to SME financing has registered some progress

Access to finance has also improved. Firms can borrow and save foreign currency in local bank accounts, as credit lines are available in both Turkmen manat and in USD. Vneshekonombank provides foreign currency loans guaranteed by the Islamic Development Bank (ISD). According to OECD interviewees, an investment loan type of product is priced at an interest rate of about 5-6%, trade-related loans at a 13%-interest rate. The number of required documents was also reviewed and streamlined, which allows for a faster application process. According to the Union of Entrepreneurs and Industrialists, the state programme on SME support for 2018-2024 has provided certain benefits to SMEs, such as land granted free of charge for up to 100 years, preferential loans, tax breaks for agricultural producers, etc. Discussions are ongoing to lift manat convertibility restrictions for products produced in free economic zones (FEZ) (U.S. Department of State, 2022[11]).

However, the business environment remains difficult to navigate

Foreign currency controls and a limited array of public financing instruments restrict firms’ access to finance

The lack of suitable legislation for financial instruments, such as the absence of capital venture funds, currency conversion, and dividend repatriation restrictions impede both domestic and foreign investment. The spread between the official and black-market exchange rates remains distortive and is being used as an import substitution subsidy, distorting competition and raising costs (EBRD, 2023[6]). Foreign investors can access Turkmen manats exclusively through equity loans from the EBRD and the Turkmen-Turkish Bank, while domestic firms have restricted access to foreign currency beyond foreign currency denominated loans. Despite their existence on paper, capital markets are not resorted to in Turkmenistan, although the 1993 Law on Securities and Stock Exchanges outlines the main principles for issuing, selling, and circulating securities. The 1999 Law on Joint Stock Societies further provides for the issuance of common and preferred stock and bonds and convertible securities in Turkmenistan, but in the absence of a stock exchange or investment company, there is no market for securities (U.S. Department of State, 2022[11]). The EBRD is currently working with local entrepreneurs to foster an early community of private investors in the country, with a product called star venture for SMEs. However, the infrastructure around it, such as an accelerator and business incubator, needs to be created.

Access to land remains restricted

Land is owned by the state. Whilst citizens have land rights, they cannot sell or mortgage land, and land rights can be transferred only through inheritance. This restricts options for firms to use land as collateral, and for the government to collect taxes on property. Foreign companies or individuals are permitted to lease land for non-agricultural purposes, upon approval of the Cabinet of Ministers, which issues the leases. There were no data available on the number of leases granted in 2021 or 2022 (U.S. Department of State, 2022[11]).

Access to finance, digitalisation and trade facilitation are areas where the government can pursue its efforts to improve the operational environment for businesses

Expand the range of available financial instruments

The banking system could be developed to offer a wider range of financial products available for firms. The government has recently started talks with international organisations to develop a national start-up ecosystem involving the development of venture capital funding with USAID. Other products such as SME lines of credit for longer tenors, the provision of partial credit guarantees, or leasing could be provided to SMEs by financial institutions in Turkmenistan. Such products would allow firms to rely less on their own funds and retained earnings to finance operations. At the macro-level, improving financial inclusion can drive employment, productivity gains and tax collection (IMF, 2019[16]).

Expand digital infrastructure

Whilst interviewees mentioned that internet speed has slightly increased, it remains the world’s slowest (0.77 Mbps) and the most expensive in Central Asia, at an average fixed broadband monthly cost of USD 45.80 (Cable.co.uk, 2023[17]). An area for further improvement includes the development of the digital infrastructure, as unreliable Internet access, slow download and upload speeds hinder business development, especially in rural areas, which may not have access to the internet altogether. Such a development should go together with the implementation of the government’s strategy for digital transformation, which includes the development of e-government services. When upgrading its digital infrastructure, policymakers should be mindful of inclusive access in rural areas, as digital access gaps are strongly associated with gaps in productivity, scaling up, innovation and growth, which contribute to inequalities among firms, and, in turn, people and places (OECD, 2022[18]).

Capitalise on the Middle Corridor’s renewed interest to facilitate trade

Turkmenistan can seize the opportunity of the renewed interest in the Middle and Southern Corridors to address transport and logistics bottlenecks, and attract investment in pipelines, railways, roads, sea transport, and logistics infrastructure (EBRD, 2023[6]). The opportunity to play a more central role in serving trade between China, Iran, Central Asia, Türkiye and southern Europe could lead to a gradual modernisation of the country’s transport networks and logistics capabilities, including border management. The government should conduct trade facilitation reforms to reduce border crossing times in tandem with an infrastructure development plan, to ensure that better infrastructure use can capitalise on smoother trade procedures (OECD, forthcoming[19]). Turkmenistan has started work with the OECD to join the OECD Trade Facilitation Indicators database (OECD, forthcoming[20]).

References

[8] ADB (2023), Turkmenistan - Asian Development Outlook April 2023, https://www.adb.org/sites/default/files/publication/863591/tkm-ado-april-2023.pdf (accessed on 27 July 2023).

[3] BTI Transformation Index (2022), BTI 2022 Country Report - Turkmenistan, https://bti-project.org/en/reports/country-report/TKM#pos8.

[17] Cable.co.uk (2023), Global Broadband Pricing League Table 2023, https://www.cable.co.uk/broadband/pricing/worldwide-comparison/#speed (accessed on 21 July 2023).

[6] EBRD (2023), Country Assessments Turkmenistan, https://2022.tr-ebrd.com/.

[9] EBRD (2023), Regional Economic Prospects - Getting By: high inflation weighs on purchasing power of households.

[7] EIU (2023), Country Report Turkmenistan 3rd Quarter 2023, https://country.eiu.com/turkmenistan (accessed on 21 July 2023).

[5] EIU (2022), Country Report Turkmenistan 1st Quarter 2022, http://www.eiu.com/FileHandler.ashx?issue_id=1251756108&mode=pdf (accessed on 24 July 2023).

[4] IMF (2023), World Economic Outlook Database, April, https://www.imf.org/en/Publications/WEO/weo-database/2023/April.

[16] IMF (2019), Financial Inclusion of Small and Medium-Sized Enterprises in the Middle East and Central Asia, https://www.imf.org/en/Publications/Departmental-Papers-Policy-Papers/Issues/2019/02/11/Financial-Inclusion-of-Small-and-Medium-Sized-Enterprises-in-the-Middle-East-and-Central-Asia-46335 (accessed on 21 July 2023).

[2] IMF (2019), IMF Staff Concludes Staff Visit to Turkmenistan, https://www.imf.org/en/News/Articles/2019/11/14/pr19414-turkmenistan-imf-staff-concludes-staff-visit (accessed on 21 July 2023).

[15] Info Trade Central Asia Gateway (2023), Central Asia Gateway: Connect Central Asia and international markets, https://infotradecentralasia.org/?utm_source=Sarbacane&utm_medium=email&utm_campaign=1st%20%20Edition%20%20-%20ENG%20%202023%20Ready4Trade (accessed on 24 July 2023).

[13] Kazakh Invest (2022), Government Considers Results of Activities of KAZAKH INVEST in 2021, https://wkr.invest.gov.kz/media-center/press-releases/v-pravitelstve-rassmotreli-itogi-deyatelnosti-kazakh-invest-v-2021-godu/ (accessed on 27 July 2023).

[10] Ministry of Justice (2023), Turkmenistanyn Adalat Ministrligi, https://minjust.gov.tm/ (accessed on 21 July 2023).

[18] OECD (2022), Key Messages - EMnet Working Group on Digital Transformation in Emerging Markets 2022, https://www.oecd.org/dev/Key_Messages_EMnet_WorkingGroup_DigitalTransformation_EmergingMarkets.pdf (accessed on 21 July 2023).

[1] OECD (2021), Improving the Legal Environment for Business and Investment in Central Asia, OECD Publishing, https://www.oecd.org/eurasia/Improving-LEB-CA-ENG%2020%20April.pdf.

[12] OECD (2020), Investment Promotion in Eurasia: A Mapping of Investment Promotion Agencies, OECD Publishing Paris, https://www.oecd.org/eurasia/competitiveness-programme/Investment-Promotion-in-Eurasia-A-Mapping-of-Investment-Promotion-Agencies-ENG.pdf.

[19] OECD (forthcoming), Realising the Trade Potential of the Middle Corridor.

[20] OECD (forthcoming), Trade Facilitation in Central Asia.

[11] U.S. Department of State (2022), 2022 Investment Climate Statements: Turkmenistan, https://www.state.gov/reports/2022-investment-climate-statements/turkmenistan/.

[14] World Bank (2019), Enforcing Contracts, https://subnational.doingbusiness.org/en/data/exploretopics/enforcing-contracts/good-practices (accessed on 21 July 2023).

Unvalid