This chapter gives an overview of the performance of the overall economy, macroeconomic developments and challenges, and the governance and institutions. Macroeconomic policy environment

Innovation, Agricultural Productivity and Sustainability in Latvia

Chapter 3. Economic stability and quality of institutions in Latvia

Abstract

3.1. Overall economic performance and medium-term growth prospects

Latvia is a small open economy located in the Baltic region of northern Europe. Latvia has been a member of the European Union since 2004, of the Eurozone since 2014 and of the OECD since 2016.

In the 1990s, Latvia’s economy went through a major economic downturn as it transitioned to a market economy (OECD, 2015). After its accession to the European Union in 2004, the economy of Latvia grew by more than 10% annually until 2007. The subsequent period was one of recession caused by an unsustainable current account deficit, the collapse of the real estate market and the large debt exposure in the midst of a global financial crisis. Since 2010, the situation has improved and Latvia’s economic growth has resumed (OECD, 2017a).

Economic reforms have progressed and Latvia appears to be the country which has taken most action on structural reform priorities and ranks first on the reform responsiveness indicator in the 2017 OECD “Going for growth” (OECD, 2017b). Latvia has adapted to the challenging international environment caused by the Russian Federation ban on EU exports. The current account balance has improved since the 2008 pre-crisis level (OECD, 2017a). The 2017 economic survey of Latvia notes the country’s recovery from the global crisis and highlights opportunities for public action to achieve better convergence in living standards and more inclusive growth (Box 3.1 summarises the main findings of the OECD Economic Surveys: Latvia 2017).

Government finances are solid and government expenditure is low (Table 3.1). The government debt-to-GDP ratio stood at 40.6% in 2016, lower than in many OECD countries. Under the National Development Plan 2014-20 (NDP 2020) a tax reform is underway until 2018, by which tax revenues are planned to be increased to 30% of GDP, the size of the shadow economy reduced and the efficiency of the State Revenue Service improved (Annex 3.A).

Table 3.1. Latvia’s key macroeconomic indicators and their projections

|

|

2014 |

2015 |

2016 |

2017 (e) |

2018 (e) |

2019 (e) |

|---|---|---|---|---|---|---|

|

Indicators |

EUR billion current prices |

Percentage changes, volume (2010 prices) |

||||

|

GDP at market prices |

23.6 |

3.0 |

2.2 |

4.6 |

4.1 |

3.6 |

|

Real private consumption expenditure |

14.5 |

2.5 |

3.3 |

4.1 |

4.1 |

3.9 |

|

Government final consumption expenditure |

4.1 |

1.9 |

2.7 |

4.1 |

3.4 |

2.8 |

|

Memorandum items: |

||||||

|

General government financial balance (% of GDP) |

-1.4 |

0.1 |

-0.5 |

-0.9 |

-0.9 |

|

|

Current account balance (% of GDP) |

-0.5 |

1.4 |

-0.8 |

-0.9 |

-1.9 |

|

|

Exchange rate, EUR per USD |

0.9 |

0.9 |

0.9 |

0.8 |

0.8 |

|

|

Consumer price index, harmonised index 2010 |

0.2 |

0.1 |

2.9 |

2.6 |

2.6 |

|

|

Unemployment rate (% of labour force) |

9.9 |

9.6 |

8.7 |

7.9 |

7.7 |

|

|

General government gross debt (% of GDP) |

46.6 |

50.5 |

48.4 |

48.1 |

47.9 |

|

Note: (e) Underlying assumptions of the projections are described in Annex A.1 of the Source report.

Source: OECD (2018a), “Latvia”, in OECD Economic Outlook, Volume 2018 Issue 1, https://doi.org/10.1787/eco_outlook-v2018-1-31-en.

Income and productivity are below levels in high income OECD countries. Emigration continues but has slowed. The young and qualified account for more than half of emigrants.

Unemployment has gradually fallen from a peak 20% in 2010 to 8.7% in 2017 (CSB, 2017) and the OECD forecasts its continued decline (Table 3.1). The OECD finds that Eastern rural areas contribute the most to unemployment lasting for more than one year. The high long-term unemployment in rural areas contributes to higher poverty. Furthermore, the OECD foresees that the high operating costs of second pillar private pension funds will lower living standards for today’s workers when they retire (OECD, 2017a).

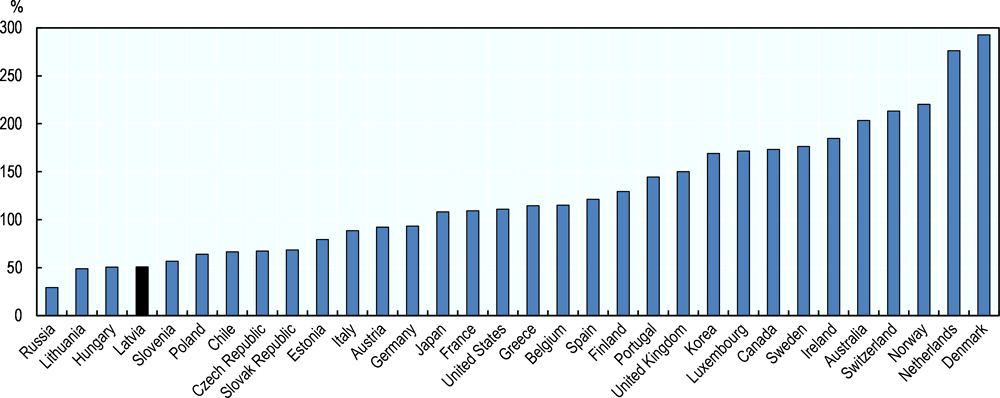

Wages have increased since 2011 (CSB, 2016). Household consumption is robust and household debt as a share of net disposable income has decreased from 89.2% in 2010 to 52% in 2015, ranking lowest in OECD economies (Figure 3.1). Private consumption is expected to contribute the most to Latvia’s demand-led economic growth in the medium term (MoF, 2015; OECD, 2017a).

Figure 3.1. Household debt, 2015

Source: OECD (2018b), Household debt (indicator), https://data.oecd.org/hha/household-debt.htm.

Box 3.1. Main findings of the OECD Economic Surveys: Latvia 2017

The survey notes a robust economic growth, progress in structural reforms, lower, yet high, unemployment, rising wages, solid government finance, financial markets confidence and low private indebtedness as well as good environmental outcomes. It also notes a low level of R&D, weak innovation activity and a high productivity gap with more advanced economies, continuous youth emigration and a wide informal sector.

The survey notes that, despite improved performance, Latvia’s skill shortage and weak innovation capacity confine exports to low value-added goods. It finds higher productivity and higher wages in firms that are integrated in GVCs and recommends addressing the skill mismatch and widespread informality through policies that encourage capital and labour flow to firms with high growth potential, for example, through better allocation of credit and mobility of workers.

The survey finds that widespread poverty is sustained by high long-term unemployment, weak social safety nets and high labour taxes for workers on low pay. It underlines local differences in unemployment and poverty, which are much higher in the eastern rural areas. Furthermore, transport and access to health care are also more limited in rural areas.

The survey recommends to mobilise additional government spending to improve low-income households’ access to housing, to health care and to education and training, for example with grants and income support to vocational and university students from low-income families.

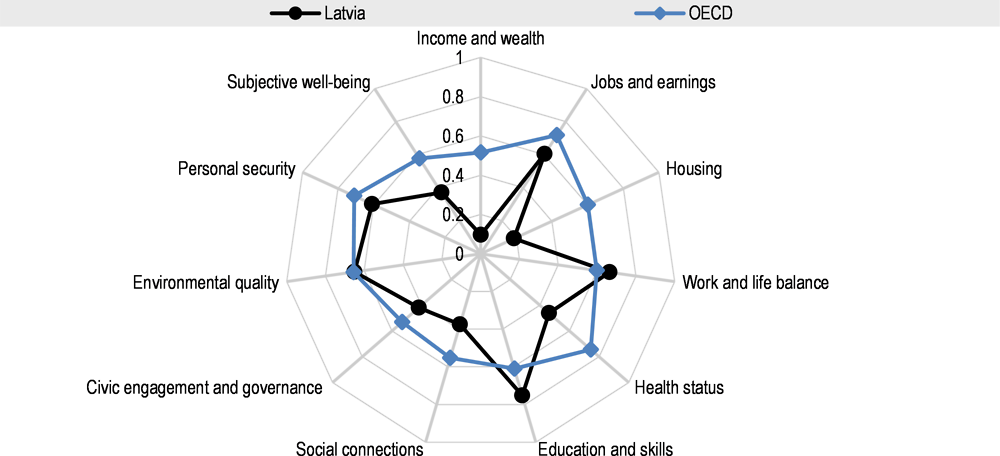

OECD Well Being indicators rank Latvia above the OECD average for Education and skills and Work and life balance, and close to the OECD average for environmental quality and Jobs and earnings (Figure 3.2). But Latvia ranks well-below average in terms of Housing, Health status and Income and wealth.

Figure 3.2. Latvia’s Well Being indicators

Note: Each well-being dimension is measured by one to four indicators from the OECD Better Life Index database. Normalised indicators are averaged with equal weights. Indicators are normalised to range between 1 (best) and 0 according to the following formula: (indicator value – minimum value)/(maximum value – minimum value). "Civic engagement and governance" includes two indicators: stakeholder engagement for developing regulations and voter turnout.

Source: OECD (2016), “OECD Better life index”, in OECD Economic Surveys: Latvia 2017.

Box sources: OECD (2017a), OECD Economic Surveys: Latvia 2017; Yashiro et al. (2017) “Moving up the global value chain in Latvia”, OECD Economics Department Working Papers, No. 1438, http://dx.doi.org/10.1787/3a486c5e-en.

As a small and open economy, Latvia is exposed to developments in neighbouring economies – the European Union and also to a smaller extent the Russian Federation. While exports of goods to the United Kingdom have grown in 2016 and 2017, the decision of the United Kingdom to leave the European Union may affect both export prospects in the medium term and return migration. Latvia has successfully diversified its export products and destinations to compensate for the drop in exports to the Russian Federation (OECD, 2017a). Traditional bioeconomy sectors; agriculture, forestry, fishery, food, and wood processing1 accounted for 57% of the total value added by the primary and secondary sectors2 in 2014 and made up 56% of the value of all exported goods in 2016, this share is 40% when deducting re-exports (Eurostat, 2017).

Government measures for promoting economic growth and jobs

Latvia’s fiscal deficit has declined from 1% of GDP in 2015 to 0.7% in 2017 and while the government has kept a strict cap on spending and fiscal deficit objectives, the 2015 economic survey of Latvia, taking into account the low-interest environment, had made the case for a deficit of 1.5% of GDP to increase government spending on investments in economic and social infrastructures which boost inclusive growth without raising the debt-to-GDP ratio (OECD, 2015). The 2017 Survey reinforced the point and noted that social spending is low and not targeted to the poorest (OECD, 2017a).

In this overall context, the government has identified the following priority directions for development:

Increase the share of state defence funding to 2% of GDP in 2020.

Promote the sustainable and balanced development of sectors and continue to revise tax load on labour.

Reduce income inequality through adjustments to taxation, to minimum wage and social allowances for dependent persons and families with children.

Increase tax revenue up to one-third of GDP mainly through improved tax collection.

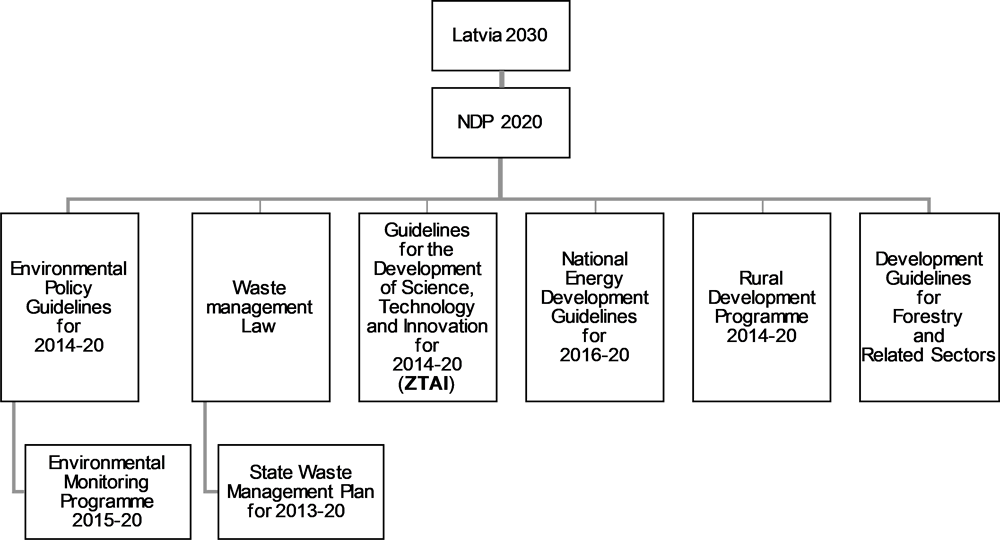

The NDP 2020 operationalises these priority directions through the following three vectors for development: Economic growth, Population welfare, and Development and regional growth. It is implemented by government ministries to address objectives as diverse as improving the transport infrastructure and facilitating access to higher education or reducing out of pocket health care payments. The Plan also funds transitional state aid and investment promotion measures in agriculture as well as activities to combat the shadow economy (MoF, 2015) (Annex Figure 3.A.1).

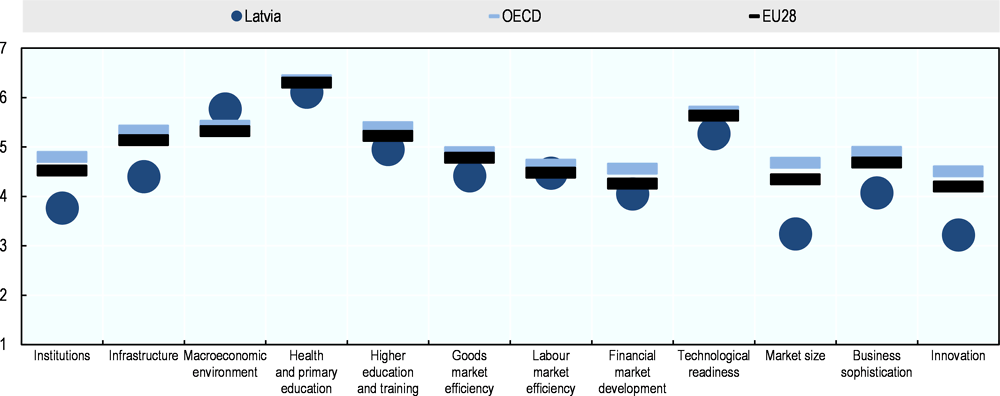

Main components of global competitiveness

Based on the World Economic Forum’s (WEF) aggregate Global Competitiveness Index (GCI) for 2017/18, Latvia ranked 54th among 138 countries. While Latvia’s rank has declined compared to previous evaluations, the macroeconomic environment indicators have improved and are higher than the EU28 average (Figure 3.4).

In terms of business sophistication, Latvia is behind its neighbours Lithuania and Estonia as well as the OECD average and the gap is widening. While participation in global value chains (GVCs) has improved, the share of companies that participate in knowledge-intensive sectors remains low. Skill mismatch and widespread informality prevent firms from moving up the GVCs. The share of domestic value embodied in foreign final demand is lower than in neighbouring Lithuania and Estonia and significantly lags behind the OECD average (Yashiro et al., 2017; Benkovskis et al., 2017)

Latvia’s 4th rank on “Flexibility of wage determination” highlights workers’ mobility across economic activities at low cost and wage flexibility. The indicator may merely reflect the labour forces’ low level of skills and may deteriorate with the generalisation of the minimum wage (Chapter 5).

Latvia’s score in innovation (83rd place) remains low and the productivity gap vis-a-vis high-income countries increases. According to Eurostat, Latvia’s gross domestic expenditure on research and development (R&D) in 2015 was one of the lowest (0.6%) in the European Union; the EU28 average was 2% (Eurostat, 2017). Another factor limiting the innovation performance of Latvian firms is the low co-operation between businesses and higher education and research institutions (Chapter 7).

Recent policy initiatives aim to foster co-operation between research institutions to develop new products. The EU-funded Applied Research Grants programme, the Post-doctoral Research Grants programme and the support programme for the Modernisation of Higher Education and Research Infrastructure are also mobilised to improve innovation. Steps have also been taken to stimulate mobility of workers between the private and the public sector (OECD, 2017a). Initiatives are also in place to foster co-operation between research and food producers and processors.

Compared to the EU28 and OECD averages, Latvia’s overall performance in global competitiveness can be improved (Figure 3.3). Considering Latvia’s small domestic market and limited innovation infrastructures this can be achieved by better integration in Global Value Chains as recommended by Yashiro et al. (2017).

Figure 3.3. Global Competitiveness Index: All components, 2017-18

Note: Indices for EU28 and OECD are the simple average of member-country indices.

Source: WEF (2017), The Global Competitiveness Report 2017-2018: Full data Edition, http://reports.weforum.org/global-competitiveness-index-2017-2018/.

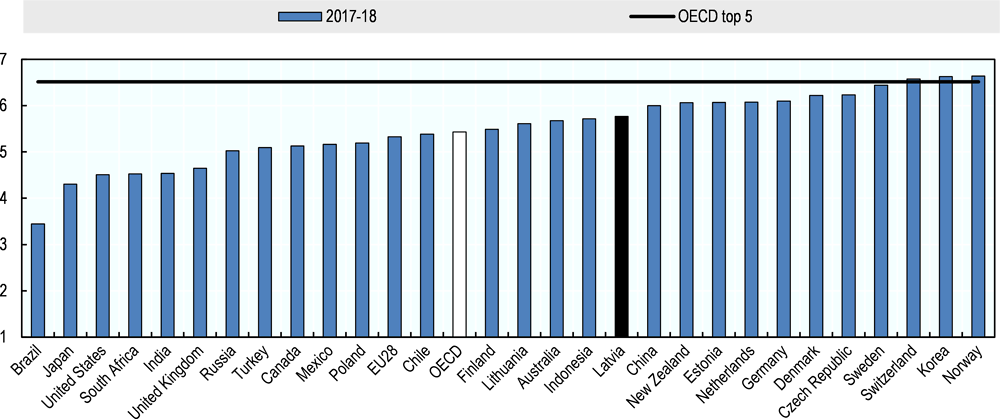

When considering the components of “Macroeconomic environment”, the Global Competitiveness Index’s 3rd pillar, Latvia’s performance is high and stable. It exceeds both the EU28 and OECD averages, although it is below the OECD top 5 performers (Figure 3.4).

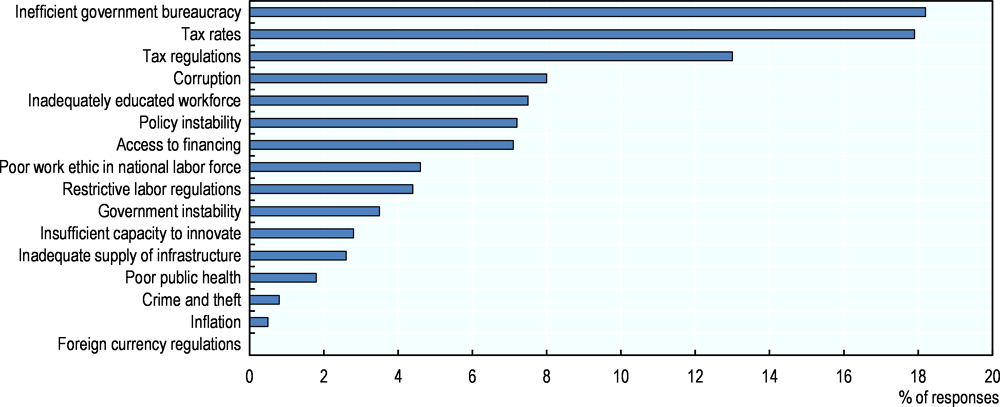

According to WEF GCI, inefficient government bureaucracy, tax rates and tax regulations are the most problematic factors for doing business in Latvia (Figure 3.5). The NDP 2020 aims to reduce red tape, to contain the informal economy from 24% of GDP in 2015 to 21% of GDP in 2018 (MoF, 2017), to ensure a predictable tax system, to improve the operation of the judicial system and to increase the efficiency of state administration (Annex Figure 3.A.1). The 2017 economic survey of Latvia also made several recommendations to combat the informal economy and to improve the enforcement of tax law (OECD, 2017b).

Figure 3.4. Global Competitiveness Index: Macroeconomic environment, 2017-18

Note: Indices for EU28 and OECD are the simple average of member-country indices. OECD top 5 refers to the average of the scores for the top 5 performers among OECD countries (Norway, Korea, Switzerland, Sweden and Luxembourg).

Source: WEF (2017), The Global Competitiveness Report 2017-2018: Full data Edition, http://reports.weforum.org/global-competitiveness-index-2017-2018/.

Figure 3.5. Most problematic factors for doing business, 2017-18

Note: From the list of factors, respondents to the World Economic Forum’s Executive Opinion Survey were asked to select the five most problematic factors for doing business in their country and to rank them between 1 (most problematic) and 5. The score corresponds to the responses weighted according to their rankings.

3.2. Governance and quality of public institutions

Governance consists of the traditions and institutions by which authority in a country is exercised. In the early 1990s, Latvia experienced an unprecedented change from a planned economy to a market-oriented one. Basic institutions of a market economy and monetary stability were established by the mid-1990s. Despite serious regional economic (1998) and global financial (2007-08) crises, today, while there is room for improvement, Latvia’s governance performance is significantly better than the average of its regional neighbours in non-OECD countries.

Regulatory process, transparency, clarity and predictability of governance and institutions

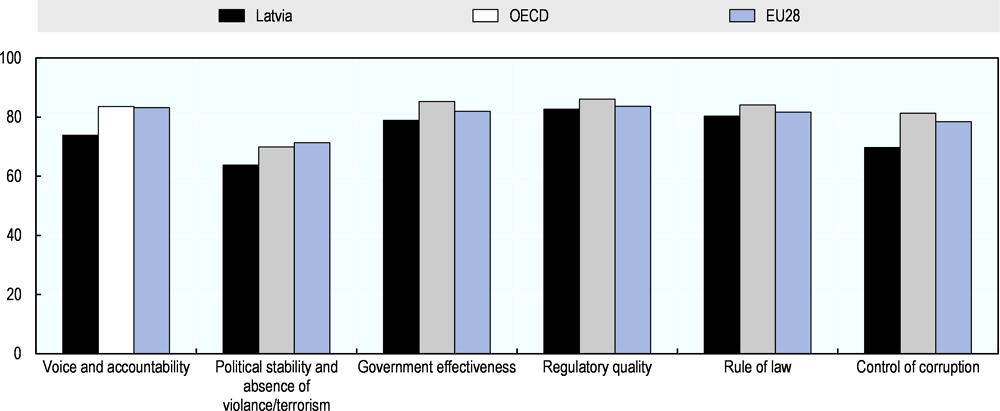

The World Bank (WB) Worldwide Governance Indicators (WGI) include six broad dimensions of governance, namely voice and accountability; political stability and absence of violence and terrorism; government effectiveness; regulatory quality; rule of law; control of corruption.

Overall, Latvia’s performance in the six dimensions of the WGI is above average (Figure 3.6). According to the WGI, Latvia ranks quite well in the quality of public institutions with the highest – 83 (percentile rank 0 to 100) ‑ in “Regulatory quality”, which captures perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development. Latvia scores lowest (64) in “Political stability and absence of violence/terrorism”, which measures perceptions of the likelihood of political instability and/or politically motivated violence, including terrorism.

Figure 3.6. Worldwide Governance Indicators: Components, 2017

Source: World Bank (2018), World Bank’s Worldwide Governance Indicators, http://info.worldbank.org/governance/wgi/index.aspx#reports.

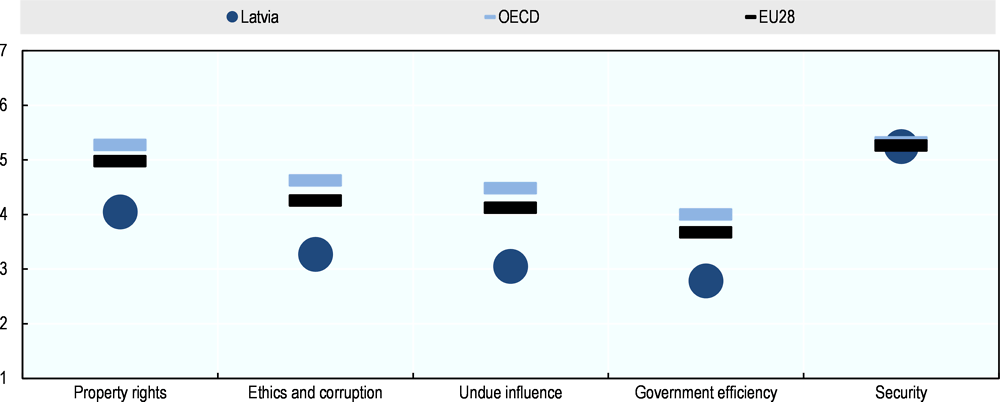

The legal and administrative framework within which individuals, firms, and governments interact has a strong bearing on competitiveness and growth. Figure 3.7 shows the performance on the five components of the “Index of public institutions” in Latvia, OECD average and EU28. Latvia’s “Government efficiency” scores lowest (2.8 on a 7-points scale). The efficiency of the legal framework in settling disputes and challenging regulations is the weakest component and points to the necessity of improvements. Also, “Undue influence” (3.1 on a 7-point scale) resulting from the low judicial independence and favouritism in decisions of government officials indicates that regulatory processes in Latvia need to be more consistent and predictable. These points were also highlighted in the 2017 economic survey of Latvia recommendations as a means to ensure the independence and expertise of the judicial system (OECD, 2017b).

Compared to the OECD and EU28 averages, Latvia’s score for public institution GCI is rather low. Despite the Public Administration Reform Plan 2020 introduced in 2017 (MK, 2017), and a broad range of reform initiatives to strengthen the judicial system, trust in public institutions is generally low in Latvia (World Economic Forum, 2017).

Figure 3.7. Global Competitiveness Index: Public institutions index by components, 2017-18

Notes: Indices for EU28 and OECD are the simple average of member-country indices.

1) Property rights refers to the average of the indices: Property rights and Intellectual property protection. 2) Ethics and corruption refers to the average of the indices: Diversion of public funds, Public trust in politicians and Irregular payments and bribes. 3) Undue influence refers to the average of the indices for: Judicial independence and Favouritism in decisions of governmental officials. 4) Government efficiency refers to the average of the indices for: Wastefulness of government spending, Burden of government regulation, Efficiency of legal framework in settling disputes, Efficiency of legal framework in challenging regulations and Transparency of government policymaking. 5) Security refers to the average of the indices for: Business costs of terrorism, Business costs of crime and violence, Organized crime and Reliability of police services.

Source: WEF (2017), The Global Competitiveness Report 2017-2018, Full Data Edition, http://reports.weforum.org/global-competitiveness-index-2017-2018/.

Environmental and natural resources concerns in institutions and the decision making process

One of the priorities of the Ministry of Environmental Protection and Regional Development (MoEPRD) is the effective use of natural resources. In 2016, the rates of Natural Resource Tax (NRT) were increased by 20-100% compared to the previous year to encourage more efficient use of natural resources. In 2017-20, it is planned to further increase NRT on waste disposal thus promoting waste sorting and recycling.

Public procurement accounts for 20% of GDP. The environmental and natural resources’ sustainability of institutions are part of Latvia’s Green public procurement plan (GPP) since 2014 – a process whereby public authorities evaluate and take into account life-cycle costs when procuring specific groups of products, services and works (MoEPRD, 2015a). Green public procurement accounted for 19% of all public procurements in 2015, however it decreased to 13-14% in 2016 and 2017. In July 2017, the plan was amended to extend the scope of mandatory application of GPP requirements and criteria3 (MoEPRD, 2018).

The promotion of GPP in Latvia is part of policy planning documents such as the Sustainable Development Strategy of Latvia until 2030 which provides that state and local government procurement tender criteria should include energy efficiency and product life-cycle analysis considerations and the NDP 2020 that requires a wider provision of energy-efficient and ecological products and services in public procurement. The promotion of GPP is one of the environmental policy targets under the Environment Policy Guidelines 2014-20 developed by the MoEPRD (MoEPRD, 2015b).

Mechanisms for ensuring policy coherence and transparency

By joining the Open Government Partnership (OGP) in 2011, Latvia committed to promoting clearly identifiable administrative, legal and public change through shaping and strengthening a people-friendly, effective, open and fair public administration in the country. Latvia is currently one of 75 countries participating in this initiative. Currently Latvia’s OGP’s third National Action Plan is proceeding. The plan was developed with contributions from public institutions, civil society and other partners in a process led by the State Chancellery. It promotes the open government values – transparency, accountability, public participation and use of technologies and innovations. Twelve commitments contribute to open, responsible and inclusive public institutions. The plan gives priority to transparency and awareness of the state and local government budget expenditures, to openness in the management of public corporations, to developing a socially inclusive portal for legal drafting, to publicity in the field of public procurement, to increased understanding of lobbying and openness of lobbying in state institutions and to the implementation of the values and ethical principles of state administration.

The NDP 2020, the Government Action Plan, the Guidelines for the Corruption Prevention and Combating 2015-2020, the Information Society Development Guidelines for 2014-20, the National Identity, Civil Society and Integration Policy Guidelines for 2012–18 and other relevant national level planning documents contribute to the implementation of OGP objectives (The State Chancellery of Latvia, 2016 and 2017).

Although the role and influence of Latvia’s civil society in decision-making have considerably increased since 2011, they are not yet considered as sufficient or satisfying to all stakeholders.

3.3. Summary

Latvia’s macroeconomic performance is stable and exceeds EU28 and OECD averages. It is characterised by solid government finances, financial markets’ confidence and low private indebtedness as well as good environmental outcomes.

The budget is balanced and public debt is one of the lowest in the European Union. The introduction of the euro has reduced the risk of currency fluctuations.

Reforms aimed at effective public administration are underway and the 2017 “Going for Growth” reform indicator has ranked Latvia as a top reformer, which confirms the positive trend in the overall development of the country.

Membership of the European single market widens market opportunities for Latvian businesses.

Low innovation capacity and business sophistication are intertwined with continuous emigration, mostly of the youth, and a wide informal sector. These factors influence the medium-term productivity and competitiveness of Latvia.

Rural areas have higher unemployment, higher poverty and less developed transport infrastructure and access to health care than urban areas.

Overall governance indicators in Latvia comply with the requirements of a modern state. The quality of public institutions in Latvia slightly lags behind the EU28 and OECD averages mainly due to a less efficient legal framework.

Since 2011 Latvia’s government is striving to improve the quality of public institutions. Efforts are ongoing and progress is observed.

References

Benkovskis, K. et al. (2017), “Export and productivity in global value chains: Comparative evidence from Latvia and Estonia”, OECD Economics Department Working Papers, No. 1448, OECD Publishing, Paris, http://dx.doi.org/10.1787/cd5710c4-en.

CSB (2017), Employment and Unemployment – Key Indicators, http://www.csb.gov.lv/en/statistikas-temas/employment-and-unemployment-key-indicators-30679.html (accessed 10 October 2017).

CSB (2016), Economy of Latvia, Macroeconomic review #69; 2016-4. “Latvijas tautsaimnieciba. Makroekonomiskais apskats” #69; 2016-4, https://www.em.gov.lv/files/tautsaimniecibas_attistiba/makro/makro_69.pdf (accessed 10 October 2017).

Eurostat (2017), Europe 2020 indicators - R&D and innovation, http://ec.europa.eu/eurostat/statistics-explained/index.php/File:Gross_domestic_expenditure_on_R_%26_D_by_sector,_2015_(%25_of_GDP)_YB17.png (accessed 16 October 2017).

MK (2017), “Public Administration Reform Plan 2020”, http://www.mk.gov.lv/sites/default/files/editor/public-administration-reform-plan-2020_.pdf .

MoEPRD (2018), Green Public Procurement English webpage, http://www.varam.gov.lv/eng/darbibas_veidi/green_public_procurement/?doc=21165 (accessed 22 October 2018).

MoEPRD (2015a), Zaļā iepirkuma veicināšanas plāns 2015.–2017. gadam (Green Procurement Plan 2015-17), http://polsis.mk.gov.lv/documents/5126 (accessed 10 October 2017).

MoEPRD (2015b), Environment Policy Guidelines 2014-20.

MoF (2017), Tax Reform in Latvia, http://www.fm.gov.lv/en/s/taxes/ (accessed 4 December 2017).

MoF (2015), “State Budget in Brief 2015-2017”, http://www.fm.gov.lv/files/valstsbudzets/2015/Valsts%20konsolidetais%20budzets%20isuma_2015_ENG04.2015.pdf (accessed 10 October 2017).

OECD (2018a), “Latvia”, in OECD Economic Outlook, Volume 2018 Issue 1, OECD Publishing, Paris, https://doi.org/10.1787/eco_outlook-v2018-1-31-en.

OECD (2018b), Household debts statistics, OECD.Stat, https://data.oecd.org/hha/household-debt.htm.

OECD (2017a), OECD Economic Surveys: Latvia 2017, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-lva-2017-en.

OECD (2017b), Economic Policy Reforms. Going for Growth, 2017, http://www.oecd.org/eco/goingforgrowth.htm (accessed 10 October 2017).

OECD (2017c), OECD Economic Outlook, Volume 2017 Issue 1, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_outlook-v2017-1-en.

OECD (2015), OECD Economic Surveys: Latvia 2015, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264228467-en.

State Chancellery of Latvia (2017), Discussion Document for the Third National Open Governance Action Plan of Latvia from 01.07.2017 until 30.06.2019 “Diskusiju dokuments par treso nacionalo atvertas parvaldibas ricibas planu laikam no 01.07.2017 lidz 30.06.2019”, http://www.mk.gov.lv/sites/default/files/editor/ogp_3.plans_diskusiju_dokuments_25.05.2017.pdf (accessed 10 October 2017).

State Chancellery of Latvia (2016), “Second National Action Plan of Latvia 01.07.2015 – 30.06.2017”, http://www.mk.gov.lv/sites/default/files/editor/ogp_2_plans_aktualizets_05.12.2016_eng_clean.pdf (accessed 10 October 2017).

WEF (2017), “The Global Competitiveness Report 2017-2018”, http://reports.weforum.org/global-competitiveness-index-2017-2018/countryeconomy-profiles/#economy=LVA (accessed 10 October 2017).

Yashiro, N. et al. (2017), “Moving up the global value chain in Latvia”, OECD Economics Department Working Papers, No. 1438, OECD Publishing, Paris, http://dx.doi.org/10.1787/3a486c5e-en.

Annex 3.A. Institutional Background

Annex Figure 3.A.1. Legislative framework and domestic policy instruments of relevance to innovation in agriculture and food sector

Source: Based on background report prepared by LLU.