This chapter reviews general incentives for firm-level investments, stemming from regulations governing entrepreneurship, access to natural resources and products and processes, and policies related to trade, investment, finance and taxation.

Innovation, Agricultural Productivity and Sustainability in Latvia

Chapter 4. General incentives for investment in Latvia

Abstract

4.1. Regulatory environment

The overall regulatory environment establishes basic conditions within which all firms, including farms, input suppliers and food companies, operate and make investment decisions. Competitive conditions in domestic markets, including low barriers to entry and exit, can encourage innovation and productivity growth, including through their impact on structural change. Regulations may also enable or impede knowledge and technology transfer directly, contributing to more or less innovation, including in sustainability-enhancing technologies (OECD, 2015).

Regulatory environment for entrepreneurship

The government of Latvia endeavours to develop an “Outstanding Business Environment” as a strategic objective of the NDP 2020 (Annex Box 4.A.1) (National Development Plan 2014-20, 2012). This overall strategic objective has been interpreted as reduced red tape, reduced share of the informal economy and reduced corruption, improvement of the operation of the judicial system and increased efficiency of state administration (Cross-Sectoral Coordination Centre, 2012).

At the same time, the Ministry of Economy’s Action Plan for Enhancing the Environment for Entrepreneurship encompasses various measures aimed at enhancing the environment for entrepreneurship (MK, 2017). The plan is developed in co-operation with the Employers’ Confederation of Latvia, the Latvian Chamber of Commerce and Industry, the Foreign Investors Council and sectoral ministries.

The Action plan reports on progress made, with a declared objective to improve Latvia’s score in the World Bank’s Doing Business1 indicators. Latvia ranked 19th among 190 countries in 2018 (Table 4.1), and 8th among EU Member States with regard to the business environment for entrepreneurs. While Latvia scores best performer for import procedures, average best performances were noted with regard to getting credit and paying taxes. As part of the “Law on Credit Bureaus” adopted in 2015, credit information bureaus contribute to the availability of credit information and credit risk management in Latvia (Law on Credit Bureaus, 2015).

Table 4.1. Latvia’s ranking in the World Bank’s Ease of Doing Business, 2018

|

Topics |

DB 2018 Rank |

|---|---|

|

Overall score |

19 |

|

Starting a Business |

21 |

|

Dealing with Construction Permits |

49 |

|

Getting Electricity |

62 |

|

Registering Property |

22 |

|

Getting Credit |

12 |

|

Protecting Minority Investors |

43 |

|

Paying Taxes |

13 |

|

Trading across Borders |

25 |

|

Enforcing Contracts |

20 |

|

Resolving Insolvency |

53 |

Note: The rank indicates Latvia’s position from 1 (easiest) to 190 (most difficult).

Source: World Bank (2016), Doing Business 2018: Reforming to create jobs, www.doingbusiness.org/~/media/WBG/DoingBusiness/Documents/Annual-Reports/English/DB2018-Full-Report.pdf.

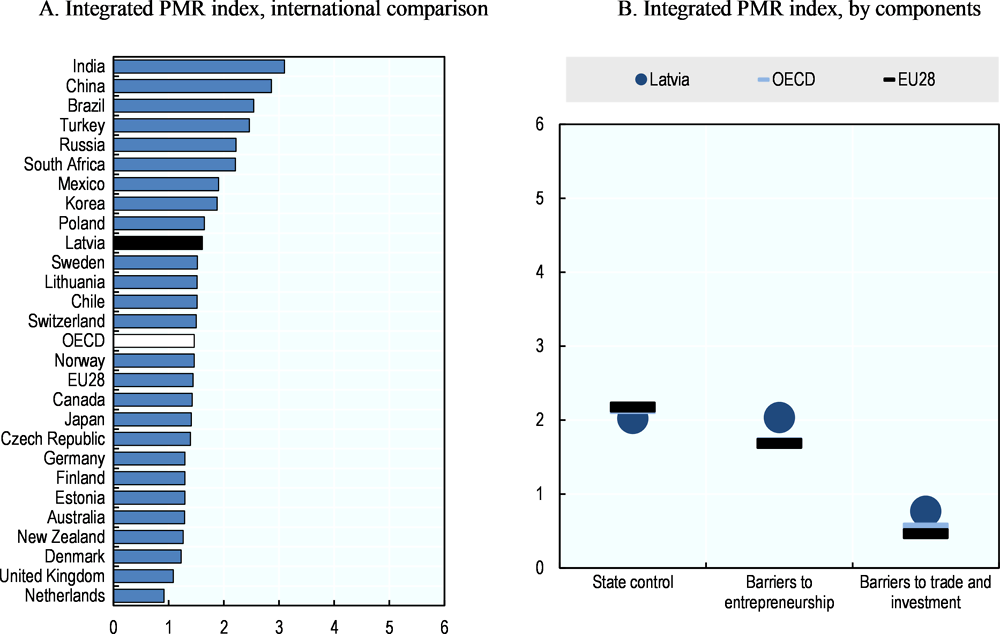

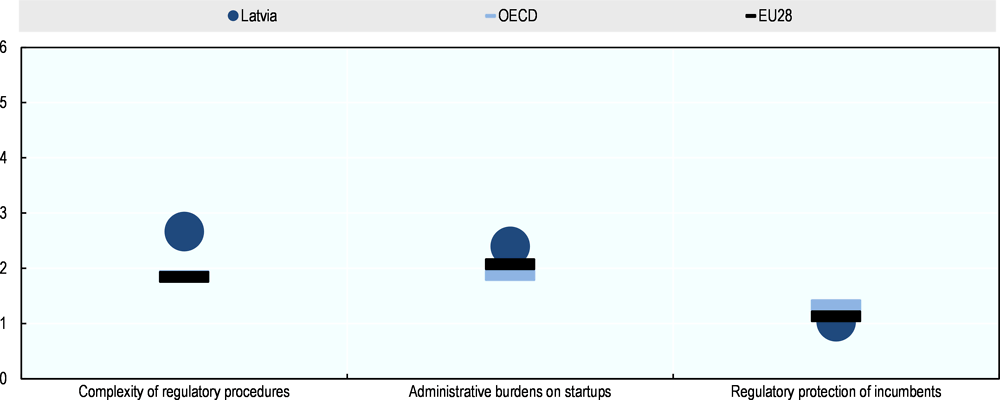

According to the OECD Product Market Regulation indicator (PMR), Latvia’s overall level of restrictiveness on key regulations is slightly higher than OECD and EU28 averages (Figure 4.1, Panel A). In 2013, state control at 2.02 was below the OECD average of 2.16, whereas barriers to entrepreneurship and barriers to trade and investment in Latvia, respectively at 2.03 and 0.77, were higher (more restrictive) than the OECD averages of 1.69 and 0.54 (Figure 4.1, Panel B).

Latvia’s regulatory protection of incumbents is less restrictive than both the OECD and EU28 averages, whereas the regulatory procedures and administrative burden on start-ups are higher in Latvia (Figure 4.2).

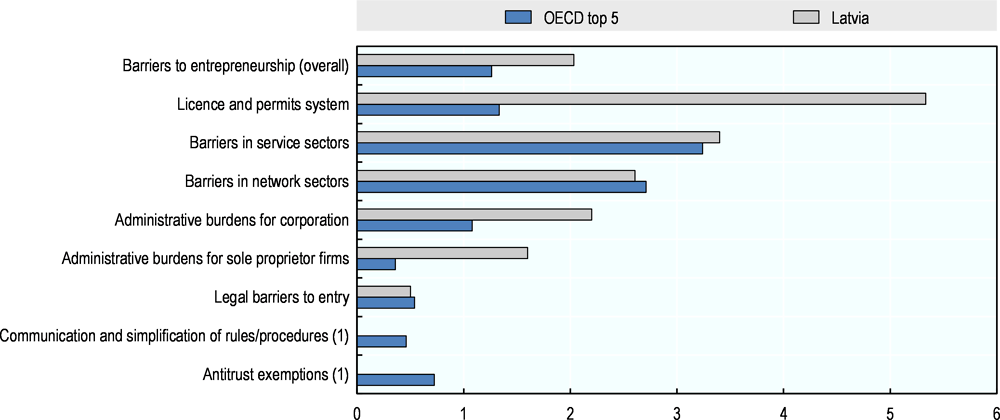

As illustrated in Figure 4.3 on barriers to entrepreneurship, Latvia scores slightly better (less restrictive) than the OECD top 5 performers on a couple of areas, while it is largely behind (more restrictive) than the OECD top 5 performers with regards to the licence and permits system and administrative burden for both corporation and sole proprietor firms.

Figure 4.1. Integrated Product Market Regulation Indicator, 2013

Note: OECD Product Market Regulation (PMR) indicators measure key regulations in the areas of state control, barriers to entrepreneurship, and barriers to trade and investment. Indices for EU28 and OECD are the simple average of member-country indices. The 2013 update of the database is the latest available.

Source: OECD (2014), Product Market Regulation Database.

Figure 4.2. Product Market Regulation Indicators: Barriers to entrepreneurship by main groupings, 2013

Note: Indices for EU28 and OECD are the simple average of member-country indices. The 2013 update of the database is the latest available.

Source: OECD (2014), Product Market Regulation Database.

Figure 4.3. Product Market Regulation Indicators: Barriers to entrepreneurship by detailed components, 2013

Notes: OECD top 5 refers to the average of the scores for the top five performers among OECD countries (Slovak Republic, New Zealand, Netherlands, Italy and United States). The 2013 update of the database is the latest available.

1. For communication and simplification of rules/procedures the PMR score of Latvia is zero (i.e. least restrictive). For antitrust exemptions the PMR scores of Latvia are zero.

Source: OECD (2014), Product Market Regulation Database.

The competition policy in Latvia generally complies with EU principles. The Competition Council ensures free and fair conditions for every market actor and oversees competition in every sector of the national economy, including agriculture and agri‑food industries. Public utilities in the energy, electronic communication, postal, household waste management and water management industries are regulated by the Public Utilities Commission. The Commission, which is independent from national and local government, oversees the development of providers of public utilities, determines the methodology for calculation of tariffs and sets them, promotes competition in the regulated sectors and supervises their compliance with the conditions of the licence among other activities. The Commission decisions may be appealed to a regional administrative court. Its decision-making body is appointed by Latvia’s Parliament and it is served by an executive body (Law on Regulators of Public Utilities, 2001).

A significant number of companies have full state ownership, three of them playing an important role in agriculture (see Box 4.1 on State owned companies and Annex Table 4.A.1).

Box 4.1. State ownership of enterprises

The government of Latvia had full (100%) ownership of 65 companies in 2016. These in turn have established 74 daughter companies. The government’s portfolio evolves as the government disengages or acquires controlling stakes in companies.

The assets of state-owned companies totalled EUR 8.73 billion in 2016. Energy, forestry, transport and storage, and telecommunications were the key industries in which state-owned companies operated in terms of company turnover, balance sheet assets and number of employees. In addition, a number of state-owned companies in the healthcare and culture sectors significantly contributed to the provision of public services (Cross-Sectoral Coordination Centre, 2017).

Three state owned enterprises play an important role in the agricultural sector. Meliorprojekts State Ltd and Ministry of Agriculture Real Estate Ltd (MoA-RE), the two are 100% government owned and offer infrastructure services. The third, the Latvian Rural Advisory and Training Centre Ltd (LLKC), government owned by 99.32%, offers advisory services and knowledge transfer (Annex 4.A).

Meliorprojekts and MoA-RE operate in rural development, sustainable management of land and water resources, rural infrastructure maintenance, landscape preservation and environmental enhancement. Meliorprojekts provides engineering and construction design services and exercises state control over the implementation of functions of national significance including drainage construction. The MoA-RE provides the improvement of drainage infrastructure.

The LLKC provides general training on farm economics. It also offers private consultations and develops farm development plans (Cross-Sectoral Coordination Centre, 2017).

While no food processing company is state-owned, state-owned companies had a stake in 39 companies, of which two were engaged in the agri-food industry and five operated in agriculture in 2016. At the beginning of 2017, all seven entities were listed for the Privatisation Agency to sell the government owned stakes (Cross-Sectoral Coordination Centre, 2017; Privatisation Agency, 2017).

Financial details are provided in Annex Table 4.A.1.

Regulations on natural resources

General regulations governing access to and use of natural resources and the environment

In terms of Supervision, monitoring and impact assessment, Environmental protection falls under the following administrations:

The Cross-Sectoral Coordination Centre, under the Prime Minister, is responsible for drafting, supervising and monitoring the implementation of the long-term Sustainable Development Strategy (Latvia 2030) and the NDP 2020.

The Ministry of Environmental Protection and Regional Development is responsible for waste management, natural resources (except forests, fish and agricultural land which are under the supervision of the MoA) resources, pollution prevention and climate, as well as Green Public Procurement. Its agency, the Latvian Environmental, Geology and Meteorology Centre is responsible for the unified environmental information system (database) and for the national environmental reporting; while the State Environmental Service and the Nature Conservation Agency are the main institutions responsible for environmental control.

The Ministry of Economy is in charge of energy including renewable energy.

The MoA is responsible for forestry, agricultural and fishery policies and resources.

Municipalities are responsible for numerous sectors related to resource efficiency: they organise and supervise the provision of utilities, the rehabilitation of mineral extraction sites and the determination of procedures for the utilisation of public-use forests and waters. Moreover, municipalities are responsible for the application of green procurement (European Environment Agency, 2015).

National targets set in Latvia 2030 comply with EU regulations and other international commitments (Table 4.2). Progress made in recent years suggests that most targets are achievable by 2030.

Over time, the monitoring of environmental performance has been extended and adapted to national priorities, objectives and regulations as well as EU and other international requirements. The regular monitoring of water quantity was started in 1875; monitoring was extended to regular surface water quality in 1946; to groundwater in 1959; to agricultural runoff in 1994 and to biodiversity in 2002. Furthermore, since 2006, three Environmental Monitoring Programmes have been carried out or are ongoing: in 2006-08; 2009-14; and 2015-20. Based on environmental monitoring, an information system is developed that allows to assess the performance of environmental protection measures and to identify the impacts of activities.

Table 4.2. Indicators and targets for natural resource use and the environmental state in Latvia’s long-term and mid-term regulations

|

Indicator |

Current state |

National target |

|

|---|---|---|---|

|

2020 |

2030 |

||

|

Share of energy produced from renewable resources in total gross energy consumption |

37.1% (2013) 3 |

40% 3 |

50% 5 |

|

Share of collected waste to be recycled |

73% (municipal waste) 26% (hazardous waste) (2016) 1 |

50% (municipal waste) 7 75% (hazardous waste) 7 |

80% 5 |

|

Increase in resource productivity (EUR per tonne of dry matter content) |

EUR 510 (2014) 8 |

EUR 600 2 |

EUR 710 5 |

|

GHG emission reduction from non-ETS sectors (incl. transport, housing, agriculture and waste management) (% of emissions against base year (2005) |

In 2015 +7% 4, 14 |

+17% 12 |

-6% 13 |

|

Share of territory under specially protected area status |

18% (2015) 6 |

18% 6 |

18% 5 |

|

Proportion of agricultural land using organic farming |

14% (2017) 11 |

>15% 9 |

>15% 5 |

|

Share of managed agricultural land as a % of all agricultural land |

87.9% (2011) 9 |

95% 5 |

- |

|

Share of forest coverage |

51% (2016) 10 |

- |

55% of total territory 5 |

Sources: 1. CSB (2017b); 2. Cross-Sectoral Coordination Centre (2012); 3. MoE (2016); 4. EEA (2014), Latvian Environment Geology and Meteorology Centre (2017); 5. Sustainable Development Strategy (2010); 6. MoEPRD (2013a); 7. MoEPRD (2013b); 8. MoEPRD (2017a); 9. MoEPRD (2016a), NDP 2020 (2012); 10. MoA (2015); 11. Eurostat (2017d); 12. European Parliament and Council (2009); 13. European Commission (2016); 14. MoEPRD (2017b).

Liability

As foreseen by the Law on pollution and the Natural Resource Tax law, different types of permits apply to activities that use underground resource or emit pollution into the environment, depending on their expected impact. In agriculture, polluting activity permits apply to animal housing, depending on the number of livestock units and the environmental sensitivity of the activity location. Similar polluting activity permits apply to fish farms. The permits are used to control and monitor polluting activities.

Waste management

In line with the EU Waste Framework Directive, the Waste Management Law prescribes procedures for waste management and the State Waste Management Plan for 2013-20 defines priority categories of waste to be collected, separated and further processed in a circular economy perspective and with an aim to reducing their harmful impacts on the environment and/or return it to the economy as a secondary material (European Environment Agency, 2015). Since 2006 more than EUR 170 million has been invested in waste treatment and disposal facilities (CSB, 2017c).

Biodiversity and Protected areas

Latvia is located in a transitional zone characterised by high biological diversity. Regulations apply to the access, use and management of natural resources. Altogether in Latvia, there are 683 specially protected nature areas, including 333 Natura 2000 sites that are under special state-level protection in order to safeguard and maintain the biodiversity (Nature Conservation Agency of Latvia, 2014). Outside protected territories, micro-reserves are established under the Law on the Protection of Species and Habitats to protect small-scale biologically rich areas. Farming and forestry activities on protected areas are limited. They must comply with specific management practices, and compensations apply.

Land use and soil

Land use is influenced by regulations on land markets. The main institutions overseeing on land use include local governments, the Land Register, the State Land Service (SLS), the Land Fund, the State Joint Stock Company (JSC) Development Finance Institution Altum (Altum) and the Forest Stewardship Council.

In Latvia, local governments oversee transactions on agricultural land. Ownership rights on agricultural land and or any other real estate must be registered in the regional office of the Land Register in the district in which the land is located. From 1 January 2018, land property registration is subject to a written, free-of-charge, statement issued by the local government.

The National Real Estate Cadastre Information System, maintained by the SLS, registers and updates data about real estates, land parcels, constructions, groups of premises and their characterising information.

Land may be acquired by citizens or legal entities of the Republic of Latvia as well as those of EU Member States, of the European Economic Area and of the Swiss Confederation. Tax registered capital companies and their shareholders, be they natural or legal persons, from states with which the Republic of Latvia has entered into international agreements regarding the promotion and protection of investments can also acquire land.

While no additional restrictions apply to the purchase of land where farming or forestry is not the dominant land use, the Law on the Land Privatization in Rural Areas specifies that agricultural and forest land can only be acquired in conformity with the territorial planning of local governments (Law on Land Privatisation in Rural Areas, 1992). The maximum area for land ownership is set to 2 000 ha and 4 000 ha under certain circumstances. Conditions concerning registration, land use, tax debt, agricultural business plan and language certification apply to natural persons and to business owners or their legal representative. According to the SLS, 76% of the total agricultural land area was owned by citizens of the Republic of Latvia; in 2016, 0.1% was owned by non-citizens of the Republic of Latvia, 22.3% by legal persons, 0.5% by the national government, 0.8% by local governments, and 0.8% was under foreign ownership (SLS data).

The Land Fund of Latvia, managed by Altum, is formed by the agricultural land accumulated at national level and has pre-emptive rights on transactions of agricultural land (see Box 4.2 on Altum). From July 2015, when it was formed, up to the beginning of 2017, the fund has spent EUR 4.6 million overall for the purchase of 112 pieces of property in all regions of Latvia; a total 2 038 hectares, of which more than 40% in Zemgale. As of the beginning of 2017, 92% of the Land Fund’s property was leased to farmers for agricultural expansion of their business, of which ten were young farmers (Altum data).

Agricultural land can be rented for a period that is not less than five years. Rental contracts must be concluded in writing and registered with the local government. From 1 January 2018, local authorities are allowed to rent, with a purchase option, agricultural land for agricultural use to natural persons having no other agricultural land. In this case, the land may be rented out for a period of 12 years, at a rate of 4.5% of the cadastral value of the property and the land may be purchased no earlier than the fourth year.

Forestry is regulated under the Development Guidelines for the Forestry and Related Sectors for 2015-20 (MoA, 2015). Forest owners can apply for two types of certification systems that promote sustainable forest management: the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC).

Box 4.2. JSC Altum

The State Joint Stock Company “Development Finance Institution Altum” (Altum) has three stakeholders: the MoF (40%), the MoE (30%) and the MoA (30%).

Altum is the operational institution for support programmes from public resources, including funding from the European Union (as part of the Rural Development Plan and structural funds) and other international institutions. Altum also attracts co-funding of projects.

Altum disburses state aid, administers loans, microcredits and credit guarantees disbursed to agricultural business (Section 6.4). Altum also provides accelerator funds and seed funding. It controls land market operations and co-finances infrastructure development.

State aid

Altum offers state aid from the national budget to various target groups with the help of financial tools (such as loans, credit guarantees, investing in venture capital funds, etc.). It operates within the boundaries allowed by EU state aid regulation (Section 3.1).

Land market intervention

Altum also administrates the Land Fund of Latvia that was established in July 2015. Altum also performs real estate lease, buyback, purchase, and sale or change transactions. It is one of the main institutions involved in land use is influenced by regulations on land markets (Sections 4.1 and 4.3).

Credit guarantee

Historically and up to 2014, the JSC “Rural Development Fund” (established in 1994) granted credit guarantees to farmers and other rural entrepreneurs of Latvia according to the loan agreements concluded with credit institutions. Credit guarantees were necessary to facilitate access to credit in the absence of sufficient collateral.

In 2015, Altum took over issuing guarantees for short-term and long-term loans granted by banks to rural entrepreneurs, agricultural producers, agricultural and forestry co-operative societies and processors of agricultural products, excluding entrepreneurs in financial difficulties. From 2016, banks, rather than entrepreneurs, contact Altum directly in case of insufficient collateral (Section 4.3).

Investment credit

Altum also offers Co-financing (mezzanine) loan programme. Co-financing (mezzanine) loans can be used to cover investment expenses related to the diversification of products with new ones, extension of capacity or a fundamental change in the overall production process, setting up of a new establishment or extension of the capacity of an existing establishment. The loan is given to companies (including agricultural companies excluding primary producers) and agricultural service co-operative societies (Section 7.3).

Altum’s Accelerator funds are invested in innovative and early development start-ups with high growth potential, and their funding is provided over two stages, in the form of pre-seed and seed stage funding. The programme also includes agricultural sector companies and agricultural service co-operative societies (Section 7.3).

International participation

Altum also takes part in international infrastructure projects.

It represents Latvia’s in the Baltic Investment Fund to which it contributed EUR 26 million. The Fund aims to increase Baltic States’ enterprises’ access to private and venture capital (Section 7.1).

Water

Based on EU Directives, water is regulated by the Water Management Law, the Law on Pollution, and the Marine Environment Protection and Management Law. Water quality and the sustainable use of natural water resources are also covered in the Environmental Policy Guidelines for 2014-20 (VARAM, 2013a). The guidelines suggest improvements to the water supply infrastructure and the implementation of the user-pays principle. Environmental policy also aims to preserve and enhance the quality of the sea environment, to protect the sea coast and to reduce the impact of economic activity on the sea environment.

Nitrates

Nitrate pollution is monitored and does not present a threat to the environment overall. In Latvia, nitrate vulnerable zones are identified in the Law on Pollution and Cabinet regulation No. 834 on the protection of water and soil from pollution with nitrates caused by agricultural activity. Increased requirements apply to these zones. The EC Nitrate Directive is included in this regulation.

Nitrate vulnerable zones occupy 825 870 ha, close to 13% of the total area or 43% of Latvia’s UAA. Since 2001, special requirements regarding the dispersal of fertilisers, storage of manure and fermentation residues apply to farms located in these zones. Farmers who use 20 ha or more of agricultural land, and who grow vegetables, potatoes, fruit trees or fruit bushes with 3 ha or more of agricultural land in nitrate vulnerable zones, have a mandatory requirement to prepare crop fertilisation plans.

Climate change

Latvia’s air quality is highly rated and no specific issues are identified. Latvia is engaged in international initiatives and has ratified the UN Framework Convention on Climate Change in 1995, the Kyoto Protocol in 2002, and the Paris Agreement in 2017. As an EU Member State, Latvia contributes to the EU GHG emission reduction targets. Latvia’s agricultural sector is the second largest source of GHG emissions. Two planning documents are currently under preparation that should help take up the climate change challenges ahead.

The 2050 National Low Carbon Development Strategy is under preparation and expected to be adopted late 2018 or in 2019. It aims to drive change in production, lifestyle and consumption patterns that will reduce economy-wide GHG emissions and enhance resource efficiency. The Strategy is expected to impact innovation, improve health through less pollution, and to provide career and investment opportunities through green growth.

When it is adopted, Latvia’s Adaptation to Climate Change Strategy 2030 will promote systematic climate change risk-benefit assessment and management so that climate related risks, such as heavy rainfalls, cold and heat waves or rising sea level are reduced and potential benefits, such as longer growing seasons or higher average temperatures, harnessed.

Regulations on products and processes

Regulations on products and processes aim to protect human, animal and plant health and the environment. Environmental and health related regulations could support innovation by building consumer and societal trust in the safety and sustainability of new products or processes. However, unnecessary or dis-proportionate regulations can limit innovation and technological developments (OECD, 2015).

In Latvia, the regulatory framework on goods for human consumption follows and implements EU directives through a number of decisions, national laws and Cabinet regulations. Legal documents regulating the production of goods for human consumption fall under the responsibility of the MoA.

Food safety law

Latvia implements the EU food safety rules and regulations and has transcribed them into national laws on safety and hygiene; animal feed; animal welfare and health; animal identification and registration; information and labelling and consumer rights protection. The MoA oversees the administration and governance of food production and agri-food processes. The ministry co-operates with other ministries as well as various scientific and non-governmental organisations when preparing legal acts.

The Law on the supervision of food handling defines responsibilities of businesses handling food; criteria for food unfit for distribution; state supervision and control of the handling of food; and procedures for recognising or registering food establishments. This law is binding for those farmers who are engaged in the handling of food and are dealing with primary manufacturing of food, food acquisition, pre-treatment, treatment, processing, manufacturing, packaging, storage, distribution or transport. The law was amended in 2009-10 and business registration was simplified. Electronic means of communication between food enterprises and the Food and Veterinary Service are now accepted. Requirements for the direct supply of primary production of food of plant origin to final consumers in small quantities on local markets were also simplified (MoA, 2009).

The Law on animal feedstuffs handling lays down the requirements for industry employees, feed labelling, supervision and control.

The Animal Protection Law establishes animal welfare standards, prescribes the duties and responsibility of animal owners, and the Veterinary Medicine Law stipulates measures for the prevention, treatment and control of animal diseases.

The Consumer Rights Protection Law defines consumer rights and sets the general requirements for the labelling of goods. The Latvian Administrative Violations Code determines administrative requirements in agriculture, veterinary and food trade and determines the fine that shall be imposed in case of violation.

EU regulations requirements and national laws have been consolidated in Cabinet implementation regulations. The Food and Veterinary Service implements the controls and decides veterinary measures and sanctions on observed violations. In a context where African swine fever occurrences have been observed, the service’s current priorities include the inspection of biosecurity requirements in pig housings, the monitoring of the livestock welfare requirements and animal identification and registration.

Organic practices and products

Organic farming plays an important role in Latvia. The sector is regulated by the EU Organic Farming Regulation and the regulation on organic production and labelling of organic products. In addition, national regulations apply that set eligibility criteria for financial support or define state fees to be paid by farmers. Organic farming is supervised by the Food and Veterinary Service, the State Plant Protection Service and the Rural Support Service. Two private institutions control organic farming: the association Environmental Quality and the state Ltd Certification and Testing Centre. The Association of Latvian Organic Agriculture represents the interests of farmers. In co-operation with the Food and Veterinary Service and the Consumer Rights Protection Centre, the MoA has produced relevant guidelines to inform producers and distributors about the legislative requirements pertaining to the use of words “bio” and “eko” in labelling food supplements, thus contributing to a single understanding of both words (MoA, 2016).

Assessment of regulatory impacts when developing new and reviewing existing regulations

Before producing new policy documents, the key principles of policy-making in Latvia as adopted by the Cabinet of Ministers (MK, 2006; MK, 2014), require to carry out a comprehensive analysis of adopted policy documents and legal acts in force (Latvijas Vēstnesis, 2017). In addition, under the Law on Environmental Impact Assessment, a strategic assessment of environmental impacts must be performed for new policy documents, including those on agriculture, forestry, fisheries, energy, manufacturing, transport, waste management, water resource management, telecommunications, tourism and mining.

Implementation of product and process safety regulation in food and agriculture

Food is one of the most regulated activities, as it directly affects consumers’ health. In Latvia, all companies involved in the handling of food have to comply with the general food safety principles to ensure food safety. The responsibility for ensuring food safety lies with food business operators, who must determine the stages in food handling which are significant from the food safety perspective, monitor them and register the results in accordance with the Law on the Supervision of the Handling of Food and the Regulation (EC) No. 852/2004 of the European Parliament and of the Council. Food business operators are also encouraged to introduce Hazard Analysis Critical Control Point (HACCP) principles in their practice. In Latvia, guidelines on good hygiene practices for several economic activities and food and catering enterprises were produced to assist the introduction of HACCP principles in businesses, while the LLKC offers training seminars for those interested.

4.2. Trade and investment policy

Trade can facilitate the flow of goods, capital, technology and knowledge and contribute to the development of people needed to innovate. Openness to trade and capital flows is conducive to innovation, as it provides a larger market for innovators, reinforces competition, increases access to new technologies, ideas and processes, including from foreign direct investment (FDI) and related technological spill-overs, and facilitates cross-country collaboration. Trade and investment openness can influence innovation throughout the food supply chain, from input suppliers to food service and retail firms. Input and output markets that operate effectively can foster productivity growth. Trade and investment openness can also facilitate the development of market mechanisms to foster more environmentally sustainable production (OECD, 2015).

Trade policy

The European Union is a single market in that it offers its 28 members a single customs union with a single trade policy and tariff. Latvia, as a Member State enjoys access to the single market for domestic business outlets and market supplies and relies on the European Union for its foreign trade relations. These relations are based on multilateral trade agreements, which have been concluded in the framework of the WTO, bilateral trade agreements and EU unilateral trade preferences. In recent years, the European Union has placed great focus on strengthening bilateral relations with a number of trading partners.

Trade openness

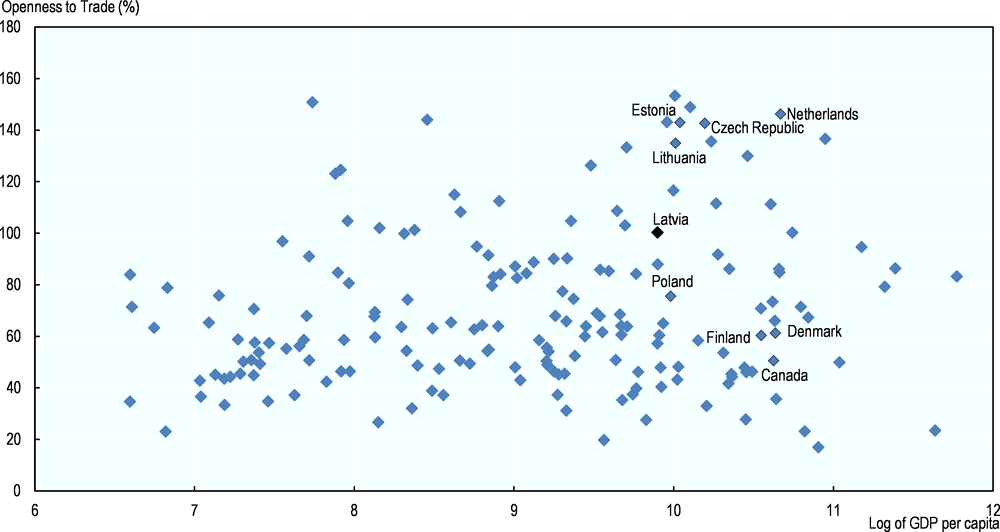

Latvia is a small economy that relies on trade for its access to goods and services through imports and on exports for business outlets revenues. While trade openness and integration in global value chains bring many economic benefits, including increased technology transfer, transfer of skills, increased labour and total factor productivity and economic growth and development, Latvia is less exposed to trade than its peers (OECD, 2017). In 2012, Latvia’s openness to trade is below that of EU countries with comparable levels of GDP per capita, while they are exposed to identical external trade conditions (Figure 4.4). This may be explained by market size but also by differences in domestic efficiency of customs and border procedures.

Figure 4.4. Openness to Merchandise Trade and GDP per capita, 2010-12

Note: “Openness to trade” is the value of merchandise trade (exports plus imports) as a percentage of gross domestic product (GDP). GDP per capita is calculated using purchasing power parity (PPP) in constant 2011 dollars.

Source: WITS (2017), http://wits.worldbank.org/visualization/openness-to-trade-visualization.html.

Efficiency and effectiveness of customs and border procedures

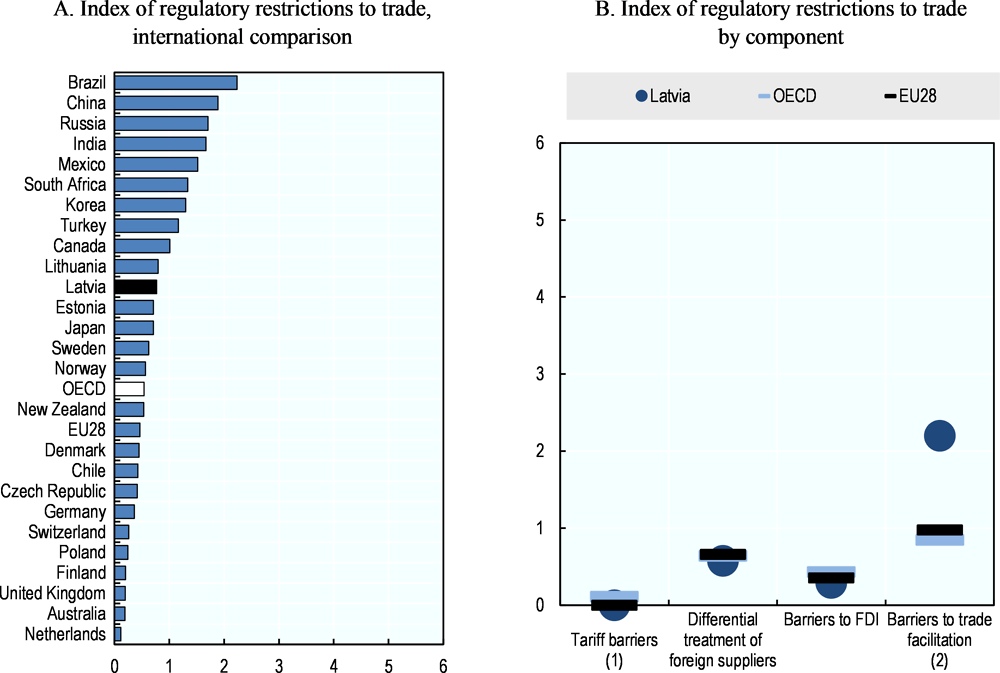

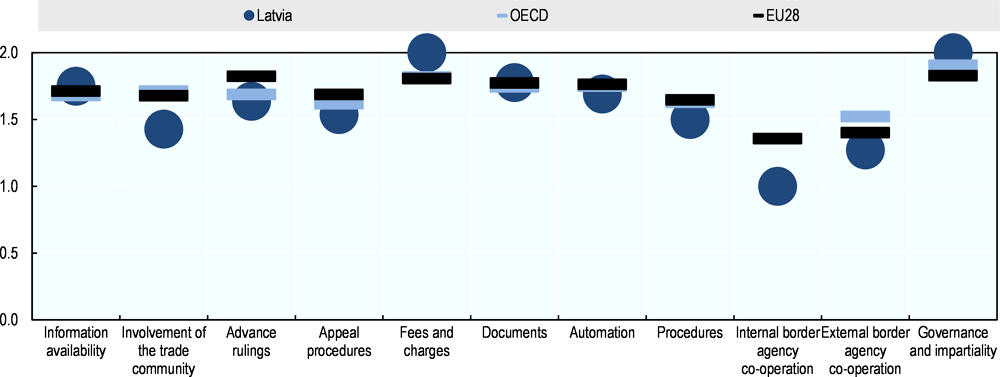

OECD PMR indicators evaluate regulatory restrictions to trade and investment. They take into account tariffs, differential treatment of foreign suppliers, barriers to FDI and so-called barriers to trade facilitation.2 The scores scale from 0 (least restrictive and most open), to 6 (most restrictive and least open). According to the index for 2013, regulatory restrictions to trade and investment in Latvia were minor — the score was less than 1 (0.77) but slightly more restrictive than the OECD (0.54) and EU28 averages (0.47) (Figure 4.5). Barriers to FDI in Latvia (0.29) were lower than the OECD (0.43) and the EU28 (0.36) averages, which indicates that Latvia is generally open to foreign investors and that foreign and domestic investors are treated equally. However, Latvia’s index number of 2.20 for the use of internationally harmonised standards and certification procedures, and Mutual Recognition Agreements points to higher restrictiveness than other trade and investment relevant areas, and also higher than EU28 (0.98) and OECD averages (0.85) (Figure 4.5). When considering the OECD Trade Facilitation Indicators, while Latvia’s performance is aligned with or close to the OECD and EU28 averages for most indicators, the trade community’s involvement and the external and internal border agency co-operation face higher barriers as shown in Figure 4.6.

Figure 4.5. Product Market Regulation Indicators: Regulatory restrictions to trade and investment, 2013

Notes: Indices for EU28 and OECD are the simple average of member-country indices. The 2013 update of the database is the latest available.

1. The tariff barrier is based on an average of effectively applied tariff, scaled within a range between 0 and 6 points, whereby a tariff below 3% is attributed zero points and a tariff above 19.6%, 6 points.

2. Barriers to trade facilitation refer to the extent to which the country uses internationally harmonised standards and certification procedures, and Mutual Recognition Agreements with at least one other country.

Source: OECD (2014), Product Market Regulation Database.

Figure 4.6. Trade facilitation performance, 2017

Note: Indices for EU28 and OECD are the simple average of member-country indices. The 2013 update of the database is the latest available.

Source: OECD (2017e), Trade Facilitation Indicators, www.oecd.org/tad/facilitation/indicators.htm.

Foreign Direct Investment (FDI) regulations

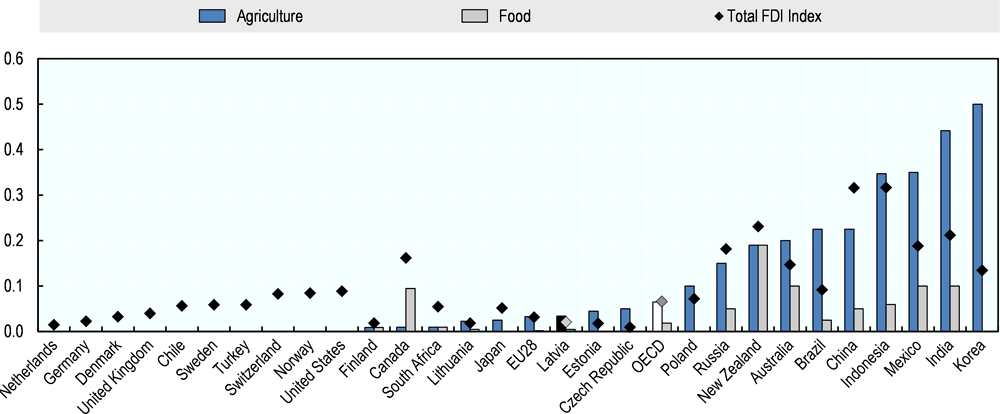

The FDI Regulatory restrictiveness index measured by the OECD describes Latvia as one of the countries with least restrictions to FDI (Figure 4.7). The scale of the index varies from 0 (least restrictive) to 1 (most restrictive). The FDI restrictiveness index for Latvia in 2017 was low at 0.021; lower than the OECD (0.066) and the EU28 averages (0.032). As regards FDI in the agriculture and food sectors, the index values (0.034 and 0.005, respectively) are lower than the OECD average (0.065 and 0.019, respectively), which indicates a low restrictiveness level, but slightly higher than the EU28 average (0.033 and 0.002, respectively). While a distinction can be made between agriculture and food to note much higher levels of restrictiveness in agriculture, as illustrated by Latvia’s relative position in Figure 4.7. The restrictions with regard to agricultural land purchase are described under the Regulatory environment for entrepreneurship (Section 4.1).

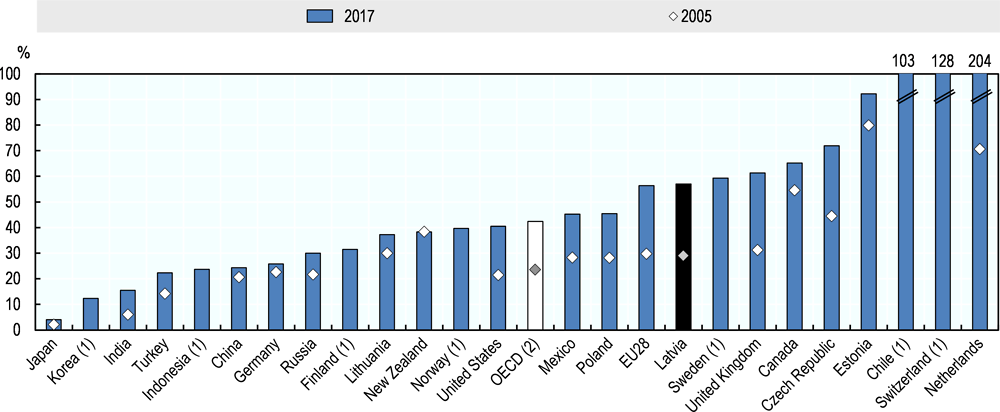

In 2017, the total FDI inward stock in Latvia reached 57% of GDP, compared with 29% in 2005. This figure is slightly higher than the OECD and EU averages (Figure 4.8). In 2015 in Latvia, the FDI inward stock in agriculture, forestry and fishing was USD 674 million, while in the manufacture of food products, beverages and tobacco products it was USD 237 million.

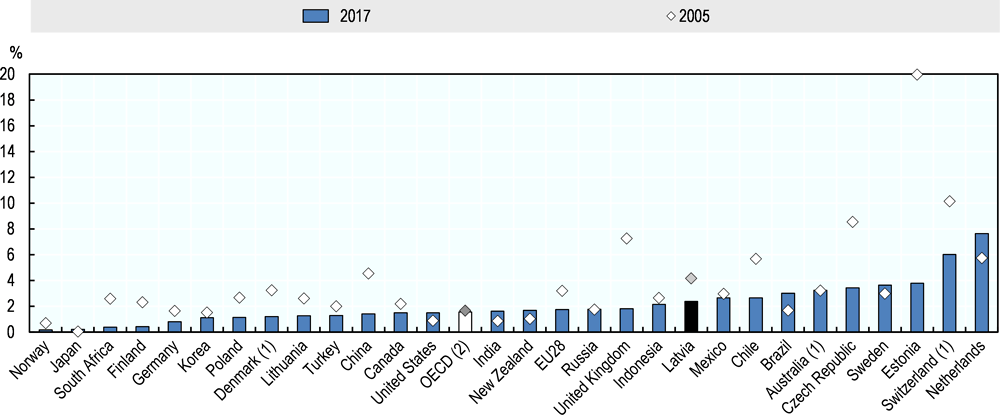

In Latvia, in 2017, the total FDI inward flow reached 2.39% of GDP (or USD 723 million), a lower figure compared to 2005 (4.2%) but higher than the OECD average (1.58%) and the EU28 average (1.76%) (Figure 4.9). The FDI inward flow in agriculture, forestry and fishing in 2015 totalled USD 18 million, while in the manufacture of food products, beverages and tobacco products it was negative (‑USD 26 million).

Figure 4.7. FDI Regulatory restrictiveness index by sector, 2017

Note: Four types of measures are covered by the FDI restrictiveness index: 1) foreign equity restrictions, 2) screening and prior approval requirements, 3) rules for key personnel, and 4) other restrictions on the operation of foreign enterprises. Countries are ranked according to Agriculture index levels. Indices for OECD and EU28 are the simple average of member-country indices.

Source: OECD (2017a), FDI Regulatory restrictiveness index, www.oecd.org/investment/fdiindex.htm.

Figure 4.8. Total FDI inward stocks, 2005 and 2017

Notes: FDI stocks measure the total level of direct investment at a given point in time. The inward FDI stock is the value of foreign investors’ equity in and net loans to enterprises resident in the reporting economy.

1. For Korea, Norway, and Switzerland, 2017 data are replaced by the nearest available year (2016). For Chile, Finland, Indonesia, Korea, Norway, Sweden, and Switzerland, 2005 data are not available.

2. OECD aggregate does not include Lithuania, as Lithuania was not an OECD member country at the time of preparation of this database.

Source: OECD (2018), FDI stocks (indicator), https://doi.org/10.1787/80eca1f9-en.

Figure 4.9. Total FDI inward flows, 2005 and 2017

Notes: FDI flows record the value of cross-border transactions related to direct investment during a given period of time. Financial flows consist of equity transactions, reinvestment of earnings, and intercompany debt transactions. Inward flows represent transactions that increase the investment that foreign investors have in enterprises resident in the reporting economy less transactions that decrease the investment of foreign investors in resident enterprises.

1. For Denmark, 2017 data are replaced by 2015. For Australia and Switzerland, 2005 data are replaced by 2006.

2. OECD aggregate does not include Lithuania, as Lithuania was not an OECD member country at the time of preparation of this database.

Source: OECD (2018), FDI flows (indicator), https://doi.org/10.1787/99f6e393-en.

4.3. Finance policy

Efficient financial markets are one key instrument that enable balanced economic development. Access to financial services can be limited or unequal across regions and firms when financial markets fail or when risks are too high. Policies that improve the functioning of financial markets can facilitate productivity enhancing investments in agriculture and farm size growth. Policies may also facilitate access to funding for sustainability enhancing investments. Low cost loans and venture capital can also be an important source of funding for innovative firms with high growth sector potential (OECD, 2015).

Financial market development

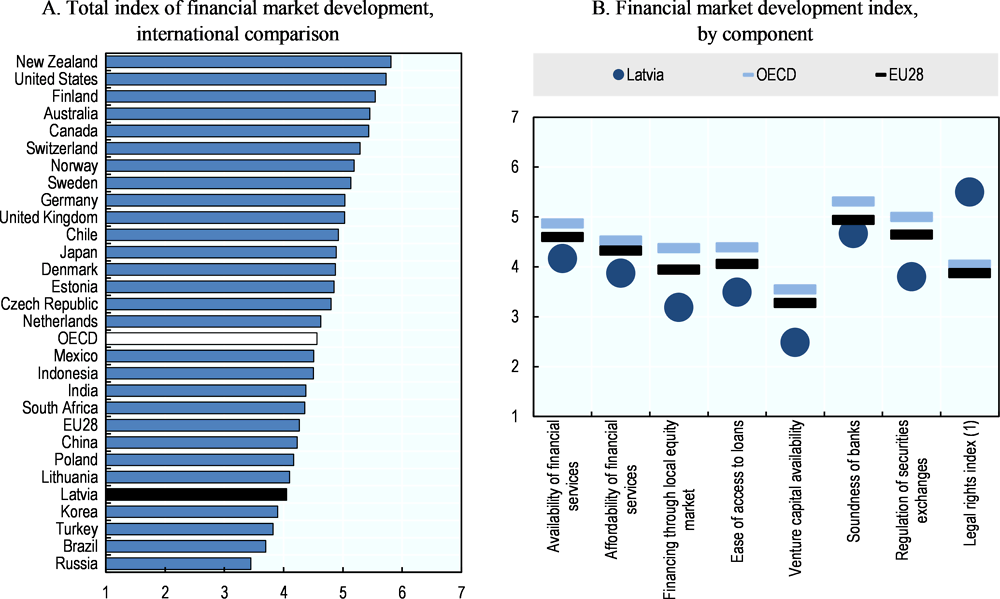

According to the WEF Global Competitiveness Index (GCI), Latvia generally ranks lower than the OECD average in financial market developments (Figure 4.10, Panel A). The mean aggregated results for Latvia (4.2) are significantly lower than the OECD average (4.54) and only slightly lower than the EU28 average (4.25). The analysis of the index components shows that the availability of loans and venture capital availability have increased the fastest in the past five years. Venture capital availability has increased and scores 2.7, lower than the OECD average (3.4) (WEF, 2016). The legal rights index that encapsulates the strength of the credit system is the only component that scores higher than the OECD average (Figure 4.10, Panel B).

The banking system is regulated by the Financial and Capital Market Commission. The main regulations include the Credit Institution Law, the Regulations on the Issue of Credit Institution and Credit Union Operating Licences (FCMC, 2009).

Banks are the main source of financing for Latvia’s entrepreneurs, mostly small and medium-sized and little information is publicly available to investors on the possibilities to invest resources in the development of these companies. In this context, the merger of the stock exchanges of the three Baltic countries into the Baltic Market may help improve the capacity for Latvian firms to raise equity. The OECD 2017 Economic survey of Latvia noted the small, yet growing, share of so-called alternative financing platforms; these include internet-based institutions (OECD, 2017).

In Latvia, in 2017 there were 16 credit institutions, and 7 branches of foreign credit institutions, functioning with an operating licence. Eighty-seven per cent of the large corporate loans are issued in one of the three largest banks (Swedbank, SEB Bank, Luminor Bank3), according to the loan portfolio, all of which have Scandinavian capital. The four largest commercial banks issued 75% of the total loans to medium-sized enterprises, 59% of the total loans granted to small enterprises and 67% of the total micro-enterprises’ loans granted to small enterprises (Micune, 2016).

Domestic credit4 provided by the banking sector in Latvia was reported at 81.5% of GDP in 2016, according to the World Bank development indicators (Figure 4.11); less than half the OECD average share and 1.8 times lower than the EU share in 2016.

At the same time private sector debt in Latvia is reported at 88.3% in 2016. The indicator has decreased by 34% compared with 2010, which was the peak year for the ratio domestic credit of GDP. In 2010, the credit burden grew due to the decline in GDP and only from 2011 domestic credit as percentage of GDP started to gradually decrease due to higher incomes and continuing decrease of credit liabilities.

The legal rights index measures the degree to which collateral and bankruptcy laws protect the rights of borrowers and lenders and thus facilitates lending. Over the past five years, scores for all the index components have gone up, the largest increase being for the availability of loans and access to venture capital (WEF, 2016).

Latvia’s scores are low in financing through local equity markets and ease of access to loans, as well as in the reliability of banks and the regulation of securities exchanges. These figures may still reflect the impact of the 2008 financial crisis and banks’ precaution in allocating credits. The OECD 2017 Economic survey of Latvia noted a likely increase in loan demands and yet banks’ lending standards have not eased (OECD, 2017).

The value of stocks traded (percentage of GDP) is the total number of shares traded multiplied by their respective matching prices. According to the World Bank (2016c), in 2004, the value of stocks traded was reported at 1.1%, the figure has decreased since then reaching the level of 0.1% in 2012, which is the most recent year available for Latvia.

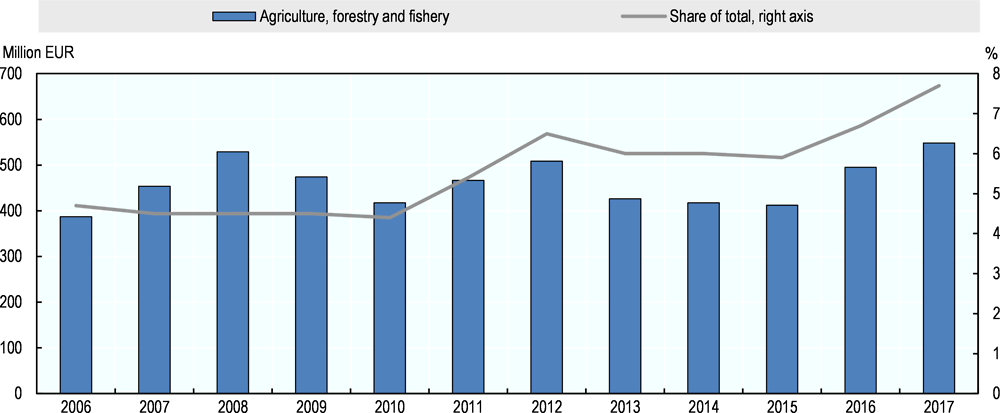

Commercial banks, as private credit institutions, allocate loans for agricultural businesses on individual commercial terms. Interest rates are set individually depending on several factors such as loan demand, types of deposits, bank decision on relief or more stringent loan terms, borrowers’ loan history etc. The loan balance granted by credit institutions to companies operating in agriculture, forestry and fishing has increased over the past ten years. Although fluctuations are seen annually, the loan balance only exceeded pre-financial crisis levels in 2017 (Figure 4.12). The share of companies operating in agriculture, forestry and fishing in total loans has grown steadily in recent years; from 5.9% at the end of December 2015 to 6.7% and 7.7 in 2016 and 2017 respectively (Figure 4.12) (Financial and Capital Market Commission, 2017).

Credit unions operate as another possibility to enhance the availability of financial resources for the population of Latvia, to promote regional development, and to facilitate the participation of the population in the national economy (Mazure, 2011). Co-operative credit unions play a dual role, since they are business companies established to perform the functions of a credit institution and to provide financial services to its members. These institutions allow agricultural businesses to receive financial resources faster, thus being a more cost-effective development solution. In Latvia, the activity of credit unions peaked in the years 2006-08 due to the economic ascent period and again in 2013.

Currently, 33 co-operative credit unions operate in Latvia, of which approximately 25 credit unions operate in rural territories (Mazure, 2016). The Latvia Credit Union of Farmers, founded in 2015, is the most recent.

Figure 4.10. Global Competitiveness Index: Financial market development, 2017-18

Notes: Indices for EU28 and OECD are the simple average of member-country indices.

1. The Legal rights index (1-to-12) is converted to a 1-to-7 scale.

Source: WEF (2017), The Global Competitiveness Report 2017-2018: Full data Edition, http://reports.weforum.org/global-competitiveness-index-2017-2018/.

Figure 4.12. Loan balance of companies operating in agriculture, forestry and fishing in Latvia, 2006 to 2017

Sources: Bank of Latvia (2018), www.bank.lv/component/content/article/4776-makroekonomisko-norisu-parskats; Financial and Capital Market Commission (2018), www.fktk.lv/lv/statistika/kreditiestades/ceturksna-parskati.html.

Agricultural crediting

In Latvia, Altum is the operational institution for support programmes from public resources, including funding from the European Union (as part of the Rural Development Plan and structural funds) and other international institutions. Altum administers loans, microcredits and credit guarantees disbursed to agricultural business (Section 6.4). The shareholders of Altum are the Ministry of Finance, the Ministry of Economy and the Ministry of Agriculture.

SME growth loans and microloans for farmers

Small and medium enterprises (SME) growth loans are available to agricultural enterprises for investments and working capital, with reduced collateral requirements. The maximum amount of investment loan is EUR 2.9 million over 2 to 15 years, limited to 90% of the total project costs, while the maximum amount of loan for working capital is EUR 285 000, over two to five years. The interest rate is flexible and based on the six-month EURIBOR rate.

Microloans are available to start or develop small businesses for micro entrepreneurs and business start-ups that do not employ more than ten employees. The maximum amount of the loan is EUR 14 300 for investments and up to EUR 7 200 for current assets with a fixed annual interest rate of 5% to 8% and a repayment period of five years. The loans are easy to obtain while the collateral value must be more than 74% of the loan amount. It is possible to apply for a loan before the business is established and to receive several loans within the framework of the programme but not more than one loan during a calendar year (Altum, 2017).

Credit guarantees for rural entrepreneurs

Historically and up to 2014, the JSC “Rural Development Fund” (established in 1994) granted credit guarantees to farmers and other rural entrepreneurs of Latvia according to the loan agreements concluded with credit institutions. Credit guarantees were necessary to facilitate access to credit in the absence of sufficient collateral.

When it was established in 2014-15, Altum took over issuing guarantees for short- and long-term loans granted by banks to rural entrepreneurs, agricultural producers, agricultural and forestry co-operative societies and processors of agricultural products, excluding entrepreneurs in financial difficulties. From 2016, banks, rather than entrepreneurs, contact Altum directly in case of insufficient collateral.

Altum guarantees up to 80% of a maximum EUR 1 million loan amount for a period up to ten years. The guarantee may cover an investment and working capital loans. In the case of agricultural and rural development businesses, in most cases the guarantee is conditional to Common Agricultural Policy Pillar 2 support implemented by the Rural Support Service and is issued on the basis of new financial obligations (Altum, 2017).

Credit guarantees are issued under the “Agricultural and Rural Development Credit Guarantee Programme” for the following measures:

investments related to primary agricultural production and processing of agricultural products;

establishment of a new holding or the transfer of ownership of an existing holding (young farmers);

vocational training and information activities in accordance with the needs of the agricultural, forestry and food sectors;

development and adaptation of agricultural and forestry infrastructure;

fishing and aquaculture measures, including the addition of working capital to these measures and investments for fisheries activities;

other measures for the development of agriculture and rural areas (acquisition of productive farms, acquisition of agricultural land, purchase of high-value animals, promotion of rural tourism and craft activities, replenishment of current assets to agricultural co-operative societies, etc.).

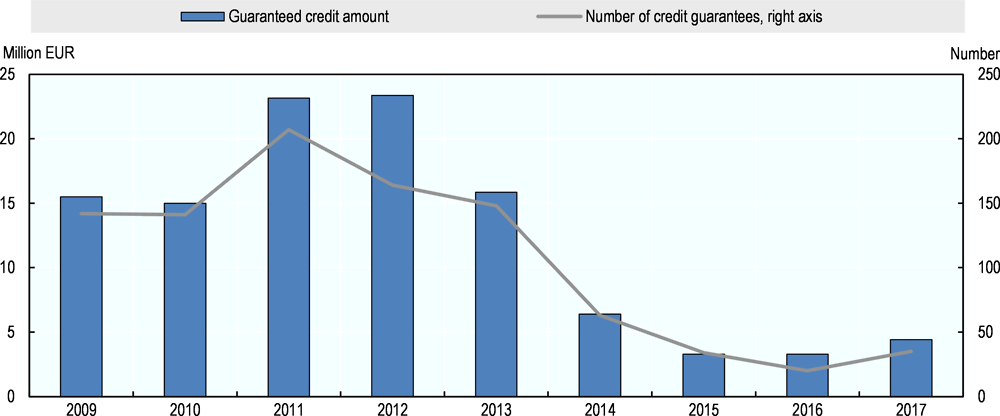

Overall, 3 473 agricultural and rural entrepreneurial loans worth EUR 144 million have been guaranteed from 1997 to 2016. In 2016, Altum issued 20 credit guarantees totalling EUR 2.35 million. The average guarantee amount was EUR 117 000, and the average premium paid for the issued guarantee was EUR 1 608 (MoA, 2018). The number of credit guarantees issued fell in 2011 when the State Mortgage and Land Bank, the largest issuer of loans guaranteed by JSC “Rural Development Fund”, was reorganised. In 2014 Altum assumed the Fund’s guarantee activities. However, the launch of Altum’s co-operation with other banks was not successful and a new approach to the administration of guarantees had to be designed (Figure 4.13).

Figure 4.13. Number of issued guarantees and guaranteed loan amounts in Latvia, 2009 to 2017

Working capital loans with fixed interest rate of 4% are disbursed for primary agricultural producers, agricultural co-operative societies and the fruit and vegetable producer groups. The loan amount can range from EUR 7 000 to EUR 1 million but for co-operative companies of agricultural services – up to EUR 2.9 million. The loan repayment period is up to two years and a private guarantee provided by the owner(s) of the company, holding at least 10% of shares can be used to secure the loan. The aim of the loan is to finance and strengthen the development of agricultural producers and providers of agricultural services (Altum, 2017). In total, 1 444 loans have been issued for the average amount of EUR 69 012.

The fishery and aquaculture sectors are not supported under the procedure stipulated by the Cabinet regulations for granting state aid for the purchase of current assets for agricultural production.

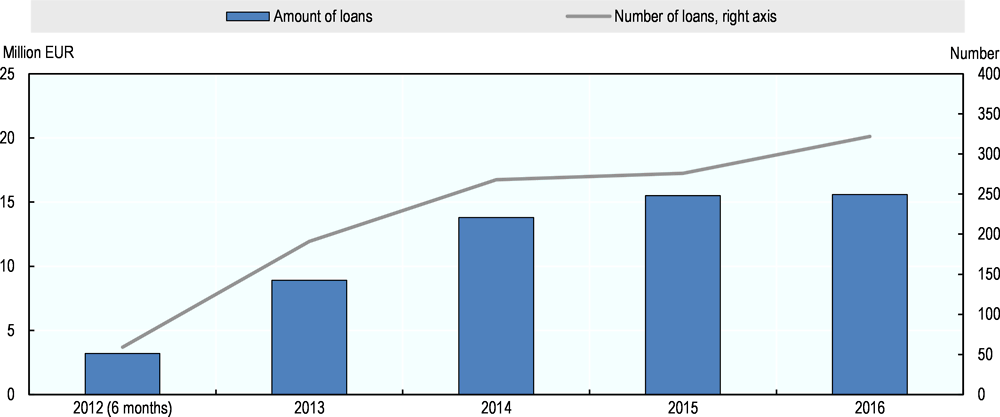

State loans for the purchase of agricultural land

Since 2012, loans are available to agricultural producers for the purchase of utilised agricultural land. Conditions apply on commodity produced and agricultural income; while young farmers are exempt (Altum, 2017). The maximum amount of loan for the purchase of one or more land plots is EUR 430 000 per entrepreneur and group of persons. The amount of loan cannot exceed 300% of the market value of the land to be purchased (in line with the evaluation performed by a certified evaluator). Additional collateral is required if the per hectare purchase price is more than 100% above the market value of the land. The interest rate consists of a fixed rate to which a flexible rate based on the price of the State Treasury resources is added. The number and the amount of loans have grown constantly (Figure 4.14). The overall budget was increased from EUR 40 million to EUR 70 million in 2016, the loan term extended from 20 to 30 years and the fixed interest rate was reduced from 2.5% to 2.2% per year (MoA, 2018).

Figure 4.14. Number and amounts of loans for the purchase of land in Latvia, 2012 to 2016

The Land Fund of Latvia

The Land Fund of Latvia, is administrated by Altum to buy property from current owners who cease activity on agricultural land. Land purchased by the Land Fund of Latvia is offered for sale or rent to entrepreneurs operating in the field of agriculture. The Fund started its operation on 1 July 2015 and within two years of operation it had purchased 112 properties in an area of 2 038 hectares for a total of EUR 4.6 million. In 2016, the Fund purchased 1 500 hectares of land (Altum, 2017).

4.4. Tax policy

Overview of the Latvian tax system

Box 4.3 contains an overview of the Latvian tax system. Latvia is characterised by a low tax proportion in terms of gross domestic product (GDP). In 2015, the average EU tax revenues amounted to 39.7% of GDP, whereas in Latvia the same proportion was only 30.6% (Eurostat, 2017c).

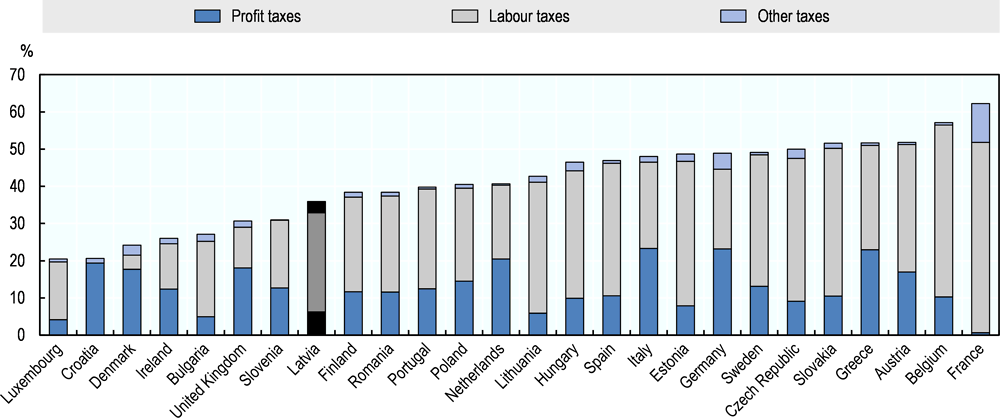

Relatively high labour taxes and very low capital taxes characterise the tax revenue structure in Latvia (World Bank, 2018) and when compared to other OECD members tax revenues from consumption (value-added taxes) were above average and income tax revenues, both personal and corporate, were below average (MoF, 2017).

Box 4.3. The Latvian tax system

The Latvian general tax system consists of 15 taxes. The relevant tax laws and the Law on Taxes and Duties define their application:

1. Personal income tax (a)

2. Corporate income tax (a)

3. Real estate tax (c)

4. Value added tax (VAT) (f)

5. Excise tax (g)

6. Customs tax

7. Natural resources tax (h)

8. Lotteries and gambling tax

9. State social insurance compulsory contributions (b)

10. Electricity tax

11. Microenterprise tax (a)

12. Vehicle operating tax (d)

13. Enterprise light-duty vehicle tax (e)

14. Subsidised electricity tax (until 31 December 2017)

15. Solidarity tax

Adjustment, exemptions and exceptions for agriculture

Within the general tax system, adjustments, exemptions and exceptions may apply to the agricultural sector:

(a) With regards to their income tax, agricultural producers choose to pay one of the three taxes on income from economic activities: personal income tax, corporate income tax or microenterprise tax.

The personal income tax does not apply to income below EUR 3 000 from agricultural activity (crop production, animal production, inland waters fishery, horticulture) and rural tourism. Furthermore EU and national support are not subject to the personal income tax.

A reduced tax rate of 15% applies on income acquired from 1 April to 30 November while performing seasonal work: planting of fruit trees, berry bushes and sowing and planting vegetables, tending of sowings or plantings, harvesting, sorting of fruits, berries and vegetables. The tax is applied if the employment relationship does not exceed 65 calendar days, the total income does not exceed EUR 3 000 in the season and if 4 months prior to the commencement of the seasonal agricultural work the person has not had other employment.

From 2018:

A new company income tax regime will enter into force whereby re-invested profit is not taxed;

Amounts received as state aid to agriculture or EU support for agriculture and rural development are deducted from the taxable base of the reporting year – by up to 50% and no more than the total taxable amount.

(b) Employers, employees and self-employed persons make social contributions, while personal income tax is deducted from wages of salaried employees in the sector.

(c) When applicable, producers of agricultural products pay the real estate tax:

Buildings and engineering structures, used exclusively in agricultural production are exempt from the real estate tax.

(d) The vehicle operating tax and the enterprise light-duty vehicle tax:

Agricultural producers pay 25% of the total rate of the transport vehicle exploitation tax for the transport vehicle, truck, trailer or semi-trailer.

(f) Producers in the agricultural sector also pay indirect taxes such as value added tax (VAT):

From 2018 a reduced VAT rate of 5%, (compared to 21% general VAT rate) applies to fresh fruits, berries and vegetables (including peeled, cut and pre-packaged, but not cooked or otherwise prepared, for example, frozen, salted or dried).

If they are not registered as value added tax payers, agricultural producers receive a 14% compensation of the value added tax upon delivering their own produced and unprocessed agricultural produce to processors of agricultural products or to eligible co-operative company, providing agricultural services, or for the State intervention purchase.

(g) Excise tax:

The excise tax on diesel fuel applicable to agriculture is 15% of the full rate. From 1 July 2018 to 31 December 2019, the rate is EUR 55.8 per 1 000 litres, and from 1 January 2020, EUR 62.1 per 1 000 litres. A volume limit applies to the purchase at reduced rate of diesel fuel used in agricultural production. The volume limit depends on the crop, from 60 to 130 litres per hectare of cultivated agricultural land that has been declared and approved for the single area payments (SAP). Diesel fuel purchased under these preferential conditions is coloured to mark it visually.

The excise tax on natural gas does not apply to agricultural use for heat supply of covered areas of agricultural land (greenhouses) and for heat supply of industrial poultry holdings (poultry house) and incubators.

(h) The natural resources tax applies to persons who carry out polluting activities.

A reform of Latvia’s tax policy started on 1 January 2018 to reduce income inequalities for workers by transferring the tax burden to consumption and capital; to reduce the underground economy in the country; to consolidate the effectiveness of operations by the State Revenue Service; to secure the predictability of the tax system at least until 2021.

Taxes on corporate and personal income

The income tax system in Latvia is shaped by three types of taxes: corporate income tax, personal income tax and microenterprise tax.

Latvia’s corporate income tax rate was one of the lowest in the European Union in 2015. The tax base was the adjusted profit or loss gained in Latvia or abroad during the taxation year and the base rate was set at 15% of the taxable income. However, taking into account labour taxes, business taxation amounted to about 30% of profits (Figure 4.15). Starting from 2018, under the new Corporate Income Tax law the corporate income tax rate is set at 20% for distributed profits and the tax is deferred until profits are distributed. The law is expected to encourage investments.

Figure 4.15. Total corporate tax rate, 2016

Note: The evaluation uses a concept of a “case study company” defined on the basis of a set of criteria, including the legal form of business (limited liability), start date of operation (January 2012), geographic location (country’s one or two largest business cities), origin of ownership (100% owned by domestic natural persons), type of activity (general industrial and commercial), size (own capital amount, number of employed, turnover, etc.). The total tax rate is the sum of taxes and contributions payable after accounting for allowable deductions and exceptions related to commercial profit of businesses before all taxes borne. The groups of taxes covered include: profit or corporate income tax; employer’s social contributions and labour taxes; property taxes; turnover taxes and other (such as municipal fees and vehicle and fuel taxes).

Source: World Bank Group and PwC (2017), Paying Taxes 2018 - The Global Picture, PwC, World Bank and IFC, www.doingbusiness.org/data.

Tax provisions for farms or agriculture-related businesses

While the general tax requirements apply to agricultural businesses; agricultural producers as well as other small and medium enterprise owners with a turnover below EUR 40 000 may opt for one of the three income taxes: personal income tax, corporate income tax or microenterprise tax. Whereas with a turnover between EUR 40 000 and EUR 300 000, the choice is between personal income tax and corporate income tax. Tax reliefs, exemptions and planning options are foreseen for agricultural businesses.

The personal income tax applies to all income.5 Starting from 2018, a progressive income tax rate is introduced. While the rate is unchanged at 23% for income between EUR 20 000 and EUR 55 000, a lower rate of 20% is introduced for income below EUR 20 000 and a higher rate at 31.4% applies to income exceeding EUR 55 000. Agricultural incomes below EUR 3 000 are exempt, and so are EU CAP payments and agricultural national support (Box 4.3).

In 2017 corporate income tax (CIT) was payable by farm businesses with a turnover exceeding EUR 300 000 during the previous taxation year. They could reduce the taxable income by the full amounts received as the national support for agriculture or the European Union support for agriculture and rural development and a tax relief of EUR 14.23 per hectare of agricultural land used in agriculture applied.

In 2018, 50% of state aid for agriculture and European Union CAP payments, but not more than the total taxable amount, can be deducted from pre-tax income.

The microenterprise tax is used to reduce the administrative and tax load for microenterprises (especially for new businesses) and in the fields with low-income potential. The microenterprise tax applies to 15% of the business’s turnover. The microenterprise tax combines state social insurance mandatory contributions, personal income tax and business risk fee for the microenterprise’s employees. In 2016, there were 606 taxpayers engaged in the agricultural production with the status of a microenterprise tax payer.

Labour taxes

While, about 76% of the total labour input in Latvian agriculture is unpaid family labour, the income of paid employees in the sector is taxed under general terms. Compulsory labour taxes cover social insurance. They are paid by employers and employees, 24.09% and 11% respectively). An employer funded business risk state fee also applies (EUR 0.36 per employee per month in 2018).

Compulsory contributions to the State social insurance and personal income tax are deducted from the employee salary prior to taxation. Income is taxed progressively: the personal income tax rate for monthly salaries up to EUR 1 667 currently stands at 20%, income above EUR 1 667 per month is taxed by 23%. Amounts that exceed EUR 4 583 (EUR 55 000 a year) are taxed by 31.4%. The 31.4% rate is not applied during the taxation year, but in accordance with the summary procedures, by drawing up an annual income declaration.

In general, personal taxable income deductions apply for:

11% of state social insurance compulsory contributions;

employer’s contribution to private pension funds and life insurance (not exceeding 10% of annual gross income in total but not more than EUR 4 000 per year);

annual differentiated6 non-taxable minimum depending on the size of the income is phased-in. In 2018 the annual differentiated non-taxable minimum is applied to annual gross income from EUR 5 280 up to EUR 12 000, the upper threshold is raised to EUR 13 200 in 2019 and to EUR 14 400 in 2020. In 2018 the annual differentiated non-taxable minimum ranges from EUR 0 to EUR 2 400 (EUR 0 to EUR 200 per month) and is raised gradually to EUR 2 760 per year (EUR 230 per month) in 2019 and to EUR 3 000 per year (EUR 250 per month) in 2020;

reliefs for dependent persons (EUR 200 per month per person in 2018, increased to EUR 230 and EUR 250 in 2019 and 2020 respectively).

The income of seasonal agricultural workers is subject to the Seasonal agricultural worker income tax and the tax rate is 15% (but not less than EUR 0.70 on each day of employment), provided that such income is derived in the period from 1 April to 30 November while performing seasonal work: planting of fruit trees, berry bushes and sowing/planting vegetables, tending of sowings or plantings, harvesting, sorting of fruits, berries and vegetables. The tax is applied if the employment duration does not exceed 65 calendar days, the total income does not exceed EUR 3 000 in the season and if the person has not had other employment during the four months preceding the agricultural seasonal work.

Real estate tax

The real estate tax payers are individuals who own, legally possess or use real estate in Latvia. The tax subject is land, edifices or parts thereof, as well as engineering structures used for economic activities. The real estate tax rate ranges from 0.2% to 3%. Generally, the tax is calculated considering the property’s cadastral value or special value rural land if the area thereof exceeds three hectares. Local governments manage the real estate tax.

The real estate tax does not apply to edifices and engineering structures used solely in agricultural production as well as land covered by restored or grown forest stands (young growths).

In order to encourage the productive use of land, the tax rate (0.2% to 3%) can be raised by 1.5%, up-to 4.5%, on uncultivated agricultural land, except for land the area of which does not exceed one hectare or for which limited agricultural operations are set in line with the regulatory enactments.

In order to limit the rapid increase of the cadastral values of the agricultural land, from 2016 to 2025 special value is set for the agricultural lands exceeding 3 ha, namely, the increase of the cadastral value shall not exceed 10% of the cadastral value of the rural land set for the previous taxation year.

Vehicle taxes

The vehicle operating tax applies, with some exemptions, to all vehicles. The tax rates are determined depending on the information available on the vehicle registration certificate in accordance with the vehicle’s CO2 emissions or the gross weight of the vehicle, the engine capacity and the engine’s maximum power. The tax does not apply to tractor machinery and automobile trailers and semi-trailers below 3 500 kg. Agricultural producers pay only 25% of the total rate of the transport vehicle exploitation tax for the transport vehicle, truck, trailer or semi-trailer.

The enterprise light-duty vehicle tax is paid by businesses and farms, that own or possess a light-duty vehicle or a truck. The tax is set as a fixed monthly payment depending on the vehicle’s registration date and engine displacement. The amount of the tax varies from EUR 120 to EUR 744 per year.

Consumption taxes

The Value-Added tax (VAT) standard rate for food in Latvia is set at 21%. For the delivery of certain goods (e.g. infant food, medicines, passenger transportation, tourism services, wood fuel and heating supply for households) a reduced tax rate of 12% is applied. Since 1 January 2018, a reduced VAT rate of 5% is applied for 3 years (after that an evaluation will be conducted) to fresh fruits, berries and vegetables (including peeled, cut and pre-packaged, but not cooked or otherwise prepared, for example, frozen, salted or dried vegetables).

The Value-Added Tax provides for both general and a special VAT scheme for transactions carried out inland by registered VAT payers. From 1 July 2016, the special VAT scheme (so-called reverse charge mechanism) in Latvia is also applied to the delivery of crops and industrial plants (including oil plant seeds) and mixtures of these goods (which are not normally used in the unaltered state for final consumption).

Agricultural producers that are not VAT payers receive a 14% compensation of VAT when delivering their own produced and untreated agricultural goods to processors, approved co-operatives, or State intervention purchase.

Excise taxes apply to alcoholic beverages, tobacco products, petroleum products, natural gas, non-alcoholic beverages and coffee, as well as electronic cigarette liquid.

However, a reduced rate of excise tax applies to diesel fuel used in agriculture. Diesel fuel purchased under these preferential conditions is coloured to mark it visually. The excise tax rate applied to agriculture is EUR 55.8 per 1 000 litres from 1 July 2018 to 31 December 2019 compared to a full rate of EUR 372. From January 2020, the tax rate will be EUR 62.1 per 1 000 litres, compared to a full rate of EUR 414 per 1 000 litres. Volume entitlements are calculated per hectare of cultivated agricultural land eligible to the Single Area Payments. They vary depending on the crop produced from 60 litres to 130 litres per hectare.

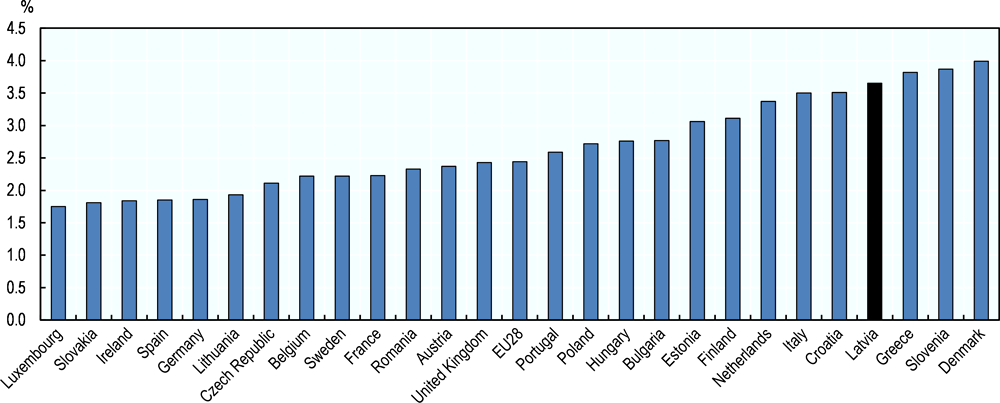

Environmental taxation

In 2015, environmental taxes in Latvia amounted to EUR 558.6 million (CSB, 2017a). In 2016, they represented 3.7% of the GDP, higher than the European Union average of 2.4% (Figure 4.16). Nonetheless, their composition is similar to the EU28 average, energy taxes make approximately three-quarters of environmental taxes, transport taxes are close to 20% and the pollution and resource taxes amounted to 3% (Eurostat, 2017b). In 2015, environmental taxes in agriculture reached 4% of the overall environmental tax amounts, compared to a 2% EU average (Eurostat, 2017a).

The natural resources taxes apply to a person who:

acquires or sells taxable natural resources, emits pollutants that are environmentally taxable or landfills waste;

sells or uses for economic activities goods harmful to the environment, or goods in packaging, as well as coal, coke and lignite (brown coal), and fireworks;

utilises in its activities radioactive substances after the utilisation of which radioactive waste is created, that is necessary to store or to dispose of in the territory of the Republic of Latvia;

registers vehicles permanently for the first time in Latvia to which the Management of End-of-Life Vehicles Law applies.

Figure 4.16. Environmental tax revenues, 2016

Tax impact on investment

According to “The Global Competitiveness Report 2017-2018” by the World Economic Forum, Latvia ranks in 117th and 118th place among 137 countries in terms of the effect of taxation on incentives to work and to invest (WEF, 2017).

Until 2018, the low profit taxation explained Latvia’s lower-than-average total tax rate – 35.9% in 2015 (Figure 4.15). This is partly because of the low corporate income tax rate and partly also because of tax allowances. Businesses in supported sectors (including the food industry), are entitled to a tax allowance of 25% of their overall initial long-term investment (up to EUR 50 million). A 15% allowance rate applies when the overall initial long-term investment amount is above EUR 50 million.

Following the corporate income tax reform in 2018, another essential factor for the promotion of investments is the new regime of the corporate income tax, that is, the tax shall not apply to the reinvested profit.

Tax incentives for private investment in R&D

Before the 2018 tax reform in Latvia, a taxpayer was entitled to reduce the income subject to corporate income tax by applying the increased coefficient of three to the expenses amount in case of expenses incurred by an employee complying with the definition of scientific personnel or scientific technical personnel, directly related to research and development activities.

According to OECD analysis, in 2016, the level of R&D promotion with tax incentives in Latvia was high. In Latvia, B-index which describes the relevant level of tax incentive (pre-tax) per additional research and development unit to which companies with certain features are generally entitled, was determined at 0.3 in the group of companies with profit (OECD, 2017a).

However, the overall relief amount for R&D investments was rather low because in 2015 research and development expenses in Latvia were registered by 30 companies and the overall relief amount was EUR 421 100 (MoF, 2017).

The approach changed with the 2018 tax reform as the corporate income tax applies after profit distribution, therefore reinvested profit, including profit reinvested in R&D activities, is no longer taxed.

4.5. Summary

With an overall positive picture, Latvia’s regulatory environment performs less well than the OECD average and opportunities for improvement exist. Barriers to entrepreneurship remain in several areas that may hinder investment decisions. These include the licence and permits system and the administrative burden for both corporation and for sole proprietor firms.

Conditions on agricultural land ownership reflect efforts to guarantee Latvian farmers access to land and the prevention of speculation on a support-eligible resource, i.e. land. Other instruments could be considered that may better address concerns and support a well-functioning land market.

Indicators of financial market developments are significantly lower than the OECD average and only slightly lower than the EU28 average. The index components have all improved in the past five years, yet only the legal rights index is above the OECD average.

The overall tax load in Latvia was considered to be moderate with a total tax and contribution rate at 36% of company profit in 2016. A tax reform introduced in 2018 plans to increase tax revenues to 30% of GDP. The reform is expected to reduce inequality, to reduce the size of the informal economy and to increase the efficiency of tax administration.

Historically, the corporate income tax also provided for an allowance for research and development expenses. However, in reality the allowances were low and the 2018 reform of the corporate income tax should incentivise R&D investments with tax exemptions on reinvested profit and allowances for investment projects, including in R&D activities.

In Latvia, there is a broad range of environmental taxes. While in recent years environmental taxes in Latvia represented 3.7% of the GDP, a higher ratio than the EU average of 2.4%, their composition is similar to the EU28 average; three–quarters of environmental taxes are levied on energy, to which transport add another 20%. In 2015, the agriculture sector contributed 4% of the overall environmental taxes.

Agriculture complies with the overall requirements of the tax codes. However, reliefs and exemptions from several taxes are provided to agricultural activities, e.g. personal income tax allowance for agricultural producers, VAT compensation for unprocessed agricultural products, real estate and vehicle tax reliefs, diesel fuel enjoys a reduced excise tax rate and natural gas a full exemption. Diesel fuel bought under these preferential conditions is coloured to mark it visually. Furthermore, two-thirds of the sector’s labour is unpaid family labour and hence receives no taxable income from the sector neither pays associated labour taxes and social security contributions.

Funding for agricultural development in Latvia is sourced through European Union programmes, other international institutions, the state and Altum.

The volume of loans granted by credit institutions to companies operating in agriculture, forestry and fishing has increased 1.3 times over the past ten years, constituting 6.7% of the total loan portfolio as of the end of December 2016.

References

Altum (2017), Services for Rural Enterprises, https://www.altum.lv/en/services/rural-enterprises/ (accessed 14 October 2017).

Bank of Latvia (2018), Loan Balance of Companies Operating in Agriculture, Forestry and Fishing, https://www.bank.lv/component/content/article/4776-makroekonomisko-norisu-parskats (accessed 30 October 2017).

CSB (2017a), Environmental taxes by type of activity database: VIG06. Vides nodokļi pa darbības veidiem, http://data.csb.gov.lv/pxweb/lv/vide/vide__ikgad__vide/VI0060_euro.px/?rxid=3d45ed82-37cb-4028-9e9c-9e6bde2ba4ba (accessed 2 November 2017).

CSB (2017b), General statistics, http://data.csb.gov.lv/pxweb/en/visp/visp__igad__dabasr/?rxid=a79839fe-11ba-4ecd-8cc3-4035692c5fc8 (accessed 29 October 2017).

CSB (2017c), Investments and current expenditure for environmental protection by environmental area (thousand euros excluding VAT), http://data.csb.gov.lv/pxweb/en/vide/vide__ikgad__vide/VI0050_euro.px/table/tableViewLayout2/?rxid=cdcb978c-22b0-416a-aacc-aa650d3e2ce0 (accessed 29 October 2017).