This chapter provides an overview of the agricultural policy framework and instruments. It gives an account of the EU Common Agricultural Policy (CAP) measures and their implementation in Latvia and also of Latvia’s national policies and budget expenditure for agriculture. The chapter then reports trends on the level and composition of payments to producers and expenditure on general services to the sector. Finally, it discusses the likely policy impact on structural change, innovation, productivity growth and sustainability performance.

Innovation, Agricultural Productivity and Sustainability in Latvia

Chapter 6. Agricultural policy framework

Abstract

6.1. Overview

Since the accession of Latvia to the European Union in 2004, agricultural and rural development policy is implemented in accordance with the legislative provisions of the Common Agricultural Policy (CAP), taking into account the specific needs of Latvia. In the programming period 2014-20, the CAP Pillar 1, financed from the European Agricultural Guarantee Fund (EAGF), covers direct payments and market measures. By means of the CAP Pillar 2, the rural development support measures are being financed from the European Agricultural Fund for Rural Development (EAFRD) with national co-financing. Their implementation is ensured in compliance with measures of Latvia’s national Rural Development Programme. Other sectoral development plans and climate change strategies are relevant to agricultural and rural development. They are summarised in Box 6.3.

6.2. Broad-based domestic measures

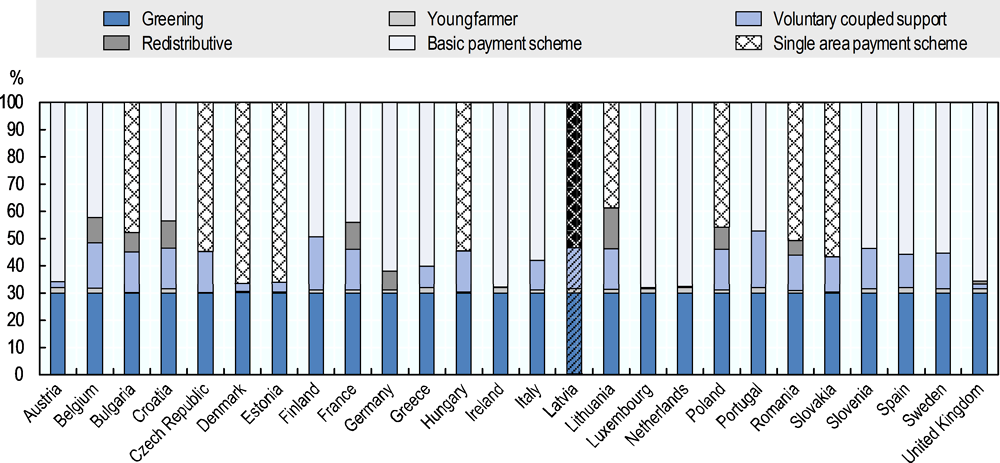

In Latvia, CAP direct payments have been available for farmers since 2004. The new system of direct payments, introduced by the CAP 2014-20 increases EU Member States’ flexibility in the management and use of their allocated resources.

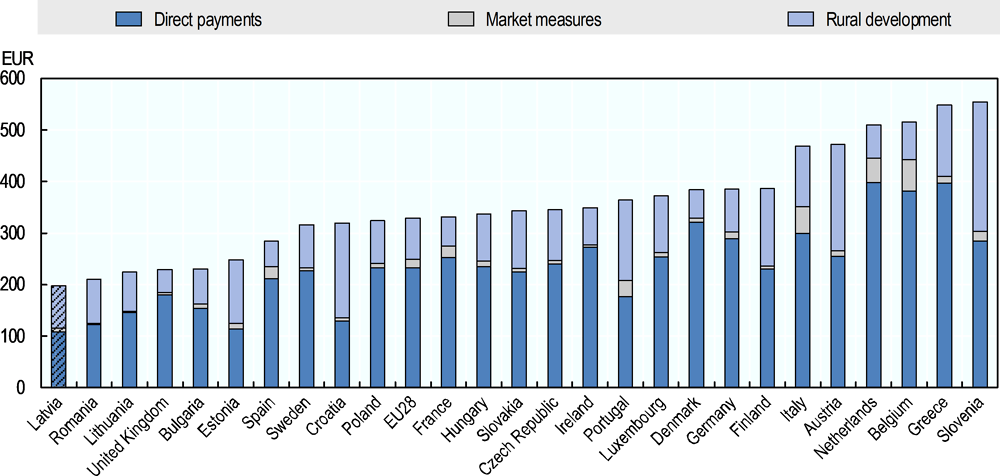

About half of Latvia’s direct payments are channelled through the SAPS (Figure 6.1). Currently, eligibility depends on agricultural land that complies with the definition of arable land, permanent grassland and permanent crops and that has been maintained in a state suitable for grazing or cultivation (Box 6.1). In 2017, with a calculated average support of EUR 108 per hectare, Latvia ranks lowest among EU Member States and compares to the EU28 average of EUR 232 per hectare (Figure 6.7).

In addition to the broad based mandatory measures, Latvia opted for several new choice payments. These include the small farmers’ support scheme and commodity specific coupled support, introduced in 2015. Thus, since 2015, in Latvia the direct payments are implemented as follows (Figure 6.1 and Box 6.1):

The mandatory Single Area Payment (SAP) scheme is extended until 31 December 2020. It offers a uniform support rate per ha1 of agricultural land to every farmer who maintains the land in a condition suitable for growing crops and grazing.

The mandatory greening payment makes up 30% of the direct payments budget under Pillar 1. The greening payment is provided conditional on the implementation of three farming practices.

The mandatory payment for young farmers.

Among choice measures, Latvia has opted to support specific commodity sectors and offers 15% of the direct payments envelope to Voluntary Coupled Support (VCS) to thirteen commodity sectors (Table 6.1) with an overall budgetary envelope of EUR 35 million in 2017. Increases in the per unit payment rates of the VCS are announced.

Latvia has also opted for the small farmers’ payment scheme.

Table 6.1. Rates of direct payments in Latvia, 2017 and 2020

|

Direct payment schemes |

Payment schemes |

Budget 2017, EUR |

|

|---|---|---|---|

|

2017 |

2020* |

||

|

SAPS** |

70 EUR/ha |

93 EUR/ha |

126 737 350 |

|

Greening payment |

41 EUR/ha |

55 EUR/ha |

69 129 000 |

|

VCS for dairy cows |

169 EUR/animals |

224 EUR/animals |

17 163 906 |

|

VCS for goats |

57 EUR/animals |

57 EUR/animals |

120 954 |

|

VCS for bovine |

75 EUR/animals |

128 EUR/animals |

4 136 679 |

|

VCS for sheep |

23 EUR/animals |

27 EUR/animals |

554 510 |

|

VCS for starch potatoes |

298 EUR/ha |

324 EUR/ha |

207 146 |

|

VCS for certified cereal seed |

59 EUR/ha |

59 EUR/ha |

730 833 |

|

VCS for certified seed of grasses and fodder crops |

66 EUR/ha |

66 EUR/ha |

291 392 |

|

VCS for certified seed potatoes |

429 EUR/ha |

429 EUR/ha |

160 218 |

|

VCS for spring rape and turnip rape |

37 EUR/ha |

37 EUR/ha |

1 003 315 |

|

VCS for vegetables |

496 EUR/ha |

615 EUR/ha |

1 433 896 |

|

VCS for fruits and berries |

135 EUR/ha |

167 EUR/ha |

870 414 |

|

VCS for protein crops |

54 EUR/ha |

70 EUR/ha |

4 608 620 |

|

VCS for barley |

43 EUR/ha |

51 EUR/ha |

3 282 767 |

Notes: *Provisional rates. ** Including amounts of payment for young farmers and small farmers’ scheme.

Source: Based on RSS (2017a), EC (2015a), and EC (2015b).

Figure 6.1. Distribution of funds amongst the direct payment schemes (excluding the small farmers’ scheme), 2016

Note: Countries are ranked in alphabetical order.

Source: Based on EC (2016b), Direct payments 2015-20. Decisions taken by Member States: State of play as at June 2016.

The mandatory direct payment for young farmers was introduced by the CAP 2014‑20. It is attributed to natural and legal persons who set-up a farm for the first time. It adds to the SAP support payment and is limited to the first 90 ha. In 2017, 2 700 farms qualified for the young farmers’ scheme; 4.6% of all farms that applied for SAPS. The payment rate was constant at EUR 42.2 per hectare until 2017. Starting from 2018 it is fixed as 35% of the national average of all direct payments per ha in 2019.2 The maximum duration of payments is five years.

The small farmers’ support scheme has been implemented by 15 EU Member States, including Latvia. Implementation of the scheme is flexible and two EU Member States (Latvia and Portugal) have chosen to grant a lump sum payment to all applicants. In Latvia, the scheme is a simplified annual lump sum payment of EUR 500 per farm, and substitutes other EU direct payments. Farmers who own or legally possess at least 1 ha of land that conforms to the agricultural land criteria as defined above are eligible. There is no maximum area threshold. In 2016, 25.5% of the total number of applicants for direct payments participated in the small farmers’ scheme (EU, 2017c). The cultivated land area amounted to 2.3% of the total area declared for CAP support. The enrolment of farmers in the small farmers’ support scheme was completed in 2015 and no new entrants can apply.

Box 6.1. Summary eligibility conditions for direct payments

Conditions apply that determine farmer eligibility to CAP direct payments. Some conditions are uniform EU-wide while Member States are offered flexibility in implementation criteria as to others.

|

Criteria |

Conditions and requirements |

|---|---|

|

All beneficiaries, with exemption of those who participate in the small farmers’ support scheme |

Cross-compliance Greening requirements: maintenance of permanent grasslands |

|

Arable land 10 ha and more |

Greening requirements: crop diversification in addition to conditions above |

|

Arable land 15 ha and more |

Greening requirements: crop diversification plus maintenance of an EFA in addition to conditions above |

|

Direct payments above EUR 2 000 |

Reduction of financial discipline |

|

SAP above EUR 150 000 |

Reduction of payments above the threshold by 5% |

|

Direct payments EUR 5 000 and more |

Conditions for active farmer (discontinued in 2018) |

Source: Based on MoA (2014a) and RSS (2017b).

The greening support payment is conditional to three agricultural practices:

Crop diversification. Depending on farm area, farmers are required to grow one to three different crops.

Defining an ecological focus area (EFA). Latvia applies the so called “forest exemption” together with three other EU Member States. The EFA requirement does not apply in parishes where forest covers more than 50% of the total land surface and the forest to agricultural land ratio exceeds 3 to 1. As a result, approximately 9% of the agriculture area is exempt from the EFA.

Maintenance of the existing permanent grasslands and non-conversion of environmentally sensitive permanent grasslands. Irrespective of the size of the area, farmers are not allowed to plough or modify permanent grasslands that have been identified as protected environmentally sensitive grasslands (grassland habitats of significance for the EU or bird habitats). The requirement for reconversion of the permanent grasslands at individual level is activated only when the ratio of areas of permanent grassland to the total agricultural area at the national level decreases by more than 5% compared to a reference ratio.

A linear reduction, the financial discipline, applies to all EU direct payments above EUR 2 000 (EU, 2016a). In 2016, in Latvia, the financial discipline applied to almost 30% of applicants for the direct payments, reducing only 1% of the total amount of the direct payments at the national level.

EU Member States are required to apply a minimum 5% reduction to single area payments in excess of EUR 150 000. Latvia, together with 15 other EU Member States, has chosen to apply the minimum requirement and to deduct labour costs (wages and taxes) paid in the preceding calendar year. In 2016, the reduction applied to 13 SAP beneficiaries.

From 2018, EU Member States can choose whether to limit payments to active farmers. Latvia, together with 18 other EU Member States has discontinued the active farmer condition.

Latvia has used the opportunity provided by Regulation No 1307/2013, to transfer funds between the two Pillars of the CAP and has transferred 7.46% of the direct payments envelope in Pillar 1 to the rural development measures in Pillar 2. By doing so Latvia compensated the reduction by 8% of EU funding of rural development for 2014-20. Pillar 1 payments are typically broad based while farm support in Pillar 2 includes farmer elected investment and conversion scheme through multi-year contracts among other schemes. These schemes bear the potential to impact farm productivity and competitiveness (Table 6.4).

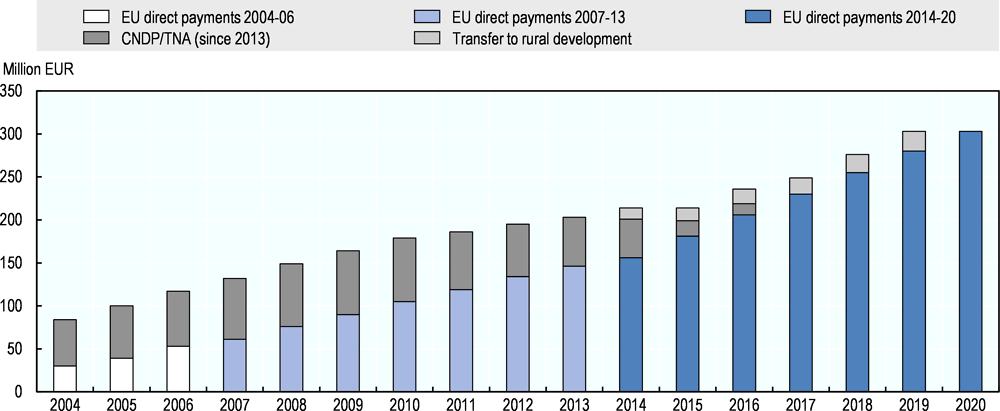

Since the accession of Latvia to the European Union, the total amount of direct payments has grown considerably. Overall, in the period from 2004 to 2020, the amount of direct payments paid will reach EUR 3.2 billion of which 77% are EU funded direct payments. In the programing period 2014-20, EUR 1.7 billion will be available for farmers in Latvia in the form of direct payments (European Union and Latvia) (Figure 6.2).

Figure 6.2. Direct payments in Latvia, 2004 to 2020

As part of the transition to the CAP at the time of EU accession, Latvian farmers were attributed complementary national direct payments (CNDP) both for cultivated areas and agricultural animals (sheep, suckler cows and slaughtered bovine animals) and for marketed milk. Up to 2006, the complementary national direct payments were entirely output related. They stimulated production in certain sectors. Since 2007, a gradual decoupling of the CNDP from output was started. Since 2007, the payments for milk were fully decoupled and in 2009, the CNDP was fully decoupled in most sectors, except for suckler cows and ewes. From 2013, the transitional national aid (TNA) replaced the CNDP. The TNA is based on past sectoral benefits with no obligation to produce. At the choice of Member States, the TNA can be granted until 2020 and its amount is gradually reduced (OECD, 2017a). In 2017 and 2018, Latvia chose not to pay TNA for lack of public finance. The main objective of the CNDP and TNA for Latvia is to bring the level of support closer to the average EU direct payment level.

Based on MoA calculations, the average level of direct payments has increased from EUR 24 per ha in 2004 to EUR 131 per ha in 2016; about half the EU average of EUR 267 per ha in 2017 (EU, 2018). As a result of external convergence under the CAP 2014-20, the distribution of the support among Member States and regions gradually changes to reduce the gaps in the levels of support received by farmers in Member States. For the Member States which receive less than 90% of the EU average level of support, from 2015 the amount of payments is gradually increased, with a target per hectare payment of EUR 196 in 2020 (OECD, 2015b). However it is estimated that, as a consequence of the increase of the eligible area, combined with Latvia’s choice measures3 and the fixed Pillar 1 budget envelope, this target will not be reached in 2020 and the MoA estimates that the average direct payments level will be less than EUR 182 per ha.

6.3. Support to specific sectors

The VCS is the most important commodity specific support. It uses 15% of Latvia’s direct payments envelope, a large part of which is captured by the bovine sector (both meat and dairy). Vegetables and seed potatoes receive the highest payments per hectares cultivated under crops. The VCS is also used to support the use of certified seeds of cereals, potatoes and grasses and fodder crops. The VCS attracts production to supported sectors and distorts the allocation of resources. As shown in an analytical exercise done with the CAPRI model, production increases in sectors receiving the VCS, thereby depressing producer prices and increasing pressure on resources and the environment (OECD, 2017b).

Latvia also implements the CAP voluntary schemes for the consumption in schools of fresh fruit, vegetables and milk. Up to July 2017, the “School milk” and “School fruit” programmes ran separately, as of August 2017 they run jointly as the “EU school scheme”.

Under the “School milk” programme, implemented since 2004/05, children in pre-schools and schools have consumed about 30 million tonnes of milk and dairy products. Support paid within the programme amounts to EUR 17.94 million, including EUR 5.01 million (28%) of EU support. A national top-up to the programme budget was granted, providing for heat-treated milk with no sugar, flavourings and other additives, to be supplied free of charge to children in pre-schools and grades 1 to 9. Adjustments are made for older school children and other dairy products.

The “School fruit” programme implemented since 2010/11 covered 91% of children in grades 1-9. Under the programme 4 528 tonnes of fruits and vegetables were consumed in total and the support paid within the programme amounts to EUR 7 million, of which 75% is EU financing. Within the programme, fresh fruits and vegetables are supplied free of charge to school children. Schools, schools’ catering companies, local municipalities or producers of fruit and vegetables can apply for aid under the “School fruit” programme in Latvia.

In the period from 2004 to 2016, market intervention was available in Latvia for the purchase of the following products:

In 2004-10 a total of 78 211 tonnes of grain and 414 tonnes of butter were purchased into public intervention.

In 2015-17 a total 5 154 tonnes of skimmed milk were purchased into public intervention and the stocks have not yet been disposed of.

Currently, there are no intervention stocks of butter and grain in Latvia.

Support for the private storage of products:

In 2005/14, contracts were concluded for private storage of 114 tonnes of long-keeping cheese.

In 2015/16 contracts were concluded for private storage of 1 463 tonnes of skimmed milk powder.

The support for private storage of butter and pork has not been used in Latvia.

In the period from 1 May 2004 to 31 March 2015, a system of milk production quota was operated throughout the European Union, including Latvia.

The EU temporary exceptional support for the livestock sector was granted several times during 2014-16, first as a response to the imports embargo introduced by the Russian Federation and subsequently as a mitigating tool against global dairy market disturbances. During this period, Latvian milk producers and owners of pig herds respectively received EUR 26 million and EUR 6 million of complementary national top-up.

The EU exceptional support for the fruit and vegetable sector was introduced in 2014 to mitigate the decrease in producers’ income resulting from the Russian embargo. However, in 2015-16, fruit and vegetable prices were high and the amount paid out until now is only EUR 19 000. The support continued in 2017.

The EU support for producer groups and organisations in the sector of fruits and vegetables is made available for professional producer groups as well as agricultural and food industry structures, focusing on the provision of information and promotion of trade in agricultural products, developing and submitting agricultural product promotion programmes. Starting from 2016, the European Commission accepts, evaluates and makes a decision on granting or denying of the EU financing.

Box 6.2. Food quality schemes

EU and national quality schemes have been introduced to promote quality-food production in Latvia. These include:

1. Organic Agriculture scheme

2. Protected Geographical Indication scheme

3. Protected Designation of Origin scheme

4. Traditional Specialty Guaranteed scheme

5. National Food Quality Scheme

Besides the production of organic foods (Sections 2.3 and 6.3), Latvia implements EU and national food quality schemes.

Latvia takes part in the European Union wide schemes for agricultural and food products. These may be registered as Protected Geographical Indication (PGI), as Protected Designations of Origin (PDO) and as Traditional Specialty Guaranteed (TSG). The “Carnikavas nēģi” and the “Rucavas baltais sviests” are registered as PGI. The “Latvijas lielie pelēkie zirņi” is registered as PDO and the “Sklandrausis”, “Jāņu siers”, “Salināta rudzu rupmaize” are registered as TSG.

Along with the EU food quality schemes, Latvia has a national food quality scheme (NFQS). Under the NFQS all stages of the food chain can be traced, the product manufacturer is certified according to the NFQS criteria and the requirements of the final product is in retail or direct delivery of the final consumer. The NFQS products are identified by two logos.

|

|

|

Higher quality products and at least 75% of the raw materials has been obtained in a single country or region (one EU Member State or region), specified on the logo. |

Higher quality products produced in full in a single country or region (one EU Member State or region), specified on the logo. |

Products of NFQS cover a vast, well-recognisable assortment of products. Late in 2017, the NFQS had 152 participants covering more than 700 products. It provides the possibility for producers to produce and for consumers to receive higher quality products, which exceed the general standard of commercial products. In Latvia NFQS is recognized by two logos “Qualitative product” “Green Spoon” and “Bordeaux spoon”. NFQS is open to all operators.

Source: MoA NFQS, 2018.

Several CAP instruments promote EU agricultural products both in the EU single‑market and in third countries. The programmes can be developed on themes linked to food quality, safety and labelling to promote the high quality level of European food. In the period from 2005 to 2016, Latvia participated in eight programmes promoting biological products, milk products, honey, fruits and berries and ornamental plants with an overall budget of EUR 4 million. A new EU agriculture promotion campaign was started in December 2015 with the slogan “Enjoy, it’s from Europe”. Under the new promotion campaign two programmes from Latvia were granted an EU contribution for 80% of their total budget. The Latvian Central Dairy Committee’s “TasteMilk” promotes Latvian dairy products in the People’s Republic of China, the United Arab Emirates, the United States, Azerbaijan, Israel and Iraq. The total budget of the programme is EUR 3 million. The Irish Latvian Chamber of Commerce in 2018 launched a promotion programme of chocolate and confectionery in the United States and Canada “Sweet to States” with a total budget of EUR 1.3 million.

Box 6.3. Sectoral development plans and climate change strategy

The Development plan for the Latvian milk sector until 2020 covers the improved productivity and quality of milk production, processing and marketing milk into high value added and niche milk products and training of milk sector experts. Various EU and national support measures are mobilised to implement the strategy (MoA, 2012).

The Latvian Bioeconomy Strategy 2030 emphasises the significance of bioeconomy in the national economy and its role in addressing issues such as global food security, dependency on fossil energy resources and climate change. The Bioeconomy Strategy expands beyond the traditional bioeconomy sectors – agriculture and forestry (both equally important in the national economy), fisheries and aquaculture, food and wood industries, to new bioeconomy sectors such as chemical, pharmaceutical and textile industries. The strategy aims to stabilise employment in the bioeconomy at 128 000 people in 2015, to increase the sector’s value added from EUR 2.33 billion in 2016 to over EUR 3.8 billion in 2030, and to increase exports from EUR 4.26 billion in 2016 to over EUR 9 billion in 2030 (MoA, 2016).

The Environmental Policy Guidelines 2014-2020 lay down general policy objectives for climate change – to ensure Latvia’s contribution toward the mitigation of global climate changes and to facilitate Latvia’s readiness to adjust to climate change and its impacts. The policy guidelines set a total emissions target of 12.16 Mt CO2 equivalent by 2020. Measures implemented include the introduction of a low carbon economy, of sustainable management practices into agriculture and facilitating the production and the use of sustainable biomass in energy production by attracting national and EU financing. The MoEPRD implements a monitoring system to assess progress towards the target.

Research is underway on the “Analysis of GHG emissions from the agricultural sector and Economic assessment of GHG emissions mitigation measures”. In addition, EU Member States report to the Commission on their current and future LULUCF actions to limit or reduce emissions and maintain or increase removals and storage. In 2016, Latvia prepared and submitted a progress report to the European Commission. As foreseen by EU decisions, Latvia has developed a crop‑ and grazing‑management monitoring and reporting system.

Latvia joined the international initiative “4 per 1 000: soils for food security and climate” in 2016. The initiative aims to increase the content of organic matter in soils and to facilitate their carbon uptake through agricultural activities that are adapted to local conditions. To reach this target, Latvia developed a digital soil database with support from the European Economic Area Financial Mechanism. Work on generalising agricultural soil information and updating is ongoing. Latvia plans to establish a national soil information system that would be based on the digital soil database.

6.4. Measures targeting specific issues

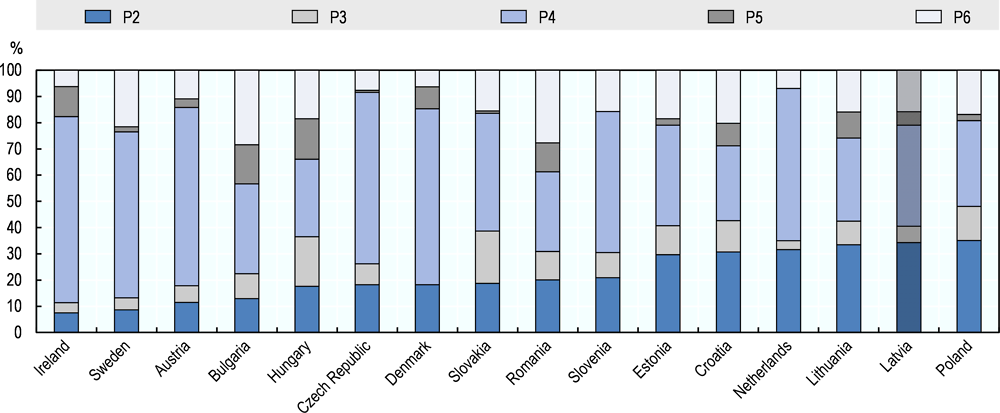

Latvia’s Rural Development Programme (RDP) defines the EU and national budget allocations to agriculture and rural development. Under the six CAP rural development priorities, Latvia has opted for the implementation of 16 support measures deemed to improve the competitiveness of farms and the management of ecosystems (Priorities P2 and P4 with respectively 34% and 39% of the total financing available in the programming period) (Table 6.2; Figure 6.3).

Figure 6.3. RDP expenditure by priorities in selected EU Member States

Notes: RDP expenditure over 2014-20, includes MS co-financing. There are six EU rural development priorities: P1 – Knowledge and innovation (is attributed throughout all priorities), P2 – Competitiveness, P3 – Food chain, P4 – Ecosystem management, P5 – Resource efficiency, climate change, P6 – Social inclusion, local development. Countries are ranked based on the share of Priority 2 expenditure (Competitiveness) in their total RDP expenditure.

Source: Based on EC (2017e), Rural development 2014-2020: Country files.

One-third of the total RDP budget is earmarked for investments (Table 6.2). Support to areas facing natural constraints receives the second largest envelope (17% of RDP expenditure). The development and maintenance of organic agriculture (9%) and providing basic services in rural areas (8%) rank third and fourth in the total RPD expenditure.

Measures incorporated in the CAP RDP 2014-20 are described in detail in Box 6.4. In 2015-16, the implementation of the support measures was started (except the support for advisory services within the measure M02 and support for co-operation within measure M16) and overall EUR 201 million has already been utilised.

Table 6.2. Indicative budget of Latvian RDP 2014-2020

Million EUR

|

Measures |

Priorities* |

Technical assistance |

Total |

% of total |

|||||

|---|---|---|---|---|---|---|---|---|---|

|

P1: Knowledge and innovation* |

P2: Competitive-ness |

P3: Food chain |

P4: Ecosystem management |

P5: Resource efficiency, climate change |

P6: Social inclusion, local development |

||||

|

M01 - Knowledge |

6.7 |

6.7 |

13.4 |

0.9 |

|||||

|

M02 - Advisory services |

3.1 |

7.3 |

10.4 |

0.7 |

|||||

|

M04 - Investments |

432.2 |

75.7 |

11.3 |

519.2 |

33.4 |

||||

|

M05 - Restoring agricultural production potential damaged by natural disasters |

5.0 |

16.4 |

21.4 |

1.4 |

|||||

|

M06 - Farm development |

48.7 |

16.0 |

30.5 |

95.2 |

6.1 |

||||

|

M07 - Basic services |

126.6 |

126.6 |

8.2 |

||||||

|

M08 - Forest |

5.6 |

31.3 |

36.9 |

2.4 |

|||||

|

M09 - Producer groups |

2.8 |

2.8 |

0.2 |

||||||

|

M10 - Environment |

111.6 |

111.6 |

7.2 |

||||||

|

M11 - Organic farming |

151.9 |

151.9 |

9.8 |

||||||

|

M12 - Natura |

24.1 |

24.1 |

1.6 |

||||||

|

M13 - ANC |

267.5 |

267.5 |

17.2 |

||||||

|

M16 - Co-operation |

19.7 |

19.7 |

1.3 |

||||||

|

M17 - Risk management |

10.0 |

10.0 |

0.6 |

||||||

|

M19 - LEADER |

79.1 |

79.1 |

5.1 |

||||||

|

M20 - Technical assistance |

63.3 |

63.3 |

4.1 |

||||||

|

Total |

510.3 |

93.4 |

574.6 |

75.1 |

236.3 |

63.3 |

1553.0 |

100.0 |

|

|

% of total |

32.9 |

6.0 |

37.0 |

4.8 |

15.2 |

4.1 |

|||

Note: Priority 1, Knowledge and innovation, is attributed throughout all priorities.

Source: Based on EC (2017e), Rural development 2014-2020: Country files (Latvia).

Box 6.4. List of RDP 2014-20 measures

M01 Knowledge transfer and information actions

1.1. Support for vocational training and skills acquisition

1.2. Support for demonstration activities and information actions

1.3. Support for farm and forest visits

M02 Advisory services, farm management and farm relief services

2.1. Support to help benefiting from the use of advisory services

M04 Investments in physical assets

4.1. Support for investments in agricultural holdings

4.2. Support for investments in processing

4.3. Support for investments in the development of agricultural and forestry infrastructure

M05 Restoring agricultural production potential damaged by natural disasters and introduction of appropriate prevention

5.1. Support for investments in preventive actions aimed at reducing the consequences of epizooty and epiphytoty

5.2. Support for investments in restoring agricultural production potential damaged by epizooty and epiphytoty

M06 Farm and business development

6.1. Business start-up aid for young farmers

6.3. Business start-up aid for the development of small farms

6.4. Support for investments in creation and development of non-agricultural activities

M07 Basic services and village renewal in rural areas

7.2. Basic services and village renewal in rural areas

M08 Investments in forest area development and improvement of the viability of forests

8.1. Support for afforestation, supplementing partially overgrown agricultural land and their tending. Afforestation and tending

8.3./8.4. Support for prevention and restoration of damage to forests from forest fires and natural disasters and catastrophic events

8.5. Support for investment in improving the resilience and environmental value of forest ecosystems

M09 Setting up of producer groups and organisations

9.1. Setting up of producer groups and organisations

M10 Agri-environment and climate

10.1. Payment for agri-environment and climate commitments

10.1.1. Maintaining of biological diversity of grasslands

10.1.2. Application of environmentally friendly practices in horticulture

10.1.3. Stubble field in winter

10.1.4. Development of conservation environment by growing nectar plants

M11 Organic farming

11.1. Payment to convert to organic farming practices and methods

11.2. Development of organic farming

M12 12.2. Natura 2000 and Water Framework Directive payments

M13 Payments to areas facing natural or other specific constraints

13.2. Compensation payment for other areas facing significant natural constraints

13.3. Compensation payments to other areas affected by specific constraints

M16 Co-operation

16.1. Support for the establishment and operation of operational groups of the EIP for agricultural productivity and sustainability

16.2. Support for the development of new products, practices, processes and technologies

16.3. Support for the development of rural tourism

M17 17.1. Crop, animal and plant insurance premium

M19 Support for LEADER local development (CLLD – community led local development)

19.1. Support for preparation

19.2. Support for implementation of operation under the CLLD

19.3. Support for inter-territorial and transnational co-operation

19.4. Support for running costs of local activity group and animation of the territory

M20 Technical assistance.

By the end of the programming period 2007-13, an ex-post evaluation of the Rural Development Programme 2007-13 was carried out (RDP 2007-13) and conclusions and proposals produced by the ex-post evaluation were taken into consideration when drawing up the RDP for the new programming period (Box 6.5). For the RDP 2014-20 the ex-ante evaluation incorporates context analysis, conformity of programmes, convergence and assessment of results as well as strategic environmental impact.

Box 6.5. Evaluation of Latvia’s Rural Development Programme

The RDP 2007-13 ex post evaluation, the ex ante evaluation of RDP 2014-20 and the RDP 2014-20 chapter on SWOT assess the impact of support measures on innovations, on the sustainable use of resources and on the structural changes in the sector (Latvian State Institute of Agrarian Economics, 2016; Latvian State Institute of Agrarian Economics, 2013a; MoA, 2014b).

With regard to innovations Latvia’s ranking is one of the lowest among EU Member States. The major drawback identified is an insufficient co-operation among research institutions and rural entrepreneurs-practitioners who implement research results into practice. The evaluations suggest that the quality of knowledge transfer and advisory services must be improved in order to facilitate the implementation of innovations. This could be done by matching advisory measures to farmers’ needs, ensuring access to science, including the latest scientific developments, facilitating their practical implementation and monitoring and evaluating advisory measures.

Farmers and entrepreneurs in other sectors must be provided not only with basic traditional knowledge, training, skill acquisition measures and advisory services, but also with the opportunities for sharing experience and peer learning, such as farm and forest visits. Topics such as economic and environmental management and application of environmentally and climate friendly agricultural and forestry practices and sustainable use of natural resources could be demonstrated.

While Latvia’s GHG performance is one of the best among EU Member States, evaluations recommend to continue support to manure storage; organic farming and precision farming. A considerable amount of CO2 from the atmosphere can be stored in soils by applying different agricultural practices. These must be implemented. Forest management can also contribute to CO2 sequestration. A rational use of land resources would require to invest in the development of qualitative, more productive and more resistant forest stands and to convert partly overgrown, low‑productivity agricultural land areas into productive forests.

While support for setting up new agricultural businesses facilitates the emerging of young and knowledgeable farmers, the evaluations find that the amount of financing earmarked for the measure is not sufficient to achieve the planned outcome. The measure is forecast to have a low impact on the sector’s development and the evaluations recommend to prioritise economically sustainable projects with a higher impact of employment in rural areas.

Support for the development of small farms is assessed as effective. However, eligibility conditions are complicated and require a business plan implemented under the guidance of an adviser. The risk exists of developing ineffective production. Furthermore the amount of available support is not sufficient to restructure the economic activity. The measure would be more effective if resources were flexible in time to enhance more investments in fixed assets.

Support for investments in agriculture, forestry and food processing must prioritise the production of new products and application of new practices and technologies. Rural holdings need support for investments that are linked to farm restructuring, to machinery and diversification, to the acquisition of energy effective equipment and the efficient use of resources. Thus, production efficiency will increase and market risks diminished. To achieve a sustainable use of resources, it is necessary to differentiate the support rates applied to the investment projects, depending on their environmental impact and the volume of innovations.

Sources: Latvian State Institute of Agrarian Economics, 2016; Latvian State Institute of Agrarian Economics, 2013a; MoA, 2014b.

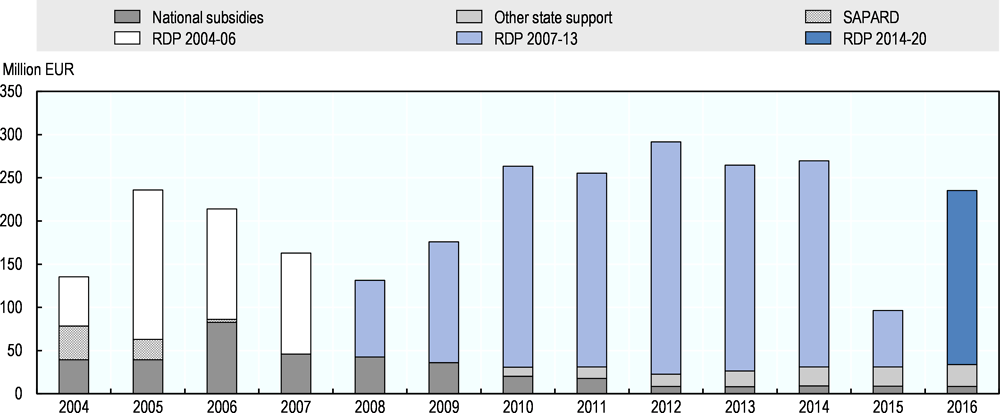

In addition to EU funding, support from the national budget is provided to agriculture under the so-called state aid. The EU Regulation No 702/2014/EU defines categories of state aid in the agricultural and forestry sectors and in rural areas that are compatible with the internal market (EU, 2014).

Under Latvia’s Agricultural and Rural Development Law, domestic support instruments include: a) credit; b) taxes; and c) support to producer groups.

Credit support to agriculture is implemented to: 1) acquire current assets needed for agricultural production; 2) acquire agricultural land for the production of agricultural commodities; and 3) provide credit guarantees for a successful implementation of projects within rural development measures (Section 4.3)

Agricultural producers are entitled to several tax exemptions and reduction, including income tax on lower incomes, real estate tax, diesel fuel and natural gas excise taxes, VAT and labour taxes (Section 4.4).

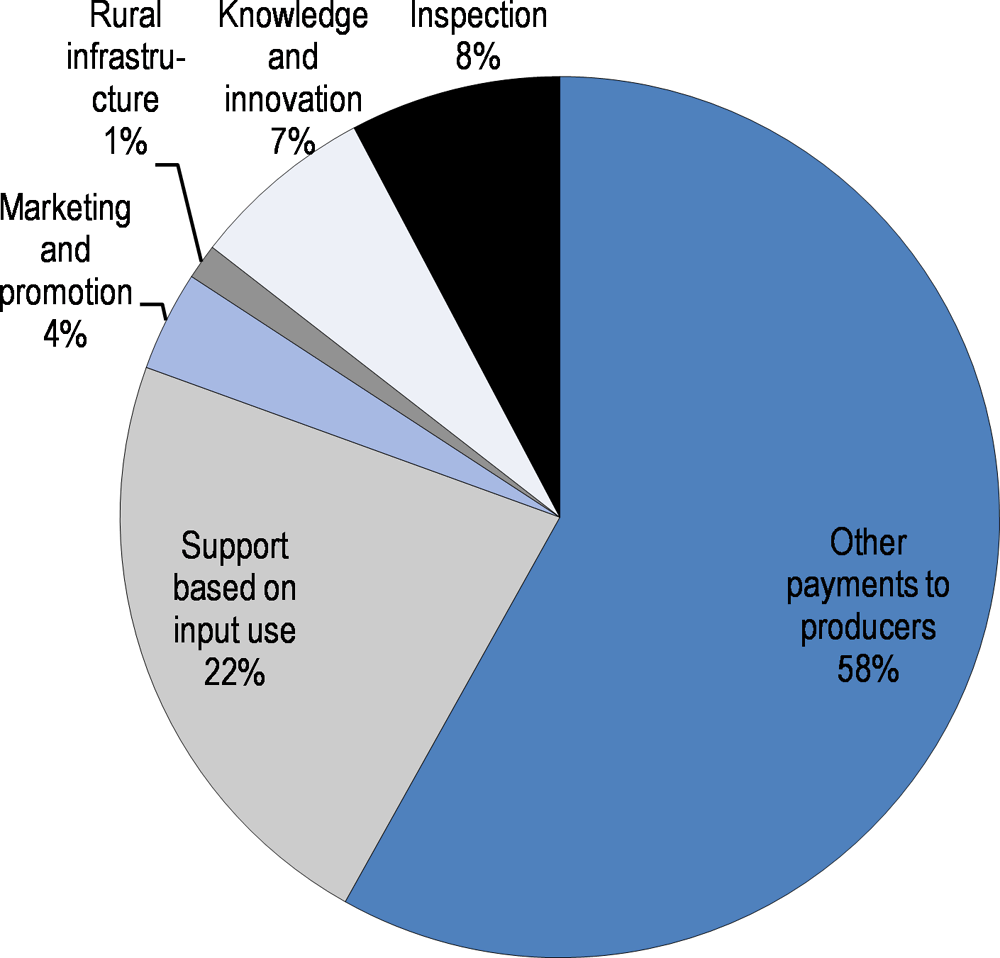

To encourage co-operation, support from the national budget has been attributed to facilitate investments and the establishment of new co-operative companies since 2000. In the period from 2004 to 2016, the total amount of the national support paid was EUR 367 million. Part of it (EUR 72 million or 20%) is classified as general services to the sector in the OECD definition of support from agricultural policy. The major share (40%) is paid to institutions carrying out controls and certification in the sector of agriculture (Figure 6.4).

Funding is also available within measures of the CAP Rural Development Programme. In 2016, the eligible co-operative companies, providing agricultural services, united 4 499 members (farm holdings) with the total turnover EUR 405 million.

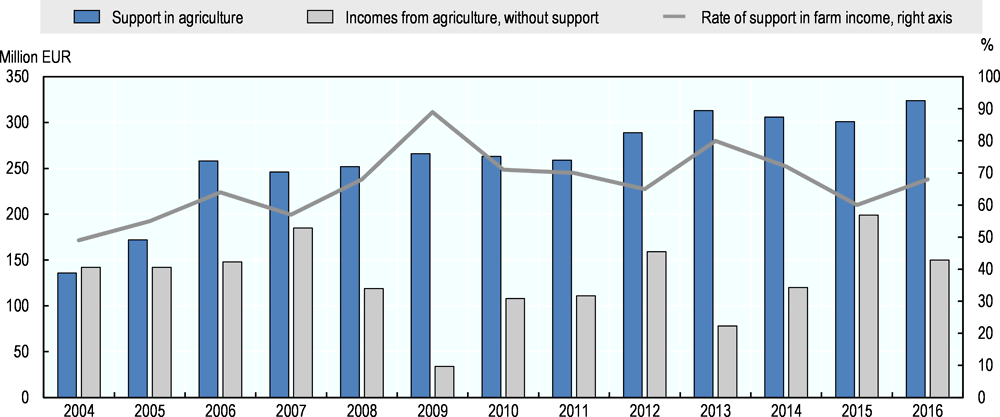

Most of national support is delivered to producers, including support based on input use, which includes credit subsidies and diesel fuel excise tax relief of EUR 39 million (Figure 6.4). During Latvia’s EU membership, the amount of support has fluctuated and its composition changed (Figure 6.5).

Figure 6.4. Composition of national support to agriculture in Latvia, 2004-16

Note: Numbers may not add up to 100 due to rounding.

Source: Based on MoA (2017a) and MoA (2017c).

Figure 6.5. Domestic support in Latvia, 2004 to 2016

Latvia’s RDP supports knowledge transfer and information measure and advisory services. The introduction of innovations also benefits from RDP support to Co-operation (Box 6.3) and to participation in working groups of the European Innovation Partnership (EIP) (Section 7.5). The measure enables a closer co-operation among producers, advisory and research services, facilitating a wider use of the available innovation measures and a more rapid and wider implementation of new solutions.

In 2008, a new subsidy for insurance policy replaced the previous agri-climatic disaster payments. Support is granted from the national budget to cover 50% of the insurance policy costs of crops and productive agricultural animals. From 2008 to 2016, more than EUR 7 million was paid under this scheme. Within the RDP 2014-20, farmers can receive a compensation to cover the actual costs of insurance policies under the support to “Crop, animal and plant insurance premium”.

At the same time, compensation takes place for natural disasters that may discourage farmers to allocate resources to risk management instruments. Latvia has opted for CAP RDP measures aimed at “Restoring agricultural production potential damaged by natural disasters and introduction of appropriate prevention measures”. This measure reduces incentives for farmers to engage in on-farm risk management actions.

Under Latvia’s RDP, investment support is granted for the diversification to non-agricultural activities and also for the development of rural tourism by encouraging the co-operation between small economic operators (microenterprises) in rural tourism. The production of biogas is no longer proposed in Latvia’s RDP 2014-20.

In Latvia, 50% of farm managers are older than 55 years of age and support is provided for business start-ups under the young farmer scheme. Under certain conditions, young farmers receive additional support for investments.

The construction of new barnyard manure storages and the use of precise technologies that ensure reduction in GHG emissions and ammonia emissions are also supported by the RDP 2014-20.

In addition to the agri-environmental measure described in Table 6.3, the tax on natural resources is an important policy instrument (Section 4.4). The natural resources tax applies to emission in the environment of taxable polluting substances. Taxable activities include animal sheds where, animal units are reared for commercial purposes (including storage and use of solid manure, liquid manure, slurry and silage juice as well as collection of drainage of waste water). In vulnerable zones, the tax applies to sheds that house ten and more animals, in vulnerable zones the number is brought down to five.

In the period after Latvia’s accession to the European Union, a considerable increase in output quantity and value and productivity was achieved in agriculture. Farm income is heavily dependent on support, the mean share of support in the income in 2004-16 was 67% (Figure 6.6).

In 2017, in Latvia, the amount of support under CAP measures paid in agriculture reached EUR 343 million, 52% through direct payments and 45% for rural development, the latter has a higher share than in most other EU Member States (i.e. 30%) (Figure 6.7).

Table 6.3. Agri-environmental measures in Latvia’s RDP

|

Support measure |

Type of support |

Proportion in total area declared for SAP in 2016, % |

Support rates, EUR per ha |

|---|---|---|---|

|

Maintaining of biological diversity of grasslands |

Compensation of foregone income and additional costs linked to fulfilment of the commitments |

2 |

55; 83-330 |

|

Application of environmentally friendly practices in horticulture |

0.3 |

74-364 |

|

|

Stubble field in winter |

5 |

87 |

|

|

Development of conservation environment by growing nectar plants |

- |

89 |

|

|

Organic farming |

Partial compensation of foregone income and additional costs linked to the commitments, undertaken when converting to organic farming or maintaining organic farming practices. |

16 |

97-485 |

|

Natura 2000 in forest territories |

Compensation of foregone income and additional costs linked to fulfilment of the commitments and constraints laid down for Natura 2000 territories |

2 |

45-160 |

Source: Based on MoA (2014b).

Figure 6.6. Support and farm income in Latvia, 2004 to 2016

Note: Farm income is net of wages paid.

Source: Based on MoA (2017a), Annual agriculture reports 2004 to 2017.

Figure 6.7. CAP expenditure per hectare, 2017

Note: Countries are ranked according to the sum of EU payments per hectare of utilised agricultural area.

Source: Calculations based on European Commission (2018), Agriculture and Rural Development Statistical factsheets and Eurostat (2018), Hectares of utilised agricultural area.

The support to measures facilitating structural changes has been assessed as one of the most successful farm development facilitating means; the beneficiaries of this support have shown the best indicators of economic growth, including, an increase in added value and turnover (Latvian State Institute of Agrarian Economics, 2013b). The structural changes resulted in increased areas of agricultural land used by farms (Table 6.4).

Table 6.4. Evaluation of the net added value by selected RDP 2007-13 measures in Latvia

EUR

|

Support measure |

Public expenditure for farm |

Increase of net added value |

Increase of net added value for 1 000 EUR* of public funding |

|---|---|---|---|

|

Support for young farmers |

34 196 |

3 325 |

138 |

|

Modernisation of agricultural holdings (investment support) |

46 908 |

-3 543 |

-108 |

|

Farm restructuring |

2 211 |

999 |

643 |

|

Enterprise creation and development (support for diversification of activities) |

107 050 |

63 602 |

845 |

Source: Latvian State Institute of Agrarian Economics (2013b).

6.5. Summary

In Latvia, the bulk of agricultural and rural development support is provided within the CAP, mostly through the uniform per hectare support under the SAP scheme. Direct support granted to specific commodities has gradually been reduced since 2004 and it made up a fifth of Pillar 1 payments in 2016.

Agricultural support accounts for a considerable share (more than 60%) of the average farm income of Latvian agricultural holdings.

Less than half of Latvian farms are commercial farms. While support offers a stable and predictable income, mostly to those who hold eligible land, it influences production choices and the allocation of resources in that it may keep unproductive farmers in the sector and divert resources from more efficient agricultural holdings.

Latvia has the lowest rate of EU financed agricultural expenditure per hectare. The national budget finances CAP instruments used to fill the gap with the average EU per hectare payment, as foreseen in EU regulations.

In accordance with EU agricultural state aid rules, the sector is also supported by several national policy instruments, including support to credit and tax exemptions.

Latvia’s RDP funds have been redirected to farmer-elected programmes with higher environmental constraints, thus encouraging and compensating for the provision of public goods.

The CAP rural development programme also supports farm level investments to improve the overall performance and competitiveness of agricultural holdings, to facilitate business start-ups, to the growth of small farms and to the diversification of activities in rural territories.

Policy signals received by farmers may be contradictory and detrimental to the longer term productivity and competitiveness of the sector. Latvia has chosen to redirect part of the funding of the broad based uniform per hectare direct payments in Pillar 1, which are least distorting, on the one hand, to farmer elected medium-term contractual schemes under Pillar 2, which contribute to farms’ modernisation and improved environmental performance and on the other hand, to attribute the maximum allowed budget to production-distorting direct support to specific commodities in Pillar 1.

References

European Commission (2018), Agriculture in the European Union and the Member States - Statistical factsheets, https://ec.europa.eu/agriculture/statistics/factsheets_en (accessed 1 August 2018).

European Commission (2017b), CAP explained. Direct payments for farmers 2015-2020, https://ec.europa.eu/agriculture/sites/agriculture/files/direct-support/direct-payments/docs/direct-payments-schemes_en.pdf (accessed 15 September 2017).

European Commission (2017c), Facts and figures on EU agriculture and the CAP. Direct payments, 5 July 2017, https://ec.europa.eu/agriculture/sites/agriculture/files/statistics/facts-figures/direct-payments.pdf (accessed 20 September 2017).

European Commission (2017d), Facts and figures on EU agriculture and the CAP. Green direct payments https://ec.europa.eu/agriculture/sites/agriculture/files/statistics/facts-figures/green-direct-payments.pdf (accessed 3 October 2017).

European Commission (2017e), Rural development 2014-2020: Country files, https://ec.europa.eu/agriculture/rural-development-2014-2020/country-files_en (accessed 27 September 2017).

European Commission (2016a), Direct Payments: Financial mechanisms in the new system, June 2016, https://ec.europa.eu/agriculture/sites/agriculture/files/direct-support/direct-payments/docs/direct-paymenst-financial-mechanisms_en.pdf (accessed 19 September 2017).

European Commission (2016b), Direct payments 2015-2020. Decisions taken by Member States: State of play as at June 2016. Information note, https://ec.europa.eu/agriculture/sites/agriculture/files/direct-support/direct-payments/docs/simplementation-decisions-ms-2016_en.pdf (accessed 13 September 2017).

European Commission (2015a), Voluntary coupled support - Other Sectors supported. Notification of decisions taken by Member States by 1 August 2014. Informative note, December 2015 https://ec.europa.eu/agriculture/sites/agriculture/files/direct-support/direct-payments/docs/voluntary-coupled-support-note-2_en.pdf (accessed 19 September 2017).

European Commission (2015b), Voluntary coupled support - Sectors mostly supported. Notification of decisions taken by Member States by 1 August 2014. Informative note, 30 July 2015 https://ec.europa.eu/agriculture/sites/agriculture/files/direct-support/direct-payments/docs/voluntary-coupled-support-note_en.pdf (accessed 19 September 2017).

EU (2018), Direct payments, https://ec.europa.eu/agriculture/direct-support/direct-payments_en (accessed September 2018).

EU (2014), Commission Regulation (EU) No 702/2014 http://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1512573388088&uri=CELEX:32014R0702.

European Parliament (2016), CAP reform Post-2020-Challenges in agriculture. Workshop documentation, http://www.europarl.europa.eu/RegData/etudes/STUD/2016/585898/IPOL_STU(2016)585898_EN.pdf (accessed 3 October 2017).

Eurostat (2018), farm structure (database) [ef_m_farmleg] http://ec.europa.eu/eurostat/data/database.

Latvian State Institute of Agrarian Economics (2016), Lauku attīstības programmas 2007-2013 Ex-post novērtējums, https://www.zm.gov.lv/public/files/CMS_Static_Page_Doc/00/00/00/97/47/Ex-postzinojums_pielikumi_SFC2007.pdf (accessed 28 September 2017).

Latvian State Institute of Agrarian Economics (2013a), Ex-ante novērtējums Lauku attīstības programmai 2014-2020, https://www.zm.gov.lv/public/files/CMS_Static_Page_Doc/00/00/01/08/06/2.pielikums_Ex-ante_nov..pdf (accessed 28 September 2017).

Latvian State Institute of Agrarian Economics (2013b), Lauku attīstības programma 2007-2013. gadam. Investīciju atdeves analīze LAP 2007-2013 pasākumos (Table 10). (Rural Development Programme 2007-13, evaluation) http://www.arei.lv/sites/arei/files/files/lapas/Investiciju%20atdeve%20LAP_%202013.pdf (accessed 1 October 2017).

MK (2004), Regulation of Cabinet of Minister No 1002 “The procedure for implementing the program document ‘Rural Development Program for 2004-2006’”, https://likumi.lv/doc.php?id=97429 (accessed 12 September 2017).

MoA (2017a), Lauksaimniecības gada ziņojumi 2004-2017 (Annual agriculture reports 2004-2017), https://www.zm.gov.lv/lauksaimnieciba/statiskas-lapas/lauksaimniecibas-gada-zinojumi?nid=531#jump (accessed 23 September 2017).

MoA (2017b), Latvijas lauksaimniecība 2017 (Latvian agriculture 2017), https://www.zm.gov.lv/public/files/CMS_Static_Page_Doc/00/00/01/10/04/fs-01usersLinda.BirinaDesktopAA2017_lauksaimniecibasgadazinojums.pdf (accessed 12 September 2017).

MoA (2017c), Programs of national subsidies 2004-2016, https://www.zm.gov.lv/zemkopibas-ministrija/statiskas-lapas/nacionalas-subsidijas?id=1651#jump (accessed 29 September 2017).

MoA (2016), Latvijas Bioekonomikas stratēģija 2030. Informatīvais ziņojums (Latvian Bioeconomic Strategy 2030), http://tap.mk.gov.lv/doc/2017_08/ZMZino_310717_LIBRA.831.doc (accessed 15 September 2017).

MoA (2014a), Latvijas lauksaimniecība 2014 (Latvian agriculture 2014), https://www.zm.gov.lv/public/files/CMS_Static_Page_Doc/00/00/00/45/84/LAUKSAIMNIECIBASZINOJUMS_2014.pdf (accessed 21 September 2017).

MoA (2014b), Latvia Rural Development Programme 2014-2020, https://www.zm.gov.lv/public/files/CMS_Static_Page_Doc/00/00/01/08/04/Programme_2014LV06RDNP001_4_1_lv002.pdf (accessed 27 September 2017).

MoA (2015), Ministry of Agriculture: Tiešie maksājumu 2015-20 (Direct payments 2015-2020), Power Point slides from 20 March 2015.

MoA (2012), Latvijas piena nozares attīstības virzieni līdz 2020.gadam (Development directions of the Latvian dairy industry till 2020), https://www.zm.gov.lv/lauksaimnieciba/statiskas-lapas/nozares-strategijas-politikas-dokumenti/latvijas-piena-nozares-attistibas-virzieni-lidz-2020-gadam?nid=1027#jump (accessed 14 September 2017).

MoA (2007a), Latvijas lauku attīstības programma 2007-2013 (Latvian Rural Development Program 2007-2013), https://www.zm.gov.lv/public/files/CMS_Static_Page_Doc/00/00/00/69/57/LAP_2007-213_versija_15_clean.pdf (accessed 10 September 2017).

MoA (2007b), Latvijas piensaimniecības nozares darbības uzlabošanas stratēģiskā programma (The strategic program for improving the performance of Latvian dairy industry), https://www.zm.gov.lv/public/files/CMS_Static_Page_Doc/00/00/00/19/15/LS_piensainiecibas_programma.pdf (accessed 15 September 2017).

MoA NFQS (2018) Food Quality Schemes https://www.zm.gov.lv/en/partika/statiskas-lapas/food-quality-schemes?nid=1150#jump (accessed 22 October 2018).

MoEPRD (2014), MK rīkojums Nr.130 “Vides politikas pamatnostādnes 2014.-2020. gadam” (Environmental Policy Guidelines 2014-2020), http://www.varam.gov.lv/lat/pol/ppd/vide/?doc=17913 (accessed 15 September 2017).

OECD (2017a), Agricultural Policy Monitoring and Evaluation 2017, OECD Publishing, Paris, http://dx.doi.org/10.1787/agr_pol-2017-en.

OECD (2017b), “Introduction to the OECD producer support estimate and related indicators of agricultural support”, https://www.oecd.org/tad/agricultural-policies/pse-introduction-august-final.pdf.

OECD (2017c), Evaluation of Agricultural Policy Reforms in the European Union: The Common Agricultural Policy 2014-20, OECD Publishing, Paris, https://doi.org/10.1787/9789264278783-en.

OECD (2015a), “Analysing policies to improve agricultural productivity growth, sustainably”, Draft Framework, May 2015, http://www.oecd.org/agriculture/agricultural-policies/Framework%20for%20the%20innovation%20website.pdf.

OECD (2015b), Agricultural Policy Monitoring and Evaluation 2015, OECD Publishing, Paris, http://dx.doi.org/10.1787/agr_pol-2015-en.

RSS (2017a), “Latvian Rural Support Service. Area payments: Aid rates and payment deadlines”, http://www.lad.gov.lv/lv/atbalsta-veidi/platibu-maksajumi/atbalsta-likmes/ (accessed 20 September 2017).

RSS (2017b), Latvian Rural Support Service. Informatīvais materiāls platību maksājumu saņemšanai 2017 (Guidlines for receiving area payments in 2017), http://www.lad.gov.lv/files/2017_info_materials_25maijs2017.pdf (accessed 20 September 2017).

Vēveris, A. (2013) “The role of the European Union in the development of Latvian agriculture. Doctoral Thesis.” Eiropas Savienības loma Latvijas lauksaimniecības attīstībā. Promocijas darbs https://dspace.lu.lv/dspace/bitstream/handle/7/5189/33005-Armands_Veveris_2013.pdf?sequence=1 (accessed 2 October 2017).

Notes

← 1. The same support rate applies to all eligible hectares of agricultural land.

← 2. In Latvia, the national average of all direct payments is EUR 168.81 per hectare in 2019.

← 3. Latvia implements the Voluntary Coupled Support Scheme and uses 15% of its direct payments budget under Pillar 1 to fund this choice measure.