On the basis of the Policy Spectrum Framework presented in Chapter 2, farm-level policy simulations based on a micro-economic modelling framework assess how different types of payment designs (ranging from practice-based to results-based payments) perform in different contexts with regard to their environmental effectiveness (reduction of nitrogen runoff and nitrous oxide emissions, and enhancement of biodiversity), policy-related transaction costs, and budgetary cost-effectiveness (government payment and public transaction costs / environmental benefits).

Making Agri-Environmental Payments More Cost Effective

3. Cost-effectiveness of alternative payment designs

Abstract

3.1. Focus of policy simulations

On the basis of the general literature review and the policy spectrum framework policy simulations are being developed to assess cost-effectiveness (including environmental effectiveness and policy-related transaction costs) of payment designs ranging from practice-based to results-based payment mechanisms, taking into account a range of different design features and a range of context-specific factors. A secondary aim is to identify which factors appear to be most influential in causing changes in the relative cost-effectiveness of different payment options.

To undertake the policy simulations, a micro-economic modelling framework has been developed (see Annex 3.A for a technical description of the theoretical framework and empirical specification of the model). This framework analyses representative production units (field parcels with uniform size of one hectare) and captures spatial heterogeneity with respect to productivity and profitability of agricultural production as well as heterogeneous environmental sensitivity of different production units. The model captures three types of environmental effects: nitrogen runoff (water quality), nitrous oxide emissions (greenhouse gas emissions), and quality of semi-natural habitats (biodiversity). Policy simulations assume that farmers are risk-neutral. Farmers’ risk aversion will be considered in Section 3.5.4.

3.2. Data

Data sources consist of regional data from Manitoba and Saskatchewan provinces of Canada, country specific data from Sweden and NUTS2 level regional data for 11 other EU countries drawn from CAPRI database.1 Altogether 38 differential production units are developed on the basis of these data.

Key data used as input for the analysis include N-fertiliser use, crop yields, production costs, and data on N-runoff and N2O emissions. Crop yield functions and environmental process functions are calibrated so that crop yield, N-runoff and N2O emissions correspond to their observed levels given the observed level of N-fertiliser use and soil type.

The environmental benefit index (EBI) is employed in simulations (see more detailed description in Annex 3.A). This index is a multi-objective index taking into account the impact on N-runoff, N2O emissions and quality of wildlife habitat. This index is a relative environmental gain index, which describes each production unit’s relative impact (across all 38 production units) on the three environmental effects at the edge of field. Thus, EBI index value is high for a given production unit, when it has relatively high N-runoff and N2O emissions or high quality of wildlife habitat. The higher is the EBI index value for a given production unit the higher are the environmental benefits if production unit participates in the agri-environmental payment scheme. All three environmental effects have the same weight in the EBI.

3.3. Baseline

Table 3.1 provides a summary of the Baseline situation without agri-environmental payments regarding nitrogen fertiliser application, wheat yield, profits from production, nitrogen runoff, N2O emissions in carbon dioxide equivalent emissions (CO2-eq) and EBI. As these results indicate, there is a large variation with respect to nitrogen application intensity, crop yield and profitability of production. Similarly, there is also large variation as regards environmental effects. This large variation provides a good basis for policy analysis as it shows how well different payment designs perform under heterogeneous contexts with respect to profitability of production and environmental sensitivity.

Table 3.1. Baseline situation without A-E payment

|

|

Nitrogen application, kg/ha |

Wheat yield, kg/ha |

Profits, EUR/ha |

N-runoff, kg/ha |

CO2-eq emissions, kg/ha |

EBI |

|---|---|---|---|---|---|---|

|

Minimum |

29 |

898 |

-54 |

4 |

55 |

22 |

|

Mean |

142 |

5656 |

200 |

16 |

649 |

51 |

|

Maximum |

196 |

9081 |

637 |

32 |

1384 |

89 |

|

Standard.dev. |

39 |

2206 |

198 |

7 |

346 |

17 |

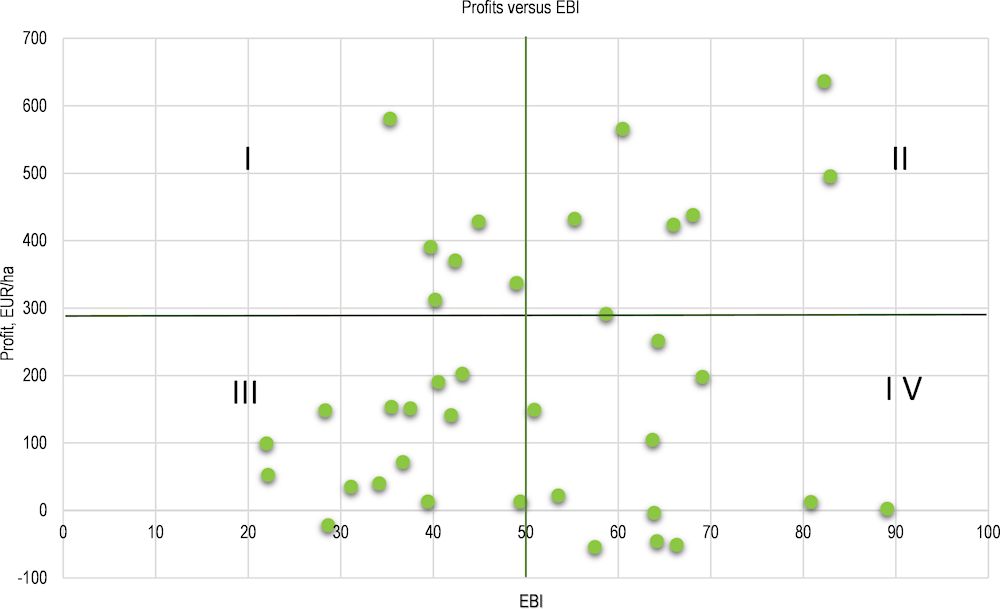

Figure 3.1 illustrates the baseline situation of profitability of production versus EBI for each modelled production unit. It illustrates the relevance of each production unit with respect to potential participation in the agri-environmental payment scheme. From a policy planner’s viewpoint, production units located in the first quadrant provide a poor benefit-cost ratio if selected to the agri-environmental payment scheme. This is because they provide low environmental benefits (due to low EBI index value) and high opportunity costs of participation (due to high profitability of production). Conversely, the most suitable production units for agri-environmental scheme are those located in the fourth quadrant that have relatively low profits and high environmental benefits. Whether production units located in quadrants two and three are suitable for agri-environmental scheme depends on the budget situation and their individual environmental characteristics (relevant for quadrant two with relatively high environmental benefits).

Figure 3.1. Profitability of production versus EBI

3.4. Policy simulations

The policy simulations are illustrative in nature and the aim is to assess how different types of payment designs (e.g. pay-for-practice vs. pay-for-result vs. pay-for-group performance) perform in different landscape contexts with regard to their environmental effectiveness, policy-related transaction costs, and budgetary cost-effectiveness. To this end, policy simulations are conducted in the context of two different fictitious landscapes. First it is assumed that there is no specific spatial structure for the landscape and that the environmental effects of heterogeneous production units do not depend on their exact location in the landscape (Fictitious landscape I). In the second case (Fictitious landscape II) the focus is on nitrogen runoff from field parcels and an artificial landscape is created in which a location of different production units is randomised to border either a watercourse (river or lake), open main ditch or other field parcels. The location of the field parcel relative to a watercourse affects the retention of nitrogen runoff before the runoff enters the watercourse and thus the actual nitrogen loading from a given field parcel to the watercourse. For parcels bordering receiving surface waters (rivers and lakes), retention is assumed to be zero; 10% retention for those bordering a main ditch; and 40% for those parcels bordering other field parcels.

Policy simulations in this section assume that farmers are risk-neutral and cost-effectiveness ranking does not consider policy-related transaction costs. Impact of policy-related transaction costs on budgetary cost-effectiveness of alternative payment designs are analysed in Section 3.4.6.

The payment designs to be assessed in the context of two different landscapes (exact location of the production unit does not affect the environmental outcome in the case of Fictitious landscape I, while it matters in the case of Fictitious landscape II) are presented in Table 3.2 and described in more detail below.

Table 3.2. Analysed payment designs for two fictitious landscapes

|

Fictitious landscape I |

Fictitious landscape II |

|---|---|

|

Uniform payment (P1) |

Uniform payment (P7) |

|

Uniform payment with EBI (P2) |

Agglomeration payment (P8) |

|

Environmentally differentiated payment with EBI (P3) |

Practice-based payment (P9) |

|

Compliance cost differentiated payment with EBI (P4) |

Results-based payment (P10) |

|

One-dimensional auction (CC) with EBI (P5) |

Hybrid payment (P11) |

|

Two-dimensional auction (CC/EBI) with EBI (P6) |

3.4.1. Payment designs for fictitious landscape I

The total budget for the agri-environmental programme is fixed at EUR 1 000. Participating farmers are expected to comply with two compliance requirements: i) reduction of nitrogen fertiliser application by 30% and ii) establishing a five-meter wide buffer strip. The level of the uniform payment is set at EUR 53/ha, reflecting the median of income forgone for complying with two compliance criteria. The following payment designs are analysed:

Uniform payment (P1) without environmental targeting: all farmers for whom the sum of the income forgone, the practice adoption (e.g. buffer strip establishment) and management costs is less than the uniform payment level are assumed to participate in the payment programme. From this subpopulation of farmers the programme participants are selected as a random draw up to the given budget limit.

Uniform payment with Environmental Benefit Index (EBI) targeting (P2):2 All farmers for whom the sum of the income forgone and the practice adoption and management costs is less than the uniform payment level are assumed to participate in the payment programme. From this subpopulation of farmers the programme participants are selected from the highest to lowest EBI index value (as the payment is the same for all participants) until the budget limit is reached.

Environmentally differentiated payment policy with EBI targeting (P3): The payment level is differentiated on the basis of EBI to reflect differential environmental benefits provided by programme participants. Three different payment levels are offered: (i) EUR 70/ha for field parcels having EBI scores 70 and above; (ii) EUR 53/ha for EBI scores 37-69; and (iii) EUR 35/ha for EBI scores 36 and below. All farmers for whom the sum of the income forgone and the practice adoption and management costs is less than the differentiated payment level for a given field parcel EBI score are assumed to participate in the payment programme. From this subpopulation of farmers the programme participants are selected from the highest to lowest ratio of EBI/payment until the budget limit is reached.

Differentiated payment policy on the basis of compliance costs with EBI targeting (P4): Payment level is differentiated between production units to reflect differential income forgone of adopting the given practices. Three different payment levels are offered to reflect differential compliance costs: (i) EUR 63/ha; (ii) EUR 53/ha; and (iii) EUR 43/ha. All farmers for whom the sum of the income forgone and the adoption and management costs of practice is less than differentiated payment level for a given production unit are assumed to participate in the programme. From this subpopulation of farmers the programme participants are selected from highest to lowest ratio of EBI/payment until budget limit is reached.

One-dimensional bid-scoring index auction (P5): Farmers’ expectations regarding the bid cap are formed on the basis of compliance costs of adopting the practices and it is assumed that farmers have identical beliefs regarding variation in compliance costs (with assumed variation by 20% around the mean).

Two-dimensional bid-scoring index auction (P6): Farmers’ expectations regarding the bid cap are formed on the basis of the ratio of bid to EBI (with assumed variation by 20% around the mean).

3.4.2. Payment designs for fictitious landscape II

The total budget for the agri-environmental programme is fixed at EUR 1 000 for all payment designs. All payment designs consider the retention of nitrogen runoff, that is, the actual impact of edge-of-field nitrogen runoff on receiving watercourse. Payment levels across different payment designs are set to correspond, on average, to that of the uniform payment of EUR 53/ha.

Uniform payment (P7) without environmental targeting: Participating farmers are expected to comply with two compliance requirements: i) reduction of nitrogen fertiliser application by 30%; and ii) establishing a 5-meter wide field margin covered by perennial grasses (in essence this will be a buffer strip for those production units bordering watercourse or main ditch and an ecological compensation area for production units bordering other field parcels). The level of uniform payment is set at EUR 53/ha, reflecting the median of income forgone for complying with the two compliance criteria. All farmers for whom the sum of the income forgone and the practice adoption and management costs is less than the uniform payment level are assumed to participate in the payment programme. From this subpopulation of farmers the programme participants are selected as a random draw up to the given budget limit.

Agglomeration payment (P8):3 Participating farmers are expected to comply with two compliance requirements: i) reduction of nitrogen fertiliser application by 30% and ii) establishing a 5-meter wide field margin covered by perennial vegetation (this will be a buffer strip for those production units bordering watercourse or main ditch and an ecological compensation area for production units bordering other field parcels). The level of uniform payment is set at EUR 53/ha, reflecting the median of income forgone for complying with the two compliance criteria. Payment is offered to all production units only when production units bordering watercourse or main ditch also comply with practice adoption. It is assumed that farmers owning the production units know each other and each other’s compliance costs, and cooperate to maximise the aggregated profit from participation of all production units. If the income forgone of practice adoption for a given production unit bordering watercourse is higher than the level of uniform payment then side-payments are offered by other production units. That is, each production unit either receives or offers side-payments depending on income forgone for practice adoption relative to the uniform payment level.

Practice-based payment (P9): The participating farmer is paid on the basis of the nitrogen application reduction and the field margin establishment and management. The payment level is EUR 1.0/kg of N fertiliser reduction relative to the baseline (farmer’s private optimum without agri-environmental payment programme) and EUR 35 per meter of field margin width. The participating farmer chooses the nitrogen application reduction and field margin width to maximise profit from participation.

Results-based payment (P10): the participating farmer is paid for abated nitrogen runoff. The payment level is EUR 6.4/kg of abated nitrogen runoff relative to the baseline without the agri-environmental payment programme.

Hybrid payment (P11): the participating farmer is paid on the basis of both practice adoption and abated nitrogen runoff. In order to respect the same average payment level across different payment designs the payment levels of practice-based payment and the results-based payment are halved from those provided in their respective payment designs. Thus, for the practice adoption the payment level is EUR 0.5/kg of N fertiliser reduction relative to the baseline and EUR 17.5/meter of field margin width. For the abated nitrogen runoff the payment level is EUR 3.2/kg of abated nitrogen runoff relative to the baseline. The participating farmer chooses the nitrogen application reduction and field margin width to maximise profit from practice adoption and nitrogen runoff reduction.

3.5. Results

3.5.1. Budgetary cost-effectiveness of different payment designs

The results are first presented for the case of Fictitious Landscape I. Table 3.3 provides key results for the first six payment designs (P1-P6). The last column of the table reports information rent as a share of payment. Information rent is overcompensation of income forgone and extra costs incurred. With uniform payments it is highest for production units that have lowest compliance costs for adopting the given practices.

Table 3.3. Fictitious Landscape I: Results for different payment designs

|

Payment type |

Budget, EUR |

Total EBI points |

Cost-effectiveness, EUR/EBI point |

Information rent, EUR/ha |

Information rent, % of payment |

|---|---|---|---|---|---|

|

Uniform payment (P1) |

954 |

808 |

1.18 |

35.2 |

66 |

|

Uniform payment with EBI (P2) |

954 |

1 085 |

0.88 |

21.9 |

41 |

|

Environmentally differentiated payment with EBI (P3) |

950 |

1 077 |

0.88 |

24.5 |

41 |

|

Compliance cost differentiated payment with EBI (P4) |

964 |

1 148 |

0.84 |

17.3 |

32 |

|

One-dimensional auction (CC) with EBI (P5) |

954 |

1 249 |

0.76 |

15.8 |

31 |

|

Two-dimensional auction (CC/EBI) with EBI (P6) |

990 |

1 369 |

0.72 |

17.3 |

45 |

As shown by earlier studies identified in the literature, the uniform payment policy (which does not employ systematic selection of participants on the basis of the cost-effectiveness) performs less efficiently than other payment types. This is indicated by its low level of environmental benefits (total EBI points), high information rent (66% overcompensation of income forgone for the adoption of the practices), and thus high cost per EBI point relative to other payment designs.

Using EBI targeting as part of a uniform payment policy greatly improves the environmental effectiveness and consequently budgetary cost-effectiveness of uniform payment. Also, the information rent is reduced, since production units with higher environmental benefits but also with higher compliance costs are selected to the agri-environmental payment programme. Overall, environmental targeting increases budgetary cost-effectiveness by 34%, that is, 34% more environmental benefits are achieved with the same government budget expenditure.

The environmentally differentiated payment with EBI targeting has the same budgetary cost-effectiveness as the uniform payment with EBI targeting but it results in slightly higher information rent per ha, as some production units that have high environmental benefits are overcompensated even more with a differential payment level. A differentiated payment based on compliance costs and with EBI targeting increases the cost-effectiveness because it reduces overcompensation to those production units that have low compliance costs and relatively low environmental benefits. Relative information rent is the second lowest among the analysed payment designs.

The one-dimensional bid scoring auction (Compliance Cost (CC) auction with EBI) performs much better than the uniform payment as farmers are selected on the basis of their benefit/cost ratio. The two-dimensional bid scoring auction performs even better with respect to cost-effectiveness. It results in the highest total EBI points, but it also somewhat increases farmers’ information rents (overcompensation of income forgone) relative to one-dimensional bid-scoring auction. The reason for higher information rents under the two-dimensional bid-scoring auction are shown by the theoretical framework presented in Annex 3.A. It shows that when farmers have access to EBI information, a higher EBI increases bids and thus the information rent for those farmers who are selected. This is confirmed in the last column of Table 3.3. The increase in information rents thus somewhat decreases the performance of the two-dimensional bid scoring auction although it is still the most cost-effective of the analysed payment designs.

Overall, these results confirm the conclusions from the literature review that the cost-effectiveness gains from environmental targeting and tailoring of the payment level are potentially very large.

Results for the Fictitious Landscape II are presented in Table 3.4. It provides key results for payment designs P7-P11. These policy simulations focus on nitrogen runoff reduction in a situation where a location of the production unit relative to watercourse matters for actual environmental outcome due to nutrient (nitrogen) retention.

Table 3.4. Fictitious Landscape II: Results for different payment designs

|

Payment type |

N-application, kg/ha |

Field margin, % |

N-runoff reduction, kg |

Budget, EUR |

Cost-effectiveness, EUR/kg |

|---|---|---|---|---|---|

|

Uniform payment (P7) |

99.6 |

5.0 |

96 |

954 |

10.0 |

|

Agglomeration payment (P8) |

99.6 |

5.0 |

121 |

974 |

8.1 |

|

Practice-based payment (P9) |

95.7 |

23.0 |

101 |

975 |

9.6 |

|

Results-based payment (P10) |

131.4 |

12.0 |

150 |

963 |

6.4 |

|

Hybrid payment (P11) |

113.2 |

17.0 |

129 |

939 |

7.3 |

Note: N-application (kg/ha) and field margin (%) are averages across production units.

As in the previous case the uniform payment without environmental targeting (P7) is the least cost-effective payment option. The cost-effectiveness of practice-based payment (P9) is also relatively low, although it provides a more flexible payment design for farmers, since farmers can optimise field margin size and N-application reduction based on their opportunity costs and payment levels for each practice adoption unlike in the case of the uniform payment. Due to incentives provided by the practice-based payment, both N-application reduction and field margin size are largest among the analysed payment designs. However, it still results in the second lowest N-runoff reduction relative to the baseline. This is because production units with the lowest opportunity costs have the strongest incentives to establish these practices, but they may at the same time have the lowest abatement potential due to their location and thus nutrient runoff retention.

Although the agglomeration payment requires the same fixed practice adoption as the uniform payment it is much more effective in N-runoff reduction, since production units with high abatement potential also participate in the payment programme. Also its budgetary cost-effectiveness is much higher than that of the uniform payment and the practice-based payment.

The most cost-effective payment design is the results-based payment, which provides direct incentives to reduce N-runoff while considering the location of the production unit and thus nutrient retention (P10). Thus, under the results-based payment N-runoff reduction is allocated to those production units with relatively high abatement potential. The results-based payment attains the largest N-runoff reduction although the average N-application level is highest and the average field margin size only the third largest among payment design options.

Hybrid payment combines features from the practice-based and the results-based payment designs. It is the second most environmentally effective and cost-effective payment type of those analysed. Practice-based features of this design reduce its cost-effectiveness relative to pure results-based payment, since it provides incentives to stronger practice adoption in the least productive production units that have smaller opportunity costs but also less abatement potential.

Overall, these results show that the results-based payment, which optimises both opportunity cost (income forgone for adopting practices) and N-runoff reduction potential, is clearly more cost-effective than other payment designs that either neglect heterogeneous opportunity costs or abatement potential or both.

3.5.2. Economic efficiency versus coverage and distributional impacts

Targeting and tailoring of agri-environmental payments may create tradeoffs between economic efficiency and distributional issues. In this section, economic efficiency and distributional impacts are analysed for the selected payment designs in the case of Fictitious landscape II.

Economic efficiency is measured here by the environmental benefits for a given budget expenditure, that is, programme expenditure EUR per kg of N-runoff reduction. Following (Wu and Yu, 2017[1]), two measures of distributional impacts are adopted: (i) coverage and (ii) distribution of outcome. Coverage is measured as the share of successful programme applicants, that is, the share of selected programme participants of all potential applicants (potential applicants are all farmers whose profit from participation is positive for a given payment design). Thus, a larger share of selected farmers is considered more equitable. Distribution of outcome is measured by income (profit) gain from programme participation for selected participants, that is, how income gain from participation is distributed among selected participants.

Following Wu and Yu (2017[1]), the measures of equity (coverage and distribution of outcome) are constructed as the aggregate scores using Gini coefficients, so that aggregate score for coverage (C) and distribution of outcome (DO) is given by C = 1 – GiniC and DO = 1 – GiniDO, respectively.4 Hence, the value of Gini in each formula is different. Both C and DO range from zero to one. For example, it is close to zero if most of the income gains from programme participation accrue to very few farmers, while it is one if income gains are equalised among all participating farmers.

Table 3.5. Economic efficiency, coverage and distribution of outcome of selected payment designs

|

Payment type |

Economic efficiency |

Coverage |

Distribution of outcome |

|---|---|---|---|

|

Uniform payment (P7) |

0.64 |

0.62 |

0.87 |

|

Practice-based payment (P9) |

0.67 |

0.45 |

0.88 |

|

Results-based payment (P10) |

1.00 |

0.74 |

0.70 |

|

Hybrid payment (P11) |

0.88 |

0.55 |

0.84 |

Note: Economic efficiency is scaled so that the most cost-effective payment design, that is, results-based payment, is scaled to one and others are scaled relative to it. For economic efficiency, coverage and distribution of outcome measures the higher the value, the greater the efficiency or equality.

The results-based payment scores highest in terms of both economic efficiency and coverage, while it is the weakest instrument as regards distribution of outcome. It promotes economic efficiency through providing direct incentives for N-runoff reduction and allocating abatement to those production units with relatively high abatement potential. It also promotes coverage, since the lowest budget expenditure per unit N-runoff reduction stretches the budget and more applicants can be selected to the programme. Its low score with regard to distribution of outcome is due to allocating most of the abatement to the production units with highest potential, and thus the income gain from this payment design varies considerably, although the payment per unit reduction is same for all participants.

The uniform payment scores poorly with respect to economic efficiency, but it performs relatively well in terms of both coverage and distribution of outcome. As regards coverage, it scores relatively well as there is no screening or targeting of applicants (e.g. based on EBI), and thus 18 production units out of 29 applicants are selected to the programme. It scores relatively well also with respect to distribution of outcome, since the median income gain for selected participants from uniform payment (EUR 53/ha) is EUR 34.6/ha with a standard deviation of 8.2.

The economic efficiency of the practice-based payment is relatively low because production units with the lowest opportunity costs have the strongest incentives to establish these practices, while their abatement potential may be low due to their location and thus nutrient runoff retention potential. The practice-based payment has a low score with respect to coverage because only 17 production units out of 38 applicants are selected to the programme. Its high score as regards distribution of outcome is due to the relatively small variation of income gain for the selected participants (median income gain EUR 19.7/ha with a standard deviation of 6.4).

The hybrid payment combines features of both the practice-based and the results-based payment and its scores for different efficiency, coverage and distribution of outcome measures reflect this. Thus, it performs better than the practice-based payment with respect to economic efficiency and coverage, while it has a slightly lower score for the distribution of outcome measure.

Overall, these measures show that there are tradeoffs between economic efficiency and distributional impacts and none of the payment designs performs best in terms of all measures. However, the results-based payment seems to perform best and the practice-based payment worst, on average.

Tradeoffs between economic efficiency and distributional impacts have implications for the political acceptability of different payment designs. Political acceptability is important for the success of the voluntary payment approach and different stakeholders weigh certain criteria over the others. For example, environmental lobbies tend to favour environmentally effective payment designs (e.g. environmental performance-based or results-based payments) that usually require detailed spatial targeting and tailoring of payments. Due to spatial targeting and tailoring of payment levels, these types of payment designs may score relatively low with respect to coverage and distribution, although their cost-effectiveness can help to stretch limited resources to cover a larger area or more farmers. In contrast, farmers and farm lobbies put relatively more weight on distributional impacts and transaction costs (especially private transaction costs) of payment designs and may thus favor designs that are not necessarily the most environmentally effective or cost-effective. For example, uniform payment approaches may be preferred by these stakeholders because they provide the same monetary compensation for all farmers, notwithstanding the fact that foregone income and extra costs may vary considerably among farmers.

3.5.3. Budgetary cost-effectiveness gains from targeting and tailoring versus policy-related transaction costs

The budgetary cost-effectiveness ranking of alternative payment designs can be affected by the required management capacities of public agencies, and the associated public sector transaction costs for design, implementation, monitoring and enforcement.

Spatial targeting and tailoring of payments imply a potential trade-off between improving the precision of payments and increasing policy-related transaction costs (PRTCs). Therefore, a good grasp of PRTCs is required to find a payment design that offers a good balance between improved precision and increased transaction costs.

Empirical literature shows that there is huge variation in policy-related transaction costs between different types of agri-environmental policy instruments (for overview of estimates see e.g. Lankoski (2016[2])). The common way to define PRTCs in the empirical literature has been to express them as a percentage of transfers. Studies demonstrate that policy instruments applied to existing commodity market transactions, such as pesticide and fertiliser taxes, imply low PRTCs on the range of 0.1-1.1% of tax revenue. On the other hand, individually tailored agri-environmental contracts have the highest PRTCs, on the range of 25-66% of payment transfer, because of their high asset specificity and the low frequency of transactions, that is, the number of contracts. Most of the payment designs have PRTCs that are on the range of 5%-15% of payment transfer. For example, Ollikainen, Lankoski and Nuutinen (2008[3]) assessed PRTCs of agri-environmental payments in Finland and found that transaction costs increase with more targeted and differentiated agri-environmental measures. For the basic mandatory measures, PRTCs are 2% of payment transfer and comparable to those of the area-based income support measures, while for more targeted measures, such as tailored fertiliser application limits and spatially targeted reduced tillage, PRTCs are on the range of 8-10% of payment transfer. Connor et al. (2008[4]) assessed the cost-effectiveness of land conservation auctions and payment policies in Australia and estimated that PRTCs are 11% and 9% for auctions and differentiated payments, respectively.

Since the focus of the analysis is budgetary cost-effectiveness (maximum environmental benefits for a given budget/payment transfer) only public administration PRTCs (policy design, implementation, monitoring and enforcement) are considered in the following analysis and ranking of payment designs.

It should be noted that farmers’ private transaction costs affect their willingness to participate in voluntary payment programmes and thus the political acceptability and ultimately, the success of the programme. While most of the existing literature focuses on public administration PRTCs, a few studies have estimated the private transaction costs for farmers of participating in agri-environmental programmes. For example, Rorstad, Vatn and Kvakkestad (2007[5]) find that these private transaction costs can range from 2.3% (payment for reduced tillage) to 9.1% (payment for preserving cattle breeds) of the compensation payment in the case of Norway. Mettepenningen, Verspecht and van Huylenbroeck (2009[6])explore farmers’ transaction costs in the context of European agri-environmental schemes and find that total private transaction costs are, on average, EUR 40.2 per ha. This is the equivalent of 14.3% of the total cost of the policy for the farmer (other costs include, for example, foregone income and investment annuity) and 25.4% of the overall agri-environmental payment. These results indicate that farmers’ private transaction costs can, in some cases, be relatively large and may thus affect farmers’ willingness to participate in voluntary payment programmes. Moreover, the farmers’ private transaction costs present in group payment schemes, such as Agglomeration Payment scheme (P8), may strongly reduce farmers’ willingness to participate in such schemes. Hence, consideration of the transaction costs for farmers of adopting different types of agri-environmental practices and payment designs is crucial for success of the selected payment approach.

Public administration PRTCs are calculated for different payment types on the basis of Finnish studies (Ollikainen, Lankoski and Nuutinen, 2008[3]; Lankoski, Lichtenberg and Ollikainen, 2010[7]). These studies are employed as they provide transaction cost estimates for payments that are linked to fertiliser use reduction and buffer strip establishment and management, which are key abatement measures in the simulation model used in this chapter.

Environmental targeting and tailoring of payment rates imply specific information for payment design, implementation, monitoring and enforcement. Transaction cost elements included in the calculations include: (i) initial outlay for the site survey and soil testing; (ii) buffer strip area and management verification; (iii) nitrogen soil testing to verify nitrogen fertiliser use reduction and to provide input to nitrogen runoff estimations; and (iv) design and implementation of EBI for environmental targeting. Some of these cost elements take place only once per payment programme period ((i) and (iv)) while others are annual. However, enforcement costs would be very high for annual monitoring and inspection of each site and thus random monitoring and inspection (20% probability) is assumed in these calculations, which is relatively high compared to actual agri-environmental payment programmes in developed countries (inspection rate 3%-5%).

The second column of Table 3.6 presents PRTCs as a share of total payment transfers for each payment design. PRTCs increase with increased targeting and tailoring of the payments and is the lowest for uniform payment and the highest for two auction designs. The third and fourth columns show budgetary cost-effectiveness of each payment design without and with PRTCs, respectively. Results show that due to relatively small differences in PRTCs between different payment designs the cost-effectiveness ranking of payment designs is only slightly affected by inclusion or exclusion of PRTCs. The cost-effectiveness rank of the uniform payment with EBI (P2) only switches with that of the environmentally differentiated payment with EBI (P3) when PRTCs are included.

The last column of Table 3.6 shows the targeting gains ratio of different payment designs. The targeting gains ratio represents the budgetary cost-effectiveness gains from environmental targeting and payment rate tailoring relative to the increase in PRTCs. Uniform payment without targeting is a benchmark for calculating this ratio (i.e. the ratio of the difference in the value of EBI points or N-runoff reduction and PRTCs for a given payment type and uniform payment). Targeting gains ratios vary greatly between different payment designs. It is highest for uniform payment with EBI targeting (P2) in which case one EUR spent on PRTCs pays back EUR 23 through cost-effectiveness gains from improved environmental targeting. Also for other targeted and tailored payment designs the gains are significant.

Table 3.6. Fictitious Landscape I: Gains from targeting and tailoring versus PRTCs

|

Payment type |

PRTCs % |

Cost-effectiveness without PRTCs |

Cost-effectiveness with PRTCs |

Targeting gains ratio |

|---|---|---|---|---|

|

Uniform payment (P1) |

9% |

1.18 |

1.29 |

- |

|

Uniform payment with EBI (P2) |

11% |

0.88 |

0.97 |

23 |

|

Environmentally differentiated payment with EBI (P3) |

13% |

0.88 |

1.00 |

8 |

|

Compliance cost differentiated payment with EBI (P4) |

13% |

0.84 |

0.95 |

10 |

|

One-dimensional auction (CC) with EBI (P5) |

14% |

0.76 |

0.87 |

13 |

|

Two-dimensional auction (CC/EBI) with EBI (P6) |

14% |

0.72 |

0.82 |

14 |

Table 3.7 provides corresponding results for Fictitious landscape II with a focus on nitrogen runoff reduction. PRTCs are the highest for the hybrid payment design (P11) which requires monitoring of both practices and results. However, even with the highest PRTCs, it remains the second best option from a cost-effectiveness viewpoint. Under this Fictitious landscape, the cost-effectiveness ranking of payment designs is not affected by inclusion or exclusion of PRTCs. Targeting gains ratio is highest for the results-based payment (P10) and much more modest for the practice-based payment (P9) and the hybrid payment (P11). Practice-based features of these payment designs reduce cost-effectiveness due to incentives provided to stronger practice adoption in the least productive production units that have smaller opportunity costs but also less abatement potential.

Table 3.7. Fictitious Landscape II: Gains from targeting and tailoring versus PRTCs

|

Payment type |

PRTCs % |

Cost-effectiveness without PRTCs |

Cost-effectiveness with PRTCs |

Targeting gains ratio |

|---|---|---|---|---|

|

Uniform payment (P7) |

9% |

10.0 |

10.9 |

- |

|

Agglomeration payment (P8) |

12% |

8.1 |

9.0 |

9 |

|

Practice-based payment (P9) |

12% |

9.6 |

10.8 |

2 |

|

Results-based payment (P10) |

12% |

6.4 |

7.2 |

19 |

|

Hybrid payment (P11) |

21% |

7.3 |

8.8 |

3 |

Overall, the above results show that due to the relatively small differences in PRTCs between the different payment designs, the cost-effectiveness ranking of the payment designs is only slightly affected by the inclusion or exclusion of PRTCs. The small variation in PRTCs may favour more targeted and tailored payment designs despite their higher PRTCs. In order to test the influence of the variation of PRTCs on the cost-effectiveness ranking of alternative payment designs, a sensitivity analysis is conducted. In this sensitivity analysis, the probability of random monitoring and inspection is increased from 20% to 35%.

Table 3.8 provides the sensitivity analysis results for Fictitious Landscape II with a focus on nitrogen runoff reduction.

Table 3.8. Fictitious Landscape II: Sensitivity analysis of the impact of higher PRTCs on the cost-effectiveness ranking of payment designs

|

Payment type |

PRTCs % |

Cost-effectiveness without PRTCs, EUR/kg |

Cost-effectiveness with PRTCs, EUR/kg |

Targeting gains ratio |

|---|---|---|---|---|

|

Uniform payment (P7) |

15% |

10.0 (5.) |

11.5 (4.) |

- |

|

Agglomeration payment (P8) |

20% |

8.1 (3.) |

9.6 (2.) |

5.4 |

|

Practice-based payment (P9) |

20% |

9.6 (4.) |

11.6 (5.) |

1.1 |

|

Results-based payment (P10) |

20% |

6.4 (1.) |

7.7 (1.) |

11.7 |

|

Hybrid payment (P11) |

35% |

7.3 (2.) |

9.9 (3.) |

1.8 |

Note: Ranking of the given payment design is given in parenthesis.

In comparison to the base case of PRTCs presented in Table 3.7, PRTCs as a share of total payment transfer (presented in the second column) have increased clearly for all payment designs. The third and fourth columns show the budgetary cost-effectiveness of each payment design without and with PRTCs, respectively. The results show that with increased PRTCs the cost-effectiveness ranking of the payment designs is now more affected by the inclusion or exclusion of PRTCs. In this case the relative performance of the uniform payment (P7) and the agglomeration payment (P8) improves, while it worsens for the practice-based payment (P9) and the hybrid payment (P11). In the last column of Table 3.8 the targeting gains ratio for all payment designs is clearly lower than the corresponding figures in Table 3.7. With increased PRTCs the targeting gains for the practice-based payment (P9) and the hybrid payment (P11) are relatively small.

3.5.4. Implications of farmers’ risk preferences

Farmers’ decisions to adopt environmentally friendly practices and their responses to different payment designs are affected by their risk preferences. Thus, it is important to consider farmers’ risk preferences and the heterogeneity in their risk aversion in agri-environmental policy design and implementation. Farmers face different types of risks, including crop yield risk, input and output price risk, and government policy risk (risks created by unpredictable changes in policies and regulations). Several types of mechanisms such as crop and revenue insurance have been developed to alleviate these risks.

The focus of this section is on the impact of risk aversion on farmers’ responses to the different payment designs in the case of Fictitious landscape II. Risk-neutral and risk-averse farmers are compared in terms of environmental practice adoption and agri-environmental programme participation.

Modeling farmers’ decisions under risk aversion is based on the expected utility (EU) framework. An exponential utility function is adopted:

(1)

As regards equation (1) any solution that maximises also maximises expected utility from profits, EU(π), and thus maximisation of a linear function of mean (μ) and variance ( of profit is equivalent to expected utility maximisation. The mean-variance approach (see e.g. (Levy and Markowitz, 1979[8]) adopted here thus implies that if a distribution is defined by its first two moments, the expected utility is a function of the distribution’s mean and variance. The constant r measures the degree of risk aversion: the larger r is, the more risk averse the farmer is. Hence, the utility of the farmer is increasing with the mean of his profits and decreases with the variance of profits. The rate of decrease with the variance is larger the more risk averse the farmer is.

Four payment designs are analysed in this section: the uniform payment (P7), the practice-based payment (P9), the results-based payment (P10) and the hybrid payment (P11). Farmers’ heterogeneous risk preferences are mainly based on Iyer et al. (2019[9]), who conducted a systematic review of farmers’ risk preferences in Europe.

As regards the variance component of modelling, the uniform payment (P7) and the practice-based payment (P9) modelling uses the variance of crop revenue, while in the cases of the results-based payment (P10) and the hybrid payment (P11), the focus is on the variance of nitrogen runoff. This is because the variance of nitrogen runoff only affects farmers’ optimal choice of inputs (nitrogen application and buffer strip establishment) in the latter two types (P10 and P11).

Table 3.9 provides results for both risk-neutral and risk-averse farmers as regards input use, profits and N-runoff and cost-effectiveness.

Table 3.9. Farmers’ risk preferences, practice adoption and expected profit of agri-environmental programme participation

|

|

Risk-neutral farmers |

Risk-averse farmers |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

N-application, kg/ha |

Buffer strip size, ha |

Profit, EUR/ha |

N-runoff, kg/ha |

Cost-effectiveness, EUR/kg |

N-application, kg/ha |

Buffer strip size, ha |

Profit, EUR/ha |

N-runoff, kg/ha |

Cost-effectiveness, EUR/kg |

|

Baseline |

140 |

- |

189 |

14.9 |

- |

127 |

- |

185 |

13.5 |

- |

|

Uniform payment (P7) |

94 |

0.05 |

213 |

8.6 |

11.2 |

75 |

0.05 |

215 |

8.2 |

11.7 |

|

Practice-based payment (P9) |

93 |

0.23 |

242 |

7.5 |

11.5 |

79 |

0.31 |

229 |

3.2 |

13.4 |

|

Results-based payment (P10) |

130 |

0.11 |

226 |

8.5 |

6.4 |

127 |

0.02 |

215 |

10.7 |

6.4 |

|

Hybrid payment (P11) |

112 |

0.16 |

227 |

7.5 |

7.8 |

118 |

0.06 |

205 |

10.9 |

10.7 |

Note: All figures shown are mean of participating farmers under each payment design and risk preference assumption.

These simulations were conducted for 14 cases, which represents one-third of those analysed in the previous sections, and so the total budget for the agri-environmental programme is reduced by two-thirds for all payment designs. All payment designs consider the retention of nitrogen runoff; that is, the actual impact of edge-of-field nitrogen runoff on the recipient watercourse. Payment levels across different payment designs are set to correspond, on average, to the uniform payment of EUR 53/ha.

Baseline results show that optimal nitrogen application intensity for risk-averse farmers is about 9% smaller than that of risk-neutral farmers as nitrogen fertiliser increases cultivation costs for sure while crop output and thus revenue is considered risky. Optimal size of buffer strip is zero in both cases as there are no incentives for the buffer strip establishment in the Baseline. Due to higher nitrogen application intensity, nitrogen runoff is about 10% higher in the case of risk-neutral farmers relative to risk-averse farmers.

If farmers have the option to choose one of these payment designs (or schemes), then the level of profits under each payment design determines which option is preferred by both risk-neutral and risk-averse farmers, since exactly the same agri-environmental budget is provided under each payment design. For both risk-neutral and risk-averse farmers, the highest average profits of selected farmers are obtained under the practice-based payment (P9), and thus this payment scheme would be the most preferred option from a profitability standpoint. However, in terms of distributional impacts (coverage and distribution of outcome), it scores lower than uniform payments since fewer farmers can be included in the programme within the given budget.

The practice-based payment (P9) is also the least cost-effective payment design for both risk-neutral and risk-averse farmers. As discussed earlier in the context of Fictitious landscape II, the practice-based payment reduces budgetary cost-effectiveness due to incentives provided for stronger practice adoption in the least productive production units that have smaller opportunity costs but also less abatement potential. Both risk-neutral and risk-averse farmers strongly adjust nitrogen application intensity and size of buffer strips under the practice-based payment relative to the incentives provided by the results-based payment (P10) and the hybrid payment (P11).

Risk-averse farmers, whose expected utility from profits is strongly affected by variance of crop revenue, adjust input use strongly as the practice-based payment provides a non-stochastic income stream. Since nitrogen application is reduced by 38% and buffer strips cover 31% of cultivated area, the resulting nitrogen runoff is very small (76% reduction relative to the Baseline).

Those risk-averse farmers who would participate in the results-based scheme adjust their input use much less than risk-neutral farmers. This is explained by the variance of nitrogen runoff that makes the results-based payment stochastic for risk-averse farmers. This stochastic feature of the results-based payment also affects how much risk-averse farmers adjust their input use under the hybrid payment scheme. Under the hybrid payment scheme risk-averse farmers’ input use is adjusted more than under the pure results-based scheme but clearly less than under the pure practice-based payment.

The most cost-effective payment design is the results-based payment (P10), with the hybrid payment (P11) being the second most cost-effective payment type of those analysed. However, their distributional impacts (coverage and distribution of outcome) are weaker than those of uniform payments, as fewer farmers can be included in the programme within the given budget.

Hence, as in Section 3.5.2 above, these results show that there are tradeoffs between economic efficiency and distributional impacts: none of the payment designs emerges as a top performer in all categories. These tradeoffs need to be minimised, while maintaining to the greatest extent possible the environmental effectiveness and budgetary cost-effectiveness of the selected payment design in order to enhance farmers’ participation in voluntary payment programmes. For example, a hybrid payments could include relatively simple practice adoption for the base payment to maximise coverage of the programme, with the environmental effectiveness and budgetary cost-effectiveness of the programme then being maximised by a bonus payment for environmental results.

References

[18] Cattaneo, A. et al. (2005), Flexible conservation measures on working land: what challenges lie ahead?, Economic Research Service (ERS), United States Department of Agriculture (USDA), https://naldc.nal.usda.gov/download/19864/PDF.

[19] Claassen, R. et al. (2004), Environmental Compliance in U.S. Agricultural Policy: Past performance and future potential.

[4] Connor, J.D., Ward, J.R. and Bryan, B. (2008), “Exploring the cost-effectiveness of land conservation autions and payment policies”, Australian Journal of Agricultural and Resource Economics, Vol. 51, pp. 303-319.

[13] Glebe, T. (2013), “Conservation auctions: should information about environmental benefits be made public?”, American Journal of Agricultural Economics, Vol. 95, pp. 590-605.

[12] Iho, A. et al. (2014), “Agri-environmental auctions for phosphorus load reduction: experiences from a Finnish pilot”, Australian Journal of Agricultural and Resource Economics, Vol. 58, pp. 1-18.

[9] Iyer, P. et al. (2019), “Measuring Farmer Risk Preferences in Europe: a Systematic Review”, Journal of Agricultural Economics, Vol. Vol. 71/No. 1, pp. 3–26, https://doi.org/10.1111/1477-9552.12325.

[17] Kuussaari, M. (ed.) (2004), Perhosten monimuotoisuus eteläsuomalaisilla maatalousalueilla.

[2] Lankoski, J. (2016), “Alternative Payment Approaches for Biodiversity Conservation in Agriculture”, OECD Food, Agriculture and Fisheries Papers, No. 93, OECD Publishing, Paris, https://doi.org/10.1787/5jm22p4ptg33-en.

[7] Lankoski, J., E. Lichtenberg and M. Ollikainen (2010), “Agri-environmental program compliance in a heterogeneous landscape”, Environmental and Resource Economics, Vol. 47, pp. 1-22.

[11] Lankoski, J. and M. Ollikainen (2003), “Agri-environmental externalities: a framework for designing targeted policies”, European Review of Agricultural Economics, Vol. 30, pp. 51-75.

[14] Latacz-Lohmann, U. and C. van der Hamsvoort (1997), “Auctioning conservation contracts: a theoretical analysis and an application”, American Journal of Agricultural Economics, Vol. 79/2, pp. 407-418.

[8] Levy, H. and H. Markowitz (1979), “Approximating expected utility by a function of mean and variance”, American Economic Review, Vol. 69/3, pp. 308-317.

[10] Lichtenberg, E. (1989), “Land quality, irrigation development, and cropping patterns in northern high plains”, American Journal of Agricultural Economics, pp. 187-194.

[6] Mettepenningen, E., A. Verspecht and G. van Huylenbroeck (2009), “Measuring private transaction costs of European agri-environmental schemes”, Journal of Environmental Planning and Management, Vol. 52, pp. 649-667.

[21] OECD (2010), Guidelines for Cost-effective Agri-environmental Policy Measures, OECD Publishing, Paris, https://doi.org/10.1787/9789264086845-en.

[3] Ollikainen, M., J. Lankoski and S. Nuutinen (2008), “Policy-related transaction costs of agricultural policies in Finland”, Agricultural and Food Science, Vol. 17, pp. 193-209.

[5] Rorstad, P., A. Vatn and V. Kvakkestad (2007), “Why do transaction costs of agricultural policies vary?”, Agricultural Economics, Vol. 36, pp. 1-11.

[15] Rude, S. (ed.) (1991), Estimation of nitrogen leakage functions: Nitrogen leakage as a function of nitrogen applications for different crops on sand and clay soils.

[20] Saha, A. (1997), “Risk preference estimation in the non-linear mean standard deviation approach”, Economic Inquiry, Vol. 35, pp. 770-782.

[16] Simmelsgaard, S. and J. Djurhuus (1998), “An empirical model for estimating nitrate leaching as affected by crop type and the long-term fertilizer rate”, Soil Use and Management, Vol. 14, pp. 37-43.

[1] Wu, J. and J. Yu (2017), “Efficiency-equity tradeoffs in targeting payments for ecosystem services”, American Journal of Agricultural Economics, Vol. 99/4, pp. 894-913, https://doi.org/10.1093/ajae/aaw095.

Annex 3.A. Policy simulation component: Theoretical framework, model calibration and data

In this annex a simple theoretical framework is developed to illustrate a farmer’s decision to participate in a government agri-environmental payment programme as well as analyse government’s selection of participants for a programme. This is followed by a description of model calibration and data requirements.

Theoretical framework for working lands AE programme

The starting point of the conceptual framework is a heterogeneous land quality model with different soil types and land productivities. Following Lichtenberg (1989[10]) and Lankoski and Ollikainen (2003[11]), land quality differs over field parcels (j) and it is ranked by a scalar measure, q, with the scale chosen so that minimal quality is zero and maximal quality is one, i.e. . Crop yield per hectare, y, is a function of land quality q and fertilizer application rate lj, that is, . In the absence of government agri-environmental payment programme farmers’ short-run restricted profits are defined as , where p and c represent the respective prices of crop and fertilizer and other cultivation costs per hectare.

In the case of government policy to enhance semi-natural habitat provision, to reduce nitrogen runoff from field parcels to watercourses and to promote soil carbon sequestration let mj(q) denote the share of field parcel of productivity q allocated to crop production that is retained as a semi-natural habitat (whether buffer strip, field-forest border biodiversity strip or enlarged field margin). Heterogeneous productivity of field parcels implies that the establishment and management of semi-natural habitats, m, results in differential opportunity costs in different field parcels. Also, biodiversity benefits, nitrogen runoff reduction effectiveness, and soil carbon sequestration differ due to differential site-productivity of environmental service provision (owing to differences in soil types, field slopes, etc.). Similarly reduction of nitrogen fertiliser application rate lj(q) contributes to reduction of nitrogen runoff and nitrous oxide (N2O) emissions.

Simple uniform payment policy for buffer strip establishment

For the ease of implementation the government can set a fixed width of buffer strip, , (e.g. 5 or 10 meters) and uniform payment for biodiversity strip In this case farmers’ profits are defined as

, (1)

where denotes the annualised establishment and management costs of buffer strip and denotes farmer’s private transaction costs of participating in agri-environmental programme. A farmer will participate in this programme if his profits under the programme, , are higher than his reservation profits, .

Differentiated payment for nitrogen fertiliser use reduction and buffer strip establishment

For spatial targeting of agri-environmental measures, here nitrogen fertiliser use reduction and buffer strip establishment, the government can implement differentiated payment levels and n this case farmers’ profits are defined as

. (2)

Conservation auctions

In the case of conservation auction farmers competitively bid for a limited amount of agri-environmental contracts. Iho et al. (2014[12]) and Glebe (2013[13]) modified Latacz-Lohmann and van der Hamsvoort (1997[14]) model and included environmental benefit index (EBI) in the bidding. Following Iho et al. (2014[12]) farmers make expectations on bid/EBI ratios when they participate in bidding. EBI values are denoted by e and the upper limit of the bidder’s expectation about the maximum expected bid/EBI is denoted by . By assumption bidders’ expectations about this implicit bid cap are uniformly distributed in the range, where the lower bar represents the minimum (defined by ) and upper bar the maximum expected bid cap. The probability that the bid is accepted is given by

(3)

Where , f(θ)is density function and F(θ) distribution function. The expected net payoff of the risk-neutral farmer from bidding is a product of the revenue from winning the bid and the acceptance probability:

, (4)

where denotes the profit under no participation and is profit under the secured conservation contract. The farmer chooses the bid, b, and thereby the ratio b/EBI, according to:

, (5)

where f(θ) is the probability density function associated with F(θ) and e is the field parcel’s EBI-value.

The difference in equation (5) represents the income forgone for adoption of agri-environmental practices (reduction of nitrogen fertiliser use and the establishment and management costs of buffer strip) and farmer’s private transaction costs of participation. The additional term is the information rent.

The optimal bid in the presence of EBI is determined by:

. (6)

Hence, when EBI matters for participation in an auction, the optimal bid depends on the conservation costs and the expected cap multiplied by the bidder’s own EBI value ().The higher is the EBI of the submitted field parcel, the higher is the bid (). Glebe (2013[13]) also shows that farmer’s optimal bid changes when he receives information about the environmental score of the field parcel and farmer’s bid increases (decreases) when informed that his environmental score is greater (smaller) than average score.

When farmers expect similar environmental performances across farmers, the optimal bid is the same as under the auction without EBI, that is, , (see Iho et al., (2014[12]). Hence, in this case farmers’ expectations are formed only on the basis of income forgone for adopting environmental practices and not on bid/EBI ratios.

Empirical application of the theoretical framework

The empirical application is built on the key features of the theoretical model.

Crop production

Per hectare crop yield is modelled as a function of nitrogen fertiliser application. A Mitscherlich yield function is applied for wheat to define the optimal fertiliser application and yield level.

(7)

Where li is nitrogen application rate in a given micro-unit (field parcel) i (i=1…38) and φi, σ and ρ are parameters.

The crop yields depend on soil productivity and soil type and these differences are incorporated through maximum yield parameter, φi.

Environmental effects

GHG emissions

GHG emissions include emissions from nitrogen fertiliser application (N2O). In the next version of the empirical model extensive grasslands, environmental (green) set-aside and buffer strips are considered to provide a net-sequestration of soil carbon (that is, they are carbon sinks).

Nitrogen runoff

The following nitrogen runoff function based on Simmelsgaard (1991[15]) and Simmelsgaard and Djurhuus (1998[16]) is employed,

, (8)

where = nitrogen runoff at fertiliser intensity level li, kg/ha, = nitrogen runoff at average nitrogen use, and are constants and li = nitrogen fertilisation in relation to the normal fertiliser intensity for the crop, 0.5 ≤ l ≤ 1.5. The first term in (8) describes nitrogen uptake by the buffer strips.

Biodiversity

The quality of arable and semi-natural habitats is measured by employing habitat quality indices based on observed species number of butterflies in different kinds of arable farmland habitats (Kuussaari and Heliölä, 2004[17]). Habitat quality indices show that oilseeds (rape seed) are two and green set-aside 5–6 times more valuable habitat for butterflies than cereal fields, whereas field edges and buffer strips are 7 times more valuable habitats. The highest quality habitat would be a natural meadow, which is 8.1 times more valuable a habitat than cereal fields. These relative weights are used when calculating a biodiversity index value for each representative production unit. Thus, the biodiversity index value of a given production unit depends on the size of field edges and the buffer strip and the chosen land use (habitat quality of the given land use). Naturally buffer strips are not established in those field parcels, which are allocated to green set-aside or extensive grasslands (e.g. a natural meadow).

Environmental benefit index

Environmental benefit index (EBI) is modelled as a relative environmental gain index for a given representative production unit as an edge-of-field relative impact on nitrogen runoff, N2O emissions, and quality of wildlife habitat (see similar approach in Cattaneo et al. (2005[18]) and Claassen et al. (2004[19])). Relative impact estimates are converted to a 0-1 impact index (EBIje) for each environmental effect:

(9)

Where min(RGe) and max(RGe) are the minimum and maximum impact estimates across all production units j for the eth environmental effect. EBIje is scaled so that the largest impact unit(s) receives 100 EBI points. Total EBI for each production unit is a weighted sum of its EBI points for three environmental effects analysed (where sum of the weights equals 1).

Farmers’ risk preferences

Regarding farmers’ risk preferences, the flexible utility function developed by Saha (1997[20]) is employed:

(10)

where θ > 0 and γ are parameters. The risk attitude measure is given by the marginal utility ratio of the utility function, . Risk aversion corresponds to θ > 0 and risk-neutrality to θ =0. Decreasing absolute risk aversion is presented by θ > 0. Hence, farmers are assumed to be risk-averse and have decreasing absolute risk aversion.

Notes

← 1. Nomenclature of territorial units for statistics (NUTS) is a hierarchical system for dividing up the economic territory of the EU and the UK for the purpose of the collection, development and harmonisation of regional statistics. NUTS2 includes 242 regions. The Common Agricultural Policy Regional Impact (CAPRI) model is an agricultural sector model that combines a global partial equilibrium model for agri-food products with non-linear programming models for NUTS2 regions in the European Union and the United Kigngdom (www.capri-model.org/docs/capri_documentation.pdf).

← 2. In performance-based screening farmers are paid according to measured environmental performance or benefits generated by using proxies, such as the environmental benefit index (EBI). For example, in the US Conservation Reserve Program (CRP) the combination of performance screening through the EBI and competitive bidding has been used to select CRP participants. This benefit-cost targeting allows policy makers to rank and select participants on the basis of the benefit-cost ratio of their bids (where the EBI represents the benefit and farmer’s bid represents cost) (OECD, 2010[21]).

← 3. For biodiversity, connected habitats are ecologically more valuable than isolated habitats and improved spatial connectivity of fragmented habitats is needed. Agglomeration payment design provides incentives for farmers to conserve spatially connected habitats. A bonus payment is paid to landowners if managed habitats achieve a desired spatial configuration.

← 4. The Gini coefficient is an indicator that describes the level of inequality for a given variable and it varies between 0 (perfect equality) and 1 (extreme inequality). The higher (lower) is the Gini coefficient, the greater is the inequality (equality).