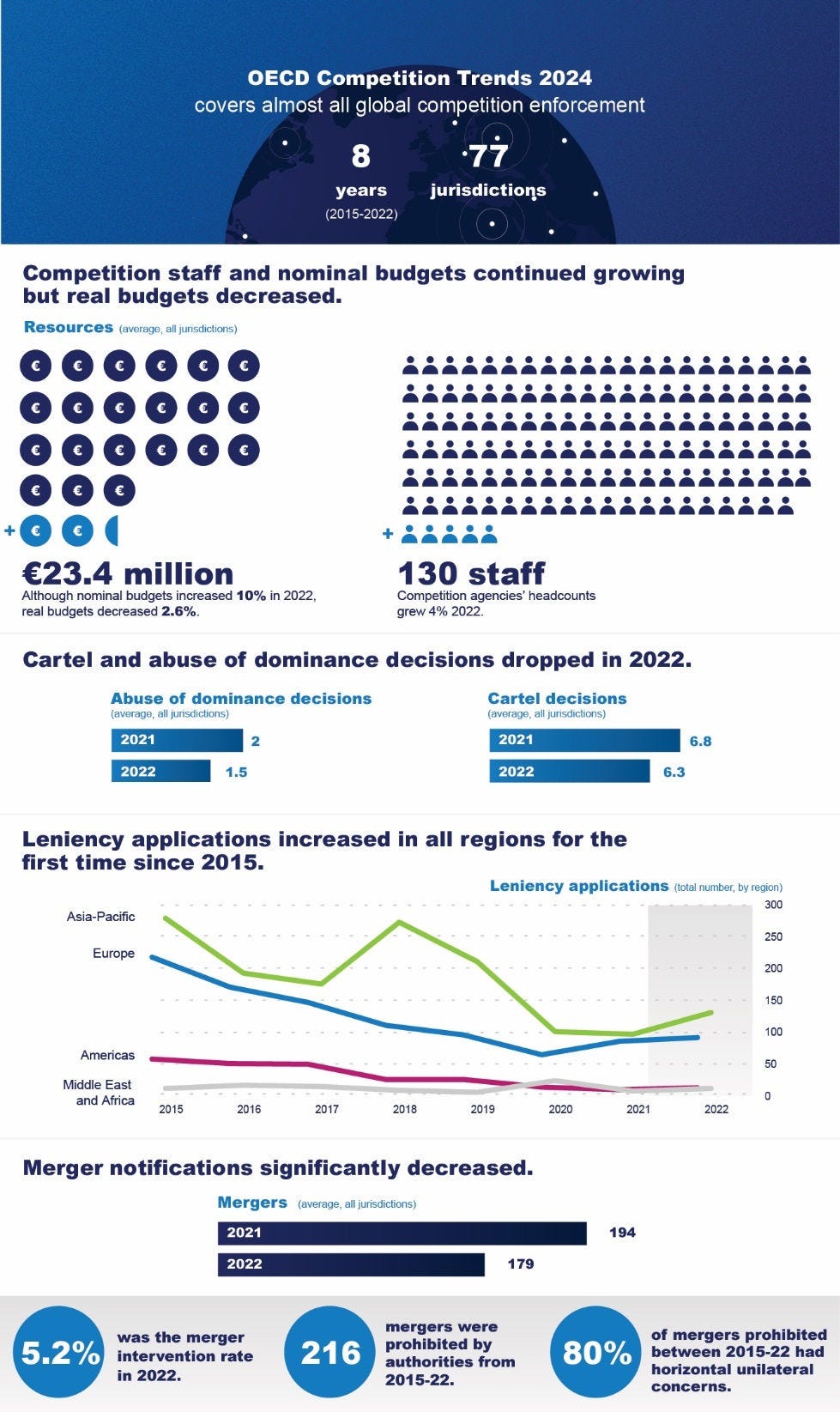

Leniency applications increased in all regions for the first time since 2015 – For the first time since 2015, when the OECD began collecting the Competition Statistics data, the total number of leniency applications increased in all regions, reversing the previous downward trend. The total number of leniency applications increased from 201 in 2021 to 248 in 2022, an annual growth rate of 23.4%. The resurgence began in 2021 in Europe, continuing in 2022, and accompanied by an increase in all regions.

Cartel ex-officio investigations increased by 19.3% – Average cartel ex-officio cartel investigations increased to 8.4 in 2022 (representing an annual growth of 19.3%), countering the steady decline from 14.7 in 2016 to 7.1 in 2021.

Cartel dawn raids remained stable – The average number of cartel dawn raids remained stable in 2022 (with an average across all jurisdictions of 3.6 in 2022, identical to 2021), slightly increasing in the Americas and Europe, while decreasing in Asia-Pacific and MEA. In all regions, we had witnessed a significant decline in 2020, mostly resulting from the Covid-19 lockdowns.

Cartel decisions decreased, mostly in Europe – In 2022, there was a decline in the average number of cartel decisions in Europe and MEA but an increase in Americas and Asia-Pacific. The average across all jurisdictions fell from 6.8 in 2021 to 6.3 in 2022. The biggest decline was in Non-OECD European jurisdictions, where the annual decrease on cartel decisions was around 41%. Two possible explanations for the decline in cartel decisions include the decrease in ex-officio investigations between 2016 and 2021 (including decrease in investigations due to covid during 2020-21) and the consistent decline in leniency applications since 2015.

Cartel bid-rigging decisions increased by 9.7% – There was an increase in bid-rigging cases between 2021 and 2022 (the only two years for which OECD CompStats data for bid-rigging decisions exist), namely from 154 to 169. The average number of bid-rigging decisions across all jurisdictions increased by 9.7% in 2022. As a percentage of all cartel decisions, bid-rigging decisions across all jurisdictions increased from 32% in 2021 to 38% in 2022, although there were some regional differences. In 2022, the region where bid-rigging decisions represented the highest percentage of cartel decisions was MEA (40%).

The industries with the most cartel decisions in 2022 were manufacturing, construction and wholesale trade – The top 10 industries based on the total number of cartel decisions remained relatively similar to the ranking in 2021. “Manufacturing”, “Construction” and “Wholesale Trade” were still the three industries with the most cartel decisions in 2022. However, they only represented 44% of all cartel decisions in 2022, down from 48% in 2021. “Agriculture, forestry, fishing and hunting” was the industry where the number of cases grew the most, representing 7% of the cases in 2022 (up from only 2.4% in 2021).

Cartel settlements decreased, notably in MEA – The average number of cartel cases with settlements was relatively stable in 2022, albeit with regional differences. Notably, in MEA, the average cartel cases closed with settlements decreased from 4.3 to 2.9.