This chapter is dedicated to merger control, providing an analysis of: (i) the OECD CompStats merger data, which is now available publicly on an individualised basis, and thus can be explained in more detail than was previously possible; and (ii) a new dataset collected by the OECD Secretariat on all prohibition decisions over the period 2015 to 2022.

OECD Competition Trends 2024

3. In focus: trends in merger control

Abstract

This year, for the first time, jurisdictions agreed to make public data on merger control on an individualised basis. With this in mind, this chapter presents trends in merger control on an aggregate basis, but explains which jurisdictions are driving these aggregate trends. Individualised merger control data can be found in the Excel file supporting this years’ report.

Trends in CompStats merger control

Merger notifications declined in OECD jurisdictions

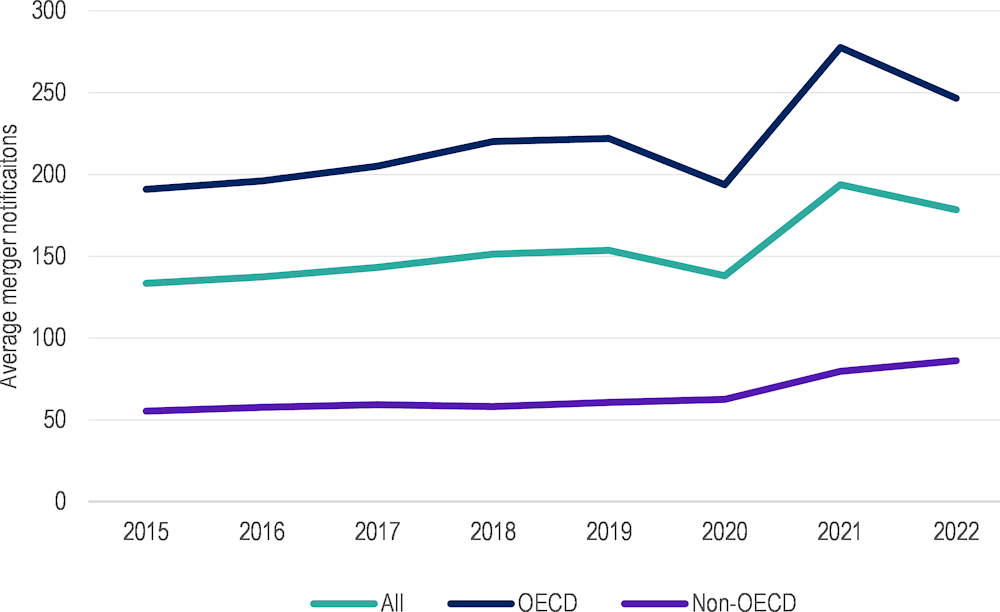

In 2022, there was a drop in the number of overall merger notifications. However, this was predominantly driven by a decline specifically in OECD jurisdictions. The number of merger notifications in non-OECD jurisdictions continued to increase in 2022, although at a slower rate than in 2021. Despite the decline in overall merger notifications in 2022, they were still higher than at any point in the period 2015 to 2020 (with an average of 179 per jurisdiction, which was above the previous peak of 154 in 2019).

Figure 3.1. Average number of merger notifications, 2015‑22

Note: Data based on the 66 jurisdictions in the OECD CompStats database that provided comparable data for all eight years.

Source: OECD CompStats database.

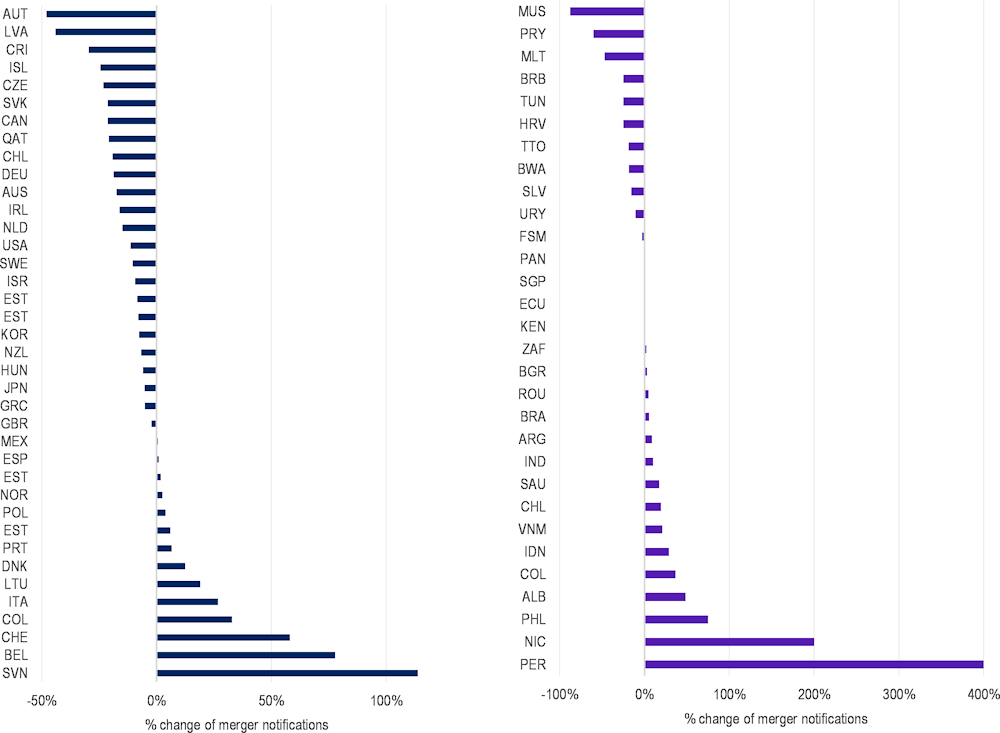

As shown in Figure 3.2, the decline in merger notifications in 2022 was common across most OECD jurisdictions with 63% of OECD jurisdictions (24 of 38 jurisdictions with relevant data for all years) observing a reduction in merger notifications, while notifications decreased in 36% (10 of 38 jurisdictions with relevant data for all years) of non-OECD jurisdictions. Furthermore, for jurisdictions that had positive percentage growth in 2022, it was much higher in non-OECD jurisdictions with an average of 47%, compared to only 26% in OECD jurisdictions. It is important to note than in the case of Peru, the percentage change is due to the extension of the merger control regime beyond the energy sector to all sectors of the economy.

The surge in merger notifications in 2021 was largely due to the significant increase in the US, from 1 580 merger notifications in 2020 to 3 413 merger notifications in 2021. However, in 2022, it decreased by 11% to 3 029 (although this value was still 92% higher than the number of merger notifications in 2020).

Figure 3.2. Distribution per jurisdiction of the percentage change in the number of merger notifications from 2021 to 2022, for OECD (left) and non-OECD jurisdictions (right)

Note: Data based on the 68 jurisdictions in the OECD CompStats database that provided data for 2021 and 2022. Each bar represents one jurisdiction.

Source: OECD CompStats database.

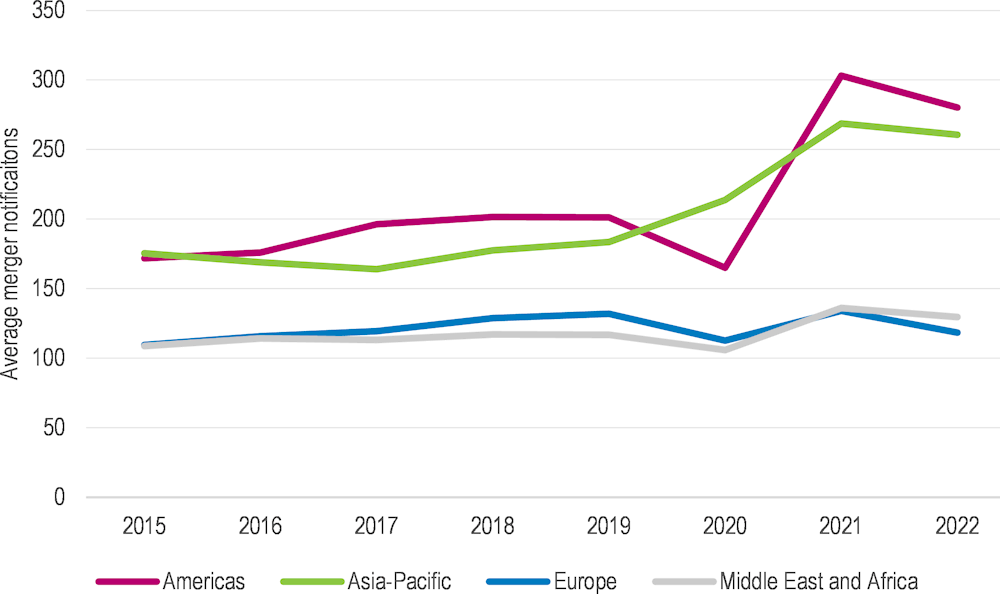

When looking at the merger notifications by region, the decline is observed in all of them. In Europe, merger notifications declined the most (12% compared to 2021), followed by the Americas (decline in 8%), MEA (decline in 5%) and Asia-Pacific (decline in 3%).

Figure 3.3. Average number of merger notifications by region, 2015‑22

Note: Data based on the 66 jurisdictions in the OECD CompStats database that provided comparable data for all eight years.

Source: OECD CompStats database.

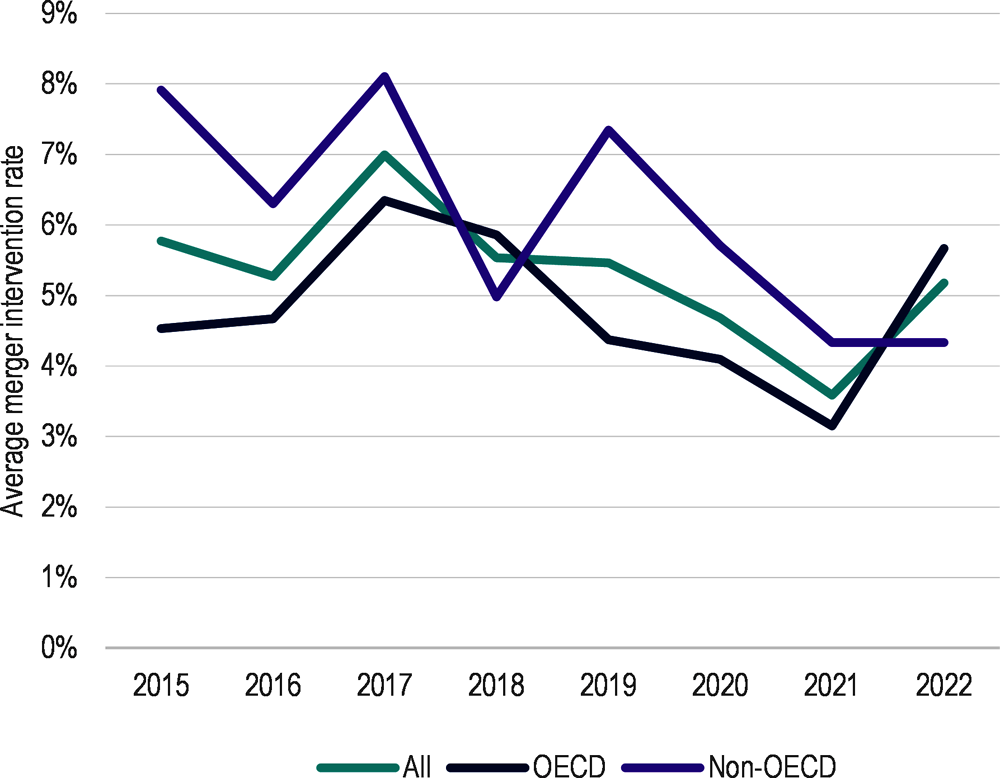

Merger intervention rate increased in OECD jurisdictions

Contrary to the previous year, there was a significant increase in the merger intervention rate – the proportion of transactions in which competition authorities intervened, either by imposing a remedy or by prohibiting a transaction – in 2022. This holds true regardless of whether withdrawn mergers are included in the numerator or not. Most of this increase was driven by OECD jurisdictions, while for non-OECD jurisdictions it remained stable.

The increase in 2022 observed in OECD jurisdictions was driven by the United Kingdom (15% in 2021 to 53% in 2022), Iceland (7% in 2021 to 30% in 2022), Greece (0% in 2021 to 10% in 2022), New Zealand (6% in 2021 to 13% in 2022) and Ireland (4% in 2021 to 10% in 2022).1

The downward decline in non-OECD jurisdictions between 2017 and 2021, was not driven by steady decline in any particular jurisdictions. The variation over time in these jurisdictions was more erratic, varying significantly from year to year. The merger intervention rate in non-OECD jurisdictions has been steadily declining from a peak of 8.1% in 2017 to a low of 4.3% in 2022.

The merger intervention rate was also declining in OECD jurisdictions over the period 2018 to 2021, however this trend was reversed in 2022, with a sharp increase. This increase in OECD jurisdictions was due to both: (i) an increase in the absolute number of merger decisions where the authority has intervened from 135 in 2021 to 173 in 2022 (i.e., increase in the numerator); and (ii) a decline in the number of overall decisions from 10 243 in 2021 to 9 026 in 2022 (i.e., decrease in the denominator).

Figure 3.4. Average merger intervention rate (excluding withdrawn mergers), 2015-22

Note: Data based on the 60 jurisdictions in the OECD CompStats database that provided comparable data for all eight years.

Source: OECD CompStats database.

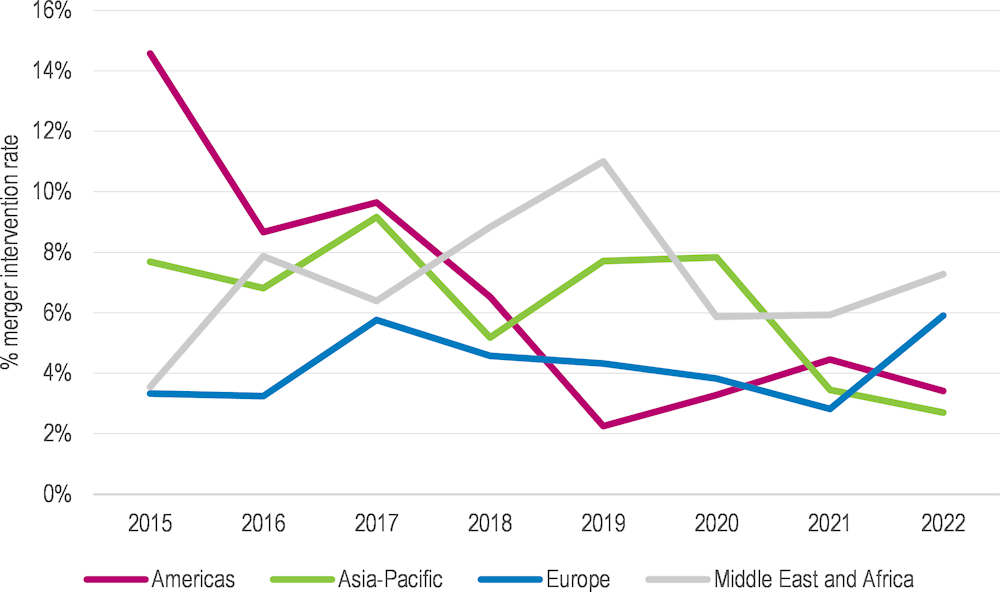

Regional differences in the evolution of the intervention rate exist. While it increased in Europe and MEA, it decreased in Asia-Pacific and Americas. MEA jurisdictions had the highest intervention rate in 2022, with an average of 7.3%, increasing from 5.9% in 2021. In Asia-Pacific, the intervention rate in 2022 was the lowest, with an average of only 2.7%, decreasing from 3.4% in 2021. In Europe, the intervention rate increased the most, from 2.8% in 2021 to 5.9% in 2022, while in the Americas, it decreased the most, from 4.5% in 2021 to 3.4% in 2022.

Figure 3.5. Average merger intervention rate (excluding withdrawn mergers) per region, 2015-22

Note: Data based on the 60 jurisdictions in the OECD CompStats database that provided comparable data for all eight years.

Source: OECD CompStats database.

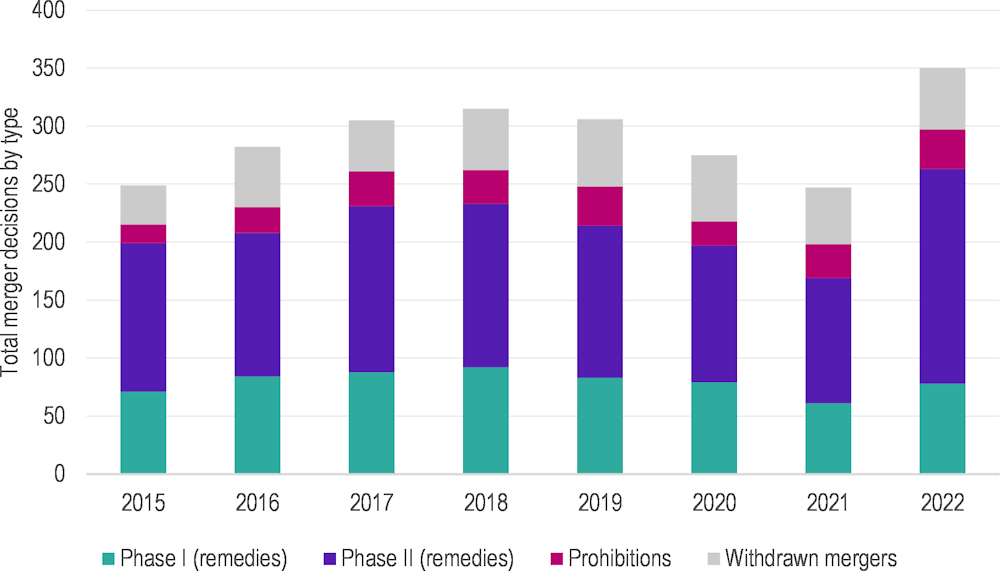

Merger remedies were more frequently used by authorities

As shown in Figure 3.6, the increase of intervention rate in 2022 was mainly due to an increase in the use of remedies. This was both the use of remedies in phase II (increasing from 108 to 185) and in phase I (from 61 to 78). Prohibitions and withdrawn mergers were relatively similar in 2022 (34 and 53, respectively) compared to 2021 (29 and 49, respectively), meaning that they do not explain the increase in the intervention rate.

Figure 3.6. Number of merger decisions by outcome where an authority intervened or a merger was withdrawn, 2015-22

Note: Data based on the 66 jurisdictions in the OECD CompStats database that provided comparable data for all eight years.

Source: OECD CompStats database.

Trends in OECD prohibitions data

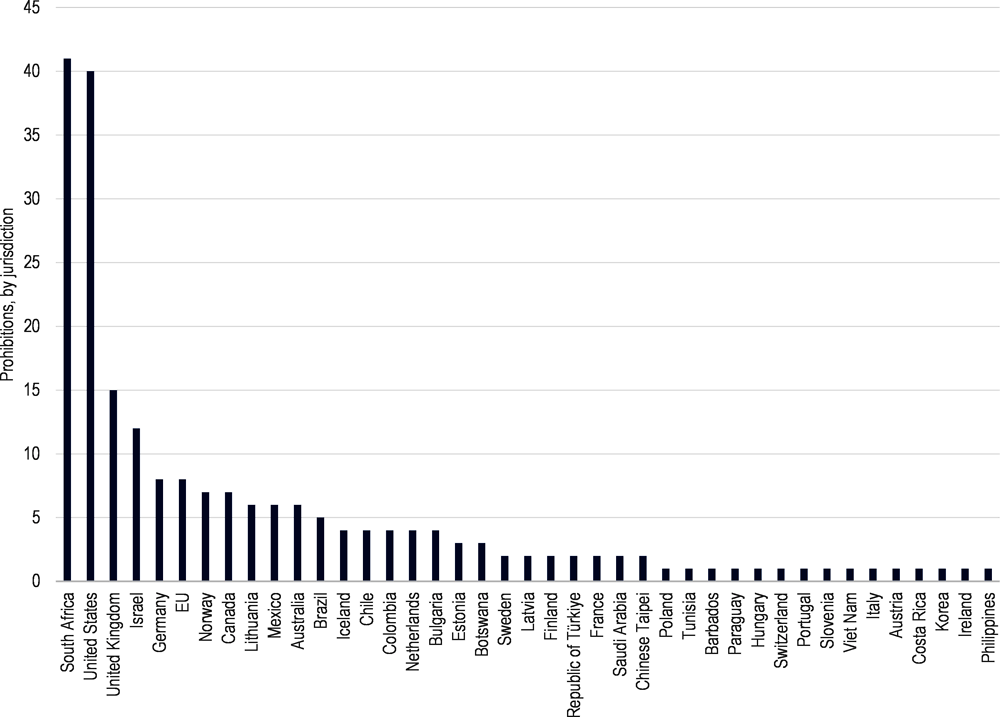

Most merger prohibitions are concentrated in a few jurisdictions

The OECD Secretariat gathered the decisions of all merger prohibitions identified by competition authorities in the Competition Statistics survey for the period 2015 to 2022. There were 216 prohibition decisions in total.

Based on a review of available prohibition decisions, competition authority websites and annual reports on the OECD website, the Secretariat created several additional variables, including: (i) theory of harm in which the authorities based their decisions (which consists of horizontal unilateral effects, horizontal coordinated effects, vertical effects, conglomerate effects and others); (ii) industry (based on the NAICS classification); and (iii) market. This section of the report provides a summary of those variables.

Most prohibitions are concentrated in a few jurisdictions. The six jurisdictions with the most prohibitions represent 57% of all prohibitions during the period 2015 to 2022 (124 of 216 prohibitions). They are South Africa, United States, United Kingdom, Israel, Germany and the European Union.

Figure 3.7. Total prohibitions, by jurisdiction, 2015-2022

Note: Data based on the 66 jurisdictions in the OECD CompStats database.

Source: OECD CompStats database.

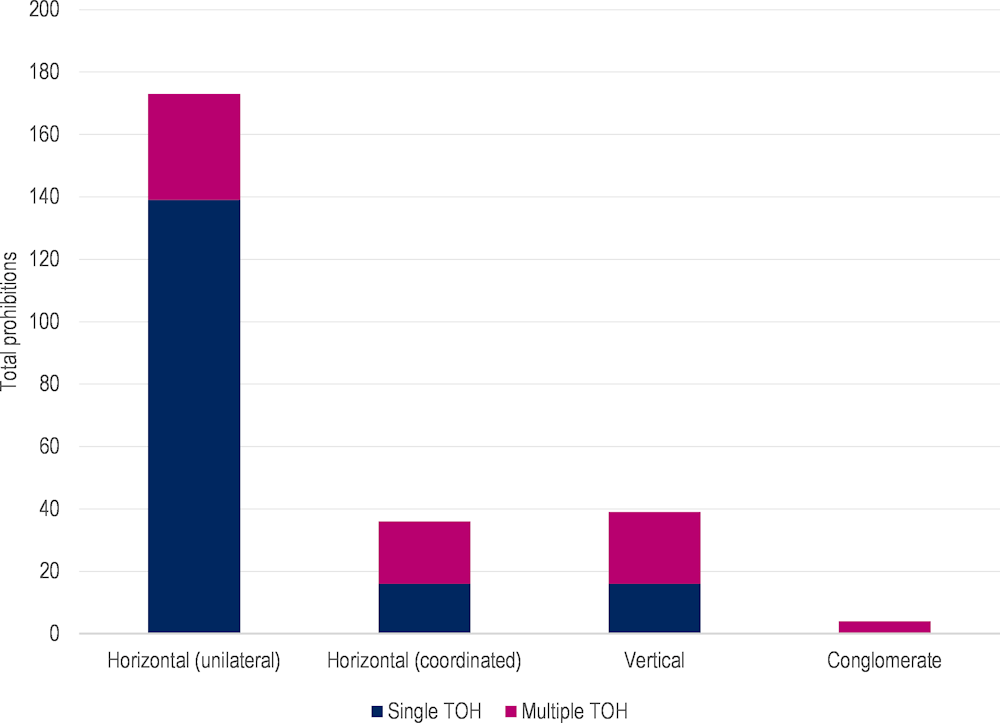

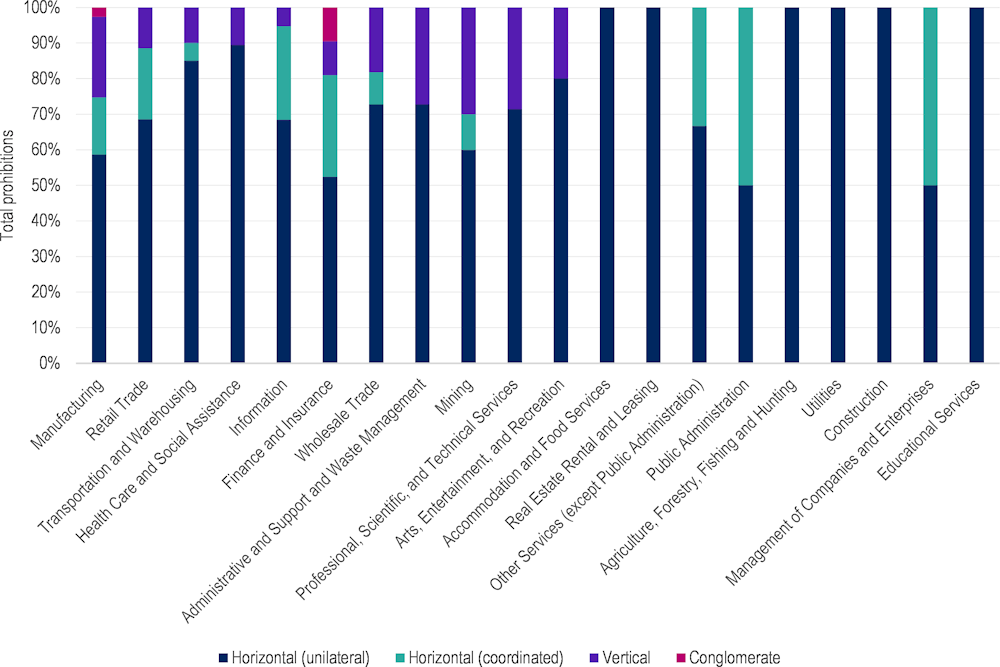

Most prohibitions rely on horizontal theories of harm

Horizontal theories of harm make up the vast majority in merger prohibition decisions (173 decisions). Horizontal coordinated theories of harm (36 decisions) are similar in amount to vertical theories of harm (39 decisions). Conglomerate theories of harm are negligible in merger prohibition decisions (only 4 decisions). There are also some jurisdictions that have other theories of harm, such as public interest theories of harm in South Africa (although these are not included in the figure below).

Several prohibitions considered multiple theories of harm in the decision, especially in cases where horizontal unilateral effects were not the main concern. While only 20% of the mergers that were prohibited as a result of horizontal unilateral concerns also considered another theory of harm, this proportion increases significantly when looking at mergers prohibited for coordinated and vertical effects (56% and 59% of the cases, respectively). All prohibitions that considered conglomerate effects also included another theory of harm.

Figure 3.8. Total prohibitions, by theory of harm and whether it relied on a single or multiple theories of harm, 2015-2022

Note: Some prohibition decisions can rely on multiple theories of harm. This is indicated in the graph. Therefore, there are more theories of harm indicated in this figure than the number of prohibition decisions. There are also some jurisdictions that have other theories of harm, such as public interest theories of harm in South Africa, however these are not included in this figure.

Source: OECD with information from competition authorities’ websites and annual reports shared by the authorities with the OECD.

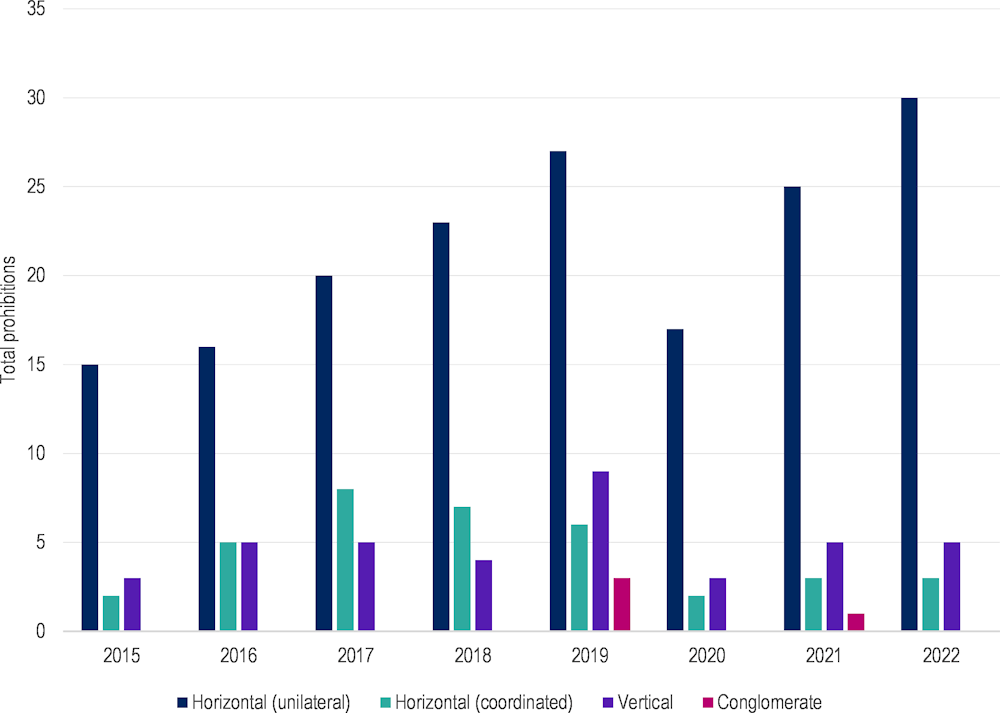

The proportion of merger prohibition decisions between the various theories of harm has been relatively consistent over time, despite some variation. For example, 2019 had a peak of prohibition decisions considering vertical and conglomerate theories of harm.

Figure 3.9. Total prohibitions, by theory of harm and year, 2015-2022

Note: Some prohibition decisions can rely on multiple theories of harm. This is indicated in the graph. Therefore, the number of times a theory of harm occurred exceeds the number of prohibition decisions. Moreover, although some jurisdictions have other (less common) theories of harm, such as public interest theories of harm in South Africa, they are not included in this figure.

Source: OECD with information from competition authorities’ websites and annual reports shared by the authorities with the OECD.

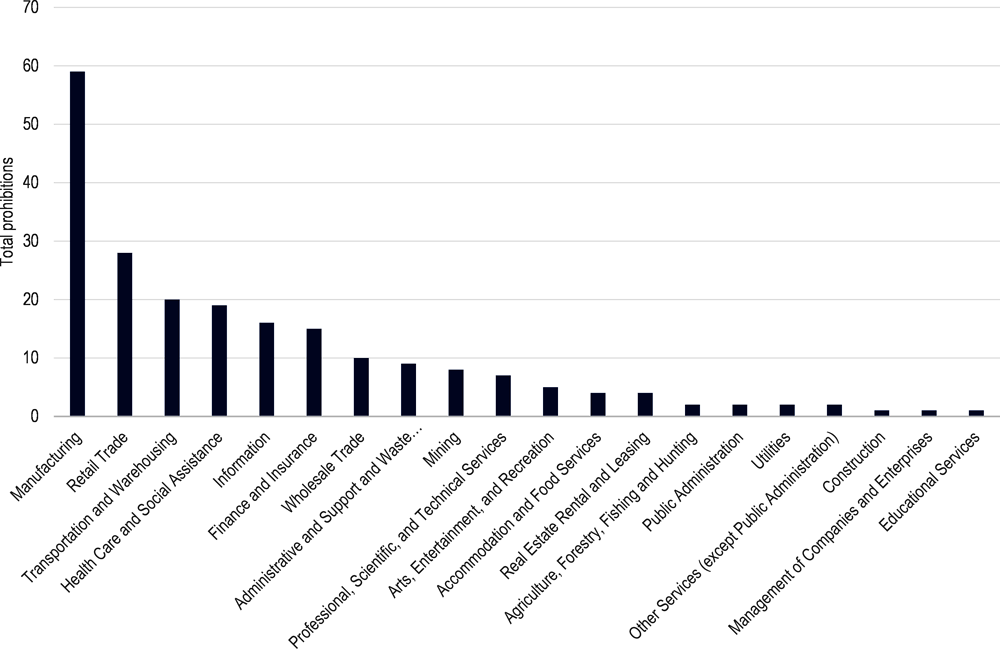

Manufacturing and Retail Trade are industries with the most prohibitions

Prohibitions are more common in industries that are typically characterised by homogenous products and where there may be more likely issues related to a horizontal overlap, such as manufacturing and retail trade. However, there are also several prohibitions in the industry “information”, which could relate, although imperfectly, to transactions in the digital markets.

Figure 3.10. Total prohibitions, by industry (NAICS), 2015-2022

Source: OECD with information from competition authorities’ websites and annual reports shared by the authorities with the OECD.

Figure 3.11. Total prohibitions, by industry (NAICS) and TOH, 2015-2022

Source: OECD with information from competition authorities’ websites and annual reports shared by the authorities with the OECD.

Note

← 1. It needs to be noted that the UK and New Zealand have voluntary merger regimes, which implies that those mergers that are notified are already more likely to be problematic. This is likely to affect the percentage of notified mergers that is challenged by the competition authority.