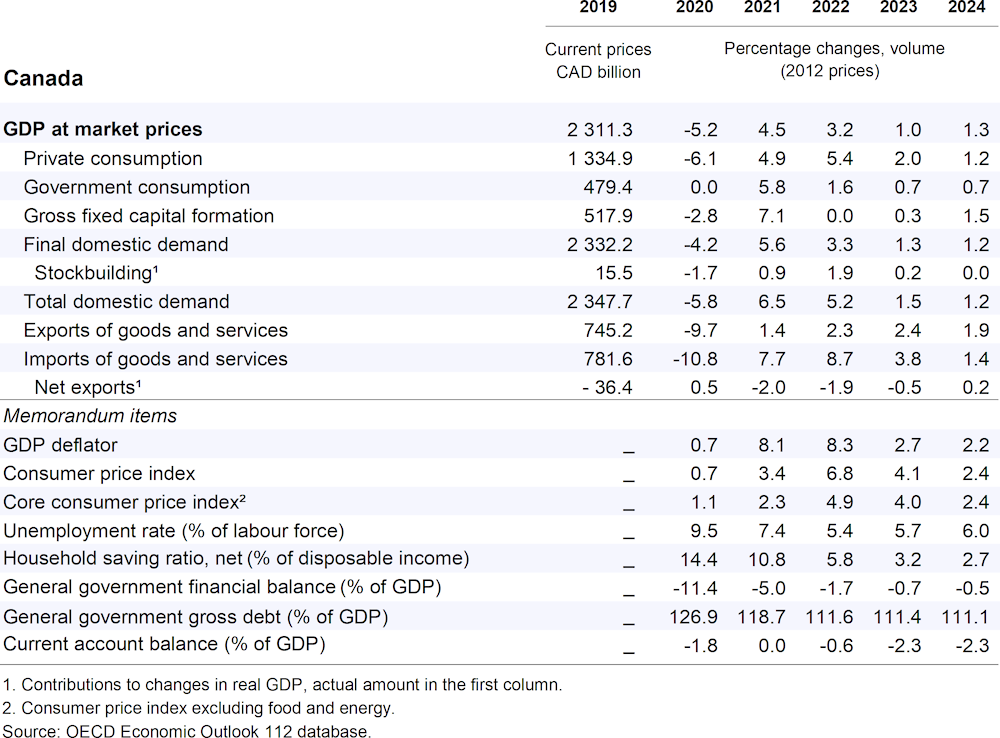

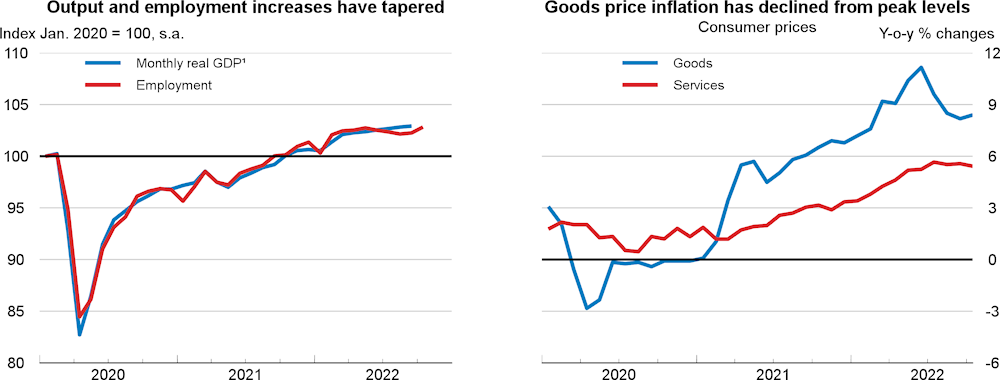

Growth in real GDP is projected to slow from 3.2% this year to 1% in 2023 before strengthening to 1.3% in 2024. Higher borrowing costs will weigh on consumer spending while export growth moderates in the near term amid deteriorating conditions abroad. Softer aggregate demand will relieve pressure on capacity, aided by continued recovery in non-housing investment. Labour markets have been tight until recently, but hiring will decline with slower output growth. Wage growth will moderate as the unemployment rate settles slightly above pre-pandemic levels. Inflation will converge on target as underlying cost drivers ease and remaining supply bottlenecks clear.

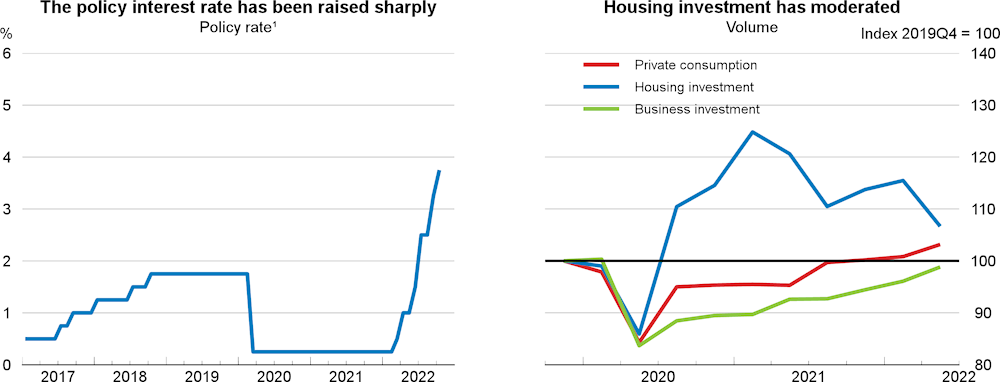

Large interest rate rises this year will help check excess demand and tame inflationary pressures. The pace of monetary tightening should slow if labour markets show signs of deteriorating. Living-cost relief is weighing on fiscal balances in 2022. Federal and provincial governments should scale back support as price pressures abate. This will reduce fiscal deficits next year and help temper aggregate demand. A raft of measures have been developed to ensure long-term growth in Canada’s economy is sustainable. Low-cost emissions mitigation depends on improving policy instruments such as carbon pricing, while supporting green investment.