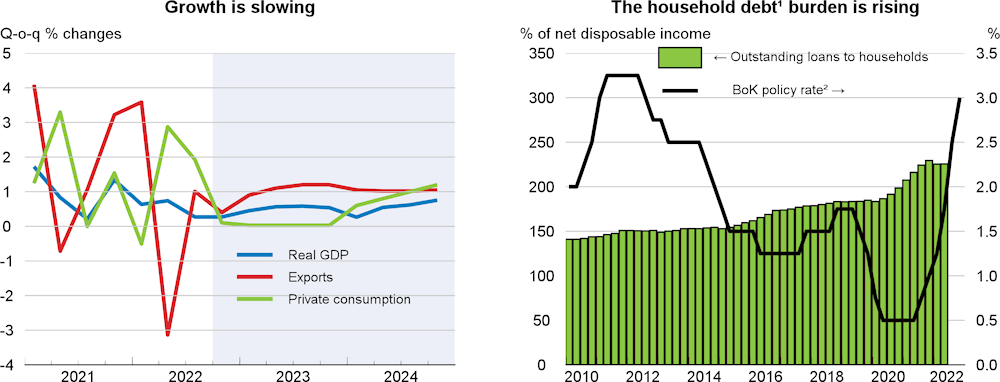

GDP growth is projected to reach 2.7% in 2022 and to slow to just under 2% in 2023 and 2024. In response to weak disposable income growth and a sluggish housing market, private consumption and investment are set to lose momentum. Declining semiconductors sales will weigh on exports in the short term. Unemployment is set to increase from the current low rate, and inflation will remain elevated for some time.

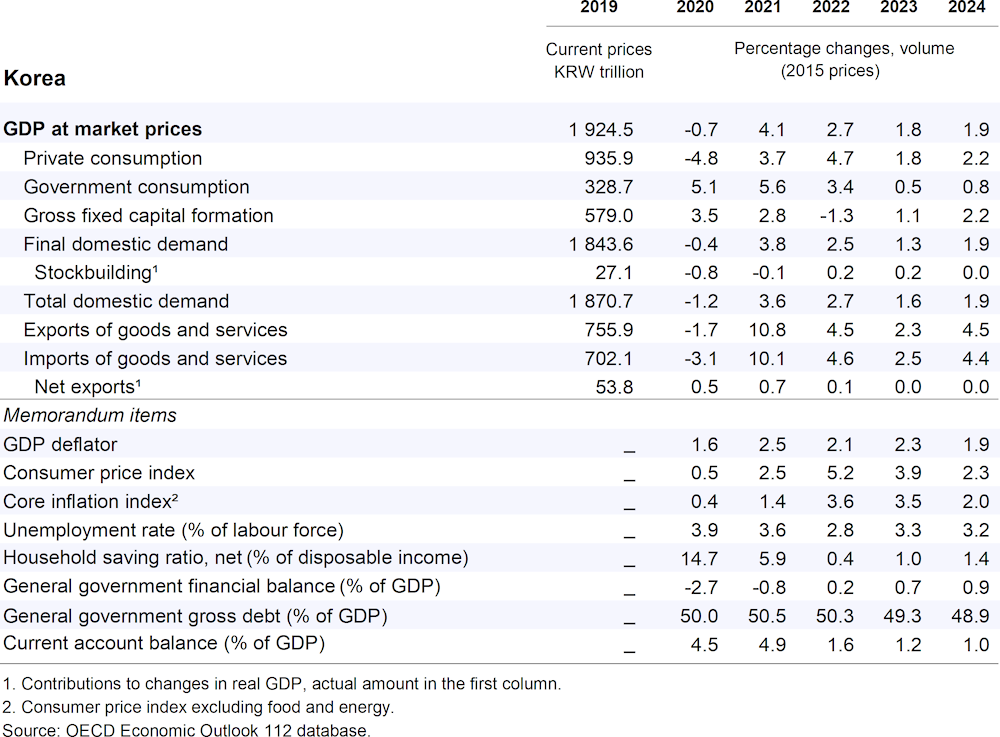

Monetary policy tightening should continue to re-anchor inflation expectations. Fiscal consolidation should proceed gradually with support moving from broad-based measures towards targeting people vulnerable to rising living costs and enhancing incentives for energy savings. Reducing gaps in social protection and reforming pensions to secure adequate retirement income in a fiscally sustainable framework are key priorities in this respect. Structural reforms should facilitate a reallocation of labour and capital to expanding sectors and strengthen competition to address productivity gaps between large and small companies.